GESHIP

Equity Metrics

January 13, 2026

The Great Eastern Shipping Company Limited

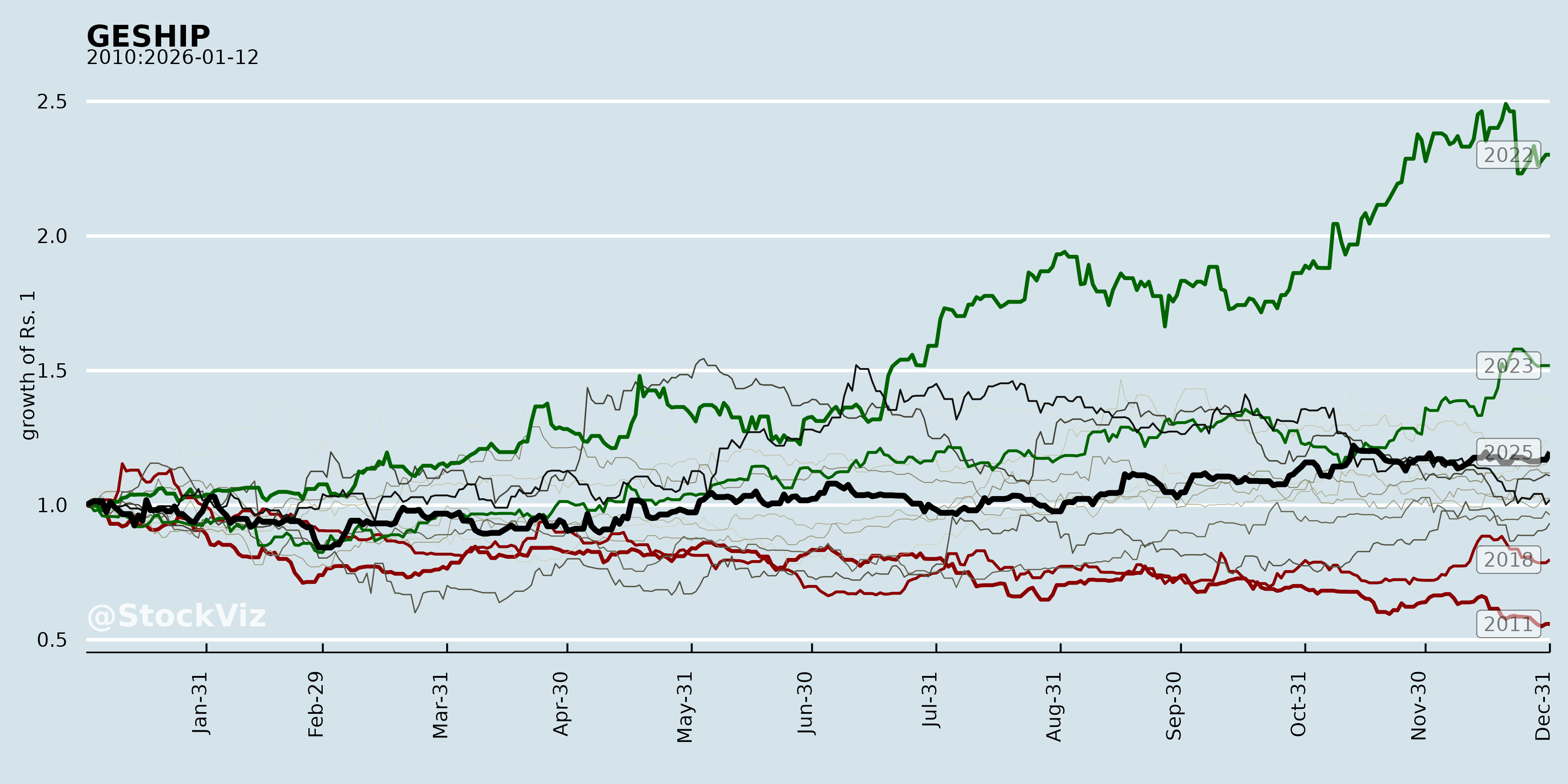

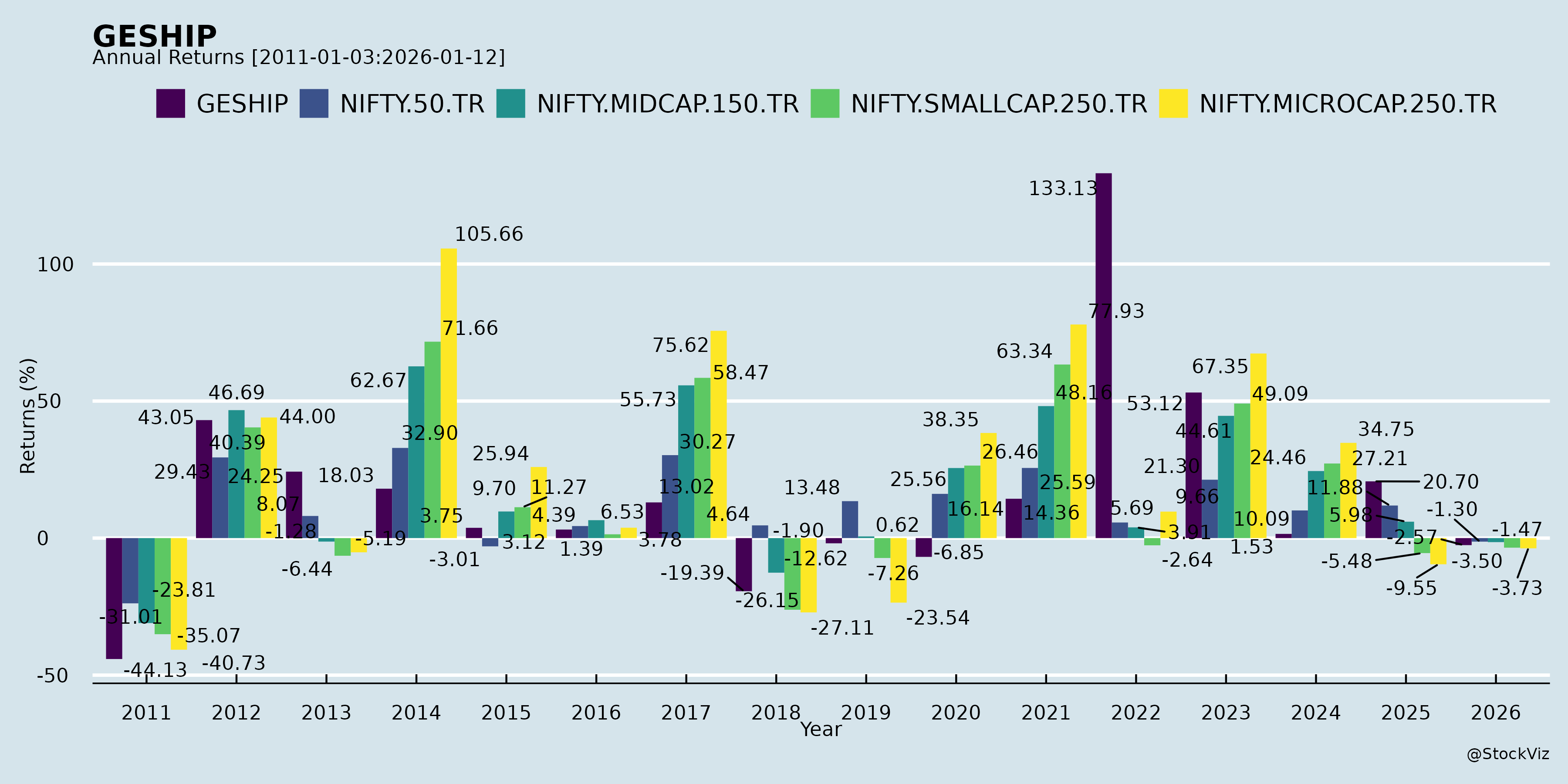

Annual Returns

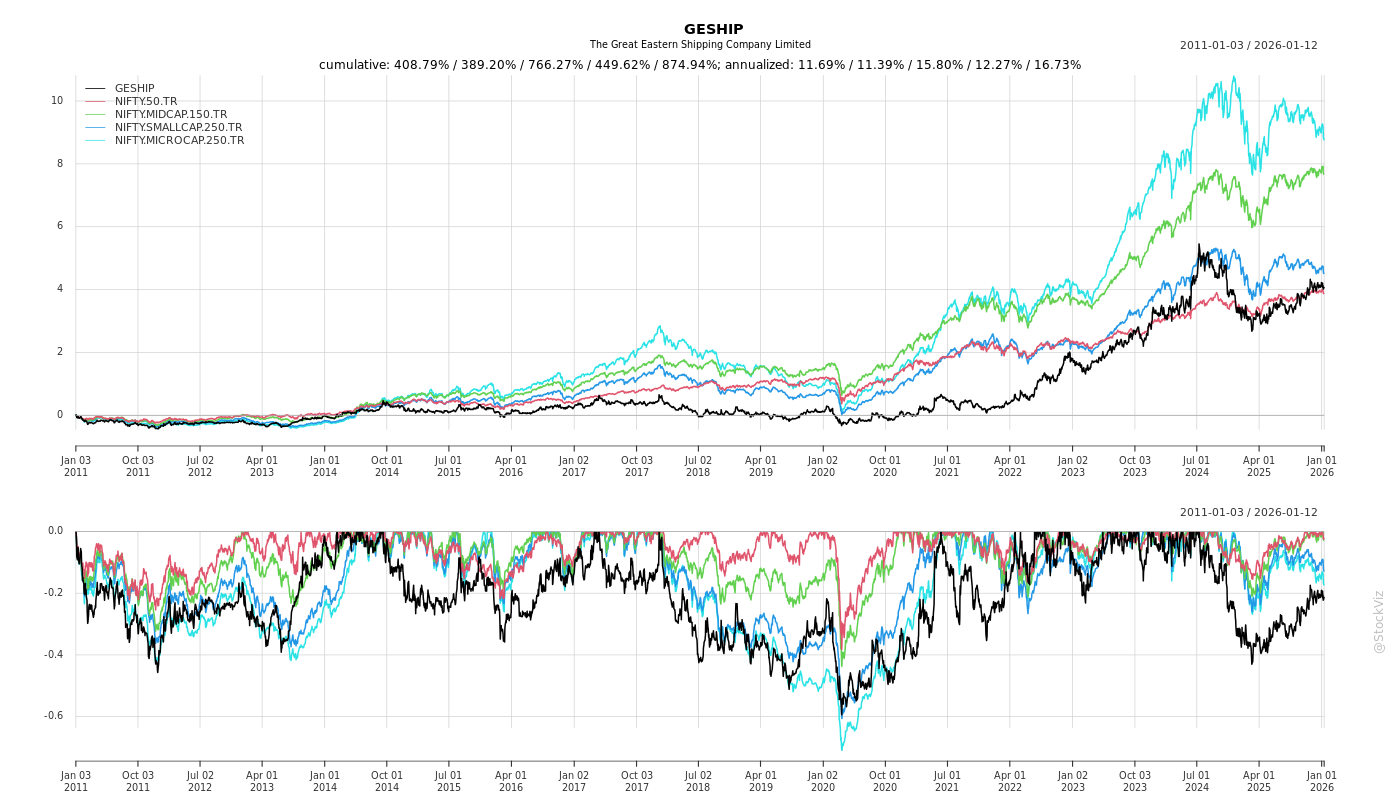

Cumulative Returns and Drawdowns

Fundamentals

Ownership

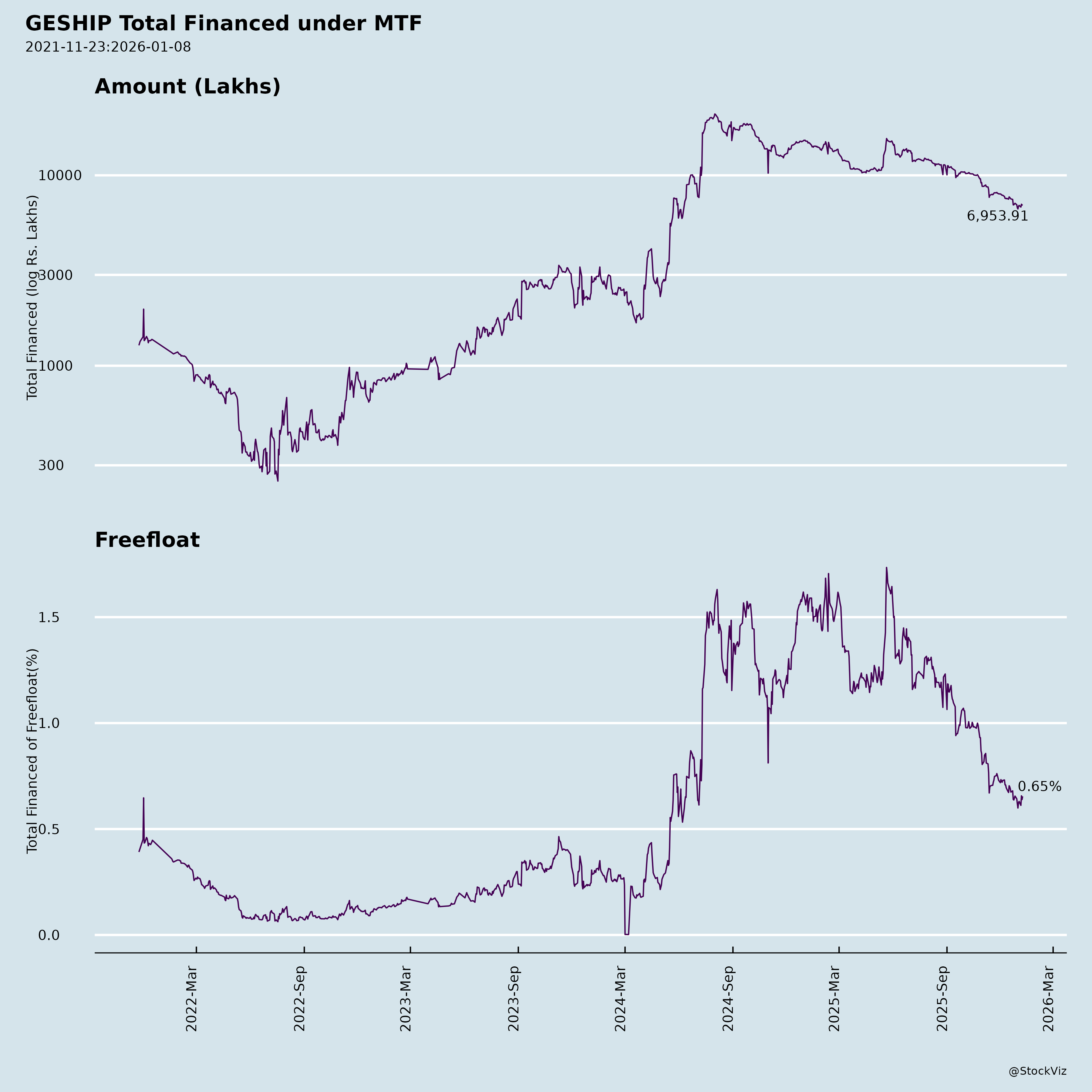

Margined

AI Summary

asof: 2025-12-08

Comprehensive Analysis of The Great Eastern Shipping Company Limited (GESHIP) – As of November 2025

(Stock Code: BSE: 500620 | NSE: GESHIP)

Based on the disclosures, financial statements, management announcements, and audit reviews dated November 2025, here is a detailed analysis of headwinds, tailwinds, growth prospects, and key risks for The Great Eastern Shipping Company Limited (GESHIP).

🔍 1. Executive Summary – Key Highlights

- Strong Interim Financial Performance:

- Profit after tax for Q2 FY26 (July–Sept 2025): ₹581.41 crores vs ₹504.50 crores YoY.

- Half-year PAT: ₹1,085.91 crores (vs ₹1,387.51 crores YoY) – down due to lower shipping segment performance.

- Earnings per share (EPS): ₹40.72 (basic), up from ₹35.34 YoY.

- Profit after tax for Q2 FY26 (July–Sept 2025): ₹581.41 crores vs ₹504.50 crores YoY.

- Dividend Payout:

- 2nd interim dividend of ₹7.20 per share declared for FY2025–26.

- Record date: November 13, 2025; payout from December 2, 2025.

- 2nd interim dividend of ₹7.20 per share declared for FY2025–26.

- Fleet Strategy Update:

- Delivery of 2005-built MR tanker “Jag Pooja” (sold in Nov 2025).

- Current owned fleet: 40 vessels, total capacity 3.32 million dwt.

- Planned downsizing of tanker fleet and expansion in dry bulk carriers (buying 1 Ultramax, selling 1 Suezmax).

- Delivery of 2005-built MR tanker “Jag Pooja” (sold in Nov 2025).

- Leadership Transition:

- Mr. K. M. Sheth (73-year tenure) steps down as Chairman effective November 9, 2025.

- Appointed Chairman Emeritus (honorary).

- Mr. Bharat K. Sheth elevated to Chairman & Managing Director.

- Mr. K. M. Sheth (73-year tenure) steps down as Chairman effective November 9, 2025.

- Solid Balance Sheet & Debt Management:

- Net cash position is strong; Net Debt-to-Equity ratio negative (-0.45x) implies surplus liquidity.

- Compliance confirmed on financial covenants for NCDs.

- Net cash position is strong; Net Debt-to-Equity ratio negative (-0.45x) implies surplus liquidity.

🌬️ 2. Headwinds (Challenges)

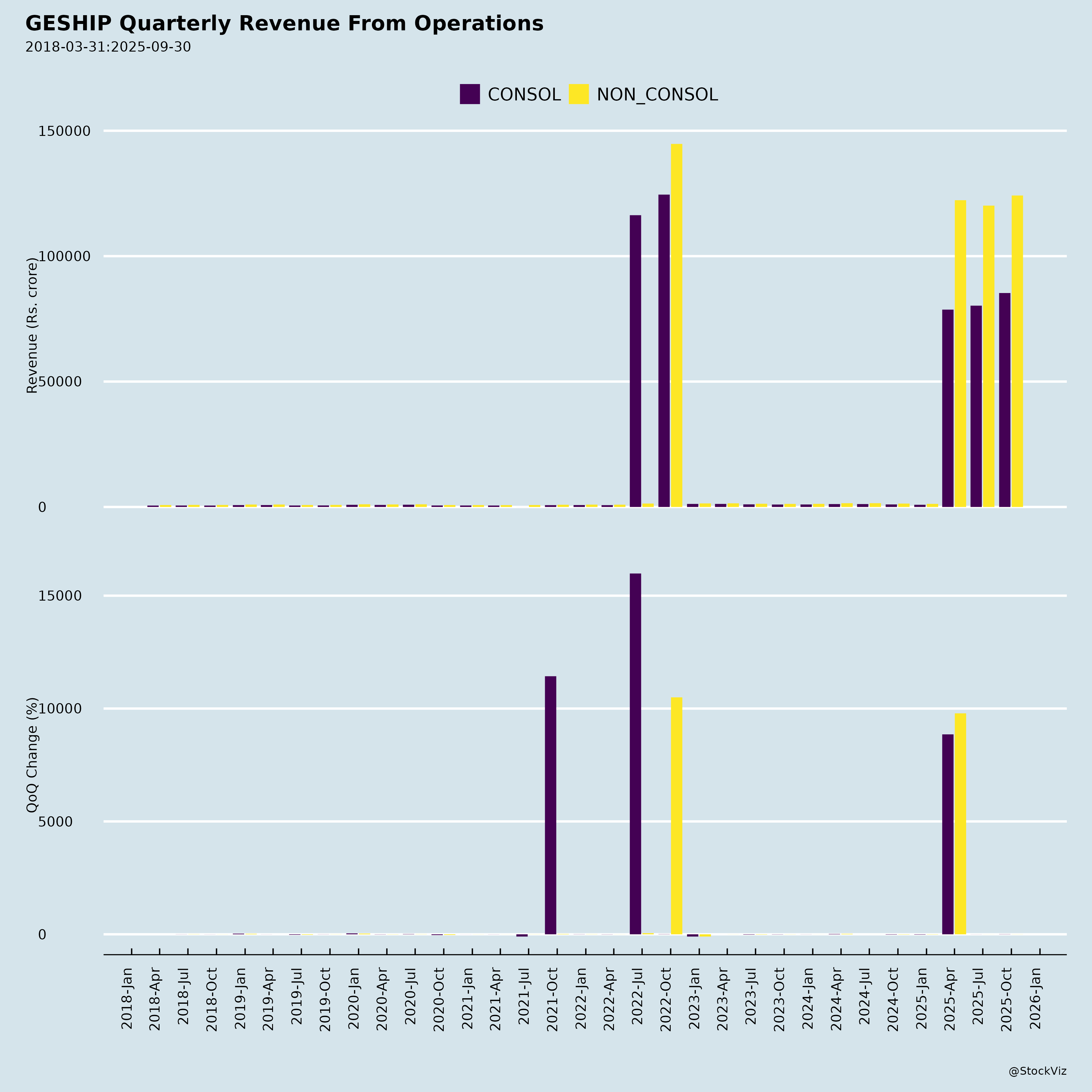

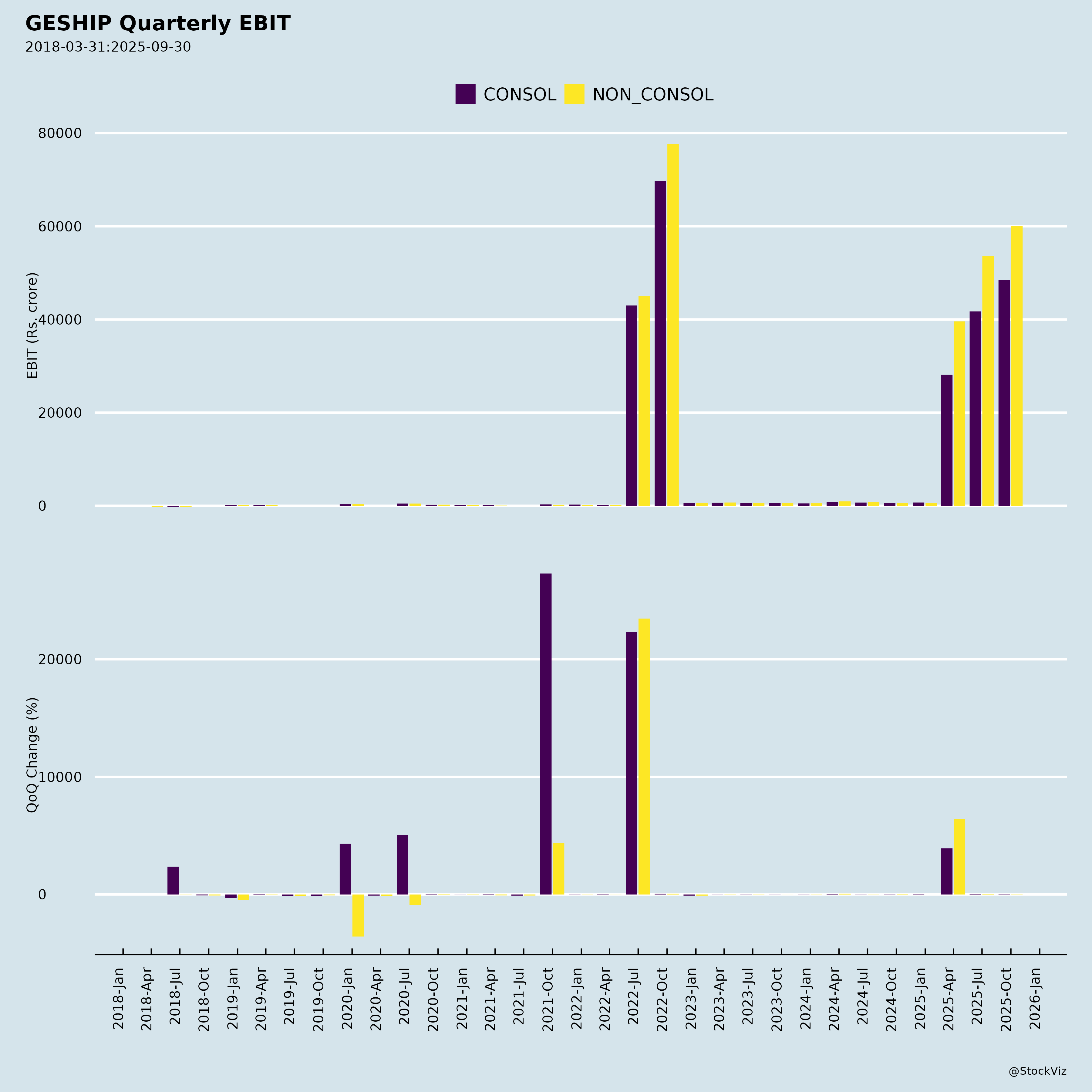

1. Decline in Shipping Segment Revenue & Profit

- Shipping revenue (Q2 FY26): ₹1,050.71 crores (down 18% YoY from ₹1,287 crores).

- Shipping profit (Q2): ₹488.52 crores (down 30% YoY from ₹528.58 crores).

- Reason: Likely due to softening freight rates in crude and product tanker markets in H1 FY26.

- Oil tanker markets (especially LR/MR product tankers) saw rate corrections globally post-highs in 2023–24.

2. Portfolio Restructuring Risks

- Active sell-down of older tanker assets (e.g., “Jag Pooja”) and planned disposal of a Suezmax suggest:

- Reduced exposure to volatile tanker earnings.

- But also potential loss of high-margin asset base if market conditions improve.

- Reduced exposure to volatile tanker earnings.

- Strategy may be defensive, possibly missing cyclical upswings.

3. Offshore Segment Underperformance

- Offshore segment profit declined sharply:

- Q2 FY26: ₹92.89 crores (vs ₹46.99 crores YoY – up, but volatile).

- Half-year offshore profit: ₹218.84 crores (vs ₹156.07 crores YoY – improvement, but weak on capital intensity).

- Q2 FY26: ₹92.89 crores (vs ₹46.99 crores YoY – up, but volatile).

- Offshore operations remain risky due to dependence on global oil exploration capex, which remains subdued.

4. Foreign Exchange Gains Masking Core Weakness

- Forex gain of ₹132 crores (net) in Q2 FY26 boosted profits.

- This is non-recurring; underlying operating profitability is weaker without it.

- High exposure to dollar-denominated revenues with INR costs may lead to volatility.

5. Aging Fleet & Deferred Capex

- While no major capex pressures seen, asset base in shipping is depreciation-heavy.

- The fleet is being strategically aged out, raising questions about long-term replacement and growth capex.

🚀 3. Tailwinds (Positive Drivers)

1. Robust Dry Bulk Market Exposure

- Dry bulk segment shows resilience:

- Baltic Dry Index (BDI) has been strong in 2024–25 due to China restocking, U.S. infrastructure spending, and supply constraints.

- GESHIP operates 14 dry bulk carriers (2 Capesize, 10 Kamsarmax, 2 Supramax), well-aligned to high-volume trade routes.

- Baltic Dry Index (BDI) has been strong in 2024–25 due to China restocking, U.S. infrastructure spending, and supply constraints.

- Dry bulker earnings potential remains elevated, supporting earnings stability.

3. Proactive Fleet Modernization & Capital Allocation

- Disposing of older, less efficient vessels (“Jag Pooja”) and planning acquisition of new Ultramax dry bulk carrier shows disciplined capital recycling.

- Focus on higher-earning, more efficient dry bulk assets ahead of potential market upswing.

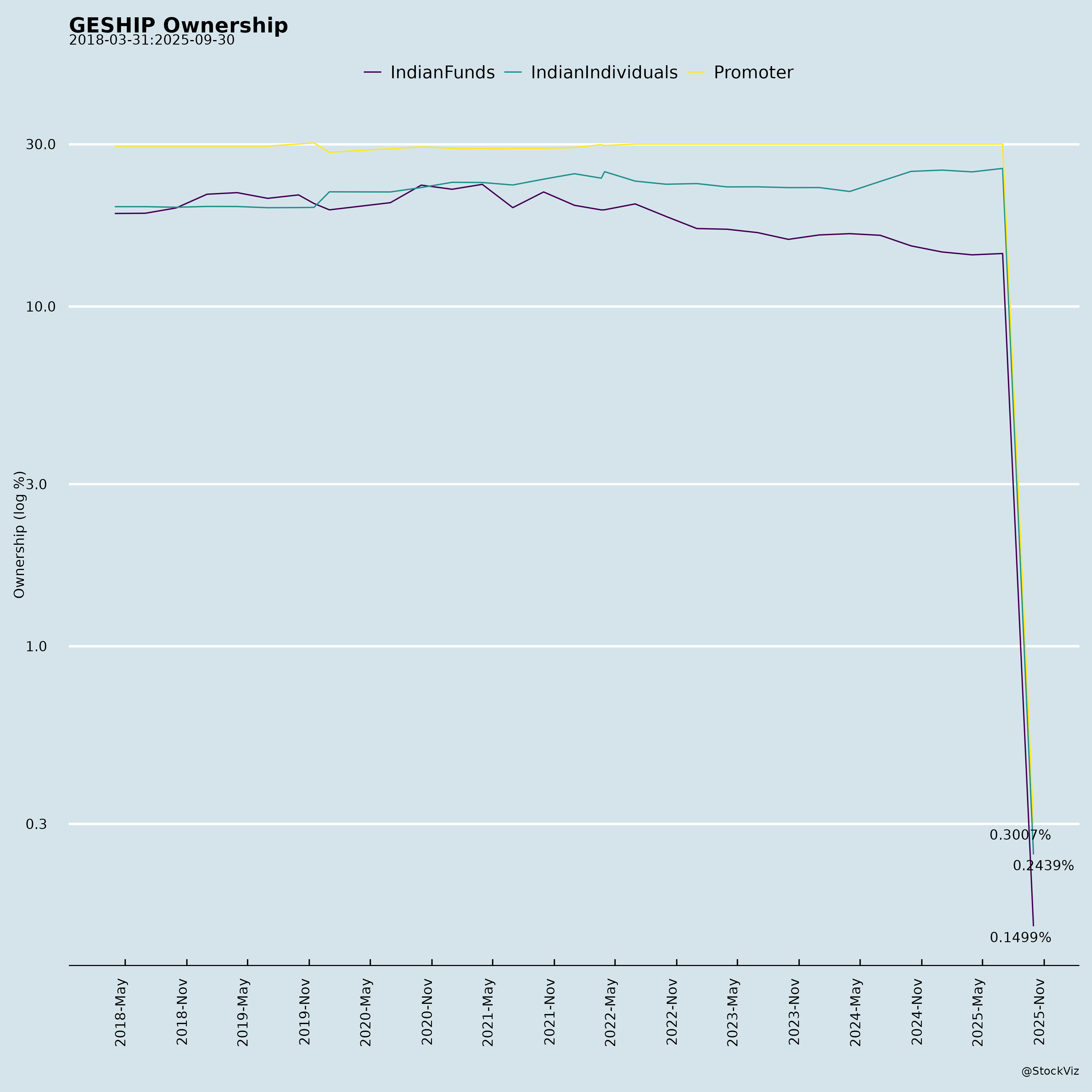

4. Strong Governance & Leadership Continuity

- Smooth succession from K.M. Sheth to Bharat K. Sheth ensures strategic continuity.

- Bharat K. Sheth has over 44 years of experience, deep operational expertise.

- No governance red flags; Deloitte has no reservations in review reports.

5. Compliance & Covenants Met

- Deloitte confirms compliance with financial covenants of secured NCDs.

- Unencumbered assets above required threshold, meeting margin requirements for unsecured debentures.

- No distress signals on balance sheet integrity.

📈 4. Growth Prospects

1. Strategic Shift Towards Dry Bulk

- Tactical reduction in tanker exposure amid uncertain oil markets.

- Expansion in bulk carriers aligns with expected strong demand in iron ore, coal, and grains.

- Potential to acquire more second-hand high-quality bulkers at favorable prices.

2. Sustainable Earnings from Stable Segments

- Bulk shipping has lower cyclicality than oil tankers.

- Diversification reduces earnings volatility → better valuation multiple potential.

3. Buyback or Special Dividend Potential

- With over ₹3,850 crores in cash and minimal debt, special dividends or buybacks are feasible.

- Could enhance shareholder returns and catalyze stock re-rating.

4. Green Fleet Transition Opportunities

- Potential to invest in scrubber-fitted or LNG-ready vessels when expanding.

- Aligning with global ESG and emission norms (CII, EEXI) can ensure future compliance and charter premiums.

5. Infrastructure Leverage via IFSC Entity

- Presence of GESHIPPING (IFSC) Limited (incorporated May 2024) in GIFT City enables:

- Tax-efficient leasing, international financing.

- Potential for global fleet monetization or leasing income.

- Tax-efficient leasing, international financing.

⚠️ 5. Key Risks

| Risk Category | Specific Risk | Impact | Mitigation Level |

|---|---|---|---|

| 1. Market Cyclicity | Dry bulk and tanker freight rates are highly cyclical; earnings can collapse rapidly in downturns. | High | Moderate (diversification helps) |

| 2. Geopolitical Exposure | Tanker operations exposed to Red Sea disruptions, Russia sanctions, Middle East tensions. | High | Partial (charter diversification) |

| 3. Fleet Capex / Replacement Risk | No significant newbuild orders; reliance on second-hand market may limit quality control. | Medium | Moderate (used market active) |

| 4. Succession Risk (partially mitigated) | While leadership transition is smooth, lack of independent succession plan beyond Sheth family. | Medium | Being addressed – long-term risk |

| 5. Regulatory & ESG Risk | Increasing CII, EEXI, EU ETS carbon levies on ships may impact older vessels. | Medium-High | Varies by vessel age |

| 6. Liquidity Traps | High cash holdings may encourage suboptimal capital allocation (e.g., low-return assets). | Medium | Company has shown discipline so far |

| 7. Dependency on Family Leadership | Board contains related parties (father-son-brother). Risk of groupthink or lack of challenge. | Medium | Audit & compliance processes strong |

💡 Investment Summary & Outlook

| Parameter | Assessment |

|---|---|

| Valuation | Potentially undervalued if considering net cash position. EV/EBITDA likely low due to strong cash reserves. |

| Dividend Yield | Expected 4–5% yield for FY26, attractive in high-interest environment. |

| Earnings Trend | Recovery in dry bulk supporting earnings; tanker segment weak but managed. |

| Catalysts | 1. Bulk market recovery, 2. Special dividend/buyback, 3. Fleet upgrade news, 4. Strategic partnerships via IFSC. |

| Downside Risks | Global recession → weak trade → freight rate collapse; war escalation affecting routes. |

✅ Conclusion: Neutral to Positive Outlook with Caution

GESHIP presents a solid, well-managed shipping company undergoing strategic transformation. While headwinds in the oil tanker market have dampened growth, the shift towards dry bulk and disciplined capital allocation is prudent. The massive cash reserves, strong dividend pay-out potential, and sound governance make it an attractive income stock.

However, long-term structural growth remains constrained unless the company makes bold moves in fleet renewal, geographic diversification, or enters logistics/terminal business.

Analyst Recommendation (based on current data):

🟡 HOLD with upside potential to BUY if a special dividend is announced or dry bulk rates surge.

Target: Monitor for strategic announcements, freight rate recovery, or buyback plans in next quarter.

Key Things to Monitor Going Forward:

- Dry Bulk Freight Rates (BDI trends).

- Q3 FY26 financials – sign of rebound in shipping segment.

- Completion of Ultramax acquisition and Suezmax sale.

- Further dividend announcements (interim or final).

- Any disclosures on green transition or decarbonization plans.

- Board independence and governance upgrades post-transition.

Sources: GESHIP Q2 FY26 Unaudited Results, Press Release (Nov 20, 2025), Deloitte Review Reports, Security Cover Certificate, SEBI Regulation Disclosures (Nov 7, 2025).

Disclaimer: This analysis is based solely on disclosed public information as of November 2025. It does not constitute investment advice.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.