Household Appliances

Industry Metrics

January 13, 2026

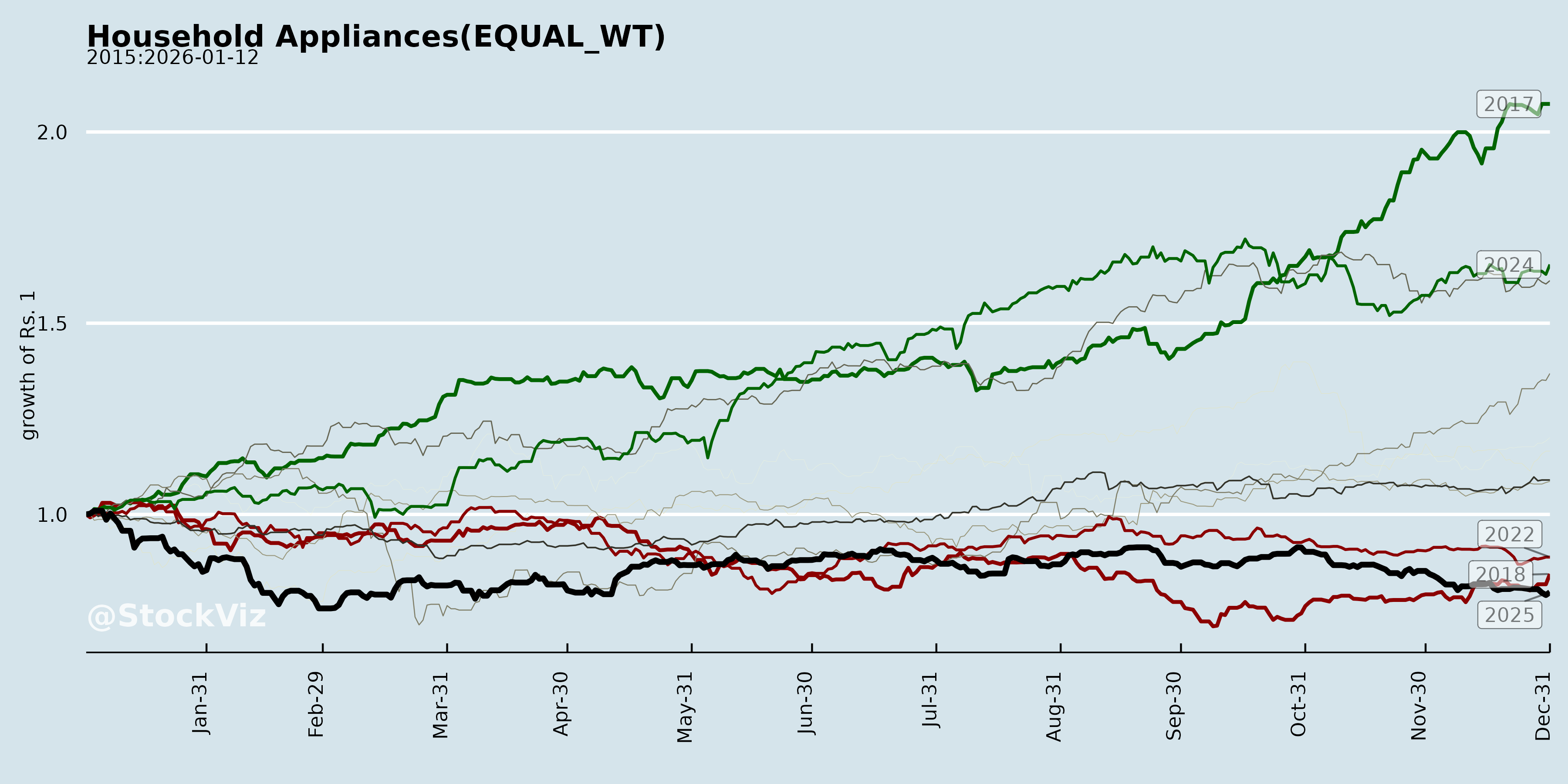

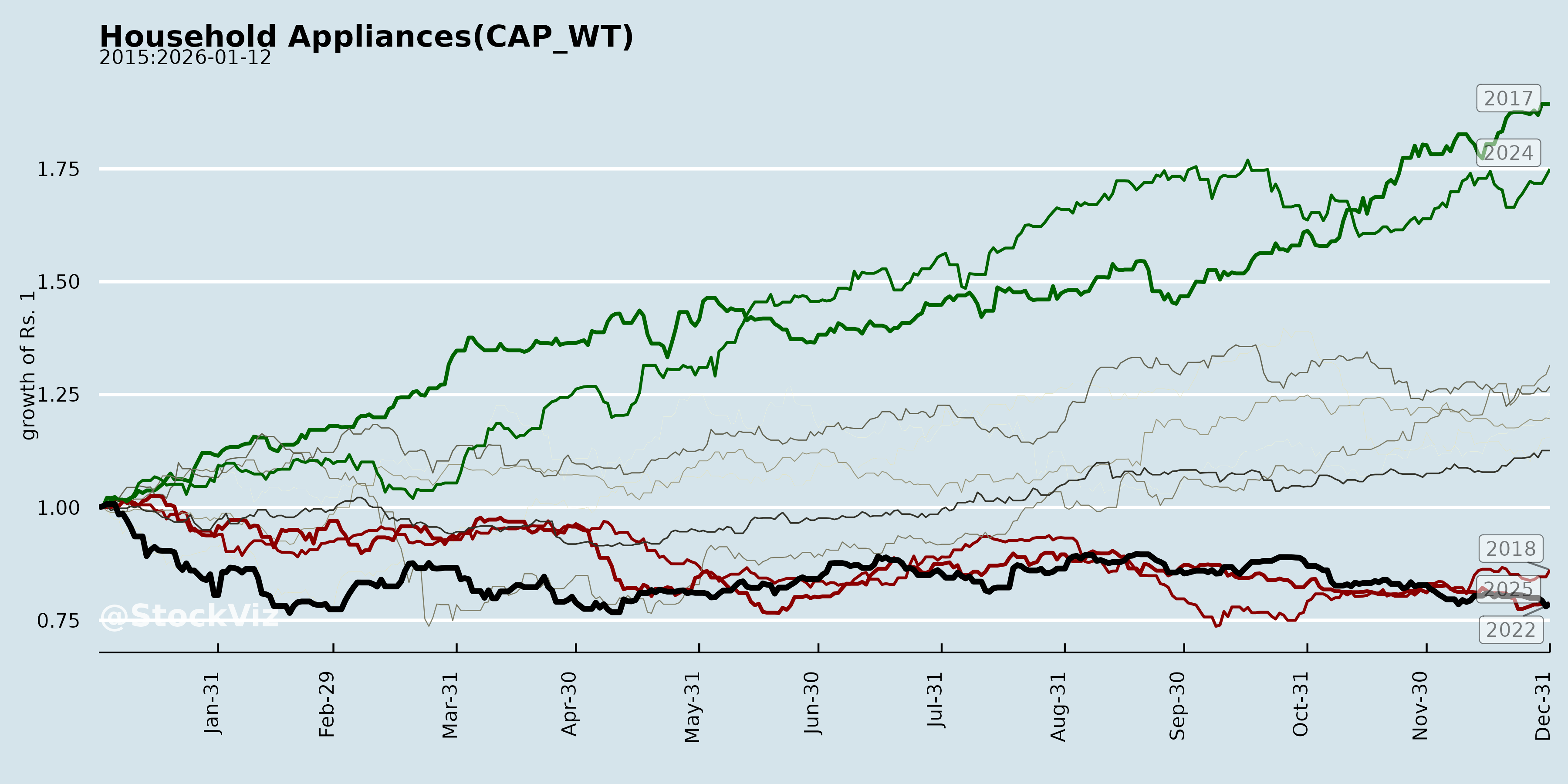

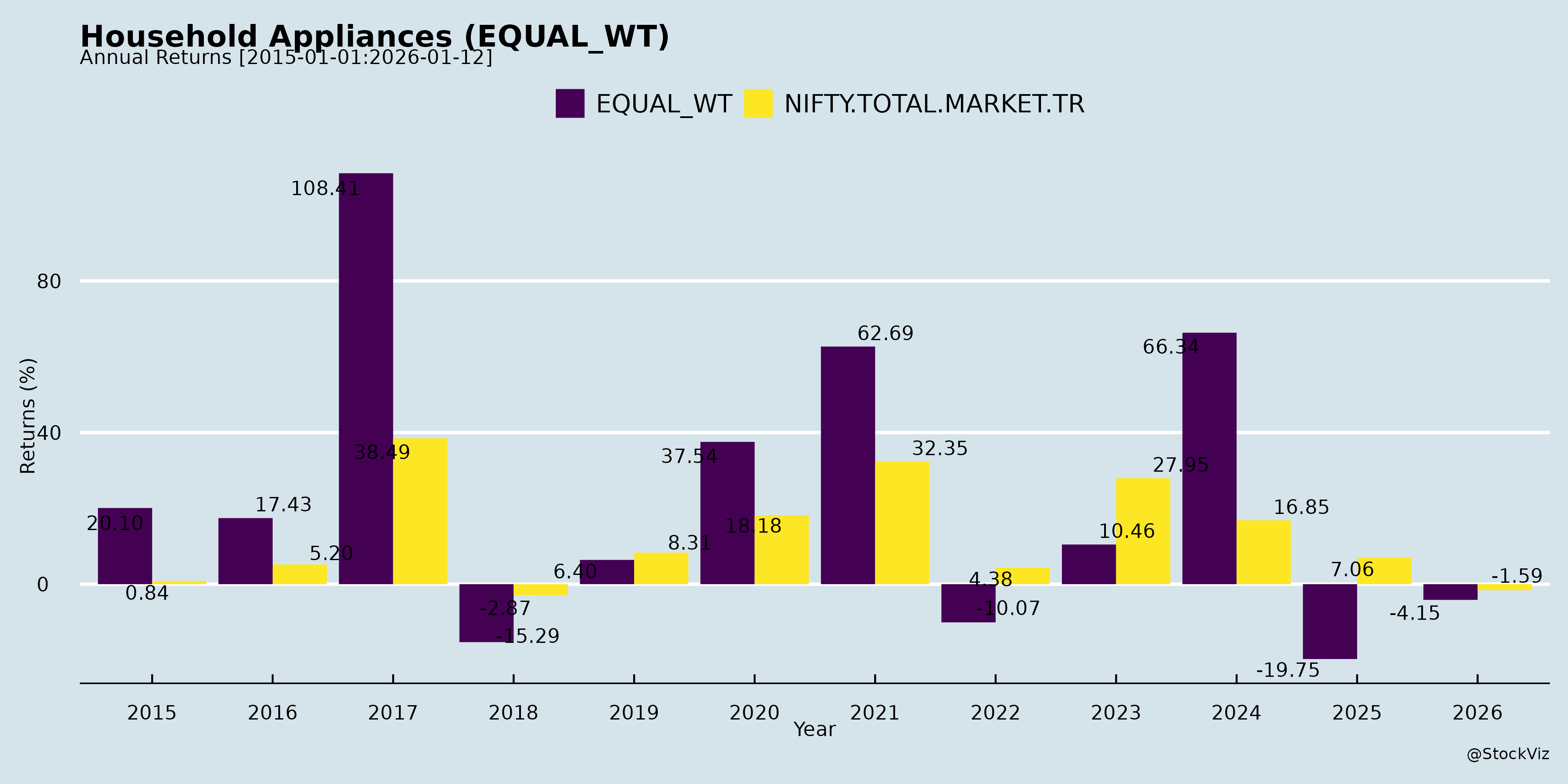

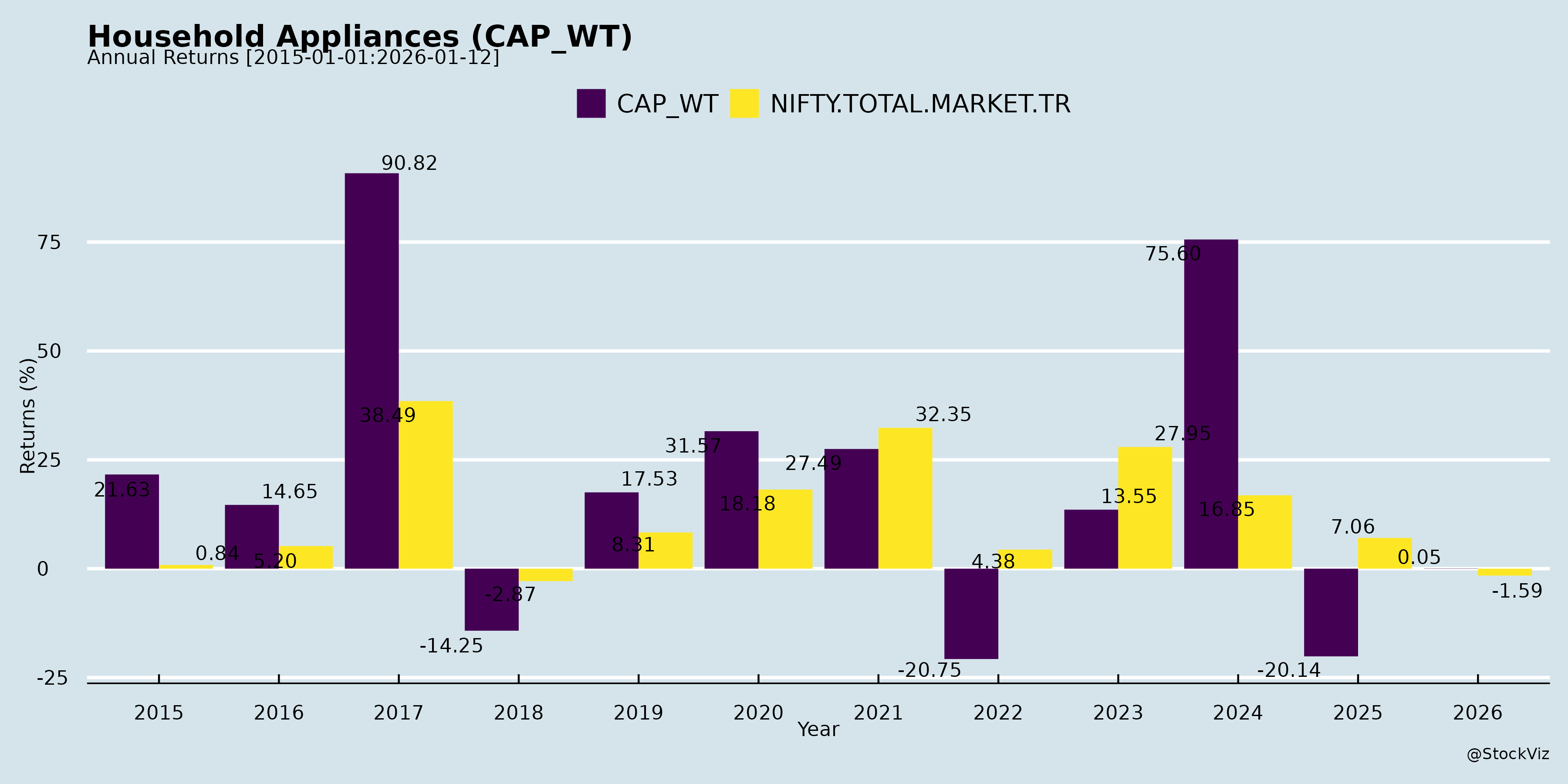

Annual Returns

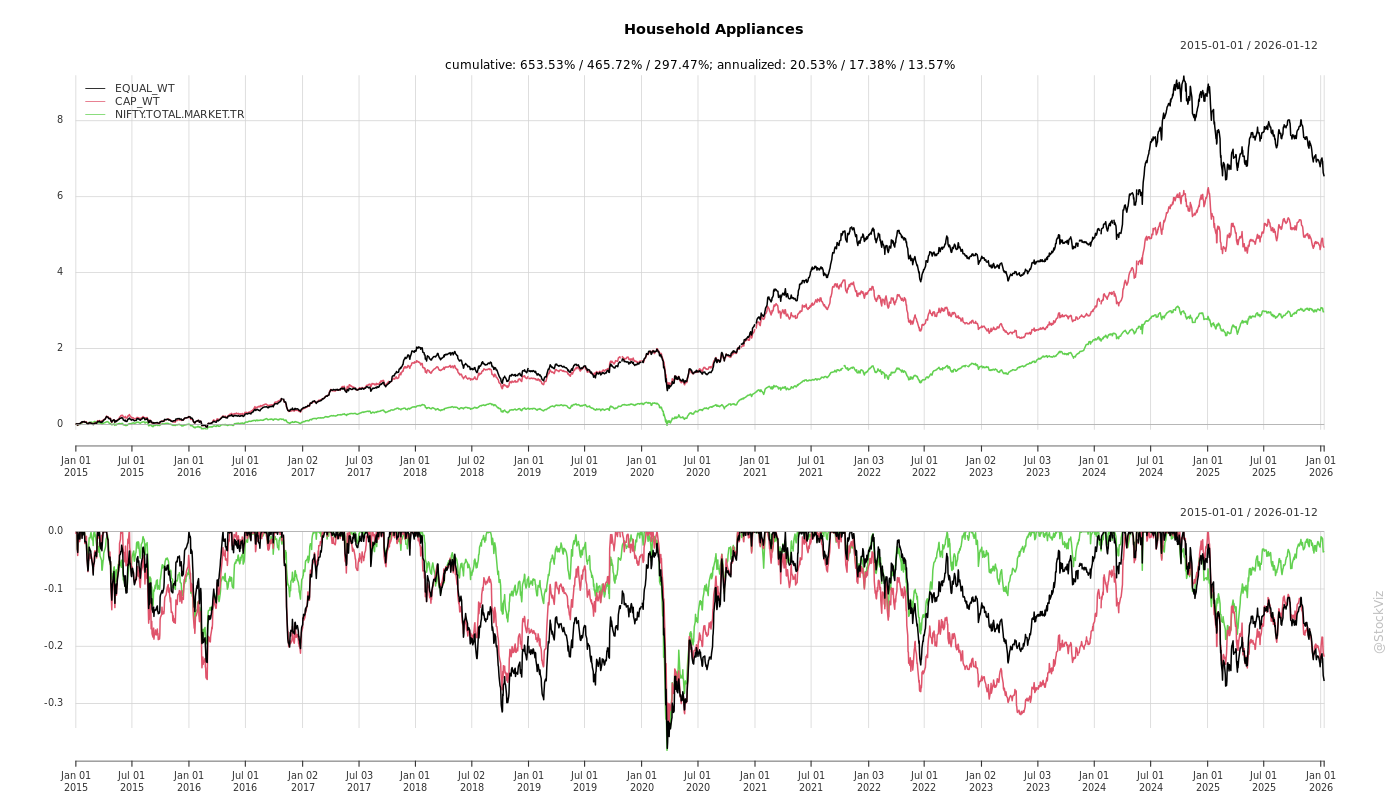

Cumulative Returns and Drawdowns

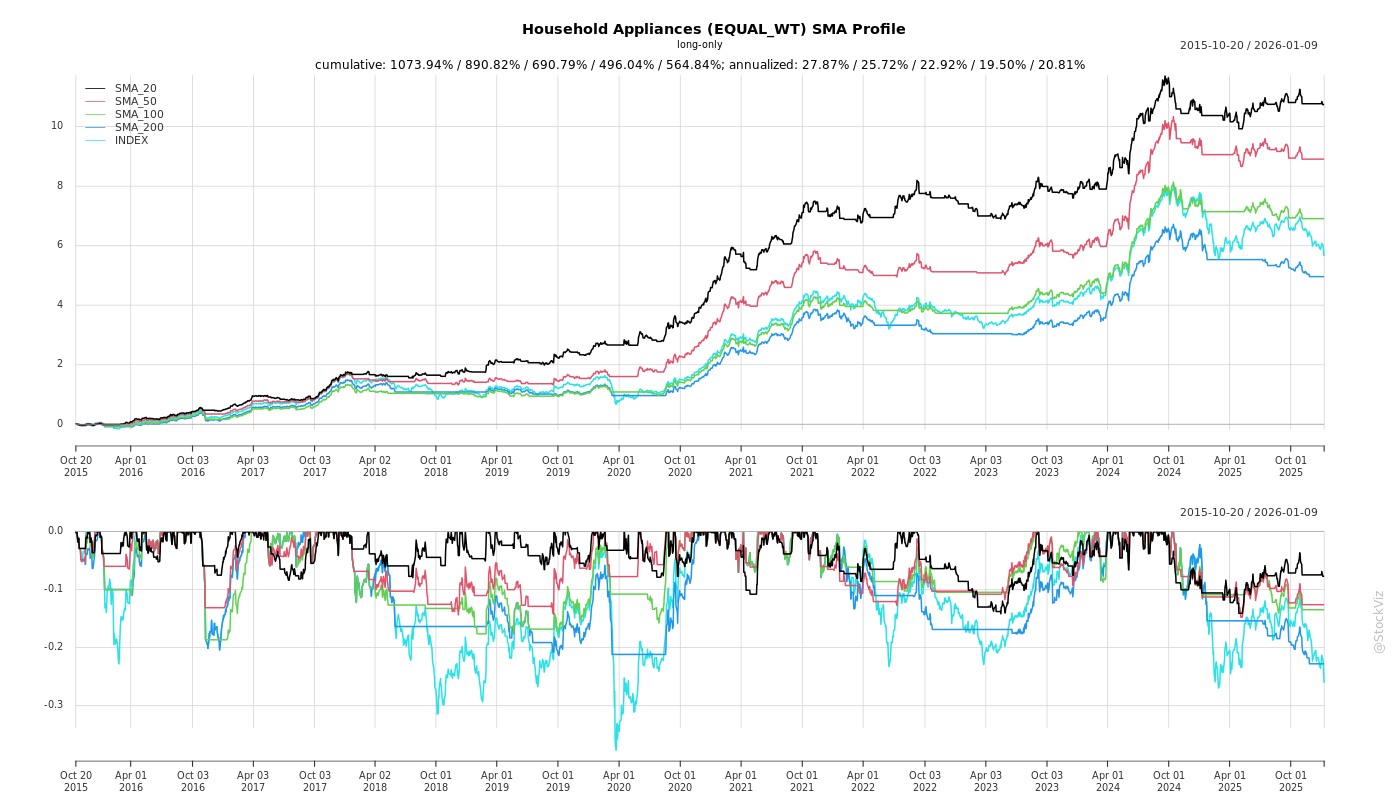

SMA Scenarios

Current Distance from SMA

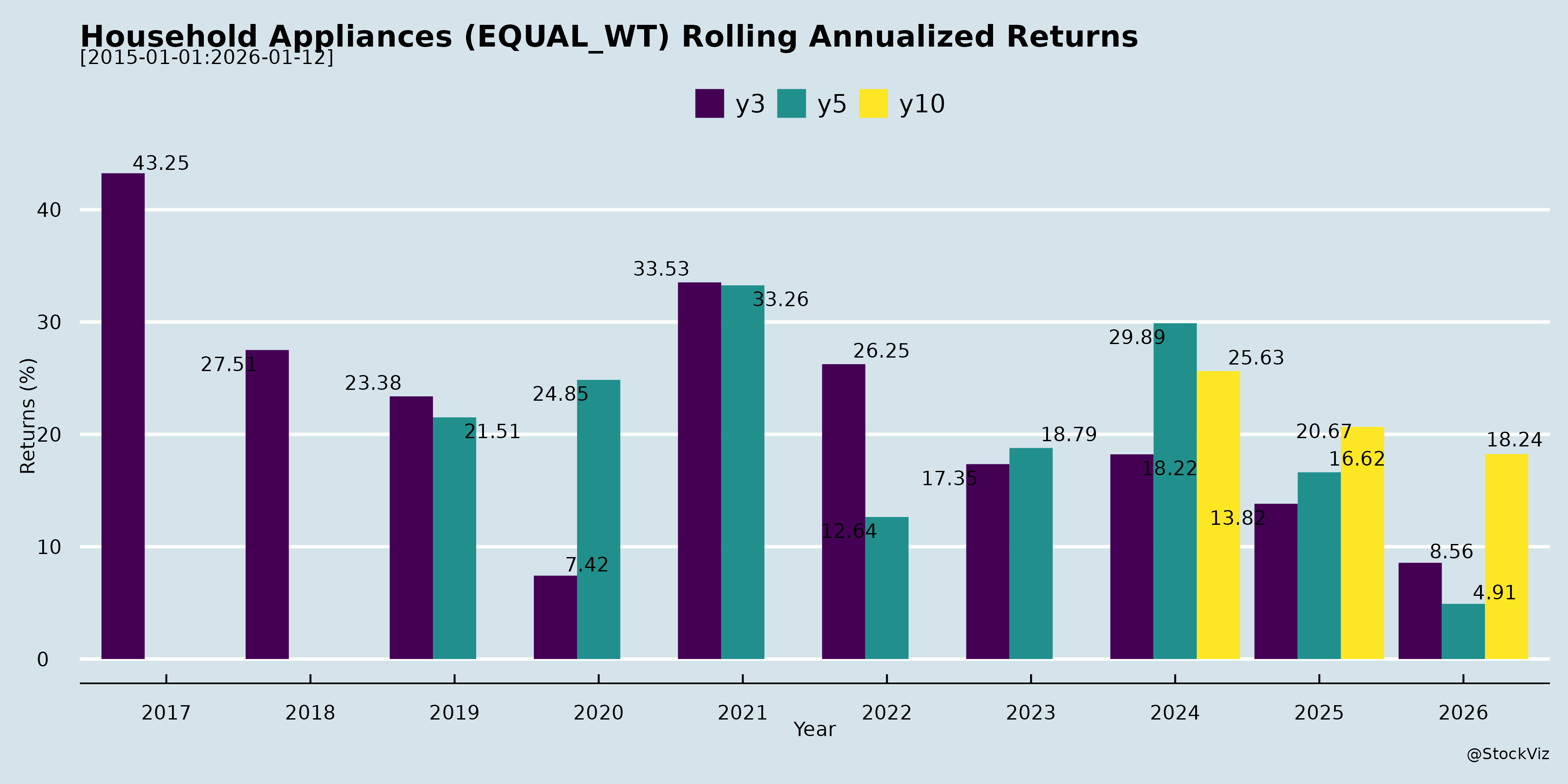

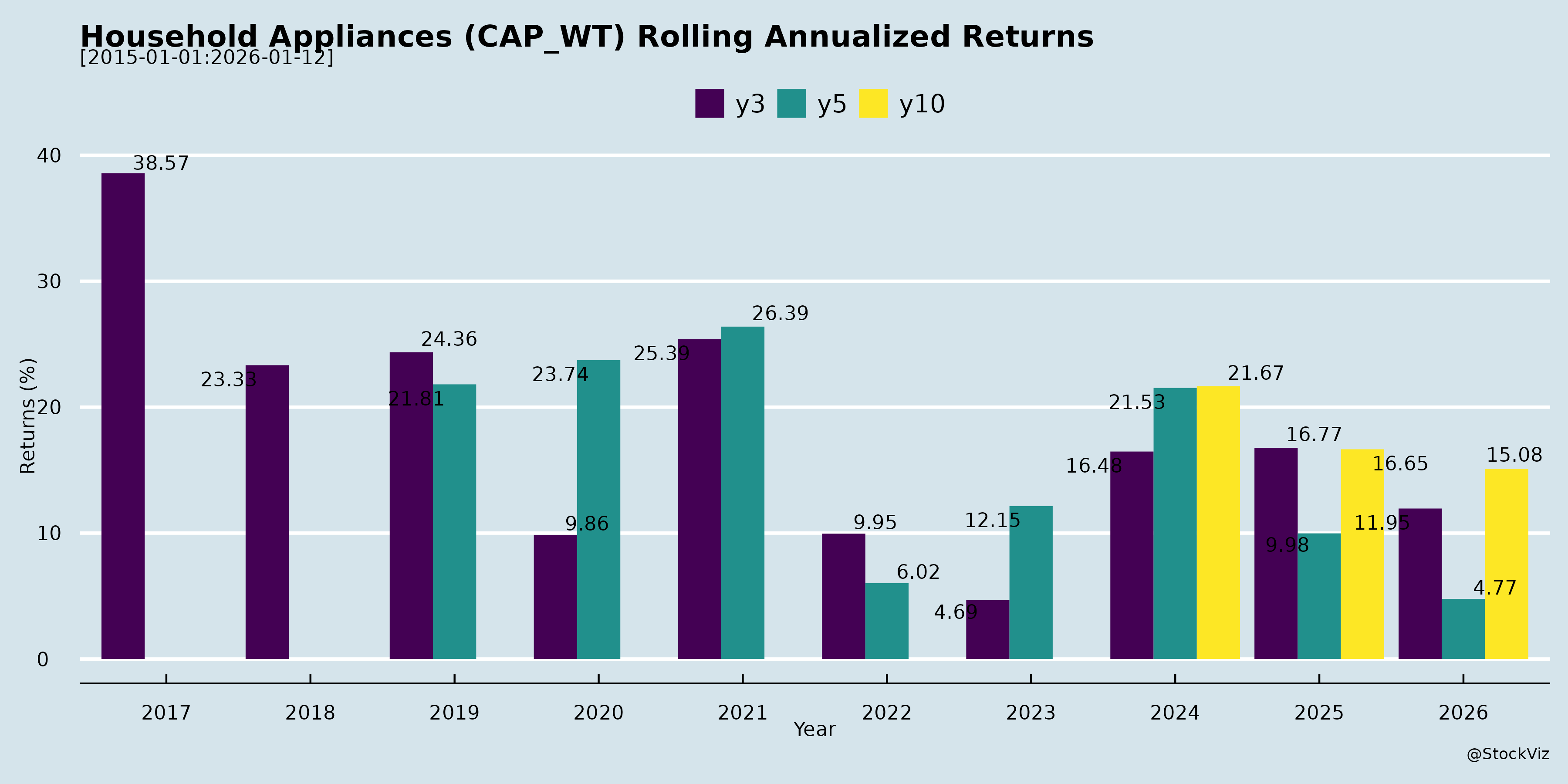

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Analysis of Indian Household Appliances Sector (Based on Q2 FY26 Earnings and Announcements)

The provided documents (primarily Q2 FY26 earnings transcripts from Voltas, Blue Star, Eureka Forbes, Bajaj Electricals, and analyst/investor meet schedules from LG, Crompton, Whirlpool, V-Guard, Symphony, etc.) offer insights into the sector’s performance amid a challenging H1 FY26. The sector (encompassing cooling appliances like ACs/fans/coolers, lighting, kitchen/small durables, water purifiers, and services) faced seasonal and policy disruptions but shows resilience in diversified segments. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

1. Headwinds (Short-term Pressures in H1 FY26)

- Weather Disruptions: Extended monsoon and unseasonal rains severely impacted summer-driven products (ACs, fans, coolers). Voltas and Blue Star reported muted secondary sales; Bajaj noted double-digit de-growth in TPW fans/coolers. October remained weak with no “mini-summer.”

- High Channel Inventory: Industry-wide issue (Voltas: ~2 months; Blue Star: 65 days vs. ideal 45). Led to deferred offtake, distress selling risks, and margin pressures from channel support (e.g., Voltas’ schemes, higher marketing spends).

- GST Transition Uncertainty: Announcement (Aug/Sep 2025) caused 4-6 weeks of demand postponement (wait-and-watch). Not all categories affected equally (e.g., no direct impact on Bajaj ECD), but spillover muted overall durables demand.

- Subdued Consumer Sentiment: Muted festive/Diwali sales despite early festivities. Bajaj/Blue Star noted skew toward premium/large durables; small appliances lagged. Macro factors like uneven recovery post-summer base.

- Margin Squeeze: Under-absorption at new plants (Voltas), fixed cost deleverage (Bajaj), and A&P spends up 21% (Eureka Forbes still expanded margins via leverage).

2. Tailwinds (Positive Structural Shifts)

- GST Rate Reductions: ACs from 28% to 18% (Voltas/Blue Star); benefits for refrigeration/food products. Expected to unlock pent-up demand, improve affordability in H2.

- BEE Energy Efficiency Norms (Jan 2026): Prompts channel stocking of old-stock (pre-label change) in Q3/Q4, driving upgrades and mix improvement (Voltas: new table products ready).

- Diversification Success: Non-seasonal categories resilient (Voltas: Voltbek appliances gaining share; Bajaj: mixers/irons/water heaters up high single-digits; Eureka Forbes: robotics ~60% of VC sales).

- Projects/Commercial Segments Strong: Voltas EMPS order book >₹6,200 Cr; Blue Star Electro-Mechanical up 16.5%; Bajaj Lighting EBIT margins at 7.9-9.2%.

- Margin Levers: VAVE/cost optimization yielding 200bps GM expansion (Bajaj); operating leverage (Eureka Forbes: EBITDA margins at 13.1%); premiumization (Voltas market share to 18.5%).

3. Growth Prospects (H2 FY26 and Medium-term Outlook)

- H2 Recovery: Consensus on rebound (Voltas/Blue Star: GST+BEE to drive stocking/upgrades; Bajaj: cautiously optimistic). CAGRs: Industry cooling ~15-19% (Blue Star); Voltas UCP targeting share gains.

- Category Expansion: | Category | Key Drivers & Outlook | |———————–|———————–| | Cooling (AC/Fans) | GST/BEE tailwinds; BLDC fans (Bajaj: 15-20% mix, 25% market); Commercial AC/Refrigeration (Voltas/Blue Star: high growth levers). | | Appliances/Kitchen| Voltbek (Voltas: #2 in semi-auto washers); Robotics (Eureka: high-teens); Kitchen (Bajaj: double-digit). | | Lighting/Switchgear| Bajaj: 9.6% growth, switchgears off to strong start; B2C focus. | | Services/Water | Eureka: High-teens AMC/filter growth; penetration <7%. |

- Medium-term (FY26-27+): 10-15% CAGR feasible via premiumization (100-300bps mix shift/year, Bajaj), new launches (e.g., Voltas CAC/VRF), diversification (Morphy Richards acquisition for Bajaj). Services/AMCs as stable revenue (Voltas/Blue Star).

- Market Leadership: Share gains (Voltas: 16%→18.5%; Eureka: stable in organized water).

4. Key Risks

- Weather Volatility: High dependency on summer (monsoon/winter forecasts critical; IMD strong winter could hurt fans).

- Inventory & Pricing Pressures: Liquidation pre-BEE may spark discounts/wars (Blue Star: pressure anticipated); high inventory risks distress.

- Commodity Inflation: Copper/steel up; price hikes (Bajaj: 1-3%) may face resistance amid weak sentiment.

- Competition: New entrants (Blue Star/Eureka note rising intensity); unorganized in filters/low-end.

- Execution/Macro: Delayed projects (Blue Star infra slow); consumer slowdown spillover; BIS norms across appliances (Bajaj navigating).

- Company-specific: Voltas/Blue Star: monsoon repetition; Bajaj: Morphy integration.

Summary

The Indian household appliances sector navigated a “rain-interrupted” H1 FY26 with ~5-10% de-growth in seasonal cooling/fans (due to monsoon, inventory, GST deferral), offset by 10-16% growth in projects/lighting/non-seasonal appliances/services. Headwinds are largely transitory (weather/GST), with tailwinds from policy (GST/BEE) poised for H2 rebound (Dec-Mar critical for inventory clearout). Growth prospects are robust at 12-18% CAGR medium-term, fueled by premiumization, diversification (commercial/services ~30-40% buffers), and low penetration. Risks center on execution amid weather/macro volatility, but resilient balance sheets (debt-free Bajaj; strong order books) and share gains mitigate. Overall outlook: Cautiously optimistic for FY26 double-digit recovery, with leaders like Voltas/Blue Star/Bajaj positioned for outperformance via scale and mix shifts. Investors should monitor Q3 secondary sales and winter demand.

General

asof: 2025-11-30

Summary Analysis: Indian Household Appliances Sector

Using the provided regulatory filings from key players (Voltas, Blue Star, Amber Enterprises, Crompton, Whirlpool, V-Guard, Eureka Forbes, TTK Prestige, IFB Industries, Symphony, Bajaj Electricals, Johnson Controls-Hitachi), the sector exhibits stable but mixed near-term performance amid routine corporate activities, minor regulatory hiccups, and strategic moves like fundraising and stake sales. V-Guard’s detailed H1 FY26 results provide the most granular financial insights (standalone revenue ₹2,679 Cr, up 1% YoY; profit ₹122 Cr, down 9% YoY; consolidated revenue ₹2,807 Cr, up 1% YoY; profit ₹139 Cr, down 14% YoY), reflecting modest growth with margin pressures. Other filings highlight operational continuity, cost optimization, and compliance. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring Performance)

- Profitability Squeeze: V-Guard H1 FY26 profit declined YoY (standalone -9%, consolidated -14%) despite flat revenue growth, driven by higher employee costs (+9% YoY), other expenses (+8% YoY), and working capital volatility (e.g., inventory up, trade payables down). Suggests cost inflation (raw materials, labor) and softening demand in segments like consumer durables.

- Cost Optimization Needs: TTK Prestige’s VRS at Hosur unit (43+ opt-ins, ~₹9.5 Cr cost) signals labor/manufacturing cost pressures, potentially due to underutilization or restructuring.

- Parent Divestment Signals: Whirlpool Corporation sold 14M+ shares in Whirlpool India (stake down to 40%), generating $166M for debt reduction. Indicates challenges in India ops (e.g., competitive pressures), with further stake cuts planned by H1 CY26.

- Demand Softness: Segment results in V-Guard show consumer durables weakening (H1 loss vs. profit YoY), amid high inventory levels (standalone ₹856 Cr, consolidated ₹999 Cr).

Tailwinds (Supportive Factors)

- Strong Fundraising Appetite: Amber Enterprises closed QIP allotting 1.26M shares at ₹7,950 (high premium), raising ~₹1,000 Cr for growth/capex. Reflects investor confidence in AC/OEM demand.

- Operational Resilience: V-Guard’s QoQ improvements (Q2 revenue +ve, profit up 18% standalone), positive operating cash flow (₹169 Cr standalone, ₹195 Cr consolidated), and ESOP allotment (3.46L shares) indicate internal momentum and employee alignment.

- Routine Stability: Trading window closures (Voltas) and AGM notices (Blue Star, Eureka Forbes) signal standard Q2/H1 reporting cadence, with no major disruptions.

- Media/Visibility Boost: Symphony’s CNBC interaction underscores positive sector outlook communication.

Growth Prospects (Opportunities Ahead)

- Capex and Expansion: Amber’s QIP funds likely for AC manufacturing ramp-up; V-Guard’s capex (₹63 Cr standalone investing outflow) in PPE/CWIP supports electronics/electricals (strong segments: electronics +5% YoY revenue).

- Segment Tailwinds: V-Guard’s electricals (+6% YoY H1 revenue) and electronics growth; AC players (Voltas, Blue Star, Amber) poised for seasonal demand (Q3 results upcoming).

- Synergies and Restructuring: V-Guard’s in-principle Sunflame merger for cost synergies; Whirlpool stake sale could enable agile India strategy.

- Overall Sector: Modest H1 growth (V-Guard +1%) with improving cash flows positions for festive/seasonal recovery; ESOPs/VRS signal long-term efficiency.

Key Risks (Potential Threats)

| Risk Category | Details | Quantifiable Impact (from Filings) | Mitigation |

|---|---|---|---|

| Regulatory/Tax Disputes | GST penalties (Bajaj: reduced to ₹0.01L from ₹8.55L; JCH: VAT disallowance ₹14.33L); consumer order (Crompton: ₹5K + replacement). | Low (total <₹25L across firms); no material financial hit. | Appeals/refunds ongoing; routine for sector. |

| Working Capital Strain | V-Guard: Inventory +ve movement but trade receivables down; cash conversion reliant on receivables (₹391-428 Cr). | H1 CFO strong but YoY dip (standalone -46%). | Improving receivables cycle. |

| Foreign Ownership Changes | Whirlpool divestment (to 40%); potential control shifts. | $166M proceeds; debt reduction positive but ops uncertainty. | Monitor further sales. |

| Litigation/Consumer | Minor disputes (Crompton air cooler); physical share re-lodgement (IFB). | Negligible; no systemic issues. | Compliance-focused. |

| Macro (Inflation/Competition) | Cost pressures (employee/depreciation up); YoY profit dips. | V-Guard EBITDA margin ~6% (stable QoQ). | VRS/ESOP for efficiency. |

Overall Outlook: Neutral to Positive. Sector faces near-term headwinds from costs/divestments but buoyed by fundraising and cash generation. Growth prospects hinge on Q3 festive/AC demand (watch Voltas/Blue Star results). Risks are low materiality, mostly operational/regulatory. Investors should track H1 results from others for confirmation; V-Guard’s stability suggests resilience in diversified appliances (fans, stabilizers, etc.).

Data as of filings up to Nov 2025; sector capex/debt reduction supportive for FY26 recovery.

Investor

asof: 2025-12-03

Analysis of Indian Household Appliances Sector

The provided documents (primarily Q2 FY26 earnings transcripts, investor presentations, and regulatory filings from key players like Voltas, Blue Star, Eureka Forbes, Bajaj Electricals, LG Electronics India, Crompton, Symphony, and others) offer insights into the sector’s dynamics. The sector encompasses cooling (ACs, fans, coolers), lighting, small domestic appliances (mixers, irons, kettles), water purifiers/softeners, air purifiers, vacuum cleaners/robotics, and EPC/projects. It faces cyclicality (weather-dependent) but benefits from low penetration (~6-7% urban for water purifiers; <2% for vacuums/robotics) and rising incomes/urbanization.

Headwinds (Short-Term Challenges)

- Weather Disruptions: Extended monsoons/rains crushed summer demand for cooling products (ACs, fans, coolers). E.g., Voltas/Blue Star reported 9-17% industry de-growth in Q2; Bajaj noted muted October despite Diwali.

- High Channel Inventory: 2-3 months’ stock (Voltas: 2 months; Blue Star: 65 days vs. ideal 45). Led to weak primary/secondary sales, distress selling risks, and margin pressure (under-absorption of fixed costs).

- GST Reforms & Demand Deferral: Anticipation of cuts (e.g., ACs from 28% to 18%) caused 1-1.5 month buying freeze (Sep-Oct). Festive demand subdued post-Diwali.

- Pricing/Inflation Pressures: Commodity hikes (copper, steel) forced 1-3% price increases (Bajaj fans); BEE rating changes (Jan 2026) risk further pressure.

- Subdued Consumer Sentiment: Shift to high-end durables (e.g., autos); rural slowdown; H1 weakness in seasonal categories (TPW fans down double-digits).

Tailwinds (Positive Catalysts)

- GST Rationalization: Expected H2 demand surge (Voltas/Blue Star: pent-up + affordability boost).

- Regulatory Tailwinds: BEE upgrades to spur premiumization/replacements (channel stocking old-stock in Q3).

- Diversification Success: Non-seasonal categories (mixers, irons, water heaters) grew single/double-digits (Voltas, Bajaj). Lighting up 9.6% (Bajaj); projects order books strong (₹6,200 Cr Voltas).

- Premiumization & Market Share Gains: Voltas RAC share to 18.5%; Eureka Forbes premium EWP up 50%; robotics 4x growth.

- Digital/Omni-Channel Shift: Eureka: 9x D2C sales, 64% digital AMCs; strong service networks (19,500+ pin codes).

- Infra/Govt Spending: Boosting projects (MEP, data centers).

Growth Prospects

- Market Expansion: Low penetration + urbanization = strong CAGRs (Eureka: Water purifiers 13-14%, vacuums/robotics 17-29%, air purifiers 18-25%; overall 13-15% to FY30). Cooling recovery in H2FY26/FY27 (Voltas: 50%+ possible on low base).

- Category Diversification: Robotics (Eureka: 25x by FY30), lighting/switchgears (Bajaj), appliances (Voltas Voltbek gaining share). Service revenues (AMCs/filters) high-margin, recurring (Eureka: ₹800 Cr FY25).

- Premium/Smart Shift: IoT/smart products (Eureka Aspire, Bajaj connected lamps); dual-brand strategies (Bajaj-Morphy).

- Company-Specific: Eureka ambition: Revenue 2x, EBITDA 3x by FY30 (17-18% CAGR); Voltas/Blue Star H2 rebound; Bajaj lighting EBIT up 46%.

- Sector Outlook: 15-20% CAGR possible (urban demand, exports like Blue Star US). Digital platforms unlock CLTV (cross-sell/up-sell).

Key Risks

- Cyclicality/Weather: Monsoon/summer variability (20-30% revenue swing); Q3 winters could mute fans/coolers.

- Inventory & Margin Squeeze: High stock risks distress selling (Blue Star: pressure till Feb-Mar); unrecovered inflation erodes GM (Bajaj VAVE ongoing).

- Regulatory/Execution: BEE/BIS disruptions (stocking rushes); new launches (switchgears, robotics) face competition (unorganized 40-50% share).

- Competition: Intense from Voltas/Blue Star (cooling leaders), unorganized (low-end), globals (premium). Market share erosion if premiumization fails.

- Macro: Rural slowdown, festive weakness persisting; forex/commodity volatility (copper up).

- Company-Specific: Debt-free but capex-heavy (Eureka ₹50-70 Cr/yr); integration risks (Bajaj-Morphy).

Summary

The Indian household appliances sector (~₹1 lakh Cr+) is at an inflection: H1 FY26 headwinds (monsoons, inventory, GST deferral) caused 4-17% de-growth in cooling/small appliances, but H2 tailwinds (GST cuts, BEE upgrades, winters) signal rebound. Growth prospects are robust (15-20% CAGR to FY30) via premiumization, diversification (robotics/service >20% CAGR), and digital platforms unlocking CLTV. Risks center on weather, inventory overhang, and competition, but resilient players (e.g., Voltas/Blue Star market leaders; Eureka service moat) are positioned for 17-24% CAGR ambitions. Overall: Cautious optimism—H2 recovery + structural drivers outweigh near-term pain.

Meeting

asof: 2025-12-02

Indian Household Appliances Sector Analysis (Q2/H1 FY26 Insights from Filings)

The sector, dominated by cooling products (ACs, fans, coolers) and diversified appliances (kitchen, lighting, washing machines), faced a challenging Q2 FY26 due to weak summer demand but showed resilience through diversification. Key insights from Voltas, Blue Star, Crompton, TTK Prestige, Symphony, V-Guard, Eureka Forbes, IFB, Bosch HC (JCHAC), and others:

Headwinds (Challenges)

- Demand Weakness & Seasonality: Muted retail offtake from lean summer, early monsoon, and GST cut (28%→18% in Voltas/Blue Star) led to deferred purchases and high channel inventory. Cooling segment (ACs) saw sharp YoY declines (Voltas UCP revenue -23%, EBITDA loss; Blue Star Unitary -10%; Crompton ECD flat). Q2 is inherently weak (post-peak summer).

- Margin Pressure: Higher marketing spends, under-absorption in new plants (Voltas Chennai/Waghodia), and input costs squeezed EBITDA (Voltas PAT -76% YoY; Blue Star PAT -27%; Crompton EBITDA margin dip).

- Working Capital Strain: Inventory buildup (Crompton +15% QoQ; Voltas inventories high) and elongated receivables led to negative operating cash flows (common across filings).

- Macro Factors: Geo-political tensions, inflation, and rural slowdown impacted volumes.

Tailwinds (Positives)

- Market Leadership & Diversification: Voltas retained #1 AC share; Voltbek (JV) fastest-growing appliance brand. Blue Star/TTK strong in projects/engineering stabilizing revenues. Crompton/IFB diversified into lighting/kitchen.

- Non-Cooling Stabilizers: Electro-mechanical projects (Voltas +10% YoY), engineering services (Blue Star resilient), and appliances (Crompton Butterfly growth) offset cooling weakness.

- Operational Resilience: Cost controls, premiumisation, and channel expansion (Voltas 30k touchpoints) supported sequential improvements (Blue Star Q2 revenue flat QoQ).

- Cash Position: Strong liquidity (Crompton ₹540cr investments; Voltas dividends paid despite dip).

Growth Prospects

- Demand Revival: GST benefits, BEE efficiency norms (Q3/Q4 FY26), and winter demand (heaters/fans) to unlock pent-up sales. Voltas MD: “Pent-up demand in upcoming quarters.”

- Portfolio Expansion: Appliances (washing machines, fridges via Voltbek) growing 2x market; complementary categories (coolers, fans) promising. International/projects (20-30% revenue) de-risk seasonality.

- Capex & Innovation: New facilities scaling (Voltas Chennai), product upgrades, premiumisation (Blue Star Voltbek share gains).

- Sector Outlook: FY26 recovery expected with 10-15% volume growth (analyst echoes in filings); diversified players (Voltas/Blue Star) best positioned.

Key Risks

- Litigation/Contingencies: Voltas Qatar bank guarantee dispute (₹406cr exposure, sub-judice).

- Execution Risks: High inventory (60-120 days turnover), capex under-absorption delaying ROIs.

- External Shocks: Weather dependency (monsoon/summer), forex volatility (imports heavy), input inflation.

- Cash Flow/Debt: Negative CFO (Voltas -₹136cr; Crompton -₹178cr), rising borrowings (Bosch HC ₹1.5bn).

- Impairments: TTK Prestige ₹32cr goodwill hit; potential in cyclical segments.

Overall Summary: Q2 FY26 was a trough (revenue -10-20% YoY for cooling majors), but fundamentals intact with diversification mitigating risks. H2 revival likely, favoring leaders like Voltas/Blue Star (EBITDA margins 5-7%). Monitor inventory normalization and litigation. Sector poised for 12-15% FY26 growth post headwinds.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.