ICICIPRULI

Equity Metrics

January 13, 2026

ICICI Prudential Life Insurance Company Limited

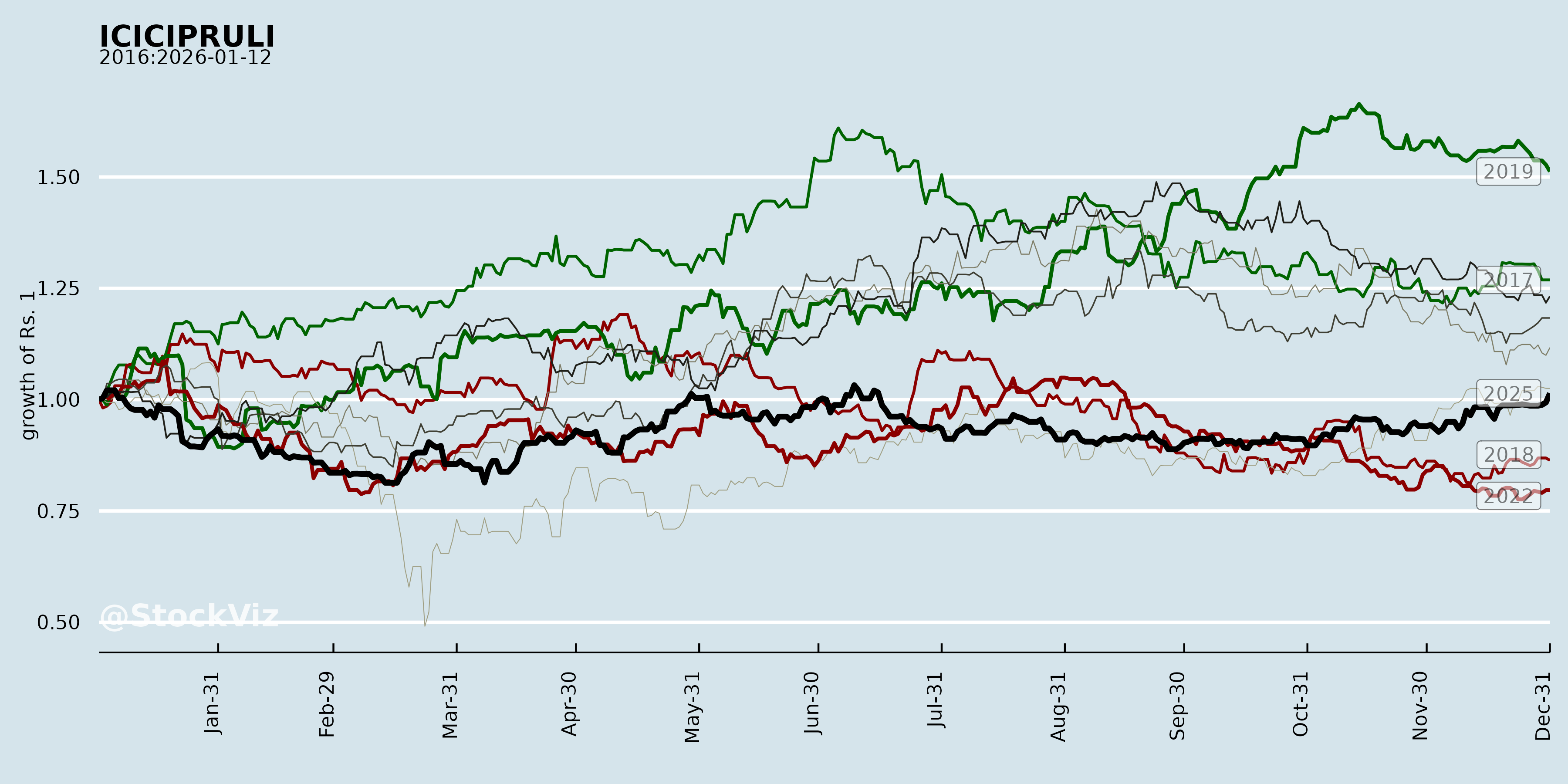

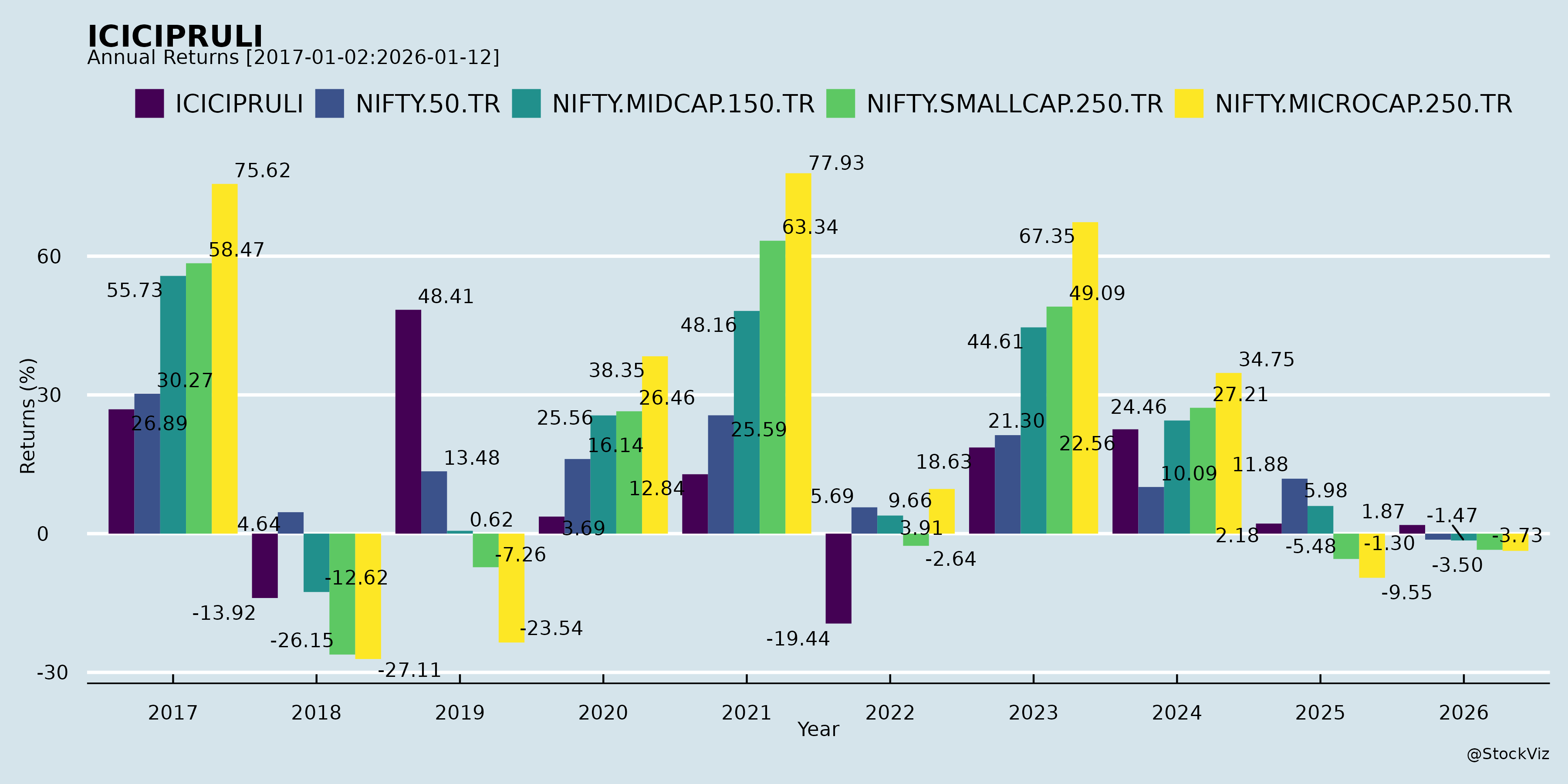

Annual Returns

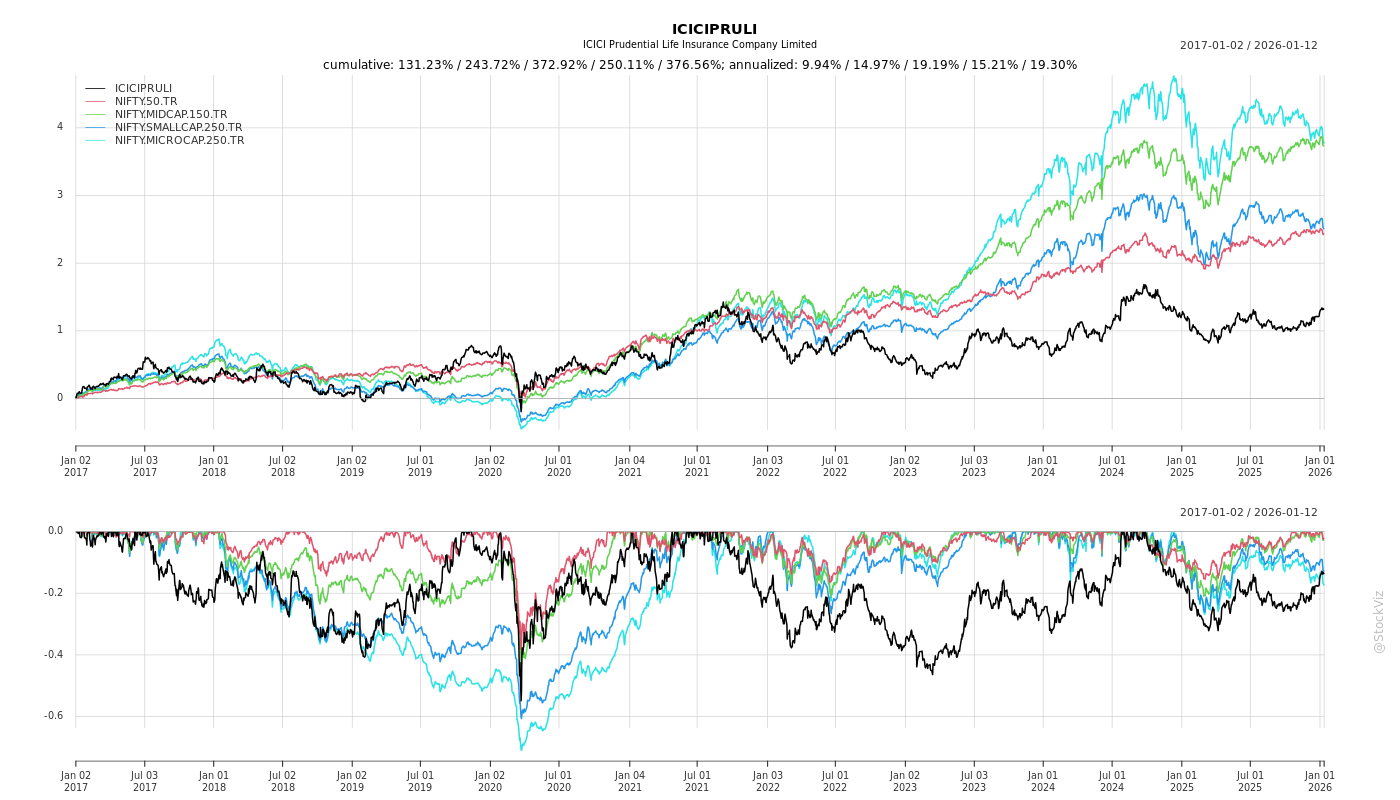

Cumulative Returns and Drawdowns

Fundamentals

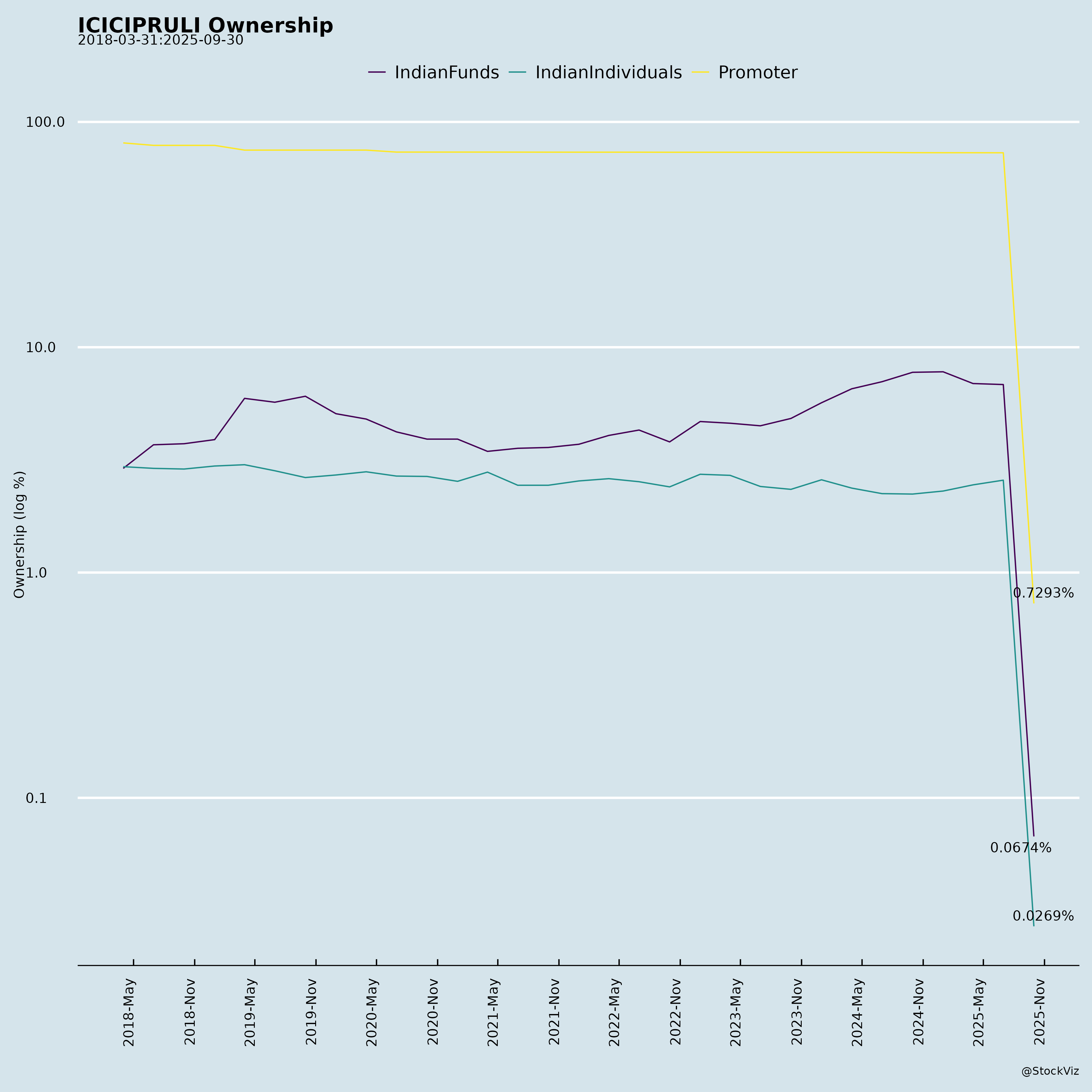

Ownership

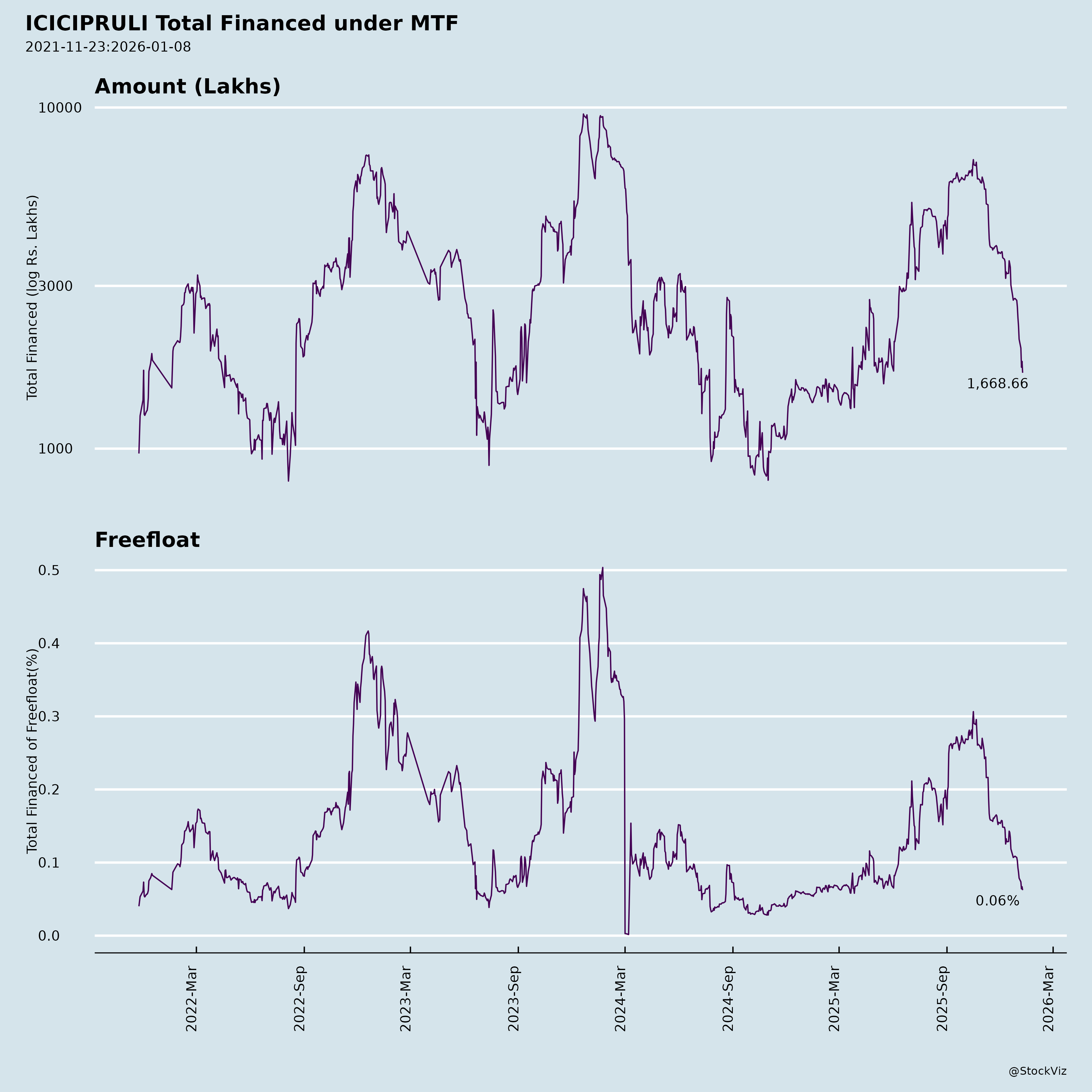

Margined

AI Summary

asof: 2025-12-04

ICICI Prudential Life Insurance (ICICIPRULI): Headwinds, Tailwinds, Growth Prospects & Key Risks

(Based on FY2025 Financials, Governance & ESG Reports)

Headwinds

- Interest Rate Volatility:

- Sensitivity analysis shows a $10% rise in reference rates reduces VNB margin by \(3.7\%\) (FY2025).

- High exposure to interest rate risk impacts profitability (e.g., bond portfolio duration risks).

- Sensitivity analysis shows a $10% rise in reference rates reduces VNB margin by \(3.7\%\) (FY2025).

- Market Competition:

- Intense rivalry from private/public sector insurers (e.g., Bajaj Allianz, Max Life).

- Pressure to maintain competitive premiums amid rising customer acquisition costs.

- Intense rivalry from private/public sector insurers (e.g., Bajaj Allianz, Max Life).

- Regulatory & Economic Risks:

- Potential regulatory changes (e.g., insurance premium tax, capital adequacy norms).

- Macroeconomic slowdown (GDP growth, disposable income) could reduce insurance penetration (currently 2.8% of GDP).

- Potential regulatory changes (e.g., insurance premium tax, capital adequacy norms).

- Operational Challenges:

- High dependency on distribution channels (e.g., agency/bancassurance mix) requiring sustained investment.

- Integration complexity in mergers/acquisitions (e.g., FY2025 acquisitions).

- High dependency on distribution channels (e.g., agency/bancassurance mix) requiring sustained investment.

Tailwinds

- Strong Growth Metrics:

- Revenue Growth: INR 203.46 billion (H1-FY2026), up \(9.2\%\) YoY.

- EV Growth: INR 505.01 billion (Sept 2025), up \(9.7\%\).

- New Business Sum Assured: INR 6.77 trillion (H1-FY2026), up \(19.3\%\).

- Revenue Growth: INR 203.46 billion (H1-FY2026), up \(9.2\%\) YoY.

- Diverse & Diversified Portfolio:

- Balanced product mix ($48.1%-\(22.5\%\) linked/non-linked) and channel mix (\(25\%\) agency, \(30\%\) bancassurance).

- Retail-centric focus (e.g., retail sum assured CAGR \(31\%\) over 3 years).

- Balanced product mix ($48.1%-\(22.5\%\) linked/non-linked) and channel mix (\(25\%\) agency, \(30\%\) bancassurance).

- Operational Efficiency:

- Cost-to-Premium ratio fell to \(19.2\%\) (H1-FY2026, vs. \(22.0\%\) prior year).

- \(99.3\%\) claim settlement ratio and \(85.3\%\) 13-month persistency (H1-FY2026).

- Cost-to-Premium ratio fell to \(19.2\%\) (H1-FY2026, vs. \(22.0\%\) prior year).

- ESG & Sustainability:

- High ESG ratings (\(AA\) by MSCI, ‘Low risk’ by Sustainalytics).

- \(96.2\%\) of fixed income assets in AAA/AA-rated bonds.

- 30% gender diversity in leadership (FY2025).

- High ESG ratings (\(AA\) by MSCI, ‘Low risk’ by Sustainalytics).

Growth Prospects

- Market Expansion:

- Protection segment CAGR of \(31\%\) (H1-FY2023–H1-FY2026) indicates untapped potential.

- FY2025 retirement savings gap (\(16.5\) trillion in FY2020) presents long-term annuity opportunities.

- Protection segment CAGR of \(31\%\) (H1-FY2023–H1-FY2026) indicates untapped potential.

- Digital Transformation:

- \(50\%\) of savings policies issued digitally (H1-FY2026), up from \(40\%\) in FY2024.

- AI/ML-driven underwriting and customer onboarding (e.g., facial recognition, CKYC integration).

- \(50\%\) of savings policies issued digitally (H1-FY2026), up from \(40\%\) in FY2024.

- Distribution Leverage:

- 30% increase in agents (H1-FY2025–H1-FY2026) and bancassurance partnerships (e.g., 2 new bank tie-ups in FY2026).

- 30% increase in agents (H1-FY2025–H1-FY2026) and bancassurance partnerships (e.g., 2 new bank tie-ups in FY2026).

- ESG Synergy:

- Growing investor demand for ESG-compliant insurers (e.g., \(14\%\) YoY growth in ESG-linked premiums FY2024).

Key Risks

- Interest Rate Sensitivity:

- High duration assets expose portfolio to \(8.2\%\) (10-year) to \(8.4\%\) (30-year) benchmark rate swings.

- High duration assets expose portfolio to \(8.2\%\) (10-year) to \(8.4\%\) (30-year) benchmark rate swings.

- Regulatory Compliance:

- IRDAI directives on data privacy (GDPR compliance), insurance products, and pricing norms.

- IRDAI directives on data privacy (GDPR compliance), insurance products, and pricing norms.

- Competition Intensification:

- New entrants (e.g., Paytm Health Insurance, Reliance General Insurance) targeting digital-first customers.

- New entrants (e.g., Paytm Health Insurance, Reliance General Insurance) targeting digital-first customers.

- Execution Risks:

- M&A integration (e.g., FY2025 acquisitions) could strain integration timelines and ROI.

- Currency fluctuation impacts foreign investments (e.g., Prudential Holdings).

- M&A integration (e.g., FY2025 acquisitions) could strain integration timelines and ROI.

Summary

ICICIPRULI remains a market leader with robust growth metrics (revenue \(+9.2\%\), EV \(+9.7\%\) YoY, retail sum assured \(+19.3\%\)). Tailwinds include digital adoption, ESG alignment, and protection segment tailwinds. Headwinds center on interest rate volatility, competition, and regulatory shifts. Growth potential lies in deepening annuity penetration, leveraging digital platforms (ICICI Pru Stack), and scaling rural/urban retail reach. Key risks require vigilant management of interest rate exposure, competitive pressures, and compliance.

Recommendation: Maintain focus on protection-led growth, enhance ESG disclosures, and optimize distribution efficiency to sustain premium growth.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.