HDFCBANK

Equity Metrics

January 13, 2026

HDFC Bank Limited

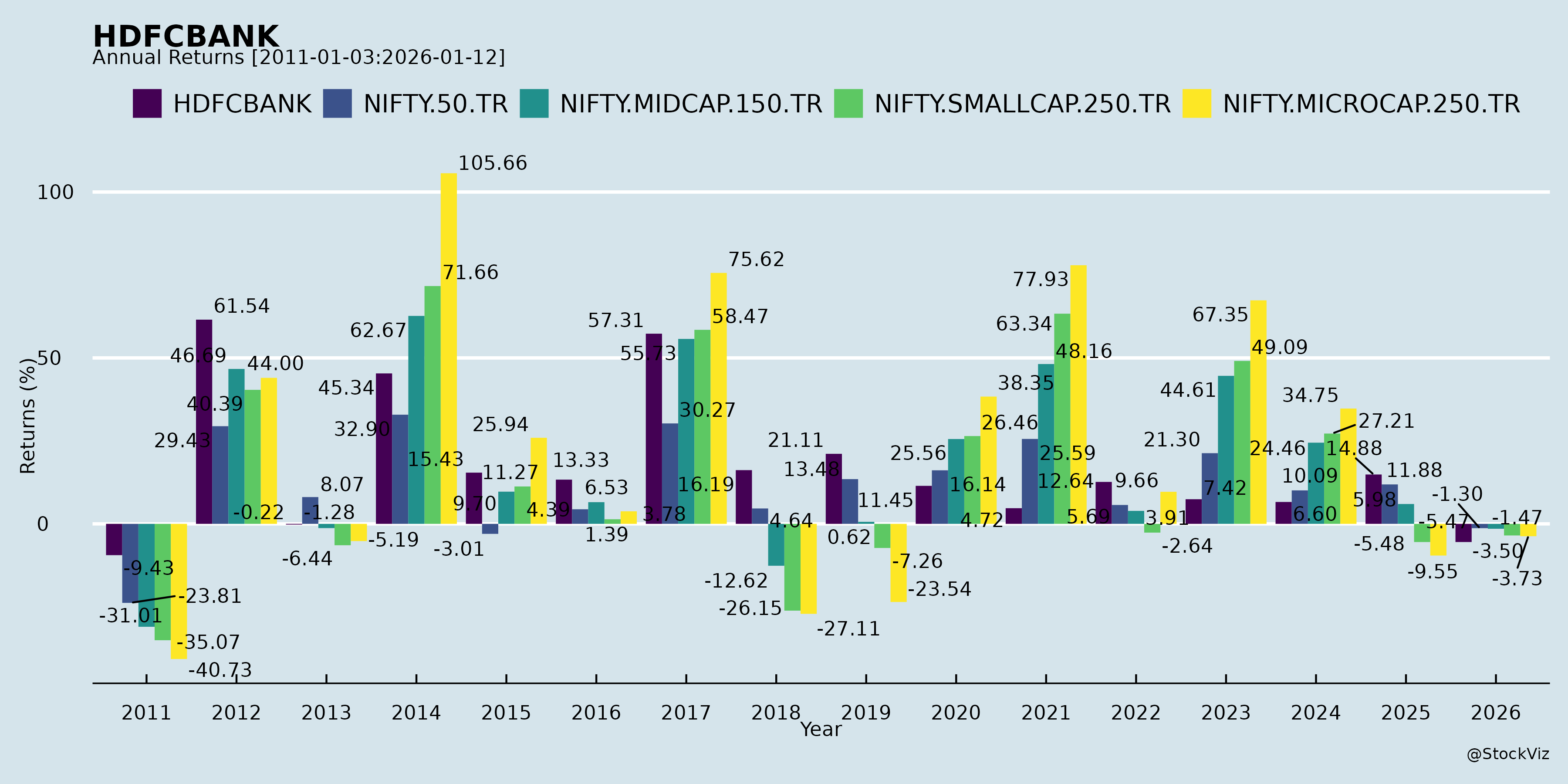

Annual Returns

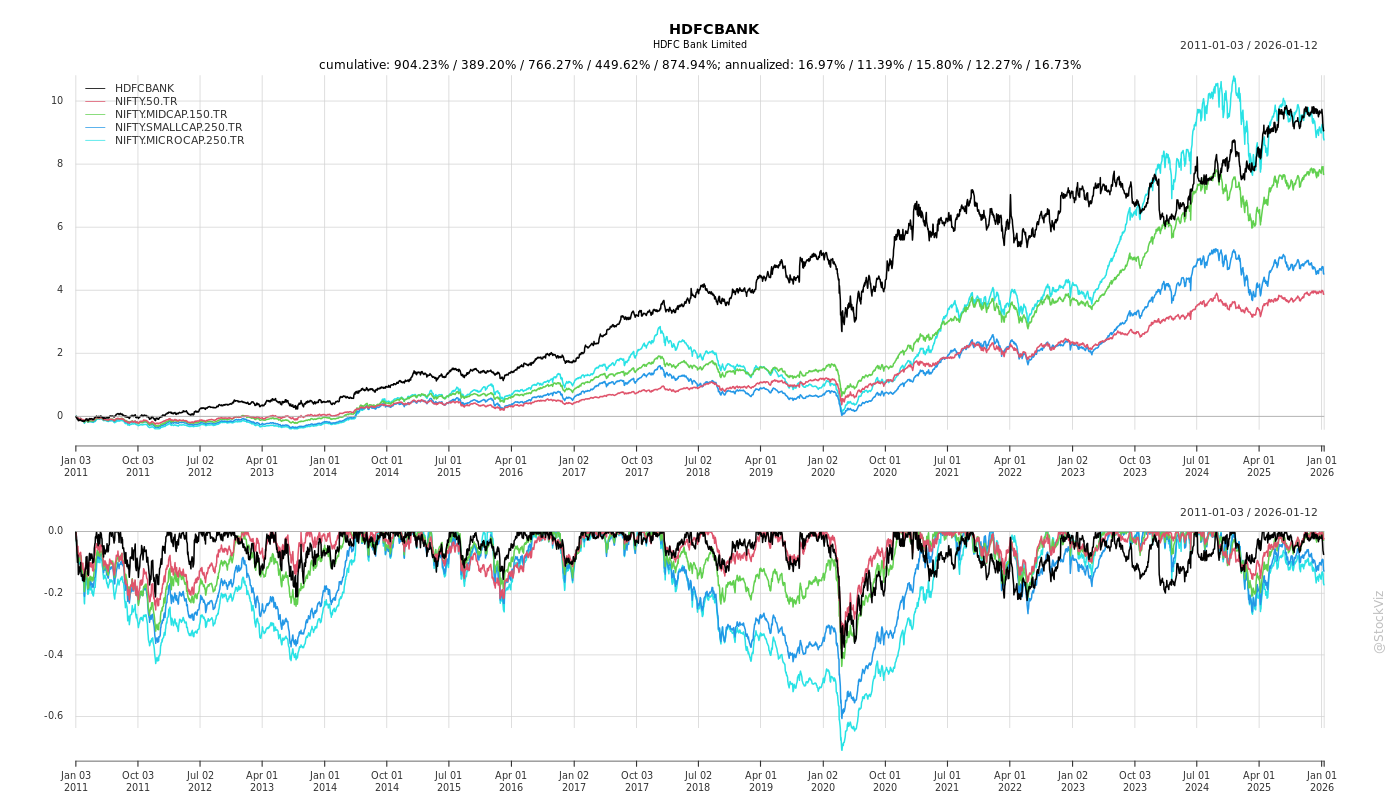

Cumulative Returns and Drawdowns

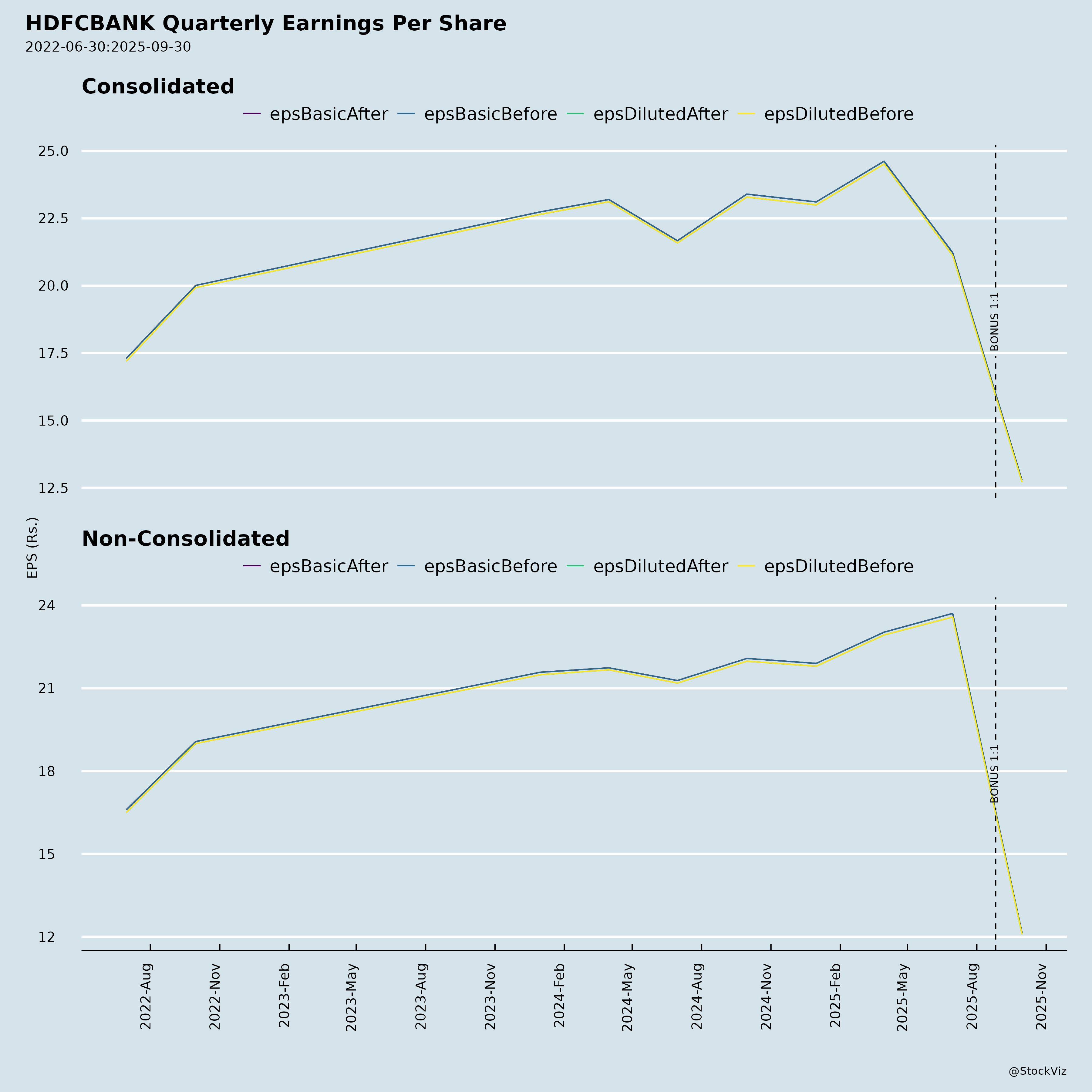

Fundamentals

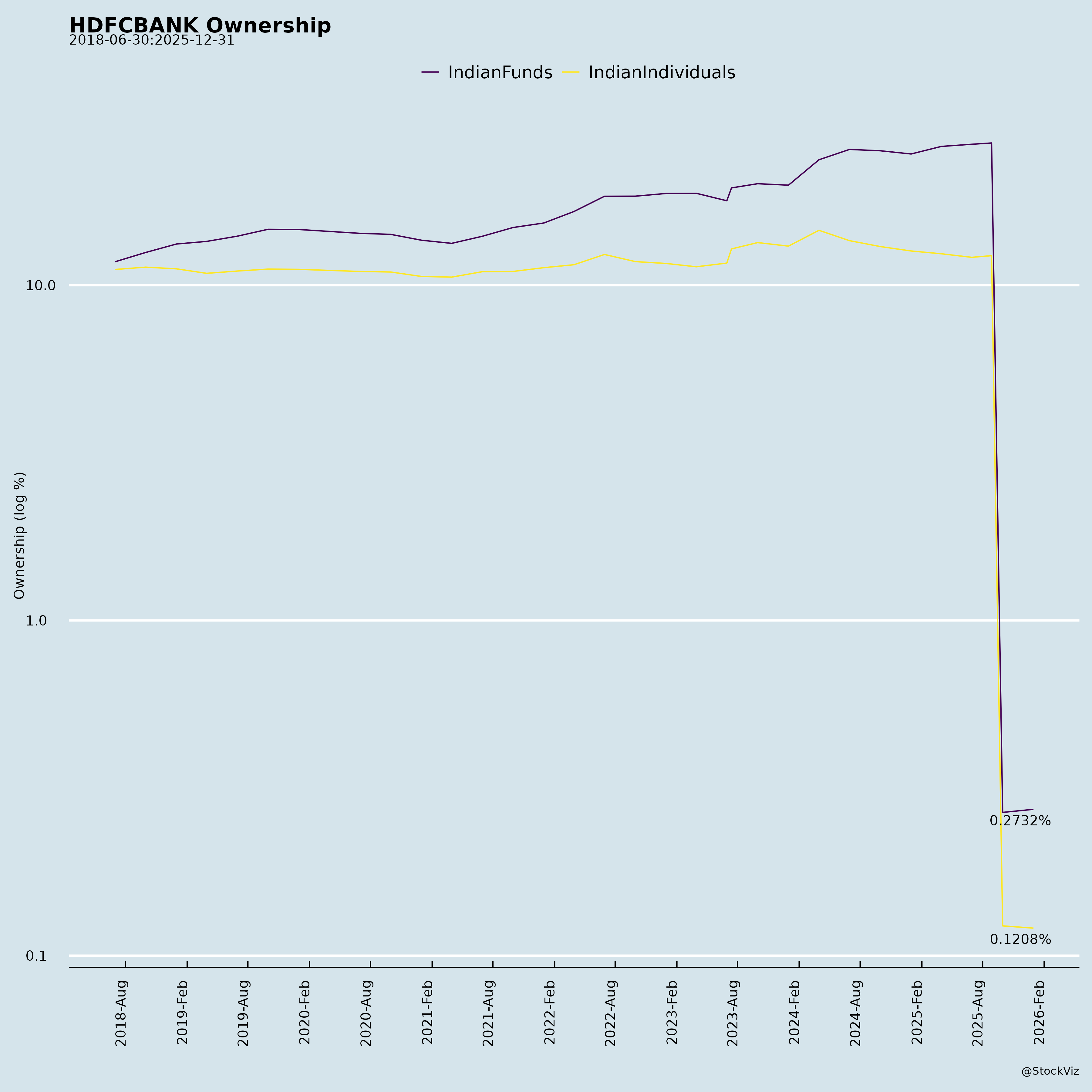

Ownership

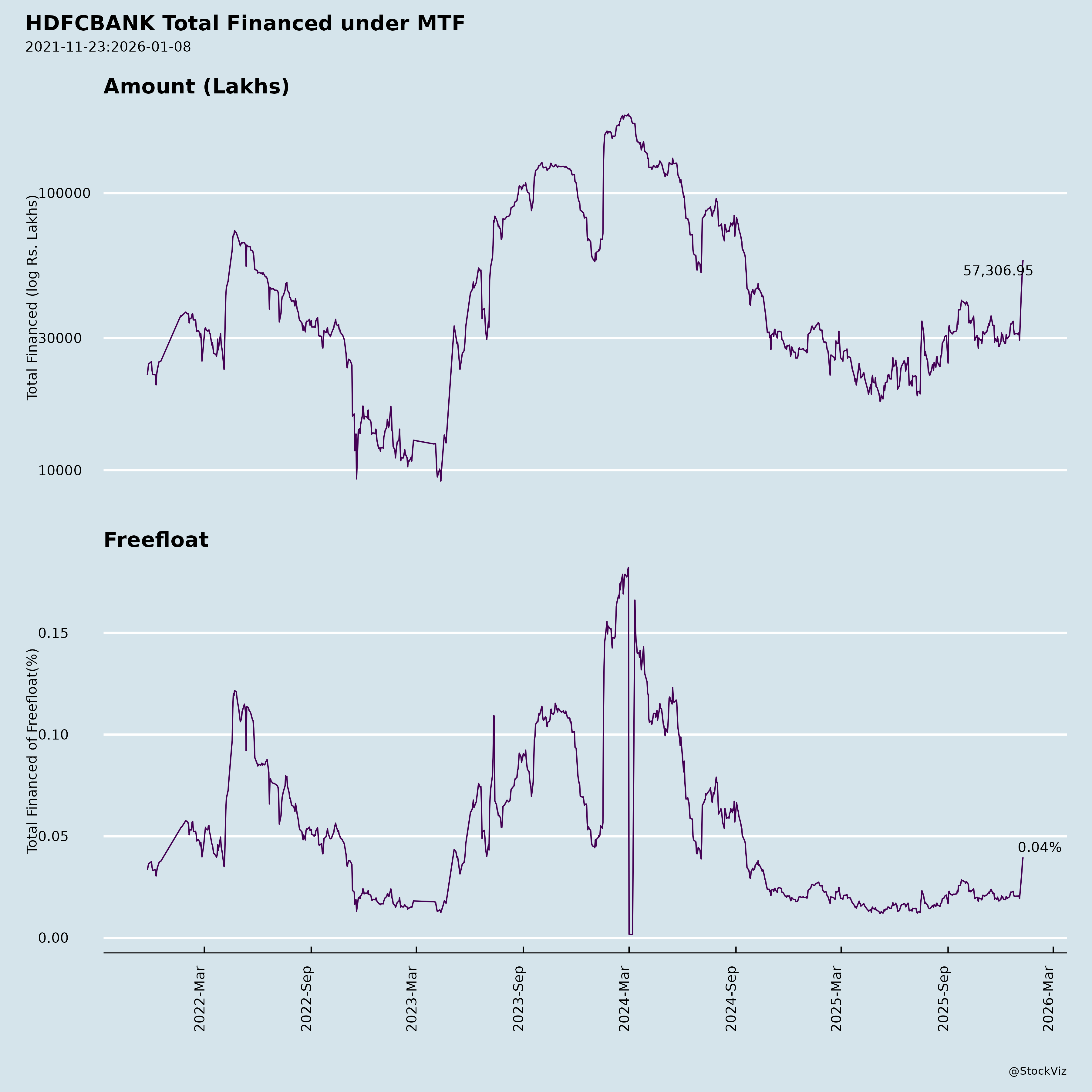

Margined

AI Summary

asof: 2025-12-03

HDFC Bank (HDFCBANK) Analysis Based on Provided Announcements

Headwinds (Challenges/Negatives)

- Regulatory Penalty: RBI imposed a ₹0.91 crore penalty (Nov 18, 2025) for violations related to interest rate directions on advances (2016), outsourcing guidelines (2006 circular), KYC norms, and Banking Regulation Act sections. Pertains to FY24 financial position. Though minor (negligible vs. bank’s scale) and corrected (bank and HDBFS now compliant), it signals past lapses in compliance, potentially inviting further scrutiny.

- Limited visibility into operational disruptions from these issues, but no material financial/operational impact disclosed beyond the fine.

Tailwinds (Positives/Supports)

- Leadership Stability: Re-appointment of Mr. Kaizad Bharucha (DIN: 02490648) as Deputy Managing Director for 3 years (subject to RBI/shareholder approval). 30+ years at bank; oversees key assets (retail/wholesale), risk, CSR, ESG, and inclusive banking. Proven in mergers (Times Bank, Centurion, HDFC Ltd), govt schemes (PMJDY, Mudra, SVANidhi—#1 private bank), Basel II, and tech transformation.

- Strong Investor Engagement: Scheduled in-person analyst meet with Macquarie (Dec 1, 2025); Q2/H1 FY26 earnings presentation shared (Oct 18, 2025), signaling transparency and confidence.

Growth Prospects

- Strategic Leadership & Assets: Bharucha drives retail/wholesale assets (home/auto loans, MSME, SME), emerging corporates, healthcare—core growth engines. Bank’s #1 private sector status by balance sheet/assets quality supports sustained expansion.

- Inclusive/Govt Initiatives: Leadership in PMJDY, PMJJBY, Mudra, SVANidhi, PMEGP; top-3 CSR ranking. Positions bank for policy-driven growth in underserved/rural segments.

- M&A Expertise & Integration: History of seamless mergers enhances inorganic growth potential.

- Investor roadshows/earnings visibility indicate positive momentum post-Q2/H1 results.

Key Risks

- Regulatory/Compliance: Recent RBI penalty underscores risks in KYC, outsourcing, interest rates; ongoing RBI approval needed for leadership changes.

- Execution Dependency: Heavy reliance on Bharucha for assets, risk, CSR—any delays in approvals or transitions could impact.

- External Factors: Schedule changes in investor meets noted; broader banking risks (e.g., economic volatility) implied by Bharucha’s risk management role, though bank’s “pristine asset quality” mitigates.

Overall Summary: Mild headwind from a small RBI penalty (already addressed), offset by strong tailwinds in leadership continuity and investor relations. Growth prospects remain robust via assets, govt schemes, and M&A expertise, with regulatory compliance as the primary watch item. Positive for long-term holders; monitor RBI approvals and Q3 updates.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.