CIPLA

Equity Metrics

January 13, 2026

Cipla Limited

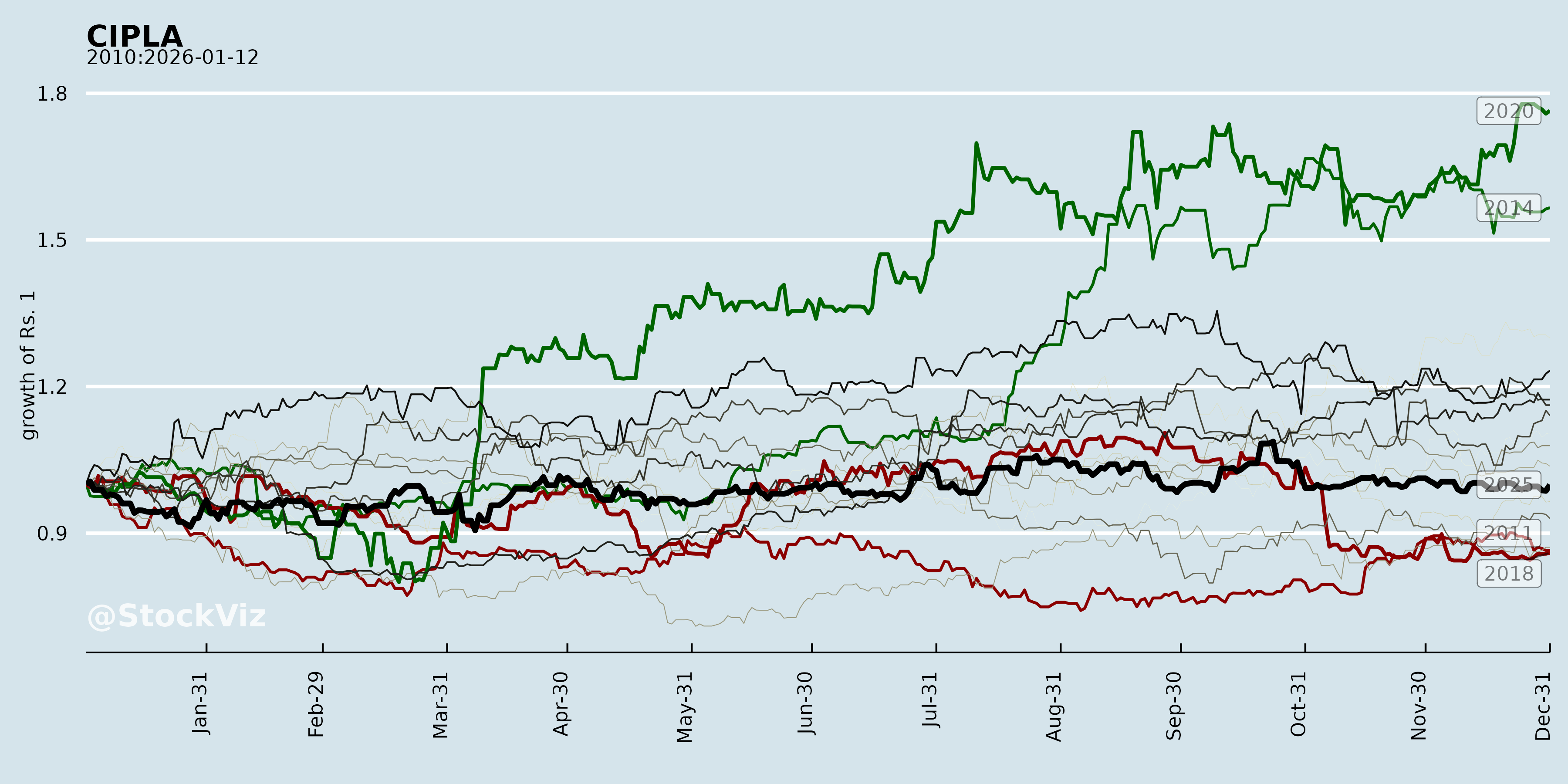

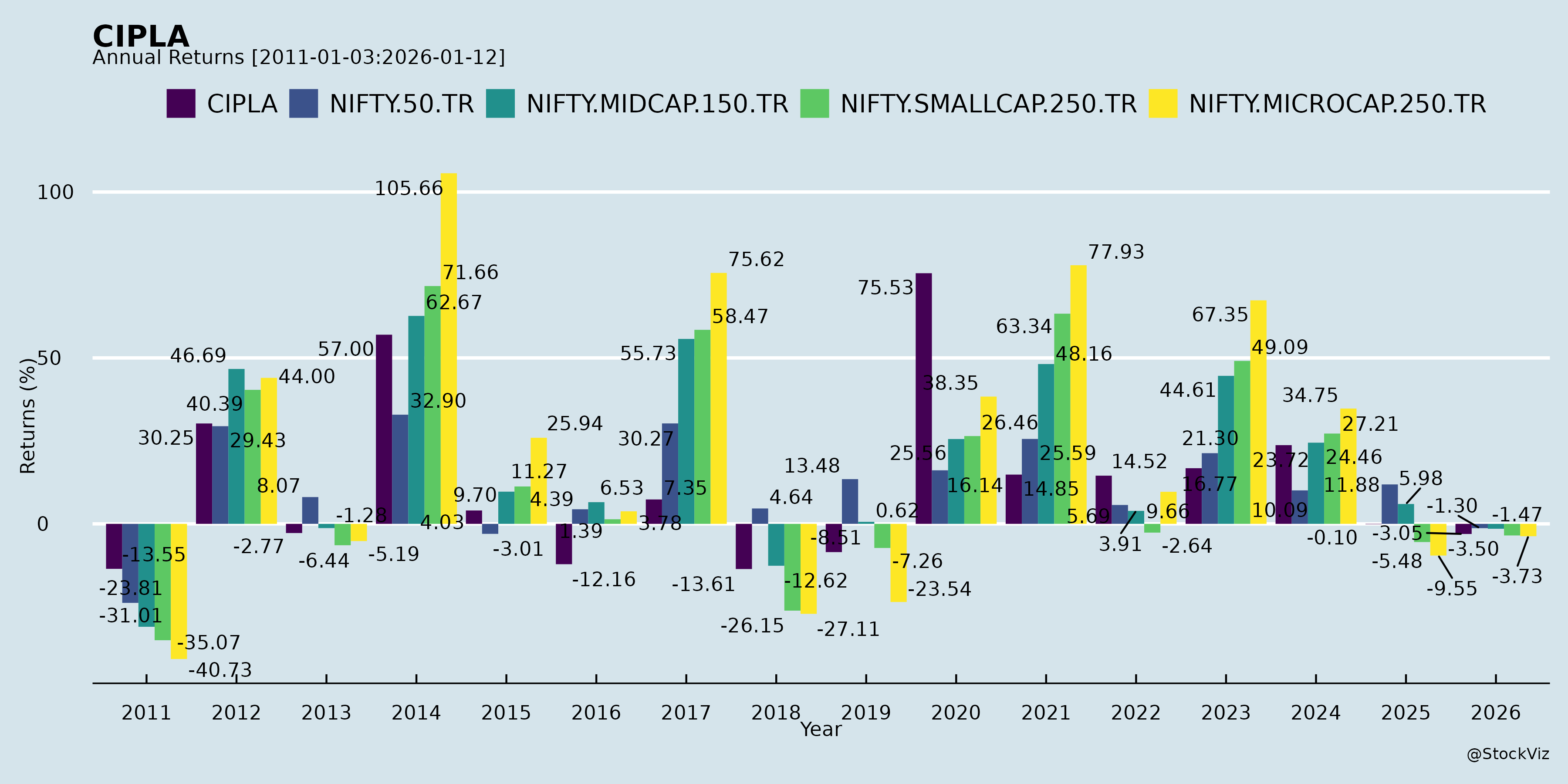

Annual Returns

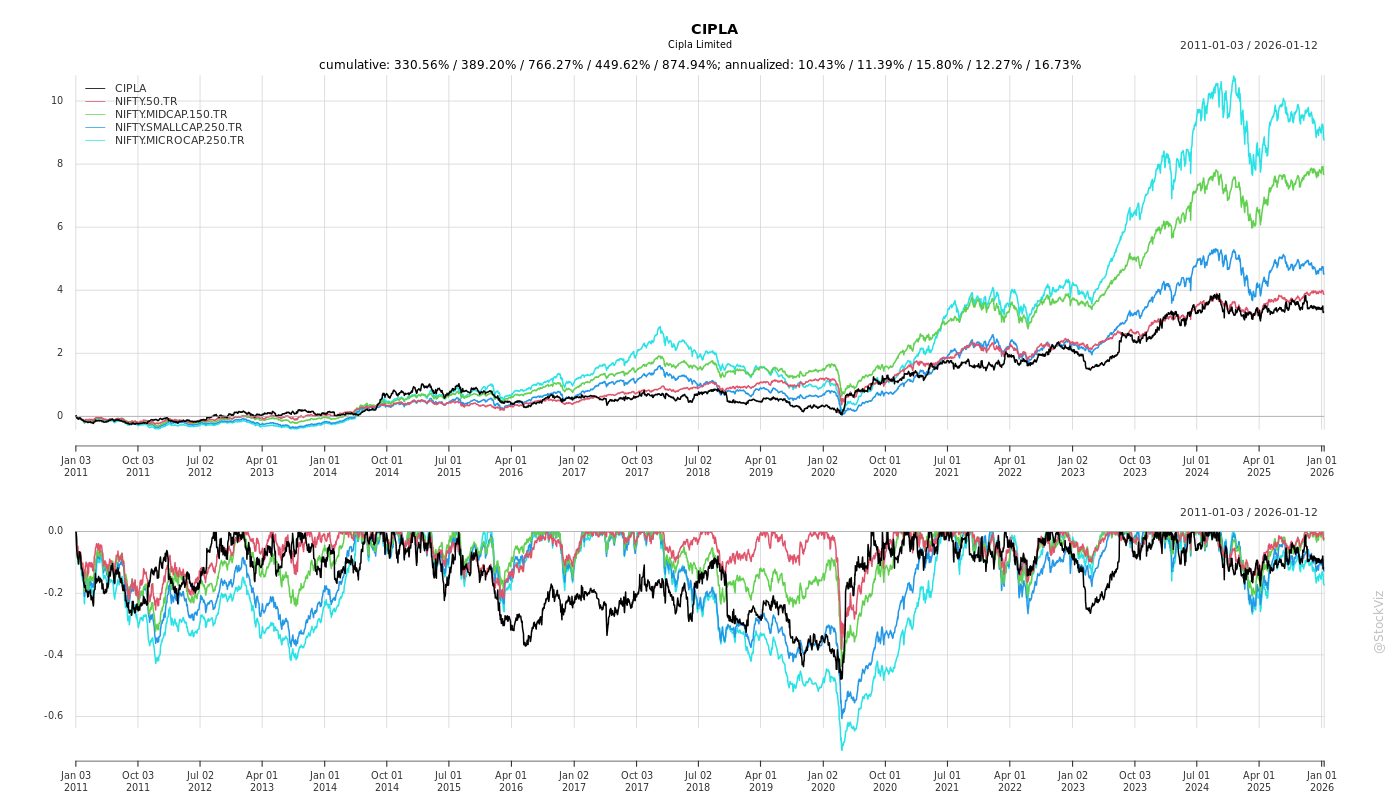

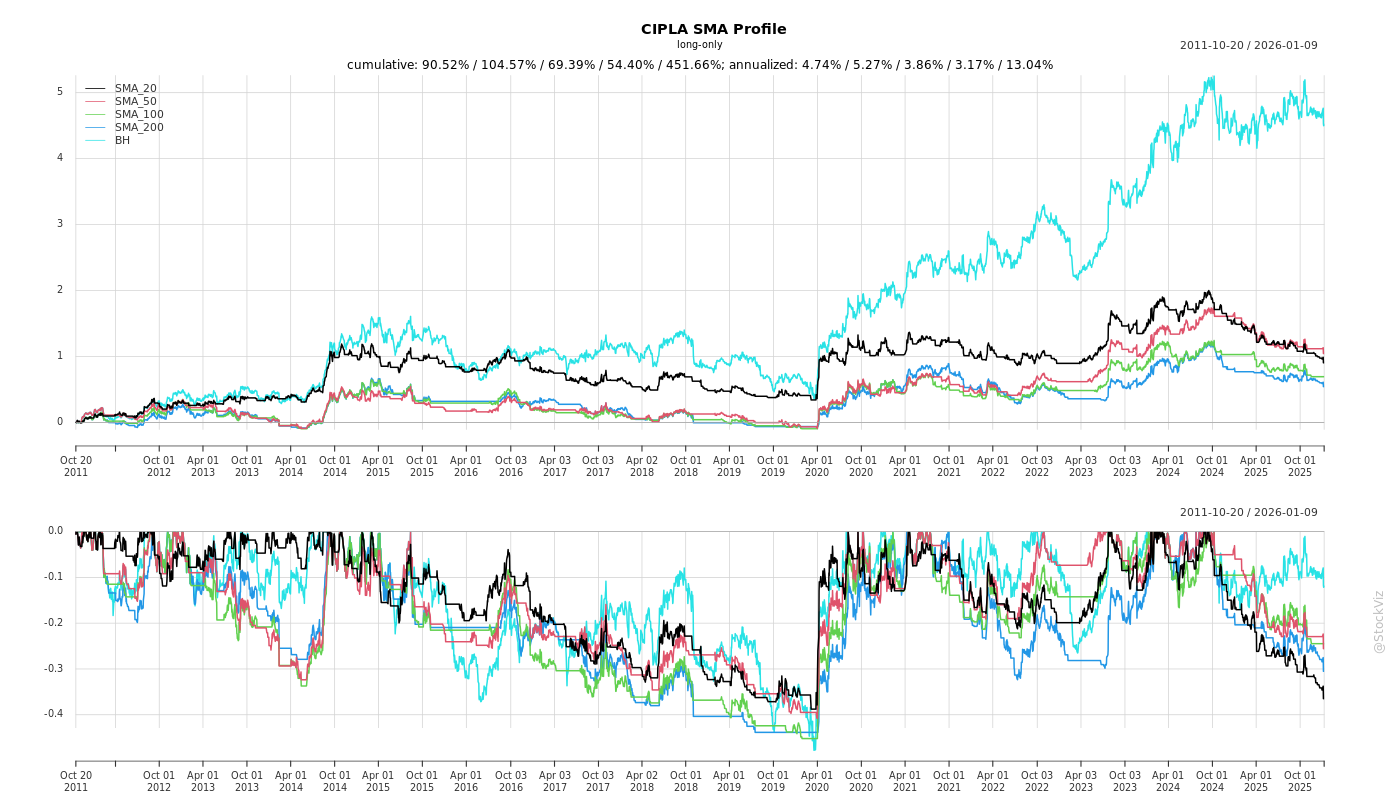

Cumulative Returns and Drawdowns

Fundamentals

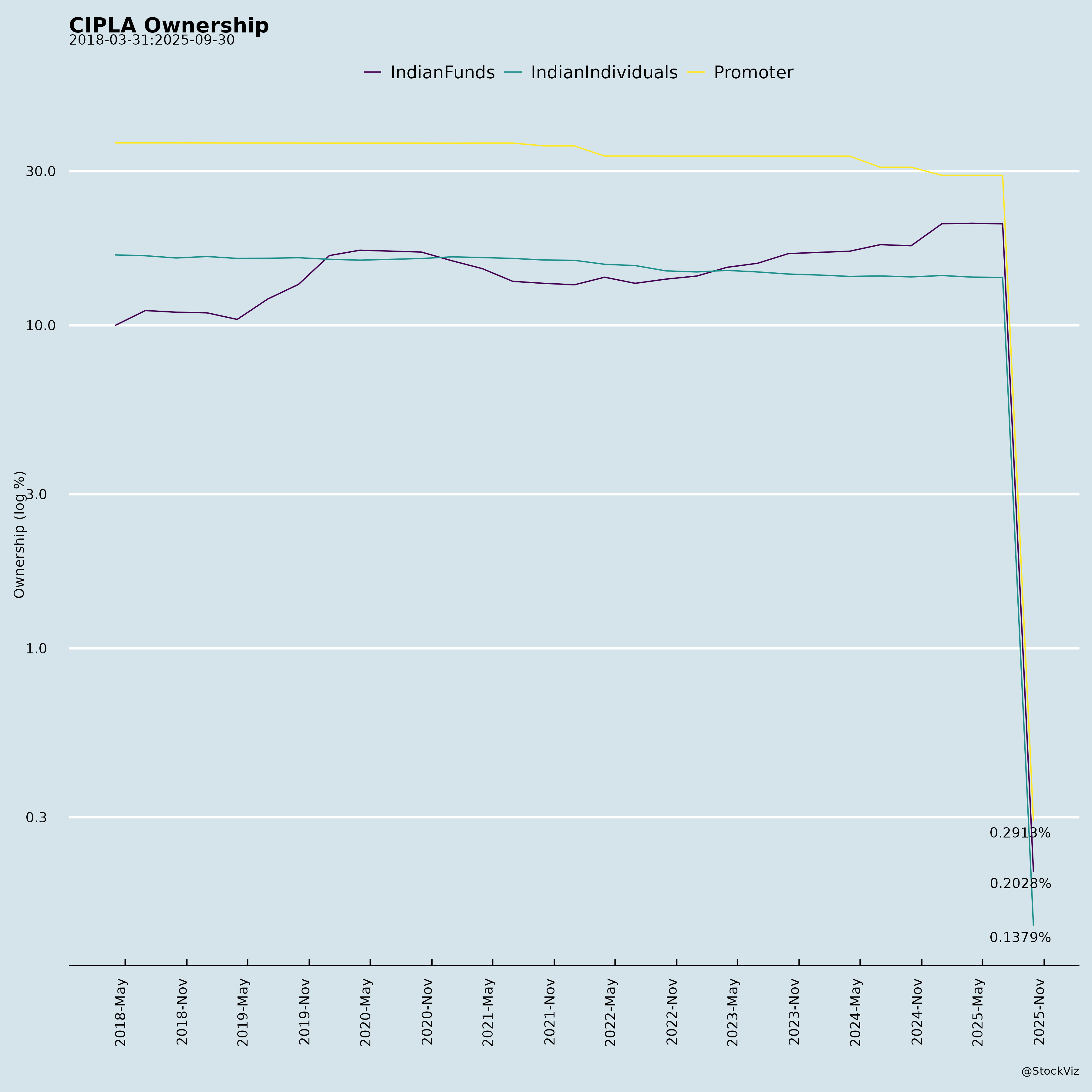

Ownership

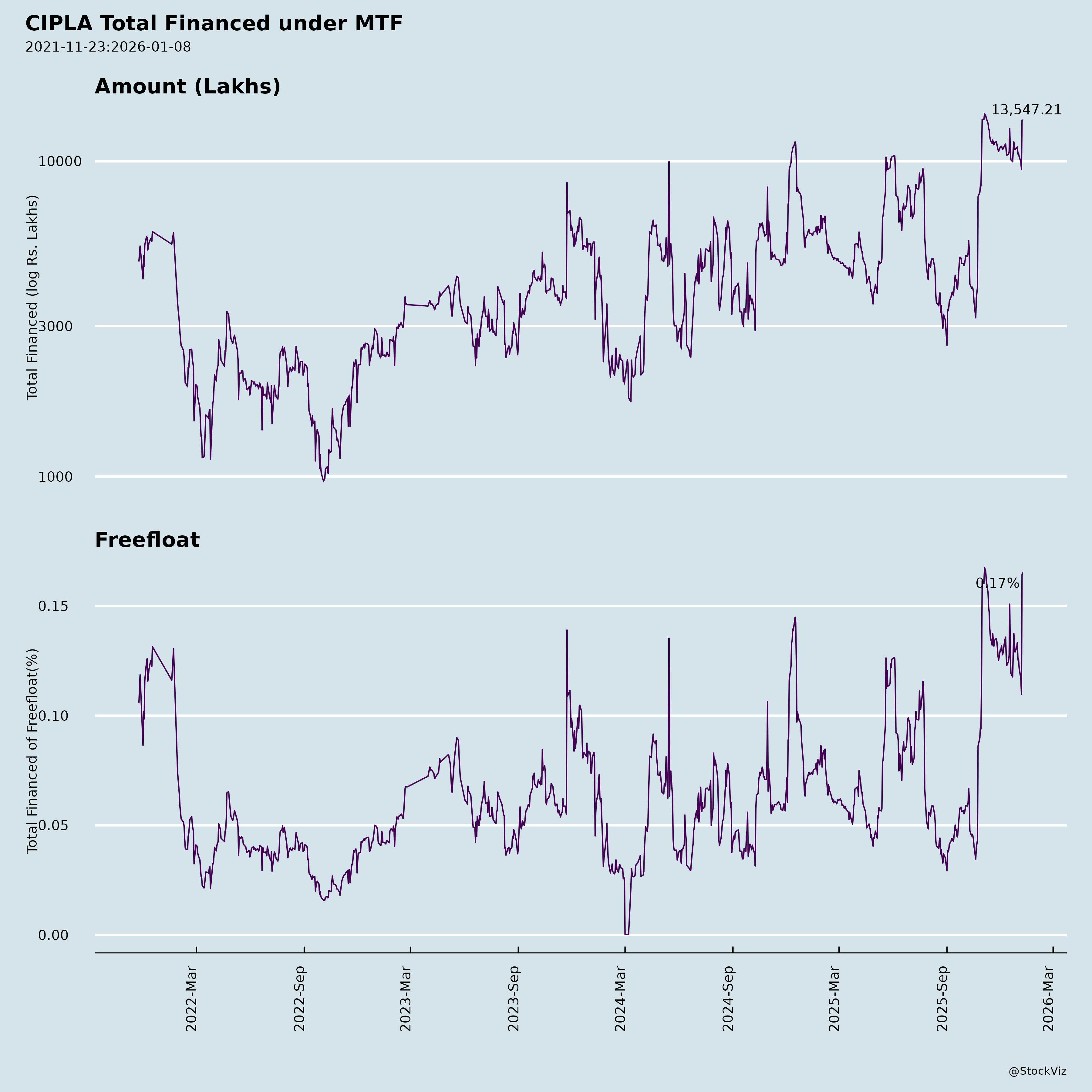

Margined

AI Summary

asof: 2025-12-03

Cipla Limited (CIPLA) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Date of Analysis: Based on Q2 FY26 Earnings (ended Sep 30, 2025), Earnings Call Transcript, Investor Presentation, and Related Disclosures (Oct/Nov 2025).

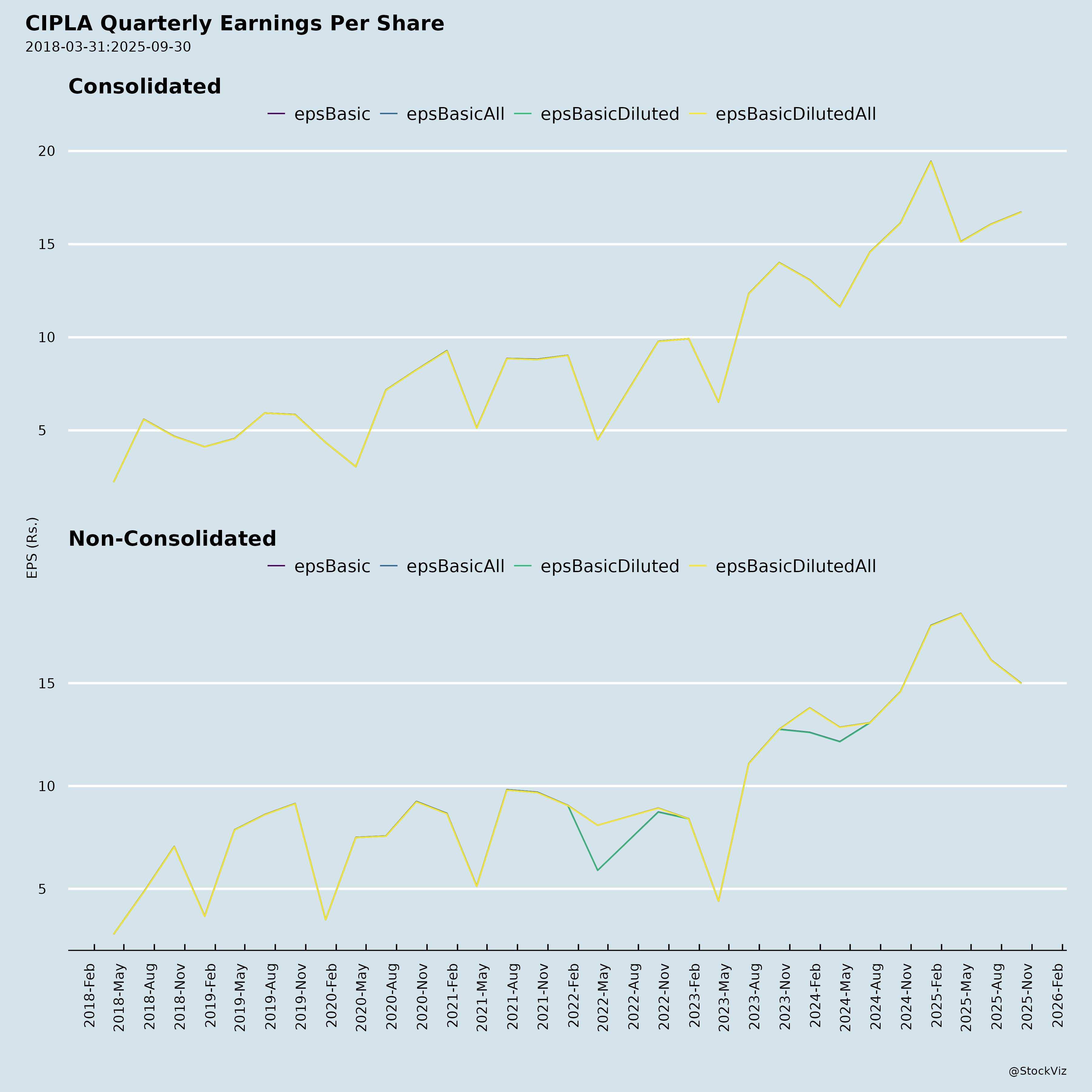

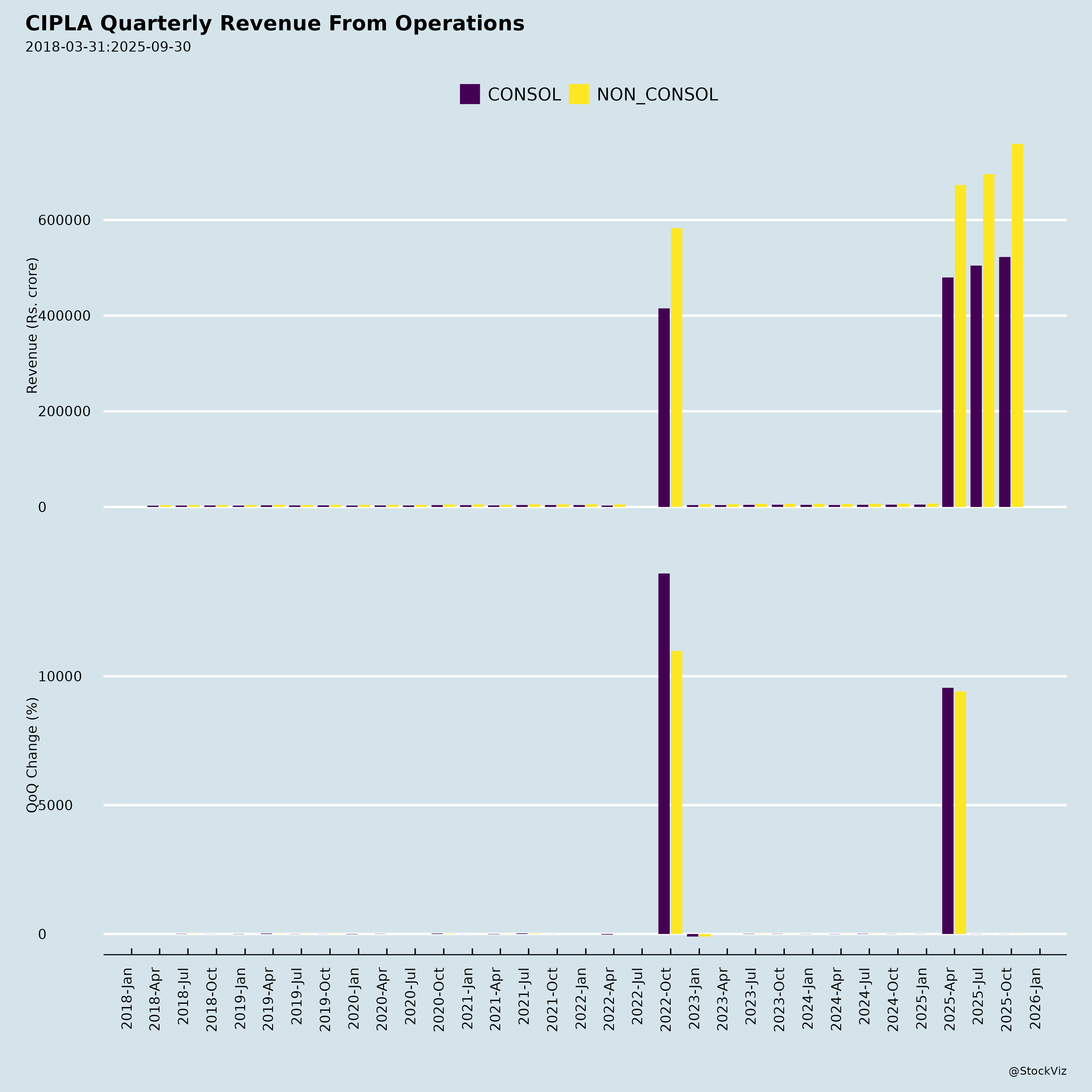

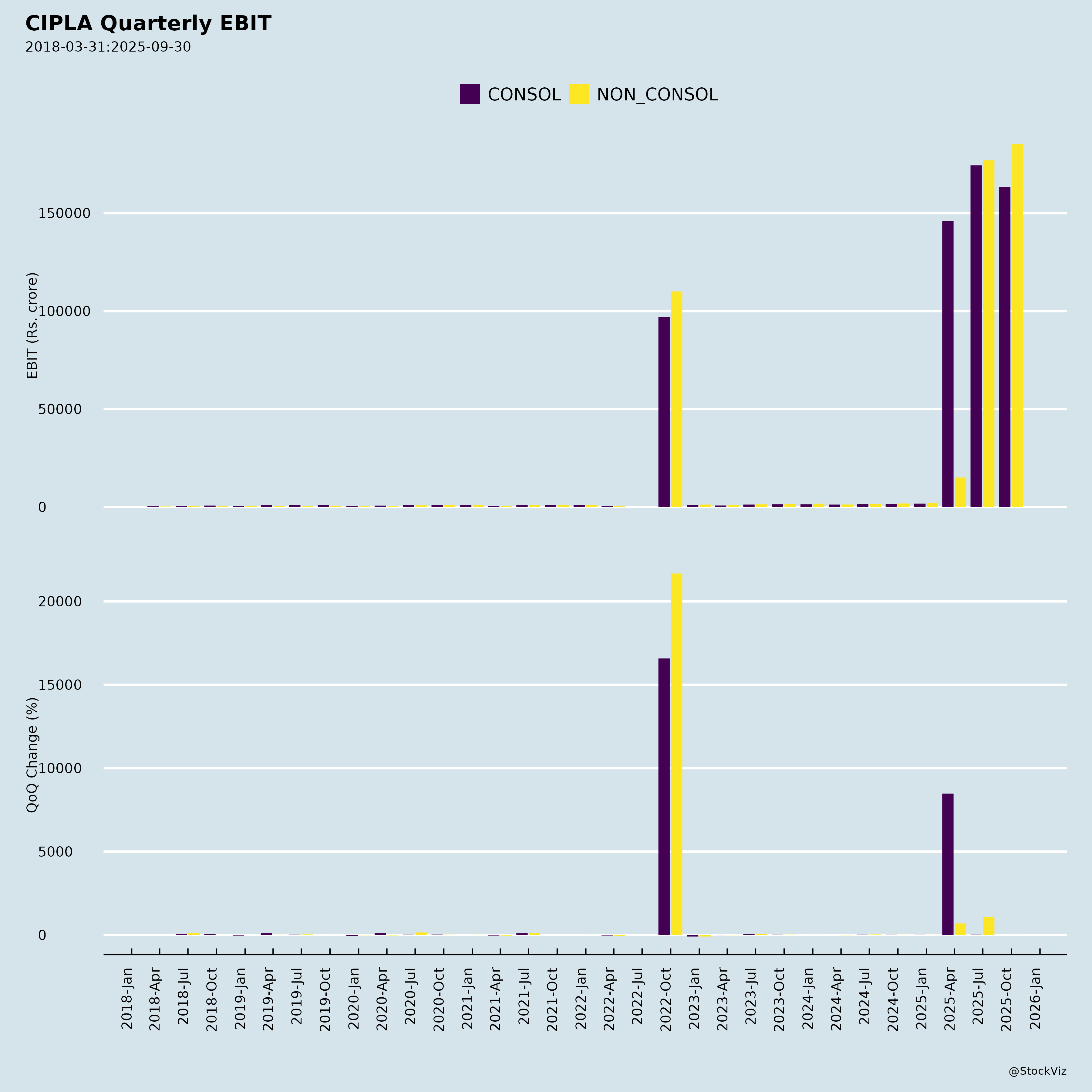

Cipla reported record Q2 FY26 revenue of INR 7,589 Cr (+8% YoY), EBITDA of INR 1,895 Cr (25% margin), and PAT of INR 1,351 Cr (+4% YoY). Growth was balanced across geographies: One India (+7%), North America ($233 Mn), One Africa (+5% USD YoY), EMEU (+15% USD YoY). Strong balance sheet with net cash of INR 9,901 Cr. Leadership transition announced: Umang Vohra steps down Mar 31, 2026; Achin Gupta appointed MD & GCEO designate (Jan 1, 2026) and full role from Apr 1, 2026.

Tailwinds (Positive Momentum)

- Diversified Revenue Growth: Balanced contributions from all key markets (India 41%, US 27%, Africa 16%, EMEU 13%). No over-reliance on single geography/product.

- India Strength: Branded Rx chronic mix at 61.8% (up YoY); key therapies (urology +17%, cardiac +13%, anti-diabetes +10%, dermatology +18%) outperforming IPM market (8%). Foracort #1 IPM brand; 29 brands >INR 100 Cr; #1 volume player (2B+ units). Trade generics double-digit growth; Consumer Health anchors (Nicotex, Omnigel, Cipladine) #1 in segments.

- US Traction: Albuterol MDI #1 (22% share, 50M+ units supplied); Lanreotide 22% share. First US biosimilar (Filgrastim) launched.

- Strategic Partnerships: Eli Lilly tie-up for Yurpeak (tirzepatide) in India (obesity/diabetes; ~200 Mn eligible patients). Exclusive nationwide rights; dedicated sales force added. Potential for semaglutide post-approval.

- Pipeline & Innovation: US: 4 respiratory (incl. gAdvair Q4 CY26) + 3 peptides (incl. liraglutide) by CY26; 285 ANDAs/NDAs under review (180 approved). India: New launches (e.g., Huena, ZEMDRI, Cipenmet for AMR; Empacip, Afrezza). R&D at 7.1% of sales (INR 539 Cr).

- Financial Health: Debt low (INR 467 Cr); high cash enables investments. ESG progress (76% Scope 1/2 emission cut; water positive; ZWTL certified); MSCI ESG upgraded to A.

- Regulatory Wins: Bommasandra site VAI by USFDA.

Headwinds (Challenges)

- India Slowdown: Branded Rx at 7% YoY (vs. IPM 8%); respiratory impacted by weak acute season (Q1 carryover). GST transition caused brief disruption.

- US Revlimid Decline: gRevlimid contribution “very small” in Q3 FY26 (near-patent expiry Jan 2026); base business growth expected but timing gaps in pipeline offsets.

- Margin Pressures: Revised FY26 EBITDA guidance 22.75-24% (down from 23.5-24.5%) due to higher R&D (+50 bps of revenue), Revlimid drop, Q4 seasonality/low margins. Q2 gross margin 67% (seq. dip 160-170 bps from mix, R&D materials, pricing).

- ESG Dip: NSE rating revised 65→64 due to Cipla USA voluntary recall (Jul 2025).

- Macro/Execution: Africa tender variability; API revenue -7% YoY.

Growth Prospects

| Segment | Key Drivers | Outlook |

|---|---|---|

| One India (41% rev) | Yurpeak/semaglutide entry (Tier 2/3 focus); chronic CAGR 16.4% (FY21-25); 6+ new launches/Q (AMR, CNS, GI, derm); trade/consumer double-digit. | Mid-teens potential; market-outperformance via execution. |

| US (27% rev) | Pipeline (gAdvair, QVAR?, peptides); biosimilars ramp; $1B run-rate FY27 (directional). Albuterol/Lanreotide scale. | Strong; launches derisked (3/4 respiratory from US sites). |

| One Africa (16%) | SA private 1.3x market (6.2% vs. 4.7%); #2 Rx rank; tender/new launches. | Margin expansion H2 FY26; sustained 5-10% USD growth. |

| EMEU (13%) | Deep penetration (DTM/B2B); highest-ever $110 Mn Q. | 15%+ USD YoY trajectory. |

| Overall | GLP-1 obesity wave; biosimilars/GLP-1 supply (CMO capacity secured); R&D acceleration (complex generics, peptides, oligo). FY26 rev growth ~8-10% implied. | 10-15% CAGR medium-term; $1B+ US, India obesity double-digit upside. |

Key Risks

- US Pipeline Delays/Revlimid Cliff: Launches FDA-dependent; Revlimid FY26 <50% FY25 (Q3 nil-like). Abraxane/Nanopaclitaxel behind targets initially.

- Competition: GLP-1 (semaglutide multi-player vs. tirzepatide differentiation); US generics (lanreotide filings); India respiratory seasonality.

- Regulatory: USFDA reinspection (Indore); ongoing litigation (e.g., QVAR).

- Margin Erosion: R&D ramp (new programs); marketing spend up 11% YoY; forex/pricing pressures.

- Execution/Transition: Leadership change; India growth regain; sales force for GLP-1 (dedicated but scaling needed).

- Macro: Tender volatility (Africa); GST/inflation in India; global supply chain (GLP-1 CMO reliance).

Summary

Bull Case: Cipla’s diversified model shines with record revenue/margins, cash-rich balance sheet, and GLP-1 entry (Yurpeak) unlocking India obesity (~INR 10,000 Cr+ TAM). US pipeline + biosimilars position for $1B+ run-rate; chronic/consumer tailwinds support 10-15% growth. Leadership transition smooth.

Bear Case: Revlimid drop + higher R&D pressures FY26 margins (22.75-24%); India Rx lag; regulatory hurdles could cap upside.

Valuation Context: Trading at ~35-40x FY26 EPS (pre-results est.); focus on FY27 recovery (post-launches). Rating: Accumulate – Strong fundamentals offset near-term US headwinds; monitor Q3 Revlimid actuals and US approvals. Target upside 15-20% in 12M on pipeline execution.

(Analysis purely from provided docs; no external data/models used.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.