DMART

Equity Metrics

January 13, 2026

Avenue Supermarts Limited

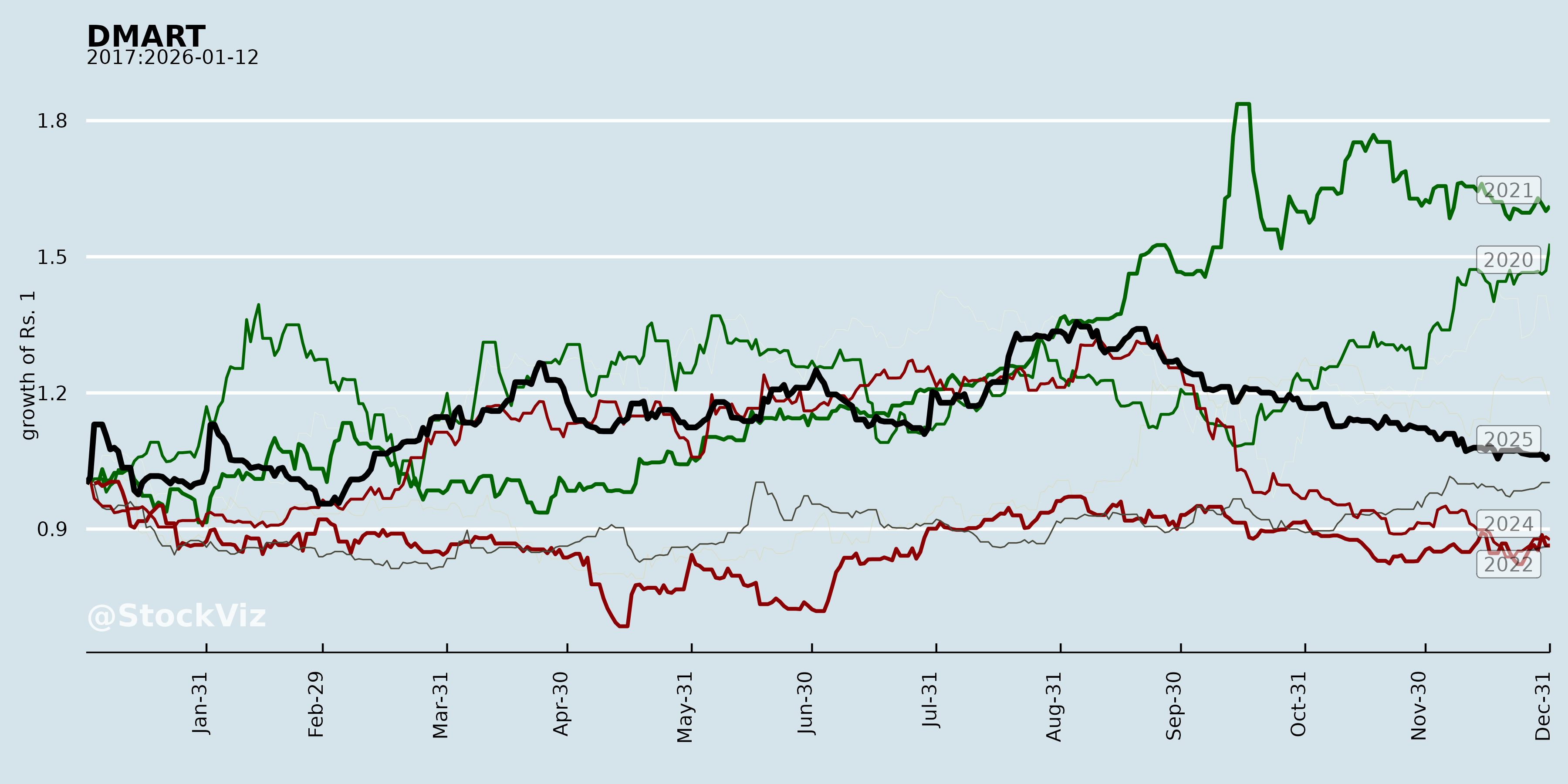

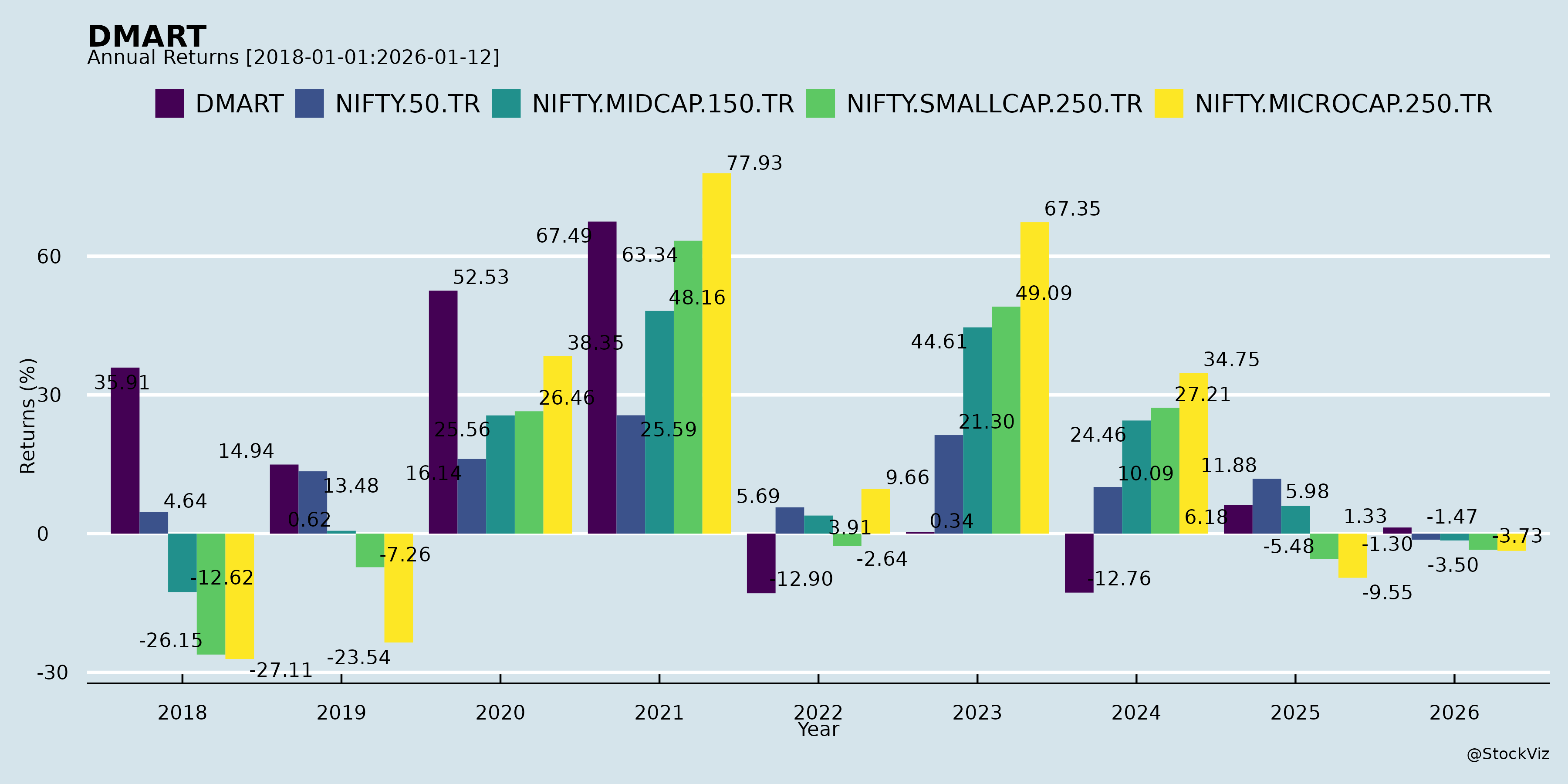

Annual Returns

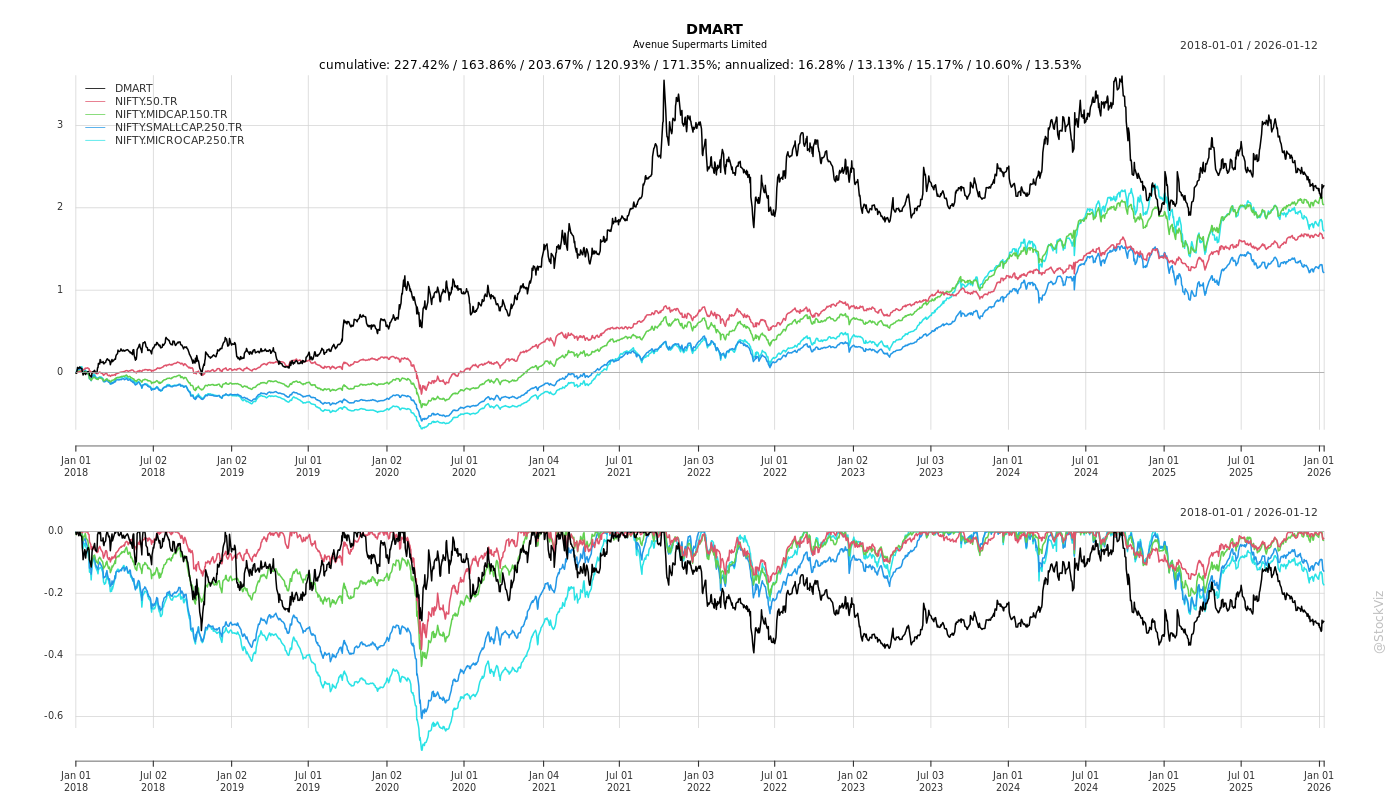

Cumulative Returns and Drawdowns

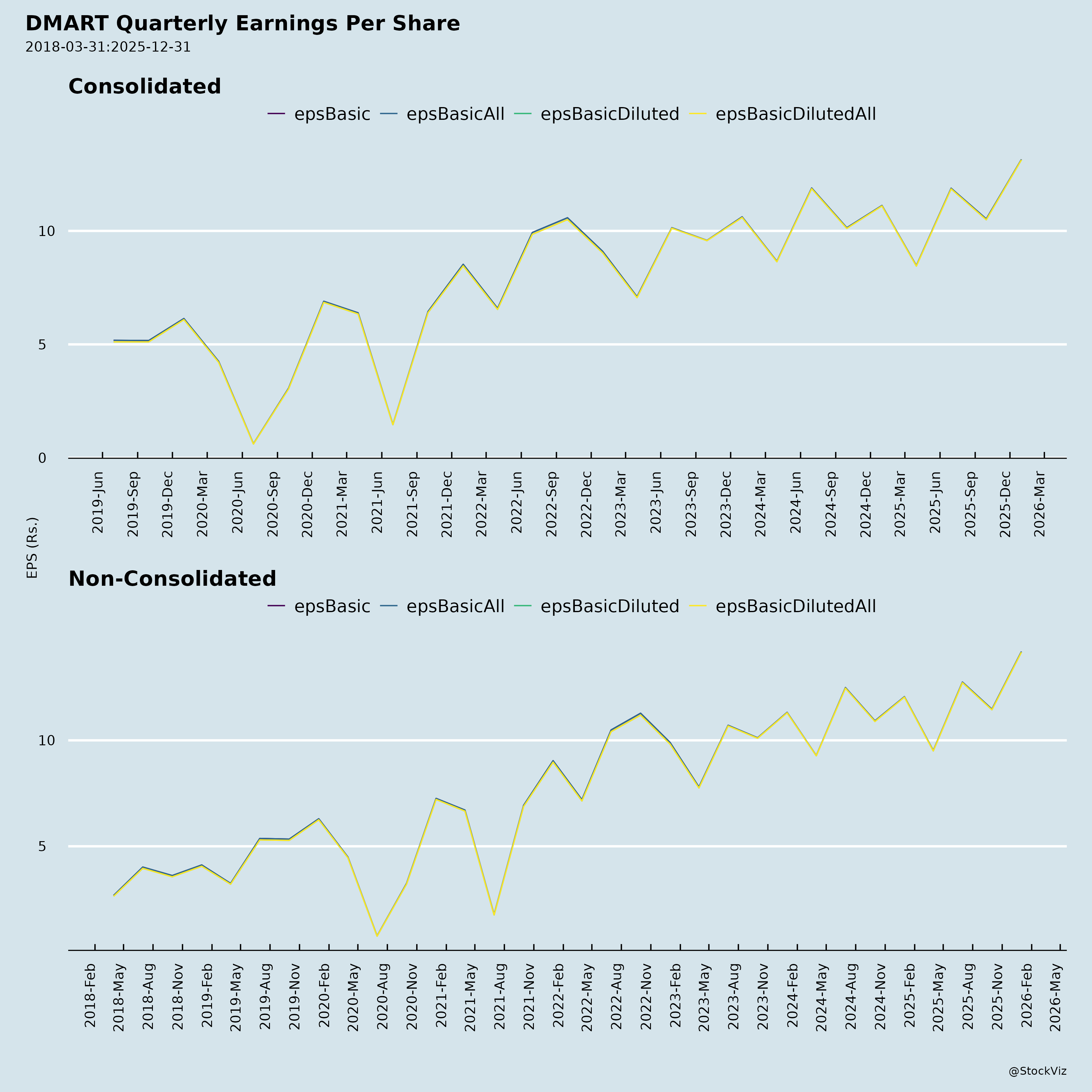

Fundamentals

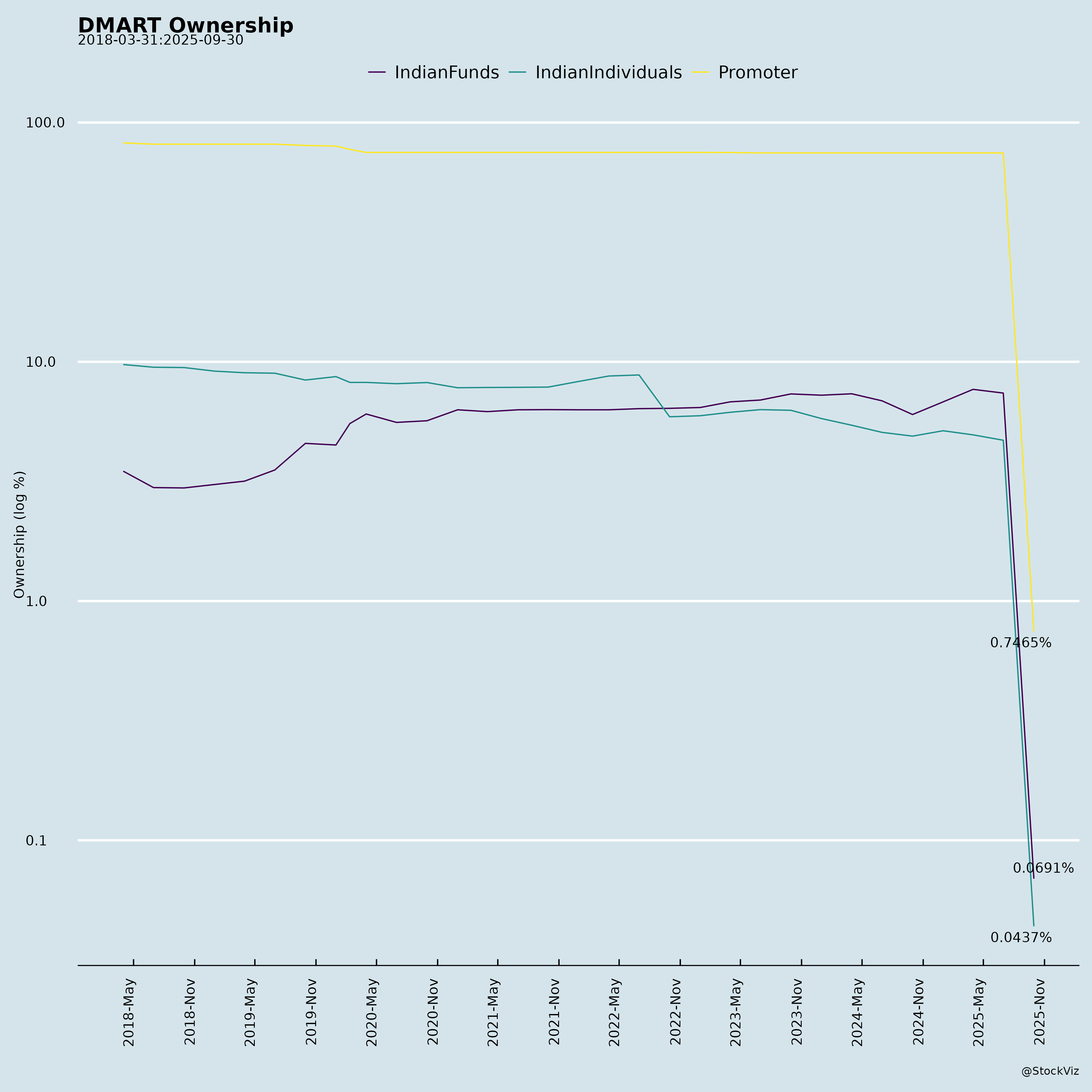

Ownership

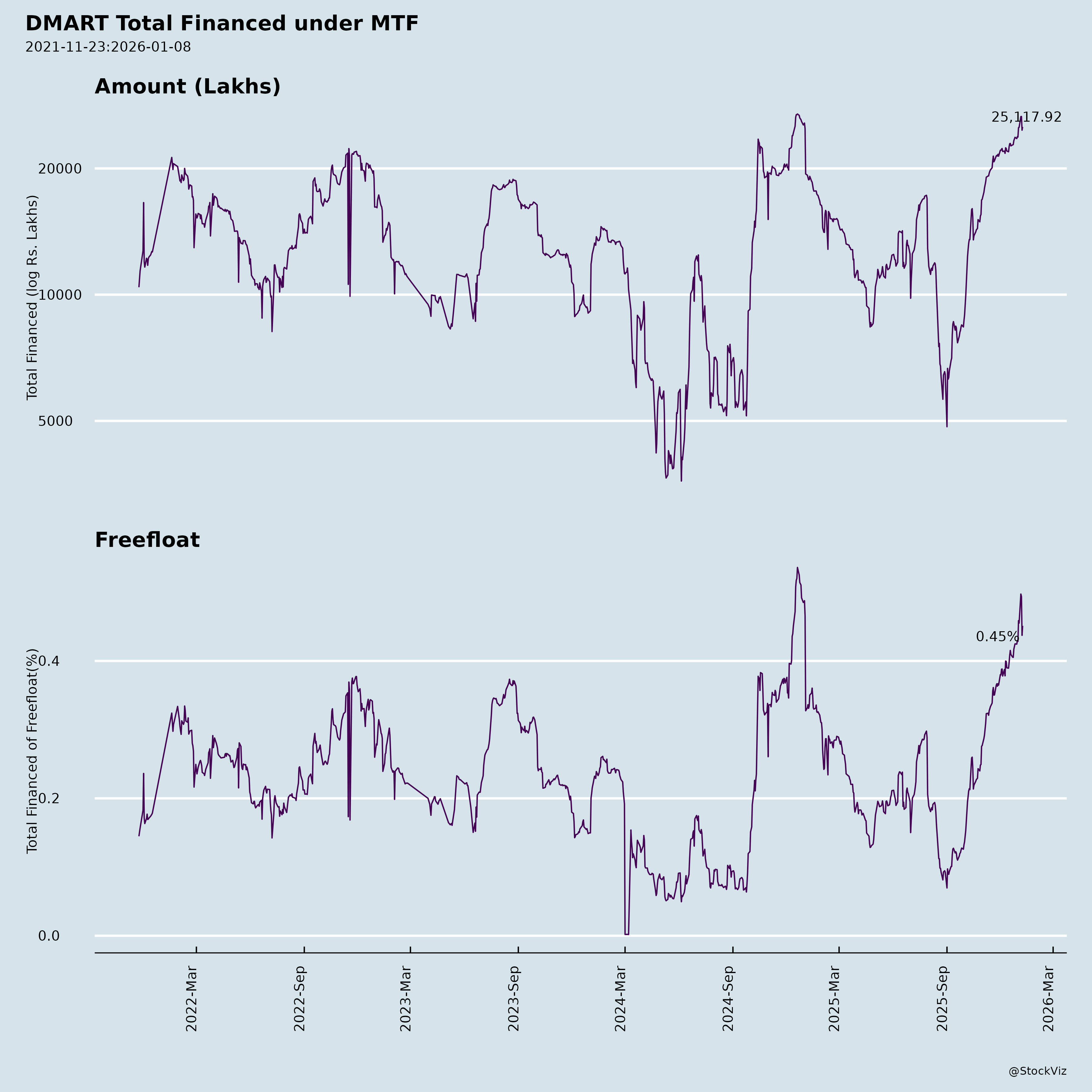

Margined

AI Summary

asof: 2025-12-03

Analysis of Avenue Supermarts Limited (DMART) – Headwinds, Tailwinds, Growth Prospects, and Key Risks

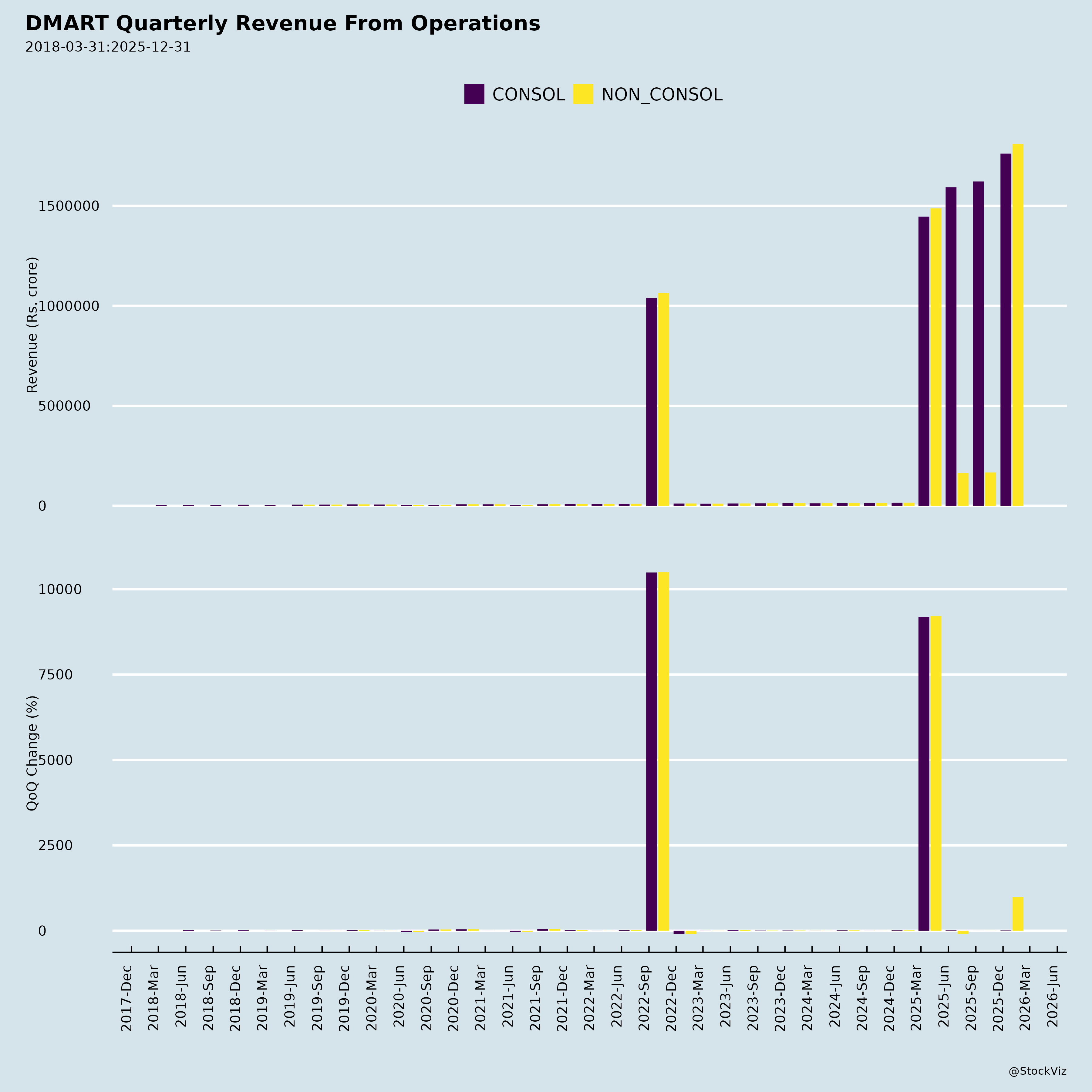

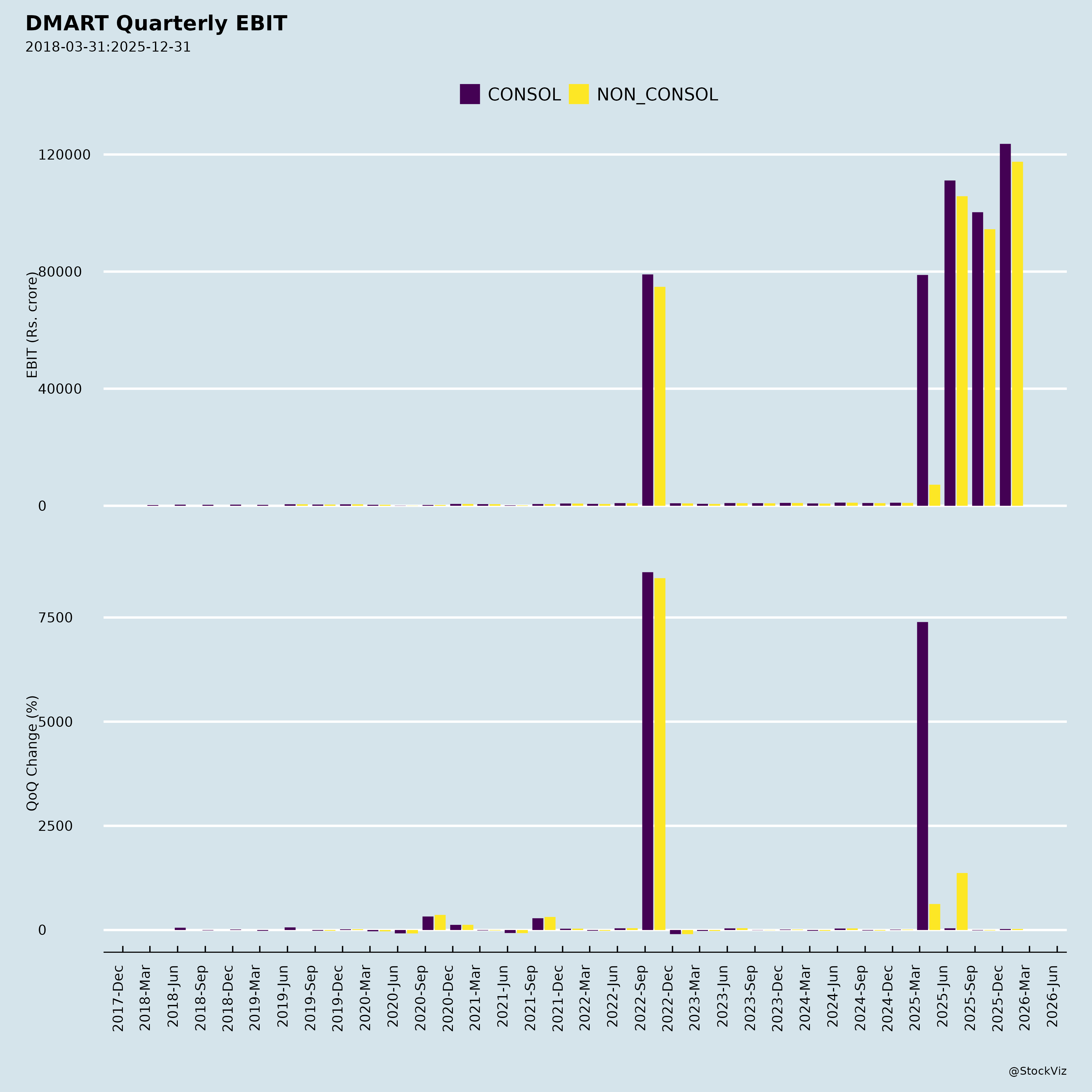

Overview: Avenue Supermarts Ltd. (DMART), operator of the D-Mart supermarket chain, reported strong top-line growth in Q2/H1 FY26 (ended Sep 2025), driven by store expansions amid a competitive Indian retail landscape. Standalone revenue grew 15.4% YoY to ₹16,219 Cr in Q2 (H1: 15.8% to ₹32,151 Cr), with PAT up 5.1% to ₹747 Cr (H1: 3.5% to ₹1,576 Cr). Store count reached 432 (+17 in H1). EBITDA margins dipped slightly to 7.6% (Q2), reflecting cost pressures. Balance sheet remains robust (low debt-equity at 0.06x, strong operating cash flow of ₹1,838 Cr in H1 standalone). Consolidated figures (including e-commerce subs) show similar trends but lower margins (PAT 4.4% H1).

Tailwinds (Positive Drivers)

- Robust Revenue Momentum: 15%+ YoY growth, fueled by 8 new stores in Q2 (17 in H1), expanding footprint to 17.9 Mn sq ft across 13 states. Revenue per store remains efficient.

- Strong Financial Health: High cash generation (H1 op. cash flow ₹1,838 Cr standalone), low leverage (debt/EBITDA <0.1x), healthy liquidity (current ratio 2.6x), and high turnover ratios (inventory 5.4x H1, trade receivables 71x). Issued ₹100 Cr commercial paper at 6% (A1+ rated).

- Operational Efficiency: EDLC-EDLP model sustains value pricing; passed GST benefits to customers. Mature (2+ yr) stores grew 6.8% YoY, indicating resilient core demand.

- E-commerce Upside: DMart Ready expanded to 19 cities, adding 10 fulfillment centers, complementing offline dominance.

Headwinds (Challenges)

- Margin Compression: EBITDA margin fell to 7.6% (Q2) from 7.9% YoY; PAT margin to 4.6% from 5.0%, due to higher employee costs (+33% YoY), finance/depreciation (+50-70%), and other expenses (+17%). Inventory build-up (₹5,387 Cr, +12% QoQ) pressured working capital.

- Mature Store Slowdown: 6.8% LFL growth signals softer discretionary spending amid inflation/competition.

- Capex Intensity: ₹1,705 Cr invested in PPE/CWIP in H1, leading to cash burn in investing activities (₹855 Cr net outflow standalone).

- Minor Regulatory Drag: ₹20.87 lakh penalty for conveyance deed delay (immaterial, <0.002% of revenue; company evaluating appeal).

Growth Prospects

- Store Expansion: Targeting 40-50 annual additions; current 432 stores leave room in underserved markets (organized retail <10% penetration in India).

- Revenue Trajectory: H1 growth of 15.8% positions FY26 for 13-15% top-line expansion, supported by 6-8% LFL + new stores. Long-term: Scale to 1,000+ stores.

- Diversification: E-commerce (DMart Ready) scaling in metros; subsidiaries contribute ~3% revenue with improving ops. Potential in private labels/high-margin categories.

- Macro Tailwinds: Rising organized retail shift, urbanization, and middle-class growth; GST reforms aid affordability.

Key Risks

| Risk Category | Description | Potential Impact | Mitigation |

|---|---|---|---|

| Competition | Intense rivalry from Reliance Retail, Amazon/Flipkart (quick commerce), and unorganized kiranas eroding share. | Margin squeeze, slower LFL growth. | Cost leadership via EDLP; focus on groceries (70% mix). |

| Consumer/Execution | Weak LFL (6.8%), inventory pile-up, or supply chain disruptions (e.g., agri volatility). | Revenue miss, working capital strain. | Efficient supply chain; 2.8x quarterly inventory turnover. |

| Regulatory/Compliance | Delays in land deeds/approvals (e.g., Haryana penalty); GST/tax changes. | Fines, capex delays. | Strong compliance; immaterial so far. |

| Financial | Rising interest rates on CP/borrowings (₹265 Cr short-term); lease liabilities up 2x YoY. | Higher finance costs (up 120% YoY). | Low net debt; strong cash flows cover 16x debt service. |

| E-commerce | Losses/slow scale in subs (e.g., ceased 5 cities); integration risks. | Diluted group margins (consol PAT 4.4%). | Selective expansion; parent dominance (97% revenue). |

| Macro | Inflation, slowdown in rural/semi-urban demand. | LFL contraction. | Defensive grocery focus. |

Summary Recommendation: DMART exhibits solid growth prospects from expansion and efficiency, outweighing moderate headwinds like margin pressure. Low-risk profile (strong balance sheet) supports premium valuation, but monitor LFL recovery and competition. Target FY26 revenue ~₹65,000-67,000 Cr; PAT growth ~8-10% if margins stabilize. Positive outlook for long-term investors.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.