DLINKINDIA

Equity Metrics

January 13, 2026

D-Link (India) Limited

Computers Hardware & Equipments

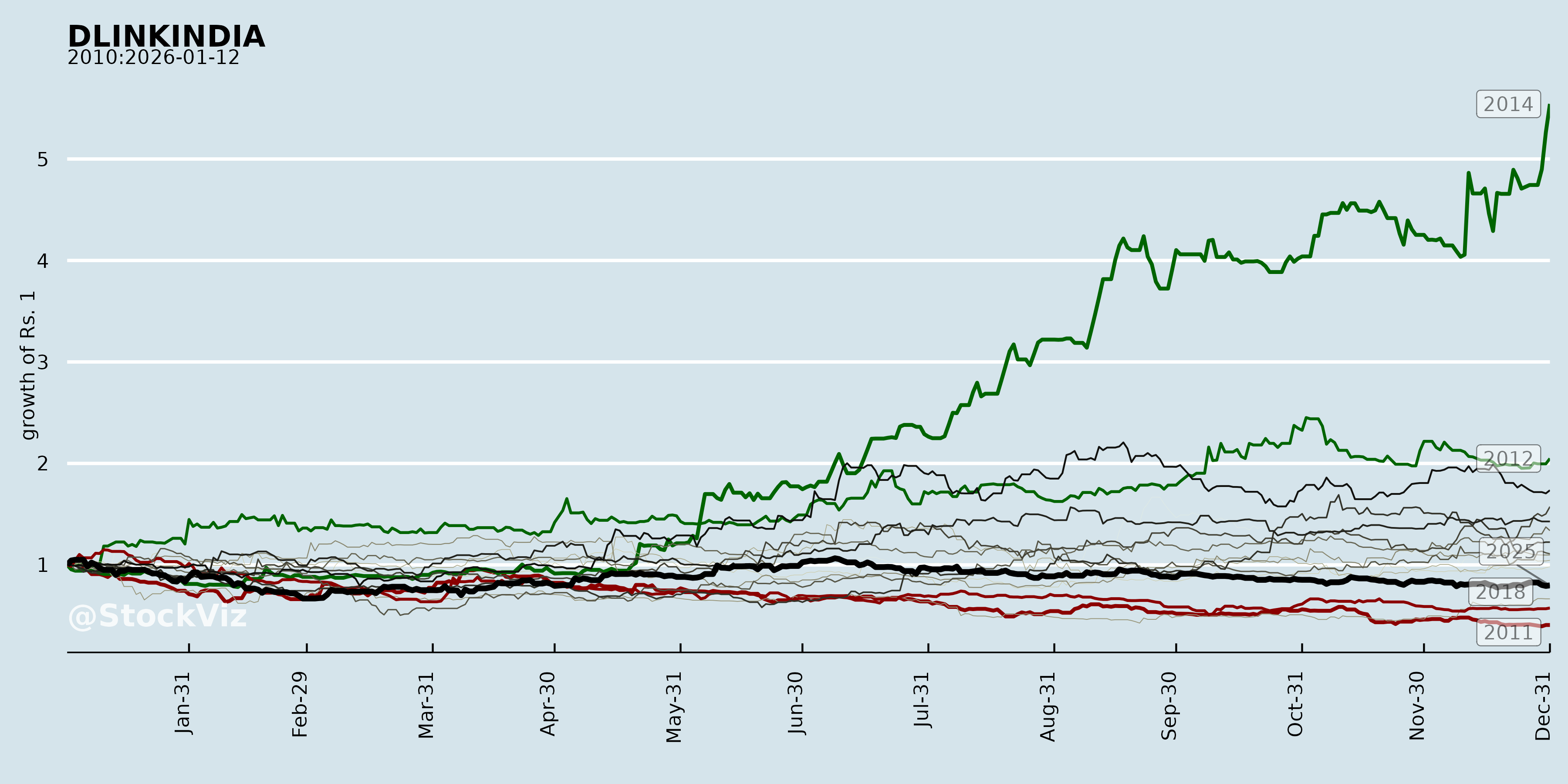

Annual Returns

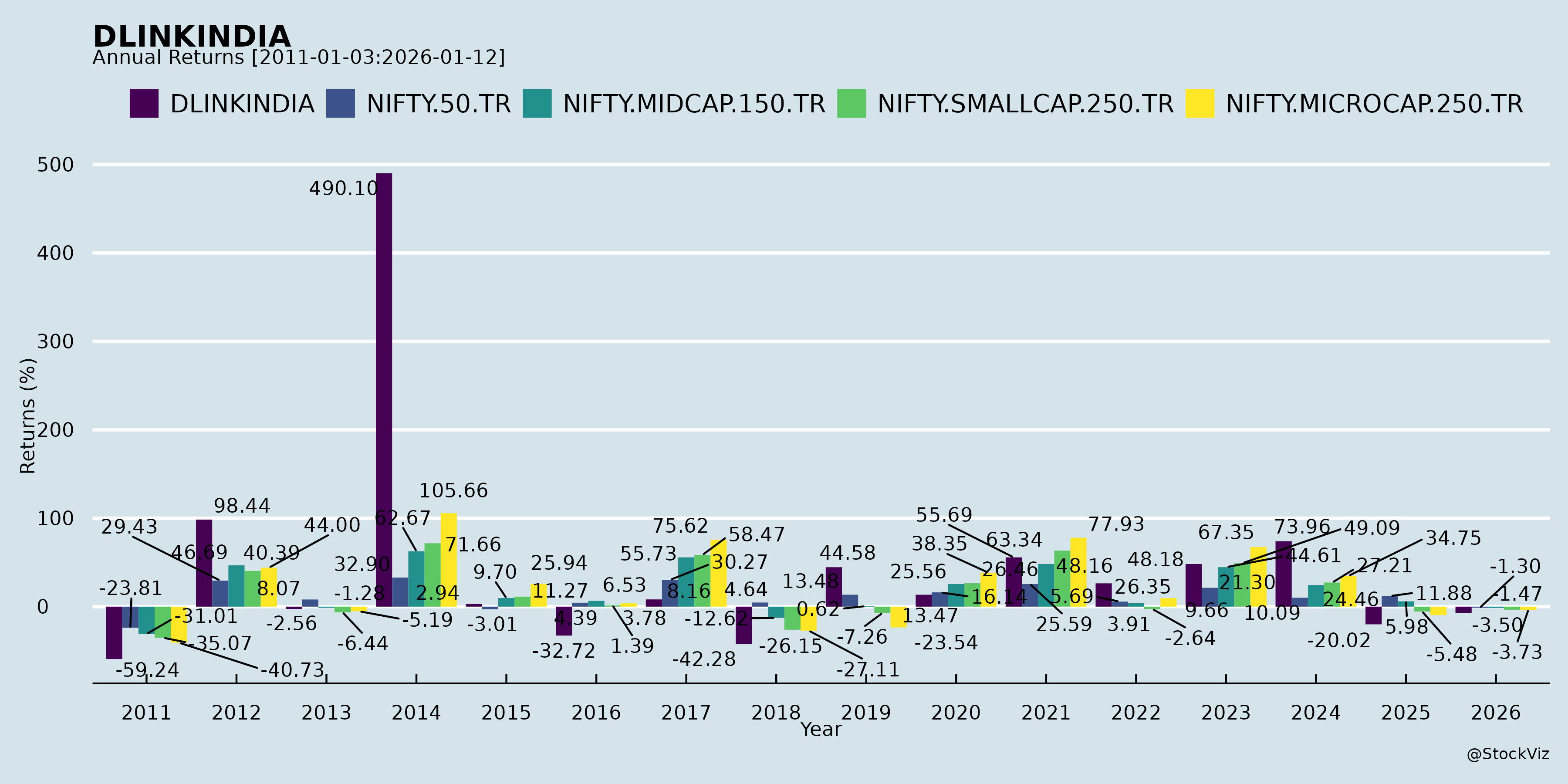

Cumulative Returns and Drawdowns

Fundamentals

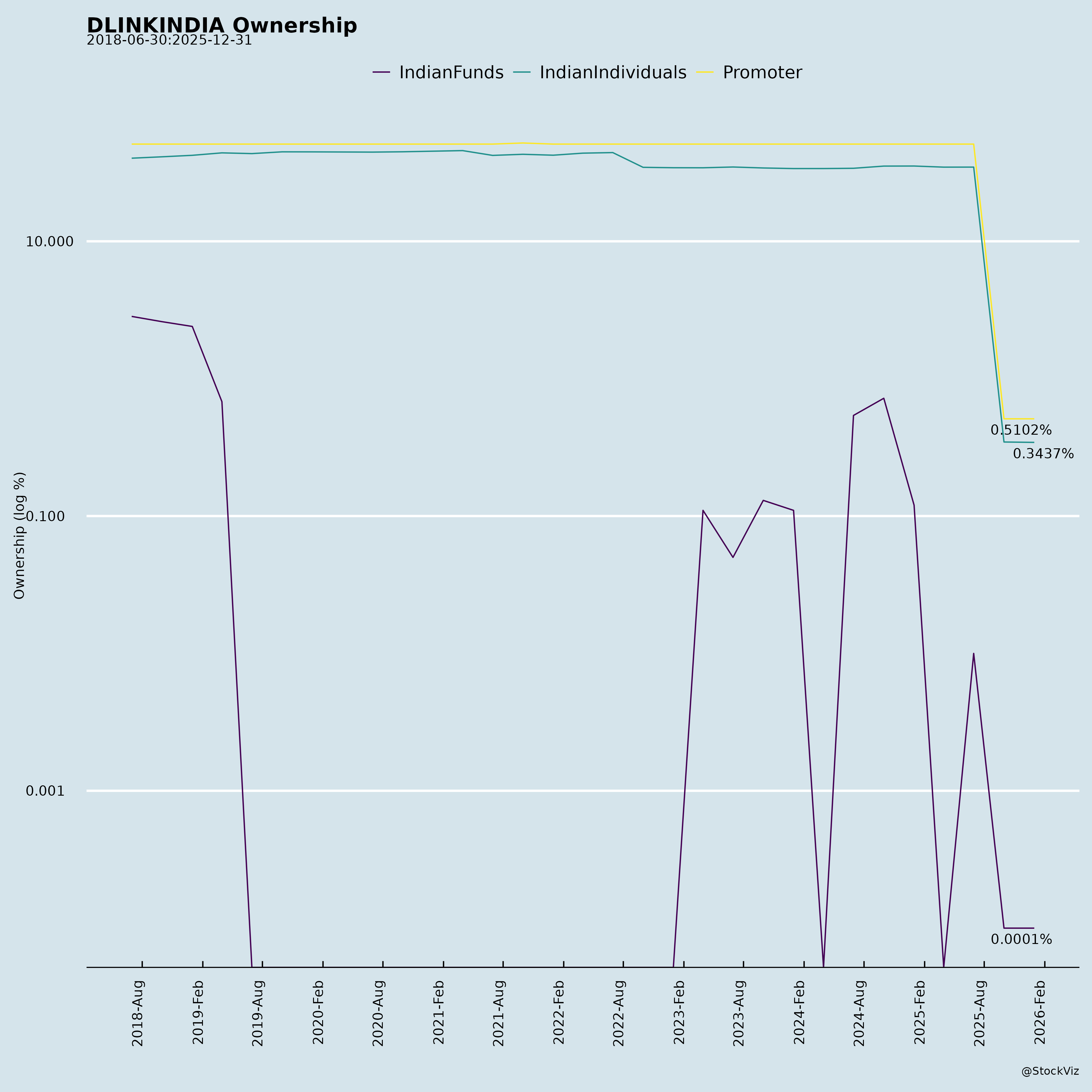

Ownership

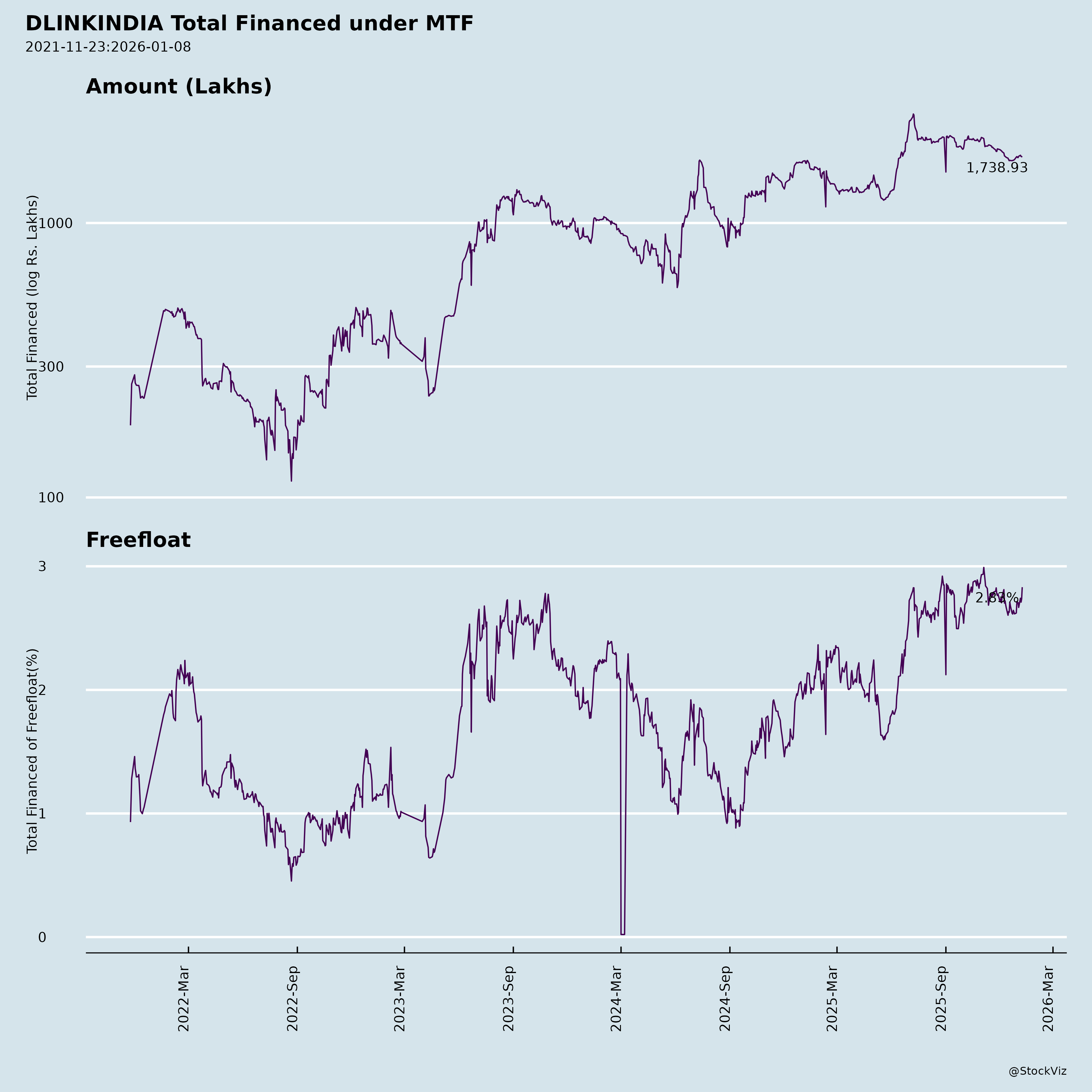

Margined

AI Summary

asof: 2025-11-27

Analysis of D-Link (India) Limited (DLINKINDIA): Headwinds, Tailwinds, Growth Prospects, and Key Risks

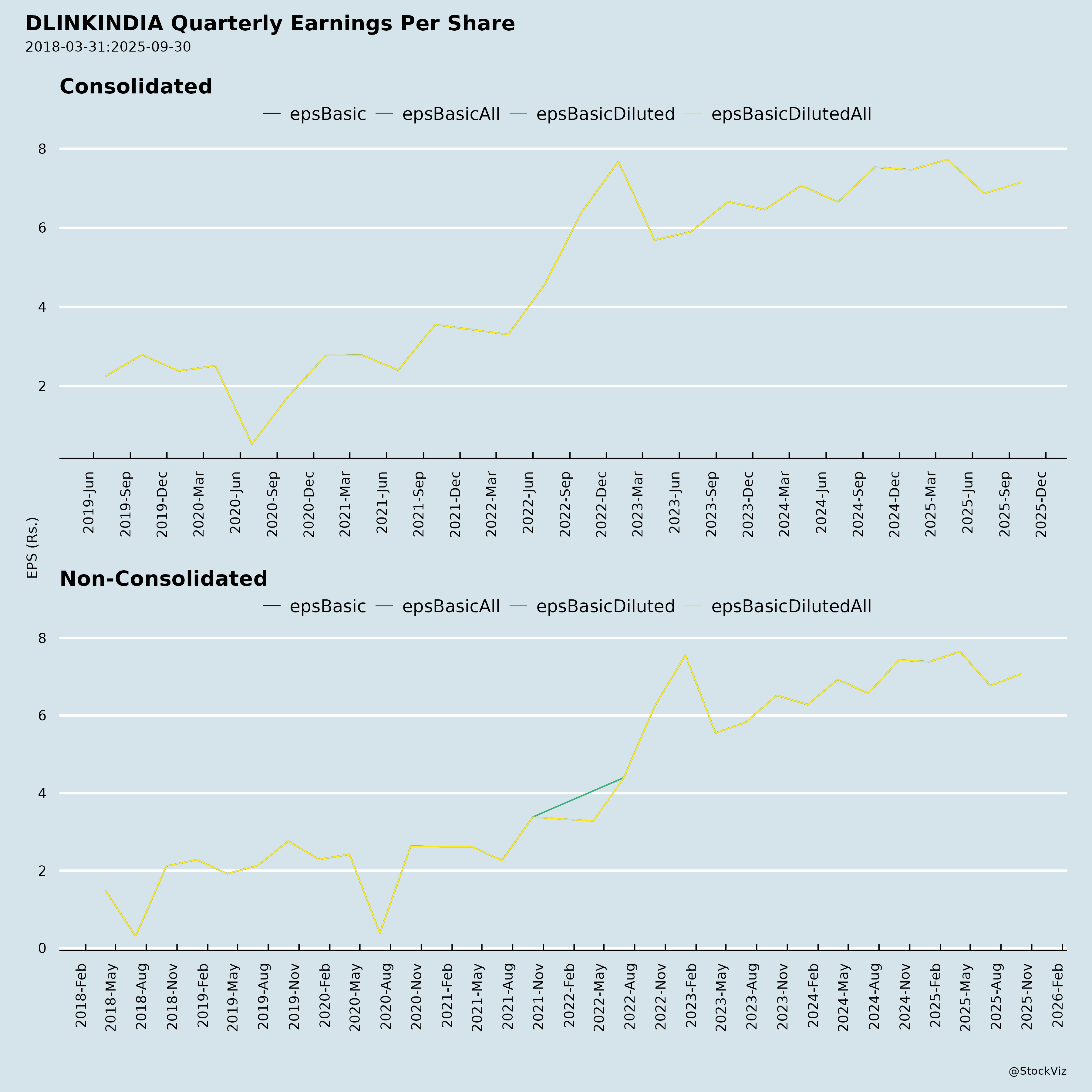

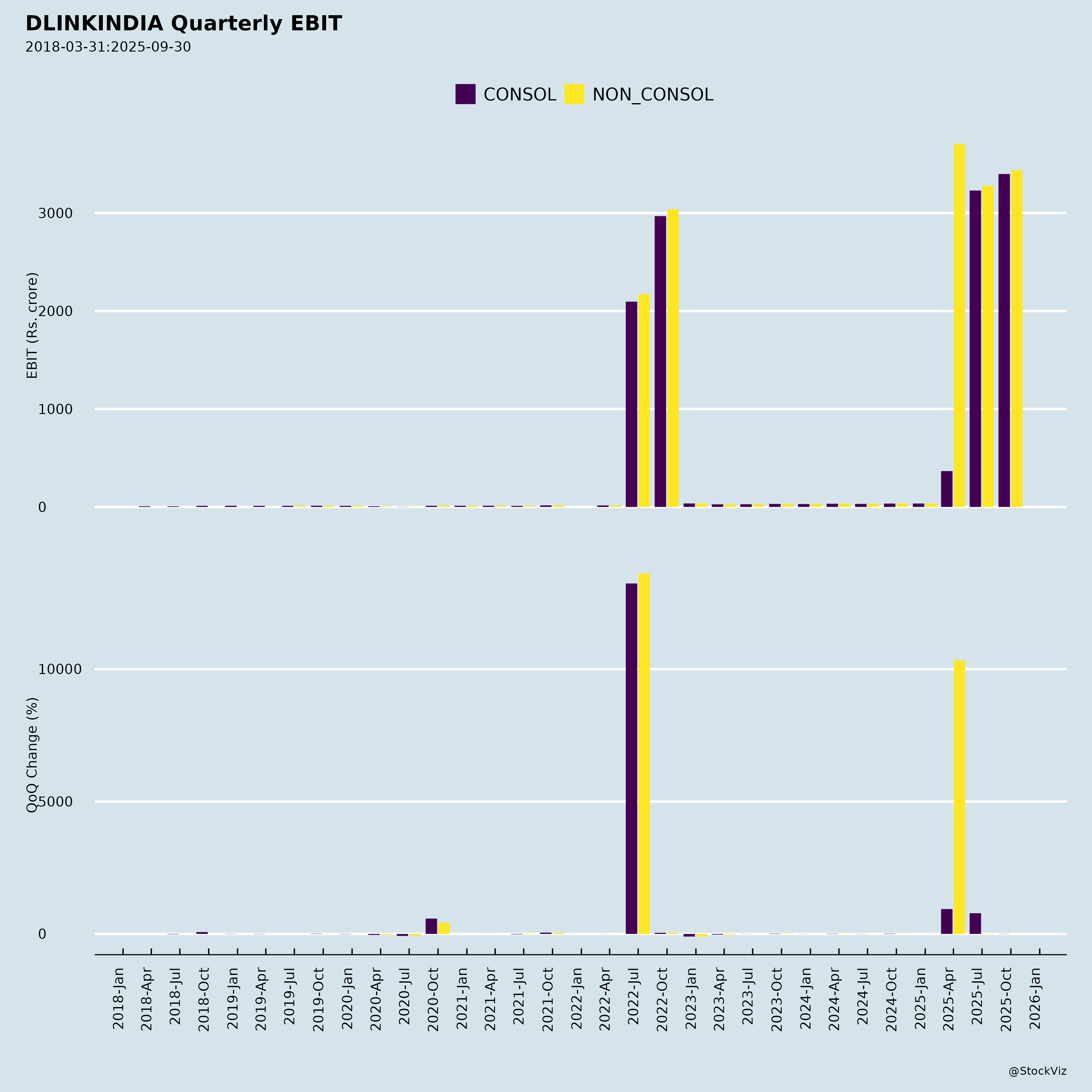

D-Link (India) Limited, a networking products company (BSE: 533146, NSE: DLINKINDIA), released strong Q2/H1 FY26 (ended Sep 30, 2025) unaudited results. Standalone revenue grew 12% YoY in Q2 to ₹374.9 Cr (H1: +6.5% to ₹723.3 Cr), with PBT stable at ₹66.3 Cr (H1) and PAT at ₹49.1 Cr (EPS ₹13.84). Consolidated figures are marginally higher (revenue ₹726.8 Cr, PAT ₹49.8 Cr). Balance sheet expanded to ₹745.7 Cr assets, driven by inventories (+49%) and investments. Operating cash flow robust at ₹43.3 Cr (standalone), but net cash down due to ₹53.3 Cr dividend payout (prior FY final + new ₹6 interim). High dividend yield (post-record date Nov 14) signals cash confidence amid board changes (director resignation, new appointment pending).

Tailwinds (Positive Catalysts)

- Robust Revenue Momentum: Q2 sales +12% YoY (standalone), driven by core networking products (single reportable segment). H1 growth despite inventory buildup suggests demand strength in routers, switches, Wi-Fi amid India’s digital push (e.g., 5G rollout, broadband expansion).

- Profitability Resilience: Gross margins stable (implied ~11-12% from purchases/inventory changes); PBT margins ~9%. Declared ₹6 interim dividend (300% on ₹2 FV) + prior ₹15 final reflects strong free cash flow generation (₹43 Cr OCF H1).

- Liquidity & Investments: ₹196 Cr liquid investments (up from ₹168 Cr); subsidiary (TeamF1) adds service revenue diversification (networking security). High dividend payout ratio boosts shareholder returns (yield ~4-5% annualized).

- Governance Stability: Unmodified limited review by BSR & Co.; committee reconstitution ensures compliance. Single-segment focus aids operational efficiency.

Headwinds (Challenges)

- Inventory Pile-Up: Stock-in-trade surged 49% YoY to ₹115 Cr (from ₹77 Cr), signaling potential demand softening or overstocking risks. Negative inventory change aided Q2 margins but could pressure working capital if unsold.

- Receivables Pressure: Trade receivables steady at ₹344 Cr (~1.5x H1 sales), implying high DSO (~150+ days). ECL provisions noted, hinting credit risks.

- Cash Drain from Payouts: Cash equivalents halved to ₹8 Cr post-dividends (₹53 Cr outflow); financing activities used ₹56 Cr. Lease liabilities up (new/modified leases).

- Board Transition: Mukesh Lulla’s resignation (personal commitments) as Non-Exec Non-Indep Director; new appointee (Mr. Alex Chiang) pending DIN—minor but could delay strategic input.

Growth Prospects

- Sector Tailwinds: Networking demand from India’s 1 Bn+ internet users, data center boom (₹1 Tn investments), enterprise 5G/Wi-Fi 7 upgrades, and cybersecurity services via subsidiary. FY25 full-year revenue ₹1,377 Cr sets base for 10-15% FY26 growth.

- Margin Expansion Potential: Purchases growth moderated; forex gains (unrealized ₹1.2 Cr) and investment income (₹8 Cr H1) support. Subsidiary contributes ~3-4% revenue uplift.

- Capital Allocation: ₹16.5 Cr investment in subsidiary; mutual fund churning (₹325 Cr buys, ₹303 Cr sales) yields gains (₹6.9 Cr). Dividend policy (₹21/share FY26 so far) attracts income investors.

- Outlook: H1 PBT flat YoY but Q2 acceleration (+ve momentum). Analysts may project 10-12% revenue CAGR FY26-28, driven by exports/domestic enterprise shift.

Key Risks

| Risk Category | Description | Mitigation/Impact |

|---|---|---|

| Working Capital | High inventories (15% of assets) + receivables (46% of assets) risk obsolescence/liquidity crunch if sales slow. | Inventory turnover ~6x; OCF covers but monitor Q3. High |

| Forex & Input Costs | Purchases (90% of expenses) likely import-heavy; unrealized FX gains volatile. Rupee depreciation could squeeze margins. | Hedging via forwards (MTM gains ₹0.2 Cr). Medium |

| Competition | Intense rivalry (TP-Link, Ubiquiti, Cisco) in commoditized networking; price wars. | Brand strength in SMB/consumer; services differentiation. Medium |

| Macro/Economic | Slowing capex (IT slowdown?), inflation on employee costs (+7% YoY). Dividend policy strains cash if growth falters. | Resilient sector; ₹26 Cr trade payables buffer. Medium |

| Regulatory/Governance | SEBI compliance (Reg 30/33); director changes, lease accounting changes. | Strong audit (BSR); committee reconstitution. Low |

| Execution | Single-segment reliance; subsidiary minor (NCI <₹0.3 Cr). | Diversification via services/goodwill (₹15 Cr). Low-Medium |

Overall Summary: DLINKINDIA exhibits solid growth (revenue + tailwinds from digital India) with healthy profitability and shareholder-friendly dividends outweighing moderate headwinds (inventory/debtors). FY26 prospects bright (10%+ growth) if inventory normalizes, but watch Q3 for working capital discipline. Trading at ~15-20x FY26 EPS (est.); suitable for dividend-growth investors. Risks tilted operational—bullish bias with caution on balance sheet bloat. (Data as of Nov 5, 2025 filing.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.