ETERNAL

Equity Metrics

January 13, 2026

ETERNAL LIMITED

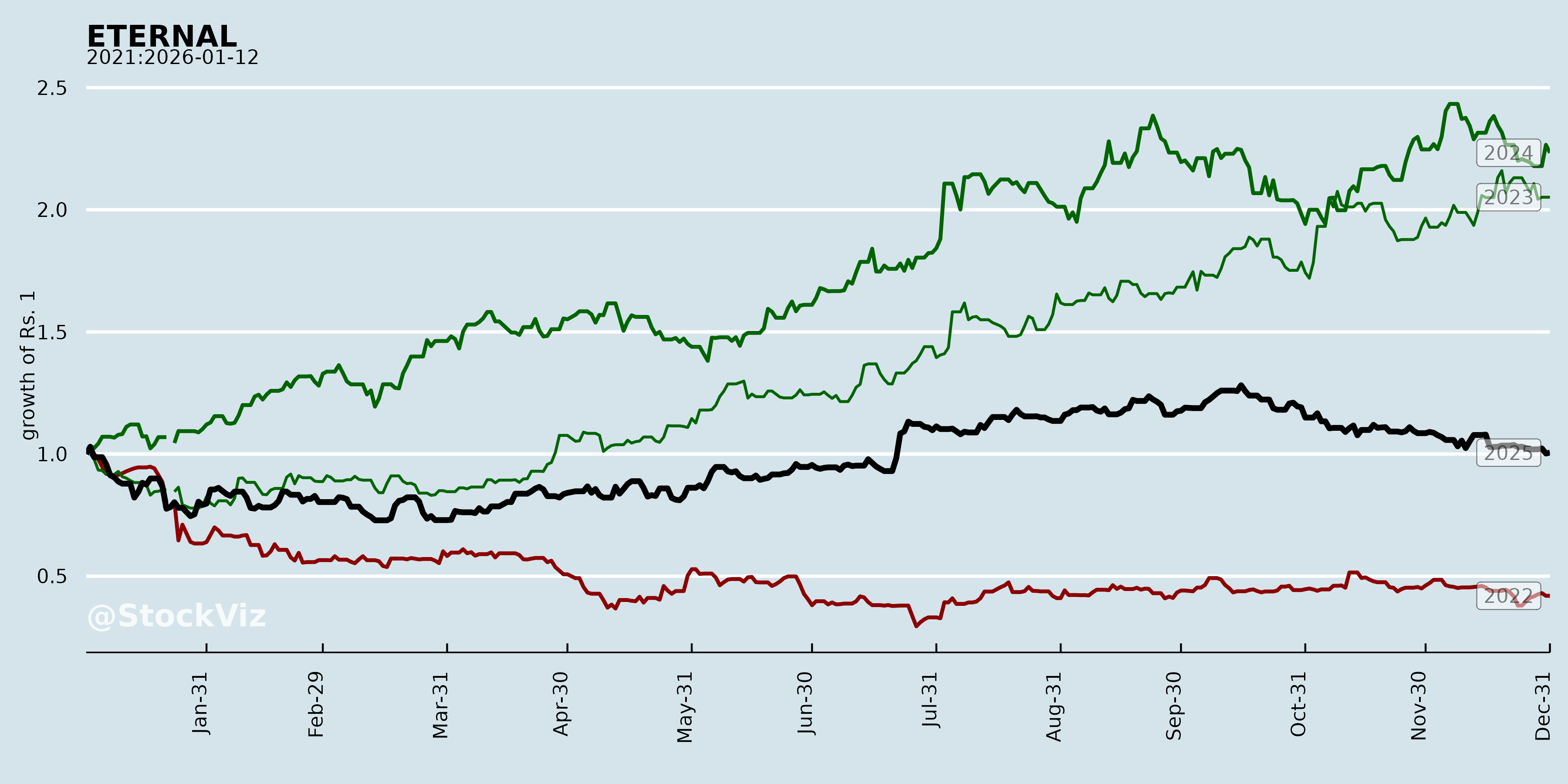

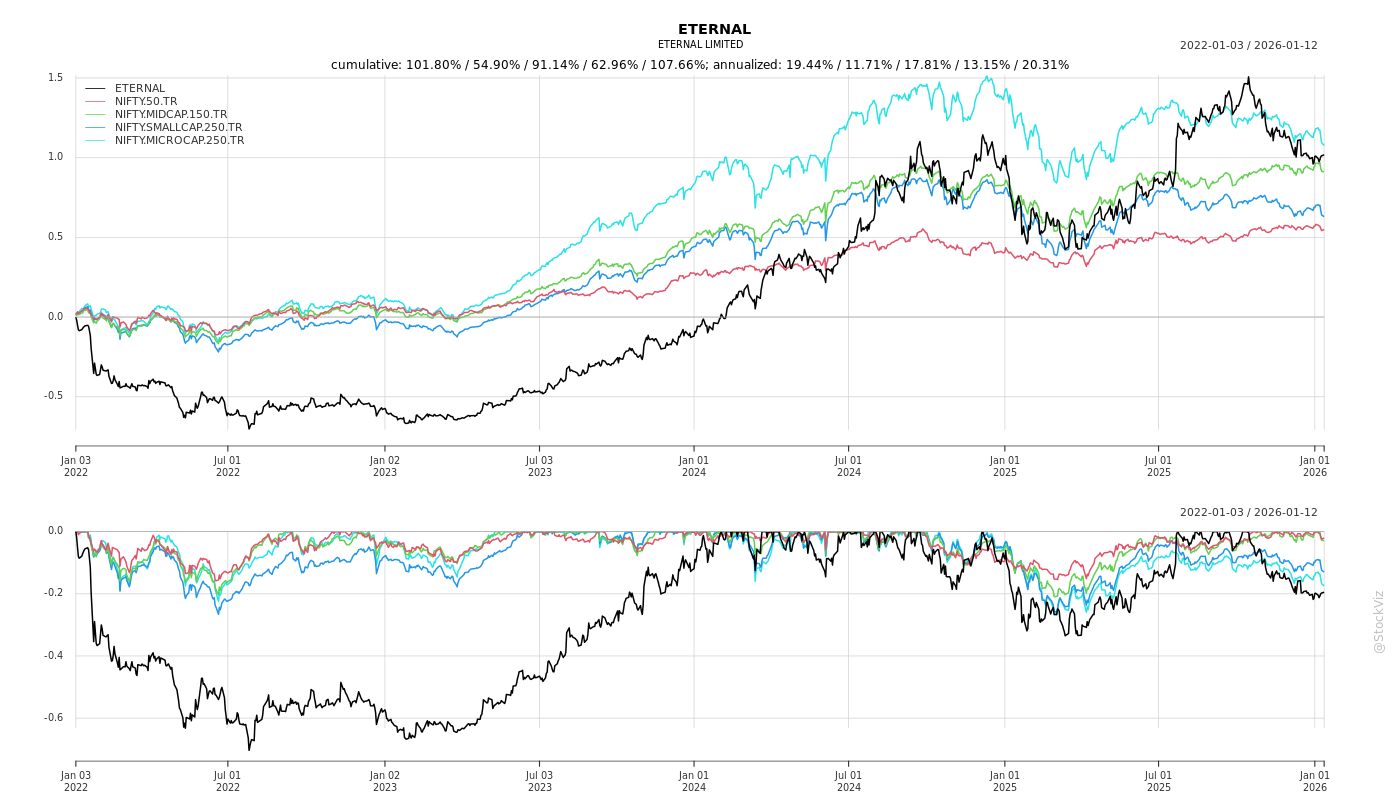

Annual Returns

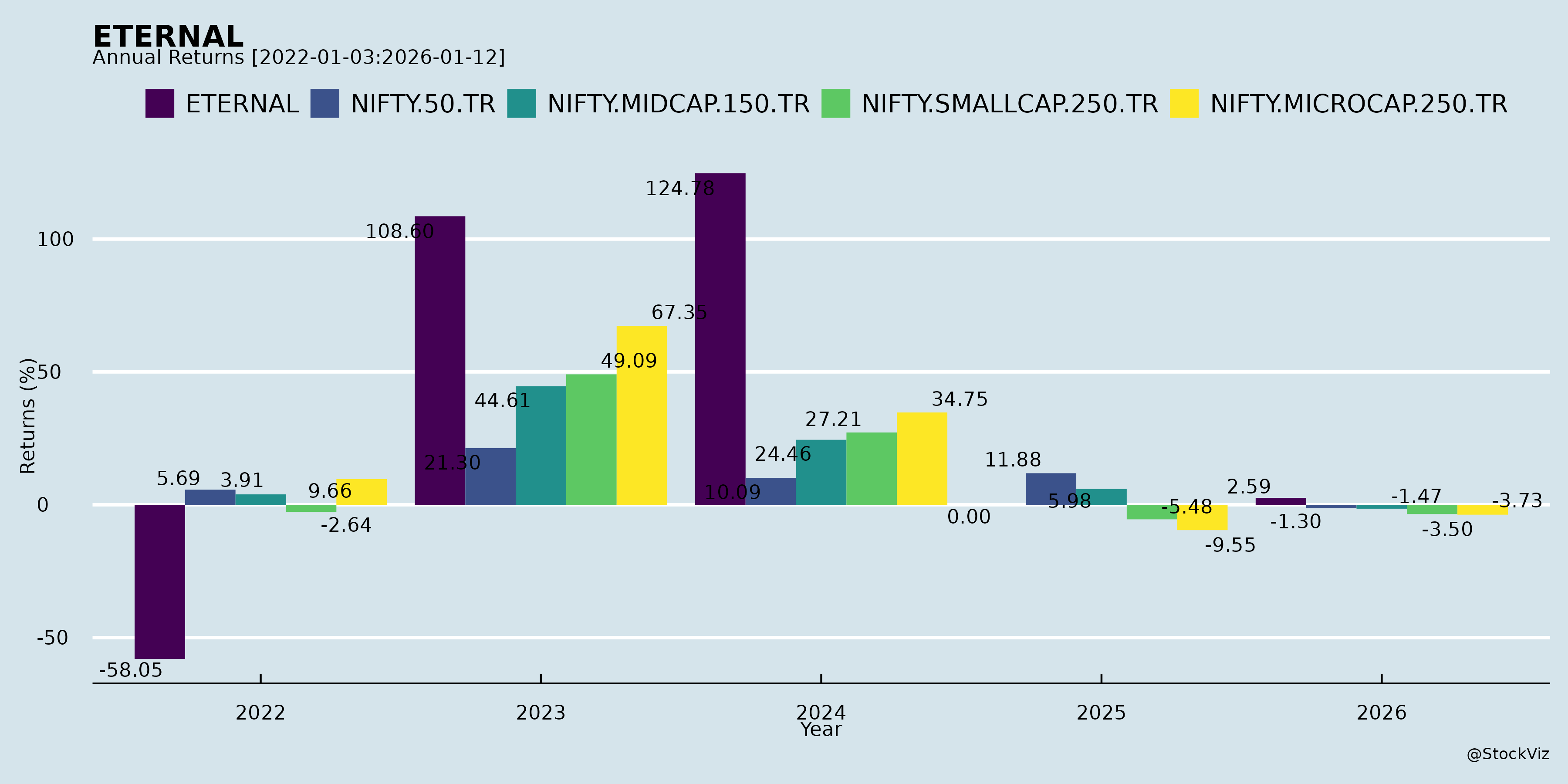

Cumulative Returns and Drawdowns

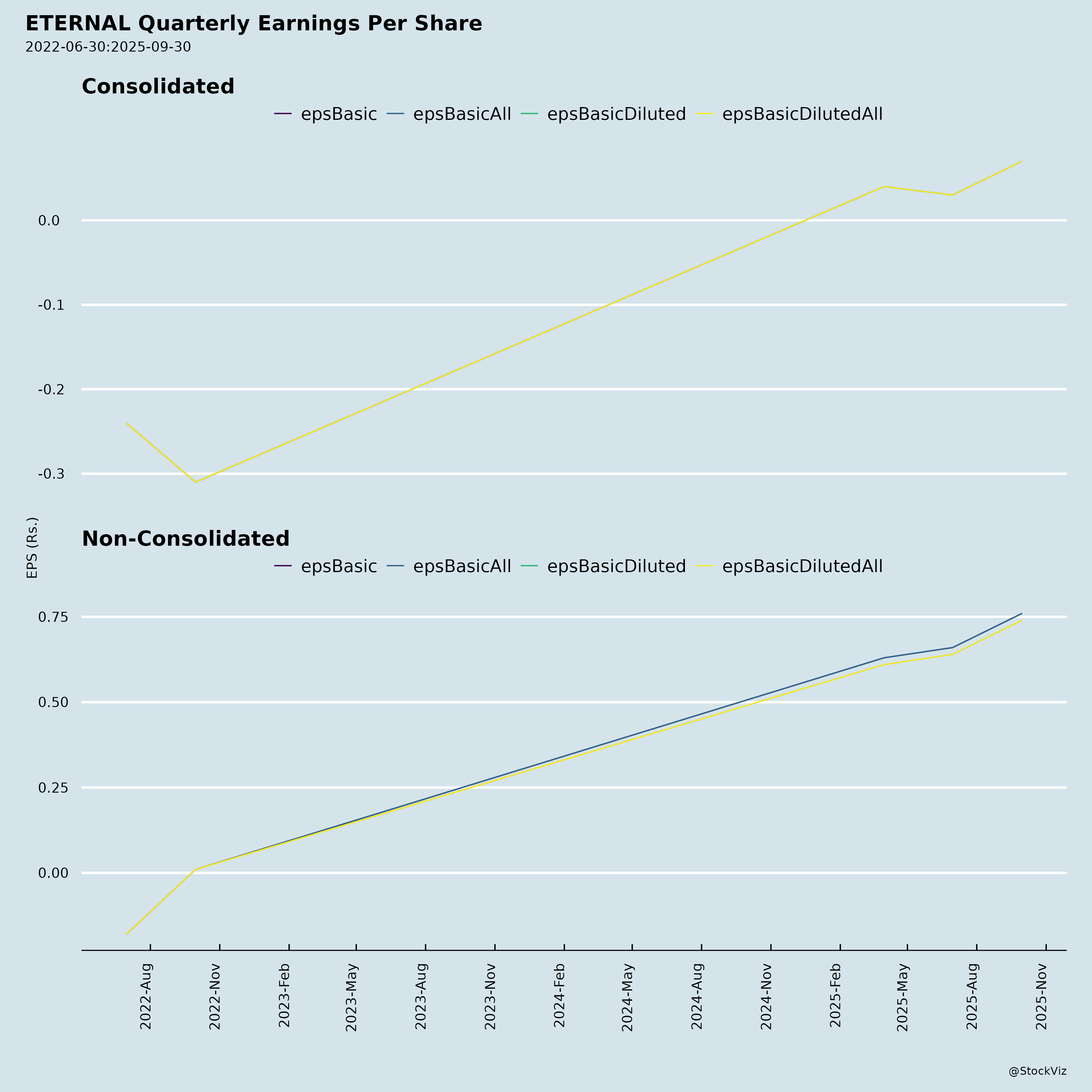

Fundamentals

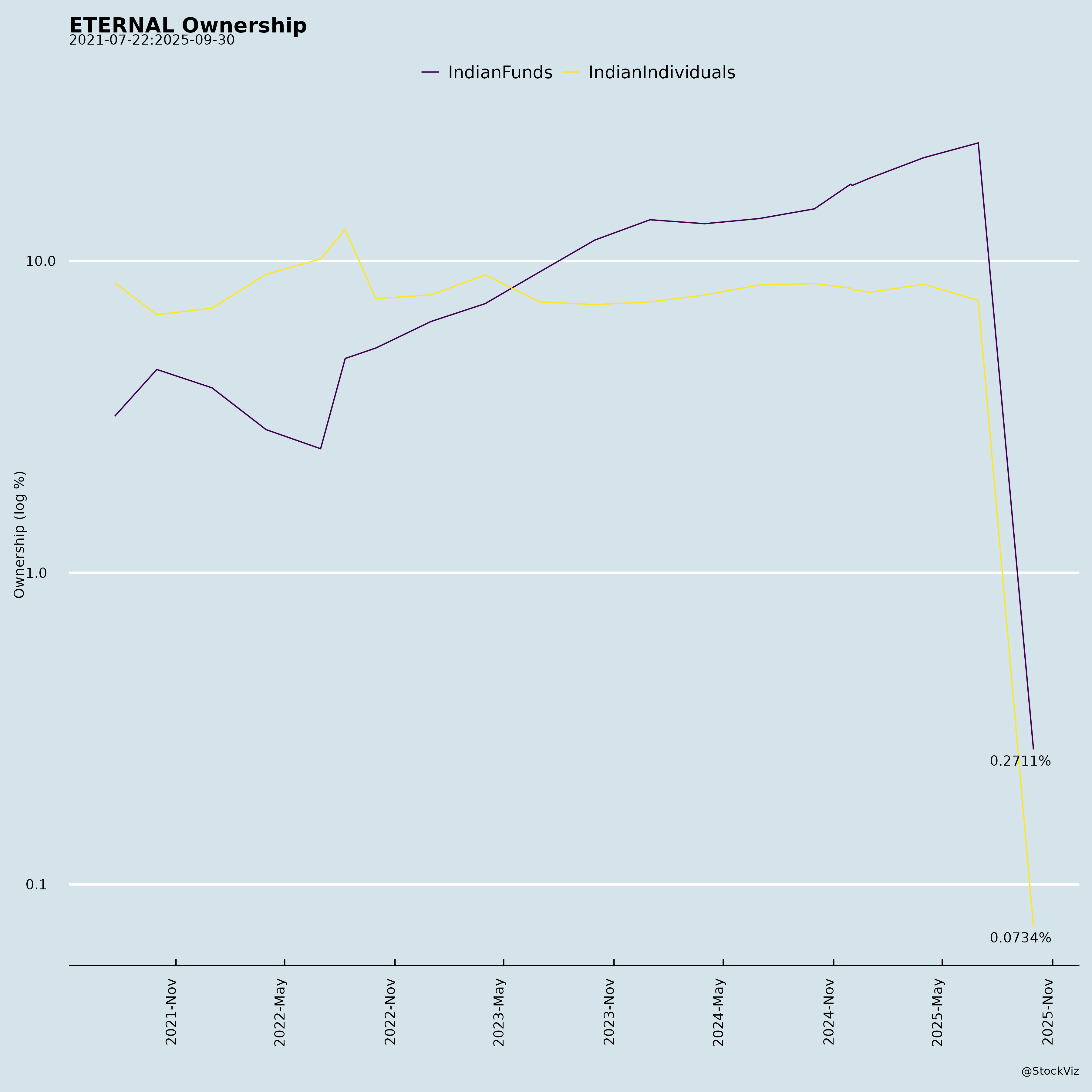

Ownership

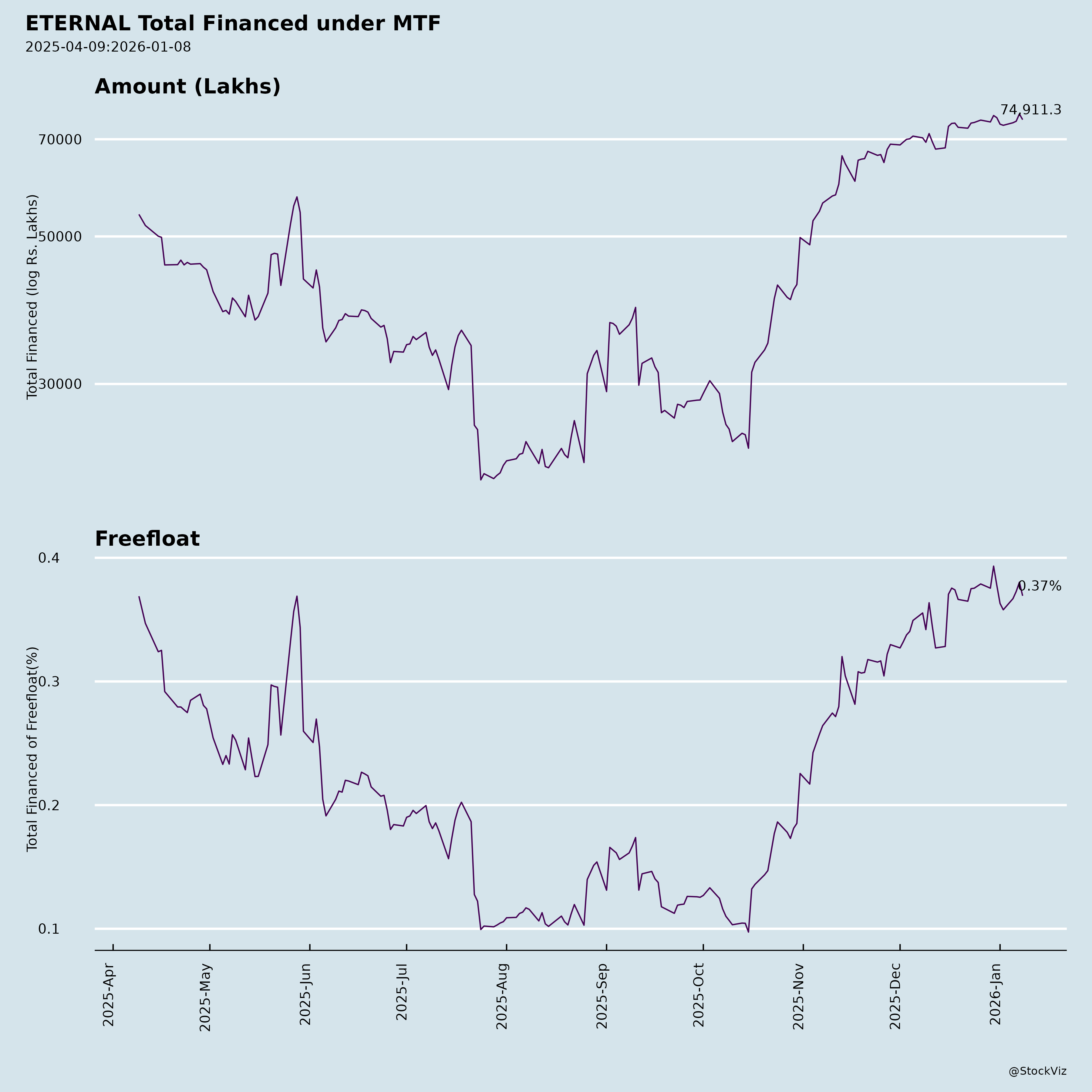

Margined

AI Summary

asof: 2025-12-03

Analysis of Eternal Limited (Scrip: ETERNAL, Formerly Zomato Limited)

Tailwinds

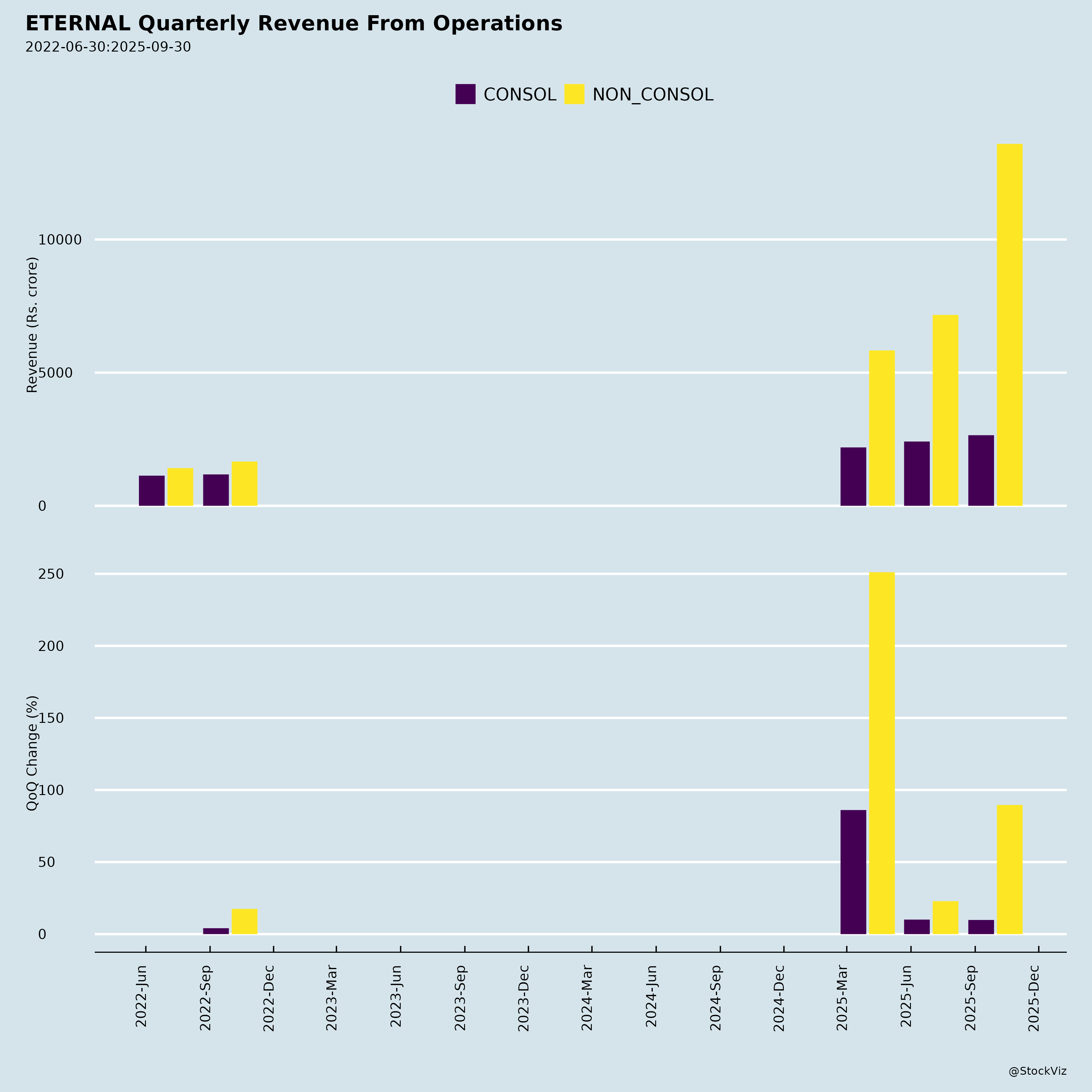

- Robust Revenue Growth: Consolidated revenue from operations surged to ₹20,753 Cr in H1 FY26 (Sep 30, 2025), up ~130% YoY from ₹9,010 Cr. Q2 FY26 revenue at ₹12,500 Cr highlights acceleration, driven by quick commerce (inventory-led model shift noted in prior periods, with direct sales via Blinkit). Purchases of stock-in-trade (₹11,332 Cr) and inventory levels (₹1,502 Cr, up from ₹176 Cr) reflect scaling of high-margin quick commerce.

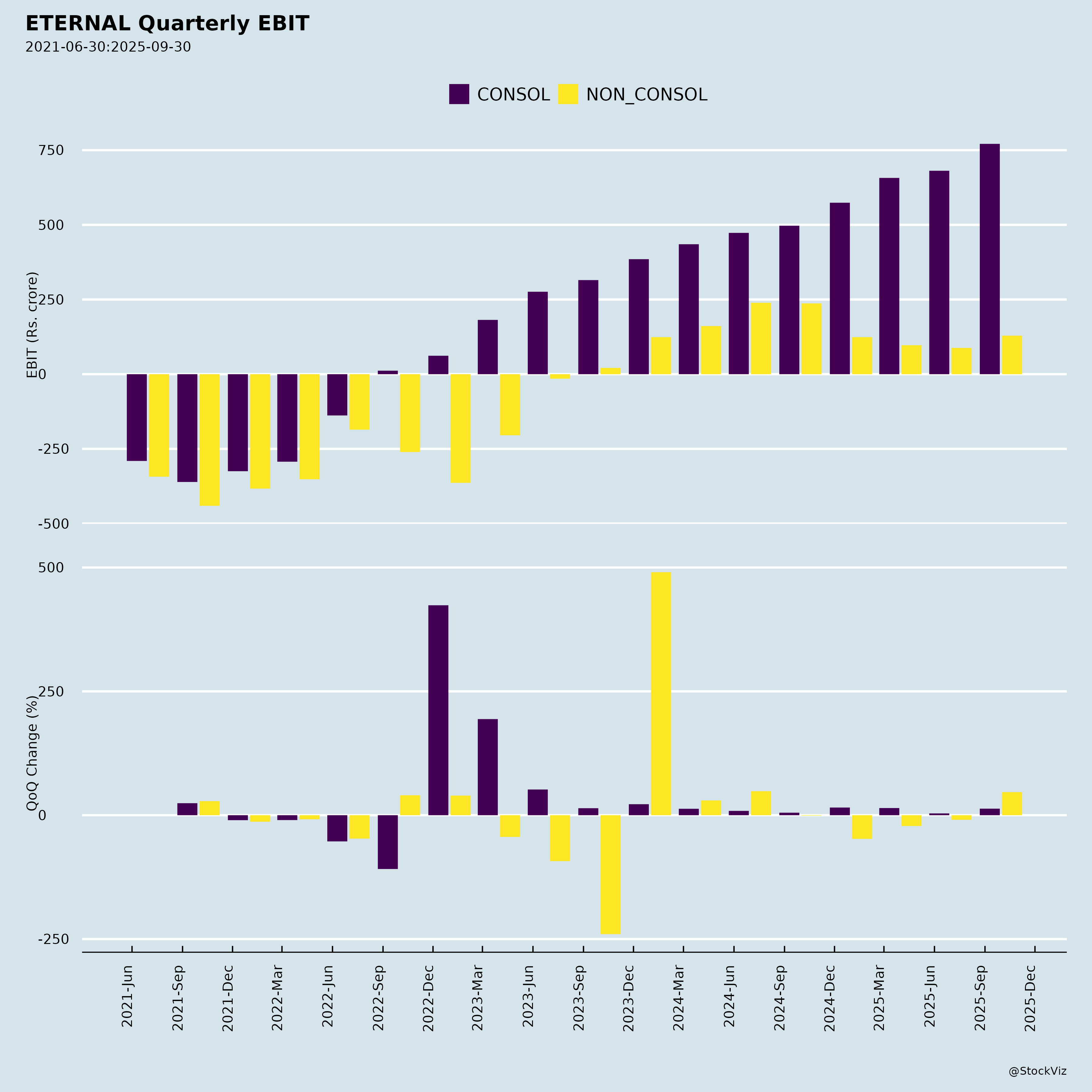

- Improving Profitability: Consolidated PBT at ₹217 Cr (vs. ₹176 Cr YoY); standalone PBT ₹1,453 Cr. EPS positive and growing. Shift to profitability amid high growth.

- Strong Balance Sheet: Equity base solid at ₹30,815 Cr (Sep 30, 2025). Investments (₹10,922 Cr non-current + ₹3,836 Cr current) provide liquidity buffer. Cash equivalents ₹431 Cr; net cash from investing positive (₹69 Cr) due to mutual fund churning.

- Strategic Moves: Proposed wholly-owned subsidiary “Eternal General Service Foundation” for CSR (hunger relief, healthcare, etc.), signaling long-term goodwill. Upcoming investor conferences (CLSA, JM Financial, Nov 2025) indicate confidence in physical engagement.

- Auditor Comfort: Clean limited review reports from Deloitte; no material misstatements.

Headwinds

- High Capex Intensity: ₹788 Cr invested in PPE/intangibles/CWIP in H1 FY26 (vs. ₹361 Cr YoY), driving PPE to ₹1,431 Cr and CWIP ₹116 Cr. Right-of-use assets ballooned to ₹3,163 Cr (likely dark stores/leases), with lease liabilities ₹3,351 Cr total.

- Cash Flow Pressure: Operating cash flow low at ₹38 Cr (down from ₹421 Cr YoY) due to inventory buildup (₹-1,344 Cr WC change) and tax outflows (₹211 Cr). Financing outflow ₹344 Cr (leases). Cash & equiv. declined to ₹431 Cr from ₹666 Cr.

- Subsidiary Drag: 20 subsidiaries + 1 trust contribute losses (₹106 Cr H1 FY26 consolidated). Unreviewed by their auditors; management deems immaterial but flags commitments to fund them.

- Modest Margins: Gross margins pressured by high delivery charges (₹4,082 Cr H1) and ads (₹1,477 Cr). PBT margin ~1% consolidated.

Growth Prospects

- Quick Commerce Leadership: Massive revenue ramp (Q2 ops ₹12,500 Cr vs. ₹4,790 Cr YoY) via Blinkit (inventory model, direct sales). Inventory scale-up and capex signal dark store expansion/network effects.

- Diversification: Hyperpure, entertainment (prior acquisitions like OTPL/WEPL for ticketing/events), payments, local services. Standalone strength (₹5,065 Cr revenue) supports group.

- Investment Income: ₹700 Cr other income (interest on bonds/govt secs/deposits) cushions ops. High investible surplus (₹14,758 Cr total investments).

- Equity Raises: Recent QIP (₹8,300 Cr FY25) and ESOP infusions bolster capital. Diluted EPS stable.

- Market Tailwinds: India quick commerce boom; physical investor meets in Mumbai suggest expansion focus.

Key Risks

- Regulatory/Contingencies: | Issue | Amount (₹ Cr) | Period/Details | |——-|—————|—————| | GST Demand (Lucknow Order) | 18.39 (tax + penalty) | Apr 2018-Mar 2019; appeal planned, “strong case”. | | GST on Delivery Charges (SCNs/Orders) | 441 (420 orders + 21 SCNs) | Oct 2019-Mar 2023; appeals filed, expert-backed defense. Auditor emphasis note. |

- Potential interest/penalties; no provision but uncertainty flagged.

- Execution/Competition: Quick commerce capex burn; subsidiary losses (e.g., ZHPL ₹998 Cr accum., BCPL ₹3,200 Cr). Impairment history (e.g., ZLSPL closure).

- Leverage: Lease-heavy (₹3,351 Cr liabilities); finance costs rising.

- Macro/External: FX translation volatility (OCI swings); 22 entities (intl. exposure: Middle East, Philippines, etc.).

- Comparability: Acquisitions (e.g., OTPL/WEPL Aug 2024, ₹2,014 Cr total) distort YoY; unreviewed subs ~₹2,165 Cr assets.

Summary

Eternal is firing on quick commerce cylinders with explosive H1 FY26 revenue growth (~130% YoY) and profitability inflection, backed by a fortress balance sheet (₹30K+ Cr equity, liquid investments). Tailwinds from scaling Blinkit and investor engagement outweigh headwinds like capex intensity and weak ops cash flow. Growth prospects remain stellar in India’s quick commerce arena, but key risks center on GST litigation (~₹441 Cr exposure, under appeal) and subsidiary funding needs. Buy/Hold for growth investors if regulatory appeals succeed (mgmt. confident); monitor Q3 cash flows and GST outcomes. Target multiples: 10-15x FY27E sales feasible on 50%+ CAGR trajectory. (Analysis purely from docs; not investment advice.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.