GODREJPROP

Equity Metrics

January 13, 2026

Godrej Properties Limited

Residential Commercial Projects

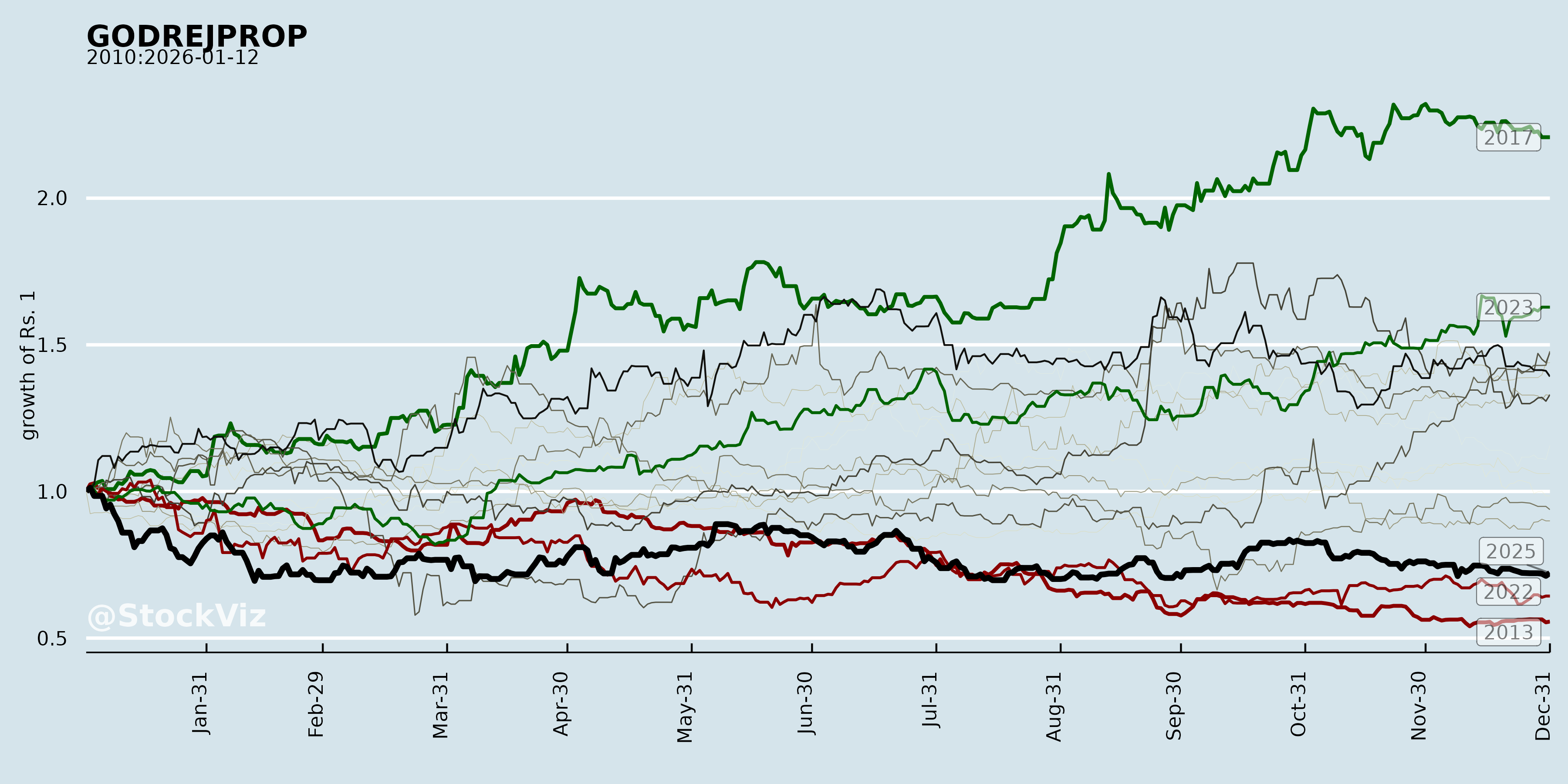

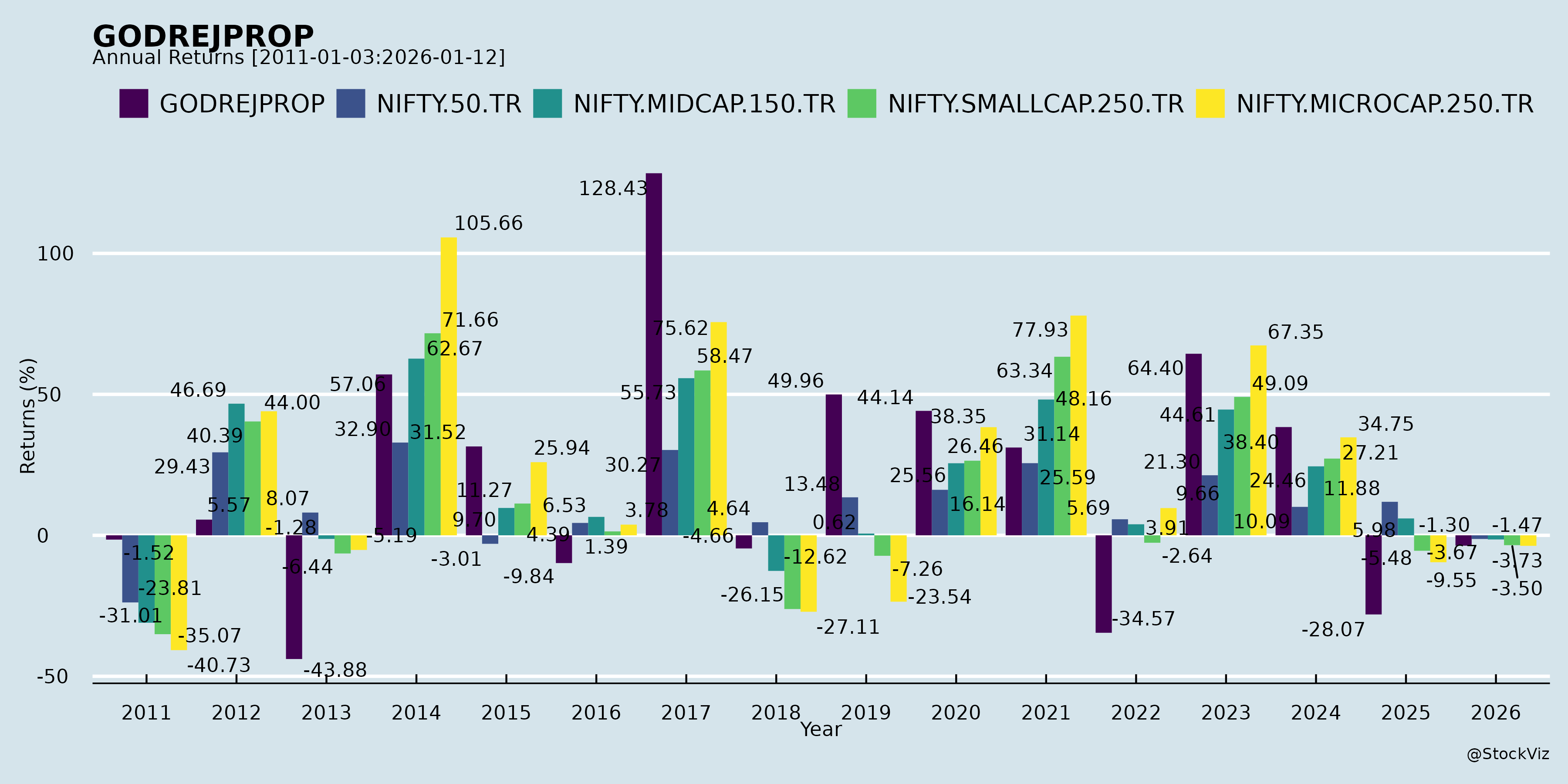

Annual Returns

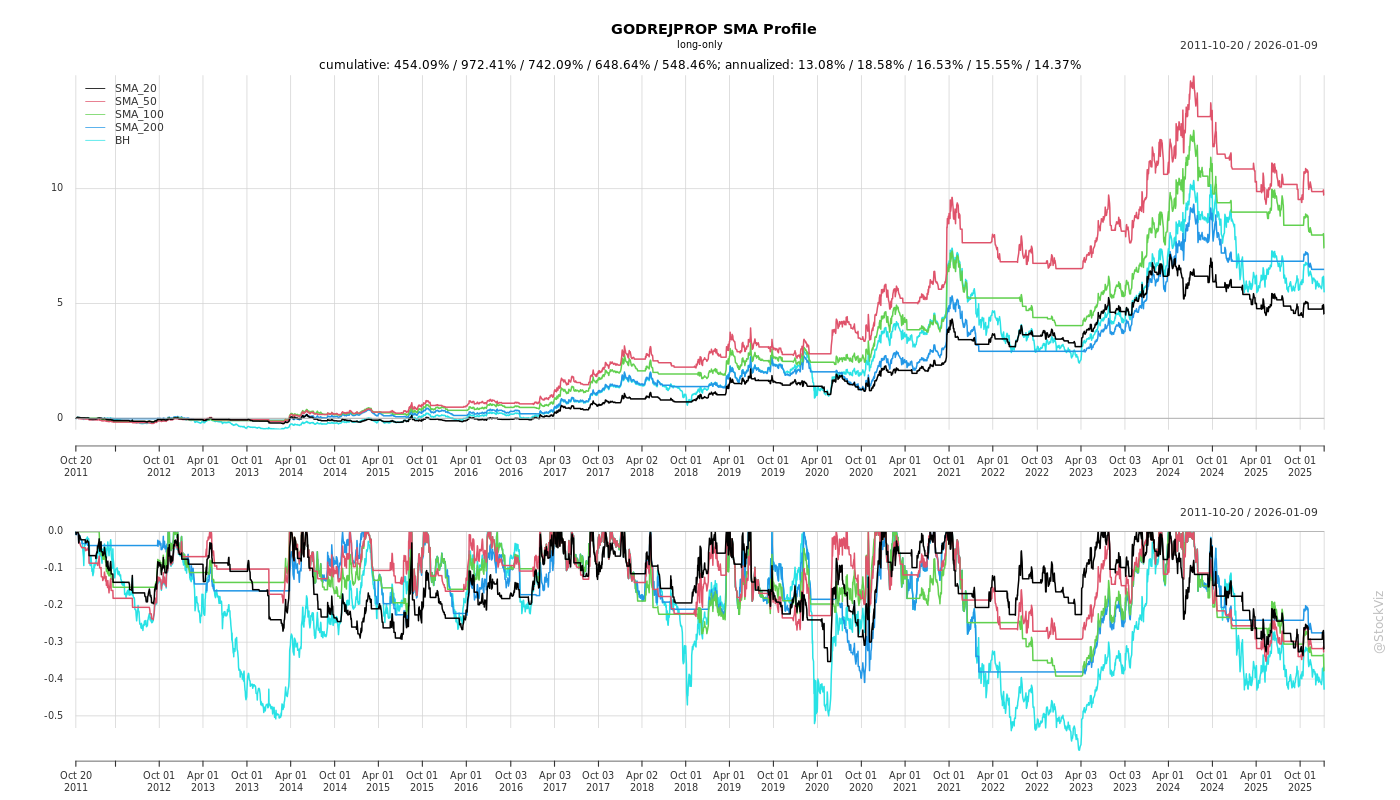

Cumulative Returns and Drawdowns

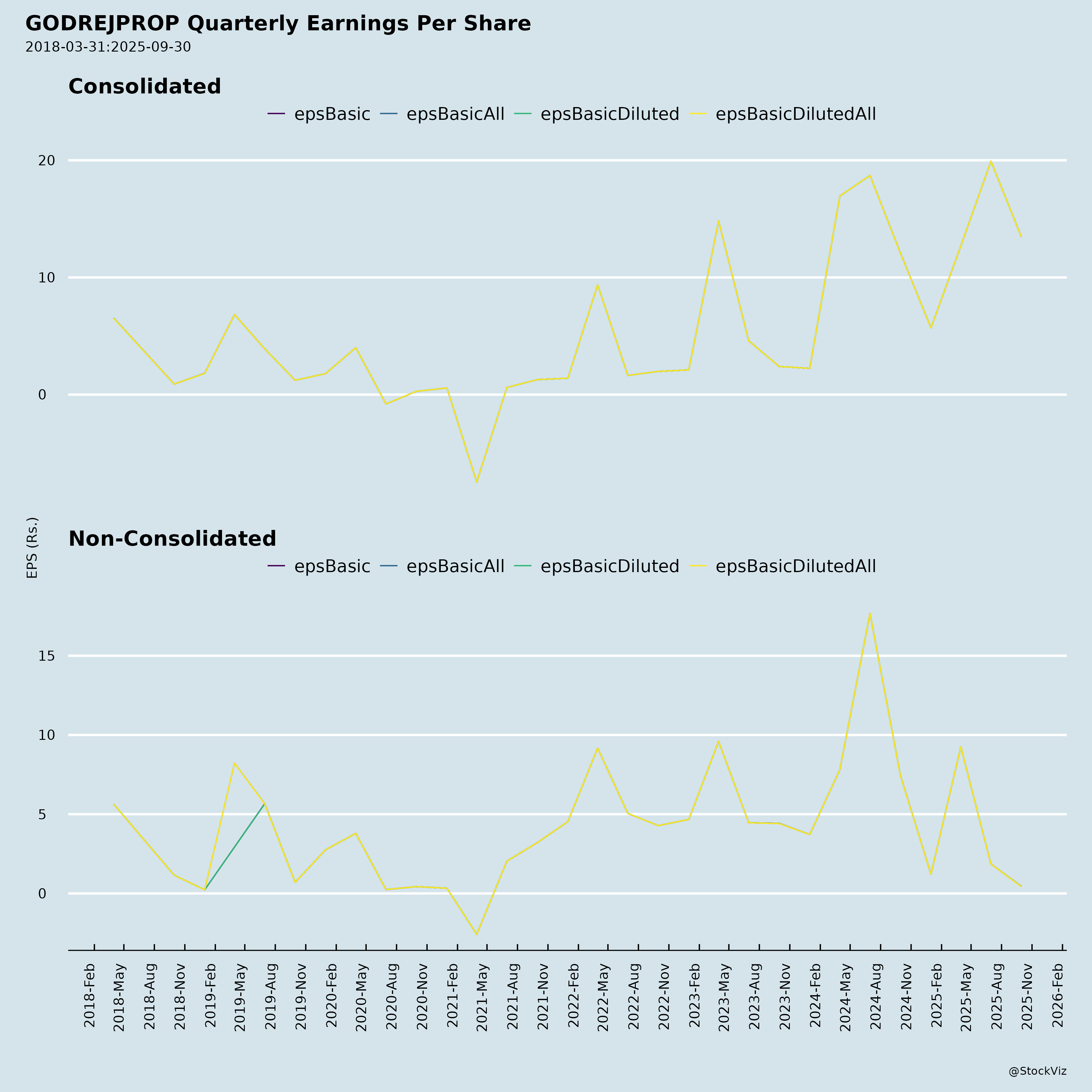

Fundamentals

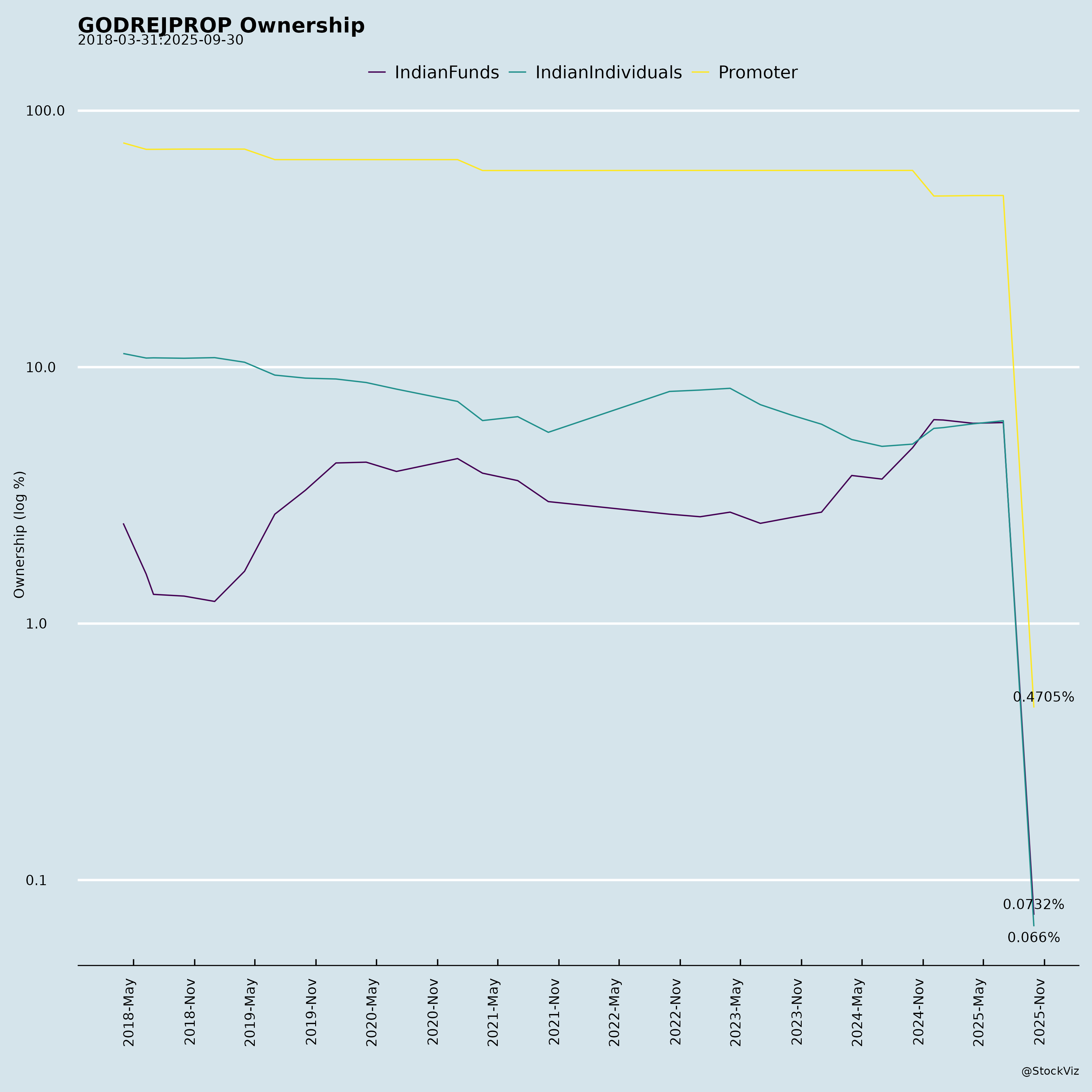

Ownership

Margined

AI Summary

asof: 2025-12-03

Analysis of Godrej Properties Limited (GODREJPROP)

Godrej Properties (GPL) demonstrated robust Q2 FY26 performance with record bookings (INR 8,505 Cr, +64% YoY), strong profitability (H1 net profit INR 1,005 Cr, +18% YoY), and aggressive business development (81% of FY26 guidance achieved in H1). The company remains on track to exceed FY26 bookings guidance (INR 32,500 Cr) amid diversified market contributions and a strong pipeline. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks, derived from the earnings transcript, investor presentation, financials, amalgamation disclosure, and recent land acquisition press release.

Tailwinds (Positive Drivers)

- Sustained Sales Momentum: 9th straight quarter of >INR 5,000 Cr bookings; 3rd consecutive >INR 7,000 Cr. H1 bookings at INR 15,587 Cr (48% of guidance). Diversified across 4 markets (Bengaluru, MMR, NCR, Hyderabad each >INR 1,500 Cr in Q2)—a first for any Indian developer.

- Strong Execution Ramp-Up: Labor force at record 32,000 (+54% QoQ); Q2 construction spend +82% YoY. Delivered 2.2 Mn sq ft in Q2; on track for FY26 deliveries guidance despite H1 softness.

- Business Development Aggressiveness: H1 additions: 9 projects, 15 Mn sq ft, INR 16,250 Cr potential BV (81% guidance). Recent wins: 5-acre Hyderabad plot (INR 4,150 Cr potential); Kukatpally (INR 3,800 Cr).

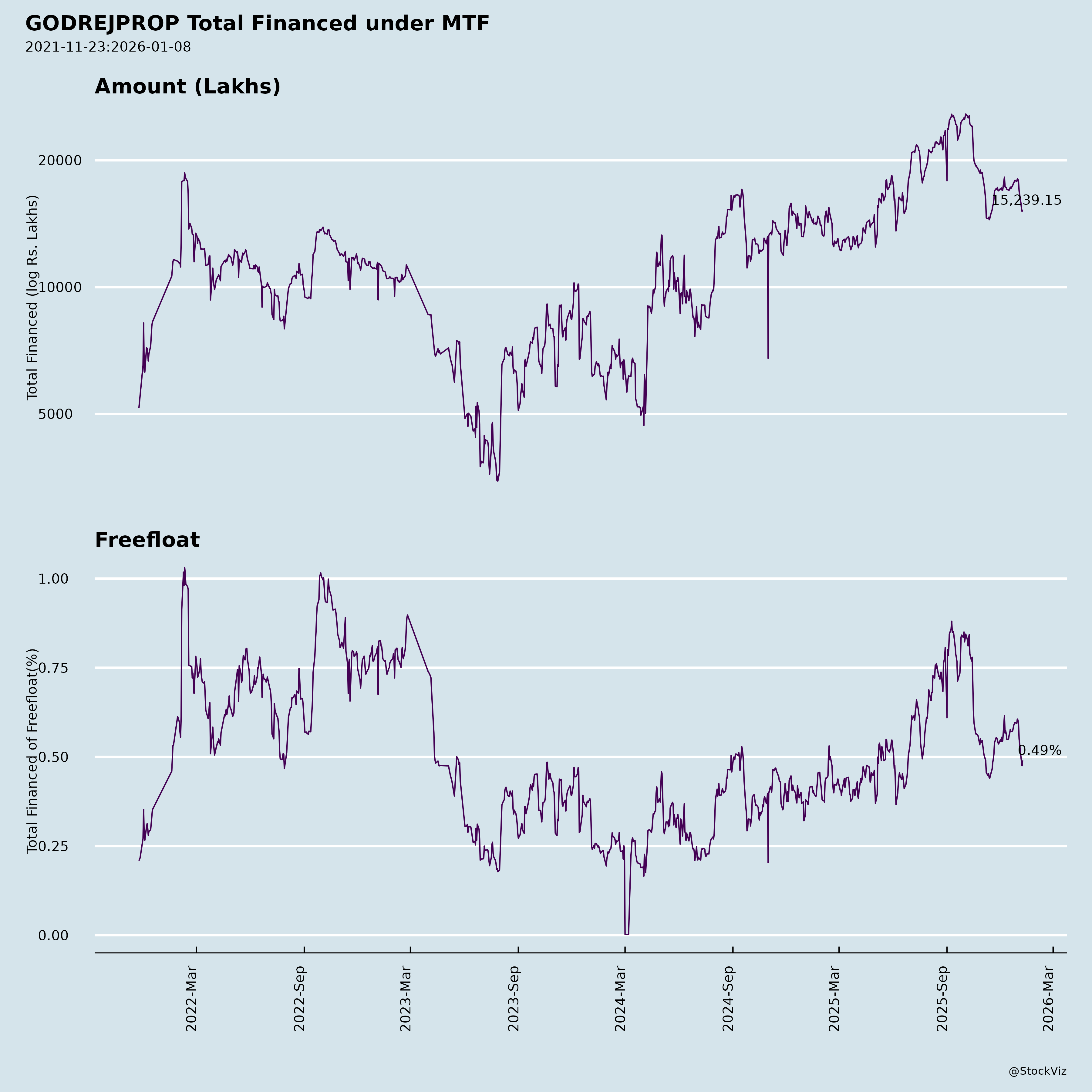

- Balance Sheet Strength: INR 6,000 Cr QIP (Dec 2024) bolsters liquidity. Net debt/equity at 0.30x (low); avg borrowing cost 7.4%. Operating cash flow resilient (H1 INR 2,137 Cr).

- Market Leadership & Brand: India’s #1 by FY25 bookings/collections/OCF. Sustainability #1 globally (GRESB 100/100; S&P DJ 89/100). 56 awards in Q2.

- Pricing Power & New Launches: Strong response to launches (e.g., Regal Pavilion Hyderabad INR 1,527 Cr; MSR City Bengaluru INR 1,032 Cr). Worli “Trilogy” (restructured to 73% area share) priced INR 80k-1.5L/sq ft, low competition.

Headwinds (Challenges)

- Collections Lagging Sales: H1 collections INR 7,736 Cr (37% guidance); back-loaded to Q4 due to milestone/OC timing. OCF down 24% YoY in H1.

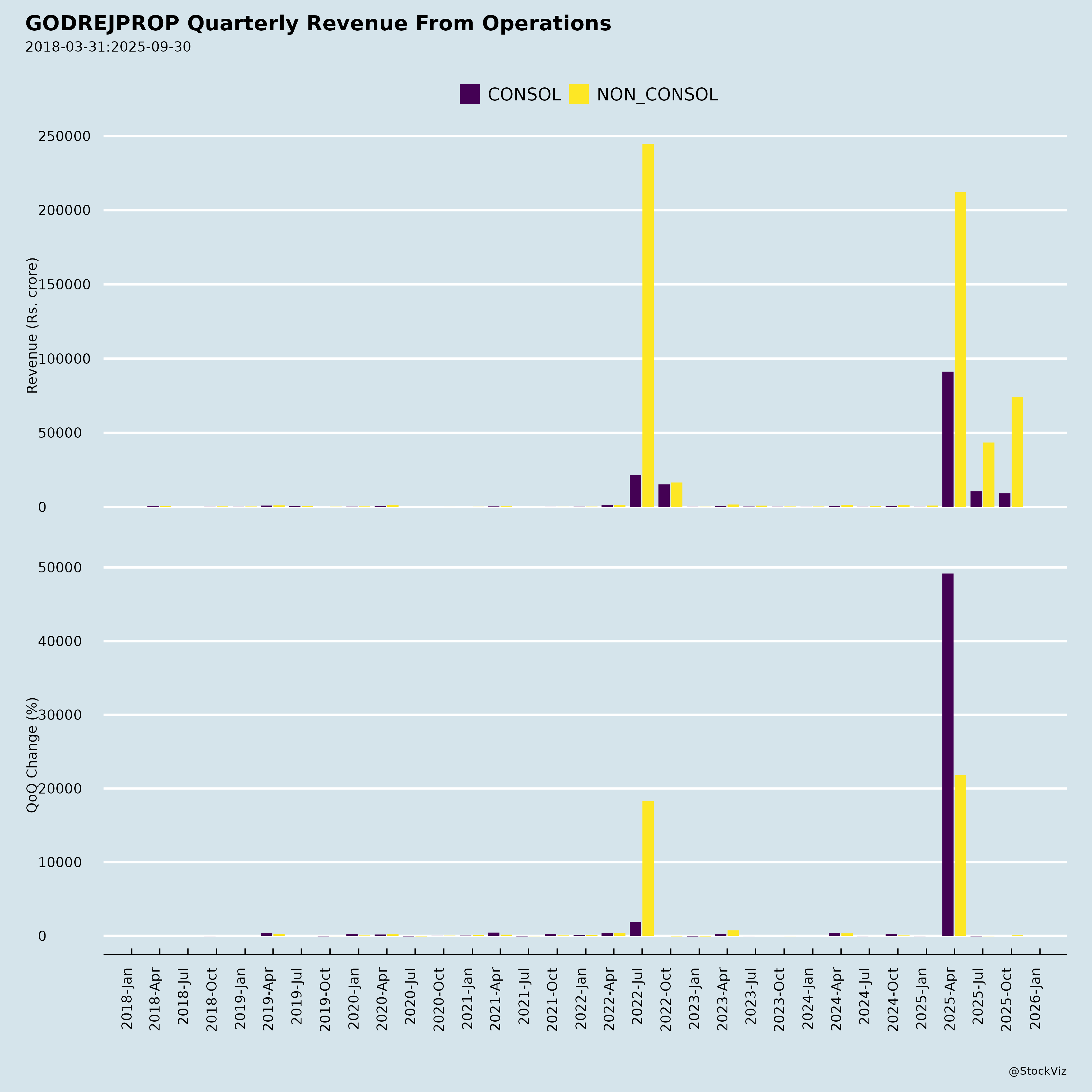

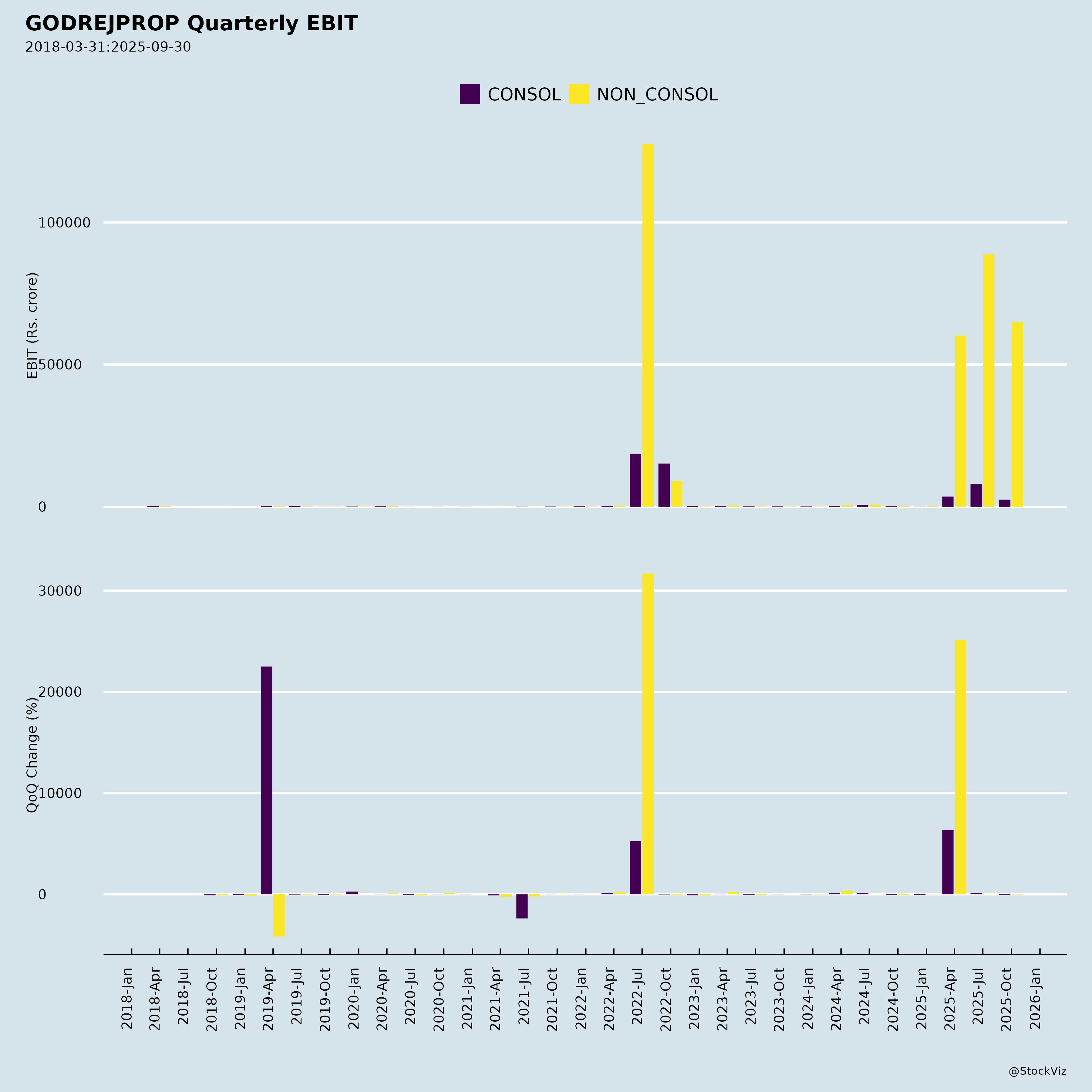

- P&L Volatility: Weak gross margins from JV structuring/OC timing mismatches (project completion accounting). Q2 EBITDA +118% YoY but reliant on older projects; newer outright OCs expected FY28.

- Execution Delays: NCR NGT/tree-cutting issues (e.g., Ashok Vihar stalled). Historical COVID impacts lingering; some pre-COVID projects delayed.

- Rising Costs: Land auctions exorbitant (e.g., Hyderabad/Navi Mumbai >INR 2,000 Cr for 10-11 acres). Construction/project outflows high (H1 ~INR 10,000 Cr).

- Market-Specific Softness: NCR H1 lag (vs. peers); Pune prices flattish; Gurgaon speculation risks (quality-focused sales, not full sell-outs).

Growth Prospects

- FY26 Outlook: Bookings to beat INR 32,500 Cr (upside from 48% H1); collections INR 21,000 Cr on track (Q4 lumpiness). Launches across 8+ cities (e.g., Worli, Greater Noida, Pune Mundhwa, Chennai, plotted in Raipur/Ahmedabad). OCF range INR 6,500-8,500 Cr.

- Medium-Term (FY28): 20% ROE target via OC step-up (newer outright projects). 20% CAGR sales growth; market share from 4.3% national (no city >10% share). Hyderabad ramp (INR 2,600 Cr CY25; new plots). Plotted entry into Indore/Panipat/Raipur/Baroda.

- Strategic Expansion: 232 Mn sq ft pipeline; micro-market penetration (e.g., Worli/Bandra). Restructurings (e.g., Worli JV to area-share) boost economics. Amalgamation of subsidiary (EHPL) streamlines structure.

- Macro Tailwinds: Resilient demand (end-user focus); Bengaluru/Hyderabad booming; national industry growth 10-13% to FY28.

| Metric | FY22 | FY25 Actual | FY26 Guidance | FY26 H1 Actual | FY28 Target |

|---|---|---|---|---|---|

| Bookings (INR Cr) | ~7,000 (annual) | 29,444 | 32,500 | 15,587 (48%) | N/A |

| Collections (INR Cr) | N/A | 17,047 | 21,000 | 7,736 (37%) | N/A |

| ROE | N/A | N/A | N/A | N/A | 20% |

Key Risks

- Execution/Regulatory: Delays from NGT/environmental clearances (NCR-specific); labor/supply chain volatility despite tech interventions.

- Cash Flow Lumpiness: Milestone/OC dependency; Q4 skew could spill to FY27 if construction slips.

- Margin Pressure: JV accounting distortions; rising land/construction costs erode embedded margins (annual disclosure planned).

- Market/Cyclical: Speculation in Gurgaon; oversupply in some micromarkets; interest rate sensitivity (despite low costs).

- Concentration: Heavy reliance on top 4 markets (80%+ sales); new markets (e.g., Hyderabad) unproven at scale.

- M&A/Structuring: Amalgamation (EHPL) needs NCLT approval; JV consolidations inflate inventory (H1 jump INR 14,000 Cr).

- External: Economic slowdown impacting affordability; competition in premium segments.

Overall Summary

Bullish Outlook with Execution Focus: GPL’s tailwinds dominate—explosive bookings, pipeline depth, and capital access position it for 20%+ growth and market leadership. FY26 set for record beats; FY28 ROE inflection via OCs. Headwinds (collections/execution) are cyclical/transitory, mitigated by ramped labor/contractors and QIP liquidity. Risks center on NCR delays and lumpiness, but diversified portfolio (221 Mn sq ft residential pipeline) and sustainability edge provide buffers. Recommendation: Strong Buy for growth investors; monitor Q3 collections/OC progress. Stock could re-rate on FY28 visibility (current net debt low at 0.30x).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.