INFY

Equity Metrics

January 13, 2026

Infosys Limited

Computers - Software & Consulting

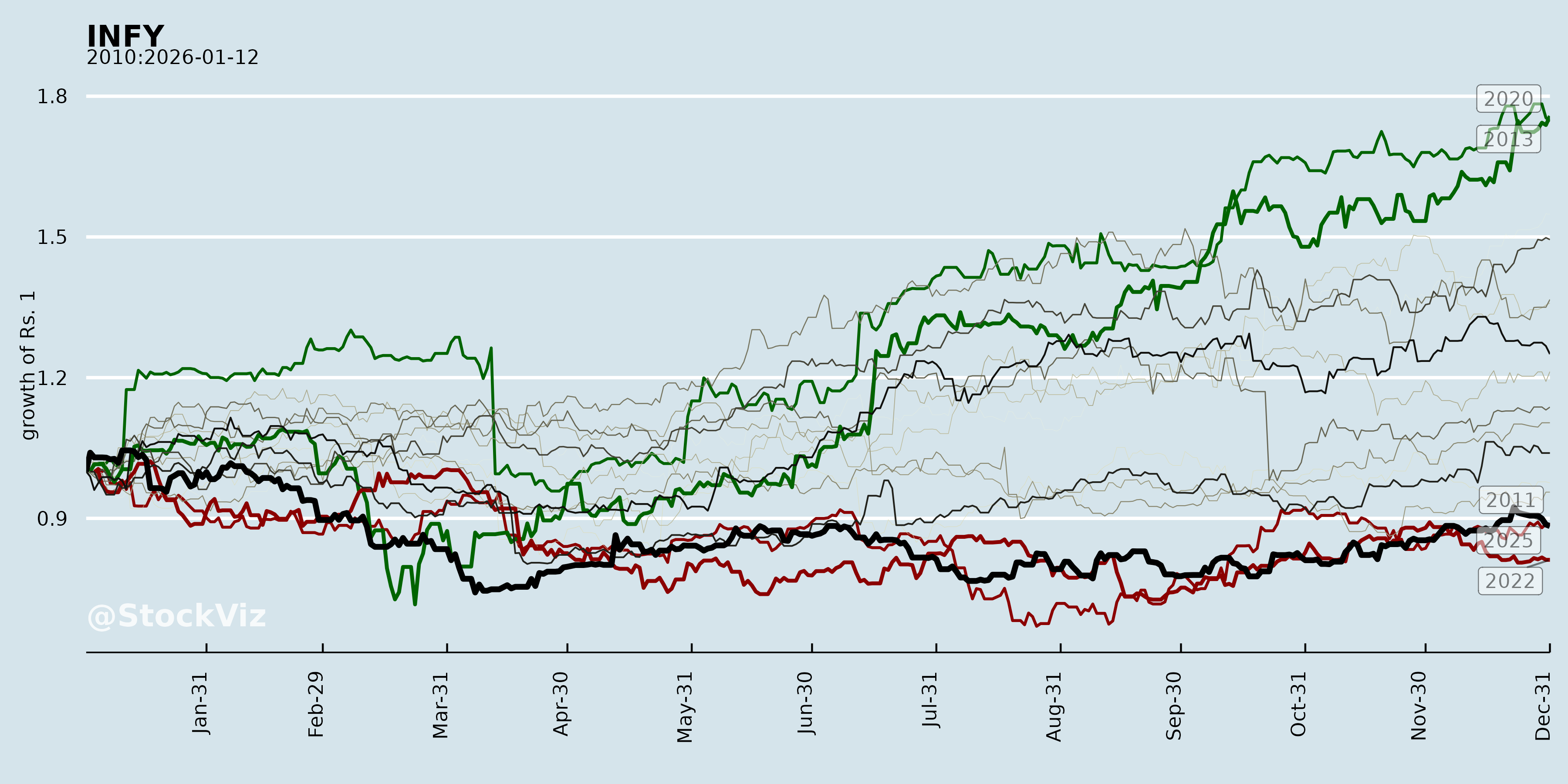

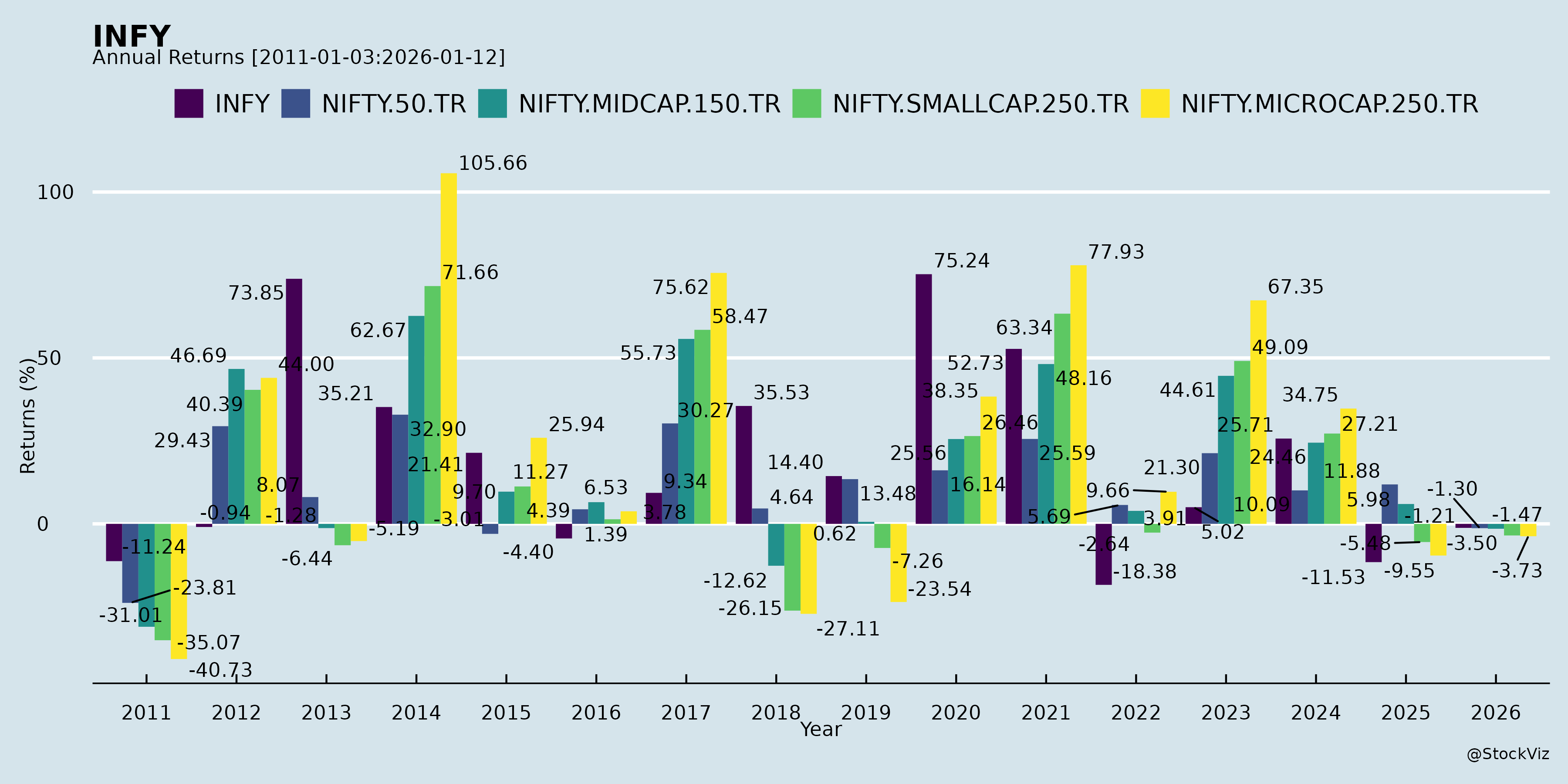

Annual Returns

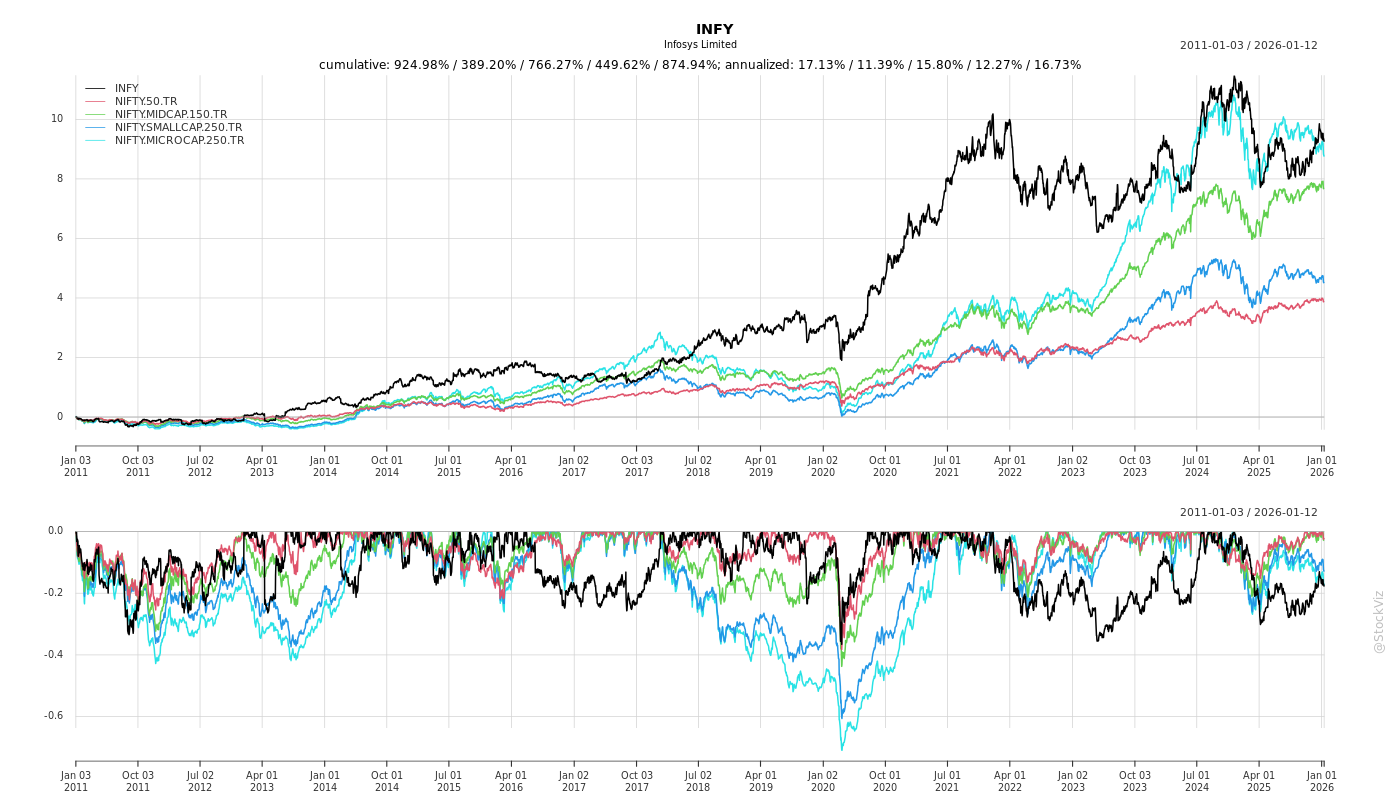

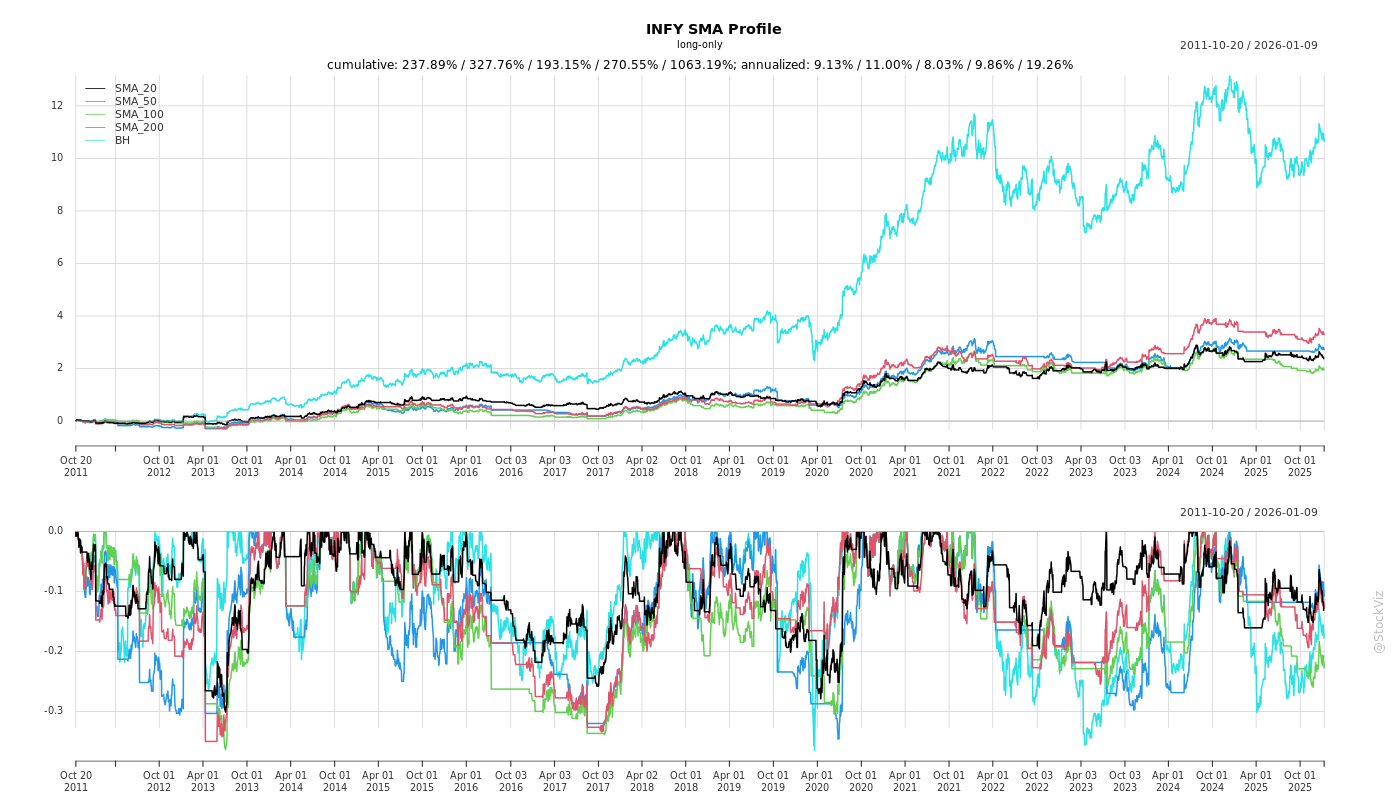

Cumulative Returns and Drawdowns

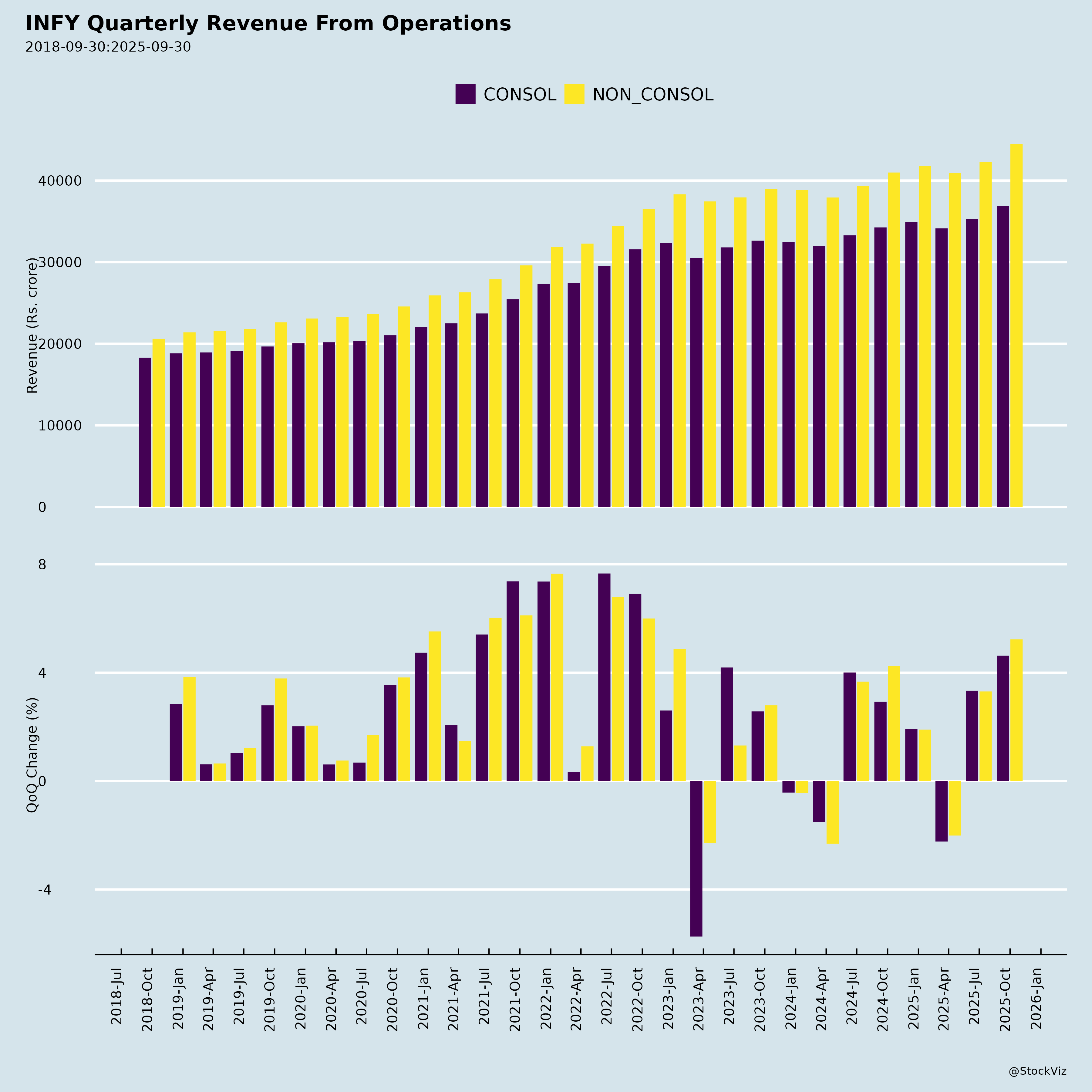

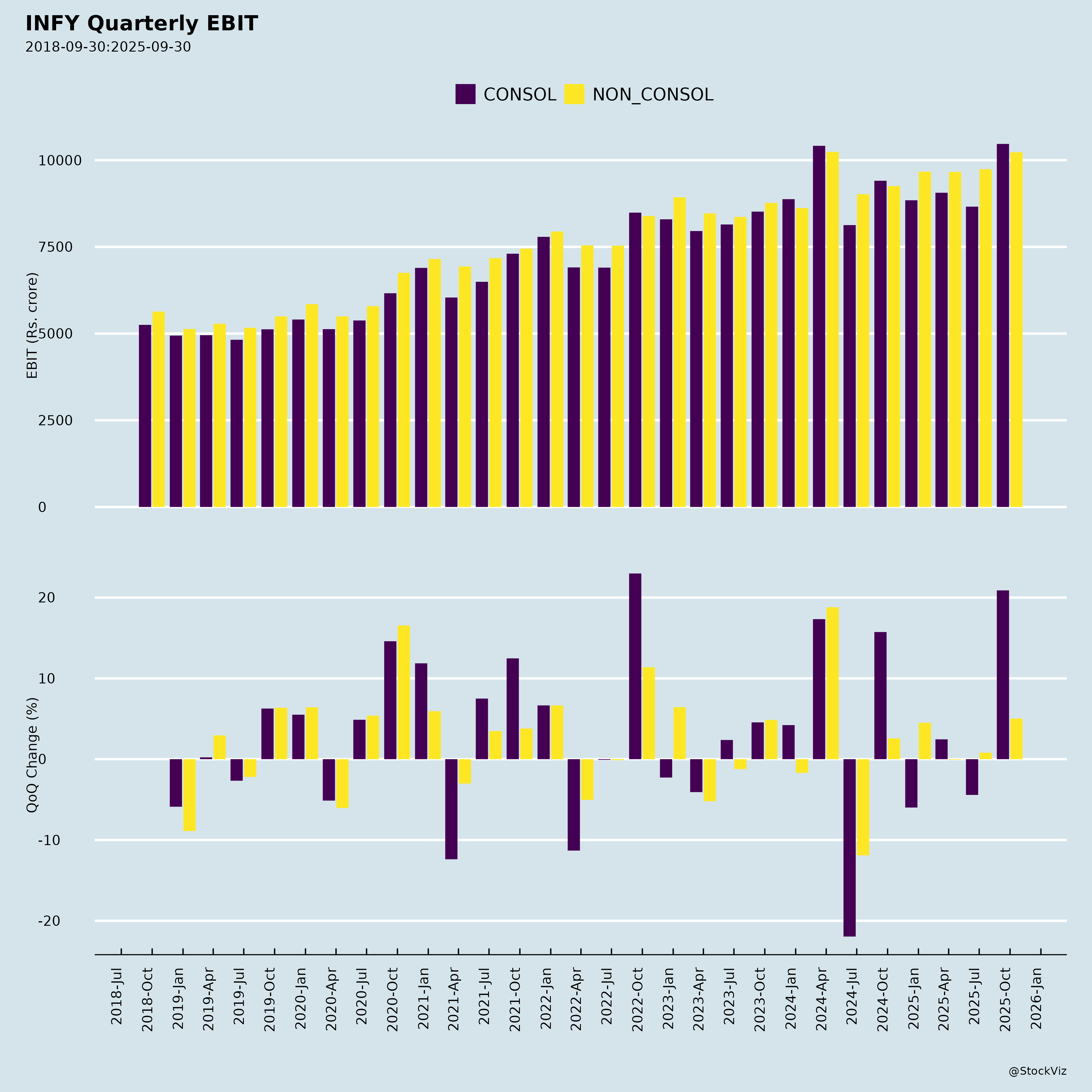

Fundamentals

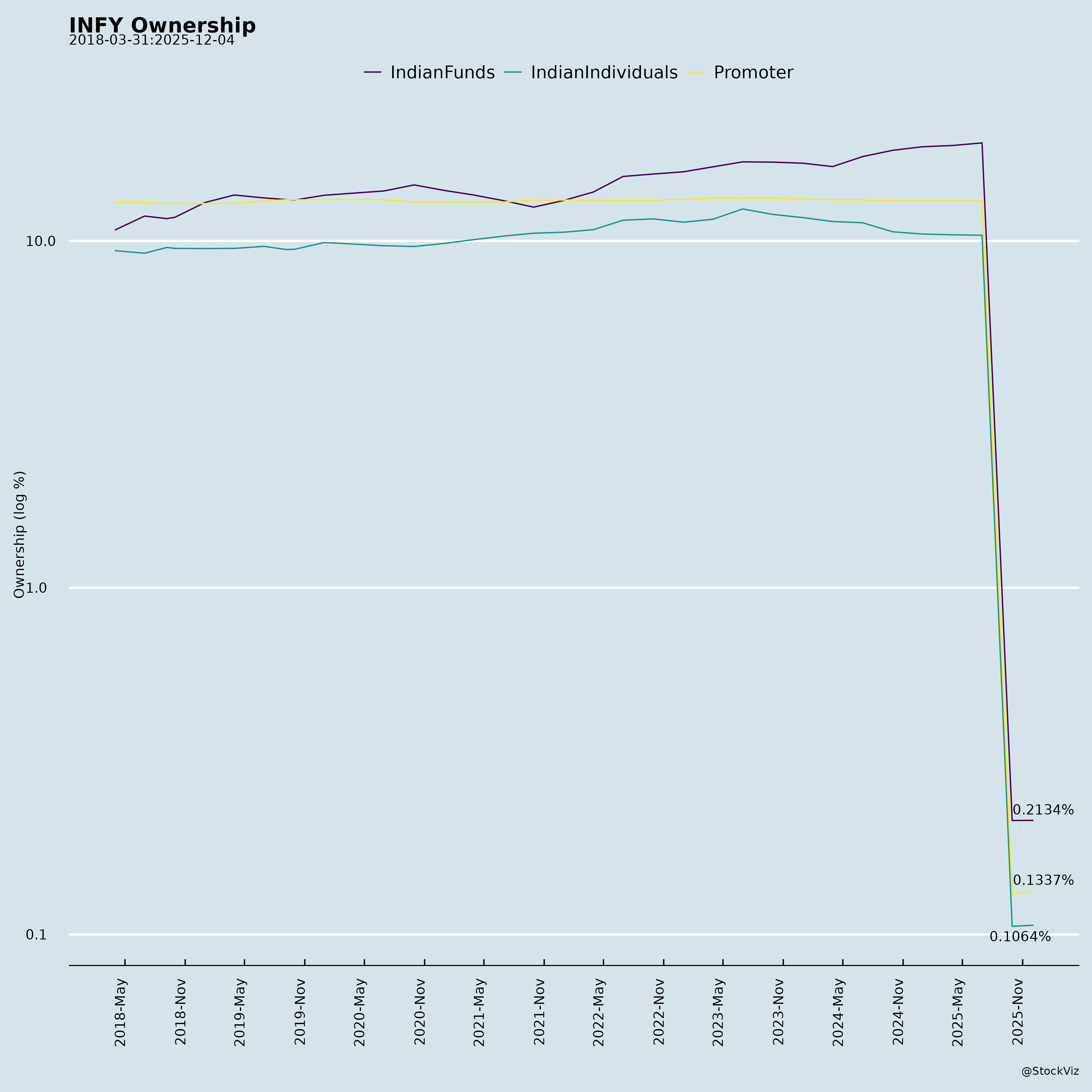

Ownership

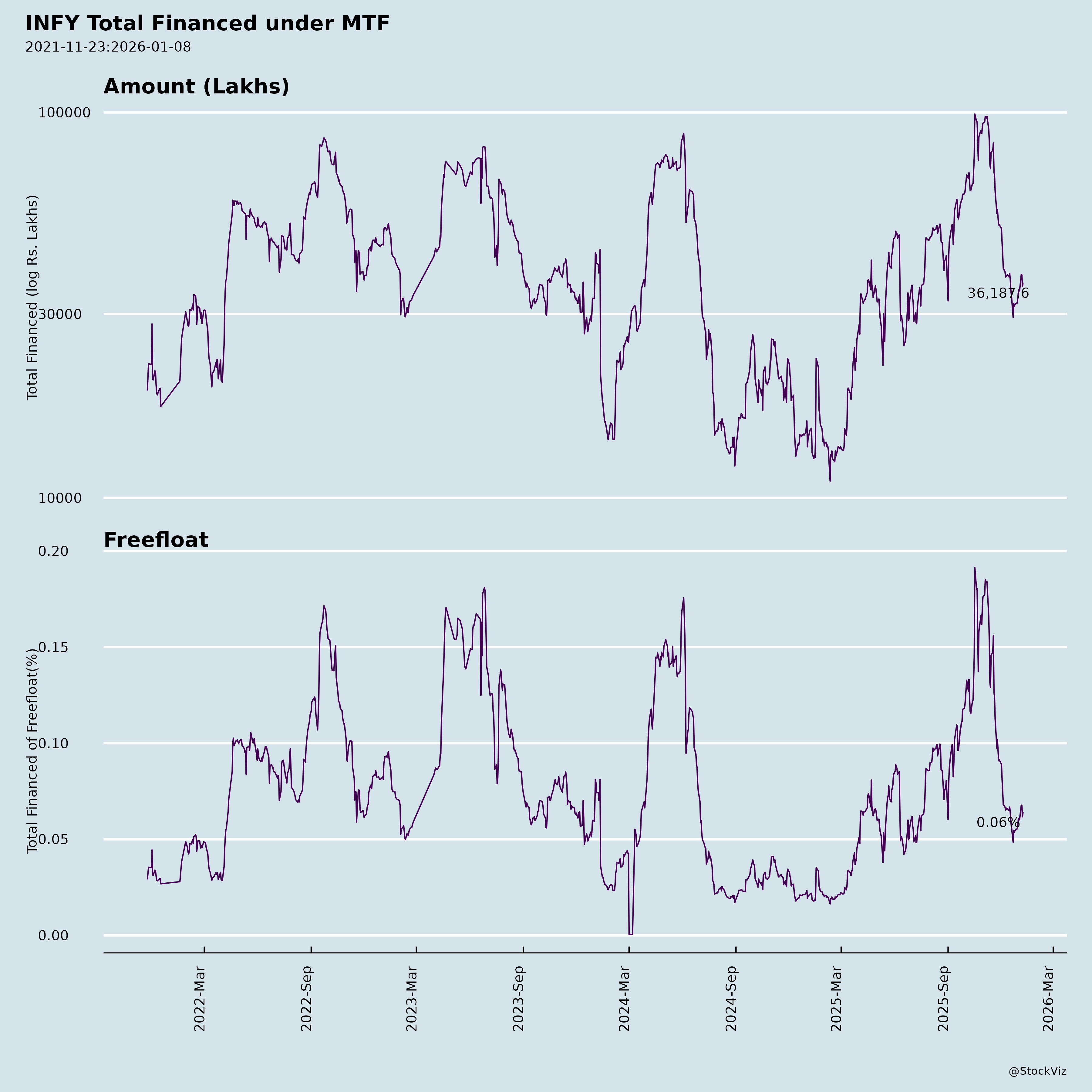

Margined

AI Summary

asof: 2025-12-08

INFY (Infosys Limited) – Investment Analysis Summary

Based on Postal Ballot Results, Buyback Proposal, and Corporate Governance Updates (November 6, 2025)

🔍 Executive Summary

Infosys Limited (INFY) has successfully passed a special shareholder resolution via remote e-voting to buy back ₹18,000 crore worth of equity shares at ₹1,800 per share. The buyback received overwhelming approval (98.81% in favor), reflecting strong investor confidence in management and corporate strategy. This analysis evaluates the headwinds, tailwinds, growth prospects, and key risks based on the disclosed data, regulations, and macro context.

✅ TAILWINDS (Positive Factors Supporting INFY)

2. Significant Capital Return Program (Buyback)

- Buyback of ₹18,000 crore (~$2.16 billion) signals:

- Confidence in long-term business sustainability and cash flow generation.

- Commitment to capital efficiency and shareholder value creation.

- The buyback size is 21.68% of consolidated free reserves, indicating financial prudence.

- Price: ₹1,800/share, likely representing a premium to prevailing market prices (assuming current trading below or near this level).

3. Healthy Cash & Balance Sheet Dynamics

- Buyback funded from free reserves and securities premium account, highlighting:

- Strong internal accruals.

- High liquidity buffer, even amid volatile tech demand cycles.

- No debt-based funding used — underscores low financial risk.

4. Enhanced Valuation Metrics Post-Buyback

- Buyback reduces outstanding shares by ~10 crores (~2.41% of paid-up capital).

- Expected improvement in:

- Earnings Per Share (EPS).

- Return on Equity (ROE).

- Shareholder capital intensity.

⚠️ HEADWINDS (Challenges & Market Risks)

1. Potential Misallocation of Capital in a Slow Growth Phase

- Infosys has faced revenue growth headwinds in recent quarters due to:

- Slowing client spending in North America and Europe (its major markets).

- Freeze or de-prioritization of IT budgets in BFSI and retail sectors.

- Critics may argue that ₹18,000 crore could be better used for:

- Acquisitions (e.g., in AI, cloud, cybersecurity).

- R&D and digital upskilling.

- Capital increases during downturns.

2. Operational Leverage Pressures

- Despite strong margins, Infosys has seen declining revenue per employee and increasing attrition.

- Buyback may signal lack of high-return organic growth opportunities.

3. Macro Uncertainty in Key Markets

- Global inflation, recession fears, and geopolitical tension continue to impact IT spending.

- U.S. and European markets (70%+ of revenue) remain vulnerable to further tech budget cuts.

🌱 GROWTH PROSPECTS (Future Drivers)

1. AI and Generative AI Acceleration

- Infosys has launched Topaz, its AI-first suite, which is being adopted across clients.

- Strong potential for AI-powered automation, cloud modernization, and data analytics partnerships.

- Buyback could free up capital for scaling AI investments post-approval.

2. Digital Transformation Services Demand

- Despite near-term macro issues, long-term digital transformation (cloud, ERP, cybersecurity, DevOps) remains a tailwind.

- Infosys’ SAP, Oracle, Salesforce partnerships position it well for ERP migration and cloud integration projects.

3. Hybrid Work & Infrastructure Modernization

- Organizations continue to refresh legacy systems and invest in hybrid IT infrastructure.

- Infosys’ systems integration capabilities remain in demand.

4. Strategic Re-positioning Under New Leadership

- New CEO Salil Parekh’s extended tenure (2025–2028) provides strategic continuity.

- Focus on operational excellence, employee engagement, and client retention.

⚠️ KEY RISKS

| Risk | Description |

|---|---|

| 1. Slower-than-expected Demand Recovery | Global economic slowdown may prolong weak IT spending, impacting revenue growth and margins. |

| 2. Talent & Attrition Challenges | High attrition (especially mid-level) and competitive wage pressures may erode margins. |

| 3. Regulatory & Compliance Risks | Buyback requires adherence to SEBI Buyback Regulations, FEMA, RBI, and SEC (for ADSs). Any non-compliance could trigger penalties. |

| 4. Execution Risk in Acquisitions | Past M&A integration (e.g., in AI/cloud firms) has been mixed; future deals may underperform. |

| 5. Currency Volatility | Revenue in USD (75%+) but costs in INR — rupee appreciation could hurt margins. |

| 6. Over-reliance on Key Clients | Top 10 clients contribute ~30% of revenue; loss of any could significantly impact results. |

| 7. Cybersecurity & Data Privacy Risk | As a service provider, Infosys is a target for cyberattacks, exposing reputational and contractual risks. |

📊 Financial Impact of Buyback (Estimated)

| Metric | Pre-Buyback | Post-Buyback (Est.) |

|---|---|---|

| Shares Outstanding | ~4,154 million | ~4,054 million |

| Buyback Size | - | ₹18,000 crore (~$2.16B) |

| Buyback Price | - | ₹1,800/share |

| Shares Repurchased | - | 10 crore |

| % of Shares Bought Back | - | ~2.41% |

| Impact on EPS | Base | ~+2.5% (all else equal) |

| Cash Depletion | High cash reserves | Slight reduction; still strong liquidity |

🏁 Conclusion: Buy, Hold, or Watch?

✅ Recommendation: Long-Term Buy / Accumulate on Dips

Rationale: - Strong balance sheet and capital management. - Shareholder-friendly capital return policy. - Management confident in long-term profitability despite current headwinds. - Strategic focus on AI and digital transformation.

📌 Key Points for Investors:

- Near-term (6–12 months): Mixed outlook due to macro pressures, possible earnings revisions.

- Medium-to-Long Term (1–3 years): Upside potential driven by AI monetization, operational improvement, and margin stability.

- Buyback provides downside protection and enhances shareholder returns during subdued valuations.

🔔 Watch For:

- Next 2 quarterly earnings for revenue growth trajectory.

- AI deal wins and utilization rates.

- Attrition and wage cost trends.

- Buyback implementation timeline (record date, tender process).

📎 Regulatory & Disclosure Compliance

- Infosys has fully complied with SEBI LODR Regulations, Companies Act 2013, and Buyback Regulations 2018.

- Transparency in voting results, public advertisement, and independence of scrutinizer reinforces investor confidence.

Final Verdict: INFY – A Defensive Tech Play with Growth Catalysts

Infosys is using its financial strength to navigate uncertainty. While not the most aggressive growth player, it offers resilience, dividends, and capital returns, making it a core holding for conservative investors in the IT sector. The successful buyback approval is a vote of confidence not just in Infosys, but in India’s corporate governance standards.

Data as of November 6, 2025. Sources: Infosys Postal Ballot Results, Scrutinizer Report, Minutes, SEBI, MCA, company filings.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.