Telecom - Equipment & Accessories

Industry Metrics

January 13, 2026

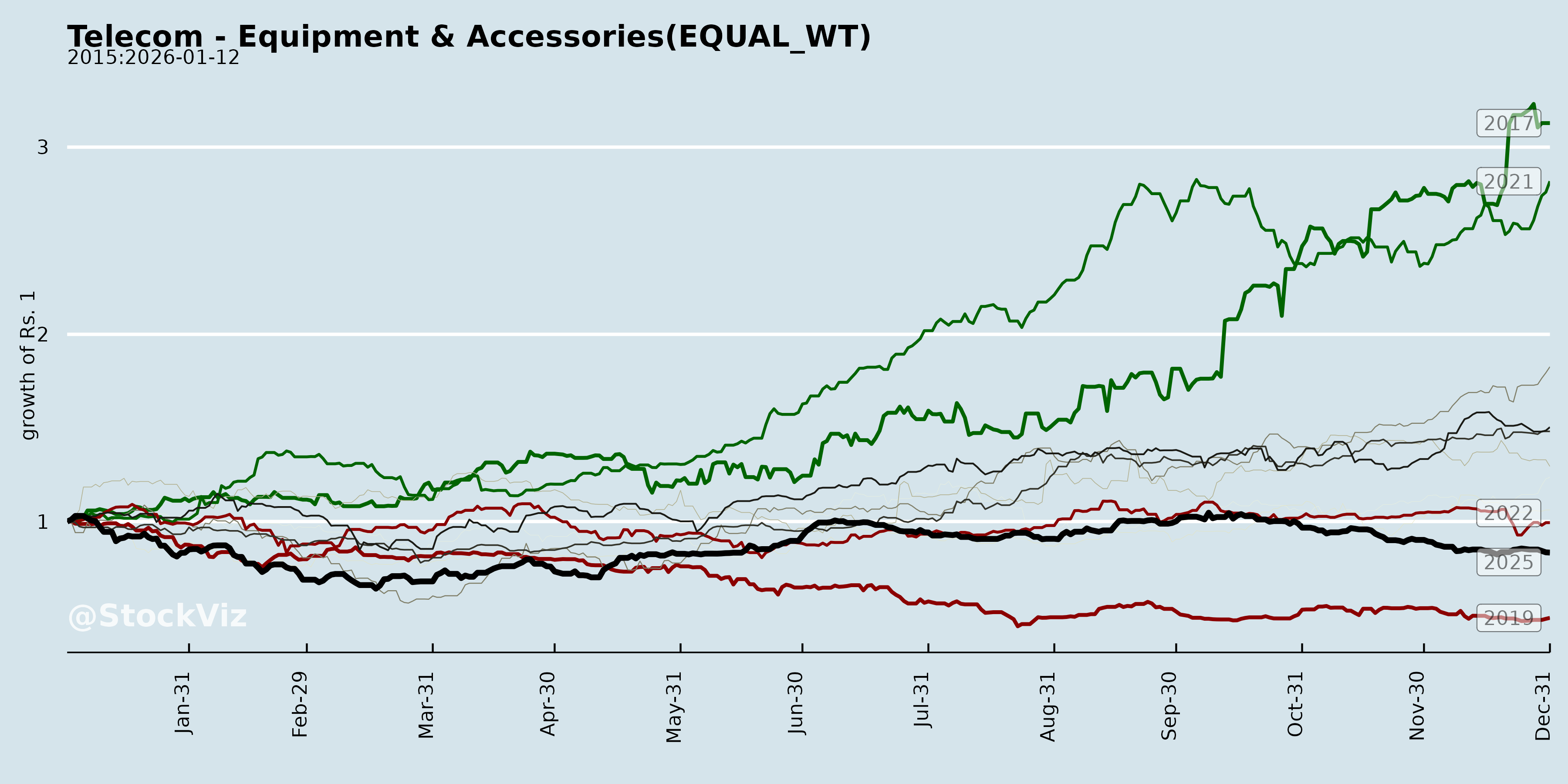

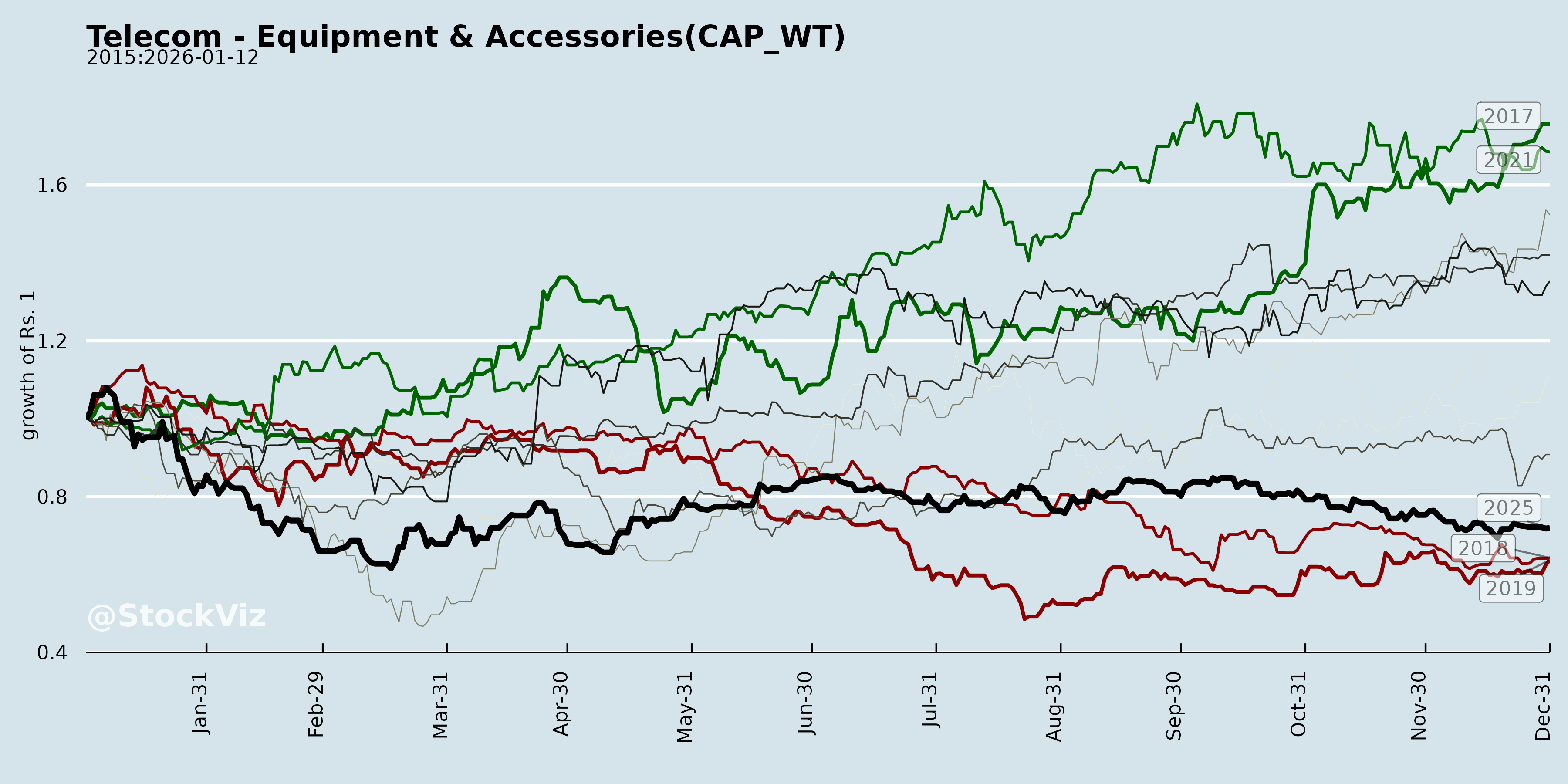

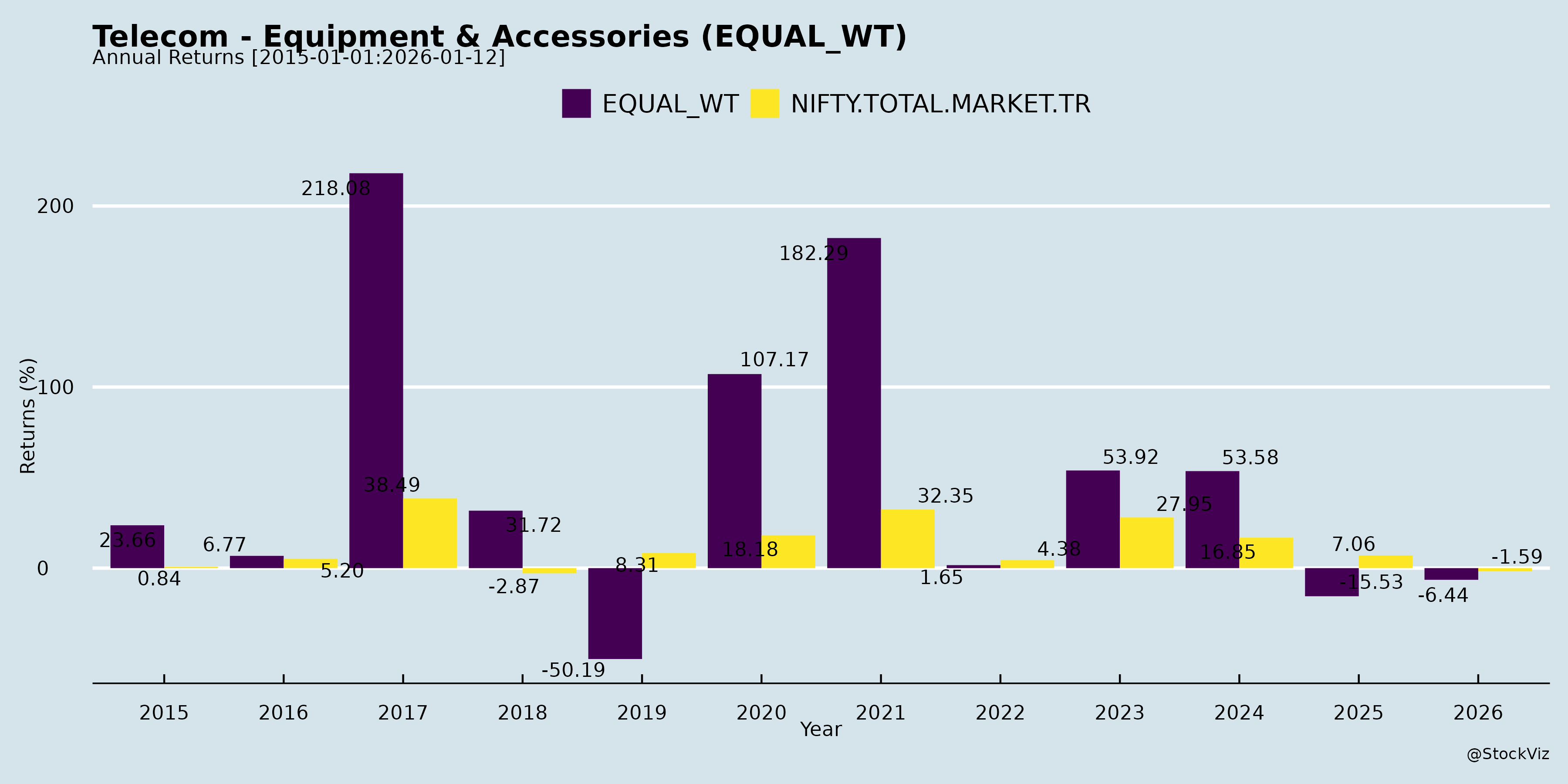

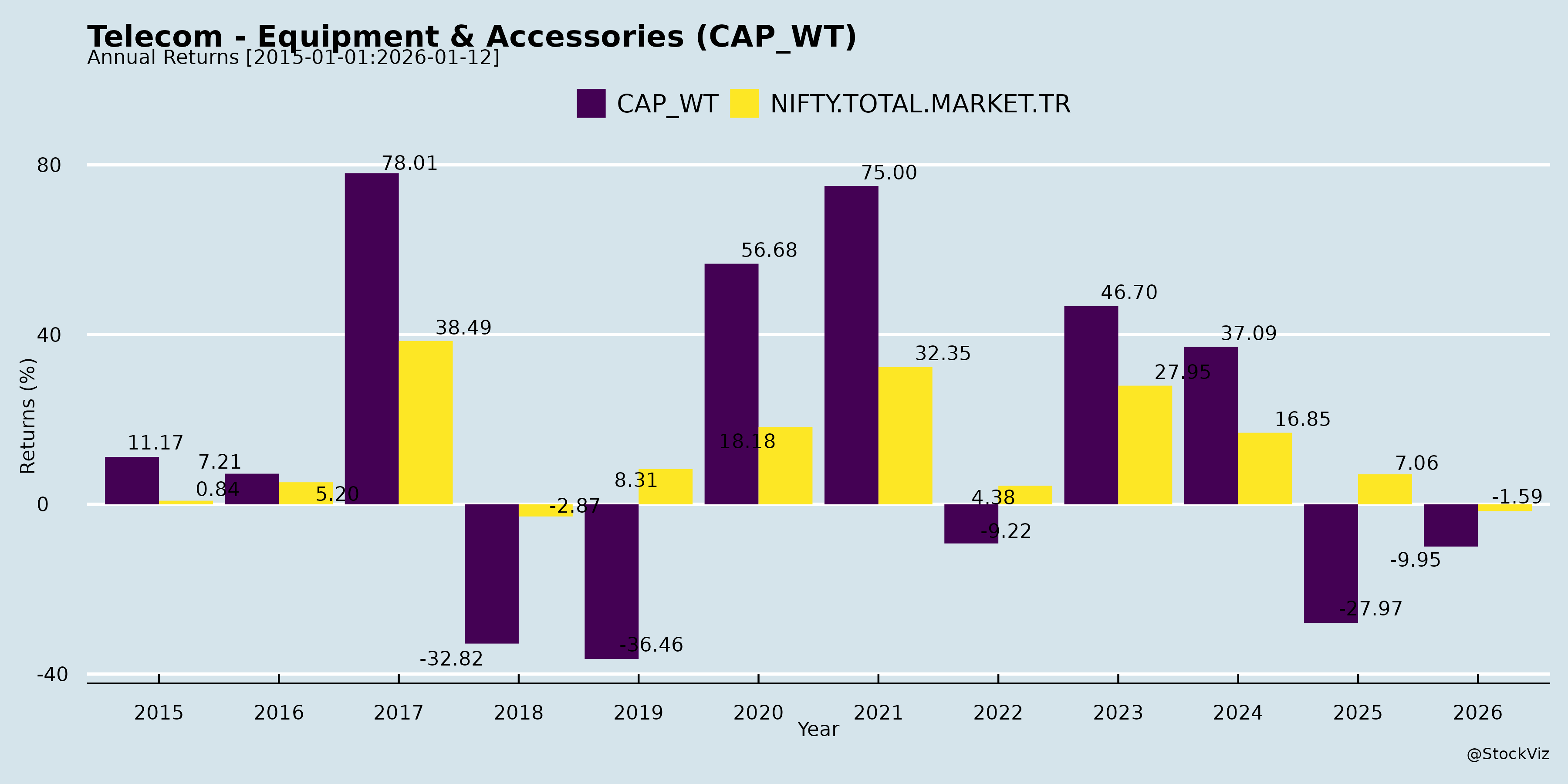

Annual Returns

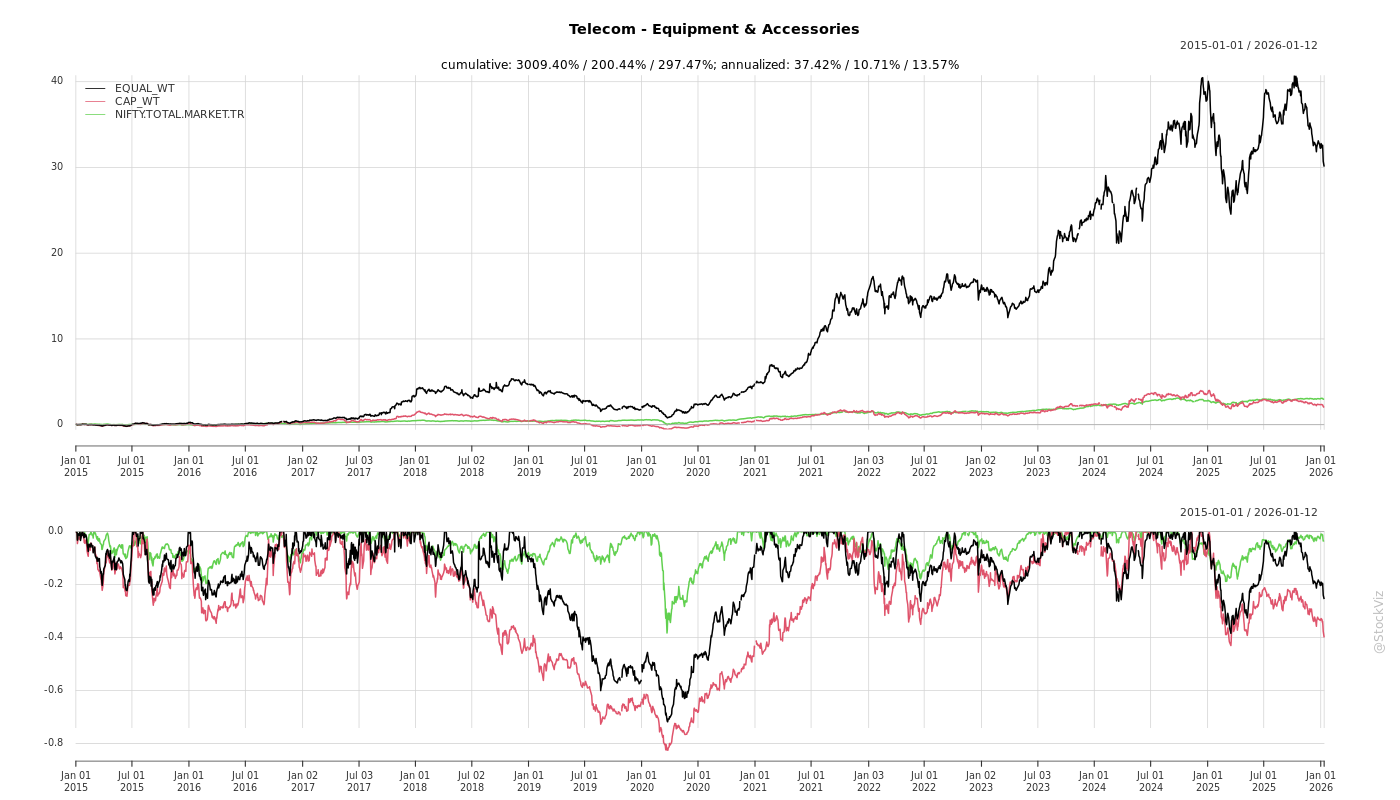

Cumulative Returns and Drawdowns

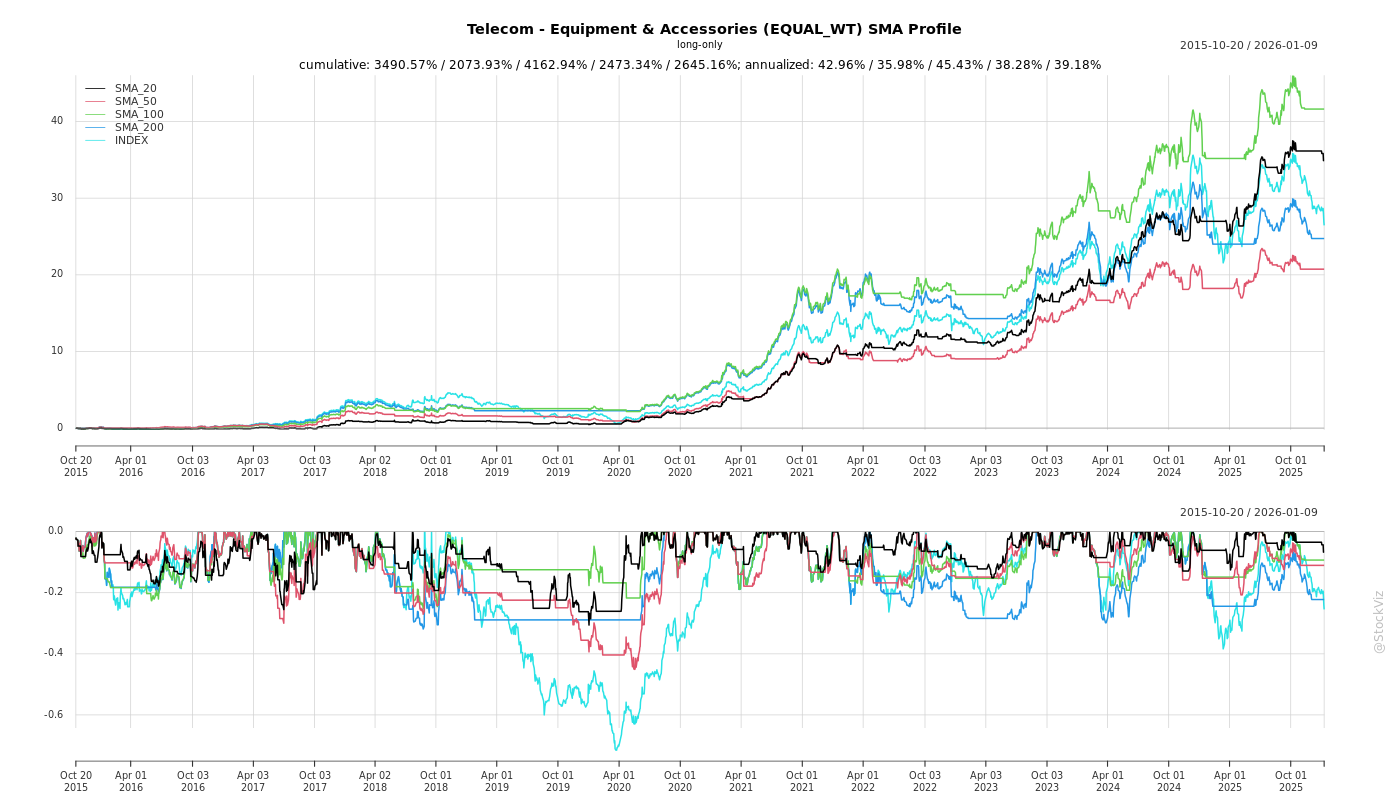

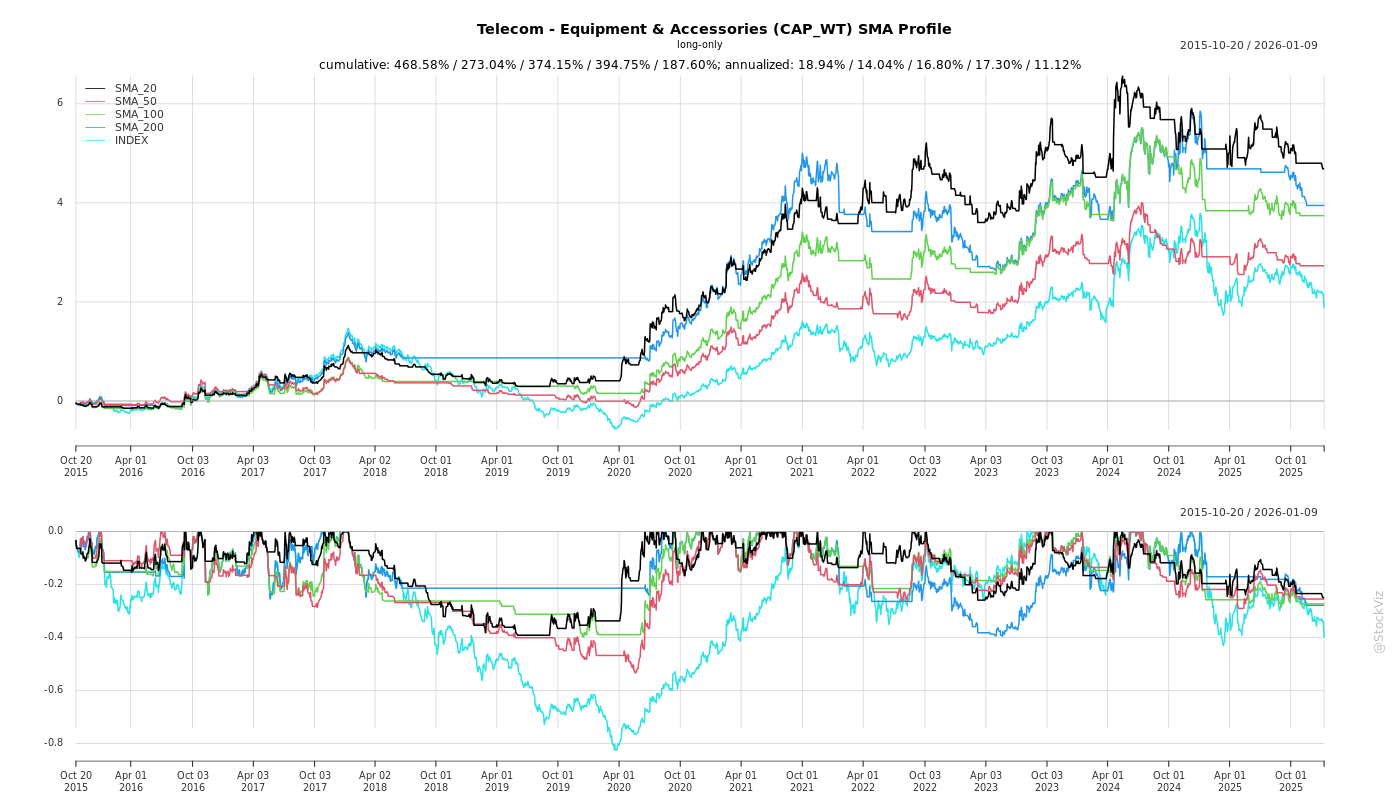

SMA Scenarios

Current Distance from SMA

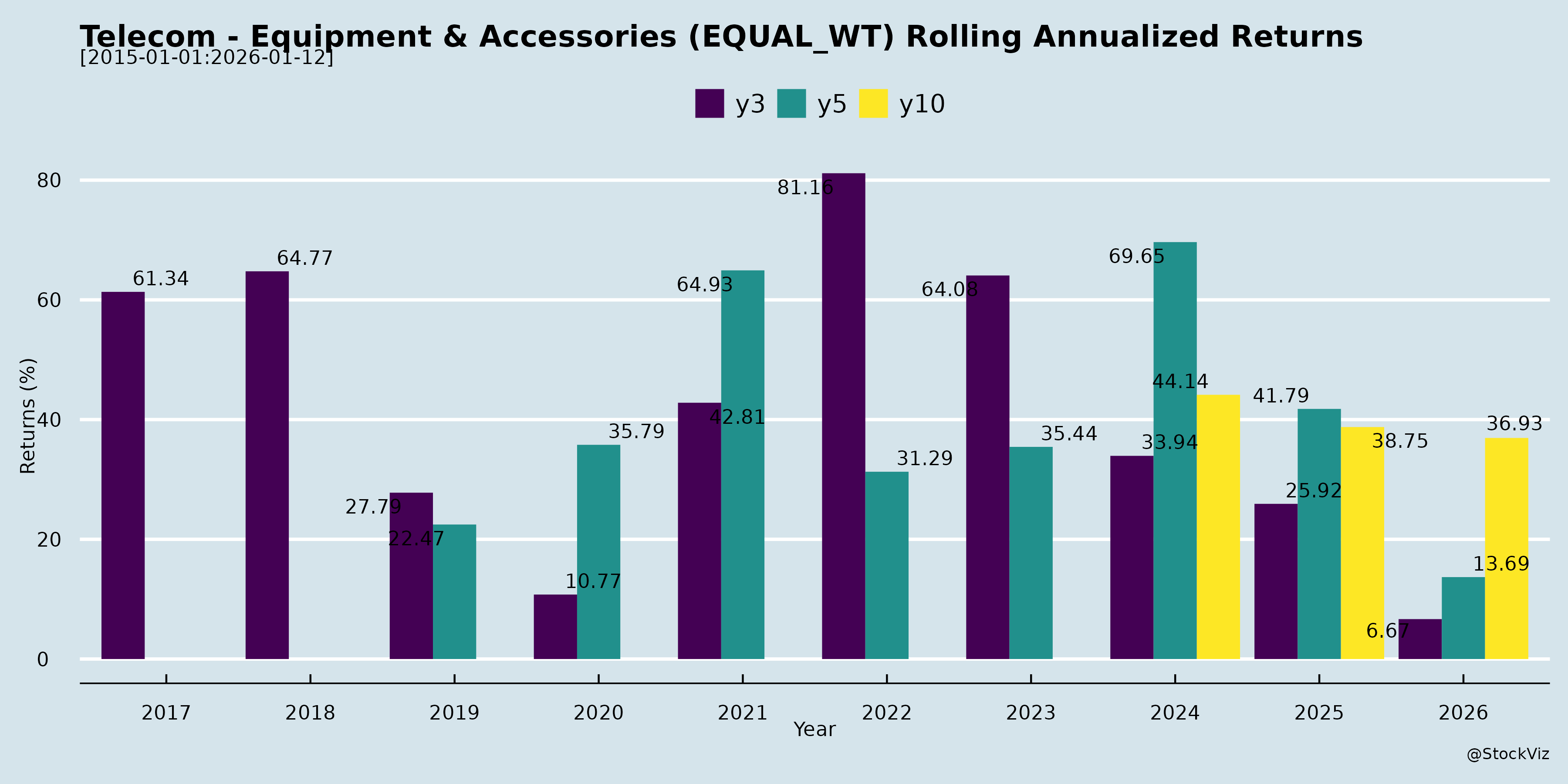

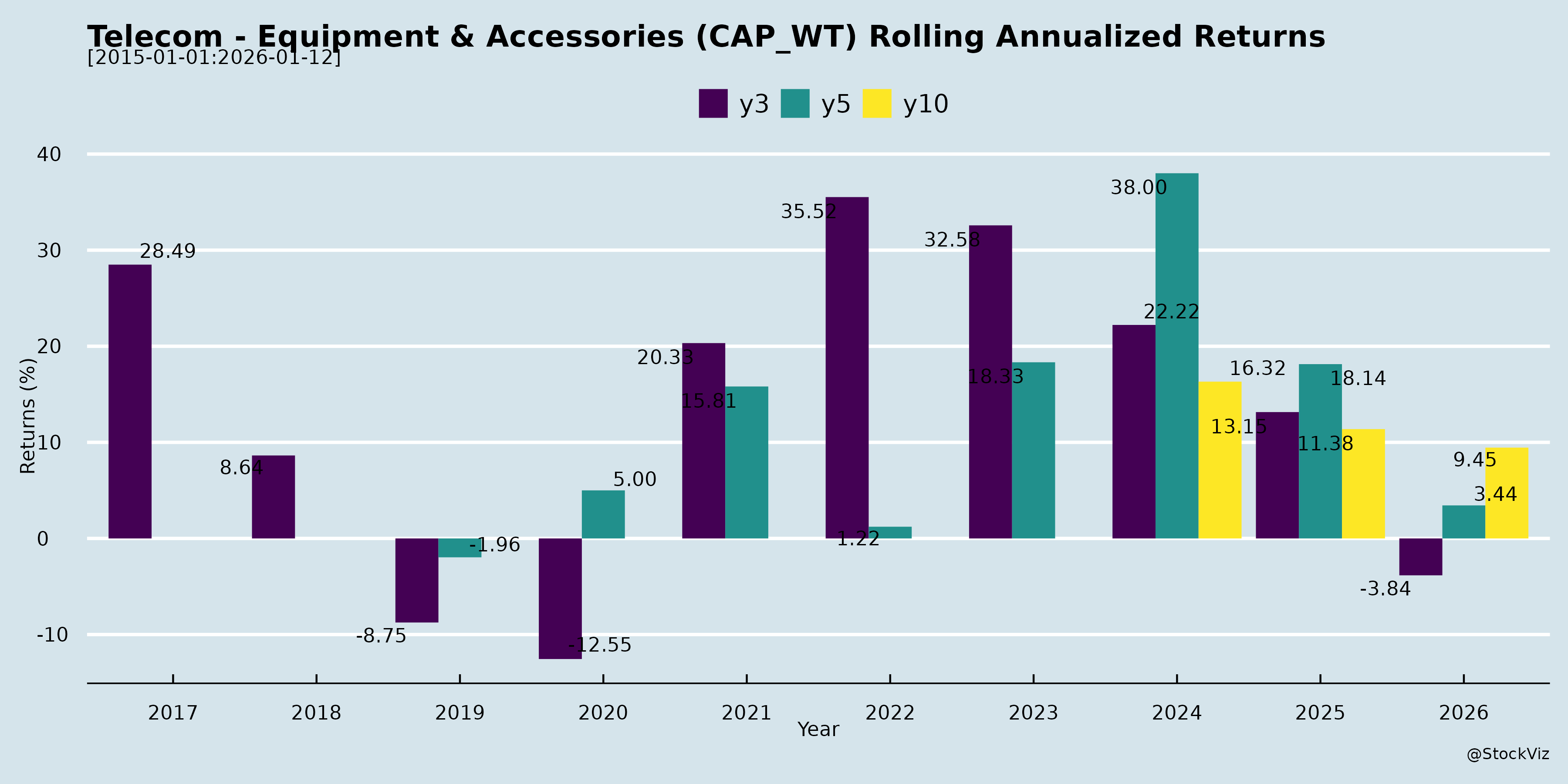

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Indian Telecom Equipment & Accessories Sector Analysis

Based on inputs from Tejas Networks (investor meet intimation), Sterlite Technologies Ltd (STL) Q2/H1 FY26 earnings transcript, and Optiemus Infracom (analyst meet intimation). These documents highlight optical networking, fiber cables, connectivity solutions, and related equipment/accessories, with STL providing the most detailed sector insights amid global/India demand cycles.

Tailwinds

- Mega Demand Cycles Aligning: Coincidence of FTTH rollouts (e.g., India BharatNet Phase-III Rs 1.3tn, US BEAD $42bn/$97bn broadband), AI-driven data center expansion (global capex $600bn+ by 2027; India 5x capacity by 2030; NA 21GW to 80GW by 2029), and 5G densification (global fiberization from 38% to 63% by 2029). CRU forecasts global OFC demand +1.7% YoY in 2025 (NA 12% CAGR to 2030).

- Strong Order Momentum & Revenue Growth: STL H1 FY26 optical networking revenue +6% YoY (Rs 1,941cr); order book Rs 5,188cr (+6% QoQ). US revenue share up to 33% (from 25%); enterprise/data centers 21% of H1 revenue.

- Innovation & Market Share Gains: STL’s high-density cables (e.g., 864-fiber IBR), multi-core fibers (Multiverse), and data center portfolio driving traction. Global OFC share outside China at 7%; aiming top-3 position. Patents (750+), sustainability (zero waste/landfill).

- Investor Confidence: Multiple physical analyst/investor meets (Tejas INDX 2025; Optiemus with 11 funds; STL post-earnings Q&A optimism).

- Margin Expansion: STL optical EBITDA margin 14.1% (H1, +200bps YoY); operational EBITDA 16.7% in Q2 (ex-tariff).

Headwinds

- US Tariff Pressures: 50% tariffs on India imports caused ~300bps EBITDA hit (Rs ~30cr impact) in STL Q2 FY26; mid-quarter reset affected fixed-price contracts. Uncertainty delaying/postponing some demand despite strong US growth (30-50% YoY inferred).

- Geographical/Seasonal Softness: EMEA decline offset US gains; H1 FY26 reflects normal seasonality post-FY25 dip.

- Cost & Debt Burdens: STL finance costs +10% QoQ (Rs 47-52cr range); net debt Rs 1,313cr (0.64x equity, 2.33x EBITDA; target <2x). Higher US lead times straining supply.

- Competition: Local US/Mexico sourcing preference amid tariffs; pricing differentials vary by design.

Growth Prospects

- Multi-Year Super-Cycle: Fiber demand to rise (global 150M to 170M fkm); hyperscaler/AI capex ($4tn DC market by 2030); Big Tech $600bn+ spend. STL expects disproportionate NA growth (telecom + DC + BEAD ramp-up next year).

- Product Expansion: Data center (Celesta IBR, copper-to-fiber shift), connectivity attach rates (20%), FTTH (OptoBlaze), and digital services (STL Digital Rs 65cr Q2 revenue, Rs 286cr order book).

- India Focus: BharatNet, DC investments (Rs 30bn planned), enterprise traction via partners (e.g., Tech Data in 70 cities).

- STL Guidance: Profitable growth via cost leadership, US/Europe ramp-up; PAT turned positive (Rs 14cr H1 vs -Rs 62cr YoY). Order intake 2x YoY (Rs 1,340cr Q2).

- Sector-Wide: High investor engagement signals optimism; Tejas/Optiemus meets indicate broadening equipment/accessories momentum.

Key Risks

- Trade/Tariff Resolution: Ongoing US-India BTA talks critical; prolonged 50% tariffs could erode margins further, delay orders, or shift to local/Mexico supply (STL US court verdict $96.5mn under appeal).

- Demand Postponement: Tariff uncertainty + supply lead times; US growth resilient but sensitive (e.g., hyperscalers/telcos watching closely).

- Execution & Capacity: Ramping US plants (1-year old); CAPEX Rs 115cr FY26 (focus R&D). Debt reduction key amid interest costs.

- Macro/Competition: Geopolitical shifts, China dominance (STL share ex-China), pricing wars in high-density products.

- Litigation/Regulatory: STL US subsidiary exposure; broader SEBI/Listing compliance.

Summary: Sector poised for robust multi-year growth (AI/5G/FTTH super-cycle, 10-12%+ CAGRs in key markets) with strong orders/innovations offsetting tariff headwinds. STL’s resilience (revenue/margin up, order book visibility) exemplifies tailwinds dominating, but tariff clarity by Q3 FY26 pivotal for sustained profitability. Risk-reward favors bulls amid investor interest.

Financial

asof: 2025-12-02

Indian Telecom Equipment & Accessories Sector Analysis (Based on Q3/9M FY25 Results of Key Players: ITI, Tejas Networks, STL, Optiemus, Birla Cable, Kavveri Defence, MRO-TEK)

The sector shows mixed performance: Strong revenue growth in select players (Tejas, Optiemus) driven by PLI incentives and 5G/defence orders, but persistent losses, high debt, and audit issues plague PSUs/legacy firms (ITI, STL, Kavveri). Overall 9M FY25 revenue up ~20-50% YoY for profitable peers, but EBITDA margins compressed (3-10%) due to finance costs (15-20% of expenses).

Headwinds

- Persistent Losses & Negative Cash Flows: ITI reported ₹210 Cr loss (9M); STL ₹84 Cr; Kavveri FY25 profit masked by write-backs amid ₹89 Cr accum. losses. High finance costs (ITI ₹178 Cr, STL ₹238 Cr, MRO-TEK ₹833 Cr) erode margins (e.g., ITI EBITDA -8%).

- Audit Red Flags & Governance Issues: ITI’s auditor issued “Disclaimer of Conclusion” (revenue recognition doubts, unconfirmed balances ₹108 Cr, MSME non-compliance); Kavveri “Qualified Opinion” (going concern, impairments, forex non-reinstatement). STL/Kavveri highlight inventory overvaluation, unbilled revenue risks.

- High Debt & Liquidity Strain: STL debt-equity 0.75x (down from 1.42x post-QIP); ITI revival plan (₹415 Bn aid, ₹302 Bn received); MRO-TEK finance costs 23% of expenses.

- Operational Delays: ITI’s ₹82 Bn ASCON project delayed (PoC pending); STL US litigation (₹965 Cr claim); Kavveri subsidiaries under IBC/bankruptcy.

Tailwinds

- Govt Support & PLI Schemes: Tejas ₹368 Cr PLI (9M), revenue ₹7 Cr (up 500% YoY); Optiemus/Birla leverage defence/telecom orders. ITI ₹15-19k Cr order book (defence focus exempts segment reporting).

- Revenue Momentum: Tejas ₹7 Cr (9M, +500% YoY); Optiemus ₹144 Cr Q3; Birla Cable ₹50k Cr 9M; MRO-TEK ₹3.6k Cr (real estate boost). 5G infra aids Tejas/STL.

- Fund Infusions: STL QIP (₹1k Cr); Kavveri warrants; ITI govt aid. Tejas merger (Saankhya Labs) adds defence tech.

Growth Prospects

- Order Book & Pipeline: ITI ₹15-19k Cr (ASCON Phase IV ₹82 Bn); Tejas high margins (EBITDA 11%); Optiemus trading/manufacturing scale-up; Birla Cable steady cables demand.

- Defence/5G Boom: PLI (Tejas ₹368 Cr 9M); ITI/Kavveri defence exemptions; STL optical networking recovery post-QIP/demerger.

- Capex/Revival: ITI unbilled ₹180 Bn conversion in 12M; Tejas FY25 rev. guidance strong; MRO-TEK real estate (₹14k Cr assets) unlocks value. Sector tailwinds: India 5G rollout, Atmanirbhar Bharat.

- Projections: Profitable peers (Tejas/Optiemus) 20-50% CAGR; PSUs turnaround via orders (ITI FY25 rev. ₹2.6k Cr 9M, up 300% YoY).

Key Risks

| Risk Category | Details | Impact (High/Med/Low) |

|---|---|---|

| Going Concern/Liquidity | ITI/Kavveri/STL: Losses, debt, delays; Kavveri subsidiaries IBC. | High |

| Audit/Compliance | Disclaimers (ITI), qualifications (Kavveri: impairments, forex, gratuity); unconfirmed balances (ITI ₹108 Cr banks, receivables). | High |

| Forex/Impairments | Kavveri forex non-reinstatement; ITI inventory obsolescence; subsidiaries losses (no impairment). | High |

| Revenue Recognition | ITI/STL: Ind AS 115 doubts (milestone-based); unbilled ₹180 Bn (ITI). | Med-High |

| Litigation/Regulatory | STL US suit (₹965 Cr); ITI PoC delays; MSME non-ID (ITI/STL). | Med |

| Execution | Order delays (ITI ASCON); real estate cyclicality (MRO-TEK). | Med |

| Macro | Input costs, forex volatility; 5G capex slowdown. | Low-Med |

Summary: Sector poised for 5G/defence-led growth (tailwinds: PLI, orders), but legacy issues (headwinds: losses, debt) dominate PSUs. Profitable firms (Tejas/Optiemus) signal revival; monitor audit resolutions & order execution for FY26 upside. Overall outlook: Cautiously Optimistic (20-30% sector growth, but high execution risks).

General

asof: 2025-12-03

Summary Analysis: Indian Telecom Equipment & Accessories Sector

Based on the provided documents from key players (ITI Ltd., Tejas Networks, Sterlite Technologies, Optiemus Infracom, Kavveri Defence & Wireless Technologies, Umiya Buildcon/MRO-TEK, Aksh Optifibre, and Tamilnadu Telecommunications Ltd./TTL), the sector shows resilience amid government support but faces execution and compliance challenges. The analysis focuses on headwinds (challenges), tailwinds (supports), growth prospects, and key risks.

Tailwinds (Positive Factors)

- Government Incentives & Policies: Strong push via Production Linked Incentive (PLI) Scheme – Tejas Networks received ₹84.95 Cr (85% of Q4 FY25 eligible incentive), signaling robust disbursements for telecom manufacturing. Make in India/Atmanirbhar Bharat emphasized (e.g., Umiya’s indigenous Network OS & hardware R&D).

- Strategic Expansions & Capital Infusion: Optiemus incorporating JV “The Factory Pvt. Ltd.” (65% stake) for electronics/IoT manufacturing; Kavveri securing trading approval for 1.425 Cr preferential shares (₹22.8 Cr raised), funding growth.

- Leadership & Governance Stability: Routine AGMs (ITI 75th, TTL 37th) with director re-appointments/approvals (e.g., ITI’s govt directors); resolved compliance issues (Sterlite waiver of NSE fine).

- Sector Demand Drivers: Focus on defence telecom (Kavveri), optical fibre (Aksh, TTL), and networking gear aligns with 5G rollout and digital infra needs.

Headwinds (Challenges)

- Regulatory & Compliance Burdens: Delays in disclosures (Sterlite fined ₹5,000 for Reg. 23(9) non-compliance, later waived); heavy reliance on SEBI/MCA circulars for virtual AGMs/e-voting.

- Leadership Transitions: Aksh Optifibre appoints interim CFO (Varun Dube) amid search for permanent role, indicating potential gaps in financial stability.

- Operational Dependencies: Govt undertakings (ITI, TTL) tied to MoC/DoT orders; execution risks in new setups (e.g., Optiemus JV incorporation pending full rollout).

- Cost Pressures: Auditor/Cost auditor remunerations rising (ITI: ₹2.8L cost audit; TTL: ₹1L statutory audit), reflecting inflation/scope expansions.

Growth Prospects

- High Potential in Indigenous Manufacturing: Umiya’s CTO appointment (30+ yrs exp. from Cisco/Huawei) to lead R&D for secure firmware/Network OS; Optiemus JV targeting consumer/industrial electronics, IoT – could capture PLI benefits and export markets.

- Funding & Capacity Build-Up: Preferential allotments (Kavveri) and PLI inflows (Tejas) enable scaling; ITI/TTL’s defence/ISRO orders highlight diversification into high-margin areas.

- Market Expansion: 5G/satellite/rural telecom demand (ITI’s govt director expertise); optical fibre focus (Aksh) amid BSNL/DoT projects. Sector poised for 15-20% CAGR (PLI-driven), with JVs/subsidiaries accelerating “Design-Make in India”.

- Timeline: Near-term (FY26): PLI tranches, JV ops; Medium-term: R&D-led products for global competitiveness.

Key Risks

- Regulatory/Compliance Risks: Frequent SEBI filings (Reg. 30/36), e-voting dependencies; non-compliance fines (Sterlite precedent) could escalate.

- Execution & Financial Risks: Interim leadership (Aksh), new entity incorporation delays (Optiemus); lock-in on preferential shares (Kavveri till 2027) limits liquidity.

- Market/Geopolitical Risks: Heavy govt reliance (90%+ revenue for ITI/TTL) exposes to policy shifts; competition from China imports despite PLI.

- Operational Risks: R&D failures (Umiya’s indigenous push); supply chain disruptions in electronics manufacturing.

Overall Outlook: Bullish with Cautious Optimism. Tailwinds from PLI/Make in India outweigh headwinds, projecting 20-25% sector growth in FY26 driven by 5G infra (₹2-3L Cr capex). Monitor execution of JVs/R&D and compliance for sustained momentum. Recommended: Track PLI disbursements and Q3 FY26 earnings for validation.

Investor

asof: 2025-11-29

Analysis of Indian Telecom Equipment & Accessories Sector

Using the provided documents (Tejas Networks Investors’ Presentation, STL Q2 FY26 Earnings Transcript, and Optiemus Infracom Q2 FY26 Update) as primary inputs, this analysis focuses on the Indian Telecom Equipment & Accessories sector. These companies represent key players: Tejas Networks (end-to-end wireless/wireline equipment), Sterlite Technologies (STL) (optical fiber cables & connectivity), and Optiemus Infracom (EMS for devices/accessories like smartphones, hearables, fintech hardware). The sector benefits from India’s digital infrastructure push but faces global trade and execution challenges.

Tailwinds (Positive Drivers)

- Government Support & Policy Push: Strong “Atmanirbharta” (self-reliance) momentum via PLI schemes (Tejas: ₹123 Cr FY24 + ₹312 Cr FY25 incentives; Optiemus: ECMS application), BharatNet Phase-III, BSNL 4G/5G rollout (Tejas: 300K+ radios shipped, 100K+ sites), and “Trusted Source” certification. PMI lists favor local suppliers.

- Mega Demand Cycles: Coinciding 5G densification (global 6.3B subs by 2030), FTTH/ FWA growth (1.9B fixed broadband users by 2030), AI/data center boom (STL: 28% CAGR optical demand; Tejas: AI middle-mile networks). North America/Europe leading resurgence (12% CAGR fiber demand ex-China).

- Innovation & R&D Leadership: Tejas (585+ patents, 65% R&D staff), STL (750+ patents, multi-core fiber/Multiverse), Optiemus (new cover glass facility with Corning). Software-defined hardware, 1.2T DWDM, high-density cables position them for 5G-Adv/6G/AI edge.

- Capacity & Partnerships: Expansions (Tejas: 16x shipment scale-up; Optiemus: new smartphone/cover glass facilities; STL: US facility). Global tie-ups (Tejas: NEC/Rakuten; Optiemus: Nothing/Ordinary Theory/OnePlus; STL: Tech Data).

- Financial Momentum: Order books strong (STL: ₹5,188 Cr; Tejas: ₹1,204 Cr; Optiemus: robust EMS inflows). Revenue growth (Tejas: 9x FY23-25; Optiemus standalone: 148% YoY Q2).

Headwinds (Challenges)

- Trade Tariffs & Geopolitics: STL hit by US 50% tariffs (300 bps EBITDA impact Q2 FY26, mid-quarter reset; shared burden on fixed-price contracts). Delays/uncertainty in US demand despite 33% revenue share (up from 25%).

- Execution & Seasonality: Tejas: H1 FY26 losses from order delays, inventory/warranty provisions (EBIT -₹626 Cr). Optiemus: Consolidated revenue dip 12% YoY Q2 due to shipment timing/product mix.

- Margin Pressures: High working capital (Tejas: ₹4,906 Cr NWC, borrowings ₹4,156 Cr), forex losses, rising interest costs (STL: up 10% QoQ). Utilization ramp-up ongoing (e.g., Optiemus US plants).

- Market/Inventory Risks: Global fiber demand turnaround post-2-year decline (STL), but competition from China/Mexico. Dependency on BSNL (Tejas: large exposure).

Growth Prospects

- Domestic Telecom Boom: BSNL 4G/5G expansion (Tejas: 100K+ sites, 22M subs), private telco upgrades, BharatNet (Tejas: leading GPON supplier). Utilities/railways/smart cities (Tejas: 40K+ switches).

- Global Exports & Diversification: Tejas (75+ countries, Africa/Italy/Malaysia wins); STL (7% global OFC share ex-China, US/Europe traction); Optiemus (export-focused JV with Ordinary Theory for AI fintech/IoT).

- AI/Data Center Super-cycle: High-capacity optics (STL: Celesta IBR 864-fiber cable; Tejas: 400G/800G DWDM). Enterprise/wearables (Optiemus: hearables roadmap).

- Projections: Multi-year upcycle (STL: order intake 2x YoY Q2); Tejas FY26 YTD revenue ₹464 Cr (post-9x growth); Optiemus PAT +33% consolidated YoY. Target: Tejas global top-tier; STL top-3 optical; Optiemus EMS leadership.

- Timeline: Short-term (FY26): BSNL/PLI execution; Medium-term (FY27+): 5G SA, BEAD funding (US $97B), data center capex ($580B 2025).

| Metric | Tejas | STL | Optiemus |

|---|---|---|---|

| Order Book | ₹1,204 Cr (93% India) | ₹5,188 Cr | Robust EMS inflows |

| Revenue Growth (Recent) | 9x FY23-25 | +6% H1 FY26 | +148% standalone Q2 |

| EBITDA Margin | 10% FY25 | 13.6% Q2 FY26 | 8% consolidated Q2 |

Key Risks

- Trade/Policy Risks (High): US tariffs persist (STL appeal ongoing; $96.5M US court verdict); BTA delays. China competition in exports.

- Execution Risks (Medium-High): Project delays (BSNL dependency ~Tejas revenue mix), supply chain (inventory buildup), capacity utilization.

- Financial Risks (Medium): Debt (Tejas net debt/EBITDA 2.33x; STL 2.33x), forex volatility, working capital strain.

- Market/Competition Risks (Medium): Demand slowdown if AI hype cools; global players (Nokia/Ericsson for Tejas; Prysmian for STL).

- Legal/Regulatory (Low-Medium): Tejas/STL lawsuits; PLI/ECMS approvals pending.

- Mitigants: Diversified geographies (STL: 42% Europe), Tata backing (Tejas), strong patents/governance (ESG awards).

Overall Summary

The sector is in a multi-year growth super-cycle driven by 5G, FTTH, AI/data centers, and PLI/Atmanirbharta (projected TAM ex-China: billions USD). Companies show resilience (margin expansion, order growth) amid headwinds like US tariffs (STL-specific) and execution delays. Bullish Outlook: 20-30%+ CAGR feasible FY26-30 via domestic mega-projects and exports, with Tejas/STL leading equipment/optics and Optiemus in accessories/EMS. Key Watch: Tariff resolution (Q3 FY26 expected), BSNL execution. Risk-reward favors longs, but monitor US trade and debt metrics. Sector poised for India’s $500B electronics ecosystem goal.

Press Release

asof: 2025-11-29

Indian Telecom Equipment & Accessories Sector Analysis

Based on provided press releases (ITI Ltd, Tejas Networks, STL, Optiemus Infracom, TTL) dated Sep-Nov 2025.

Tailwinds (Positive Drivers)

- Government Support & Indigenous Push: Strong alignment with Make in India, Atmanirbhar Bharat, and National Quantum Mission (₹6,000 Cr outlay). Partnerships with Kerala Govt (ITI’s Kerala Savaari 2.0 multi-modal app), PowerGrid (Tejas’ 400Gbps DWDM), DoT/IIT-Madras (STL’s MCF testbed), and state PSUs like TTL highlight policy backing for local manufacturing and e-gov projects.

- Technological Advancements: Deployment of cutting-edge tech like Tejas’ TJ1600 DWDM (1.2 Tbps/wavelength, alien wavelength), STL’s Multi-Core Fiber (MCF) with QKD (170km secure keys + 800Gbps data), enabling 5G, data centers, AI, and quantum-secure networks.

- Diversification & Revenue Streams: Expansion beyond core telecom—ITI into transport apps (₹9.36 Cr revenue from 3.6L trips), Optiemus JV for smart hardware (fintech/AI devices), signaling multi-modal growth.

- Market Demand: Surging bandwidth needs from hyperscalers, telcos, enterprises; quantum market projected at $140Mn by 2030 (34.6% CAGR).

Headwinds (Challenges)

- Dependency on Govt Contracts: Most wins (ITI, Tejas, STL) tied to PSUs/govt depts (e.g., Kerala Labour, PowerTel, NQM), exposing to budget delays, policy shifts.

- Execution & Scale-Up Hurdles: Pilot-to-full rollout (ITI’s app expansion, Tejas’ greenfield upgrades) faces trial risks; quantum demos (STL-QNu) are early-stage, needing commercialization.

- Competition & Imports: Global giants in DWDM/quantum; reliance on foreign JV partners (Optiemus-Ordinary Theory) amid supply chain vulnerabilities.

- Financial Scrutiny: TTL’s Q2 results intimation suggests ongoing profitability pressures in legacy PSUs.

Growth Prospects

- High (Strong Outlook): Sector poised for 20-30% CAGR via 5G rollout, data center boom, quantum infra (NQM target: quantum-secure by 2031). Key opportunities: Pan-India DWDM upgrades (Tejas model), MCF/QKD for AI/8K streaming (STL), smart hardware exports (Optiemus), integrated transport apps (ITI). Total addressable market expands with multi-modality (metro/auto/ambulance integration) and defense/IoT diversification.

- Projected Catalysts: Greenfield projects, alien wavelength for brownfield upgrades, global deployments (STL/Tejas in 75+ countries).

Key Risks

| Risk Category | Description | Mitigation from Docs |

|---|---|---|

| Execution | Delays in integration/testing (e.g., Kerala Savaari pilots, DWDM commissioning). | ITI/Tejas technical support commitments. |

| Regulatory/Approval | Statutory nods for JVs (Optiemus), NQM compliance. | Binding term sheets/MoUs in place. |

| Technological | Quantum immaturity; MCF/QKD scalability unproven. | Proven demos (170km QKD + 1.8Tbps). |

| Financial/Market | Revenue concentration (govt ~70%); forex/competition. | Diversification (apps/hardware); SAFE harbour noted. |

| Geopolitical | Supply chain for optics/chips; US-China tensions. | Indigenous focus (Make in India). |

Overall Summary: Bullish sector with tailwinds from govt tech-push outweighing headwinds. Growth anchored in optical/DWDM/quantum upgrades and diversification; monitor Q2 results (TTL) and JV executions for near-term triggers. Risks moderate, tilted toward execution in emerging tech.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.