Education

Industry Metrics

January 13, 2026

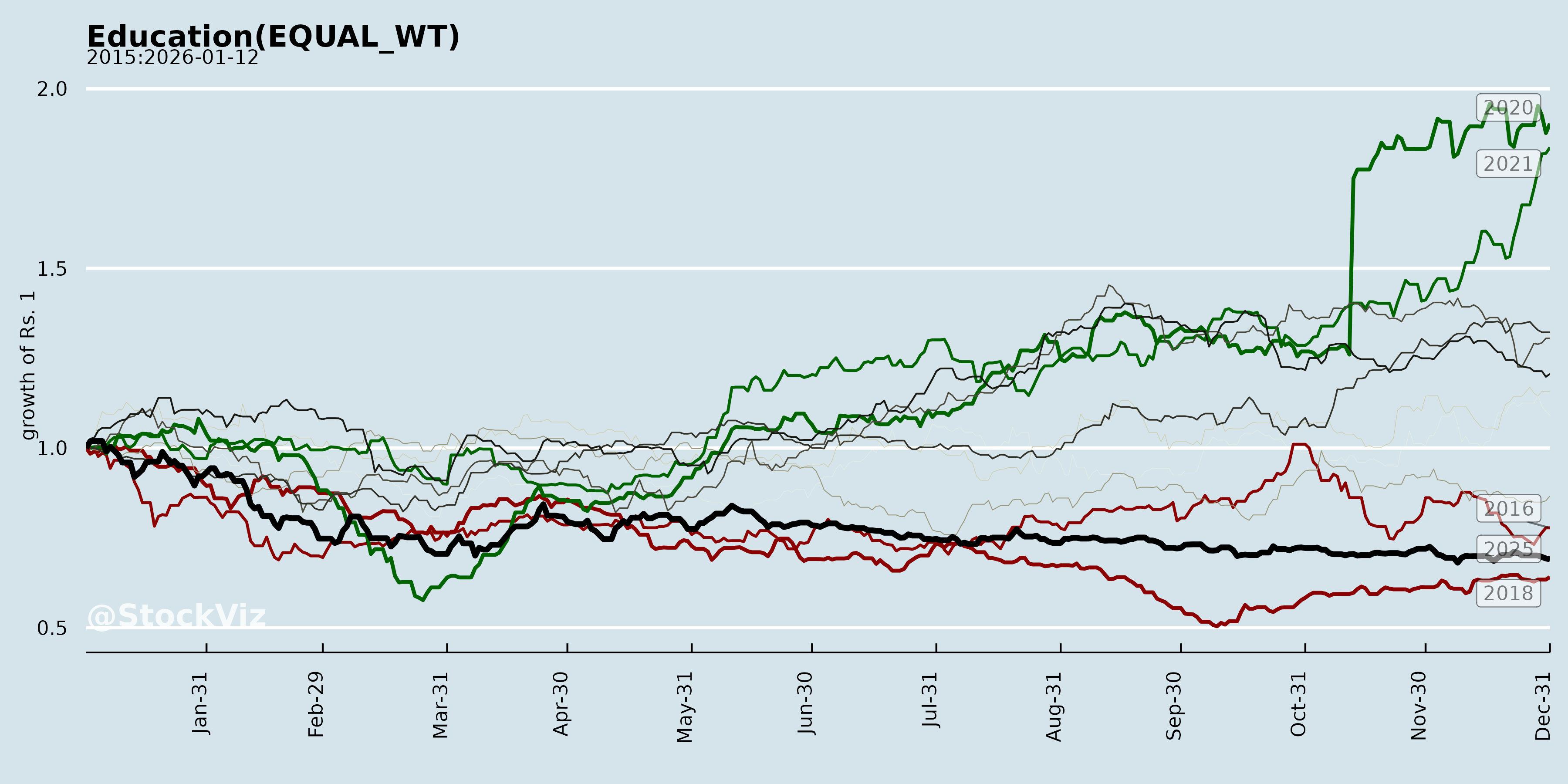

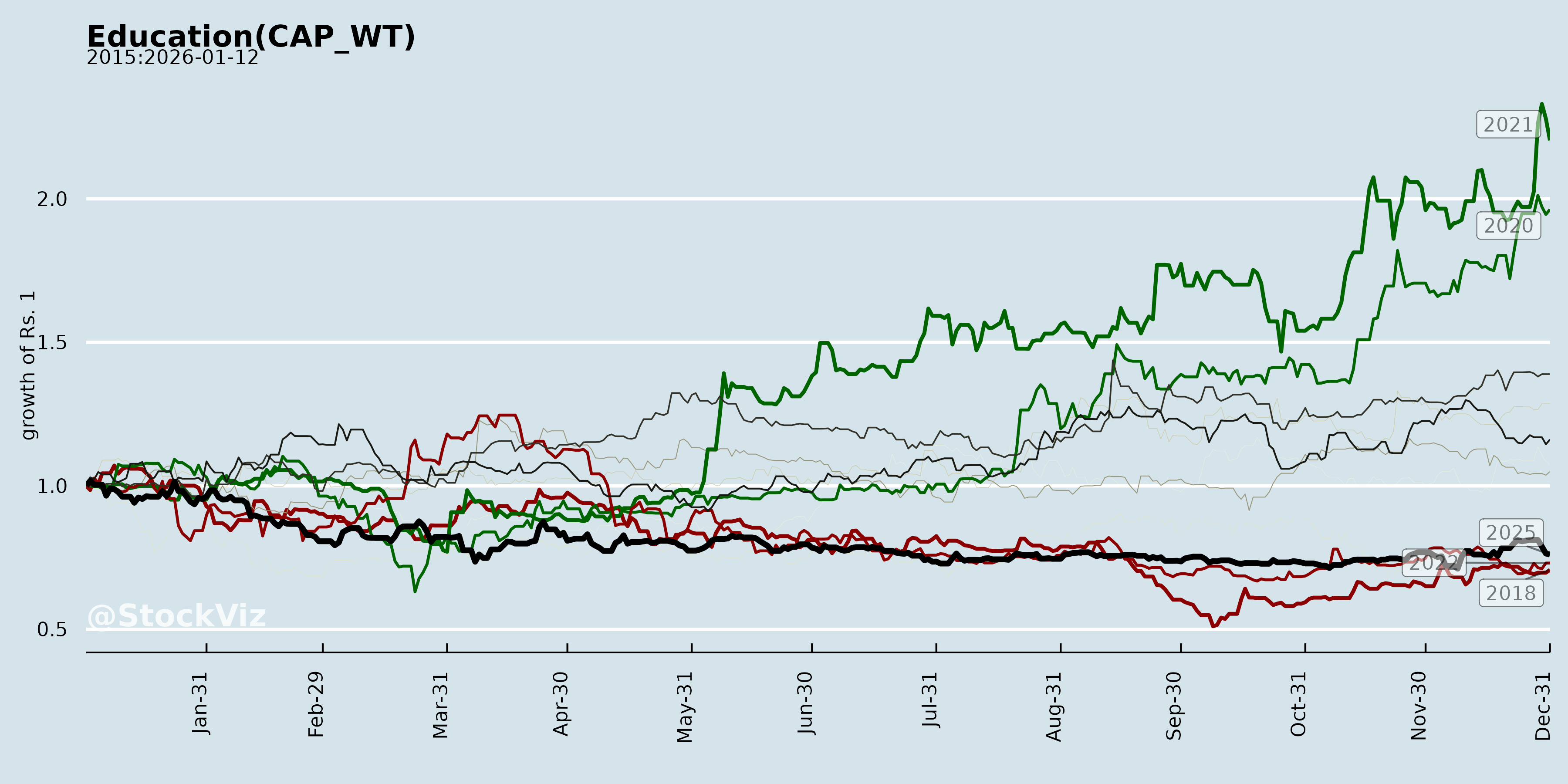

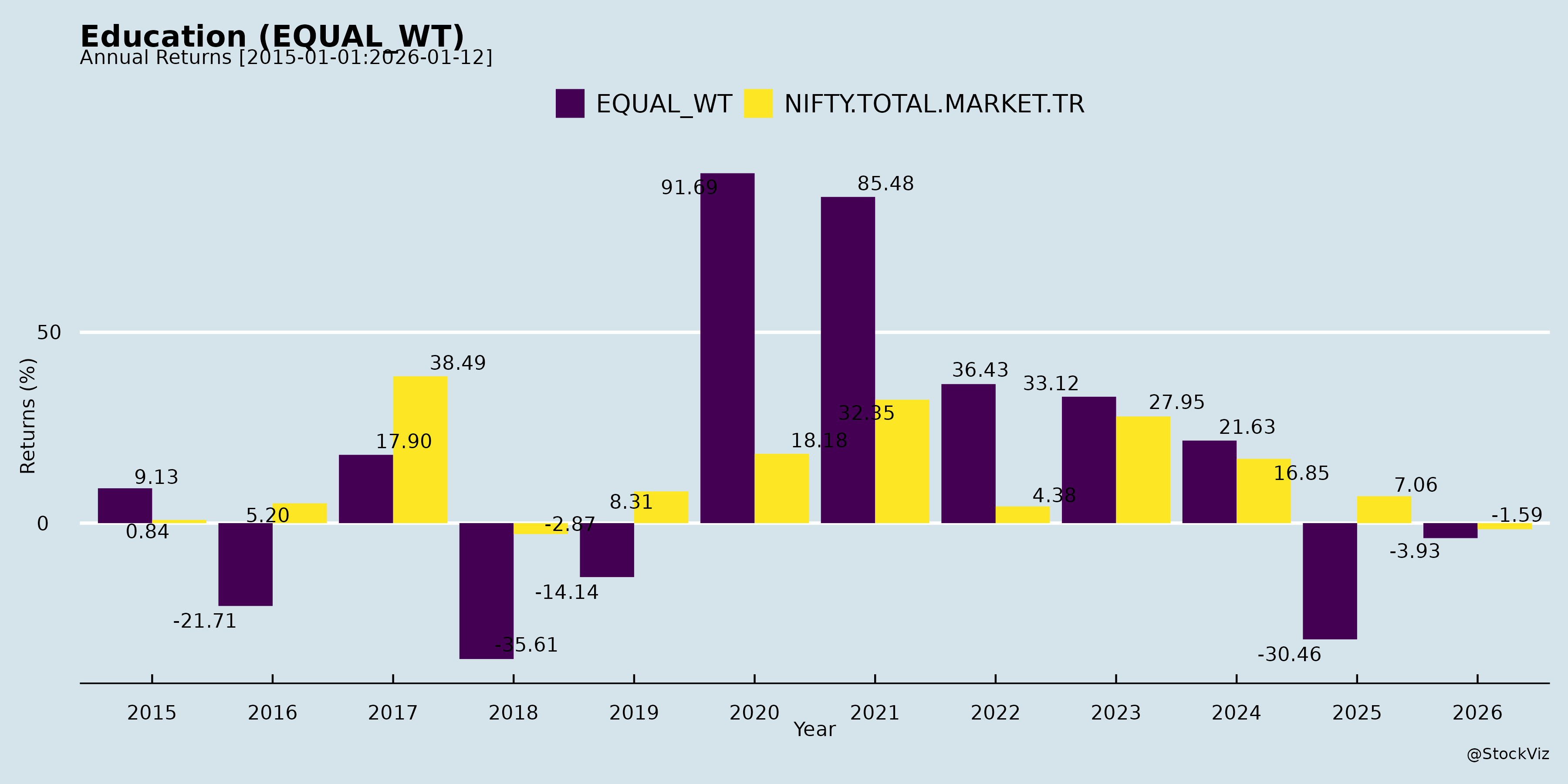

Annual Returns

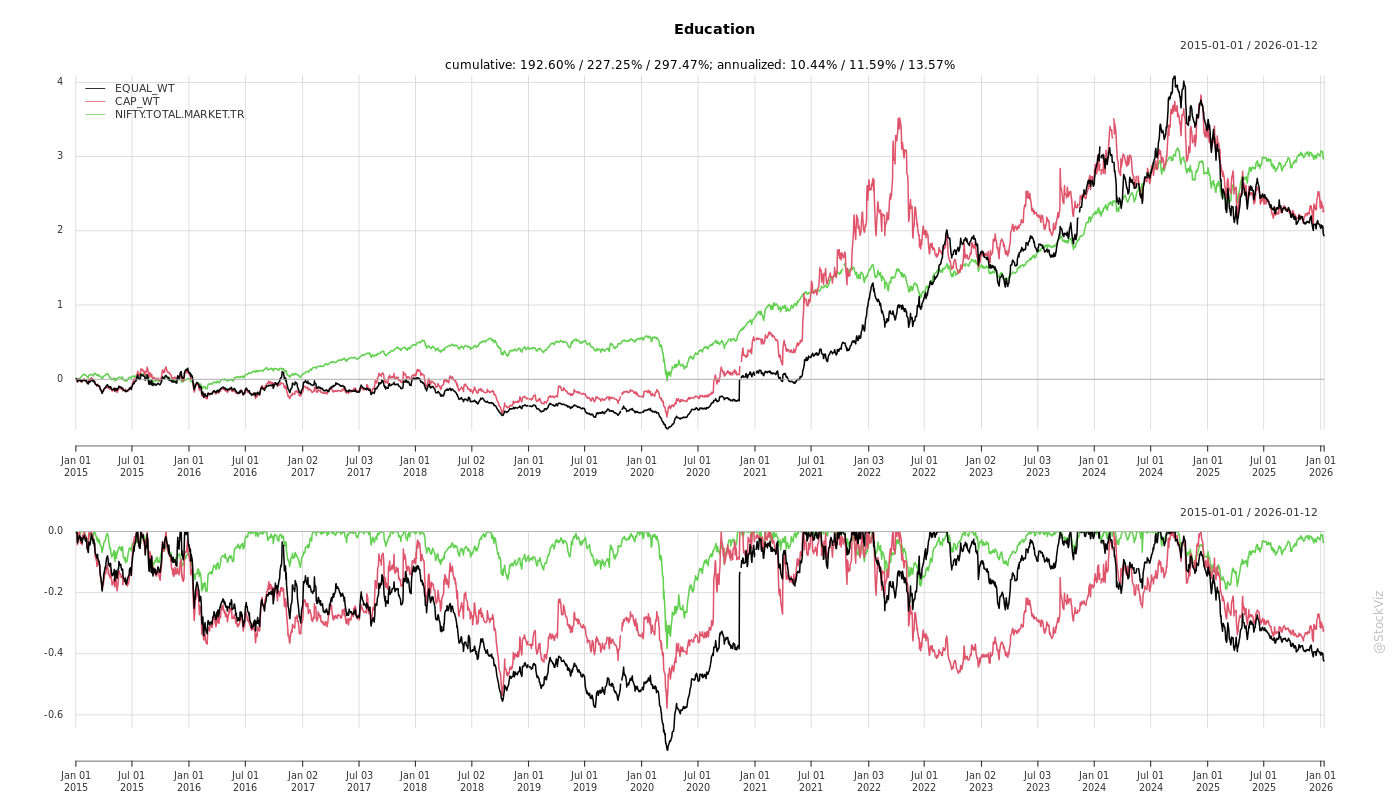

Cumulative Returns and Drawdowns

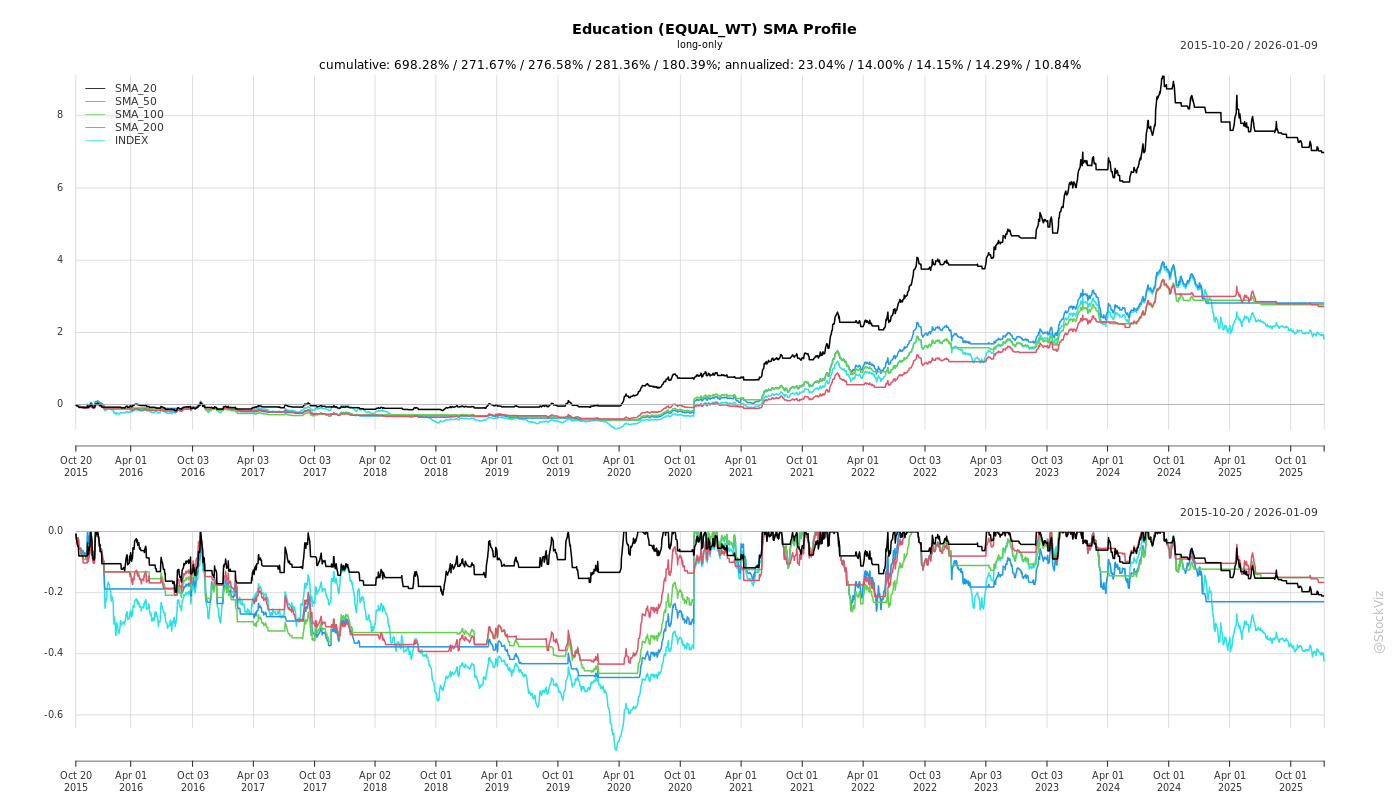

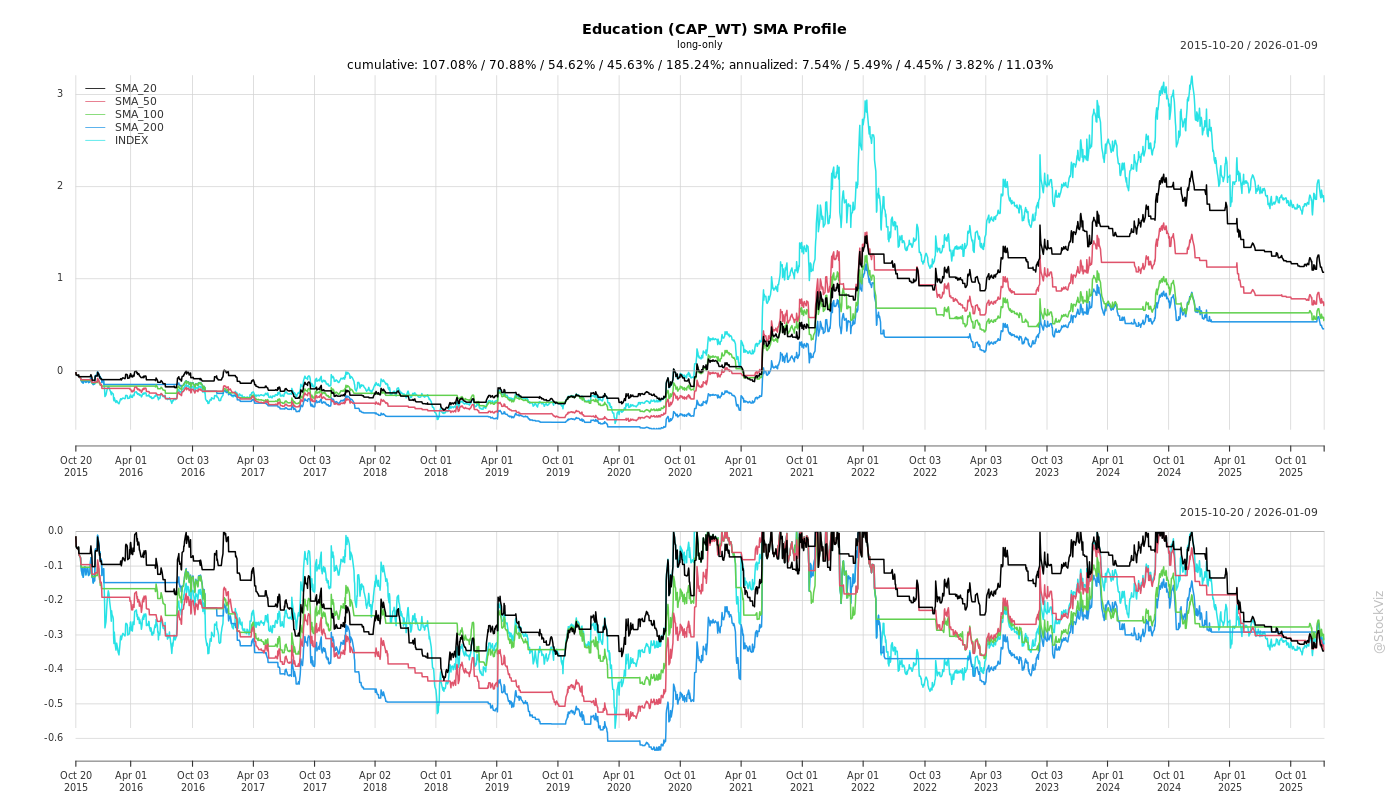

SMA Scenarios

Current Distance from SMA

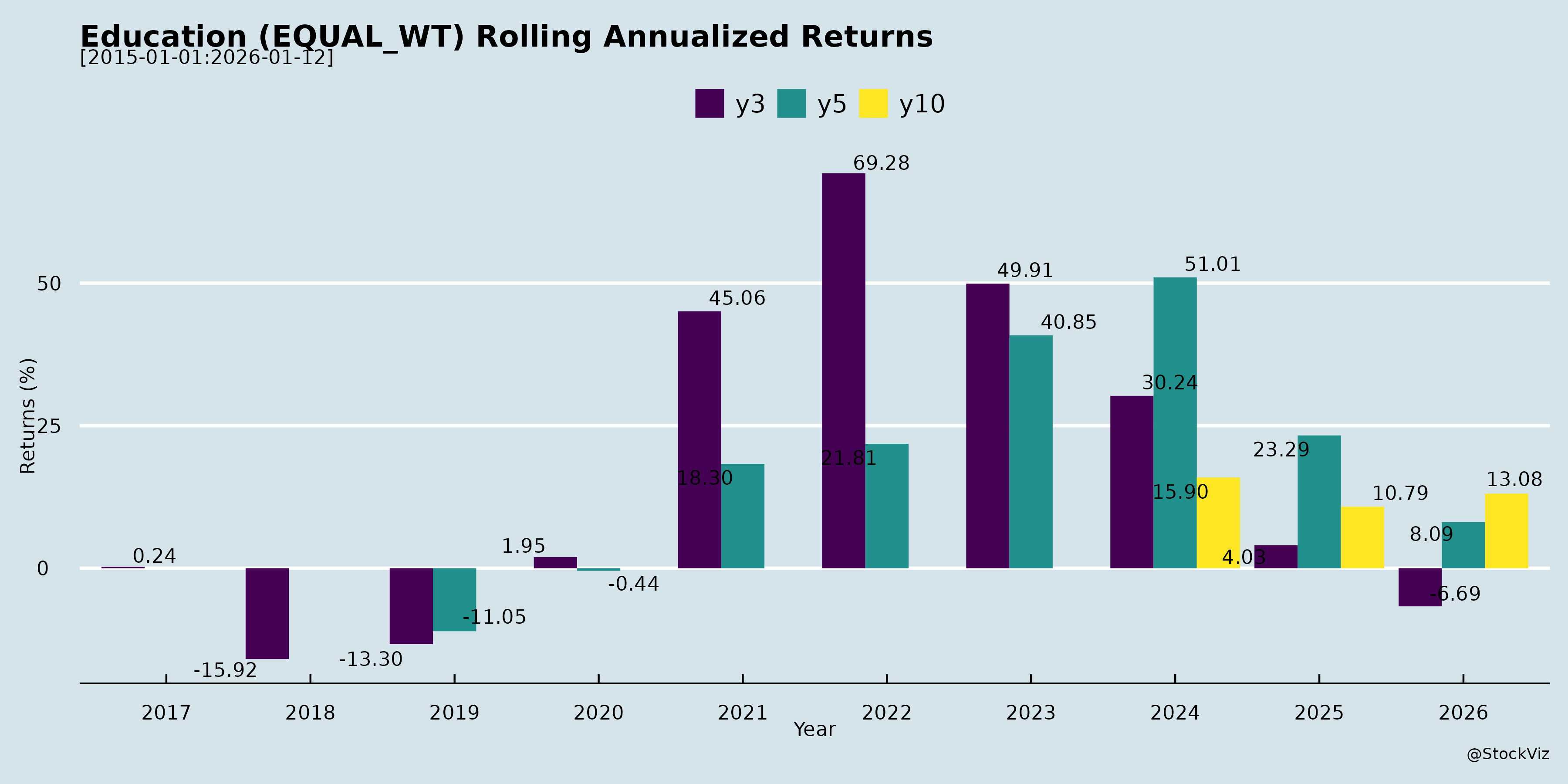

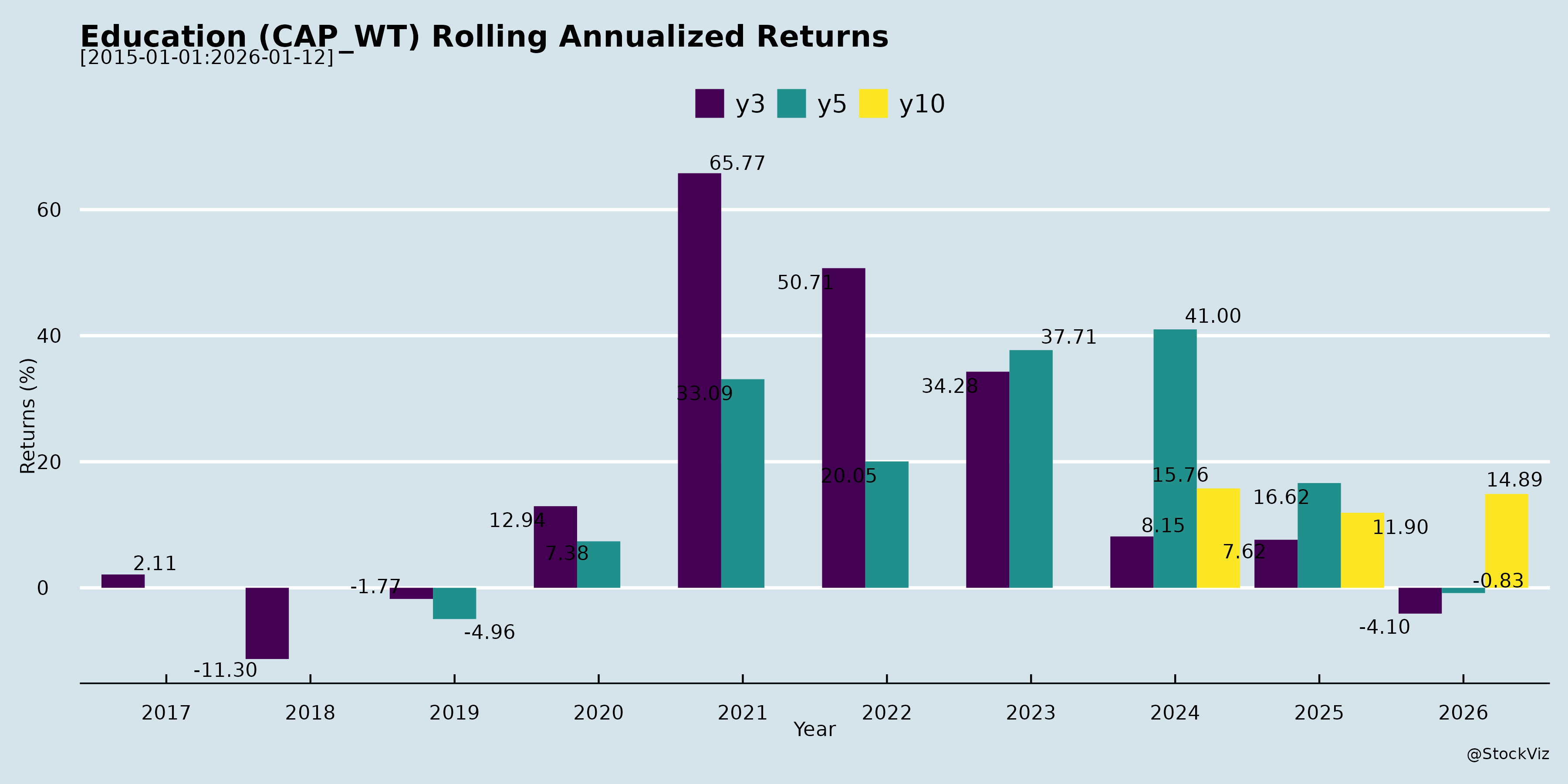

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Indian Education Sector Analysis (Based on CL Educate and NIIT Learning Systems Filings/Transcripts)

The analysis draws from H1 FY26 earnings transcripts of CL Educate Limited (test prep EdTech, MarTech, digital assessments via DEXIT) and Q2 FY26 of NIIT Learning Systems Limited (NIIT MTS) (managed training services with AI focus). Both reflect resilience amid flux, with acquisitions driving growth but macro pressures evident.

Tailwinds

- Digital & AI Adoption: NIIT’s AI-enabled revenue at ~10% (expected rapid growth via AI studio for content/effectiveness); CL integrating AI for doubt-solving, SOP analysis, and test simulations. Platforms like VOSMOS (metaverse) and EasyApply enhance monetization.

- Acquisitions & Synergies: CL’s DEXIT (ex-NSEIT) fully integrated, adding Rs 139 cr revenue (+12% YoY, EBITDA +40%); NIIT’s MST Group (Germany) adds 7 clients, industrials exposure (21% of revenue), near-shore efficiency.

- Client Traction & Renewals: NIIT: 100% renewals, 3 new MTS logos + expansions; CL: DEXIT client retention, new wins (Ayush, UIDAI). Revenue visibility at $409 mn (NIIT).

- Emerging Segments: CL’s BBA-IPM/UG growth (IIM programs); platform monetization (test series, publishing bundles); NIIT’s industrials (auto, energy, mining) and life sciences traction.

- Stable Core: MarTech +6% YoY (international +33%); DEXIT annuity-like flows (IRDA, NTA).

Headwinds

- Pricing & Mix Pressure: CL EdTech: Volumes held but ARPU down due to online/low-ticket shift (test series, domain-specific); MBA challenged (CAT applications dip); CUET “lost flavor” from glitches/easy papers.

- Market Flux: Test prep offline-online shifts, Law exam timing eroding crash courses; NIIT: Volatile economy, longer decision cycles, cost scrutiny delaying discretionary L&D spend.

- Acquisition Costs: CL PAT down to Rs 1.5 cr (vs Rs 7.5 cr) from Rs 26 cr finance costs (Rs 200 cr debt) + depreciation; NIIT: Transient expenses (acquisitions, MTM losses).

- Seasonality: DEX/Certifications skewed; NIIT Q2 vacation impact in Europe; consulting -22% QoQ.

- Standalone Declines: CL test prep softening; NIIT India MTS flat/slight dip.

Growth Prospects

- Strong Topline Momentum: CL H1 revenue +64% to Rs 319 cr (DEX-led); NIIT Q2 +20% YoY/CC (+15%), FY26 guidance 12.5-13% CC growth, 20-21% EBITDA margins.

- Diversification: CL’s “three-engine” model (EdTech/MarTech/DEX) scales independently with cross-synergies (e.g., DEX for MBA/BBA tests). NIIT: Pipeline robust across tech/telecom, life sciences, BFSI; AI multi-year opportunity (L2/L3 training upgrades).

- Organic + Inorganic: NIIT organic 10%+; CL new variants/partnerships (schools, tuition centers). International: NIIT 40% digital from abroad; potential equity raises (CL Q3).

- Efficiency/Expansion: NIIT capex in GenAI; CL debt reduction focus. Revenue visibility up YoY; outsourcing tailwinds from skills gaps/layoffs.

- Outlook: H2 likely similar/stronger (CL DEX pipeline); NIIT Q3 +2-3% QoQ CC.

Key Risks

| Risk Category | Details | Mitigants |

|---|---|---|

| Macro/Decision Cycles | Volatility, inflation, tariffs (EU-China chips/auto impact NIIT MST); client cost discipline delays deals. | Outsourcing uptick in uncertainty; 100% renewals, diversified clients (104 logos). |

| Debt & Costs | CL Rs 200 cr acquisition debt (6-yr, high interest); INDAS adjustments (Rs 5 cr/Q). | Premature repayment plans; strong EBITDA (CL +101%, NIIT stable). |

| Competition/Preferences | Online players erode pricing (CL); L&D prioritization after IT/BPO (NIIT). | Market share retention; AI differentiation (pole position per Fosway). |

| Regulatory/Execution | CUET glitches, exam shifts (Law); integration hiccups (though smooth). | DEX govt ties (NTA/ICAI); capital reduction scheme (CL Rs 183 cr cash escrow). |

| Concentration/One-offs | NIIT North America wind-down; CL prior ICAI boost. | Distributed flows (annuities, on-demand); new contracts pipeline. |

| Geopolitical | Tariffs/supply chain ripples (auto/industrials). | Near-shore (MST Eastern Europe); multi-vertical focus. |

Summary: Sector shows robust growth (20-64% YoY) via AI/digital assessments/acquisitions, offsetting test prep flux. Tailwinds from tech integration/synergies outweigh headwinds (pricing/macro), with 12-13% FY26 guidance realistic. Risks center on debt/macro but mitigated by renewals/pipelines. Bullish on diversified players like CL/NIIT amid skilling demand.

Financial

asof: 2025-12-02

Analysis of Indian Education Sector (Based on Q3 FY25 Financial Results)

The provided documents cover unaudited Q3/N9M FY25 results (ended Dec 31, 2024) from key listed players like NIIT Learning Systems (NIIT MTS), NIIT Ltd., CL Educate, Global Education, Zee Learn, Compucom Software, Tree House, and others. The sector shows mixed performance: resilience in corporate training/digital segments amid persistent legacy issues (debt, litigation). Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Momentum)

- Revenue & Profit Growth in Core Segments: NIIT MTS reported 6% YoY revenue growth to ₹12,236 Mn (N9M) and 13% PAT growth to ₹1,788 Mn, driven by operations (₹4,189 Mn Q3). NIIT Ltd. saw 18% revenue rise to ₹2,713 Mn (N9M). Global Education delivered 39% PAT growth (₹2,394 Mn N9M). Compucom stable at ₹2,407 Mn revenue.

- Operational Efficiency: Declining finance costs (NIIT MTS: ₹148 Mn N9M vs ₹225 Mn prior). Employee costs up but controlled (e.g., NIIT MTS 6% YoY rise).

- Digital/ESOP Momentum: ESOP issuances (NIIT MTS: 10 Mn options outstanding; CL Educate: 75k ESOPs) signal talent retention amid EdTech push.

- Segment Strength: Corporate training/upskilling (StackRoute, NIIT USA) and single-segment focus (education services) aid scalability.

Headwinds (Challenges)

- Losses & Declines: CL Educate Q3 loss ₹312 Mn (revenue flat); Zee Learn ongoing losses (₹375 Mn Q3 PAT loss) with negative working capital. Tree House minimal ops (₹144k revenue Q1 FY26).

- High Costs/Litigation Drag: Elevated finance costs (Zee Learn: ₹955 Mn Q3); exceptional items/impairments (CL Educate GST demand ₹1,281 Lacs).

- Insolvency/Legal Overhang: Zee Learn subsidiaries in CIRP (DVPL); Tree House FIRs, arbitrations (e.g., Vadodara property dispute).

- De-growth in Some: NIIT Ltd. revenue flat YoY; MT Educare in CIRP (no results).

Growth Prospects

- EdTech/Corporate Training Boom: NIIT MTS (YTD revenue +6%, EPS ₹13.17); Global Education (EPS ₹4.70 N9M). CL Educate acquiring NSEIT DEX (₹23,000 Lacs) for digital exams.

- International Expansion: NIIT subsidiaries (USA, Ireland, Malaysia) contribute ~25% revenue; forex gains.

- M&A/Single-Segment Focus: CL Educate DEX deal; NIIT MTS single-segment (Ind AS 108 compliant).

- Recovery Potential: Post-demerger stability (NIIT MTS/NIIT Ltd.); projected FY25 growth via upskilling (StackRoute, etc.).

- Outlook: Sector FY25 revenue ~10-15% CAGR possible via digital shift (ESOPs indicate confidence).

Key Risks

| Risk Category | Details | Exposure |

|---|---|---|

| Financial/Liquidity | High debt (Zee Learn ₹206 Cr total debt); negative WC (CL Educate, Zee Learn); guarantee invocations (Zee Learn ₹6,370 Cr exposure). | High (Zee Learn, CL Educate) |

| Legal/Regulatory | CIRP/NCLT (Zee Learn DVPL/MT Educare); FIRs/arbitrations (Tree House Vadodara, franchise disputes); GST demands (CL Educate ₹1,281 Lacs). | Very High (Zee Learn, Tree House) |

| Impairment/Recoverability | Unimpaired guarantees/investments (Zee Learn ₹677 Cr recoverable); audit qualifications on ECL (Zee Learn). | High (Zee Learn ₹344 Cr DVPL exposure) |

| Operational | Single-segment reliance; subsidiary losses (CL Educate ₹37 Lacs Q3). | Medium |

| Going Concern | Auditor emphasis (Zee Learn); negative PAT in stressed firms. | High (Zee Learn, MT Educare) |

Overall Sector Summary: Moderate Growth with High Risks. Tailwinds from corporate/digital training (NIITs shine) offset by legacy debt/litigation in legacy players (Zee Learn, Tree House). Prospects hinge on resolutions (e.g., Zee Learn settlements) and EdTech M&A. Investors should monitor NCLT outcomes; sector PE compression likely amid risks. Positive: 10-15% N9M revenue CAGR in top performers.

General

asof: 2025-11-29

Analysis of Indian Education Sector (Vocational Training & Edtech Focus)

Based on the provided disclosures from listed education companies (e.g., Aptech, NIIT, CL Educate, MT Educare, Zee Learn, Tree House, etc.) under SEBI LODR Regulation 30, here’s a structured analysis of headwinds (challenges), tailwinds (supportive factors), growth prospects, and key risks. These announcements (dated 2025) reflect a mixed sector landscape: innovation in skill-based programs amid compliance hurdles and financial pressures. The sector includes vocational training (IT, animation, 3D printing), test-prep, and preschool segments, with companies expanding globally/domestically.

Summary Table

| Aspect | Key Observations from Disclosures | Implications for Sector |

|---|---|---|

| Headwinds | - Regulatory lapses (CL Educate: Cautionary letters from BSE/NSE for delayed investor meet disclosure). - Tax/GST demands (MT Educare: ₹4.07 Cr demand on subsidiary for FY22, including penalties). - Insolvency distress (Zee Learn: Lender appeal withdrawal in CIRP; MT Educare under CIRP). |

Increased scrutiny, cash flow strain, and operational disruptions from compliance/tax issues. |

| Tailwinds | - Strategic partnerships (Aptech: MoU with WOL3D for 3D Printing & Design program). - Subsidiary consolidation/funding (NIIT Ltd: 100% ownership of IFBI; NIIT Learning Systems: $13 Mn equity infusion in step-down sub). - Investor engagement (Career Point: Bharat Connect Conference). |

Strong push into emerging skills (3D printing, AI/cyber/cloud), corporate upskilling demand. |

| Growth Prospects | - Vocational diversification (Aptech/NIIT: Animation + tech printing/bootcamps; ProAlley online courses). - Global/corporate expansion (NIIT USA: Leveraging subs for corp clients; Aptech’s 1000+ centers). - Routine compliance enabling stability (Compucom/Global Edu/Tree House: KYC/AGM/KMP disclosures). |

High potential in Industry 4.0 skills (3D, AI, VFX); online/enterprise training to tap ₹50,000 Cr+ market by 2027 (est.). |

| Key Risks | - Financial (Tax demands, CIRP exposure: Potential ₹4+ Cr hits; dividend restrictions). - Regulatory (Repeated SEBI warnings; delayed disclosures). - Operational (Insolvency in peers like MT/Zee could signal broader funding crunch). |

Litigation delays growth; non-compliance fines; sector vulnerability to economic slowdowns. |

Detailed Insights

- Headwinds (Challenges Pressuring the Sector):

- Regulatory Compliance Burden: CL Educate’s cautionary letters highlight lapses in SEBI LODR (e.g., 2-day advance notice for investor calls). Boards must now address these, risking fines/recurrence penalties.

- Tax & Legal Liabilities: MT Educare’s ₹4.07 Cr GST demand (tax + interest + penalty) on a material sub underscores audit risks. Appeals are planned, but outflows could strain FY26 finances.

- Insolvency Echoes: Zee Learn/MT Educare’s CIRP proceedings (ongoing since 2022/2023) indicate debt pressures in test-prep/preschool segments, potentially eroding investor confidence.

- Tailwinds (Positive Momentum):

- Innovation & Partnerships: Aptech’s non-binding MoU expands into 3D printing, blending animation/design with hardware skills—aligning with “Make in India” and manufacturing revival.

- M&A and Capital Infusion: NIIT’s moves (₹62.7 Mn acquisition; $13 Mn in subs) strengthen balance sheets for tech bootcamps (AI/cloud), targeting corporate reskilling amid IT hiring rebound.

- Visibility Boost: Conferences (Career Point) and routine filings (Tree House AGM: 99.99% approvals) signal operational normalcy and governance.

- Growth Prospects (Opportunities Ahead):

- Skill-First Demand: Shift to practical programs (3D printing, VFX/games via ProAlley) positions firms for ₹10,000 Cr+ vocational market. Aptech/NIIT’s global footprint (1000+ centers) aids exports.

- Digital/Enterprise Pivot: NIIT’s focus on corp upskilling (North America bootcamps) taps hybrid learning post-COVID; online platforms reduce costs.

- Sector Resilience: Passed AGMs (Tree House) and KMP disclosures (Global Edu) indicate stable governance, enabling fundraising. Overall, edtech-vocational hybrid could grow 20-25% YoY with govt. skilling initiatives (e.g., Skill India).

- Key Risks (Potential Threats):

- Financial Volatility: Tax/penalty demands (e.g., MT’s ₹4 Cr) and CIRP (Zee/MT) could lead to asset freezes/dividend halts; quantify: 1-5% revenue impact for midcaps.

- Regulatory/Disclosure Risks: SEBI’s November 2024 circular tightens event reporting—non-compliance (as in CL) invites actions.

- Macro/Sector-Specific: Competition from unlisted players (Byju’s recovery?); economic slowdowns hit discretionary spends (preschool/test-prep). Insolvency contagion risk if funding dries up.

- Execution: MoUs (Aptech) are non-binding; delays in program rollout could miss market windows.

Overall Sector Summary

The Indian education sector (esp. listed vocational/edtech players) shows resilient growth tailwinds from tech-skilling partnerships and subsidiary investments, countering headwinds like regulatory slips and tax disputes. Growth prospects are strong (15-20% CAGR est.) in niche areas like 3D/AI training, but risks remain elevated due to 2-3 firms in distress (CIRP/tax). Investors should watch Q2FY26 earnings for demand trends and litigation outcomes. Positive: Consolidation (NIIT) signals maturity; Negative: Compliance lapses could trigger broader SEBI probes. Recommendation: Selective bullish on innovators like Aptech/NIIT; cautious on distressed names (MT/Zee).

This analysis is derived solely from the provided filings; broader market data could refine it.

Investor

asof: 2025-11-29

Indian Education Sector Analysis

Using the provided documents from CL Educate Limited (test prep/EdTech, MarTech, digital assessments via DEXIT) and NIIT Learning Systems Limited (NIIT MTS, corporate L&D/MTS with AI focus), here’s an analysis of the Indian Education sector (encompassing K-12/UG test prep, assessments, corporate skilling/L&D outsourcing). Insights reflect H1/Q2 FY26 performance amid macro volatility.

Headwinds (Challenges Pressuring Performance)

- Pricing & Margin Pressure in Test Prep/EdTech: Shift to low-ticket online/self-study programs (e.g., MBA test series), offline-online flux, and competition eroding ARPU. CL Educate noted volumes stable but realizations compromised; test prep declined YoY.

- Regulatory/Exam Disruptions: CUET losing market flavor due to glitches/implementation issues (though difficulty rising); Law exams shifted to Dec, eliminating crash courses but stabilizing longer programs. CAT applications dipped.

- Macro Volatility & Cost Discipline: Corporates delaying L&D spends (longer decision cycles); NIIT MTS highlighted scrutiny on discretionary outlays despite marginal consumption pickup.

- Acquisition-Related Costs: Higher finance costs (CL: ₹26 Cr vs. ₹1 Cr YoY) and depreciation from debt-funded buys (DEXIT, MST); NIIT noted transaction expenses dragging PAT.

- Seasonality: DEX/MTS uneven (H1 boosted last year; Europe vacations impacted Q2).

Tailwinds (Supportive Factors Driving Resilience)

- Strong Revenue Diversification: Acquisitions fueling growth—CL: 64% YoY to ₹319 Cr (DEXIT 44% contribution); NIIT MTS: 20% YoY (15% CC), AI at 10% of revenues. Three-pillar model (EdTech/MarTech/Assessments) reducing legacy dependency.

- Client Retention & Synergies: 100% renewals (NIIT); DEXIT seamless NSEIT integration, zero disruption, test sim synergies. NIIT added 10 logos (incl. MST’s 7), revenue visibility ₹409 Cr.

- AI-First Momentum: NIIT pole position in AI-learning (Fosway recognition); embedded AI boosting effectiveness (not just efficiency), enabling L2/L3 training upgrades. CL incorporating AI for doubt-solving/SOP.

- New Segment Traction: BBA-IPM/UG growth (IIM programs); platform monetization (EasyApply); institutional tie-ups. MarTech stable (6% YoY, intl. up 33%).

- Operational Discipline: EBITDA growth (CL: 101%; NIIT: 20.3% margins); cost controls via variable outsourcing amid uncertainty.

Growth Prospects (Opportunities Ahead)

- High Double-Digit Expansion: NIIT guides 12.5-13% CC FY26 growth (organic 10%+); CL’s DEXIT (12% YoY, 40% EBITDA growth) and synergies position group as “three-engine platform.” Annualize H1 for ~₹600-650 Cr potential.

- AI & Digital Scaling: AI revenues to grow rapidly (NIIT); CL’s DEX (27L assessments) + test prep sims. Corporate skilling amid layoffs/skill gaps (outsourcing up in volatility).

- Inorganic/Geographic Push: CL planning equity raise for DEX/others; NIIT’s MST unlocks DACH industrials (21% of biz), near-shore efficiencies. UG/Law/BBA, publishing bundles, intl. MarTech.

- Market Tailwinds: Rising CUET difficulty; UG IIMs; skill obsolescence driving L&D (tech/telecom/life sciences strong). Platform plays (monetization, partners) for recurring revenue.

- FY26 Outlook: Mid-teens organic growth feasible; margins 20%+ sustainable with leverage.

Key Risks (Potential Downside Threats)

- Debt & PAT Volatility: CL’s ₹200 Cr acquisition debt (6-yr term) + INDAS adjustments (₹5 Cr/qtr); premature repayment uncertain. NIIT’s deal-linked debt mix.

- Execution in Flux Markets: Test prep ARPUs/margins at risk if online/low-price shift persists; new launches (UG/AI) unproven. Integration hiccups (e.g., NSE brand loss).

- Macro/Geo Risks: Prolonged uncertainty (tariffs, EU-China chips tussle) delaying deals (NIIT pipeline robust but cycles stretch); sector slowdowns (tech layoffs).

- Competition & Dependency: Online players eroding offline; reliance on marquee exams/clients (IRDA/ICAI/NTA); CUET non-revival.

- Capex/Investment Drag: MarTech/Utsav investments (3% EBITDA dip); NIIT’s sales/capability spends cap leverage.

Summary

The Indian Education sector shows resilience amid flux, with tailwinds from AI, acquisitions, and diversification outweighing headwinds like pricing pressure and macro delays. CL Educate’s 64% topline surge (DEXIT-led) and NIIT MTS’s 20% growth/AI traction signal mid-teens FY26 prospects, pivoting from legacy test prep to assessments/L&D outsourcing (₹600+ Cr run-rate). Key monitor: Debt costs (PAT drag) and macro recovery. Bull case: AI scales to 20%+ revenues, inorganics unlock ₹100 Cr+ adds. Bear case: Prolonged volatility caps organic at low-teens, erodes EdTech margins. Overall, positive structural shift to digital/AI, but tactical risks persist—favor diversified players like these.

Press Release

asof: 2025-11-29

Indian Education Sector Analysis (Based on Provided Press Releases)

The press releases from CL Educate, NIIT Ltd., NIIT MTS, and Zee Learn highlight positive momentum in EdTech, upskilling, AI integration, and diversified education services. They reflect a sector leveraging technology for growth amid steady revenue expansion. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- AI and Tech Adoption: Strong push into AI-driven solutions, e.g., NIIT’s “Building Agentic AI Systems” program (targeting autonomous AI talent gap, backed by McKinsey/Deloitte projections of $2.6-4.4T value), NIIT MTS’s award-winning NVERSE AI tool, and Vidysea’s AI for personalized study abroad guidance.

- Revenue Growth and Efficiency: CL Educate reported 7% YoY revenue growth to ₹263 Cr (9M FY25), with stable ~7% EBITDA margins; Q3 revenue up 6%.

- Strategic Expansions: CL’s ₹230 Cr + earn-out acquisition of NSEIT (20%+ market share in ₹7,000 Cr digital assessments market); Zee Learn’s $1M seed in Vidysea; NIIT MTS’s global awards (7 wins) validating enterprise L&D services.

- Diversification: Entry into social events (Kestone Utsav), MarTech/EdTech growth, and vocational/upskilling (recruitment exams, certifications).

Headwinds (Challenges)

- Margin Pressures: CL Educate noted EBITDA dip to 7% (vs. 8% YoY) and a “challenging quarter” for EdTech/MarTech margins, signaling cost inflation or competitive pricing.

- Execution Delays: CL’s NSEIT acquisition awaits consummation; Vidysea addresses outdated study abroad processes (e.g., admissions/visas).

- Talent and Market Gaps: Industry-wide need for AI upskilling (only 15% processes semi-autonomous per Capgemini), with risks from wage inflation/recruitment.

Growth Prospects

- High-Growth Markets: Digital assessments (₹7,000 Cr), Agentic AI (25% companies piloting by 2025 per Deloitte), study abroad (AI-personalized guidance for global institutions).

- Upskilling Demand: Programs like NIIT’s 25-week AI specialization (hands-on with LangChain, etc.) align with India’s AI hub ambitions; enterprise L&D (NIIT MTS’s 100% renewal rate, NPS 9/10).

- Investment and Innovation: Seed funding trends (Vidysea), portfolio diversification (test-prep to assessments/events), and scalable tech platforms position sector for 5-6 quarter outlook (per CL CFO).

- Global/Enterprise Scale: NIIT MTS serves 32 countries; awards boost credibility for workforce transformation.

Key Risks

- Acquisition/Integration: Deal completion (e.g., NSEIT earn-out tied to FY25 performance) and synergy realization.

- Competition and Economics: Intense rivalry, pricing environment, tech/wage inflation (explicitly noted in CL release).

- Regulatory/Forward-Looking Uncertainties: SEBI compliance, policy changes; forward-looking risks (competition, retention) could materially impact results.

- Tech Dependency: Over-reliance on AI hype; slower adoption if enterprise pilots fail (e.g., only 50% by 2027 per Deloitte).

Summary: The sector enjoys robust tailwinds from AI upskilling, digital expansion, and revenue stability (7% growth), with strong growth prospects in ₹7,000 Cr+ markets like assessments and autonomous AI. However, headwinds like margin erosion and execution hurdles persist, alongside risks from competition, integration, and macro factors. Overall outlook positive, driven by tech innovation, but requires vigilant cost management and deal execution for sustained momentum.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.