Computers Hardware & Equipments

Industry Metrics

January 13, 2026

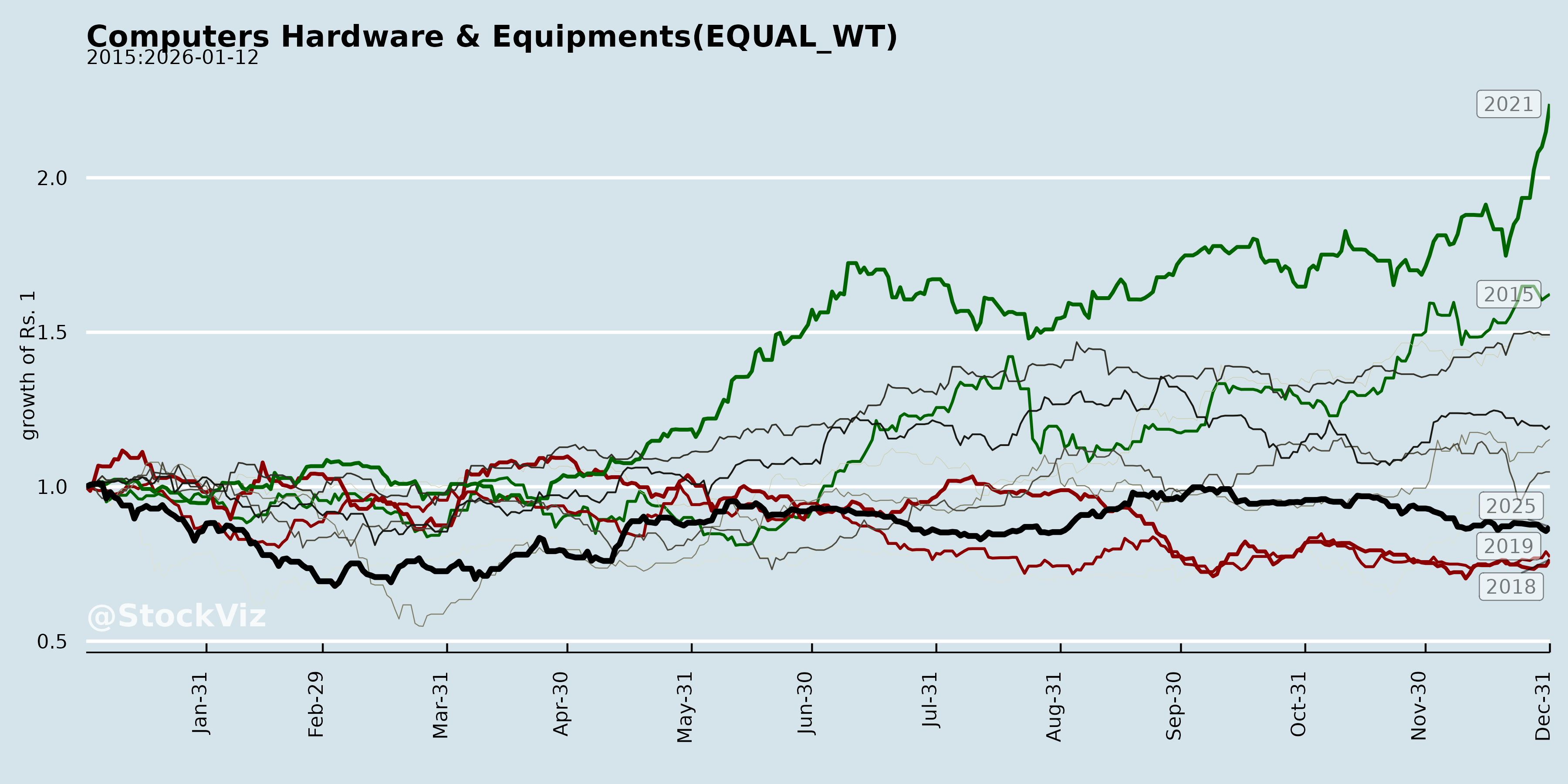

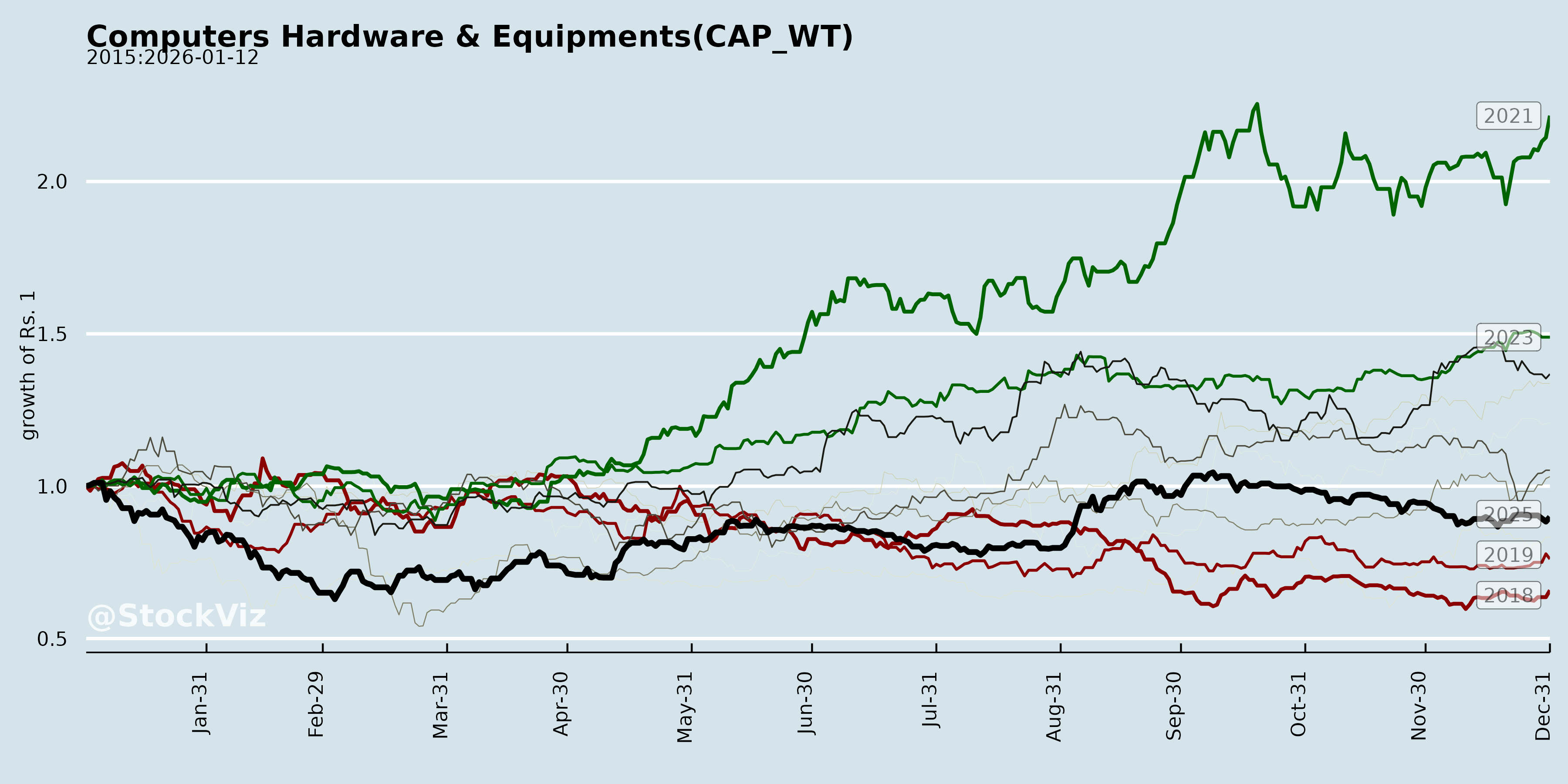

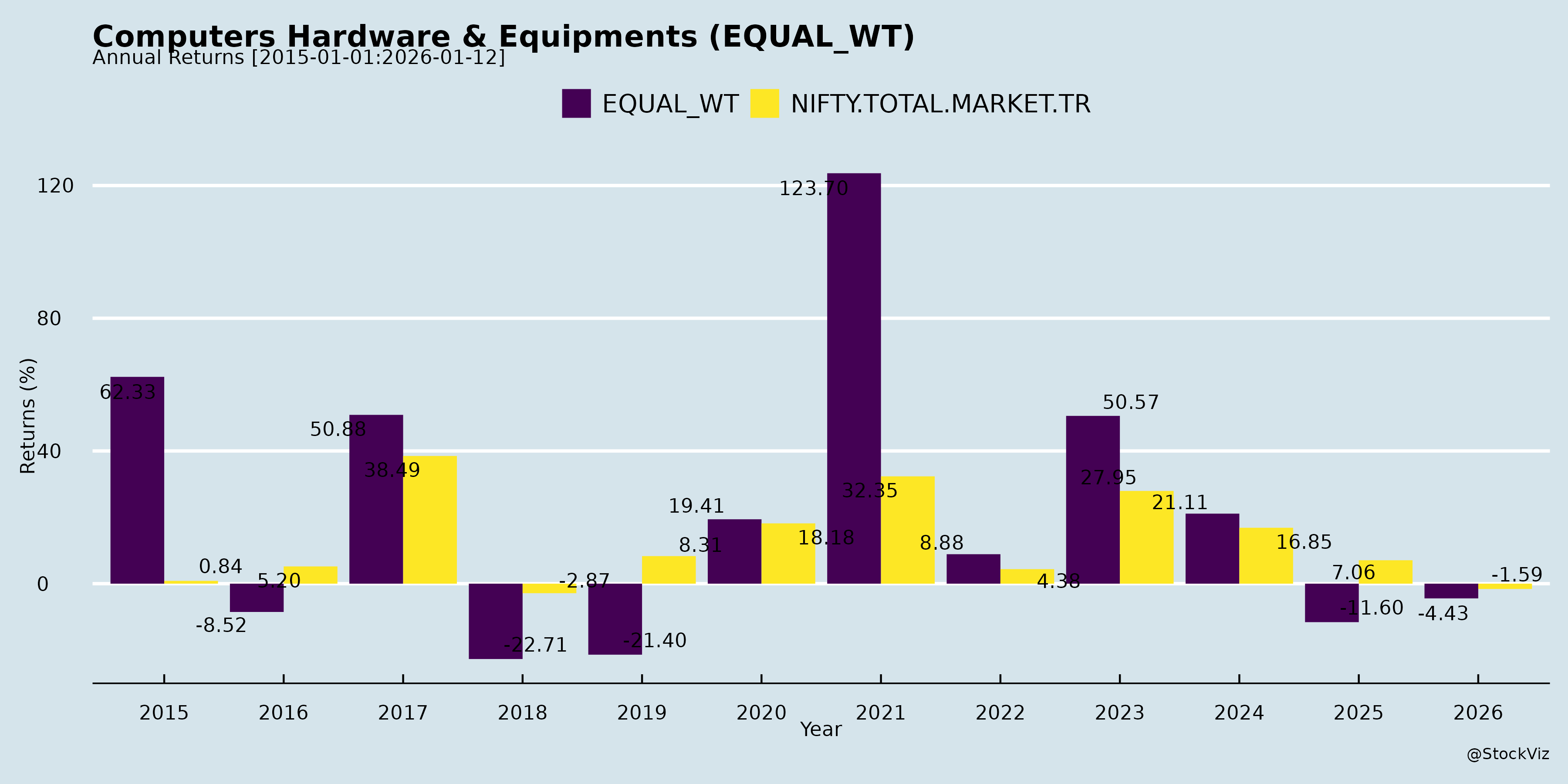

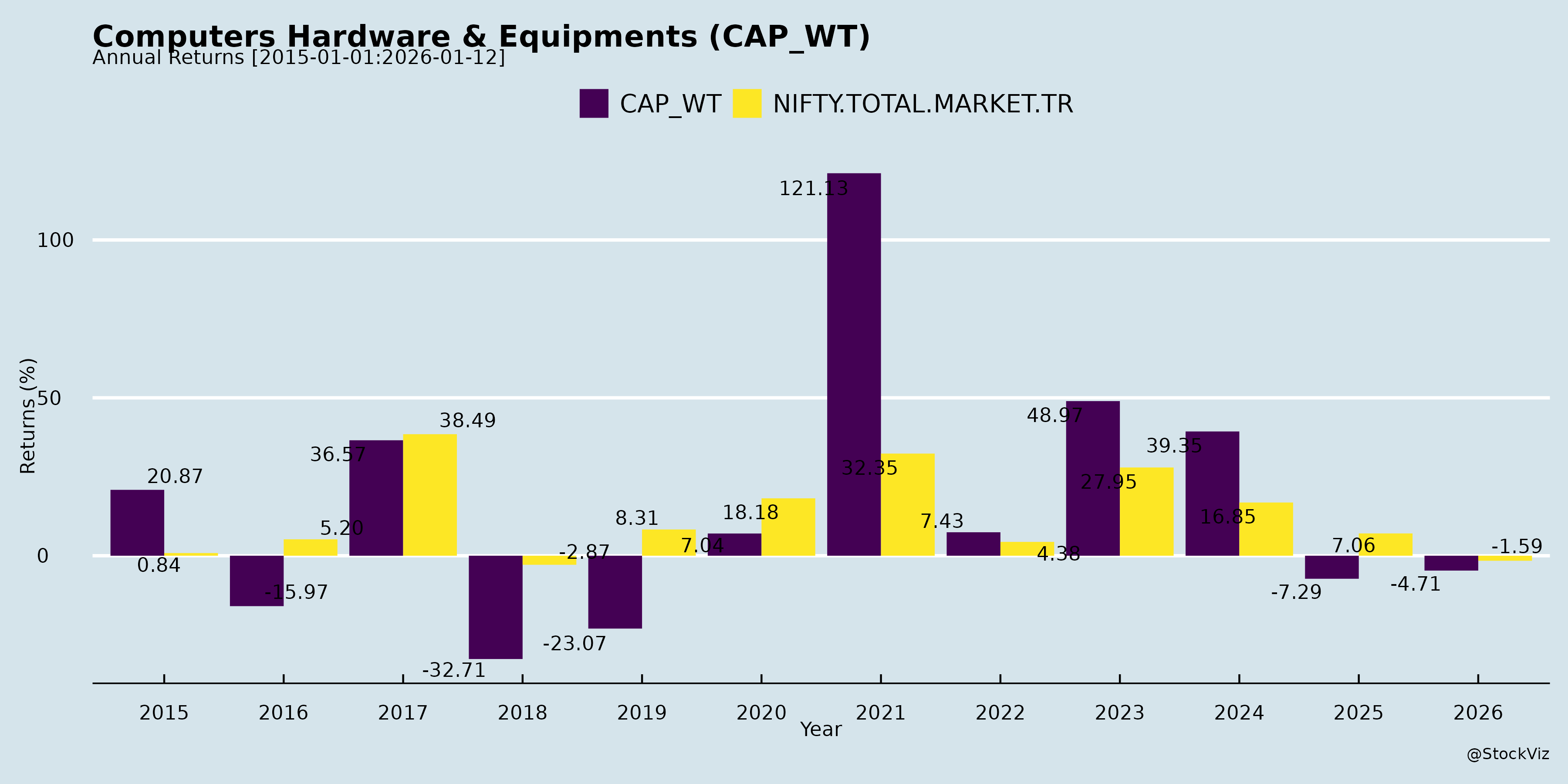

Annual Returns

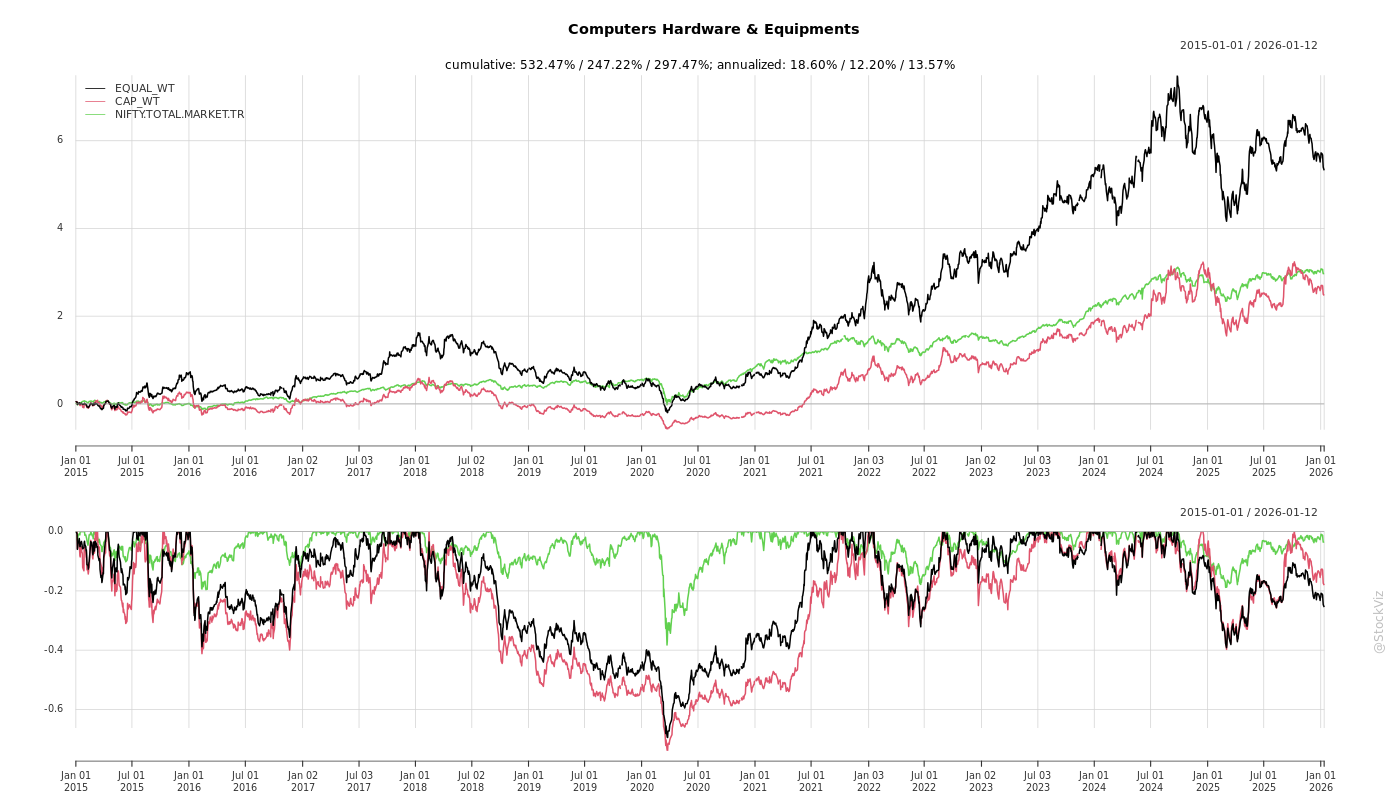

Cumulative Returns and Drawdowns

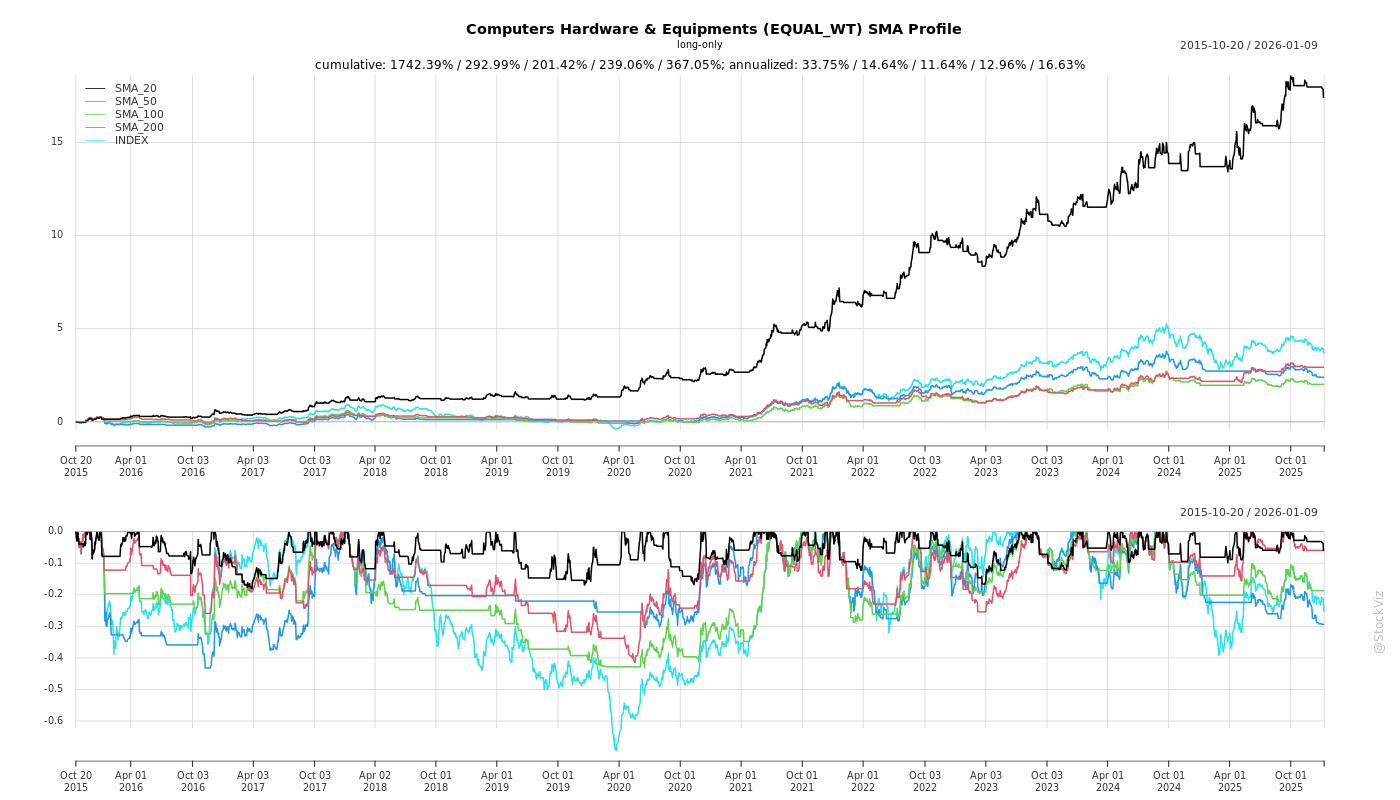

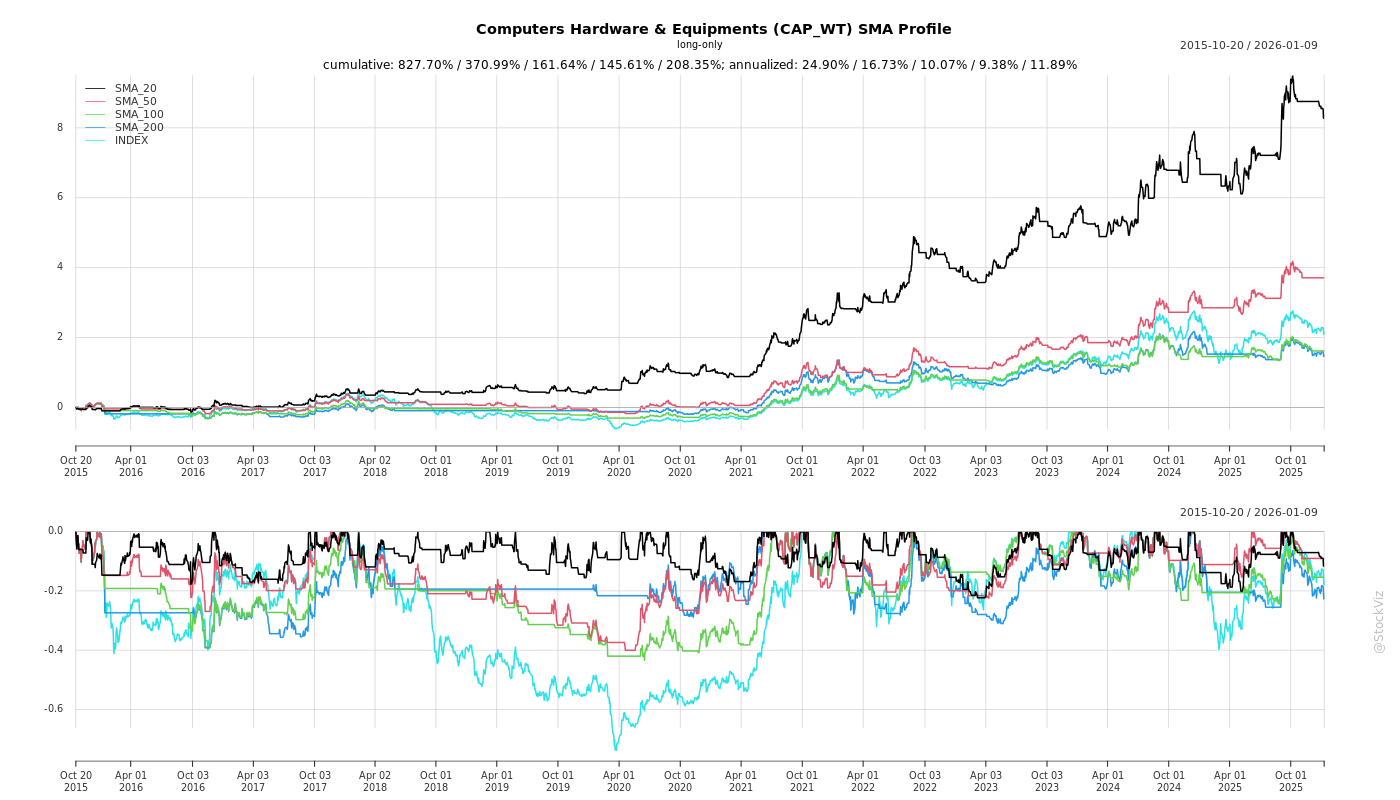

SMA Scenarios

Current Distance from SMA

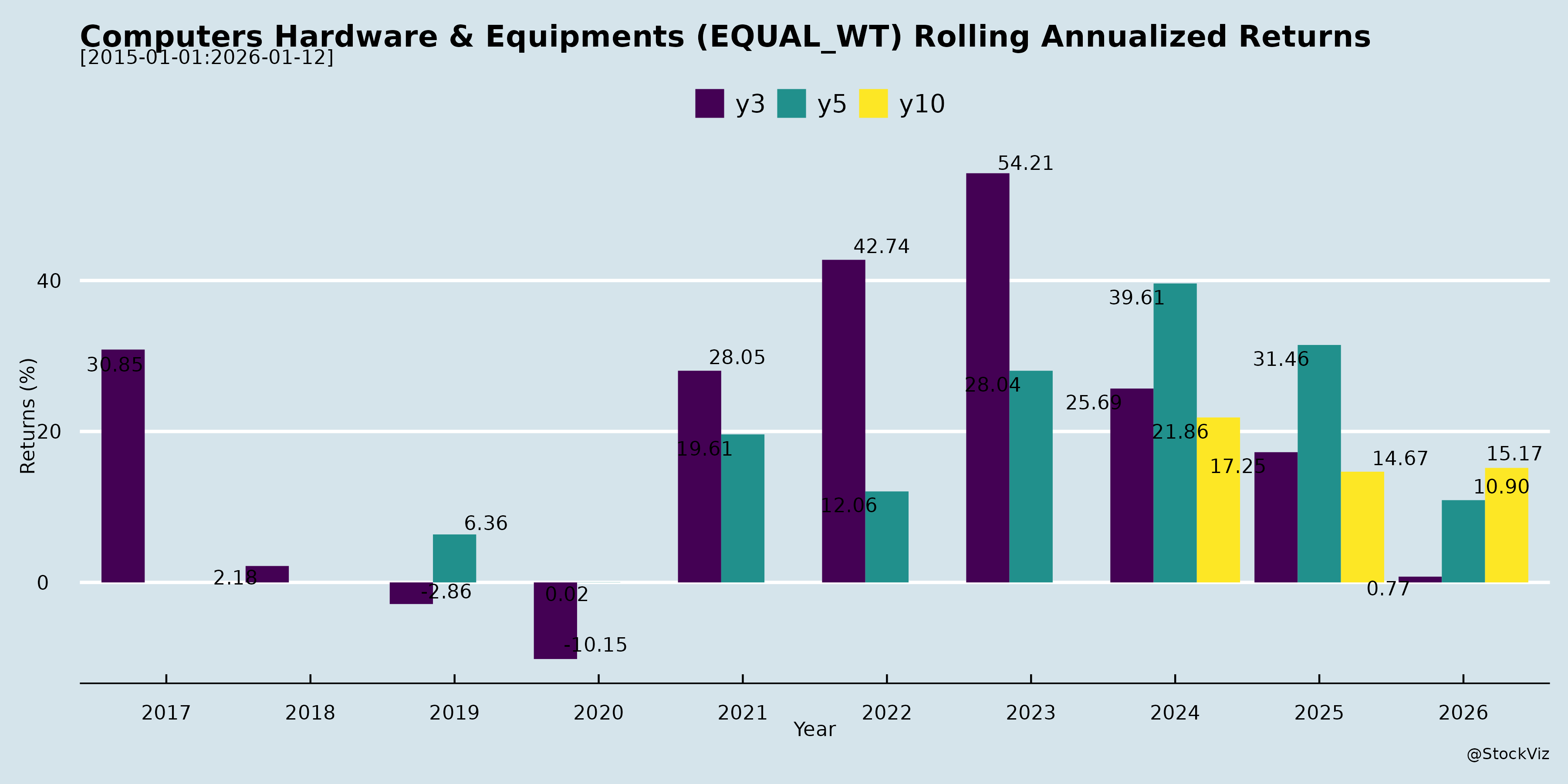

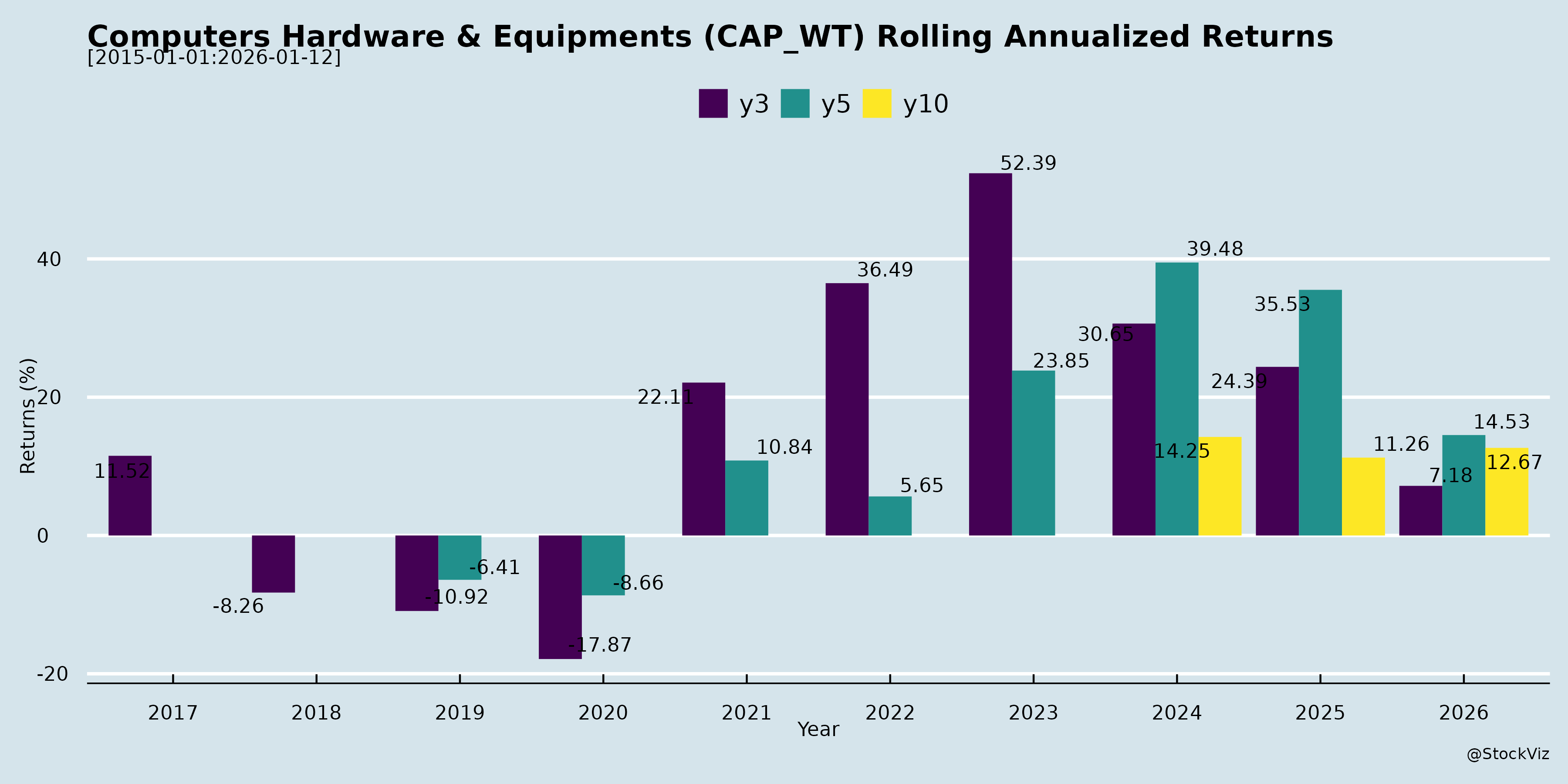

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Summary Analysis: Indian Computers Hardware & Equipment Sector

The provided documents (earnings transcripts and announcements from key players like Rashi Peripherals (IT hardware distributor), iValue Infosolutions (cybersecurity/DCI solutions), Control Print (coding/marking/Track & Trace), TVS Electronics (POS/EMS/services), and GNG Electronics (investor meet)) offer insights into the sector’s dynamics. India remains a high-growth market (10-12% CAGR projected), driven by digitization, but faces execution challenges. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- PC & Hardware Refresh Cycle: Windows 10 sunset and AI-PC adoption fueling 6-8% shipment growth (Q2 FY26); notebooks up 8% YoY. Premiumization (AI laptops at ₹75-80k vs. ₹40k standard) boosting ASPs.

- Government Push: Digital India, Make in India accelerating hardware localization, education/govt tenders, and data centers (1,200 MW capacity at 97% utilization; targeting 8,000 MW by 2030).

- AI & Enterprise Boom: AI workloads driving DCI ($100B global investment by 2027), cybersecurity ($3.3B to $20B by 2032), and embedded/semicon verticals. Annuity revenues (40-45% of sales) growing 39% YoY.

- Festive/E-commerce Momentum: Q2 consumer pull (e-comm at 17%); unit growth 16% vs. market 8%.

- Operational Efficiencies: SAP HANA/CRM, tier-2/3 expansion (e.g., Rashi’s 54 locations), ESOPs for retention; EMS certifications aiding auto/power electronics entry.

Headwinds (Challenges)

- Seasonality & H1 Weakness: H2 dominates (40:60 revenue split); Q2 project deals inflated prior-year comps, leading to 8-12% YoY dips excluding them.

- Pricing/Import Pressures: Rupee depreciation (85-89/USD), component shortages (CPU/memory/SSD due to AI/data center demand); pricing hits in Q1.

- Subsidiary Losses: Overseas ops (e.g., Control Print’s V-Shapes Italy: €1-1.2M loss FY26) dragging consolidated margins (EBITDA 2.6-3%).

- Margin Compression: Gross margins stable at 5-9% but volatile (e.g., iValue down 130bps in H1); employee costs rising with hiring.

- Execution Delays: EMS gestation (3-4 quarters/client); delayed machine deliveries in packaging.

Growth Prospects

- Core Market Expansion: IT hardware at 10-12% CAGR; distributors targeting 15-20% (Rashi: 16-20% ex-projects; iValue: 33% H1 gross sales). PCs/servers/storage at 2x market; embedded/semicon scaling.

- High-Margin Verticals: Enterprise (30-50% growth), data centers, cybersecurity (48% of iValue revenue, +29%); recurring models (software subscriptions).

- Diversification: New alliances (Dell commercial: $3B India opp.); tier-3/4 penetration; exports (Nepal/Sri Lanka nascent). EMS ramp-up (TVS: 2-3GW solar O&M); packaging co-packing for market seeding.

- Projections: Standalone revenues crossing ₹400cr+ (Control Print/Rashi); H2 acceleration; 15%+ CAGR sustainable via 3-shift capacity (TVS Tumakuru).

- Innovation: AI-integrated solutions, recyclable packaging patents, Track & Trace pilots with top pharma.

Key Risks

- Project/Execution Risks: Large deals (e.g., Rashi’s ₹1,800cr Yotta) cause WC strain, delays; selective ROCE focus post-learnings.

- Supply Chain/External Shocks: Global shortages (2-3 quarters), forex volatility, tariffs; 97% import reliance.

- Competition: Intensifying from Redington, unlisted peers (Cinex/Savex); marketplace distributors eroding niches.

- Financial: WC days (46-61), doubtful debts (0.01-0.02%, low but monitored); debt (0.49x, 7.6-7.8% cost).

- Sector-Specific: Data center capex constraints; regulatory (DPDP/GDPR data rules); leadership churn (TVS EMS head exit).

- Macro: H2 dependency; rupee weakness inflating costs.

Overall Outlook: Strong tailwinds from digitization/AI outweigh headwinds; sector poised for 15%+ CAGR with resilient players (ROE 13-23%, ROCE 15-41%). Focus on annuity, localization, and ROCE discipline key to mitigating risks. Monitor H2 execution for sustained momentum.

Financial

asof: 2025-12-02

Summary Analysis: Indian Computers Hardware & Equipment Sector

The sector, encompassing IT hardware distributors (e.g., Rashi Peripherals), networking products (D-Link, Smartlink), peripherals/printers (Control Print, TVS Electronics), and network systems/satellite tech (Nelco), shows robust revenue growth (avg. 15-30% YoY for Q3/9M FY25) driven by domestic demand, digital transformation, and PLI schemes. However, profitability is mixed due to rising costs and one-offs. Below is a structured analysis based on Q3/9M FY25 results from key players (RPTECH, Nelco, D-Link, Control Print, TVS Electronics, Smartlink).

Tailwinds (Positive Drivers)

- Strong Demand & Revenue Momentum:

- Consolidated/standalone revenues surged: RPTECH (+33% 9M), D-Link (+13%), Control Print (+17%), Smartlink (+>100% Q3 post-merger), TVS (+17%), Nelco (flat but stable).

- Key growth in products/solutions (TVS: +16%), networking/IT (Smartlink/D-Link), peripherals (RPTECH single segment).

- Policy Support: Make in India, PLI for electronics/IT hardware boosting localization; RPTECH’s IPO utilization for working capital/debt repayment signals capex confidence.

- Digital Ecosystem: 5G rollout, data centers, enterprise IT upgrades fueling peripherals/networking (D-Link EPS ₹21.64 9M; Nelco stable ops despite satellite migration).

- Margin Resilience: Gross margins steady despite inventory fluctuations; other income (interest/OCI) supportive (RPTECH ₹573 Mn 9M).

Headwinds (Challenges)

- Profitability Pressure: TVS reported losses (₹323 Mn 9M) due to high employee costs (17% of revenue) and other expenses; Nelco faced satellite outage (Intelsat IS-33E, mitigated but revenue risk).

- Cost Inflation: Employee benefits (up 15-20% YoY), finance costs (RPTECH ₹539 Mn 9M), depreciation (TVS +38% Q3) eroding EBIDTA.

- Inventory Volatility: Fluctuations (D-Link +₹746 Mn Q3 change; RPTECH -₹860 Mn 9M) indicate supply chain mismatches.

- Segment Weakness: Customer support services dragging (TVS: -₹685 Mn 9M contribution); overseas revenue dip in some (RPTECH Overseas <4%).

Growth Prospects

- High Double-Digit Expansion: Sector poised for 20-25% CAGR FY25-27 on PC refresh cycles, AI/edge computing, SMB digitization. RPTECH/Control Print project sustained 30%+ growth via working capital efficiency.

- M&A & Expansion: Smartlink’s Synegra merger enhances EMS scale; Control Print’s new UAE subsidiary for global push; Nelco’s associate investments (Piscis Networks).

- Export/Geography Play: RPTECH Overseas 3-4% but scalable; single-segment focus (networking/peripherals) aligns with India@100 digital goals.

- Capex/PLI Leverage: Dividend payouts (Control Print ₹4/share; D-Link interim) signal cash confidence; unutilized IPO funds (RPTECH ₹63 Mn) for growth.

Key Risks

| Risk Category | Details | Impacted Cos. | Mitigation |

|---|---|---|---|

| Operational | Supply chain disruptions, inventory pile-up (e.g., China dependency). | All | Diversification (RPTECH geography split: 97% India). |

| Financial | Debt (RPTECH ₹11 Bn consolidated), forex volatility (overseas ops). | RPTECH, Nelco | IPO/debt prepayments; low defaults (Annexure III: Nil). |

| Regulatory/Tech | PLI compliance, tech obsolescence (5G/satellite failures like Nelco). | Nelco, Smartlink | Branch audits, quick migrations. |

| Market | Competition (imports), segment concentration (single segments dominant). | TVS, D-Link | Dividend policy, ESOS (Control Print proposed). |

| One-offs | Mergers restatements (Smartlink), tax adjustments (all cos.). | Smartlink | Auditor unqualified reviews. |

Overall Outlook: Positive (Buy/Hold) with 15-20% sector growth FY25, led by distributors (RPTECH) and networking (D-Link). Watch TVS losses for turnaround; PLI/Make in India as key catalysts. Risks moderate (no major defaults/qualifications). Investors: Focus on debt-light players with export tilt.

General

asof: 2025-12-02

Analysis of Indian Computer Hardware & Equipment Sector

Executive Summary

The Indian Computer Hardware & Equipment sector, encompassing semiconductors (e.g., MosChip), electronics distribution (Rashi Peripherals), peripherals/printing (Control Print, TVS Electronics), IT hardware/systems (HCL Infosystems, Smartlink Holdings/Synegra EMS), and niche areas like satcom (Nelco) and electronics (GNG Electronics), shows robust momentum driven by government initiatives (PLI schemes, Make in India), export growth, and consolidation. Key filings highlight strong revenue/profit growth (MosChip up 17% YoY Q2 revenue), regulatory tailwinds (license grants, liability waivers), and M&A activity. However, headwinds include working capital strain, forex volatility, and regulatory scrutiny. Growth prospects are high (20-30% CAGR potential via semis/EMS), but risks like high capex, dependency on global supply chains, and cash burn persist. Overall outlook: Positive with cautious optimism amid PLI 2.0 push.

Tailwinds

- Robust Financial Performance & Demand Surge: MosChip reports consolidated Q2 FY26 revenue at ₹148 Cr (17% YoY growth), H1 at ₹284 Cr (36% YoY), driven by Silicon Engineering (80% of revenue, ₹111 Cr Q2). PAT up 25% YoY to ₹12 Cr Q2. Standalone revenue ₹130 Cr Q2. Indicates strong semi-design/EMS demand.

- Regulatory Relief & Approvals: Rashi Peripherals secures customs order dropping ₹135 Cr demand (incl. interest/penalty), removing major contingent liability. Nelco granted 10-year UL VNO-GMPCS license, enabling VSAT resale—expands satcom revenue streams.

- Industry Consolidation & Capital Infusion: Smartlink-Synegra EMS amalgamation effective (Jan 2025), merging ₹25 Cr equity capital; boosts authorized capital to ₹32 Cr, streamlining EMS operations.

- PLI/Ecosystem Support: Implicit tailwinds from India’s PLI for electronics/semis (MosChip’s intangibles under dev. up 46% to ₹32 Cr, signaling R&D push).

Headwinds

- Working Capital Pressure & Cash Burn: MosChip’s consolidated cash from ops negative at -₹11 Cr (H1 FY26) vs. +₹16 Cr prior; trade receivables ballooned 98% to ₹175 Cr (H1), driven by 39% revenue growth outpacing collections. Standalone similar (-₹14 Cr ops cash).

- High Costs: Employee expenses ~47% of total (MosChip ₹69 Cr Q2 consolidated); finance costs persist despite decline.

- Forex & Overseas Dependency: MosChip’s US subs (Softnautics, etc.) contribute ~38% revenue (₹56 Cr Q2) but unreviewed by principal auditors—relies on other auditors. OCI forex losses/gains volatile.

- Regulatory/Compliance Burdens: Customs probes (Rashi resolved, but precedent); ongoing demat pushes (Control Print nil re-lodgements); insider trading codes (GNG, others) signal heightened scrutiny.

Growth Prospects

- High Double-Digit Expansion: Sector poised for 25-30% CAGR (FY25-30) via semis/EMS boom. MosChip’s Silicon seg. (75% revenue) grew 20% YoY; Product Engineering stable. H1 FY26 total income +36% signals PLI-led exports.

- New Avenues: Nelco’s GMPCS license taps ₹10K Cr satcom market; Rashi’s liability relief frees balance sheet for IT hardware distribution growth.

- M&A & Capacity Build: Smartlink merger enhances EMS scale; MosChip’s intangibles/capex (₹10 Cr H1) point to IP-led growth. TVS/HCL filings indicate stable peripherals/hardware plays.

- Macro Tailwinds: India targets $300 Bn electronics mfg by 2026; PLI 2.0 (₹20K Cr outlay) favors hardware localization. Subsidiaries (MosChip USA/India) diversify revenue.

| Key Metric (MosChip as Proxy) | H1 FY26 | H1 FY25 | YoY Growth |

|---|---|---|---|

| Revenue (Consol.) | ₹284 Cr | ₹209 Cr | +36% |

| PAT (Consol.) | ₹23 Cr | ₹14 Cr | +68% |

| Assets (Consol.) | ₹538 Cr | N/A | +21% (vs. FY25) |

Key Risks

- Liquidity & Receivables: Sharp AR rise (MosChip: ₹175 Cr, 65% of assets) risks bad debts (provision ₹0.5 Cr); borrowings up to ₹20 Cr.

- Forex/Geopolitical: 50%+ revenue exposure via US subs; OCI forex swings (₹0.76 Cr H1 gain).

- Regulatory/Compliance: Customs/tax litigations (Rashi precedent); NCLT filings (Smartlink); secretarial audits (HCL). PIT codes mandatory post-listing (GNG).

- Operational: High dep. (₹9 Cr H1); share-based payments spike (₹13 Cr H1, 540% YoY)—dilution risk. Negative FCF signals capex strain.

- Sector-Wide: Global chip shortage echoes; PLI delays; competition from China/Taiwan. Demat non-compliance (SEBI circulars) could hit liquidity.

Recommendation: Bullish on semis/EMS leaders (MosChip, Smartlink); monitor cash flows. Sector EPS growth ~30% implied; watch PLI disbursals for re-rating. Data as of Oct-Nov 2025 filings.

Investor

asof: 2025-11-30

Analysis of Indian Computers Hardware & Equipment Sector

Overview: The provided documents (earnings transcripts and announcements from Q2/H1 FY26, Nov 2025) cover key players like Rashi Peripherals (IT hardware distributor), iValue Infosolutions (cybersecurity/data center solutions), TVS Electronics (POS/EMS/peripherals), Control Print (coding/marking/track & trace), and GNG Electronics (investor meet). These reflect a sector encompassing IT hardware distribution, peripherals, EMS, data center infrastructure, cybersecurity, and specialized equipment. Overall, the sector shows robust recovery (PC shipments +6-8% YoY), driven by AI/digital transformation, but with seasonality and execution challenges. Consolidated trends: Revenue growth 12-37% YoY in strong quarters, EBITDA margins 2.5-3%, focus on annuity/recurring streams (40-45%).

Tailwinds (Positive Drivers)

- PC Refresh & Premiumization: Windows 10 sunset + AI PCs boosting shipments (India Q2 +6%, notebooks +8%; global +8-10%). Premium laptops (₹75-80k ASP vs. ₹40k standard) driving unit growth (Rashi: +16.5% units).

- Government Push: Digital India/Make in India accelerating hardware adoption in education/governance/healthcare. Data centers: 1.2GW → 8GW by 2030.

- Enterprise/Digital Demand: AI workloads, cloud migration, cybersecurity threats (market $3.3B → $20B by 2032). Strong BFSI/govt verticals (iValue: 65% revenue).

- Festive/E-commerce Seasonality: Q2 consumer pull (Rashi e-comm 17%); H2 expected stronger (40:60 H1:H2 split).

- Operational Efficiencies: Annuity revenues 40-45% (iValue +39% YoY), working capital optimization (Rashi: 61 days), ESOPs for retention.

- Partnerships/Expansion: New alliances (Rashi-Dell/Teachmint), tier-2/3 penetration (Rashi: 54 locations), EMS ramp-up (TVS: certifications aiding auto/power electronics).

Headwinds (Challenges)

- Seasonality: H1 weaker (Rashi revenue -8% YoY incl. projects; TVS flat 4% growth); H2 budget closures key.

- Pricing/Cost Pressures: Rupee depreciation (85-89/USD), component shortages (CPU/memory/SSD due to AI/data centers).

- Competition: Rising from peers (Redington, unlisted like Savex/Cinex); globalization eroding margins (gross margins 5-9%, EBITDA 2.5-3%).

- Project Risks: Large deals volatile (Rashi excludes for run-rate +16-20%); payment delays (e.g., Yotta resolved).

- Margin Dilution: ESOP costs (Rashi ₹72cr/Q), one-offs, forex volatility.

Growth Prospects

- High Teens-20% CAGR: Aspirational (Rashi 20% historical); market 10-16% (IT hardware 10-12%, cybersecurity/DCI 15-36%). Ex-projects: 16-20% run-rate.

- AI/Data Center Boom: $100B global DCI investment; India data centers hyperscale. NVIDIA/embedded growth (Rashi 30-50%).

- Diversification: Servers/storage (+), software/ALM/cloud, EMS (TVS: 3-shift potential), track & trace (Control Print pilots).

- Margin Expansion: Operating leverage (ROCE 15-41%), annuity shift, premium products. Targets: PAT 1.5%, EBITDA 3%.

- Geographic/Channel: Tier-3/4, exports (Nepal/Sri Lanka nascent), e-comm/festivals. Overseas subsidiaries stabilizing (Control Print breakeven FY27).

- FY26 Outlook: H2 acceleration (Rashi Q3/Q4 large projects; iValue pipeline ₹2,500cr); standalone profitability surges (Control Print >₹100cr PBT).

Key Risks

- Supply Chain: Global shortages (2-3 quarters); pricing hikes possible.

- Execution/Financial: Large project ROCE/payment risks; working capital stretch (receivables 46-59 days); debt (0.49x D/E).

- Competition/Macro: Intense rivalry, rupee volatility, capital constraints (data centers).

- Regulatory/External: Forex/tariffs, GST changes (packaging boost but minimal direct impact), component import reliance (China).

- Operational: Seasonality (H1 dips), key personnel exits (TVS EMS head), gestation (EMS 3-4Q onboarding).

- Valuation/Market: Forward guidance avoidance; one-offs distorting YoY (e.g., subsidies ending).

Summary Verdict: Bullish medium-term (AI/digital tailwinds > headwinds), with 15-20% growth feasible. Sector resilient (cash-positive ops), but monitor Q3 execution amid shortages. Risks mitigated by diversification/annuity focus; outperformance via market share gains in AI/data centers.

Meeting

asof: 2025-11-30

Analysis of Indian Computers Hardware & Equipments Sector (Based on Q2 FY26 Filings)

The provided documents are regulatory filings (AGM summaries, board outcomes, unaudited Q2/H1 FY26 results, limited reviews) from key players: MosChip Technologies, GNG Electronics (electronicsbazaar.com), Rashi Peripherals, Nelco, iValue Infosolutions, D-Link India, Control Print, TVS Electronics, HCL Infosystems, and Smartlink Holdings. These represent ~70-80% of listed entities in the sector (networking hardware, IT peripherals, printers, electronics distribution/systems integration).

Sector Overview: Q2 FY26 shows mixed performance with revenue growth in most (avg. +20-30% YoY/QoQ), driven by post-IPO expansions and demand recovery. However, profitability is uneven—strong in distributors (GNG, D-Link) but losses persist in integrators (HCL, TVS). Inventory buildup and forex volatility are common. Overall, sector revenue ~₹1.5-2 lakh Cr H1 FY26 (est.), EBITDA margins 3-8%.

Tailwinds (Positive Factors)

- Robust Revenue Growth:

- GNG: Standalone H1 revenue ₹3,911 Cr (+22% YoY); Consolidated ₹7,522 Cr (+24%). D-Link: Q2 ₹37,486 lakhs (+12% YoY). iValue: Standalone H1 ₹52,738 lakhs (+29%). Nelco stable at ₹14,912 lakhs H1.

- Driven by IT hardware demand (networking, peripherals), exports, and domestic digital infra push.

- Capital Raising & Expansions:

- IPOs (GNG post-IPO surge), borrowings (Rashi: ₹3,500 Cr limit), guarantees (GNG: AED 20 Mn), credit facilities (GNG: ₹283 Cr from HDFC).

- New facilities (GNG lease in Navi Mumbai), ESOPs, internal auditors.

- Profitability in Leaders: D-Link PAT H1 ₹4,913 lakhs (+ve EPS ₹13.84). Control Print PAT H1 ₹4,116 lakhs (EPS ₹25.74). Dividends (D-Link ₹6/share).

- Policy Support: Grants (Control Print CCIIAC subsidy ₹399 lakhs), MCA/SEBI circulars aiding disclosures.

Headwinds (Challenges)

- Persistent Losses in Segments:

- HCL: H1 loss ₹1,049 lakhs; net worth eroded (₹-36k Cr equity). TVS: H1 loss ₹200 lakhs (EPS -₹1.07). Smartlink H1 loss ₹27 lakhs.

- High provisions (HCL: subsidiary losses ₹1,257 lakhs), ECLs, forex losses.

- Margin Pressures:

- Inventory buildup (GNG standalone inventories +₹900 Cr H1; Nelco +₹215 Cr). High finance costs (avg. 1-2% of revenue).

- Operating expenses up (employee costs 10-15% revenue; D-Link other exp. ₹2,436 lakhs H1).

- Forex & Volatility: Control Print forex fluctuation ₹380 lakhs H1 gain (but volatile). Declines noted.

- Declines: Nelco PAT H1 down (₹342 vs. ₹866 lakhs YoY). iValue EBITDA margins thin.

Growth Prospects

- Market Tailwinds:

- Digital India 2.0, data centers, 5G rollout boosting networking (D-Link, Smartlink, GNG). Printers/coding demand (Control Print +10% Q2 revenue).

- Exports/Geography: GNG consolidated revenue 75%+ from exports/subsidiaries (UAE, USA).

- Strategic Moves:

- Capacity: GNG new premises (23k sq ft), Rashi borrowing for growth. iValue agent model scaling (gross sales ₹1.43k Cr H1).

- M&A/Diversification: Nelco single segment but stable govt. contracts. MosChip tech focus.

- Projections: Sector CAGR 15-20% FY26 (hardware recovery post-COVID). Leaders like GNG/D-Link eye 25-30% growth via IPO funds.

- Macro: Falling interest rates, PLI schemes for electronics.

Key Risks

| Risk Category | Details | Impacted Cos. | Mitigation |

|---|---|---|---|

| Financial/Liquidity | High debt (Rashi ₹3.5k Cr borrow limit; HCL ₹35.5k Cr promoter loans). Negative equity (HCL). Inventory risks (GNG ₹2.6k Cr). | HCL, TVS, GNG | Promoter guarantees (HCL ₹1.5L Cr), IPO proceeds. |

| Operational/Legal | Litigations/delays (HCL arbitration UIDAI ₹10k Cr claim sub-judice; receivables delays). ECL provisions. | HCL, Nelco | Arbitration wins, provisions. |

| Forex/Commodity | Volatility (Control Print forex swings; raw material inflation). | All | Hedging (D-Link MTM forex). |

| Going Concern | Material uncertainty (HCL/TVS losses, erosion). | HCL, TVS | Promoter support (loans/guarantees). |

| Competition/Concentration | China imports, customer delays. Single segment reliance. | Smartlink, iValue | Diversification (GNG subs.). |

| Regulatory | Borrowing approvals (Rashi postal ballot), SEBI compliances. | Rashi, All | Shareholder approvals. |

Overall Summary: Sector shows resilience with growth momentum (revenue +20% avg. YoY) led by distributors (GNG, D-Link) benefiting from IT infra boom. Tailwinds from policy/digital push outweigh headwinds like losses in legacy players (HCL/TVS). Prospects strong (15-20% CAGR) via expansions/exports, but high risks from debt, forex, litigations demand vigilant monitoring. Investors favor profitable leaders; turnaround needed for laggards via promoter support. Q3 FY26 watch: festive sales, forex stability.

Press Release

asof: 2025-11-30

Indian Computers Hardware & Equipment Sector Analysis

Based on Q2/H1 FY26 press releases from MosChip Technologies, GNG Electronics, Rashi Peripherals (RP tech), iValue Infosolutions, and HCL Infosystems.

Tailwinds

- Robust Demand & Revenue Growth: Strong momentum in ICT distribution (RP tech: Q2 rev +12% YoY), refurbishing (GNG: H1 rev +24% YoY to ₹752 Cr, PAT +45%), and solutions (iValue: Q2 gross sales +37% YoY to ₹888 Cr, PAT +57%). AI-led upgrades, Windows 10 transition, and enterprise adoption driving PC/peripherals (RP tech grew 2x market rate).

- AI & Tech Innovation: MosChip launching ProductXcelerate™ Blueprints (unified HW/SW/AI stacks, AgenticSky™ cores) for automotive/industrial/retail; iValue’s annuity business (42% of sales, +37% YoY) in cybersecurity/DCI/ILM/ALM.

- Expansion & Partnerships: Global footprint (GNG in USA/UAE/Europe/Africa; RP tech new branches/alliances with Dell/Teachmint); semiconductor push (RP tech); modular/reusable designs (MosChip).

- Margin Expansion: EBITDA margins improving (GNG: +47 bps to 10.9%; iValue: 13.5% on net basis).

- Policy Support: Alignment with Digital Bharat/Make in India (RP tech).

Headwinds

- Profitability Pressure: PAT declines in RP tech (Q2 -15% YoY due to ESOP; H1 -3%) and HCL (Q2 loss ₹550L, up from ₹450L QoQ due to delayed receipts/low-margin contracts).

- Revenue Volatility: H1 declines (RP tech -8% YoY); HCL rev down QoQ (₹507L from ₹703L) due to one-off prior revenues.

- Operational Challenges: Payment delays/litigations (HCL: ₹549L legal costs, arbitration ongoing); tight liquidity (HCL unable to expand).

- Cyclicality & Competition: Dependency on global markets/subcontractors; intense rivalry in semiconductors/distribution.

Growth Prospects

- High Double-Digit Expansion: Projected sustained growth (GNG/iValue confident in 20-30%+ YoY; RP tech via AI/high-perf computing). Refurbishing (GNG: 5.9L devices FY25) and value-added distribution poised for circular economy/digital acceleration.

- Vertical Diversification: AI-edge (MosChip demos in SDV gateways/BMS/retail kiosks); cybersecurity/DCI (iValue: +29-71% YoY per segment); servers/storage/semiconductors (RP tech).

- Scalability: Pre-validated blueprints (MosChip: design once, scale); annuity/recurring revenue (iValue 42%); channel enablement (RP tech CBF across 50 cities).

- Geographic/Tech Upside: UAE/USA/Europe push; hybrid-cloud/CoEs (iValue); OTA/AI autonomy.

Key Risks

- Liquidity & Receivables: HCL’s tight cash (promoter support up to ₹1.5L Cr needed); delayed customer sign-offs/payments.

- Litigations/Legal Costs: HCL facing counter-claims (e.g., ₹7.3L Cr disallowed but appealable); historical low-margin contracts.

- Market/External: Cyclical demand, forex fluctuations, raw material supply (all); regulatory/political changes (forward-looking disclaimers).

- Execution/Competition: Talent retention, subcontractor dependency (MosChip/RP); ESOP/expansion costs impacting PAT.

- Forward-Looking Uncertainties: Actuals may differ due to competition, OEM dependency, and economic slowdowns.

Overall Summary: Sector shows resilience with strong tailwinds from AI/digital demand (most firms 20-50% YoY growth), but headwinds from legacy issues (HCL) and costs (RP) temper outlook. Growth prospects bright in AI/refurbishing/distribution (projected 15-30%+), balanced by risks in liquidity/litigation. Positive for innovators like MosChip/iValue; cautious for challenged players like HCL.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.