DLF

Equity Metrics

January 13, 2026

DLF Limited

Residential Commercial Projects

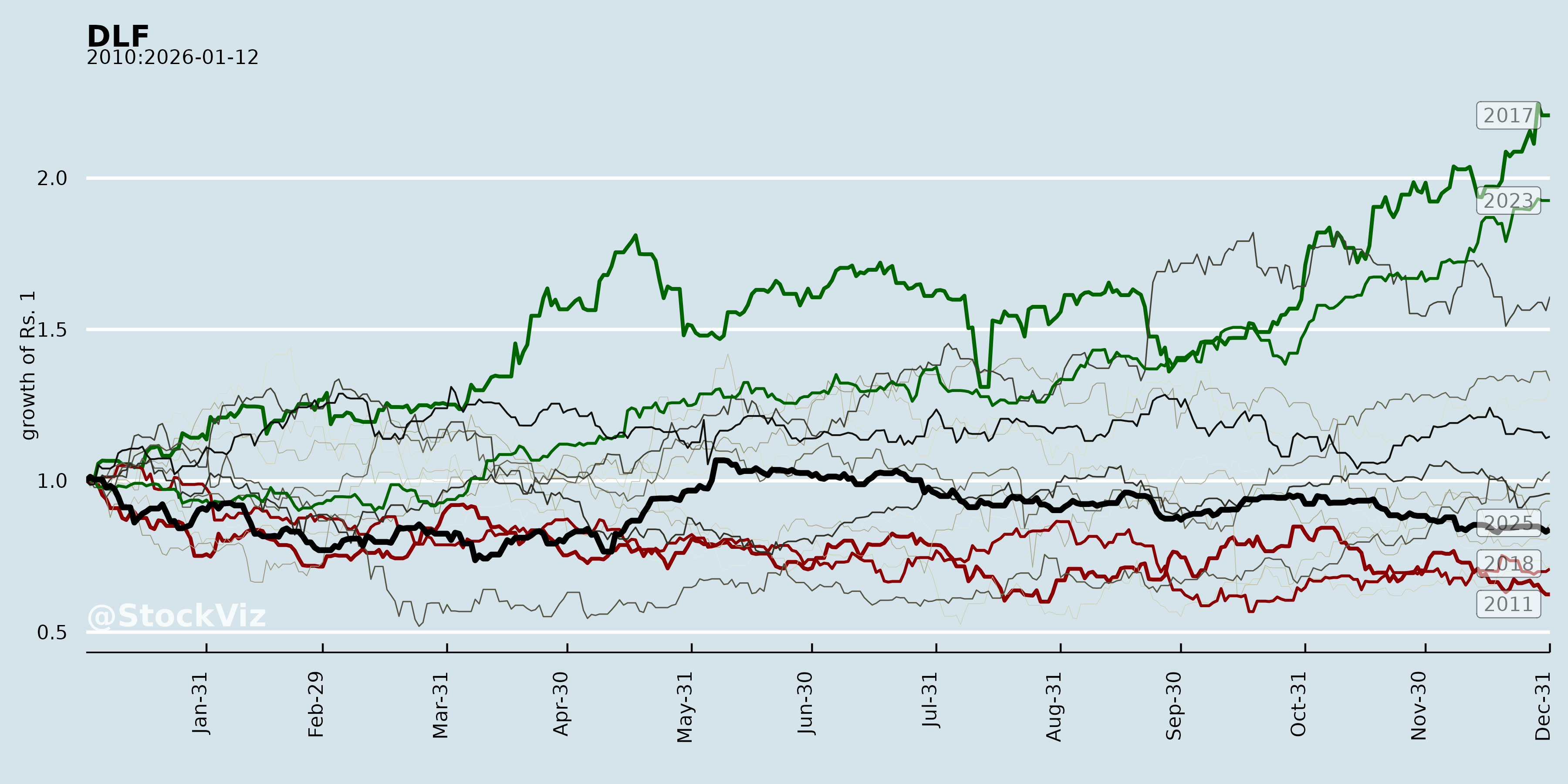

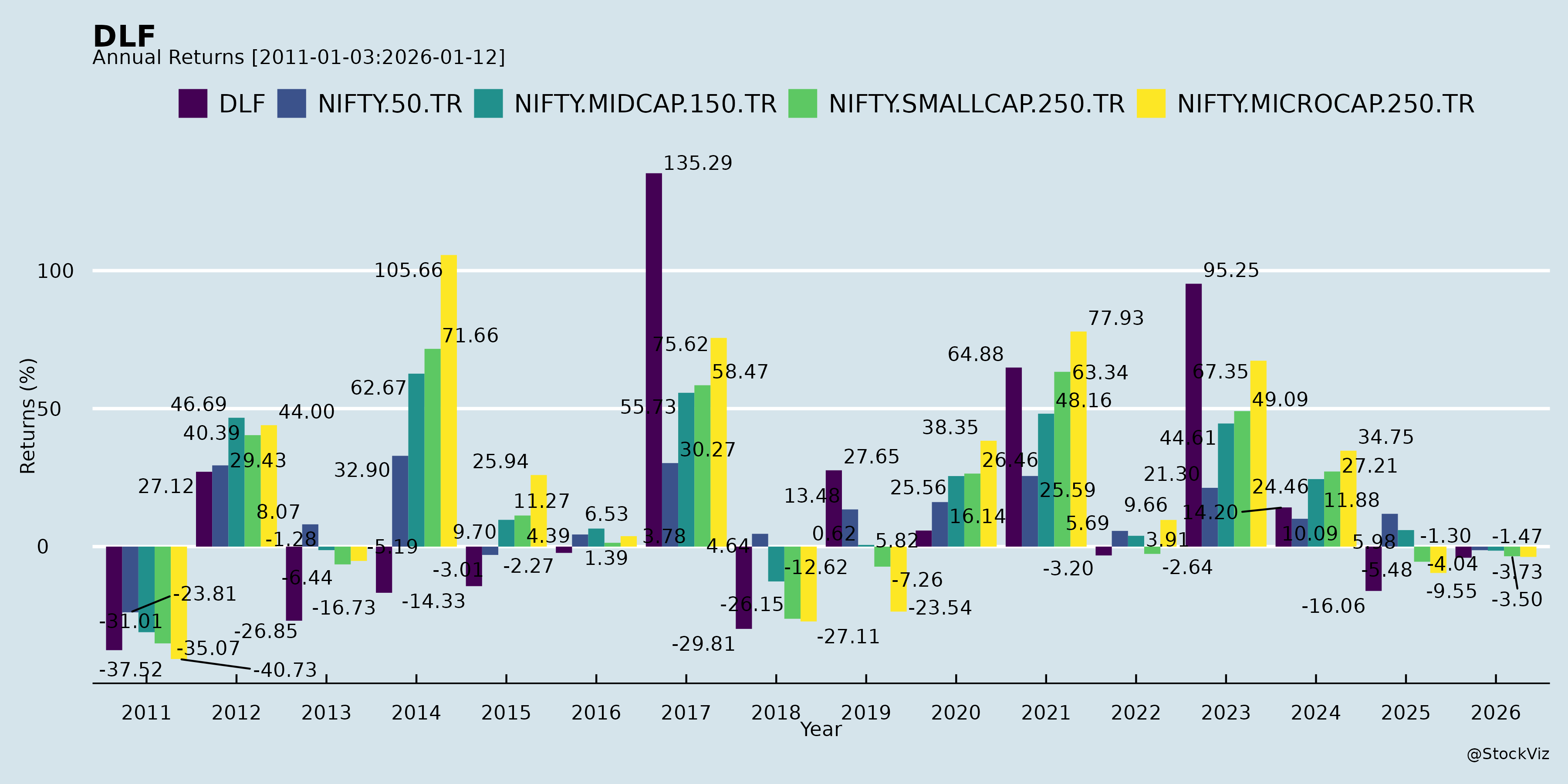

Annual Returns

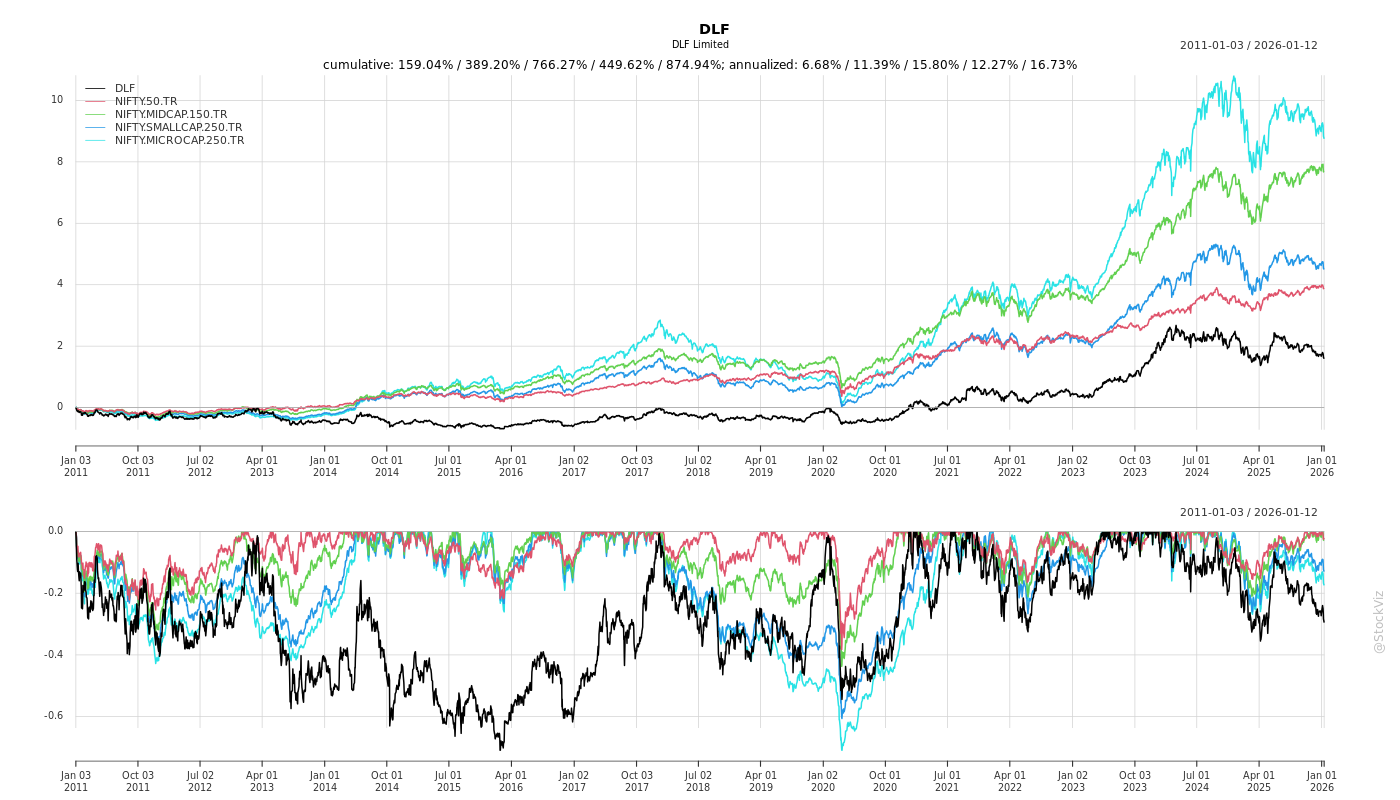

Cumulative Returns and Drawdowns

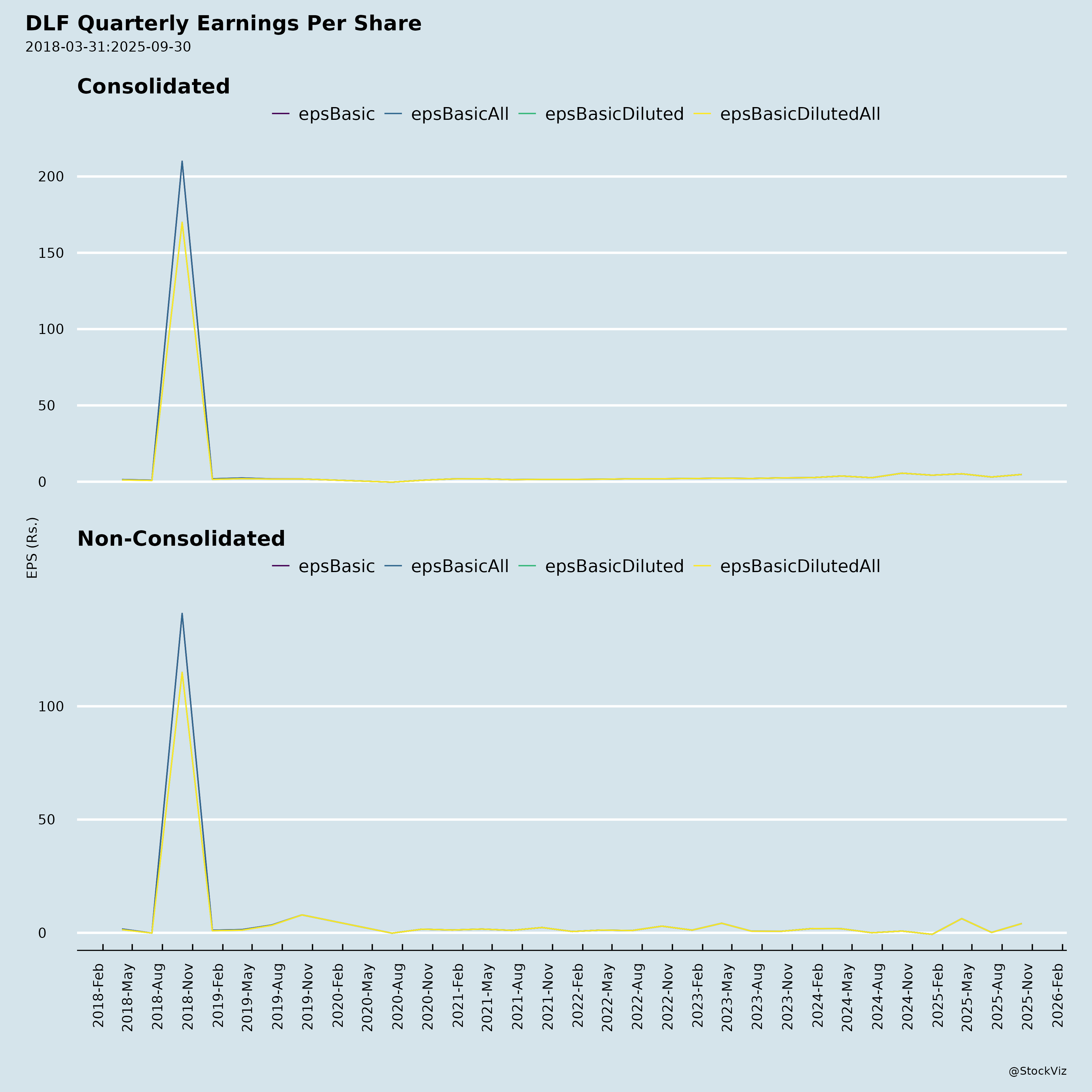

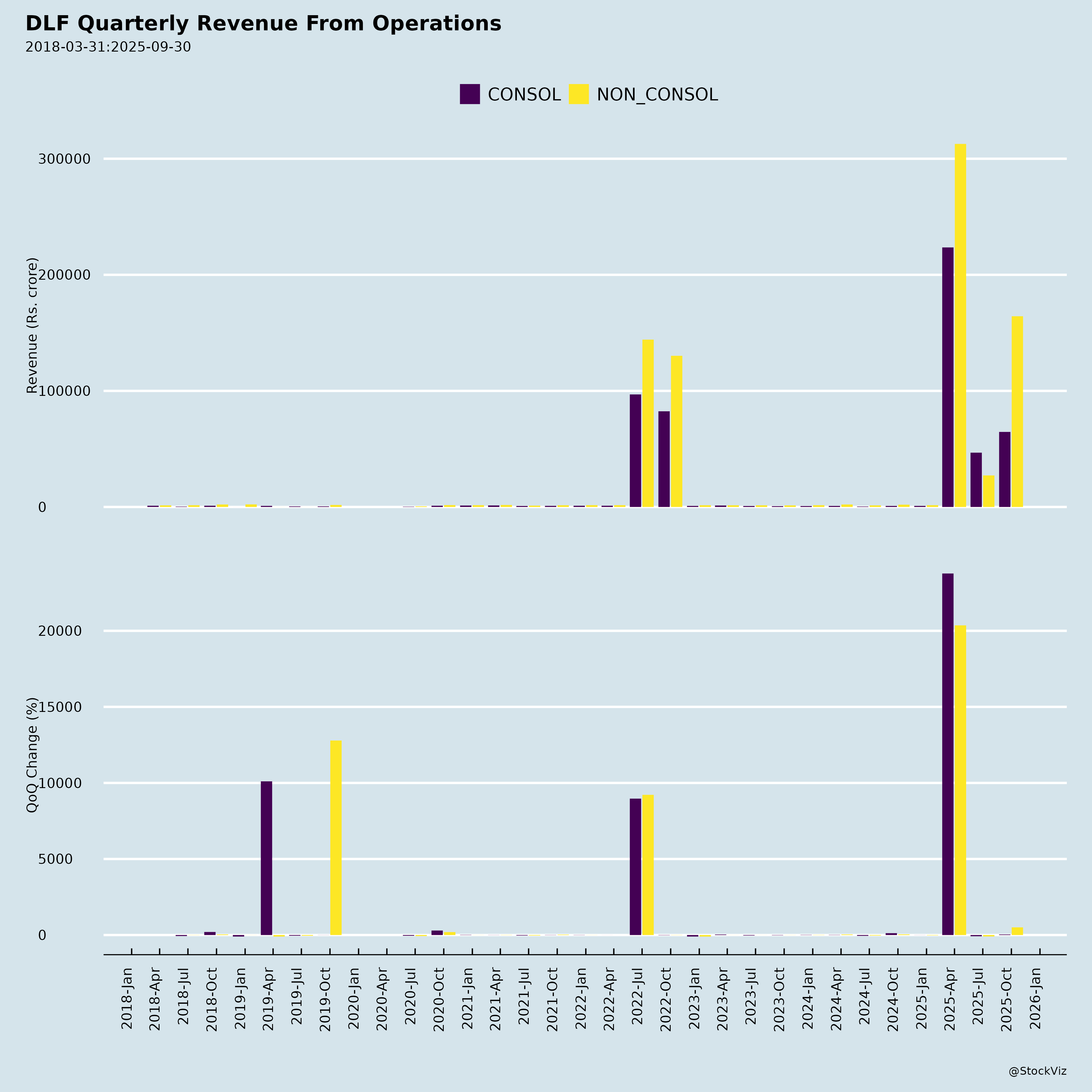

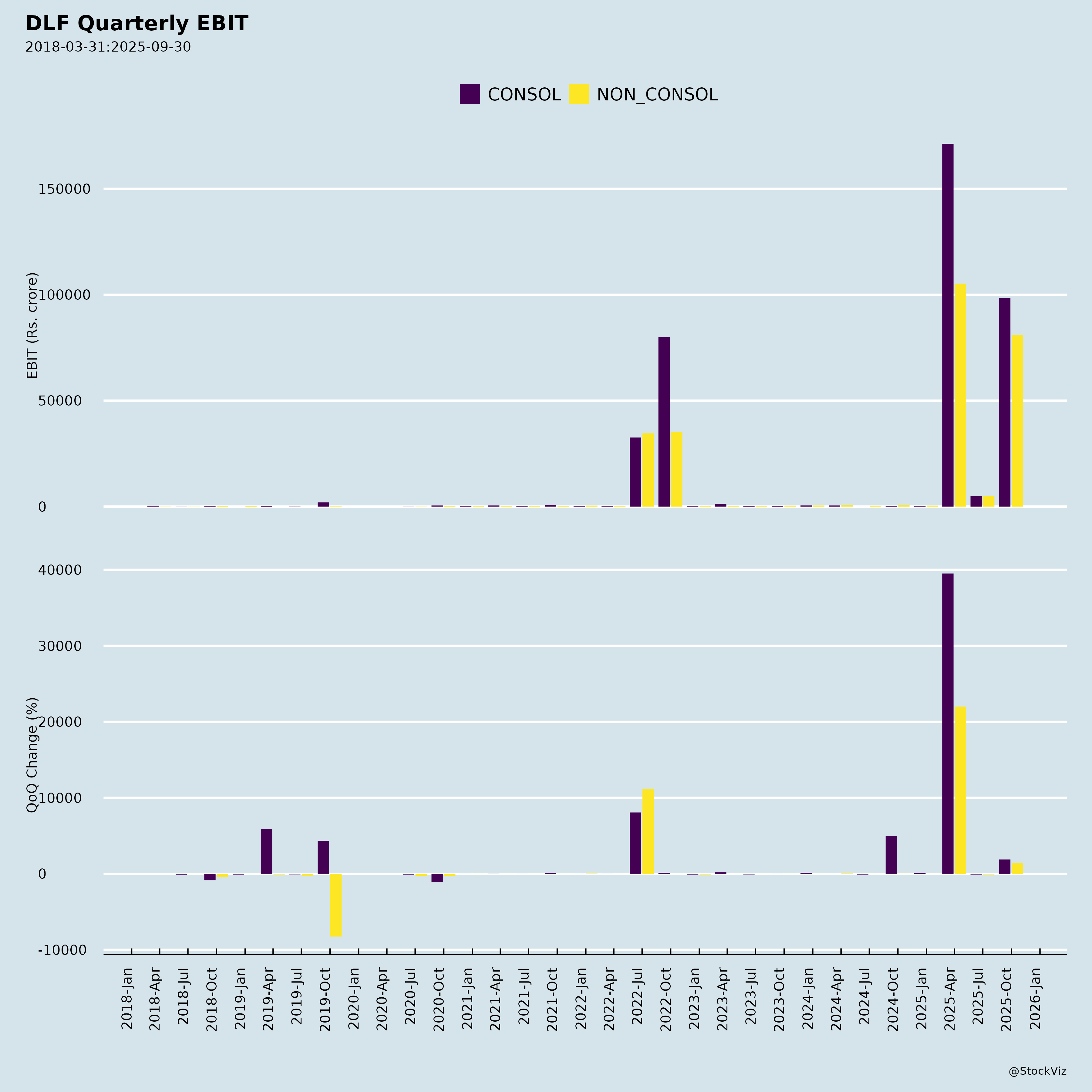

Fundamentals

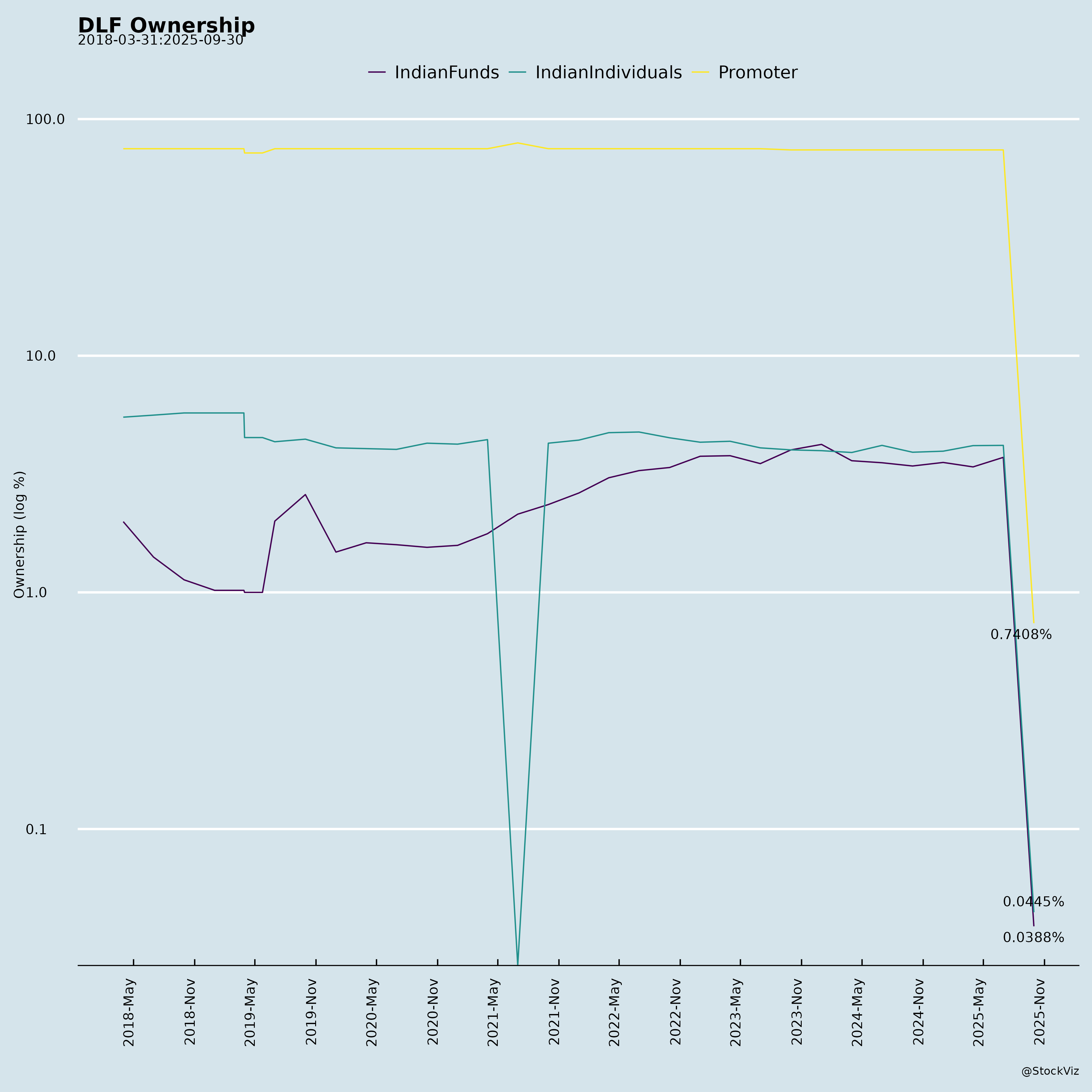

Ownership

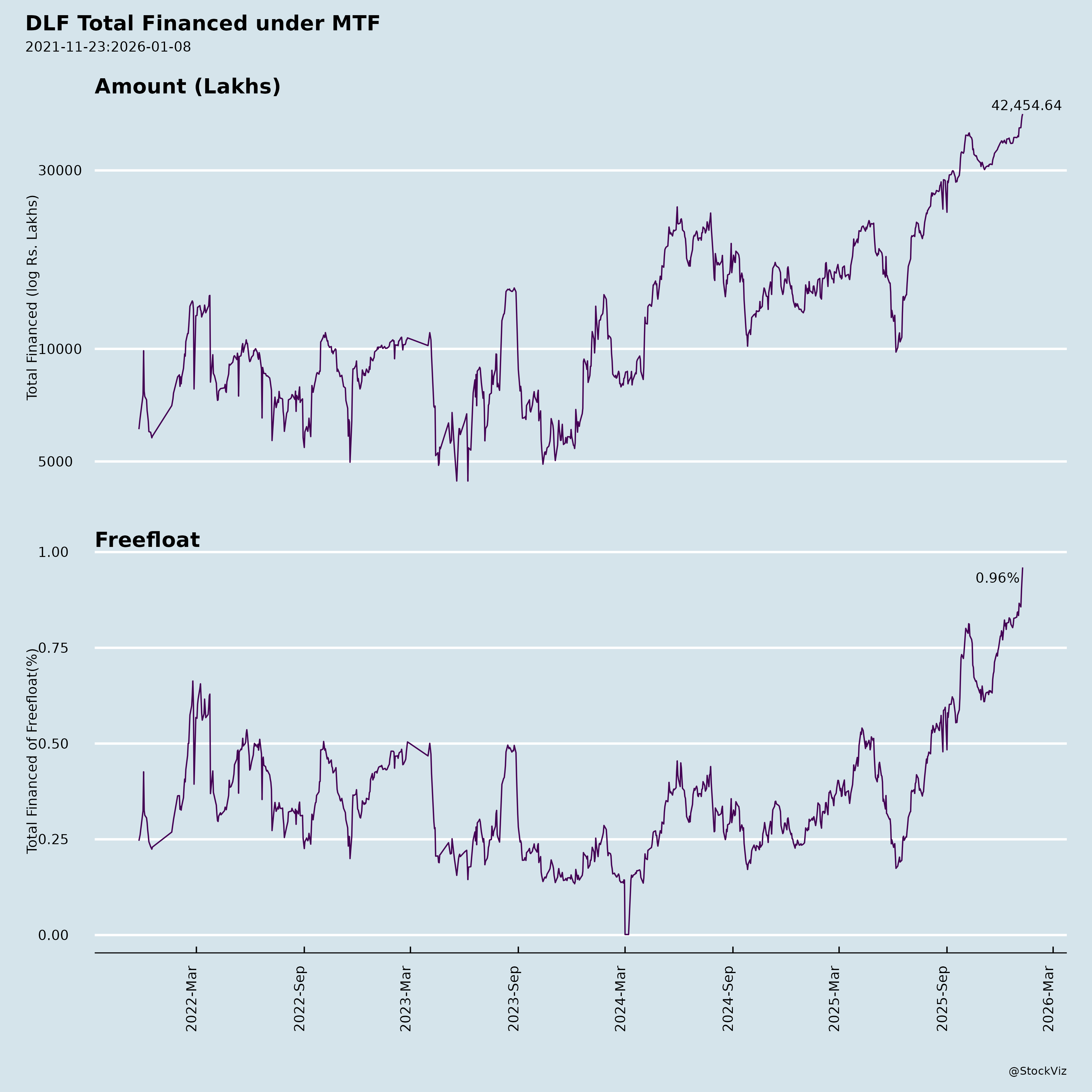

Margined

AI Summary

asof: 2025-12-08

Based on the provided press release and official communication from DLF Limited dated 30th October 2025, here is a comprehensive analysis of the company’s headwinds, tailwinds, growth prospects, and key risks, tailored for investors and stakeholders evaluating DLF as a publicly listed real estate stock in India.

🔍 Summary Overview (Q2FY26)

DLF reported strong financial performance in Q2FY26, marked by: - Net Profit: ₹1,171 crore

- Consolidated Revenue: ₹2,262 crore

- EBITDA: ₹902 crore

- Net Operating Cash Surplus: ₹1,137 crore

- Net Cash Position: ₹7,717 crore (despite ₹1,485 crore dividend payout + ₹963 crore debt repayments)

- New Sales Bookings (Q2): ₹4,332 crore | H1FY26 Total: ₹15,757 crore (in line with annual guidance)

Additionally, its annuity arm, DLF Cyber City Developers Ltd (DCCDL), delivered: - Revenue: ₹1,822 crore

- EBITDA: ₹1,412 crore (+12% YoY)

- Profit: ₹643 crore (+23% YoY)

- Annuity portfolio expanded to 49 million sq ft (msf)

- Received 5-Star GRESB Rating and named Global Sector Leader (Unlisted) for ESG performance

🌬️ Tailwinds Supporting DLF

- Favorable Macroeconomic Environment

- Resilient Indian economy

- Rising demand for homeownership, especially among HNIs and premium segments

- Strong preference for branded, credible developers — a clear advantage for DLF

- Strong Sales Momentum

- Maiden launch in Mumbai (The Westpark) successful, indicating successful market diversification beyond NCR

- Healthy demand in super-luxury segment across metros

- H1FY26 sales of ₹15,757 crore suggest guidance is on track, signaling confidence in full-year delivery

- Robust Annuity Business Growth

- DCCDL shows double-digit revenue, EBITDA, and profit growth (23% YoY profit increase)

- Annuity portfolio now at 49 msf, among the largest organically grown portfolios in India

- Expansion through new additions: Atrium Place (Gurugram, 2.1 msf) and DLF Midtown Plaza (Delhi, 0.2 msf)

- Improved Credit Profile

- CRISIL upgraded DLF’s credit rating to AA+ with Stable outlook

- Reflects strong balance sheet, high cash flows, and disciplined capital management

- ESG & Sustainability Recognition

- 5-Star GRESB rating & Global Sector Leader recognition enhances investor appeal, especially global institutional investors focused on ESG

- Healthy Balance Sheet & Cash Flow Generation

- Net cash position of ₹7,717 crore despite significant outflows (dividends + debt repayments)

- Operating cash surplus of ₹1,137 crore indicates self-sustaining operations and funding capacity for capex

- Large Land Bank & Identified Pipeline

- Development potential of ~280 msf across residential and commercial

- Enables long-term visibility and calibrated product launches aligned with market demand

⚠️ Headwinds & Challenges

- Geographic Concentration Risk

- While Mumbai launch is promising, a large portion of DLF’s revenues and assets remain concentrated in the National Capital Region (NCR)

- Diversification beyond Delhi NCR and Mumbai remains limited

- High Payout Ratio Impact

- Dividend of ₹1,485 crore paid during Q2 may constrain near-term reinvestment flexibility

- While it rewards shareholders, it reduces retained capital for aggressive expansion or acquisitions

- Sensitivity to Interest Rates & Financing Costs

- Though net cash positive, future large-scale developments may require external financing, making them vulnerable to interest rate hikes or tighter monetary policy

- Execution Risk in Capex Program

- Company plans robust capex to grow annuity portfolio — delays or cost overruns could erode margins

- Market Volatility in Premium Residential Segment

- Super-luxury segment can be cyclical and discretionary; economic slowdowns or policy changes could dampen demand

- High-ticket sales are sensitive to liquidity availability among HNIs

- Regulatory & Land Title Risks

- As with all Indian real estate firms, delays in approvals, environmental clearances, or land title disputes could impact project timelines

📈 Growth Prospects

| Area | Outlook |

|---|---|

| Residential Business | Strong momentum in super-luxury and premium housing, aided by brand equity. Mumbai entry opens new high-value market. H1 sales indicate FY26 guidance will be met or exceeded. |

| Annuity Business (Commercial Leasing) | DCCDL is a core value driver with consistent double-digit growth. Portfolio expansion and high occupancy in Grade-A offices in prime locations provide stable, inflation-linked income. Plans for further capex suggest continued scaling over medium term. |

| Portfolio Expansion | With 49 msf operational annuity portfolio and identified pipeline, DLF is well-positioned to add 5–7 msf annually over next few years. |

| Diversification | Entry into Mumbai residential market reduces regional concentration risk and taps into high-demand market. Potential for expansion into other Tier-1 cities. |

| Capital Allocation Flexibility | Strong net cash position allows flexibility for strategic acquisitions, share buybacks, or accelerated development if market conditions turn favorable. |

⚠️ Key Risks (Investor Considerations)

| Risk Type | Description |

|---|---|

| Macroeconomic Risk | Economic slowdown, inflation, or monetary tightening could reduce buyer sentiment in premium housing. |

| Sector-Specific Risk | Real estate is inherently cyclical and sensitive to policy changes (e.g., GST, RERA, urban planning reforms). |

| Execution Risk | Delays in project delivery or leasing could affect revenue recognition and cash flows. |

| Competition | Rising competition from other premium developers and REITs (e.g., Embassy REIT, Brookfield) in commercial space. |

| Forward-Looking Statements | Management cautions that projections are subject to uncertainties; actual performance may differ due to external factors. |

✅ Investment Thesis Summary

| Parameter | Assessment |

|---|---|

| Financial Health | Strong – high net cash, robust operating cash flow, improving credit rating |

| Growth Trajectory | Positive – solid sales, expanding annuity business, new market entry |

| Valuation Driver | Annuity business (DCCDL) – generates stable, high-margin income; ESG leader |

| Dividend Policy | Shareholder-friendly – large payout, but sustainable given cash flow |

| Long-Term Outlook | Constructive – backed by large land bank, brand strength, and balanced growth strategy |

🏁 Conclusion

DLF Limited is demonstrating enduring strength across both its development (residential sales) and annuity (commercial leasing) businesses. Backed by a strong balance sheet, growing cash surplus, and increasing investor confidence (evidenced by CRISIL upgrade and ESG accolades), the company is well-positioned to capitalize on favorable sector tailwinds.

While challenges like geographic concentration, interest rate sensitivity, and project execution risks persist, DLF’s disciplined capital management, premium brand positioning, and diversified revenue streams mitigate many of these concerns.

➤ Verdict: Neutral to Positive Outlook for Mid-to-Long Term Investors

DLF appears to be transitioning into a more balanced, cash-generative real estate giant with dual engines of growth — high-value residential sales and a world-class commercial annuity engine. With consistent performance and clear guidance adherence, it remains a core holding in Indian real estate equity portfolios.

For Further Updates:

Contact DLF’s Investor Relations or Corporate Communications team as listed in the press release.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.