CHENNPETRO

Equity Metrics

January 13, 2026

Chennai Petroleum Corporation Limited

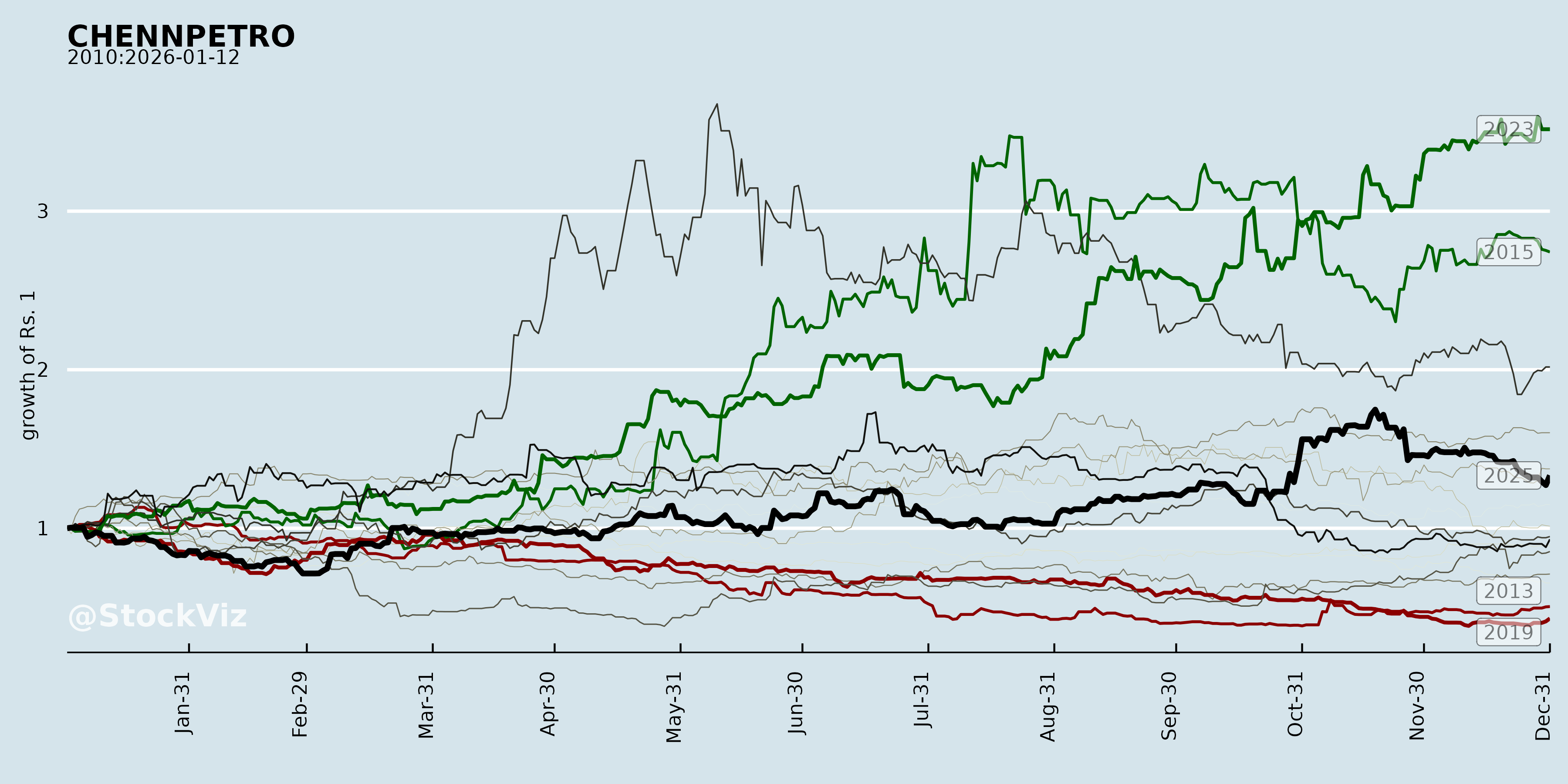

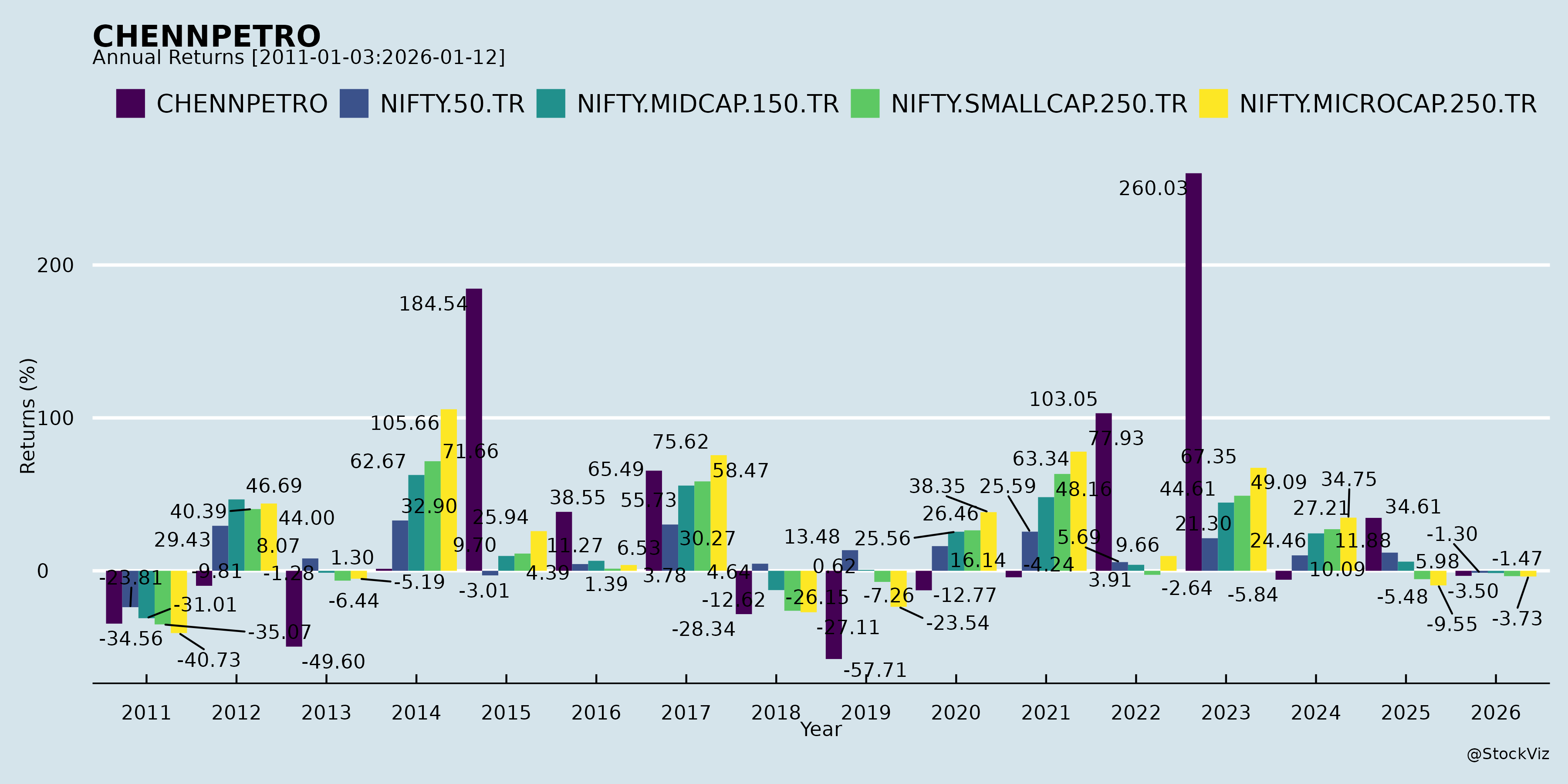

Annual Returns

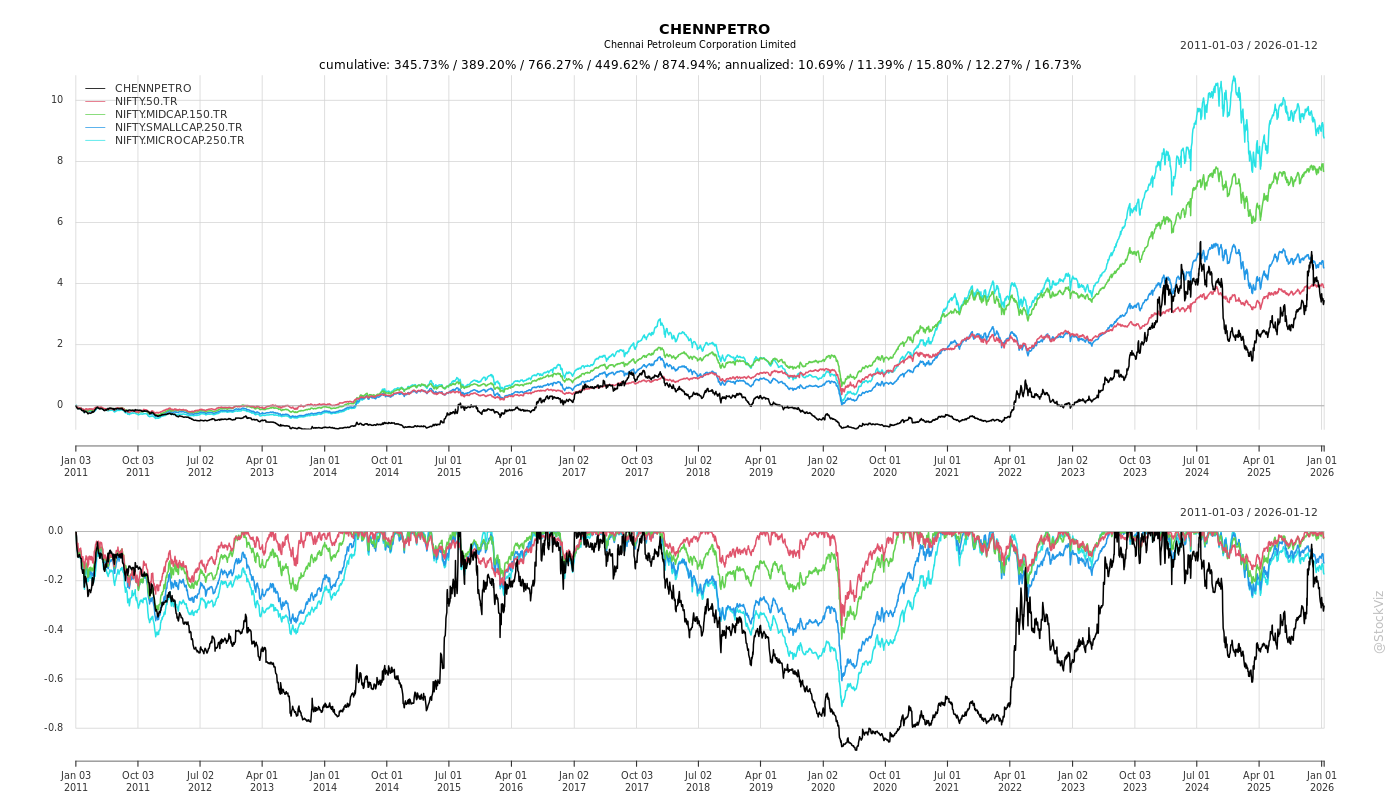

Cumulative Returns and Drawdowns

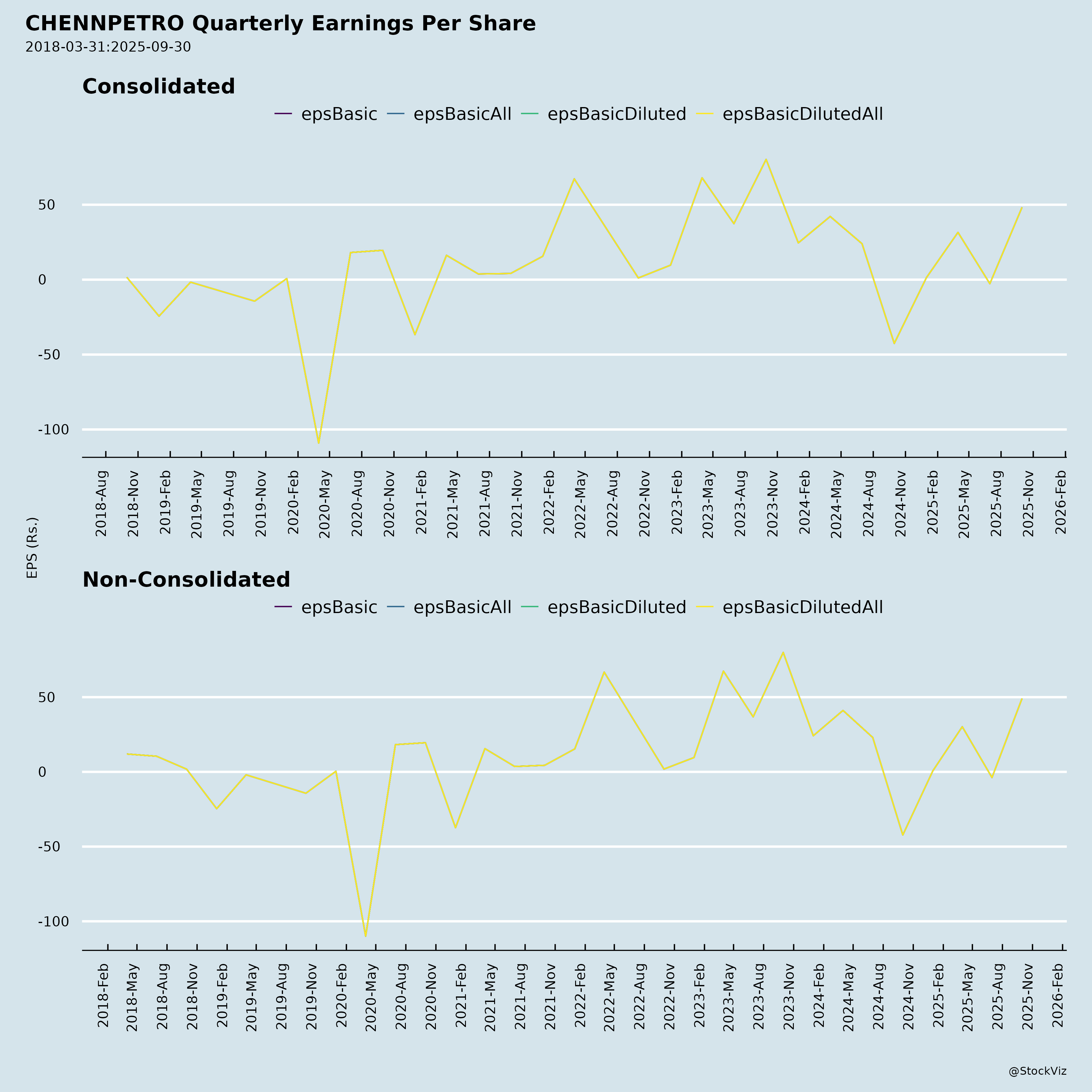

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-03

Summary Analysis for CHENNPETRO (Chennai Petroleum Corporation Limited)

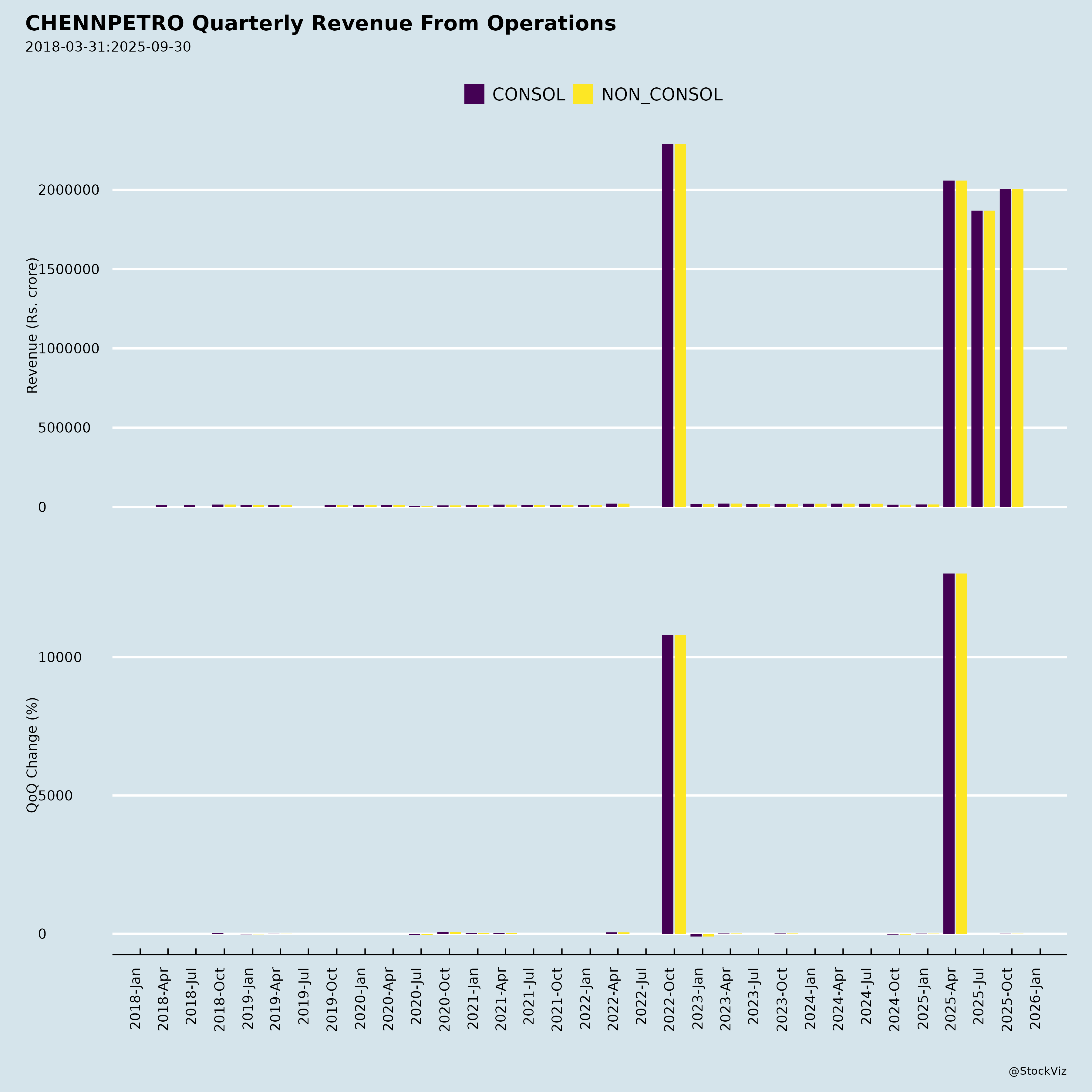

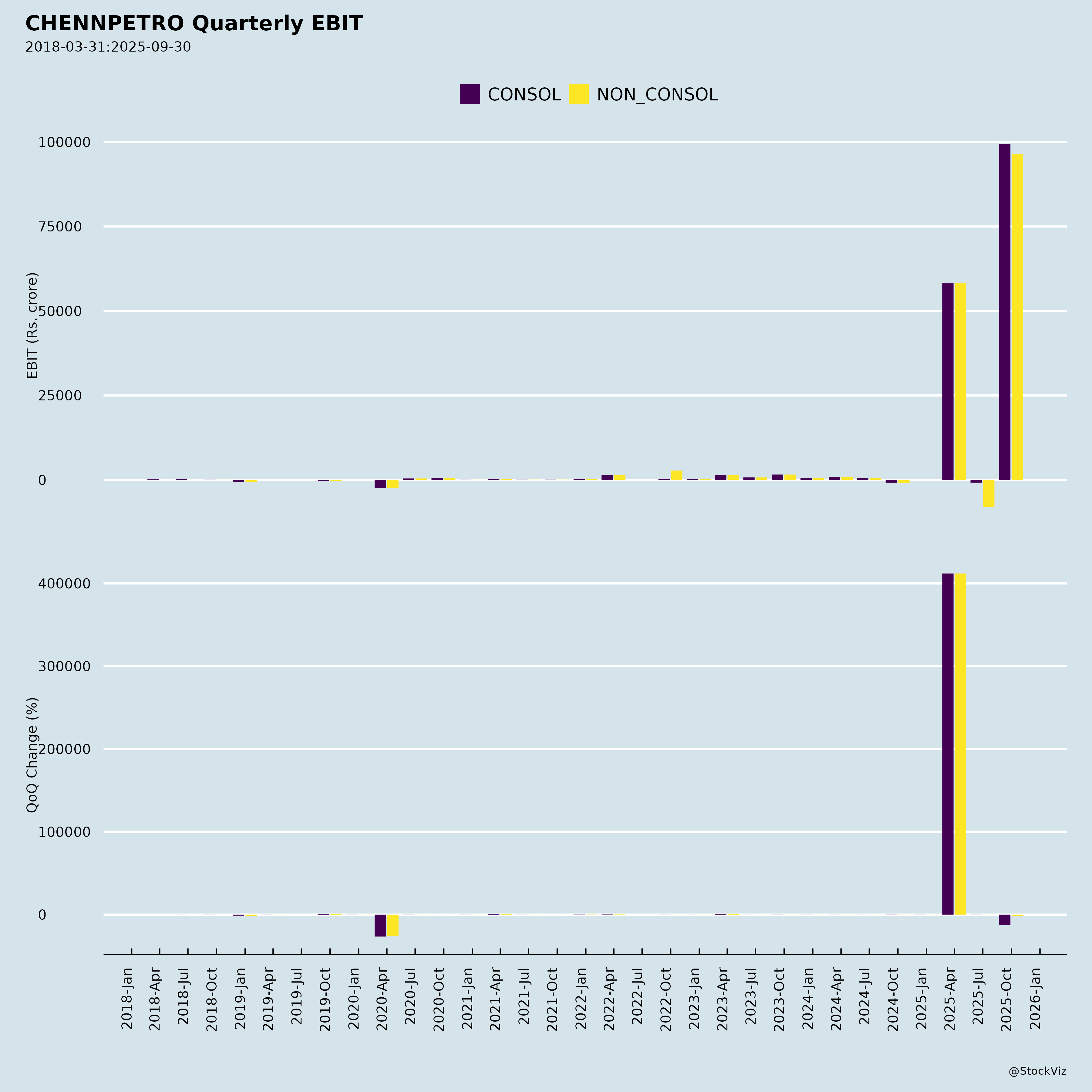

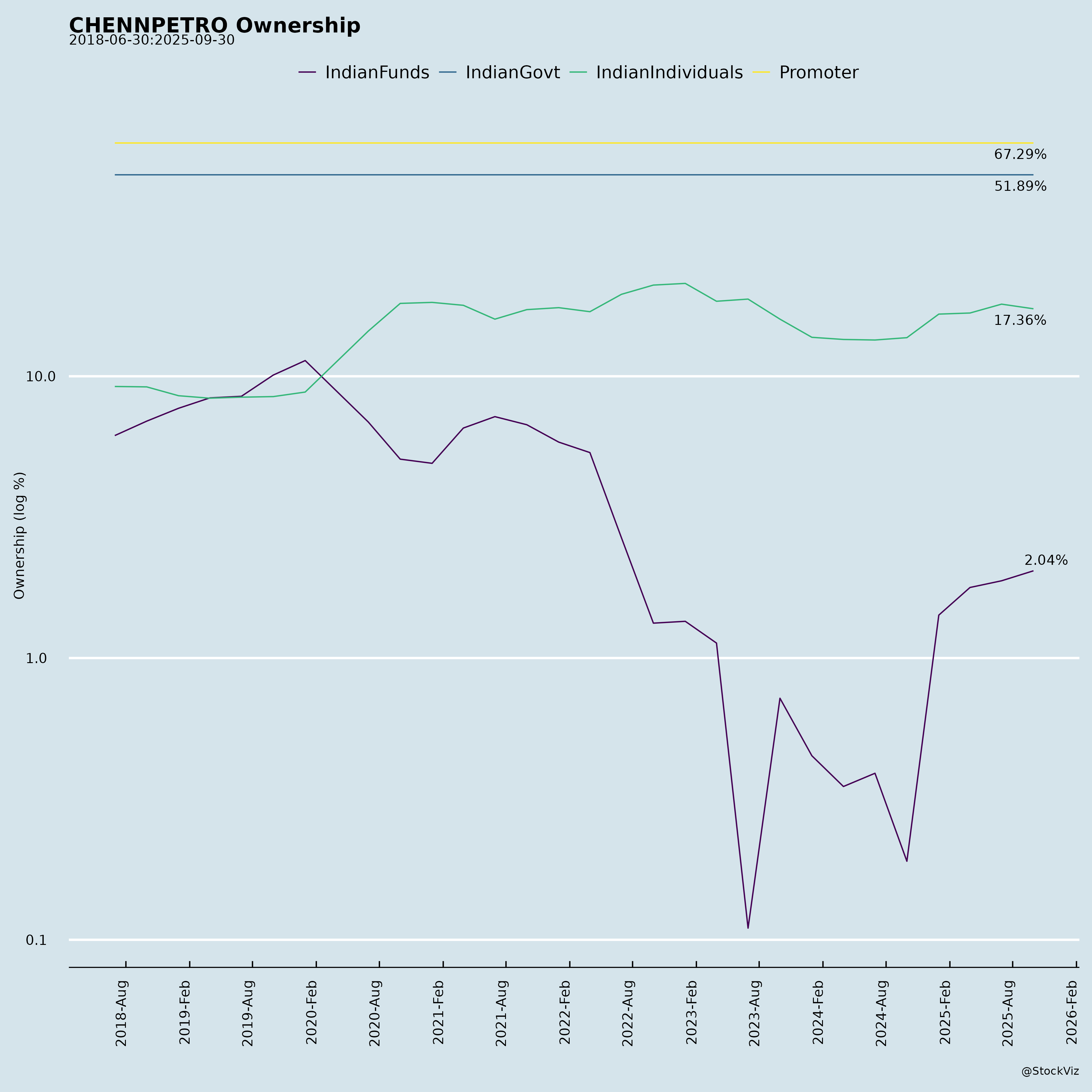

CHENNPETRO, a government-owned refinery (subsidiary of IOCL), demonstrated a strong operational and financial turnaround in Q2/H1 FY26 (ended Sep 30, 2025), driven by high capacity utilization (114%), record distillate yield (~80%), and GRM recovery to US$6.17/bbl (H1 avg.). Revenue grew 11% YoY in H1 to ₹38,717 Cr (standalone), with PAT swinging to ₹675 Cr profit from ₹287 Cr loss. Debt reduced (D/E 0.22), cash from ops strong at ₹1,393 Cr, but governance issues persist. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Catalysts)

- Operational Excellence: Crude throughput up 44% YoY in Q2 (3.013 MMT) and 22% in H1 (5.994 MMT) at 114% capacity utilization. Best-ever distillate yield supports higher-value product sales.

- Financial Recovery: GRM surged to US$9.04/bbl in Q2 (vs negative US$1.63 YoY); H1 revenue +11%, PAT turnaround. Strong FCF from ops (₹1,393 Cr H1) enabled debt repayment (NCDs redeemed) and dividends (₹74 Cr H1).

- Improved Balance Sheet: Equity up to ₹8,555 Cr, D/E down to 0.22 (from 0.39 FY25), current ratio 1.54. Inventory reduction aided liquidity.

- Parent Support: 90%+ sales to IOCL (₹36,834 Cr H1), stable RLNG purchases, and dividend income from JVs.

- Market Tailwinds: Rising Indian petroleum demand; Singapore GRM benchmark (US$4.8/bbl H1) indicates favorable refining cycle.

Headwinds (Challenges)

- Governance Lapses: Non-compliance with Reg 17(1) SEBI LODR (no woman independent director); fines of ₹5.43L each from BSE/NSE for Q2 FY26. Auditor flags board composition shortfall; waivers sought but recurring issue.

- Heavy Parent Reliance: Transactions with IOCL dominate (sales ₹36,834 Cr, purchases ₹1,575 Cr H1), exposing to transfer pricing/group risks.

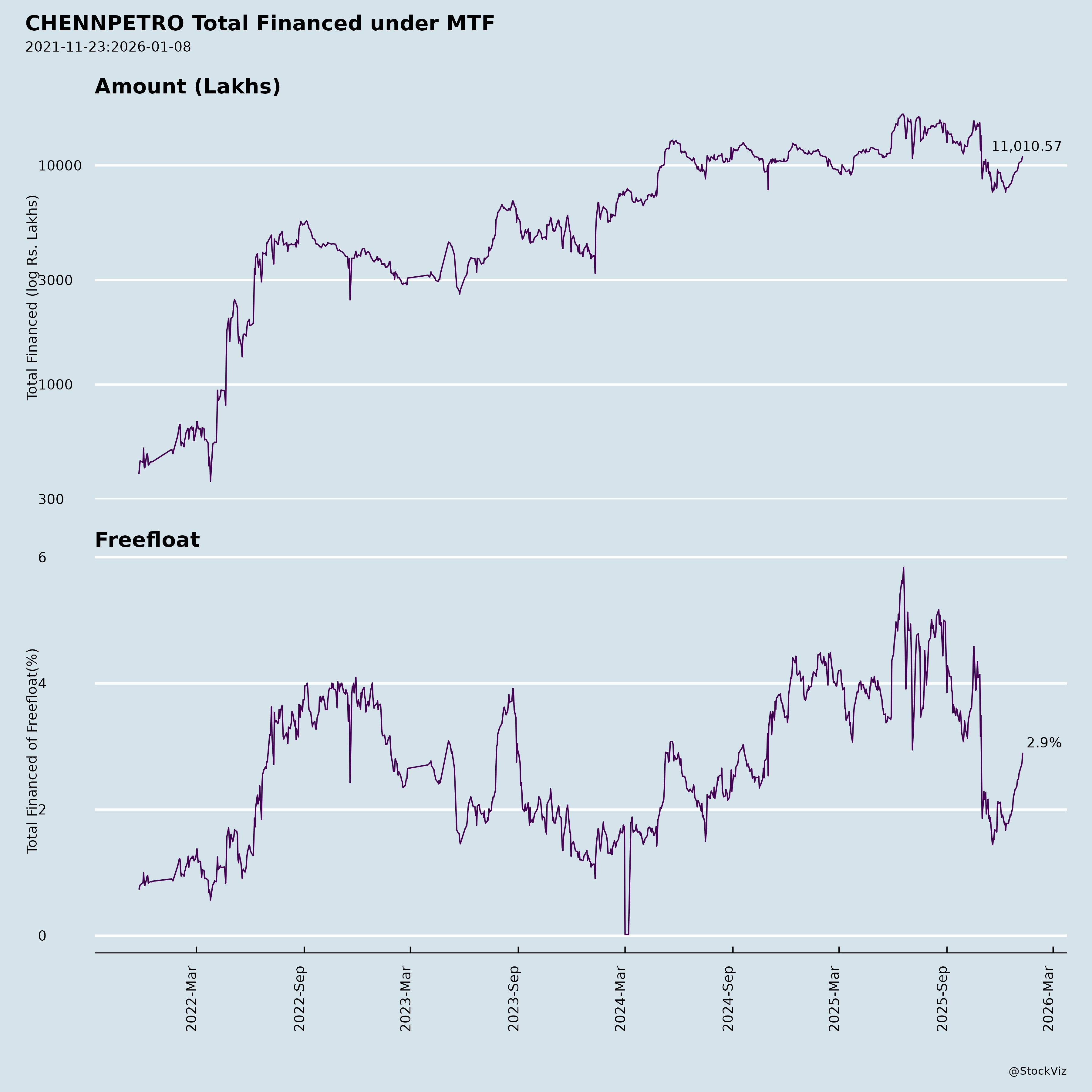

- Liquidity Squeeze: Cash equivalents near-zero (₹0.07 Cr from ₹184 Cr); short-term borrowings up slightly despite repayments.

- Margin Volatility: Refining inherently cyclical; prior negative GRM highlights vulnerability despite recent uptick.

- Capex Drag: ₹264 Cr outflow H1 on PPE/CWIP; assets held for transfer (₹1,289 Cr) signal potential divestitures.

Growth Prospects

- Volume Expansion: Sustained 110%+ utilization could drive FY26 throughput to 11-12 MMT (vs 10.45 FY25), boosting revenue 10-15% if GRM holds ~US$6/bbl.

- Efficiency Gains: High distillate yield and energy focus position for premium margins; potential BS-VI upgrades or expansions via parent IOCL synergy.

- JV/Associate Upside: Equity method gains from Indian Additives (₹29 Cr dividend), CBRPL (₹85 Cr warrants invested); consolidated PAT benefits (₹33 Cr share H1).

- Policy Support: As govt PSU, benefits from MoP&NG nominations (board fixes pending) and India’s refining capacity push to 450 MMTPA by 2030.

- Debt-Free Trajectory: Low leverage enables capex/reinvestment; GRM >US$8/bbl could yield PAT ₹2,000-3,000 Cr FY26.

Key Risks

| Risk Category | Description | Potential Impact |

|---|---|---|

| Commodity Price Volatility | Crude/ product price swings; GRM sensitivity (e.g., drop to <US$5/bbl erodes profits). | High: Could revert to losses (as FY25). |

| Regulatory/Governance | Ongoing board non-compliance fines/penalties; delays in ID appointments by MoP&NG. | Medium: Reputational; stock discounts. |

| Concentration | Single petroleum segment; 90% IOCL exposure (receivables ₹1,178 Cr). | High: Group policy changes or disputes. |

| Geopolitical/Macro | Oil supply disruptions, rupee depreciation inflating crude costs. | High: Refining EBITDA ~70% GRM-linked. |

| Operational/Liquidity | Turnaround/maintenance shutdowns; low cash exposes to working capital spikes. | Medium: Inventory/receivables volatility (trade rec. up ₹1,058 Cr H1). |

| Execution | CWIP delays (₹284 Cr); JV risks (e.g., CBRPL project). | Low-Medium: Govt-backed mitigation. |

Overall Outlook: Bullish short-term on ops/margins, but monitor GRM (>US$6/bbl key), board fixes, and oil prices. Target upside 20-30% if FY26 GRM sustains; downside if <US$4/bbl. Valuation attractive post-recovery (low D/E, ROE rebound). Investors: Favor for refining cycle play, hedge governance risks.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.