IDEA

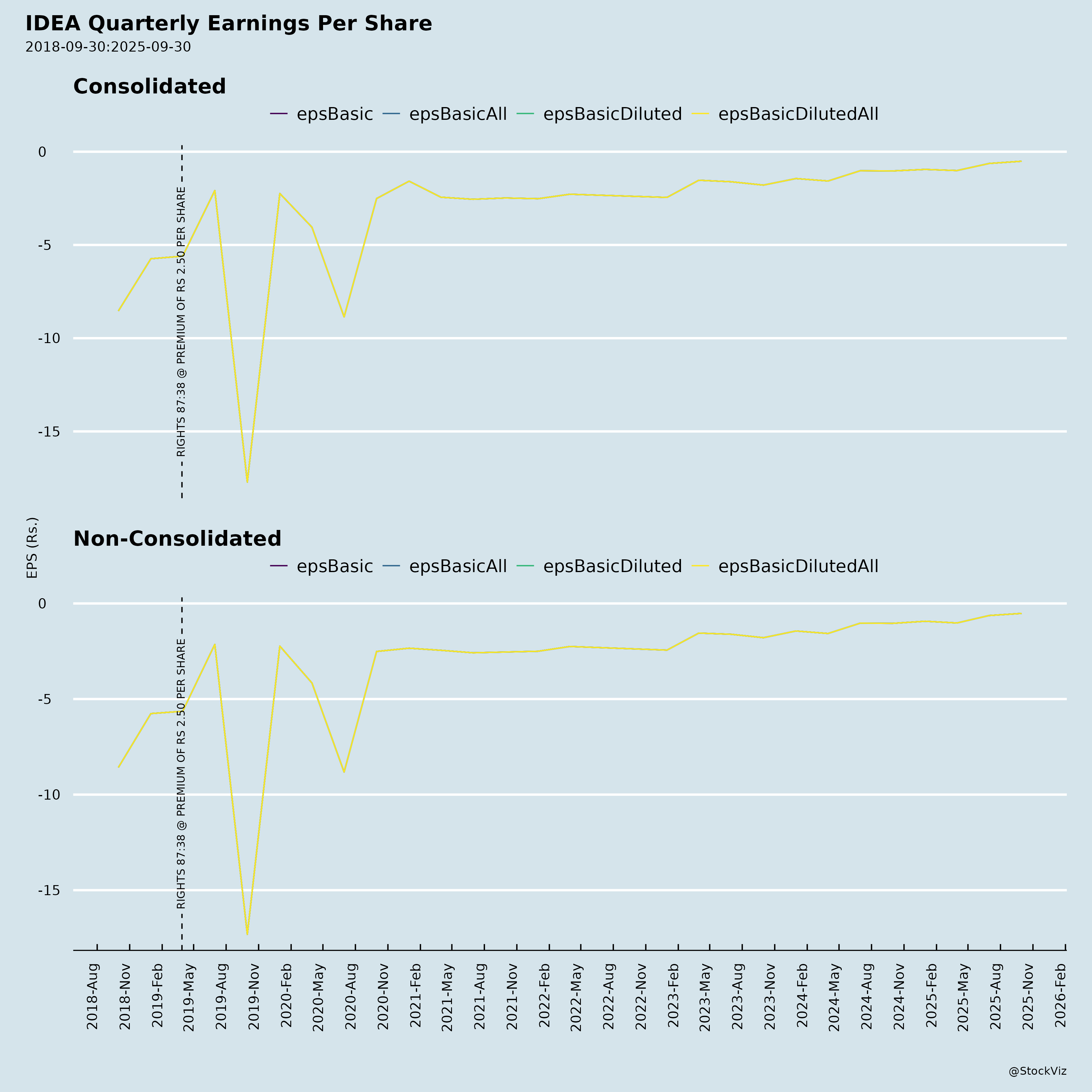

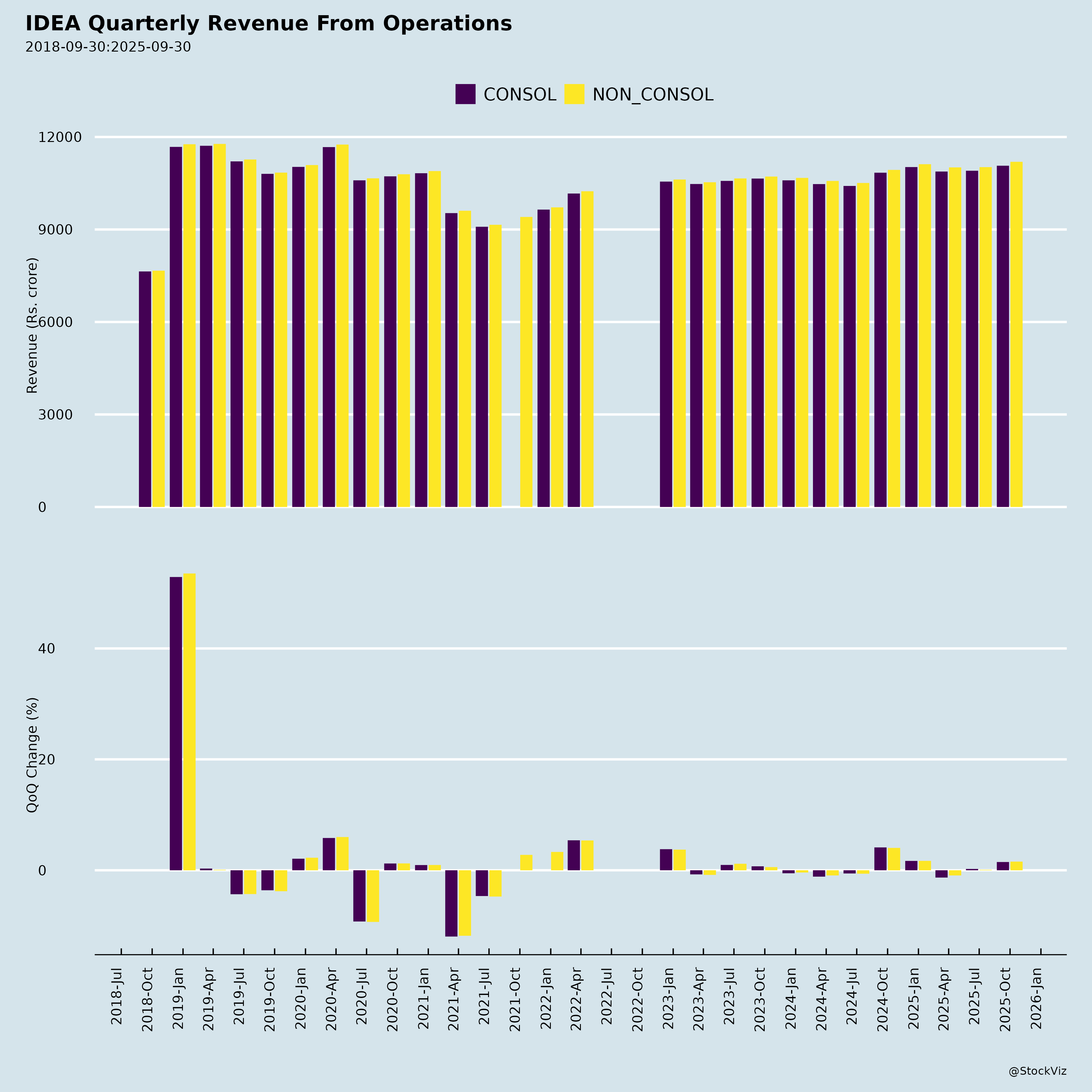

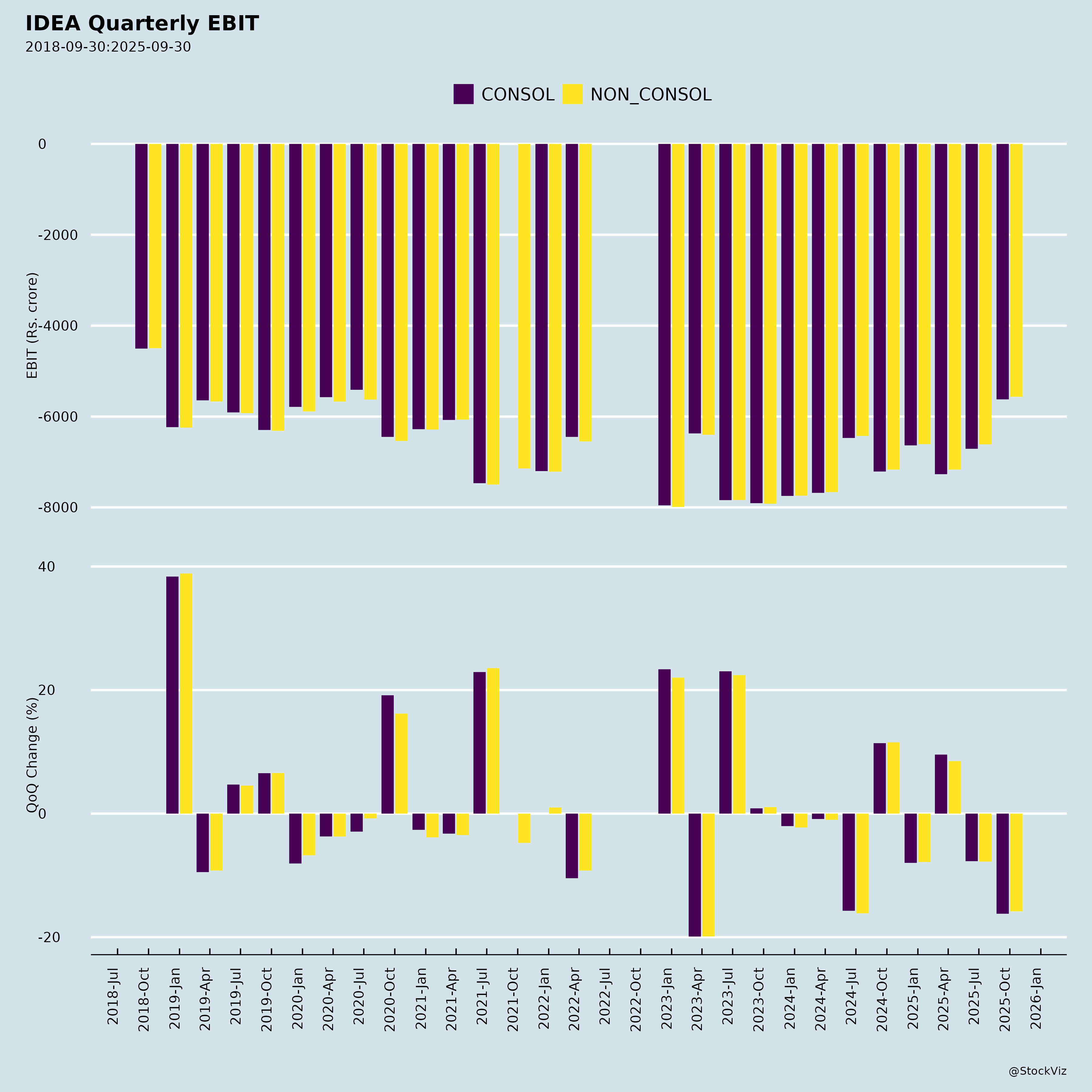

Equity Metrics

January 13, 2026

Vodafone Idea Limited

Telecom - Cellular & Fixed line services

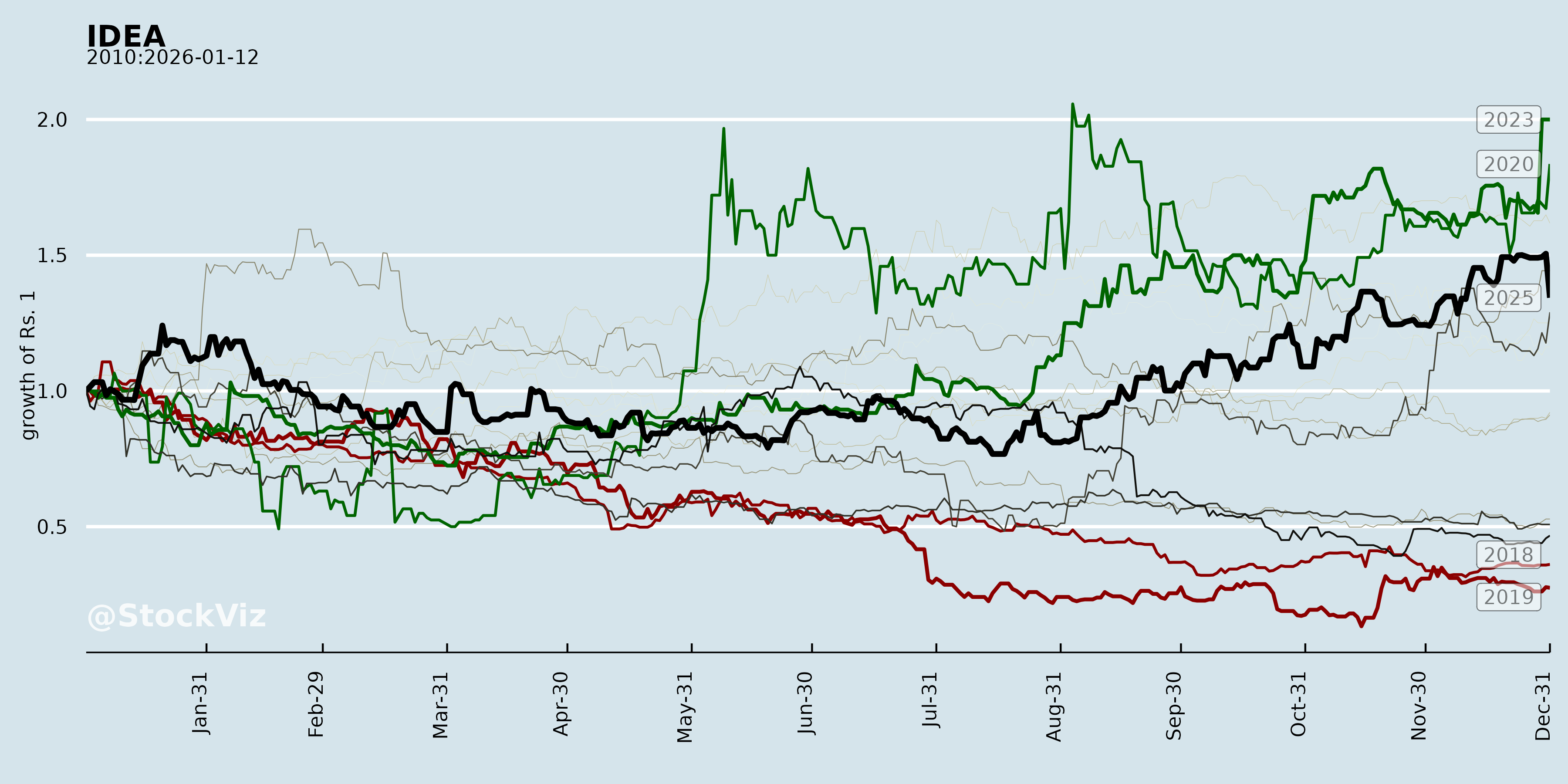

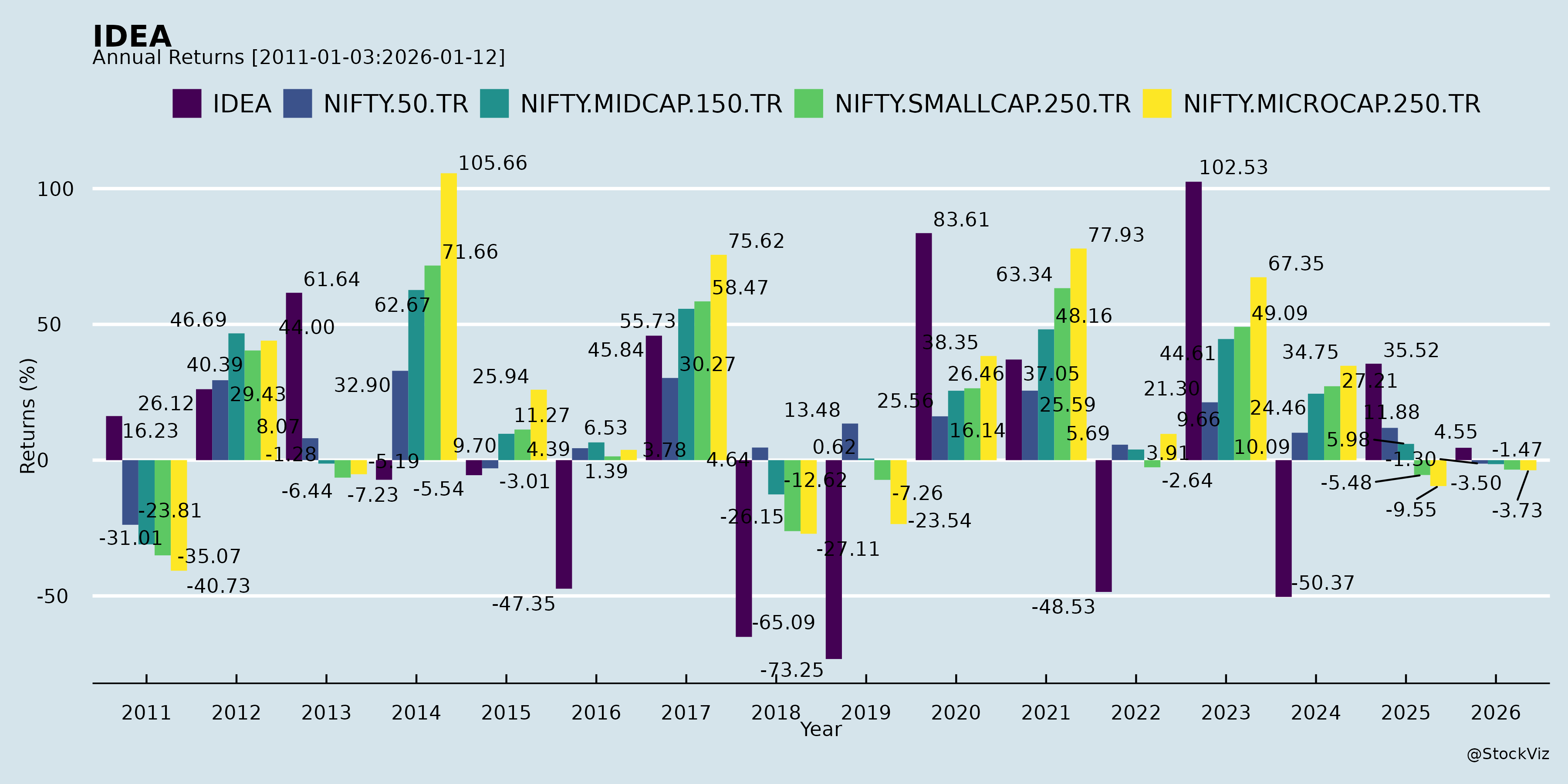

Annual Returns

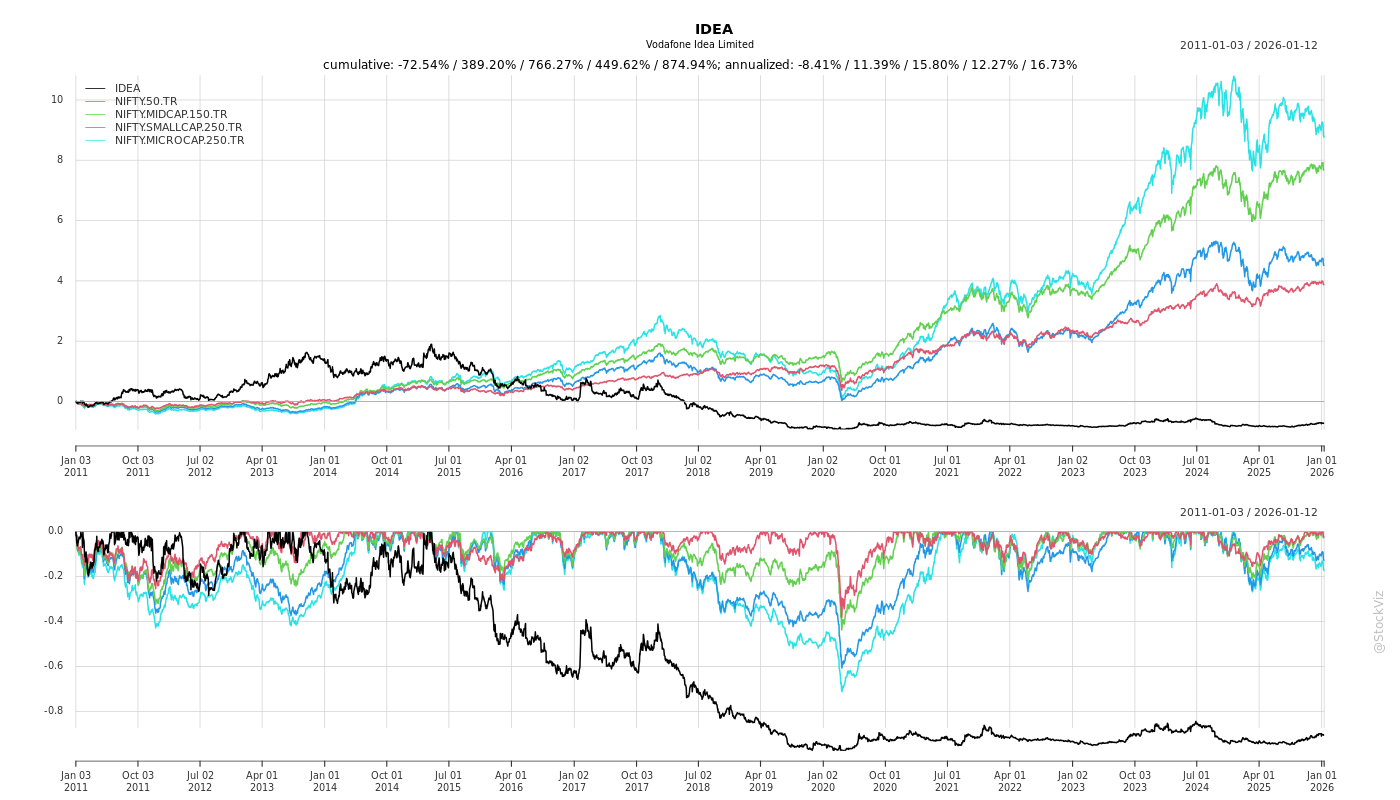

Cumulative Returns and Drawdowns

Fundamentals

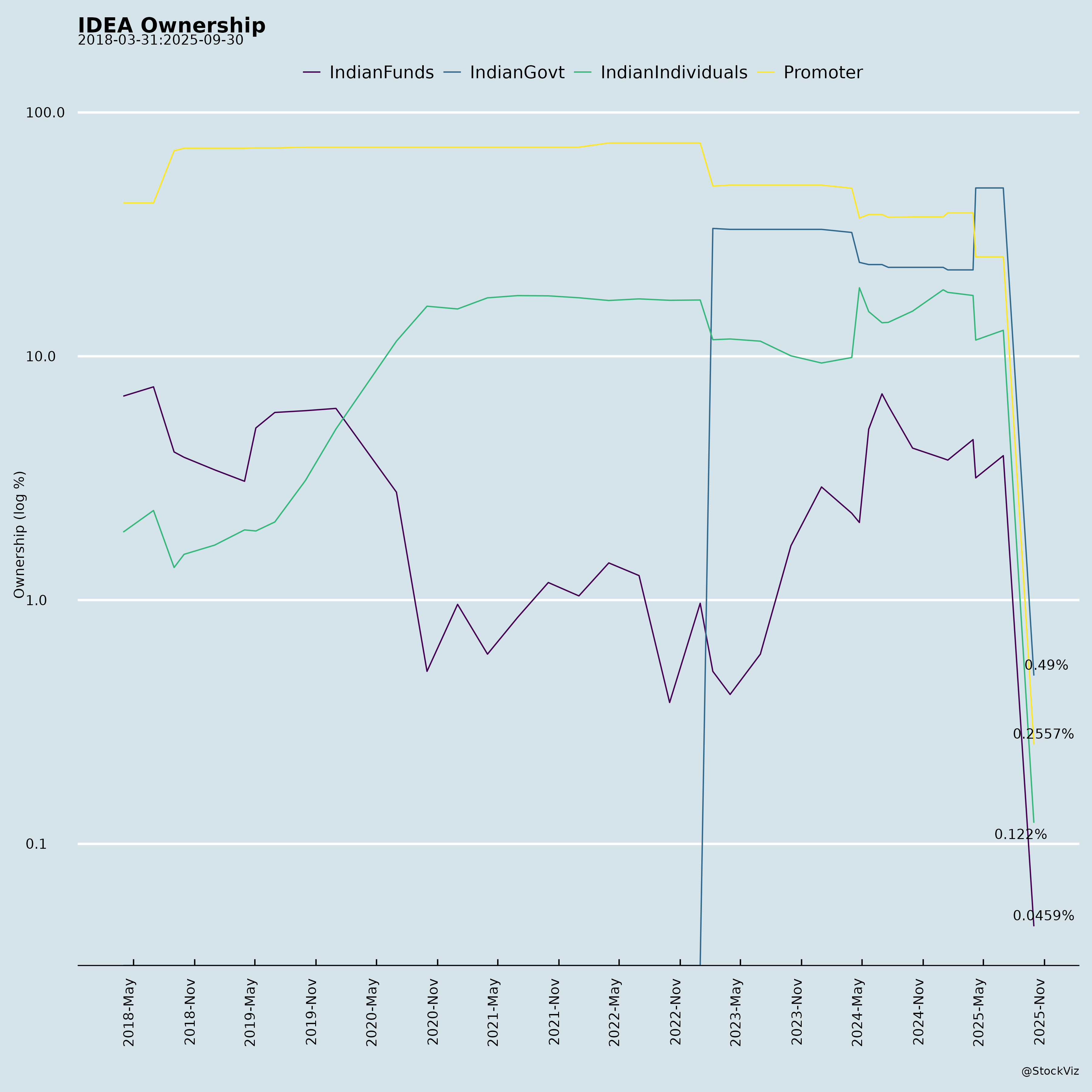

Ownership

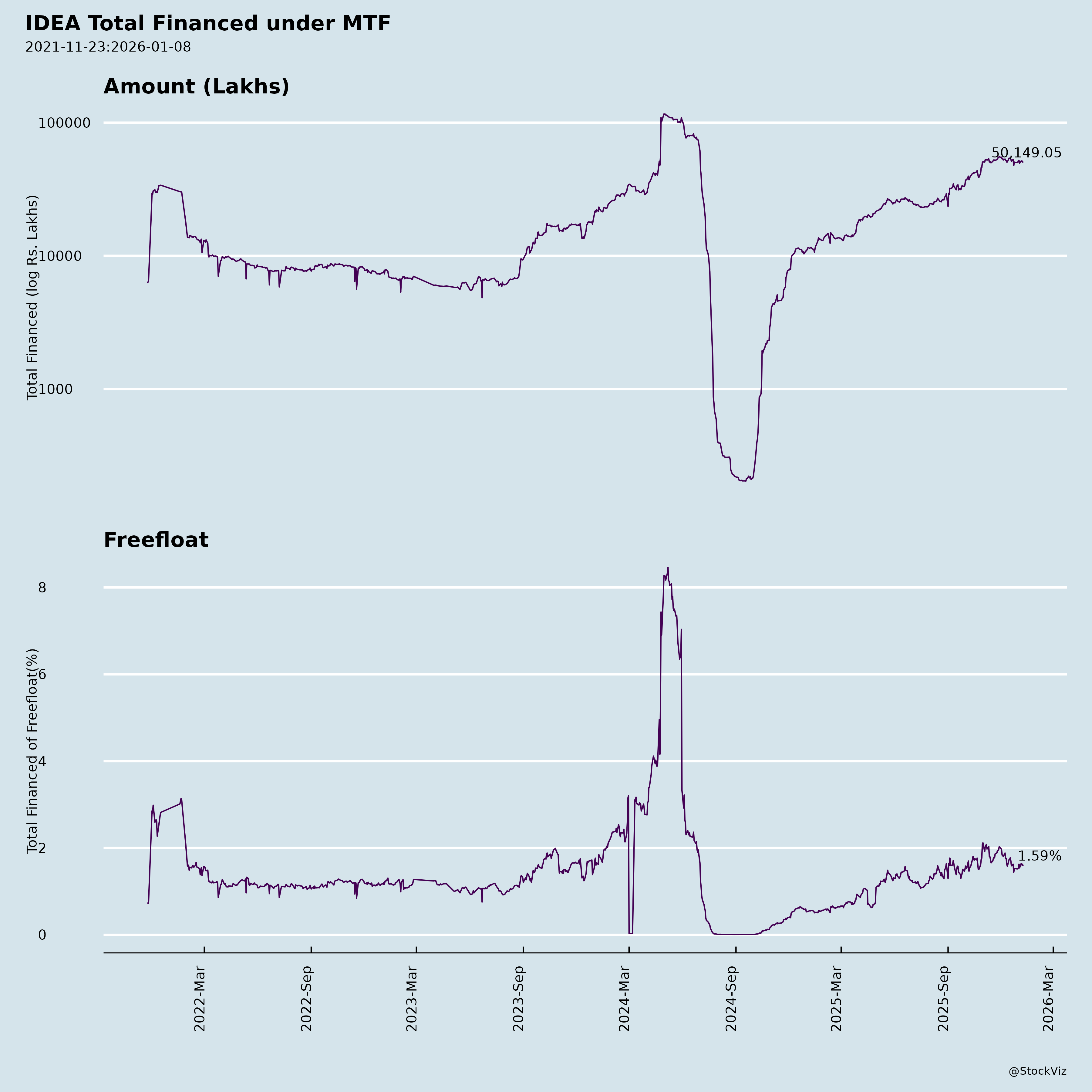

Margined

AI Summary

asof: 2025-12-03

Vodafone Idea Limited (IDEA) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: Vodafone Idea (Vi) reported Q2 FY26 (ended Sep 2025) results showing modest revenue growth (Rs 111.9 bn, +2.4% YoY) driven by ARPU uplift (Rs 180, +8.7% YoY) amid network investments. Cash EBITDA dipped slightly YoY to Rs 22.5 bn due to higher opex, but improved QoQ. Subscriber base at 196.7 mn with 4G/5G at 127.8 mn (stable YoY). Heavy capex (H1: Rs 42 bn; FY26 plan: Rs 75-80 bn, long-term Rs 500-550 bn) focuses on 4G (84% coverage, targeting 90%) and 5G rollout (29 cities in 17 circles). Persistent losses (PAT: -Rs 55 bn), negative net worth (-Rs 825 bn), and high debt (AGR ~Rs 79k Cr, spectrum dues) persist, with auditor’s going concern emphasis. Supreme Court AGR relief (reconsideration up to FY17) is a key positive.

Headwinds (Challenges Pressuring Performance)

- Subscriber Erosion: Net loss of ~1 mn in Q2 (vs 0.5 mn QoQ); long-term churn from 5.2 mn to 1 mn, but seasonality and BSNL competition noted. 4G/5G data usage (18.5 GB/month) lags peers (28 GB).

- High Debt Burden: AGR dues Rs 78.5-79k Cr (FY26 installment Rs 164 bn under moratorium, pending relief); spectrum payments Rs 25.6 bn by Sep 2026; bank debt Rs 15.3 bn (Rs 14.4 bn due in 12 months). Finance costs Rs 46.8 bn (Q2).

- Persistent Losses & Cash Burn: H1 net loss Rs 121 bn; negative net worth; cash EBITDA margin 21.1% (stable but thin). Opex pressures from network investments.

- Regulatory/Operational Drag: Minor GST penalty (Rs 12.7 lakh, disputing); covenant breaches on some bank loans.

Tailwinds (Supportive Factors)

- ARPU Momentum: +8.7% YoY from upgrades, tariff hikes (Jul 2024), and premium plans (Non-Stop Hero, REDX Family, Vi Guarantee). Data traffic +21.4% YoY.

- Network Progress: 4G coverage +7 pp YoY to 84%; capacity +38%, speeds +17% (vs Mar’24). 5G in 99% revenue circles; broadband sites ~527k.

- AGR Relief Catalyst: Supreme Court (Oct/Nov 2025) allows DoT to reconsider/reconcile dues up to FY17 (incl. interest/penalty); govt’s 49% stake signals support.

- Enterprise & Digital Growth: Vi Business momentum (IoT lab, CCaaS, smart metering 12 mn deployments); Vi App enhancements (Vi Finance, Games, Shop). Non-wireless revenue +6-7% QoQ.

- Funding/Leadership: Debt reduction (banks: -Rs 17 bn YoY); new CEO Abhijit Kishore (Aug 2025); capex funded internally for FY26 H2.

Growth Prospects (Medium-Term Opportunities)

- Network-Led Recovery: 90% 4G coverage + 5G expansion could reverse churn, drive 4G/5G subs to >130 mn. Data growth (India’s traffic to lead globally by 2030) supports ARPU premiumization (e.g., 5G packs Rs 349+).

- ARPU/Tariff Upside: Room for hikes (India ARPU lowest globally at ~$2.4); target higher via family plans, roaming (151 countries), Vi Protect security.

- Enterprise/Digital Monetization: IoT (12 mn smart meters), cloud/SD-WAN, partnerships (Google Workspace, Aditya Birla Capital). Vi App as “digital companion” (finance, OTT, payments).

- Market Tailwinds: Rural teledensity 60%, smartphone penetration to 75% by 2030; Digital India/UPI boom. Vi’s spectrum (highest per sub excl. mmWave) positions for 5G leadership.

- Guidance: FY26 capex Rs 75-80 bn; long-term Rs 500-550 bn for pan-India competitiveness. Potential equity/debt raises post-AGR clarity.

Projected Trajectory: Revenue/EBITDA growth 10-15%+ annually post-capex ramp-up; breakeven by FY28+ if AGR relief materializes and subscribers stabilize.

Key Risks (High-Impact Uncertainties)

- AGR Resolution (Highest Risk): No relief could trigger Rs 164 bn FY26 payment; delays funding/capex. Auditor flags going concern dependency on DoT support/fundraises.

- Funding Gap: Capex needs Rs 500-550 bn; reliant on banks/NBFCs/equity. Current rating BBB- limits access; covenant issues.

- Competitive Pressure: Jio/Airtel dominance (higher 5G penetration, data usage); BSNL tariff disruption. Gross adds > CMS but net churn persists.

- Execution/Operational: Capex delays could miss 90% coverage/5G scale; lower 5G traction if handsets slow.

- Macro/Regulatory: Tariff hike delays; forex volatility on dues; GST/DoT disputes.

Overall Summary: Vi is at an inflection point with network investments yielding ARPU/data gains, bolstered by potential AGR relief (tailwind). However, headwinds from debt/churn dominate short-term, with execution risks high. Growth hinges on FY26 capex delivery, subscriber inflection at 90% coverage, and AGR outcome. Investment Thesis: High-risk/high-reward turnaround play; positive if relief comes (target multiples expansion), but downside if delayed (further dilution/stress). Monitor DoT talks and Q3 capex.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.