DRREDDY

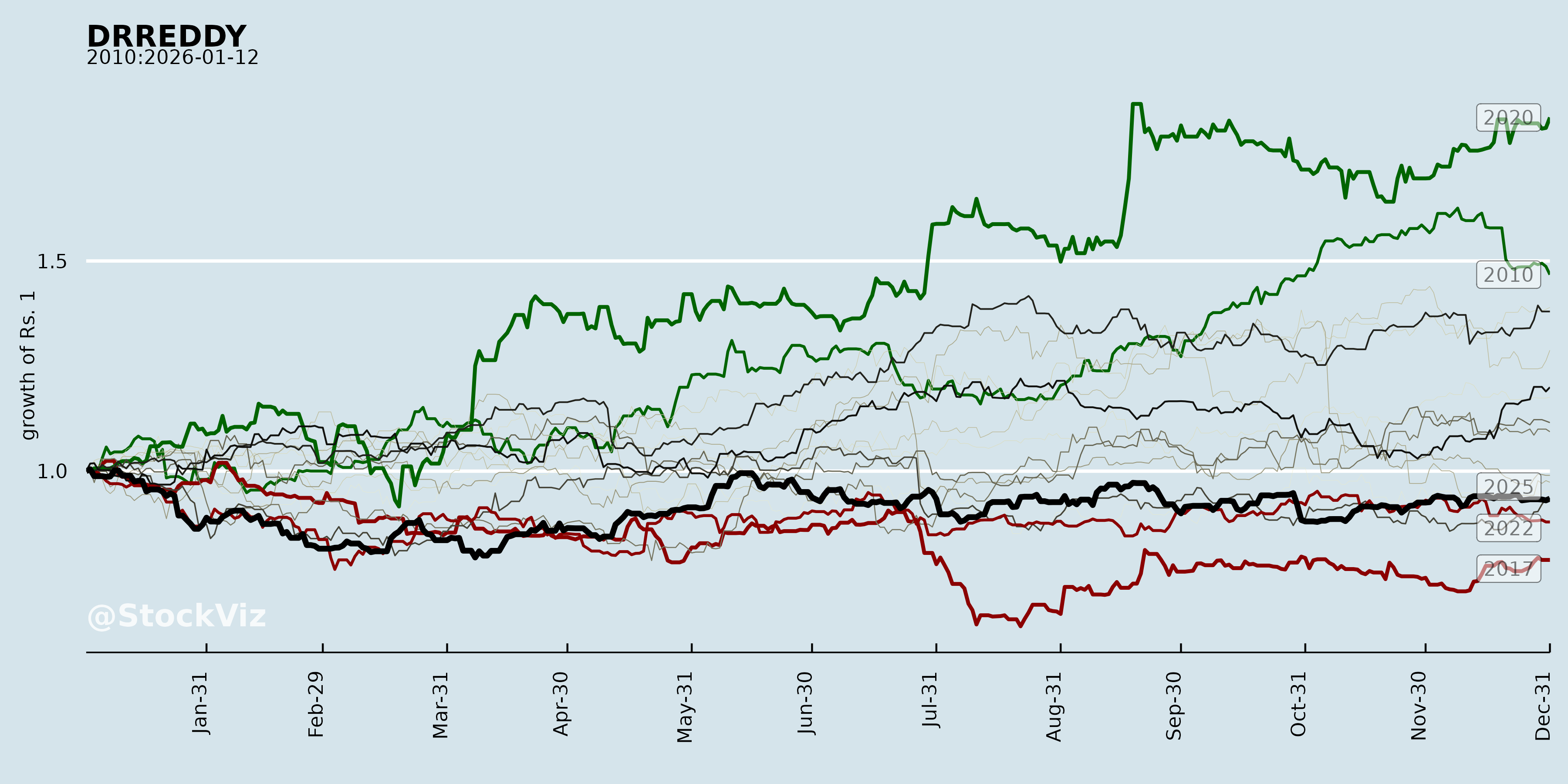

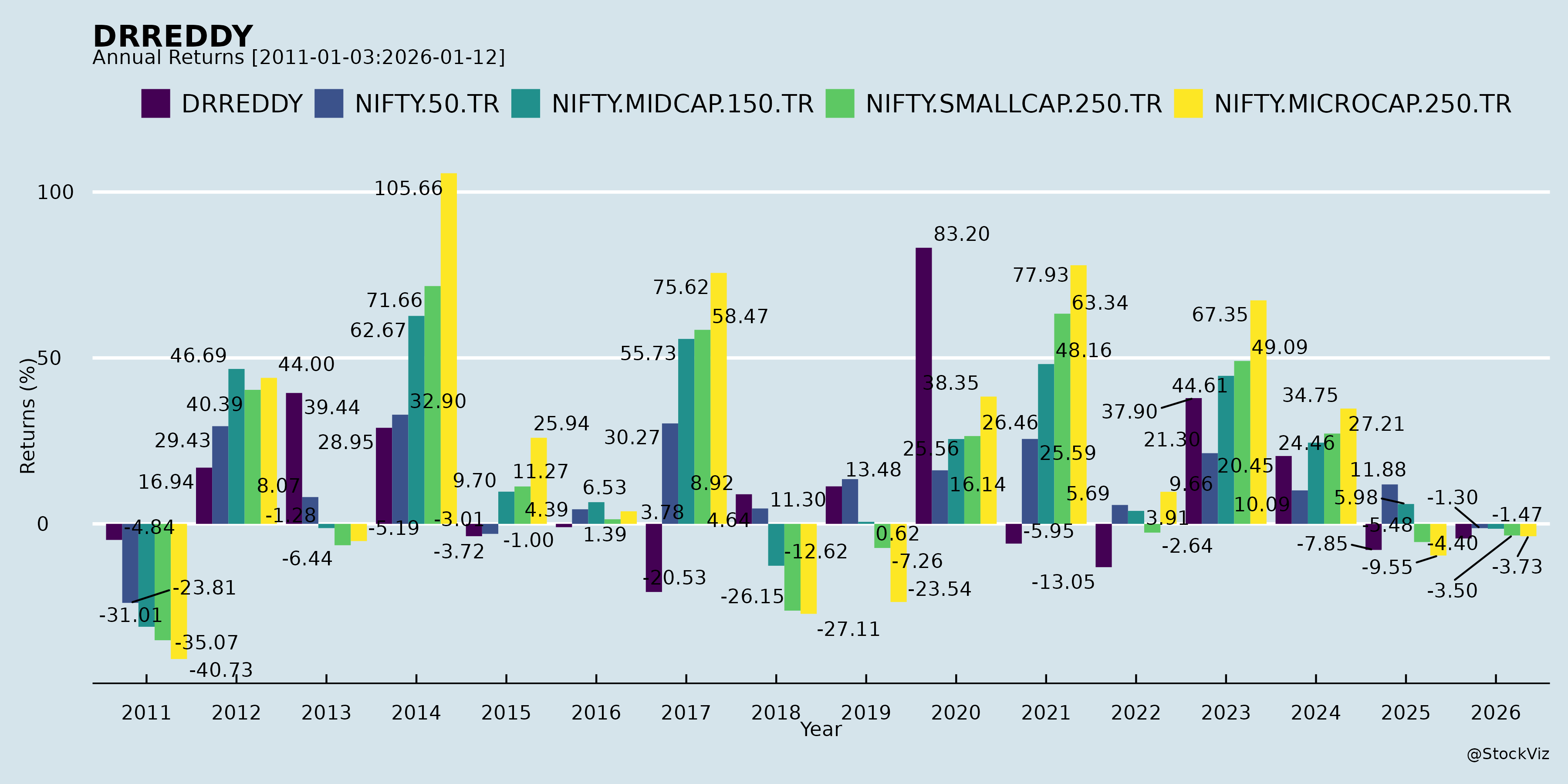

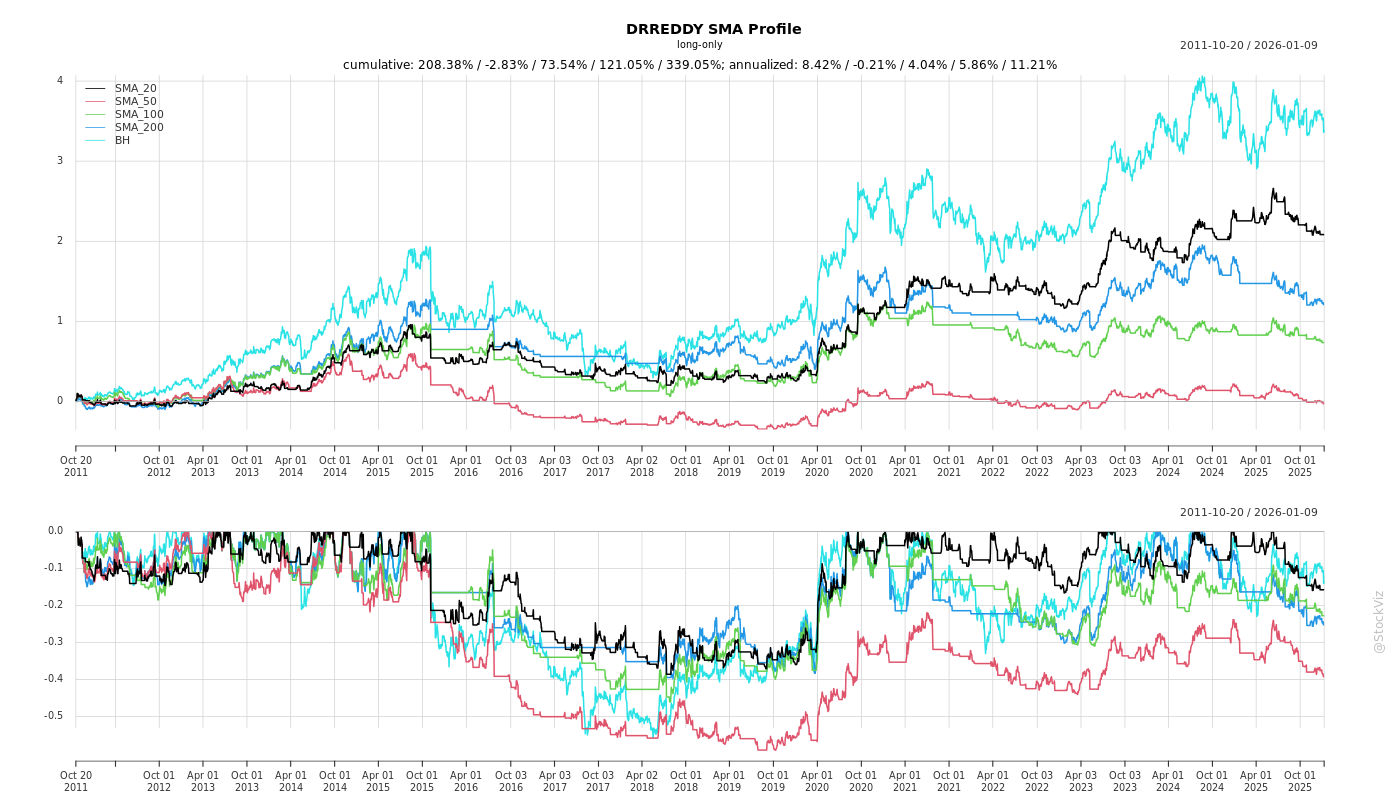

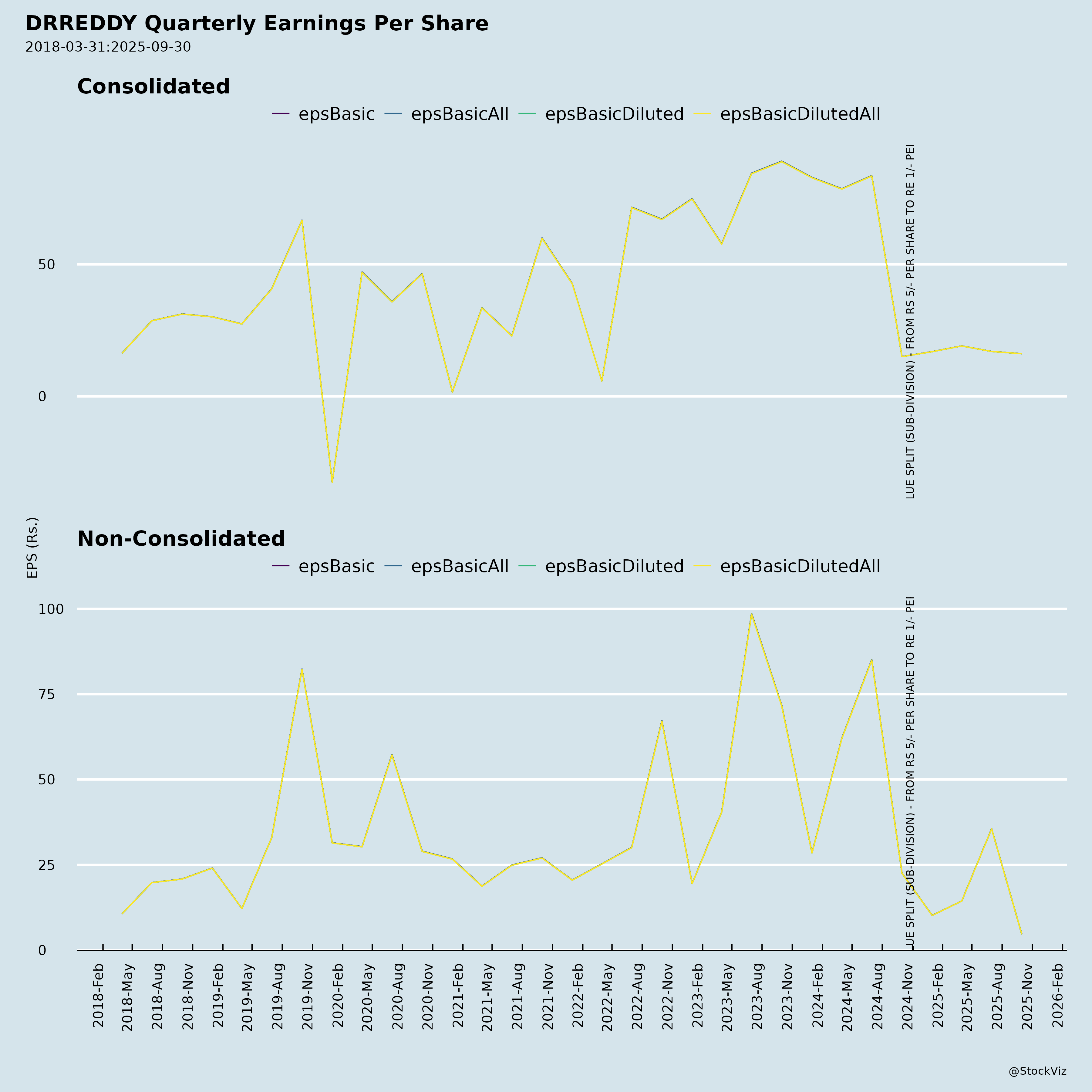

Equity Metrics

January 13, 2026

Dr. Reddy’s Laboratories Limited

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

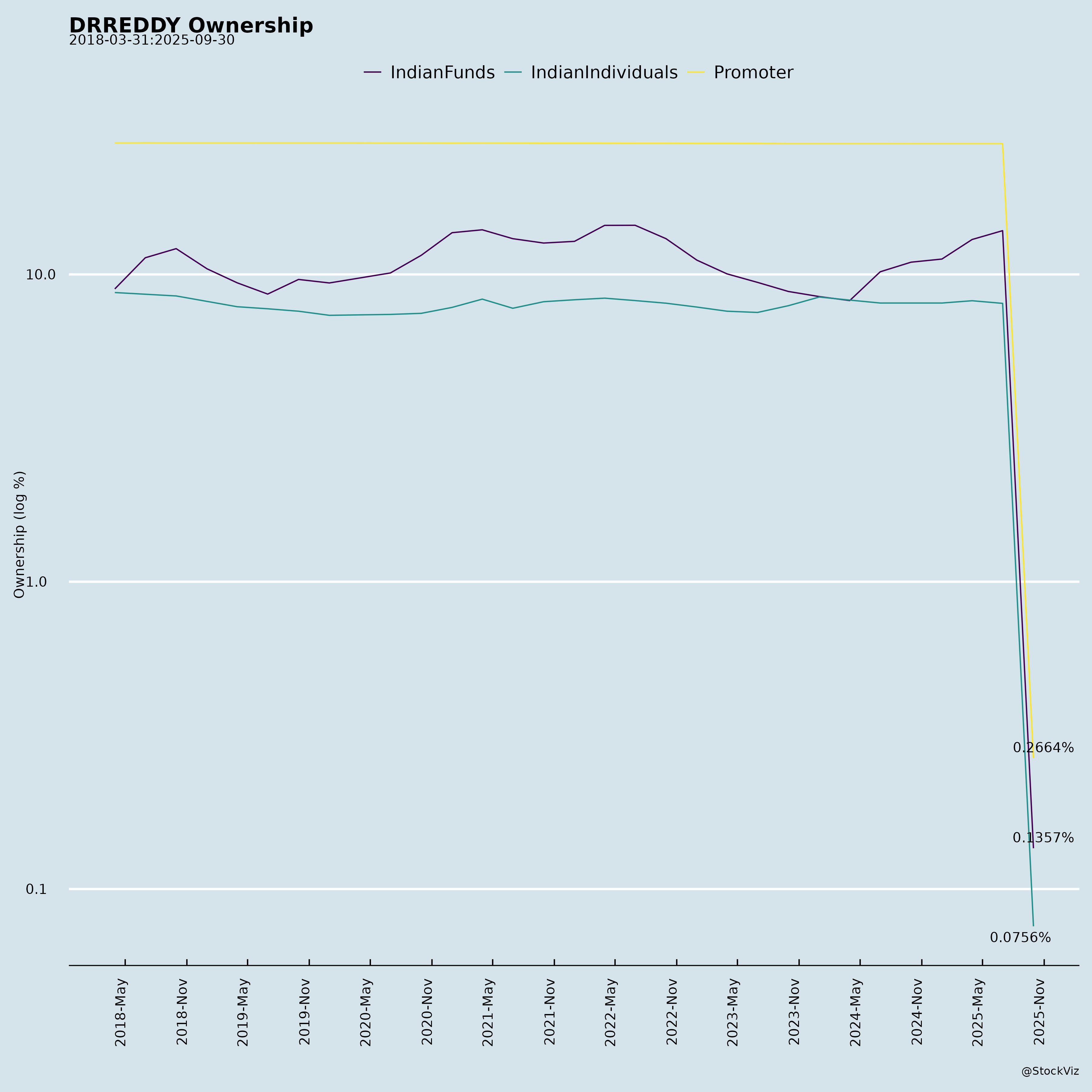

Ownership

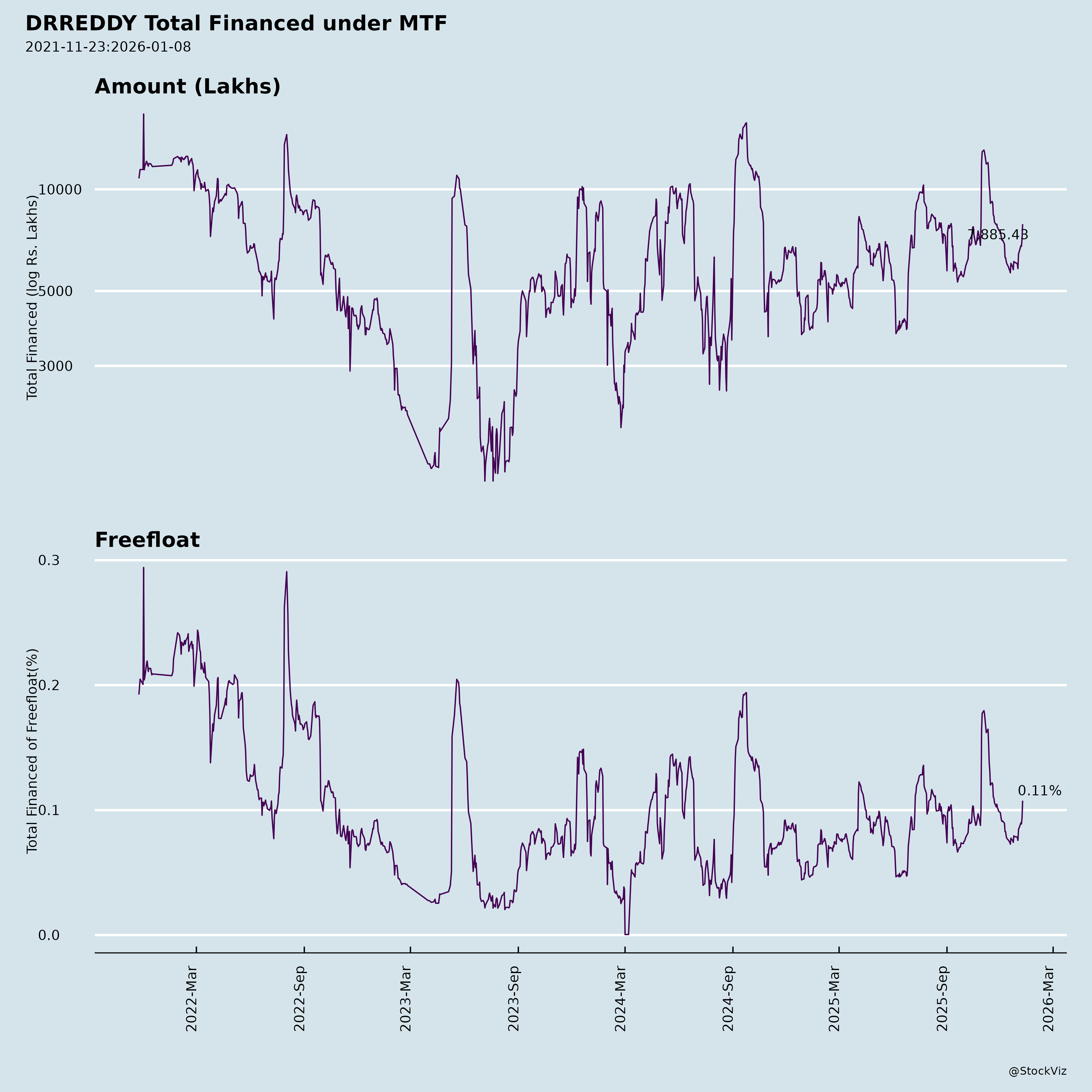

Margined

AI Summary

asof: 2025-12-08

Dr. Reddy’s Laboratories Ltd. (DRREDDY / 500124 / RDY) – Analysis of Headwinds, Tailwinds, Growth Prospects & Key Risks

As of December 2025 – Based on Q2 FY26 Results & Subsequent Disclosures

Executive Summary

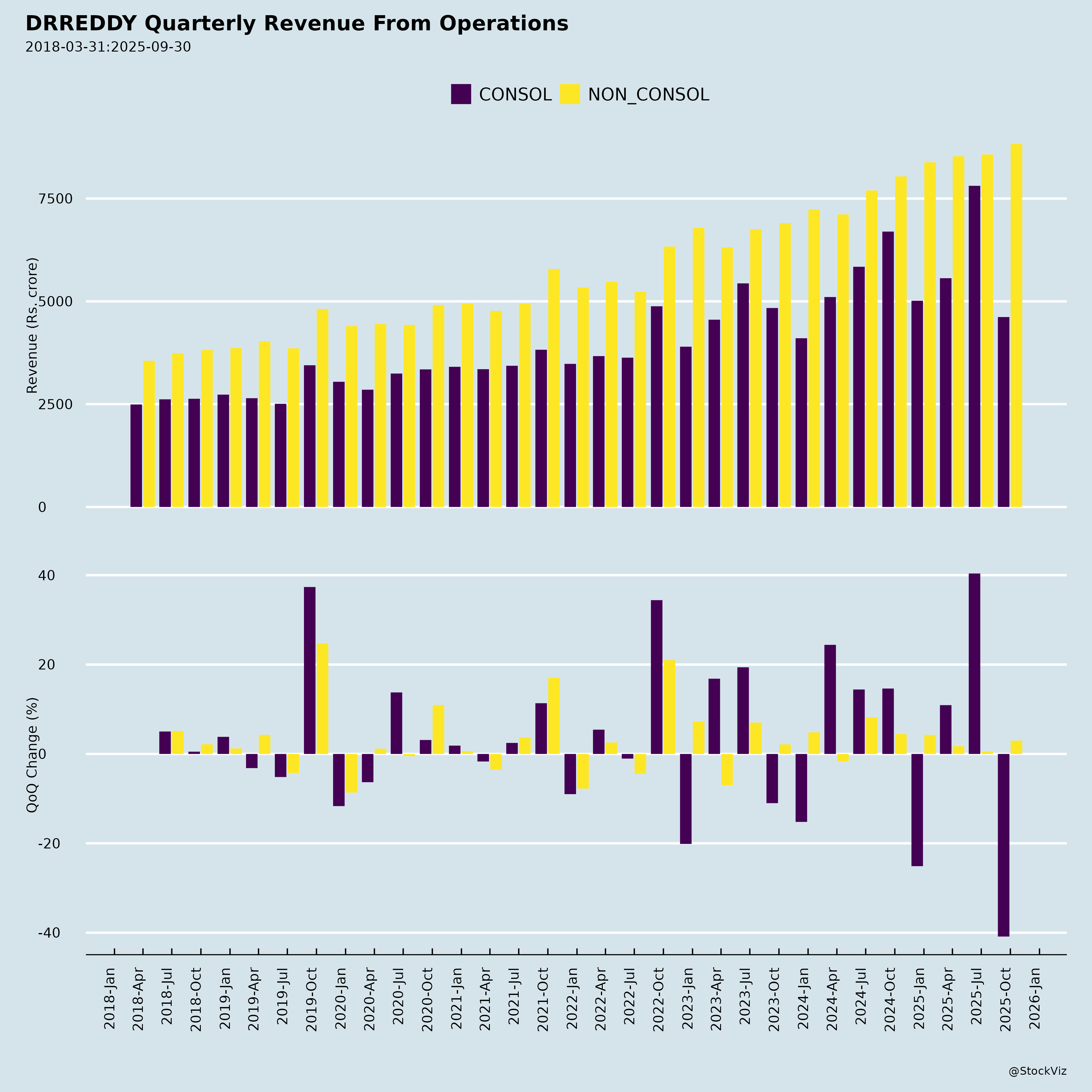

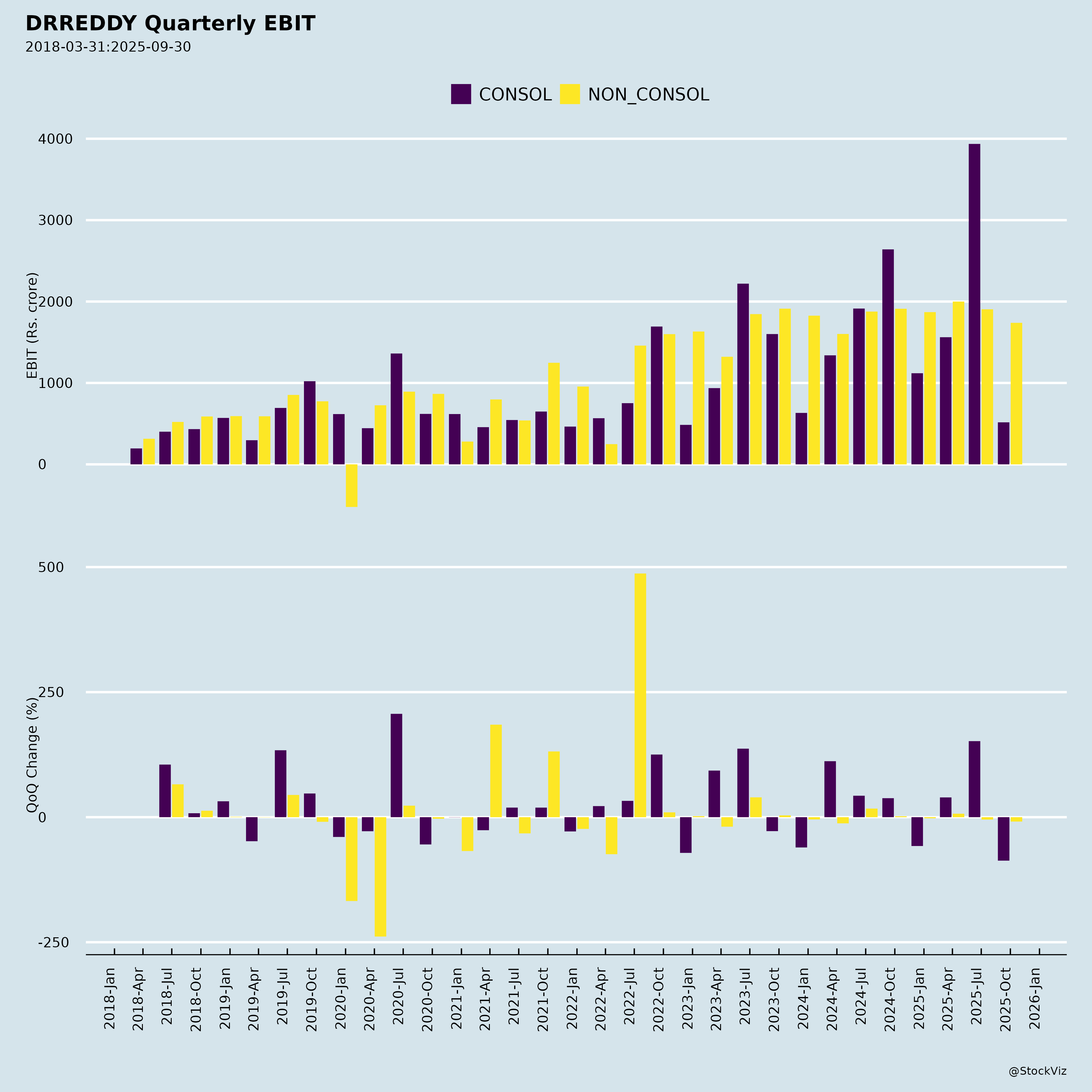

Dr. Reddy’s Laboratories delivered resilient performance in Q2 FY26 (Sep 2025) with near double-digit revenue growth (9.8% YoY), sustained EBITDA margins at 26.7%, and 14% YoY PAT growth to ₹1,437 Cr. Despite headwinds in North America due to price erosion and decline in Lenalidomide sales, the company reported broad-based growth across geographies including strong momentum in India, Europe (boosted by NRT acquisition), and Emerging Markets (EM) driven by new launches and favorable forex.

Strategic progress in biosimilars (denosumab approval in EU), innovation in specialty (PCAB®, Colozo®), in-licensing, M&A (Stugeron®), and ESG advancements highlights its long-term growth trajectory. However, regulatory scrutiny has increased, and short-term margin pressure persists due to mix and integration costs.

The company remains in a net cash surplus position (~₹2,751 Cr), offering strategic flexibility for capital allocation and growth initiatives.

I. Key Financials (Q2 FY26 – Sep 2025)

| Metric | Q2 FY26 (Sept 2025) | YoY Growth | QoQ Growth |

|---|---|---|---|

| Revenues | ₹8,805 Cr | +9.8% | +3% |

| EBITDA | ₹2,351 Cr | +3% | +3% |

| EBITDA Margin | 26.7% | -1.7 ppt | Stable |

| PBT | ₹1,835 Cr | +4% | +4% |

| PAT (Attributable) | ₹1,437 Cr | +14% | +1% |

| EPS (Diluted) | ₹17.25 | +15% | +1% |

| RoCE (Annualised) | ~22% | Slight dip | - |

| Capex | ₹511 Cr (QoQ increase) | +74% |

Note: Underlying growth ex-NRT at +17% YoY in Europe, highlighting organic momentum.

II. Business Highlights – Tailwinds (Growth Drivers)

1. Diversified Global Generics Momentum

- Global Generics Revenues: ₹7,850 Cr (+10% YoY)

- India (₹1,578 Cr, +13% YoY) – Led by new brand launches (PCAB®, Colozo®), volume growth, and improved pricing.

- Ranked #9 in IPM (Sep 2025) with 23 brands > ₹100 Cr.

- Therapy leadership: #1 in Stomatologicals, #2 in Vaccines.

- Emerging Markets (₹1,655 Cr, +14% YoY) – Fueled by new product launches (24 in Q2) and favorable forex (e.g., Russia +28% YoY).

- Russia: ₹875 Cr (~7% of total revenue); market outperformed peers.

- Europe (₹1,376 Cr, +138% YoY) – Driven by NRT acquisition (₹700 Cr revenue) and integration (2/3 value integrated).

- North America (₹3,241 Cr, +13% YoY) – Resilient despite erosion, with new launches (Sacubitril/Valsartan, Fluorouracil cream) and ANDA pipeline.

- India (₹1,578 Cr, +13% YoY) – Led by new brand launches (PCAB®, Colozo®), volume growth, and improved pricing.

2. Innovation & Pipeline Advancements

- India launches:

- Tegoprazan (PCAB®) – Novel drug in acid-related GI diseases.

- Linaclotide (Colozo®) – For chronic constipation.

- EMA’s CHMP positive opinion → EU biosimilar approval:

- AVT03 (denosumab biosimilar) for Prolia® & Xgeva® — approved by European Commission (Nov 2025).

- To be marketed as Acvybra® (syringe) and Xbonzy® (vial).

- Partnership with Alvotech supports global rollout (EU + UK semi-exclusive, US exclusive).

- AVT03 (denosumab biosimilar) for Prolia® & Xgeva® — approved by European Commission (Nov 2025).

- COYA 302 IND accepted by USFDA – A novel oncology candidate.

3. Strategic M&A & In-Licensing

- Acquisition of Stugeron® & related Janssen brands across 18 APAC & EMEA markets for $50 million.

- Reinforces India portfolio and access to key emerging markets.

- Gradual transition ongoing.

- Strengthening emerging markets presence: Now in 48 countries (EM).

4. ESG Strengths & Operational Excellence

- MSCI ESG Rating: ‘A’ (2nd consecutive year).

- Sustainalytics ESG Risk Rating: 18.4 (low risk).

- Waste diversion: 99.9% landfill-free (‘Diamond Standard’ by TÜV SÜD).

- LEED Platinum certification for FTO-11, Srikakulam – first Indian pharma plant to achieve this.

- Net cash surplus: ₹2,751 Cr – Strong balance sheet flexibility.

III. Headwinds & Challenges

1. Price Erosion & Mix Issues in North America

- North America under pressure due to:

- Generalized price erosion in generics market.

- Decline in Lenalidomide sales (high-margin product).

- Despite 13% YoY growth, Q2 growth lagged behind market (+0.1% vs -2.1% IQVIA MAT) – shows some recovery but still challenging.

- Pending approvals: 73 ANDAs (incl. 46 Para-IV, 20 FTF), indicating potential future upside.

2. Margin Pressure in PSAI & GM

- PSAI Segment: ₹945 Cr (+12% YoY) but gross margin declined from 30% to 10% YoY.

- Due to product mix shifts and lower operating leverage.

- Gross Margin down to 54.7% (from 59.6% YoY) – impacted by:

- Mix (lower-margin biosimilars/NRT).

- NRT integration costs.

- VAT provision (one-off in Q1).

- RoCE softened to ~22% (from 27.5% in Q2 FY25).

3. Regulatory Scrutiny

- USFDA issued Form 483s:

- Bachupally (biologics facility) – 5 observations.

- Mirfield, UK (API facility) – 7 observations.

- Voskresensk (Middleburg) plant classified ‘VAI’ post-Russia GMP inspection.

- No red flags, but delays in approvals or compliance upgrades could impact supply and growth.

4. Integration Risks – NRT Acquisition

- High growth in Europe is influenced by NRT acquisition.

- While 2/3rd business value integrated, full integration success will determine synergy realization and margin improvement.

IV. Growth Prospects & Strategic Focus (2025–2027)

| Area | Growth Drivers |

|---|---|

| Core Generics | India double-digit growth, EM expansion, new launches (US/Europe), ANDA pipeline (73 pending). |

| Innovative Brands (India) | PCAB®, Colozo® – novel GI launches offer premium margins and leadership. |

| Biosimilars | EU approval of AVT03 – major in Europe. Versavo® (bevacizumab) already launched in UK. US biosimilar launches via partners. Expansion of biologics capacity. |

| Specialty & Pipeline | COYA 302 (oncology) IND accepted – early-stage but promising. Partnerships (e.g. Alvotech) derisk development. |

| Emerging Markets | Broad footprint in Russia, CIS, and ROW. Local manufacturing & localization strategies. |

| M&A / In-Licensing | Acquisitions like Stugeron® show focus on value-add brands. Further bolt-ons likely in APAC/EM. |

| Ecosystem Investments | Digital, quality compliance, ESG leadership – long-term cost discipline and access. |

FY26 revenue guidance implied at ~10% YoY growth, with EBITDA margin above 25%.

V. Key Risks

| Risk Category | Specific Risks |

|---|---|

| Commercial Risks | - Sustained price erosion in US generics market. - Dependence on few key products (e.g. Lenalidomide). - Competition from complex generics space. |

| Regulatory Risks | - Ongoing USFDA inspections (Form 483) and remediation timeline. - Potential for import alerts or delays in ANDA approvals. - CDSCO / EMA / FDA scrutiny in biosimilars space. |

| Geopolitical Risks | - Russia market volatility (sanctions, forex, logistics). - Dependency on CIS market (14% of EM). |

| Financial & Currency Risks | - Rupee appreciation could hurt export margins. - Rising interest rates impacting capex/cost of capital. |

| Integration & Execution Risk | - Successful integration of NRT and Stugeron is key. - M&A multiples and synergy delivery. |

| Tax & Legal Risks | - GST Appellate Order (Nov 2025): penalty ₹3.47 Lakh (not material, but highlights tax audit exposure). - Potential for future disputes. |

VI. Conclusion: Investment Thesis – Neutral to Positive Bias

Strengths:

✅ Diversified global footprint across 83 markets.

✅ Robust new product pipeline in generics, biosimilars, and branded generics.

✅ Strategic M&A and acquisitions enhancing brand footprint.

✅ Strong ESG profile enhances valuation and sustainability of operations.

✅ Healthy cash flow & net cash surplus – financial resilience.

Challenges:

⚠️ Margin pressures in PSAI and overall GM.

⚠️ Regulatory cloud over US facilities requires active monitoring.

⚠️ North America dynamics remain tough despite new launches.

Outlook:

- Near-term growth (~10% CAGR) supported by India, EM, acquired assets, and biosimilars.

- Long-term growth accelerator: Biosimilars pipeline (AVT03, upcoming assets) and specialty (COYA 302).

- Valuation: Trading at moderate P/E (~30–32x FY26 EPS), justified by global scale and innovation transition.

Rating: Accumulate (for long-term investors), Hold (trading at fair value).

Watch triggers:

- Biosimilar launches in US/EU.

- Resolution of USFDA Form 483s.

- Margin recovery in H2 FY26.

- Further strategic in-licensing/M&A.

Prepared as of: December 2025

Sources: Q2 FY26 Investor Presentation, Press Releases, GST Notice, Regulatory Filings

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.