GTPL

Equity Metrics

January 13, 2026

GTPL Hathway Limited

TV Broadcasting & Software Production

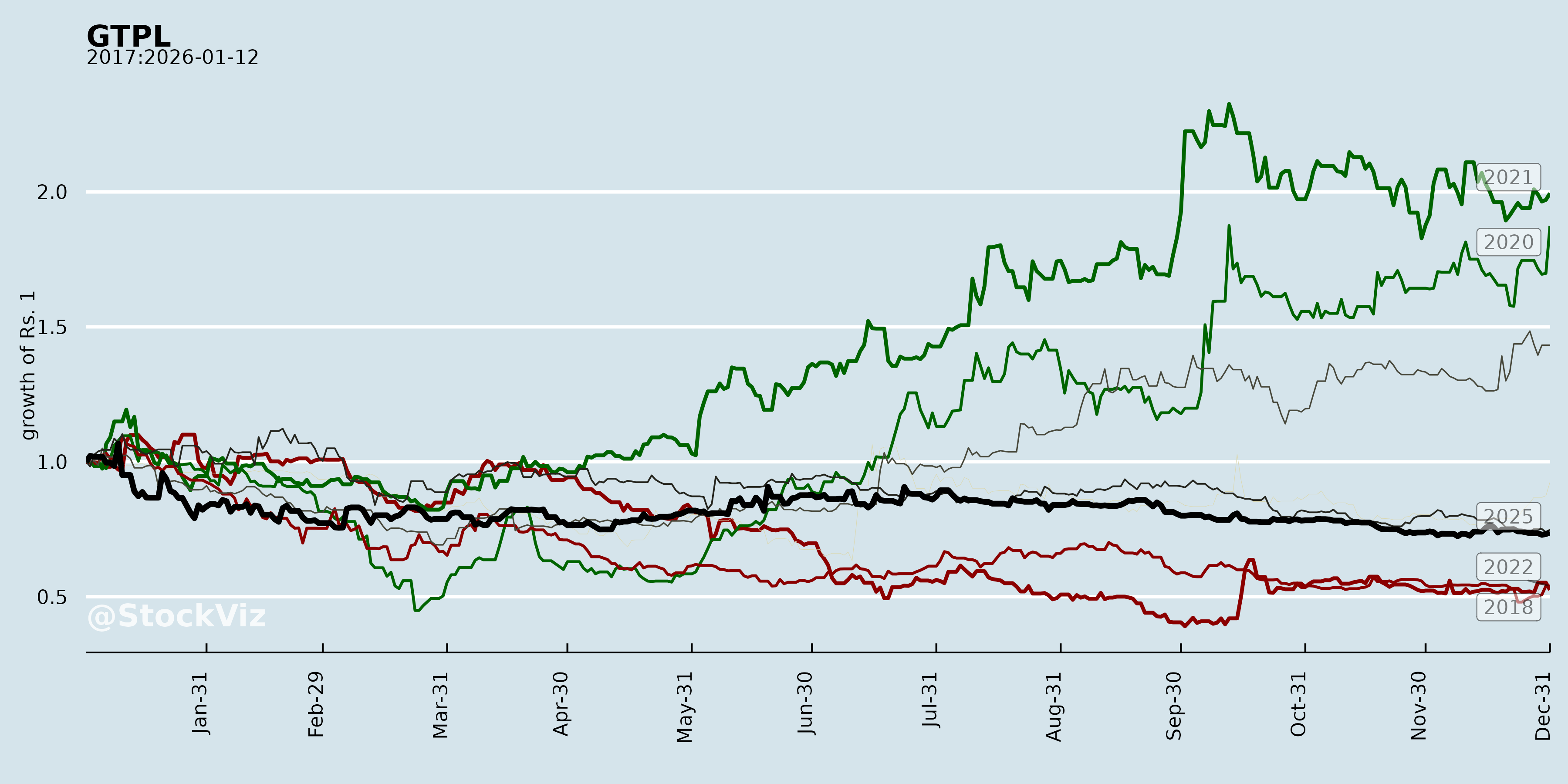

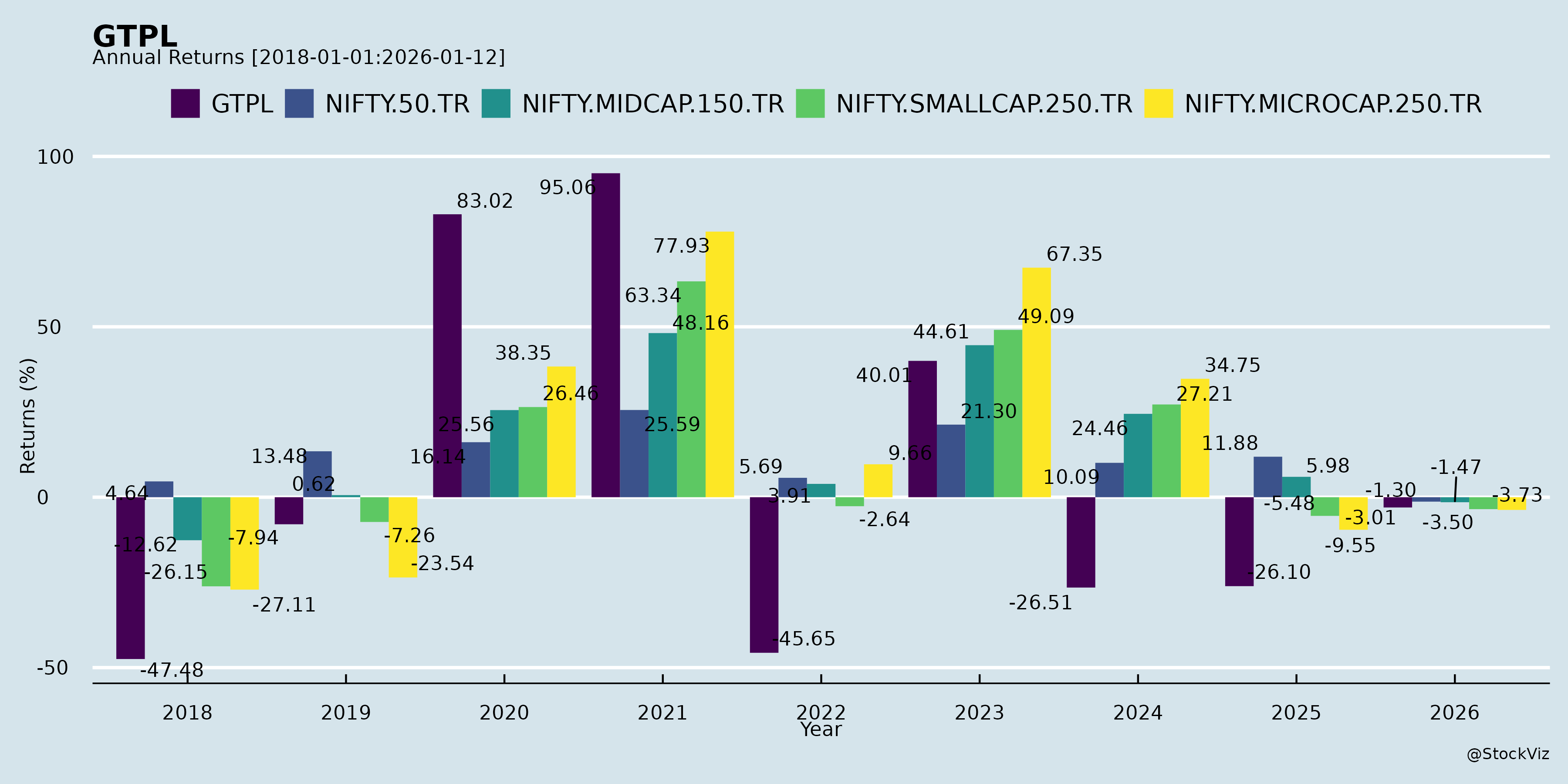

Annual Returns

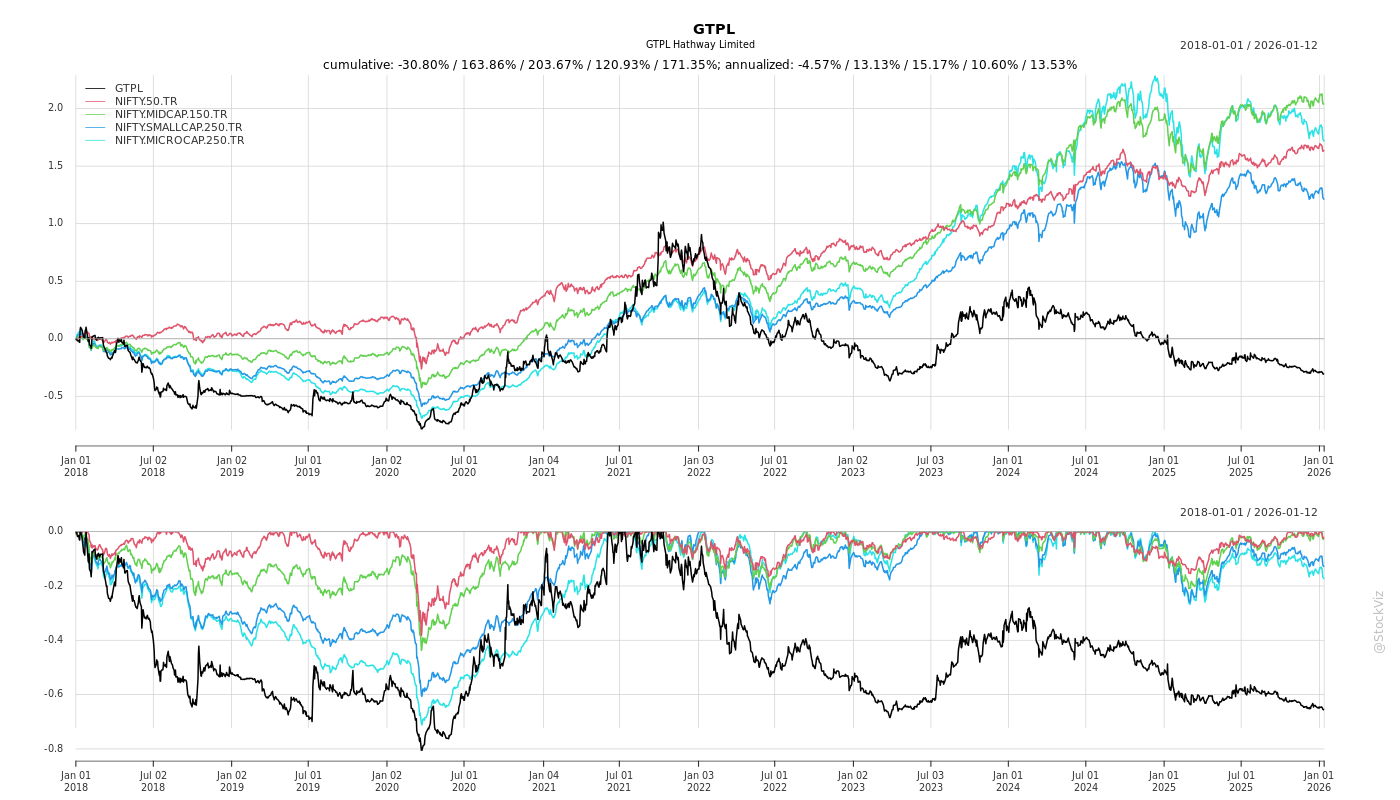

Cumulative Returns and Drawdowns

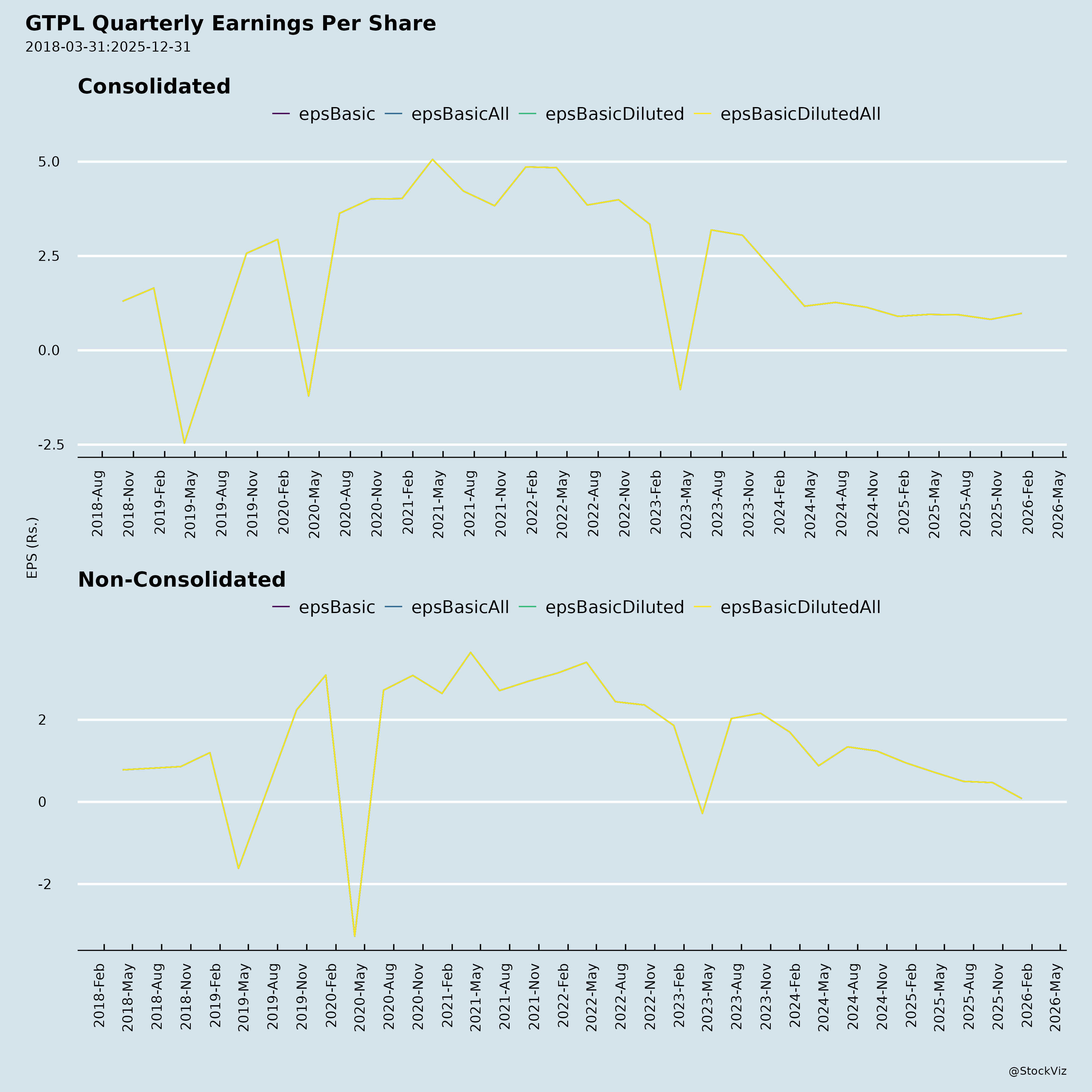

Fundamentals

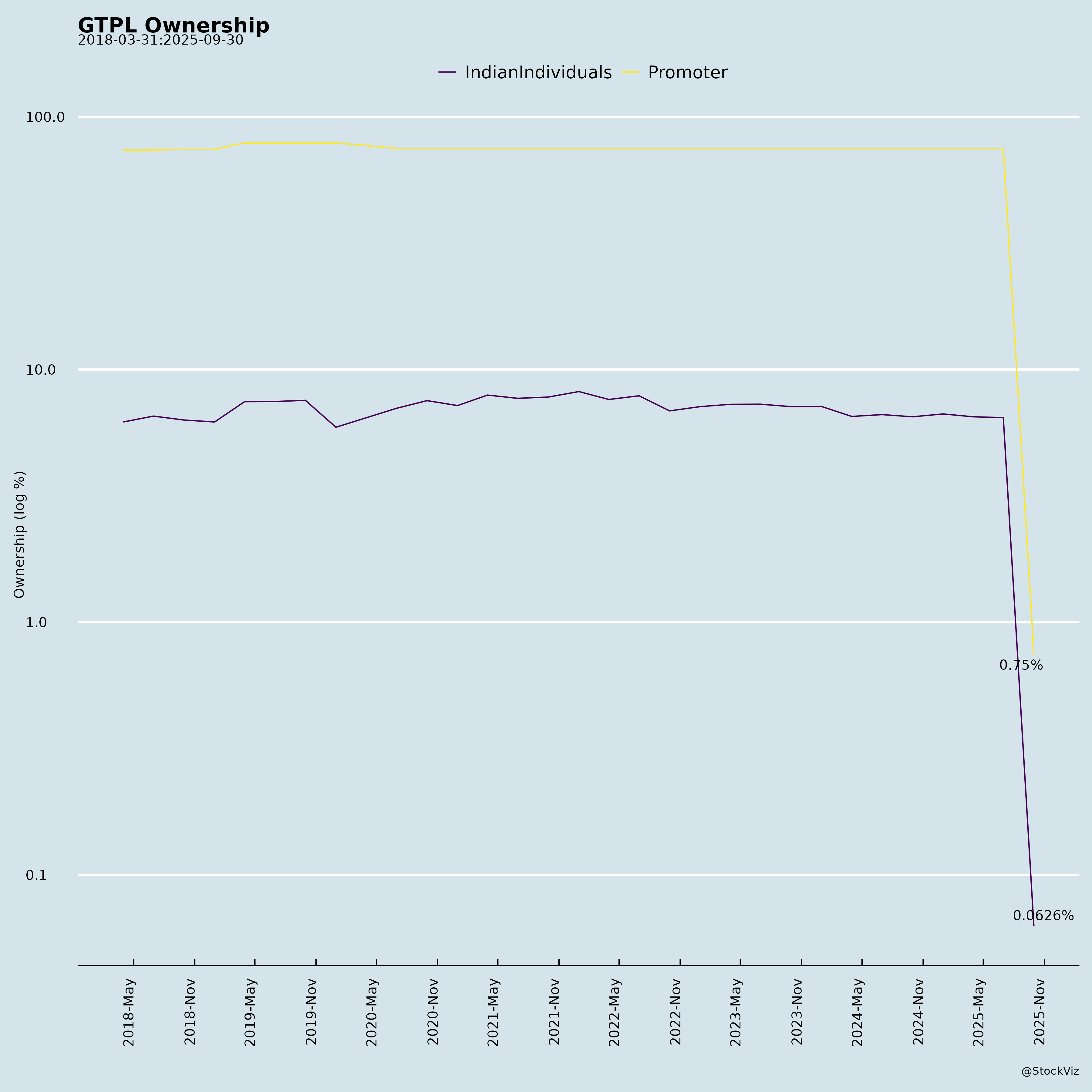

Ownership

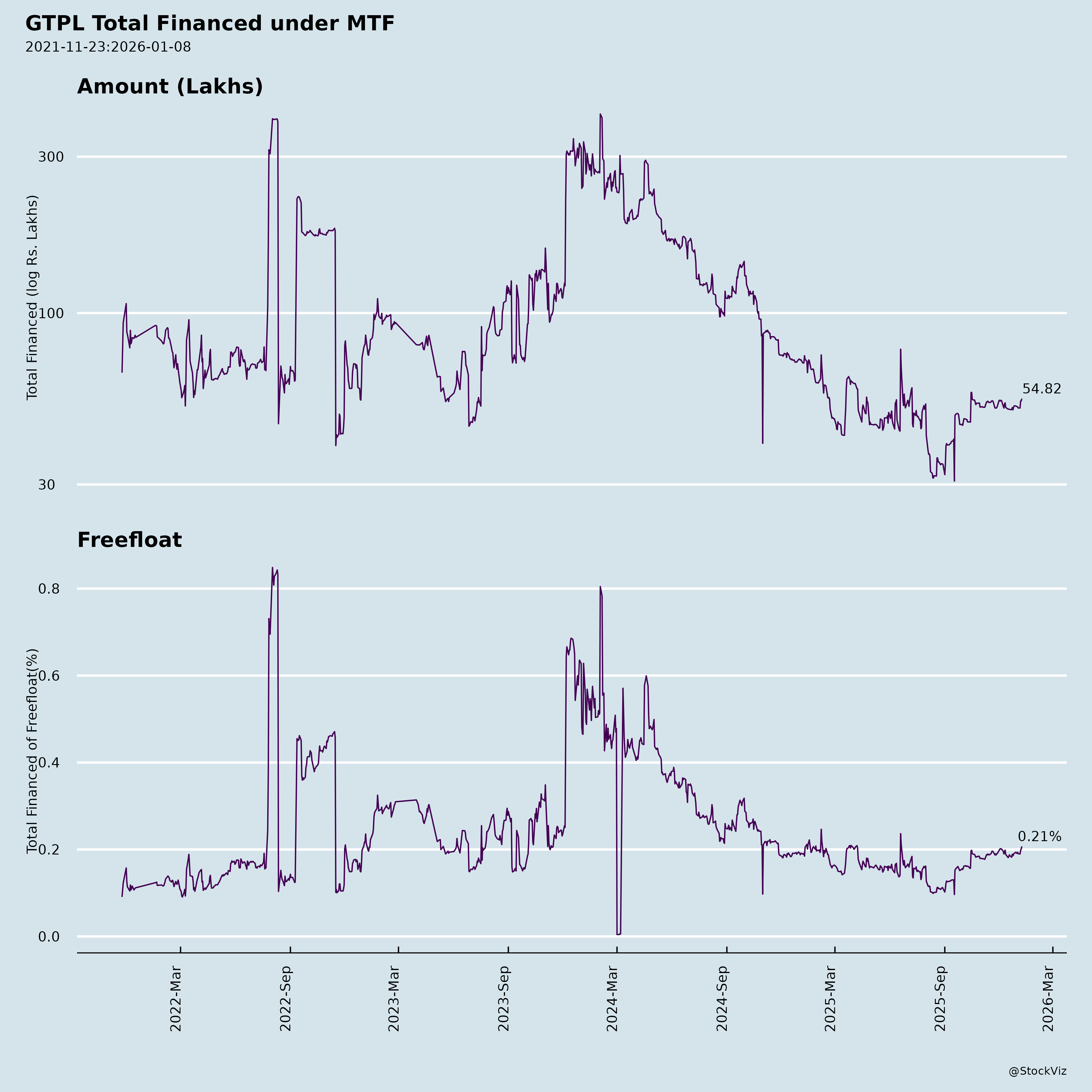

Margined

AI Summary

asof: 2025-11-27

GTPL Hathway Limited (GTPL) - Q2 FY26 Analysis

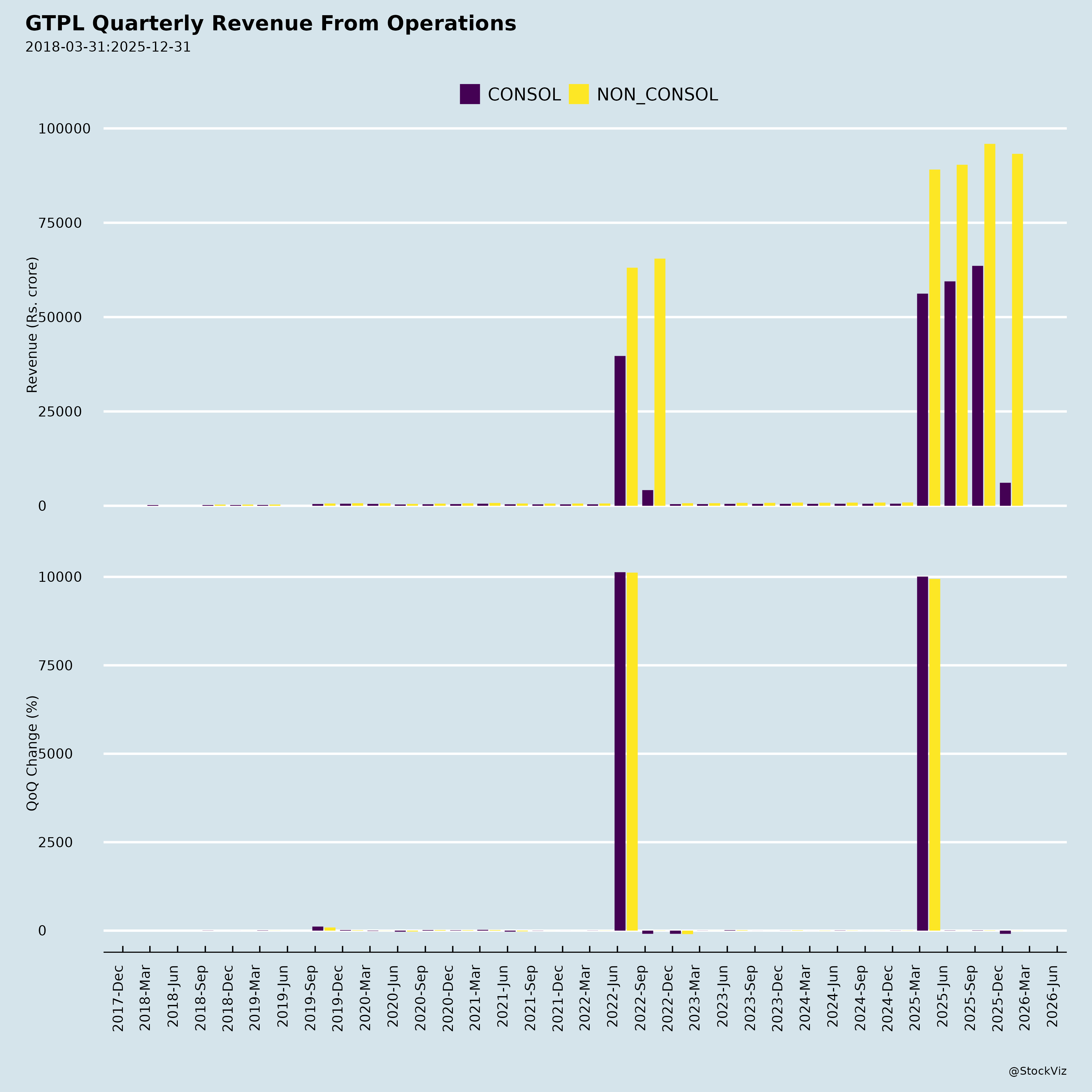

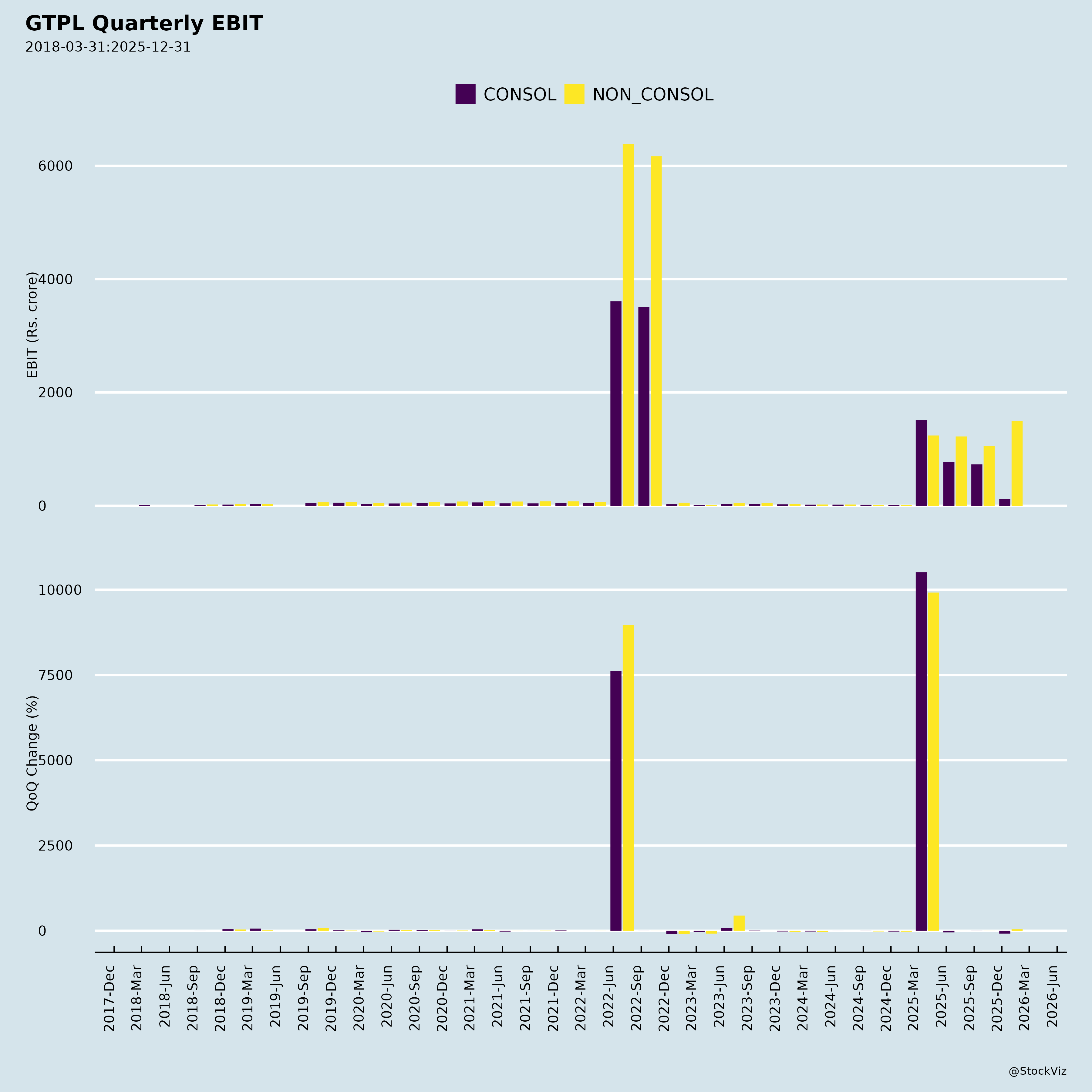

Overview: GTPL Hathway, India’s largest Multi-System Operator (MSO) by subscribers, reported consolidated revenue of ₹9,649 Mn (+12% YoY, +6% QoQ), driven by strong placement/carriage income (+29% YoY). However, core subscription revenue (CATV -3% YoY; Broadband +2% YoY) remained muted amid subscriber stagnation (Cable TV: 9.50 Mn active; Broadband: 1.05 Mn, +1% YoY). EBITDA margins dipped to 11.4% (stable operating margin at 22%), with PAT at ₹93 Mn. Balance sheet remains robust (net debt/equity 0.2x; H1 OCF ₹1,291 Mn). Focus on HITS launch (Q3 FY26), bundling (Cable+Broadband+OTT), and inorganic growth signals strategic pivot amid competition.

Headwinds (Key Challenges)

- Subscriber Stagnation/Churn: Cable TV active subs flat at 9.50 Mn (paying 8.80 Mn); Q2 decline of ~0.1 Mn due to heavy rains, lack of major events (e.g., post-IPL lull). Broadband additions muted (flat QoQ) despite +17% data usage (410 GB/month) and ARPU uptick (₹465).

- Competitive Intensity: Broadband pressured by Jio/Airtel (deep pockets, aggressive pricing) and Air Fiber (initial euphoria stabilizing); satellite broadband looming (high equipment costs untested in India). Cable TV faces DTH, DD Free Dish in rural areas.

- Revenue Pressure: CATV subscription down 3% YoY; overall EBITDA -3% YoY due to rising pay-channel costs (+21% YoY, offset by incentives).

- Seasonal WC Ballooning: Trade receivables/payables up ~₹460 Mn each (broadcaster settlements peak mid-year, taper by March; historical trend).

Tailwinds (Supportive Factors)

- Revenue Diversification: Non-subscription (placement/carriage/marketing) surged 29% YoY, buffering core weakness; total revenue +12% YoY.

- Operational Resilience: Stable 22% operating EBITDA margin; ARPU uplift (+₹5 YoY broadband); 80%+ digital collections; 48K+ partners enabling pan-India footprint (26 states, 1,500+ towns).

- Strong Fundamentals: Cash-positive (8-year FCF track record); low leverage; consistent dividends (20% FY25); infrastructure edge (100K+ Km owned fiber, 975+ channels incl. 130 owned).

- Market Leadership: No.1 MSO (Gujarat, India); No.2 West Bengal; leading private wireline broadband in Gujarat.

Growth Prospects

- HITS Platform (Q3 FY26 Launch): Pan-India reach (rural/hilly/cable-dark areas), 100% coverage vs. current limits; delivery cost savings; enhances distribution (content/OTT bundling).

- Cable TV Expansion: 180 Mn addressable TV households (GTPL: 9.5 Mn); organic/inorganic consolidation (40 Mn from unorganized/MSOs); new states (e.g., Arunachal, Chhattisgarh); bundling (Genie: Cable+OTT; Buzz app: Live TV/Gaming).

- Broadband Upside: 5.95 Mn homepass (75% FTTX-ready); convert 12 Mn Cable households; B2B ramp-up (100+ clients); rural Gujarat/AP/Telangana/Maharashtra focus. India wired penetration ~14% (vs. 35% global); target 100 Mn wired homes in 5 years (FTTH CAGR 17.6%).

- Guidance/Targets: 8-11% subscription CAGR; FY26 capex ₹350-400 Cr (STB/CPE/HITS); ARPU gradual hikes via tiered packages/upselling.

- Long-Term: TV subs to 214 Mn by 2030; bundling/layering (OTT/Gaming/TV Everywhere) for retention/ARPU; govt. digital push (BharatNet tenders).

Key Risks

| Risk Category | Description | Mitigation/Status |

|---|---|---|

| Regulatory/Litigation | DoT license fee demands: ₹9,754 Mn (parent, incl. cable revenue); ₹3,434 Mn (GTPL Broadband); ₹249 Mn (step-down sub). Contingent (no provision); TDSAT stays/Supreme Court pending. | Legal opinions favorable; ApGR excludes MIB activities; historical wins (e.g., ISPAI judgment). |

| Competition | Wireless (Air Fiber/satellite) eroding wired share; DTH/Free Dish in rural. | Wired superiority (FTTH proven); HITS for underserved areas; bundling loyalty. |

| Execution/Subscriber | Churn from events/weather; flat additions despite demand. | HITS/bundling; B2B; 17% extraction potential in Gujarat. |

| Financial | High capex (H1: ₹153 Cr); WC volatility (receivables). | Strong OCF; low debt; seasonal normalization. |

| Macro | Rural penetration slow; data pricing sensitivity. | Govt. initiatives; ARPU-led growth. |

Investment Thesis Summary: GTPL’s defensive MSO position and broadband pivot offer stability, but near-term growth hinges on HITS execution and sub-additions amid competition. Attractive for long-term wired broadband play (low penetration), but regulatory overhang warrants monitoring. Valuation likely supported by steady margins/cash flows; target multiple catalysts in H2 FY26.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.