EMBDL

Equity Metrics

January 13, 2026

Embassy Developments Limited

Residential Commercial Projects

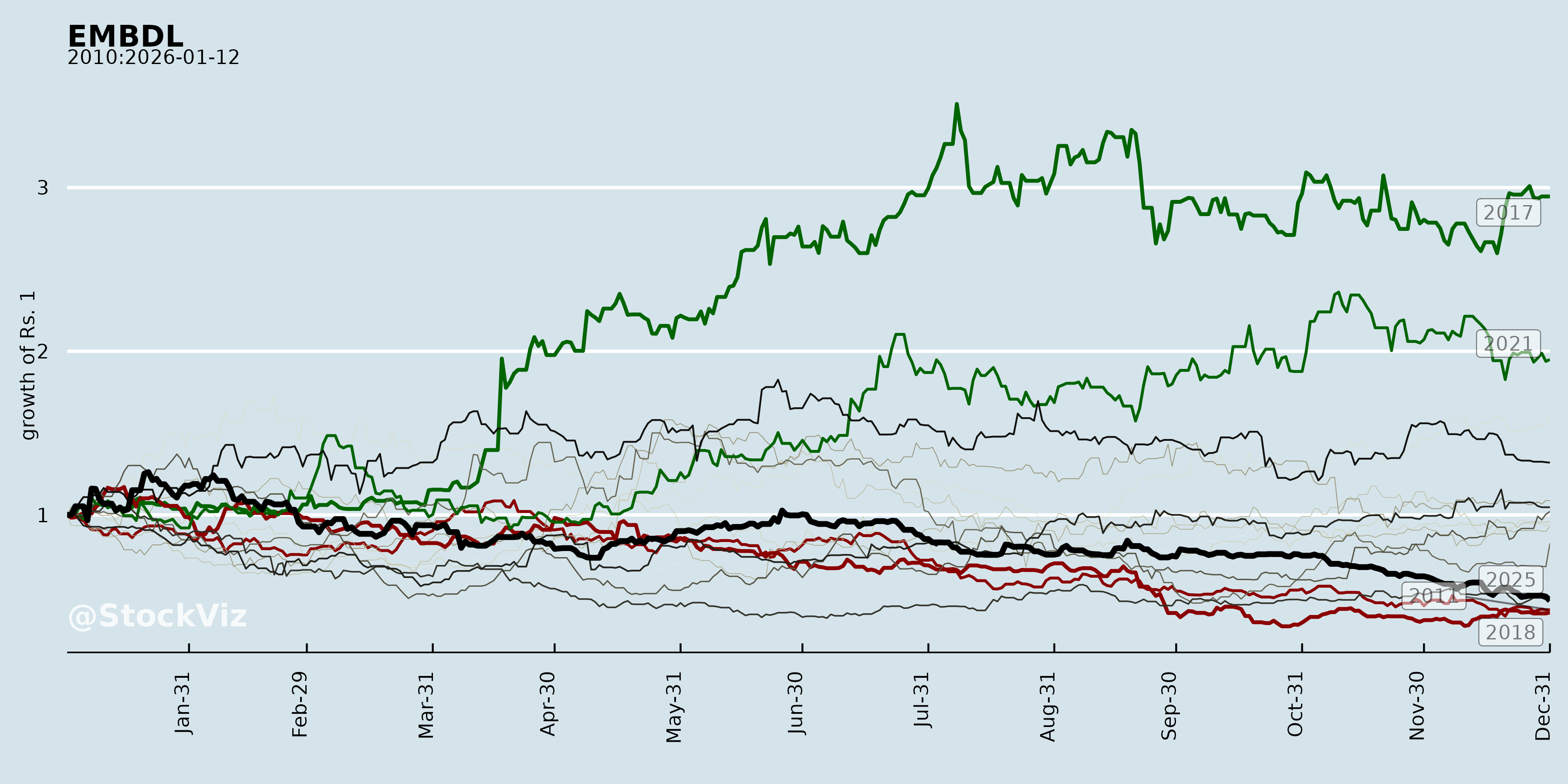

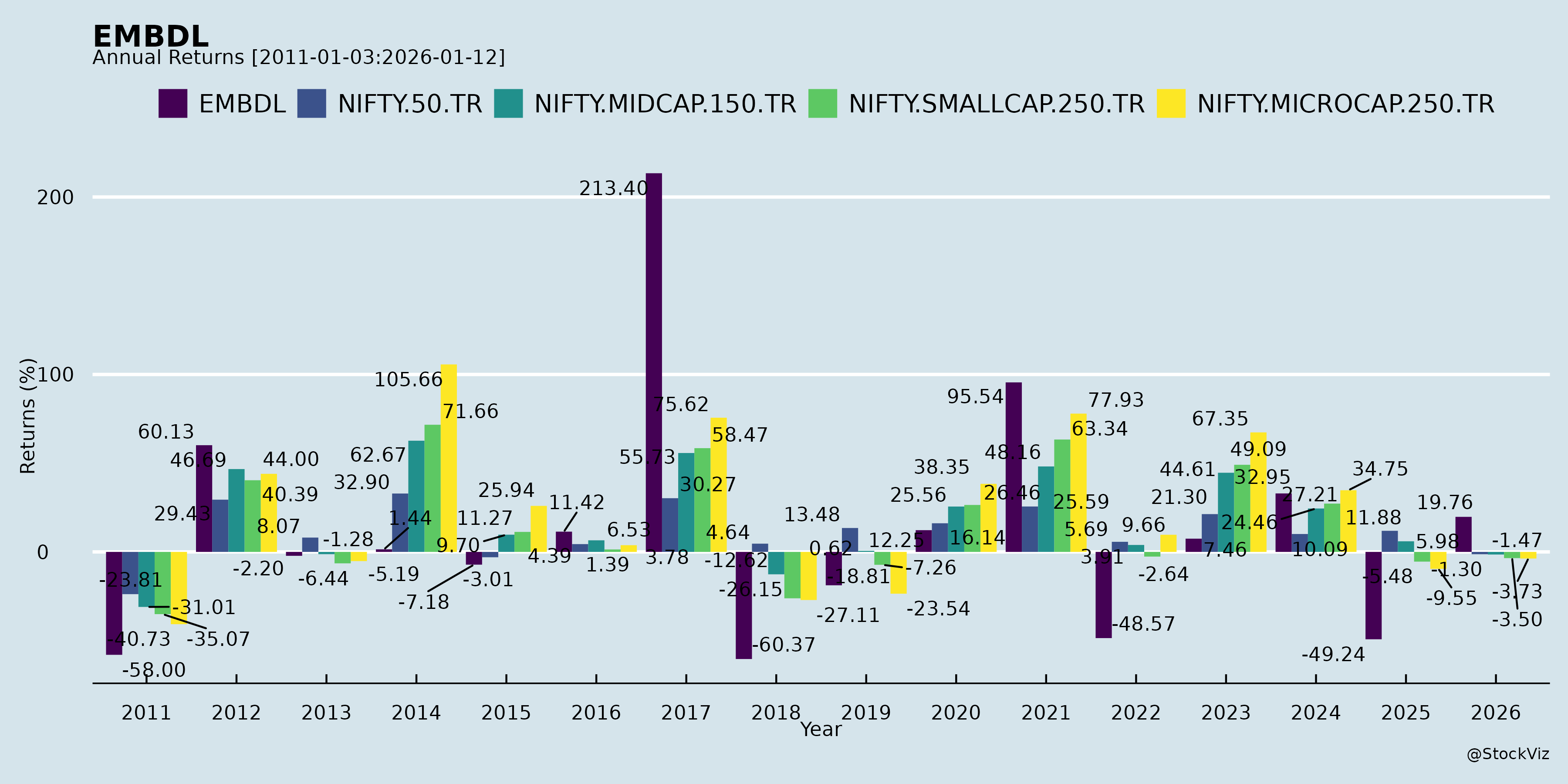

Annual Returns

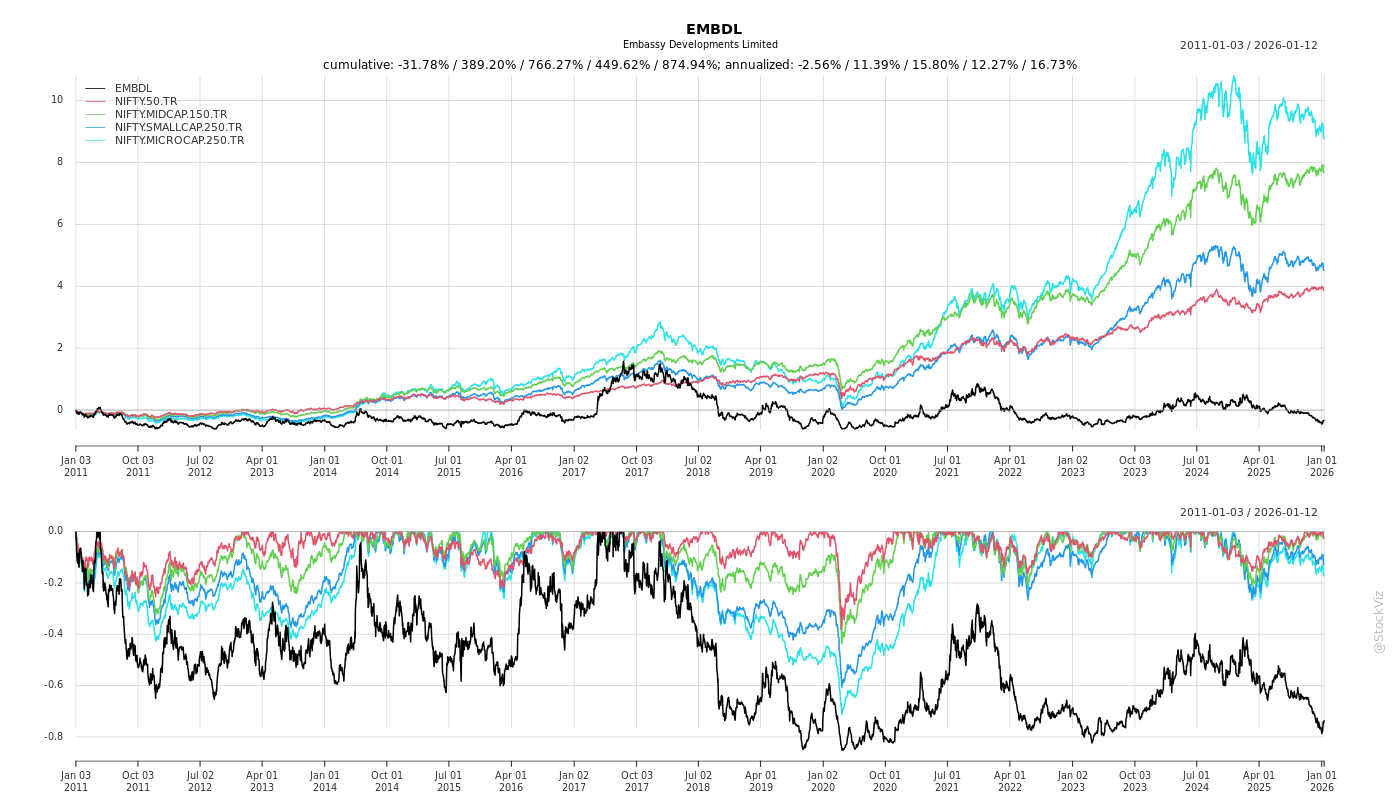

Cumulative Returns and Drawdowns

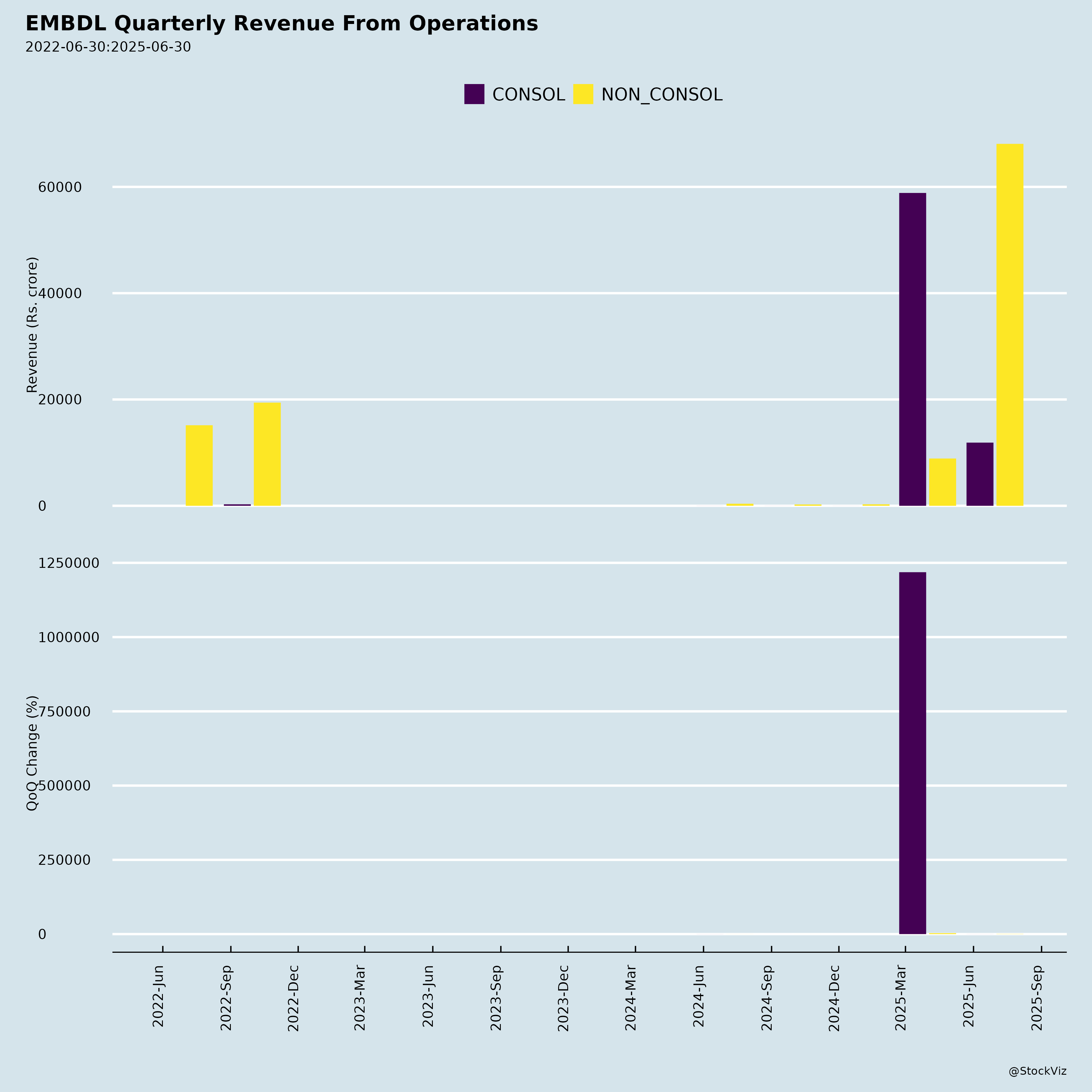

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-11

Based on the comprehensive set of regulatory filings and financial disclosures provided for Embassy Developments Limited (EMBDL), here is a detailed analysis of the headwinds, tailwinds, growth prospects, and key risks associated with the company. This assessment is grounded in financial trends, strategic developments, accounting treatment notes, management communication, and industry context.

Executive Summary

Company Overview:

Embassy Developments Limited (formerly Indiabulls Real Estate and Equinox India) is a prominent Indian real estate development company that underwent a reverse acquisition via the amalgamation of Nam Estates Private Limited (NAM) with EMDL in January 2025. The restructured entity now operates under the “Embassy Group” brand, aligning with a stronger institutional promoter group (JVHPL and subsidiaries). The filings reflect a transition from legacy turmoil to strategic stabilisation, with implications for comparability, capital structure, and future growth.

🔍 1. Tailwinds (Growth Enablers & Opportunities)

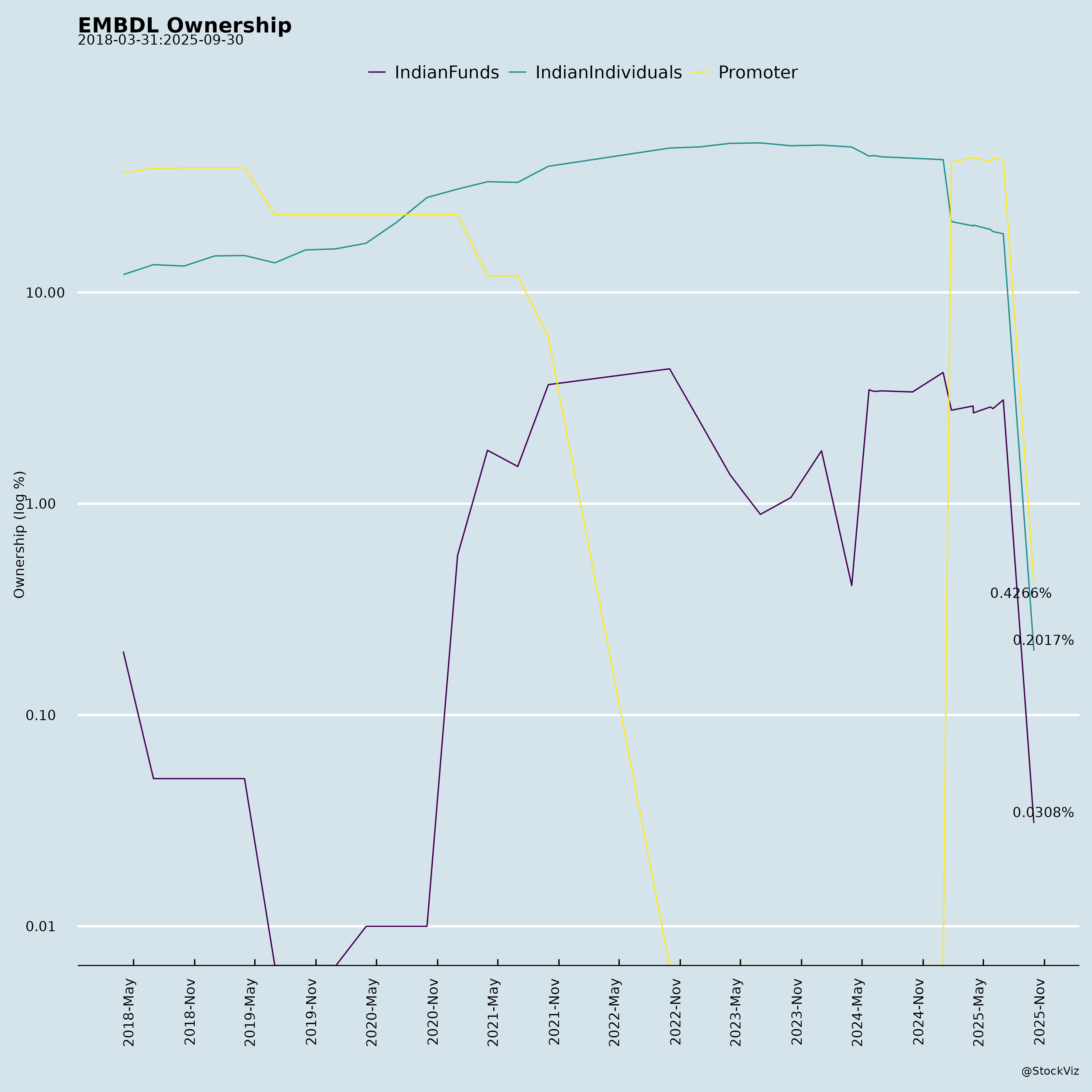

a) Strategic Reverse Merger and Credible Promoter Backing

- The amalgamation with Nam Estates (NAM) in January 2025 marked a transformative event, allowing the company to retain the EMDL listing while effectively becoming NAM under reverse acquisition accounting (Ind AS 103).

- JV Holding Private Limited (JVHPL) now forms the promoter/promoter group, bringing institutional credibility, stronger governance, and long-term capital commitment.

- This merger significantly improved balance sheet quality, with NAM’s asset-light and high-quality office-led real estate platform integrated into EMDL’s structure.

✅ Positive signal: Market perception shifted toward re-rating potential post-promoter change and clean-up of legacy balance sheet issues.

b) Strong Liquidity Generation in Operations

- Net cash inflow from operating activities (Consolidated): ₹2,685 million (H1 FY26)

- Operating cash flow before working capital changes turned positive at ₹2.77 billion in H1 FY26 — a turnaround from prior weakness.

- Driven by effective inventory management, particularly in real estate development projects (changes in inventories: +₹4.93B in H1 FY26), reflecting project sell-out momentum or completion.

💡 Suggests improving asset conversion cycle and ability to generate internal cash flow.

c) Completion of Critical M&A — Squadron Developers Acquisition

- Full acquisition of Squadron Developers Limited (100%) post-conversion to a public limited company.

- Provides portfolio augmentation and potential for value unlocking through brownfield development or asset monetisation.

📈 Strategic bolt-on acquisition shows active portfolio rationalisation and focus on operational consolidation.

d) Large Equity Capital Infusion Without Execution (Intentional Deleveraging)

- Received ₹12,056.49 crore in equity proceeds during FY25–26 H1 via share warrants, plus additional ₹71.09 crore pending allotment.

- Despite having enabled authority to raise ₹2,000 crore more via QIP, the board has decided not to proceed, citing sufficient liquidity.

- This signals:

- Strong investor confidence (warrant subscribers participated fully).

- Management prudence and comfort with current solvency/liquidity.

- No immediate need for further equity dilution.

✅ Strong equity inflows improve debt-to-equity profile and reduce refinancing risk.

e) High-Quality Commercial Real Estate Flagships

- The group owns premium commercial assets like One World Center (Mumbai), Embassy REIT assets, and others.

- Although not directly reflected in standalone figures due to REIT structures, the brand carries significant development and management capabilities in institutional-grade office parks and integrated cities.

🌪️ 2. Headwinds (Challenges & Weaknesses)

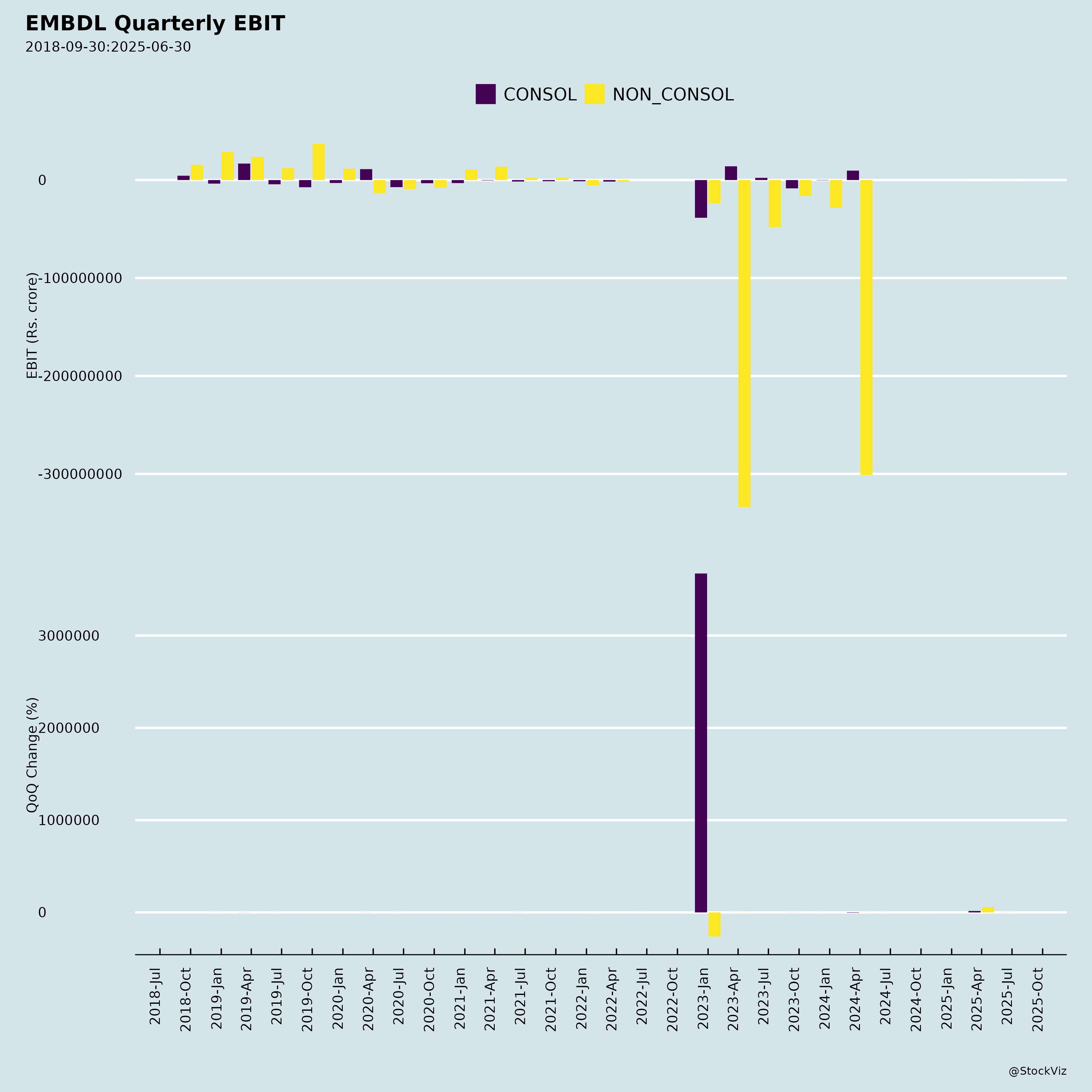

a) Massive Consolidated Net Losses

- Consolidated Net Loss (Q2 FY26): ₹1,526 million

- Standalone Net Loss (Q2 FY26): ₹405 million

- Despite strong top-line, losses stem from:

- High finance costs (₹1,355M in Q2; ₹2.95B in H1 FY26)

- Large other expenses (₹591M in Q2), including structural costs, administrative overheads, or restructuring provisions.

- Standalone EBITDA negative, though partially explained by transitional phase post-merger.

⚠️ High leverage remains a drag on profitability; despite operational improvement, bottom line under pressure.

b) Accounting Complexity: Periods Not Comparable

- Note 3 (Standalone) & Note 4 (Consolidated): Financial results for FY26 periods are not comparable with FY25 or earlier due to reverse acquisition accounting (NAM becomes accounting acquirer).

- Previous year data (e.g., Q2 Mar 2024) is that of NAM before merger, making year-on-year growth misleading.

- This reduces investor ability to gauge actual performance trends.

❗ Complicates fundamental analysis and peer benchmarking until full comparative cycles are available.

c) Widening Asset-Liability Maturity Mismatch

- Total Borrowings (Consolidated): ₹46,359 million (non-current + current)

- Cash & Equivalents: ₹7,734 million

- A significant portion of liabilities (bank loans, NCDs) is short-term, raising refinancing risk, especially if credit conditions tighten.

- Despite adequate liquidity now, rollover risk exists for near-term debt maturities.

🔎 Net debt levels remain concerningly high despite capital infusion.

d) Lapse of Warrants & Forfeited Proceeds

- In December 2025, 47.5 million warrants lapsed, leading to forfeiture of ₹132.49 crore of upfront payments.

- This reflects:

- Dilution risk aversion by warrant-holders (potentially anticipating share price underperformance or uncertainty).

- Or complexity in conversion mechanism, reducing uptake.

- While cash is forfeited, it may signal lack of confidence among smaller/later investors.

🔄 A mixed sign: beneficial to existing shareholders (no dilution) but raises questions about market sentiment.

🔮 3. Growth Prospects

a) Monetisation of Commercial & Industrial Assets

- Portfolio includes leased commercial properties (e.g., One World Center), industrial parks, and tech zones.

- Potential for REIT formation or strategic stake sale in income-generating assets.

- Could shift model from pure developer to asset-light operating business.

b) Strong Backlog in Development Projects

- Large inventory: ₹120,632 crore in inventories (consolidated) — suggests substantial ongoing development activity.

- As sales progress, inventory declines contribute positively to operating cash flows (as seen in FY26 H1).

c) Institutional and Developer Credibility Restored

- With new promoters and clean-up of legacy issues, the company is better positioned to:

- Partner with global funds.

- Access private debt markets.

- Win large B2B commercial leases.

d) Geographic & Segment Focus Clarity

- Operates in single geographical and business segment (India, real estate development) — streamlining strategy.

- Focus likely on premium office spaces, integrated townships (e.g., Embassy Manyata), and industrial infrastructure.

⚠️ 4. Key Risks

| Risk | Implication |

|---|---|

| 1. Legacy Litigation and Unresolved Disputes | The write-off of £61.85M SPA receivable (GBP) via mediation suggests protracted disputes from prior management. While resolved, similar unresolved overseas exposure may exist. |

| 2. Foreign Subsidiary Risks (Brenformexa Ltd) | Auditor’s “Emphasis of Matter” on Brenformexa Ltd shows ₹6,290M impairment — a red flag on past overseas investments. Potential reputational and compliance risk. |

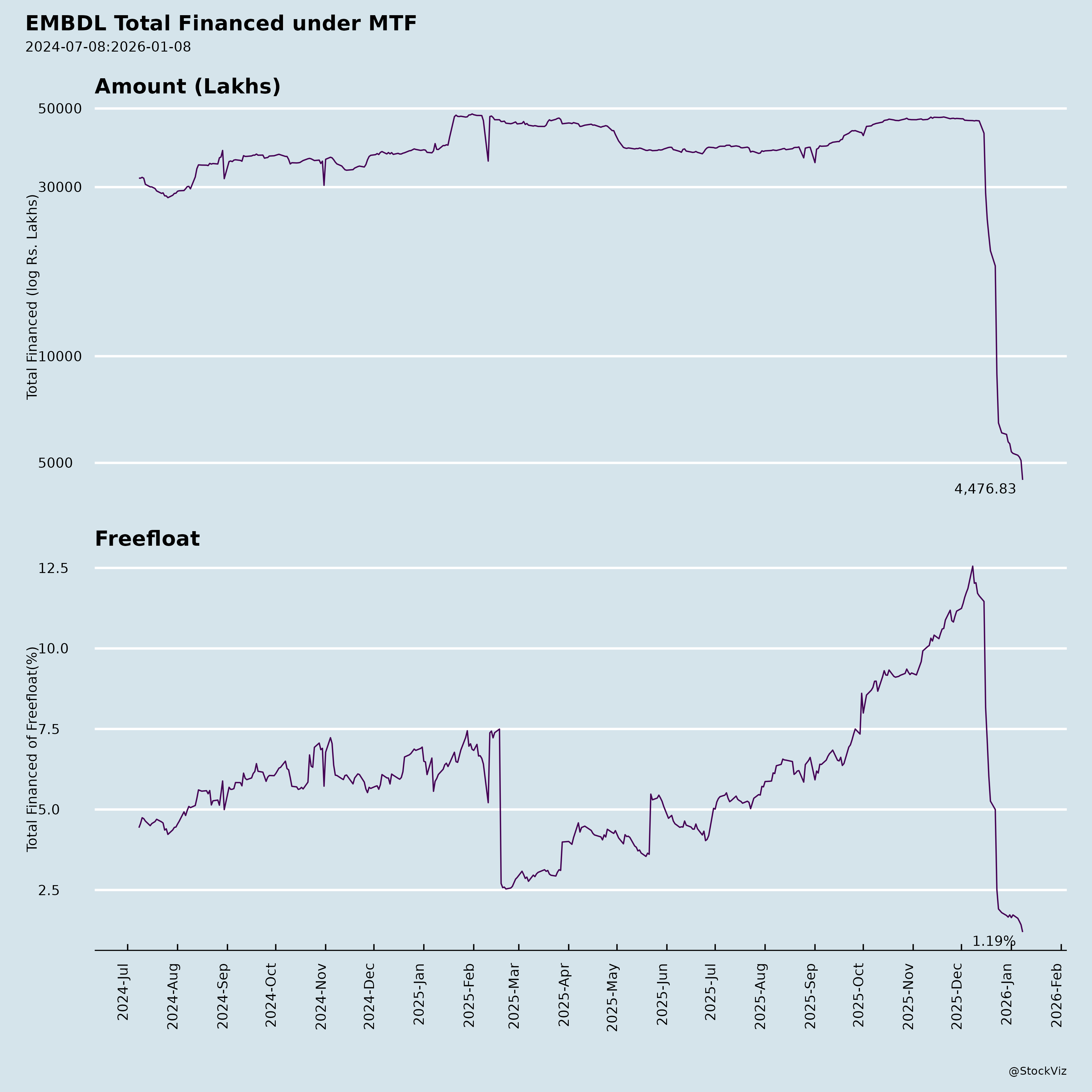

| 3. Dependence on Capital Markets for Survival | Despite recent funding, future projects may require external capital. Market access could be disrupted due to real estate sector sentiment or rating downgrades. |

| 4. Governance Uncertainty | Rapid change in name, shareholders, and structure can lead to investor skepticism. Need for consistent quarterly execution to build trust. |

| 5. Sector-Specific Risks | Real estate remains sensitive to interest rates, demand cycles, regulatory changes (RERA), and land clearances. |

| 6. Liquidity Risk in Spite of Cash | High current liabilities (₹56,386M) suggest tight working capital management. A single project delay can strain liquidity. |

📊 Financial Snapshot (Consolidated, H1 FY26)

| Metric | Value (₹ in crores) |

|---|---|

| Total Revenue (H1 FY26) | ₹10,352 |

| Total Expenses (H1 FY26) | ₹11,357 |

| PAT (Loss after tax) | ₹(874) |

| Total Comprehensive Income | ₹1,587 |

| Total Assets | ₹2,08,572 |

| Net Debt (approx) | ~₹1.25 lakh crore (est.) |

| Cash & Equivalents | ₹7,734 |

| Equity Share Capital (Post-issue) | ₹2,741 crore (↑ due to warrant conversion) |

📉 Despite revenue contraction vs. prior year (₹21,800 cr in FY25 vs ₹10,350 cr H1 FY26), the data is distorted by accounting reclassifications — not necessarily indicative of distress.

✅ Conclusion & Investment Outlook

Overall Rating: Cautiously Constructive (Transition Phase)

| Aspect | Assessment |

|---|---|

| Leadership & Strategy | ✅ Highly improved with credible promoters |

| Balance Sheet Health | ⚠️ High debt, but capital-raising has reduced stress |

| Profitability | ❌ Still deep in losses; depends on cost rationalisation |

| Cash Flow | ✅ Strong operating inflows — positive sign |

| Accounting Clarity | ❗ Complex post-merger — requires careful analysis |

| Valuation Attractiveness | 💡 Potential for re-rating if deleveraging succeeds |

Recommendation:

- Medium to Long-Term Investors: The stock may be worth considering as part of a restructuring/recovery play.

- Short-Term Investors: High volatility expected until deleveraging clarity, refinancing plans, and consistent profit growth emerge.

- Watch Triggers:

- Debt reduction in next 2–3 quarters.

- Guidance on future capital raising or asset monetisation.

- Improvement in standalone EBITDA margin.

- Any REIT or joint venture formation announcement.

🔚 Final Note

Embassy Developments Limited is at a critical inflection point, having navigated a complex promoter transition and reverse merger. While the financial statements are not comparable and the path to profitability remains steep, the influx of equity capital, operational cash flow improvement, and credible management suggest a foundation for recovery.

The company is no longer the distressed legacy Indiabulls entity but a repositioned real estate player aiming for sustainable, institutional-grade growth. However, prudence is warranted until sustained earnings momentum and balance sheet normalisation are demonstrated.

“Embassy is not out of the woods, but it’s no longer lost in them.”

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.