Aluminium

Industry Metrics

January 13, 2026

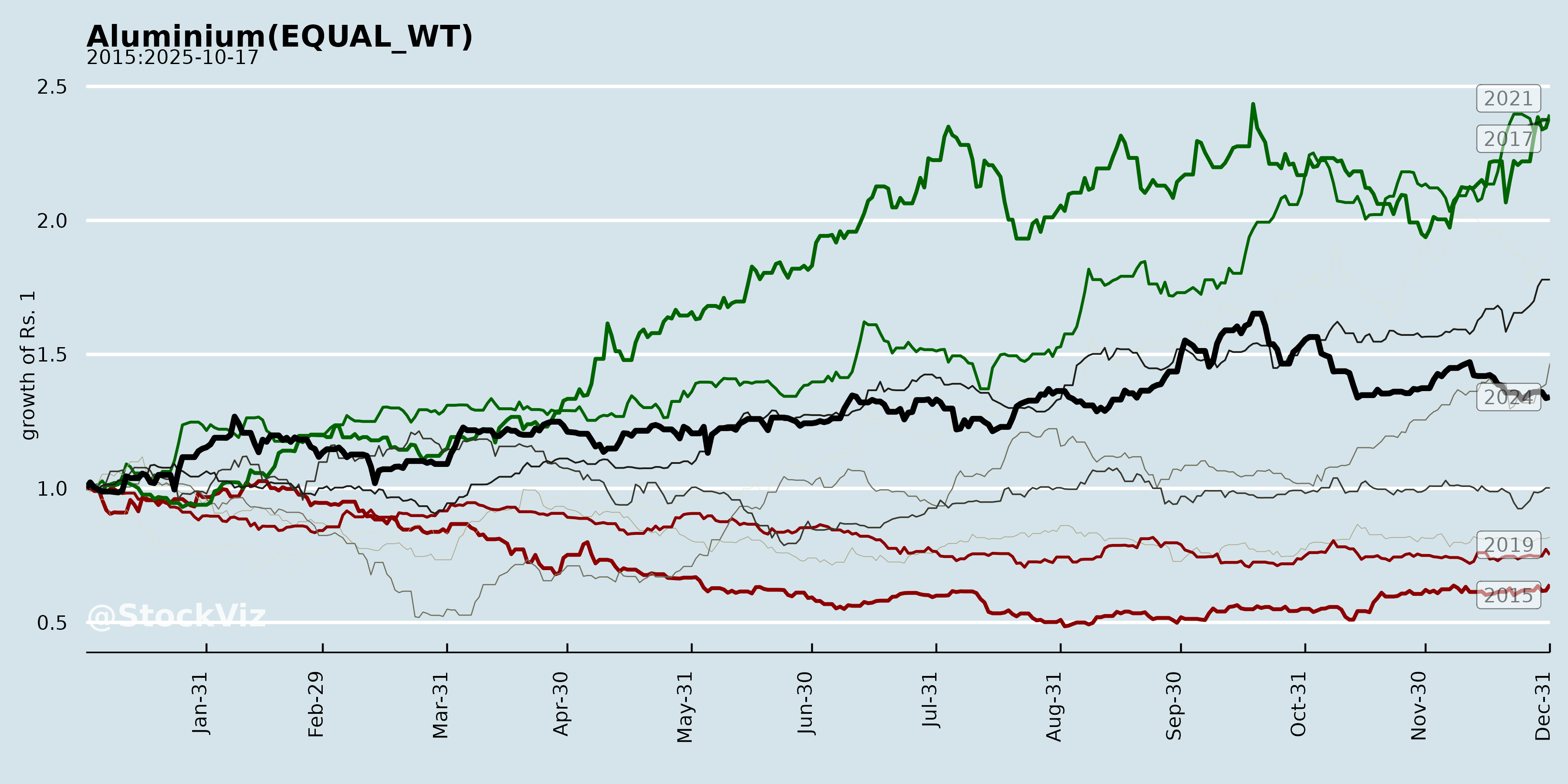

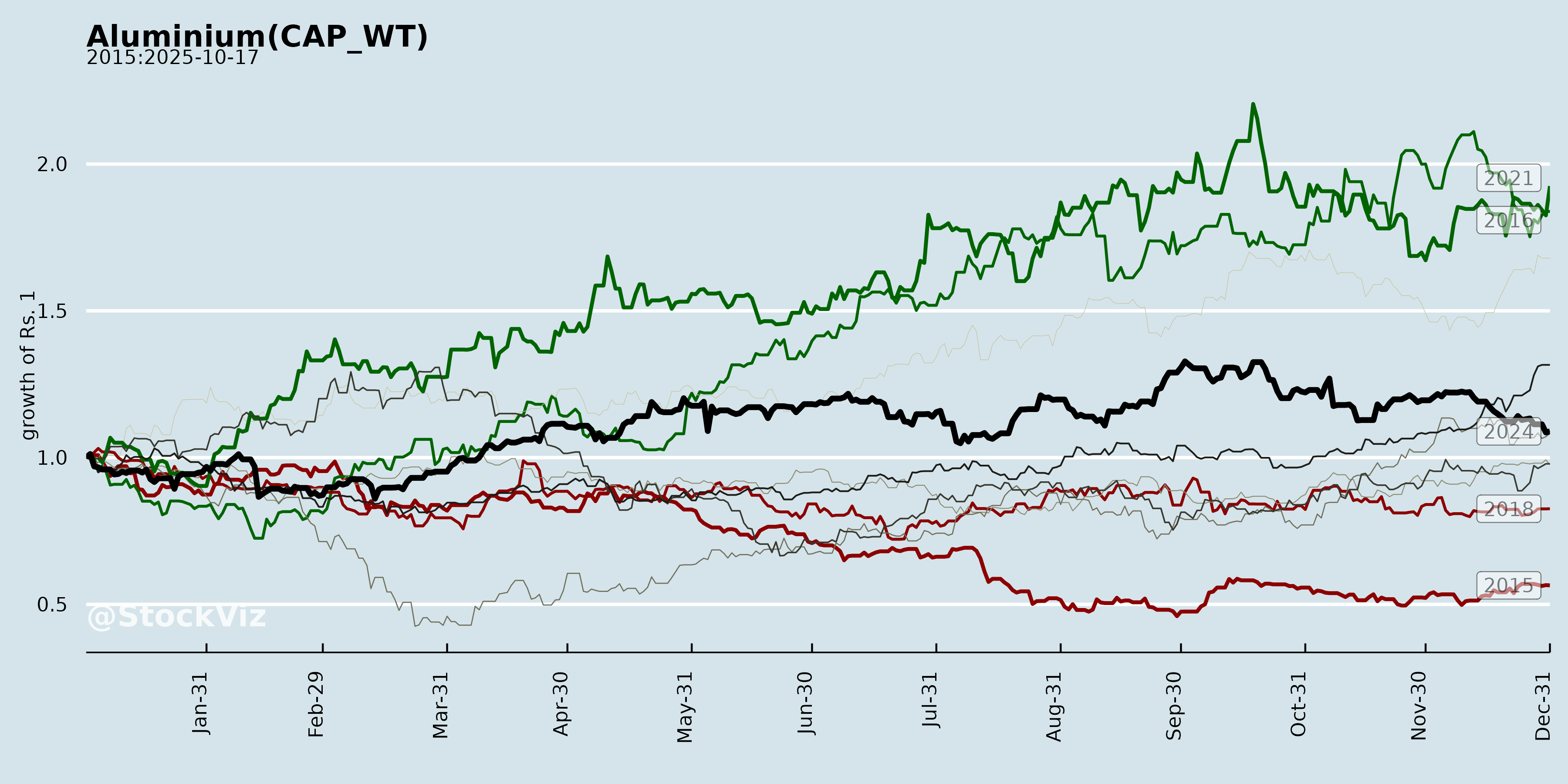

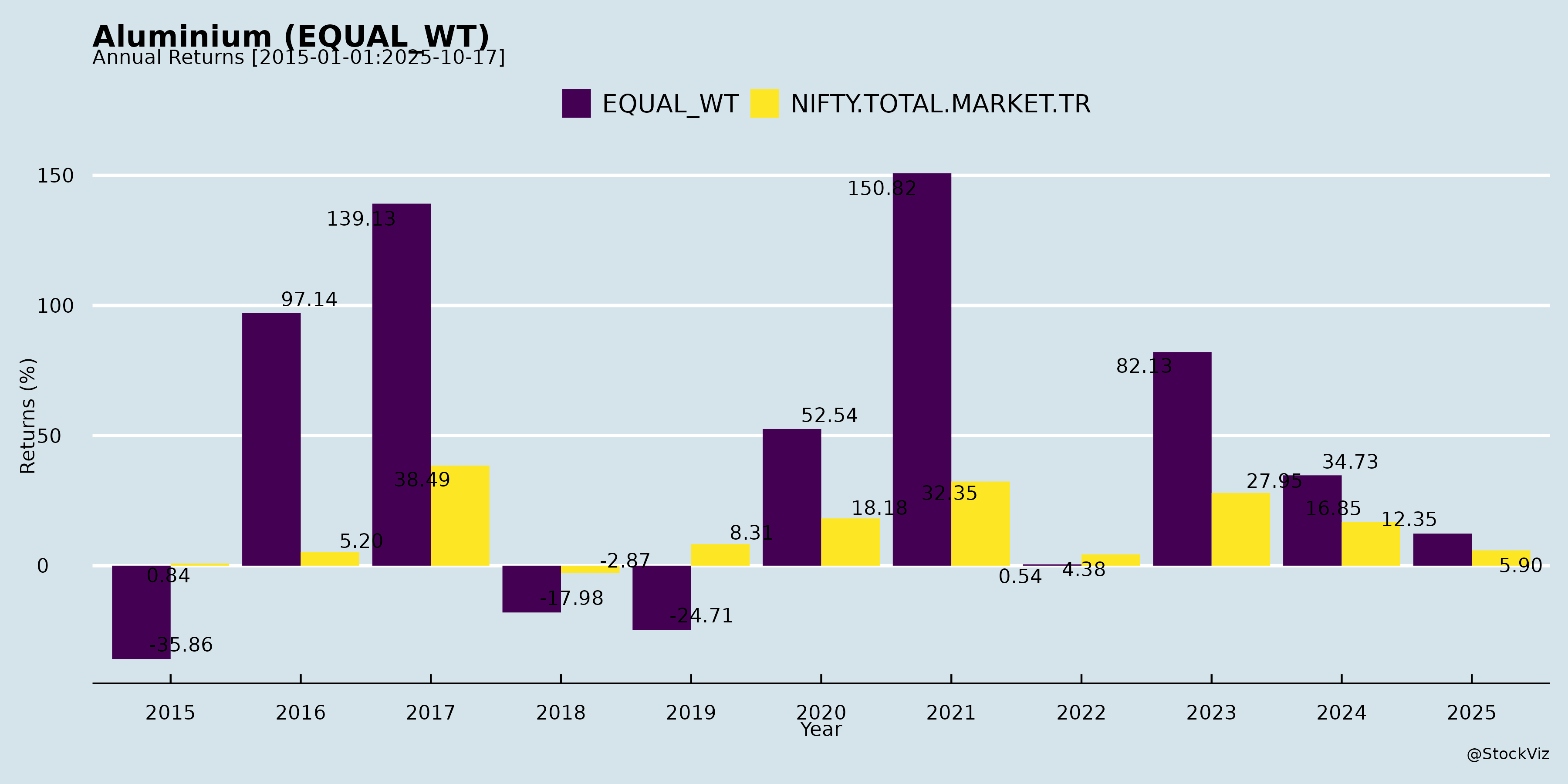

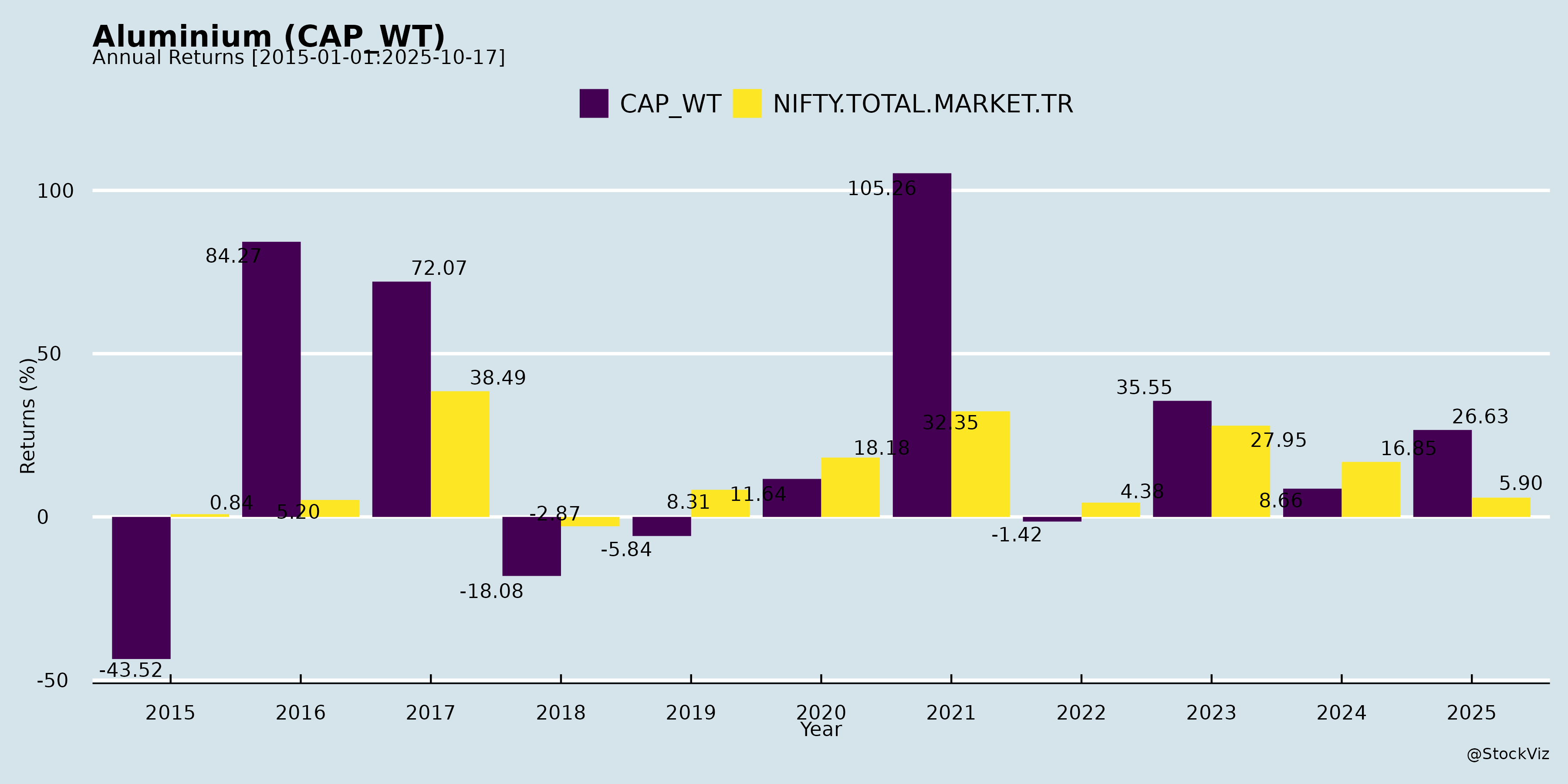

Annual Returns

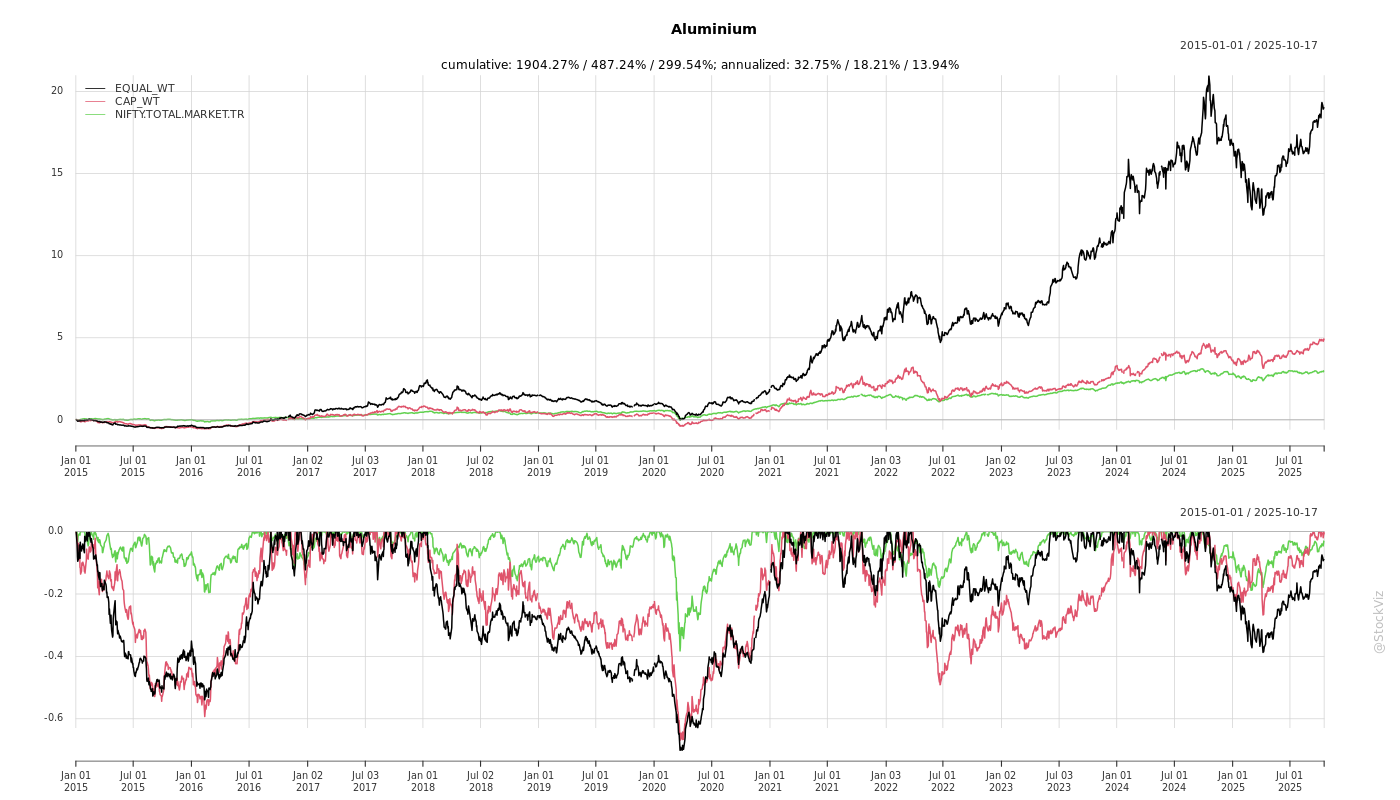

Cumulative Returns and Drawdowns

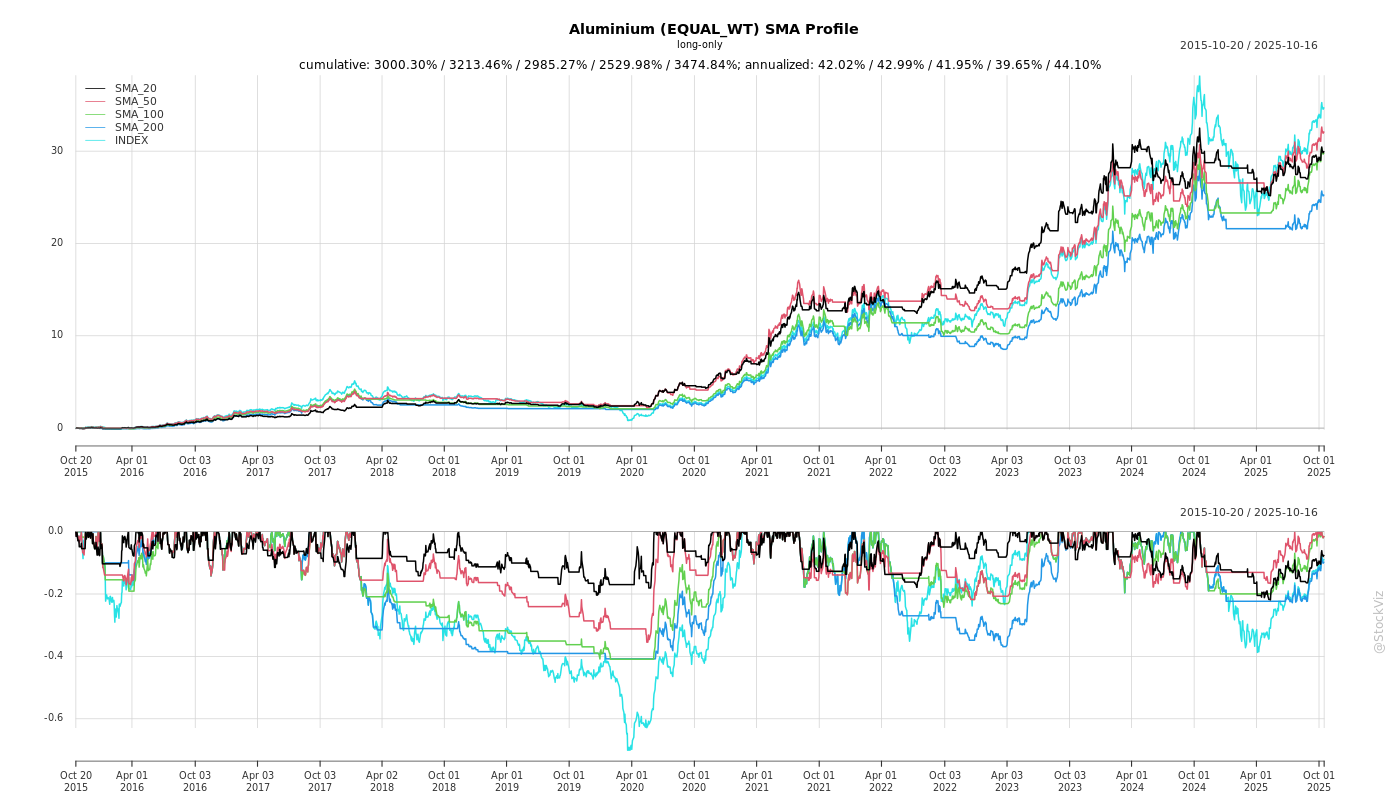

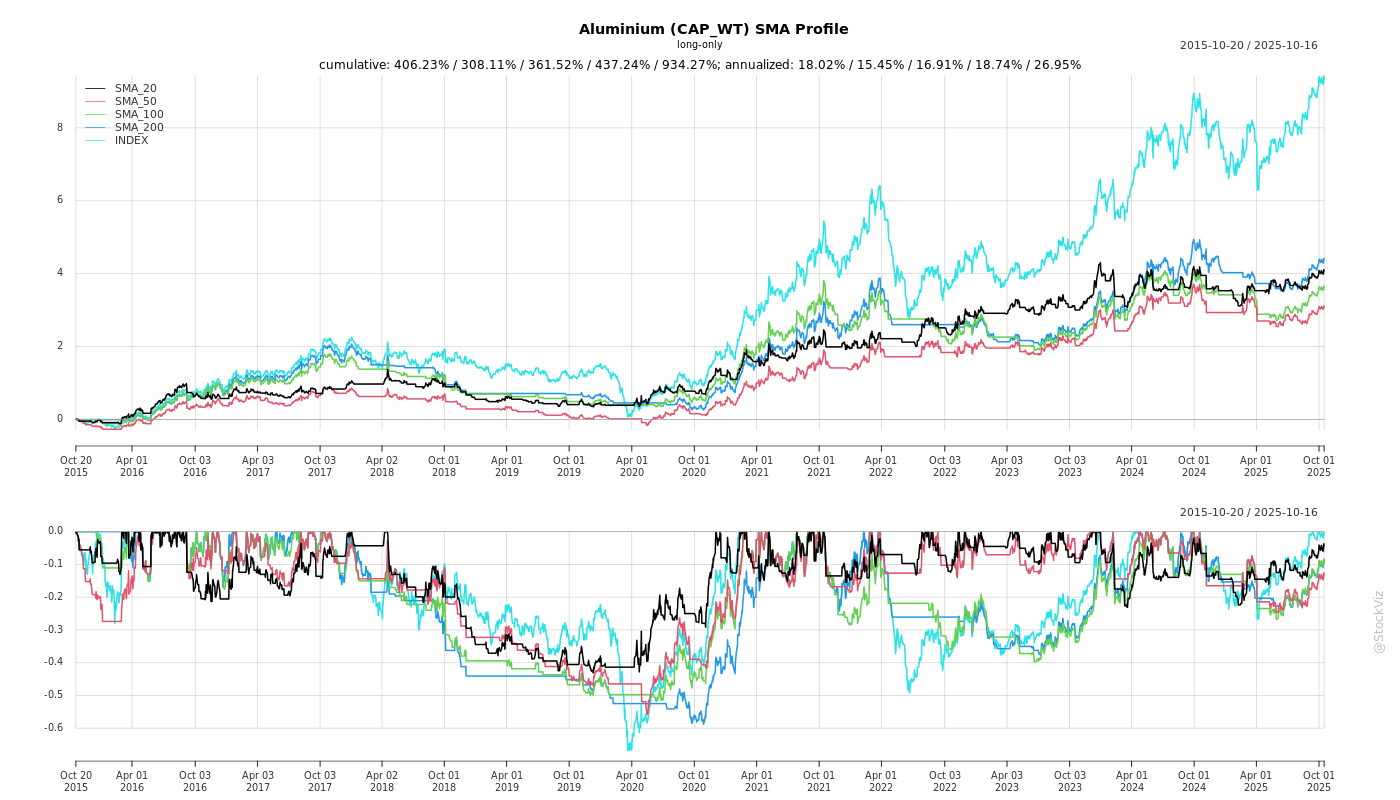

SMA Scenarios

Current Distance from SMA

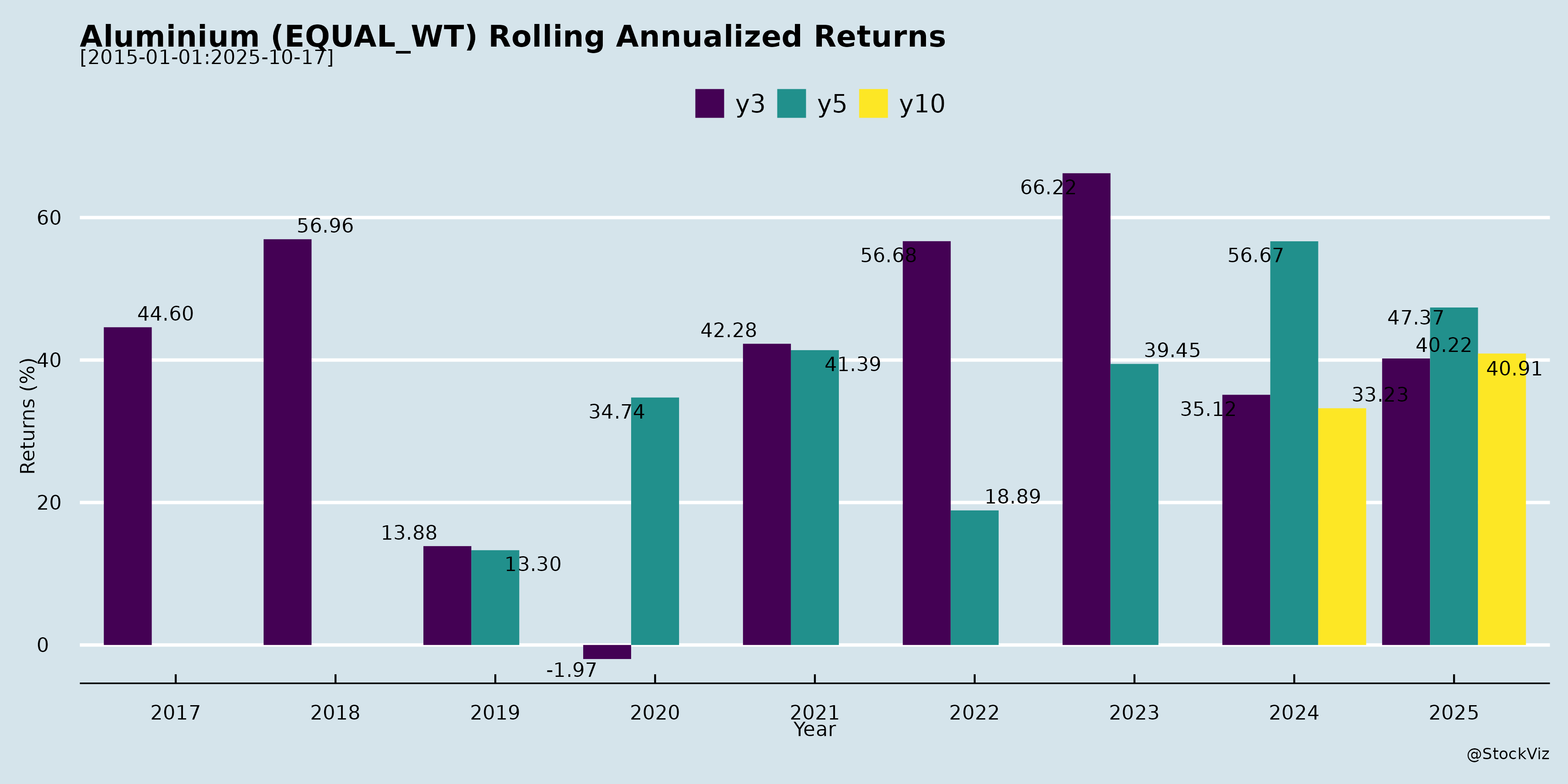

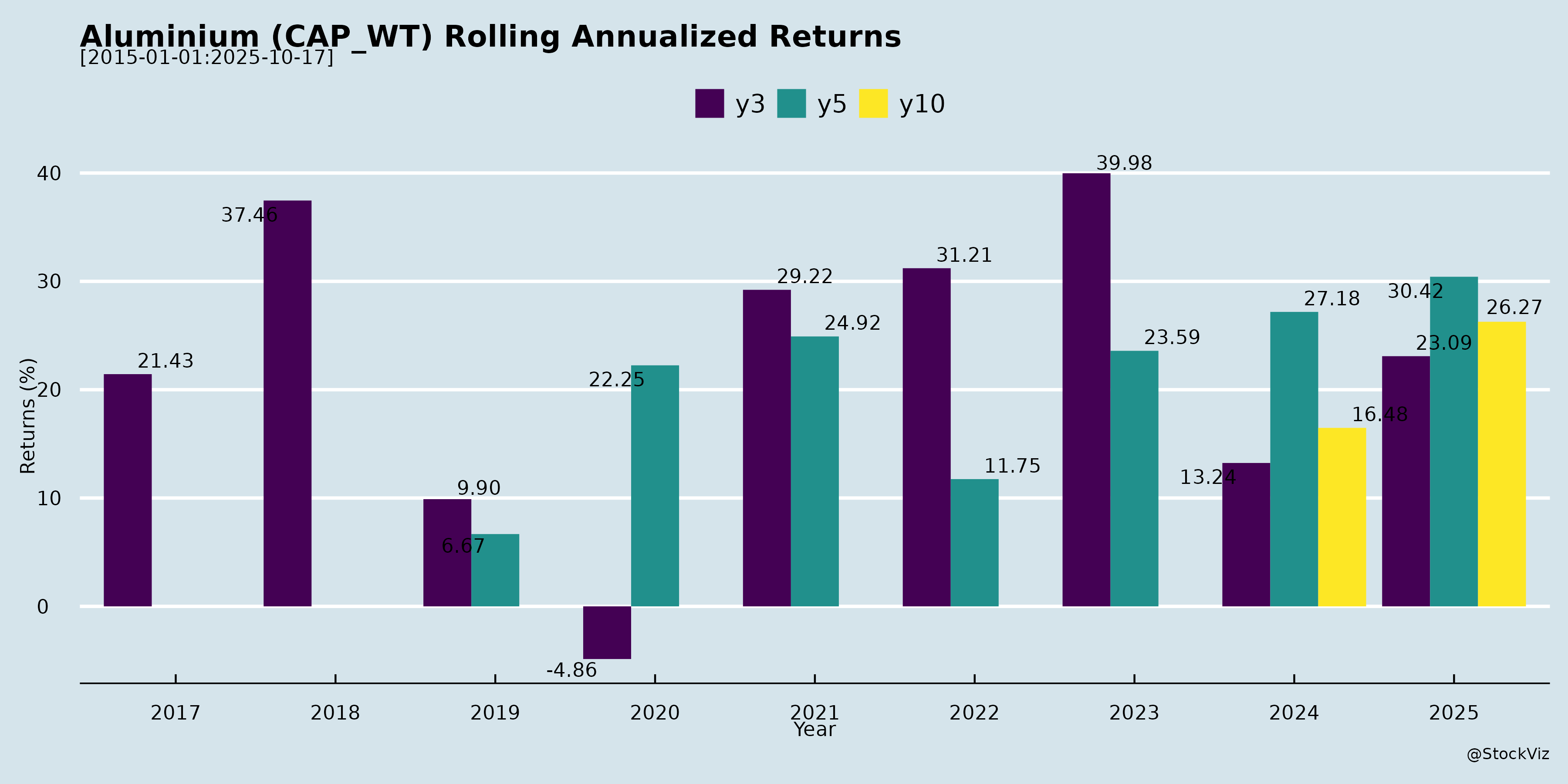

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis of Indian Aluminium Sector

Based on the provided documents (primarily NALCO and MAAN Aluminium earnings transcripts from Q2/H1 FY26, supplemented by Hindalco’s plant visit notice and MMP’s analyst meet intimation), here’s a structured analysis of the Indian Aluminium sector. Insights reflect upstream (mining/refining/smelting like NALCO/Hindalco) and downstream (extrusion/value-add like MAAN) dynamics. The sector shows resilience amid global oversupply but benefits from domestic demand tailwinds.

Tailwinds (Positive Factors)

- Robust Operational Performance & Efficiencies: NALCO reported record Q2/H1 FY26 with H1 revenue +18%, PAT +50%, driven by 31% higher alumina production and 3% cast metal growth. Cost savings from technical efficiencies (e.g., lower caustic consumption to 96kg/ton) and captive coal ramp-up (to 4MT from 2.6MT) offset input inflation; power costs moderated despite monsoons.

- Domestic Demand Surge: Low per-capita Al consumption offers huge runway. EV, solar, defense, infra, railways, and aero sectors drive growth. MAAN emphasized “Make in India” shift, with OEMs seeking import substitutes (e.g., roof rails, precision tubing). Domestic premiums at ~10% over LME (vs. 6-7% norm).

- Capacity Expansions & Value-Add Focus: NALCO: Refinery to 3.1MT by Jun’26 (80% complete, +5LT FY27 sales); 0.5MT smelter by 2030. MAAN: Extrusion doubled to 24k TPA; new anodizing/machining/powder coating for 15-18% margins (vs. 8-10% vanilla). Dewas precision unit (Rs46 Cr capex) as 100% import substitute.

- Hedging & Fixed Margins: Downstream converters like MAAN hedge 95-98% via MCX/LME, insulating margins (10% EBITDA blended, targeting 15-18%).

- Diversification: NALCO’s KABIL JV (Argentina lithium) progressing to pilot in 1-1.5 years; potential commercial mining.

Headwinds (Challenges)

- Weak Alumina Prices: Global oversupply (Indonesia refineries, China smelter cuts) pressured prices (Q2 $380, spot $320; H2 guidance $320-340). NALCO H2 alumina sales ~6-6.5LT (full-year 12.5LT).

- Input Cost Inflation: CP Coke (Rs30.6k to 42k/ton), caustic (Rs37k to 41k), despite efficiencies. NALCO power/fuel flat YoY despite volumes.

- Export Disruptions: US ADD (50-55%) hit MAAN’s exports (down from 70-73% to 45-50% mix), causing demand destruction and 27-28% utilization dip post new press. Holiday slowdowns exacerbate.

- Demand Seasonality: Monsoon rains curbed metal sales (NALCO); MAAN noted 1.5-year slowdown.

- High Capex Intensity: NALCO ~Rs30k Cr (smelter+power); MAAN Rs110+ Cr over 3 years. Utilization dips during ramps (6-8 months cycle).

Growth Prospects

- Short-Term (FY26-27): NALCO: 47kT metal sales; H2 Al LME $2,800-2,900; 5LT incremental alumina. MAAN: Ramp 24k TPA extrusion to 80% utilization; value-add EBITDA to 15-18%; Dewas unit online Q1/Q2 FY27.

- Medium-Term (3-5 Years): 3-5x revenue/EBITDA growth (MAAN); NALCO full expansions add 1MT refinery +0.5MT smelter. Sector-wide: EV/aero/defense penetration; NALCO lithium as new revenue stream.

- Long-Term: Per-capita demand gap closure; export recovery (US bounce-back expected); 80%+ utilizations. Investor interest high (Hindalco plant visits, MMP/NALCO analyst meets).

Key Risks

- Price Volatility: Alumina/Al LME swings ($100/t Alumina or $100/t Al impact muted by margins but sensitive; NALCO cost-realization gap ~Rs10-14k/t alumina).

- Execution Delays: NALCO refinery (Jun’26), Pottangi mine (Jun’26), smelter DPR (Jun’27); MAAN ramps (teething issues on Italian press).

- Trade/Geopolitical: US ADD escalation or new tariffs; China/Indonesia supply gluts.

- Input/Regulatory: Bauxite mine renewals (NALCO to 2029/35, potential royalty hikes); coal CESS removal benefits but FSA dependency; power grid reliance (NALCO cut to 77MU from 381MU).

- Macro: Recessionary US demand; monsoon variability; high debt/capex funding (NALCO cash ~Rs7.9k Cr supports).

Overall Outlook: Bullish with caution. Tailwinds from domestic infra/EV and expansions outweigh headwinds, positioning sector for 15-20%+ CAGR. Upstream stable on volumes/costs; downstream high-growth via value-add. Monitor alumina prices and US trade for near-term volatility. No UPSI shared in interactions.

Financial

asof: 2025-11-29

Indian Aluminium Sector Analysis (Q3 & 9M FY25 Insights from Key Players: Hindalco, NALCO, Maan Aluminium, MMP Industries, Manaksia Aluminium)

Based on the unaudited financial results of these companies (covering ~Dec 2024), the Indian Aluminium sector exhibits robust YoY growth driven by volume expansion, cost efficiencies, and upstream strength, but faces regulatory overhangs and input cost pressures. Majors like Hindalco (global via Novelis) and NALCO dominate positives, while smaller players (Maan, MMP, Manaksia) show steady but modest traction. Aggregate revenue up ~10-40% YoY; PAT surges 50-200%+ for leaders.

Tailwinds (Positive Drivers)

- Strong Demand & Volume Growth: Hindalco’s revenue +10% YoY (Q3: ₹58,390 Cr), NALCO +39% (Q3: ₹4,662 Cr), driven by upstream (bauxite/alumina) and downstream (foils, conductors). Novelis (Hindalco) at ₹34,461 Cr (+5% YoY). Smaller firms like MMP (+20% YoY) and Maan (+segment growth) benefit from domestic infra/auto demand.

- Cost Efficiencies: Raw material costs down (NALCO chemicals segment PAT margin ~51%; Hindalco upstream EBITDA +14%). Lower finance costs (Hindalco -13% YoY).

- Insurance & One-offs: Hindalco’s ₹154 Cr flood recovery; land sale gains (₹573 Cr).

- Policy Support: Odisha incentives; solar/open-access power investments (MMP ₹40 Cr project).

Headwinds (Challenges)

- Input Cost Pressures: Power/fuel remains 6-18% of expenses (Hindalco ₹3,770 Cr Q3; NALCO ₹827 Cr). Provisions for electricity duty (Hindalco/NALCO ₹197 Cr).

- Operational Disruptions: Hindalco’s Switzerland flood (₹250 Cr impairment, ₹1,005 Cr total costs 9M); inventory writedowns.

- Margin Compression QoQ: Hindalco EBITDA margin dipped to 9% (from 11%); smaller firms volatile (Manaksia EBITDA ~1.5%).

- Global Exposure: Forex/hedging volatility (Hindalco OCI loss ₹857 Cr Q3); Novelis CHF loan aid tied to flood recovery.

Growth Prospects

- Capacity & Diversification: Hindalco upstream (₹27,957 Cr 9M rev., +17% YoY); NALCO chemicals (₹5,071 Cr, +32% YoY). Downstream (foils/conductors) scaling—MMP LVPC project (₹87 Cr), Maan single-segment focus.

- Exports & Value-Add: Novelis global strength (51% of Hindalco rev.); NALCO JVs (e.g., GACL CCDs ₹500 Cr).

- Sustainability: Solar/wind (despite PPA delays); renewables JVs (NALCO Utkarsha).

- Outlook: 10-15% sector growth FY25 (infra, EV, renewables demand); Hindalco/NALCO guide strong EBITDA (₹25,000+ Cr 9M).

Key Risks

| Risk Category | Details | Exposure |

|---|---|---|

| Regulatory/Legal | ORISED Act (mineral tax, retrospective; staggered payments from 2026)—no provision yet (Hindalco/NALCO). Wind PPA delays (NALCO ₹106 Cr extra impairment). Electricity duty ambiguity. | High (NALCO/Hindalco upstream). |

| Commodity Volatility | Alumina/LME prices, power costs (30-40% opex). | Medium-High (all). |

| Operational | Disruptions (floods, plant halts); impairments (Hindalco ₹223 Cr 9M). | Medium (global ops). |

| Forex/Debt | Debt ₹73,392 Cr (Hindalco); USD/CHF exposure. | High (Hindalco). |

| Liquidity/Tax | MAT credit reversals (Hindalco ₹239 Cr writeback); high capex. | Medium. |

| Competition | Chinese dumping; imports pressure smaller players (Maan/MMP margins <5%). | Medium (downstream). |

Summary: Sector resilient with tailwind dominance (demand/cost leverage → PAT +50-200% YoY), positioning for 12-15% growth FY25 amid infra boom. Headwinds moderate (costs offset by efficiencies), but regulatory risks (ORISED/PPA) loom large—monitor SC hearings. Smaller firms lag on scale but eye niche growth. Bullish outlook; watch LME (~$2,500/t) and power reforms. (Data as of Feb 2025 filings; Ind AS compliant, unmodified reviews.)

General

asof: 2025-11-29

Analysis of Indian Aluminium Sector (Based on Provided Documents)

The documents primarily cover Novelis Inc. (wholly-owned subsidiary of Hindalco Industries Ltd.), National Aluminium Company Ltd. (Nalco), Maan Aluminium Ltd., and MMP Industries Ltd.. Novelis dominates the input (~95%), providing deep insights into global operations with Indian parentage (Hindalco-listed). Analysis focuses on headwinds (challenges), tailwinds (supports), growth prospects (opportunities), and key risks for the Indian Aluminium sector, emphasizing rolled products, recycling, and end-markets like packaging, automotive, and aerospace.

Headwinds (Short-Term Pressures)

- Cost Inflation & Input Challenges: Novelis reports higher scrap prices reducing metal benefits (less favorable vs. prior year), net tariffs (e.g., US Customs duties on Brazilian shipments ~$19M possible exposure), and elevated conversion costs (up due to inefficiencies). H1FY26 metal input costs rose $944M YoY.

- Operational Disruptions: Oswego (NY) fire (Sep 2025) → $550-650M negative cash flow impact (H2FY26), $100-150M EBITDA hit; expected restart Dec 2025. Past Sierre (Switzerland) flood ($101M prior-year charges). MMP Industries: Factory incident (Apr 2025) delayed Umred plant restart until May 31, 2025.

- Restructuring & One-Offs: Novelis’ 2025 Efficiency Plan → $116M H1 charges (cumulative $113M); plant closures (e.g., Richmond/Fairmont, Changzhou idling).

- Demand/Mix Weakness: Lower automotive/specialty shipments (customer production halts in Europe/Asia); flat rolled product shipments stable but mix unfavorable.

- Regulatory Fines: Nalco fined ₹10.86L (incl. GST) by BSE/NSE for Reg 17(1) non-compliance (board composition, Q2FY26).

Impact: Q2FY26 Adjusted EBITDA down 9% YoY ($422M); H1 down 13% ($838M). Nalco/MMP minor but signal compliance/ops risks.

Tailwinds (Positive Supports)

- Pricing Power: Novelis net sales +10% Q2/$12% H1 YoY, driven by +143%/+126% LMP surges and +10%/+3% LME prices. Favorable hedging ($158M H1 gain).

- Volume Resilience: Flat rolled shipments stable (941kt Q2, 1,904kt H1); gains in beverage packaging (+ in Europe/Asia), aerospace (OEM backlogs).

- Cost Efficiencies: 2025 Plan targeting $300M annualized savings by FY28 (labor/ops/footprint); SG&A down 5%/4% YoY. Lower interest expense (6% YoY).

- Financing Flexibility: Novelis liquidity $2.9B; new bonds ($500M Series 2025A/B), term loan repricing (margin cut to SOFR+1.75%). Nalco/Maan routine disclosures (no major issues).

- Sustainability Edge: High recycled content (63% FY25, targeting 75% by 2030); ASI certifications (22 plants).

Impact: Q2 net income +27% ($163M); H1 + beverage/price offsets volume/mix headwinds.

Growth Prospects (Medium/Long-Term Opportunities)

- Demand Drivers: Strong aluminum substitution (lightweighting, sustainability vs. PET/steel). Beverage packaging resilient (recyclable); automotive/aerospace growth (fleet modernization, backlogs at Airbus/Boeing). Novelis: Bay Minette (Alabama) greenfield (600kt capacity, ~$5B capex) advancing; FY26 capex $1.9-2.2B for expansions/recycling.

- Efficiency/Capacity Ramp: Multi-year investments (debottlenecking, scrap processing tech). Novelis FY26 EBITDA outlook tied to ~80% capacity utilization post-disruptions.

- Sustainability Leadership: Carbon neutral by 2050 (<3t CO2e/t by 2030); circular economy (recycling in 15/29 facilities). Indian peers (Nalco) benefit from govt. push (e.g., PLI schemes).

- Export/Regional: Asia/South America shipments +12%/+11% Q2; Brazil ops resilient post-tariff notice.

- Sector Tailwinds: Global Al demand +2-3% CAGR; India-specific (auto/EV, infra) via Hindalco/Nalco.

Outlook: Novelis targets sustained margins via premiums (LMP/conversion); sector growth 4-6% CAGR to 2030 on green transition.

Key Risks (High-Impact Threats)

| Risk Category | Details | Mitigants |

|---|---|---|

| Operational | Fires/floods (Oswego/Sierre/MMP); scrap competition (higher prices, lower availability). | Insurance (recoveries noted); recycling expansions. |

| Geopolitical/Trade | Tariffs/duties (US on Brazil ~$22M deposit +$19M possible; general trade barriers). | Hedging; exemptions advocacy. |

| Financial | Debt ($6.9B total; leverage ~3.5x target, but fire/tariffs may exceed); FX volatility (EUR/BRL/KRW). | $2.9B liquidity; repricings. |

| Market/Demand | Automotive slowdowns (OEM halts); scrap economics pressure costs. | Diversification (beverage 50%+ mix). |

| Regulatory/Compliance | SEBI fines (Nalco); env./tax litigations (Novelis $118M possible). | Efficiency plan; legal appeals. |

| Execution | Capex overruns (Bay Minette); start-up costs ($13M H1 excluded from EBITDA). | Phased spend; maintenance $300M. |

Overall Summary: Indian Aluminium (via Hindalco/Novelis) faces near-term headwinds from disruptions/costs (EBITDA pressure), but tailwinds from pricing/volumes support resilience. Growth prospects strong on sustainability/demand (e.g., Bay Minette), targeting $300M savings. Key Watch: Oswego recovery, tariffs, scrap dynamics. Sector leverage moderate; long-term positive on green Al shift. Nalco/Maan/MMP minor; no systemic red flags.

Data as of Sep 30, 2025 (Q2FY26); FY26 guidance intact despite disruptions.

Investor

asof: 2025-12-03

Indian Aluminium Sector Analysis

Based on inputs from Hindalco (plant visit intimation), NALCO (Q2/H1 FY’26 earnings transcript), MAAN Aluminium (Q2 FY’26 earnings transcript), and MMP Industries (analyst meet intimation). The sector shows robust upstream production (NALCO) and downstream value-add focus (MAAN), amid expansions and cost efficiencies. Key themes: volume growth, price volatility, and capacity ramps.

Tailwinds (Positive Drivers)

- Strong Operational Performance: NALCO reported record Q2/H1 FY’26 with bauxite excavation +13% YoY (Q2), alumina +15%, metal +3.5%; H1 revenue +18%, PAT +50%. Efficiencies added ~INR 300 Cr savings.

- Cost Discipline: Captive coal ramp to 4 MT (vs. 2.6 MT last year), power/fuel costs stable (-INR 53 Cr YoY H1 despite volumes up); CESS removal saves ~INR 67 Cr in H2. Alumina cost reductions via lower caustic consumption (96 kg/ton).

- Favorable Pricing Outlook: Aluminium LME at $2,850 (up from $2,597 Q2 avg.); H2 guidance $2,800-2,900. Alumina spot $320 (Q2 avg. $380), but historical Q3/Q4 recovery expected ($320-350).

- Domestic Demand Shift: Low per capita consumption; push into EV, solar, defense, railways, aero (MAAN). Make in India aiding import substitution (e.g., MAAN’s Dewas precision plant).

- Export Resilience: MAAN maintained 45-50% US exposure despite ADDs; NALCO alumina exports dominant (50% production ex-smelter).

Headwinds (Challenges)

- Alumina Price Weakness: Global oversupply (Indonesia refineries ramp-up, China smelter cuts); spot $320 vs. $380 Q2 avg., H2 guidance $320-340 (81% H1 sales volume growth offset by prices).

- Trade Barriers: US anti-dumping duties (up to 55%) caused demand destruction for extruders (MAAN volumes dipped; utilization to 27-28% post new capacity); impacted FY23-25 exports.

- Input Inflation: CP coke +37% YoY (INR 30k to 42k/ton), caustic +11% (37k to 41k); monsoon rains hit metal demand (NALCO Q2 sales lower).

- Utilization Dips: MAAN’s new 24 KT extrusion press caused short-term drop (80% to 27-28%); NALCO inventory management limits storage.

Growth Prospects

- Upstream Expansions: NALCO refinery +1 MT to 3.1 MT by June 2026 (80% complete, INR 4,500 Cr spent; 5 LT incremental FY’27 sales); smelter +0.5 MT + CPP by 2030 (INR 30,000 Cr capex, funded internally/JV).

- Downstream Value-Add: MAAN targeting 5x revenue in 3-5 years via anodizing (3.6 KT), machining (1.4 KT ramp), powder coating, roof rails (100% import sub); EBITDA 15-18% (vs. current 10% blended). Precision tubing plant Q1/Q2 FY’27.

- Volume Guidance: NALCO alumina 12-12.5 LT FY’26 (H2 6-6.5 LT), metal 470 KT; MAAN extrusion ramp to 80% utilization by FY’29.

- Diversification: NALCO lithium JV (Argentina mines; pilot in 1-1.5 yrs); EV/defense trials (MAAN). Infra/EV boom to drive 3-5x sector growth.

- Financial Strength: NALCO cash ~INR 7,900 Cr (Sep’25), targeting INR 20,000 Cr; low debt enables capex.

Key Risks

- Commodity Volatility: $100/t alumina or LME swings impact margins (NALCO resilient via cost gap, but H2 sensitivity noted).

- Execution Delays: NALCO refinery (June’26 target slipped from Sep’25); Pottangi bauxite mine (MDO tender Dec’25, start June’26); MAAN capex cycle 6-8 months.

- Regulatory/Geopolitical: Bauxite lease renewals (2029/35; potential royalty hikes); US ADDs escalation; lithium exploration outcomes.

- Demand/Macro: Recession (US/EU slowdown), monsoon impacts; competition from China/Indonesia.

- Capex Overruns: NALCO INR 30,000 Cr smelter; MAAN Rs 110 Cr+ value-add (funded via equity/debt).

Overall Summary: Indian aluminium sector is poised for multi-year growth (expansions, value-add, EV/infra tailwinds) with NALCO’s upstream strength offsetting alumina weakness. Q2/H1 beats signal recovery, but trade barriers and prices pose near-term drag. Bullish 3-5 year outlook (volumes +20-50%, EBITDA 15-18%), contingent on execution and LME stability. Investors: Focus NALCO for upstream, MAAN for downstream upside.

Meeting

asof: 2025-12-02

Indian Aluminium Sector Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

The analysis is based on Q2/H1 FY26 (ended Sep 30, 2025) unaudited financial results and announcements from key players: Hindalco Industries (market leader, integrated player with global ops via Novelis), NALCO (upstream-focused PSU), Arfin India (mid/small-cap downstream), and ancillary updates from Maan Aluminium, MMP Industries, and Manaksia Aluminium. These reflect a mixed but resilient sector amid global metal volatility, domestic infra push, and capacity expansions. Sector revenue growth (e.g., Hindalco +13% YoY consolidated, NALCO +18% YoY standalone) signals recovery, but profitability pressures persist.

Tailwinds (Positive Factors)

- Robust Demand & Revenue Growth: Hindalco’s consolidated revenue at ₹66,771 Cr (Q2, +12% YoY) driven by Novelis (41% of revenue, auto/packaging demand). NALCO standalone revenue ₹4,292 Cr (Q2, +7% YoY) via chemicals/aluminium segments. Arfin revenue ₹23,680 Cr (H1). Infra/auto EV push supports upstream (bauxite/alumina) and downstream (foils/conductors).

- Cost Efficiencies & Tax Benefits: Deferred tax credits (Hindalco ₹253 Cr write-back H1; NALCO reassessment under Sec 115BAA). Lower finance costs YoY (Hindalco consolidated -10%).

- Strong Cash Flows & Dividends: NALCO net cash from ops ₹2,721 Cr (H1), interim dividend ₹4/share (80%). Hindalco ops cash ₹8,036 Cr (H1). Arfin interim ₹0.11/share. Signals shareholder confidence.

- Dividend Payouts & Shareholder Returns: High yields (NALCO total FY25 ₹10.50/share; Hindalco prior dividends).

- Policy Support: Coal mine acquisitions (Hindalco’s Bandha, EMIL Mines) secure raw materials.

Headwinds (Challenges)

- Input Cost Pressures: Power/fuel expenses high (Hindalco ₹6,912 Cr H1; NALCO ₹1,461 Cr). Materials consumed ~70-80% of revenue across firms.

- Inventory Build-Up & Working Capital Strain: Negative changes in inventories (Hindalco -₹8,762 Cr H1 ops cash impact; Arfin -₹3,040 Cr). Trade receivables up (NALCO ₹28 Cr vs ₹186 Cr prior).

- Margin Compression: EBITDA margins squeezed (Arfin H1 PAT down 37% YoY to ₹35 Cr). Impairments (Hindalco ₹170 Cr H1).

- Revenue Recognition Issues: NALCO non-recognition from wind plants due to PPA delays (sub-judice).

- Profit Volatility: Hindalco Q2 PAT ₹4,741 Cr but exceptional fire loss ₹182 Cr (Novelis).

Growth Prospects

- Capacity Expansions: Hindalco’s Bay Minette (US) greenfield rolling/recycling plant (~₹44,293 Cr capex, 600kt capacity). NALCO capex ₹896 Cr H1. Upstream focus (coal mines, bauxite).

- Downstream Diversification: Value-add (foils, conductors) – Hindalco Aluminium downstream ₹7,162 Cr H1 revenue (+19% YoY). Arfin/MMP/Manakasia focus on specialty alloys.

- Global Footprint: Novelis (Hindalco sub) drives 60%+ revenue; acquisitions (AluChem, EMIL Mines) pending CFIUS/SPA closure.

- Sustainability: Recycling emphasis (Novelis); renewables tie-ups (NALCO issues resolving).

- Outlook: Sector capex ~₹50,000+ Cr (FY26); EV/infra demand to drive 8-10% CAGR (aluminium demand ~4mt FY26).

| Company | H1 Revenue Growth (YoY) | PAT Growth (YoY) | Key Driver |

|---|---|---|---|

| Hindalco (Cons.) | +12% | +25% | Novelis +15% |

| NALCO (Stand.) | +18% | +50% | Chemicals +35% |

| Arfin (Cons.) | -16% | -37% | Inventory destock |

Key Risks

| Risk Category | Details | Impacted Companies |

|---|---|---|

| Regulatory/Legal | CBI chargesheet (Hindalco coal misutilization, summons issued; no quantifiable impact yet). NALCO PPA disputes (wind revenue blocked, sub-judice). | Hindalco, NALCO |

| Geopolitical/Approvals | US acquisitions (AluChem) delayed by CFIUS/govt shutdown. | Hindalco |

| Commodity Volatility | LME aluminium prices fluctuate; forex exposure (Novelis). Impairments on assets/financials. | All |

| Operational | Fire incidents (Novelis Oswego ₹182 Cr exceptional loss). High capex execution (Bay Minette delays?). | Hindalco |

| Financial | Debt rise (Hindalco borrowings +10% to ₹73k Cr); interest coverage ~4-5x. Working capital cycles lengthen. | Hindalco, Arfin |

| ESG/External | Power costs (30-40% opex); carbon regs/tariffs. China dumping risk. | Upstream players (NALCO) |

Overall Summary: Indian aluminium sector is cautiously optimistic with tailwinds from infra/EV demand and expansions outweighing headwinds like costs/legal hurdles. Majors (Hindalco/NALCO) show resilience (20-50% PAT growth), but smaller players (Arfin) face pressure. Growth hinges on raw material security and global execution; monitor LME prices and regs. FY26 EBITDA growth est. 10-15% sector-wide.

Press Release

asof: 2025-11-29

Indian Aluminium Sector Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Using the provided documents from Hindalco Industries (leading private player), NALCO (leading PSU), and MMP Industries (mid/small-cap downstream player) as inputs, here’s a concise analysis of the Indian aluminium sector for Q2/H1 FY26 (ended Sep 2025). These reflect robust operational performance amid global volatility, with upstream strength and downstream diversification driving resilience. Overall, the sector shows resilient growth (revenue/PAT up 13-30% YoY across players), supported by domestic demand but tempered by external pressures.

Tailwinds (Positive Drivers)

- Strong Upstream Margins & Cost Discipline: Hindalco’s Aluminium Upstream EBITDA/tonne at $1,521 (up 13% YoY, 45% margins – industry-best), driven by higher volumes/realisations. NALCO’s “best-ever” Q2/H1 performance underscores PSU efficiency.

- Downstream Volume/Mix Gains: Hindalco Downstream EBITDA up 69% (record ₹261 Cr); MMP Foil revenue up sharply, Powders ~60% of revenue with 20-25% H2 growth expected.

- Domestic Demand Surge: Infra/housing (PM Awas Yojana, coal production to 1.5bn tons by 2030), EVs (lightweighting), renewables (solar/wind conductors), packaging/pharma (foils). MMP notes AAC blocks demand from fly ash mandates (GST cut to 12%).

- Policy/Export Support: Anti-dumping duties on Chinese foils (MMP/Hindalco benefit); govt initiatives (Make in India, mining infra). Record dividends (NALCO ₹1,928 Cr FY25) signal PSU health.

- Sustainability Edge: Hindalco/NALCO/MMP emphasize recycling, zero emissions, solar (MMP 20% energy from 5.5MW, expanding to 40-50%).

Headwinds (Challenges)

- Global Volatility & Pricing Pressures: Hindalco revenue up but Novelis EBITDA down 9% due to tariffs; Copper EBITDA in-line despite declining TC/RCs. MMP H1 PAT down 91% YoY from fire loss (₹17 Cr, insured) & pricing pressure in foils.

- External Shocks: MMP fire (Apr 2025) caused shutdown; monsoon delays in conductors. Novelis shipments flat YoY.

- Margin Compression: MMP EBITDA margin 7.1% (down from 9.8% H1 FY25); Hindalco EBITDA up 6% but slower than PAT.

- Input/Cost Volatility: Higher finance costs (MMP up due to expansions); global aluminium price fluctuations.

Growth Prospects

- Capacity Expansions: Hindalco Aditya Phase 2 (193KT, ₹10,225 Cr, FY29); MMP insulators (10L units), conductors (+1,200 MTPA Q4FY26), solar (7MW Q2FY27), wire rods (₹13-15 Cr backward integration). NALCO interim dividend signals reinvestment potential.

- Diversification: MMP into high-margin insulators (400kV approvals Dec 2025), LVPC cables; Hindalco Novelis cost savings ($125Mn FY26, $300Mn FY28); powders for ISRO/Europe exports.

- Sector Outlook: India aluminium demand CAGR 6-7% to $39Bn by 2032E (MMP); EVs/renewables/infra to drive 20-25% segment growth (powders/conductors). H2FY26 rebound expected (MMP revenue double in conductors).

- EBITDA/PAT Momentum: Hindalco PAT +21% Q2; MMP Q2 PAT +20%; stable Net Debt/EBITDA (Hindalco 1.23x).

Key Risks

| Risk Category | Details | Mitigation (from Docs) |

|---|---|---|

| Operational | Fire/incidents (MMP ₹17 Cr loss); monsoon/project delays. | Insurance coverage; diversified plants (MMP 4 units). |

| Commodity/Market | Aluminium price volatility; import competition (China foils/tariffs). | Cost efficiencies (Novelis); anti-dumping duties; domestic focus. |

| Financial | Rising debt (MMP LT borrowings to ₹39 Cr); forex/tariff impacts (Novelis). | Healthy cash flows (MMP ₹25 Cr H1 ops); low leverage (Hindalco). |

| Execution | Expansion delays (MMP Phase II Q4FY26); export reliance (MMP Europe). | Strong order book (record powder exports); JV partnerships (Toyo). |

| Macro/Regulatory | Global volatility; GST/tax changes; EV/infra policy shifts. | Integrated model (Hindalco); govt ties (NALCO 51% GoI stake). |

Summary: Indian aluminium sector is bullish short-term (Q2 PAT/revenue growth 20%+/13% across players) with strong tailwinds from domestic infra/EVs/sustainability, offsetting headwinds like tariffs/volatility. Growth prospects high (CAGR 6-32% via expansions/diversification), targeting H2FY26 acceleration. Key risks manageable (operational/financial, insured/leveraged low), but monitor global prices/execution. Outlook: Positive, with Hindalco/NALCO as upstream anchors, MMP exemplifying downstream agility. Sector poised for resilient expansion amid India’s capex cycle.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.