HINDALCO

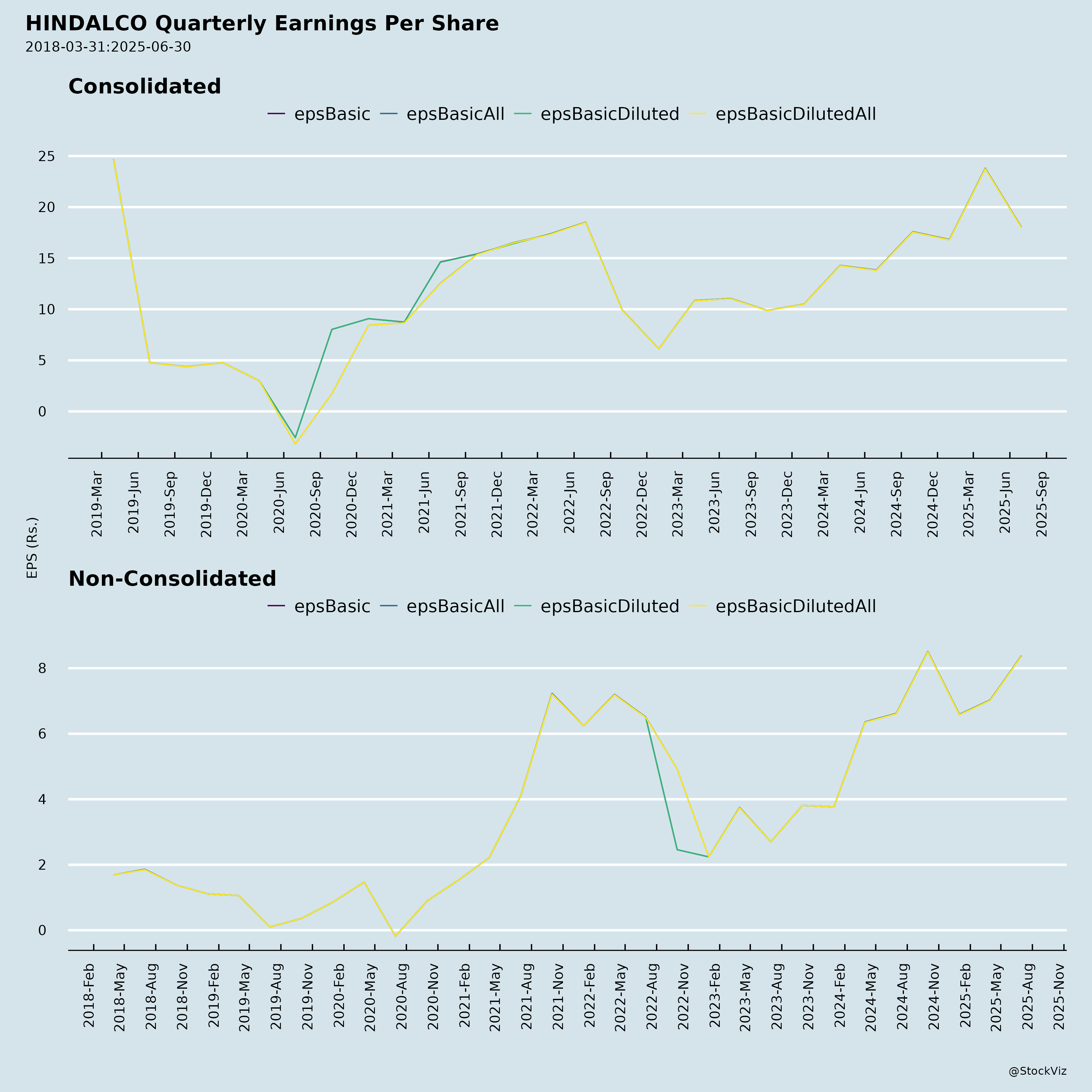

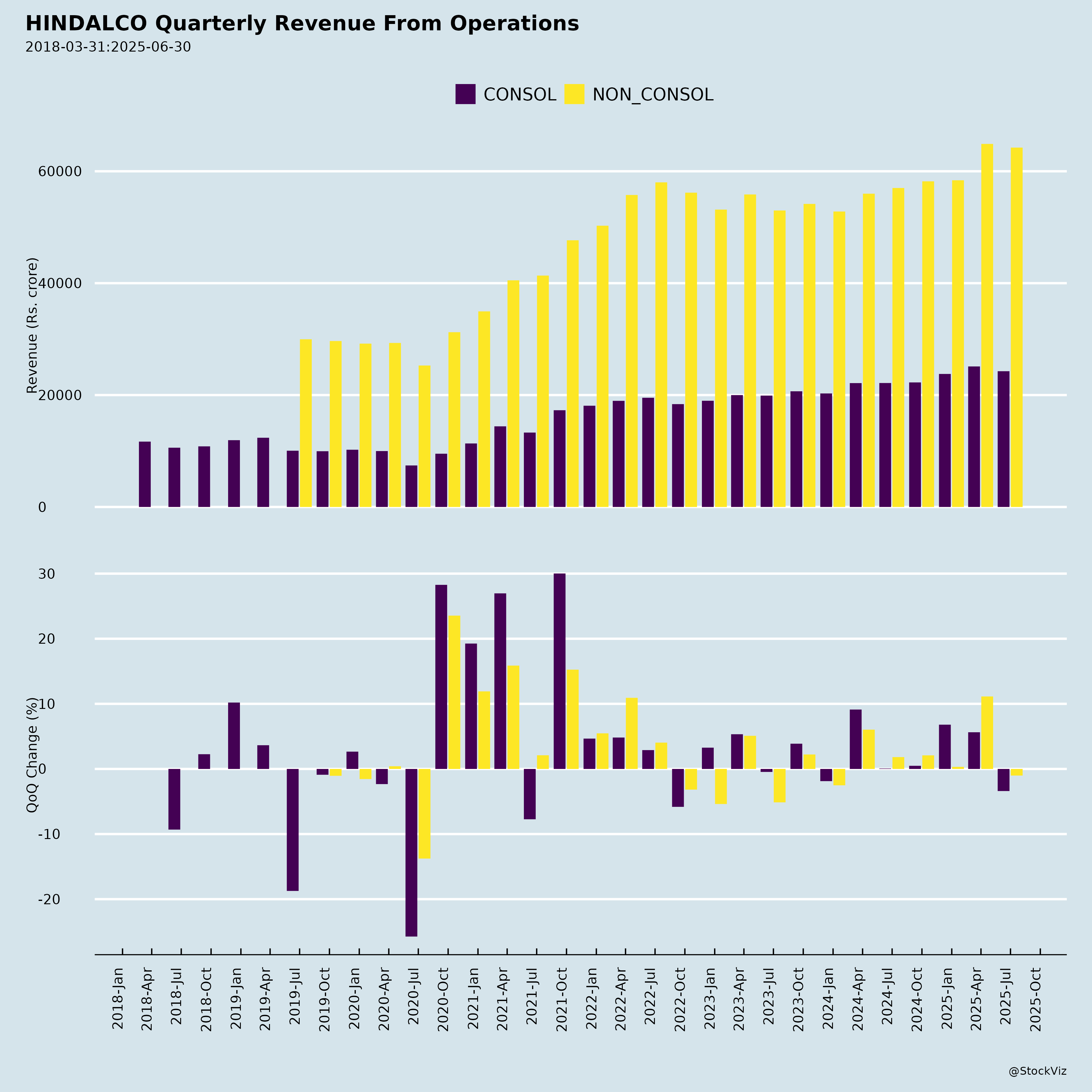

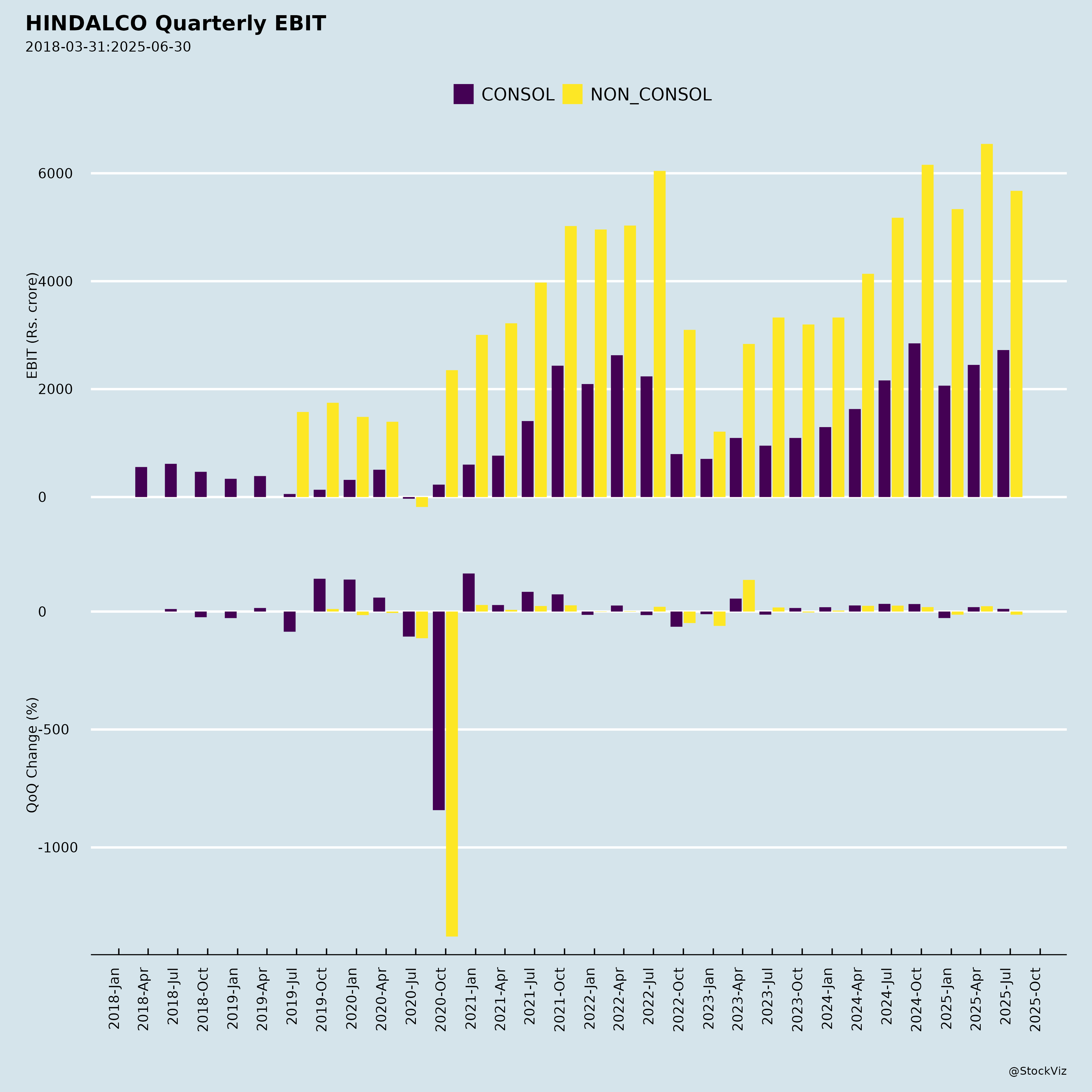

Equity Metrics

January 13, 2026

Hindalco Industries Limited

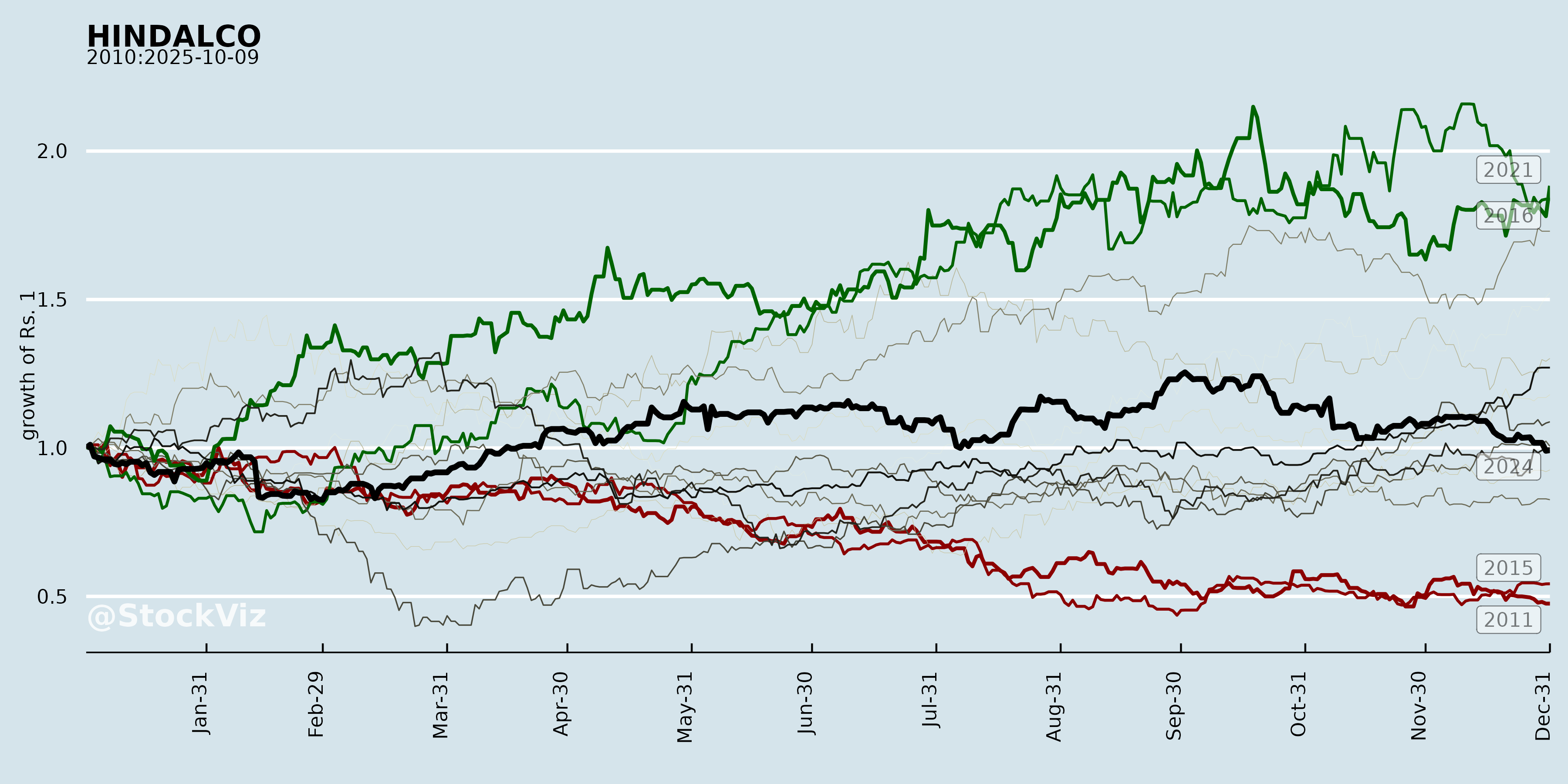

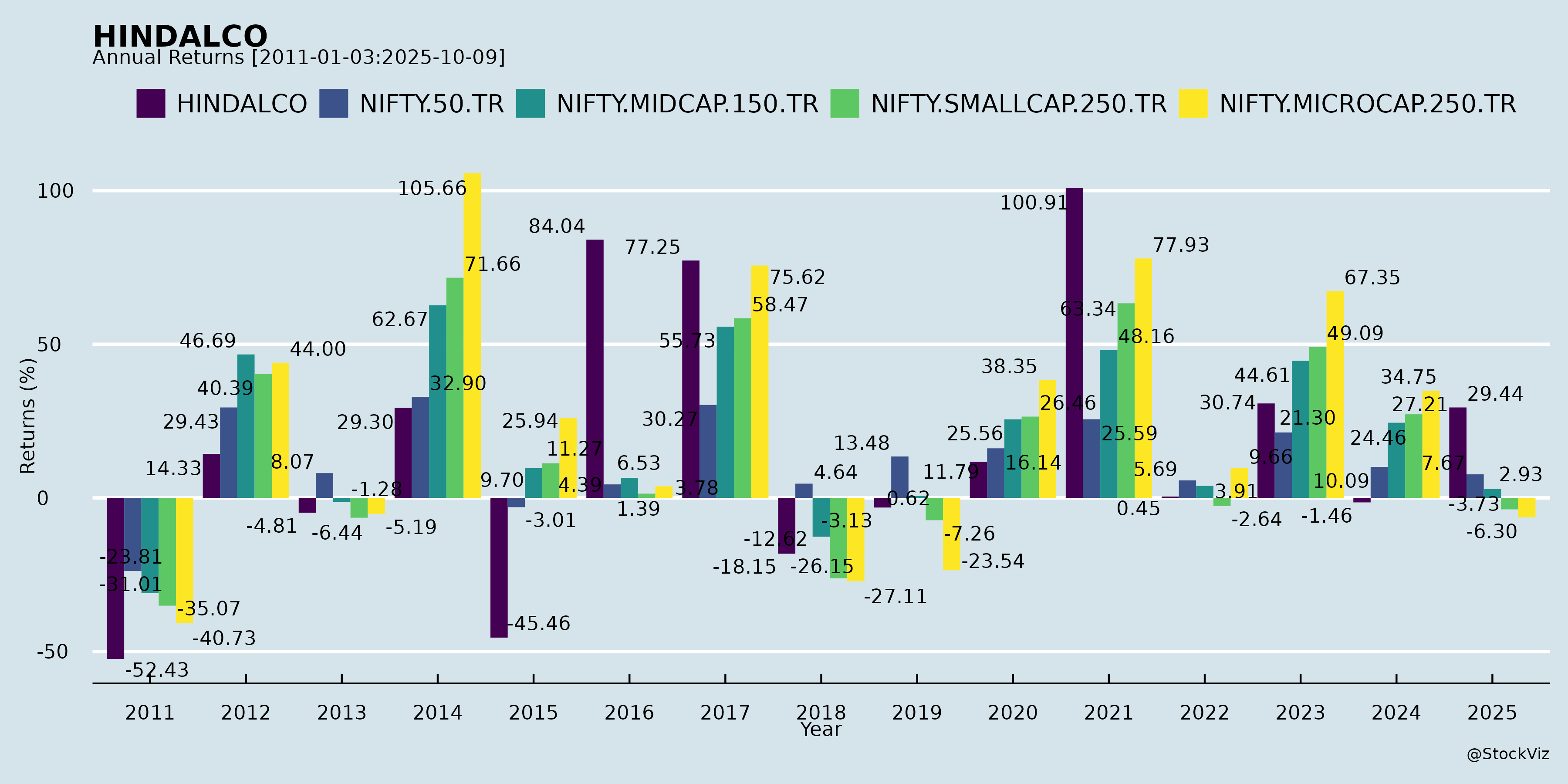

Annual Returns

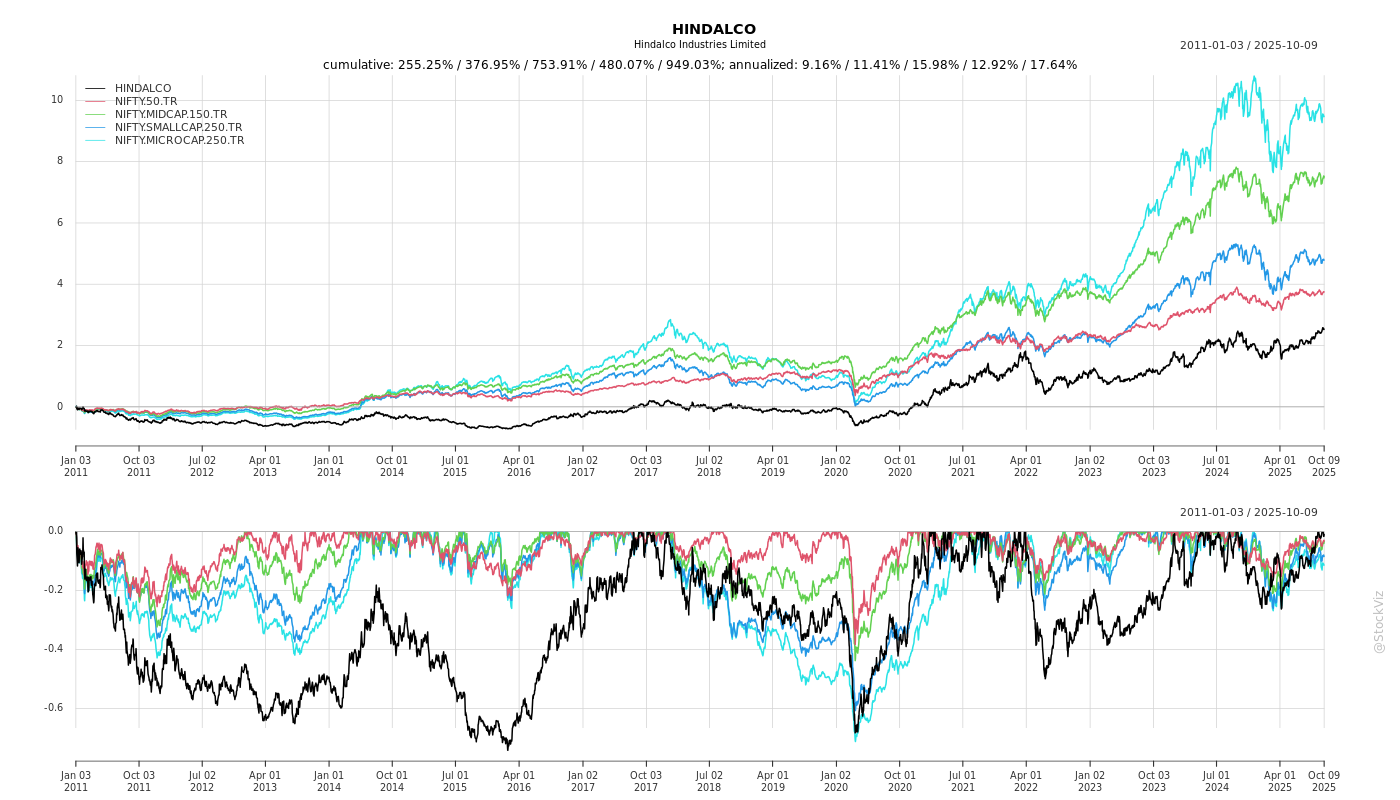

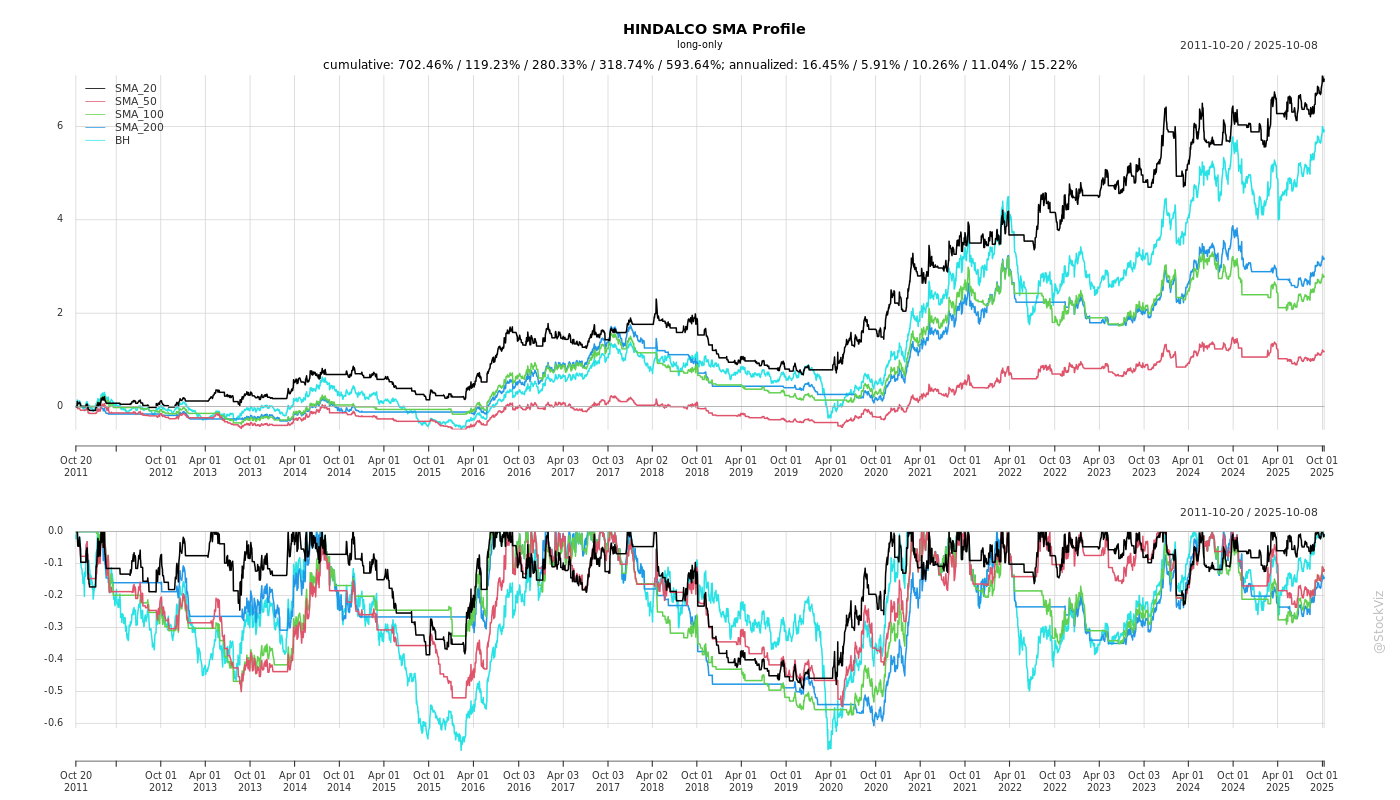

Cumulative Returns and Drawdowns

Fundamentals

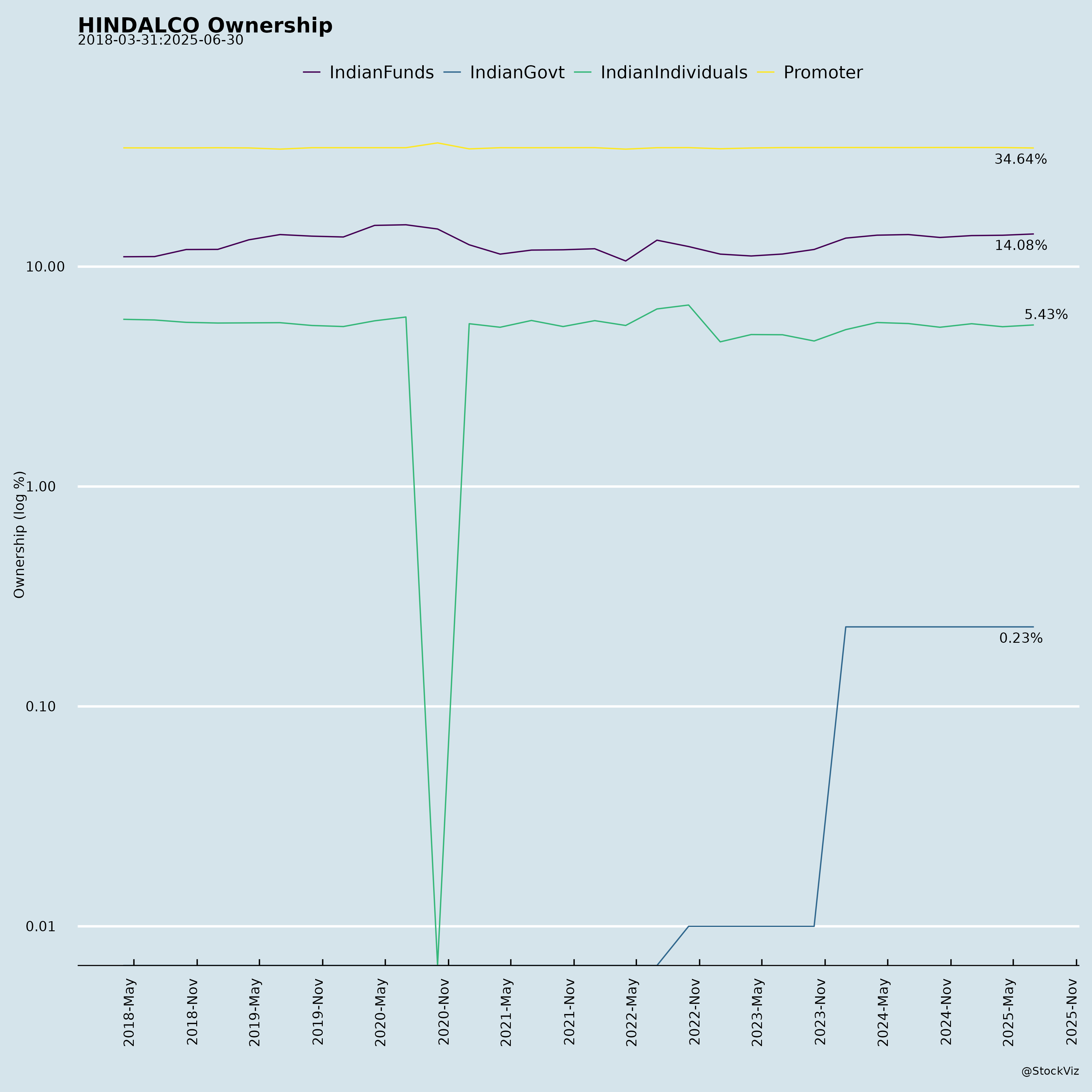

Ownership

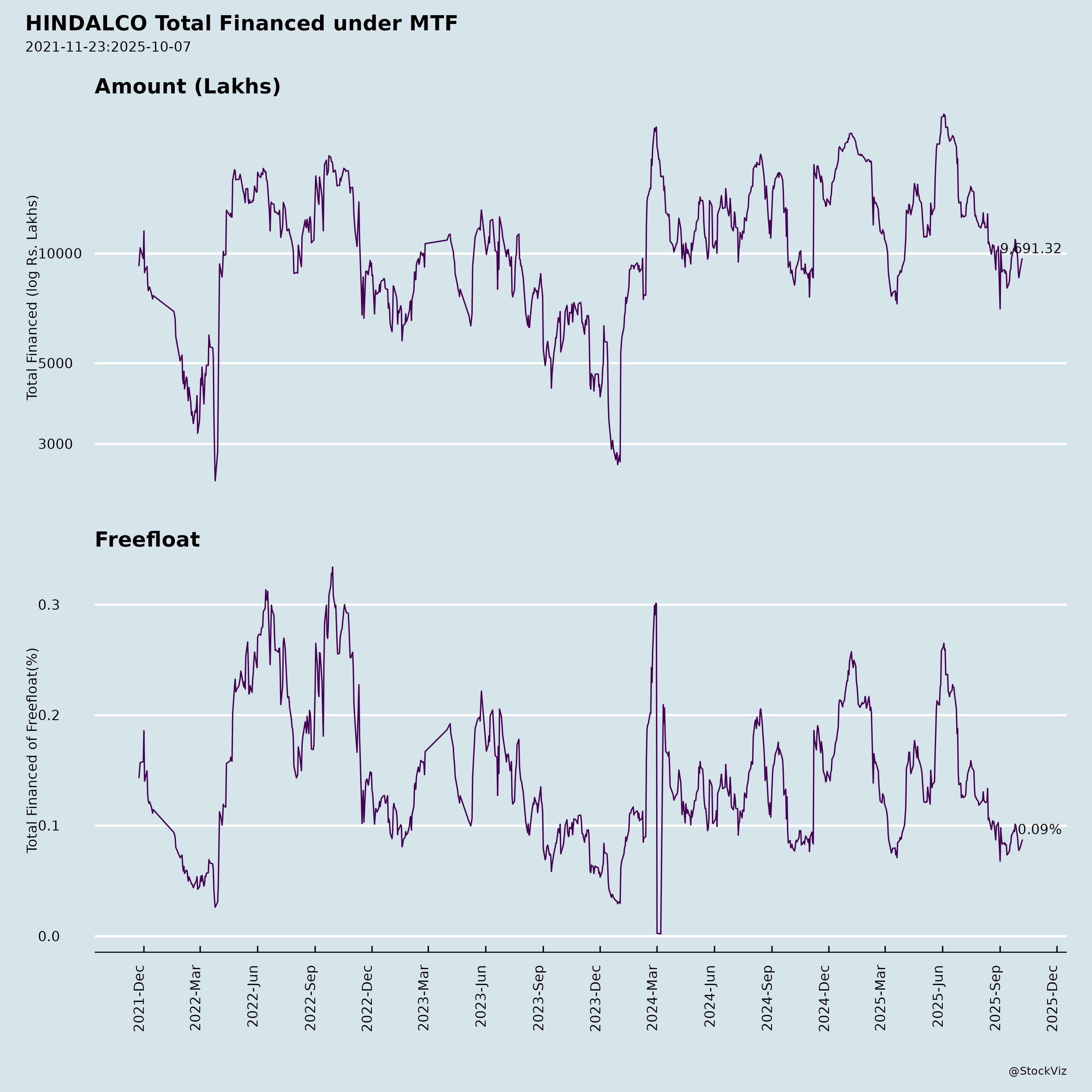

Margined

AI Summary

asof: 2025-11-29

HINDALCO Industries Limited: Analysis of Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: Hindalco (Aditya Birla Group’s metals flagship) reported strong H1 FY26 results (ended Sep 30, 2025), with consolidated PAT at ₹8,745 Cr (up 25% YoY), driven by robust India Aluminium Upstream (45% EBITDA margins) and resilient Copper. Novelis (100% subsidiary) showed revenue growth (H1: $9.5B, +12%) but EBITDA pressure (H1: $838M, -13%) amid disruptions. Leverage at 1.23x Net Debt/EBITDA remains healthy amid $10B growth capex. Stock trades at attractive multiples (P/E 10x, P/B 1.33x vs. Nifty 50 avg. 68.8x/7.6x).

Headwinds (Short-term Pressures)

- Commodity & Input Costs: Novelis faced higher scrap prices (less favorable metal benefit) and net tariffs (e.g., US aluminum imports dispute: $22M deposit, potential $19M more). LME/LMP volatility impacted margins (Novelis Adj. EBITDA/ton: $440, down from $507).

- Operational Disruptions: Novelis Oswego fire (Sep 2025) caused $21M Q2 charges; expected H2 cash impact $550-650M (Adj. EBITDA $100-150M hit), restart Dec 2025. Restructuring (2025 Efficiency Plan): $116M H1 charges.

- Demand Softness: Automotive/specialty shipments down (e.g., Europe customer halts); macro uncertainty in Europe/NA offset packaging strength.

- High Capex Drag: $10B+ investments (e.g., Bay Minette $5B) led to negative FCF ($499M H1); H1 capex $913M (up from $717M).

- FX/Trade: Currency volatility (e.g., weaker EUR/BRL aided some regions but hurt others); US tariffs/trade barriers add uncertainty.

Tailwinds (Supportive Factors)

- Pricing Power & Realizations: Higher LME avg. ($2,532/ton, +3%) & LMP (+126%) boosted revenue (consol. +13% Q2). India Upstream: EBITDA/ton $1,495 (+14%).

- Cost Efficiencies: Novelis targeting $300M+ annual savings by FY28 ($125M FY26 run-rate); SG&A down 5% Q2. India: Captive coal (88% self-sufficiency by FY33) lowers costs.

- Volume Resilience: Novelis shipments flat (941kt Q2); India Upstream +4% (341kt Q2). Downstream records (e.g., EBITDA +69% Q2).

- Strong Balance Sheet: Liquidity $2.9B; India net cash (-0.41x leverage). ROCE 19.6% H1.

- Sustainability Edge: 63% recycled content (target 75% by 2030); low-carbon focus aligns with demand.

Growth Prospects (Medium-Term Opportunities)

- Novelis (Global Leader in FRP): 600kt Bay Minette (FY27, $5B capex, 420kt cans/180kt auto); recycling expansions (Guthrie/UAL FY25, Latchford FY27). Target EBITDA/ton $600+; non-LME EBITDA to 70%. Demand: Packaging +4%, auto/aerospace +3-5%.

- India Upstream: >2MT Al capacity (Aditya Ph2: 193kt FY29); alumina >5.5MT. Captive coal mines (Chakla/Meenakshi/Bandha).

- India Downstream/Copper/Specialty Alumina: FRP +170kt (FY26); Copper smelter (300kt FY29), recycling (200kt); battery foils/enclosures, aerospace. Total India capex ~$6.2B.

- Sustainability/Circularity: Low CO2 (<3t/ton FRP by 2030); EV/battery (foils, enclosures), aerospace/defense.

- Overall: $10B capex to drive 5MT+ Al capacity; ROIC focus (scale, recycling). FCF post-maint. capex: $2B potential.

| Key Metrics (FY26 Guidance) | Target |

|---|---|

| Capex | $1.9-2.2B |

| Leverage (Net Debt/EBITDA) | ~3.5x (Novelis); 2.0x consol. |

| Shareholder Returns | 8-10% of post-maint. FCF |

Key Risks

| Risk Category | Description | Mitigants |

|---|---|---|

| Commodity/Price | LME/LMP/scrap volatility; TC/RC decline (Copper). | Hedging; 50% non-LME EBITDA target. |

| Execution | Bay Minette/Aditya delays ($5B+ capex); overruns. | Phased approach; strong FCF track record. |

| Geopolitical/Trade | US tariffs (Oswego, Brazil imports); China surplus. | Diversified regions; recycling/local sourcing. |

| Operational | Disruptions (fires/floods); labor/unions. | Insurance; efficiency plans. |

| Regulatory | CBI chargesheet (coal mine); env./tax changes (e.g., 115BAA). | Legal reviews; compliance focus. |

| Macro/Demand | Auto slowdown; China weakness. | Packaging resilience; EV/aero growth. |

| Liquidity/Debt | Capex peaks; rising rates. | $2.9B liquidity; 1.23x leverage. |

Summary: Hindalco’s integrated model shines amid volatility—India delivers margin leadership (Upstream 45%), offsetting Novelis headwinds (tariffs/fire). Tailwinds from pricing, efficiencies, and sustainability drive resilience. Growth via $10B+ capex positions for 5MT+ Al capacity, targeting superior ROIC. Risks center on execution/trade, but healthy leverage (1.23x) and FCF support 8-10% returns. Bullish outlook for long-term; near-term volatility from Novelis disruptions. Attractive valuation (top-5 Nifty 50 PAT rank; P/E 10x). Buy/Accumulate on dips for 20-25% upside in 12-18 months.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.