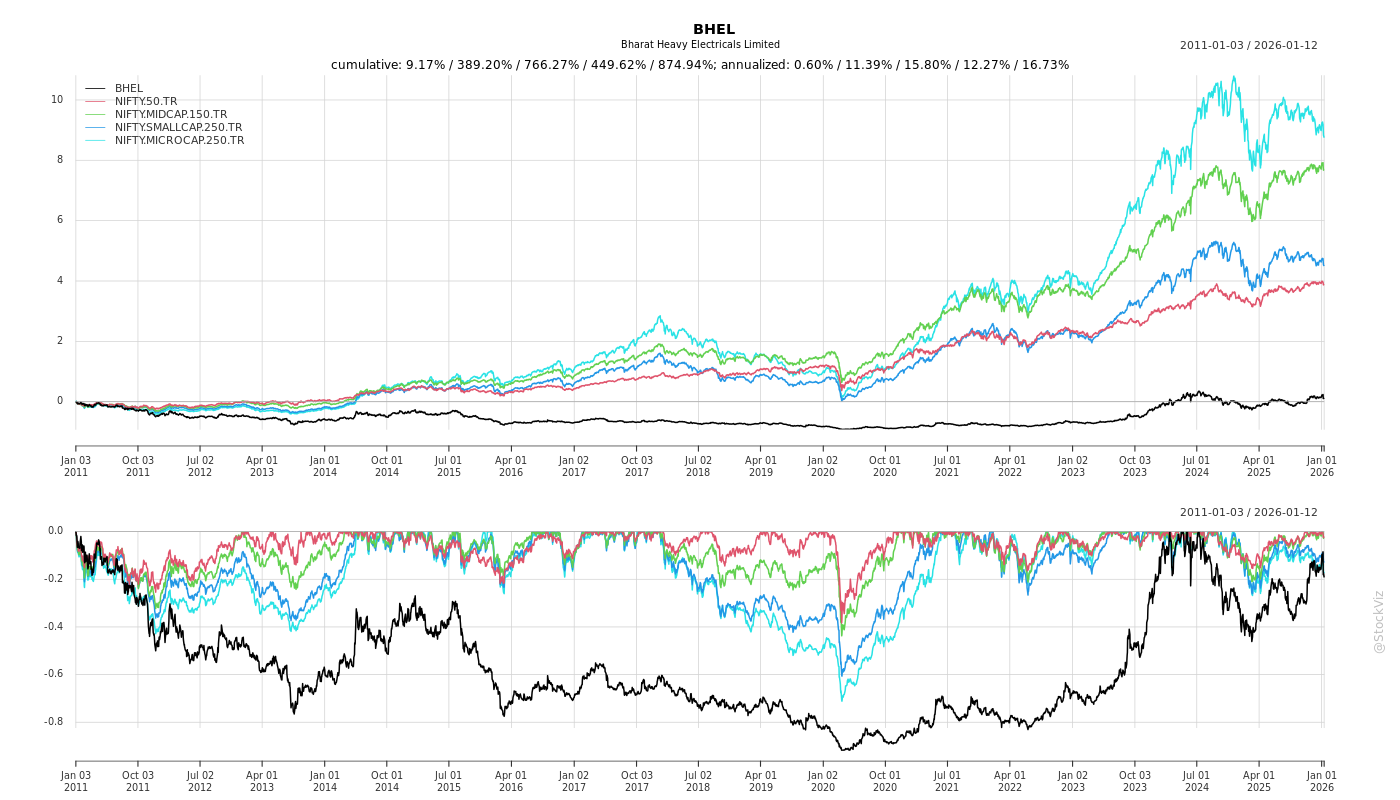

BHEL

Equity Metrics

January 13, 2026

Bharat Heavy Electricals Limited

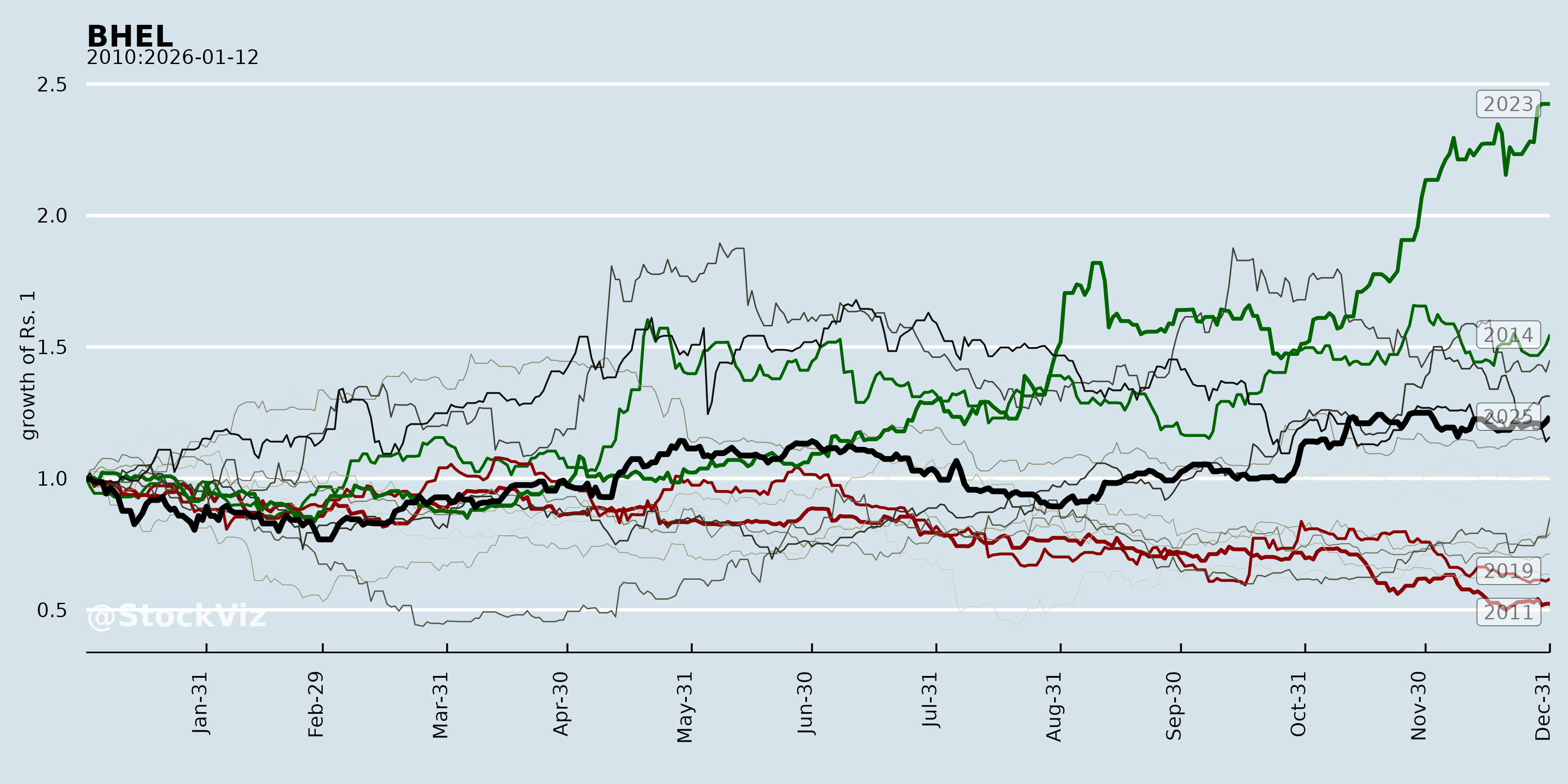

Annual Returns

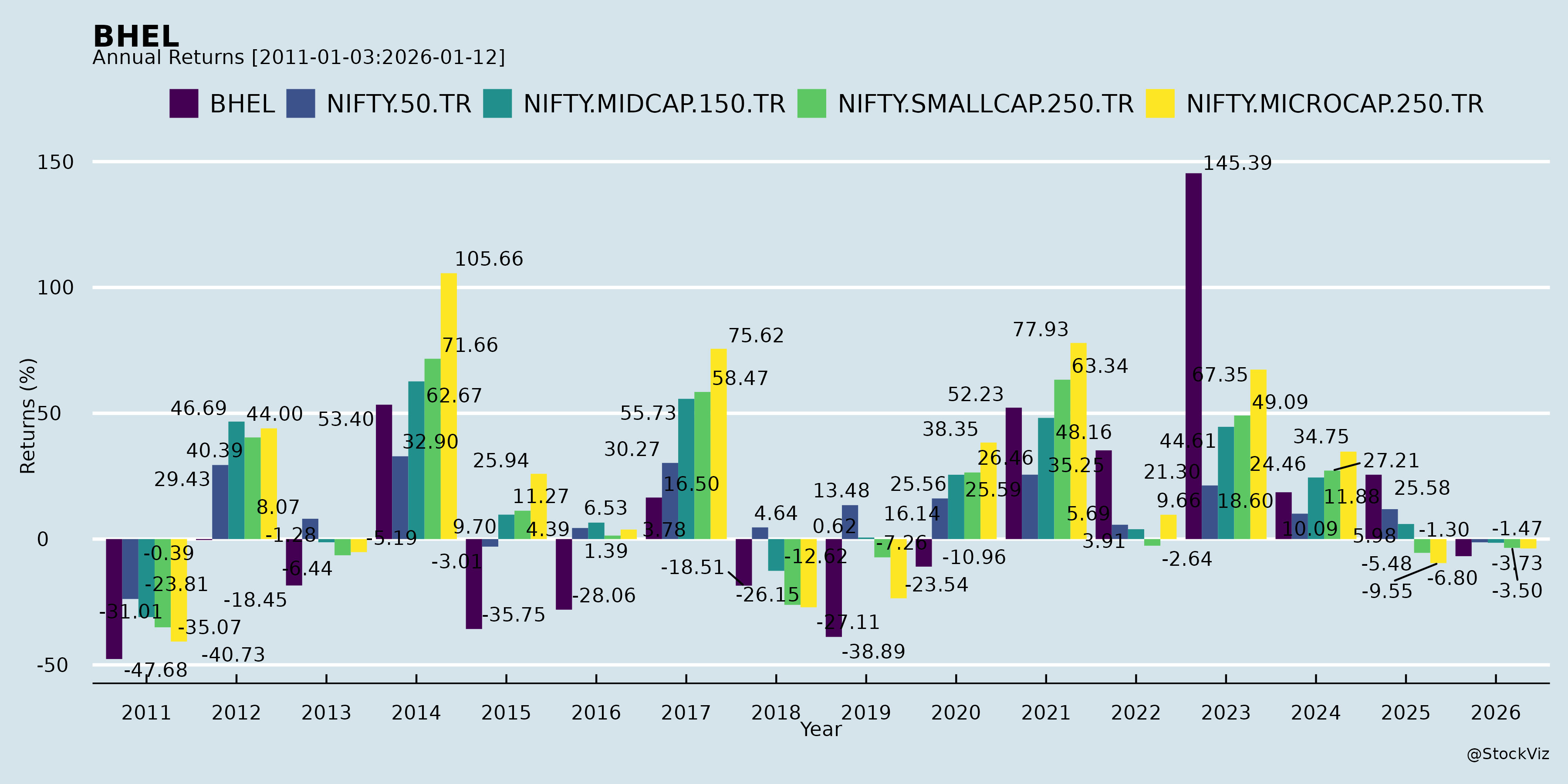

Cumulative Returns and Drawdowns

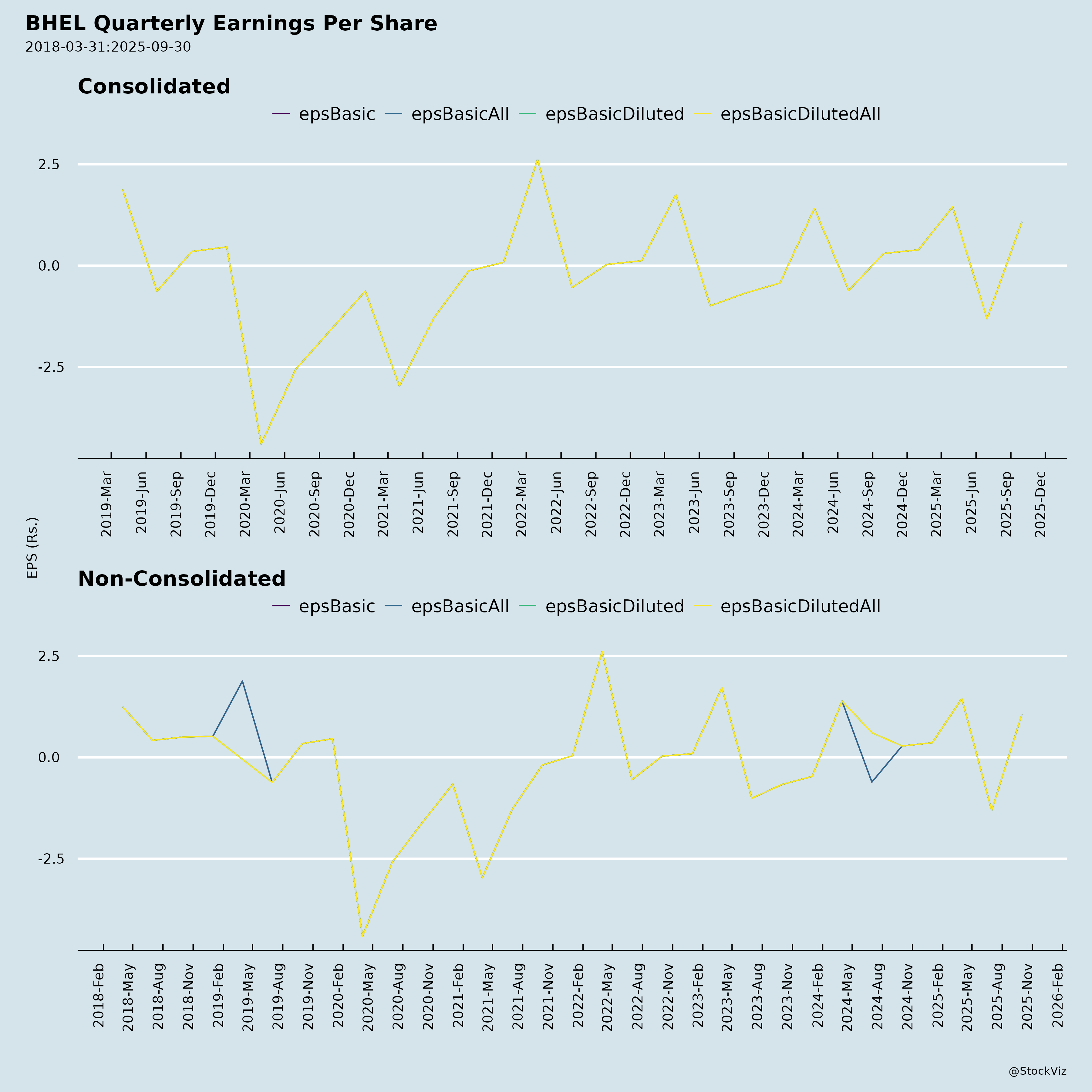

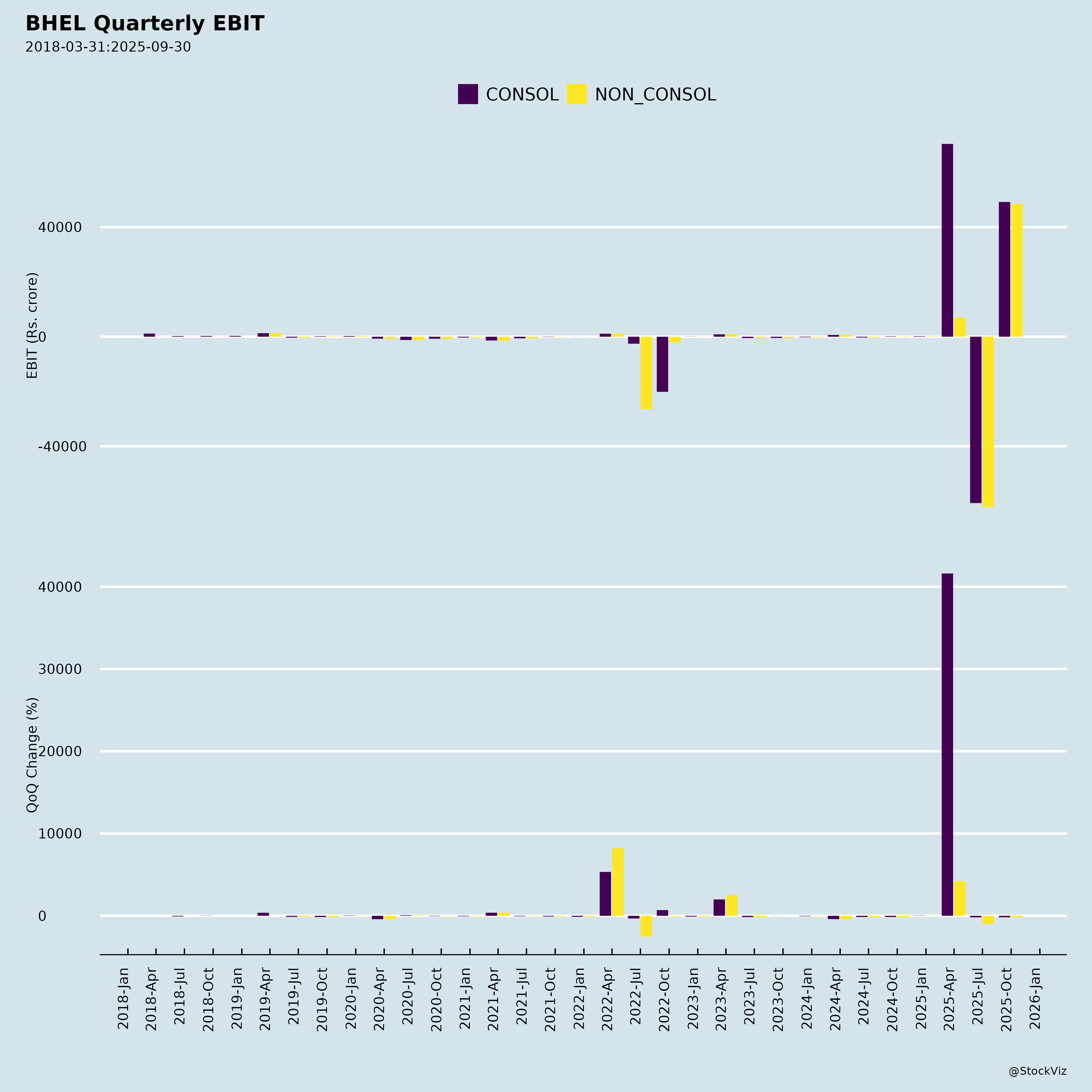

Fundamentals

Ownership

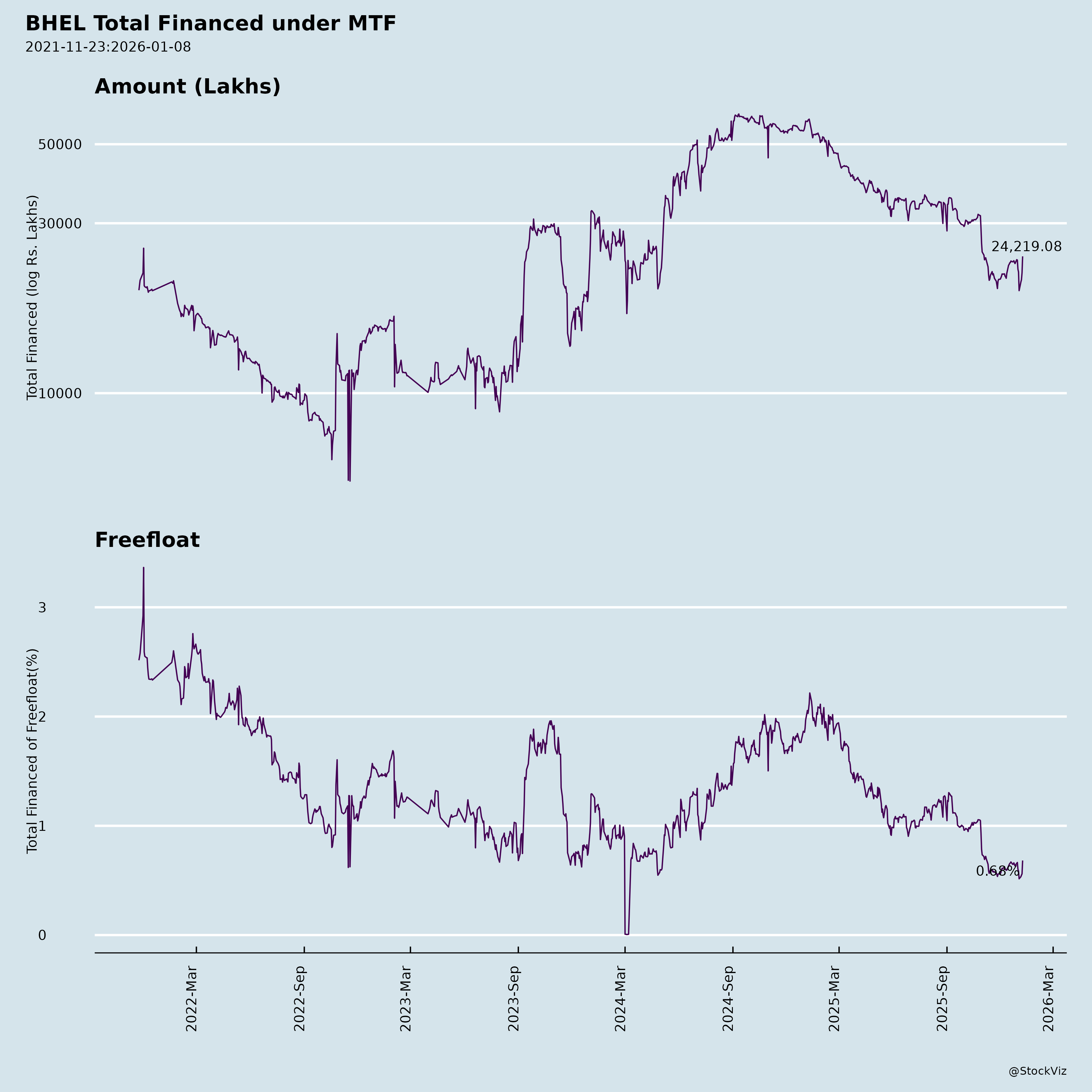

Margined

AI Summary

asof: 2025-12-03

BHEL Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Summary Overview: BHEL, a leading PSU in power equipment and EPC, shows signs of recovery in Q2 FY26 (ended Sep 2025) with revenue growth and profitability turnaround, driven by strong Power segment execution and new orders. H1 FY26 revenue grew 7.7% YoY to ₹12,999 Cr, but remains loss-making overall (PAT loss ₹87 Cr). Recent NTPC order (>₹6,650 Cr) bolsters order book. However, high working capital needs, receivables risks, and governance issues persist. Overall, tailwinds from power demand outweigh headwinds, supporting medium-term growth.

Tailwinds (Positive Catalysts)

- Order Inflows & Power Sector Momentum: Secured major EPC NOA from NTPC for 1x800 MW Darlipali STPP Stage-II (₹6,650+ Cr excl. GST, 48-month execution via international bidding). Power segment revenue up 13% YoY in H1 to ₹9,575 Cr (67% of total), signaling robust execution.

- Financial Recovery in Q2: Standalone revenue +14% YoY to ₹7,512 Cr; PAT swing to ₹368 Cr profit (vs ₹97 Cr YoY). H1 revenue +8% YoY; segment results improved (Power: ₹84 Cr profit pre-tax/finance vs loss prior Q).

- Regulatory Wins: Favorable GST appeal order sets aside ₹10.76 Cr demand + ₹7.74 Cr interest + ₹1.07 Cr penalty (FY21 mismatch), no financial impact.

- PSU Advantages: Govt backing aids order visibility in thermal power/infra; investor meetings (Dec 5, 2025) enhance visibility.

- Balance Sheet Stability: Net worth ~₹24,784 Cr; low debt-to-assets (0.15); strong ratings (CARE A1+/Ind A1+ for CP).

Headwinds (Challenges)

- Persistent Losses & Cash Burn: H1 PAT loss ₹87 Cr (standalone); negative operating cash flow ₹1,182 Cr due to ₹2,595 Cr inventory buildup and ₹635 Cr receivables rise. Q1 loss ₹455 Cr dragged H1.

- High Costs: Employee expenses ₹2,942 Cr (23% of H1 revenue); finance costs ₹376 Cr; other expenses elevated.

- Working Capital Strain: Trade receivables turnover 3.02x (annualized); inventories at ₹12,475 Cr (up 26% QoQ).

- Governance/Compliance: BSE/NSE fines ₹5.43 lakh each for <50% Independent Directors (Q2 FY26); waiver sought, but highlights govt appointment delays.

Growth Prospects

- Power Sector Tailwind: India’s thermal capacity addition (supercritical projects) favors BHEL’s EPC expertise; Darlipali order adds to pipeline. FY25 revenue ₹28,339 Cr; H1 growth positions FY26 for 10-15% top-line expansion.

- Segment Diversification: Industry segment steady (H1 revenue ₹3,424 Cr, results ₹587 Cr pre-tax/finance); potential in coal gasification JVs.

- Order Book Build: >₹6,650 Cr new order; unallocable assets ₹14,259 Cr indicate execution ramp-up. Target: Double-digit revenue CAGR via NTPC/others.

- Margin Improvement: Q2 operating margin 7.7%; deferred tax benefits (₹29 Cr H1 credit) aid profitability. Long-term: Infra push (e.g., PLI schemes) supports 5-8% PAT margins.

Key Risks

- Receivables & Provisions (High): ₹211 Cr overdue from Sudan (civil war; no provision, potential PBT hit); ₹98 Cr RVUNL dues (>3 yrs old; partial payment received, but escalation risk). Auditors’ emphasis of matter flags these.

- Execution/Cash Flow (Medium-High): Negative CFO; high advances/customers deposits volatility (₹2,367 Cr inflow H1).

- Regulatory/Policy (Medium): GST/tax disputes; board composition fines; govt director delays impact compliance (Reg 17(1)).

- Macro/External (Medium): PSU payment delays; forex losses (Sudan USD exposure); competition from private players (L&T, Siemens).

- Operational (Low-Medium): Inventory pile-up signals capex ramp; JVs (e.g., RPCL/NBPPL) fully impaired.

Investment Outlook: Positive medium-term (buy on dips) due to order wins and power demand, but monitor receivables/cash flow quarterly. Target multiples: 15-20x FY27 EPS on improving profitability. (Data as of Sep 2025 filings; no forward-looking guarantees.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.