BIRLACABLE

Equity Metrics

January 13, 2026

Birla Cable Limited

Telecom - Equipment & Accessories

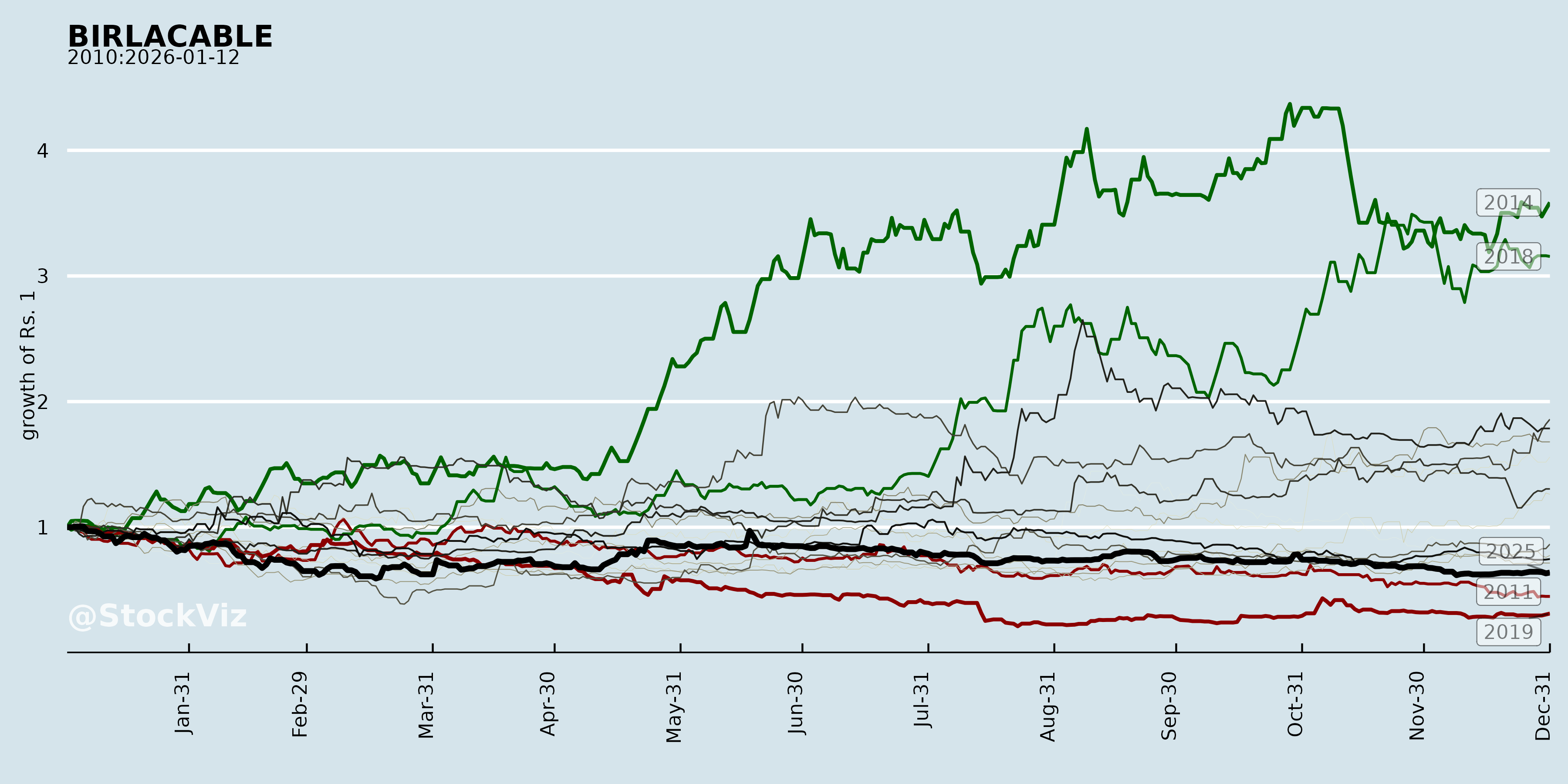

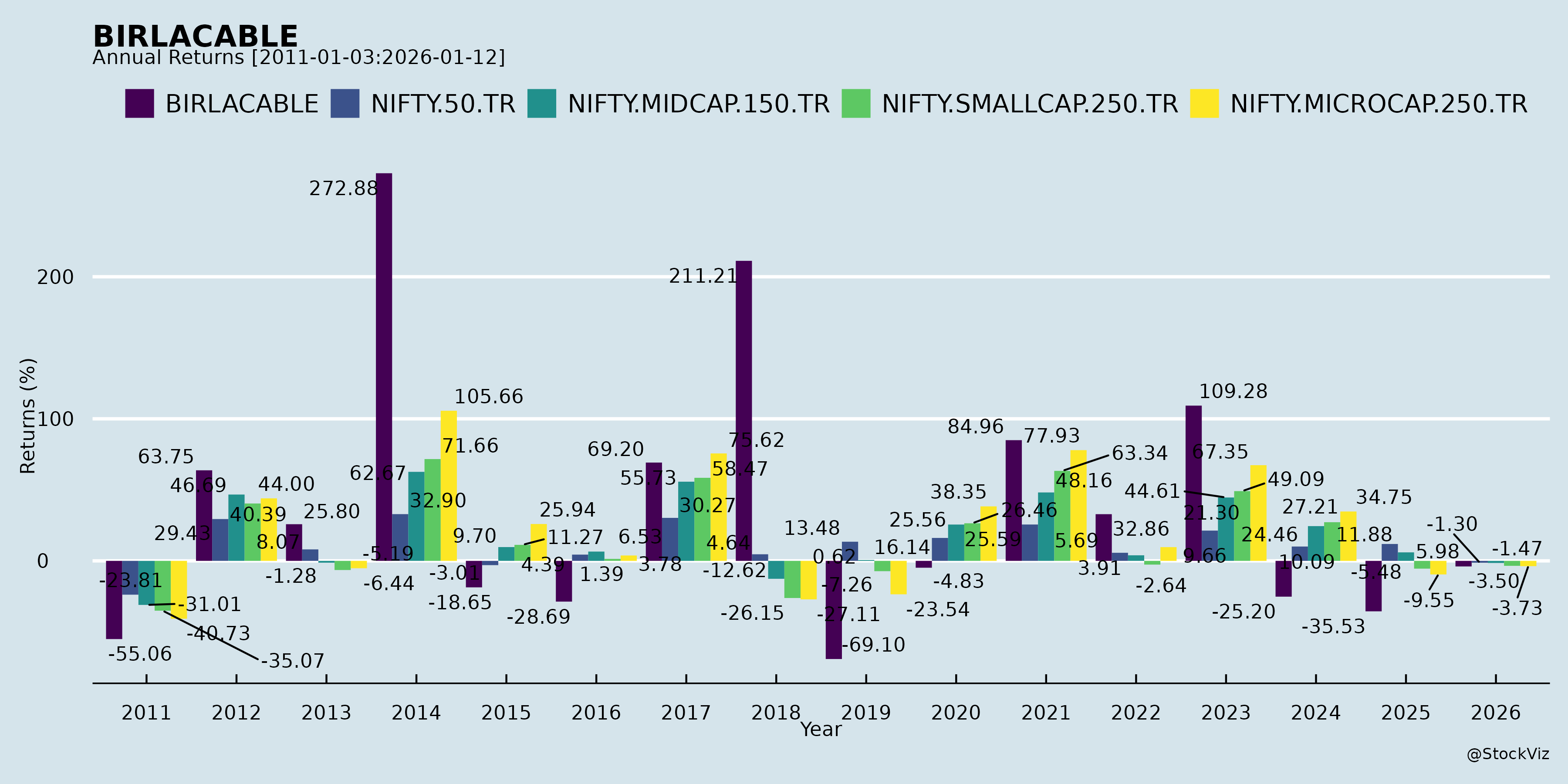

Annual Returns

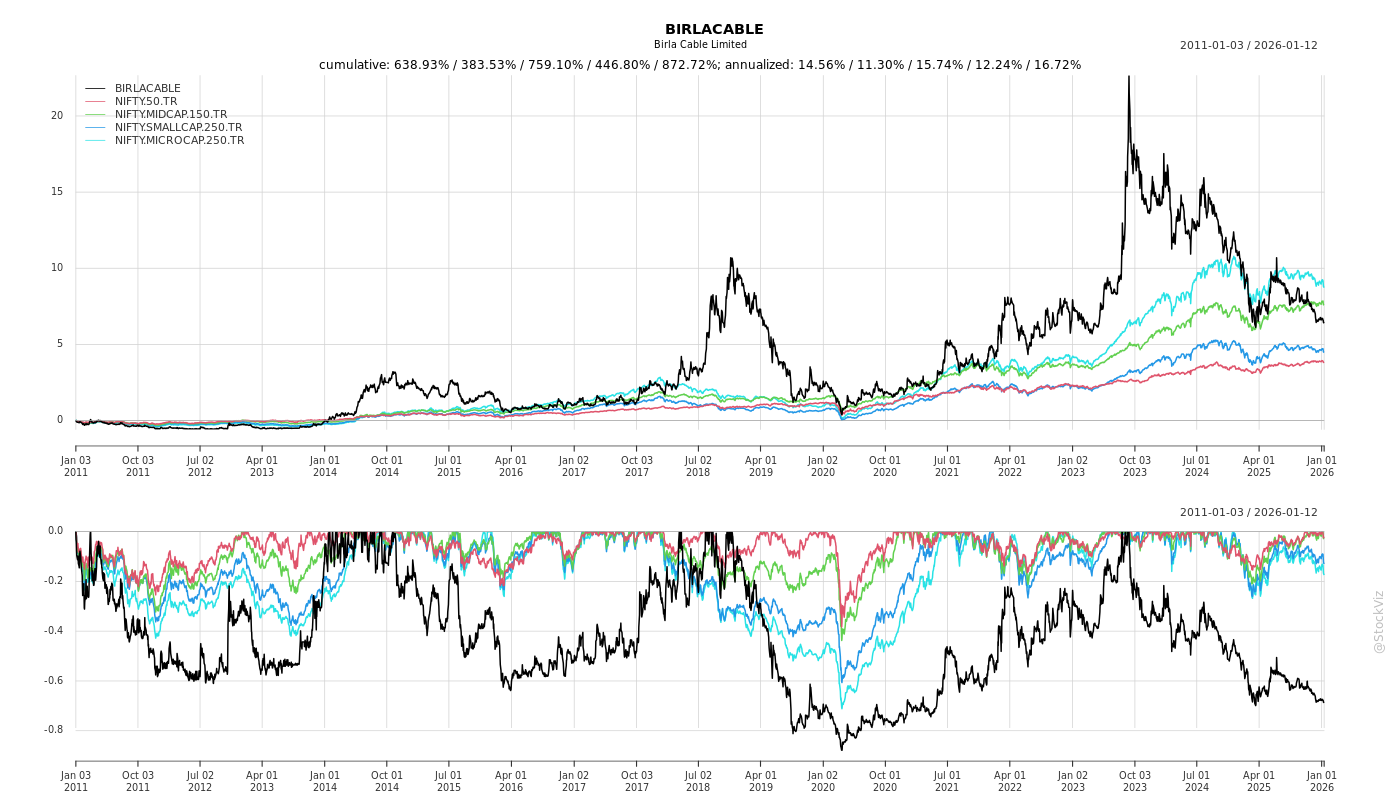

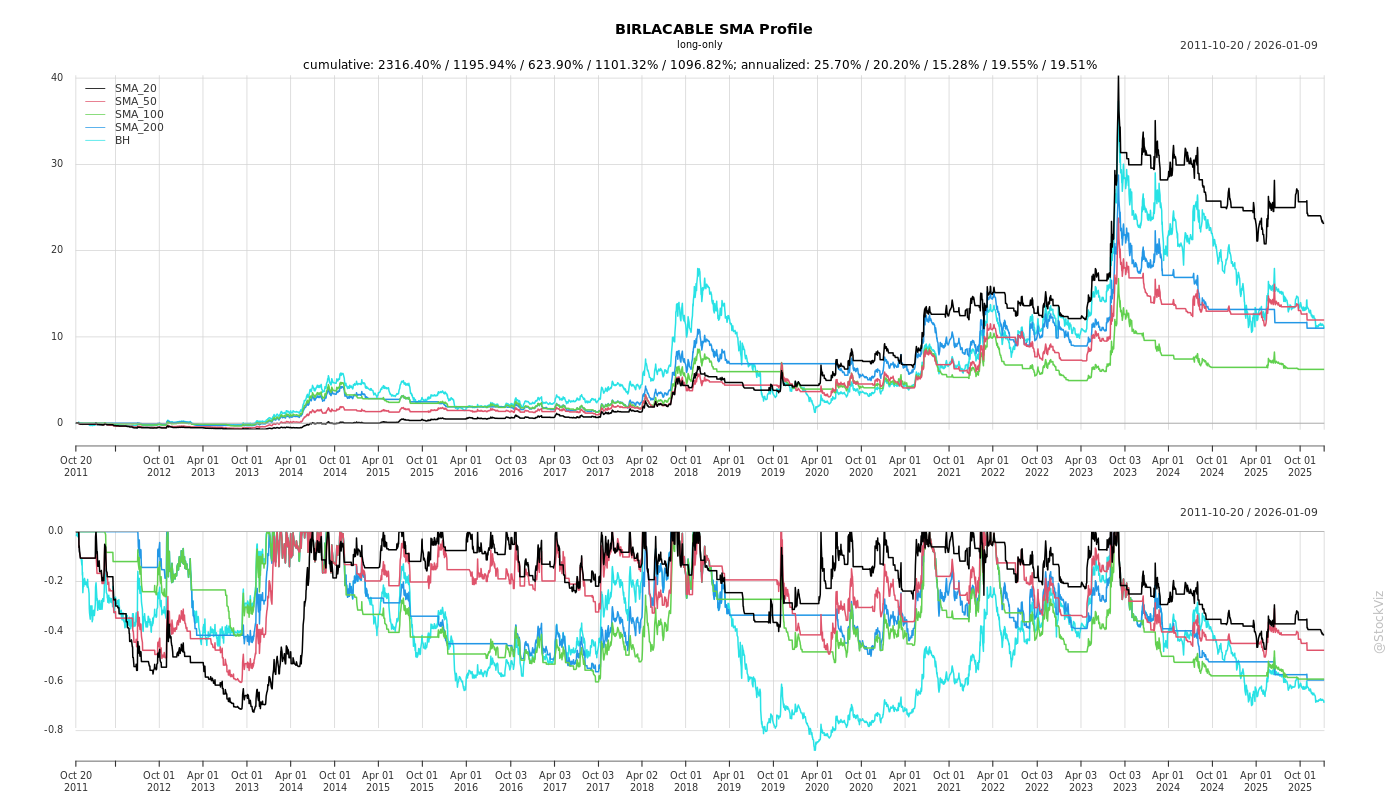

Cumulative Returns and Drawdowns

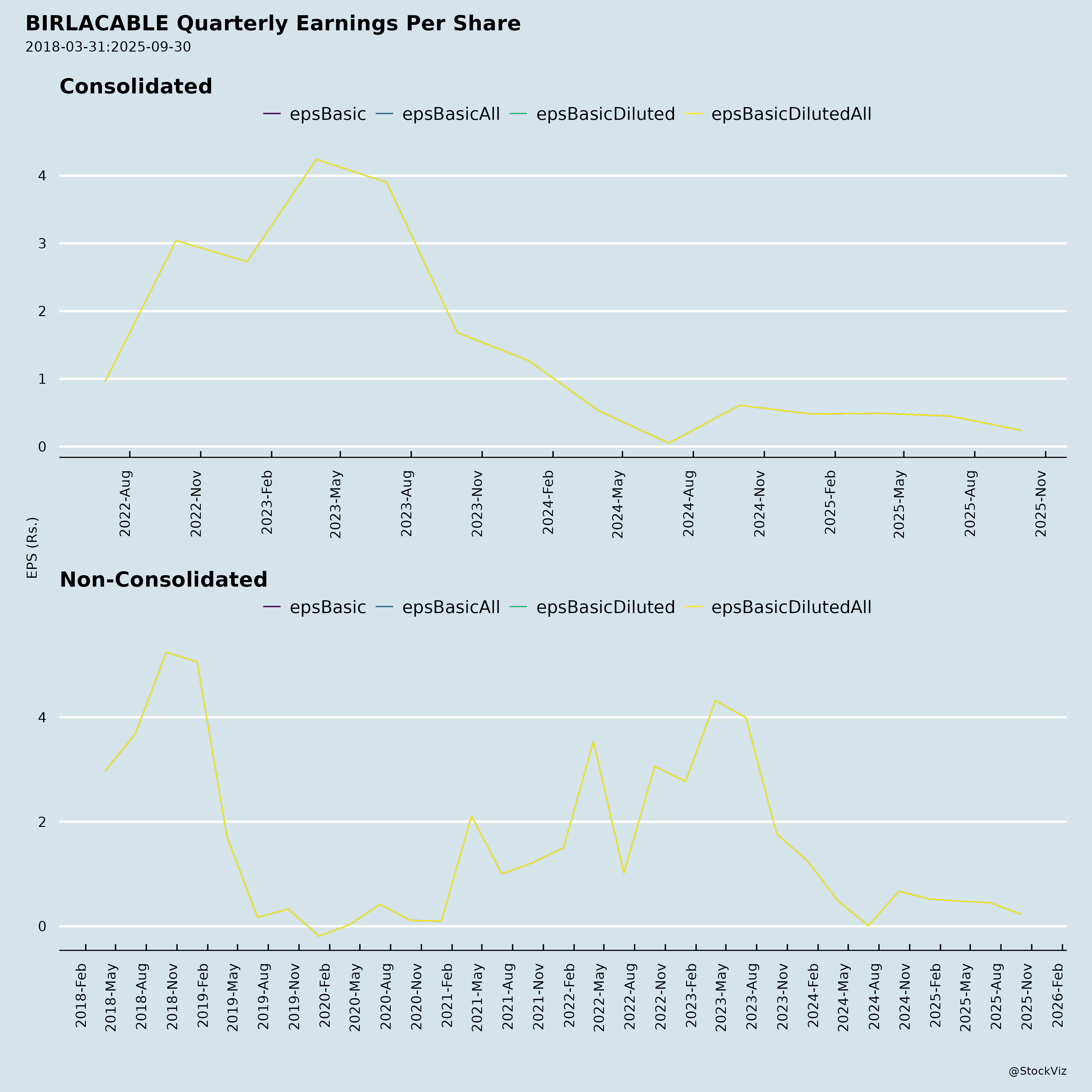

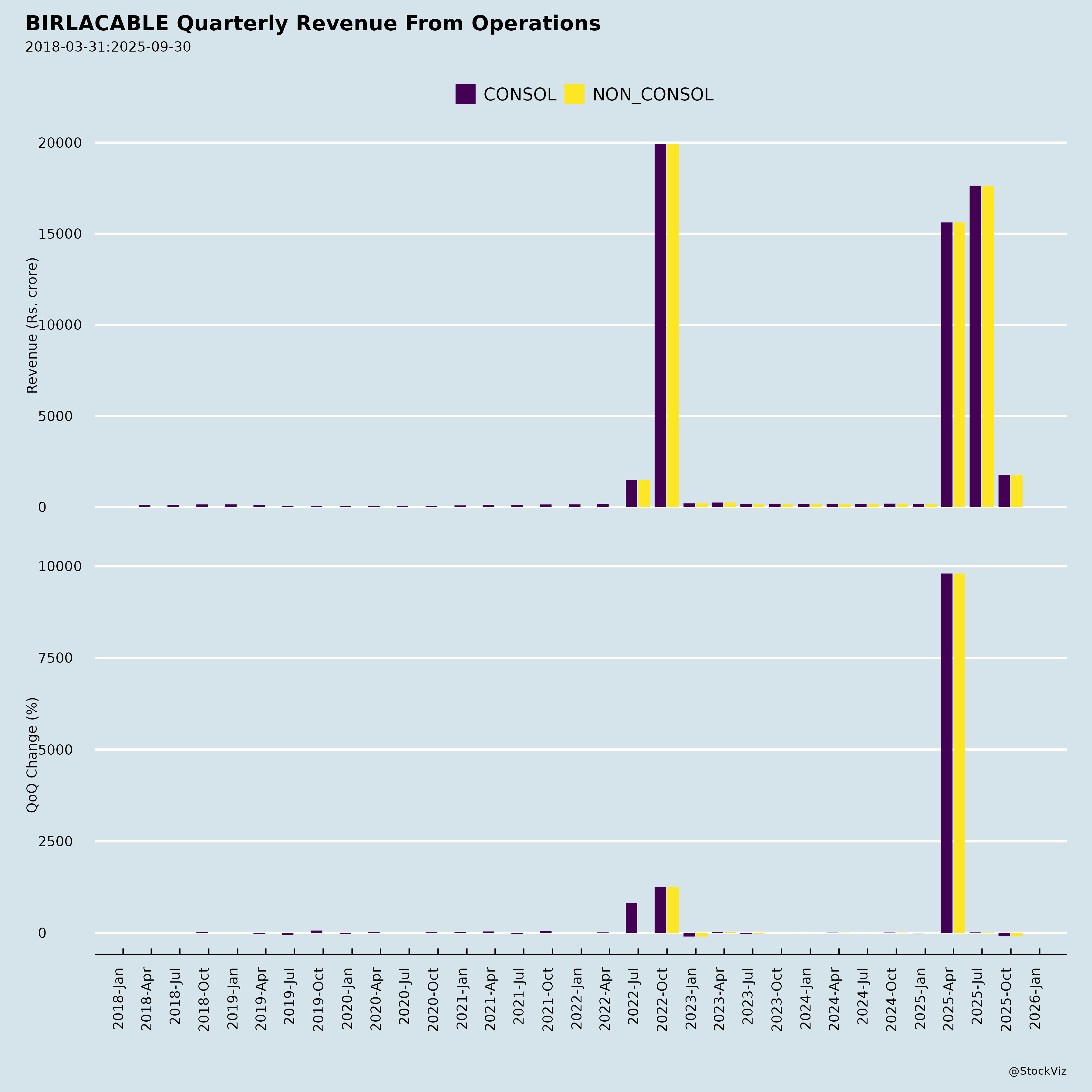

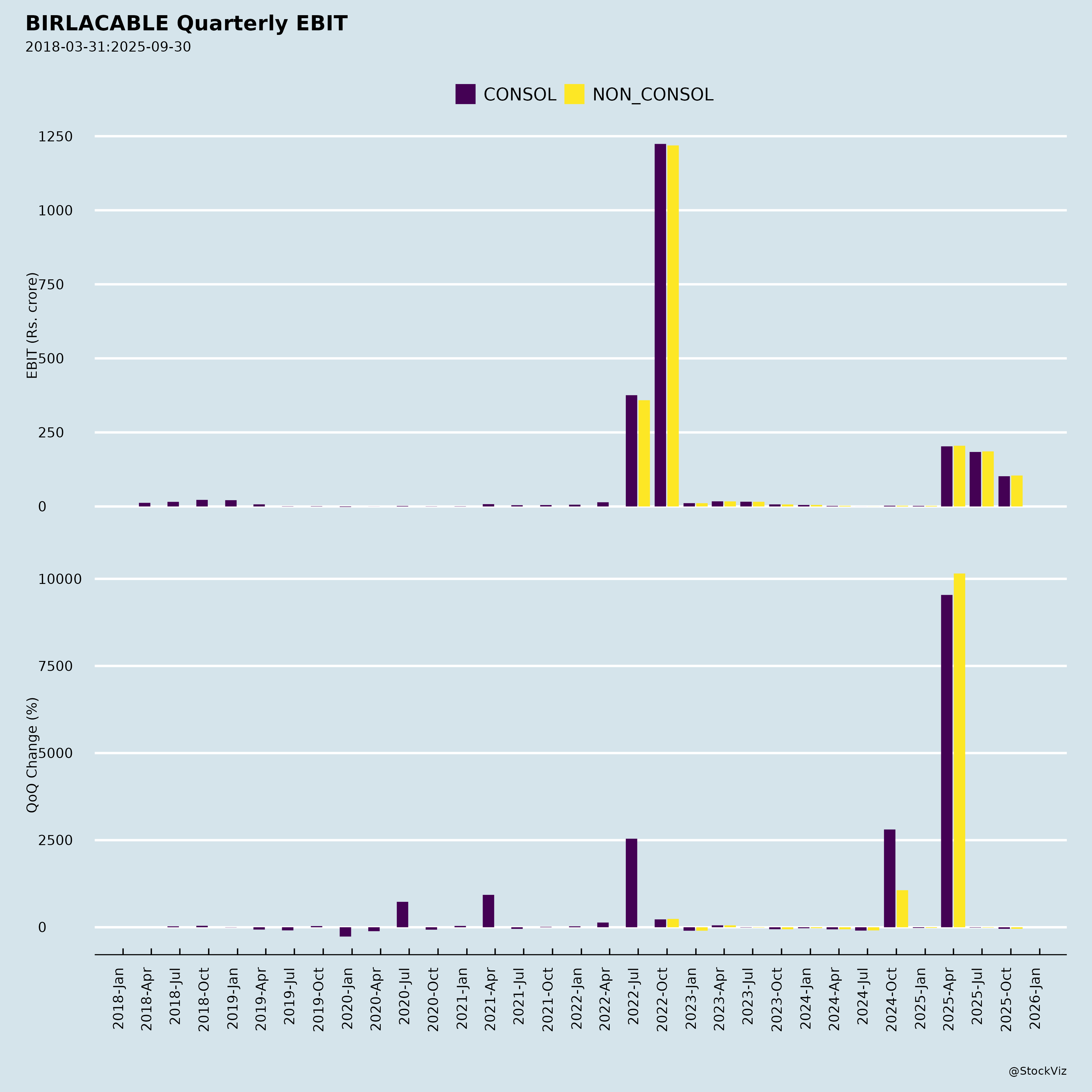

Fundamentals

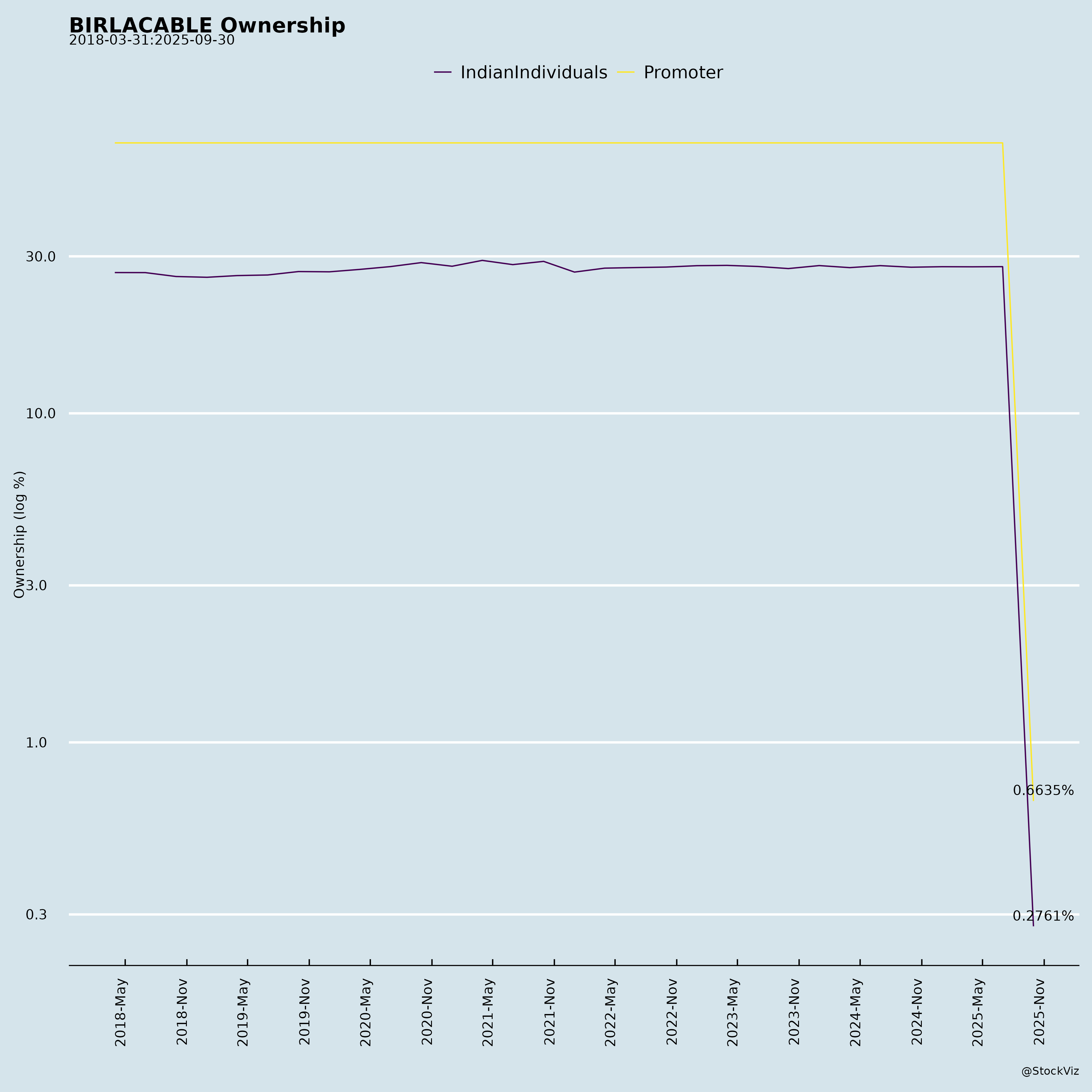

Ownership

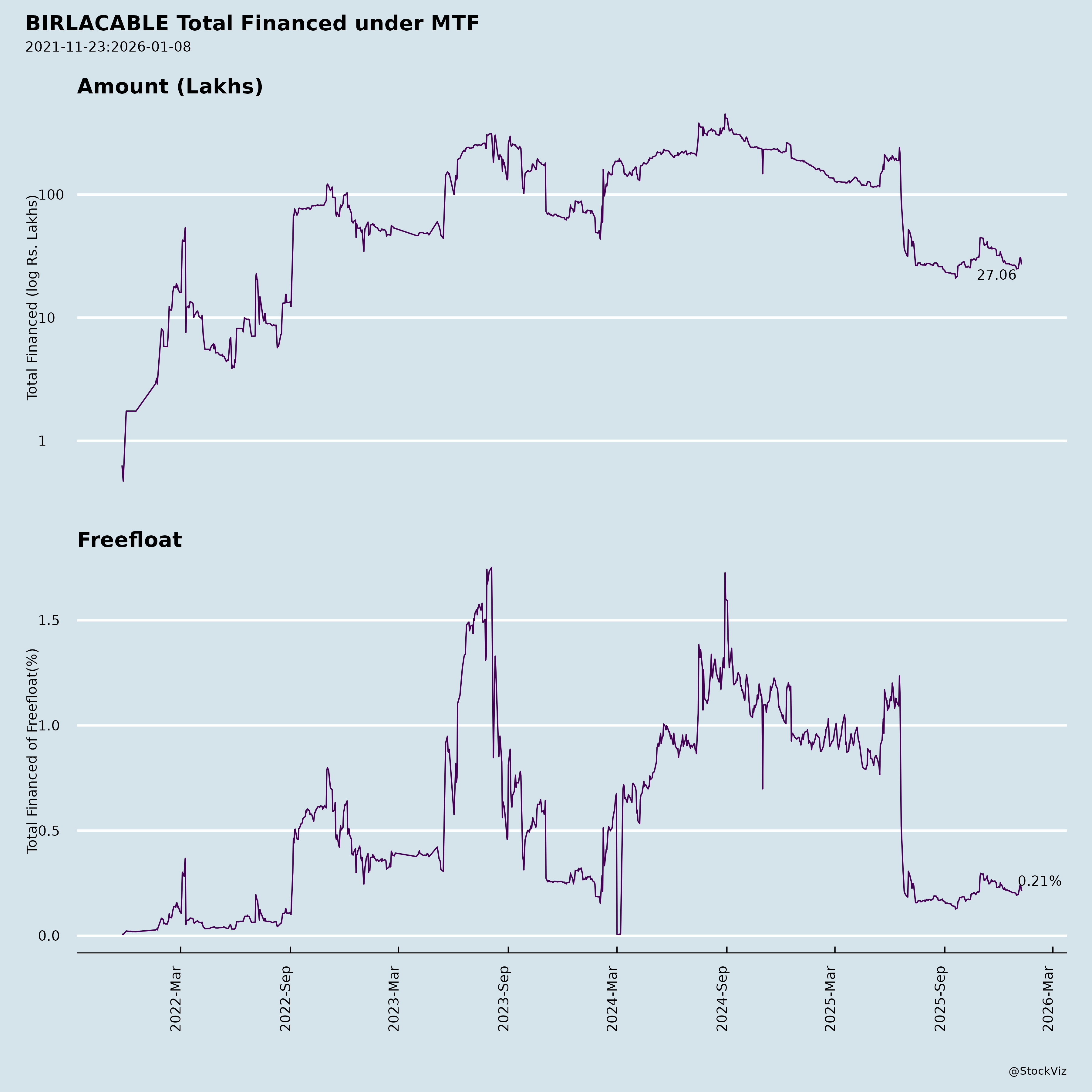

Margined

AI Summary

asof: 2025-11-27

Analysis of Birla Cable Limited (BIRLACABLE)

Birla Cable Limited is a listed Indian company (BSE: 500060, NSE: BIRLACABLE) primarily engaged in manufacturing cables (single reportable segment under Ind AS 108). The provided documents cover: (1) a favorable GST appeal outcome (Sep 2025), dropping a ₹11.90 Cr liability (demand + penalty), and (2) unaudited H1 FY26 financials (ended Sep 30, 2025), showing stable revenue but working capital pressures. All figures in ₹ lakhs unless noted. FY26 H1 revenue flat YoY at ~₹352 Cr; net profit stable at ~₹204 Cr standalone (consolidated ~₹207 Cr).

Tailwinds (Positive Factors)

- Regulatory Win: GST demand/penalty of ₹594.90 Lacs (CGST+SGST) + equal penalty (~₹11.90 Cr total) fully dropped by appellate authority (Sep 12, 2025). No financial/operational impact; enhances credibility amid prior adjudication order (Jan 2025).

- Debt Reduction & Lower Costs: Long-term borrowings down 10% QoQ/YoY to ₹339 Cr; finance costs halved YoY (₹491 Lacs vs ₹692 Lacs H1 FY25). Supports margin stability.

- Asset Growth: Non-current investments up ~39% to ₹588 Cr (standalone), signaling strategic liquidity/cash deployment. Total equity up to ₹271 Cr (+6% YoY).

- Stable Revenue: H1 revenue +1.4% YoY at ₹352 Cr; resilient amid sector cyclicality. Auditor limited review clean (no material issues).

Headwinds (Challenges)

- Profitability Pressure: PBT flat/slightly up H1 YoY (₹286 Lacs) but Q2 sequential drop (₹102 Lacs vs Q1 ₹184 Lacs). NP margins thin (~0.6%); volatile OCI (actuarial gains/losses) drives total comprehensive income swings (H1 +₹1,636 Lacs).

- Working Capital Strain: Inventories +37% to ₹70 Cr (raw material heavy); trade receivables steady at ₹166 Cr. Result: negative CFO (-₹524 Lacs vs +₹5,082 Lacs prior H1), tied to ops.

- Cost Volatility: Raw material costs ~83% of revenue; Q2 changes in inventories +₹356 Lacs hurt margins. Impairment loss ₹32 Lacs (financial assets).

- Cash Burn: Net cash down to ₹32 Lacs; financing outflows from debt repayment/dividends.

Growth Prospects

- Sector Tailwinds: India’s cable demand boosted by PLI scheme, 5G rollout, power infra (e.g., green energy grid), and housing. Single-segment focus positions BIRLACABLE well; revenue trajectory stable (FY25 full-year ₹662 Cr).

- Operational Leverage: Debt paydown (total borrowings ~₹11 Cr) lowers interest burden; potential for capex recovery (CWoIP low at ₹12 Lacs). Subsidiary (Birla Cable Infrasolutions DMCC) adds minor revenue (~₹0.36 Cr H1, immaterial).

- Balance Sheet Strength: Assets +4% to ₹432 Cr; RoE potential from equity base (₹300 Cr share capital). FY26 guidance implicit: steady topline, margin expansion via cost control.

- Upside Catalysts: Infra capex revival post-elections; export potential via Dubai subsidiary. EPS stable at ₹0.68 (H1); dividend history intact.

Key Risks

| Risk Category | Details | Potential Impact |

|---|---|---|

| Working Capital | High inventories/receivables (40%+ of assets); negative CFO signals liquidity crunch. | Margin erosion; funding costs up if borrowing rises. |

| Commodity/Price | Raw materials (e.g., copper) ~80% costs; forex unrealized gains volatile. | Input inflation could squeeze 1-2% margins. |

| Regulatory/Litigation | Ongoing GST/Excise probes (prior ₹200 Cr demand dropped, but recurrence risk). | Cash outflows if adverse rulings. |

| Cyclical Demand | Cables tied to infra/telecom; slowdowns (e.g., monsoon delays) evident in Q2 revenue dip. | Revenue volatility; order book opacity. |

| OCI/Actuarial | Employee benefits remeasurements swing total income (H1 ₹1,673 Lacs gain). | EPS distortion; investor confusion. |

| Execution | Capex subdued; subsidiary unaudited/management-certified (immaterial but adds opacity). | Growth miss if infra delays. |

Overall Summary: BIRLACABLE shows resilience with stable revenue, debt deleveraging, and a key GST win as major tailwinds, but faces near-term headwinds from inventory pile-up and thin margins (net profit <1% of revenue). Growth prospects moderate (5-10% topline CAGR feasible via infra boom), but execution risks loom. Neutral outlook – suitable for long-term infra play; monitor Q3 working capital. Valuation context (not provided): Trade at reasonable multiples if debt trends continue. Investors: Focus on receivables cycle and raw material hedges.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.