Shipping

Industry Metrics

January 13, 2026

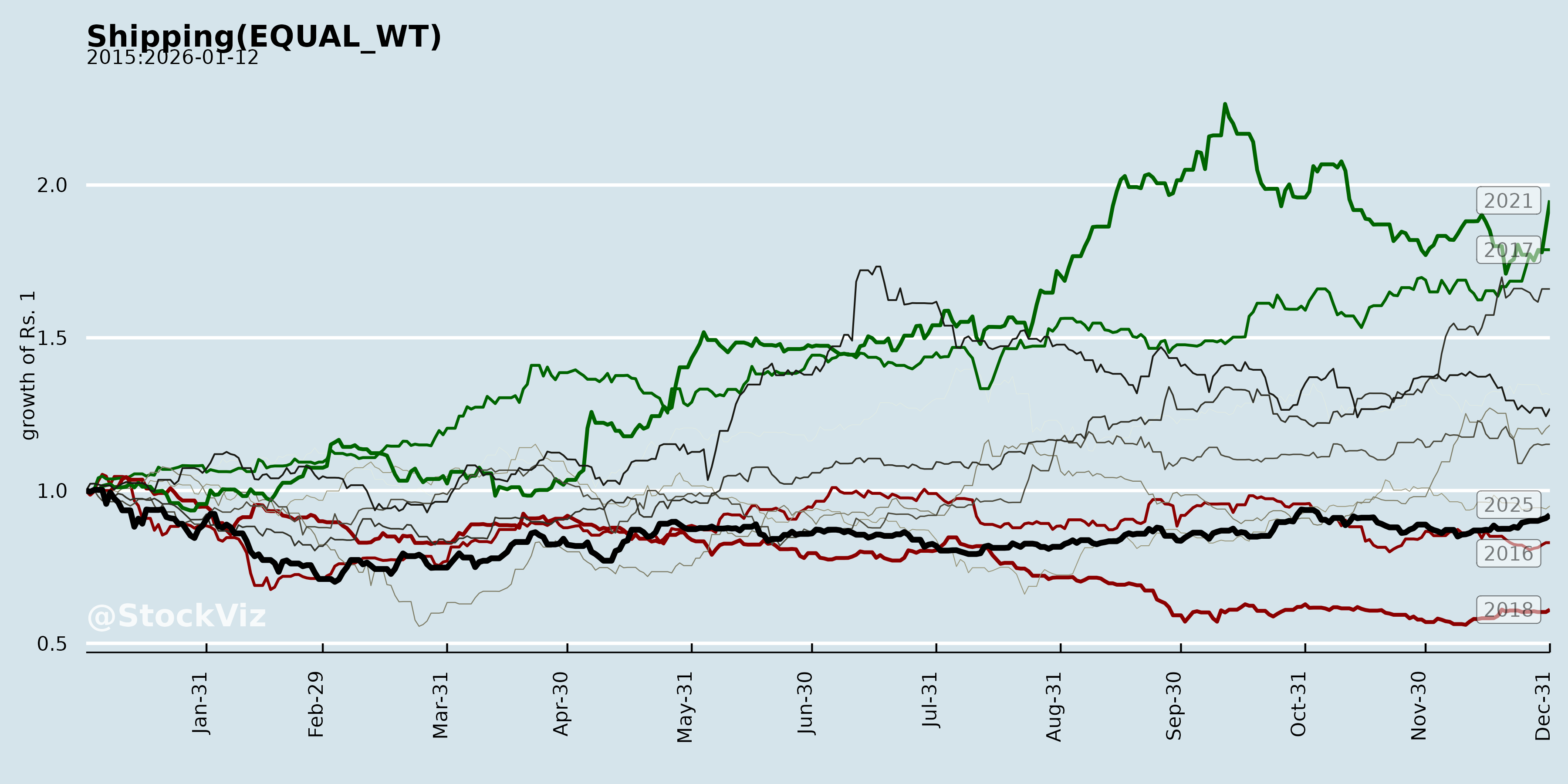

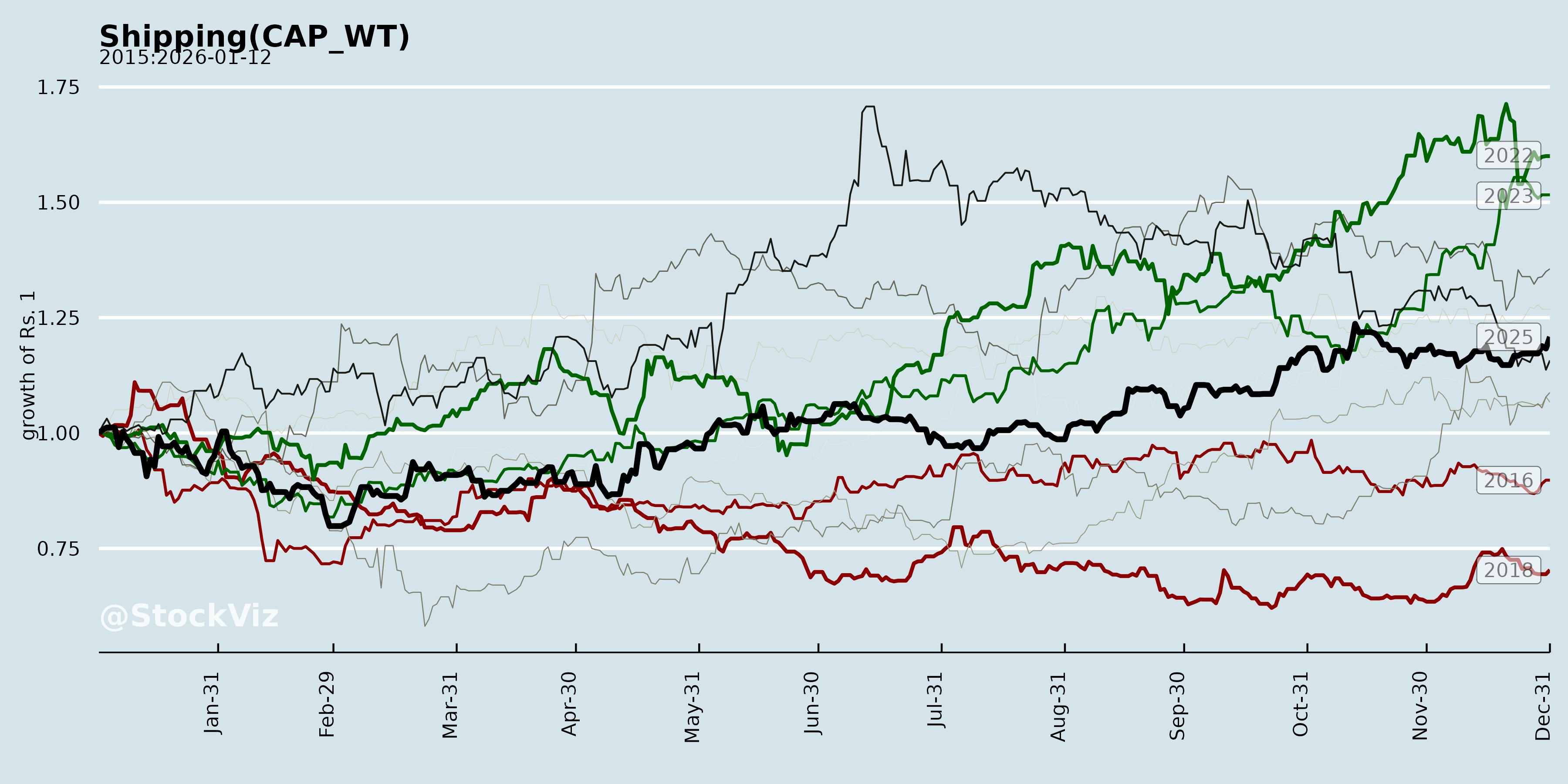

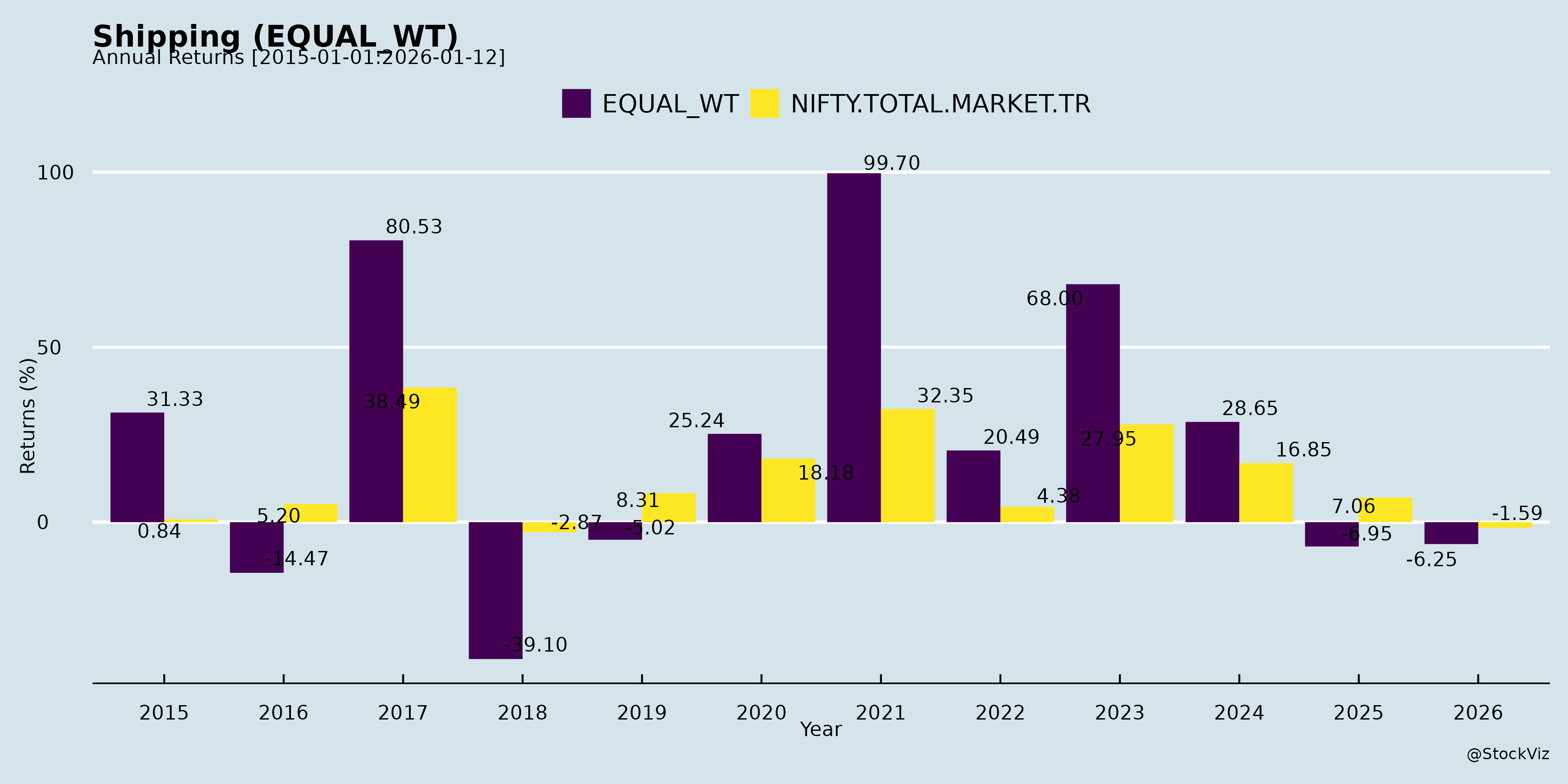

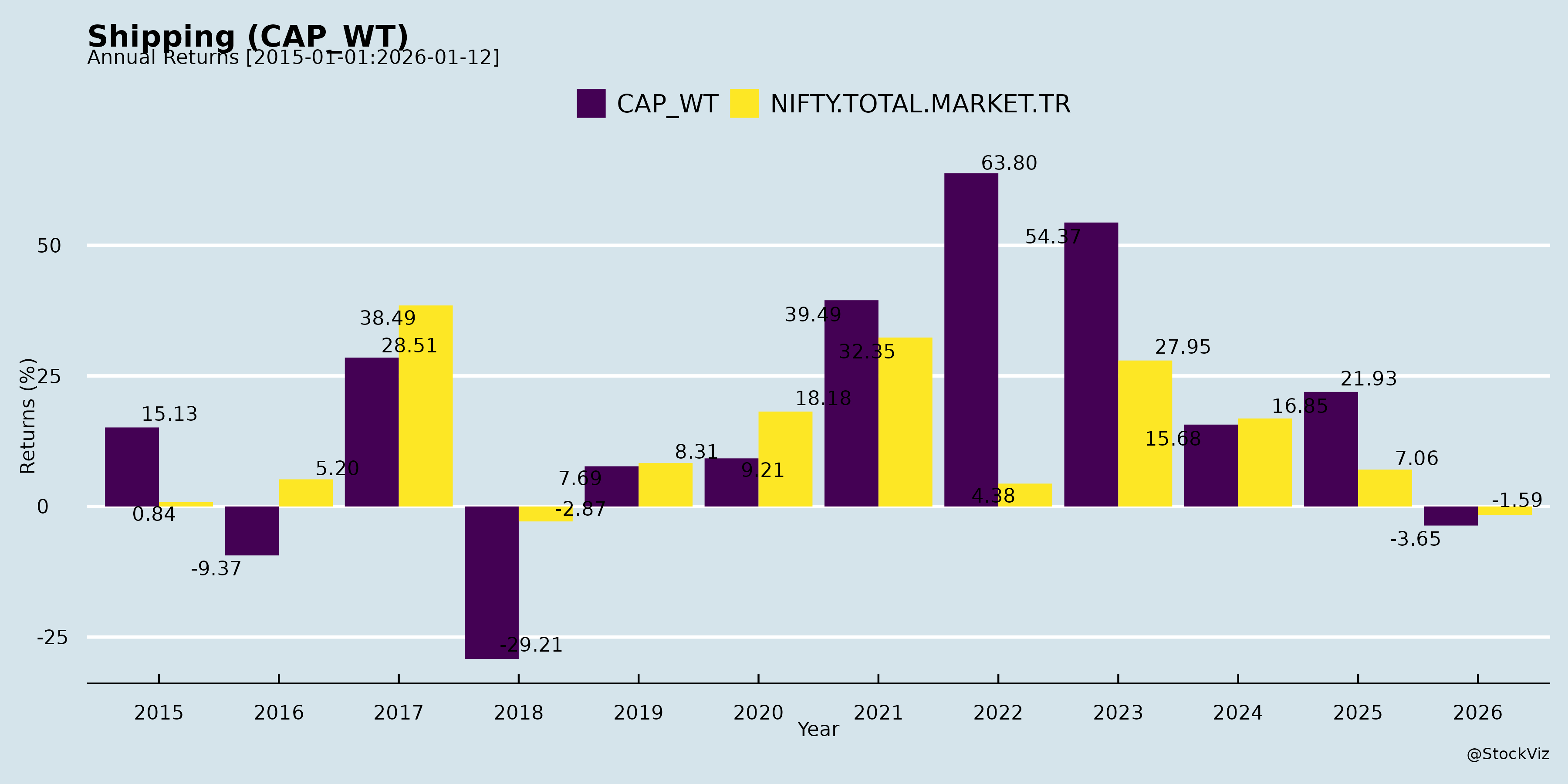

Annual Returns

Cumulative Returns and Drawdowns

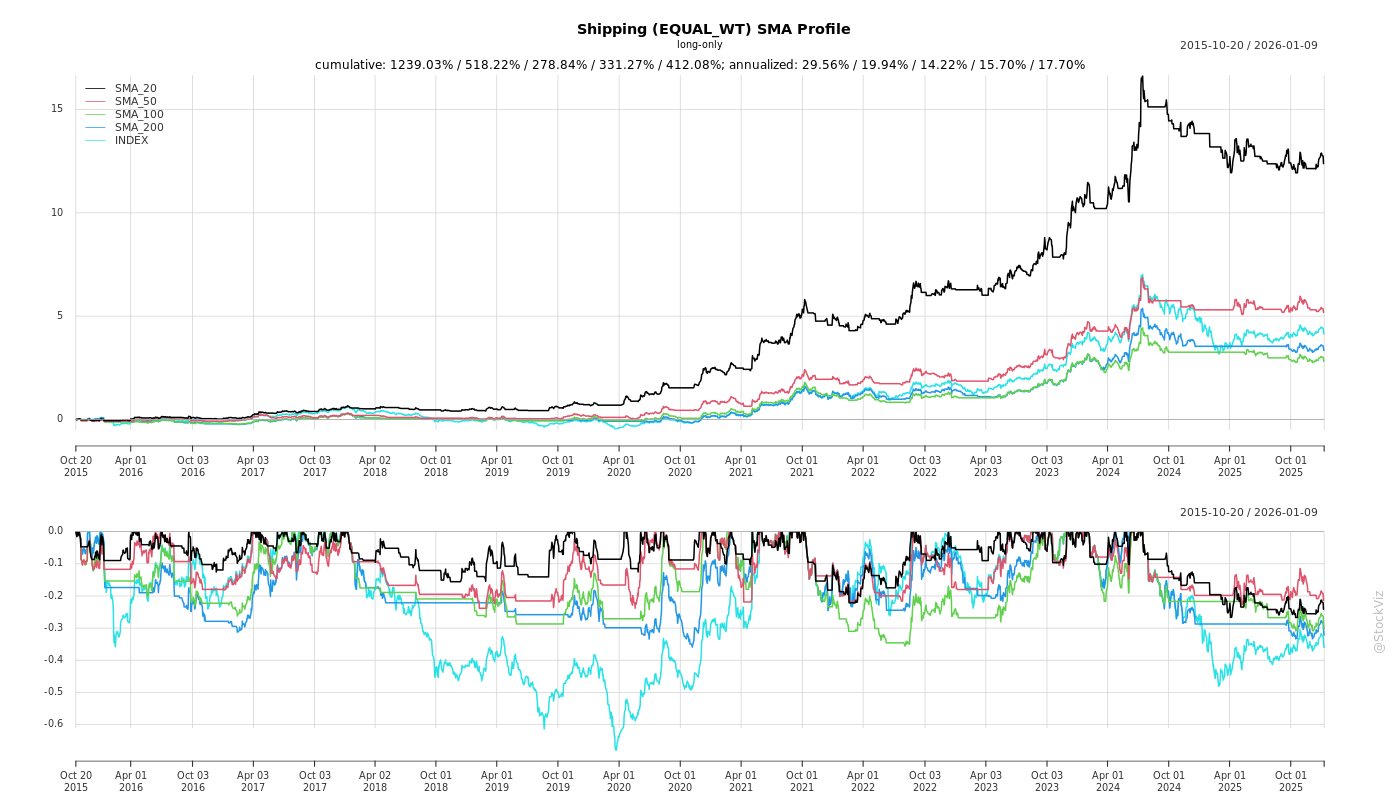

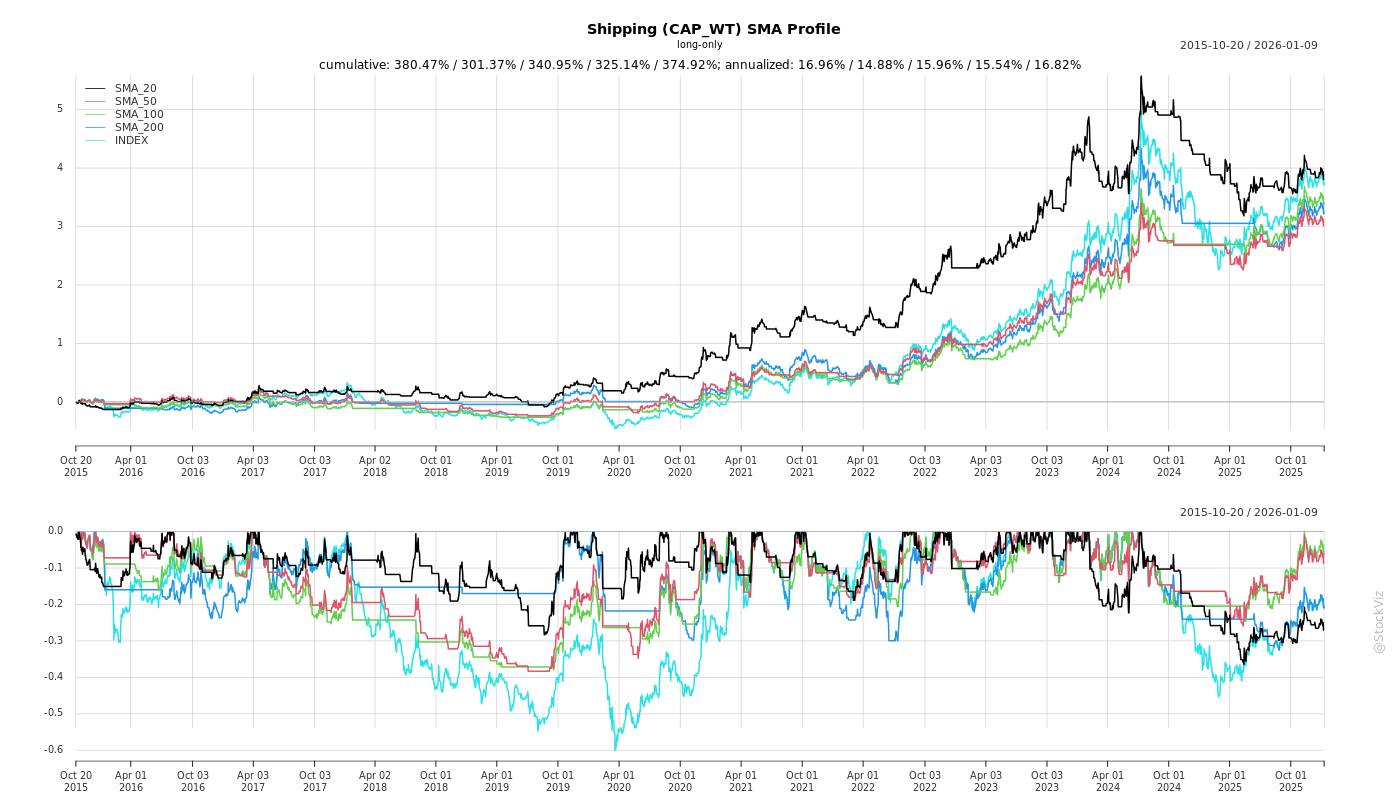

SMA Scenarios

Current Distance from SMA

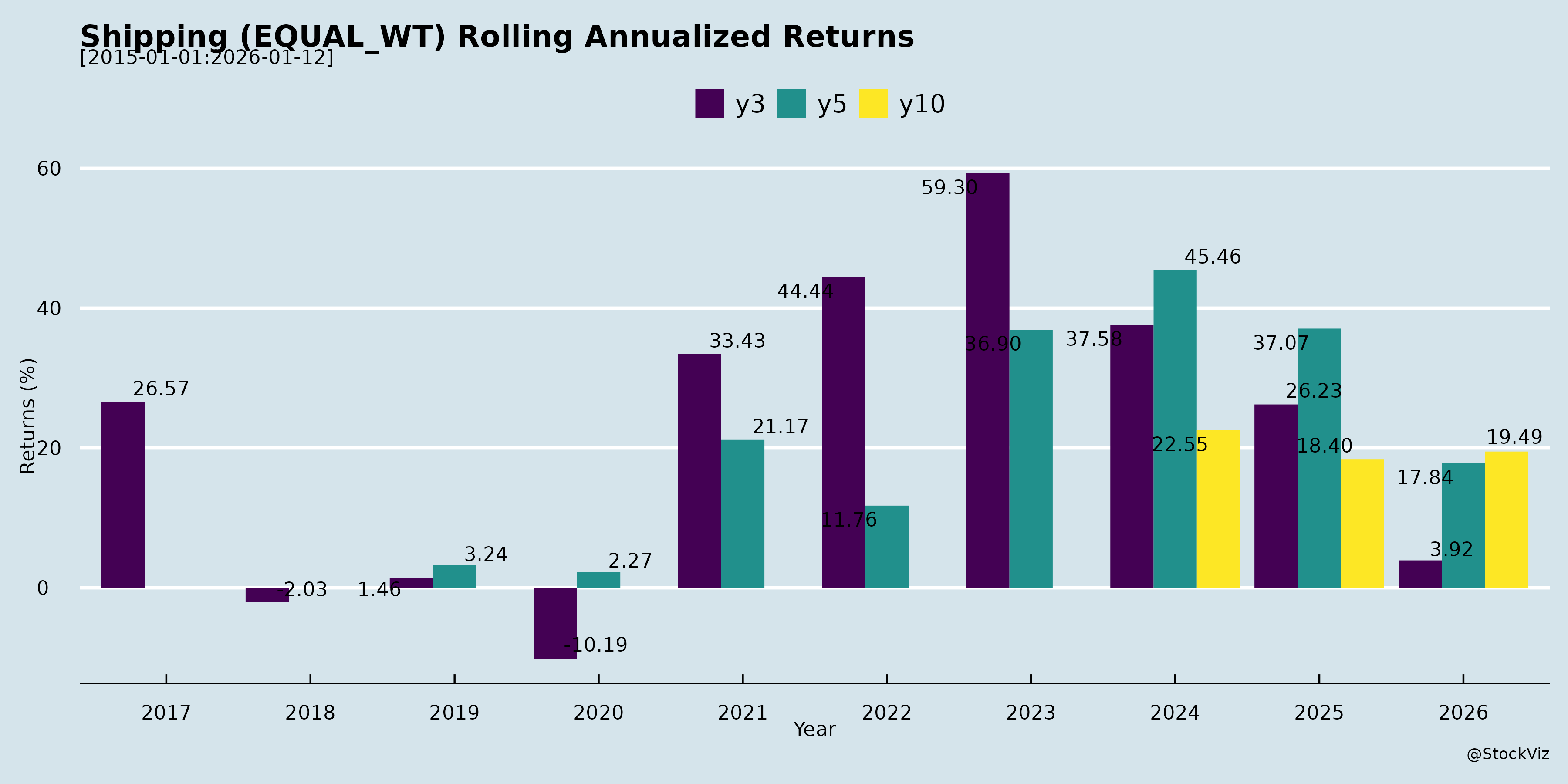

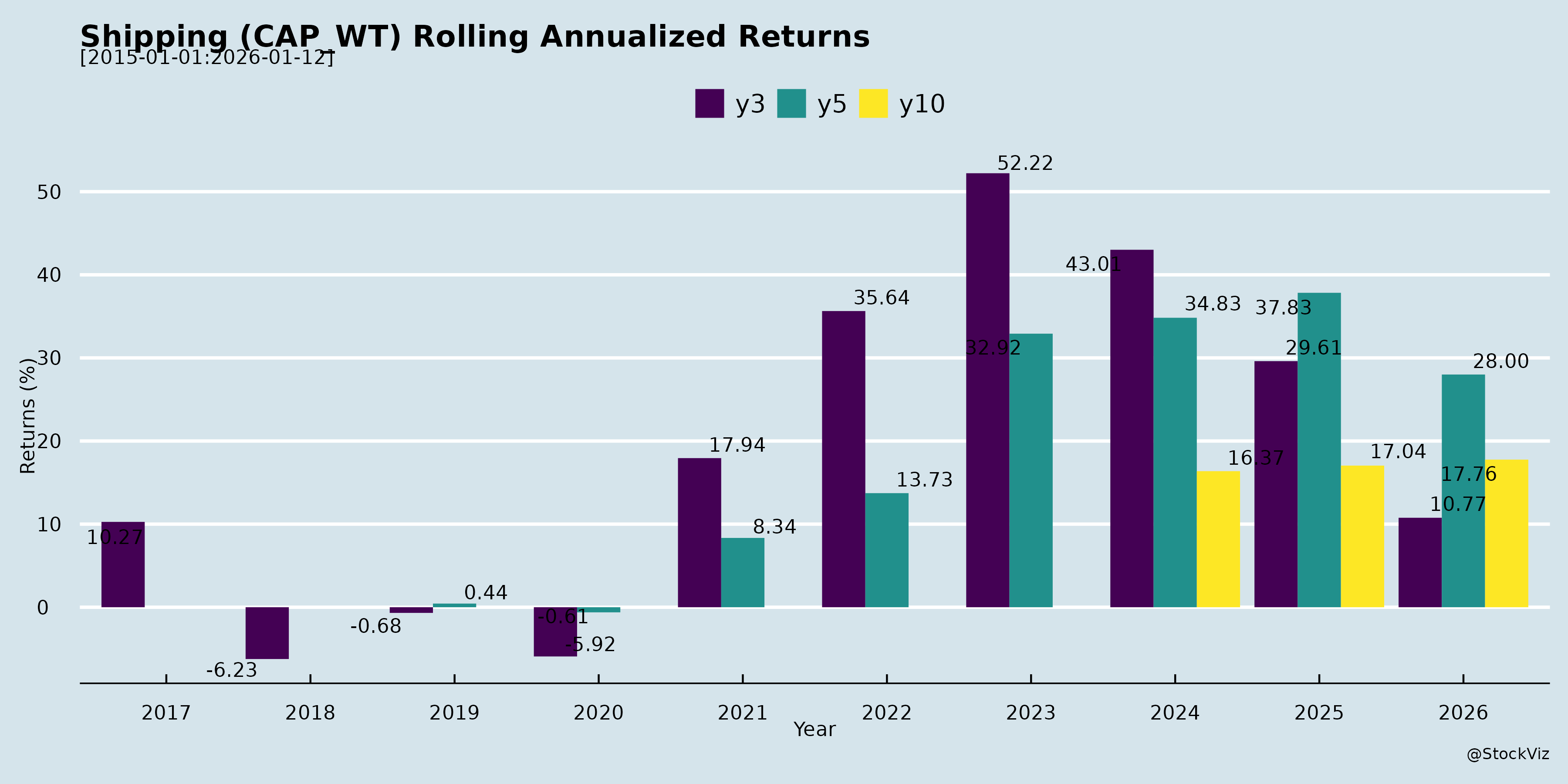

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Indian Shipping Sector Analysis (Based on GESHIP, SCI, and Seamec Documents)

The analysis draws primarily from The Great Eastern Shipping Company (GESHIP)’s detailed Q2 FY26 earnings transcript (key player in tankers, bulkers, LPG, and offshore), with limited insights from Shipping Corporation of India (SCI)’s earnings disclosure and Seamec’s (offshore-focused) investor roadshow intimation. GESHIP reflects broader sector dynamics: resilient spot markets, asset value stability, and cash-rich balance sheets amid global trade/geopolitical shifts.

Tailwinds

- Strong Freight Markets: Crude tankers (VLCC/Suezmax) tightening due to OPEC production increases, Brazilian supply growth, China stockpiling, and Russian sanctions disrupting 10-15% of fleet. Product tankers buoyed by trade growth and cracks; dry bulk supported by iron ore (+14% YoY imports), grain front-loading (tariff fears), and minor bulks (bauxite/fertilizers). LPG rates spiked to ~$60k/day on US-China tariff disruptions.

- Favorable Supply Dynamics: Low scrapping in strong markets; moderate orderbooks (crude 13%, products 18%, dry bulk 10-11%; LPG higher at 29%). Yards saturated with LNG/containers, delaying newbuilds to 2028-29.

- Asset Price Recovery: Uptick in tankers/bulkers (products/MRs recovering from mid-2025 lows); stable NAV (GESHIP up Rs.60/share to ~Rs.1,484).

- Financial Strength: GESHIP net cash $550M (Rs.7,000cr+), low debt ($186M), dividends (Rs.7.20 interim). Proactive hedging (INR debentures to synthetic USD loans at ~3.5% fixed).

- Policy Support: Govt. focus on shipbuilding/repair, Sagar Mala (coastal shipping boost); GESHIP participates actively.

- Offshore Resilience: High utilization (jack-ups 75%+ visibility), vessels fixed long-term; Seamec’s roadshow signals investor interest.

Headwinds

- YoY Profit Pressure: GESHIP standalone profits flat QoQ but down vs. Q2 FY25 (ship sales, capacity drop, softer product/dry bulk rates).

- Geopolitical/Trade Disruptions: Russian refinery outages/sanctions, US-China tariffs (grains/LPG rerouting), reducing efficiency.

- Segment-Specific Weakness: Dry bulk/coal softer (China infra slowdown, renewables); LPG trade inefficiencies; product rates stable but below Q1 FY25 peaks (~$20k/day).

- High OPEX in Offshore: Rig mobilization costs lumpy (Q3/Q4 FY26 hit); short-term contracts add volatility.

- FX/Debt Volatility: Rupee depreciation aids NAV (Rs.30/share gain) but hits P&L via MTM losses on swaps (net long USD position mitigates).

- Aging Fleet: GESHIP switching old (e.g., 20-yr tankers) for new (Ultramax bulker); requires capex.

Growth Prospects

- Opportunistic Capex: GESHIP holds cash for “weak markets” (historical deployments Rs.5,500cr/decade); switch strategy (40+ fleet), newbuilds (e.g., Suezmax at $80M/unit), second-hand buys. Capacity to double fleet quickly (2016-18 precedent).

- Spot/Short-Term Exposure: ~90% fleet (tankers/bulkers) spot-exposed to capture upside; 4 offshore vessels on short-term for max rates.

- New Segments: Monitoring containers (post-boom correction, high orderbook); coastal via Sagar Mala.

- Offshore Repricing: Key vessels/rigs repricing H2 FY26/H1 FY27 at elevated levels.

- SCI/Seamec Synergies: SCI’s earnings call and Seamec’s roadshows indicate sector momentum; govt. ecosystem buildout (foreign vessel registrations, shipbuilding targets).

- Long-Term Demand: Global trade (China imports), energy transition delays favoring tankers/bulkers.

Key Risks

- Rate Volatility: Spot-heavy exposure vulnerable to demand shocks (e.g., China real estate/steel down, tariff escalations); no rate forecasts given unpredictability.

- Geopolitical: Sanctions (Rosneft/Lukoil, shadow fleet), Red Sea/Ukraine disruptions amplifying tightness but risking oversupply if resolved.

- Supply Surprises: Scrapping delays (owners hold in strong markets); yard flexibility if LNG/containers slow.

- Regulatory/FX: Delayed carbon regs (IMO); rupee depreciation MTM losses (normalized out); currency mismatch if unhedged.

- Execution/Capex: Lumpy rig costs; capital deployment bandwidth tested in weak markets (team prepped, but timing key).

- Macro: Refinery returns easing cracks; renewables curbing coal/LPG; over-reliance on China (50%+ demand driver).

Overall Summary: Indian shipping (exemplified by GESHIP) enjoys strong tailwinds from tight supply, trade flows, and policy push, driving NAV accretion and cash piles despite softer YoY profits. Growth hinges on disciplined capex in downturns, with prospects in spot upside and diversification. Headwinds are transient (geopolitics), but risks center on volatility and execution. Sector poised for 2-3yr visibility (low new supply), favoring cash-rich players like GESHIP (P/NAV 0.73x). SCI/Seamec add offshore/govt.-backed depth. Outlook: Cautiously optimistic; hold cash, deploy opportunistically.

Financial

asof: 2025-12-01

Analysis of Indian Shipping Sector: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Executive Summary

The Indian shipping sector, as reflected in Q3 and 9M FY25 financial results from key players like The Great Eastern Shipping Company (GESHIP), Shipping Corporation of India (SCI), Transworld Shipping Lines (TSL), and limited insights from Essar Shipping, demonstrates resilience and profitability amid cyclical recovery. GESHIP and SCI reported strong profits (GESHIP: ₹593 Cr Q3 profit; SCI: ₹65 Cr consolidated 9M profit), driven by tanker and bulk segments, while TSL showed turnaround from prior losses. Tailwinds from high freight rates and fleet optimization outweigh headwinds like volatility and insurance disputes. Growth is supported by global trade and energy demand, but risks from geopolitics and claims persist. Overall, the sector outlook is positive with EBITDA margins ~50% (GESHIP) and net debt-equity negative (cash-rich balance sheets).

| Metric | GESHIP (9M FY25) | SCI (9M FY25, Consolidated) | TSL (9M FY25, Standalone) |

|---|---|---|---|

| Revenue | ₹4,100 Cr | ₹4,390 Cr | ₹336 Cr |

| Net Profit | ₹1,981 Cr (EPS ₹139) | ₹658 Cr (EPS ₹14) | ₹39 Cr (EPS ₹18) |

| Key Segments | Shipping (strong), Offshore (recovery) | Tankers (48% rev), Bulk/Liner (variable) | Shipping (single segment) |

Tailwinds (Positive Drivers)

- Robust Freight Rates & Demand: Tanker (crude/product) and bulk segments thriving due to global energy demand (e.g., GESHIP tanker revenue up; SCI tankers ₹2,682 Cr 9M rev). Liner recovery post-COVID.

- Fleet Optimization & Sales Gains: GESHIP realized ₹462 Cr profit on ship sales (older vessels like Supramax/Suezmax); SCI/TSl focus on efficiency.

- Strong Balance Sheets: Low debt (GESHIP Debt/Equity 0.19x, Net D/E negative); high cash (GESHIP ₹3,864 Cr cash equivalents). Healthy ratios (DSCR 4.8x, Interest Coverage 15x).

- Dividends & Shareholder Returns: GESHIP ₹24.3/share interim FY25; SCI stable payouts.

- Operational Efficiency: Forex gains (GESHIP ₹104 Cr 9M), low fuel costs relative to revenue (~8-10%).

Headwinds (Challenges)

- Segment Volatility: SCI Bulk/Liner losses (e.g., Bulk ₹20 Cr Q3 loss); TSL prior fire incident (₹663 lakhs additional repair costs Q3 FY25).

- High Operating Costs: Fuel/stores ~25-30% of expenses (GESHIP ₹319 Cr fuel 9M); employee costs rising (SCI ₹41 Cr 9M).

- Insurance & Claims Delays: TSL auditor qualification on ₹3,752 lakhs unconfirmed insurance recovery (fire on MV SSL Brahmaputra); cargo claims ₹15 Cr pending.

- Forex & Derivative Volatility: GESHIP ₹58 Cr derivative losses 9M; SCI notes reconciliation impacts.

- Regulatory/Compliance Issues: SCI disinvestment delays, PRP disputes (₹11 Cr pending); Essar NSE queries on result signing.

Growth Prospects

- Global Trade & Energy Boom: Rising LNG/crude demand (SCI JVs like ILT1-4 contribute ₹18 Cr 9M profit); GESHIP Offshore up 20% YoY.

- Fleet Expansion/Modernization: GESHIP newbuilds implied; TSL IFSC subsidiary (₹2 Cr investment); SCI FPO funds for tonnage.

- Digital/IFSC Push: GESHIP/TSL IFSC entities for global ops; SCI tech/offshore growth.

- Government Support: SCI Navratna status, demerger (non-core assets to SCILAL); sector benefits from PLI-like schemes.

- Projections: GESHIP operating margin ~53%; SCI tanker dominance positions for 10-15% CAGR if rates hold.

Key Risks

| Risk Category | Description | Impact/Mitigation |

|---|---|---|

| Geopolitical/Route Disruptions | Red Sea/Houthi attacks (implied in forex/volatility); SCI notes agent recon. | High; Diversify routes, insurance. |

| Freight Rate Cyclicality | Spot market drops (SCI Bulk Q3 loss). | Medium; Long-term charters (GESHIP 50%+). |

| Insurance/Claims | TSL ₹37 Cr disputed recovery; cargo suits. | High; Auditor flags Ind AS 37 non-compliance. |

| Regulatory/Disinvestment | SCI privatization delays; PRP/DPE disputes. | Medium; Essar compliance lapses. |

| Fuel/Inflation | Oil price spikes (GESHIP fuel 8% rev). | Medium; Hedging (derivatives used). |

| Debt/Refinancing | SCI ₹150 Cr unallocated interest; rising rates. | Low (GESHIP prepaid borrowings). |

| FX/Interest | Rupee volatility (GESHIP forex gain ₹104 Cr but risk). | Medium; Natural hedge via USD revenues. |

Final Outlook

Bullish near-term with profits up 15-100% YoY (GESHIP/SCI), supported by energy shipping tailwinds. Growth via modernization/IFSC could drive 12-18% revenue CAGR FY25-27, but monitor Q4 freight softness and TSL claims. Sector ROE ~20-30% sustainable if risks managed. Investors: Favor GESHIP (premium valuation) over SCI (disinvestment overhang).

Data sourced from Q3/9M FY25 filings; all figures consolidated unless specified.

General

asof: 2025-12-03

Indian Shipping Sector Analysis

Based on the provided announcements from key players (Great Eastern Shipping, SCI, Shreeji Shipping Global, Seamec, Essar Shipping, Transworld Shipping), the sector shows resilience amid regulatory scrutiny, with positives from dividends, expansions, and strategic shifts. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks. Analysis draws from dividend payouts (strong cash flows), compliance issues, charter deals, JV registrations, and debt actions.

Tailwinds (Positive Factors)

- Robust Dividend Payouts: Multiple firms (GESHIP: ₹7.20 interim/share; Transworld: ₹1.50 proposed) signal healthy profitability, cash generation, and shareholder returns amid FY25-26. TDS communications reflect proactive compliance and broad investor base (residents/non-residents).

- Government Support for Coastal Shipping: Shreeji’s charter for MV SJ LILY highlights policy push for coastal routes (cost-efficient vs. road/rail, emission reductions, highway decongestion), creating annuity revenues and resilience.

- IFSC/International Expansion: Seamec’s JV (SEARETE INDIA IFSC) registration in GIFT City enables tax-efficient global ops, financing, and forex hedging.

- Debt Discipline: Essar’s partial NCD redemption (₹889M principal + interest/premium) reduces leverage, improving balance sheets.

Headwinds (Challenges)

- Regulatory Compliance Pressures: SCI fined ₹5.43L (BSE/NSE) for board composition lapses (Reg 17(1) SEBI LODR); PSUs face delays in govt-nominated independent directors, risking recurring penalties.

- Tax & Administrative Burden: Extensive TDS/DTAA guidelines (GESHIP, Transworld) for dividends underscore complexity in exemptions (Forms 15G/H, TRC, Form 10F), PAN-Aadhaar linking, and cut-offs (e.g., Nov 13, 2025), increasing admin costs and litigation risks.

- PSU Governance Delays: SCI’s reliance on “Competent Authority” for board appointments highlights structural hurdles in PSUs.

Growth Prospects

| Area | Key Drivers from Docs | Potential Impact |

|---|---|---|

| Coastal Logistics | Shreeji’s charter with AMNS; ongoing talks; govt incentives. | Transformational: Shift from stevedoring to integrated ops; multi-year demand from bulk cargo (e.g., steel); high entry barriers favor incumbents. |

| IFSC/Global Hubs | Seamec’s GIFT City JV. | Access to int’l funding, ship leasing; positions for offshore/international growth. |

| Stable Core Ops | Dividend consistency; Essar debt reduction. | Sustained earnings from tankers/dry bulk; annuity charters enhance revenue quality. |

| Overall | Sector evolution to “asset-backed” models; coastal as “growth engine.” | 10-20%+ revenue upside if coastal scales; PSUs like SCI stabilize with board fixes. |

Key Risks

| Risk Category | Details | Mitigation/Implications |

|---|---|---|

| Regulatory | Fines (SCI); SEBI LODR non-compliance; TDS errors leading to higher withholding/refund claims. | High for PSUs; potential escalations if unresolved. |

| Tax/Compliance | DTAA misuse (non-residents); invalid docs (PAN/TRC); Rule 37BA disputes on TDS credit allocation. | Refunds via ITR possible, but delays cash flows; indemnity clauses shift liability to shareholders. |

| Operational | Confidential charter terms (Shreeji); vessel age/compliance (e.g., <30 yrs, P&I clubs, DG Shipping). | Exposure to execution risks, counterparty defaults (e.g., AMNS). |

| Sectoral | Inferred: Govt delays (SCI); dependency on bulk cargo cycles. | Macro: Fuel volatility, geopolitics not covered but amplify dividend sustainability risks. |

| Financial | Partial debt redemptions signal ongoing leverage; higher TDS erodes net payouts. | Balance sheet strain if rates rise. |

Overall Outlook: Moderately Positive. Tailwinds from policy (coastal/IFSC) and dividends outweigh headwinds, with growth in niche areas like coastal shipping. Risks are compliance-heavy but manageable via proactive filings. Sector poised for 8-12% CAGR if regulatory hurdles clear; monitor PSU governance and global trade. Investors: Focus on dividend yields, charter backlogs.

Investor

asof: 2025-11-30

Summary Analysis of Indian Shipping Sector

Based on the provided documents, primarily the Q2 FY26 earnings call transcript of The Great Eastern Shipping Company Limited (GESHIP) (India’s largest private shipping firm), supplemented by disclosures from Shipping Corporation of India (SCI) and Seamec Limited (offshore-focused), the Indian shipping sector shows resilience amid volatile global markets. GESHIP reports steady profits (Rs.581 Cr consolidated), NAV growth (Rs.60/share QoQ to ~Rs.1,484), and a net cash position of ~$550 Mn, with a modernizing fleet (~40 vessels post-commitments). SCI and Seamec indicate ongoing investor engagement but lack detailed insights. Key themes include spot market exposure, currency matching via USD swaps, and caution on high order books. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Factors)

- Strong Crude Tanker Demand: OPEC production cut unwinding, new Brazilian/Middle East supply, China inventory builds, and Russian sanctions (10-15% tanker fleet sanctioned) driving VLCC/Suezmax/Aframax rates higher. GESHIP’s crude tankers (spot-exposed) benefit directly.

- Tight Fleet Supply: Low scrapping (strong markets discourage it), modest order books (crude 13%, dry bulk 10-11%), and yard capacity constrained by LNG/container orders (delays newbuilds to 2028-29). Global offshore orderbook at 2.5% supports rigs/OSVs.

- Asset Price Recovery: Uptick in tankers/bulker values (e.g., MR products recovering from mid-2025 lows); GESHIP NAV resilient despite sales/aging.

- Product/Dry Bulk/LPG Stability: Product cracks strong, Russian refinery disruptions aiding substitution trades; dry bulk iron ore (+14% YoY imports), frontend grain loading (Panamax/Kamsarmax boost); LPG rates spiked to $60k/day on US-China tariffs.

- Financial Strength: GESHIP net cash ($550 Mn), low debt ($186 Mn NCDs), dividends (Rs.7.20 interim), and rupee depreciation gains (Rs.30 of NAV uplift; net dollar long).

- Policy Support: Govt initiatives like Sagar Mala (coastal shipping boost); rising India focus on shipbuilding/repair attracts foreign tonnage.

Headwinds (Challenges)

- Rate Pressures in Key Segments: Product tankers (MRs) down significantly YoY (~$20k/day narrow range); dry bulk flat/slightly lower H1 CY25; coal weak amid renewables/hydropower growth.

- High Order Books: LPG (29%), products (18%) risk oversupply; aging fleet (e.g., GESHIP’s 20-yr old tankers) needs switching, reducing capacity/profits.

- Geopolitical/Trade Disruptions: US-China tariffs hit grains/LPG; Russian drone attacks/refinery outages create uncertainty; no floating storage economics yet.

- Opex/Capex Loads: Offshore rigs face lumpy mobilization costs (Q3/Q4 FY26 hit); vessel repricings (e.g., 4 high-capability AHTS/MPSSVs) add volatility.

- FX/Financing Costs: INR debenture-to-USD swaps yield ~3.5% fixed USD but MTM losses on depreciation (net +2% benefit assumed at 3% annual depreciation); current net cash buffers this.

- Lower YoY Profits: GESHIP standalone flat QoQ but down vs. Q2 FY25 (profit-on-sale impact, lower rates/capacity).

Growth Prospects

- Fleet Modernization & Expansion: GESHIP adding Ultramax bulker (Q4 FY26 delivery), scrapping old tankers; maintaining ~40 vessels via “switch strategy” (sell old, buy new). Capacity to deploy Rs.2,000 Cr+ annual accruals + debt.

- Spot/Short-Term Exposure: ~90% fleet spot (tankers/dry bulk), 4 offshore vessels on short-term (maximizing rates); rigs 75% covered FY26 (repricings H2 FY26/H1 FY27 at high levels).

- Capital Deployment: $7,000 Cr cash hoard; historical success (2016-18: 30→50 ships); newbuild potential (e.g., 2-4 Suezmax @ $80 Mn each). Watching containers for post-boom correction (high orderbook, falling box rates).

- Offshore Upside: Global supply glut of old rigs/OSVs; GESHIP’s 3 rigs active +1 short-term; Seamec’s roadshows signal investor interest.

- Sector Ecosystem: SCI/Govt push on coastal/shipbuilding; GESHIP open to India coastal opportunities.

Key Risks

- Market Cycle Volatility: Rates unpredictable (e.g., no forecasts given); potential crude/product softening if sanctions ease/OPEC stabilizes; dry bulk weak on China steel/real estate slowdown. | High Orderbook Segments | LPG/products oversupply by 2027-28. |

- Geopolitical/Regulatory: Russian sanctions escalation, US-China tariffs, future IMO carbon rules (delayed, but could accelerate 20+ yr scrapping).

- Currency & MTM: Rupee depreciation aids NAV but hits P&L via swaps (normalized results strip this); assumes 3% annual drop.

- Execution/Deployment: Cash pile-up if weak markets delay buys (GESHIP confident in team/bandwidth for 50-60 vessel scale-up).

- Company-Specific: Rig off-hire/mobilization drags Q3/Q4; FX buckets (derivatives, cash reval, sub-investments) add P&L noise.

Overall Outlook: Balanced—tailwind from supply tightness/crude strength offsets headwinds in products/LPG. Growth via opportunistic buying in downturns; risks tilted to volatility but mitigated by cash fortress/conservative leverage. GESHIP’s normalized profits stable; sector poised for govt-backed domestic upside. Monitor Russian sanctions, China demand, and orderbook deliveries.

Meeting

asof: 2025-12-01

Indian Shipping Sector Analysis (Based on Q2/H1 FY26 Filings)

The provided filings from key players—Great Eastern Shipping (GESHIP), Shipping Corporation of India (SCI), Shreeji Shipping Global (SHREEJISPG), Seamec Ltd., Essar Shipping, and Transworld Shipping Lines (TSLL)—offer insights into the sector’s mixed performance amid volatile freight rates, fleet expansions, and operational challenges. Overall, tankers and bulk segments show resilience, but offshore and liner segments face pressures. H1 FY26 revenue growth (e.g., SCI +5% YoY standalone) contrasts with patchy profitability due to costs and one-offs.

Tailwinds (Positive Drivers)

- Robust Profitability in Core Segments: SCI’s tanker segment drove H1 revenue (₹1,77,086 lakhs), with PAT ₹51,912 lakhs (standalone). GESHIP’s AGM showed near-unanimous approvals (99%+ votes) for financials/re-appointments, signaling stability. TSLL revenue steady at ₹19,298 lakhs (consolidated H1).

- Dividends & Capital Returns: SCI declared ₹3/share interim (30% payout), following ₹6.59 final. TSLL proposed ₹1.50 final.

- Fleet Modernization: SCI acquired 2 VLGCs (Sahyadri, Shivalik); SHREEJISPG raised ₹3,695 Cr via IPO for Supramax dry bulk carriers; Seamec/CapEx visibility (₹20,764 lakhs CWIP).

- Segment Strength: Bulk/tankers resilient (SCI tanker PBT ₹42,480 lakhs H1); unallocated income supports (SCI ₹4,181 lakhs).

Headwinds (Challenges)

- Profit Declines & Losses: Seamec Q2 loss ₹2,479 lakhs (PBT); TSLL Q2 loss ₹855 lakhs PBT (consolidated). SCI Q2 PBT down 32% YoY to ₹20,070 lakhs amid higher expenses (₹1,23,284 lakhs).

- Operational Disruptions: TSLL fire on MV SSL Brahmaputra (Jan 2024) led to exceptional items (₹398 lakhs recovery Q2).

- Cost Pressures: Rising depreciation (SCI +11% H1), finance costs (TSLL +26% YoY H1), and forex/reconciliation issues (SCI notes on receivables/payables).

- Segment Weakness: Seamec bulk/offshore losses; SCI liner/bulk dips.

Growth Prospects

- Fleet Expansion & Capacity Addition: SHREEJISPG post-IPO vessel orders (delivery FY27); SCI/Seamec CWIP signals newbuilds. GESHIP Article changes may enable flexibility.

- Disinvestment/Strategic Shifts: SCI ongoing (PIM since 2020); Essar approved divestments in loss-making subs (ESDMCC, OGDSHL) to redeem NCDs/FCCBs, freeing capital.

- Segment Tailwinds: Tanker/gas strength (SCI VLGCs); SHREEJISPG geographic diversification (India 98% revenue). Potential M&A (TSLL approved 100% stake in logistics arms).

- Capital Access: SHREEJISPG IPO success (listed Aug 2025); strong balance sheets (GESHIP ₹10 Cr+ votes in favor).

Key Risks

- Operational/Execution: Vessel incidents (TSLL fire), repairs/delays (SCI notes on demerger leasebacks pending disinvestment).

- Financial/Leverage: High debt (SCI borrowings ₹2.56 Cr; Essar subs negative net worth ₹885 Cr combined); forex volatility (SCI revaluation impacts).

- Regulatory/Compliance: Pending reconciliations (SCI trade recs/tax assets); disinvestment delays (SCI DIPAM process); overseas investments (Essar OI Rules compliance).

- Market/Cyclical: Freight rate volatility, fuel costs, geopolitical risks (Red Sea/offshore demand). Exceptional items recur (TSLL insurance recoveries).

- Liquidity: CapEx heavy (Seamec ₹23,318 lakhs PPE purchases H1); unutilized IPO proceeds (SHREEJISPG ₹2,513 Cr).

Summary: Indian shipping benefits from tanker/bulk tailwinds and fleet investments (H1 revenue up ~5-10% YoY for majors), but headwinds from costs/losses temper outlook. Growth hinges on expansions/disposals (SCI/Essar), with FY26 PAT potentially flat-to-up 5-10% if rates hold. Risks center on ops/debt; monitor Q3 for freight recovery. Sector PE ~8-12x; selective buys in tankers/offshore.

Press Release

asof: 2025-11-30

Indian Shipping Sector Analysis (Based on Provided Announcements)

The analysis draws from recent disclosures by three listed Indian shipping companies: Great Eastern Shipping (G E Shipping) (diversified tanker/dry bulk), Shreeji Shipping Global (dry-bulk logistics focus), and Transworld Shipping Lines (container feeder/dry bulk). These reflect a mixed sector outlook: strength in dry bulk and logistics amid container segment weakness. Key metrics show revenue growth in Shreeji (+17% YoY H1 FY26), fleet optimization at G E Shipping, but losses at Transworld due to aging assets.

Tailwinds (Positive Drivers)

- Strong Dry Bulk Demand: Baltic Handysize Index rose from 690 to 856 points in Q2 FY26 (Transworld), driven by tight supply and coastal demand in India. Shreeji’s dry-bulk focus delivered robust H1 FY26 EBITDA (+34% YoY to ₹118.63 Cr, 36.68% margin).

- Operational Resilience & Expansion: Shreeji overcame monsoon seasonality with revenue growth (₹323 Cr H1 FY26) via diverse services (80+ vessels, 370+ equipment), long-term contracts, and new LOI for floating crane at Diamond Harbour. G E Shipping optimized fleet (40 vessels, 3.32 mn dwt) by selling aging tanker “Jag Pooja”.

- Domestic & Policy Support: Resilient Indian coastal container trade (Transworld) and non-major port focus (Shreeji: Navlakhi, Bedi, etc., plus Sri Lanka). IPO capital at Shreeji fuels service expansion.

- Margin Expansion: Shreeji’s EBITDA margins up 461 bps YoY; charter income stable at G E Shipping/Transworld.

Headwinds (Challenges)

- Container Segment Weakness: Global volatility hit rates (SCFI down 8.1% to 1319 points; Transworld revenue -22% YoY to ₹98 Cr in Q2 FY26, PAT loss of ₹9 Cr).

- Aging Fleet & High Opex: Transworld’s 4 container vessels (nearing 30 years) drove sharp maintenance costs and lay-ups, causing EBITDA drop (₹18 Cr Q2 FY26 vs. ₹50 Cr prior year).

- Seasonal & Macro Pressures: Monsoon curbs H1 revenues (Shreeji); geopolitical tensions, U.S. demand weakness, and oversupply soften global rates.

- Profit Volatility: Shreeji’s PAT flat YoY (₹79.91 Cr) due to exceptional income offset; Transworld shifted from profit to loss.

Growth Prospects

- Fleet Modernization & Capacity Addition: G E Shipping’s pending Suezmax sale/Ultramax buy (H2 FY26); Shreeji’s crane facility and IPO-funded diversification (cargo handling, STS lighterage). Transworld eyes vessel replacements with equity raise.

- Domestic Logistics Boom: Shreeji’s 30+ year legacy in non-major ports positions it for port-led growth; FY25 revenue ₹584 Cr signals scalability to FY26 “strong performance”.

- Dry Bulk/Feeder Momentum: Coastal resilience and global dry bulk uptrend support 10-30% YoY growth in select segments (e.g., Shreeji EBITDA).

- Pipeline Strength: Shreeji’s projects, G E Shipping’s 3.32 mn dwt scale, and Transworld’s 12-vessel fleet (chartered to Avana) offer upside if macros stabilize.

Key Risks

| Risk Category | Description | Impacted Companies |

|---|---|---|

| Fleet Age/Availability | High replacement costs; few suitable vessels (Transworld). | Transworld (high); G E Shipping (managed via sales). |

| Geopolitical/Macro | Freight rate volatility, U.S./Europe demand weakness, tensions. | All (container-heavy Transworld most exposed). |

| Operational/Cost | Maintenance surges, seasonal monsoons, lay-ups. | Transworld (losses); Shreeji (mitigated). |

| Financial | Exceptional items distort profits; equity needs for capex. | Shreeji (one-off income); Transworld (funding gap). |

| Regulatory/Market | Port restrictions, oversupply; forward-looking uncertainties (disclaimers). | All. |

Summary

Bullish on Dry Bulk/Logistics (Shreeji, G E Shipping) with tailwinds from demand, margins, and expansions outweighing seasonal headwinds; cautious on Containers (Transworld) due to aging fleets and global softness. Overall Sector: Moderately positive growth (10-20% revenue potential FY26) via modernization and domestic focus, but risks from macros and capex loom large. Investors should monitor fleet renewal progress and freight indices (e.g., BHSI/SCFI) for Q3 FY26 inflection. Dry bulk outperforms containers amid volatility.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.