Telecom - Cellular & Fixed line services

Industry Metrics

January 13, 2026

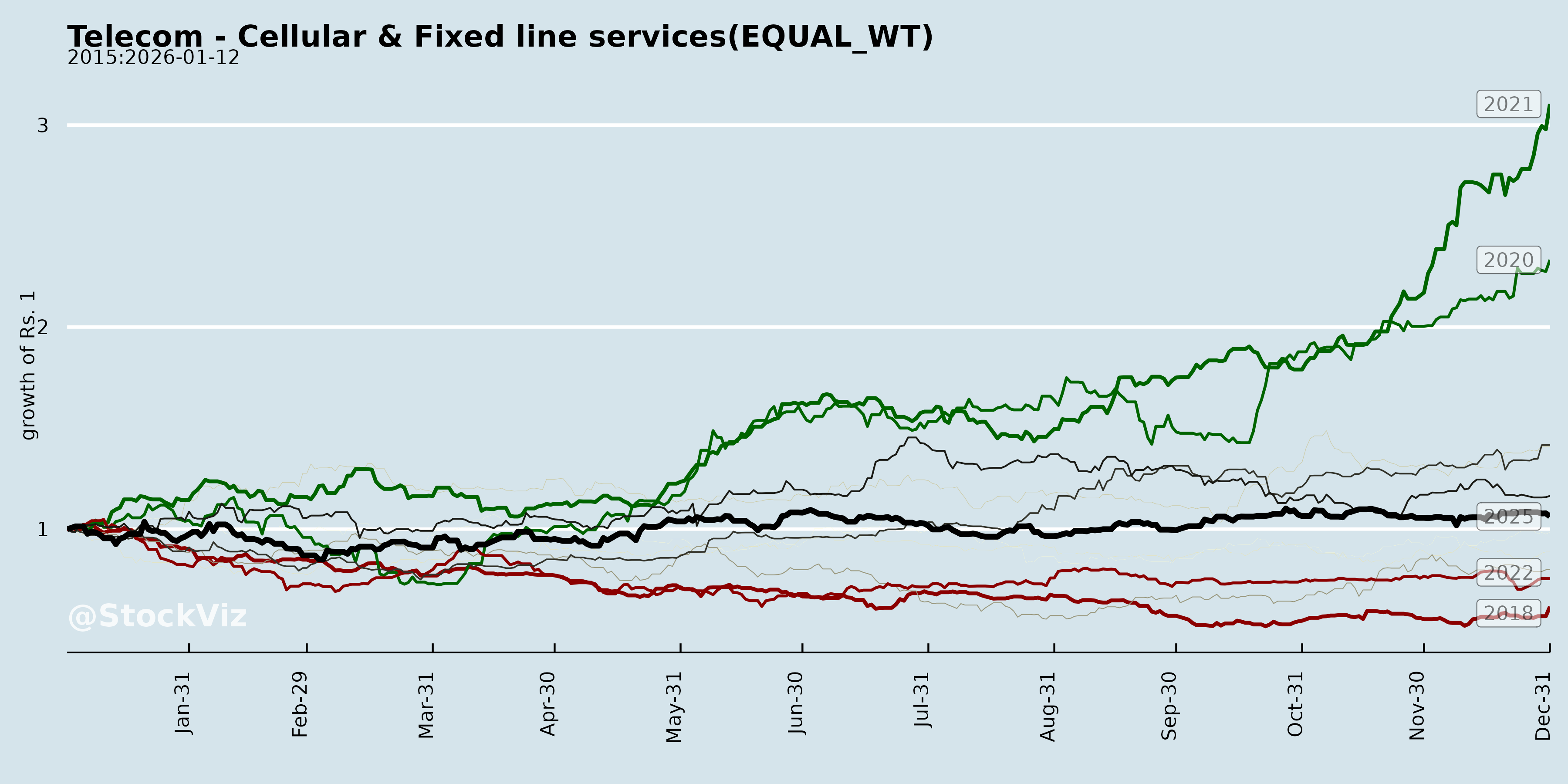

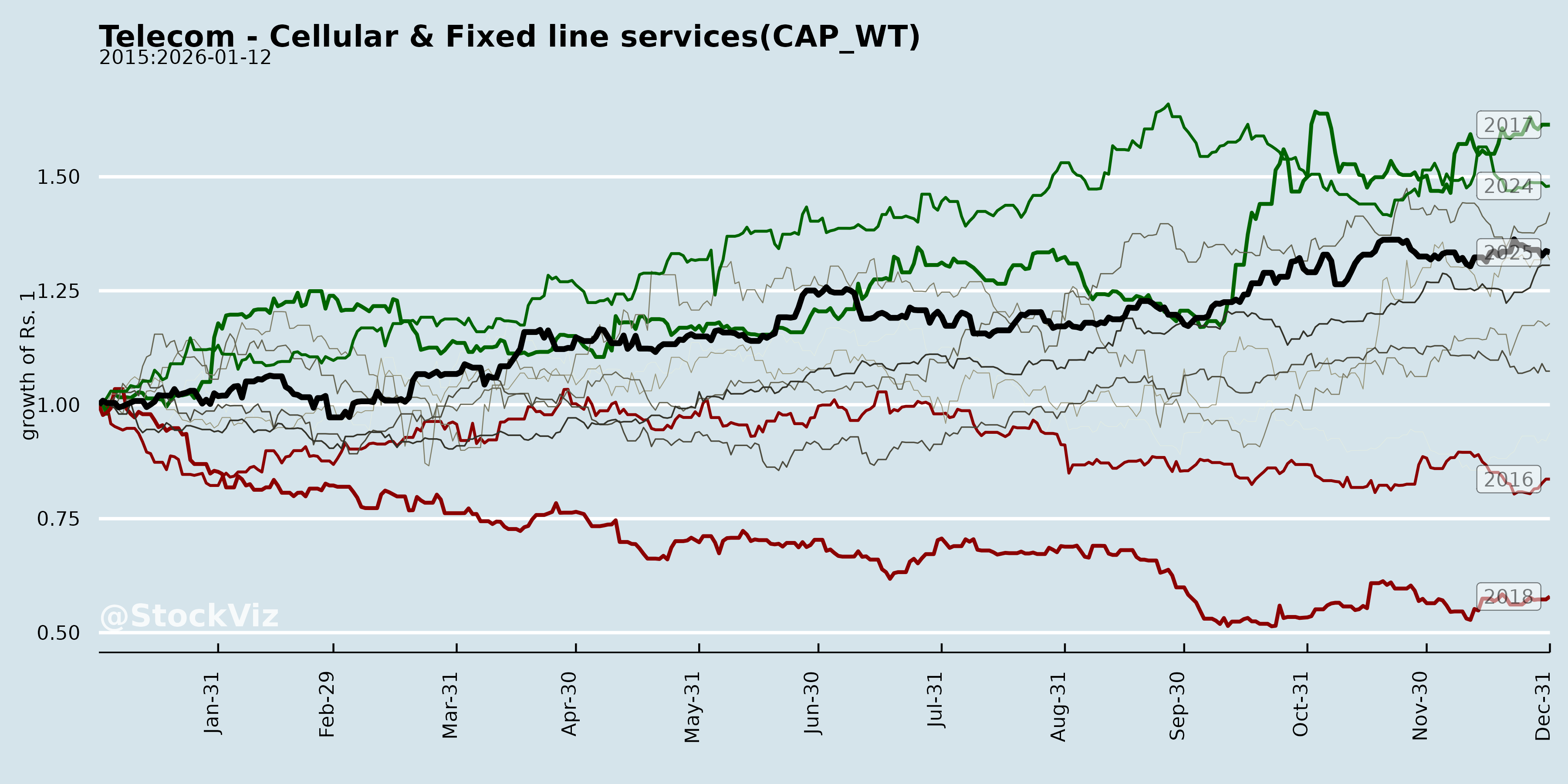

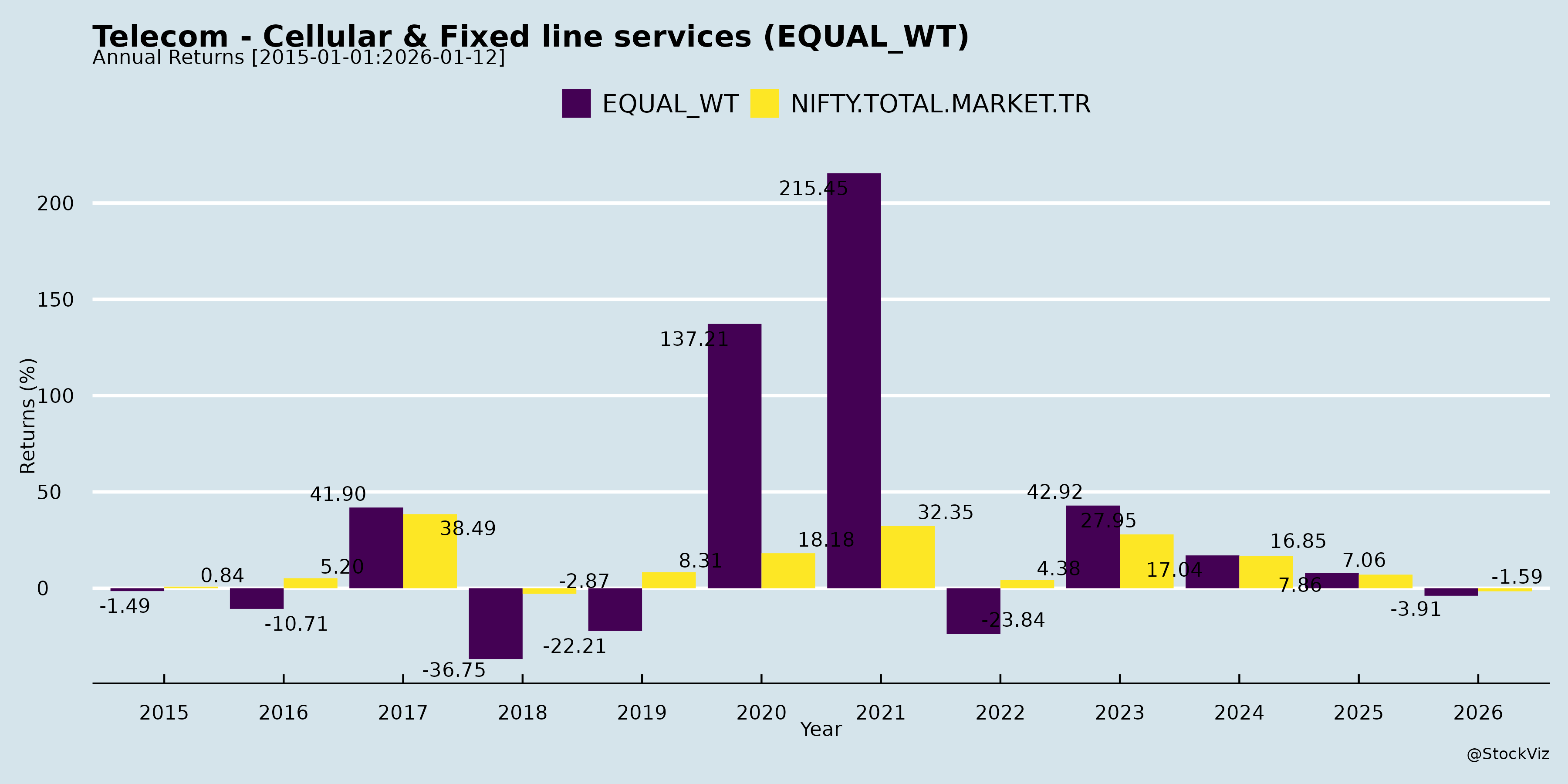

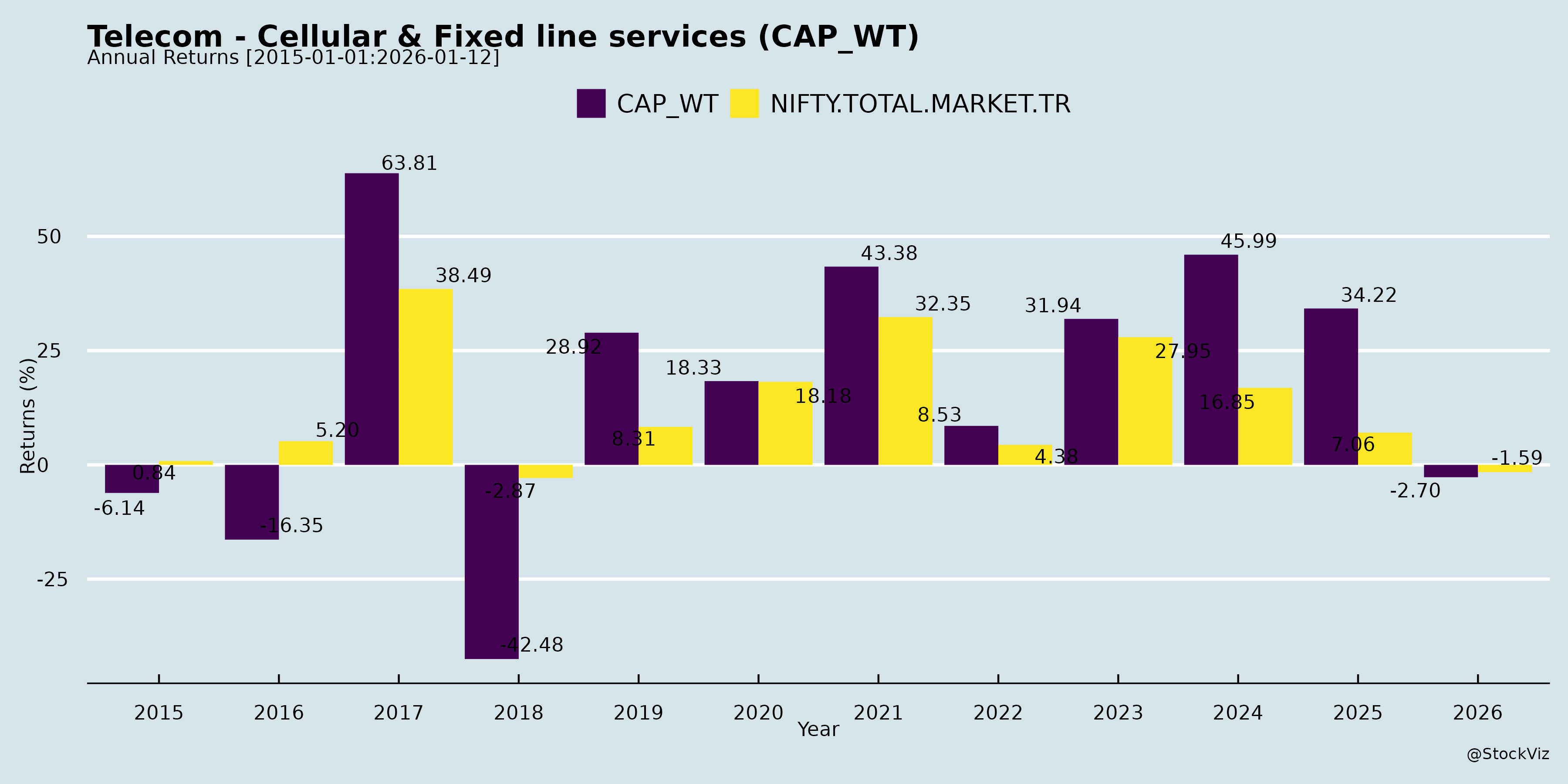

Annual Returns

Cumulative Returns and Drawdowns

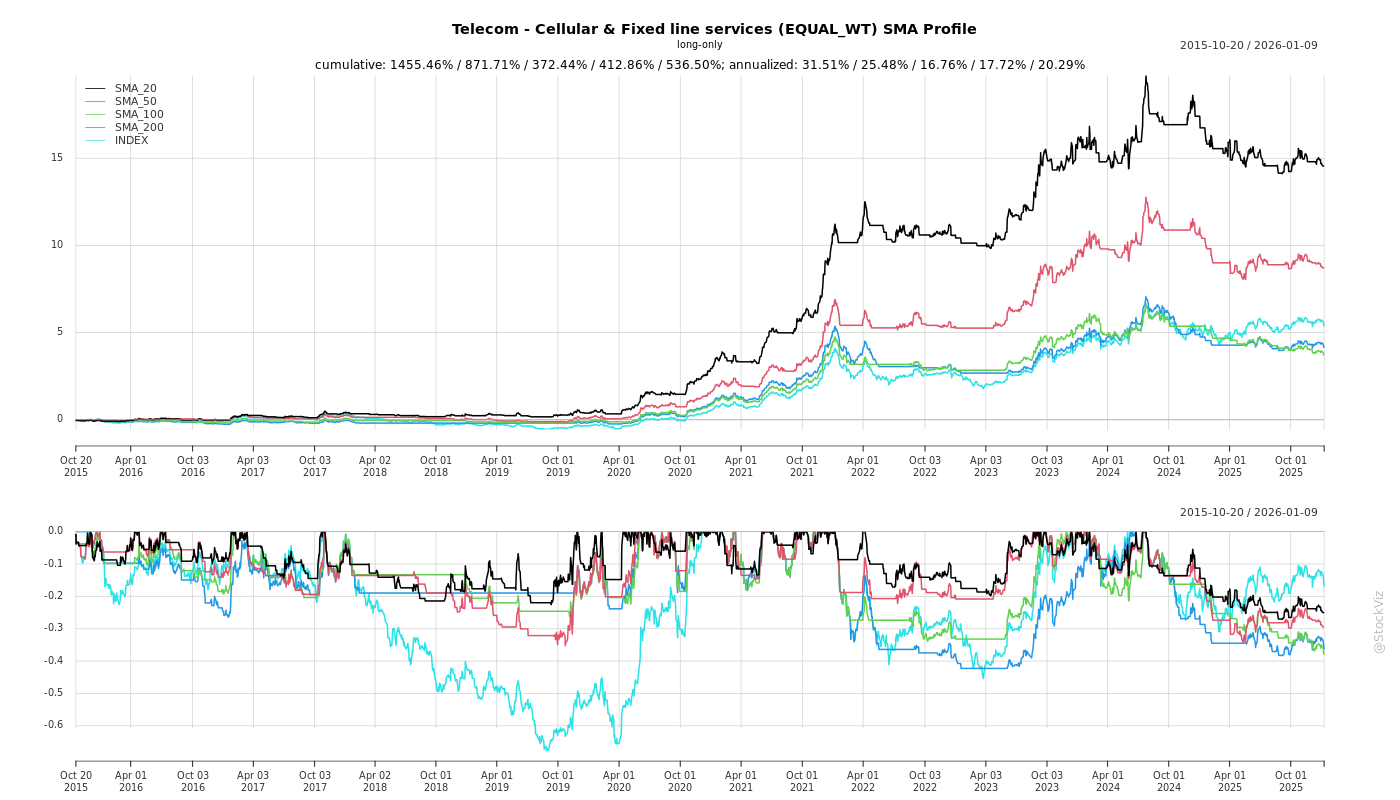

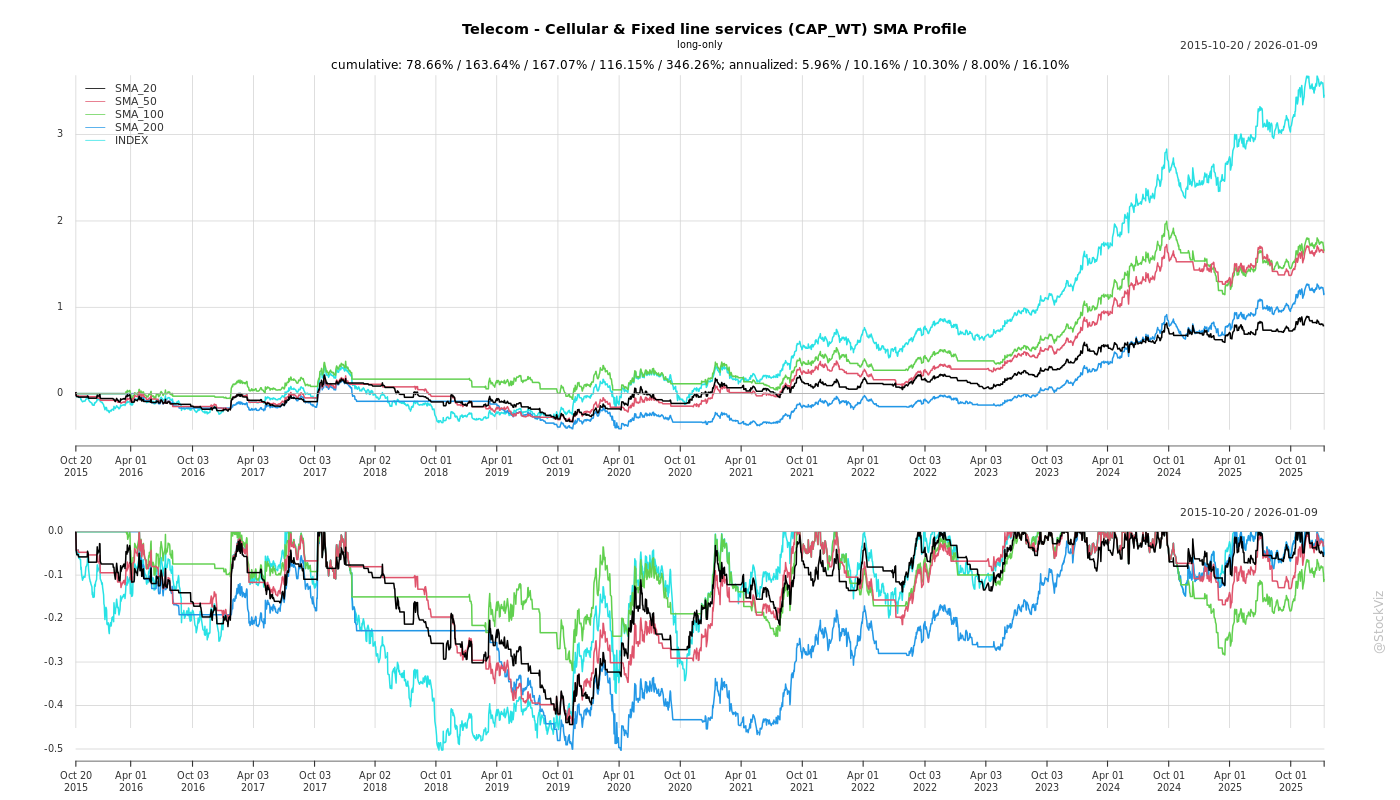

SMA Scenarios

Current Distance from SMA

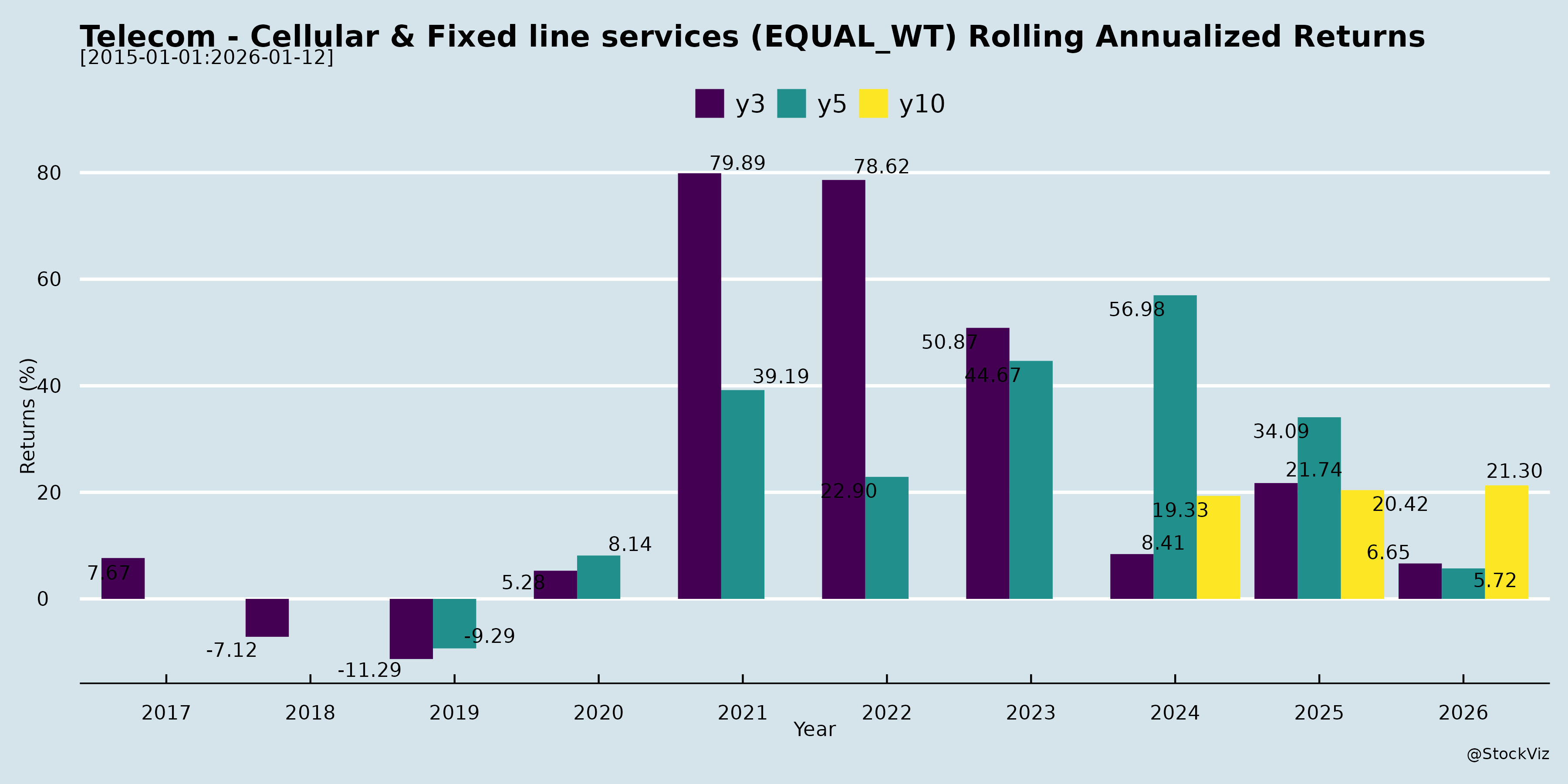

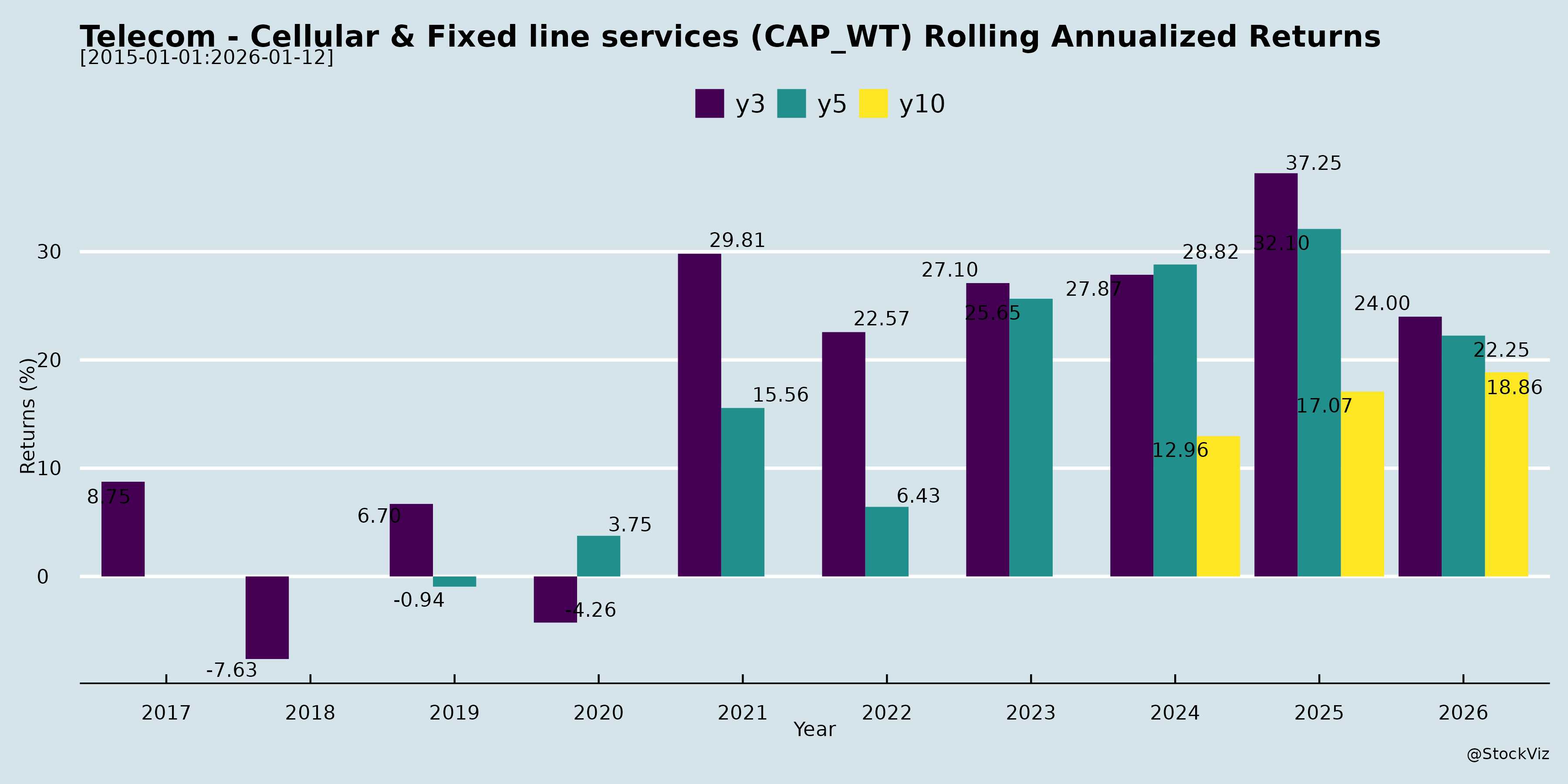

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Indian Telecom Sector (Cellular & Fixed Line Services) Analysis

Based on provided documents (primarily Vodafone Idea Q2 FY26 Earnings Transcript, supplemented by investor meeting disclosures from Bharti Airtel, Bharti Hexacom, and Tata Communications), the analysis focuses on cellular (wireless/mobile) and fixed-line/enterprise services. Vodafone Idea (Vi) provides the most granular insights into market dynamics, while others signal ongoing investor engagement amid network expansions and funding needs. Dates are futuristic (2025), but trends reflect current/persistent sector themes.

Tailwinds

- Robust Market Demand & Digital Adoption: Wireless teledensity at 83% (urban 127%, rural 60%), ~1.2B subscribers, internet base nearing 1B (44% rural). Data traffic up 21.4% YoY; UPI transactions surged 31% YoY to Rs25 lakh Cr. Govt’s Digital India/Viksit Bharat 2047 drives smartphone penetration and data growth (India to be top mobile data generator by 2030).

- Network Investments Yielding Results: Vi expanded 5G to 17 circles (99% revenue, 29 cities); 4G coverage to 84% (from 77% in Mar’24), capacity +38%, speeds +17%. 4G/5G subscribers at 127.8Mn (+0.4Mn YoY). Data usage up 20.3% YoY (18.5GB/customer/month). ARPU +8.7% YoY to Rs180.

- Product Innovation & Retention: Prepaid hits like Non-Stop Hero (unlimited data), Vi Guarantee (extra validity); postpaid REDX Family (unlimited 5G/IR). Enterprise: IoT lab, AI-CCaaS, SD-WAN, partnerships (Google Workspace, Aditya Birla). Vi App growth (Vi Finance, games, OTT).

- Financial Stability Signals: Vi revenue +2.4% YoY (Rs111.9B); EBITDA +3% (Rs46.9B, margin 41.9%). Cash EBITDA +3% QoQ. Enterprise/non-wireless revenue +6-7% QoQ. Investor meets (Airtel, Hexacom, Tata Comm with Macquarie/others) indicate confidence.

- Regulatory Relief Potential: Supreme Court (Oct/Nov 2025) allows govt/DoT to reassess AGR dues (pre-2016-17), with govt as 49% Vi stakeholder emphasizing 3-private-player need.

Headwinds

- Subscriber Churn & Market Share Pressure: Vi lost ~1Mn subscribers QoQ (down from prior quarters but still negative); seasonality + BSNL competition noted. Data usage lags peers (18.5GB vs 28GB); peers have 40%+ 5G traffic offload vs Vi’s early-stage rollout.

- High Debt & Funding Squeeze: Vi AGR dues ~Rs78.5-79k Cr; total capex plan Rs500-550B (H1: Rs42B). Bank debt down to Rs15.3B but reliant on lenders/NBFCs/govt relief. Finance costs Rs46.8B (ex-IndAS: Rs36B); steady-state ~prior quarters.

- Capex Intensity: Q2 capex Rs17.5B; H2 focus on coverage (to 90%) but capacity needs rising with traffic. Network opex up YoY due to investments/power seasonality.

- Competition & Differentiation: BSNL gaining gross adds; peers ahead in 5G scale/pricing (Vi at Rs349 vs peers Rs349-379). Rural gaps persist.

- Fixed-Line/Enterprise Lag: Less emphasis; Tata Comm focuses on global events, but sector faces high infrastructure costs.

Growth Prospects

- 5G & Coverage Expansion: Vi targeting 90% 4G coverage in “few quarters” (additional ~Rs4k Cr capex); 5G to more cities/handset penetration rises. Potential traffic offload in early circles.

- ARPU/Monetization Uplift: Unlimited 5G plans, roaming (151 countries), Vi Protect (AI spam/cyber). Tariff hikes likely (industry-led, not tied to AGR).

- Enterprise/Digital Pivot: Vi Business: IoT (12Mn smart meters/3yrs), AI/cloud/SOC, MSME programs. Vi App/OTT scaling for non-telco revenue. Tata Comm emphasizes customer experience/digital infra.

- Rural/Digital Economy: Low penetration + govt push = sustained subscriber/data growth. Partnerships (Aditya Birla, Genesys, AWS) for finance/OTT/IoT.

- Sector Outlook: Pan-India 5G maturity, enterprise digital transformation (AI, cybersecurity), UPI/Digital Bharat fueling 20%+ data CAGR.

Key Risks

- Funding Execution: Capex fully dependent on debt tie-ups (banks/NBFCs); delays if govt AGR relief slow (no repayments pre-Mar’26, but uncertainty).

- Churn Acceleration: Failure to hit 90% coverage/5G scale could worsen losses to BSNL/peers; urban-rural imbalance.

- Regulatory Uncertainty: AGR reconciliation timeline unclear; adverse DoT outcome could strain cash flows.

- Operational/Execution: Capacity gaps vs traffic surge; NSA-to-SA 5G migration costs. Vendor trials (domestic) unconfirmed.

- Macro/Competition: No tariff hikes if leaders delay; forex/power inflation; 4-player market eroding pricing power.

Summary: Indian telecom enjoys strong tailwinds from digital demand and investments (e.g., Vi’s 5G/4G progress, ARPU gains), positioning for 5G/enterprise-led growth. However, headwinds like Vi’s debt/churn and capex funding loom large, with risks centered on regulatory relief and execution. Sector resilience hinges on 3-player viability (govt-backed) and tariff hikes; investor meets signal optimism but underscore funding focus. Overall, moderate growth (low-teens revenue CAGR) with high risk-reward for laggards like Vi vs leaders (Airtel).

Financial

asof: 2025-12-01

Analysis of Indian Telecom Sector (Cellular & Fixed Line Services)

Using the provided documents from Vodafone Idea (IDEA), Bharti Hexacom (BHARTIHEXA), Tata Communications (TATACOMM), and Tata Teleservices Maharashtra (TTML) as primary inputs, this analysis focuses on the cellular (mobile voice/data) and fixed line services sub-sectors. These filings cover Q3/Nine Months FY25 (ended Dec 2024) results, clarifications, auditor reports, and disclosures. The sector shows polarization: strong performers (Bharti Hexacom, Tata Comm) drive growth via data/5G/digital, while laggards (Vi, TTML) grapple with legacy debt/AGR issues. Overall revenue growth is data-led, but profitability is uneven.

Headwinds (Challenges Pressuring the Sector)

- High Debt and Finance Costs: TTML reports ₹1,275 Cr finance costs (9M FY25), with EBITDA/interest coverage at 0.82x; Vi implied high leverage; Tata Comm’s debt-equity at 0.34x but rising short-term borrowings. Sector-wide AGR dues (e.g., TTML’s curative petition rejected; Tata Comm’s ₹7,777 Cr contingent liability) exacerbate cash strain.

- Regulatory & Litigation Overhang: Persistent AGR disputes (Tata Comm/TTML disclose DoT demands ₹8K+ Cr; Vi’s historical burden). Spectrum/license fees high (Bharti Hexacom: ₹2,074 Mn Q3). Recent SC rulings on license fees add uncertainty.

- Shrinking Voice Revenue: Tata Comm’s Voice Solutions down QoQ; fixed line elements (Real Estate leases) stable but minor. Cellular voice margins pressured by data shift.

- Operational Losses in Weak Players: TTML’s ₹969 Cr 9M loss, negative networth (₹-19,326 Cr); Vi’s structural issues persist despite clarifications.

- Capex Intensity: Depreciation high (Bharti Hexacom ₹5,315 Mn Q3; Tata Comm ₹637 Mn), tied to 5G/network ops.

Tailwinds (Supportive Factors)

- Robust Data Revenue Growth: Bharti Hexacom’s mobile revenue ₹21,931 Mn (Q3, +25% YoY implied); Tata Comm Data Services ₹4,917 Cr (+6.2% YoY), Digital ₹2,313 Cr (+10.2% YoY). Fixed line complements via enterprise (Tata Comm’s Transformation/Real Estate).

- Margin Expansion: Bharti Hexacom EBITDA margin 53% (pre-D&A); Tata Comm 20.4% (+23 bps YoY). Operating leverage from scale (Bharti’s DSCR 15x; ISCR 7.62x).

- Restructuring & Asset Monetization: Tata Comm divesting Payment Solutions, redomiciling subs; Bharti issued ₹4 Bn CPs; parent support for TTML (Pan Tata Group).

- 5G & Digital Ecosystem: Bharti Hexacom’s mobile dominance (97% segment revenue); Tata Comm’s AI/NVIDIA infra, CPaaS growth.

- Improved Liquidity Metrics: Bharti’s debt-equity 0.78x (down from 1.41x); Tata Comm net profit margin 4.4%.

Growth Prospects

- Data/5G Led Expansion: Cellular data to drive 15-20% CAGR (Bharti’s 62,589 Mn 9M revenue +20% YoY; Tata Comm Gross Revenue +2.9% YoY). Fixed line via enterprise SD-WAN, NaaS (Tata Comm awards).

- ARPU Uplift & Subscriber Addition: Bharti’s EPS ₹20.50 (9M); Tata Comm PAT +473% YoY Q3. 5G monetization, AI-edge computing (Tata Comm press release).

- Consolidation & M&A: Vi/Tata struggles open doors (e.g., Jio/Airtel acquisitions?); Tata Comm’s sub reviews unlock value.

- Enterprise/Fixed Line Synergies: Tata Comm’s Data/Transformation (₹883 Cr 9M); Bharti’s Homes/Office ₹645 Mn Q3 (+19% YoY).

- Outlook: Sector revenue ~₹3-3.5 Tn FY25 (data-led); 5G capex peaks FY26, margins to 25-30% for leaders.

Key Risks

| Risk Category | Description | Impacted Cos. | Mitigation |

|---|---|---|---|

| Regulatory/Litigation | AGR/DoT demands (₹7-8K Cr contingent); tariff caps. | All (esp. TTML, Tata Comm, Vi) | Legal stays (TDSAT/SC pending); defenses filed. |

| Debt Sustainability | Negative coverage (TTML 0.8x); CP maturities (Bharti/TTML). | TTML, Vi | Parent infusions; asset sales. |

| Competition | Jio/Airtel dominance erodes Vi/TTML share. | Vi, TTML | Data pivot; 5G differentiation. |

| Execution | 5G ROI delays; forex (Tata Comm subs). | Bharti, Tata Comm | Strong balance sheets (Bharti networth ₹53 Bn). |

| Macro | Capex cycle, inflation on ops costs. | All | Data demand buffers. |

| Going Concern | TTML’s losses/negative equity. | TTML | Tata Group support letter. |

High Risk: Weak players (Vi/TTML) face delisting/insolvency; Medium Risk: Litigation resolution; Low Risk: Leaders (Bharti/Tata Comm) well-positioned.

Summary

The Indian telecom sector (cellular/fixed line) is resilient yet bifurcated—leaders like Bharti Hexacom (23% 9M revenue growth, 16% NPM) and Tata Comm (data/digital +6-10% YoY) ride tailwinds of 5G/data surge, margin gains, and restructuring for high growth prospects (15%+ CAGR via ARPU/digital). However, headwinds from AGR/debt plague laggards (TTML ₹969 Cr loss; Vi implied distress), with key risks in regulation (SC/TDSAT outcomes) and liquidity. Net Positive Outlook: Data/5G tailwinds outweigh issues for top players (70% market share); consolidation could stabilize sector. FY25 growth ~10-12% revenue, but profitability hinges on debt resolution. Investors favor Bharti/Tata Comm; avoid Vi/TTML without catalysts.

Data sourced exclusively from filings; sector inferences based on disclosed metrics.

General

asof: 2025-11-29

Summary Analysis: Indian Telecom Sector (Cellular & Fixed Line Services)

The provided disclosures from key players (Bharti Airtel, Vodafone Idea, Bharti Hexacom, Tata Communications, Tata Teleservices Maharashtra Ltd. (TTML), MTNL, and Reliance Communications (RCOM)) highlight a mixed outlook for the Indian telecom sector. The industry faces persistent regulatory and financial headwinds but shows tailwinds in digital infrastructure and sustainability. Growth is anchored in data centers and enterprise services, amid elevated risks from debt, compliance, and legal actions. Below is a structured analysis:

Headwinds (Challenges Constraining Performance)

- Regulatory and Compliance Pressures: Ongoing AGR dues litigation (Vodafone Idea Supreme Court modification limits relief to FY17; potential ₹50k+ TRAI penalties in TTML BRSR). SEBI LODR violations led to ₹5.43L fines each on NSE/BSE for MTNL (board composition non-compliance). Frequent disclosures signal heightened scrutiny.

- Financial Distress and Legacy Debt: RCOM under CIRP since 2019; ED provisional attachment (Nov 2025) of ₹1,452Cr assets (incl. Millennium Business Park, Dhirubhai Knowledge City) over alleged ₹40,000Cr bank fraud/money laundering via fund diversion. MTNL/TTML report negative net worth (TTML: -₹19,570Cr); high turnover rates (18.4% permanent employees).

- Operational Inefficiencies: No workers but reliance on contractors (TTML); e-waste/battery waste up (TTML: 151MT in FY25). Customer complaints high (TTML: 40k+ annually, mostly service-related).

Tailwinds (Supportive Factors)

- Digital Infrastructure Push: Airtel’s Nxtra Vizag (₹5Cr data center sub) signals capex in high-growth data centers. TTML’s wired telecom/cloud (94.6% turnover) and ISO certifications (9001, 27001, 45001) enhance credibility.

- Sustainability Momentum: TTML’s BRSR highlights progress (25% water reduction, renewable transition via 6.7MW captive plant, 15% gender diversity up from 12%). Tata Code of Conduct extended to value chain; 100% training coverage on ethics/POSH.

- Funding Access: Tata Comm’s ₹200Cr CP issuance/listing at 6.05% (maturity Feb 2026) indicates stable short-term liquidity.

Growth Prospects

- Data Centers & Enterprise Digital Services: Strong tailwind from Airtel/TTML (53% recycled network material; capex on smart racks/free cooling). B2B focus (TTML: enterprises/SMEs; 0% exports, 100% domestic). Projected renewable shift and water circularity (Aalingana goals) to cut costs/emissions.

- 5G/Broadband Expansion: Implicit in efficiency investments (TTML energy intensity down to 44GJ/₹Cr turnover). Customer engagement via iManage app; low attrition via feedback.

- ESG-Driven Investor Appeal: TTML’s reasonable assurance (BSI) and material issues (customer satisfaction, data security) position it for green financing. Overall sector ARPU uplift from 5G/data demand could drive 10-15% CAGR in enterprise segment.

Key Risks

| Risk Category | Details | Severity (High/Med/Low) | Mitigation Noted |

|---|---|---|---|

| Regulatory/Legal | AGR/dues (Vi); SEBI fines (MTNL); ED attachment/fraud probes (RCOM: ₹2,929Cr SBI loss). Supreme Court AGR cap to FY17 limits relief. | High | DoT appointments (MTNL); appeals filed. |

| Financial/Liquidity | High debt/NPAs (RCOM outstanding ₹40kCr); devolved LCs/BGs (multiple banks). Negative net worth (TTML). | High | CP issuance (Tata Comm); renewables for cost savings. |

| Operational/Cyber | Data breaches/cyber risks (TTML Principle 2/9); 40k+ complaints; supply chain ESG gaps (48% assessed). | Medium | ISO 27001/22301 certs; BCP/DR; supplier audits. |

| Governance/Fraud | Fund diversion (RCOM: mutual funds/infra siphoning); CIRP asset alienation (Bonn Inc. flat sale). | High | Whistleblower/POSH policies (TTML 100% coverage). |

| Market/Competition | Churn from QoS penalties; 0.52% sales via dealers (TTML). | Medium | Customer NPS surveys; diversity (15% women). |

Overall Outlook: Sector growth (8-12% CAGR) hinges on data/5G tailwinds, but headwinds from debt/regulations cap near-term recovery. Leaders like Airtel/TTML (ESG focus) are better positioned vs. distressed peers (RCOM/MTNL/Vi). Monitor Supreme Court AGR/NCLT RCOM outcomes for pivots. Recommendation: Prioritize debt resolution and digital capex for resilience.

Investor

asof: 2025-12-03

Indian Telecom Sector (Cellular & Fixed Line Services) Analysis

Based on the provided documents (Bharti Airtel, Vodafone Idea Q2 FY26 Earnings Transcript, Bharti Hexacom, and Tata Communications announcements dated Nov-Dec 2025). The analysis draws primarily from Vodafone Idea’s (Vi) detailed earnings insights, reflecting a lagging private player amid sector-wide trends. Airtel/Hexacom/TataComm docs highlight investor engagement (e.g., Macquarie conferences), signaling sustained interest but no new operational data. Sector context: ~1.2B wireless subs, 83% tele-density (127% urban, 60% rural), nearing 1B internet subs (44% rural).

Tailwinds (Positive Forces)

- Digital Adoption & Data Boom: Explosive growth in UPI (19.6B txns, +31% YoY, Rs.25L Cr value) and “Digital Bharat” vision fuel demand. Vi data traffic +21.4% YoY; 4G/5G usage +20.3%; avg. usage 18.5GB/sub/month (up from prior lows).

- Network Investments Yielding Results: Vi’s capex (Rs.17.5B in Q2, Rs.42B H1) boosted 4G coverage to 84% (+7% YoY), capacity +38%, speeds +17%. 5G rolled out to 17 circles/29 cities (99% revenue coverage).

- ARPU & Premiumization: Vi consumer ARPU +8.7% YoY to Rs.180 via plans like Non-Stop Hero, REDX Family, Vi Guarantee. 4G/5G subs at 127.8Mn (+0.4Mn YoY).

- Enterprise/Diversification Momentum: Vi Business growth in IoT (12Mn smart meters target), AI-CCaaS, cloud/SD-WAN; partnerships (Google Workspace, AWS). Non-wireless revenue +6-7% QoQ/YoY.

- Digital Ecosystem: Vi App enhancements (Vi Finance, Games, OTT) drive engagement; roaming in 151 countries with unlimited data in 40+.

Headwinds (Challenges)

- Subscriber Pressure: Vi lost ~1Mn subs QoQ (seasonal, but churn slowing from 5.2Mn prior); data customers declined despite +90k BTS added L12M. BSNL gains noted; peers lead in 5G subs/usage (Vi at 18.5GB vs. peers’ 28GB).

- High Debt & Funding Squeeze: Vi AGR dues ~Rs.78.5-79k Cr; bank debt down to Rs.15.3B but capex (Rs.7.5-8k Cr FY26) reliant on internal accruals. Cash EBITDA dipped 3.4% YoY to Rs.22.5B due to network opex.

- Capex Intensity: Rs.500-550B long-term plan for 90% 4G coverage/5G; H1 spend Rs.42B, but delays risk coverage gaps.

- Lagging 5G Scale: Early-stage (launched Mar’25); peers have 40%+ data on 5G. Vi NSA architecture, but SA migration pending.

- Opex Pressures: Network costs stable but up YoY from investments; finance costs volatile (Q2 drop from settlements/forex).

Growth Prospects

- 5G & Coverage Expansion: Vi targeting 90% 4G in “few quarters” (Rs.4k Cr more); 5G traffic offload in early circles. Sector poised for mobile data leadership by 2030.

- ARPU Uplift & Tariff Hikes: Premium 5G plans (Rs.349+); industry-wide hikes likely (Vi: “probably yes,” not tied to AGR relief).

- Enterprise/Non-Linear Revenue: Vi IoT lab, ReadyForNext for MSMEs; TataComm focus implies B2B strength. Digital services (Vi App/OTT) for monetization.

- Rural/Digital Inclusion: 60% rural tele-density; smartphone/data affordability to add subs.

- Partnerships & Efficiency: Vi with Aditya Birla, Genesys; potential ICR/alt-vendors for cost savings.

Key Risks

- Funding/Debt Resolution: Vi capex dependent on bank/NBFC debt; AGR relief (SC Oct’25 allows GoI reassessment up to FY17) timeline uncertain (DoT talks ongoing). Govt. stake (49%) supportive but delays possible.

- Market Share Erosion: Ongoing churn to BSNL/peers; no finite timeline for Vi sub-additions despite fundamentals.

- Competition Intensity: Airtel leads (investor meets signal confidence); Reliance/BSNL pressure on pricing/5G.

- Regulatory/Execution: AGR reconciliation, tariff delays, power outages. 5G NSA-to-SA shift costs.

- Macro: High capex amid EBITDA margins ~42% (reported)/21% (cash); forex/depreciation (Rs.55.7B Q2).

Summary

Bullish Long-Term Outlook Moderated by Near-Term Execution Risks. Tailwinds from digital India (data/5G growth, ARPU up) and investments (Vi revenue +2.4% YoY to Rs.111.9B) support recovery, with enterprise/digital as key differentiators. Headwinds like sub-losses/churn and funding needs cap momentum—Vi cash EBITDA -3.4% YoY reflects this. Growth hinges on 90% coverage, 5G scale, and AGR relief (enabling Rs.50-55k Cr capex). High Risk of Share Loss if funding delays; tariff hikes critical for sustainability. Sector attractive (high tele-density upside), but Vi (debt-laden) trails Airtel; investor meets underscore scrutiny. Recommendation: Monitor Q3 capex/funding updates; positive if sub-churn inflects by FY26-end.

Meeting

asof: 2025-12-02

Indian Telecom Sector Analysis: Cellular & Fixed Line Services (Based on Q2/H1 FY26 Filings)

The Indian telecom sector, dominated by cellular (mobile voice/data) and fixed line (broadband/homes) services, shows a bifurcated landscape: robust growth in market leaders (Bharti Airtel, Bharti Hexacom, Tata Communications) driven by data premiumization and digital services, contrasted by severe distress in legacy players (Vodafone Idea, MTNL, RCOM, Tata Teleservices Maharashtra). Key filings highlight Airtel’s dominance (revenue ₹1,016 Bn H1 FY26, up 27% YoY), Hexacom’s regional strength, and Tata Comm’s enterprise focus, while others report mounting losses, insolvency, and regulatory overhangs. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges)

- High Debt & Interest Burden: Finance costs dominate losses (e.g., MTNL: ₹1,496 Cr H1 FY26, 65% of expenses; RCOM/TTML under CIRP with defaults). Vi’s customer uncertainty (Voda Idea filing notes AGR/DoT support dependency).

- Regulatory & Legacy Dues: AGR disputes persist (MTNL: ₹7,827 Cr DoT demands; Airtel notes Indus Towers’ customer risks). Spectrum charges/license fees up (Airtel: ₹75 Bn H1 FY26).

- Operational Losses & Erosion: Negative net worth (MTNL: -₹28,812 Cr); cash burn (MTNL EBITDA negative). Churn high in distressed firms (Vi, MTNL).

- Revenue Migration/Decline: MTNL’s ops handed to BSNL (SLA FY26), slashing direct revenue; RCOM/TTML insolvent.

- Macro Pressures: Tata Comm notes “macro headwinds”; competition erodes margins in fixed line.

Tailwinds (Positive Factors)

- Data Premiumization: ARPU growth (Airtel: ₹251 Q2 FY26, +10% YoY; Hexacom: +10% to ₹251). Data usage surges (Airtel: 27% YoY; Hexacom: 18.5% to 30.7 GB/user/month).

- Tariff Discipline & Consolidation: Airtel’s leadership (mobile India revenue ₹555 Bn H1, +17% YoY); Indus Towers now subsidiary boosts infra control.

- Digital/Enterprise Shift: Tata Comm digital portfolio +17% YoY; Hexacom homes/offices +47% YoY revenue.

- Govt Support: Vi CEO appointment signals revival; MTNL/BSNL merger talks, sovereign bonds (MTNL: ₹17,571 Cr approved).

- Margin Expansion: Airtel EBITDA 58% H1; Hexacom 54% Q2 (+433 bps YoY).

Growth Prospects

- Cellular Data/5G: 4G/5G penetration (Airtel smartphone base 78%; Hexacom +8% YoY). Data traffic to drive 15-20% CAGR (Airtel Africa +35% revenue).

- Fixed Line/Broadband: Homes growth (Hexacom: +60K customers Q2, +60% YoY base); enterprise NaaS/cloud (Tata Comm leader in Gartner).

- Consolidation/M&A: Vi revival via equity/debt raises; BSNL/MTNL merger could streamline ops.

- ARPU/Monetization: Tariff hikes, 5G services (Airtel/Hexacom ARPUs rising); digital VAS (Airtel Perplexity AI tie-up).

- Market Size: India ~1.2 Bn connections; data-led shift favors leaders (Airtel/Hexacom FY26 revenue growth 10-14%).

Projected FY26 Outlook: Leaders (Airtel/Hexacom) 12-15% revenue growth; sector EBITDA margins ~45-50%; distressed recovery via restructuring.

Key Risks

| Risk Category | Description | Impact (from Filings) |

|---|---|---|

| Regulatory/Legal | AGR/DoT demands (₹7K+ Cr for MTNL); spectrum OTC disputes. | High (MTNL contingent liability ₹3.2K Cr; Vi customer going concern). |

| Financial Distress | Debt defaults/NPA (MTNL ₹3K Cr; RCOM CIRP); negative cash flows. | Critical (MTNL adverse audit; Vi 0.48% dissent on CEO). |

| Operational | Revenue erosion via BSNL migration (MTNL); churn (Vi/MTNL 2-3%). | Medium-High (MTNL ops handed over; Airtel notes receivable risks). |

| Competition | Jio/Airtel dominance squeezes Vi/MTNL market share. | High (Vi ARPU lag; MTNL customer surrender). |

| Execution | 5G capex (Airtel ₹223 Bn H1); BSNL SLA delays (MTNL). | Medium (Airtel capex sustainable; MTNL unquantified revenue loss). |

| Going Concern | MTNL/RCOM/TTML viability (insolvency, losses). | Existential (adverse opinions; CIRP ongoing). |

Overall Sector Verdict: Optimistic for Leaders (Airtel/Hexacom/Tata Comm: data tailwinds outweigh risks); High Risk for Laggards (Vi/MTNL/RCOM: revival hinges on govt aid/mergers). Sector poised for data-led growth (~10-12% CAGR), but consolidation essential for viability.

Press Release

asof: 2025-11-29

Indian Telecom Sector (Cellular & Fixed Line Services) Analysis

Based on provided press releases (Bharti Airtel, Vodafone Idea/Vi, Bharti Hexacom, Tata Communications, Tata Teleservices – all dated 2025). These documents highlight positive developments in network expansions, 5G rollouts, financial growth, and value-added services, reflecting sector momentum amid 5G transition and digital demand.

Tailwinds (Positive Drivers)

- Accelerated 5G Rollouts: Vi expanding to 23 cities (e.g., Ahmedabad, Jaipur, Pune) with unlimited data offers from ₹299 plans; strong adoption (>70% eligible users). Airtel/Hexacom imply 5G/4G synergies via ARPU uplift and data traffic growth (27% YoY in Hexacom).

- Network Expansion in Underserved Areas: Airtel’s pioneering coverage in Ladakh’s remote Man & Merak villages (50km corridor near Pangong Lake), enabling tourism, security, and digital payments.

- ARPU & Data Growth: Hexacom’s mobile ARPU up to ₹251 (+10% YoY), smartphone base at 78%, data usage at 30.7 GB/month/user (+27% YoY).

- Fixed Line Broadband Surge: Hexacom’s Homes & Offices (FTTH/FWA) revenues +47% YoY, +60K customers (0.6M base across 117 cities).

- Financial Strength: Hexacom Q2FY26 revenues +10.5% YoY (₹2,317 Cr), EBITDA margins +433 bps to 54.2%; net debt/EBITDAaL at 0.64x.

- Value-Added Services: Partnerships (Airtel/Hexacom with Perplexity AI; Tata Comm. with Real Madrid for fan engagement; TTBS ‘Mira’ mascot for SME digital adoption).

Headwinds (Challenges)

- High Capex Intensity: Vi’s 1 lakh new towers, 65K+ 4G sites, and 5G in 17 circles; Hexacom’s ₹368 Cr quarterly capex; Airtel’s remote deployments signal ongoing heavy investments amid spectrum costs.

- Phased & Uneven Rollouts: Vi’s “phased manner” across priority circles; remote terrains (e.g., Ladakh high-altitude) pose logistical hurdles.

- Competition Pressure: Airtel/Hexacom dominance in ARPU/customer metrics; Vi playing catch-up post-5G spectrum acquisition.

- Legacy Debt/Financial Strain: Implied in sector context (Vi’s historical AGR issues); Hexacom notes improving but still elevated net debt ratios (1.25x EBITDA).

Growth Prospects

- 5G Monetization: Nationwide coverage (Vi: 17 circles; Airtel ecosystem) to drive data explosion, ARPU hikes, and enterprise apps (IoT, AI via Xtelify/Perplexity).

- Rural/Remote Penetration: Full Chushul-Pangong connectivity (Airtel) unlocks tourism/security; potential for 84%+ 4G population coverage (Vi) to extend digitally.

- Fixed Line Boom: FTTH/FWA expansion (Hexacom +46.9% revenues) targets underserved homes/offices; asset-light partnerships with local operators scalable.

- Digital Ecosystem: Enterprise focus (Tata Comm. fan loyalty via MOVE™; TTBS SME tools) + consumer perks (AI search, unlimited 5G) to boost retention/revenues.

- Overall Metrics: Customer bases growing (Hexacom: 28.6M +4.1% YoY); 4G speeds +26%, capacity +35% (Vi) sets stage for 5G-led double-digit revenue growth.

Key Risks

| Risk Category | Description | Mitigation from Docs |

|---|---|---|

| Execution | Delays in 5G/FTTH rollouts due to terrain, supply chains (e.g., Ladakh, high-altitude sites). | Partnerships (Nokia/Ericsson/Samsung for Vi; asset-light FTTH). |

| Financial | Capex funding amid debt (Vi/Hexacom); price wars eroding margins. | Margin expansion (Hexacom EBITDA +20% YoY); ARPU uplift. |

| Regulatory/Competitive | Spectrum auctions, tariff hikes, Jio/Airtel dominance squeezing Vi/others. | Not directly addressed; focus on differentiation (remote coverage, AI). |

| Macro | Economic slowdown curbing SME/consumer spend; forex volatility for global partnerships. | SME targeting (TTBS ‘Mira’); tourism/digital payments focus. |

| Tech/Operational | Cybersecurity, network reliability in remote areas; 5G device penetration. | AI-SON for efficiency (Vi); 78% smartphone base (Hexacom). |

Summary: The sector enjoys strong tailwinds from 5G acceleration, data demand, and broadband growth, with promising prospects in rural/digital services (10-20% YoY metrics). Headwinds center on capex/debt, but improving financials (e.g., Hexacom) provide buffer. Key risks are execution-heavy, but partnerships and ARPU gains signal resilience. Bullish outlook for leaders like Airtel/Hexacom; Vi catching up via scale. Overall, positions Indian telecom for Digital India leadership.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.