GICHSGFIN

Equity Metrics

January 13, 2026

GIC Housing Finance Limited

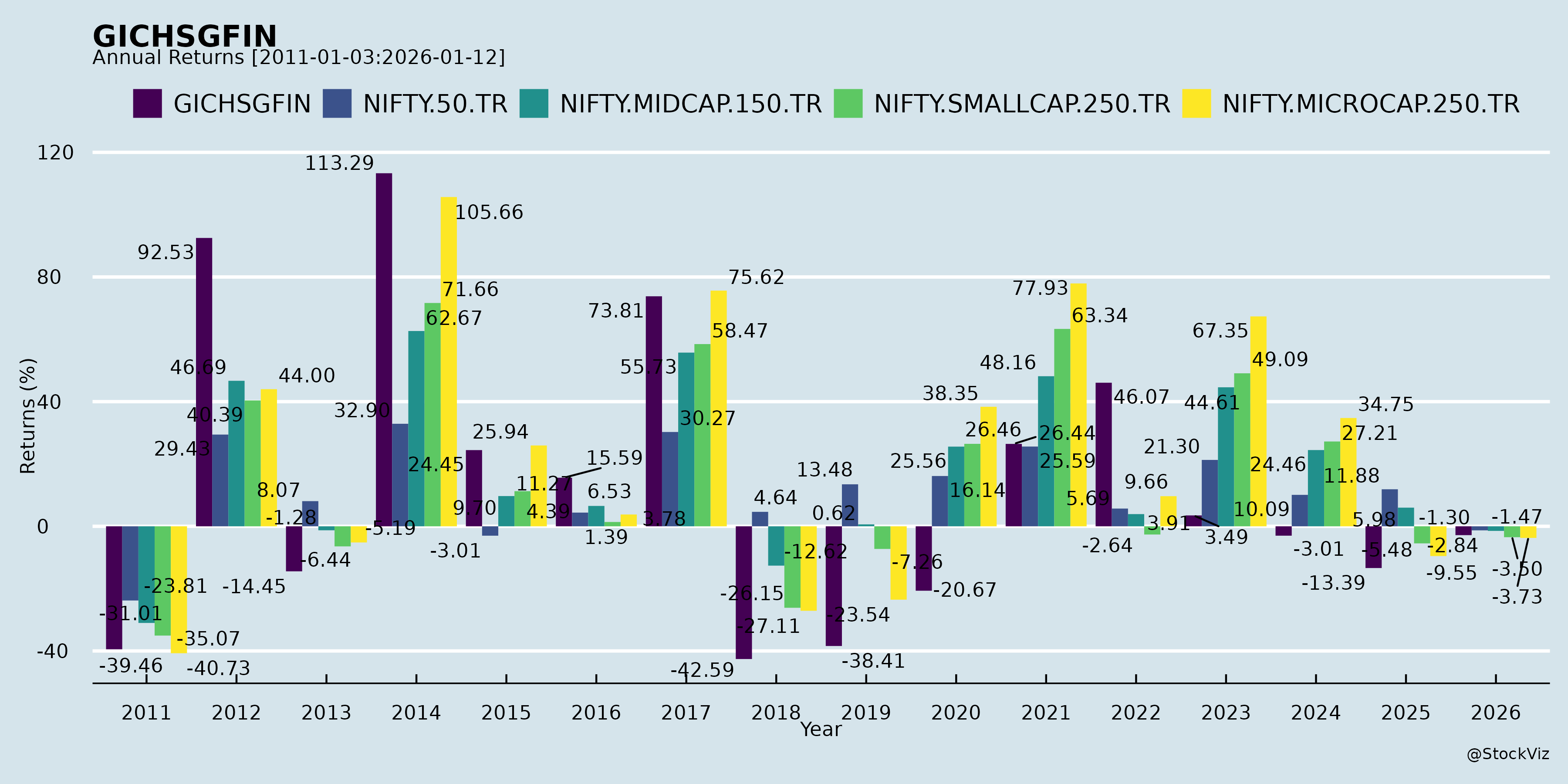

Annual Returns

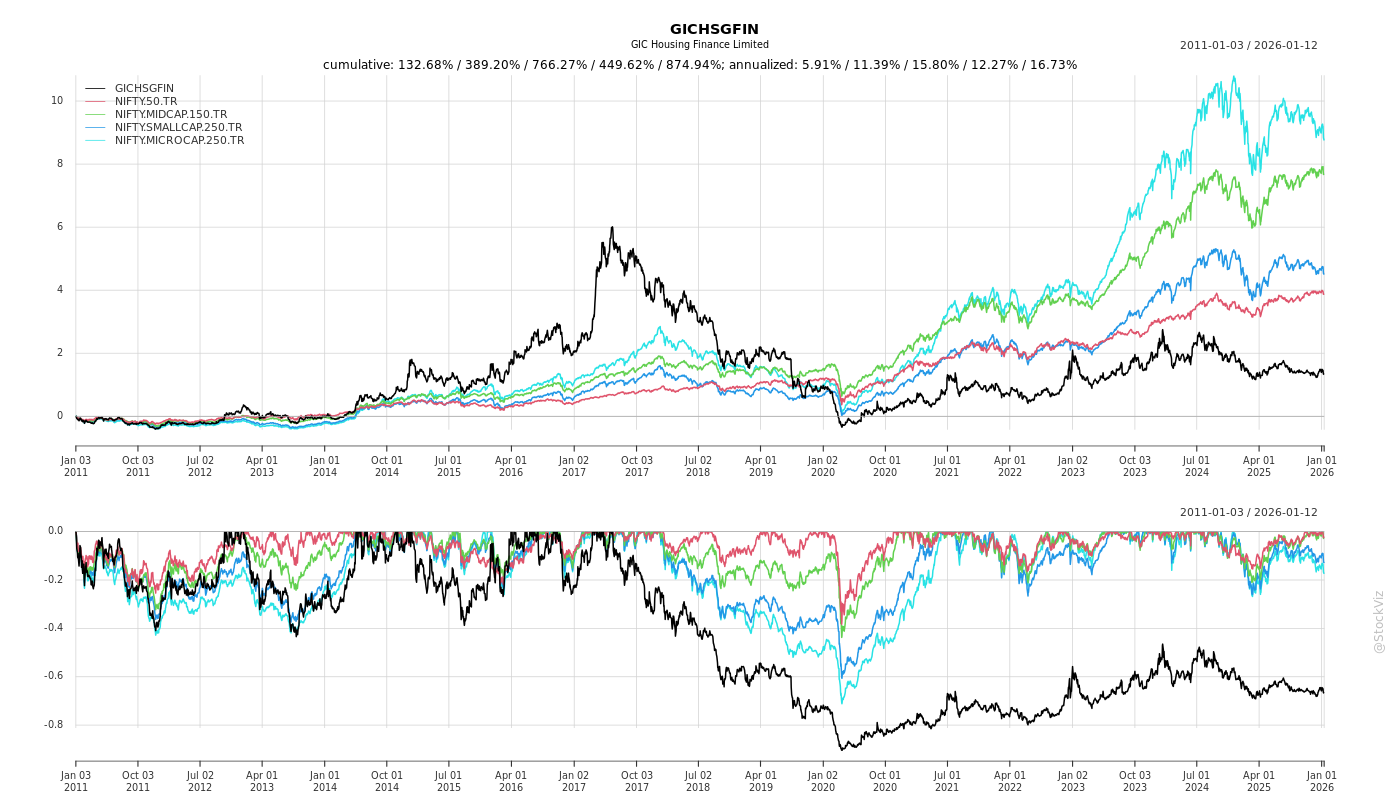

Cumulative Returns and Drawdowns

Fundamentals

Ownership

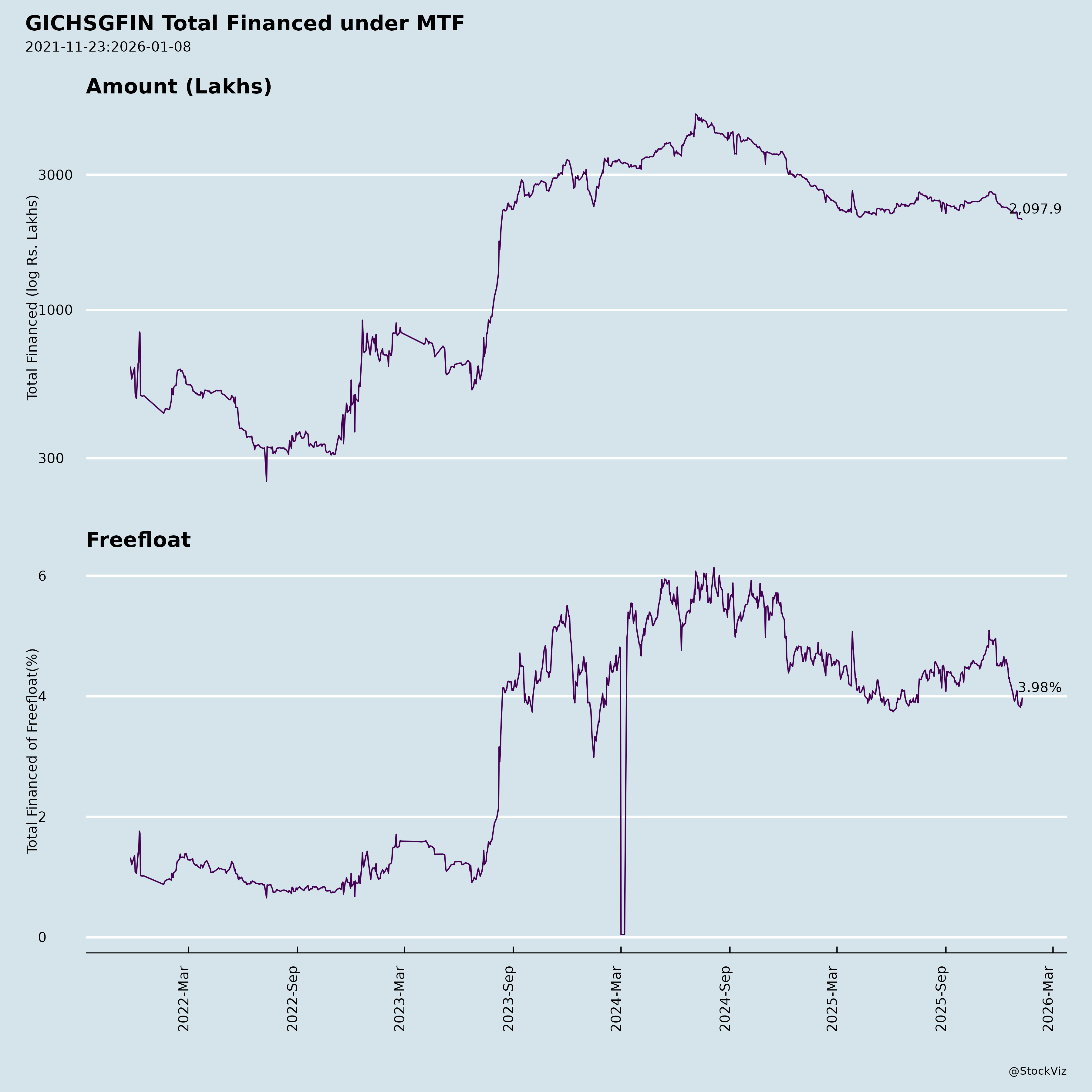

Margined

AI Summary

asof: 2025-11-27

Analysis of GIC Housing Finance Ltd. (GICHSGFIN)

GIC Housing Finance Ltd., a listed housing finance company (HFC) in India (NSE: GICHSGFIN), focuses on retail housing loans. The provided documents cover Q2/H1 FY26 financial results (ended Sep 30, 2025), board outcomes (Nov 13, 2025), senior management changes (SMPs), related party disclosures (NIL material), NCD fundraising plans, security cover compliance (>100%), and postal ballot approval for a new Independent Director (96.92% approval). Financials show resilient loan growth amid asset quality pressures. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Catalysts)

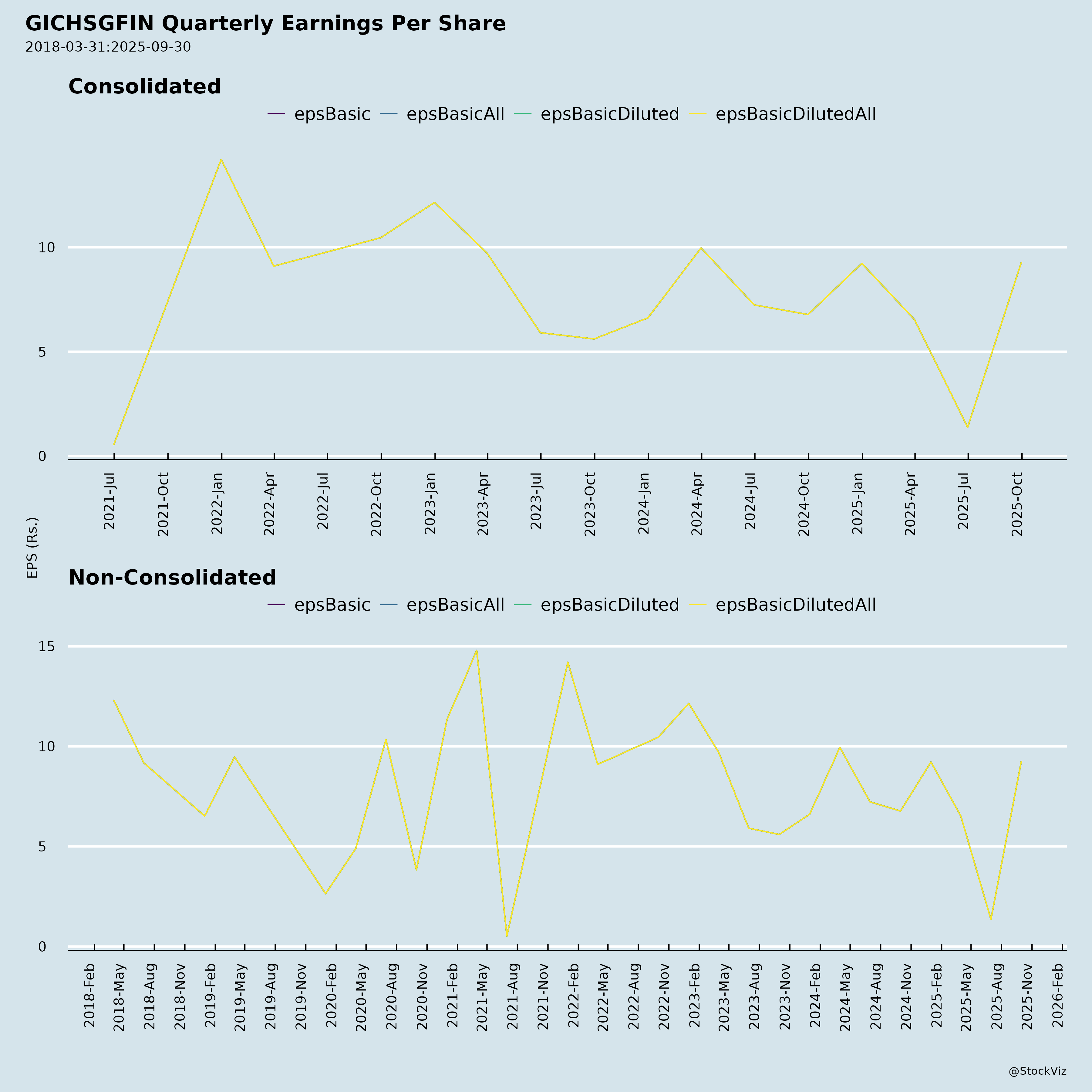

- Strong Q2 Recovery & Loan Book Expansion: Standalone net profit surged to ₹4,995 lakh in Q2 FY26 (vs. ₹733 lakh in Q1), driving H1 profit to ₹5,730 lakh. Loan book grew ~2.4% QoQ/YoY to ₹10,45,258 lakh, reflecting robust disbursals amid India’s housing demand.

- Improved Liquidity: Cash & equivalents jumped to ₹16,272 lakh (from ₹5,338 lakh FY25-end), supported by net financing inflows (₹24,561 lakh in H1).

- Fundraising Momentum: Board approved GID/KID for secured NCDs via private placement; recent issuances (Series 8/9, ₹1,000 Cr) fully utilized for lending. Security cover >100% (e.g., 103-109% per ISIN), with clean auditor certificates.

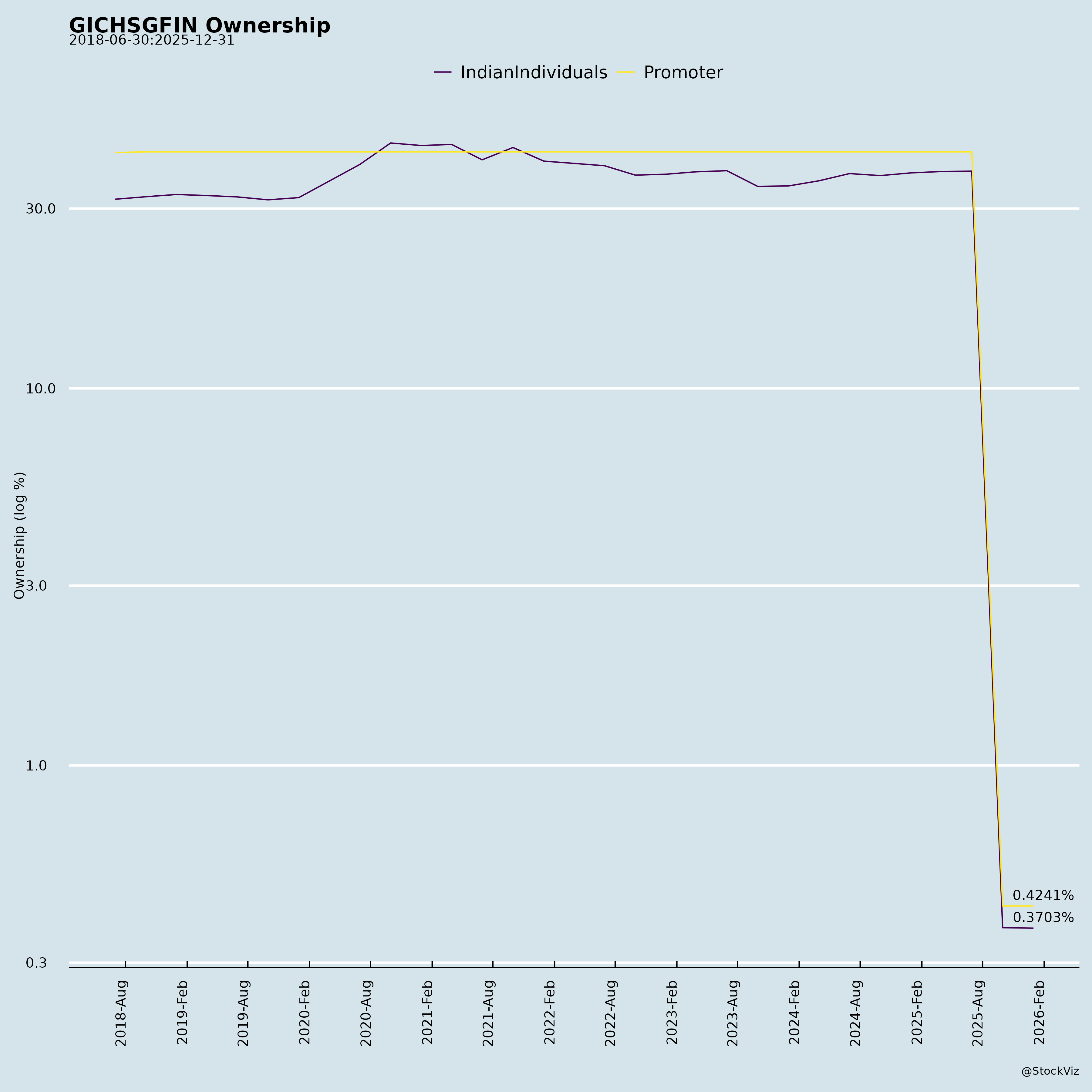

- Governance Enhancements: Internal SMP reshuffles (e.g., new Legal Head, HR/Admin/Credit/Internal Audit heads) for operational efficiency. Postal ballot approved new Independent Director (DIN: 08072065) with near-unanimous support (Promoters 100% in favor).

- Stable Capital Structure: Net worth up to ₹1,99,759 lakh; Debt-Equity at 4.20x (manageable for HFC). PCR improved to 57% despite Stage 3 rise.

Headwinds (Challenges)

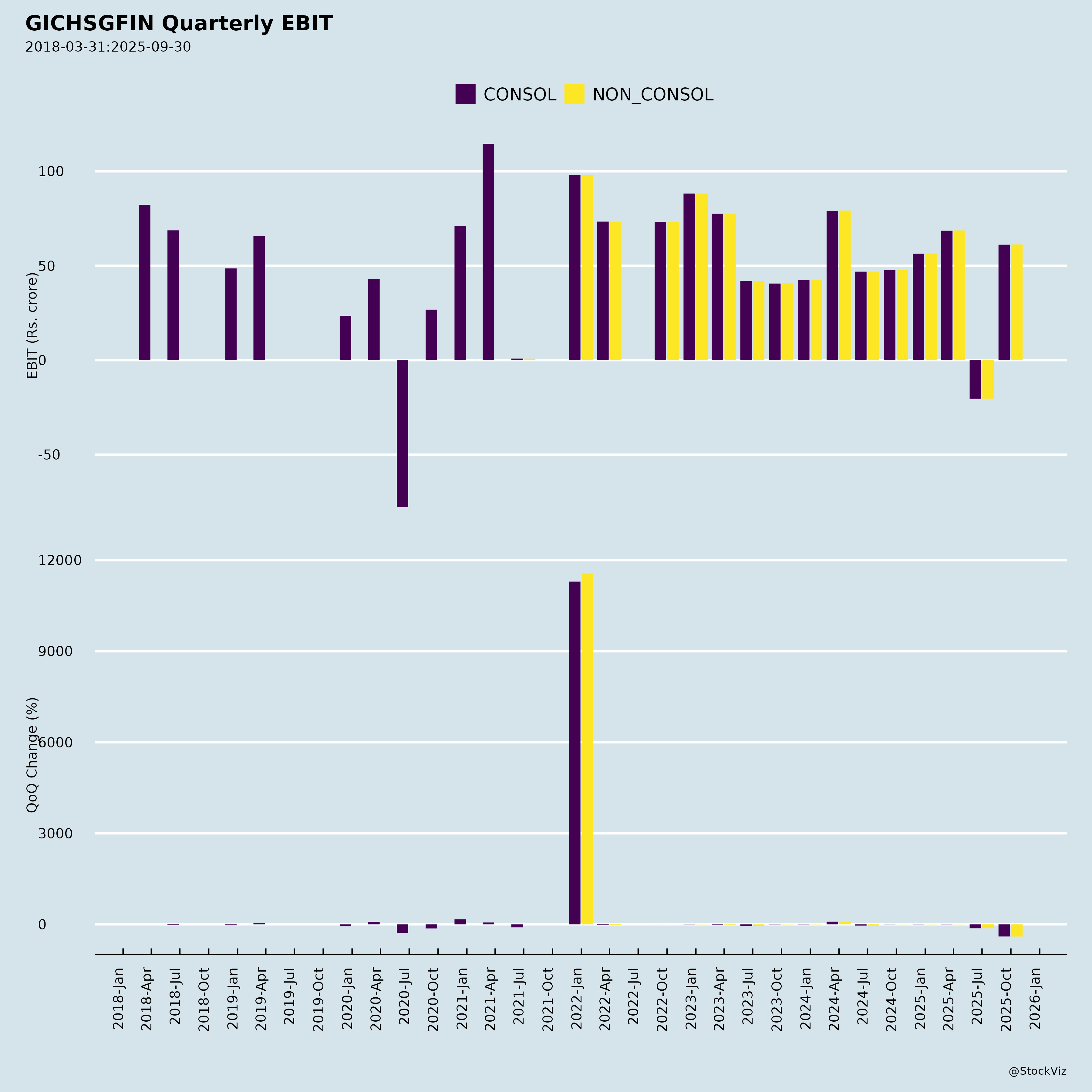

- Profit Pressure from Asset Quality: H1 PBT down 57% YoY to ₹4,075 lakh, driven by high impairment (₹7,618 lakh, esp. Q1 ₹7,797 lakh). Stage 3 assets rose to 4.52% (vs. 2.78% YoY), signaling stress in loan portfolio.

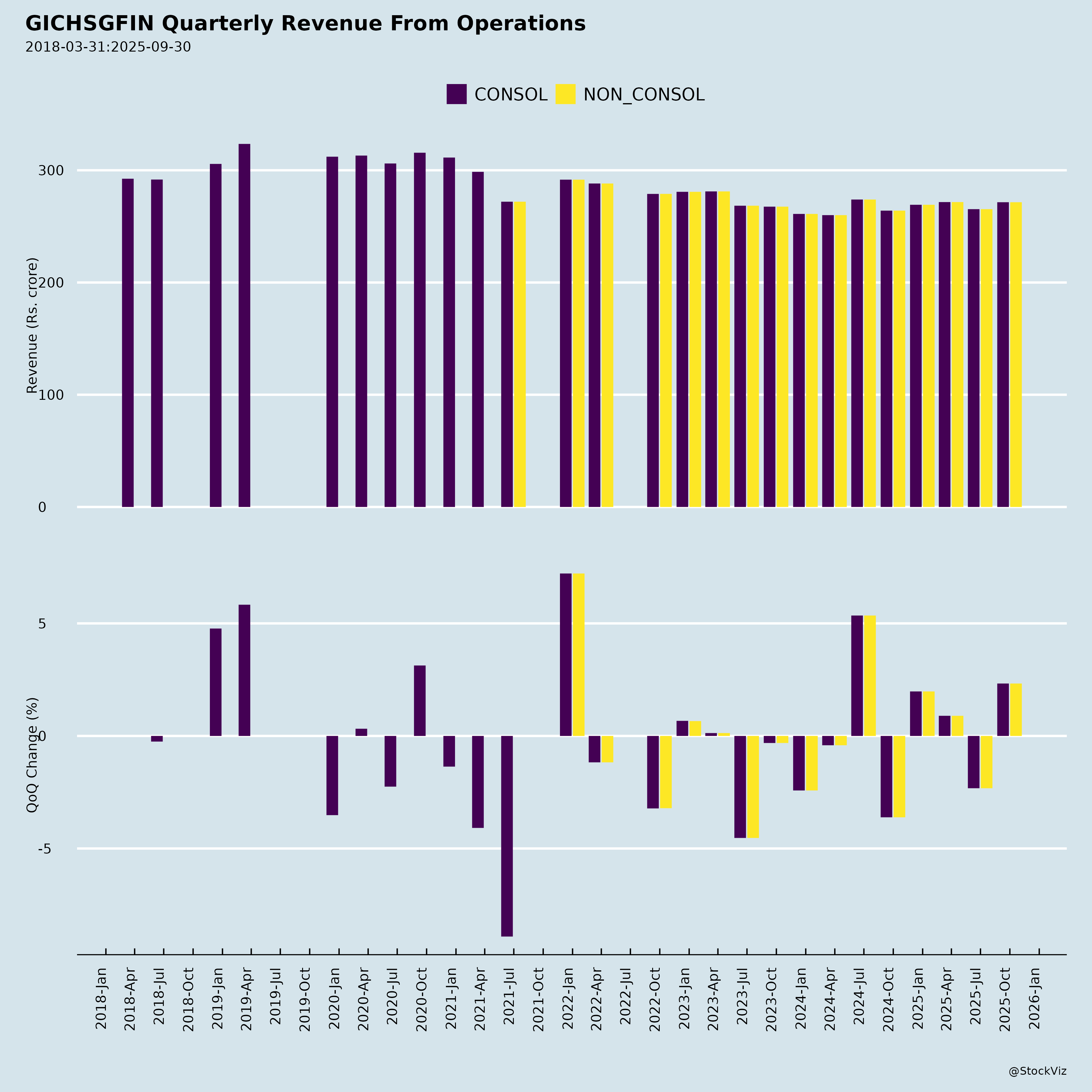

- Margin Squeeze: Finance costs at ₹34,570 lakh (high debt servicing); Net Interest Margin implied weak (total income flat YoY). Negative operating cash flow (₹-10,045 lakh) highlights working capital strain.

- NIL Physical Share Activity: No re-lodgement requests (per SEBI circular), but reflects low retail engagement; minor overhang from legacy physical shares.

- High Expenses: Employee costs up 16% YoY; Other expenses volatile (negative in Q2 due to reversals?).

Growth Prospects

- High (Medium-Term: 15-20% AUM CAGR Potential):

- India’s affordable housing boom (PMAY, urbanization) favors HFCs. Loan AUM trajectory (₹10.45 Cr) positions for 10-15% FY26 growth via fresh NCDs (₹1,000 Cr+ pipeline).

- Retail focus (standard assets dominate security pool); Investments grew to ₹28,790 lakh for diversification.

- Subsidiary (GICHFL Financial Services) adds minor revenue (consolidated similar to standalone).

- Trading window reopens Nov 16, 2025, signaling normalcy post-results.

- Catalysts: Policy tailwinds (RBI/NHB rate cuts?), SMP expertise in credit/recovery, and clean RPTs (NIL) enhance execution.

Key Risks (High-Moderate Severity)

| Risk Category | Description | Mitigation/Impact |

|---|---|---|

| Credit/Asset Quality | Stage 3 at 4.52% (up sharply); ECL revisions added ₹5,416 lakh provisioning in Q1. Vulnerable to economic slowdown/unemployment. | PCR 57%; Standard assets secure NCDs. High Risk – Monitor Q3 NPAs. |

| Liquidity/Interest Rate | Negative op. CF (₹-10 Cr); Debt ~81% of assets (₹9.05 Cr borrowings). Rate hikes could spike costs. | Strong cash buffer; 1x+ asset cover. Moderate Risk. |

| Funding Dependency | Relies on NCDs/banks (e.g., ₹468 Cr inflows H1); rollover risk if yields rise. | Diversified lenders (IDBI/Vistra trustees); No deviations in proceeds use. Moderate Risk. |

| Regulatory/Operational | HFC norms (NHB); Insider trading code updates; SMP transitions (e.g., Legal Head superannuation). | Compliant disclosures; Auditor unqualified reviews. Low Risk. |

| Market/Execution | Flat revenue YoY; Competition from banks/NBFCs. Low public voting (0.68% non-inst.) signals passive shareholders. | Promoter control (42% stake); Housing demand resilient. Moderate Risk. |

Overall Outlook: Positive with Cautious Bias. Tailwinds from loan growth/fundraising outweigh headwinds, but asset quality deterioration caps upside. Expect 10-12% AUM growth FY26, with RoE ~12-15% if NPAs stabilize. Stock could re-rate on Q3 recovery/NHB easing; watch Stage 3 trends. Recommendation: Accumulate on dips for long-term housing play. (Data as of Sep 30, 2025; standalone basis unless noted.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.