CUB

Equity Metrics

January 13, 2026

City Union Bank Limited

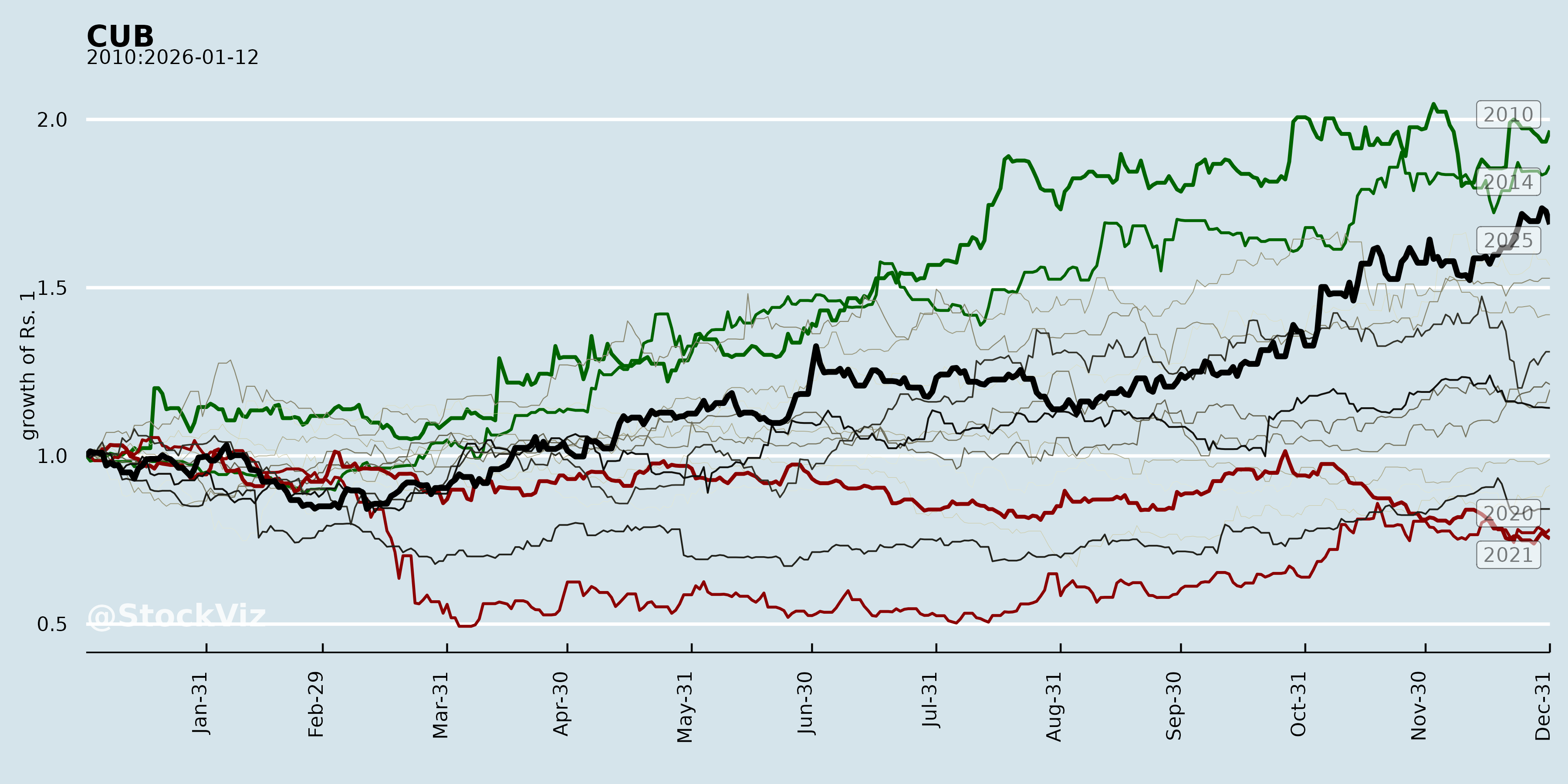

Annual Returns

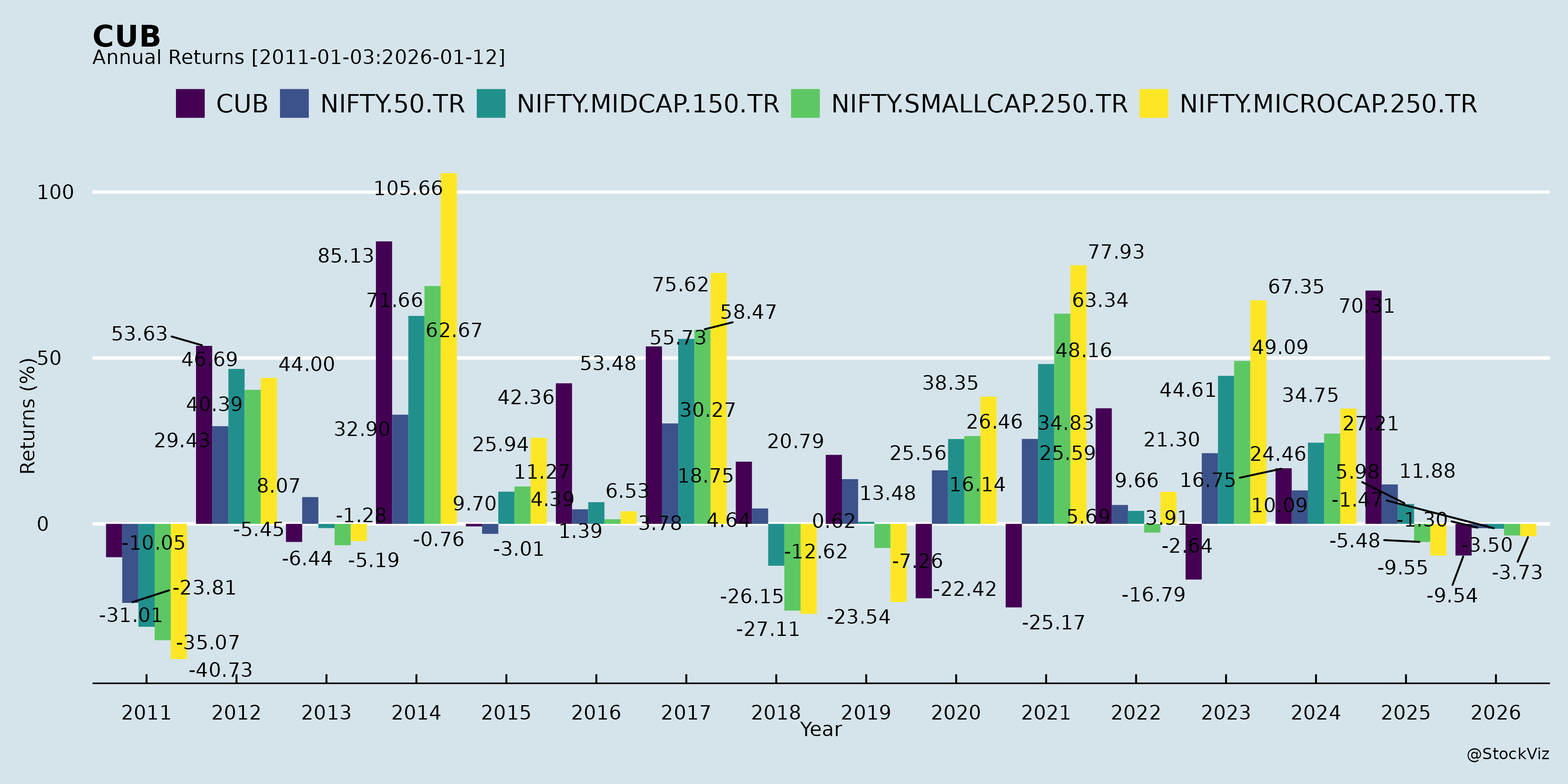

Cumulative Returns and Drawdowns

Fundamentals

Ownership

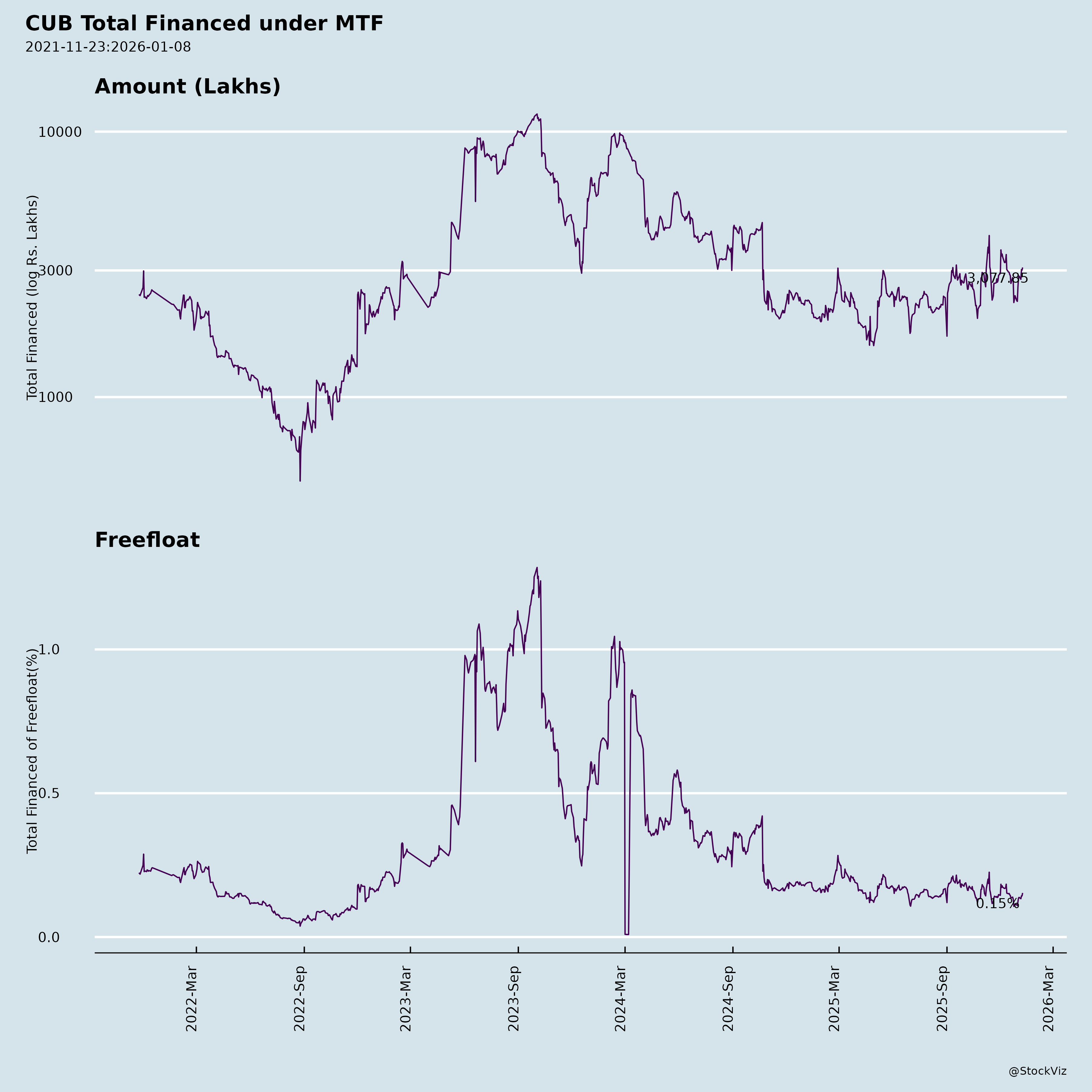

Margined

AI Summary

asof: 2025-12-03

City Union Bank (CUB) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: City Union Bank (CUB), a 121-year-old private sector bank listed on NSE/BSE (Scrip: CUB/532210), reported robust Q2/H1 FY26 results (ended Sep 30, 2025). Key highlights include 21% YoY deposit growth to ₹69,486 Cr, 18% advances growth to ₹57,561 Cr, 15% PAT growth to ₹329 Cr (Q2) / ₹635 Cr (H1), improving NPAs (GNPA 2.42%, NNPA 0.90%), and strong CAR at 21.68%. Focus remains on granular MSME/retail/trading loans (42% of advances), with digital push and South India dominance (557/901 branches in TN). Below is a structured analysis based on the provided filings.

Tailwinds (Positive Drivers)

- Strong Balance Sheet Growth: Deposits +21% YoY, advances +18% YoY, total business +20% YoY. CASA at 28% supports stable funding; CD ratio healthy at 83%.

- Asset Quality Improvement: GNPA down 112 bps YoY to 2.42%; NNPA down 72 bps to 0.90%. PCR at 82% (incl. TW). Slippages controlled via recoveries/upgradations.

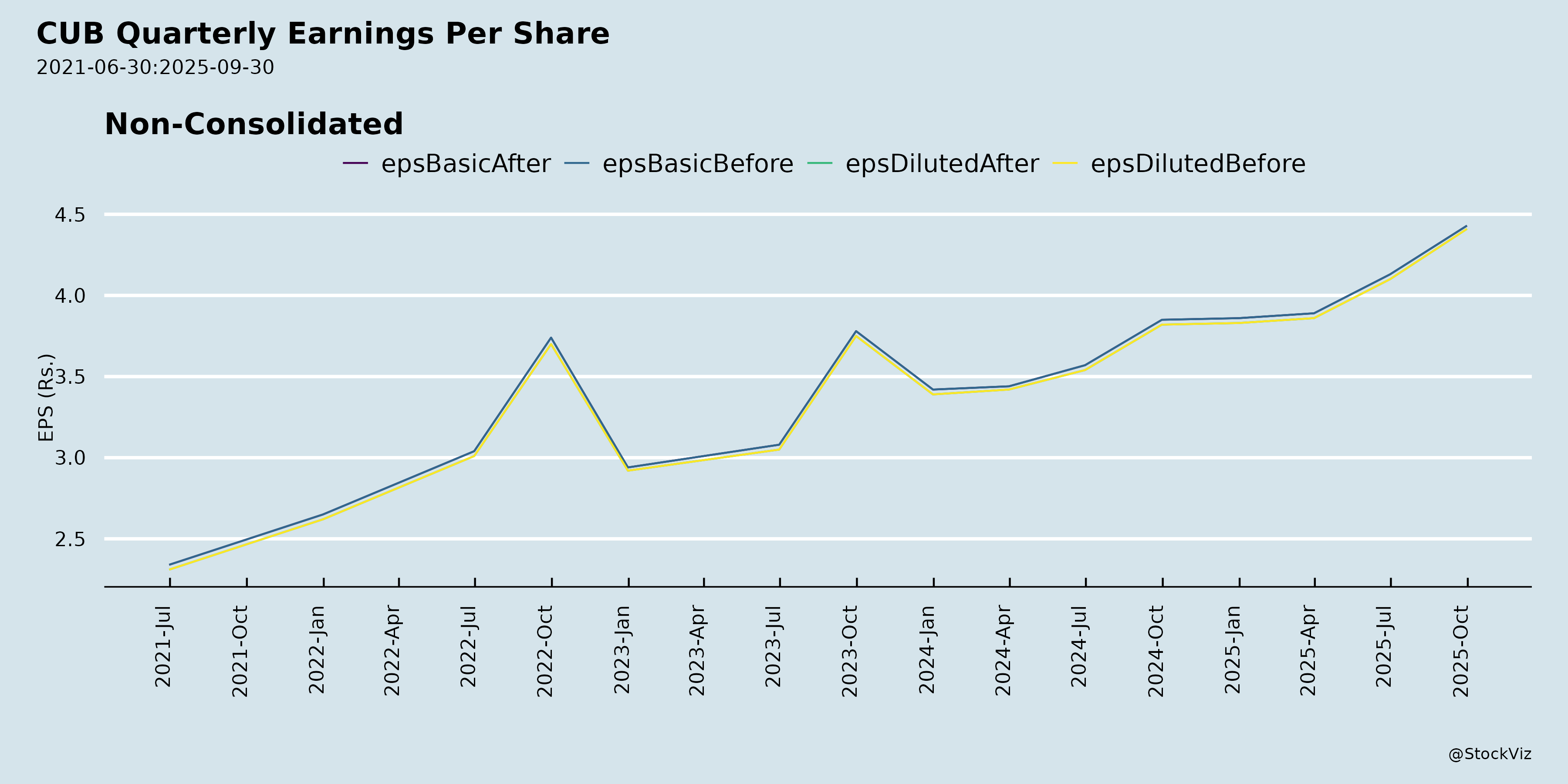

- Profitability Resilience: ROA stable at 1.59% (Q2), ROE 13.35%; NIM 3.63% (sequential uptick). PAT growth 15% YoY despite higher opex.

- Capital Strength: CAR 21.68% (Tier-1 20.71%), well above RBI norms; supports growth without dilution.

- Digital & Operational Momentum: New UPI features (e.g., Circle, Help, Multi-Signatory), awards (AI/ML, cybersecurity), MSME corporate card, digital lending. 901 branches (new in Bengaluru).

- Granular Portfolio: Top-20 exposure <7%; gold loans 28% of advances (low LTV ~61%, GNPA 0.9%). MSME/trading focus yields higher returns.

Headwinds (Challenges)

- Margin Pressure: NIM slight YoY dip (3.63% vs. 3.67%); cost of deposits stable but yield on advances marginally down (9.66% vs. 9.81%). Rising deposit costs (5.71%) amid rate environment.

- Cost Inflation: Opex +20% YoY (employee costs +22%); CIR up to 49.16% (from 47.06%). Efficiency ratio 48.66%.

- Provisioning Needs: Bad debt provisions ₹110 Cr (H1); ECL contingency ₹10 Cr added. Restructured standards at 1.03% of advances.

- Regional Concentration: 83% branches/deposits in South India (TN 63%); vulnerable to regional slowdowns.

- Macro Sensitivity: MSME/agri focus (40%+ advances) exposed to economic cycles, monsoon risks.

Growth Prospects

- High Double-Digit Trajectory: 10-year CAGR >10% in business/profits; H1 FY26 sustains 15-20% YoY growth. Target: Continued 15-18% advances expansion via MSME/retail (gold loans +13% QoQ).

- Branch/Digital Expansion: 901 branches (Pan-India push); digital products (UPI innovations, CUB Desire/Depend, WhatsApp banking) to boost low-cost deposits/CASA.

- Yield Enhancement: Trading/MSME (42%) higher yields; digital lending, PSLC trading (purchased ₹118 Cr, sold ₹114 Cr).

- Profitability Upside: ROA/ROE sustainable at 1.5-1.6%/13%; NIM stabilization via deposit re-pricing. Dividend track record (121 years profitability).

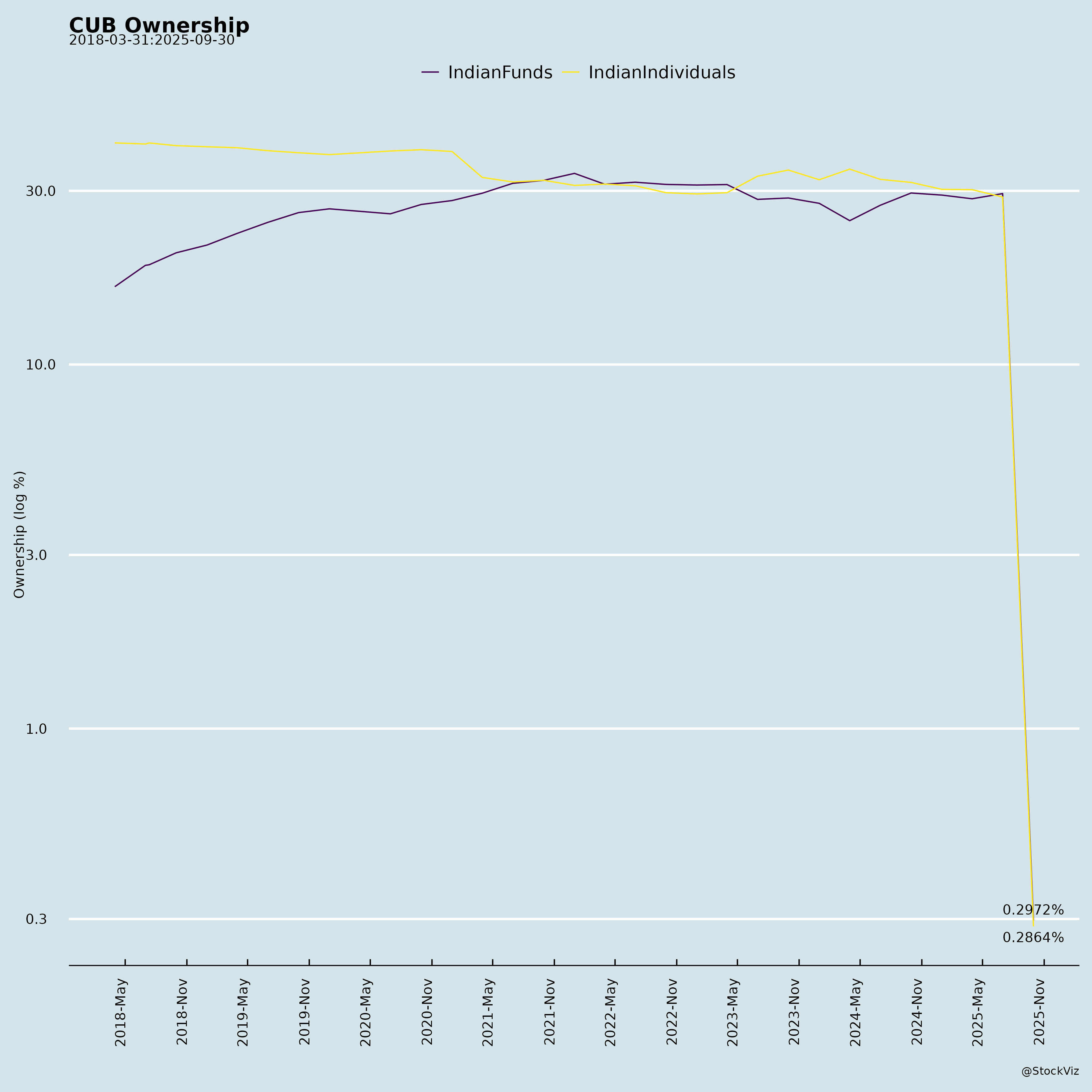

- Market Opportunity: Untapped MSME segment; partnerships (fintechs like Perfios, TVS Credit) for scalability. FII headroom 14% (current 26%).

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Credit/Asset Quality | MSME slowdown, gold price volatility (28% advances); reclassified non-UDYAM loans. | Granular portfolio, collaterals (residential/PG), PCR 82%; recoveries strong. |

| Interest Rate | Rate cuts/hikes squeeze NIM; deposit competition. | Fixed-rate migration, granular deposits (no CDs/bulks). |

| Operational/Cyber | Rising opex/CIR; digital expansion risks. | Efficiency 48.66%; cybersecurity awards; robust governance (7/10 indep. directors). |

| Regulatory | RBI norms (e.g., PSLC, restructuring disclosures); Basel III Pillar 3 (LCR/NSFR on website). | High CAR; compliant (e.g., unhedged FX provision ₹2.72 Cr). |

| Liquidity/Market | Funding reliance on deposits; FPI flows volatile. | LCR/NSFR compliant; diversified investors (HDFC/SBI AMCs top holders). |

| Macro/Geopolitical | Regional (South India) exposure; inflation/recession. | Diversified sectors (no infra/consortium); 121-yr stability. |

Summary: CUB exhibits strong tailwinds from growth, asset quality fixes, and digital agility, positioning for 15%+ earnings CAGR. Headwinds like costs/NIM are manageable with healthy capital. Growth prospects solid in MSME/retail, but risks center on credit cycles and macros. Investment View: Positive for long-term; attractive at current valuations (ROE>peer avg, low NPAs). Monitor NIM/CIR in upcoming quarters. (Analysis based solely on provided Q2 FY26 docs; cross-check latest market data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.