BLUESTARCO

Equity Metrics

January 13, 2026

Blue Star Limited

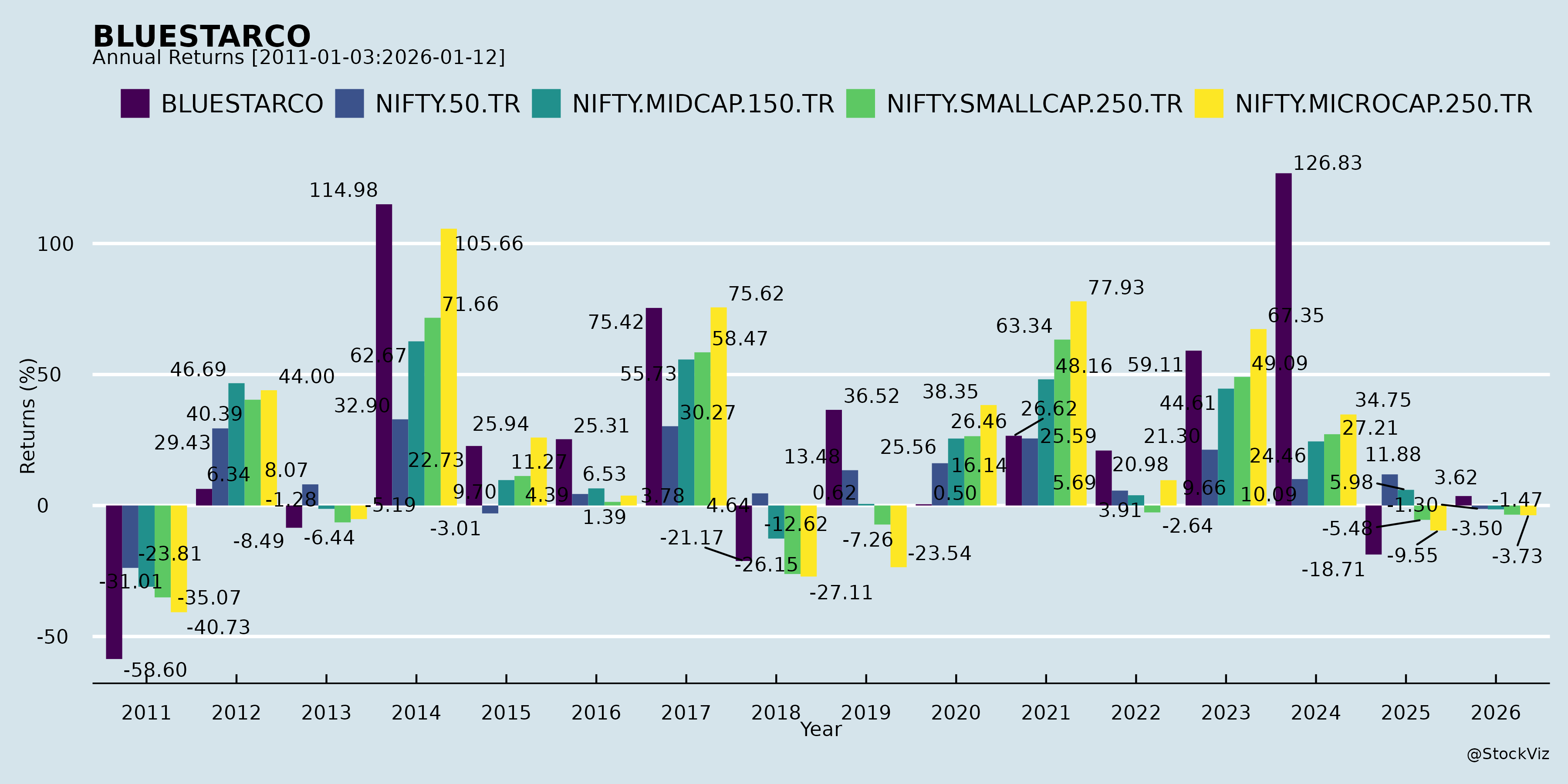

Annual Returns

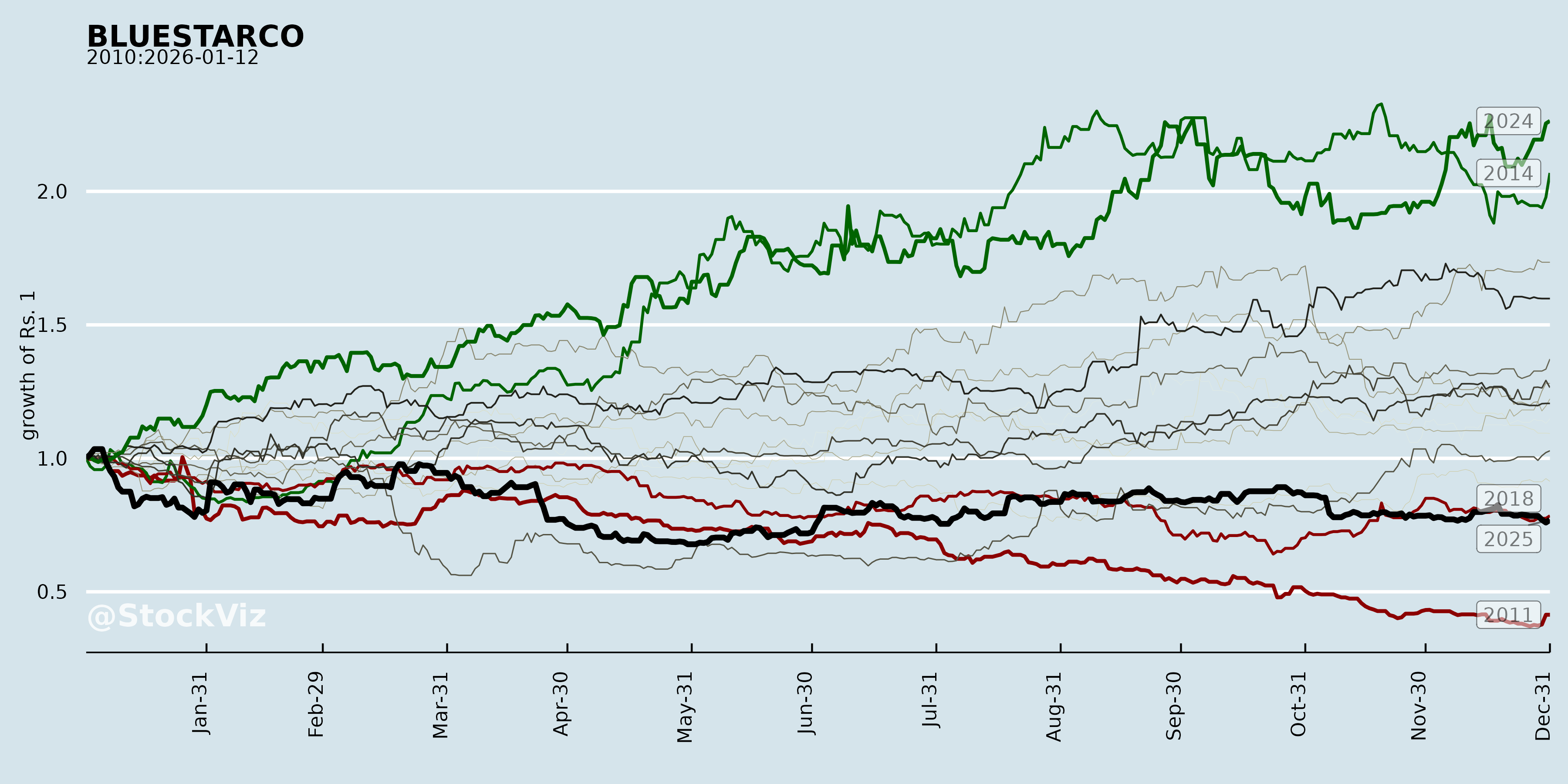

Cumulative Returns and Drawdowns

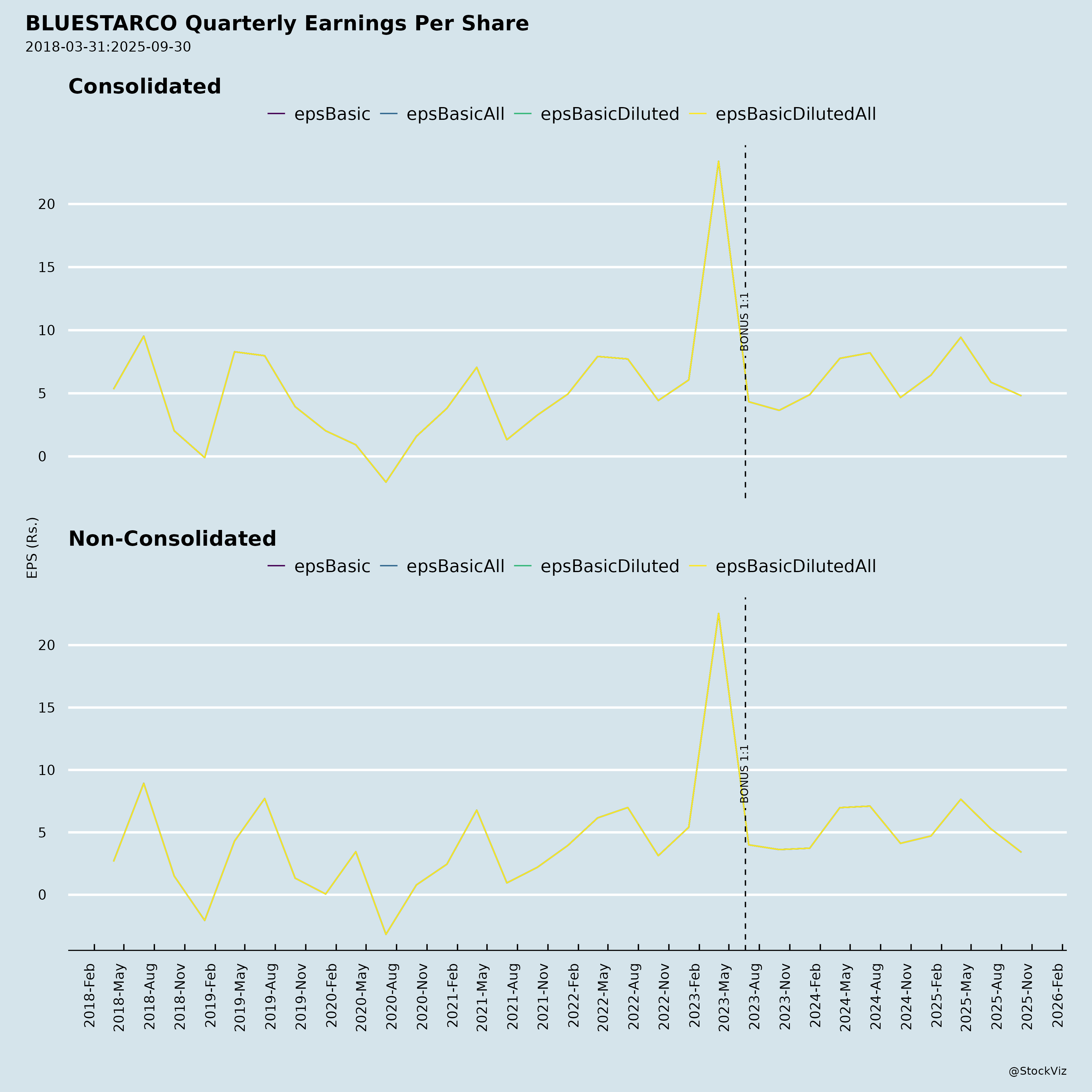

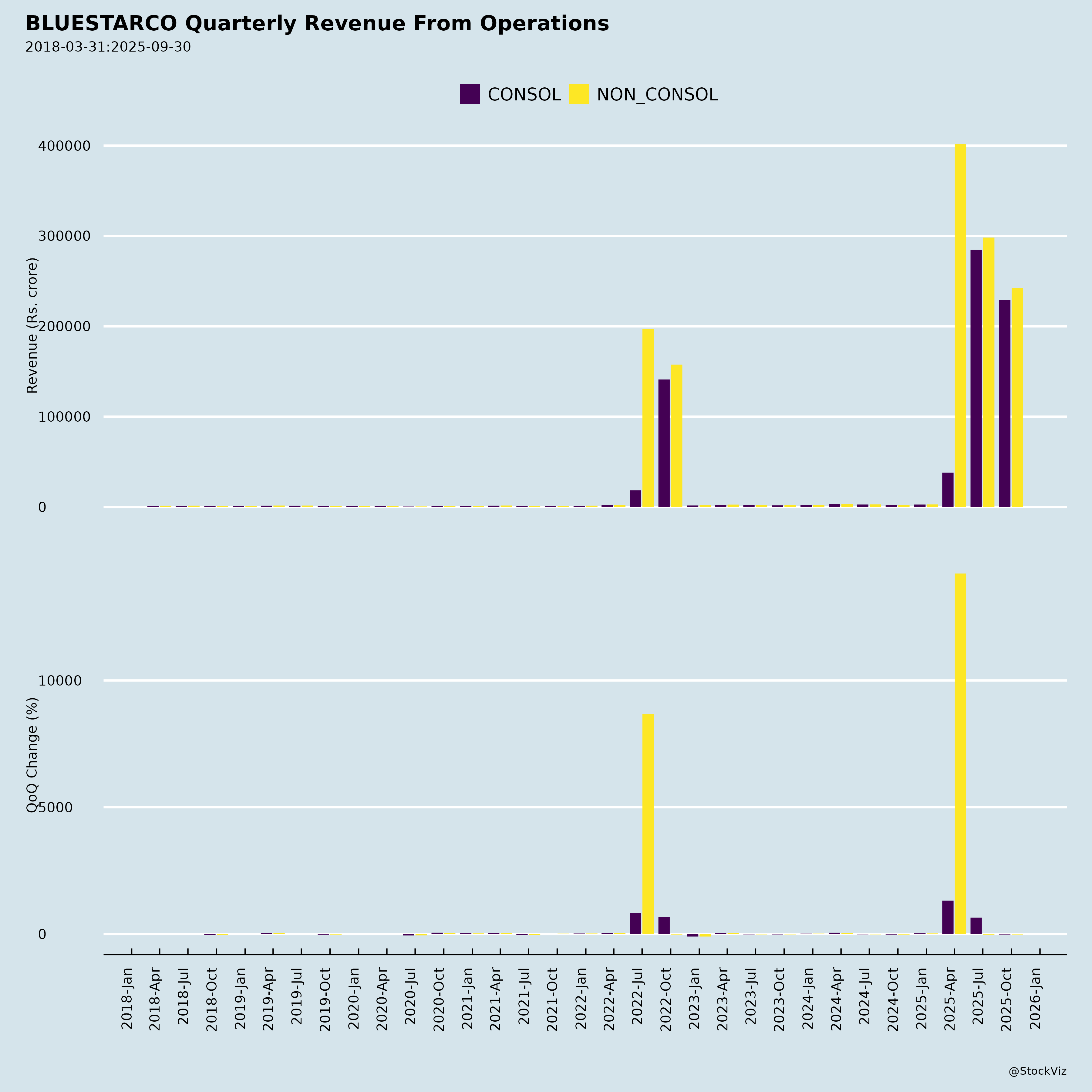

Fundamentals

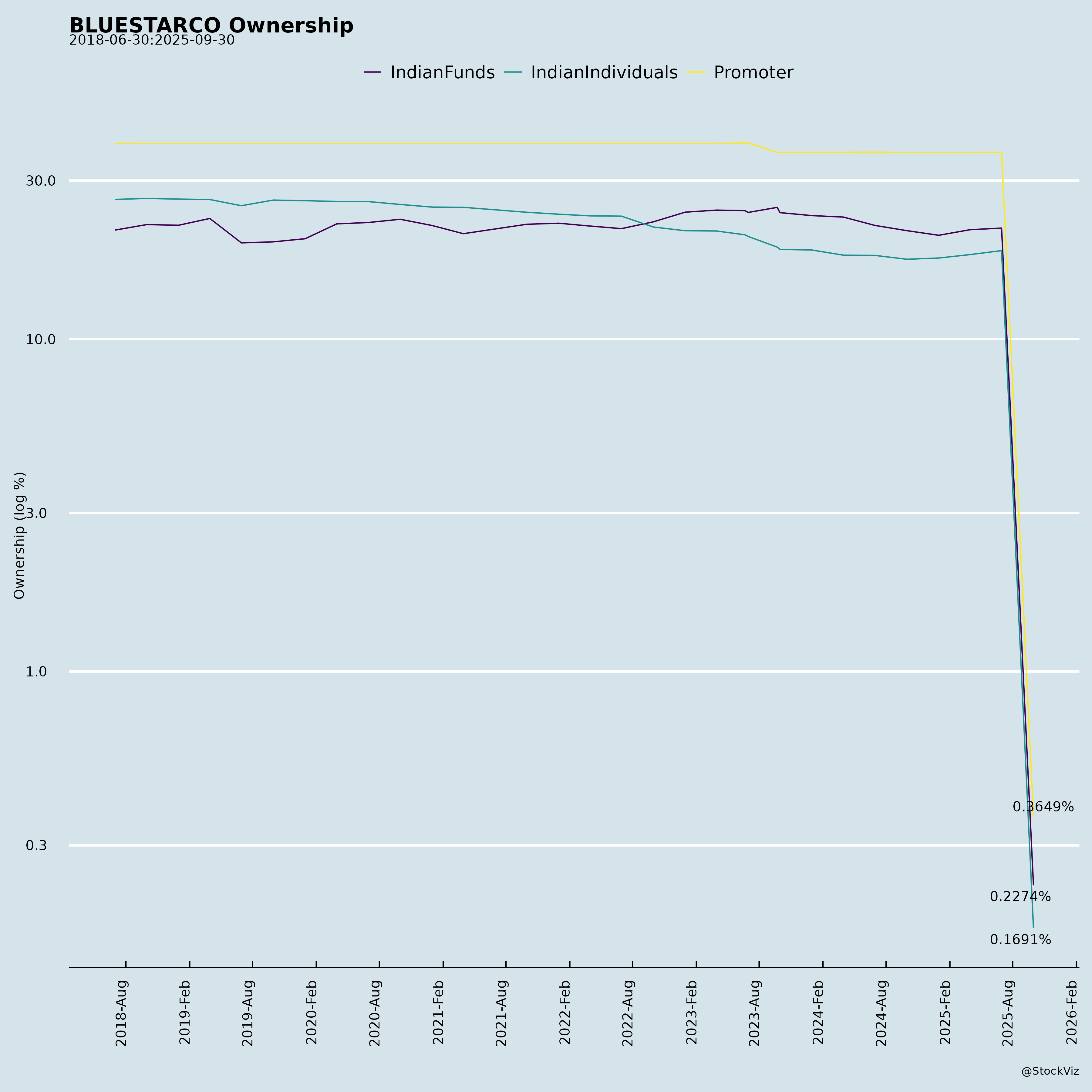

Ownership

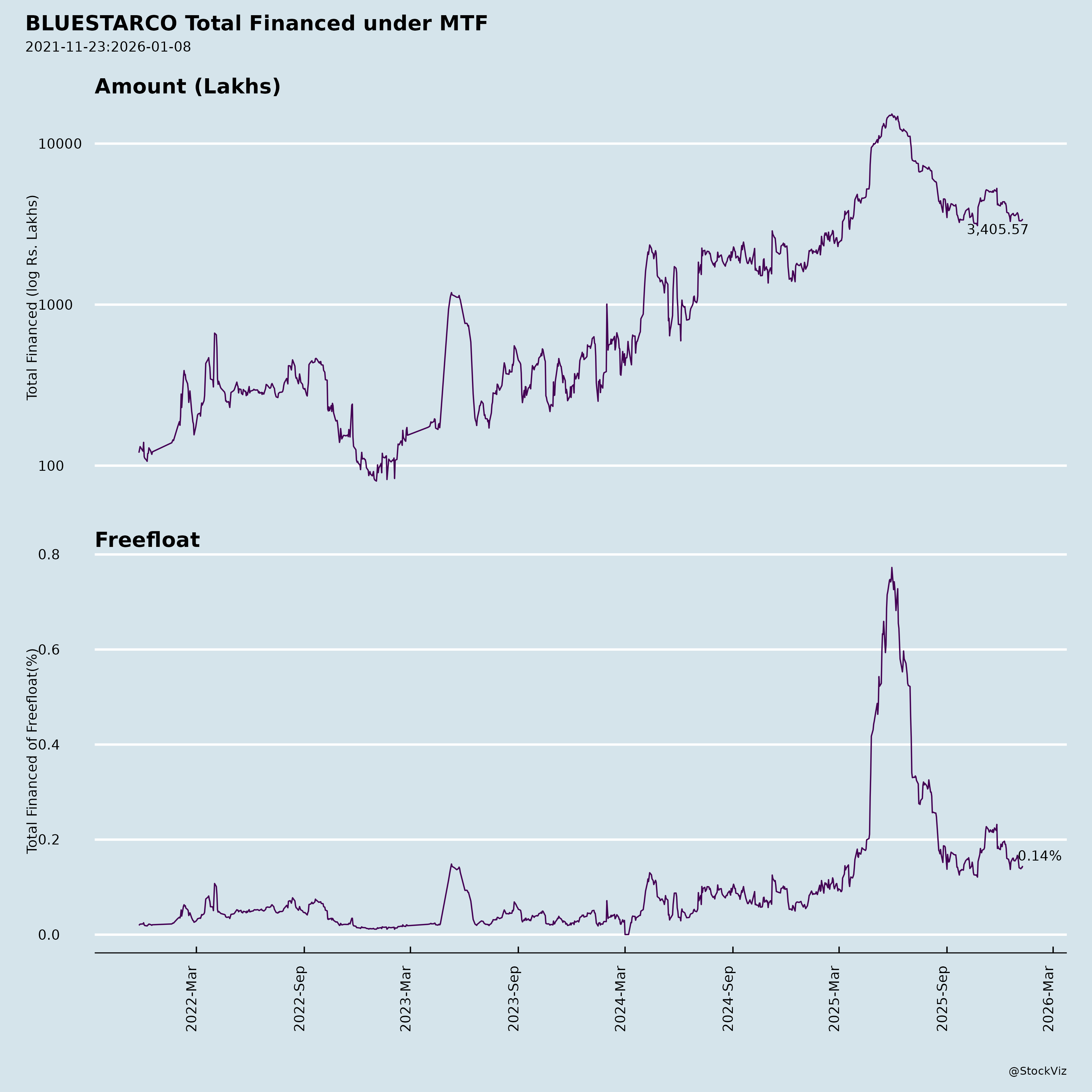

Margined

AI Summary

asof: 2025-12-03

Blue Star Limited (BLUESTARCO) - Q2 & H1 FY26 Analysis

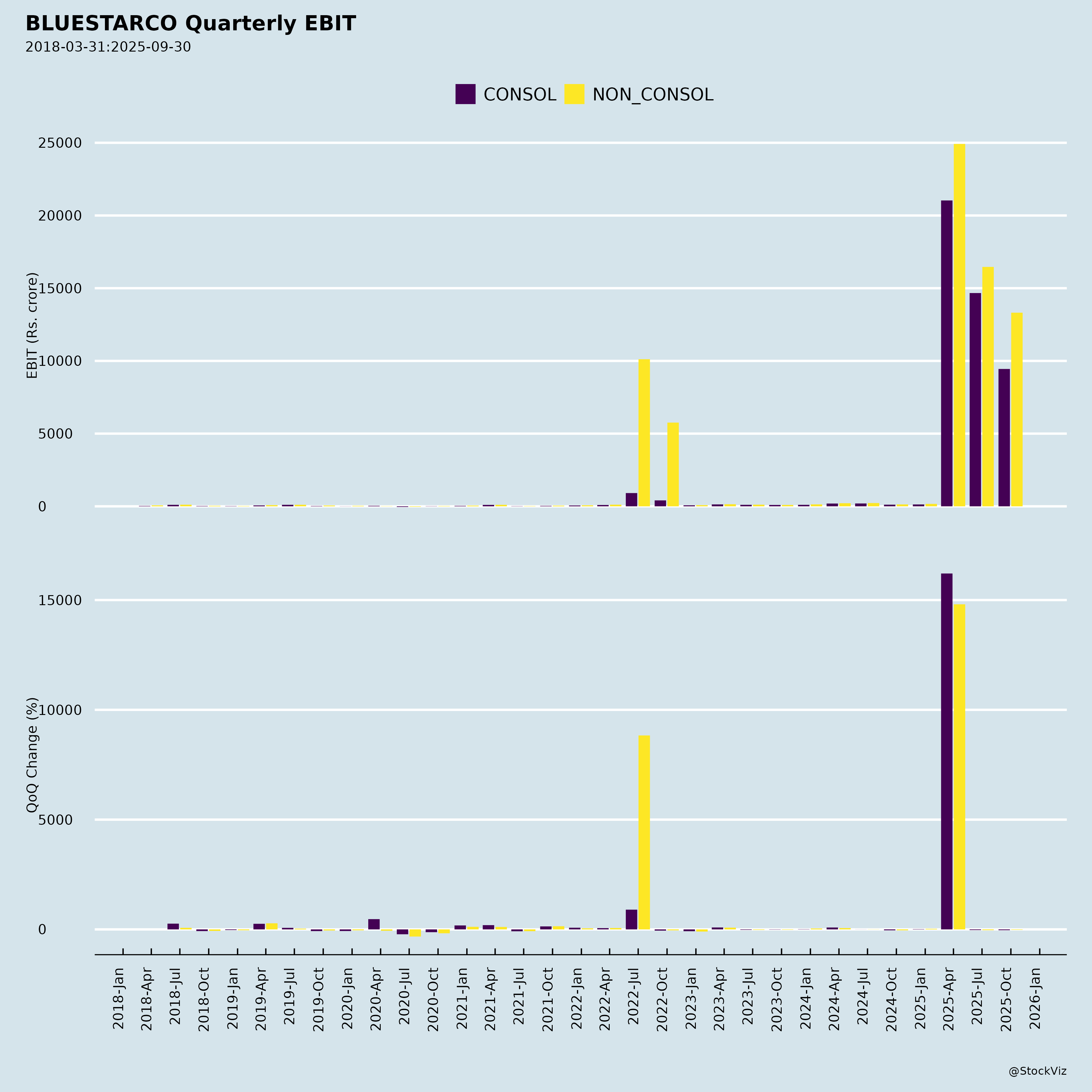

Blue Star Limited, a leading Indian air conditioning and refrigeration company, reported modest consolidated revenue growth of 6.4% YoY to ₹2,422 cr in Q2 FY26 (H1: +5.1% to ₹5,405 cr), amid weather disruptions and GST-related deferrals. EBITDA margins improved to 7.6% (+110 bps YoY) in Q2, driven by Segment 1 strength, though PAT grew only 2.8% YoY to ₹99 cr (H1 PAT -17% to ₹220 cr). Order book stands at ₹7,120 cr (+7.9% YoY). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, derived from the earnings call transcript, financial results, investor presentation, and press release.

Headwinds (Near-Term Challenges)

- Weather Disruptions: Extended monsoon/rains across India led to weak secondary sales in Room AC (-12% vs. industry -17% in Q2) and Commercial Refrigeration. Festival season post-Diwali remained dull despite GST cuts.

- GST Rate Rationalization: Announcement (Aug 15, effective Sep 22) deferred Room AC and Commercial AC demand, causing a mid-quarter lull.

- High Inventory Levels: ~65 days of sales (company + channel; ideal: 45 days), vs. 34 days last year. Industry levels higher, risking liquidation pressure and margin erosion in H2.

- Segment-Specific Weakness: | Segment | Q2 Revenue Growth | Margin Impact | |———|——————-|—————| | Unitary Products (Room AC + Refrig.) | -9.5% | 6.2% (-80 bps) | | Professional Electronics & Industrial | -20.1% | Improved to 9.6% (expense cuts) |

- Projects Slowdown: Muted order inflows/finalizations; infra projects (e.g., metro, railways) execution delays. EMP order book -3.9% YoY to ₹4,840 cr.

- Balance Sheet Strain: Shift to net debt of ₹417 cr (from net cash ₹185 cr YoY); inventory up, capex ongoing, working capital days elevated (inventory turnover: 118 days).

Tailwinds (Supportive Factors)

- Segment 1 Resilience: Electro-Mechanical Projects + Commercial AC revenue +16.5% to ₹1,664 cr; margins at 8.8% (+50 bps) due to favorable mix (data centers/manufacturing > infra).

- Margin Discipline: Overall EBITDA +22.8% YoY; cost controls (e.g., ad spends, manufacturing efficiencies) protected Unitary margins QoQ.

- Market Share Gains: Room AC de-growth milder than industry (H1: BS -10% vs. industry -15%). Leadership in ducted systems, scroll chillers; top-3 in VRF/screw chillers.

- Order Book Strength: Total +7.9% YoY; billing growth from execution.

- International Momentum: US supplies scaled in H1; product approvals for US/Europe.

- Policy Benefits: GST cuts on food products to boost refrigeration; energy label change (Jan 1, 2026) expected to drive pre-summer inventory liquidation.

Growth Prospects

- Short-Term (H2 FY26): Flat to low-single digit overall growth (prior guidance +5% toned down). Room AC: 35% secondary sales surge Sep 22-Diwali, but H2 hinges on inventory drawdown, early summer, and label change (possible -15% to 0% risk). Commercial AC/Refrig.: Revival expected. Projects: Steady execution.

- Medium-Term (FY26-FY27): | Business | Guidance | |———-|———-| | Room AC | Flat FY26; 15% MS by FY27; 15-19% CAGR (FY25-30) | | Commercial AC | 12% CAGR (shops, Tier 2/3, hospitals) | | Projects | 10-15% (data centers, manufacturing; selective infra) | | Overall | >Industry (15%+ CAGR past 3-5 yrs); BS outperformance via share gains.

- Long-Term Drivers: Data centers (MEP leadership, chiller dev.), manufacturing capex, infra revival, international expansion (US trade deal), IoT/energy-efficient products, new launches for Summer 2026.

Key Risks

- Weather & Seasonality: High dependence on summer (80% Room AC sales); ongoing rains could worsen H2.

- Inventory/Margin Pressure: High channel stock may force discounts pre-label change; guidance: 7-7.5% for Unitary/EMP margins.

- Execution Delays: Infra projects slowing headroom for new orders.

- Regulatory/Policy: MedTech uncertainties; energy label/refrigerant shifts.

- Liquidity/Capex: Net debt up (capex for digitalization/reliability); DSCR healthy but monitor if sales miss.

- Macro: Muted private capex enquiries; competition in growing AC market (CAGR 15-19%).

- Forex/Trade: US tariff risks for exports.

Summary

Blue Star demonstrated resilience with Segment 1 driving growth (+16.5%) and margins amid weather/GST headwinds hammering Unitary Products (-9.5%). Tailwinds like market share gains, strong order book, and policy boosts (GST, labels) support H2 recovery and 10-15% medium-term CAGR, targeting faster-than-industry growth. However, elevated inventory/debt and weather risks cap FY26 to flat/low growth, with margins at risk (guidance: 7-7.5%). Buy/Hold for long-term players; monitor H2 inventory liquidation and summer outlook. ROCE dipped to 4.0% (H1), but balance sheet remains manageable (D/E 0.27).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.