INDUSINDBK

Equity Metrics

January 13, 2026

IndusInd Bank Limited

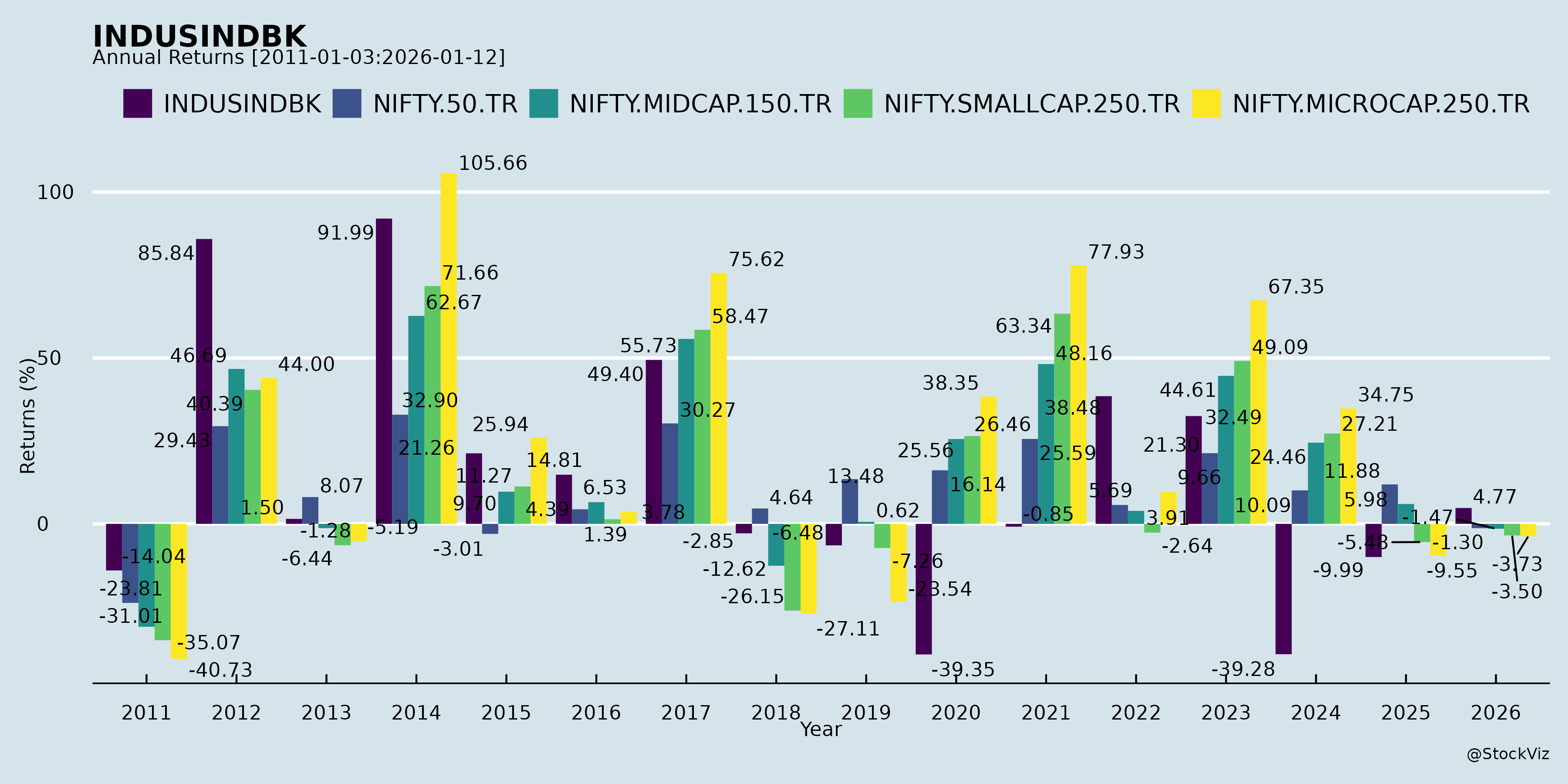

Annual Returns

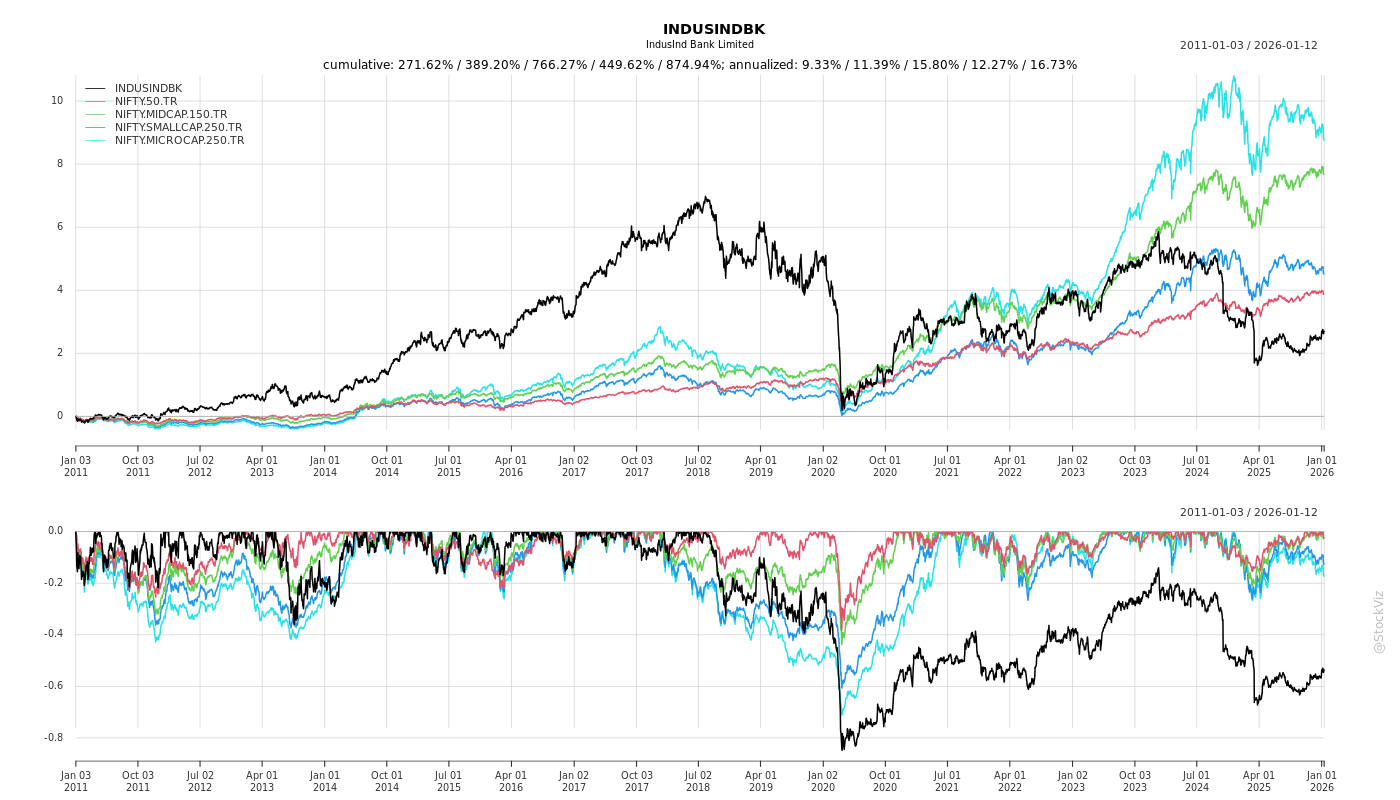

Cumulative Returns and Drawdowns

Fundamentals

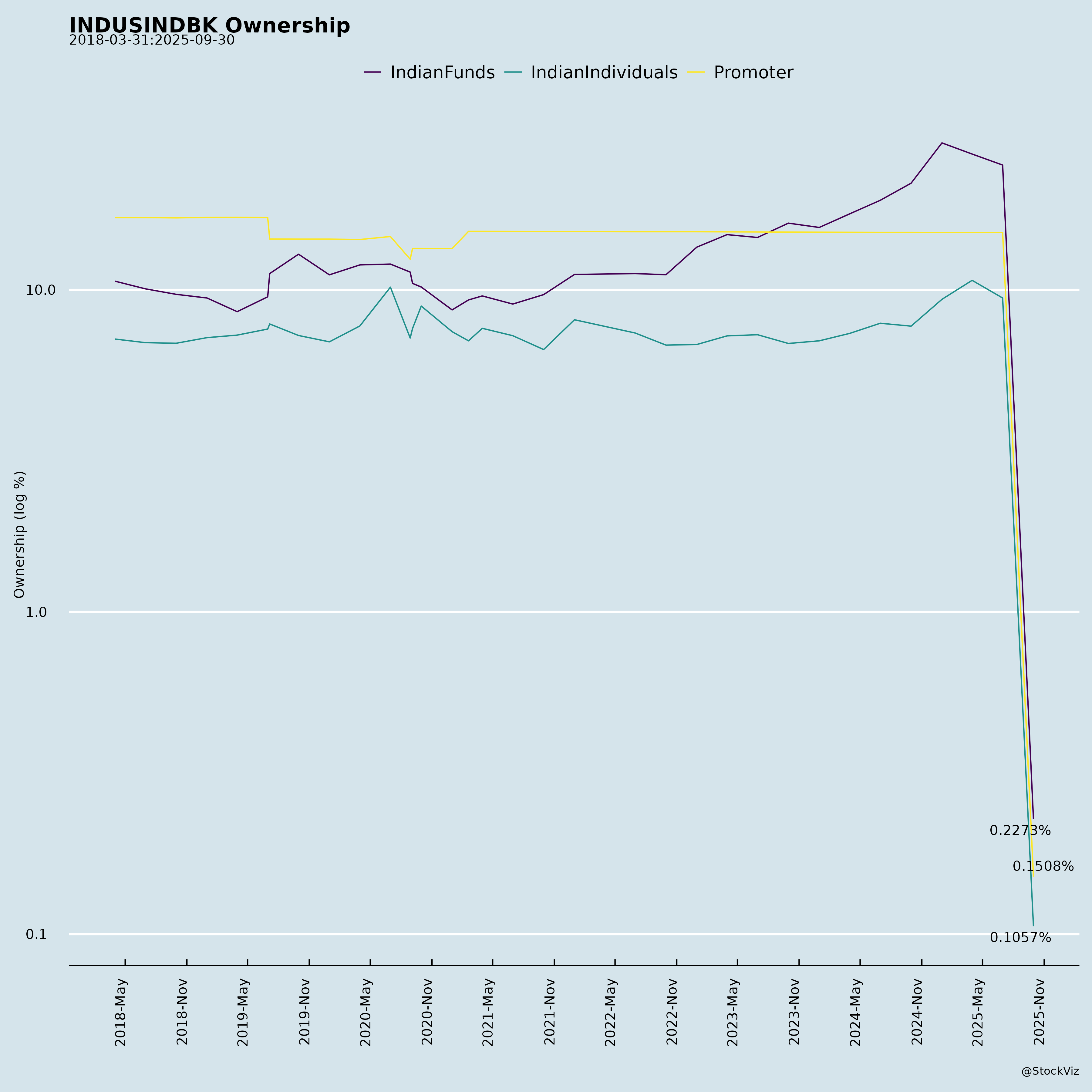

Ownership

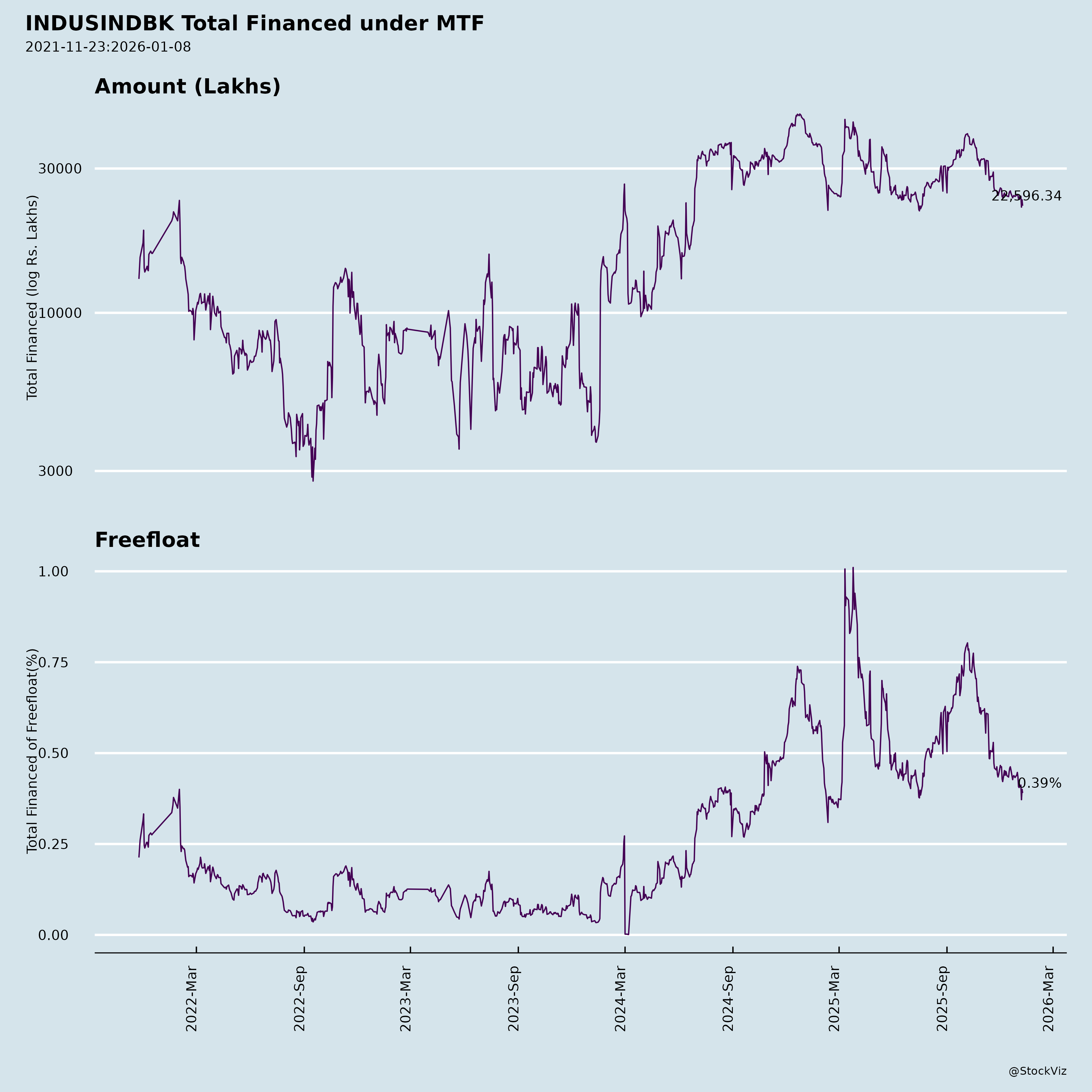

Margined

AI Summary

asof: 2025-12-03

IndusInd Bank (INDUSINDBK) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Summary Overview:

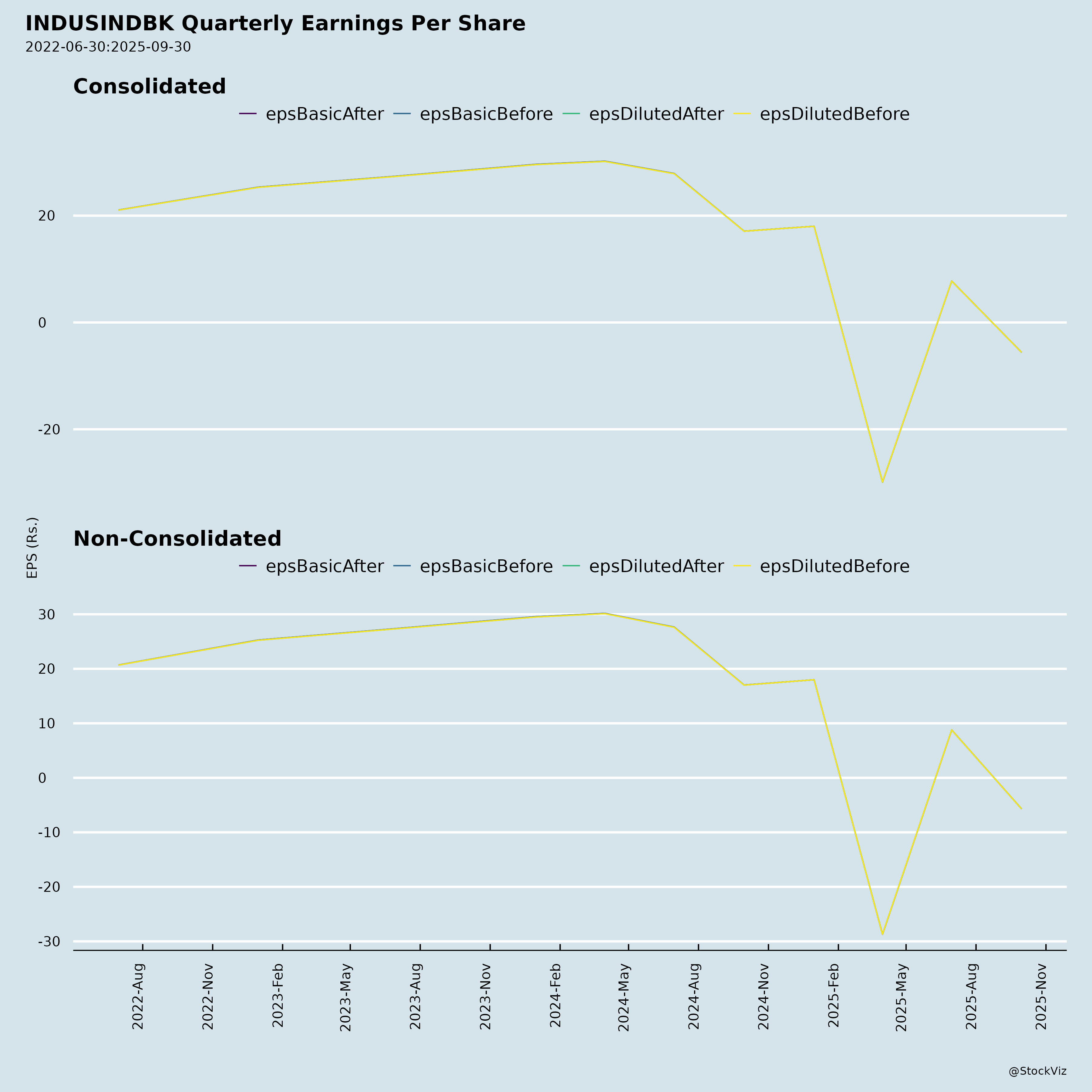

IndusInd Bank reported a challenging Q2 FY26 (Sep 2025) with a net loss of ₹437 Cr (vs. ₹1,331 Cr profit YoY), driven by high provisions (up 45% YoY to ₹2,631 Cr) amid microfinance stress, leading to loan/deposit contraction (down 9%/6% YoY). NIM compressed to 3.32% (down 76 bps YoY), but asset quality stabilized QoQ (GNPA 3.60%, NNPA 1.04%), PCR improved to 72%, and CRAR remained robust at 17.10%. The bank denied capital raise rumors, emphasizing strong buffers. Retail-focused franchise (60% loans) and digital momentum provide resilience, but microfinance (7% loans) is a drag. Outlook: Cautious recovery play with high capital enabling selective growth.

Headwinds (Key Pressures)

- Balance Sheet Contraction: Loans down 9% YoY to ₹3.26 lakh Cr; deposits down 6% YoY to ₹3.90 lakh Cr due to deliberate de-risking (e.g., microfinance book slashed 35% YoY to ₹21k Cr amid stress).

- Profitability Squeeze: NII down 18% YoY to ₹4,409 Cr; NIM at 3.32% (down 76 bps YoY, 14 bps QoQ) from yield compression (11.23%) and rising deposit costs (6.23%, up 32 bps YoY). Net loss from elevated provisions; cost-to-income at 66% (up 1401 bps YoY).

- Microfinance Stress: Portfolio GNPA at 18.81% (up from 16.39% QoQ); fresh slippages peaked; collections dipped to ~98% (from 99%+). Industry cyclical pressures evident.

- Market Perception: Speculative news on $1 Bn QIP (denied Nov 21), signaling capital concerns despite strong CRAR.

- Higher Costs: Operating expenses up 2% YoY; fee income down 27% YoY.

Tailwinds (Supportive Factors)

- Asset Quality Stabilization: GNPA stable at 3.60% QoQ (PCR up to 72%); NNPA down to 1.04%. Vehicle finance (29% loans) resilient (GNPA ~2-3%); corporate ratings improved.

- Strong Capital & Liquidity: CRAR 17.10% (Tier-1 15.88%, excluding H1 PAT); LCR avg. 132% (well above 100%). Enables deleveraging without equity dilution.

- Granular Retail Franchise: 60% loans retail (vehicle/non-vehicle); CASA 31%; retail deposits ~47% (per LCR). Low reliance on bulk deposits.

- Digital Momentum: INDIE MAU up 39% QoQ; digital DIY assets up 41% YoY; ~90-100k monthly digital clients at 0.2-0.5x offline CAC.

- Diversification: Vehicle (29%, stable disbursals), LAP/BB growth; treasury low-risk; ESG ratings strong (61/100 CRISIL).

Growth Prospects

- Retail & Digital Scaling: Vehicle finance market leader (35+ yrs vintage); non-vehicle retail (e.g., LAP up 10% YoY). Digital 2.0: 45-50% DIY share; BFIL rural reach (1.64L villages).

- Deposit Mobilization: Granular retail focus (47% LCR retail deposits up 1% YoY); branch expansion (3,116 outlets).

- NIM Recovery Potential: Yield/cost stabilizing QoQ; focus on high-yield retail (13.45% consumer yield).

- Post-Stress Rebound: Microfinance cleanup (79% disbursals to >1-yr vintage clients) positions for FY27 growth; overall loan mix 60:40 retail:wholesale.

- Macro Tailwinds: Economic recovery (fiscal/monetary support); potential rate cuts aiding NIM. Target: Sustainable ROA/ROE via 3-4% NIM, <60% cost-income.

Key Risks

- Microfinance Concentration (7% loans): High slippages (new stress indexed up); industry over-leverage (portfolio 44% unique BFIL+1); BFIL auditor qualified review on governance/operational losses.

- Provisioning Drag: Conservative stance (₹10,444 Cr provisions, 3.2% loans) could persist if stress spreads (e.g., two-wheelers GNPA 11.61%).

- Regulatory/Compliance: Past discrepancies (derivatives ₹1,960 Cr, MFI income ₹846 Cr) under probe; disciplinary actions ongoing. BFIL governance lapses noted.

- Interest Rate & Macro Sensitivity: NIM vulnerability to rate hikes; slowdown in vehicle/MSME could hit 40%+ loan book.

- Execution Risks: Deposit outflows if wholesale flight continues; digital scaling amid competition; capital event if RWA swells without growth.

Investment Thesis Snapshot: Hold/Neutral – Defensive positioning (high CRAR/LCR) cushions downside, but microfinance cleanup caps near-term earnings. Growth hinges on retail/digital execution and MFI normalization (H2 FY26+). Monitor Q3 provisions and deposit trends. Valuation: Likely trading at discount to peers on asset quality fears, but strong buffers limit severe downside.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.