ICICIGI

Equity Metrics

January 13, 2026

ICICI Lombard General Insurance Company Limited

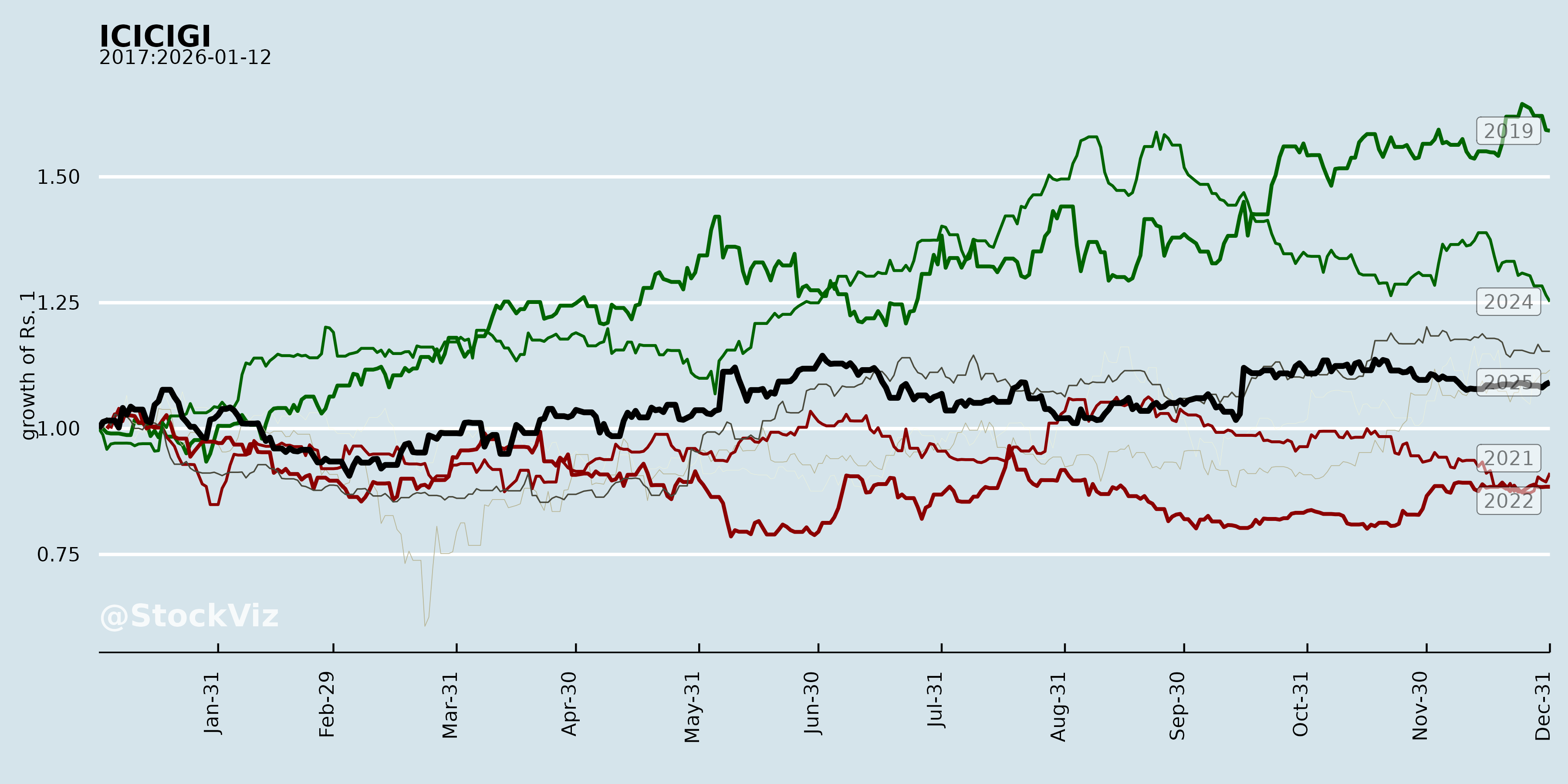

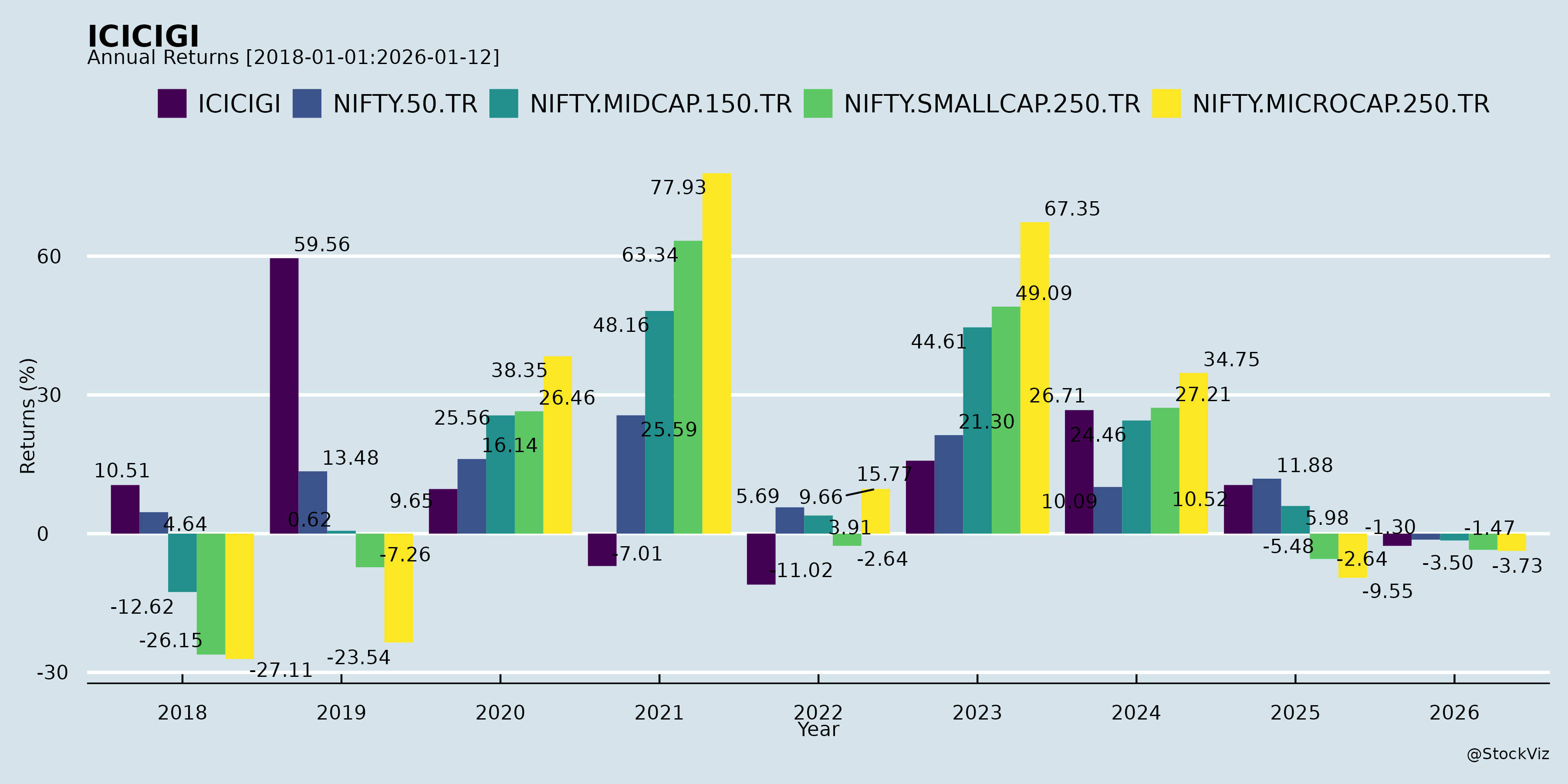

Annual Returns

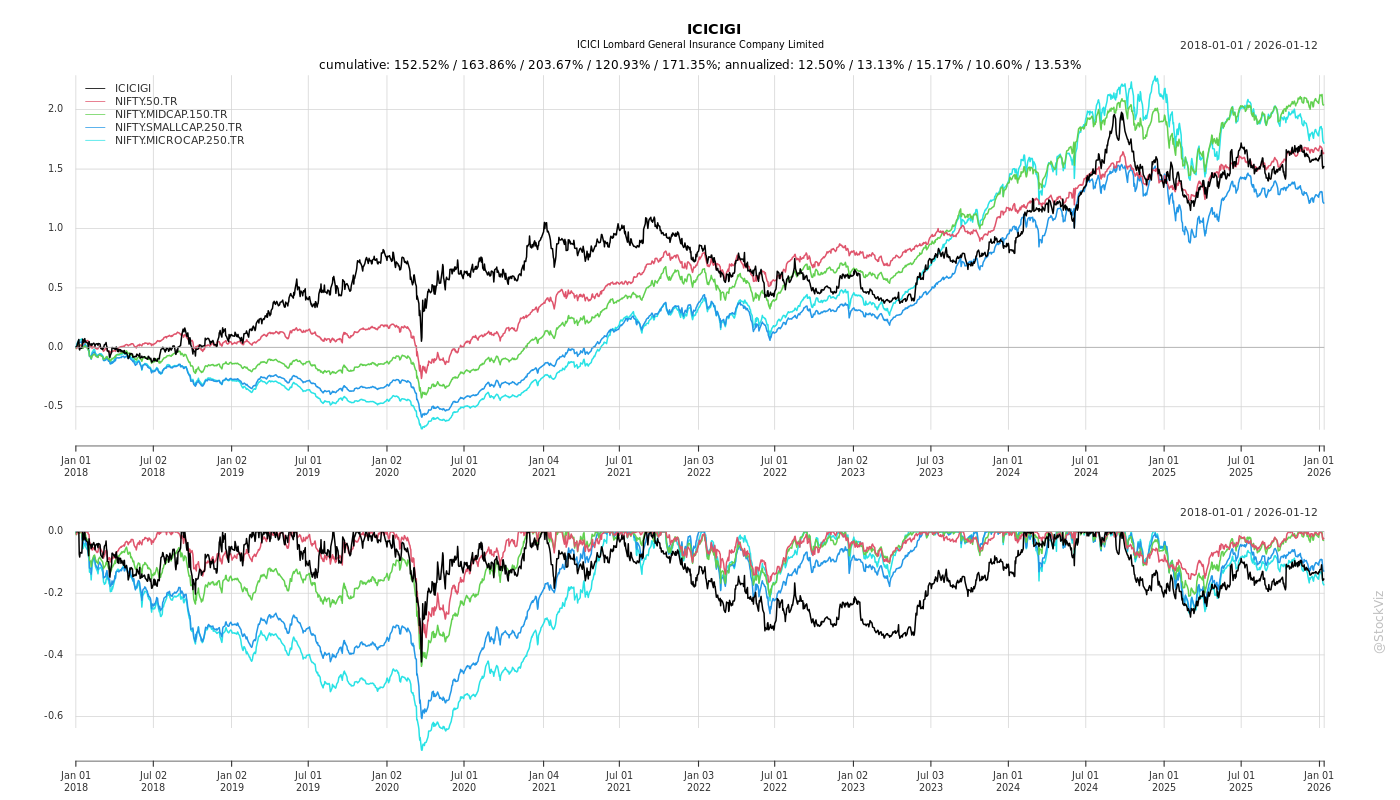

Cumulative Returns and Drawdowns

Fundamentals

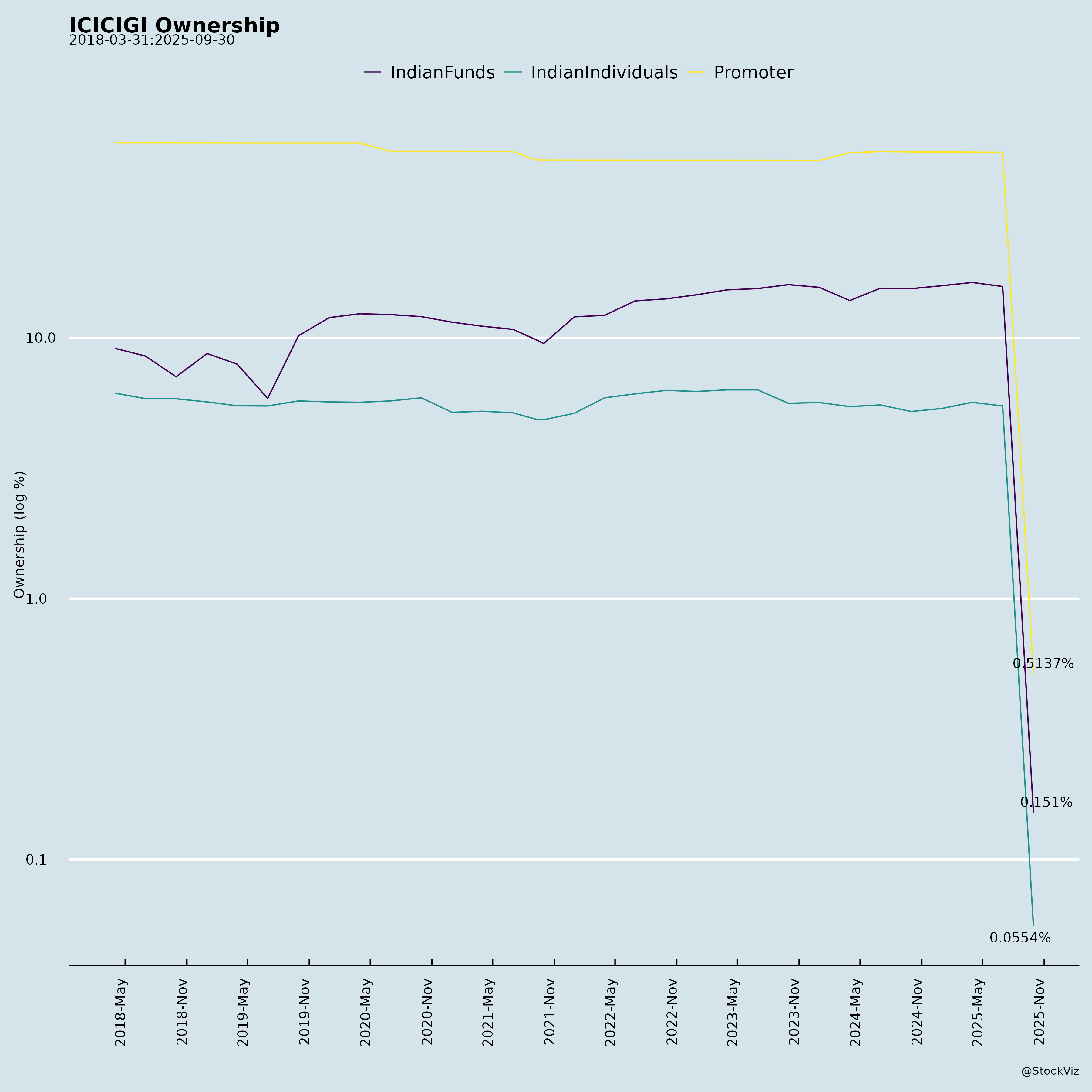

Ownership

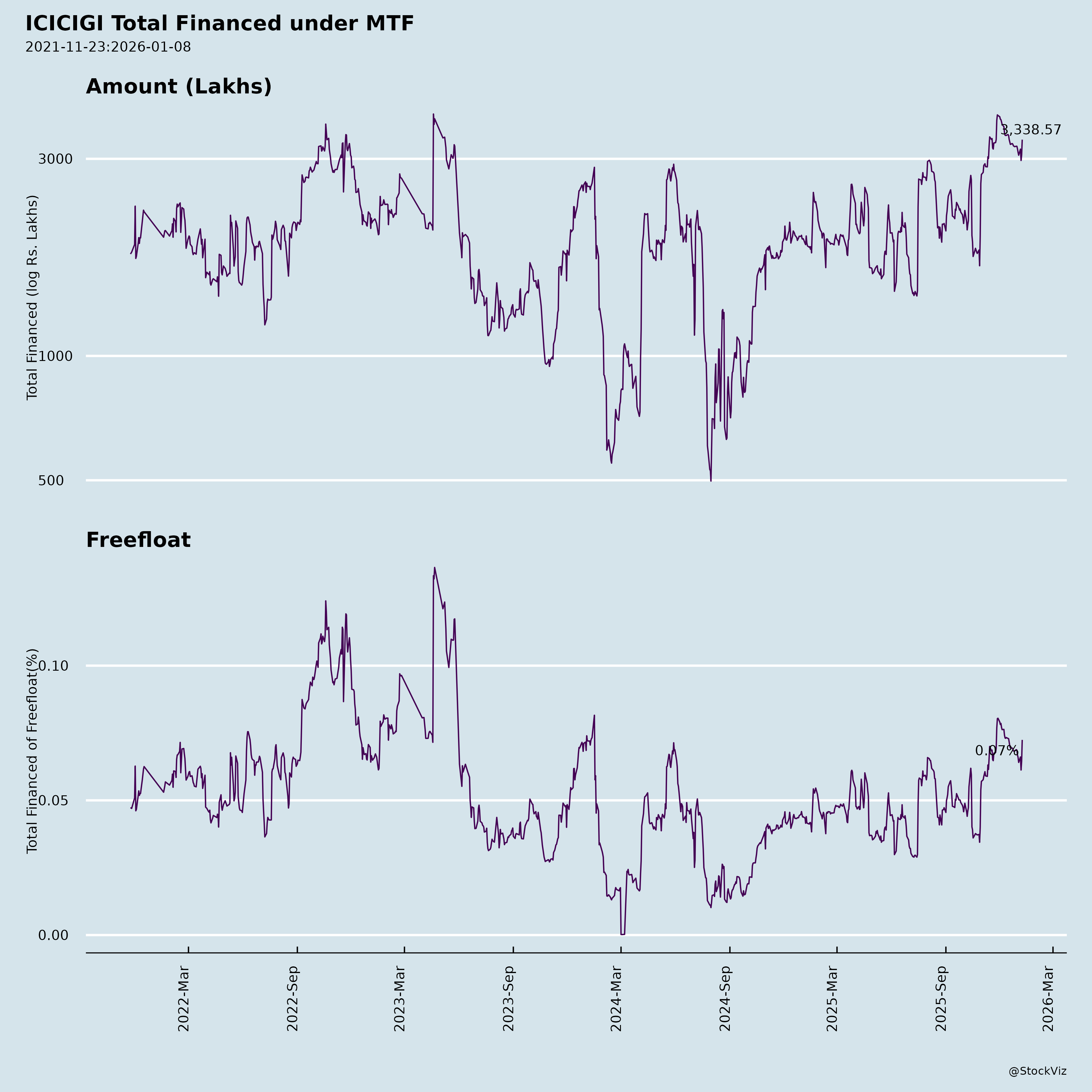

Margined

AI Summary

asof: 2025-12-03

ICICI Lombard General Insurance (ICICIGI) Analysis

Period Analyzed: Q2 & H1 FY2026 (Apr-Sep 2025, reported Oct 2025). All figures on 1/n basis (IRDAI mandate from Oct 2024 for long-term products; impacts ~₹68 Cr GDPI downward).

Financial Snapshot (H1 FY2026)

| Metric | Value | YoY | Industry |

|---|---|---|---|

| GDPI | ₹143.3 Bn | -0.5% | +7.3% |

| GDPI ex Crop/Mass Health | - | +3.5% | +10.5% |

| PAT | ₹15.7 Bn | +22.9% | - |

| ROAE | 20.8% | +50 bps | - |

| CoR (ex CAT) | 103.3% | +110 bps | 115.0% |

| Solvency | 2.73x | - | >1.5x req. |

Dividend: ₹6.50/share (vs ₹5.50 prior H1).

Headwinds

- Subdued Growth: GDPI de-growth vs industry; Motor (+2.2%, share 10.4%) hit by pricing wars/competition (industry +7.6%). Commercial +6.5% (vs +14.2%). Crop de-growth from tenders.

- Margin Pressure: CoR up to 104% (Motor OD LR 68.5%, Fire 65.8%); CAT losses ₹0.73 Bn.

- 1/n Norm Impact: Lower reported GDPI/premium recognition; not fully comparable.

- GST Demand: ₹47 Cr tax + ₹47 Cr penalty (FY19-23) from Bhopal CGST; ~30% of H1 PAT (appeal/writ planned, “no impact at this stage”).

Tailwinds

- PAT/ROE Strength: +23% PAT driven by investments (₹25 Bn income, +13%; cap gains ₹6 Bn). ROAE 20.8% >> industry avg.

- Retail Health Outperformance: +25% growth (share 3.7% from 3.2%; Sep >4%); claims settled 99.6% in 30 days.

- GST Reforms Boost: Zero GST on health premiums (Sep volumes up); auto GST cuts aiding festive demand (Sep Motor +6.5%, new PC/TW +18%/8.5% > industry).

- Operational Excellence: App 18.4 Mn downloads (GWP ₹2.1 Bn); NPS Health 72/Motor 66; differentiated service desks.

Growth Prospects

- H2 Momentum: Reforms + festive tailwinds (Navratri PC/TW sales +35%); expect Motor recovery (OEM strength). Retail health to scale on affordability.

- Industry Backdrop: +7-10% GDPI (ex crop/mass); multiline edge (Fire +27% Q2).

- Medium-Term: Penetration low (0.6% GDP); reforms unlock ₹2.2-3.1 Tn stimulus. Target profitable growth (CoR ~103%, ROE 18-20%).

- FY26 Outlook: GDPI 8-12% (mgmt optimistic); Retail health upward trajectory.

Key Risks

| Risk | Details | Mitigation |

|---|---|---|

| Regulatory | GST demand (₹94 Cr); 1/n norm volatility. | Appeal/writ; conservative reserving. |

| Competition | Motor pricing pressure (CoR 125% industry); share loss tactical. | Portfolio shift (PC/TW up); underwriting discipline. |

| CAT/Claims | Floods impacted Q2; historical low exposure but volatile. | Reinsurance (A- rated); VAS/risk mgmt. |

| Investment | Equity 14% portfolio; rate cuts. | YTM 7.39%; duration 4.74 yrs; unrealized gains ₹16 Bn. |

| Execution | Crop tenders; group health muted (microfinance slowdown). | Diversified channels (1.47L agents); digital focus. |

Overall: Resilient profitability amid growth moderation; reforms position for H2/FY27 acceleration. Stock likely supported by PAT beat/dividend, but watch GST resolution/Motor recovery. Buy/Hold on dips for long-term growth (CAGR 13-20% GWP/PAT historical).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.