GLFL

Equity Metrics

January 13, 2026

Gujarat Lease Financing Limited

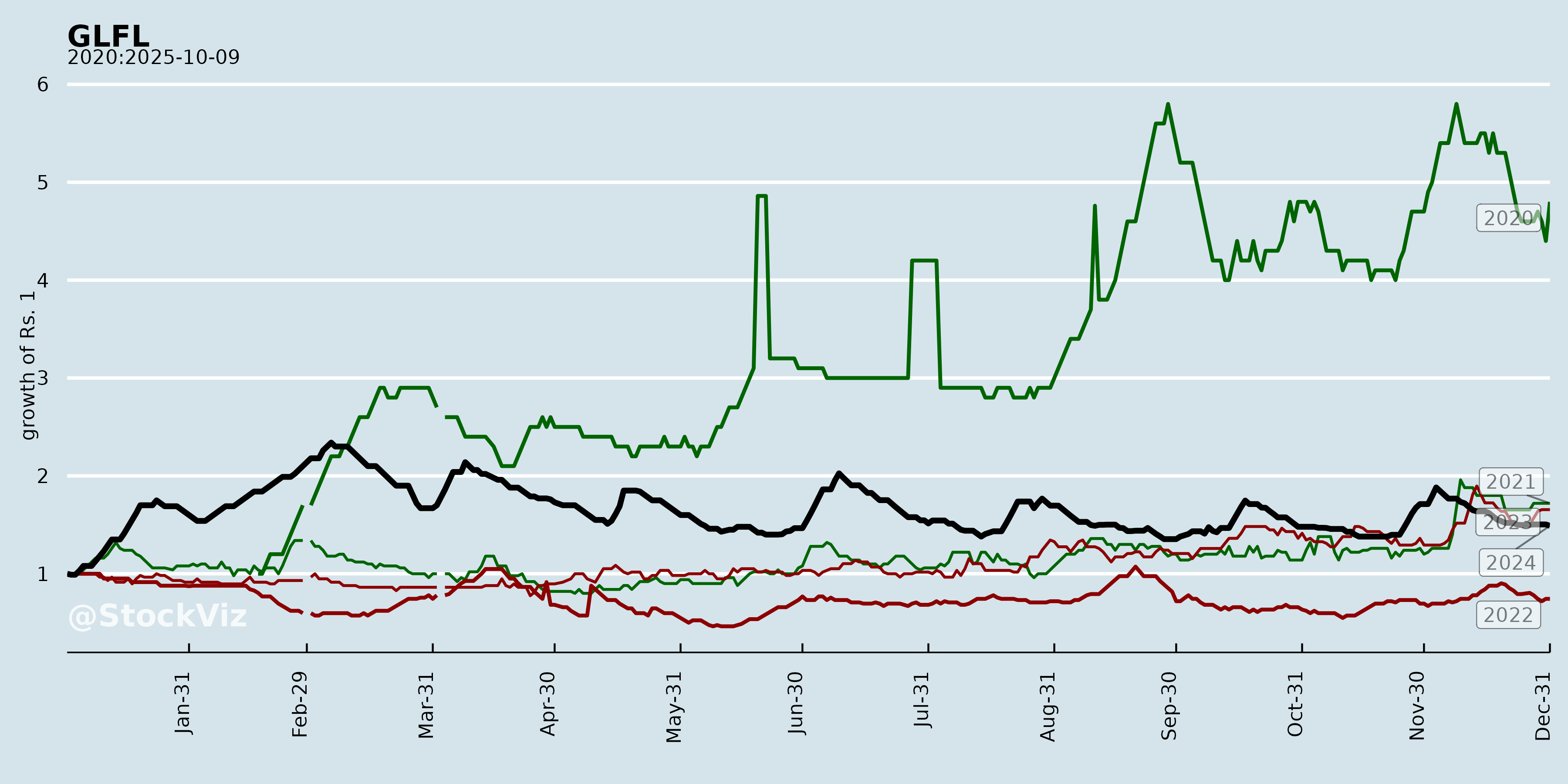

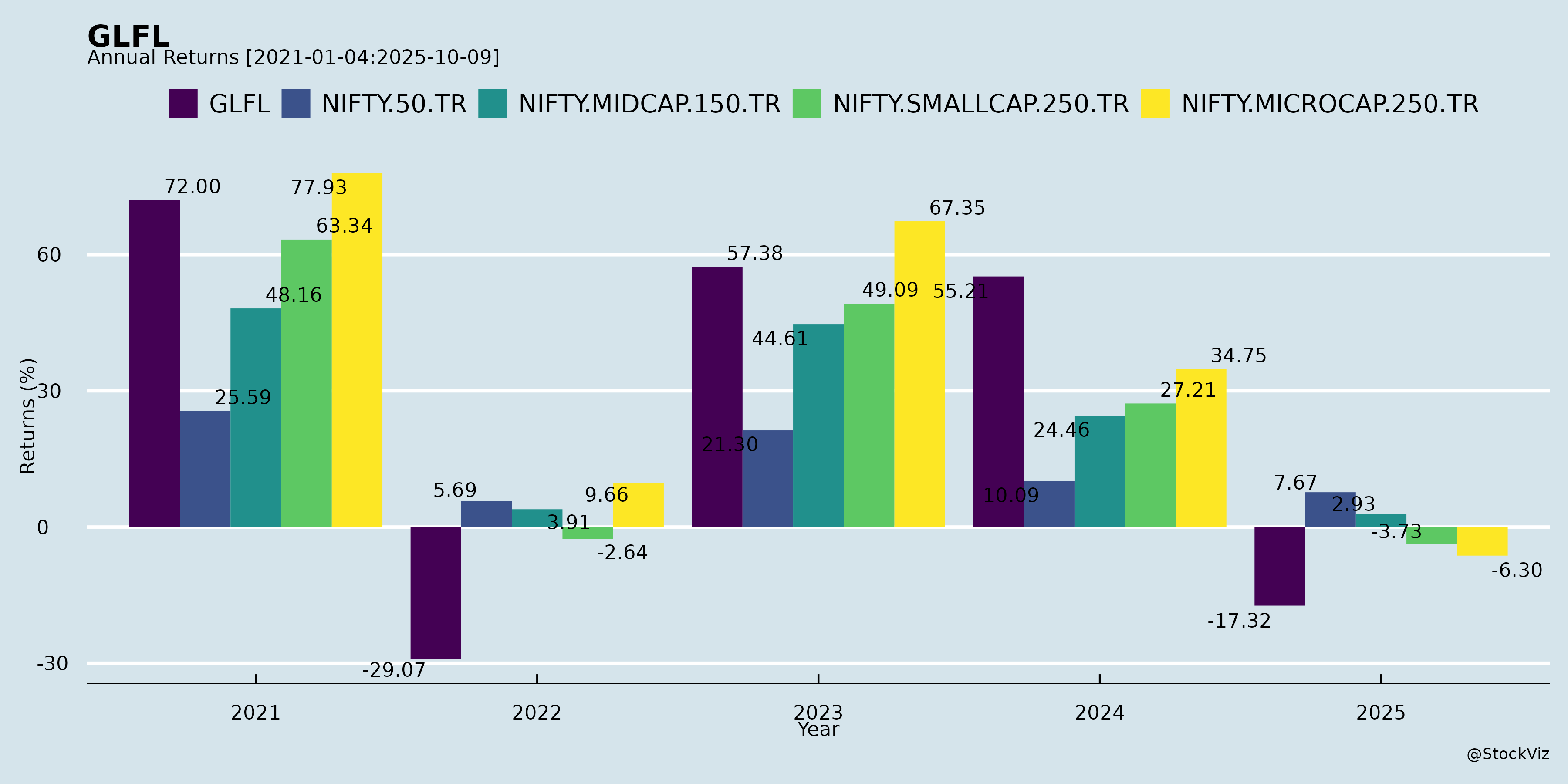

Annual Returns

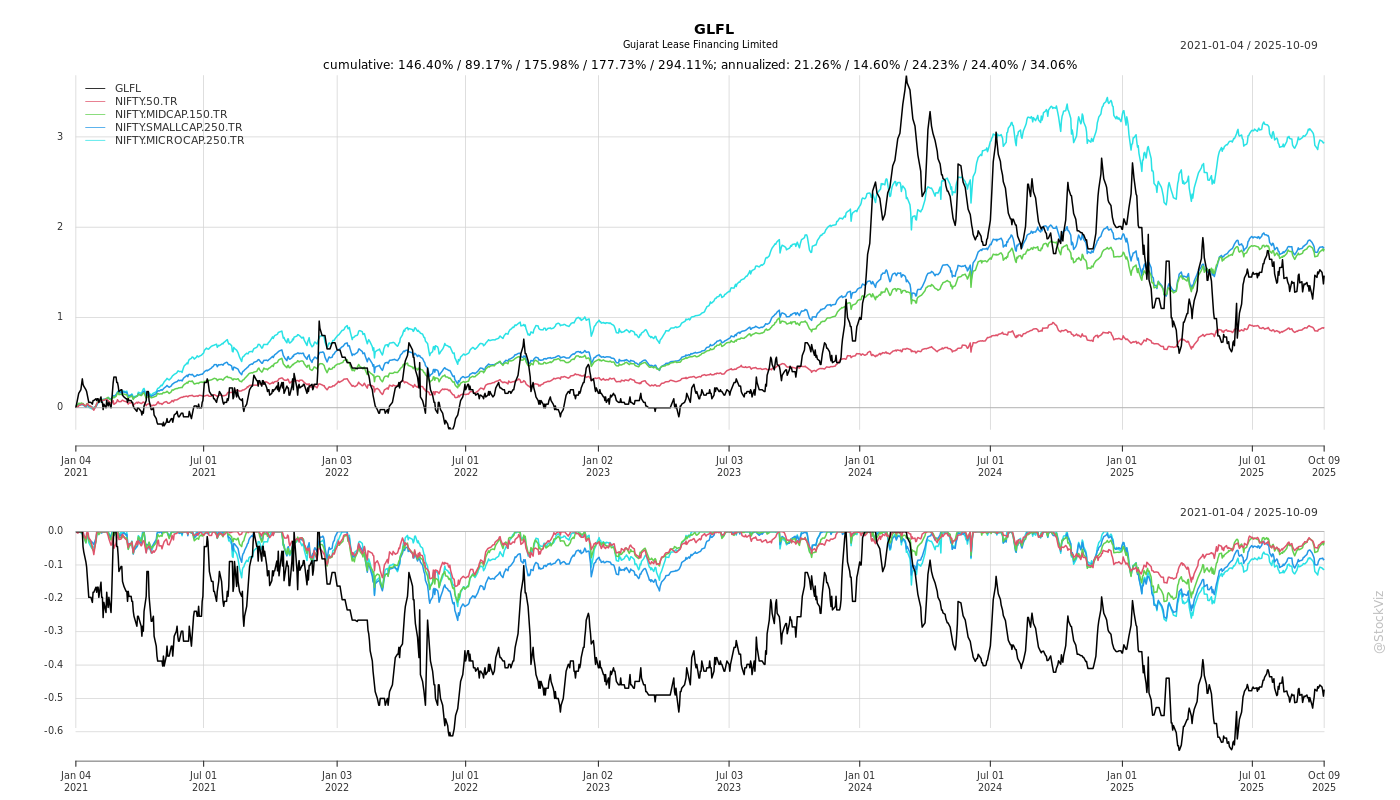

Cumulative Returns and Drawdowns

Fundamentals

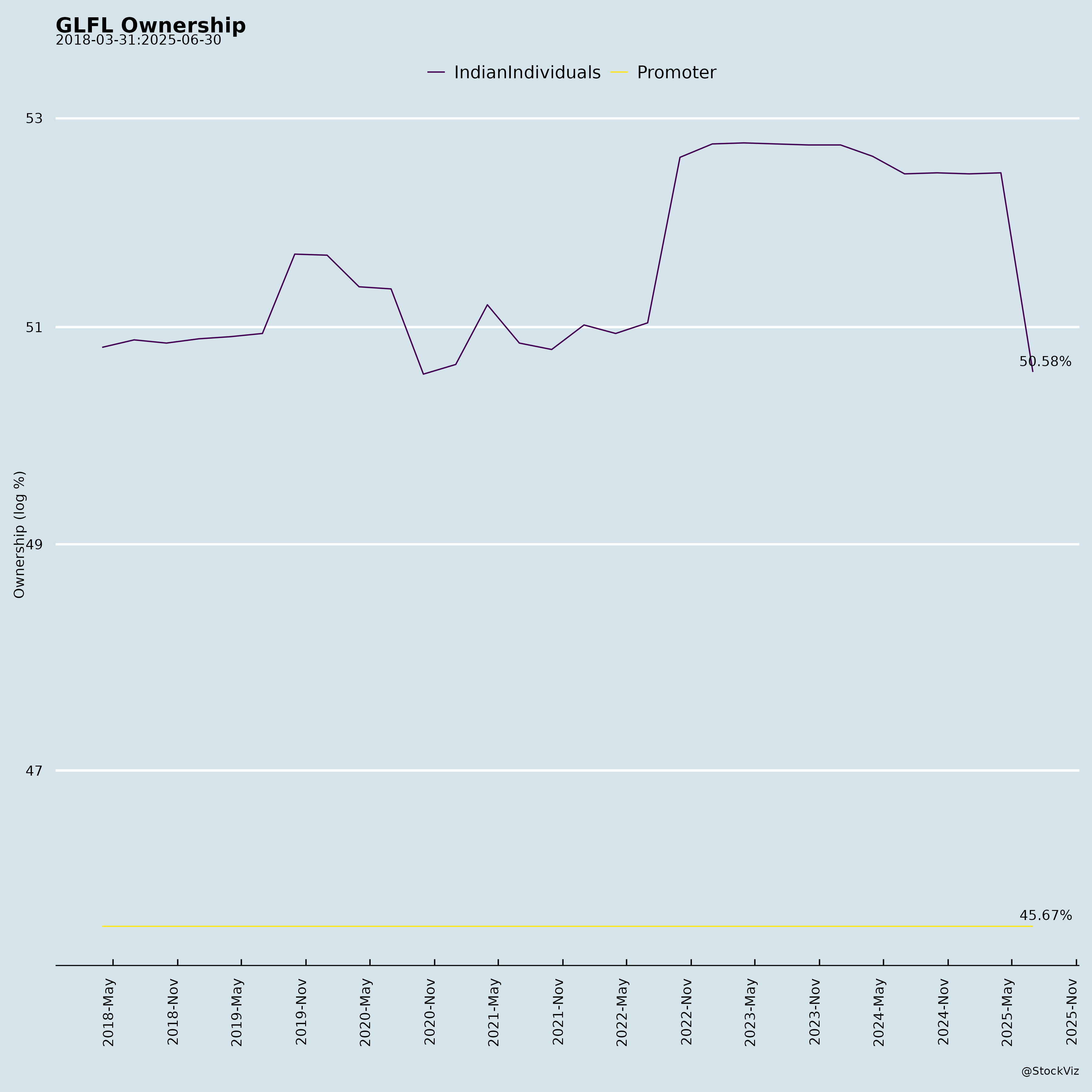

Ownership

Margined

AI Summary

asof: 2025-12-10

Comprehensive Analysis of Gujarat Lease Financing Limited (GLFL) – Stock: GLFL (BSE: 500174 | NSE: GLFL)

Based on Unaudited Financial Results for Q2 and H1 FY26 (Sep 30, 2025) and Regulatory Disclosures Dated October 17, 2025

🔍 Summary Overview

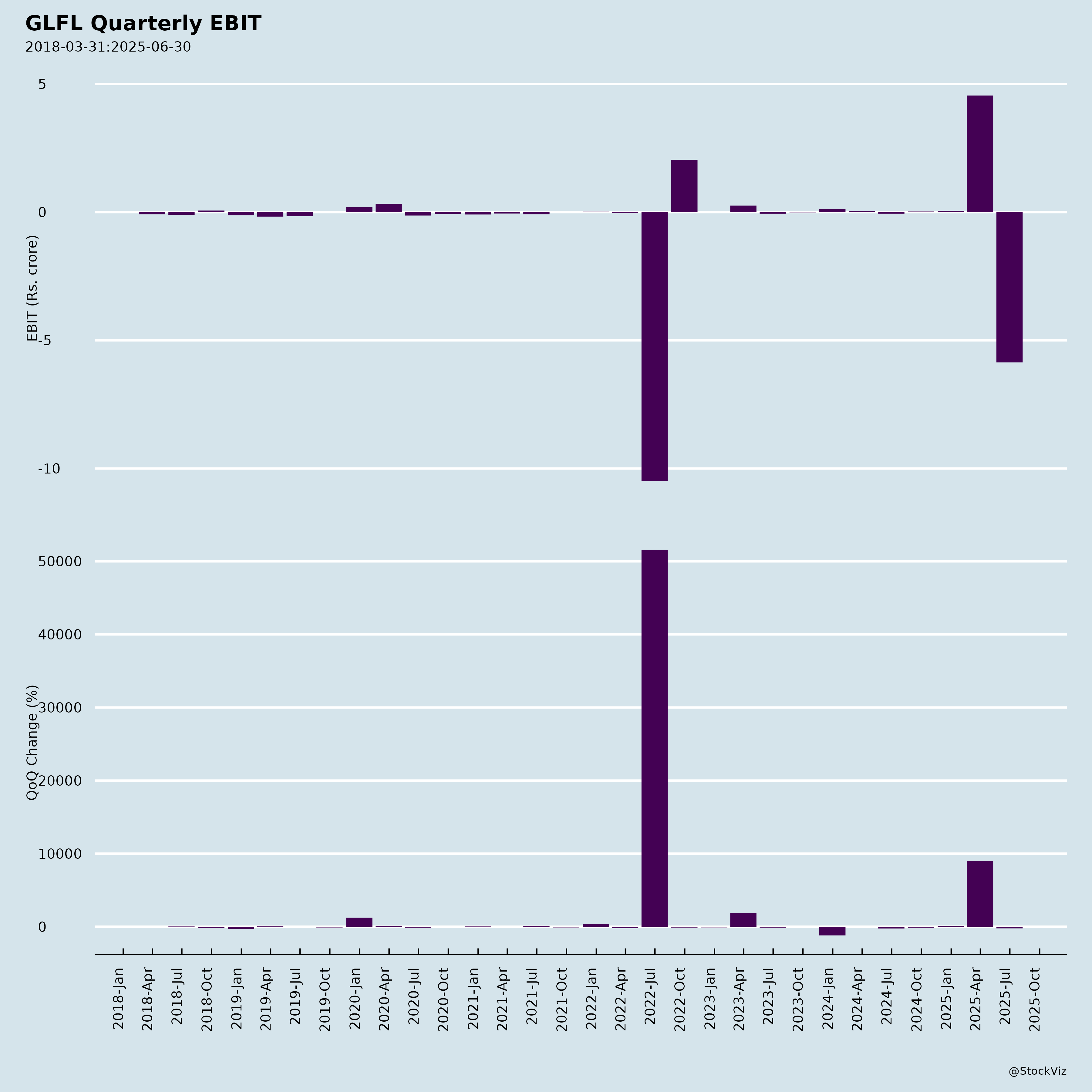

Gujarat Lease Financing Limited (GLFL) is a non-operational, legacy finance company that continues to exist in a non-going concern status, with negative net worth, minimal income from passive sources, and no active business operations or plans. Despite reporting a small quarterly profit of ₹2.12 lakhs, the company is effectively in a state of financial wind-down.

Its financial statements are prepared on a liquidation basis, with assets (mainly financial and real estate) stated at lower of cost or realizable value, due to the absence of future business activity.

🌬️ Headwinds (Negative Factors)

❌ Non-Going Concern Assumption

- The financial statements are prepared under non-going concern basis.

- Explicitly mentioned: “The company does not have any business plan and does not intend to have any business activity in near future.”

- Implication: The company is winding down, not scaling up. Investors should not expect revival or earnings growth.

-

- As of September 30, 2025:

- Total Equity: ₹(409.41) crores (negative ₹409.41 lakhs)

- Accumulated losses exceed capital.

- Total Liabilities (₹1,043.85 crores) > Total Assets (₹634.44 crores)

- Total Equity: ₹(409.41) crores (negative ₹409.41 lakhs)

- This is a severe red flag indicating balance sheet insolvency.

- As of September 30, 2025:

💸 Minimal Revenue from Core Operations

- Revenue from Operations: ₹0.00 for the quarter and YTD.

- All income (₹10.56 lakhs in Q2 FY26) comes from Other Income, likely interest or asset monetization.

- The company is not operational in any meaningful sense.

🏗️ Legacy Liabilities & Legal Pending Items

- ₹1,000 crores of borrowings appear as financial liabilities.

- A scheme of arrangement with 16 banks was approved in 2004 (19 years ago), and final deed of assignment of charged assets is still not completed.

- Long pendency indicates unresolved legal/creditor complexity.

💵 Unabsorbed Tax Losses Not Recognized

- The company has carry-forward losses and unabsorbed depreciation, but deferred tax assets not recognized due to lack of future profitability visibility.

- No tax shield benefit can be booked.

📉 No Earnings Visibility or Growth Plan

- No business strategy, capex plans, or new revenue initiatives.

- No reportable segments – consistent with zero business activity.

🌬️ Tailwinds (Positives / Mitigating Factors)

💰 Consistent Passive Income

- Other Income: ₹10.56 lakhs (Q2 FY26), up from ₹10.50 lakhs YoY.

- Income likely from bank interest, rent, or financial assets.

- While not scalable, it provides modest cash inflow for administrative continuity.

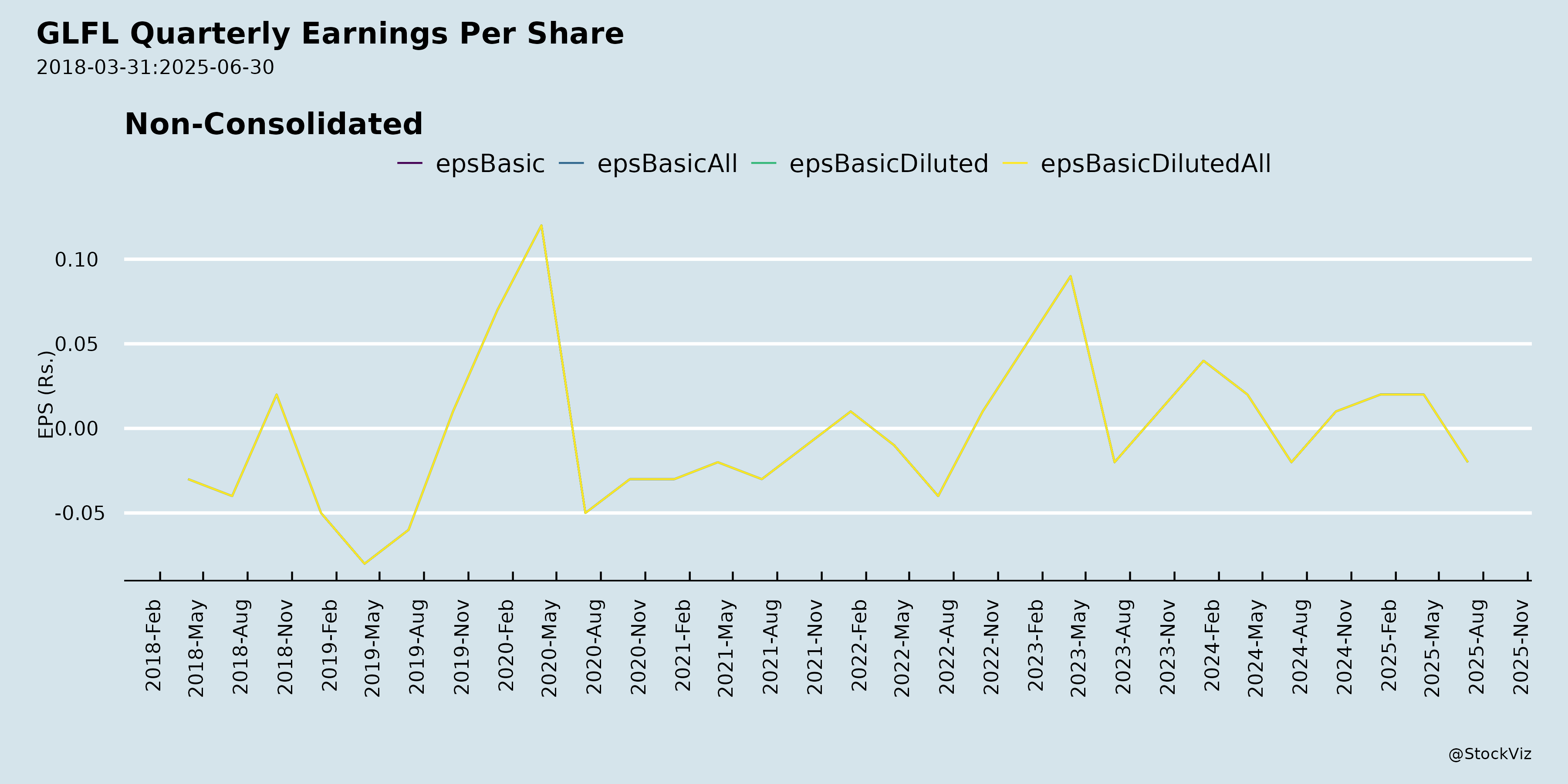

💹 Small Profitability in Q2 FY26

- Profit after tax: ₹2.12 lakhs, despite zero operations.

- Slight improvement vs ₹2.45 lakhs in Q2 FY25 (very minor deterioration).

- Shows cost control — expenses down YoY for the quarter (₹8.44L vs ₹8.05L).

💧 Positive Operating & Investing Cash Flow

- Net Cash from Operating Activities: ₹(18.17) lakhs

- But Net Cash from Investing Activities: ₹21.03 lakhs — primarily due to ₹565 crores release from other bank balances, indicating liquidity unlocking.

- Net Increase in Cash: ₹0.85 lakhs for H1 FY26.

- Suggests realization of locked-in financial assets or interest income.

- Net Cash from Operating Activities: ₹(18.17) lakhs

🏦 Statutory Auditor’s Clean Review

- The limited review by auditors (G.K. Choksi & Co.) concludes no material misstatement found.

- Enhances reporting credibility, though review ≠ audit.

✅ Regulatory Compliance

- Timely disclosure under SEBI LODR, Board approval within minutes, digital signing by CS — suggests a well-managed shell.

- Maintains listing obligations despite inactivity.

🔐 Large Cash Reserves

- Cash & Cash Equivalents: ₹574 crores

- Along with Other Bank Balances: ₹1.94 crores, this is substantial for a dormant company.

- Potential value unlockable via dividend, buyback, or corporate action.

- Cash & Cash Equivalents: ₹574 crores

📈 Growth Prospects (Very Limited)

| Aspect | Assessment |

|---|---|

| Core Business Revival | ❌ Unlikely. No plans or capability. |

| Revenue Growth | ❌ Zero operations → no growth. |

| New Markets / Activities | ❌ None. Explicitly stated: “no business plan”. |

| Asset Monetization | ✅ Potential. High cash and receivables. |

| Corporate Restructuring / Takeover | ⚠️ Possible, given listing status and clean review, but constrained by negative equity. |

| Dividend Potential | ⚠️ Possible if surplus is distributed after resolving liabilities. |

Overall Growth Outlook: ⚫ Negligible / Non-existent. The company is a shell entity. Any “growth” would be via financial restructuring or sale of listing, not operational performance.

⚠️ Key Risks

| Risk Type | Description |

|---|---|

| Balance Sheet Insolvency | Liabilities exceed assets by ₹409+ crores. Technically insolvent. |

| Regulatory / Delisting Risk | If net worth remains negative, BSE/NSE may initiate delisting under equity infraction rules. |

| Zero Business Model | No operations, no strategy — extremely vulnerable to obsolescence. |

| Unresolved Bankers’ Settlement (2004) | Legacy issue may resurface; regulatory or creditor challenge possible. |

| Lack of Future Tax Assets Recognition | No future income → deferred tax assets remain trapped. |

| Corporate Governance Risk | One-off profits and cash fluctuations may mislead low-volume traders. |

💡 Investor Takeaways

| Perspective | Viewpoint |

|---|---|

| Fundamental Investor | ❌ Avoid. No earnings, no operations, negative equity. |

| Speculative Trader | ⚠️ Caution. Possible volatility on back of cash balance or event-driven actions (e.g., dividend). |

| Shell Hunting / Reverse Merger | ⚠️ Possible, but negative net worth and creditor issues deter acquirers. |

| Long-Term Holders | ⚠️ Only if expecting value unlock via asset distribution. Not a growth play. |

📌 Final Summary

| Category | Assessment |

|---|---|

| Financial Health | 🟥 Critically Weak (Negative Equity, Liab > Assets) |

| Operations | 🟥 Inactive / Dormant Company |

| Earnings | 🟨 Passive only, non-recurring |

| Cash & Liquidity | 🟩 Healthy (₹574 crores cash) |

| Growth Prospects | 🔴 None |

| Regulatory Status | 🟩 Compliant, but under scrutiny risk |

| Investment Suitability | ❌ Not suitable for income or growth investors ⚠️ Only speculative interest from shell traders or restructuring experts |

✅ Conclusion

Gujarat Lease Financing Limited (GLFL) is not a functioning enterprise, but a dormant financial shell with significant past liabilities and substantial liquid assets. While recent filings confirm no immediate accounting irregularities, the company presents extreme financial fragility and zero growth outlook.

Any investor interest should be strictly event-driven — e.g., potential special dividend, corporate action, or takeover — and not based on operational fundamentals.

Recommendation: Strong Avoid for most investors. Monitor only for corporate restructuring signals.

📍 Key Watch Items Going Forward: - Movement on final deed of asset assignment to banks. - Use of ₹574 crore cash balance — will it be distributed? - Any proposal to wipe off accumulated losses. - SEBI or exchange action due to prolonged negative net worth. - Board’s intent — liquidation, revival, or dormancy?

Prepared As Of: October 18, 2025

Based Solely on Public Disclosures Dated October 17, 2025

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.