GLOBAL

Equity Metrics

January 13, 2026

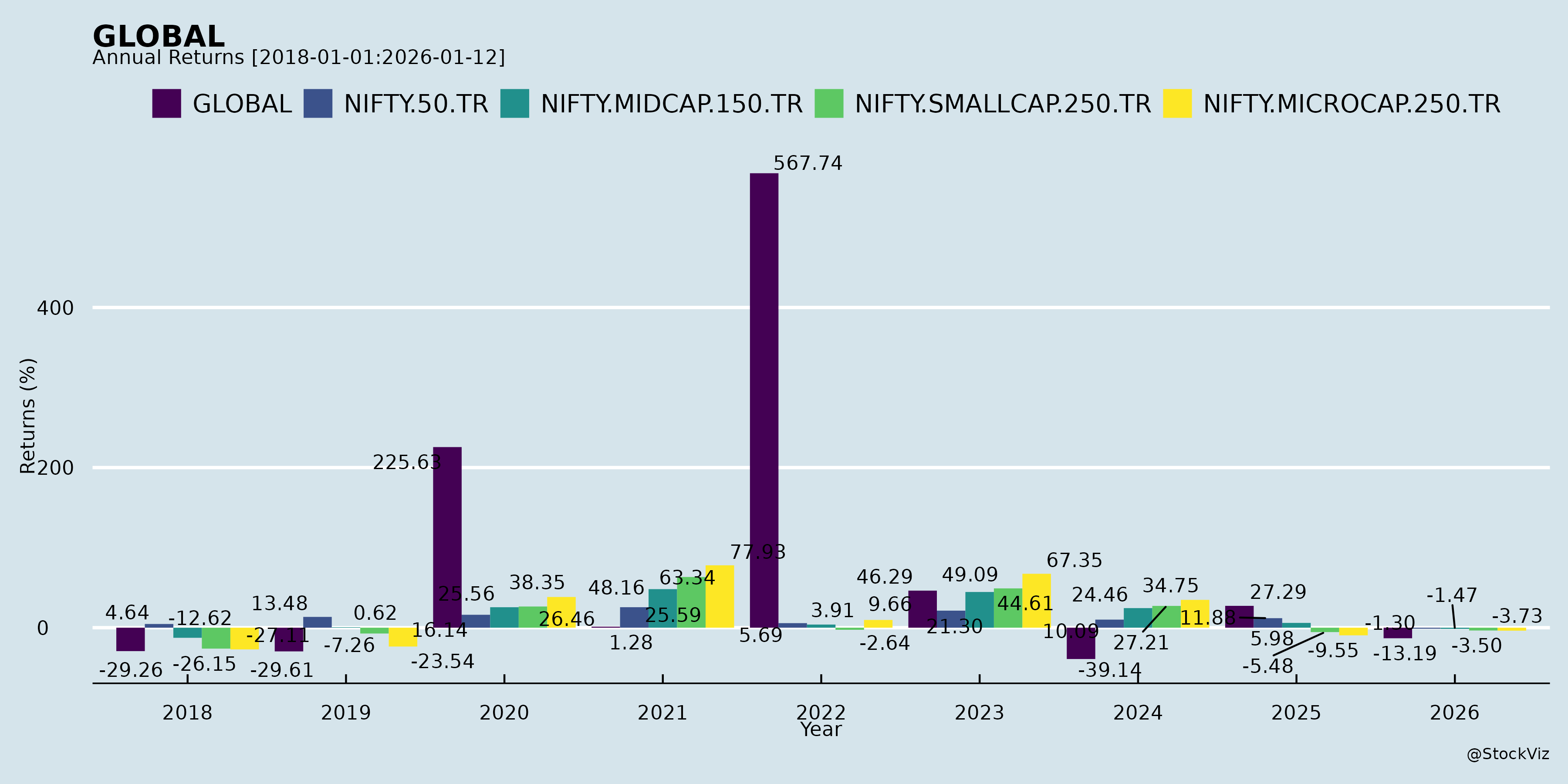

Global Education Limited

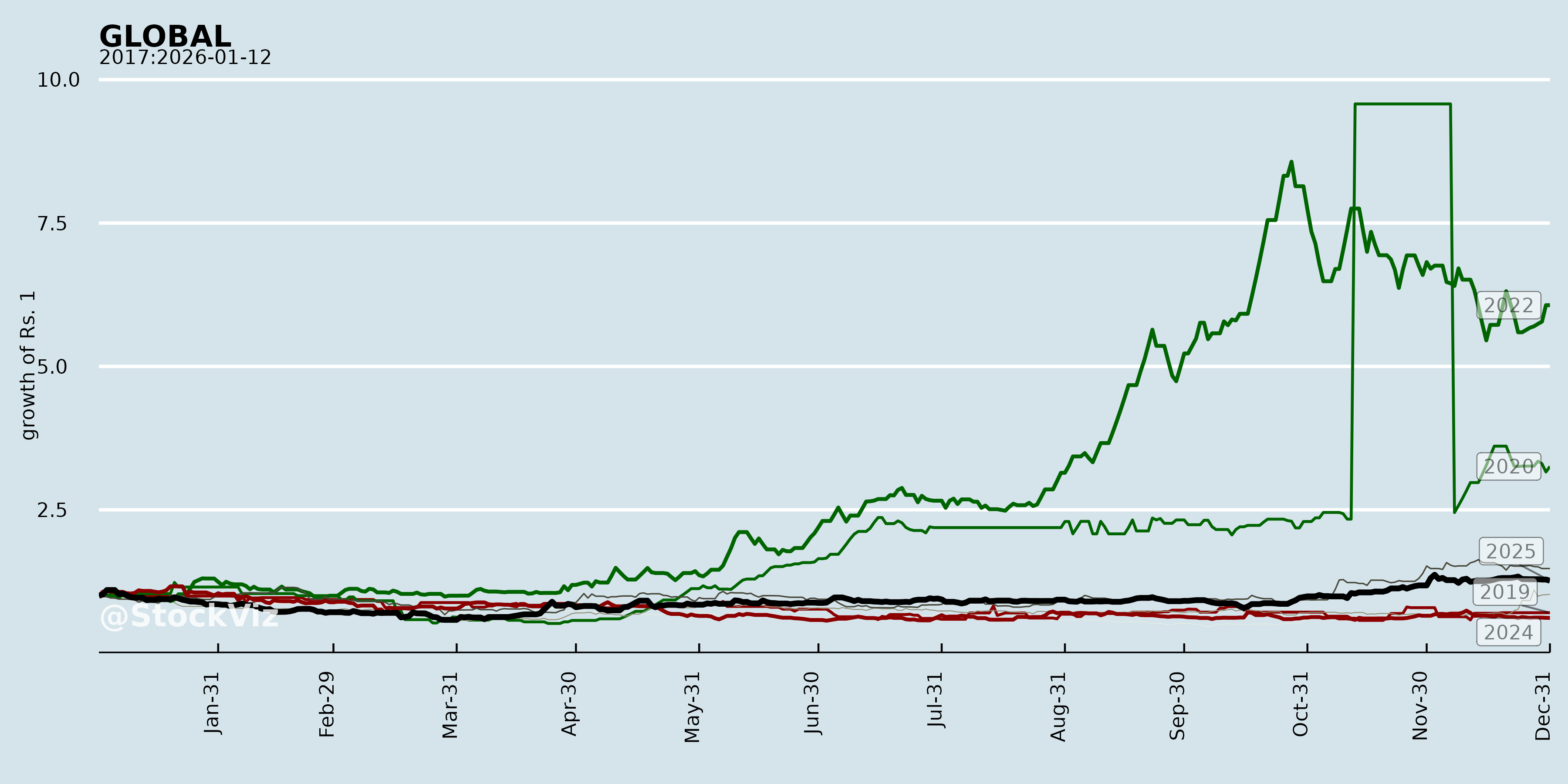

Annual Returns

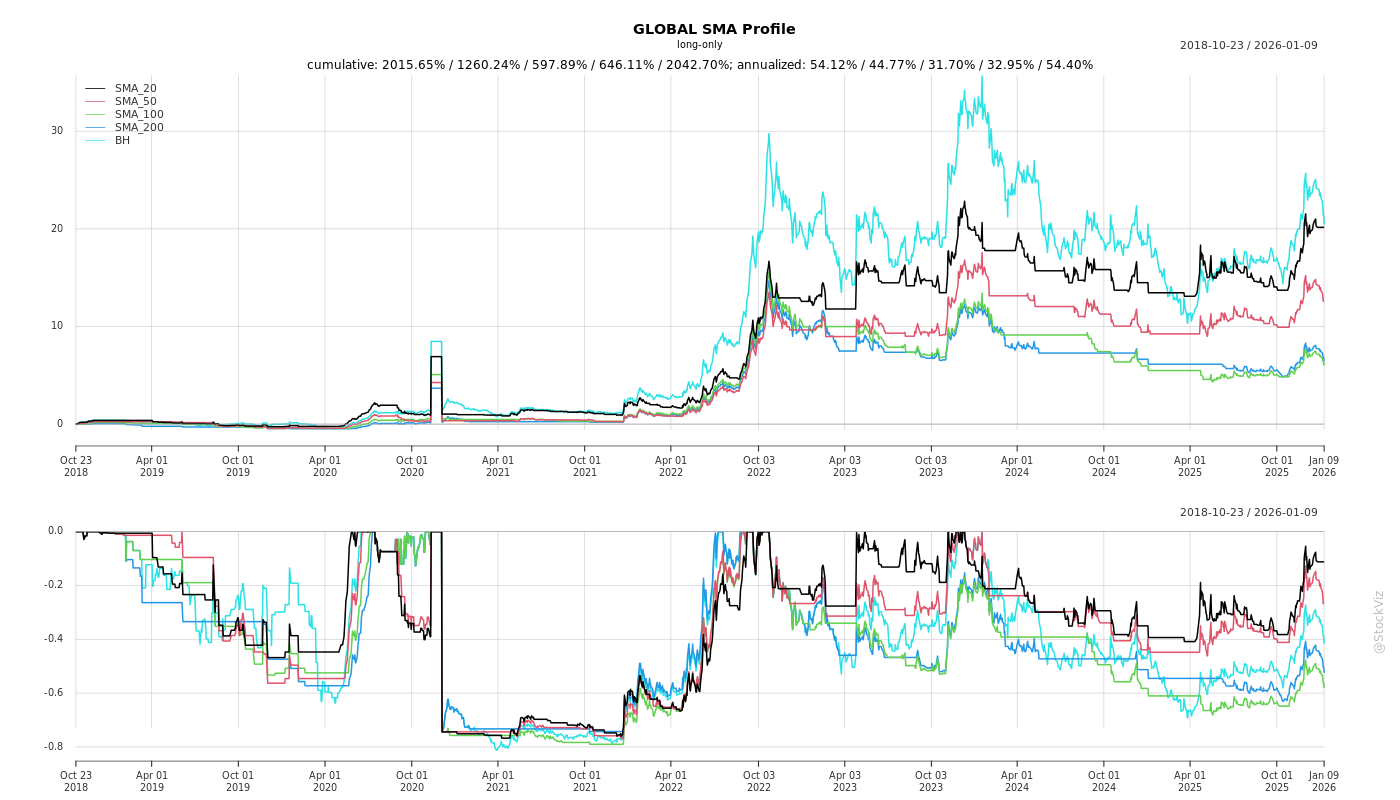

Cumulative Returns and Drawdowns

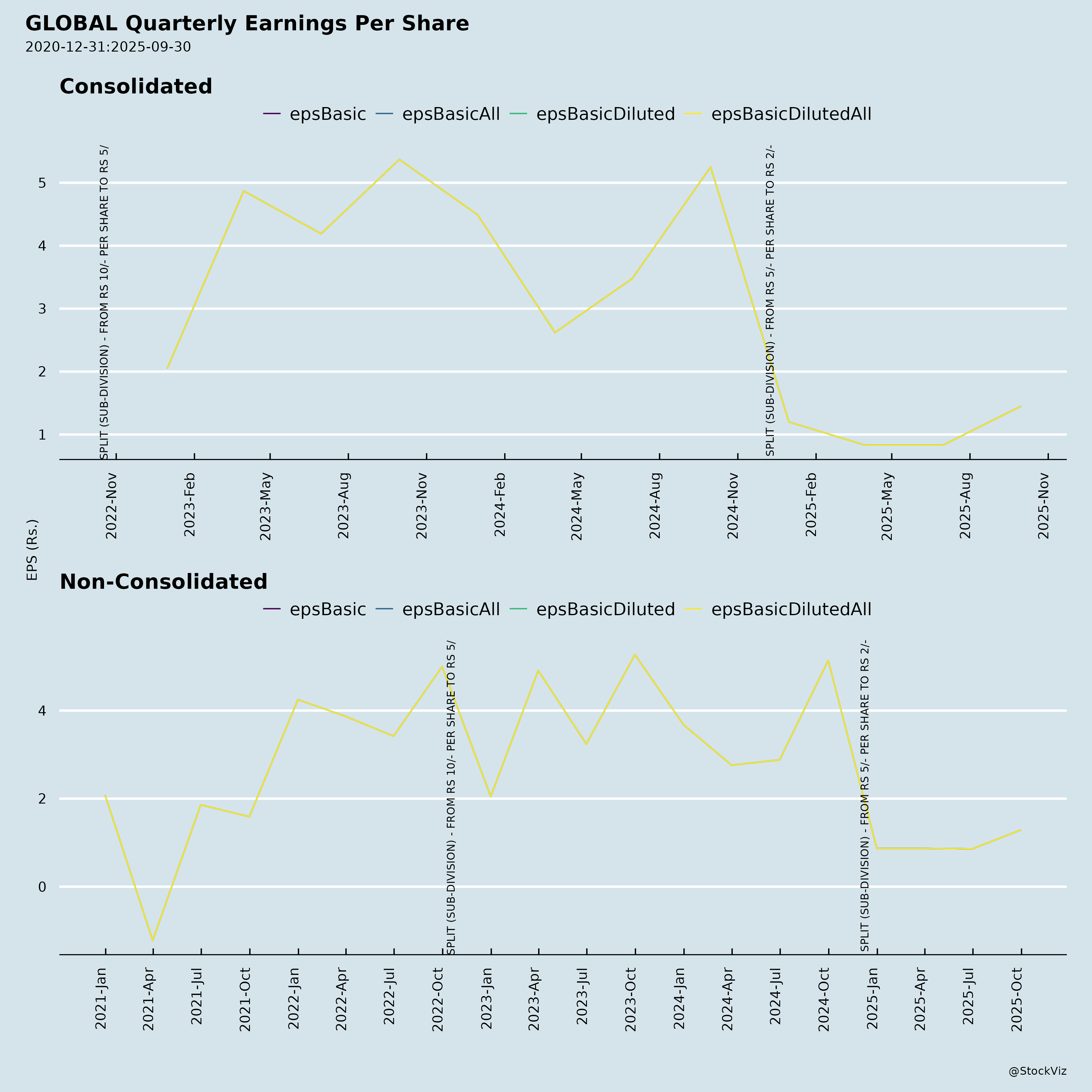

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-11-27

Analysis of Global Education Limited (GLOBAL) - Headwinds, Tailwinds, Growth Prospects, and Key Risks

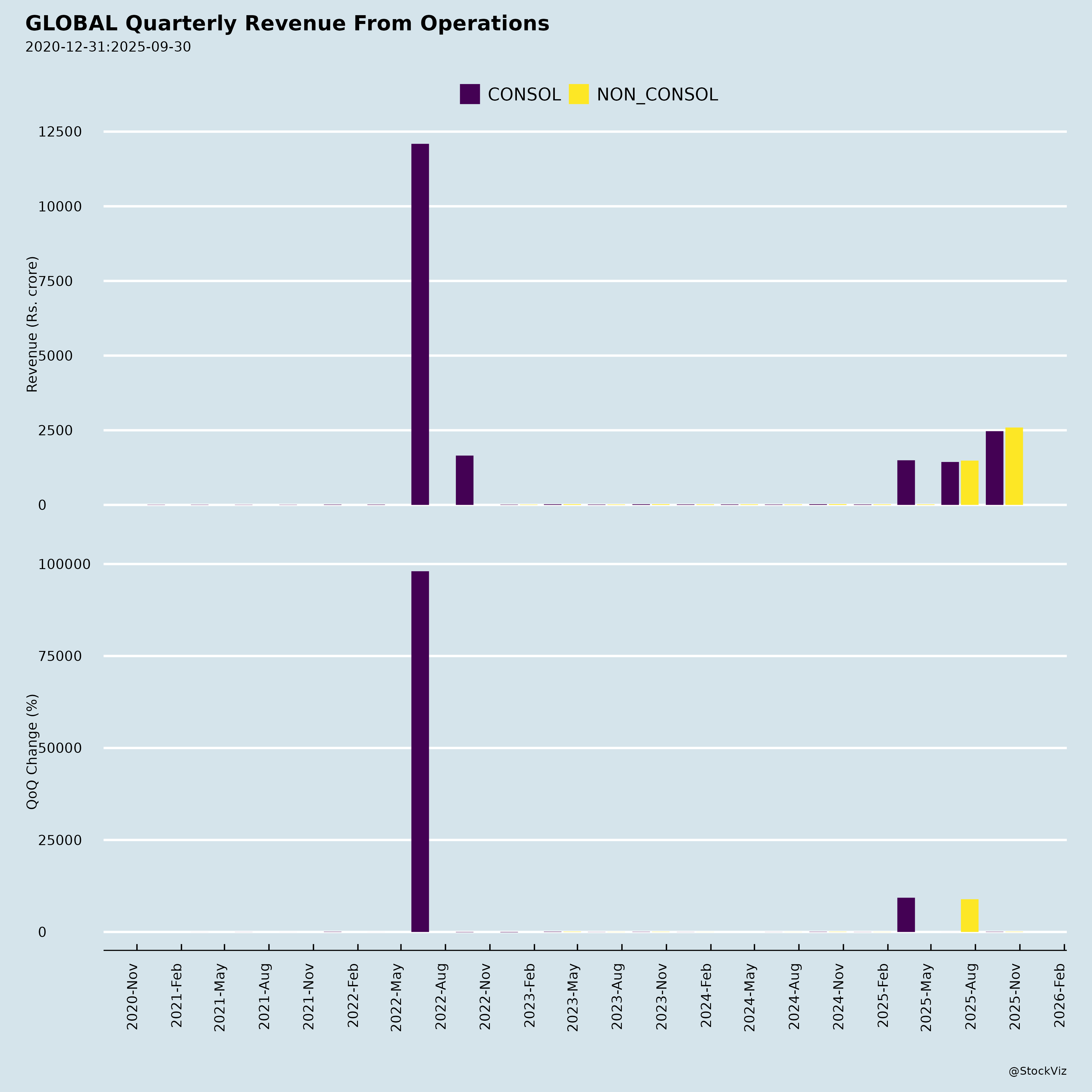

Global Education Limited (CIN: L80301MH2011PLC219291, NSE Symbol: GLOBAL) operates in two primary segments: Educational Training & Development Activities (e.g., training academies via subsidiaries like Global BIFS Academy, Global Sports Academy) and Business Support Activities (potentially trading/finance-related). The company released unaudited Q2/H1 FY26 results (ended Sep 30, 2025), showing steady growth amid a strong balance sheet. Standalone revenue grew 5% YoY to ₹39.08 Cr (H1), with consolidated at ₹40.74 Cr (+4%). Net profit stood at ₹10.96 Cr standalone / ₹11.60 Cr consolidated attributable to owners, with EPS ₹2.15/₹2.28. Key highlights include a ₹0.50/share interim dividend (25% payout), new CFO appointment, and approval of a new Independent Director via postal ballot.

Tailwinds (Positive Factors)

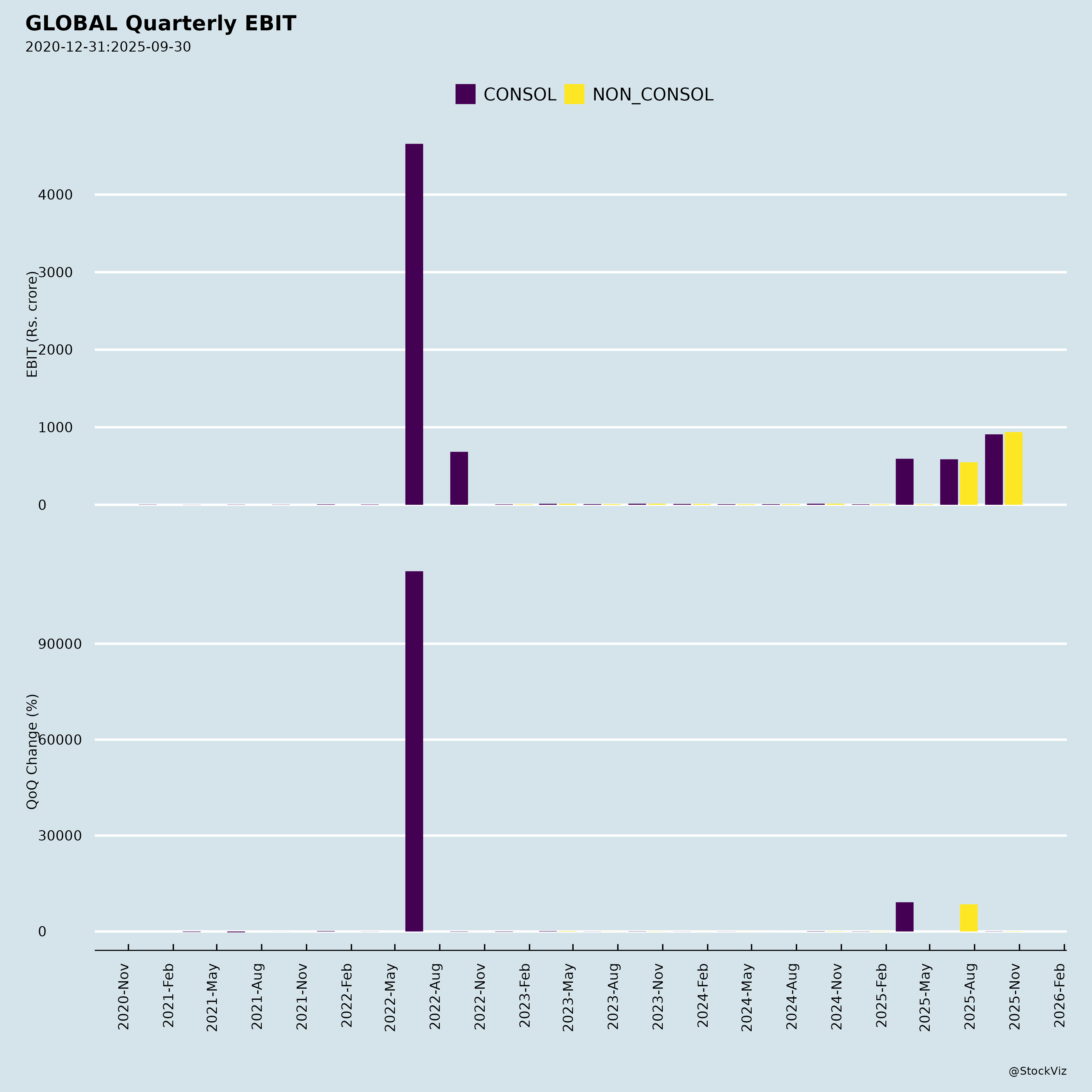

- Robust Profitability & Margins: Operating EBITDA margin ~43% (standalone H1), net profit margin ~28%. Profit before tax up to ₹14.95 Cr standalone (+31% YoY adjusted), driven by other income (₹2.56 Cr) and interest income.

- Strong Balance Sheet: Equity ₹112 Cr (standalone), reserves up 9% to ₹102 Cr. No significant debt (all debt ratios “NA”). Current ratio 4.07x, inventory turnover efficient (13 days). Investments surged 44% to ₹58 Cr.

- Dividend Policy & Shareholder Returns: First interim dividend signals confidence; prior FY25 dividend paid ₹2.55 Cr.

- Segment Momentum: Business Support revenue doubled QoQ/H1 (+82% YoY to ₹27 Cr), offsetting slower Education segment. Associates (e.g., YOLA Stays) added ₹0.72 Cr profit share.

- Management Stability: New CFO (Anshul Jain, 7+ yrs exp. in finance/audit) appointed; clear KMP disclosure protocol. New Independent Director approved (99.99% votes).

Headwinds (Challenges)

- Moderate Revenue Growth: H1 revenue +5% YoY standalone (flat QoQ in Q2), lagging prior high-growth (FY25 full-year ₹68 Cr). Education segment down 46% YoY (₹12 Cr), possibly seasonal/competitive pressures.

- Rising Costs: Employee expenses +83% YoY (₹6.46 Cr), other expenses +104% QoQ. Operational expenses volatile (traded goods cost ₹10.77 Cr).

- Working Capital Strain: Trade receivables up 19% to ₹32.53 Cr (111-day turnover); cash from ops negative on WC changes (-₹1.96 Cr), leading to 39% cash decline (₹2.83 Cr).

- Subsidiary Volatility: Subsidiaries contributed modestly (₹1.46 Cr revenue H1) but with losses in some (net ₹-0.76 Cr PAT); reliance on unreviewed associate data.

Growth Prospects

- High (Medium-Term: 15-25% CAGR Potential):

- Diversification: Business Support (69% H1 revenue) scaling rapidly; education via 4 subsidiaries (e.g., Ownprep, YOCO Stays) and sports/academy focus aligns with India’s skilling boom (govt. push via NEP 2020, skill India).

- Investment Pipeline: Capex ₹4.28 Cr (standalone), investments ₹18 Cr (net outflow); total assets +14% to ₹125 Cr.

- Expansion: Operations in India-only; potential in microfinance/housing (CFO’s prior role) and stays/sports verticals. Record date for dividend (Nov 12, 2025) underscores payout discipline.

- Projections: If Business Support sustains 50%+ growth and Education rebounds, FY26 revenue could hit ₹85-95 Cr (25%+ YoY), supported by low debt/cash-gen (₹8.99 Cr ops cash standalone).

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Operational | High receivables (26% of assets); inventory/trading volatility (₹3.82 Cr stock). Segment concentration (Business Support 69%). | Strong current ratio; efficient turnover ratios. |

| Financial | Negative WC cash flow; dividend payout amid capex (₹2.55 Cr paid). Forex-free but inflation-sensitive costs. | Zero debt; reserves buffer (91% of equity). |

| Regulatory/Compliance | SEBI-listed; KMP changes, disclosures mandatory. Auditor reliance on mgmt.-certified subsidiary data (limited review). | Compliant filings; unmodified audit reports. |

| Market/External | Education competition (e.g., edtech peers); economic slowdown impacting training demand. Associate profits unreviewed. | Diversified segments; India-focused. |

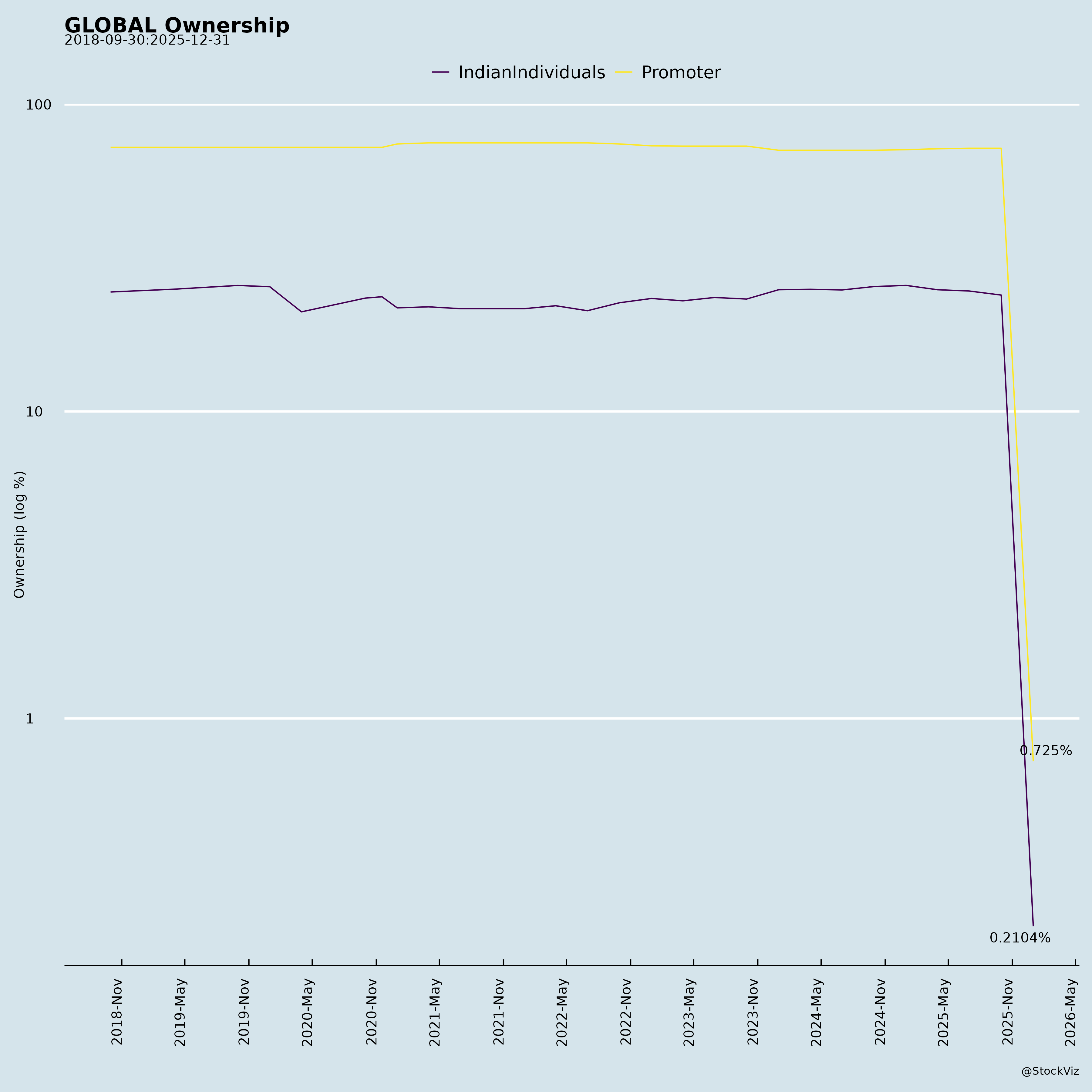

| Governance | Promoter holding ~72% (voting control); low public participation in postal ballot (73 voters). | New Ind. Director; transparent disclosures. |

Overall Summary: GLOBAL exhibits strong tailwinds from profitability, zero-debt balance sheet, and Business Support growth, positioning it for solid medium-term prospects (15-25% revenue CAGR) in education/skilling. Headwinds like moderate top-line growth and WC pressures are manageable given cash buffers. Low-moderate risk profile (buy/hold for growth investors), but monitor receivables and Education segment recovery. FY26 outlook positive post-dividend/CFO stability; watch Q3 for sustained momentum. (Analysis based solely on provided docs; no external data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.