Electrodes & Refractories

Industry Metrics

January 13, 2026

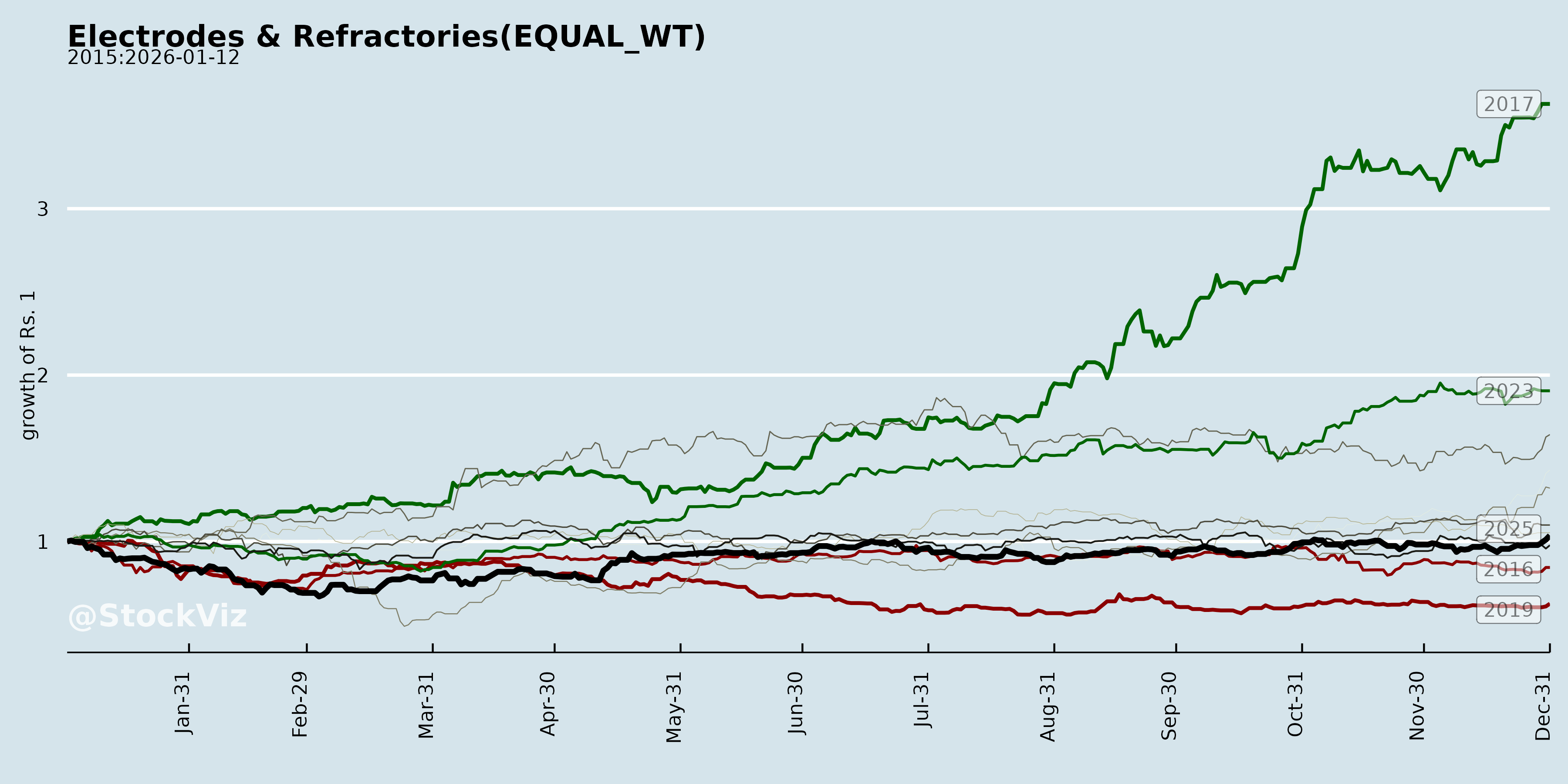

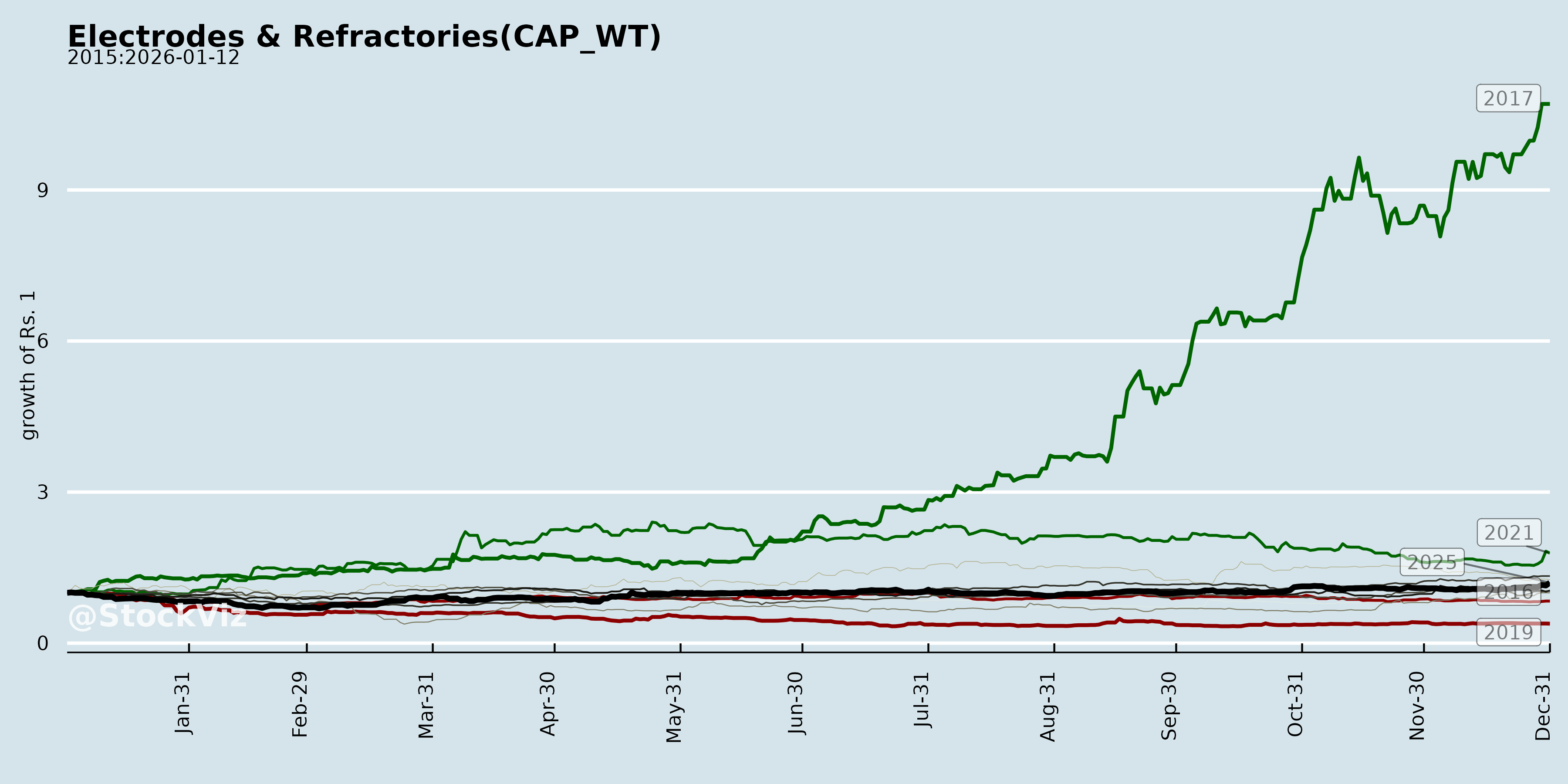

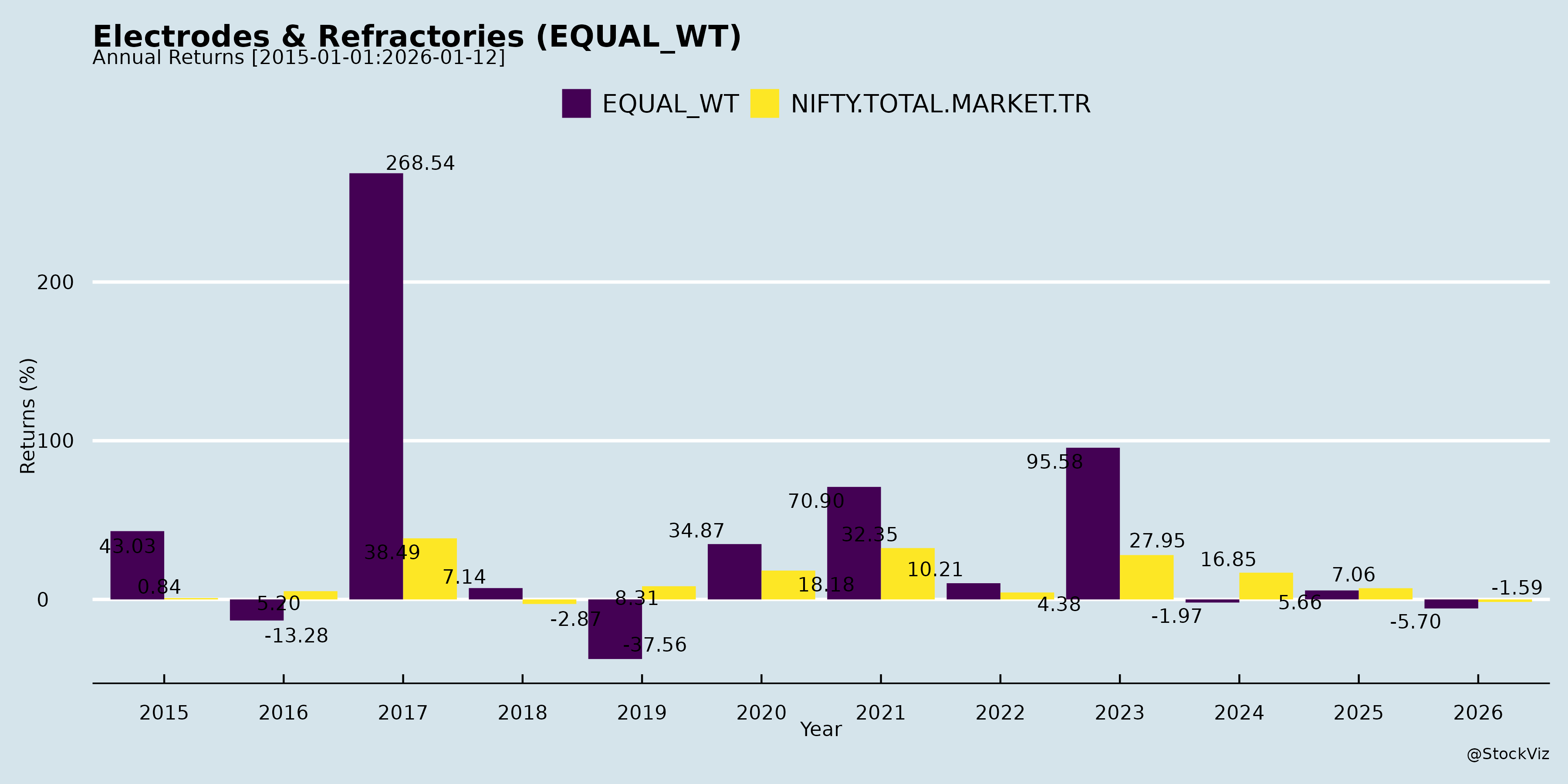

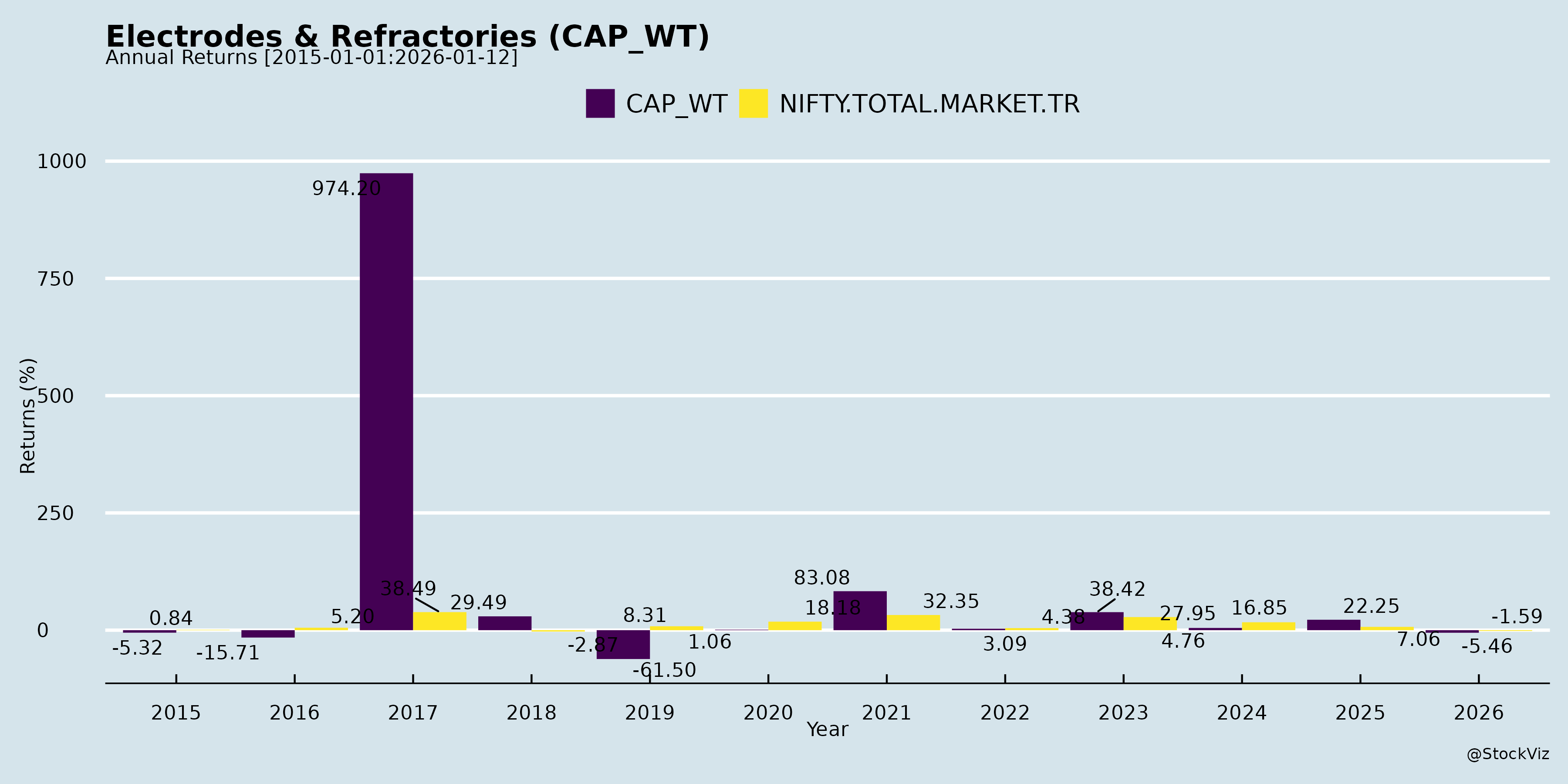

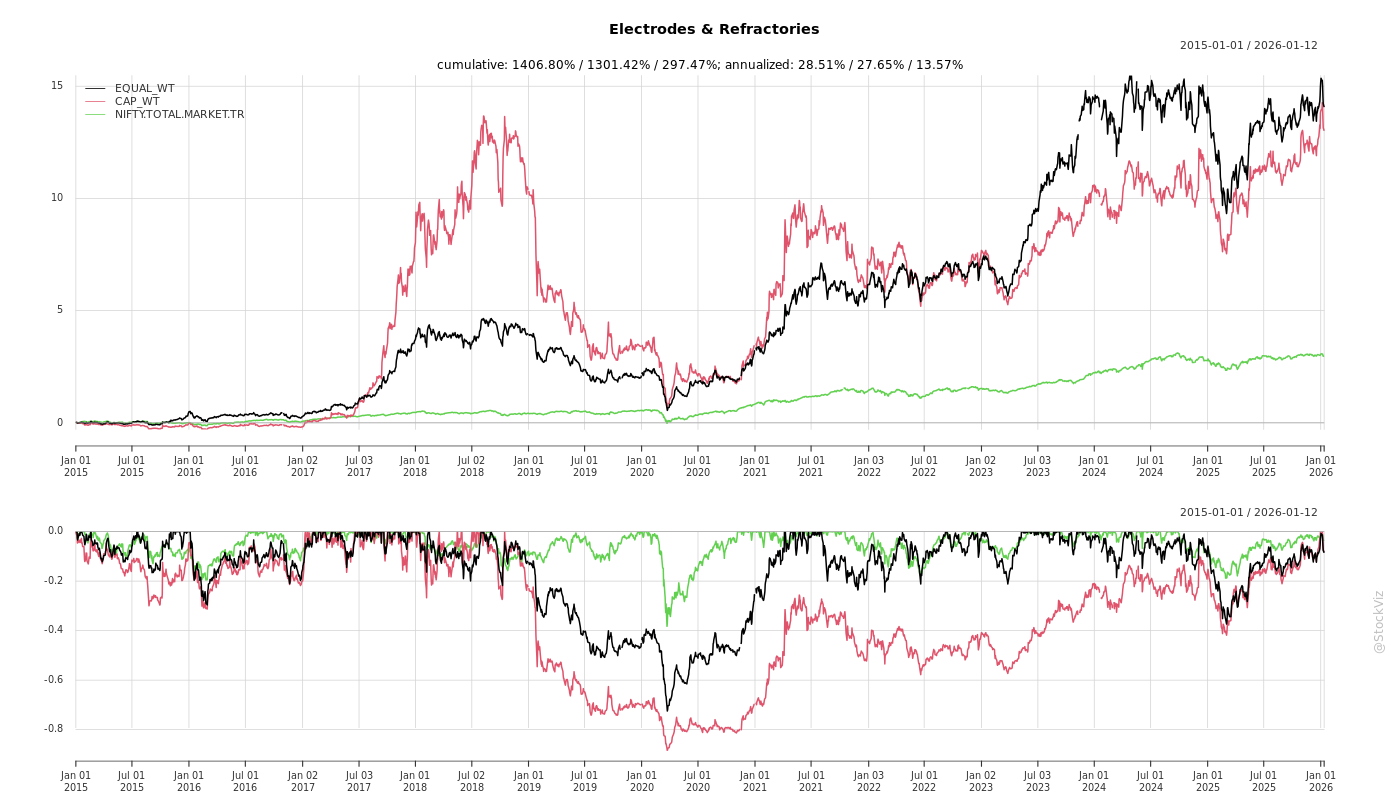

Annual Returns

Cumulative Returns and Drawdowns

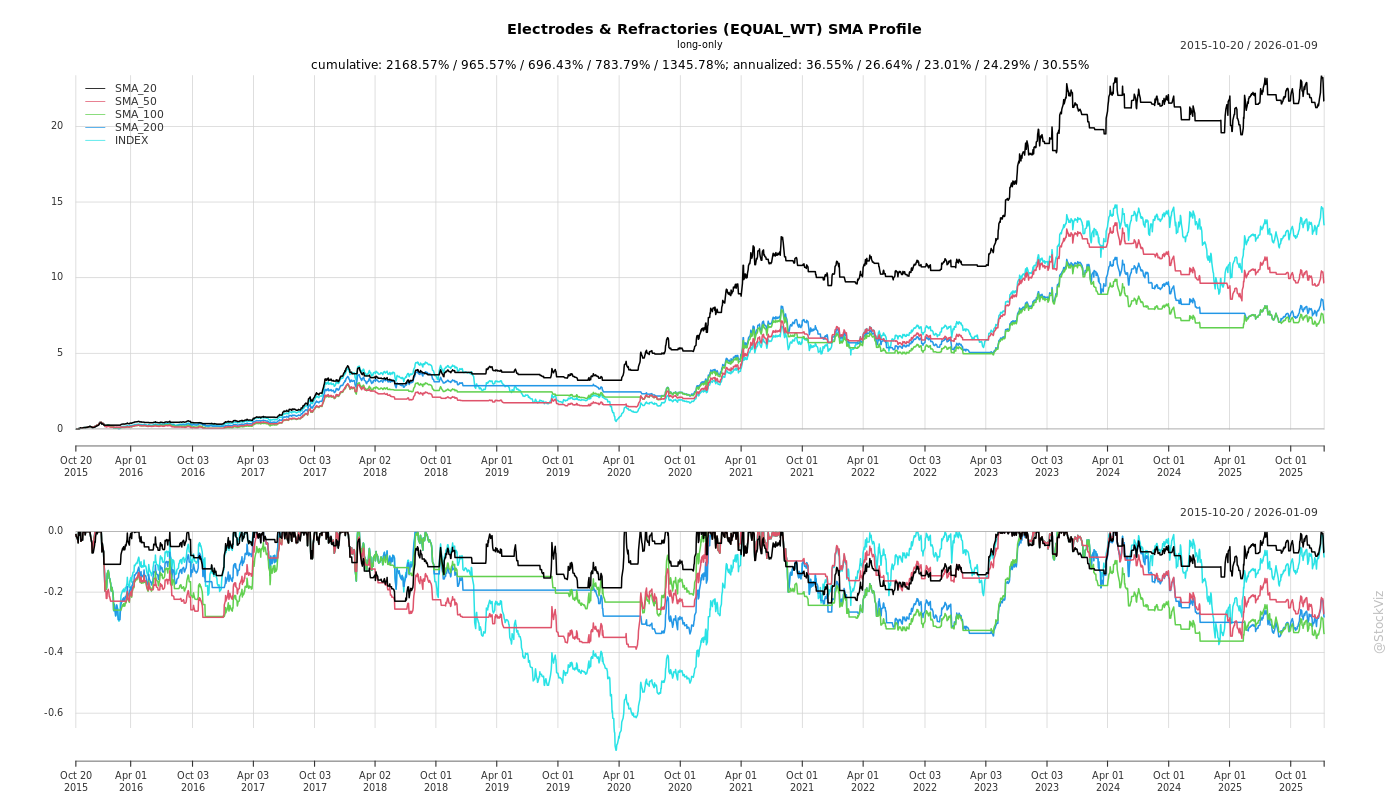

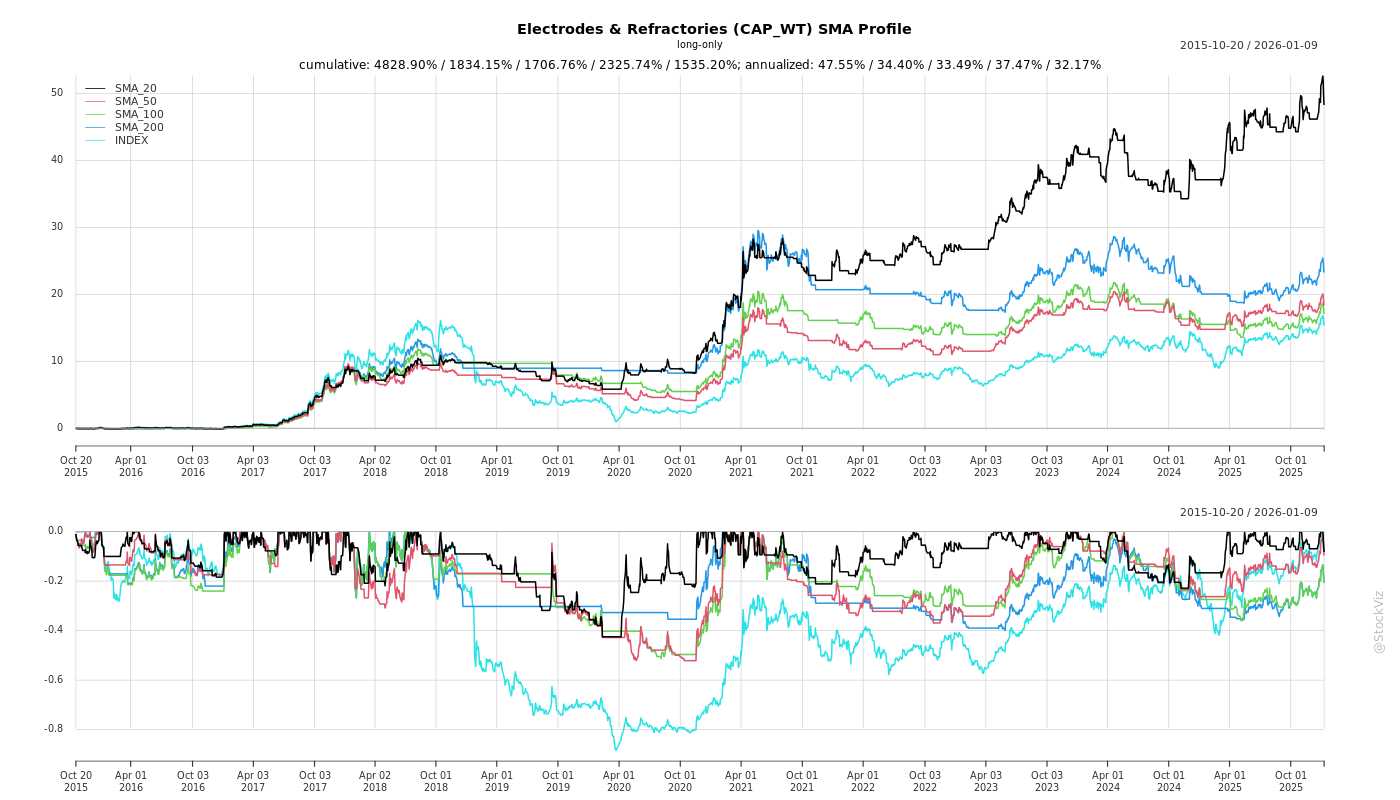

SMA Scenarios

Current Distance from SMA

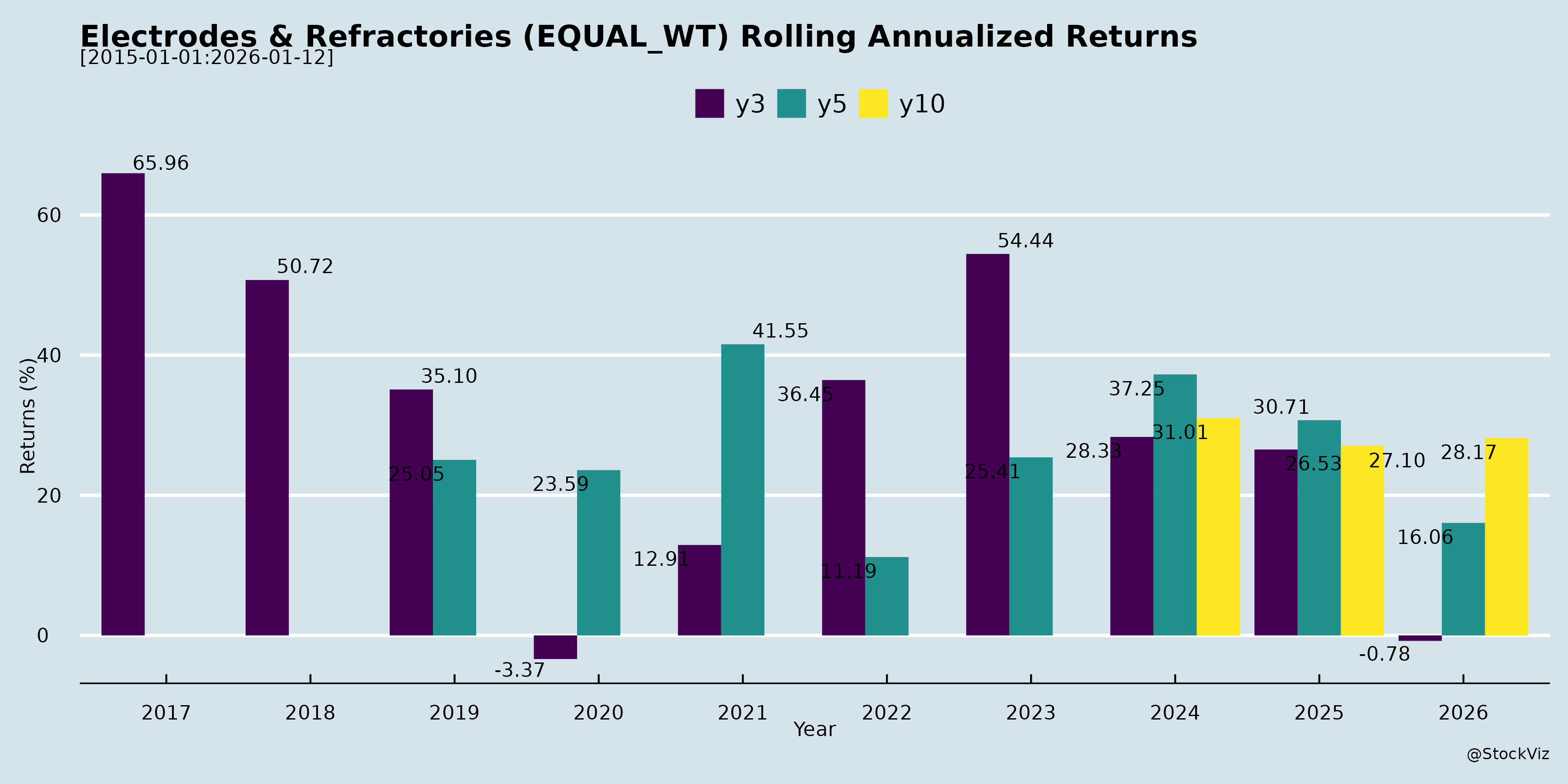

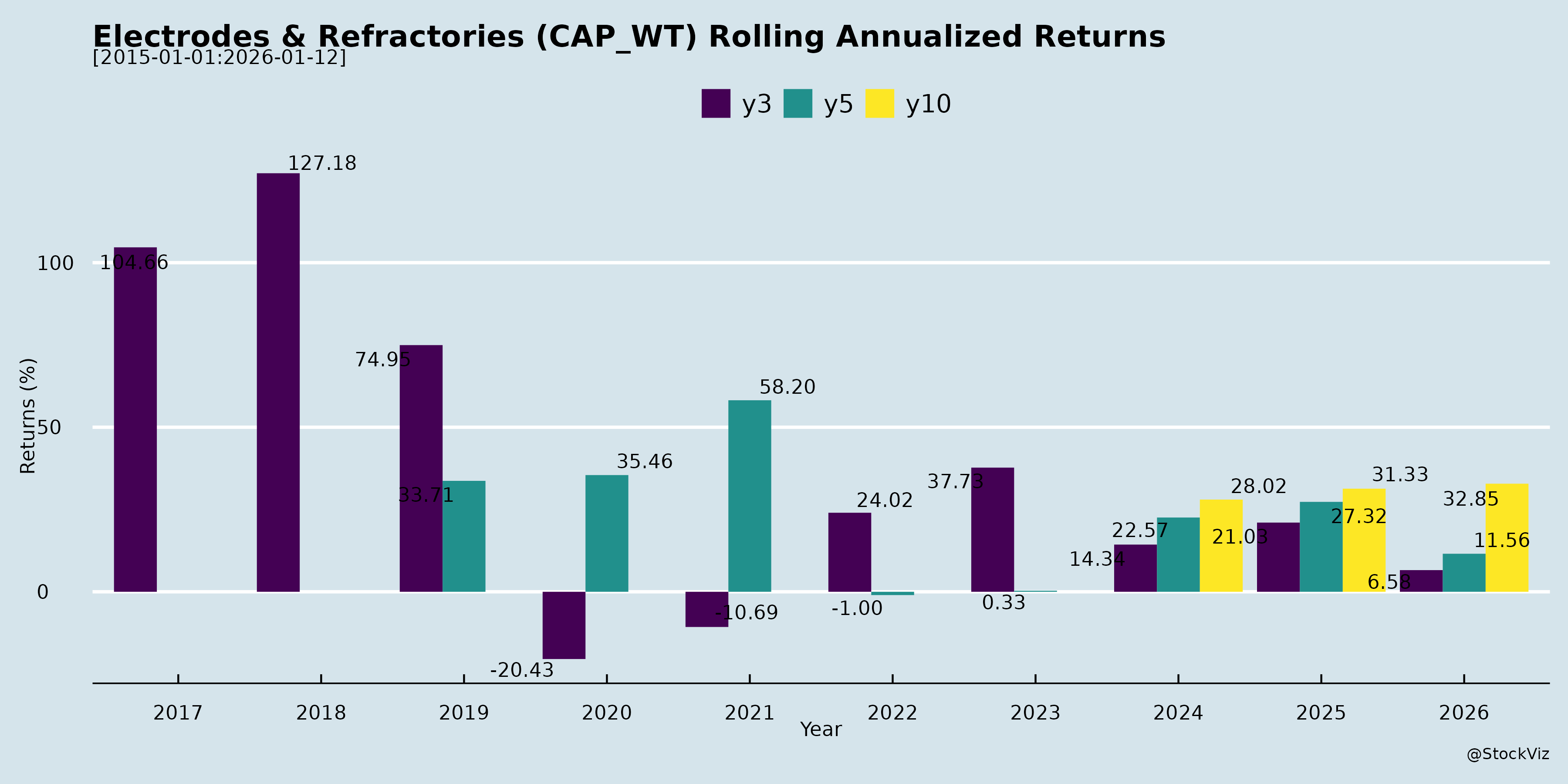

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Indian Electrodes & Refractories Sector Analysis

Based on Q2 FY26 updates from Graphite India, HEG, IFGL Refractories, RHI Magnesita India, and Raghav Productivity Enhancers (Nov 2025). Sector tied to steel (key driver), with Graphite Electrodes (GE) facing pricing pressure and Refractories benefiting from India shift.

Headwinds

- Global Steel Weakness: Crude steel output down 1.5% YoY (9M25: 1,373MMT); China -2.6% (exports +9.2% YoY, pressuring ex-China prices). Ex-China flat (-0.1% YoY), Europe/US muted (Japan -4.5%, Korea -3.4%).

- Chinese Oversupply: Aggressive GE pricing (HP/UHP dominant), intensified competition; stable but low electrode prices (Q1-Q2 flat).

- US Tariffs: 50% reciprocal duty on GE (10-12% of HEG sales); customers resist absorption, potential diversification needed.

- Export Decline: Refractories exports -20-21% YoY (IFGL); strategic domestic pivot amid weak EU/UK demand.

- Raw Material Stability at Highs: Needle coke/electrode prices flat (2-3Q); alumina stable post-rise but freight impacts margins (IFGL EBITDA 8-13%).

- Low Industry Utilization: Global GE ~65-70% (vs. India 90%+); prices firm only >80-85%.

Tailwinds

- India Steel Boom: +10.5% YoY output (122MMT, 9M25); demand +9% (2025-26). Infra/auto drive refractories (IFGL domestic +27% Q2/+29% H1, 78% of standalone revenue).

- Operational Resilience: HEG volumes up (90%+ util., EBITDA +61% YoY); cost-efficient single-location ops in India.

- Diversification: HEG 35 countries (U.S. <12%, Europe ~10%); refractories non-ferrous/cement growth (IFGL ladle/magnesite).

- Stable Inputs: Needle coke flat; alumina plateau (no sharp hikes).

- Regulatory Support: EU CBAM/quotas (2026) to boost local steel/EAF; global EAF shift.

Growth Prospects

- Short-Term (FY26): Volume-led (HEG 85-90% util. FY26 vs. 80% FY25); India domestic dominance (refractories 20-29% growth). H1 revenue/EBITDA up (HEG +23/+61%, IFGL +12/+12% standalone).

- Medium-Term (FY27-28): EAF adds ~20MMT steel (CY26-27) → +30kT GE demand; HEG +15kT capex (INR650cr, ready Q1 CY28). Refractories greenfields (IFGL Odisha/Gujarat, INR600-650cr total, FY28-29). Dolomite/stainless steel ramp (IFGL).

- Long-Term: Ex-China GE demand +200kT by 2030 (EAF/climate goals); EBITDA doubling (HEG Greentech FY27); non-steel (cement, gasification).

- Financials: Debt-free (HEG INR1,167cr treasury); ROCE 6.7% (IFGL); PAT growth (HEG +111% standalone Q2).

Key Risks

- Trade/Geopolitical: US tariffs unresolved (hopes for 10-25% cut); China GE exports absorb incremental demand.

- Demand Delay: Steel recovery slower (Q3 flat per HEG); macro headwinds (geopolitics, inflation).

- Pricing Power: Flat/no uptick Q3-Q4 FY26; Chinese dominance caps margins (industry needs prices > current lows).

- Execution: Capex overruns/delays (HEG 2.5yr timeline vs. peers); HEG demerger (NCLT Apr26). Needle coke ramp-up for expansions.

- Subsidiary Losses: Europe/Monocon (IFGL EBIT -INR16cr H1, breakeven FY26); US rebound fragile.

- RM Volatility: Freight/alumina spikes; inventory comfortable but tied to refineries.

Overall Outlook: Cautious FY26 (volume > price growth, India buffers globals); bullish medium-term on EAF/India steel. Indian players (HEG/IFGL) outperform globally via high util./domestic shift. Monitor US tariffs, China exports, steel Q3 data.

Financial

asof: 2025-12-01

Summary Analysis: Indian Electrodes & Refractories Sector (Q3 FY25 Insights from Key Players)

The sector’s performance in Q3 FY25 (quarter/9M ended Dec 2024) reflects mixed results amid softening electrode prices and inventory corrections, driven by weak global steel demand (esp. exports to China/Europe) and domestic steel overcapacity. Graphite electrode-focused players (Graphite India, HEG, IFGL) faced pricing pressure, while refractories (Vesuvius, RHI Magnesita, Orient Ceratech) showed resilience. De Nora reported losses due to one-off warranty provisions. Aggregate revenue growth ~5-10% YoY for 9M, but EBITDA margins compressed 200-500 bps due to inventory writedowns (e.g., Graphite: ₹149 Cr provision). Steel production (key driver) grew ~3% YoY in India, but global slowdown caps upside.

Headwinds (Key Pressures)

- Electrode Price Collapse: Sharp fall in graphite electrode prices (Graphite: NRV writedowns ₹149 Cr standalone/₹153 Cr consolidated; IFGL/Heg implied via inventory adjustments). Led to segment losses (Graphite Carbon: -₹1 Cr Q3; RHI: -₹13 Cr).

- Weak Export Demand: Europe/America segments down 10-20% YoY (HEG Europe: softer; RHI/Heg exports muted). Currency volatility and Chinese dumping hurt.

- High Input Costs: Power/fuel up 10-15% YoY (Graphite: ₹89 Cr Q3; Orient: ₹994 Lacs). Raw materials (needlecoke/graphite) volatile.

- Inventory Overhang: Changes in FG/WIP negative but prior writedowns persist (Graphite: ₹298 Cr FY24 peak).

- One-offs: Warranty provisions (De Nora: ₹106 Cr Q3 loss); exceptional gains absent post-FY24 land sales (Graphite: ₹954 Cr prior).

Tailwinds (Supportive Factors)

- Domestic Steel Resilience: India steel output steady; infra push (e.g., PLI schemes) aided refractories (Vesuvius: strong FY24 growth; RHI: revenue flat but margins up).

- Other Income Boost: Investments/forex gains propped profits (HEG: ₹113 Cr Q3; Graphite: forex/unallocable income).

- Cost Controls: Employee/stores expenses flat YoY; operational leverage in stable plants (HEG Graphite: EBITDA up).

- Margin Recovery Signs: Power reversals (Graphite FY24: ₹43 Cr credit); efficiency gains (RHI: segment results improving).

- Capex Discipline: Lower depreciation in some (De Nora flat), signaling pause post-expansions.

Growth Prospects

- Steel Capacity Expansion: India targeting 300 MTPA by 2030 (from ~140 MTPA); electrodes/refractories demand to rise 8-10% CAGR. Graphite/HEG well-positioned for EAF/steel boom.

- Export Revival: Potential China stimulus/US infra spend could lift Q4/FY26 (HEG/RHI exports 40-50% revenue).

- Value-Added Shift: Refractories/monolithics growth (Orient/Vesuvius: 10-15% YoY); green steel (low-carbon electrodes) tailwind.

- M&A/Subsidiary Synergies: RHI/HEG expansions via JVs/subs (IFGL new JV for magnesite bricks).

- Outlook: FY25 revenue flat-to-5% up; FY26 10-15% if steel revives. EPS growth led by HEG/Graphite (₹20-40/share).

Key Risks

| Risk Category | Description | Impact (from Filings) |

|---|---|---|

| Pricing/Volume | Electrode price volatility; steel slowdown (China 2% dip). | Graphite/HEG: 20-30% revenue drop Q3 YoY. |

| Cost Inflation | Power/fuel (30-40% costs); needlecoke shortages. | Orient/RHI: Fuel up 15%; EBITDA squeeze. |

| Inventory/Liquidity | NRV writedowns; working capital strain. | Graphite: ₹149 Cr hit; De Nora cash burn. |

| Regulatory/Tax | GST/power tariff hikes; tax disputes (IFGL/Graphite appeals). | Provisions/disputes: ₹800L+ (IFGL). |

| Geopolitical/FX | Export bans (Russia/Ukraine); INR depreciation. | HEG/RHI: Forex OCI volatility ₹10-20 Cr. |

| Execution | Warranty claims (De Nora); capex delays. | De Nora: ₹140 Cr FY25 hit. |

Overall Sector Outlook: Cautious Neutral for FY25 (revenue flat, margins 12-15%); Bullish FY26 on steel capex. Monitor steel PMI/China exports. HEG/Graphite leaders; De Nora turnaround key. Investors: Favor diversified players (RHI/Vesuvius) over pure-play electrodes.

General

asof: 2025-11-29

Summary Analysis: Indian Graphite Electrodes & Refractories Sector

Using the provided filings from key players (Graphite India, HEG, Vesuvius India, RHI Magnesita India, Raghav Productivity Enhancers, IFGL Refractories, De Nora India), the sector shows routine operational stability with minor positive signals (e.g., ESG recognition) amid compliance-heavy disclosures. No major disruptions or breakthroughs noted. Insights are inferred from governance, asset moves, ratings, and market queries, contextualized against steel demand (primary driver for electrodes/refractories). Overall sentiment: neutral to mildly positive, with steel cycle tailwinds offset by compliance burdens.

Tailwinds (Supportive Factors)

- ESG Momentum: HEG Ltd. received an unsolicited ESG score of 66.2 (Nov 2025) from SES ESG Research, signaling strong sustainability credentials based on public data. This enhances investor appeal amid global push for green steel/electrodes.

- Market Sentiment: Raghav Productivity Enhancers addressed exchange queries on “significant price movement” (Nov 2025), attributing it to market-driven factors with full Reg 30 compliance. Indicates speculative/positive interest, possibly tied to sector recovery.

- Asset Optimization: Vesuvius India’s sale of idle Visakhapatnam factory land (Rs. 30.51 Cr, Oct 2025) post-operations cessation unlocks non-core value without revenue impact, improving balance sheets.

- Stable Governance: Routine director changes (Graphite India) and promoter inter-se transfers (IFGL Refractories, no aggregate holding change) reflect continuity.

Headwinds (Challenges)

- Capacity Rationalization: Vesuvius ceased operations at a factory (intimated Oct 2025), signaling potential underutilization amid volatile steel demand or cost pressures.

- Compliance Overload: De Nora India’s shareholder letter emphasizes mandatory PAN/KYC/nomination updates (per SEBI circulars), with risks of service restrictions/dividend delays for non-compliant physical holders. Similar burdens across sector (e.g., RHI Magnesita’s TDS docs deadline).

- Price Volatility Scrutiny: Exchanges probing Raghav’s price surge highlights regulatory watch on speculative trading, potentially deterring retail flows.

Growth Prospects

- Steel Linkage Upside: Sector tied to India’s steel expansion (EAF/arc furnaces). ESG tailwind (HEG) positions players for green steel mandates. Dividend payout (RHI Magnesita: Rs. 2.50/share) signals cash confidence.

- Asset Monetization: Non-core sales (Vesuvius) could fund capex/tech upgrades for high-margin electrodes/refractories.

- Promoter Stability: IFGL’s inter-se transfer (0.61% shares at Rs. 212 vs. VWAP Rs. 294) maintains 72.43% promoter holding, supporting long-term investments.

- Limited Visibility: No explicit demand cues; prospects hinge on steel capex (e.g., 200M+ tonnes target by 2030), but filings focus on compliance over expansion.

Key Risks

- Regulatory/Compliance: High (KYC freezes, TDS scrutiny, surveillance probes); non-compliance could disrupt dividends/payouts (e.g., De Nora/RHI).

- Operational Idle Capacity: Factory closures (Vesuvius) risk if steel demand softens further.

- Market/Volatility: Price swings under watch (Raghav); promoter transfers must stay compliant to avoid SAST triggers.

- Governance Turnover: Director exits (Graphite India) minor but cumulative changes could signal board refresh needs.

- External (Macro): Steel slowdown (China oversupply, infra delays) unmentioned but implicit; ESG scores unsolicited, so not guaranteed outperformance.

Overall Outlook: Sector resilient (no red flags), with ESG/market interest as near-term positives. Growth moderate (steel-dependent), but risks skewed to compliance. Monitor Q3FY26 earnings for steel volume cues. Recommendation: Neutral; favor ESG-strong names like HEG.

Investor

asof: 2025-11-29

Indian Graphite Electrodes & Refractories Sector Analysis

Overview: The sector serves the steel industry (primary demand driver), with graphite electrodes (GE) critical for EAF steelmaking and refractories for linings/furnaces. Indian players (e.g., HEG, Graphite India, IFGL Refractories) benefit from India’s robust steel growth (~9-10% YoY) amid global slowdowns. Q2 FY26 shows resilience: HEG reported volume-led revenue growth (90%+ utilization), debt-free status; IFGL saw 12-18% YoY revenue growth (78% domestic). Challenges persist from Chinese exports and flat pricing, but long-term EAF transition supports outlook.

Headwinds

- Weak Global Steel Demand: Global crude steel output down 1.5% YoY (1,373 MnT in 9M25); China -2.6% (exports +9.2% YoY), pressuring ex-China production (-0.1% YoY). Refractory demand stable but muted.

- Chinese Competition/Dumping: Aggressive GE/refractory exports at low prices dominate HP-grade; erodes margins globally. Industry utilization ~65-70% ex-China.

- Pricing Pressure: GE prices flat QoQ (realization ~USD 3,500/t implied at HEG); refractory pricing plateaued (no hikes expected). Spreads (GE vs. needle coke) compressed at cycle lows.

- Trade Barriers: US 50% reciprocal GE duties (hoping reduction; 10-12% HEG exposure); EU CBAM/quotas from 2026 may aid local steel but disrupt flows.

- Input Costs: Needle coke/alumina stable but high (~1/3 GE price rule-of-thumb); ocean freight volatility impacts imports.

- Regional Weakness: Europe/UK slowdown (recovery only +1.3-3.2% by 2026); US steady but tariff-hit.

Tailwinds

- India Steel Boom: +10.5% YoY production (122 MnT in 9M25); demand +9% in FY26/27 (infra/auto push). Domestic revenue share rising (IFGL: 78%).

- High Operational Efficiency: Indian GE players at 90%+ utilization vs. peers (GrafTech ~65%); cost advantages from single-location India ops.

- EAF Transition: Global shift to low-emission EAF (~51% ex-China steel); +20 MnT new EAF capacity in CY26-27 (+30k t GE demand). Long-term: +200k t GE by 2030 ex-China.

- Diversification: GE sales across 35 countries (balanced); refractories expanding non-ferrous/cement/stainless (dolomite demand gap).

- Strong Balance Sheets: Debt-free (HEG); treasuries ~INR 1,200 Cr (INR 830 Cr to Greentech post-demerger).

- Raw Material Stability: Needle coke/alumina plateaued; no sharp hikes foreseen.

Growth Prospects

- Short-Term (FY26): Volume-led (HEG: 85-90% FY26 util. vs. 80% FY25); India domestic +27-29% YoY (IFGL). EBITDA margins stable (HEG resilient; IFGL 13% standalone).

- Medium-Term (FY27-29): Expansions: HEG +15k t (INR 650 Cr, ready Q1’28); IFGL greenfields (Odisha/Gujarat, INR 600-650 Cr total, FY28-29). New EAF/stainless/cement capacities absorb output.

- Refractories-Specific: Dolomite refractories undersupplied (50% import reliance; +15-20% stainless demand); flow control/non-ferrous pilots scaling (IFGL ladle magnesia carbon +500-600 t/m).

- Strategic Moves: HEG demerger (NCLT by Apr’26); IFGL US/Europe turnaround (breakeven FY26); tech transfers (Sheffield to India).

- EBITDA Outlook: HEG margins firm at 80-85% util.; IFGL H2 stable (no raw mat. tailwinds). Sector ROCE ~7% (IFGL); long-term 30-40% EBITDA possible in niche (e.g., anodes).

| Metric | FY26E | FY27-28E |

|---|---|---|

| Steel Demand (India) | +9% | +9% |

| GE Volumes (Indian Players) | +10-15% (util. ramp) | +20%+ (expansions) |

| Refractory Domestic Growth | +20-25% | +15-20% (capex live) |

Key Risks

- Demand Downturn: Prolonged steel weakness (e.g., China exports persist; geopolitics delay EAF ramp).

- Chinese Supply Surge: Excess HP/UHP capacity floods markets; needle coke ramp-up lags but competitive.

- Tariff Escalation: US duties >25% force GE volume diversion (lower realizations); EU CBAM disrupts 2026 flows (~10% Europe exposure).

- Capex Execution: Delays in expansions (2-3 yr timeline); INR 1,200-1,300 Cr sector-wide spend.

- Margin Erosion: Flat prices + inventory overhang; raw mat. spikes (needle coke tied to refineries).

- Macro/External: Currency depreciation, freight hikes; demerger delays (HEG).

Net Outlook: Cautiously Positive. Near-term resilience from India volumes/margins; medium-term upside from EAF/global recovery (prices firm >80% util.). Indian players’ cost edge/DIY focus mitigates China risk. Monitor Q3 steel data/US-India trade talks. Target: 15-20% revenue CAGR FY26-29; EBITDA margins 25-30% at peak cycle.

Press Release

asof: 2025-11-29

Analysis of Indian Graphite Electrodes & Refractories Sector

Using the provided announcements from HEG Limited (graphite electrodes via subsidiary TACC), RHI Magnesita India (refractories), and Raghav Productivity Enhancers Ltd. (RPEL, silica ramming mass for steel furnaces), the sector shows resilience amid steel demand softness but strong alignment with clean energy transitions. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds

- Robust Financial Performance: Record results across players—RHI Magnesita reported Q2 FY26 revenue of ₹1,035 Cr (+8% QoQ), shipments +9%, EBITDA +7%, PAT +9%; RPEL achieved highest-ever H1 FY26 revenue (driven by +29% YoY volumes), PAT/MT +16%, with Q2 sales ₹64 Cr (+29% YoY). Demonstrates pricing power, cost discipline, and execution strength.

- Export Momentum & Market Penetration: RPEL’s exports +26% YoY despite local competition; eastern India share rose to 35% (from 26%), with 25 new customers (16 exports). Superior product quality commands 3-8x premiums.

- Policy & Financing Support: HEG/TACC secured ₹1,230 Cr SBI credit for 20,000 MTPA greenfield lithium-ion battery anode facility in Dewas—first-of-its-kind in India, backed by Atmanirbhar Bharat, Make in India, and EV/clean energy push.

- Diversification & Customer Stickiness: RPEL’s top-10 customer share fell to 26% (diversified base of 248 clients), +18% repeat sales; RHI’s iron-making and 4PRO solutions gaining traction.

Headwinds

- Domestic Steel Slowdown: RPEL explicitly notes “slowdown in domestic steel markets” impacting demand; sector heavily tied to steel (electrodes/refractories critical for furnaces).

- Input Cost Pressures: RHI highlights “persistent market challenges, including input cost pressures,” squeezing margins despite revenue growth.

- Logistics & Regional Challenges: RPEL absorbs 100-150% higher logistics costs for eastern markets despite Rajasthan base.

Growth Prospects

- Clean Energy & EV Transition: HEG/TACC’s battery-grade graphite anode project positions sector for lithium-ion battery demand (EVs, storage); sustainable tech aligns with India’s self-reliance in energy materials.

- Capacity Utilization & Expansion: RPEL at 79% utilization (uptrend), planning customer-proximate growth and R&D for foundry/semiconductors; RHI’s 141 KT shipments signal volume-led scaling.

- Export & Innovation Leadership: RPEL’s global footprint (36 countries), NABL R&D lab; sector’s shift from commoditized to productivity-enhancing products (e.g., RPEL’s niche in silica ramming mass).

- Steel Recovery Potential: RHI’s iron-making strength and overall +8-9% QoQ metrics suggest momentum if steel capex rebounds.

Key Risks

- Cyclical Steel Dependency: Prolonged domestic slowdown could cap volumes; electrodes/refractories ~80-90% steel-linked.

- Project Execution: HEG/TACC’s ₹1,230 Cr greenfield faces delays/tech risks in cutting-edge battery materials.

- Cost Volatility & Competition: Rising inputs (RHI); export pricing pressure from locals despite premiums (RPEL).

- Macro/Regulatory: Global steel/EV slowdowns, import competition (though reducing via PLI schemes), and forex/logistics fluctuations.

Overall Summary

The sector benefits from strong tailwinds like record profits, export growth, and EV/battery pivots (e.g., HEG’s facility), driving high growth prospects in clean energy (20,000 MTPA anode capacity) and steel recovery. However, headwinds from steel softness and costs persist, with risks centered on execution and cyclicality. Outlook remains positive: capacity utilization improving, diversified revenues, and policy tailwinds could yield 15-30% YoY growth if steel stabilizes. Investors should monitor Q3 steel data and TACC project timelines.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.