IRCTC

Equity Metrics

January 13, 2026

Indian Railway Catering And Tourism Corporation Limited

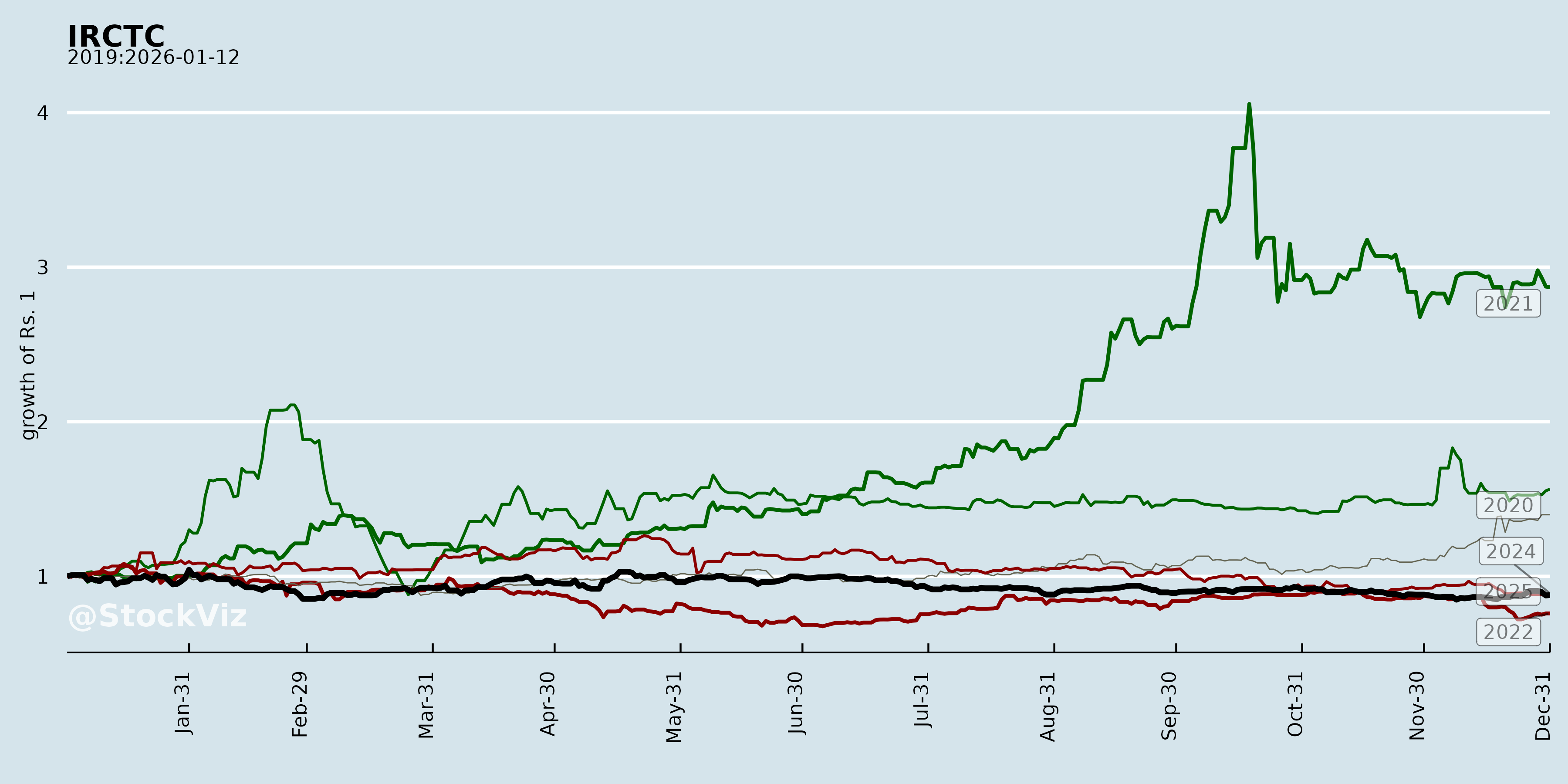

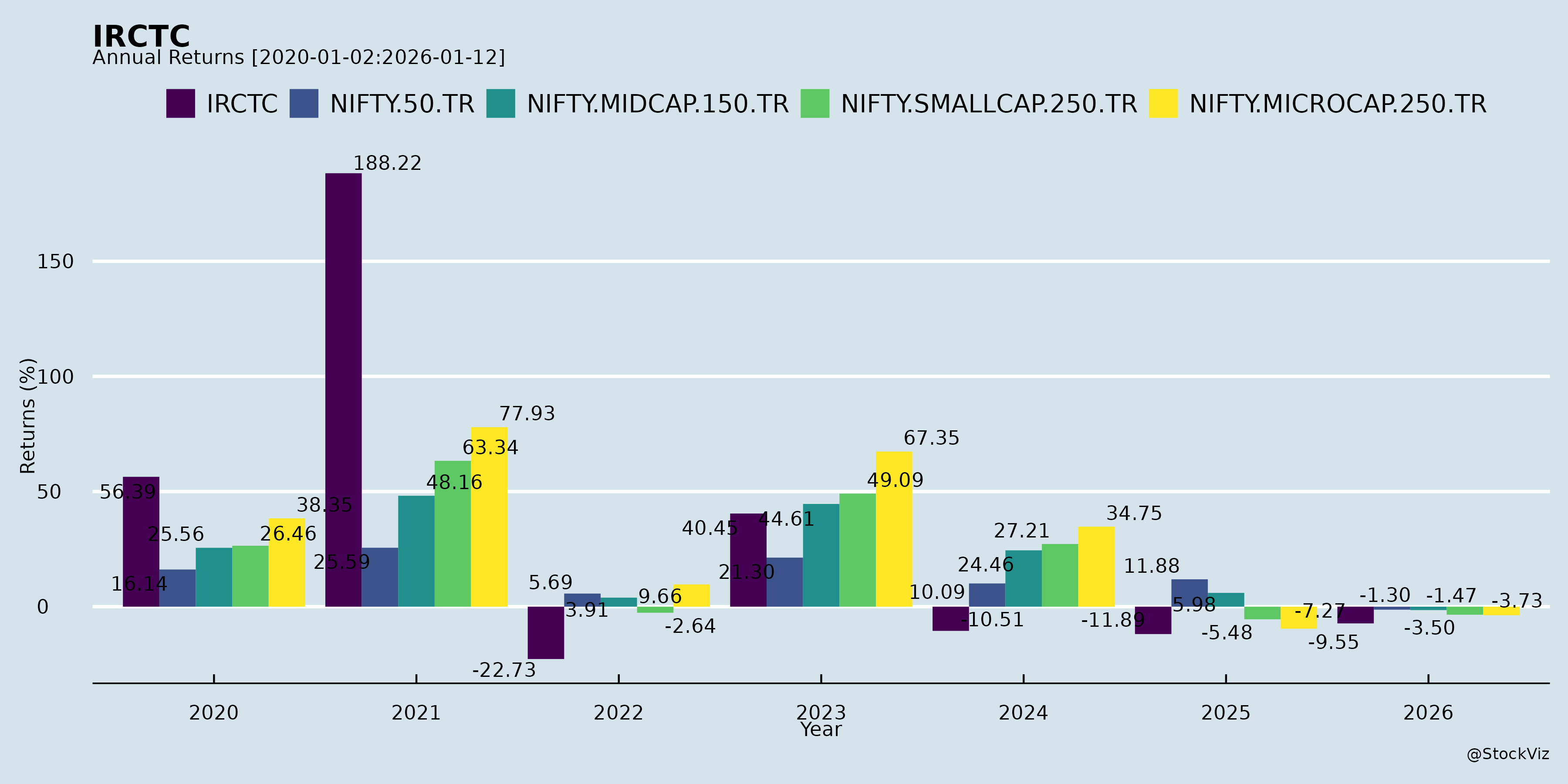

Annual Returns

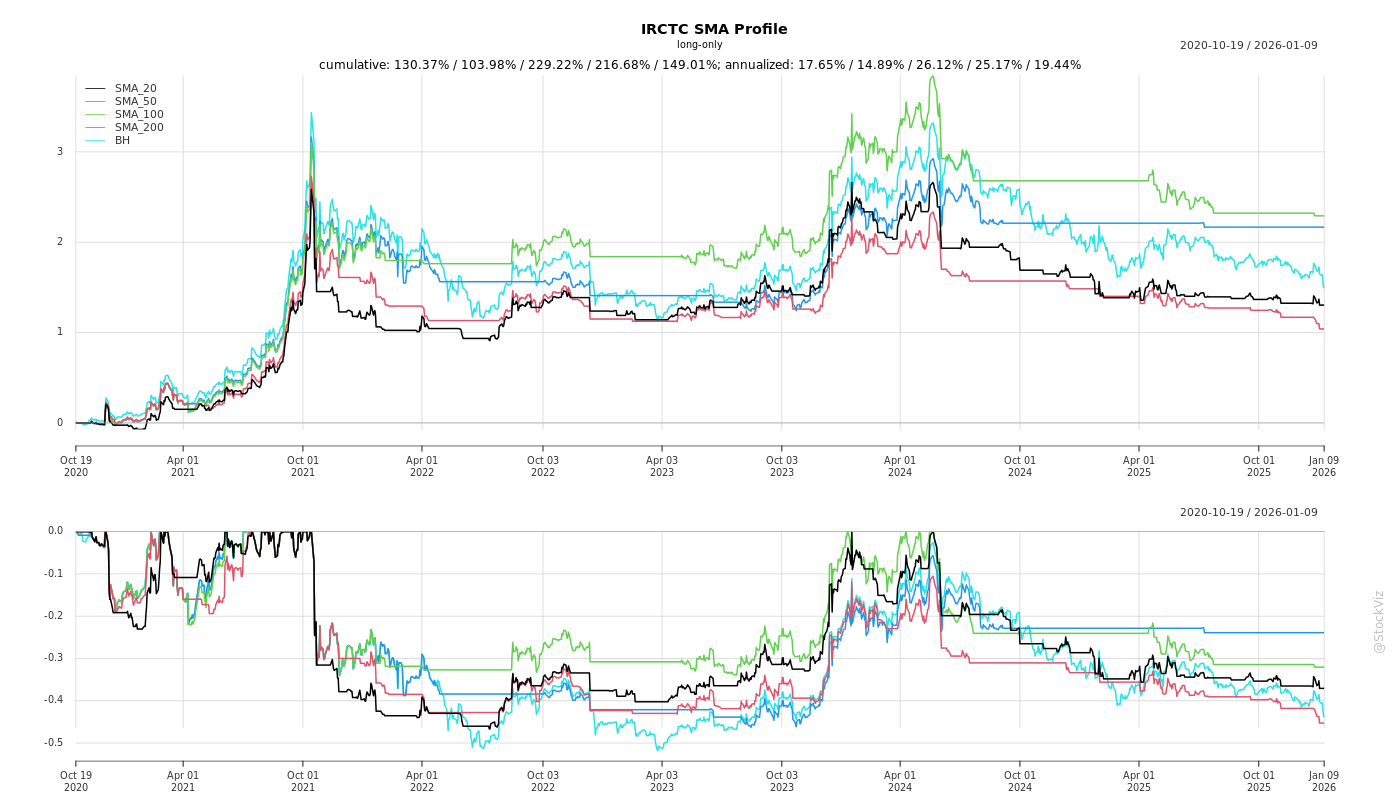

Cumulative Returns and Drawdowns

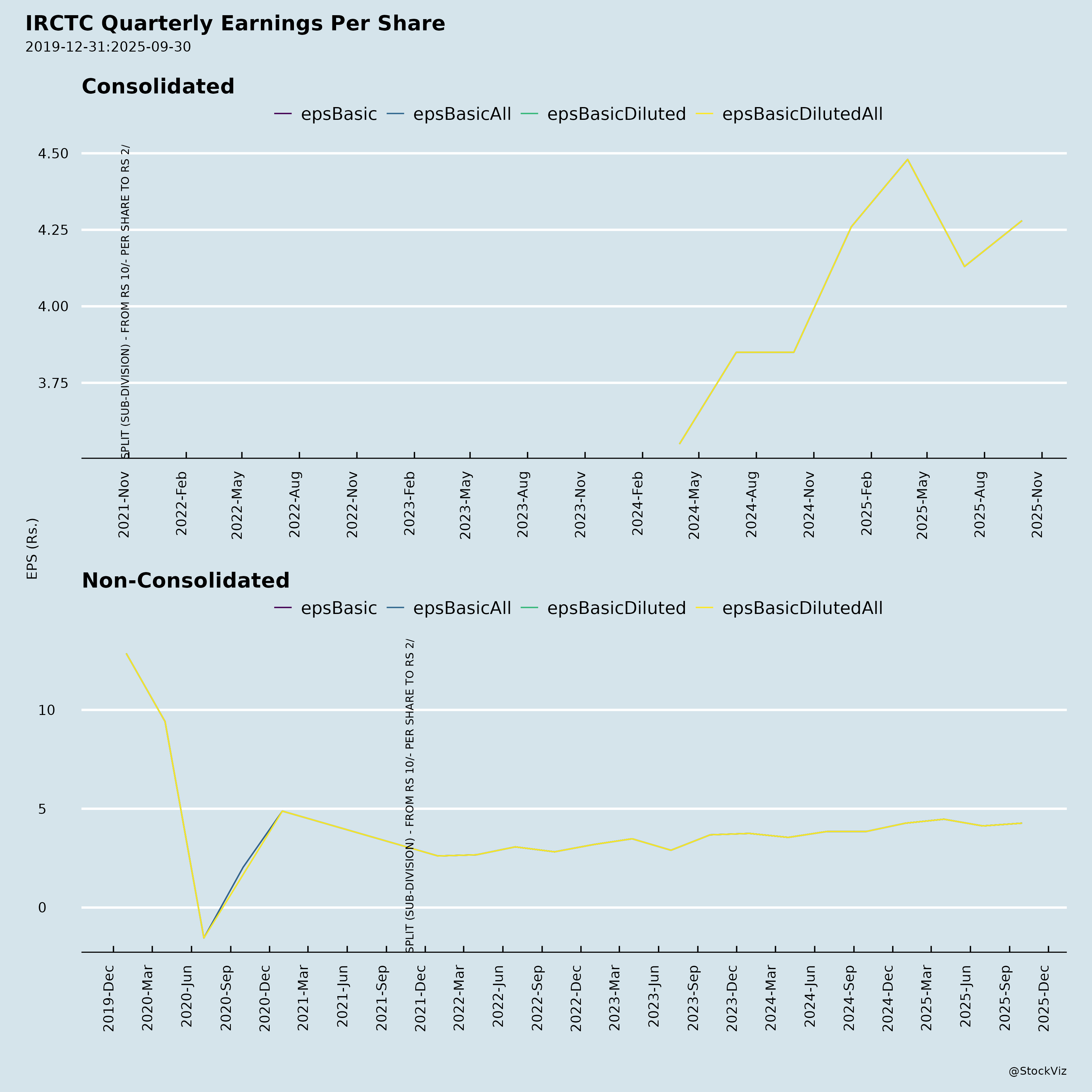

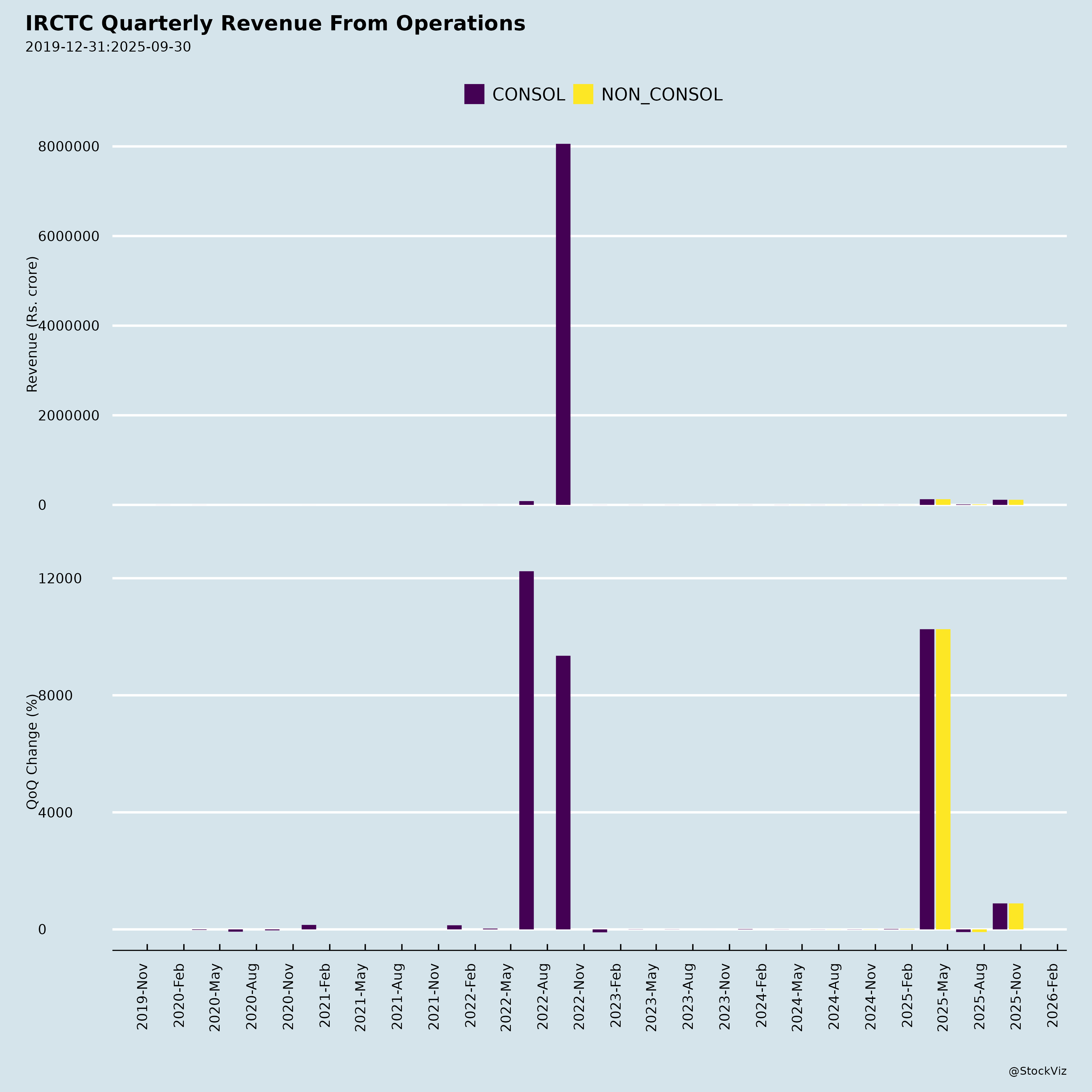

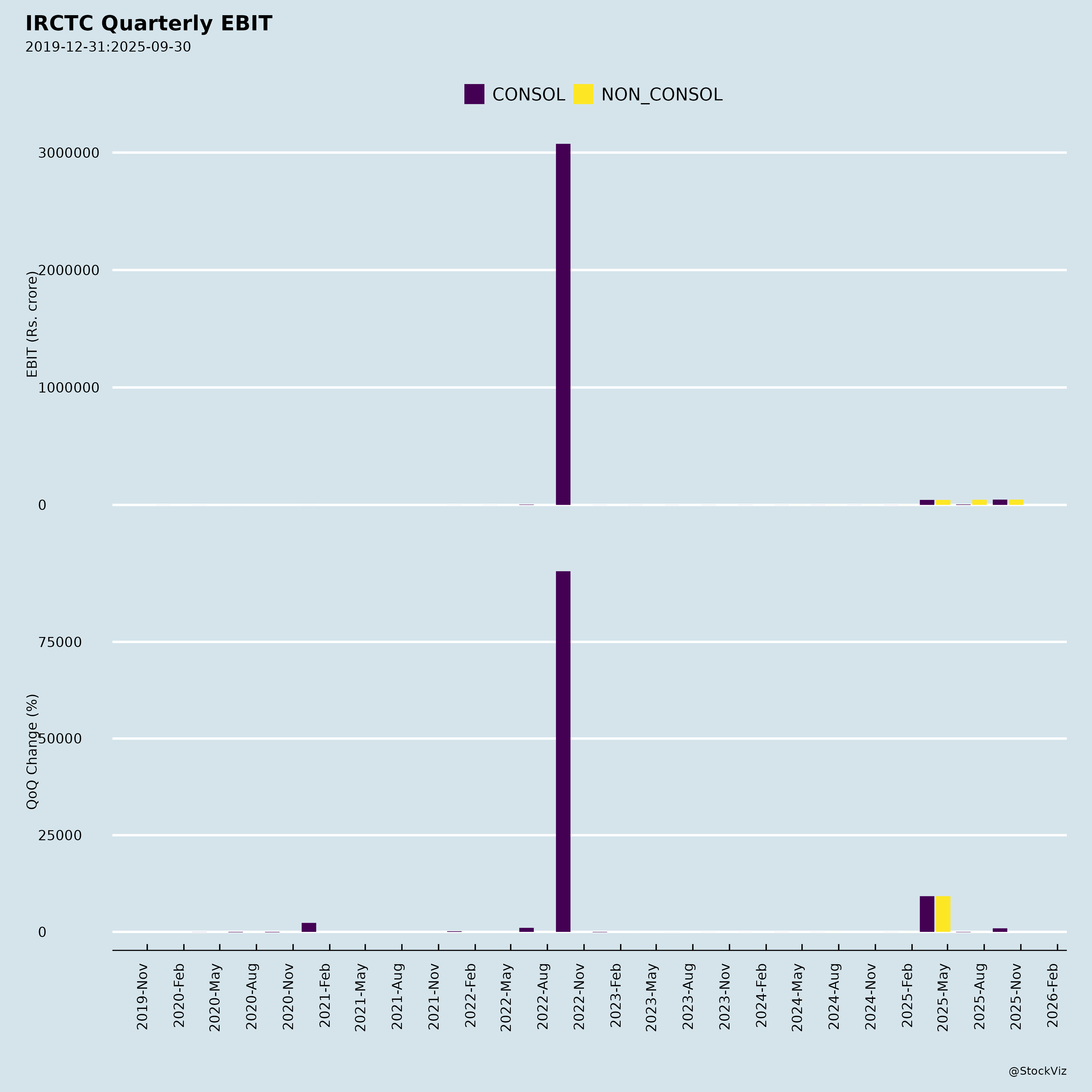

Fundamentals

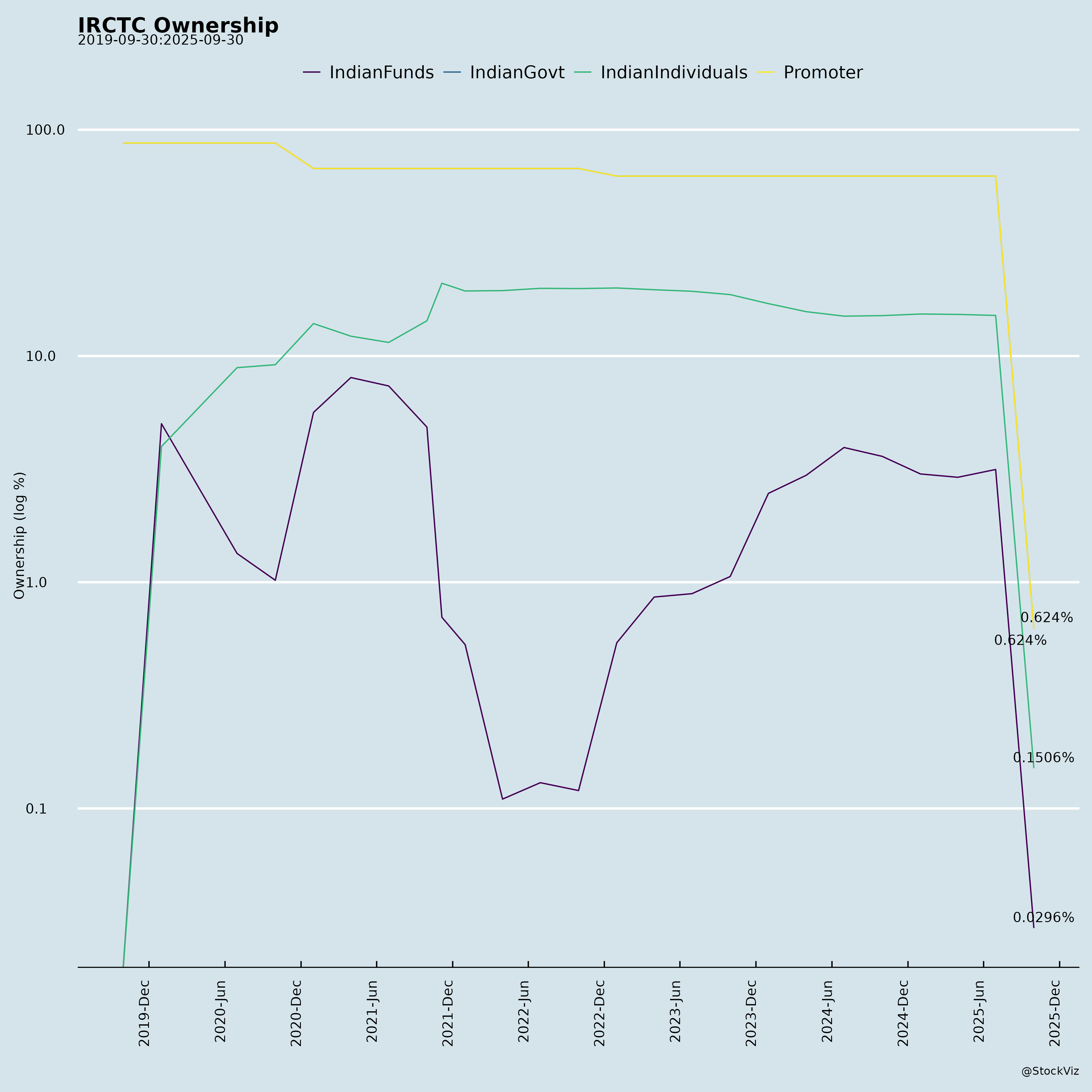

Ownership

Margined

AI Summary

asof: 2025-12-08

Based on a comprehensive analysis of the disclosed documents for Indian Railway Catering and Tourism Corporation Ltd. (IRCTC) — including the unaudited standalone and consolidated financial results, auditor review reports, related party disclosures, and regulatory event disclosures — here is a detailed assessment of the headwinds, tailwinds, growth prospects, and key risks associated with the company, followed by a concise summary.

🔍 1. Headwinds (Challenges / Downside Risks)

| Factor | Analysis |

|---|---|

| Regulatory Non-Compliance Fine | IRCTC has been fined ₹5.43 lakh each by BSE and NSE for failing to appoint a Woman Independent Director on its board as required under SEBI (LODR) Regulation 17(1). This represents governance headwinds. Although the company states it is a government entity and depends on the Ministry of Railways (MoR)/President of India for appointments, repeated non-compliance may affect investor perception and ESG ratings. |

| Outstanding Legal & Arbitration Matters | Despite favorable Supreme Court ruling, past litigation (e.g., arbitration claims of ~₹7,471 crore) required significant procedural and financial outlays (e.g., ₹8,471 crore bank guarantee deposited). While IRCTC is not financially impacted now, such matters consume management bandwidth and pose reputational risks. |

| Sub-Judice GST Profiteering Case | A National Anti-Profiteering Authority (NAA) notice alleging ₹504 crore profiteering related to Railneer bottled water pricing remains pending before GST Appellate Tribunal. Although the company argues MRP is government-controlled, this legal overhang persists and could involve potential future liability. |

| Input Tax Credit (ITC) Dispute with Rail Neer DCOs | IRCTC reimburses GST claims to Developer-Cum-Operators (DCOs) of 4 PPP Rail Neer plants net of ITC availed by them, but DCOs are not fully disclosing ITC, leading to incomplete claim validation. Claims worth ₹232.7 lakh were accounted in H1 FY26, but disputes remain unresolved. This poses receivables risk and litigation exposure. |

| Litigation Dependency on Indian Railways for Reimbursement | In several disputes (e.g., catering service differential claims), IRCTC argues that Indian Railways, not IRCTC, bears ultimate liability. However, delays or refusals in reimbursement would directly impact IRCTC’s balance sheet. Dependence on MoR for settlements introduces uncertainty. |

🌬️ 2. Tailwinds (Positive Catalysts)

| Factor | Analysis |

|---|---|

| Strong Financial Performance | IRCTC reported robust unaudited financials for Q2 and H1 FY26 (Sep 30, 2025). While exact revenue growth isn’t visible, cash flow from operations has improved significantly over the past year. Cash & equivalents grew from ₹37,579 lakhs (Mar ’25) to ₹60,273 lakhs (Sep ’25). |

| High Profitability & Low Leverage | The balance sheet shows net cash-rich position, low lease liabilities, and growing equity base (Other Equity up from ₹350,330 lakhs to ₹410,033 lakhs). Equity is primarily retained earnings, indicating strong internal accruals. |

| Supreme Court Victory on Arbitral Award | The Supreme Court’s verdict in favor of IRCTC on Oct 7, 2025, dismissing major arbitration claims, is a major positive. This removes a cloud of uncertainty and potential liability (~₹4,200 crore had earlier been upheld). It also affirms IRCTC’s legal and operational stance. |

| Exceptional Gains from Railways | ₹580.49 lakh income recognized in H1 FY26 due to reduced fixed/variable/custody charges on Tejas Express trains as per MoR directive. This signals cooperative relationship post-Catering Policy 2017 and potential for further cost rationalizations. |

| One-Time Reconciliation Gains | FY25 exceptional items include ₹4,788.73 lakh net gain from legacy balance reconciliation and write-back of excess provisions. This boosts profitability, reduces conservatism, and reflects better accounting maturity. |

| Interim Dividend Declaration | A dividend of ₹5 per share (250% on ₹2 face value) is declared for FY26, signaling confidence in liquidity and profitability. Shareholders benefit despite no debt repayment or buyback. |

🔮 3. Growth Prospects

| Area | Potential & Outlook |

|---|---|

| Dominance in Online Rail Ticketing | IRCTC remains the monopoly player in e-ticketing (Indian Railways network). With rising digital penetration and over 10 million daily bookings, ticket commission (service fee model) is a stable, high-margin business. Even small changes in per-ticket revenue can significantly boost earnings. |

| Rail Neer Expansion | The PPP model for Rail Neer via 4 plants shows scalability. With Railways pushing self-sufficiency in safe drinking water, expansion of brand footprint across stations could drive volume and branding revenue. |

| Tourism Segment Revival | Catering and tourism segments bore disruptions post-2020. The reversal of charges (Golden Chariot example) and reconciliation gains suggest revival. Post-pandemic travel (especially pilgrimage and tourist routes) can fuel growth in tourism packages, charter, and hospitality. |

| Monetization of Data & Ancillary Services | IRCTC sits on vast user data (travel patterns, demographics). Monetizing this via ads, credit scoring, insurance tie-ups, or travel ecosystems (hotels, cabs) is a latent opportunity. |

| Digital Ecosystem Expansion | IRCTC’s forays into retail (e-catering), payments (IRCTC Payments Ltd), and logistics could yield long-term synergy benefits. Payments subsidiary already contributes to consolidated results. |

⚠️ 4. Key Risks (Consolidated View)

| Risk Type | Key Points |

|---|---|

| Regulatory & Sovereign Risk | Dependent on Ministry of Railways for board appointments, policy direction, and reimbursement in disputed cases. Delays in action by government bodies (e.g., women director appointment) can trigger exchange penalties and governance concerns. |

| Litigation & Legal Exposure | Recurring legal battles (arbitrations, GST, ITC claims) — though mostly resolved favorably — still pose financial, reputational, and operational risks. The NAA profiteering case remains a material risk. |

| Revenue Concentration | Heavy reliance on rail ticketing and Railways-related contracts. Diversification into high-margin B2C retail or tech platforms is ongoing but limited. A shift in IR policy could disrupt revenue. |

| Execution Risk in PPP Projects | Rail Neer and Tejas are PPP models. Delays or mismanagement by DCOs, as seen in ITC disputes, could affect margins and timelines. |

| Technological & Cyber Risk | IRCTC’s platform handles millions of transactions daily. Any system outage or breach could severely damage customer trust and trigger regulatory scrutiny. |

| Limited Transparency in Segmental Assets | Company states it is impracticable to allocate assets across segments — limits investors’ ability to analyze segment ROI or asset efficiency. |

✅ Summary: IRCTC Investment Outlook (as of Nov 2025)

| Aspect | Evaluation |

|---|---|

| Financial Health | Strong — growing reserves, positive cash flows, net cash position. Interim profits supported by operational efficiency and exceptional gains. |

| Governance | Moderate concern — regulatory fine for non-compliance (no woman director), though explained as government appointment bottleneck. Needs improvement. |

| Legal Status | Significant improvement — Supreme Court win removes major prior risk. Other cases still pending or under appeal, but exposure appears contained. |

| Growth Trajectory | Stable + improving — core ticketing generates reliable income. Ancillary businesses (Rail Neer, tourism, payments) show signs of revival and scalability. |

| Dividend Policy | Shareholder-friendly — Rs 5 interim dividend (250%) reflects strong cash position and confidence. |

| Key Risks | Sovereign dependency, ongoing GST/profiteering case, ITC disputes with DCOs. |

| Market Opportunity | Monopoly in rail e-ticketing, large unmet demand in travel tech and FMCG (Rail Neer), growing digital adoption. |

🔚 Conclusion & Investment Sentiment

IRCTC continues to be a “Wide Moat,” Govt-Backed Monopoly" play with strong financials and stable revenue streams.

The recent legal resolution in its favor is a major positive, boosting confidence. The dividend and cash buildup signal financial strength.

However, governance issues (board composition), sovereign dependency, and pending regulatory cases pose moderate downside risks.

Outlook: Neutral to Positive

- Long-term investors: May view this as a low-beta, dividend-generating blue-chip PSU with latent value in digital expansion.

- Growth investors: Might find limited upside unless non-ticketing segments scale significantly.

- Watch: Resolution of NAA case, MoR approvals for independent directors, and expansion of IRCTC Payments and Rail Neer.

📌 Key Figures at a Glance (Standalone, as of Sep 30, 2025)

| Metric | Value (₹ Crore approx.) |

|---|---|

| Total Assets | ₹763,088 Lakhs (~₹76,300 Cr) |

| Cash & Equivalents | ₹60,272.77 Lakhs (~₹6,027 Cr) |

| Equity | ₹426,033.41 Lakhs (~₹42,603 Cr) |

| Bank Balances (non-cash) | ₹232,126 Lakhs (~₹23,212 Cr) |

| Profit Before Tax (PBT) | ~₹90,000 Lakhs (H1 FY26) |

| Interim Dividend | ₹5/share (250% on ₹2 FV) |

| Audit Status | Unaudited (Limited Review by Statutory Auditors) |

⭐ Final Verdict: Hold (Accumulate on Dips)

| Criteria | Rating |

|---|---|

| Financials | ✅✅✅✅ (Strong) |

| Governance | ⚠️✅✅ (Partial Concern) |

| Growth | ✅✅✅ (Moderate) |

| Risk Profile | ⚠️⚠️✅ (Controlled but Present) |

| Dividend Yield | ✅✅✅✅ (Attractive) |

Ideal for conservative investors seeking stable returns and dividends, but monitor governance and litigation developments closely.

Data Source: IRCTC’s November 12 & 30, 2025 disclosures, BSE/NSE filings, Auditor Reports, Financial Statements (Unaudited), CIN: L74899DL1999GOI101707.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.