HDFCLIFE

Equity Metrics

January 13, 2026

HDFC Life Insurance Company Limited

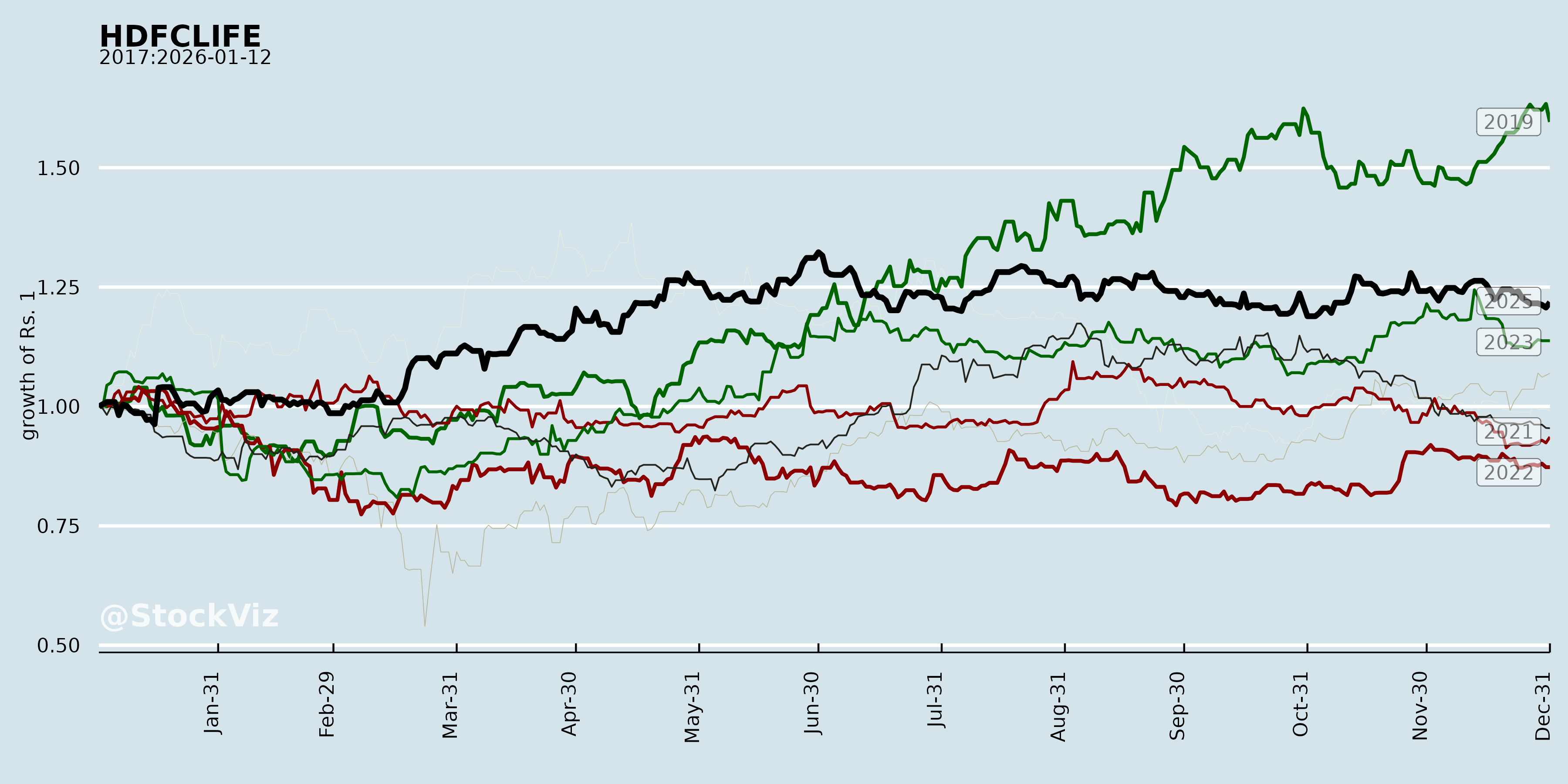

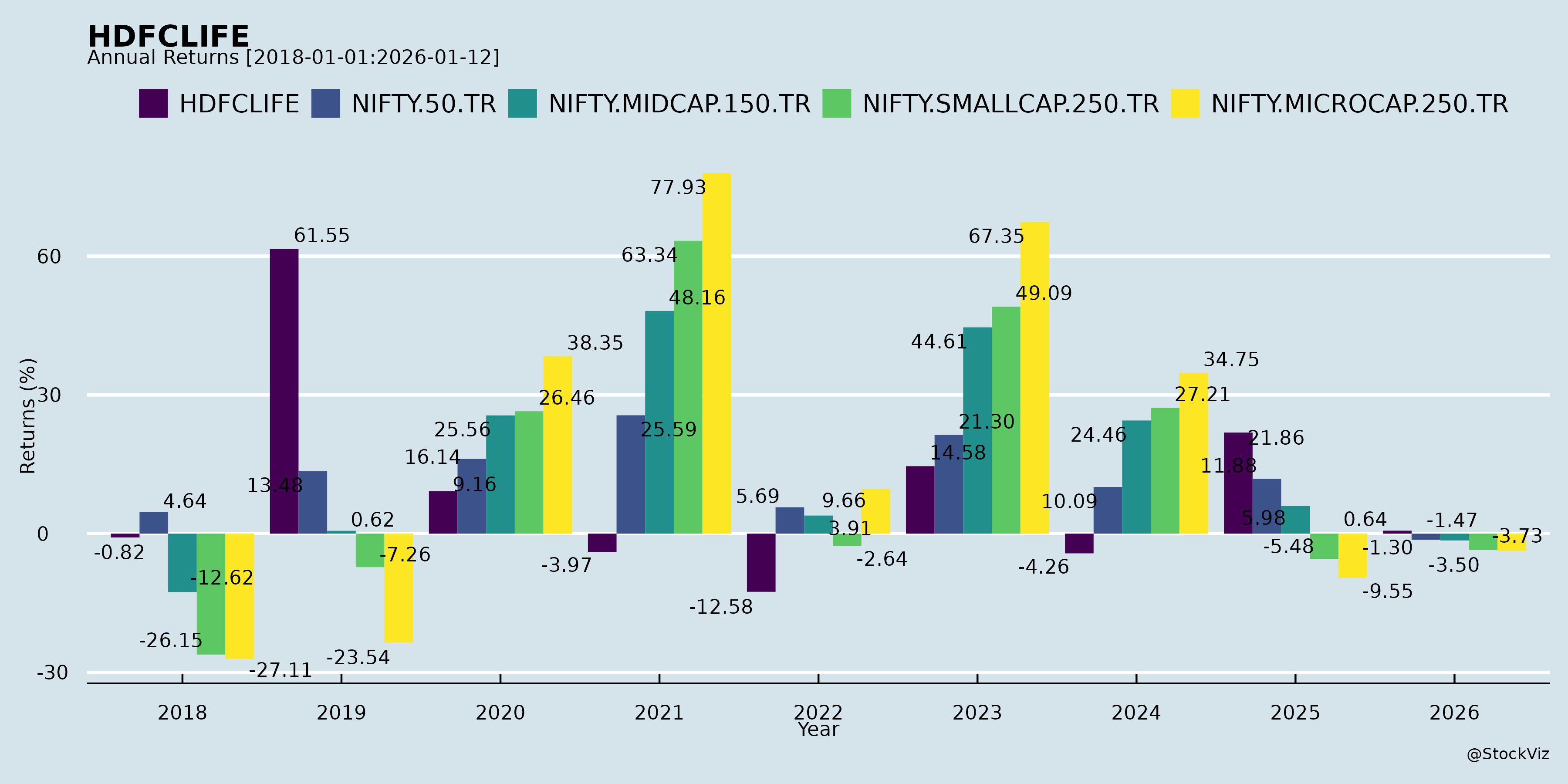

Annual Returns

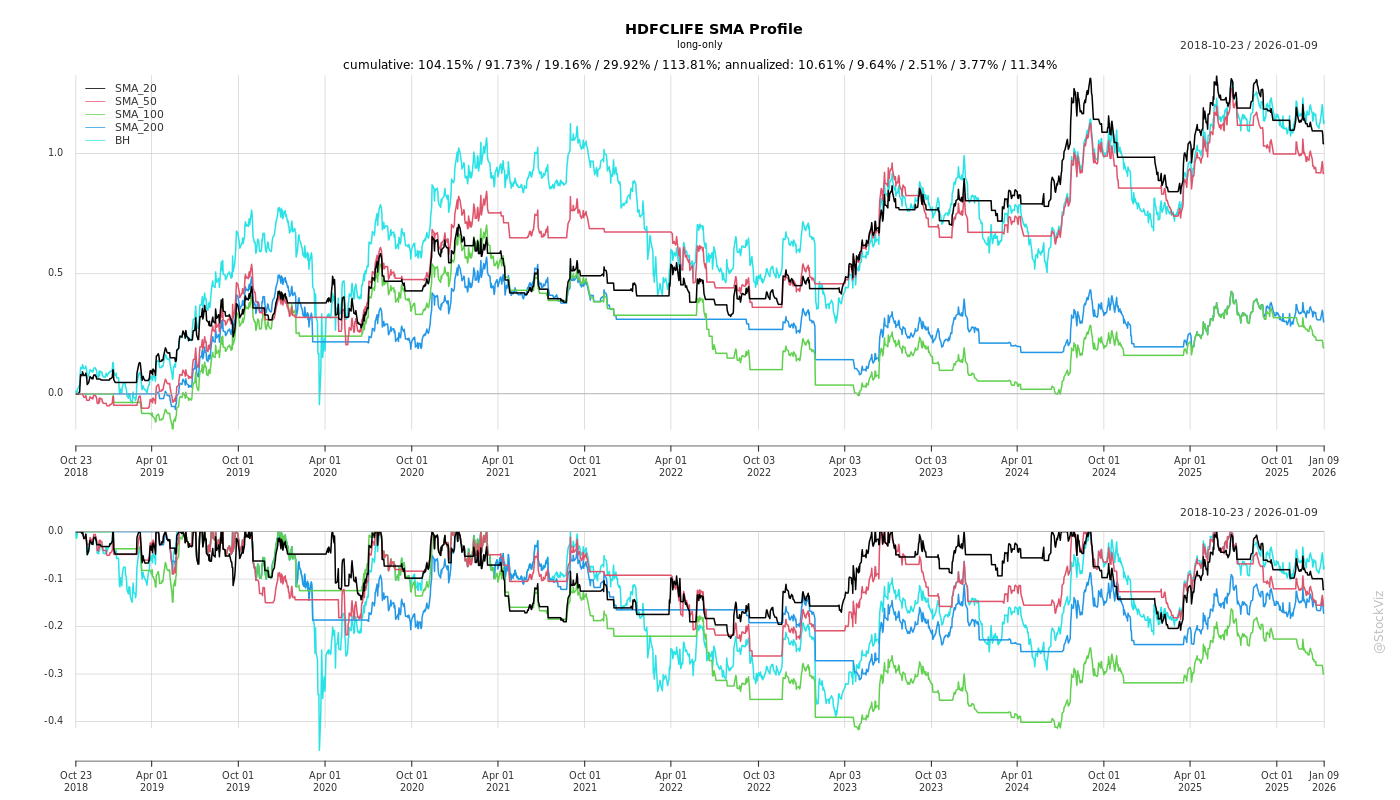

Cumulative Returns and Drawdowns

Fundamentals

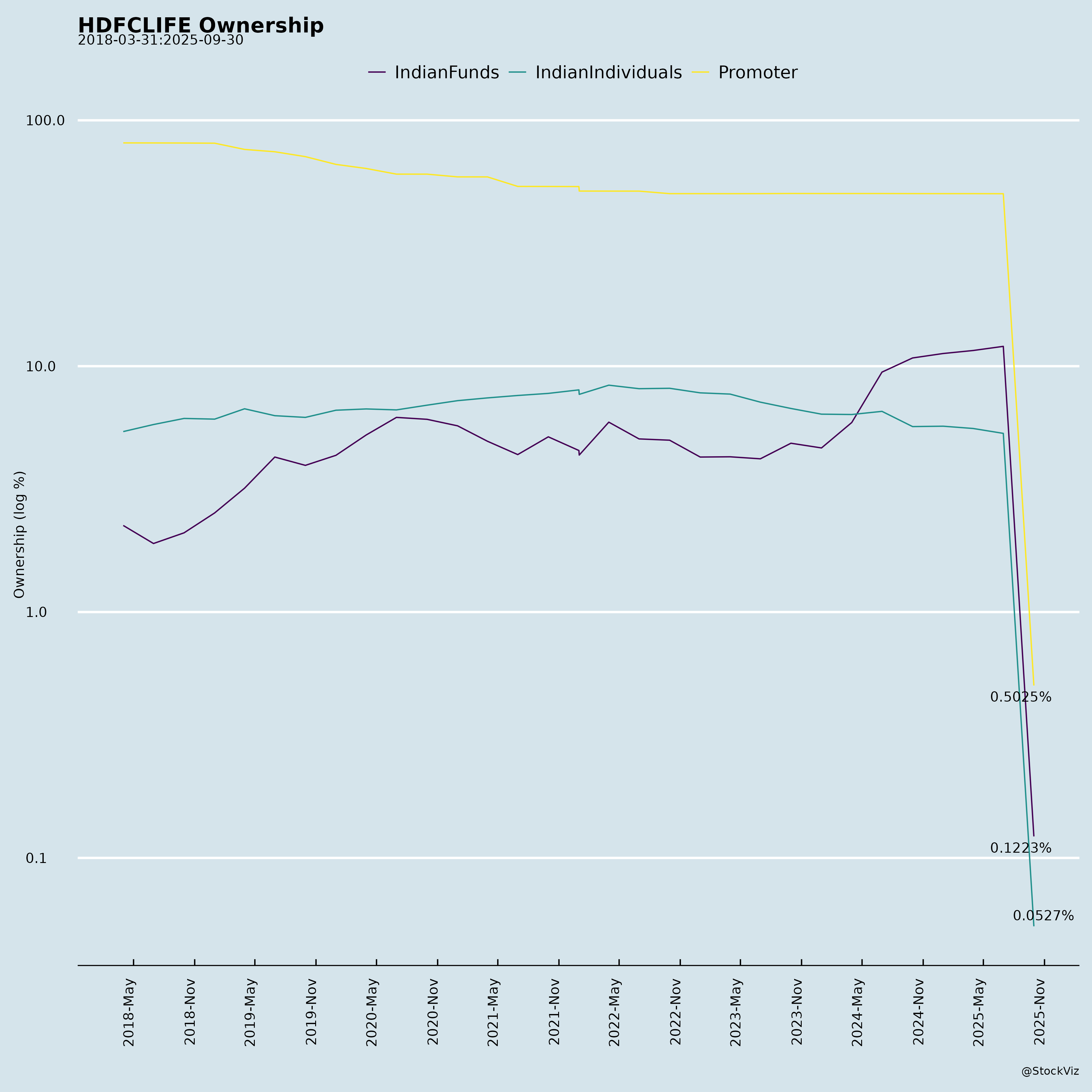

Ownership

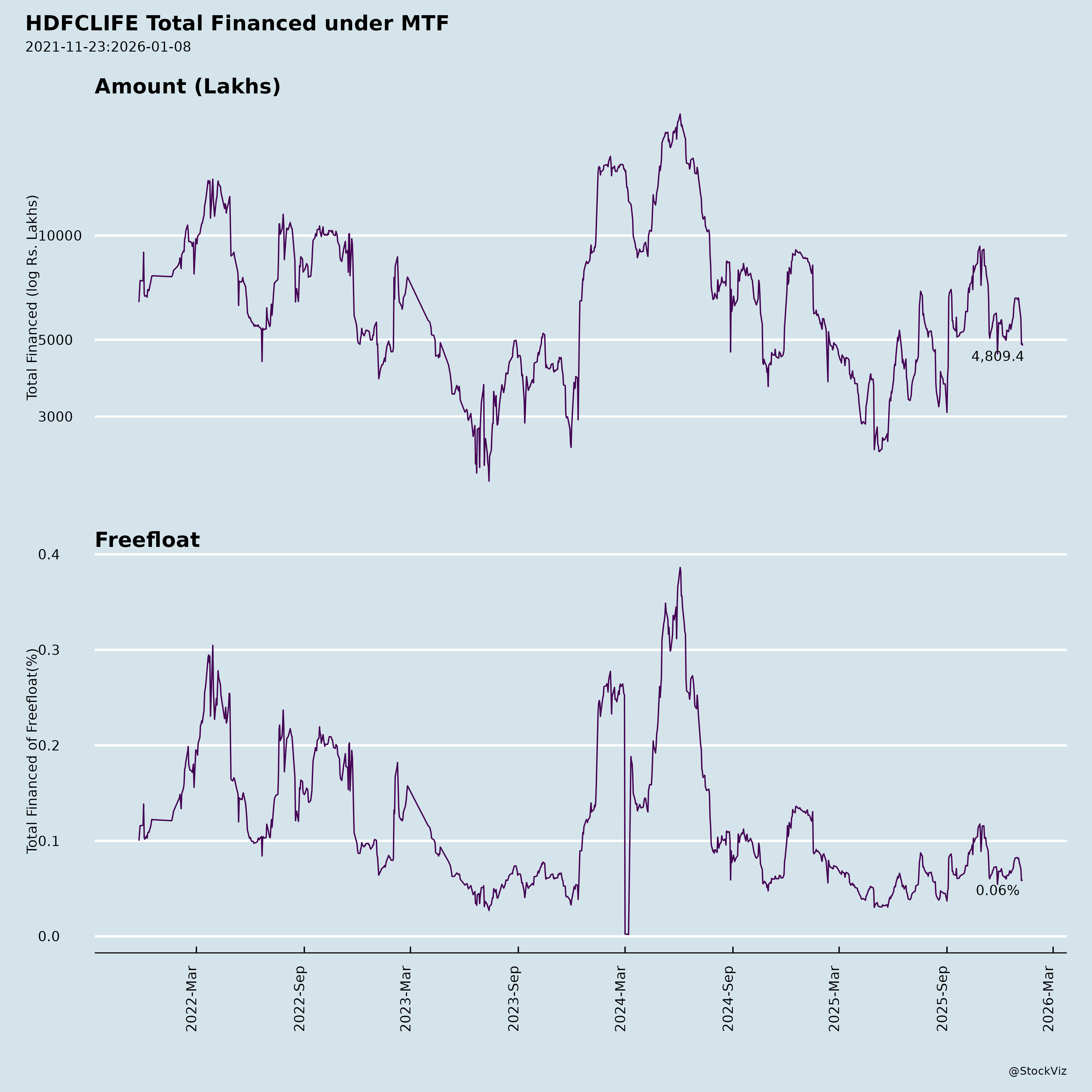

Margined

AI Summary

asof: 2025-12-03

HDFC Life Insurance Company Limited (HDFCLIFE) Analysis

Summary based on Q2/H1 FY26 filings (ended Sep 30, 2025), including financial results, ESOP allotment, board outcomes, and investor disclosures.

HDFC Life reported robust premium growth amid a competitive insurance landscape, with H1 net premium up ~14% YoY (standalone: ₹3,324 Cr) and PAT up ~9% (₹993 Cr). Solvency remains strong at 175%, but policyholders’ account showed a small deficit due to high actuarial liabilities. Stock implications: Positive momentum from growth, offset by market volatility and regulatory overhangs.

Tailwinds (Positive Drivers)

- Premium Momentum: H1 gross premiums surged (FY: +10%, Renewal: +18%, Single: +14% YoY), driven by non-participating life (₹1,263 Cr), annuities, and ULIPs. Individual life ULIP premiums up sharply.

- Profitability: Shareholders’ PAT grew 9% YoY to ₹993 Cr (standalone), with EPS at ₹4.61. Existing business surplus strong (₹314 Cr).

- Balance Sheet Strength: Solvency ratio 175% (vs. 150% regulatory min.), low NPAs (Gross <0.1%), and approval for ₹750 Cr subordinated NCDs to bolster Tier-2 capital for expansion.

- Operational Metrics: Persistency stable (13th month premium: 86%), conservation ratios >85% in key segments. ESOP allotment (7.6L shares) signals employee alignment.

- Market Engagement: Investor presentations and meets (e.g., Macquarie, Citi tours) hosted; Superbrands award enhances brand.

Headwinds (Challenges)

- Policyholders’ Deficit: H1 surplus turned to ₹-9 Cr deficit (vs. +₹107 Cr YoY), due to ₹2,400 Cr rise in actuarial liabilities and high claims/benefits (₹1,801 Cr).

- Investment Yields: Negative yields with unrealized gains in some segments (e.g., non-par non-linked: -1.1%), reflecting equity market volatility impacting ULIPs/FVCA (down to ₹642 Cr policyholders’).

- Cost Pressures: Expenses of Management ratio up to 21.5% (YoY: 21.1%), with employee/other expenses rising.

- Cash Flow Dip: Net cash from operations strong but investing outflows high (₹8,341 Cr purchases); borrowings reduced post ₹600 Cr redemption.

- Macro: Potential rate cuts could pressure yields; seasonality noted (interim results not indicative of FY).

Growth Prospects

- Sector Tailwinds: India’s life insurance penetration <5%; HDFC Life’s market share ~17% positions it for 15-20% industry growth (AUM/protection push).

- Product Mix Shift: Non-par (45% mix) and protection/annuities driving margins; ULIP revival (H1: ₹750 Cr individual). Reinsurance arm (HDFC Re) adding niche growth.

- Distribution/Capital: Strong bancassurance (HDFC Bank tie-up), digital push; fresh NCDs enable new business expansion (VNB growth implied via premiums).

- Projections: Analysts eye 12-15% premium CAGR FY26; PAT could hit ₹4,000-4,500 Cr if persistency holds and yields stabilize. RoEV ~18-20%.

- Upside Catalysts: IRDAI reforms (surrender value), falling rates boosting embedded value (~₹45,000 Cr est.).

Key Risks

| Risk Category | Details | Mitigation/Impact |

|---|---|---|

| Regulatory | Ongoing GST disputes (₹1,041 Cr demand + penalty; appeals filed, ₹211 Cr refund pending). IRDAI norms on expenses/capital. | Contingent liability ₹2,471 Cr; strong compliance track record. |

| Market/Investment | Equity volatility hit ULIP yields/FVCA; 40%+ AUM in equities/linked. Rate sensitivity. | Diversified portfolio (govt bonds dominant); solvency buffer. High impact on Q3 if markets dip. |

| Operational | New business strain (₹-267 Cr H1); persistency dips in longer cohorts (51st month: 62%). Lapse risk in mass products. | Improving 13th month (86%); focus on quality business. Medium impact. |

| Credit/Asset Quality | Gross NPAs stable but monitored (shareholders: 0.07%). | Provisions low; net NPAs nil. Low probability. |

| Competition/Macro | Intense rivalry (SBI Life, ICICI Pru); slowing FY/single premiums if economy softens. | #2 private player; 20%+ YoY FY premium growth differentiates. |

| Execution | Actuarial assumptions (mortality/lapse); debt servicing (DSCR 8.7x). | Relied on appointed actuary; borrowings manageable (14% D/E). |

Overall Outlook: Bullish with caution. Tailwinds from growth/embedded value outweigh headwinds; stock could re-rate to 2.5-3x EV on premium beats. Target ₹750-850 (20-30% upside from ~₹650 levels est.). Monitor Q3 yields, GST updates, and persistency. Buy on dips for long-term compounding in insurance boom.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.