Other Financial Services

Industry Metrics

January 13, 2026

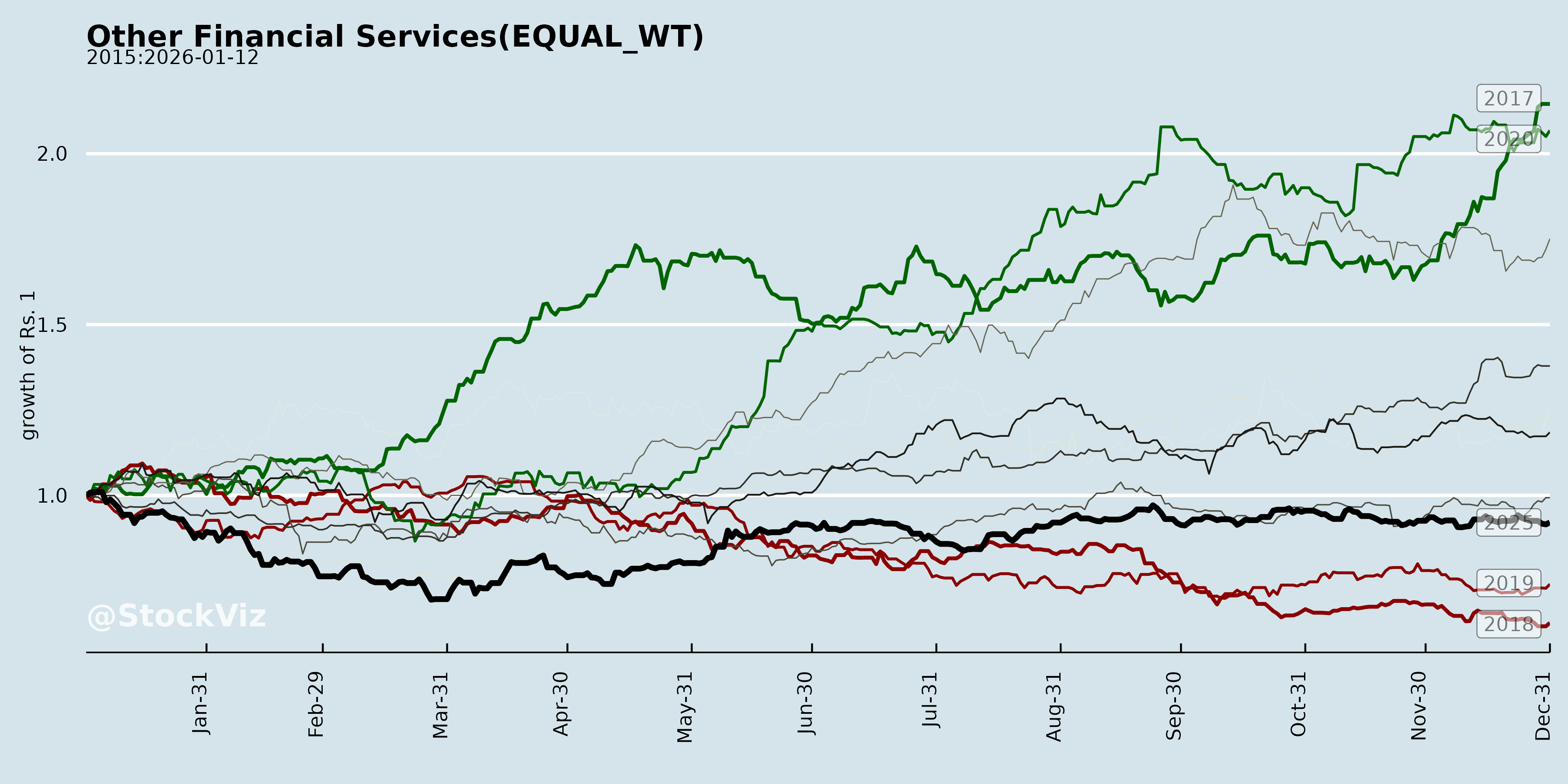

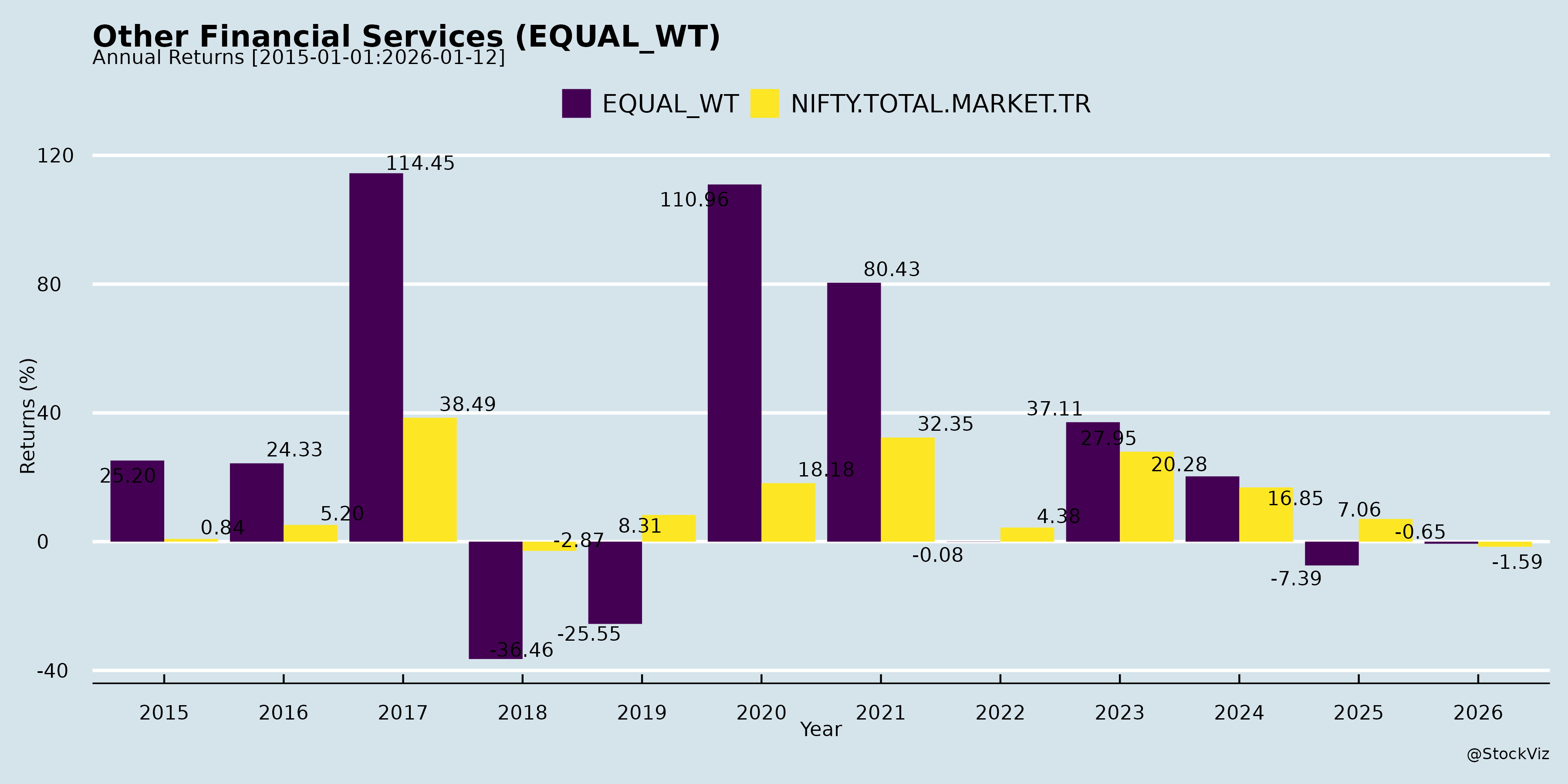

Annual Returns

Cumulative Returns and Drawdowns

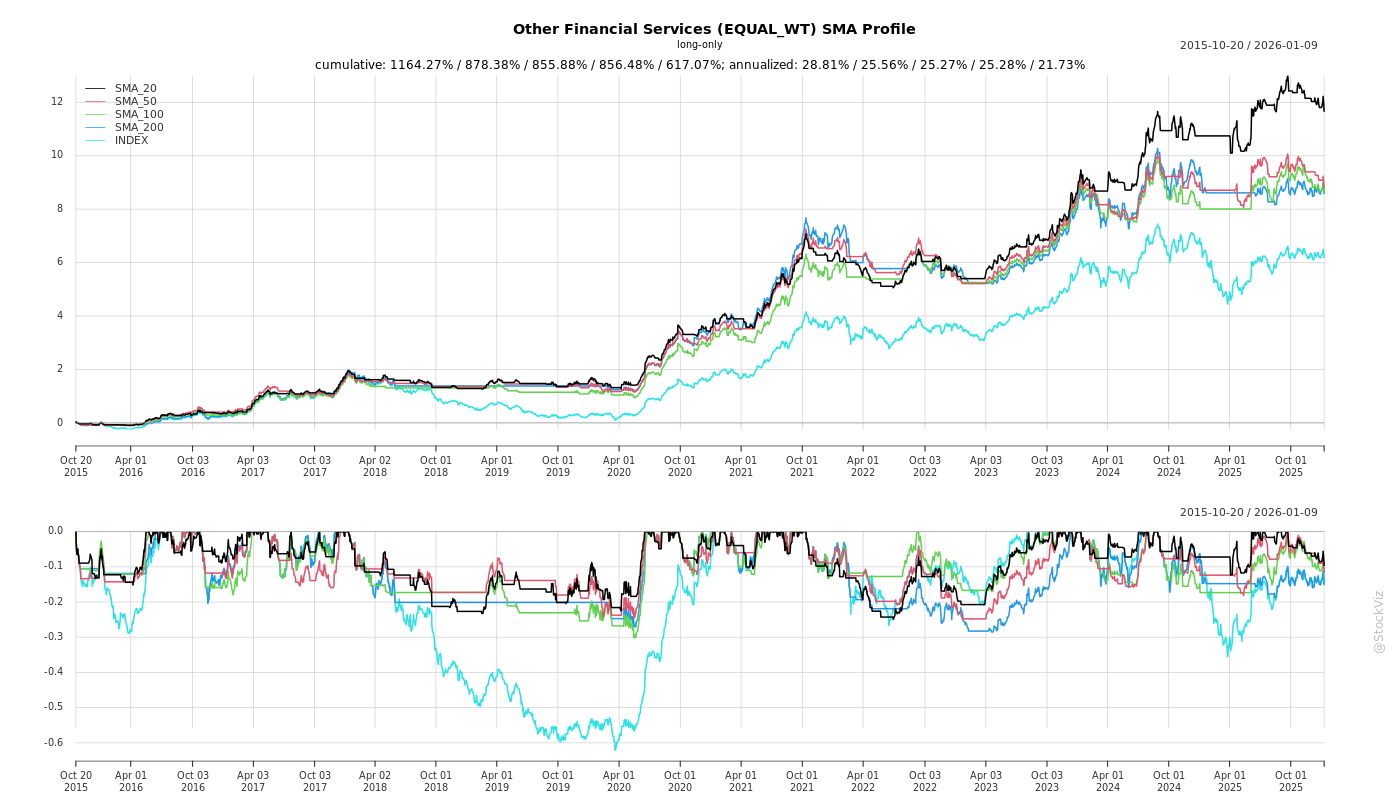

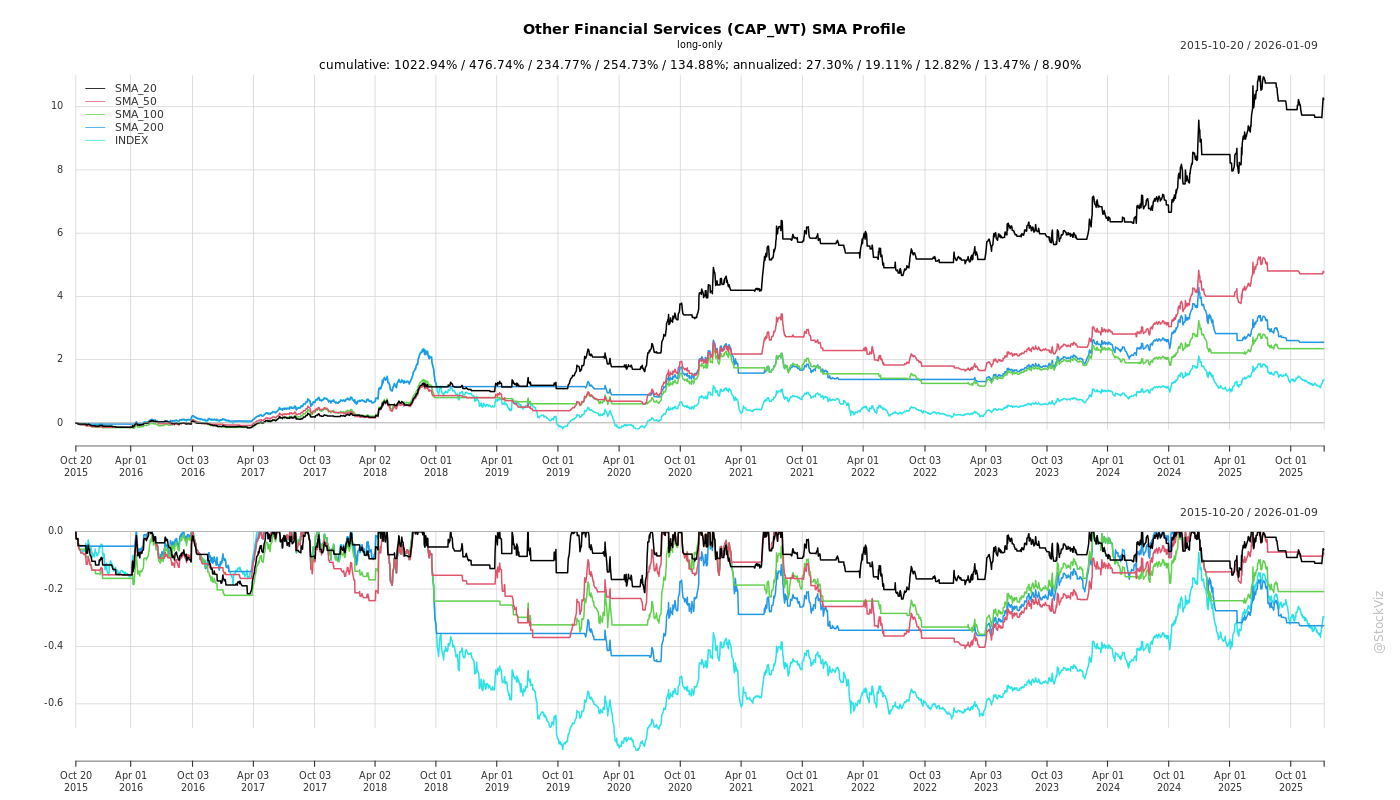

SMA Scenarios

Current Distance from SMA

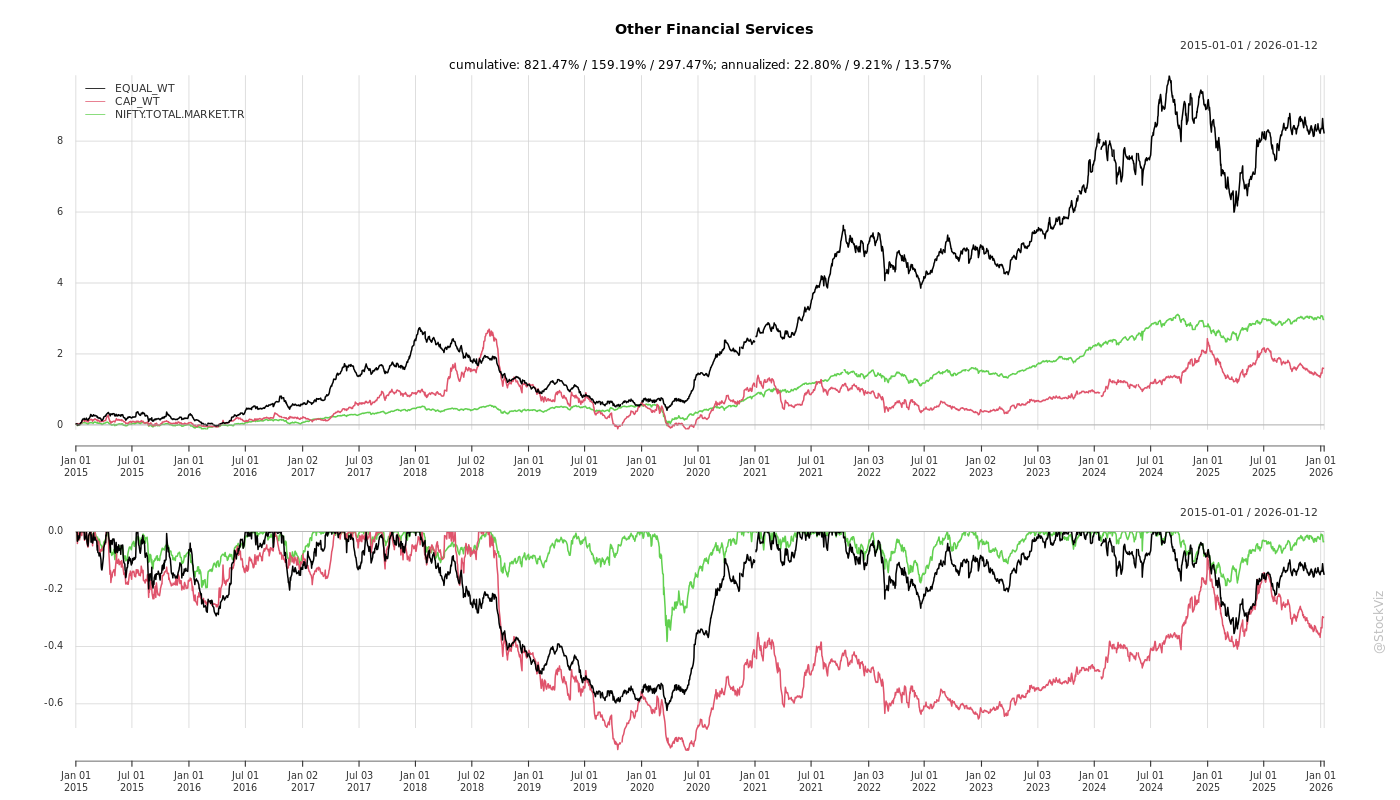

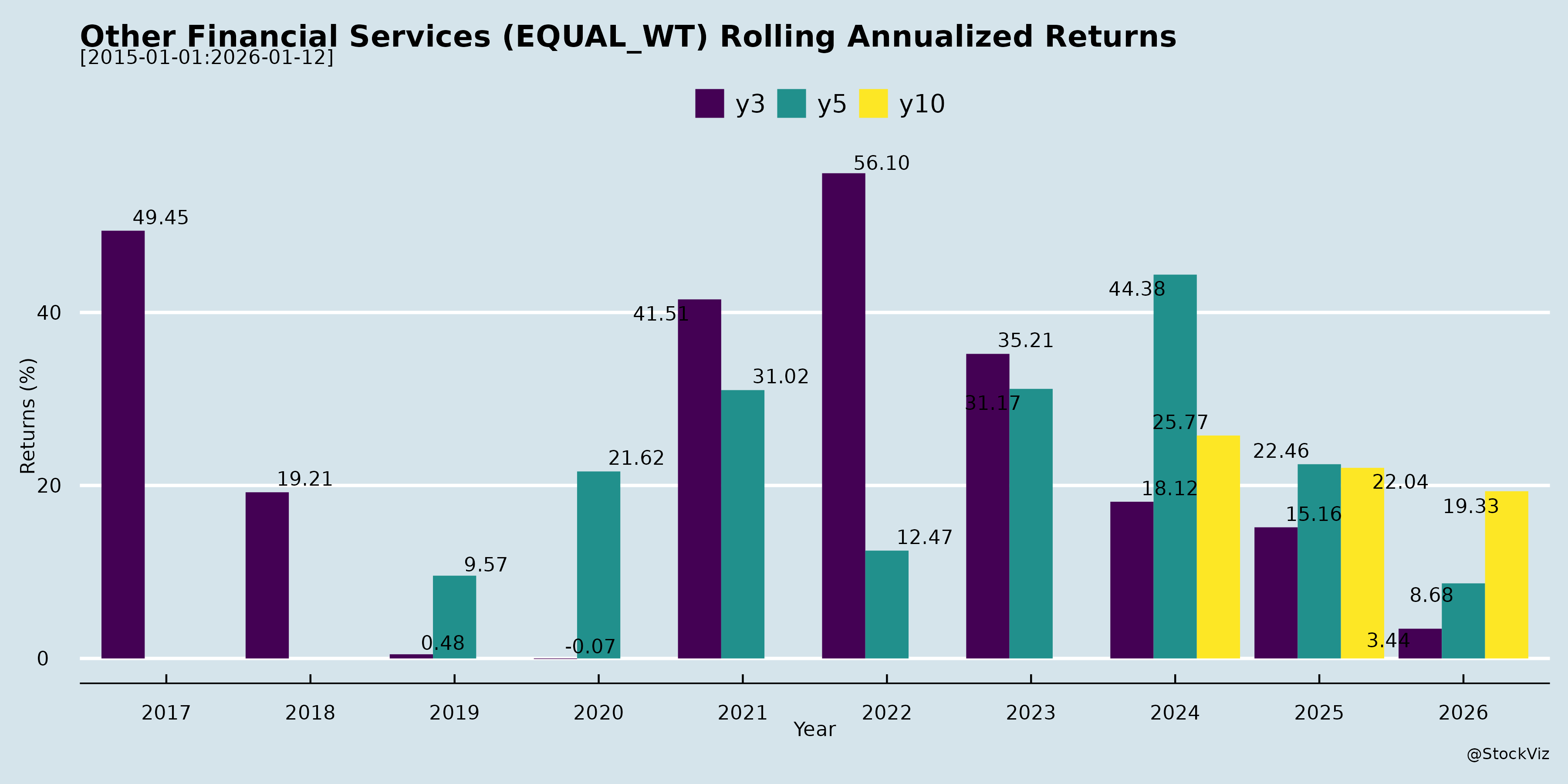

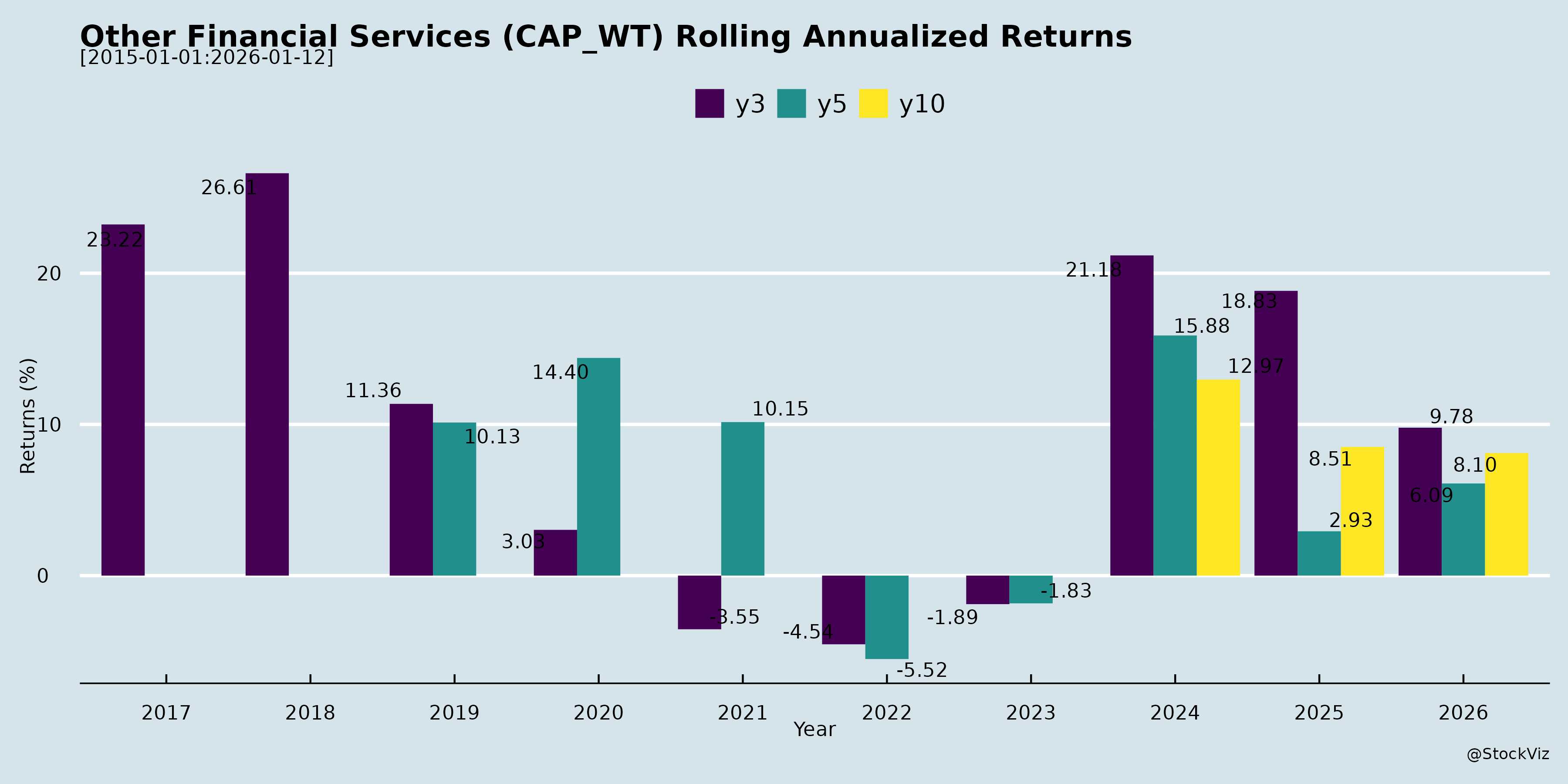

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Analysis of Indian Other Financial Services Sector

Using the provided Crisil Analyst Call transcript (May 2025) as the primary input—representing key players in ratings, analytics, benchmarking, and risk solutions—and the minor Wealth First intimation (indicating ongoing investor engagement), here’s a structured analysis for the Indian Other Financial Services sector (encompassing credit ratings, market intelligence, analytics, portfolio management, and related services). Crisil’s insights reflect sector dynamics, given its leadership and S&P Global affiliation.

Headwinds

- Global Macro Uncertainty: US tariffs, geopolitical tensions (e.g., trade realignments), and policy shifts post-elections are straining growth, consumer sentiment, trade, and inflation. S&P Global forecasts slowdowns, leading to tighter client budgets and delayed discretionary spends (impacting global analytics/revenue ~flat/negative in CY2024).

- Discretionary Spending Cuts: Global banks (esp. large US/UK) and asset managers curtailing non-essential spends amid cost-to-income pressures, bank failures (e.g., SVB), and elections. Crisil’s Research, Analytics & Solutions (RAS) segment saw muted CY2024 growth (~flat) and only +2% in Q1 FY25.

- Domestic Moderation: Bank credit growth slowed to 11% (Feb 2025) from 16.6%; wholesale/large corporate credit at 9.8%/5.2%. Bond issuances muted post-Oct 2024 (+3.9% YoY in Q1 2025) due to rate cut anticipation.

- Competitive/Structural Pressures: GCC scaling, offshoring competition, and low-end bank loan erosion (e.g., banks skipping ratings for <₹10 Cr loans). Pricing remains competitive.

Tailwinds

- Domestic Resilience: India’s GDP at 6.5% FY26 (investment-driven); RBI’s 50 bps rate cuts (to accommodative stance), softening G-Sec yields (<6.5%), boosting bond traction (CY2024 +12.5%). Bank credit expected at 12-13% FY26 (NBFC risk weights rolled back, tax cuts, lower rates).

- Corporate Strength: Deleveraging, healthy balance sheets (NPAs at 2.5-2.6%), earnings CAGR 12% (FY19-25), mutual fund AUM at 18.2% GDP. Capacity utilization ~75%, supporting infra/renewables/EV capex.

- Sector-Specific Demand: Investor preference for “best-in-class” ratings (Crisil leadership); surveillance/new ratings momentum (+32.5% YoY Q1 FY25). Global traction in private markets, GenAI, benchmarking, and transformation (cloud/AI/ML).

- Franchise & Tech: Crisil’s new branding, GenAI integrations (e.g., Credit+ ICON, Fulcrum), GAC growth from S&P delegations. Recognitions (Chartis RiskTech 100).

Growth Prospects

- Short-Term (FY25-26): Ratings (Crisil Ratings + GAC) to lead with 20-30% quarterly momentum, driven by bonds (+ expected from rate cuts), mid-corporates, infra. RAS recovery via India research/consulting (+momentum), Coalition Greenwich (CIB/commercial banking scaling), Integral IQ (private capital, midsize banks, offshoring).

- Medium-Term: Private capex revival (post-geopolitical clarity), capex-intensive sectors (70% industrial capex: steel/cement/CVs), mutual funds/passives. GenAI as efficiency booster/opportunity (e.g., credit reports, analytics). Portfolio diversification (global 40-50% revenue) hedges India risks; target GAC/S&P expansion.

- Overall: Crisil’s FY24 revenue +3.8%, Q1 FY25 +10.2%; PBT/PAT +16% QoQ. Sector poised for 10-15% growth if macros stabilize, led by domestic (ratings/intelligence) and niche global (benchmarking/AI).

| Segment | CY2024 Growth | Q1 FY25 Growth |

|---|---|---|

| Ratings Services (incl. GAC) | Strong (domestic bonds + surveillance) | +32.5% YoY |

| RAS (Intelligence + Greenwich + Integral IQ) | Marginal decline | +2% YoY |

Key Risks

- Geopolitical/Macro: Tariffs/trade wars delaying capex (brownfield/NCLT acquisitions preferred over greenfield); global slowdown spilling to India (downside GDP bias).

- Client/Revenue Volatility: Discretionary deferrals (global banks); deposit-credit gap narrowing LDR (81% high), limiting lending.

- Operational: FX fluctuations (hedged via forwards); attrition (stable, industry-aligned); talent/people risk as “talent company.”

- Regulatory: Potential SEBI tightening (end-use monitoring, equity track record for MA ratings—feedback stage, no final guidelines); RBI measures on NBFCs.

- Tech/Competition: GenAI disruption (early POCs, but domain expertise mitigates); GCC/third-party competition in offshoring.

Summary: The sector shows resilience (domestic tailwinds > headwinds), with ratings/analytics driving near-term growth amid global caution. Prospects hinge on rate cuts, capex revival, and GenAI adoption, but geopolitics pose the biggest overhang. Crisil’s Q1 FY25 outperformance (+10% revenue) signals potential upside if uncertainties ease; monitor annual trends over quarters for true momentum. Wealth First’s meeting indicates sustained investor interest.

Financial

asof: 2025-12-02

Analysis of Indian Other Financial Services Sector

The provided documents cover Q1 FY25 (e.g., Crisil), Q3 FY25 (e.g., Investment Trust, Maha Rashtra), and FY25 annual results/clarifications from firms in ratings (Crisil), securities/broking/advisory (Prime Securities, Investment Trust), NBFCs/investment trusts (Maha Rashtra, NDL Ventures), and others (Delphi, GACM). This represents a diverse sub-sector including ratings, broking, advisory, asset management, and legacy NBFCs. Overall, the sector shows resilient core operations amid market volatility, but faces legacy/regulatory drags. Below is a structured analysis:

Tailwinds (Positive Factors)

- Robust Revenue & Profit Growth in Core Segments: Crisil reported 10% QoQ revenue growth (₹813 Cr consolidated), driven by Ratings (+6% QoQ) and Research/Analytics (+17% YoY). Prime Securities saw 47% YoY revenue surge (₹78.9 Cr for 9M FY25) and 122% PAT growth, fueled by fee/commission income. Investment Trust’s broking/financing segments grew revenues 16% YoY.

- Diversification & New Verticals: Prime expanded into wealth management (new subsidiary) and fintech (41.68% stake in Ark Neo). Crisil’s analytics segment dominates (67% revenue share). Investment Trust benefits from multi-segment play (broking 57% revenue).

- Strong Balance Sheets & Dividends: High cash/investments (Prime: ₹195 Cr), interim dividends (Crisil: ₹8/share), and dividend income from subs (Crisil standalone: ₹72 Cr).

- Market Recovery Signals: Secondary markets fatigue noted but countered by rising deal pipelines (Prime).

Headwinds (Challenges)

- Market & Valuation Pressures: Prime highlights “excessive valuations, large issuances” causing 10-30% index/sector declines, delaying fundraises. Investment Trust’s trading activities near-zero revenue.

- Qualified Audit Reports & Provisions: Maha Rashtra has repeated qualifications—no provision for delayed interest (₹36L for 9M, cumulative ₹322L overstated profit); legacy deposits (₹3,042L outstanding post-2009 court scheme). Auditors emphasize RBI registration cancellation (2002).

- Pending Regulatory/Structural Issues: Multiple schemes/demergers pending NCLT/approvals (Investment Trust, NDL Ventures). Maha Rashtra’s property sale deal lapsed (₹1,273L received).

- Subsidiary/Associate Volatility: Investment Trust’s asset mgmt. segment loss-making (₹1,791L for 9M). Maha Rashtra reports massive associate losses (₹3,312L for 9M).

Growth Prospects

- High Potential in Ratings & Analytics: Crisil’s 10% FY24 revenue growth (₹3,260 Cr), with Ratings up 5% and Analytics 9%; Q1 FY25 PBT margins ~28%. Sector tailwind from increasing credit needs/digitalization.

- Wealth/Fintech Expansion: Prime’s annuity + transactional model scaling; new platforms (DhanLAP). Investment Trust’s financing (25% revenue share) grew 58% YoY.

- 9M FY25 Trends: Aggregate PAT growth (Prime +122%, Crisil steady); full-year outperformance (Prime 9M PAT > FY24 full-year).

- Outlook: 15-20% sector CAGR possible via fintech/wealth (projected ₹10Tn AUM by 2027), supported by capital markets boom (IPOs, PE deals).

Key Risks

| Risk Category | Details | Impacted Firms | Mitigation |

|---|---|---|---|

| Regulatory/Compliance | RBI cancellations, pending schemes, deposit liabilities (₹3K Cr+), interest non-provision. | Maha Rashtra, Investment Trust | Court deposits (₹1,397L), but escalates costs. |

| Audit & Provisioning | Qualified opinions; overstated profits (e.g., Maha Rashtra ₹322L cumulative). | Maha Rashtra | Prudence in tax/DTA recognition. |

| Market/Cyclical | Volatility in broking/trading; high valuations delaying deals. | Prime, Investment Trust | Diversified segments (advisory stable). |

| Associate/Subs Dependency | Losses from associates (₹3.3K Cr in Maha); unreviewed subs. | Maha Rashtra, Investment Trust | Equity method accounting; monitoring. |

| Liquidity/Legacy | Unencashed cheques (₹237L), lapsed deals. | Maha Rashtra | Year-wise reconciliations. |

| Operational | Single-segment reliance (NDL Ventures: minimal ops). | NDL, Delphi, GACM | Clarifications on filings; low revenue base. |

Summary

The Indian Other Financial Services sector exhibits strong tailwinds from ratings/advisory growth (Crisil/Prime leading with 10-47% revenue/PAT jumps) and diversification into wealth/fintech, positioning for 15%+ CAGR amid capital market expansion. However, headwinds like market fatigue and legacy NBFC issues (Maha Rashtra’s qualifications/deposits) cap momentum. Growth prospects are bright for analytics/broking (9M outperformance), but key risks center on regulations (pending approvals, RBI curbs) and provisions (interest/deposits), potentially eroding 10-20% profits in stressed firms. Investors should favor diversified players like Crisil/Prime; monitor legacy-exposed names. Sector PE likely 20-25x on FY26 earnings recovery.

General

asof: 2025-12-03

Summary Analysis: Indian Other Financial Services Sector

Using the provided disclosures (Regulation 30 announcements from companies like Crisil, Centrum Capital, Wealth First Portfolio Managers, Prime Securities, The Investment Trust of India (ITI), Delphi World Money, NDL Ventures, Reliable Data Services, and GACM Technologies), this analysis focuses on the Other Financial Services sector (encompassing NBFCs, investment trusts, portfolio managers, securities firms, broking/advisory, and niche players like forex/remittance and AIF setups). These filings highlight corporate actions, financials, expansions, and challenges as of mid-to-late 2025. The sector shows resilience amid diversification but faces regulatory, legal, and governance headwinds.

Tailwinds (Positive Drivers)

- Expansion & Diversification: Strong push into high-growth areas like fintech (Crisil’s ₹33.25 Cr investment for 4.08% stake in Online PSB Loans), AIFs (Prime Securities incorporating subsidiaries for AIF sponsorship/management with ₹650L investment), and portfolio management (Wealth First’s BSE listing of 1.06 Cr shares). ITI’s multi-segment revenue (broking ₹7,496L, financing ₹6,023L in H1FY26) underscores broad-based operations.

- Capital Raising & Incentives: Rights issues (GACM revising record date), ESOP extensions (ITI extending FFSIL-ESOP 2017 to subsidiaries for talent retention), and listings signal access to equity capital. ITI’s consolidated revenue grew to ₹15,659L in H1FY26 (from ₹19,527L YoY, though selective), supported by broking/advisory recovery.

- Regulatory Compliance Momentum: Timely disclosures (e.g., Centrum’s e-voting rectification, ITI’s OCPS redemption) reflect adherence to SEBI norms, boosting investor confidence.

- Operational Scale: ITI’s subsidiaries (e.g., ITI Securities Broking, Antique Stock Broking) and associates contribute ~₹718L profit share in H1FY26, highlighting group synergies.

Headwinds (Challenges)

- Profit Pressures & Segment Weakness: ITI’s H1FY26 PAT fell 53% YoY to ₹1,582L (consolidated), driven by asset management losses (₹555L) and higher finance costs (₹2,207L). Broking/investment advisory revenues declined 26-71% YoY in Q2FY26.

- Governance & Auditor Issues: Auditor resignations (Reliable Data Services’ statutory auditor cited “preoccupation”) and re-appointments (NDL Ventures) raise red flags on internal controls.

- Legal & Reputational Noise: Delphi’s filings highlight orchestrated misinformation, unauthorized investor data misuse, and interlocutory court orders (status quo in shareholder suits), eroding sentiment amid rights issue completion.

- Cash Flow Strain: ITI’s operating cash flow turned negative (₹645L outflow in H1FY26) due to working capital spikes (e.g., receivables up ₹9,823L), with borrowings rising to ₹51,476L.

Growth Prospects

- High (Medium-Term: 15-25% CAGR Potential):

- Fintech/AIF Boom: AIF setups (Prime) and PSB loans tie-ups (Crisil) tap India’s growing alternatives market (AUM >₹10L Cr). Portfolio management (Wealth First listing) and broking (ITI’s 44% revenue share) benefit from rising retail participation.

- Rights Issues & Consolidation: GACM/Delphi’s capital raises fund M&A/travel synergies (Delphi integrating Ebix’s global travel). ITI’s financing (40% revenue) poised for NBFC-like growth amid credit demand.

- Demerger/Structuring: ITI’s pending demerger of non-lending into Distress Asset Specialist could unlock value (pending NCLT approval).

- Sector Tail: RBI easing for NBFCs, rising HNIs, and digital remittances (Delphi’s forex pivot) support 20%+ revenue growth. ITI’s H1 assets at ₹1.52L Cr (stable YoY) indicate scale-up room.

Key Risks

| Risk Category | Description | Severity (High/Med/Low) | Examples from Filings |

|---|---|---|---|

| Regulatory/Legal | Litigation (Delphi suits on jurisdiction/rights), pending approvals (ITI demerger, AIF registrations), SEBI scrutiny on ESOPs/postal ballots. | High | Delphi’s unauthorized comms & court transfers; ITI scheme pending NCLT. |

| Governance | Auditor churn, data misuse (Delphi investor lists hacked/shared). | High | Reliable resignation; NDL re-appointment post-tenure. |

| Financial/Operational | Rising costs (ITI finance costs +18% YoY), negative cash flows, segment losses (asset mgmt). | Medium | ITI’s ₹31L Cr working capital drag; OCPS redemptions. |

| Market/External | Volatility in broking/advisory (ITI Q2 dip), rumor amplification via social media. | Medium | Centrum e-voting fixes; market-dependent revenues (ITI broking 44%). |

| Execution | Rights issue delays (GACM record date revision), subsidiary integrations. | Low | Wealth First smooth listing; Prime AIF timeline (6 months). |

Overall Outlook: Moderately positive with growth prospects outweighing headwinds (sector poised for 15-20% expansion via fintech/AIFs), but key risks center on governance/legal frictions. Investors should monitor Q3FY26 results, litigation outcomes (e.g., Delphi), and regulatory nods (ITI demerger). Recommended: Focus on diversified players like ITI/Crisil for stability; avoid high-litigation names like Delphi short-term.

Data sourced solely from filings; no external assumptions. Financials in ₹ Lakhs unless stated.

Investor

asof: 2025-11-29

Summary Analysis: Indian Other Financial Services Sector

(Based on Crisil Limited’s Q3FY25 Analyst Presentation and Wealth First Portfolio Managers’ Q2&H1FY26 Investor Presentation. This sector encompasses ratings, analytics, wealth/portfolio management, and advisory services, reflecting broader trends in financial analytics, credit intermediation, and asset management.)

Headwinds (Challenges Pressuring Performance)

- Macro-Economic Pressures: Sluggish private capex, constrained bank credit growth (10% YoY as of Aug’25), and 32.9% YoY de-growth in bond issuances due to global volatility and geopolitics. India’s GDP steady at 6.5%, but risks tilted downside.

- Market Volatility: Equity market corrections led to MTM losses and lower trading/other income (e.g., Wealth First’s total revenue down 11.8% YoY in Q2FY26; Crisil notes profitability focus by banks curbing discretionary spends).

- Cost Inflation: Higher operating expenses from one-time items (e.g., BSE listing, PMS renewal, CSR at Wealth First; employee costs up 36.8% YoY in Q2FY26) and appraisals/incentives, compressing margins (e.g., Wealth First cost-to-income at 30.7%; Crisil Ratings margin dipped to 45.2%).

- Segment-Specific: Ratings revenue growth moderated (6.6% in Q3FY25); analytics firms face measured bank spends amid automation push.

Tailwinds (Supportive Factors)

- Resilient Core Operations: Steady growth in fee-based income (Crisil: ops income +9.4% 9MFY25; Wealth First: business activity income +13.3% H1FY26). Trail revenues flat/resilient despite market dips.

- Client & AUM Expansion: Strong net inflows (Wealth First: equity SIPs robust; AUA +5% YoY to ₹12,574 Cr). High client/RM vintage (>80% clients >5 years; 53% RMs >5 years) drives stickiness/referrals.

- Favorable Sector Dynamics: Rising financialization (equities AUM share to 70%+ by FY29), govt infra/deregulation push, and non-bank credit growth. Crisil’s AI-led solutions and global presence (4,600+ employees) bolster analytics demand.

- Strategic Moves: Acquisitions (Crisil-McKinsey PriceMetrix), JV AMC (Wealth First-69.7% stake), and IRDAI insurance broking approval tap underpenetrated markets.

Growth Prospects (High Potential, 15-20%+ CAGR Medium-Term)

- Market Tailwinds: Serviceable wealth assets to grow from $2.7Tn to $9.3Tn (13% CAGR); specialized WM AUM from $0.3Tn to $1.6Tn (18% CAGR). Equities AUM >20% CAGR on SIP/lump-sum inflows and 10-12% earnings growth.

- Company-Specific: Crisil’s Ratings (+20% 9MFY25) and Analytics (+5.3%) leadership; global benchmarking wins. Wealth First targets AMC launch (MF AUM to ₹279Tn by 2047) and insurance (penetration <4% vs. global 7%).

- Sector-Wide: Financial literacy, deregulation, and infra spend to drive 15-25% AUM/income CAGR. Dividend payouts (Crisil ₹16/share; Wealth First ₹8/share) signal confidence.

| Key Metric | Crisil (9MFY25) | Wealth First (H1FY26) | Sector Projection |

|---|---|---|---|

| Revenue Growth | +9.4% | +13.3% (core) | 15-20% CAGR |

| AUM/AUA Growth | N/A | +5% (₹12.6Tn) | 18% CAGR (WM) |

| PAT Growth | +13% (PBT) | -7.4% (temp dip) | 15%+ medium-term |

Key Risks

- Market & Volatility Risk (High): MTM losses from equity corrections (e.g., Wealth First trading income down); dependency on equity AUM (59% share).

- Execution & Regulatory Risk (Medium): Delays in AMC/SEBI approvals; new ventures (insurance, acquisitions) face integration hurdles.

- Competition & Margin Pressure (Medium): Banks/non-banks ramping automation/AI; rising costs could squeeze margins (already 45-60%).

- Macro/Geopolitical Risk (Medium): Downside GDP revisions, tariffs impacting capex/credit.

- Concentration Risk (Low-Medium): Wealth First’s Gujarat focus (70% clients); Crisil’s India-centric ratings.

Overall Outlook: Positive with Resilience. Tailwinds from financialization and strategic expansions outweigh headwinds, positioning the sector for 15-20% growth. Short-term volatility manageable via fee-based models; long-term prospects strong amid India’s wealth boom (top 1-3% households hold 70-80% financial assets). Monitor equity markets and regulatory timelines.

Meeting

asof: 2025-12-03

Summary Analysis: Indian Other Financial Services Sector (Based on Provided Filings)

The provided documents cover regulatory disclosures, financial results (Q2/H1 FY26), AGMs, postal ballots, and corporate actions from companies like Crisil, Centrum Capital, Wealth First Portfolio Managers, Prime Securities, The Investment Trust of India (ITI), Delphi World Money, NDL Ventures, Reliable Data Services, Maha Rashtra Apex Corporation, and GACM Technologies. These firms operate in NBFCs, portfolio management, broking, wealth advisory, and fintech spaces. Overall, the sector shows resilience with profit growth amid expansion, but faces expense pressures and regulatory hurdles. Key metrics: Revenue up ~20-100% YoY in most (e.g., Wealth First +38%, GACM +110%), profits strong (e.g., Wealth First PAT ₹25cr H1), supported by capital raises and strategic moves.

Tailwinds (Positive Drivers)

- Robust Financial Performance: Strong top-line growth from broking, advisory, and trading (Wealth First revenue ₹43cr H1, up 15%; GACM ₹12cr H1, up 110%; Prime ₹70cr H1, up 33%). PAT surges (Wealth First ₹27cr H1; GACM ₹6cr H1) driven by operational leverage and fair value gains.

- Capital Infusion & Shareholder Confidence: High AGM/postal ballot approvals (Centrum 99.6%; Reliable 100%; ITI ESOP extension). Corporate actions like bonuses/splits (Delphi 2:1 bonus post 5:1 split), rights issues (Delphi), and mergers (NDL-HLF) signal liquidity boost.

- Strategic Expansions: Subsidiary funding (Crisil USD30mn line), ESOP extensions (ITI), team scaling (Prime headcount +244% to 120), and diversification (NDL into NBFC via HLF merger; Wealth First subsidiaries adding revenue).

- Dividend Payouts: Wealth First ₹4/sh (40%); Reliable ₹0.04/sh, rewarding investors.

- Regulatory Green Lights: RBI NOC for NDL merger; arm’s-length RPTs approved.

Headwinds (Challenges)

- Rising Costs: Employee expenses up sharply (Prime +60% H1 to ₹27cr; Wealth First +35% to ₹6cr) due to hiring for growth. Other expenses (impairments, finance costs) pressure margins (Prime total expenses +96% H1).

- Lumpy Revenue: Trading income volatile (Wealth First F&O swings); advisory episodic (Prime emphasis on annuity flows via wealth mgmt).

- Debt & Leverage: Some borrowings (Centrum subsidiary sale for deleveraging); finance costs persist (GACM/Wealth First).

- Compliance Burden: Frequent filings (postal ballots for Centrum/ITI), auditor qualifications (Prime on recoverability/DTA), and RPT approvals needed.

Growth Prospects

- NBFC/Fintech Boom: NDL-HLF merger (25:10 swap ratio) positions it as scaled NBFC (HLF assets ₹7,299cr); GACM/Wealth First fintech push (AUM growth, 400+ clients at Prime Trigen).

- Wealth & Broking Tailwinds: Rising AUM (Prime 300+ families), MF distribution (Wealth First ₹1,800cr+ business income H1). Digital shift aids scalability.

- Capital Markets Rally: Equity infusions (GACM ₹49cr H1), bonuses/splits enhance liquidity/attract retail.

- M&A/Inorganic: Crisil sub funding, Centrum sub sale proceeds for pivots; sector consolidation (e.g., NDL).

- Outlook: FY26 EPS growth 20-50% possible (Wealth First 25.37 H1); NBFC credit demand (HLF vehicle loans) + tech advisory.

Key Risks

- Regulatory/Compliance: SEBI/RBI scrutiny on RPTs (Reliable/Centrum approvals), ESOPs, mergers (NCLT pendency); DTA recognition (Prime/ITI).

- Credit/Recoverability: Receivables uncertainty (Prime ₹2,795Lakh NCLT case); impairments (Prime ₹105cr H1).

- Market Volatility: Trading/FV gains sensitive to equity markets (Wealth First OCI losses ₹52L).

- Execution/Integration: Post-merger synergies (NDL), sub performance (Crisil UK, Wealth First subs); team scaling costs.

- Liquidity/Debt: High capex (GACM ₹34cr H1) strains cash (operating cash negative ₹3cr); forex exposure (Crisil USD loan).

- Sector: Competition in broking/wealth; economic slowdown impacting advisory fees.

Overall: Sector buoyed by capital markets upcycle and inorganic bets, but cost discipline key. Growth tilted positive (NBFC pivot), monitor Q3 for merger progress/expenses. Positive sentiment from approvals/dividends.

Press Release

asof: 2025-12-03

Summary Analysis: Indian Other Financial Services Sector

Using the provided documents (Crisil Q3FY26 results, Prime Securities FY25 results, and Delphi World Money clarification), the analysis focuses on key players in ratings/analytics (Crisil), securities/wealth advisory (Prime), and forex/remittances/travel (Delphi). Overall, the sector shows resilience amid India’s steady GDP growth (6.5%) but faces global headwinds. Below is a structured summary:

Tailwinds (Positive Drivers)

- Robust Domestic Growth & Financial Performance: Crisil reported 12.2% YoY revenue growth (₹911 Cr) and 14.8% PBT growth in Q3FY26; 9M PAT up 14.2%. Prime Securities achieved 34% revenue growth (₹89 Cr), 106% PAT surge (₹38 Cr), and ₹220 Cr cash pile in FY25. India’s resilient economy (rural demand, low CPI at 1.5%, fiscal support) supports analytics/ratings demand.

- Business Expansion & Diversification: Crisil’s Ratings (+11.2%) and Research/Analytics (+12.7%) segments thriving; proposed McKinsey PriceMetrix acquisition boosts global wealth benchmarking. Prime launched wealth management via subsidiary (33-member team, tech platform live). Delphi integrated Ebix’s global travel (tix/MICE/holidays), leveraging forex strength post-rights issue completion.

- Annuity + Transactional Revenue Mix: Prime emphasizes rising deal sizes/numbers; Crisil’s leadership in ratings/benchmarks (Gartner recognitions) ensures steady flows. High dividends (Crisil ₹16/share, Prime ₹1.5/share) signal confidence.

Headwinds (Challenges)

- Macro Slowdown Indicators: Crisil highlights bond issuances down 32.9% YoY, bank credit growth at 10% (vs. 13.6% prior), large industry credit at 1.8% (vs. 8.6%). Global volatility (US policy shifts, FX/commodity swings) noted by Prime/Crisil.

- Operational Pressures: Crisil’s employee costs up (₹492 Cr in Q3); muted credit offtake despite RBI steps. Prime cites volatile markets limiting quarterly comparability.

- External Noise: Delphi faces orchestrated rumors via unauthorized comms/WhatsApp/media, misrepresenting withdrawn legal suits (status quo order nullified).

Growth Prospects

- High (10-15%+ Sector CAGR Potential): India’s fastest-major-economy status + AI/domain expertise (Crisil) drives analytics/ratings. Prime’s wealth vertical + advisory scale-up; Delphi’s forex-travel convergence (via in.via.com/Mercury Travels legacy) positions for synergies. Acquisitions/subs (Crisil Canada/McKinsey, Prime Trigen) expand global footprint. Expect sustained double-digit revenue/PAT growth if credit cycles revive.

Key Risks

- Macro/Geopolitical: Global uncertainties/downside to GDP (Crisil); volatility impacting transactional revenues (Prime).

- Regulatory/Legal: Credit constraints despite RBI easing; Delphi’s suits (though withdrawn) highlight litigation/misinfo risks, including investor data misuse.

- Execution/Integration: Acquisition closing risks (Crisil’s USD38M deal); segment interdependencies (Crisil unallocables). High employee/professional fees (Crisil) vulnerable to talent wars.

- Market/Competitive: Rumor amplification eroding trust (Delphi); advisory not amenable to short-term extrapolation (Prime).

Overall Outlook: Positive with Caution. Tailwinds from India’s growth and firm-specific momentum outweigh headwinds, but global risks and isolated legal noise warrant monitoring. Sector EPS/dividends remain attractive; focus on Q4FY26 for credit revival cues. Investors should prioritize official disclosures.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.