FEDERALBNK

Equity Metrics

January 13, 2026

The Federal Bank Limited

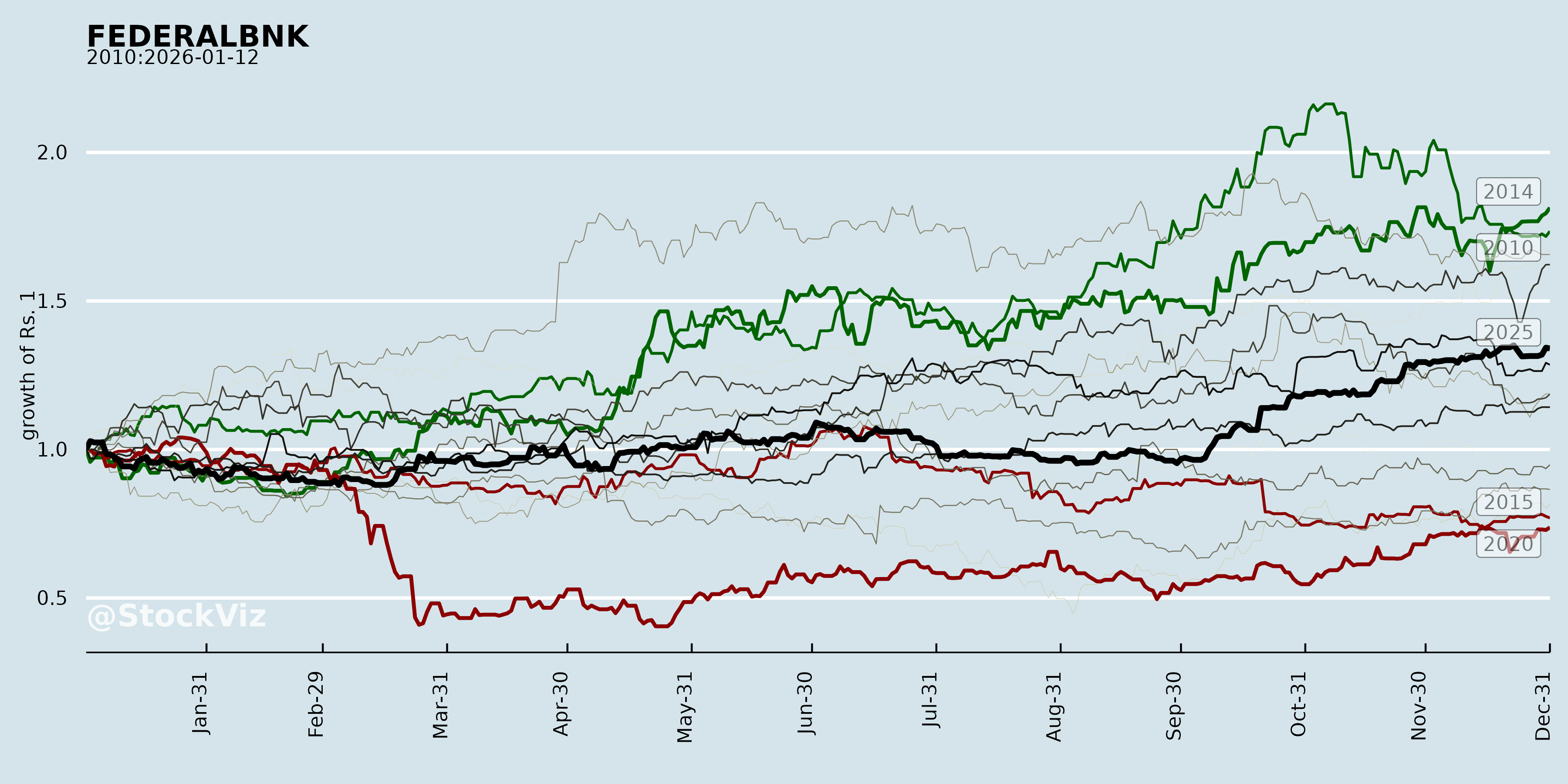

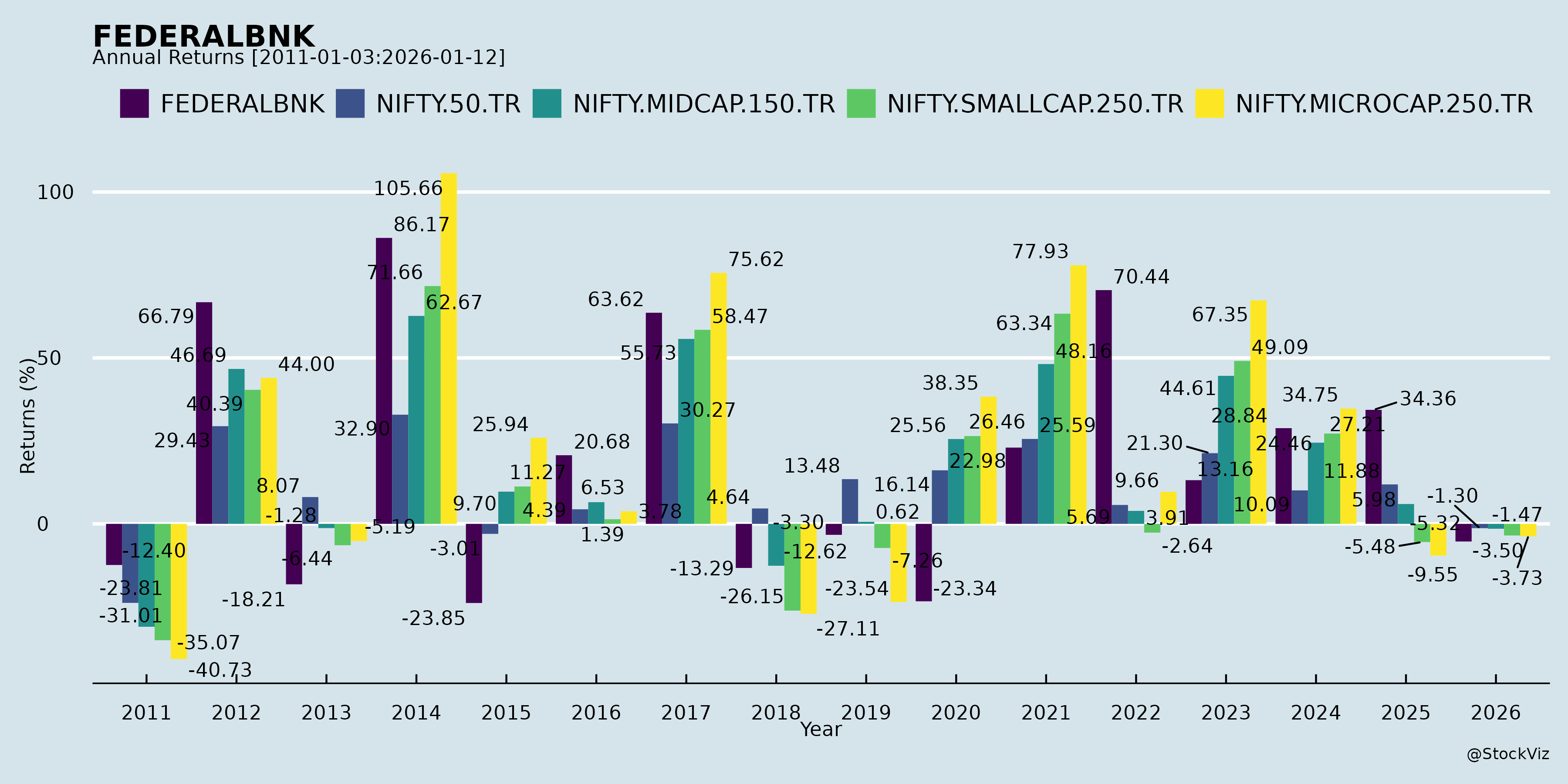

Annual Returns

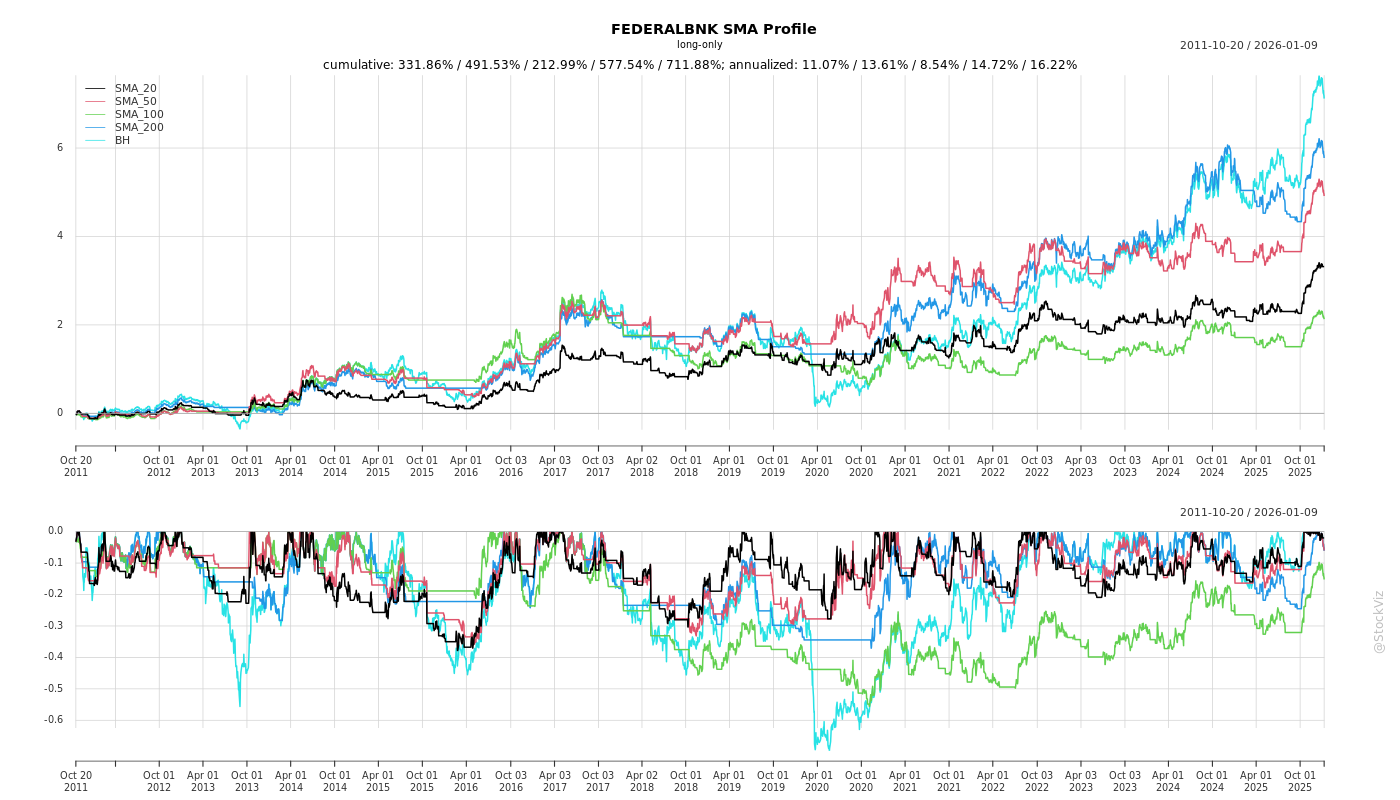

Cumulative Returns and Drawdowns

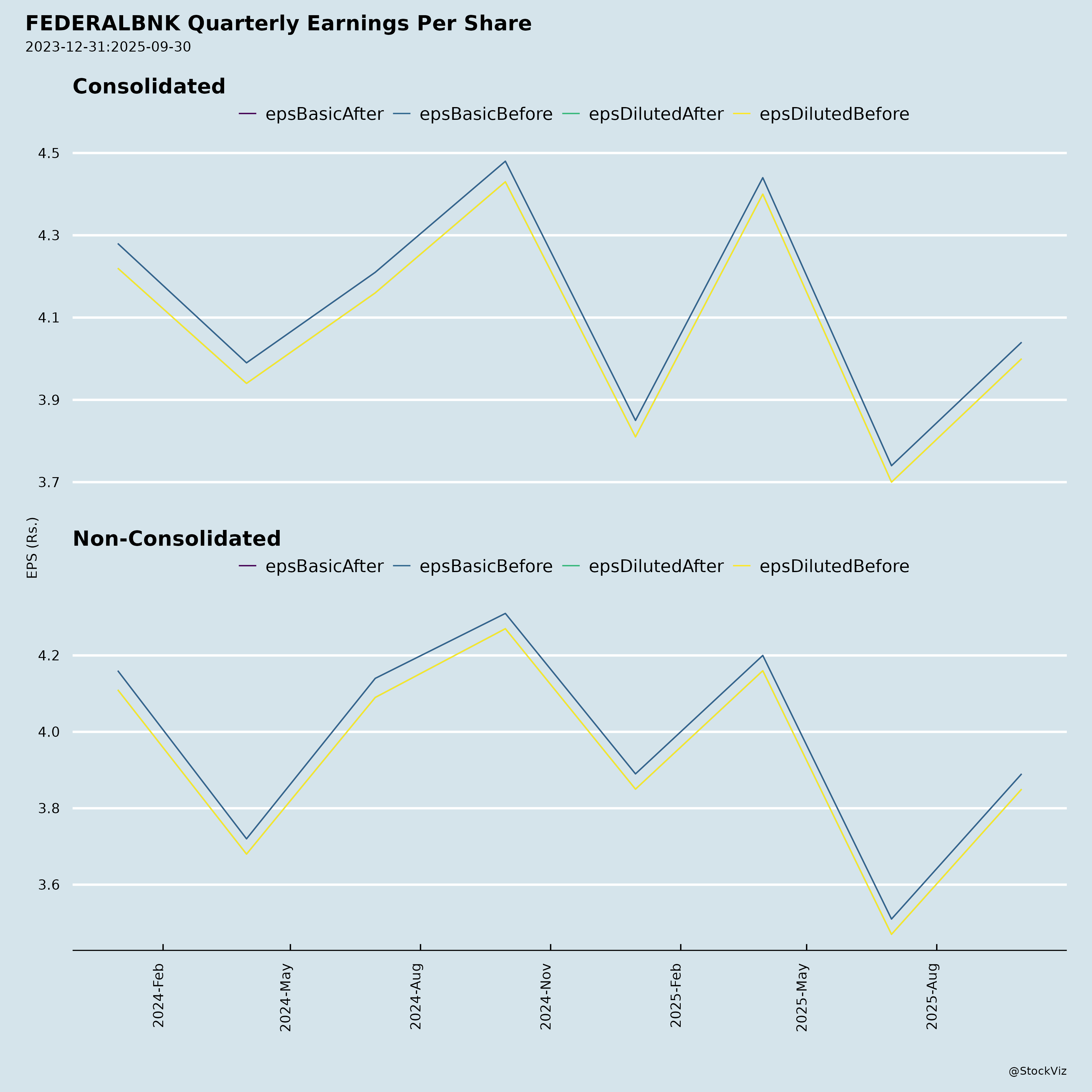

Fundamentals

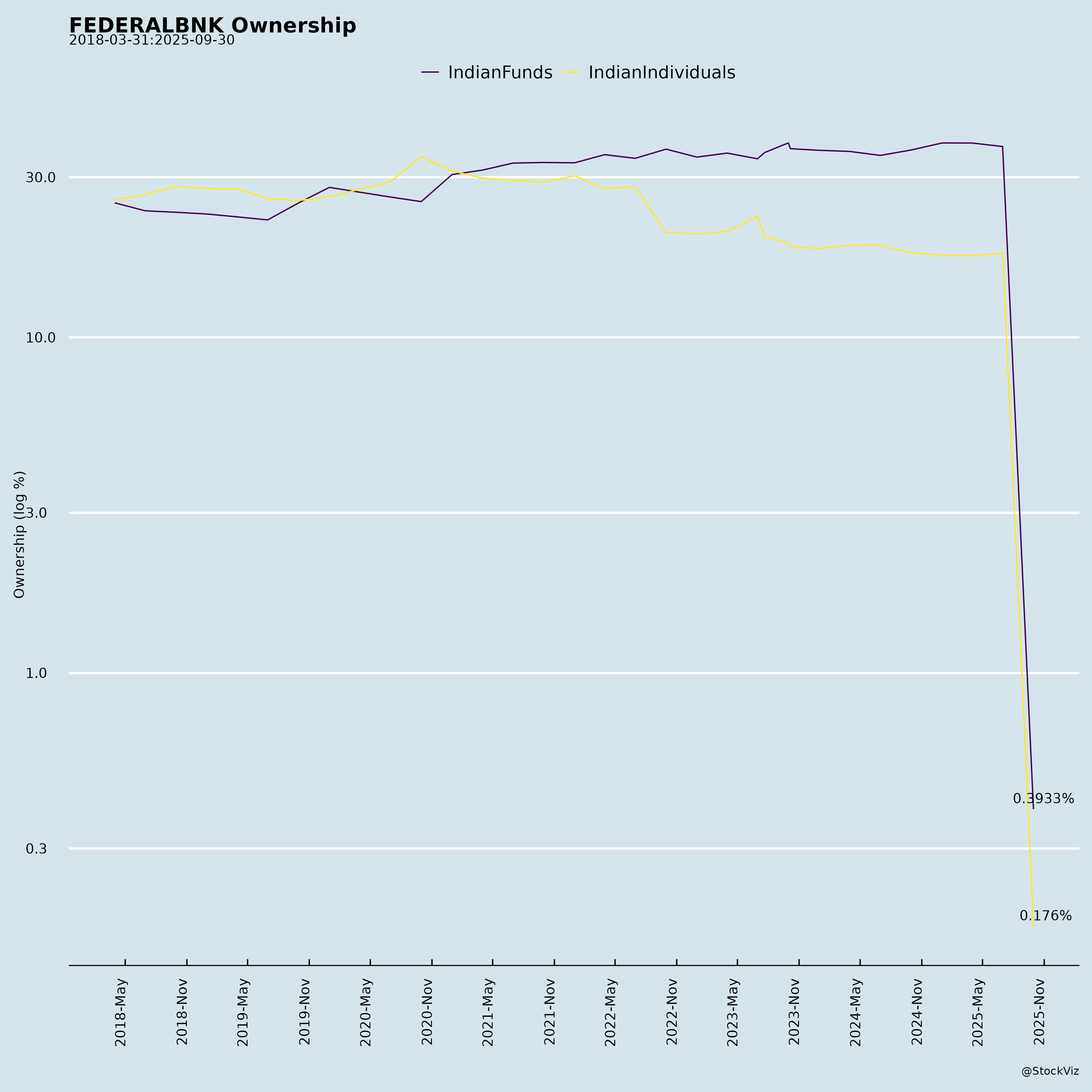

Ownership

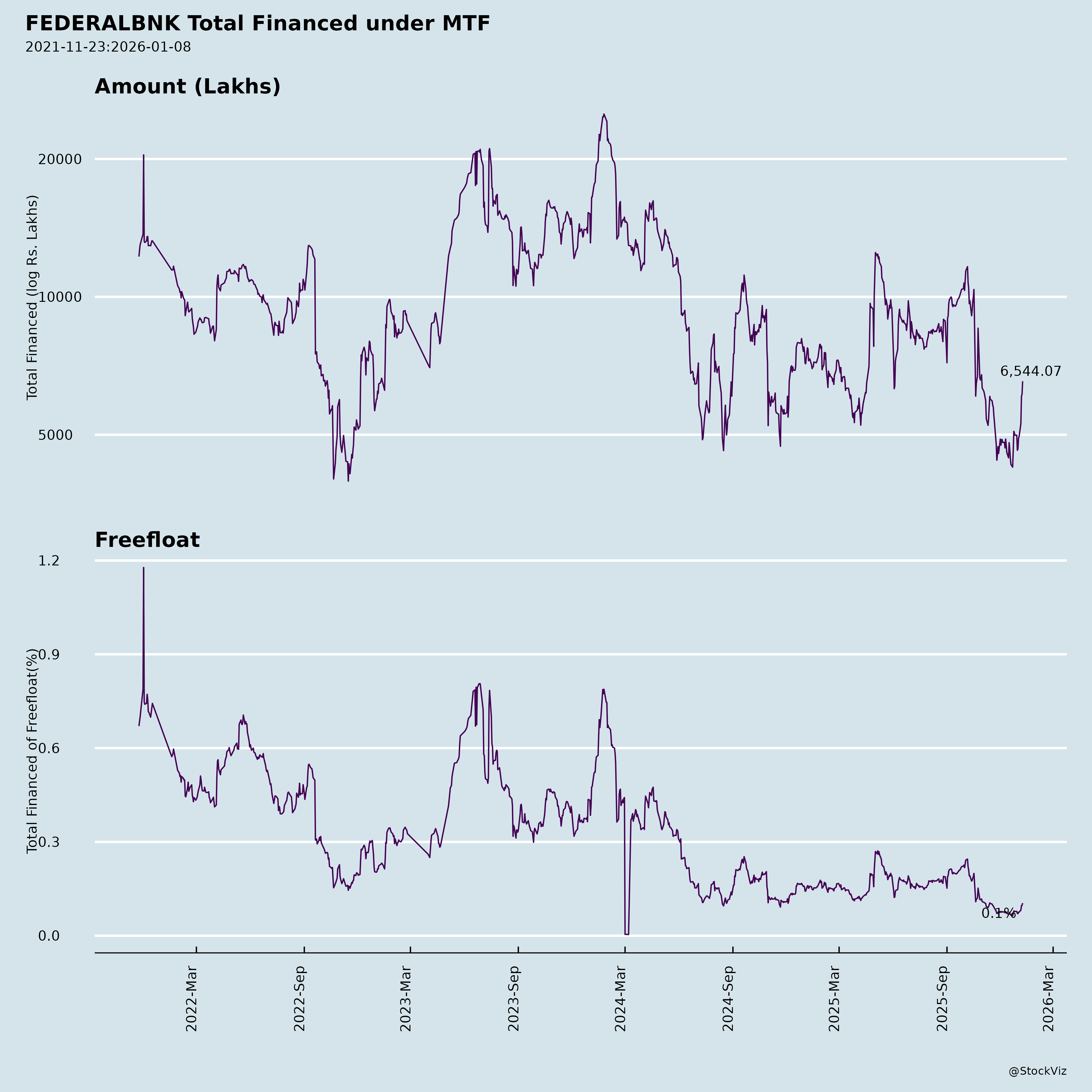

Margined

AI Summary

asof: 2025-12-03

Federal Bank (FEDERALBNK) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Federal Bank reported robust Q2 FY26 (Sep 2025) results with record NII (₹2,495 Cr, +5% YoY/+7% QoQ) and fee income (₹886 Cr, +13% YoY/QoQ), driven by deposit growth (7% YoY), stable NIM (3.06%, +12 bps QoQ), and decadal-best asset quality (GNPA 1.83%, NNPA 0.48%). Balance sheet at ₹3.56 lakh Cr; ROA/ROE at 1.09%/11.01%. Key strategic move: EGM-approved preferential warrant issue (~₹6,200 Cr) to Warburg Pincus (Asia II Topco), potentially adding 9.99% stake post-conversion, bolstering capital (CRAR 15.71%). Below is a structured summary.

Tailwinds (Positive Drivers)

- Earnings Resilience: Highest-ever NII and fees (para-banking up sharply); total income +4% YoY. Fee-to-assets >1%, diversified (insurance +69% YoY, forex +41%).

- Liability Franchise: Deposits +7% YoY (CASA +11% to 31%, granular CASA+<₹3Cr deposits at 83%); NRE/remittance market share ~21%.

- Asset Quality Strength: GNPA stable at 1.83% (down 26 bps YoY), PCR 73%; slippage 0.94%, credit cost 50 bps. Recoveries/upgrades ₹265 Cr.

- Capital Infusion: ₹6,200 Cr warrants (25% upfront) from Warburg Pincus; enhances growth firepower amid strong CRAR.

- Digital/Operational Efficiency: 93%+ txns digital; 15.5L active mobile users; partnerships (Jupiter, PhonePe) driving cards/loans. Cost/income stable at 54%.

- Retail/SME Focus: Retail book 28% of advances (+1% YoY); high-yield segments (cards, gold, micro) growing; diversified portfolio (retail/SME ~62%).

Headwinds (Challenges)

- Profitability Pressure: Net profit -10% YoY (₹955 Cr) due to higher provisions (+35% YoY) and opex (+9% YoY); RoE dipped to 11% from 13.65% YoY.

- Margin/Yields: Yield compression (14 bps QoQ) offset by CoF decline; NIM stable but vulnerable to rate cuts.

- Macro Environment: “Weathering macro challenges” noted; slower advances growth (6% YoY vs. deposits); retail remuneration revisions faced ~8% dissent in EGM.

- Cost Dynamics: Cost/income at 54%; business/employee ₹32 Cr (healthy but scaling pressures).

- Dependence on Key Verticals: Agri/MFI slippages elevated; corporate book selective but low-yield.

Growth Prospects (Medium-Term Outlook)

- High (Funded by Capital Raise): Warrants provide ~₹6,200 Cr for 15-20% loan CAGR targeting retail/SME (62% book), digital lending, and high-yield (cards +19% YoY, gold stable). Deposits momentum (CASA target 35%+) via NRE/digital.

- Fee/Non-Interest Income: Para-banking scaling (insurance, cards); aim for 15%+ CAGR, fee-to-assets >1.2%.

- Digital Expansion: 92% digital txns, Feddy AI (10L queries/Q), partnerships (90+ for lending/payments); mobile vol ₹25K Cr/month.

- Projections: 12-15% BS growth FY26-28; RoE 14-16% with NIM 3.1-3.2%; EPS ₹15-18 FY26. Warburg’s board nominee (post-5% stake) adds governance/strategic expertise.

- Triggers: RBI/CCI approvals for warrants; Q3 execution on retail disbursals.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Asset Quality | Macro slowdown could raise slippages (0.94%); agri/MFI vulnerable (GNPA contrib. ~7%). | PCR 73%, conservative underwriting; PCR target 75%+. |

| Interest Rate/NIM | Rate cuts erode yields; CoF sticky. | CASA build-up; high-yield shift (mid-yield 45% book). |

| Regulatory/Execution | Delays in RBI/CCI nods for warrants; ESOS dilution (~2L shares/Q). | Strong track record; EGM approvals secured (99%+ for warrants). |

| Concentration | Top-20 exposure ~8.5% (declining); corporate 37% book. | Granular retail/SME focus; rating skew to investment-grade. |

| Competition/Cyber | Intense private bank rivalry; digital risks. | Partnerships, ISO certifications; 356 RPA processes. |

| Capital Utilization | Sub-optimal deployment post-raise. | Proven RoRWA 1.92%; retail pipeline strong. |

Overall Summary: Federal Bank is well-positioned with tailwinds from capital raise, fees, and asset quality outweighing YoY profit dip and macro headwinds. Growth prospects strong (12-15% BS CAGR) via retail/digital, but execution on warrants and NIM key. Valuation supportive (trading ~1.5x FY26 BVPS); recommended BUY for 15-20% upside in 12M (target ₹220-230). Risks tilted to macros/execution (medium).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.