HEG

Equity Metrics

January 13, 2026

HEG Limited

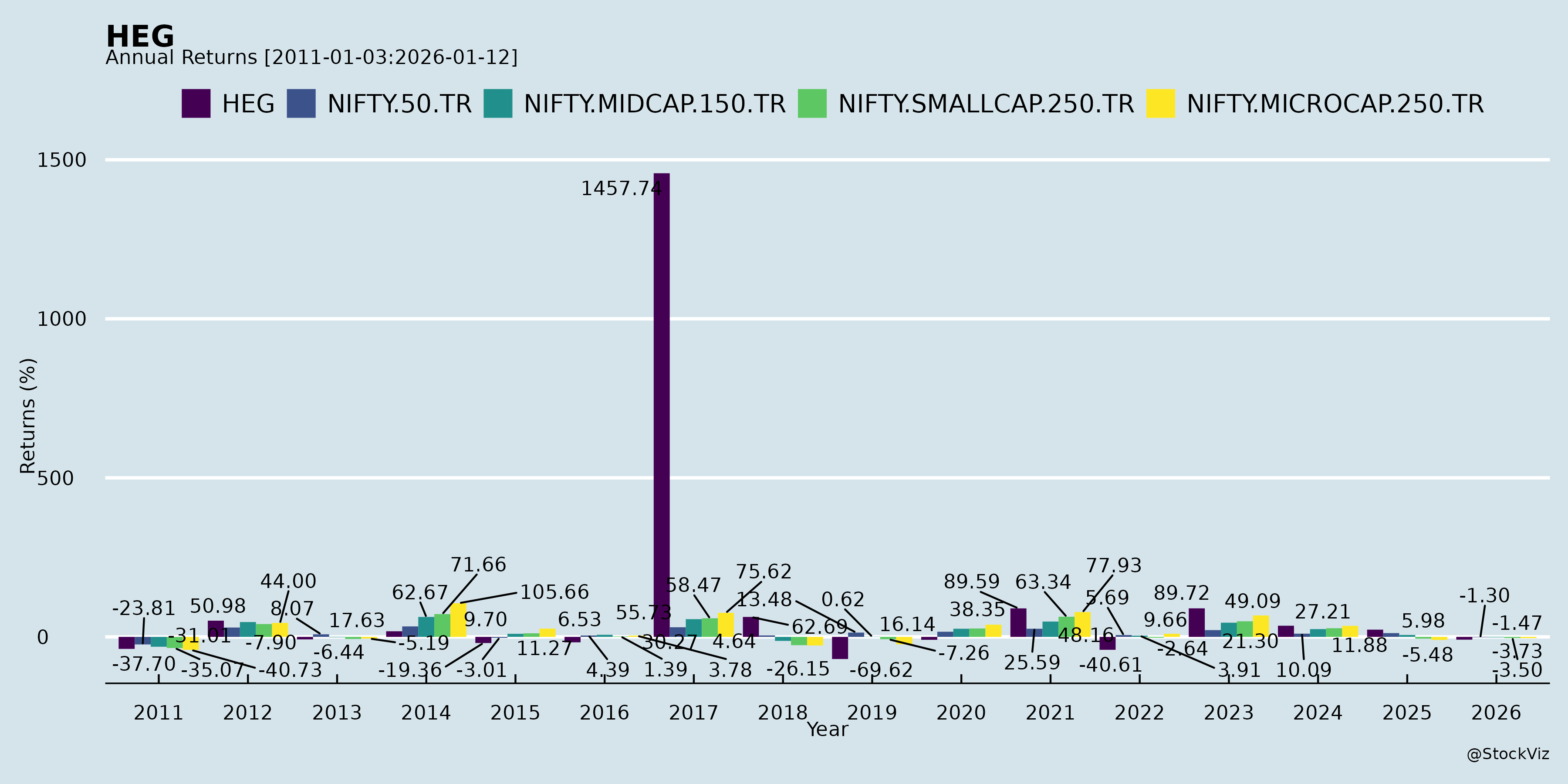

Annual Returns

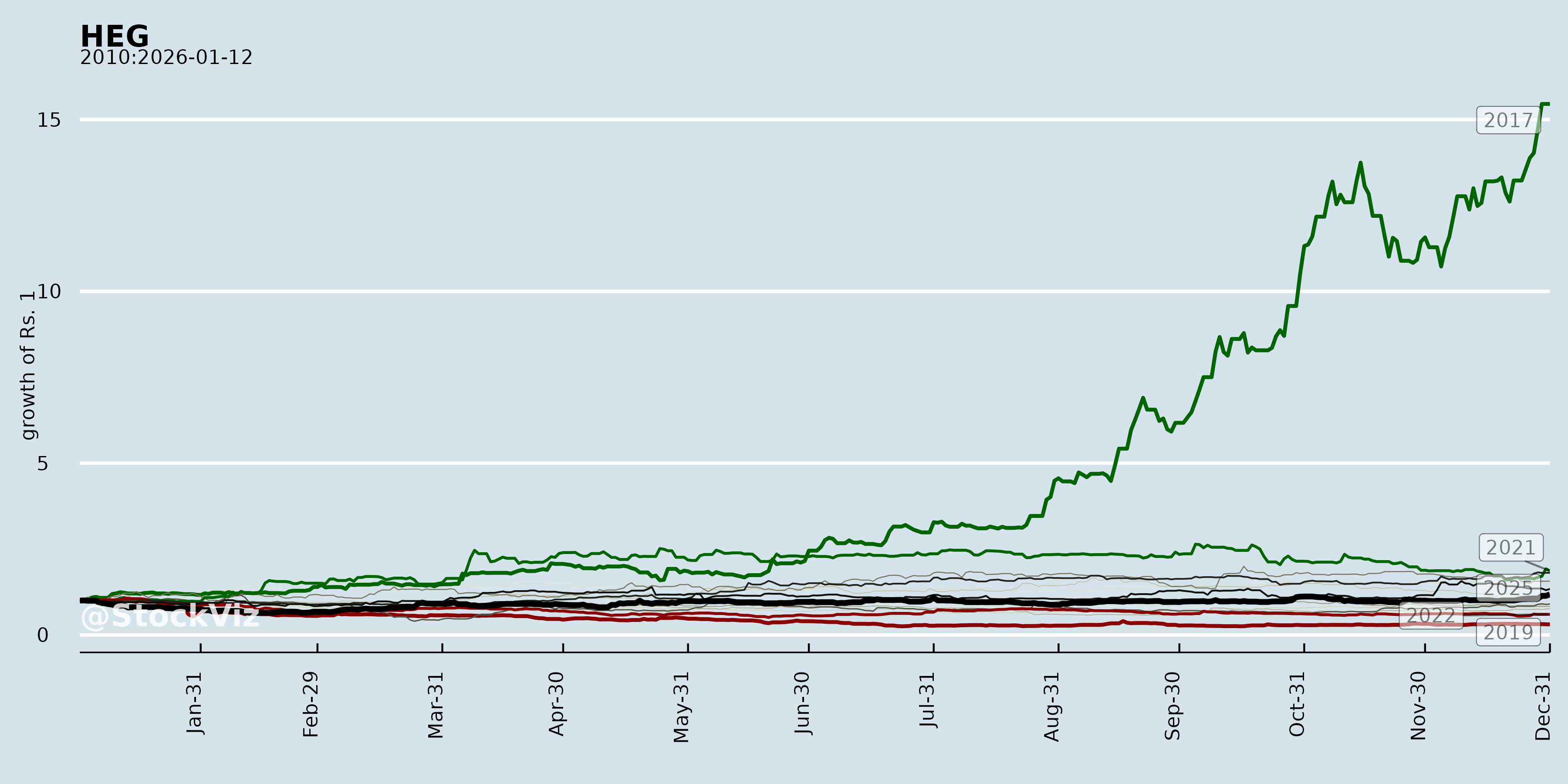

Cumulative Returns and Drawdowns

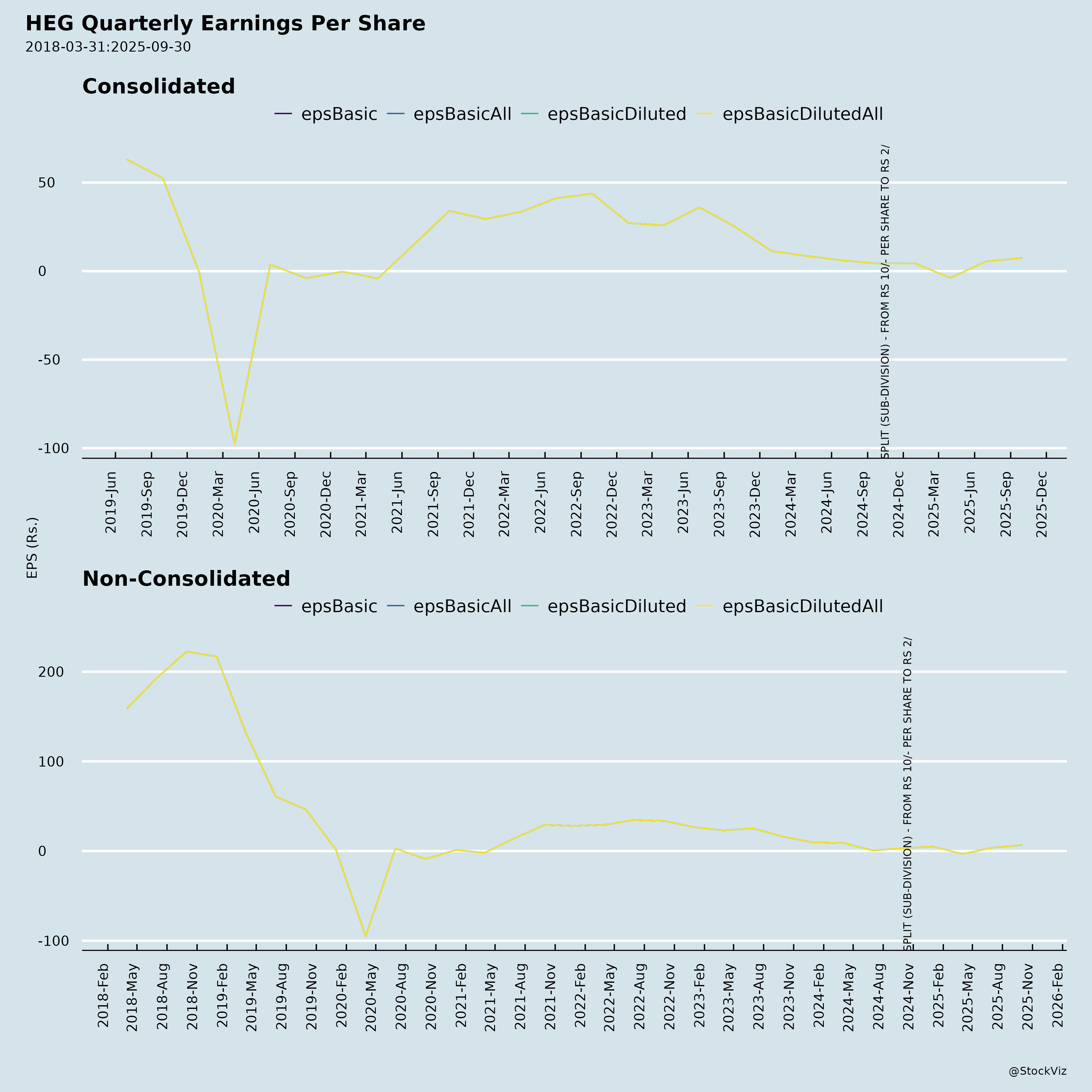

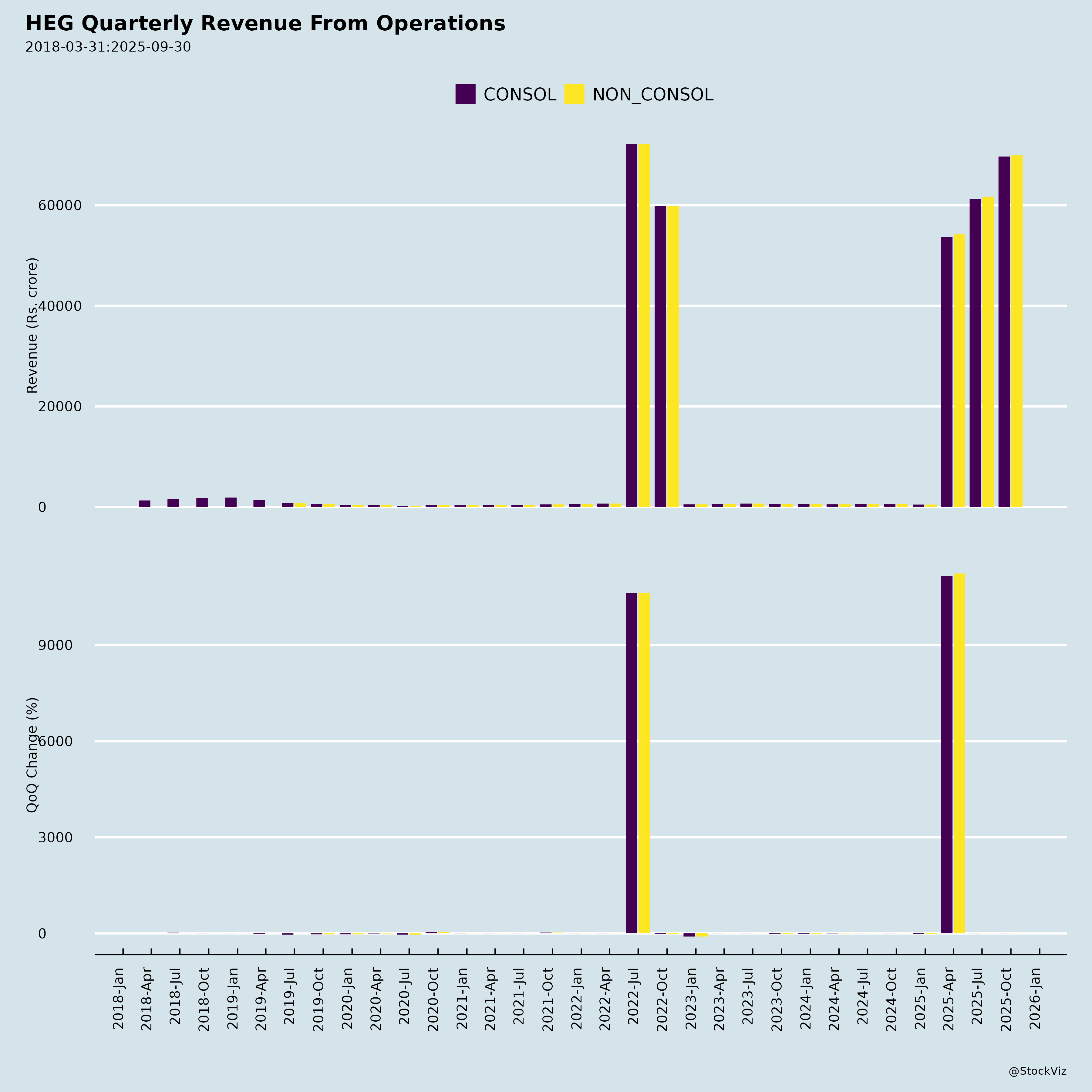

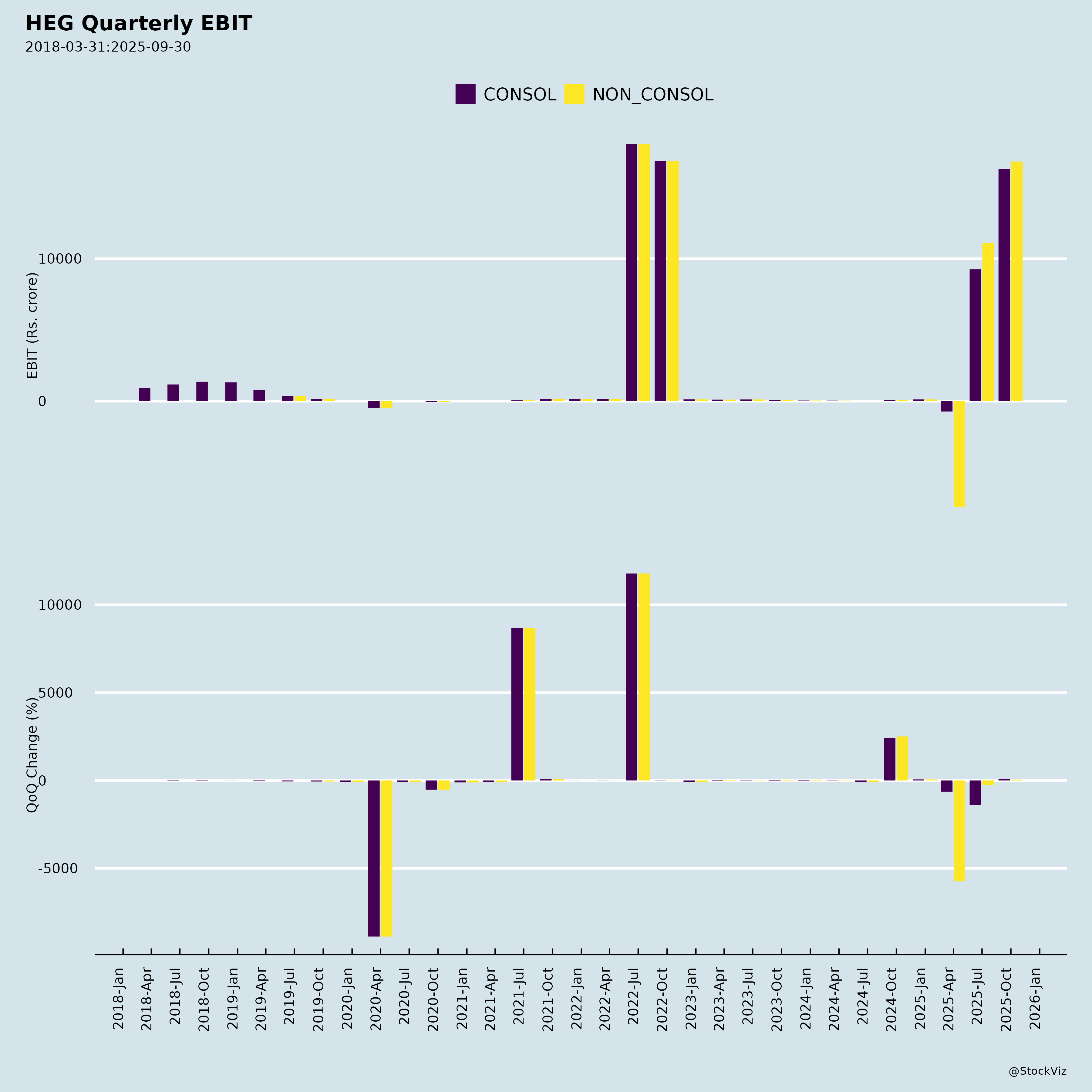

Fundamentals

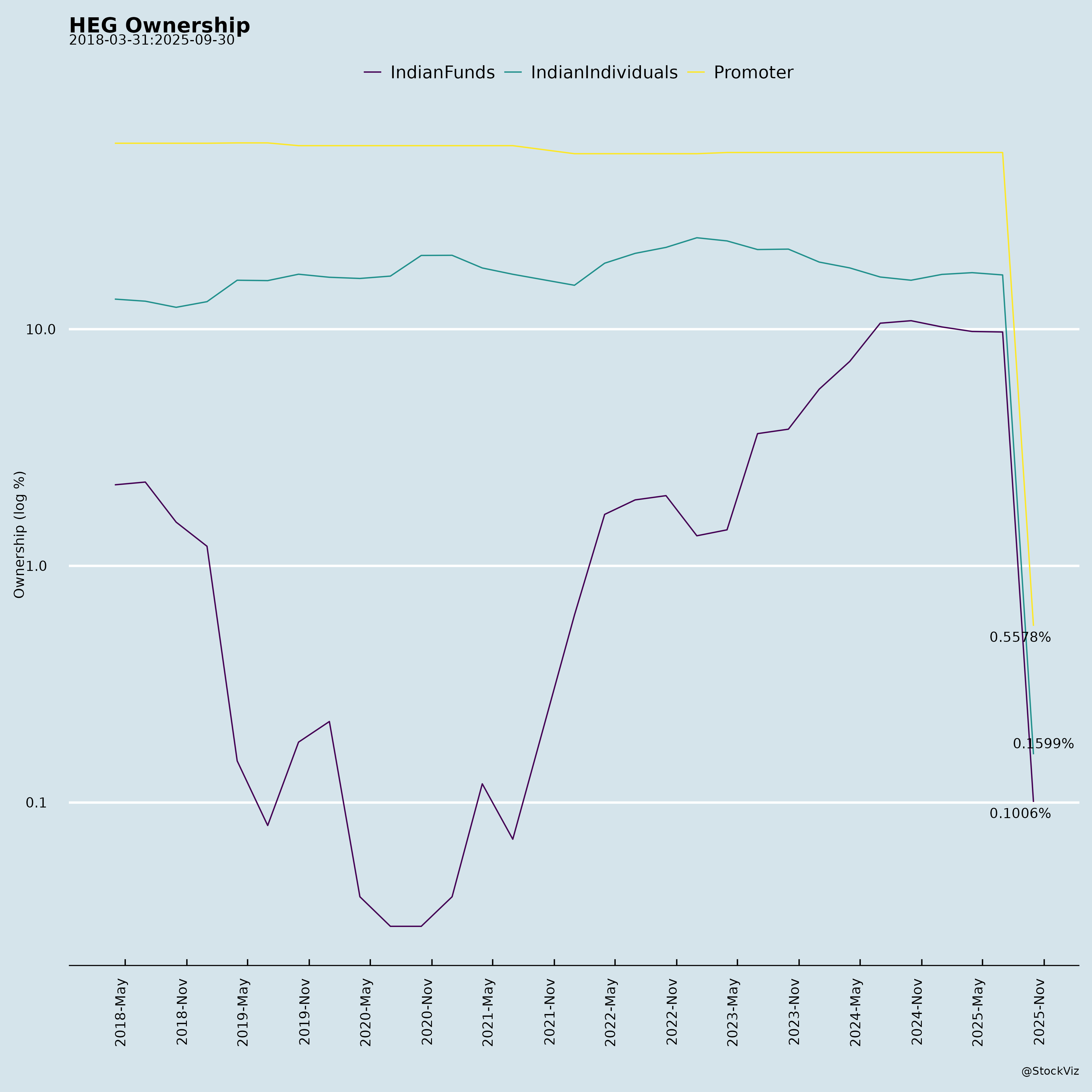

Ownership

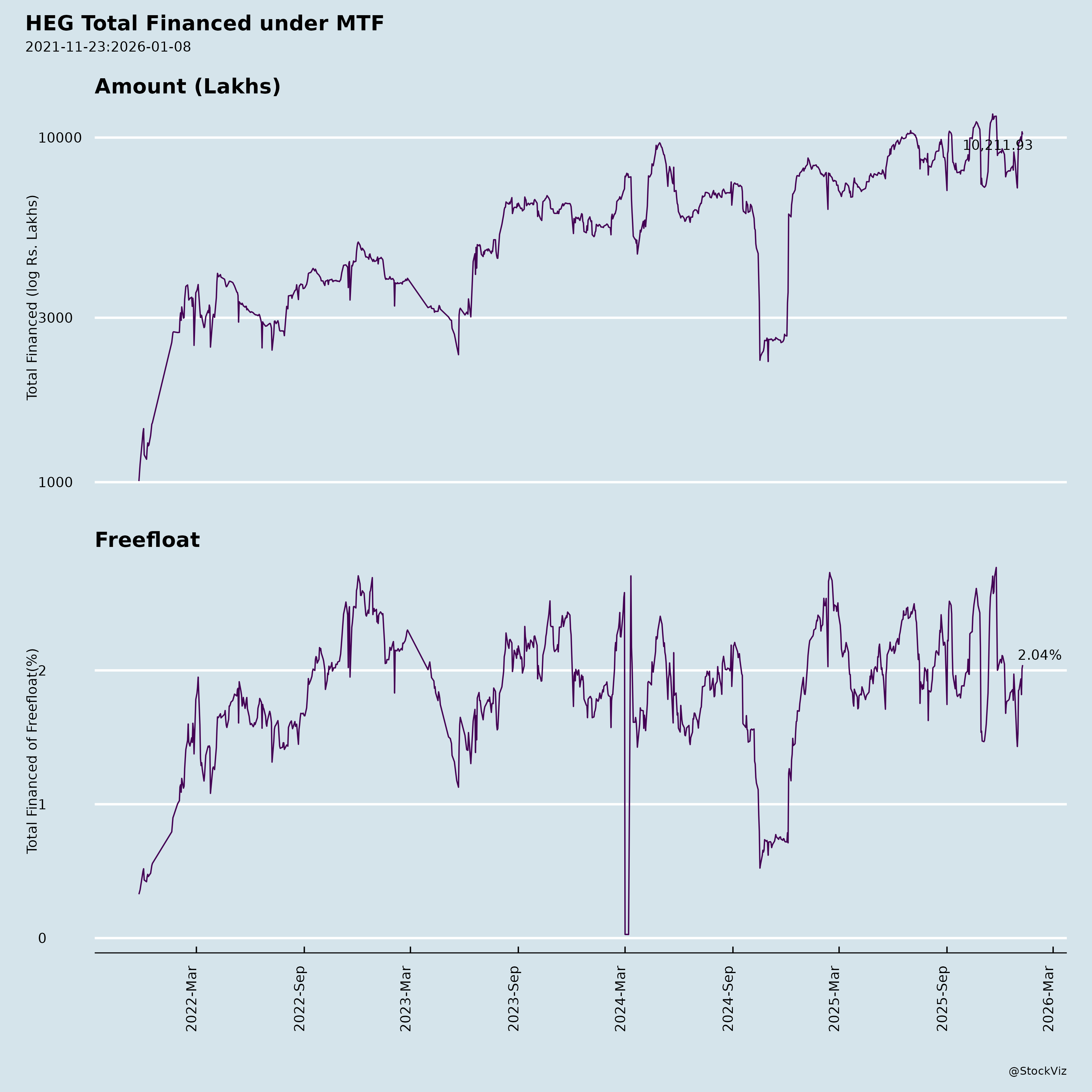

Margined

AI Summary

asof: 2025-12-03

HEG Limited (NSE/BSE: HEG) Analysis

HEG is a leading graphite electrode (GE) manufacturer (100k tons capacity, expanding to 115k), with exposure to power (hydro) and greentech (via subsidiaries like TACC for battery anodes, BESS EPC/IPP). Q2 FY26 showed resilience: Revenue +23% YoY to ₹697 Cr (standalone), EBITDA +61% to ₹226 Cr, PAT +111% to ₹131 Cr (standalone); 90%+ utilization vs. peers’ lower levels. Debt-free, ₹1,167 Cr treasury. Demerger into Graphite (HEG Graphite) + Greentech entities progressing (NCLT by Apr 2026).

Headwinds

- Weak Global Steel/GE Demand: Global crude steel -1.5% YoY (1,373 MMt 9M25); China steel output -2.6% YoY, exports +9% to 58 MMt (Q2), dumping HP/UHP GE, flat prices (realization ~$3,500/ton implied).

- US Tariffs: 50% reciprocal duty risk (US=10-12% sales); customers resist pass-through, potential absorption/diversification needed (hoping for settlement).

- Low Industry Utilization: Global ex-China ~65-70% (vs. HEG 90%+); prices firm only at 80-85% avg. utilization.

- Input Costs/Margins: Needle coke flat but spread tight (~1/3 GE price historically); CBAM/EU quotas may help EU steel but delayed (2026).

- Regulatory: GST notices ₹282 Cr each (FY19-20/FY20-21 IGST refunds; mgmt confident of drop).

Tailwinds

- Operational Edge: Single-location low-cost India base; highest utilization (90%+ H1 FY26 vs. 80% FY25); diversified (35 countries, <10% EU/US each).

- India Resilience: Steel +10.5% YoY (122 MMt 9M25), infra/auto push.

- Strong Finances: Net cash ₹1,167 Cr; EBITDA margins ~32%; no LT debt.

- ESG/Policy: Score 66.2; EAF transition (51% ex-China steel); CBAM/EU quotas to boost EU EAF (~45% now).

- Greentech Diversification: Hydro (278 MW full ownership post-acquisition); BESS (1→6 GWh EPC); IPP (200 MWh Q2 FY27, 1 GW/2 GWh FY28).

Growth Prospects

| Segment | Key Drivers | Outlook |

|---|---|---|

| GE (Core ~95% Rev) | 90% FY26 util. (vs. 80% FY25); +15k tons exp. (₹650 Cr capex, ready Q1 CY28); +20 MMt global EAF steel (CY26-27) → +30k tons GE demand; UHP mix 70-75%. | Vol. +ve FY26; prices firm FY27+ on EAF/supply cuts; +200k tons ex-China by 2030. |

| Greentech (TACC et al.) | Anode plant (20k MTPA, Dewas; ₹1,230 Cr SBI loan + ₹633 Cr HEG OCDs); EBITDA FY26 ₹200-225 Cr (double FY27); BESS/IPP scale-up. | FY27+ ramp-up; IRR 30-40%, margins 35-40%; aligns w/ EV/battery self-reliance. |

| Overall | Demerger unlocks value; FY26 EBITDA guide intact; treasury deployment. | Med-term bullish (EAF structural); FY26 vol. focus, FY27+ pricing/vol. growth. |

Key Risks

| Risk | Severity | Mitigation |

|---|---|---|

| GE Pricing/China Dumping | High | Diversification (non-China focus); cost edge; EAF tailwind. |

| US Tariff Impact | Medium | 10-12% exposure; monitoring talks; alt. markets. |

| Steel Cycle/Demand | High | L/T EAF +ve; India buffer; no over-inventory. |

| Needle Coke Supply | Medium | Comfortable inventory; refineries can ramp (tied to demand). |

| Execution (Exp./Demerger) | Medium | Phased capex; SEBI/NCLT progressing. |

| Subsidiary/Associates | Low-Med | Hydro litigation (refunds pursued); TACC funded. |

| Investment Volatility | Low | GrafTech stake MTM gains (₹102 Cr H1); prudent treasury. |

Overall: Resilient Q2 amid headwinds; tailwinds from ops/expansion position for FY27+ recovery. Greentech de-risks core cyclicality. Buy/Hold for L/T EAF theme; monitor steel/US tariffs. Target upside on demerger/expansion milestones.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.