HCLTECH

Equity Metrics

January 13, 2026

HCL Technologies Limited

Computers - Software & Consulting

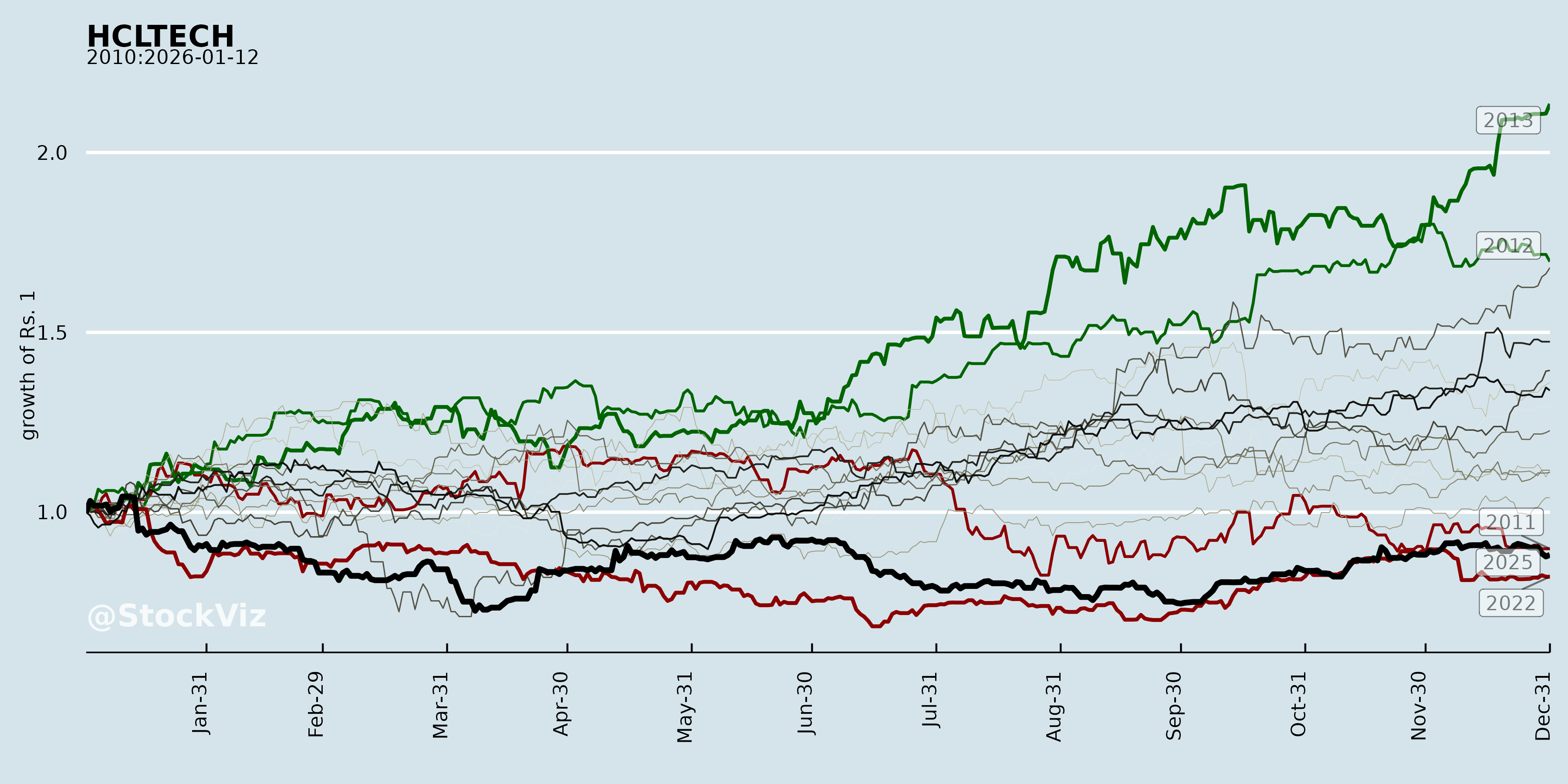

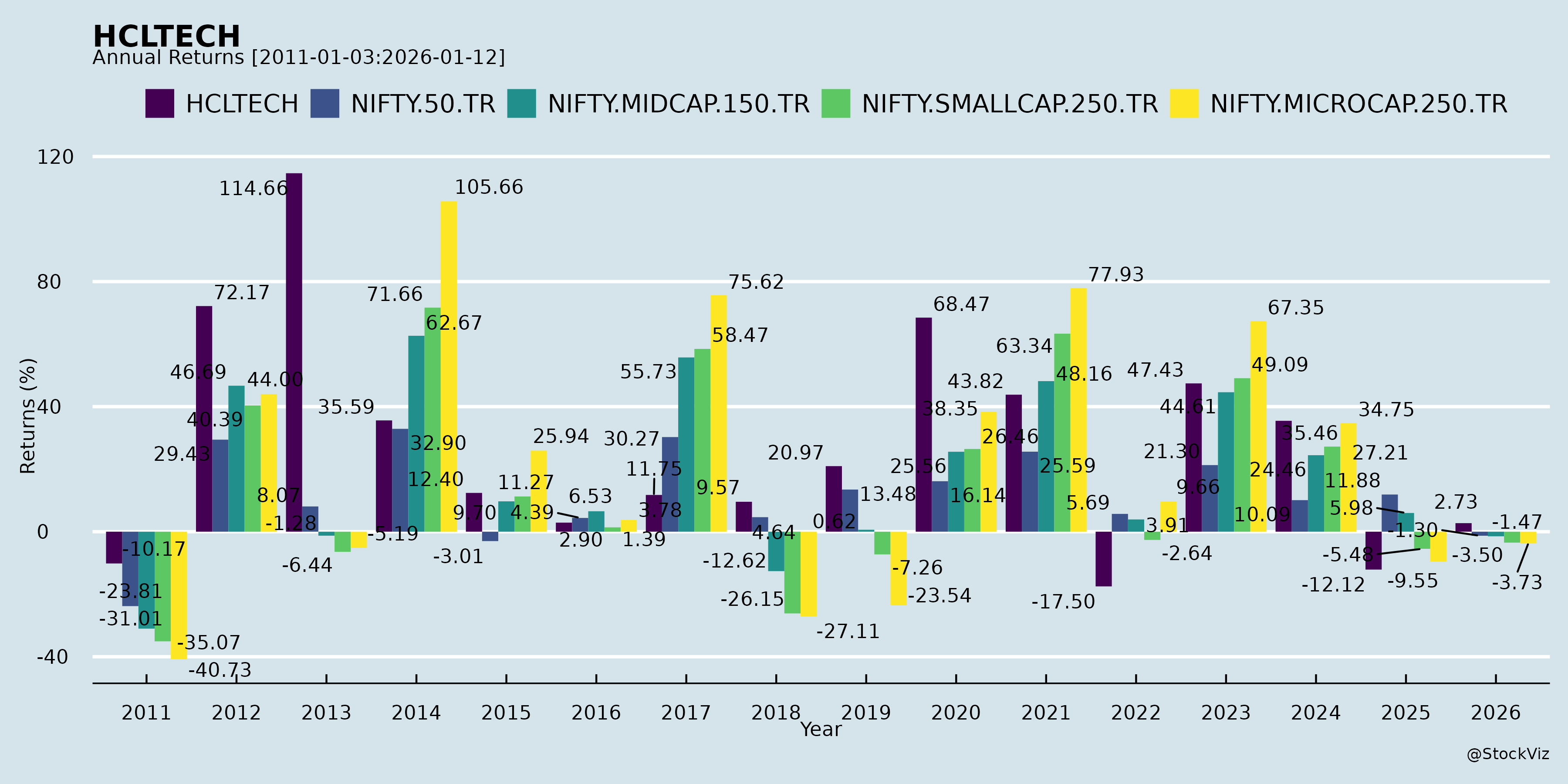

Annual Returns

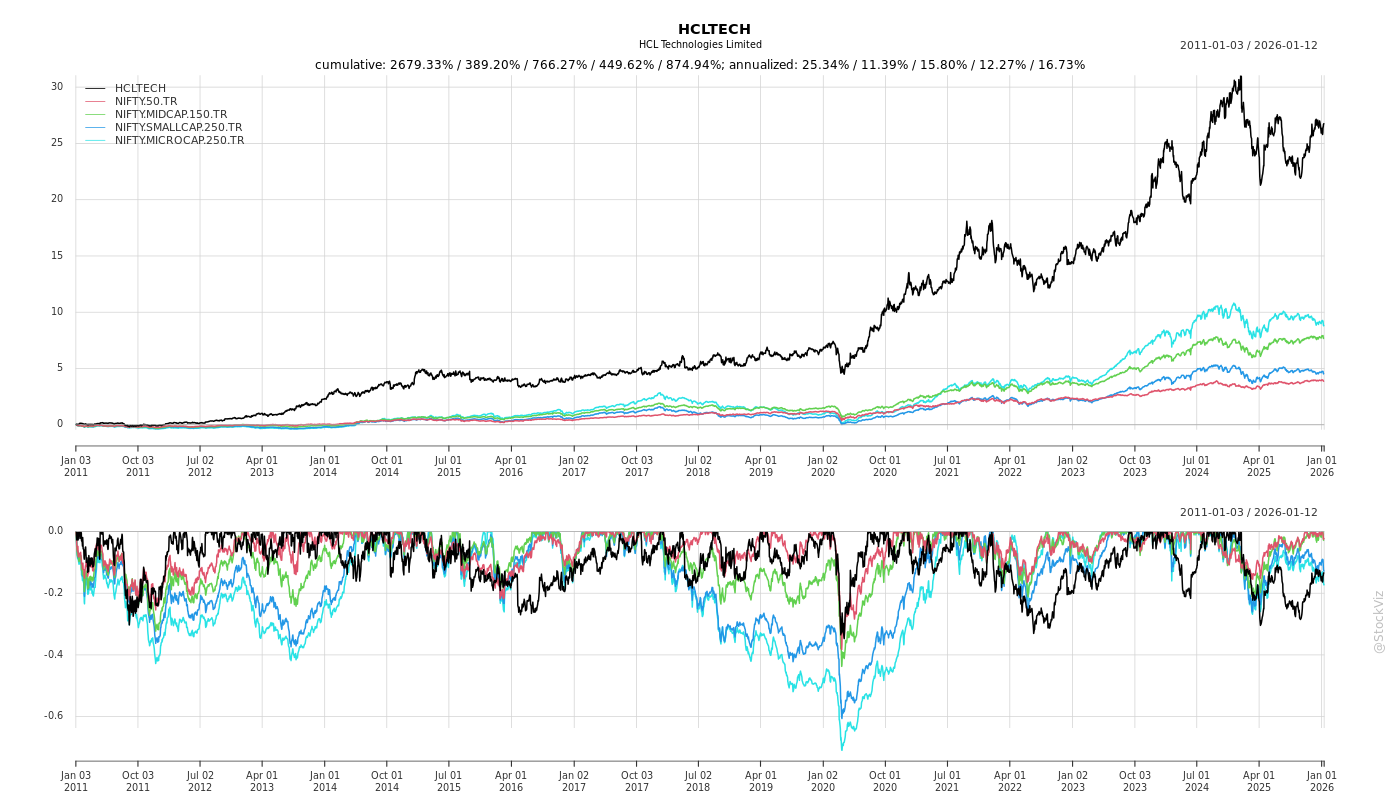

Cumulative Returns and Drawdowns

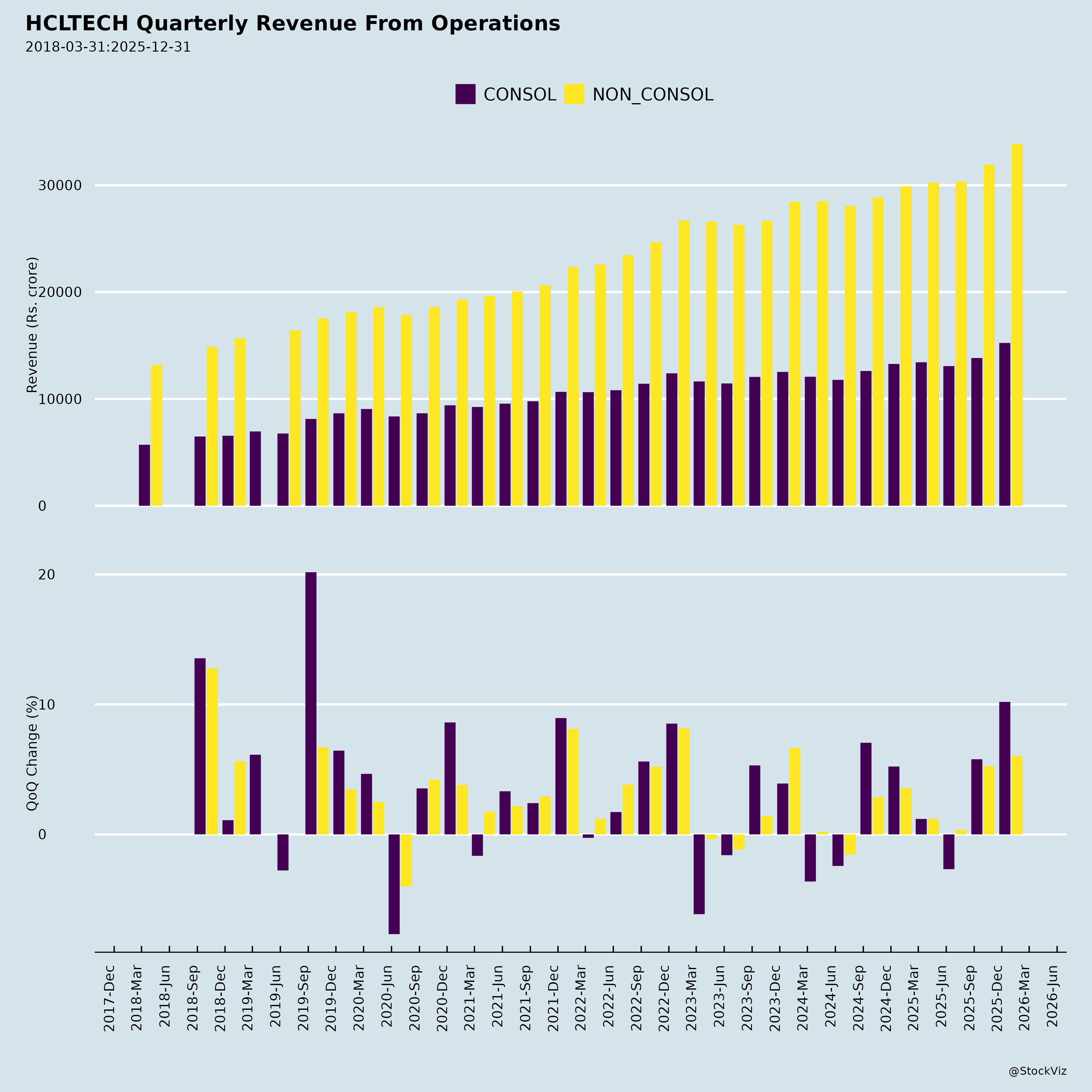

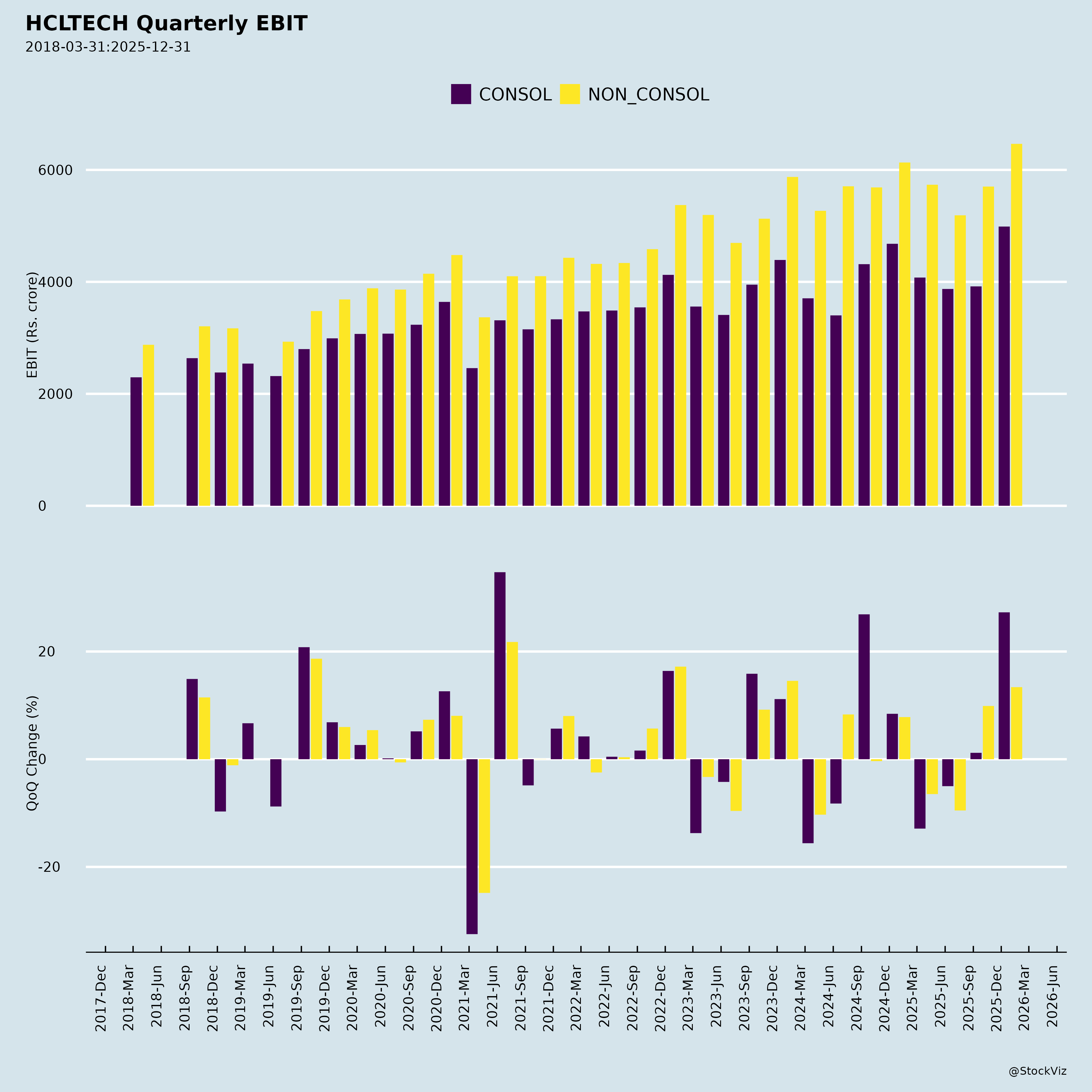

Fundamentals

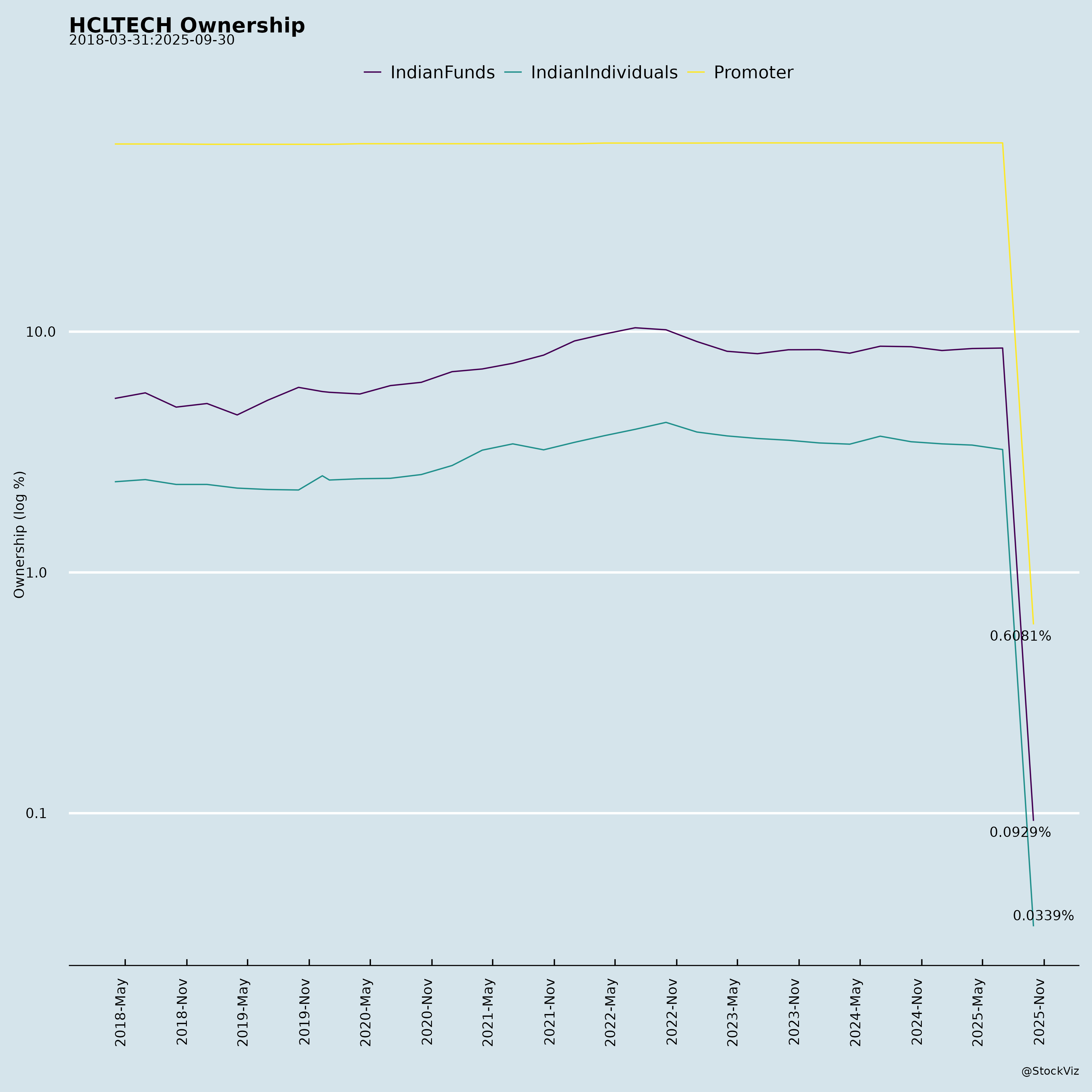

Ownership

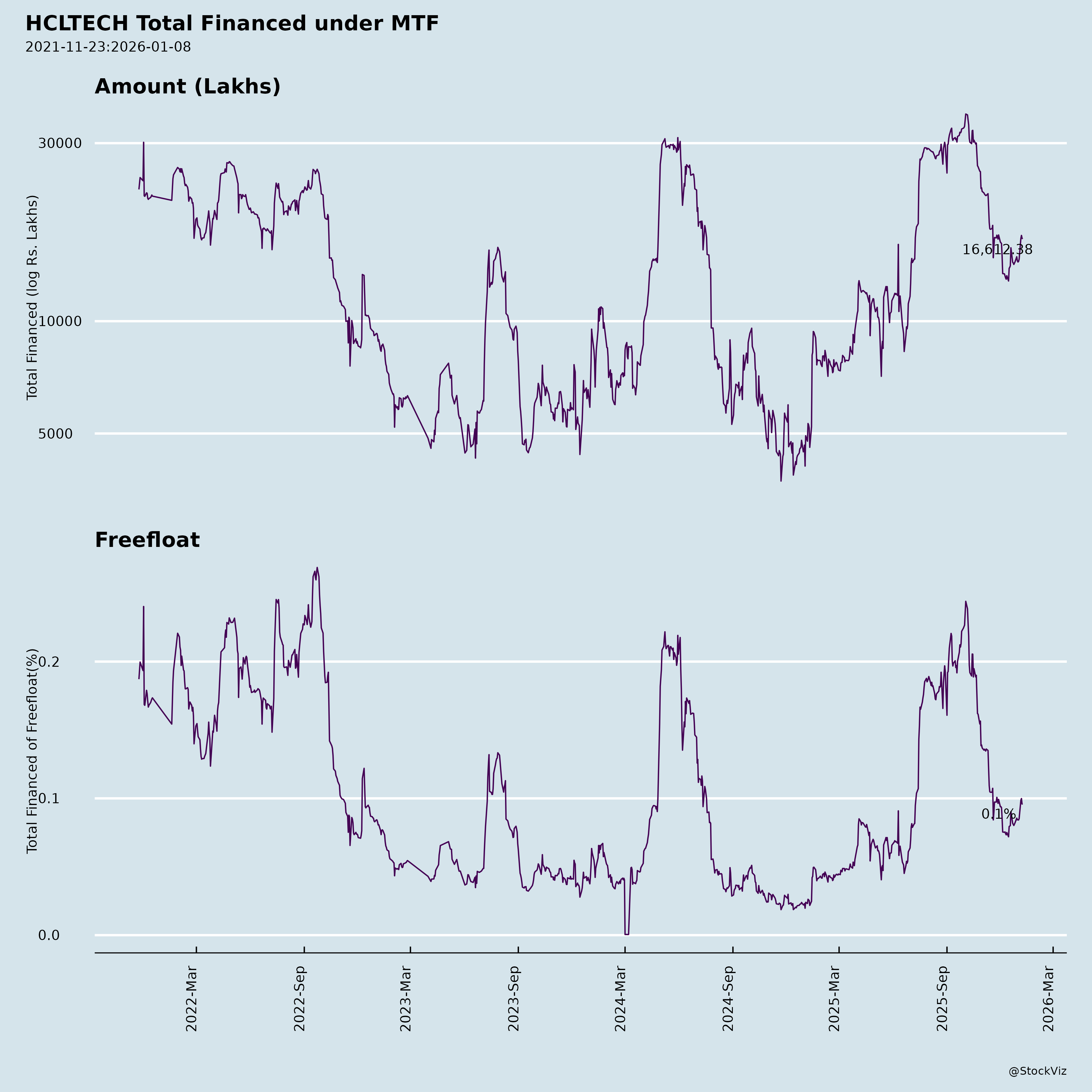

Margined

AI Summary

asof: 2025-12-03

HCLTech (HCL Technologies Ltd.) Analysis: Q2 FY26 (Ended Sep 30, 2025)

HCLTech delivered a robust Q2 FY26 with revenue of $3,644M (up 2.4% QoQ / 4.6% YoY CC), EBIT margin of 17.5% (+116 bps QoQ), and record bookings of $2.6B (first time >$2.5B without mega deals). Services drove growth (up 2.5% QoQ CC), fueled by AI momentum (Advanced AI revenue >$100M, ~3% of total). Guidance raised for Services (4-5% FY26 CC growth). Strong cash generation (LTM FCF/NI 125%) supports 91st consecutive dividend ($0.14/share equiv.). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- AI Monetization & Differentiation: Advanced AI (Agentic AI, Physical AI, AI Factory) crossed $100M quarterly revenue. AI Force v2.0 deployed in 47 accounts (target: top 100 clients). 30-50% productivity gains in SDLC/BPO; embedded in most deals/renewals. Partnerships (Nvidia, Dell, Pearson, MIT, SailPoint) and awards (Dell AI Partner of Year) enhance ecosystem.

- Bookings & Pipeline Strength: $2.6B TCV (up 42% QoQ), balanced across verticals/geos. Robust pipeline with AI as “central to nearly every deal.”

- Margin Recovery & Efficiency: EBIT up 116 bps QoQ to 17.5% (ex-restructuring: ~18%). Utilization gains via Project Ascend; ROIC at 38.6% LTM (+290 bps YoY). DSO improved to 78 days.

- Services Momentum: Up 5.5% YoY CC; Digital (42% mix) up 15% YoY. Strong verticals: BFSI (+11.4%), Tech (+13.9%), Telecom (+11.7%). Client additions: +2 ($50M), +14 ($20M), +7 ($10M).

- Financial Resilience: Net cash $3.3B; dividend payout 95.7% of NI. Low visa dependence (~few hundred/year).

- Talent & ESG: Headcount +3,489 (revenue/employee +1.8% YoY); attrition 12.6% LTM. 110+ analyst leadership positions; TIME’s top India tech firm.

Headwinds (Challenges)

- Software Softness: Revenue down 3.7% YoY CC (perpetual licenses weak); FY26 guidance unchanged at 3-5% due to this.

- Vertical/Macro Pressures: Auto slowdown drags Manufacturing (-1.8% YoY); discretionary spend cautious amid uncertainty.

- Cost Pressures: Restructuring (55 bps Q2 hit, ongoing Q3/Q4); wage hikes (70-80 bps Q3 impact). Localization from H1B changes may raise training costs.

- AI Cannibalization: Renewals show deflation in some SOWs (5/10 top renewals flat/decline due to AI productivity); net new bookings offset but requires higher run-rate (~$2.5B/qtr).

- Forex Volatility: INR depreciation aided margins (+56 bps), but reversal could hurt.

Growth Prospects

- AI as Growth Engine: Transition to “AI monetization phase”; IPs (AI Force, UnO) key to deals. Target: Scale to 100 top clients; new pillars (AI Factory, Advisory). Additive demand in modernization (e.g., Ericsson, retailer deals).

- Services Expansion: FY26 guidance 4-5% CC; Digital/Geos (Europe/ROW strong). Emerging verticals: Retail/CPG, Lifesciences, Public Services.

- Software Recurring Shift: Subscriptions/Support +9% YoY; ARR $1.06B (+0.6% YoY CC). Gartner Leader in AST/SOAP.

- Large Deals & Diversification: $100M+ programs in modernization/AI; G2000 focus. Pipeline “record high,” AI-embedded.

- M&A/Partnerships: Recent acquisitions (CTG from HPE, Zeenea) accretive; ecosystem (Nvidia AI Factory deals).

- Long-term: Non-linear growth via AI (revenue/employee uptick); industry to shift to “people + IP” model.

Outlook: 3-5% FY26 CC revenue growth (on track); margins 17-18%. Multi-year potential from AI wave creating “big winners.”

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| AI Disruption | 25-50% productivity in SDLC/BPO/ITOps could deflate renewals if new demand lags (1-2 yr scaling). | Proactive AI embedding; modernization elasticity; $2.5B bookings run-rate target. |

| Macro/Vertical | Discretionary slowdown; Auto weakness; unpredictable environment. | Diversified portfolio (BFSI/Tech strong); AI pilots converting. |

| Cost/Execution | Wage hikes (Q3/Q4 hit); restructuring spillover; localization training. | Utilization gains; AI productivity; low visa reliance. |

| Competition | Intense in AI/services; OEMs in IP backyard. | Differentiated IPs (AI Force); 110+ leadership positions. |

| Forex/Regulatory | Currency volatility; H1B fees/talent localization. | Hedging; global model (low visa need). |

| Operational | Scaling AI/talent upskilling; client concentration (top 10: 20%). | 820 AI black belts; adding mid-tier clients. |

Overall Summary: HCLTech is well-positioned in the AI era with strong execution (revenue/bookings beat, margin recovery). Tailwinds (AI, bookings, efficiency) outweigh headwinds (software, costs), supporting 4-5% Services growth. Prospects bright via AI IPs/deals, but risks from disruption/macro require vigilant offset via modernization. Buy/Hold thesis intact; monitor Q3 wage impact and AI revenue ramp. Valuation: Attractive vs. peers on ROIC/cash flow. (Stock: NSE/BSE: HCLTECH; FY26 EPS est. ~₹70-75).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.