CHALET

Equity Metrics

January 13, 2026

Chalet Hotels Limited

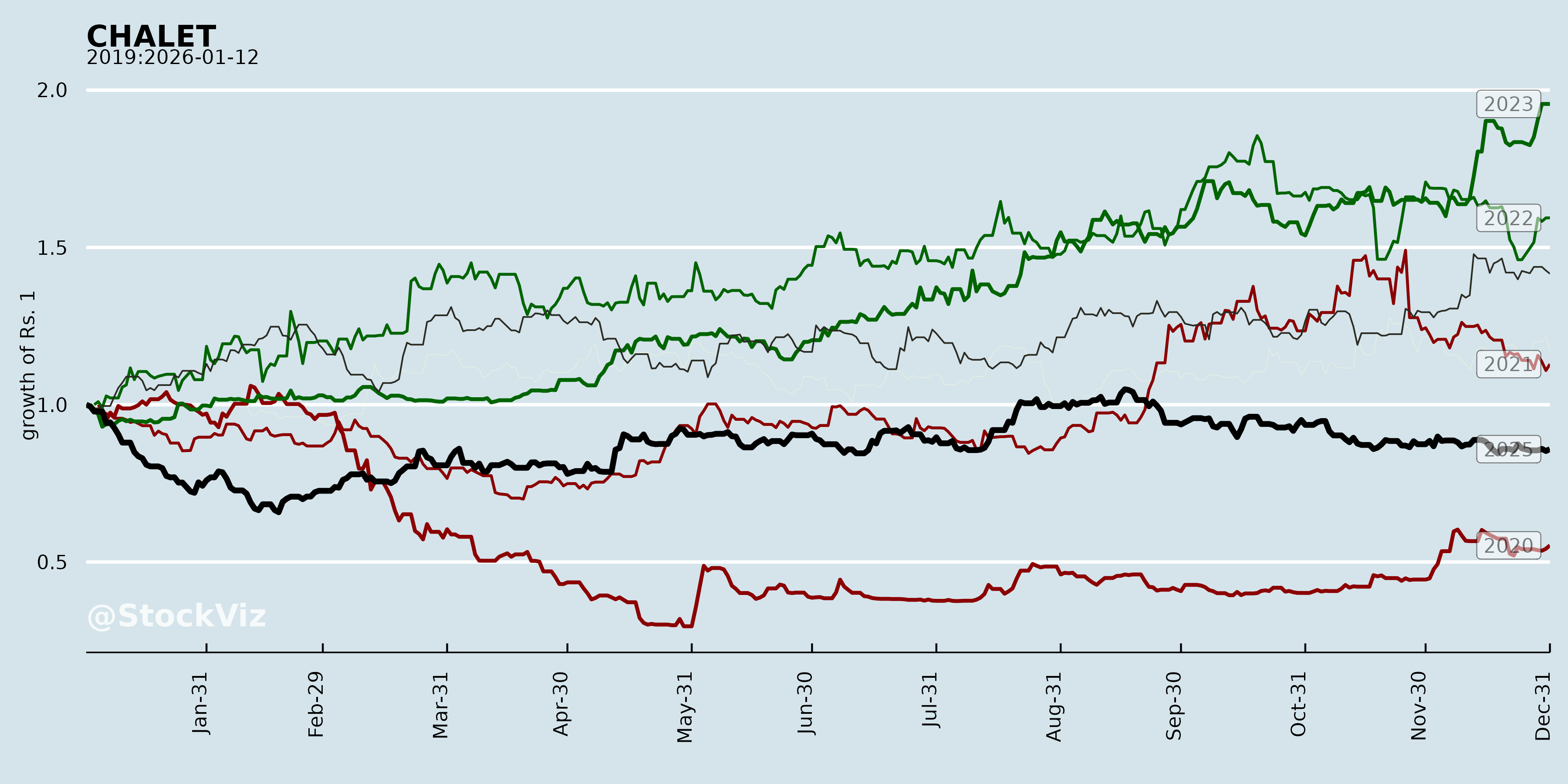

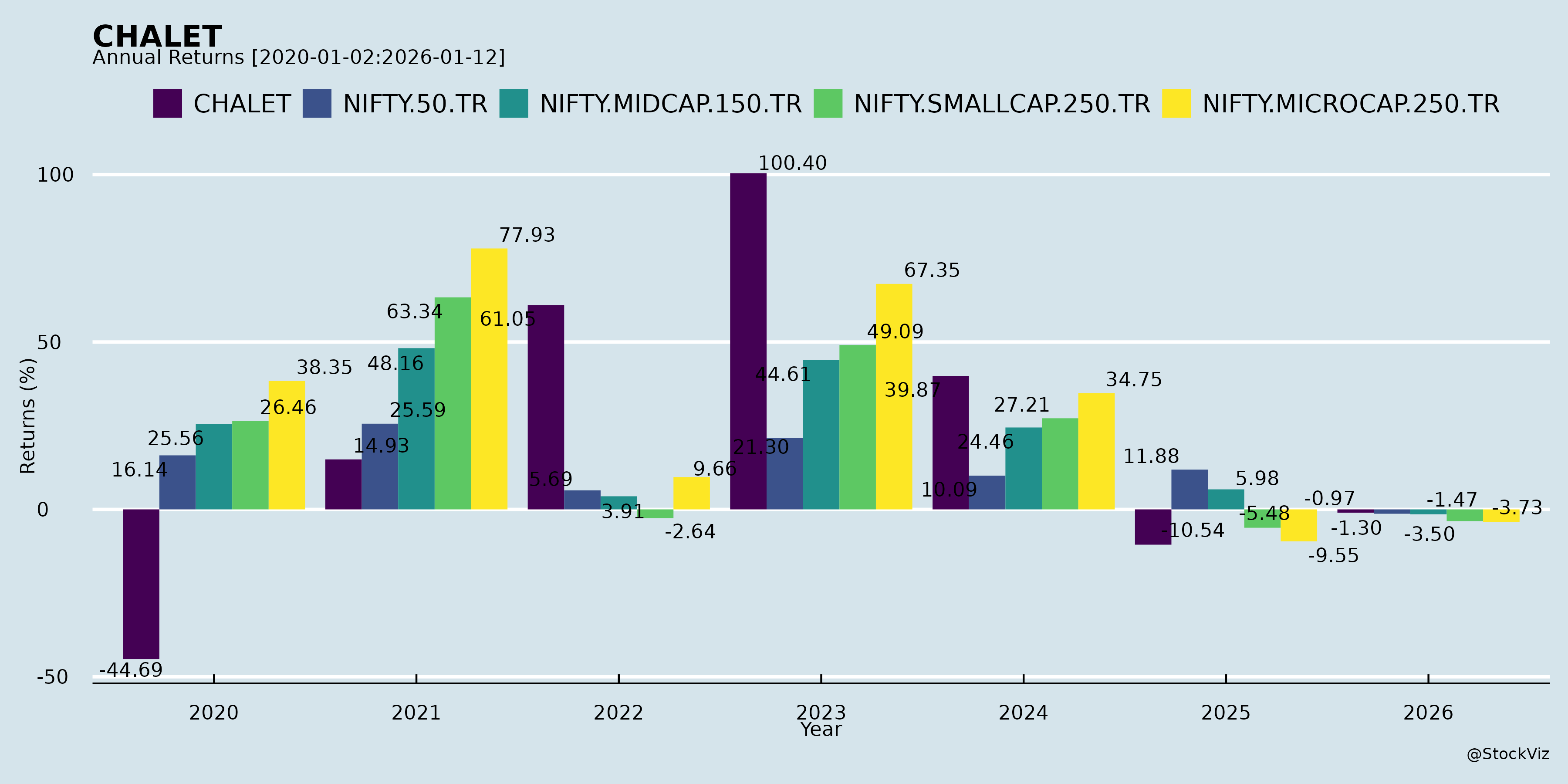

Annual Returns

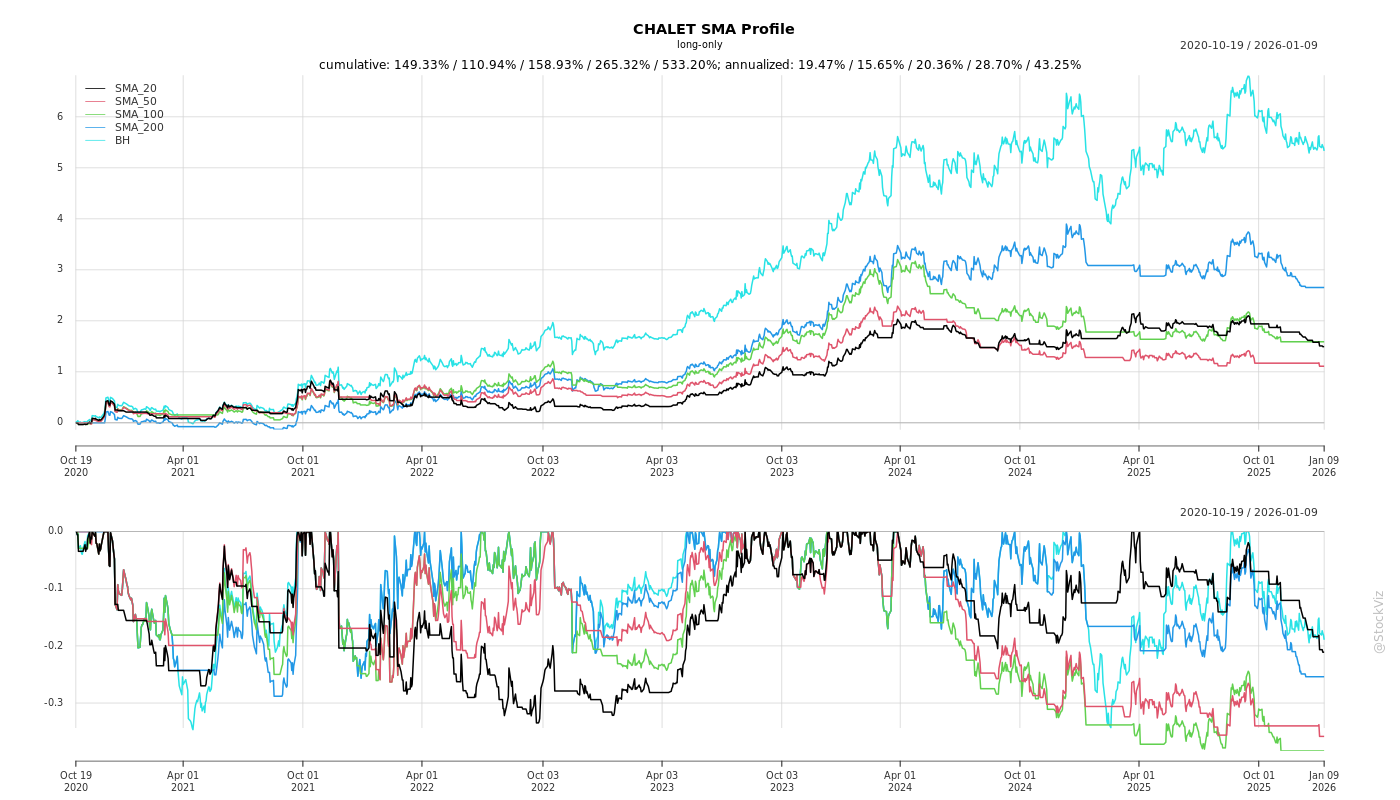

Cumulative Returns and Drawdowns

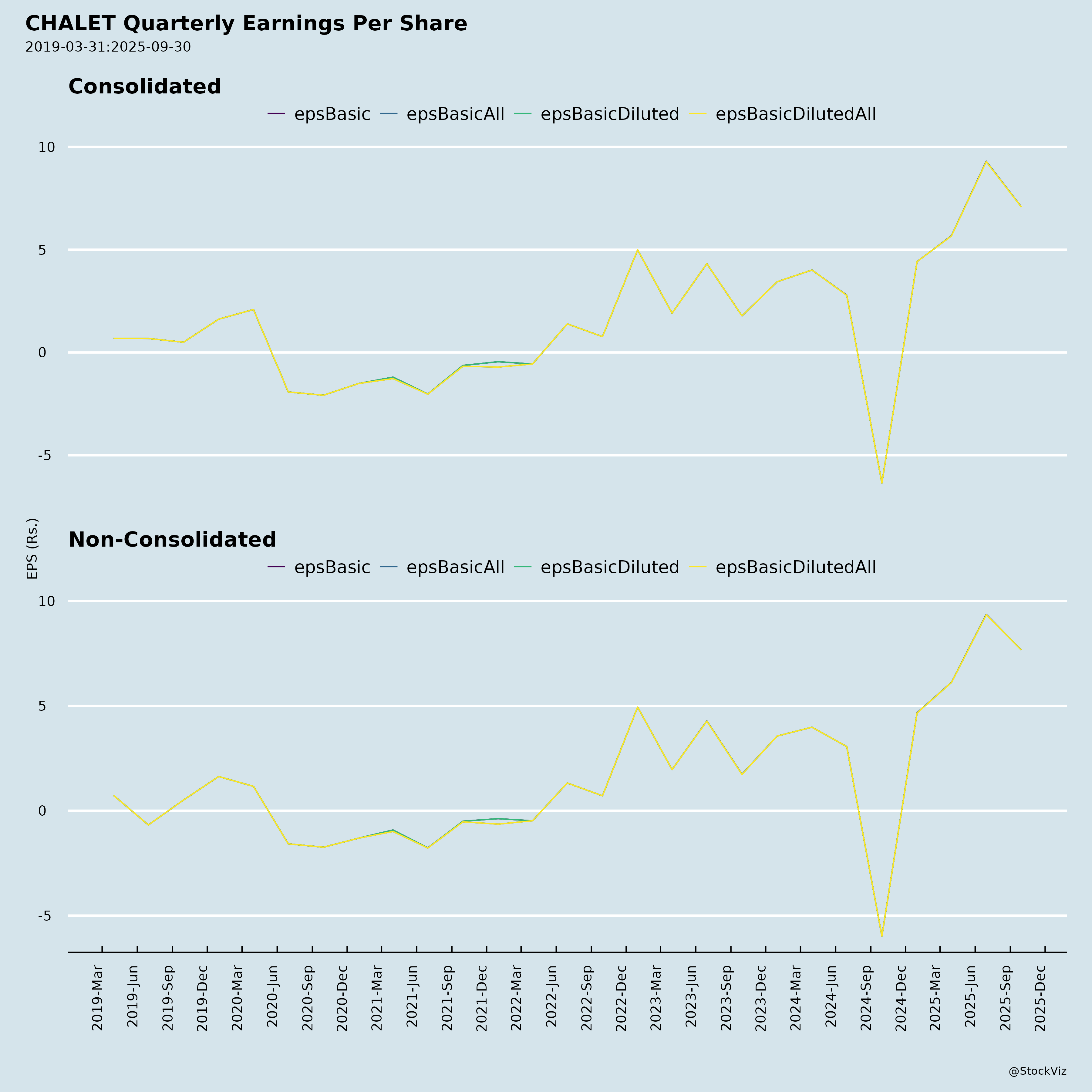

Fundamentals

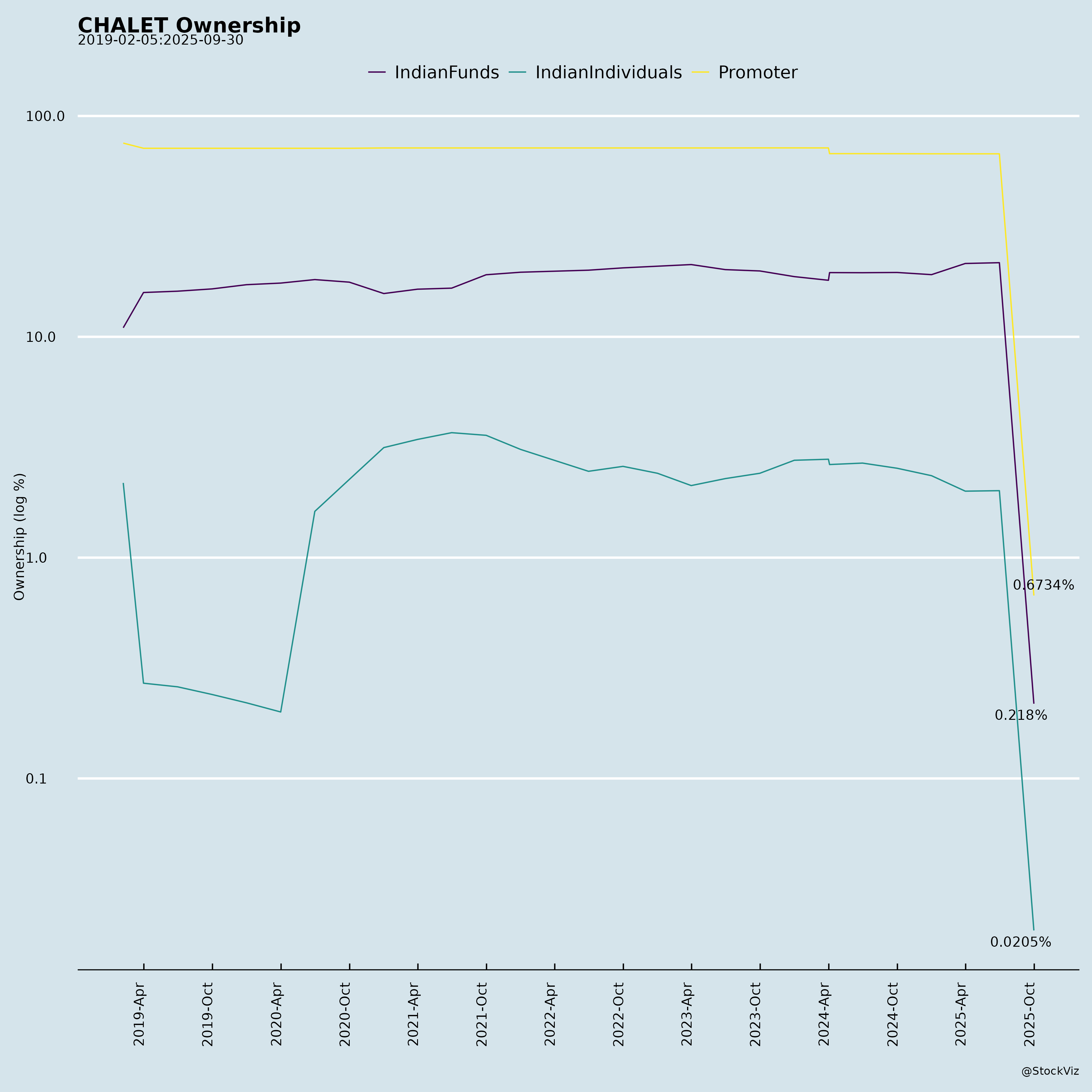

Ownership

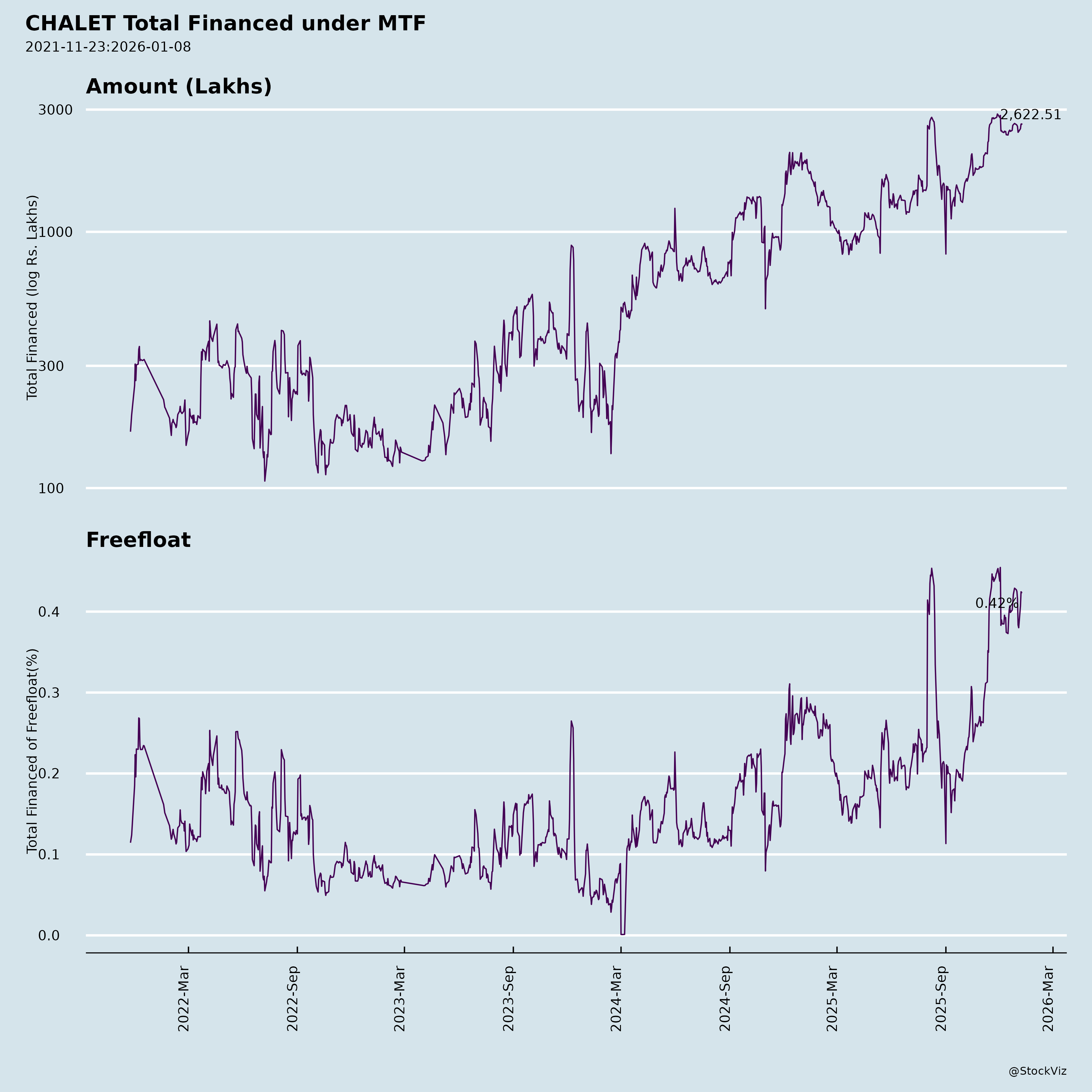

Margined

AI Summary

asof: 2025-12-03

Chalet Hotels Limited (CHALET) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

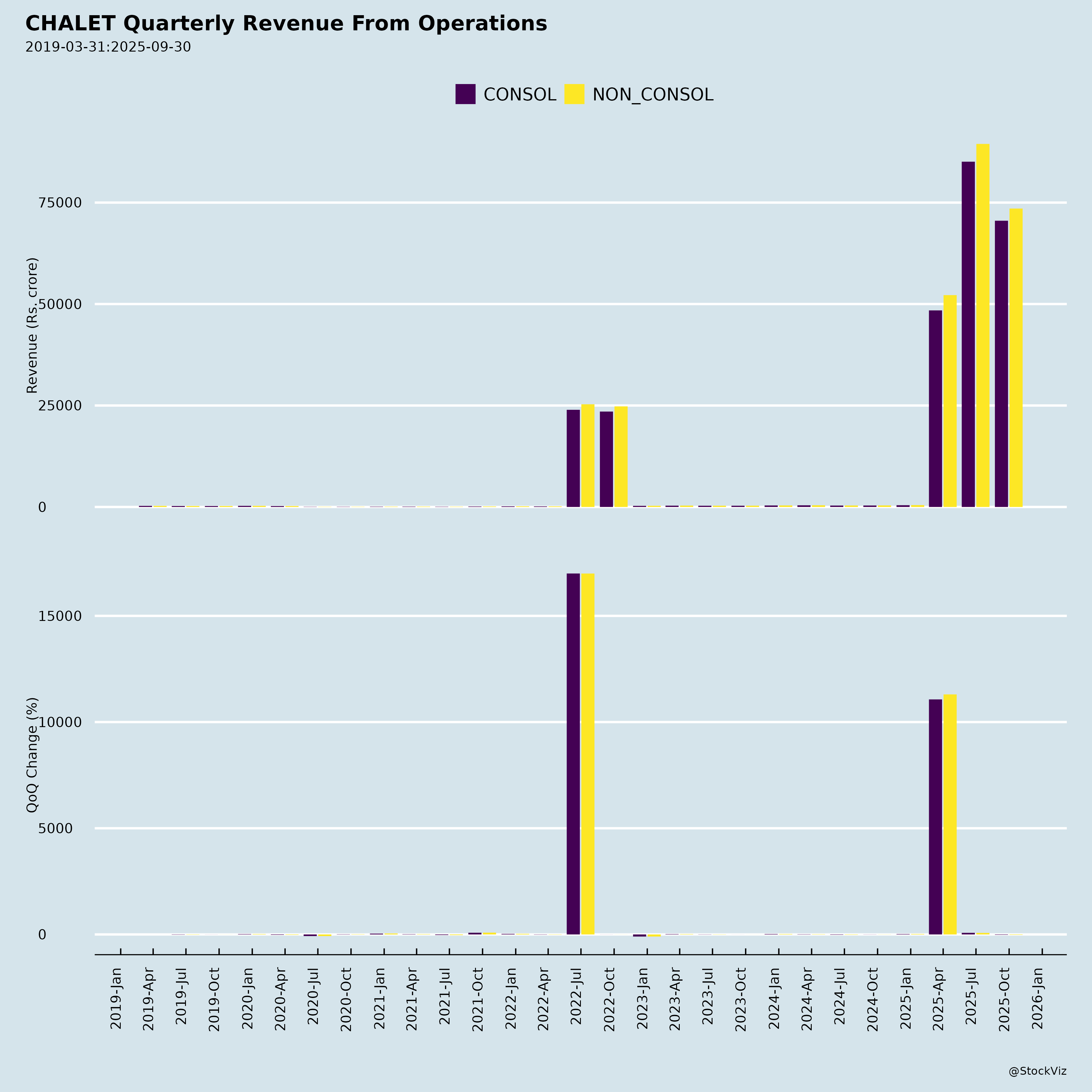

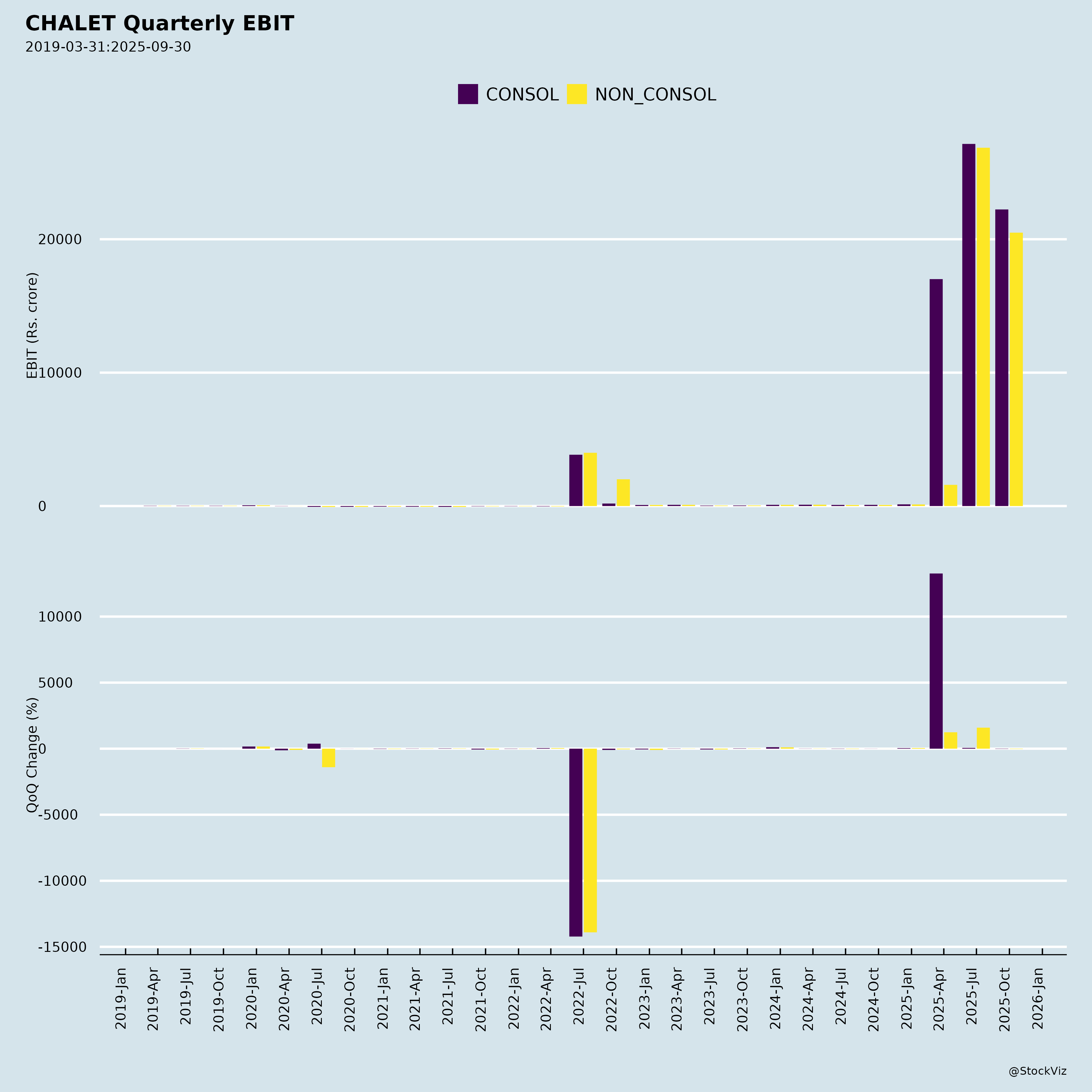

Chalet Hotels Limited (BSE: 542399, NSE: CHALET), part of K Raheja Corp, is a diversified hospitality player with ownership/operations in hotels (11 operational properties, ~3,389 keys), commercial real estate (CRE, 2.4 msf operational + 0.9 msf pipeline), and residential projects. Q2 FY26 (ended Sep 30, 2025) results show robust consolidated performance: Total Income ₹7.4 bn (+94% YoY), EBITDA ₹3.1 bn (+98% YoY, 41.4% margin), PAT ₹1.5 bn (vs. ₹1.4 bn loss YoY). Core hospitality revenue grew 13% YoY to ₹3.8 bn (RevPAR +5% at ₹8,115). Maiden interim dividend of ₹1/share (10%) declared. Below is a structured analysis based on filings (financial results, analyst presentation, disclosures).

Tailwinds (Positive Drivers)

- Strong Operational Metrics & Diversification: Hospitality EBITDA margins stable at ~40-44%; CRE annuity business at 82% margins (revenue +76% YoY). Residential project delivered ₹2.8 bn revenue in Q2, aiding overall growth.

- Financial Resilience: Net debt/EBITDA ~3.5x (comfortable); DSCR 2.2x, ISCR 6.8x. Internal cash flows from hotels cover debt servicing; QIP proceeds (₹10 bn in FY25) reduced leverage.

- Brand & Sustainability Edge: Launch of owned “ATHIVA” premium lifestyle brand (joy, wellness, sustainability focus; 6 hotels/900+ keys pipeline). First hospitality firm to meet EV100 (100% EV guest fleet); DJSI score 67 (6th globally in category); Great Place to Work certified.

- Asset Optimization: “Asset sweating” via F&B/banquets in hotels; CRE revenue covers debt costs.

- Shareholder Returns: Maiden dividend signals maturity and confidence.

Headwinds (Challenges)

- Quarterly Volatility: Q2 revenue -18% QoQ; occupancy dipped to 67% (-7 pp YoY) due to weather/geopolitical factors.

- Residential Normalization: High Q2 revenue (₹2.8 bn) from Bengaluru project handovers (55 flats); future quarters may see moderation as project nears completion.

- Cost Pressures: Employee/power costs up; finance costs ₹454 mn (elevated debt at ₹24.4 bn net).

- Macro Sensitivity: Hospitality cyclicality; prior deferred tax hit (₹2 bn reversal in Q2 FY25 due to Finance Act changes).

- Margin Compression: Hospitality margins -1.4 pp YoY to 40% amid competitive pricing.

Growth Prospects

- Robust Pipeline: 1,180 keys + 0.9 msf CRE under development (e.g., Taj Delhi Airport ~385 keys H1 FY27; Athiva Goa resorts FY28; Hyatt Airoli ~280 keys; Cignus Powai Tower II). Expands to 10 cities from 7.

- ATHIVA Scalability: Owned brand for leisure/premium segments; leverages group land bank/development expertise.

- CRE Expansion: From 2.4 msf to 3.3 msf; annuity-like high-margin revenue.

- Organic/M&A: Greenfield/brownfield strategy (e.g., recent acquisitions like Westin Himalayas); group opportunities in key cities.

- Projections: Historical CAGRs (revenue 22%, EBITDA 24% FY23-25); pipeline adds ~35% to keys. Management eyes superior RevPAR/outperformance via execution.

| Segment | Current | Pipeline | Potential Upside |

|---|---|---|---|

| Hotels | 3,389 keys | +1,180 keys | +35% capacity |

| CRE | 2.4 msf | +0.9 msf | High-margin annuities |

| ATHIVA | 1 operational | 5 upcoming (900+ keys) | Brand scalability |

Key Risks

- Litigation (High Impact): Vashi (Navi Mumbai) land dispute (Four Points hotel, ₹438 mn PPE + ₹46 mn prepayments). Supreme Court status quo (Oct 2025 update: converted to Civil Appeals); potential demolition if CIDCO prevails. Management: “No material loss expected,” but unresolved.

- Debt & Liquidity: Gross debt ~₹24 bn; refinancing/reflow risks amid rate cycles. CP issuance (₹1 bn, A1+ rated) adds short-term exposure.

- Execution/External: Pipeline delays (e.g., construction/infra); hospitality demand volatility (e.g., occupancy dips); competition from branded chains.

- Regulatory/Tax: TDS/dividend compliance; deferred tax volatility (e.g., FY25 Finance Act impact). Pending NCLT scheme for subsidiaries.

- Concentration: Heavy Mumbai reliance (~45% keys); residential one-off revenue.

Summary

Bull Case (Buy/Accumulate): CHALET is a growth story with diversified high-margin assets (hotels + CRE annuities), strong pipeline (35%+ capacity addition), and owned brand ATHIVA positioning it for premium/leisure boom. Q2 results validate execution amid headwinds; dividend enhances appeal. Target upside from RevPAR recovery (historical outperformance) and pipeline monetization. Valuation: Trades at reasonable multiples given 20%+ revenue CAGR potential.

Bear Case (Caution): Litigation overhang (Vashi), debt burden, and post-residential normalization could pressure FY26 growth. Occupancy/RevPAR softness signals macro risks.

Overall Outlook: Positive (Tailwinds > Headwinds); monitor Supreme Court (Vashi) and Q3 occupancy. FY26 guidance intact: Core growth 15-20%+, pipeline delivery key. Recommended for long-term investors in Indian hospitality recovery.

Data as of Nov 4, 2025 filings; stock price/reaction post-results not analyzed.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.