GLENMARK

Equity Metrics

January 13, 2026

Glenmark Pharmaceuticals Limited

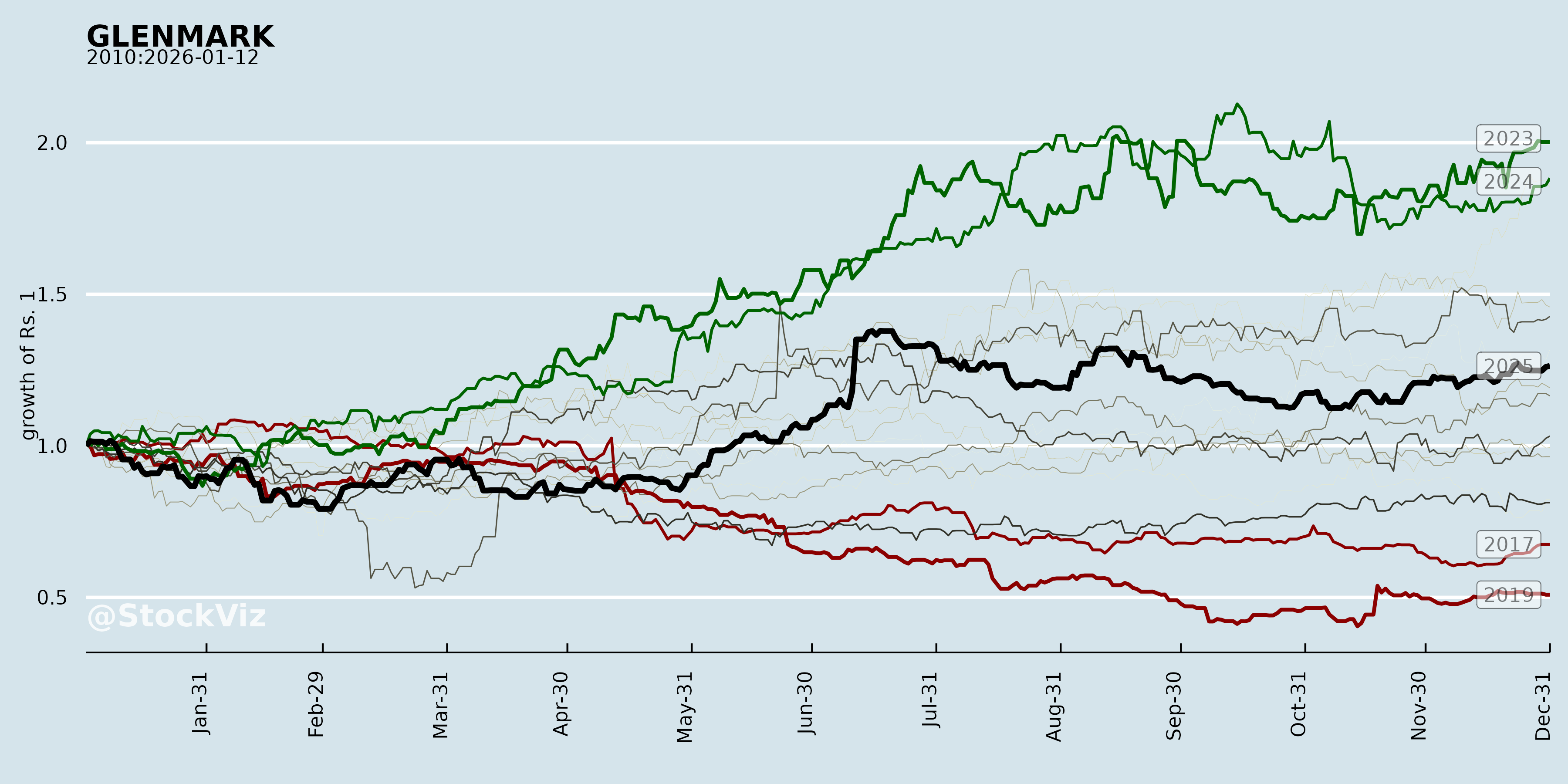

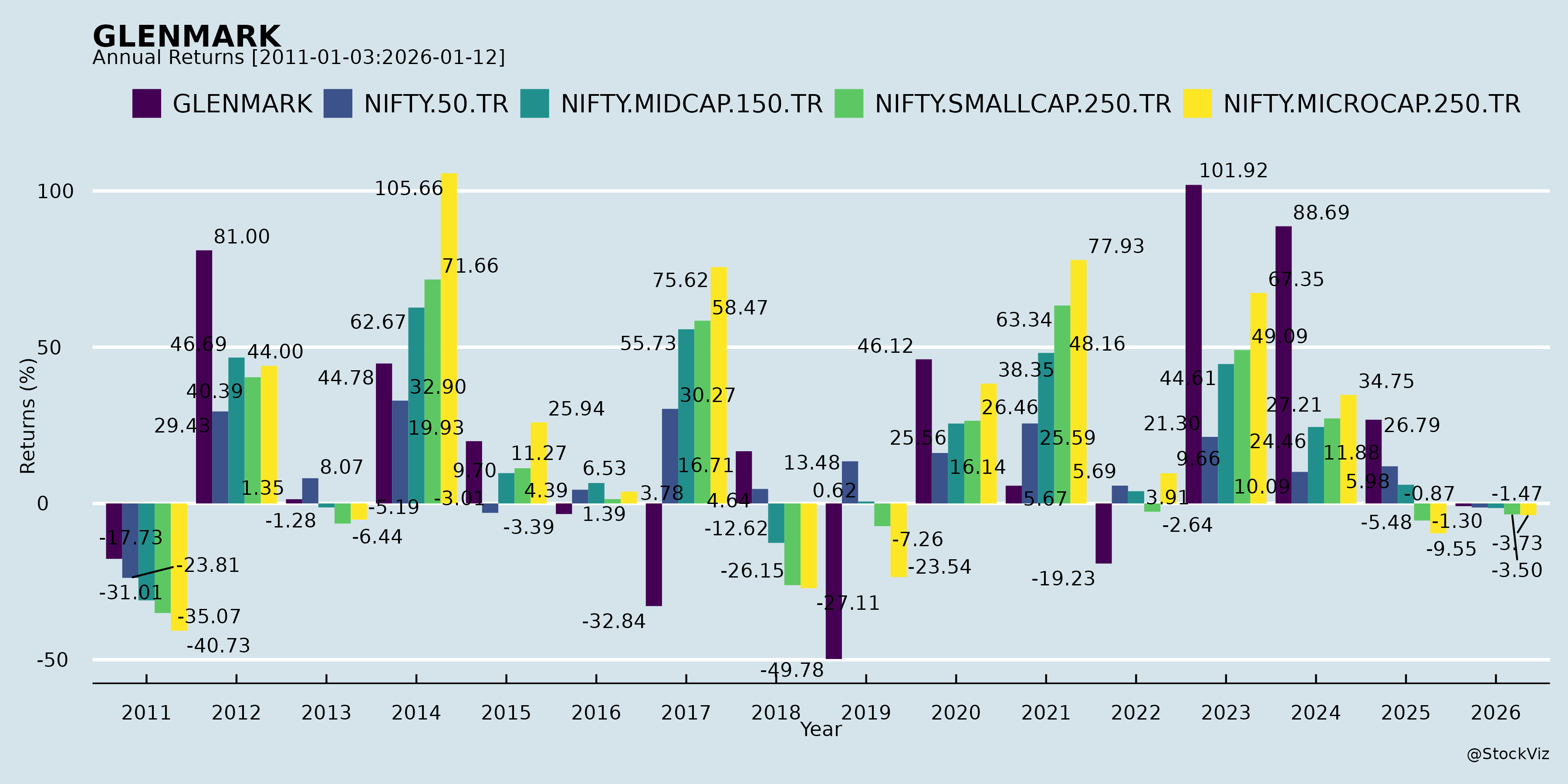

Annual Returns

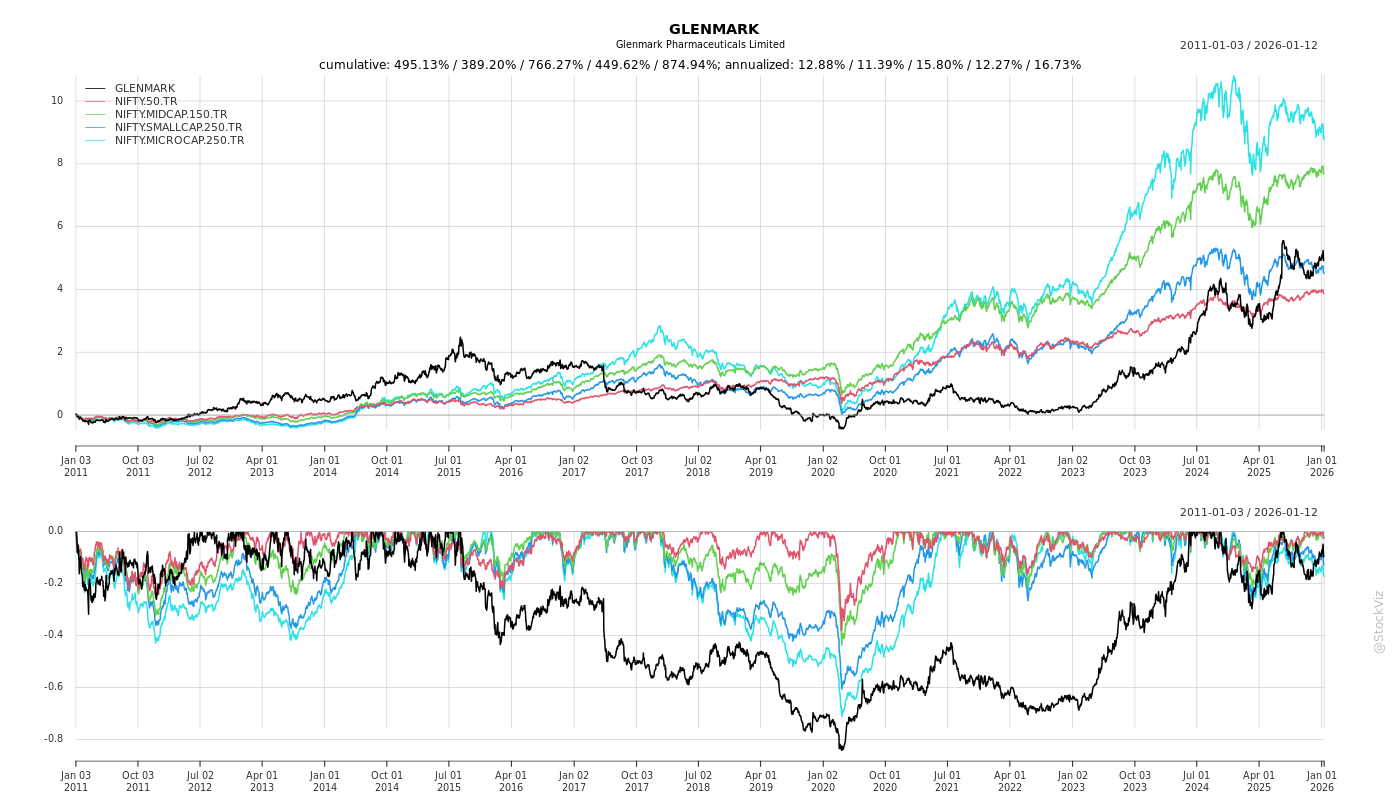

Cumulative Returns and Drawdowns

Fundamentals

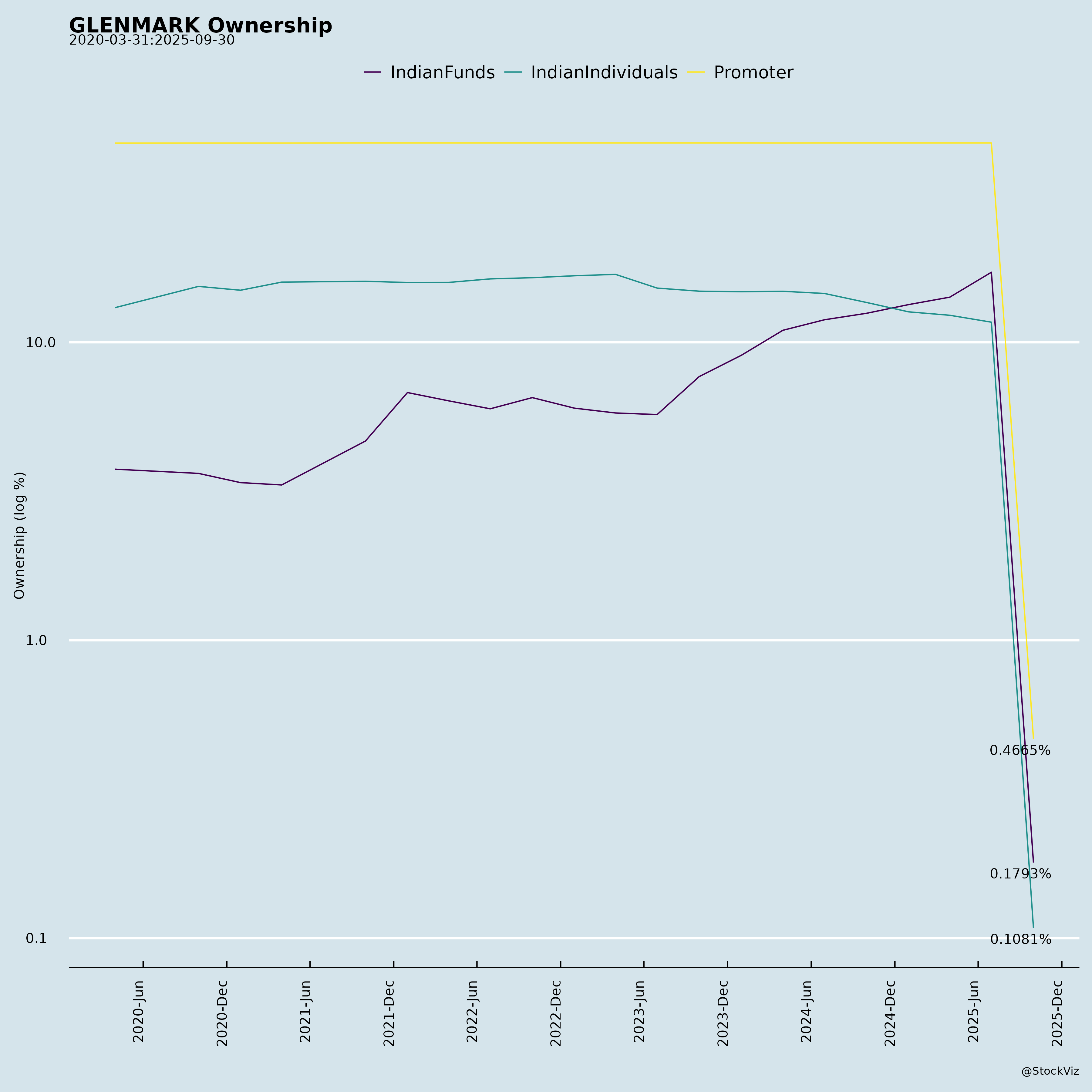

Ownership

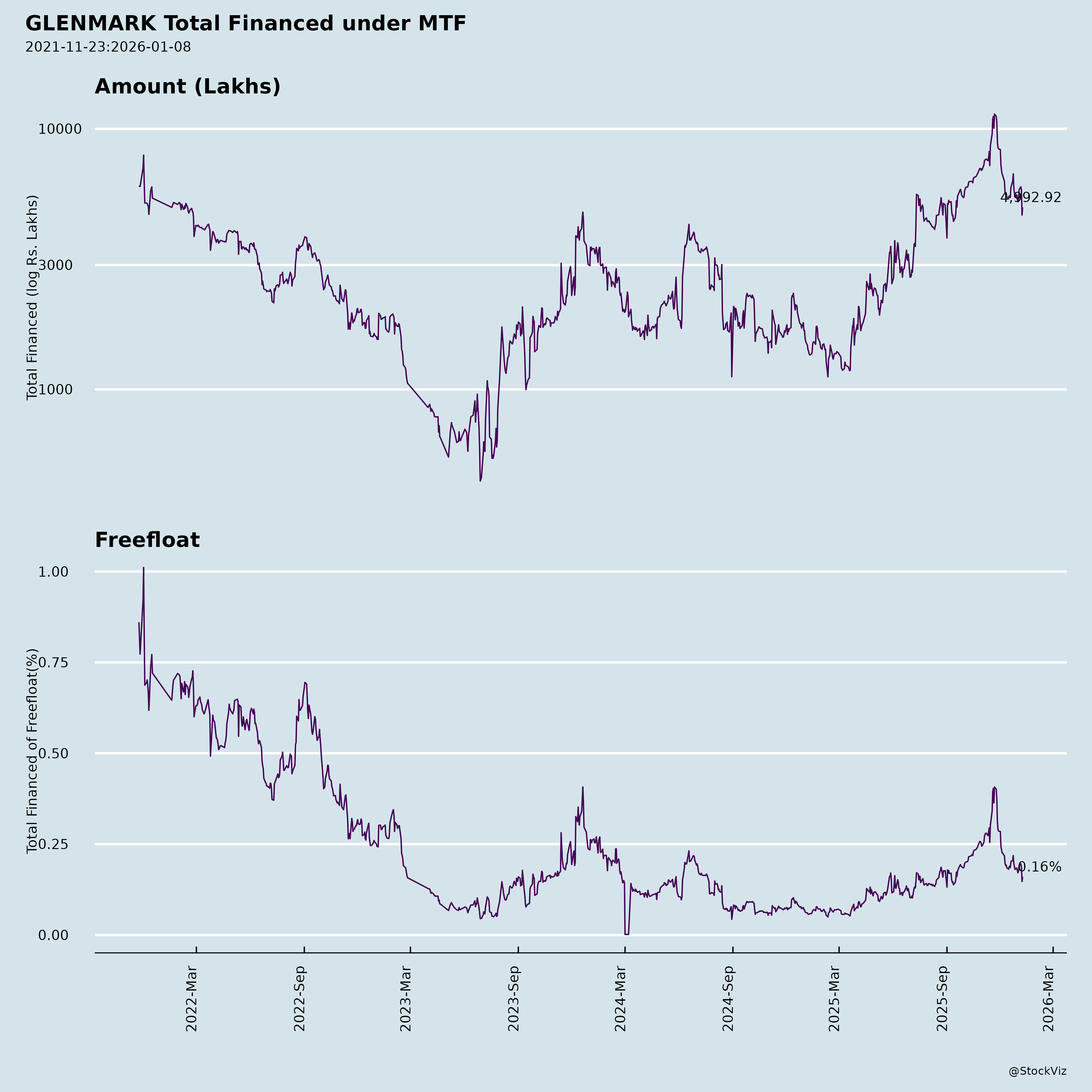

Margined

AI Summary

asof: 2025-12-08

Based on a comprehensive analysis of the provided financial disclosures, earnings report, auditor’s review, and press releases from Glenmark Pharmaceuticals Limited (GLENMARK – Scrip Code: 532296) as of November–December 2025, the following structured summary outlines the headwinds, tailwinds, growth prospects, and key risks for the company:

🔍 Company Overview

- Segment: Pharmaceuticals (Generics, APIs, OTC, Specialty)

- Operations: Global (India, US, Europe, Emerging Markets)

- Segments: One reportable segment – Pharmaceuticals

- ESG Focus: ESG committee reconstituted with strong leadership (ex-Cabinet Secretary Mr. P.K. Sinha as Chair)

- R&D Focus: IGI Therapeutics SA (innovation arm)

- Listed on: BSE & NSE

✅ TAILWINDS (Positive Catalysts)

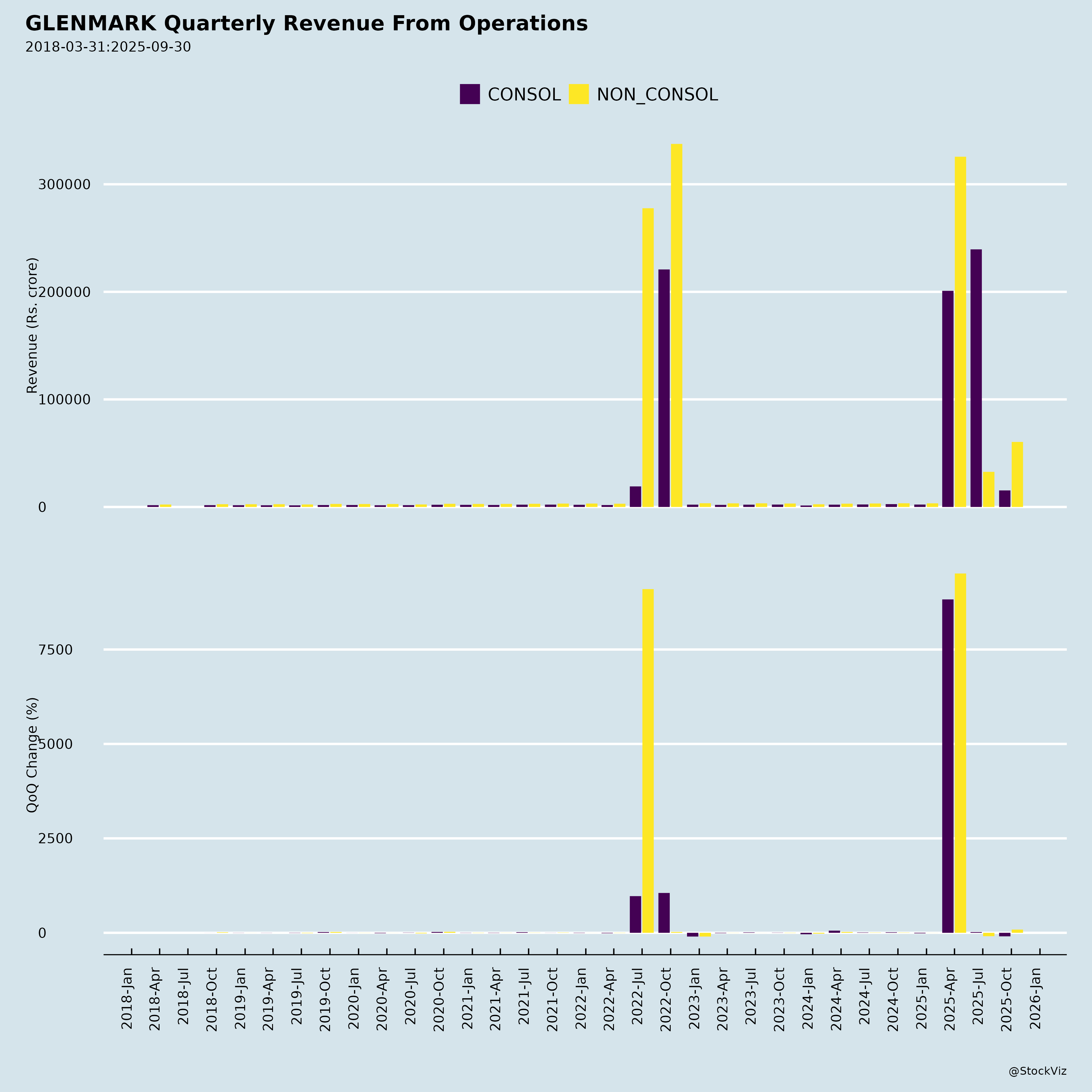

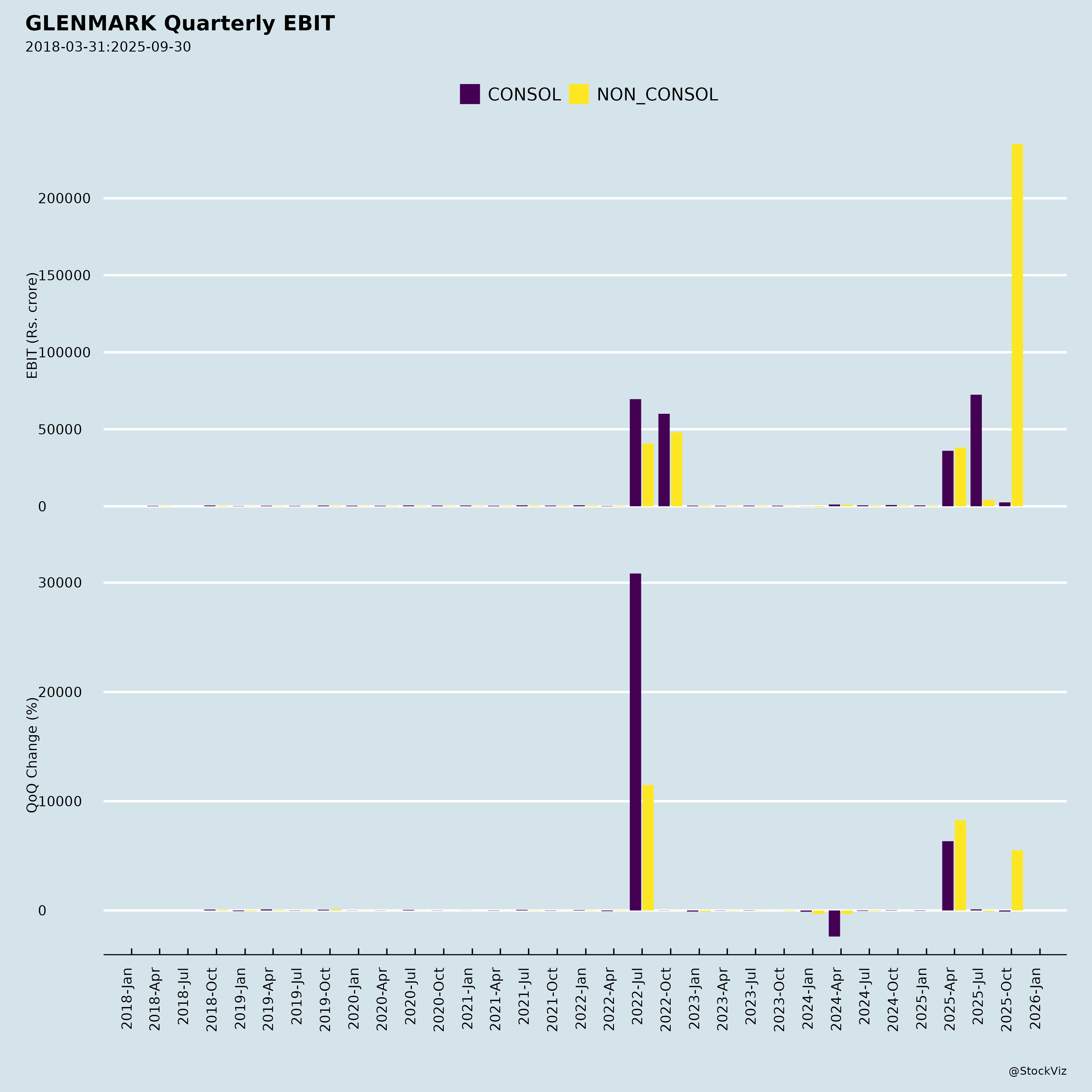

1. Strong One-Off Revenue Driver: AbbVie Licensing Deal

- $700M upfront payment from AbbVie for exclusive rights to develop, manufacture, and commercialize ISB 2001 in major markets (North America, Europe, Japan, Greater China).

- $525 million recognized as revenue in Q2 FY26 (July–Sept 2025), providing a significant short-term top-line boost.

- This is a high-margin, non-dilutive capital inflection point — rare in Indian pharma — signaling confidence in Glenmark’s R&D pipeline.

✅ Impact: Large cash inflow, improves balance sheet, enhances valuation, funds future R&D.

2. FDA Regulatory Recovery – Monroe (USA) Facility Cleared

- Monroe, NC facility received EIR with Voluntary Action Indicated (VAI) status from U.S. FDA (Nov 2025) after June 2025 inspection.

- Ends nearly 2.5-year Warning Letter (since June 2023), allowing resumption of commercial manufacturing.

- Prior Form 483 had 5 observations; clearance indicates regulatory compliance improvement.

✅ Impact: Restores supply chain reliability, regains credibility with US generics clients, supports revenue growth.

3. Zero FDA 483 Observations at Aurangabad Facility

- Successful Pre-Approval Inspection (PAI) at Chhatrapati Sambhajinagar (Aurangabad) facility with zero observations.

- Increases likelihood of product approvals in the pipeline and reflects strong operational compliance.

✅ Impact: Regulatory tailwind; strengthens portfolio approval momentum in US generic market.

4. Positive Cash Flow Recovery (Operating Level)

- Net cash from operating activities (Consolidated, H1 FY26): ₹28,356 crore

- Marked improvement vs. H1 FY25: (–₹3,635 crore)

- Adjusted for large one-offs, underlying operations show operational recovery.

✅ Impact: Strong underlying working capital management improvement.

5. Profitability Turnaround (Ex-Ethics) in Standalone

- Despite extraordinary charges, base profitability recovering:

- PBT before exceptional items: ₹7,498 crore (Half-year, standalone, up 5.3% YoY)

- Core operations stable amid pricing pressures.

✅ Impact: Foundational strength in business model persists.

6. Dividend Payout Credibility

- Interim dividend of ₹2.50/share (₹705.5 crore) approved.

- Signals confidence in liquidity and shareholder returns.

❌ HEADWINDS (Challenges & Drags)

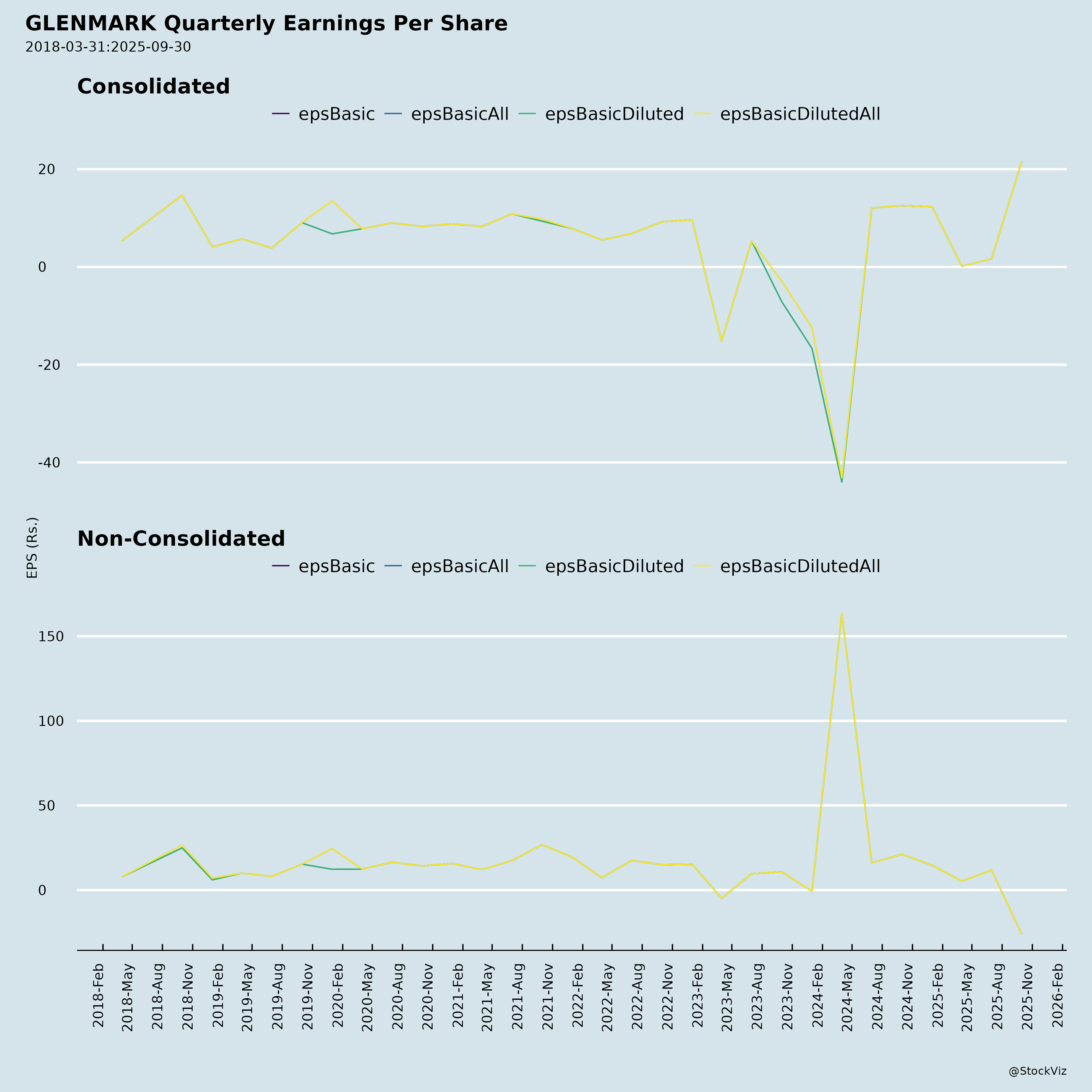

1. Massive Exceptional Charges (Litigation Reserves)

Q2 FY26 Charges:

- Standalone & Consolidated exceptional loss: ₹9,318 crore (Q2) / ₹1,792 crore (H1 vs. prior H1)

- Key components:

- ₹9,318 crore: New U.S. antitrust settlement with United Healthcare Services Inc. (last opt-out plaintiff): ₹976 crore provision + associated costs.

- ₹5,901 crore: Inventory write-offs post GST 2.0 and new inventory management model.

- ₹4,885 crore: Receivables & current asset provisions.

- ₹2,089 crore: PPE impairment.

❌ Impacts net profit:

- Standalone PAT Q2: (₹7,392 crore) loss vs. ₹3,302 crore profit Q1

- EPS (Basic): ₹(26.19) down from ₹11.70

⚠️ Note: These are non-recurring but extremely heavy; may skew investor perception.

2. Impaired US Litigation Cloud

- Multiple antitrust suits in the U.S. (generic drug pricing allegations).

- Total settlements across FY24–FY26 exceed $132.25 million (~₹10,000 crore+).

- While company denies wrongdoing and cites “commercial settlement”, continuing reputational risk exists.

❌ Lingering ESG/litigation perception risk, especially in Western markets.

3. Restructuring in IGI Therapeutics

- IGI TSA restructured & manufacturing unit in Le-Chaux-de-Fonds (Switzerland) shut down.

- Total exceptional cost: ₹1,978 crore (FY25).

- CMC (Chemistry, Manufacturing, Controls) transitioned to CDMO — long-term cost control, but near-term disruption.

❌ Signal of pipeline prioritization; non-core R&D scaled back.

4. Decline in Indian & Emerging Market Revenue

- Domestic Formulations Growth Stagnant: Not highlighted as a driver; core Indian generic market likely facing pricing erosion and competition.

- Exports: U.S. segment not explicitly growing — likely under pressure from generic pricing declines.

5. High Leverage & Funding Needs

- Total Financial Liabilities (Standalone): ₹24,923 crore

- Net debt: Not directly stated, but significant lease and borrowing liabilities.

- No equity fundraising disclosed, but large one-time cash inflow from AbbVie helps.

❌ Refinancing risk in medium term if earnings remain volatile.

📈 GROWTH PROSPECTS

| Driver | Outlook |

|---|---|

| R&D Monetization | High potential – AbbVie deal opens door for future licensing. ISB 2001 likely an immuno-oncology/biologic asset. Pipeline focus may shift toward innovation. |

| U.S. Generic Recovery | Improving – Monroe facility restart and successful PAI at Aurangabad indicate better regulatory compliance. New product approvals likely to resume. |

| Emerging Markets & APIs | Stable revenue streams; not expanding but resilient. |

| ESG & Sustainability Credibility | SBTi approval strengthens ESG profile — advantage in global institutional investing. |

| Consumer Care Spin-off Completed | Transferred to GCCL (slump sale for ₹2,400 cr); non-material revenue, but improves strategic focus on core pharma. |

🔮 Potential Re-rating Drivers: - Sustained FDA compliance - Repeat deals from IGI TSA pipeline - Cost rationalization post restructuring

⚠️ KEY RISKS

- Regulatory Risk (FDA Exposure):

- Despite progress, past Warning Letter history makes U.S. business vulnerable; another quality lapse could trigger backtracking.

- Litigation Risk:

- U.S. antitrust suits may not be fully resolved; new private lawsuits possible. Ongoing need for large provisions.

- Pipeline Risk for IGI TSA:

- After AbbVie deal and restructuring, future R&D output may shrink unless new assets show promise.

- Inventory & Working Capital Volatility:

- ₹5,901 crore inventory provision signals legacy model inefficiencies — GST 2.0 digitization may hit margins short-term.

- Currency & Global Macroeconomic Risk:

- ~40%+ revenue from international markets — exposure to INR appreciation, supply chain inflation, trade barriers.

- Generic Price Erosion in US/EU:

- Industry-wide headwind; Glenmark has limited pricing power in commoditized markets.

🔚 SUMMARY: Investment Thesis – Neutral to Positive

| Parameter | Assessment |

|---|---|

| Short-Term (6–12 months) | ❗ Mixed – Heavy losses from exceptional items may spook market, but Abbvie cash infusion and FDA recovery are strong positives. |

| Medium-Term (1–3 years) | ✅ Positive – Regulatory recovery should boost U.S. sales; cost optimization post-restructuring; potential for more IP monetization. |

| Valuation | Likely depressed due to one-time losses; actual operating EPS > ₹50/share annualized. Could be undervalued if turnaround holds. |

| Best Case | Glenmark replicates IGI model with new assets, wins U.S. approvals, deleverages. → Stock re-rating. |

| Worst Case | New FDA observations, more litigation, or poor R&D output → continuing volatility. |

💡 Final Conclusion

Glenmark is at an inflection point: - Massive headwinds from legacy litigation and inventory writedowns have caused short-term pain. - But strong tailwinds — the $700M AbbVie deal, FDA clearance, and strategic spin-offs/restructuring — position the company for recovery and potential transformation. - Primary growth avenue shifting from volume-driven generics to innovation-led licensing. - Investors should focus on cash flow, regulatory compliance, and next pipeline milestones rather than headline losses.

✅ Recommendation: Watchful optimism — a turnaround play with potential for outperformance if execution improves. Suitable for value + event-driven investors.

Let me know if you’d like a DCF valuation, peer comparison, or visual dashboard summary (PPT/Excel) based on the data.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.