BIOCON

Equity Metrics

January 13, 2026

Biocon Limited

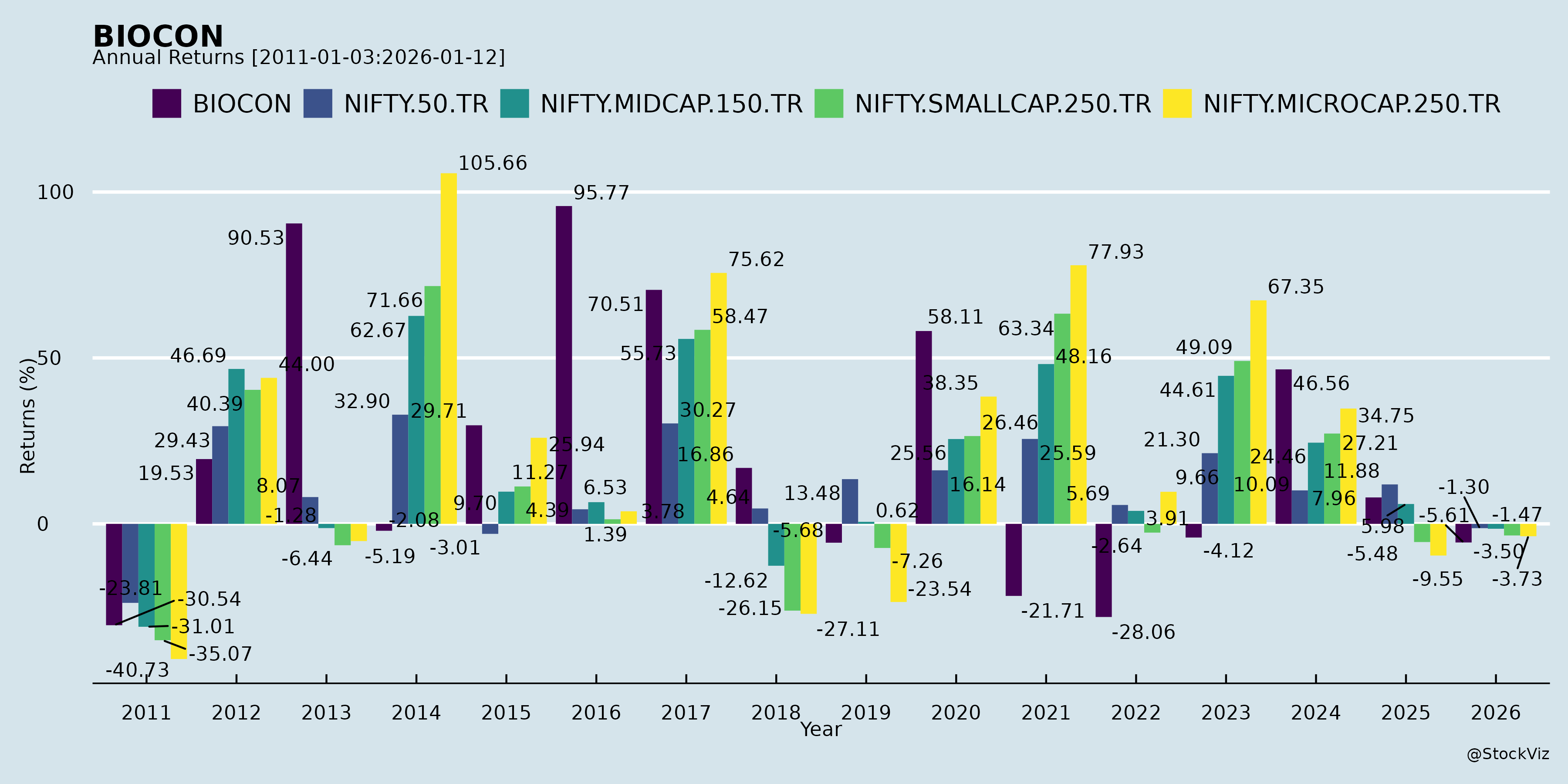

Annual Returns

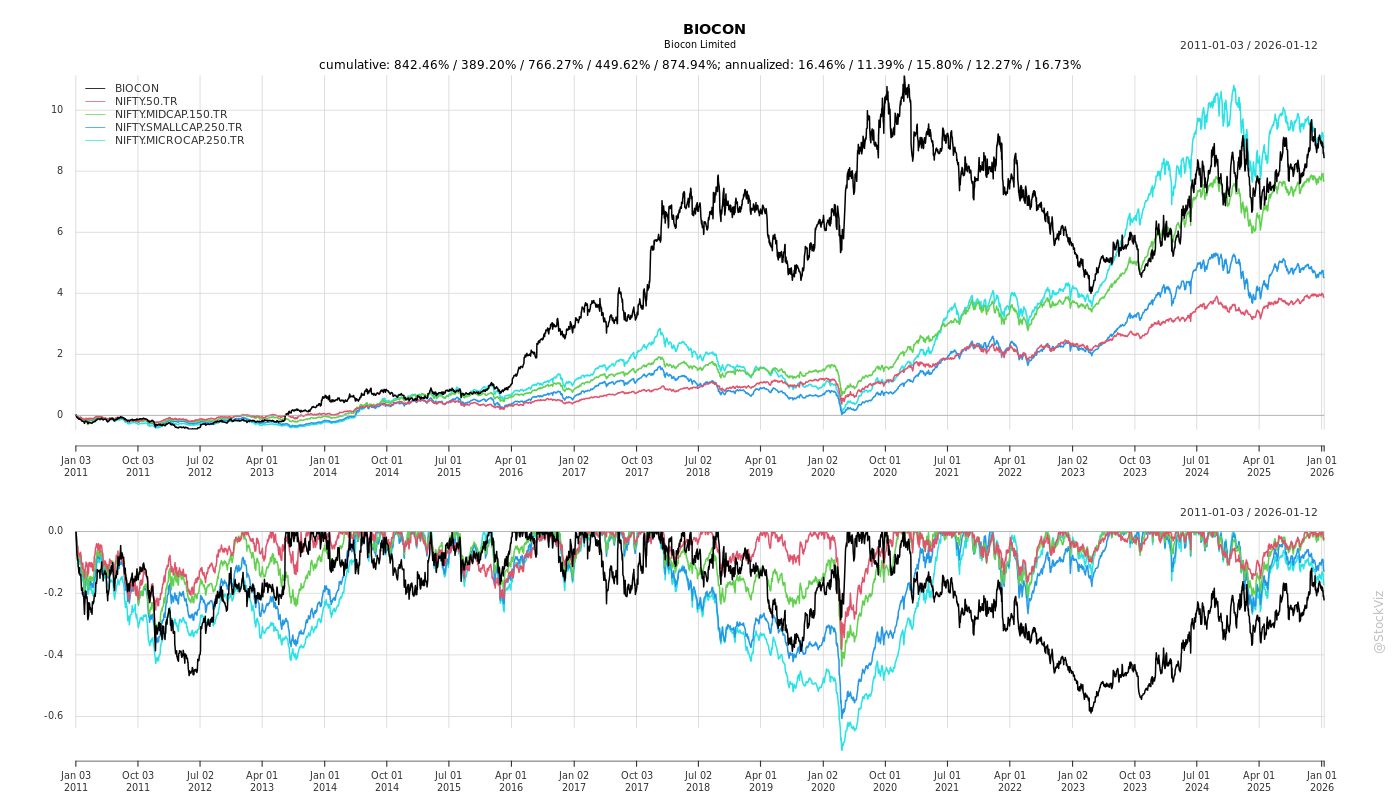

Cumulative Returns and Drawdowns

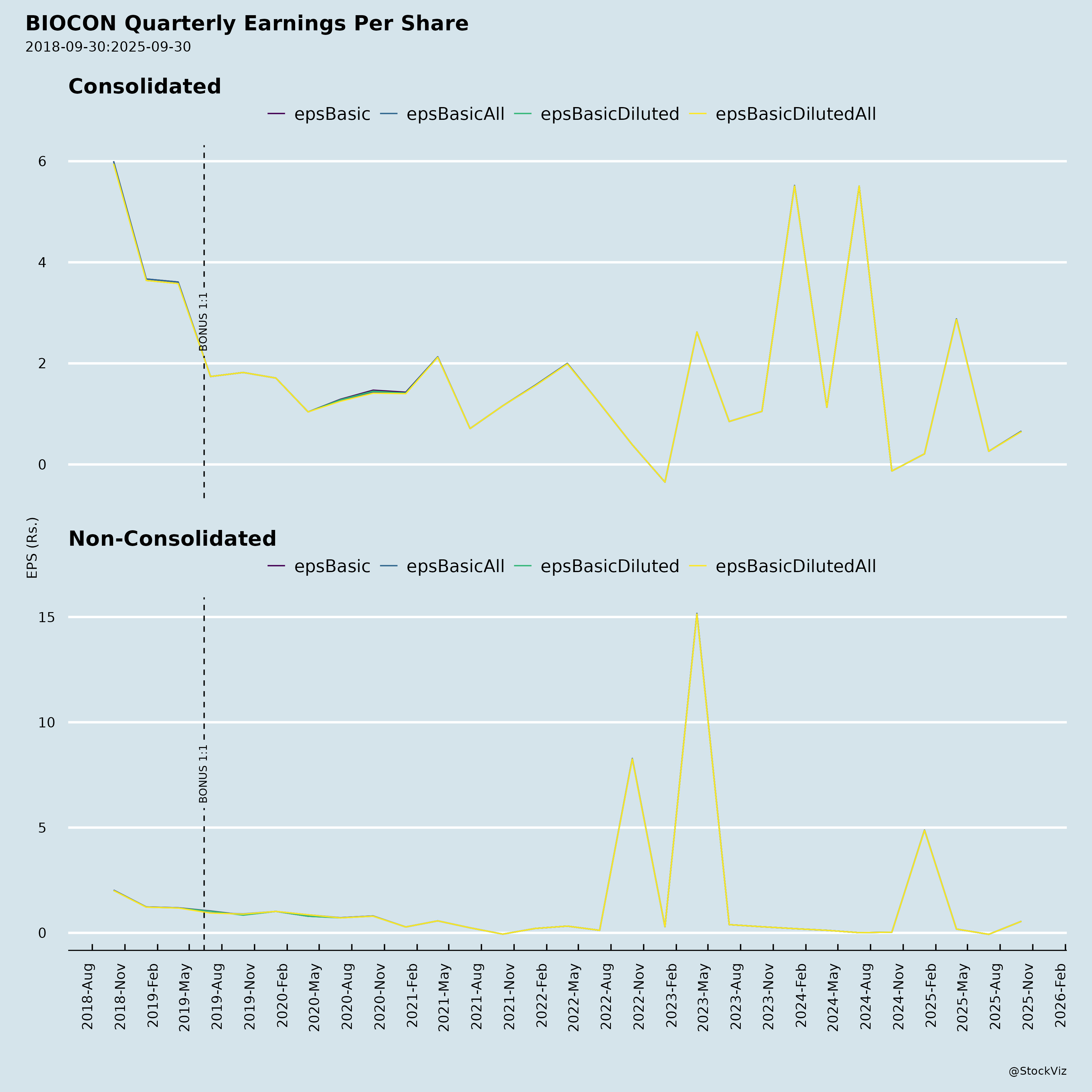

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-03

Biocon Limited (BIOCON) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Based on Q2 FY26 Earnings (ended Sep 30, 2025), Financials, Presentations, Transcripts, Approvals, and Recent Updates (e.g., Tofacitinib FDA approval, Denosumab Europe settlement). All figures in ₹ Cr unless stated.

Tailwinds

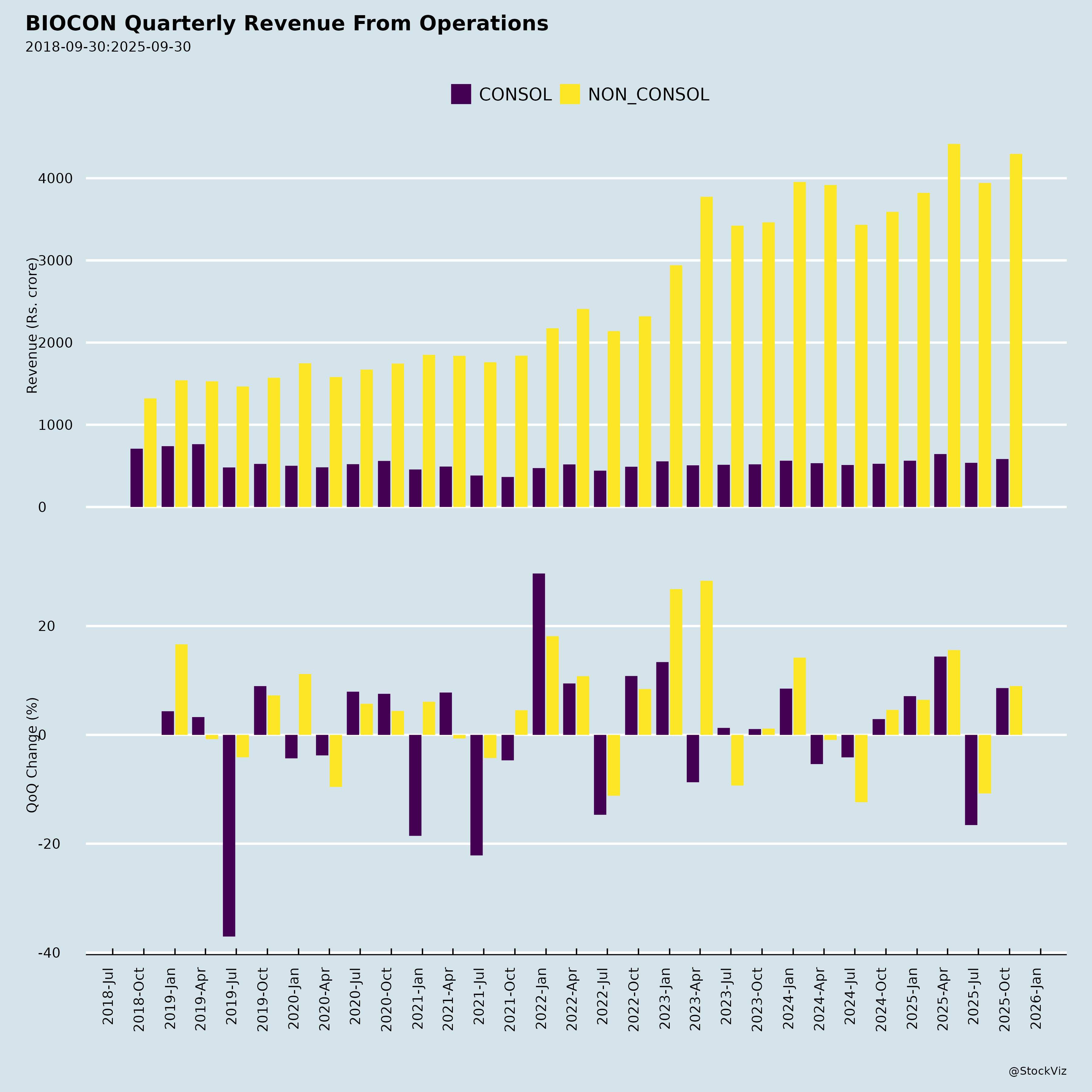

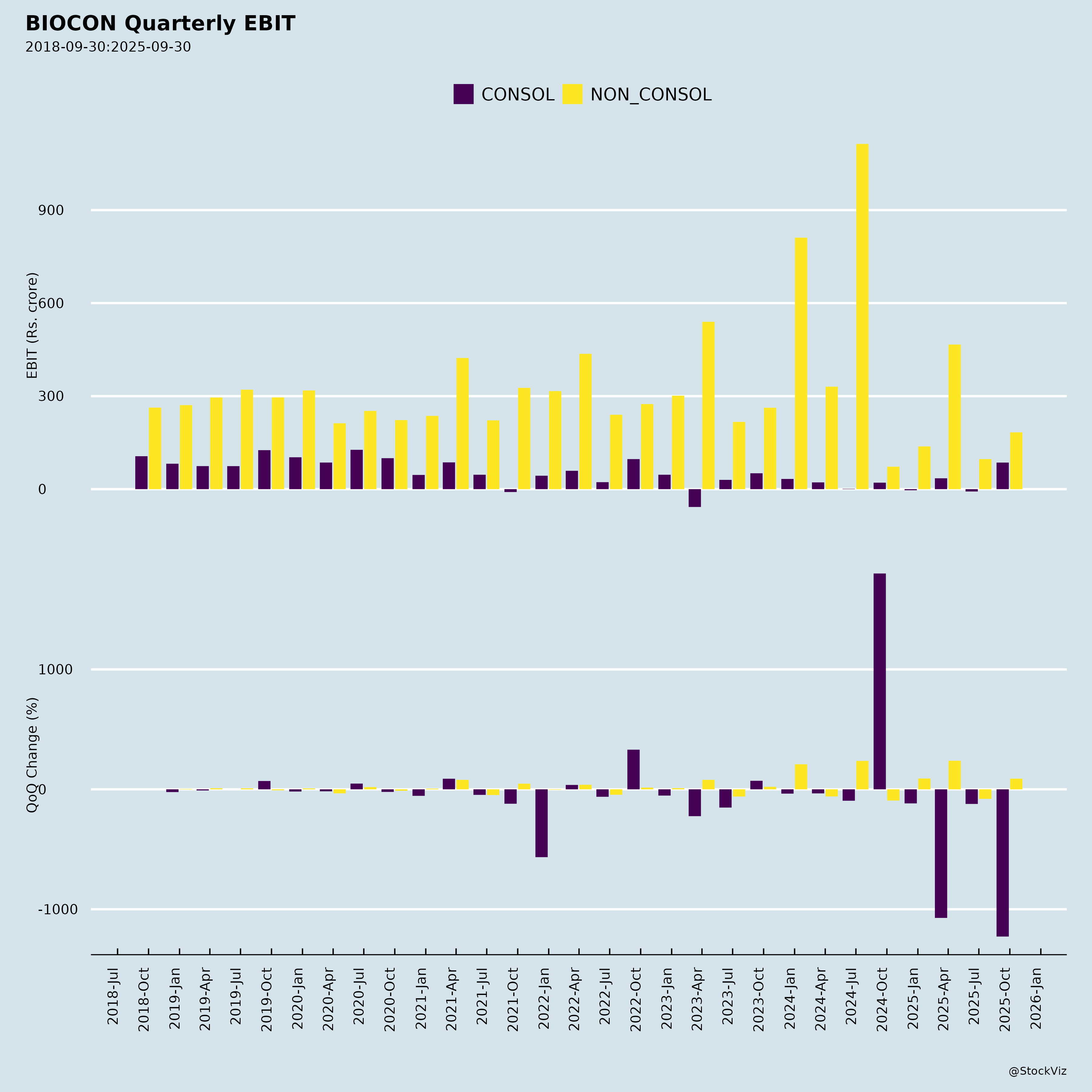

- Robust Revenue & Margin Momentum: Group revenue +20% YoY to 4,296 (Total 4,389); Core EBITDA +23% to 1,218 (28% margin). Biosimilars led with +25% YoY to 2,721 (EBITDA +43% to 669, 25% margin, +400 bps YoY). Generics +24% YoY to 774. 5 consecutive quarters of revenue growth.

- Debt Deleveraging: QIP raised ~45,000 (Jun 2025) used to settle Goldman Sachs (Jun), Kotak (Oct), and Edelweiss CCDs (~300 by Jan 2026). Annual interest savings ~300 from FY27. Early NCD redemption (500) and CP repayment (600). Net debt reduction improves profitability (PBT ex-exceptionals +153% YoY to 183).

- Biosimilars Traction: Yesintek (bUstekinumab) market-leading in US (>70% formulary coverage); Oncology stable (Ogivri/Fulphila >25% share); Insulin franchise (interchangeable bAspart/Glargine via Civica CA partnership). New launches: bBevacizumab, bAflibercept. Denosumab US FDA approved + Amgen settlements (US Oct, Europe/ROW Dec 2, 2025 entry).

- Regulatory Wins: Tofacitinib ER ANDA (final 11mg, tentative 22mg). NJ OSD facility FDA inspection (1 minor observation, resolved).

- ESG Strength: S&P CSA score 71 (+3 pts); Syngene EcoVadis 74 (91st percentile); Golden Peacock Award.

Headwinds

- Persistent Losses in Generics: EBITDA 43 (up YoY but low vs. historical); H1 fixed costs from new facilities (Vizag, Cranbury, peptides) drag margins (mid-40s gross). Pricing pressure in statins; formulations (40% mix) lower-margin than APIs (60%).

- CRDMO Softness (Syngene): Revenue +2% YoY to 911; EBITDA -18% to 215 (23% margin) due to biologics inventory correction. H1 in-line but FY26 guidance steady (no upgrade).

- High R&D & Capex: Biosimilars R&D 7-9% of revenue (180/Q2); Generics 8-10% (71/Q2). CWIP high (consolidated 46,108).

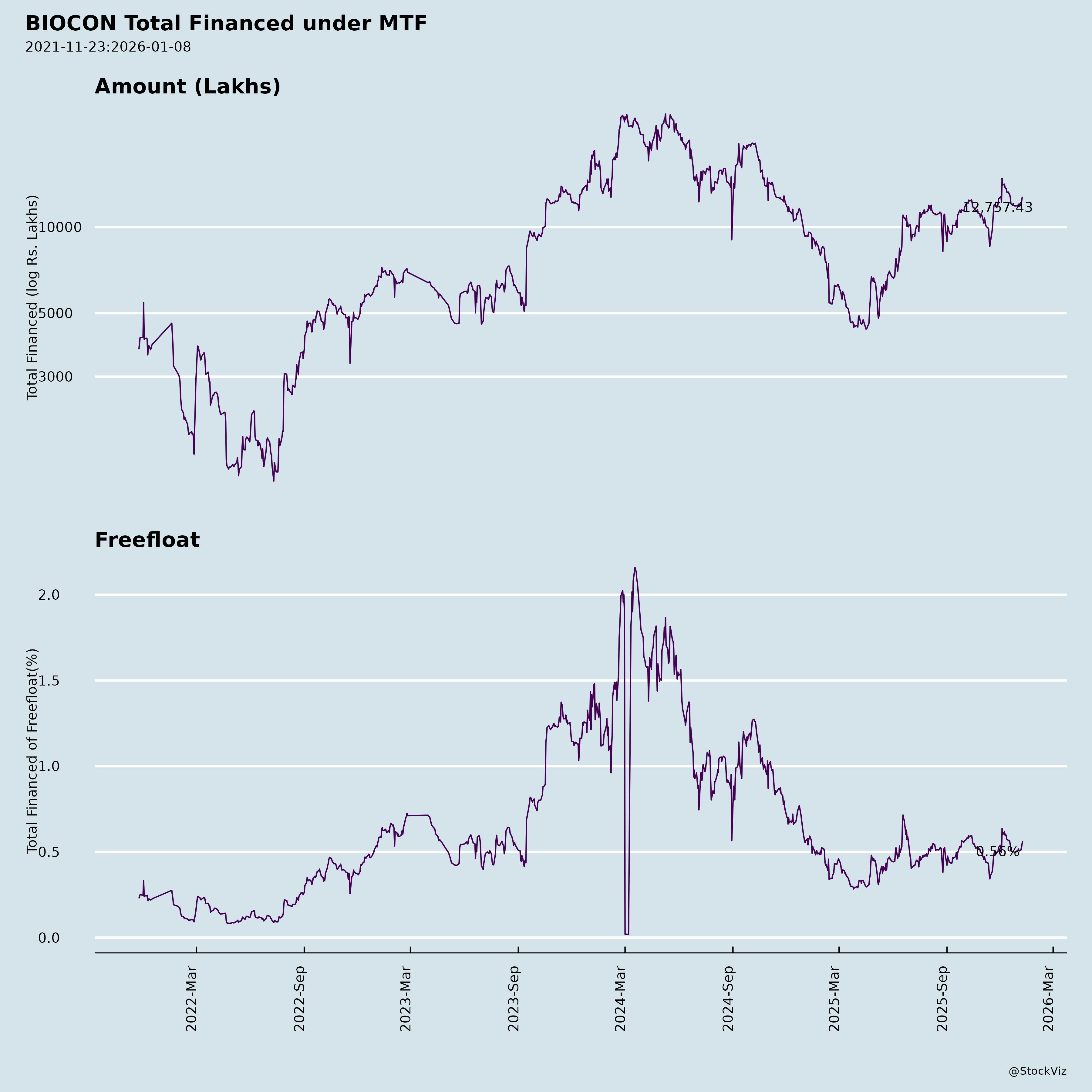

- Elevated Debt/Interest: Consolidated borrowings 1,05,700 (NC) +53,377 (C); interest expense 1,234 (standalone H1). Short-term maturities ~69 bn (Sep).

- Forex/Inventory Volatility: Unrealized FX losses; Syngene receivable write-off (277).

Growth Prospects

- Biosimilars (65%+ Group Revenue): “Accelerate” phase with 5 launches delivered (per Q4 FY25 guidance). Pipeline: bDenosumab imminent; Immunology/Oncology expansion (Ustekinumab in 7 EU mkts). Geo-mix stable (US 40%, EU 35%, EM 25%). FDA guidance eases Phase III needs → faster/cheaper dev (advantage to integrated players like Biocon).

- Generics Ramp: Semaglutide (gOzempic) filings (Canada/Brazil); Liraglutide/Dasatinib/Sacubitril-Valsartan launches. GLP-1/injectables focus; no capacity constraints (shared infra + CMOs). H2 FY26 strengthening expected.

- Insulin/Diabetes Franchise: Only interchangeable bAspart (US traction via IDNs); Glargine scaling (Civica + states). GLP-1 adjacency positions Biocon uniquely vs. pure insulin players.

- Syngene/CRDMO: Phase III trial win (US biotech); ADC expansion; clinical footprint (Aus/NZ/UK/EE). Medium-LT growth from diversified services.

- Overall: 120+ countries; vertically integrated (lab-to-market). FY26 Biosimilars PBT >100/qtr (2nd straight); Group profitability up as debt exits.

Key Risks

- Regulatory/Patent: US formulary exclusions (e.g., OptumRx/ES for Aspart); Amgen/other litigations; FDA/EMA delays (e.g., Denosumab commercialization measured due to 5 players +5 pipeline).

- Competition/Market Share: Biosimilars ASP erosion (market share inverse); generics pricing (statins); newer players accelerating post-FDA guidance.

- Execution/Commercial: Ramp-up risks for launches (Aspart procedural in H2 FY26); tender predictability in EM; IDN traction for Denosumab (medical/pharmacy split).

- Financial/Liquidity: Refinancing short-term debt (CP up to 550); forex volatility (cash +9,306 H1 but high borrowings); capex (PPE +8,646 H1).

- Macro: US/EU reimbursement; EM tender volatility; FX (₹ vs. USD).

Summary

Bull Case (Tailwinds Dominate): Biocon’s biosimilars engine (25% growth, margin expansion) + debt cleanup (~300 savings) positions for inflection in FY27 profitability. Insulin/GLP-1 + Denosumab launches unlock US/EU/EM value; integrated model de-risks vs. peers. Q2 validates “Accelerate” phase; H2 generics/CRDMO steady. Target: Sustainable 20%+ revenue CAGR, EBITDA margins >25%.

Bear Case (Headwinds Persist): Generics losses + CRDMO softness cap near-term profits; debt overhang/refinancing risks amid high R&D/capex. Launch delays/competition could erode ASPs/market share.

Overall Outlook: Positive momentum (revenue beat, balance sheet repair) outweighs risks; stock poised for re-rating on launches/debt reduction. Monitor Q3 debt exit + Aspart/Denosumab traction. FY26 consensus: Revenue ~17,000-18,000; improving PAT. (Ratings as of Dec 2025 docs; EV/EBITDA ~15-20x fwd.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.