BCG

Equity Metrics

January 13, 2026

Brightcom Group Limited

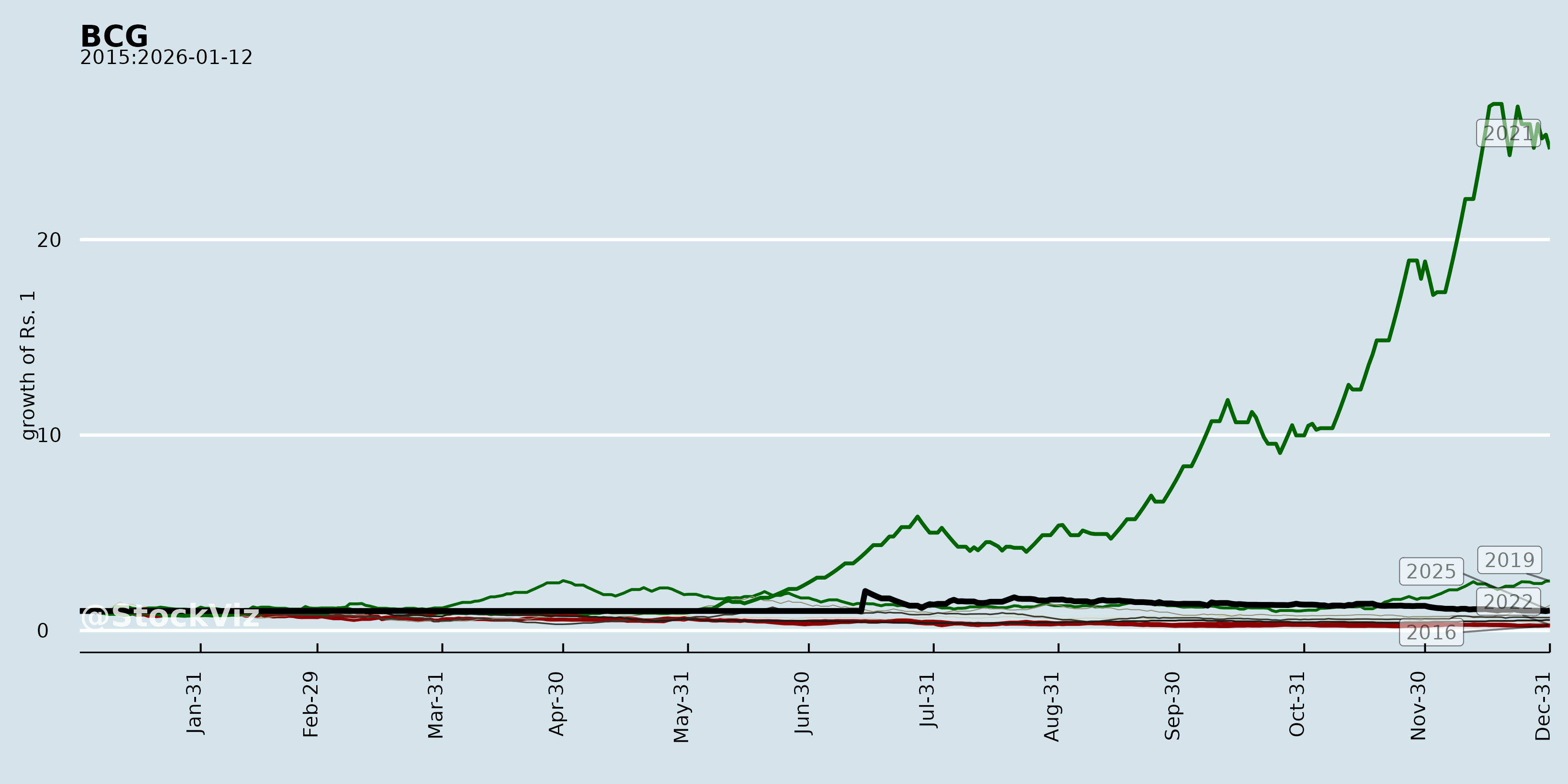

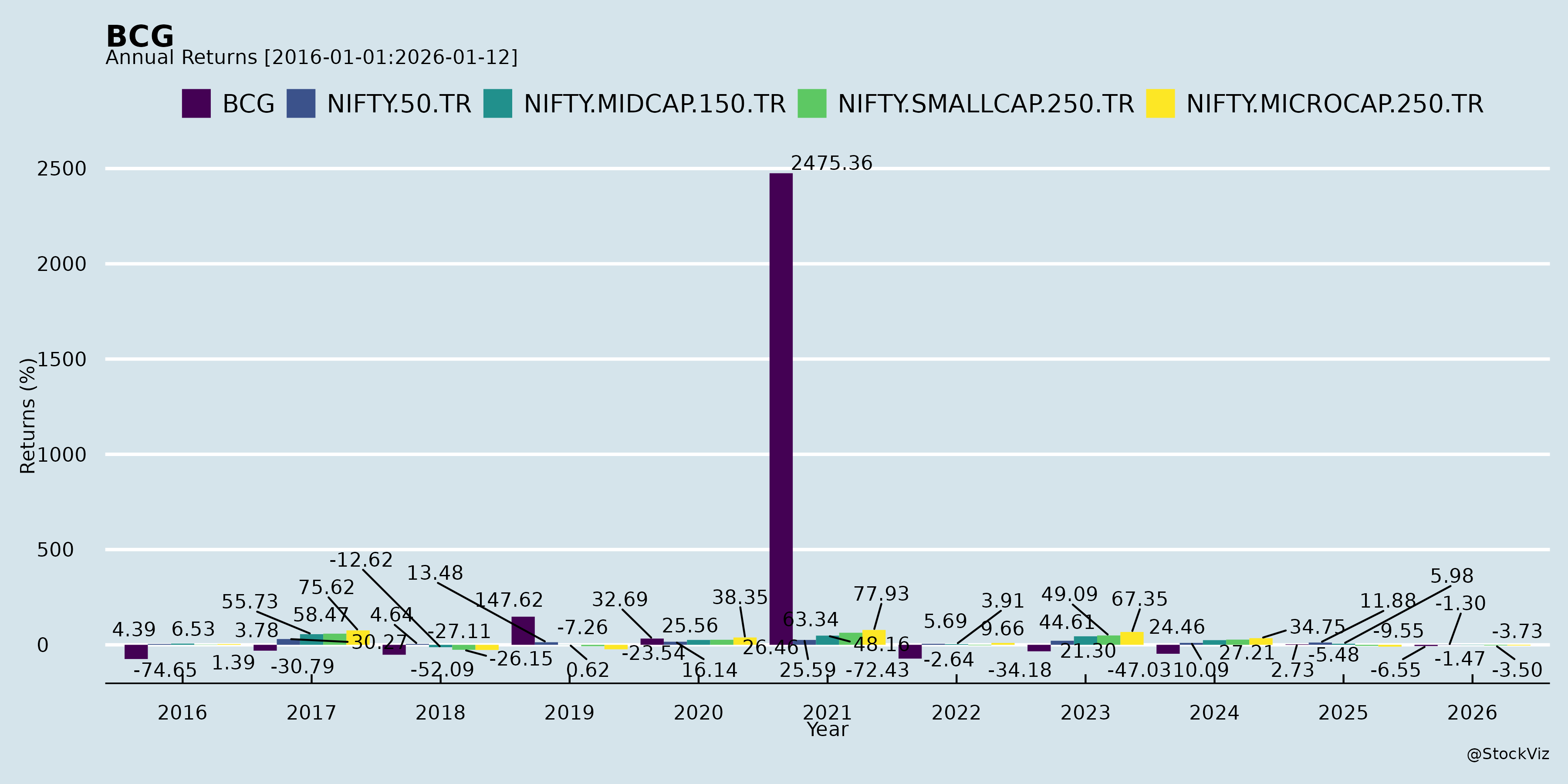

Annual Returns

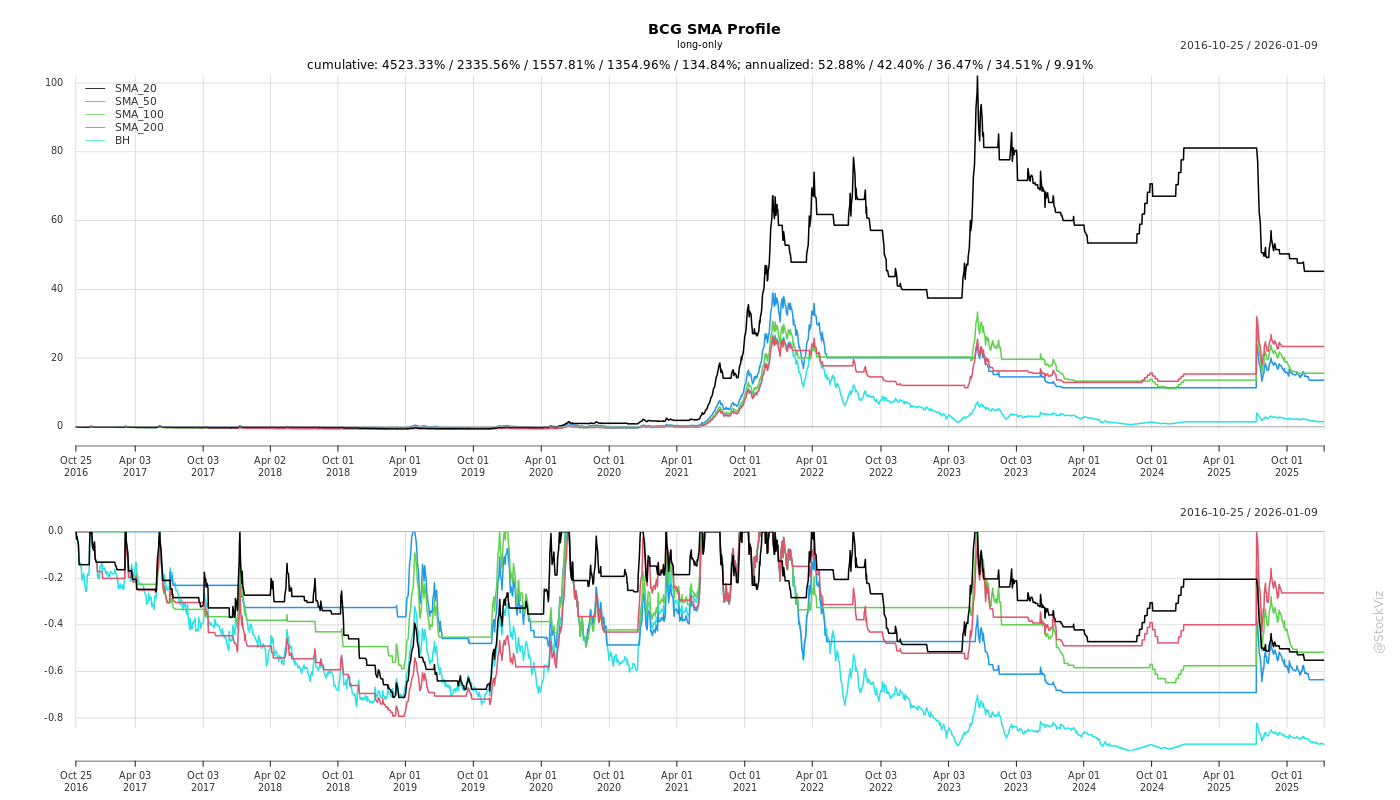

Cumulative Returns and Drawdowns

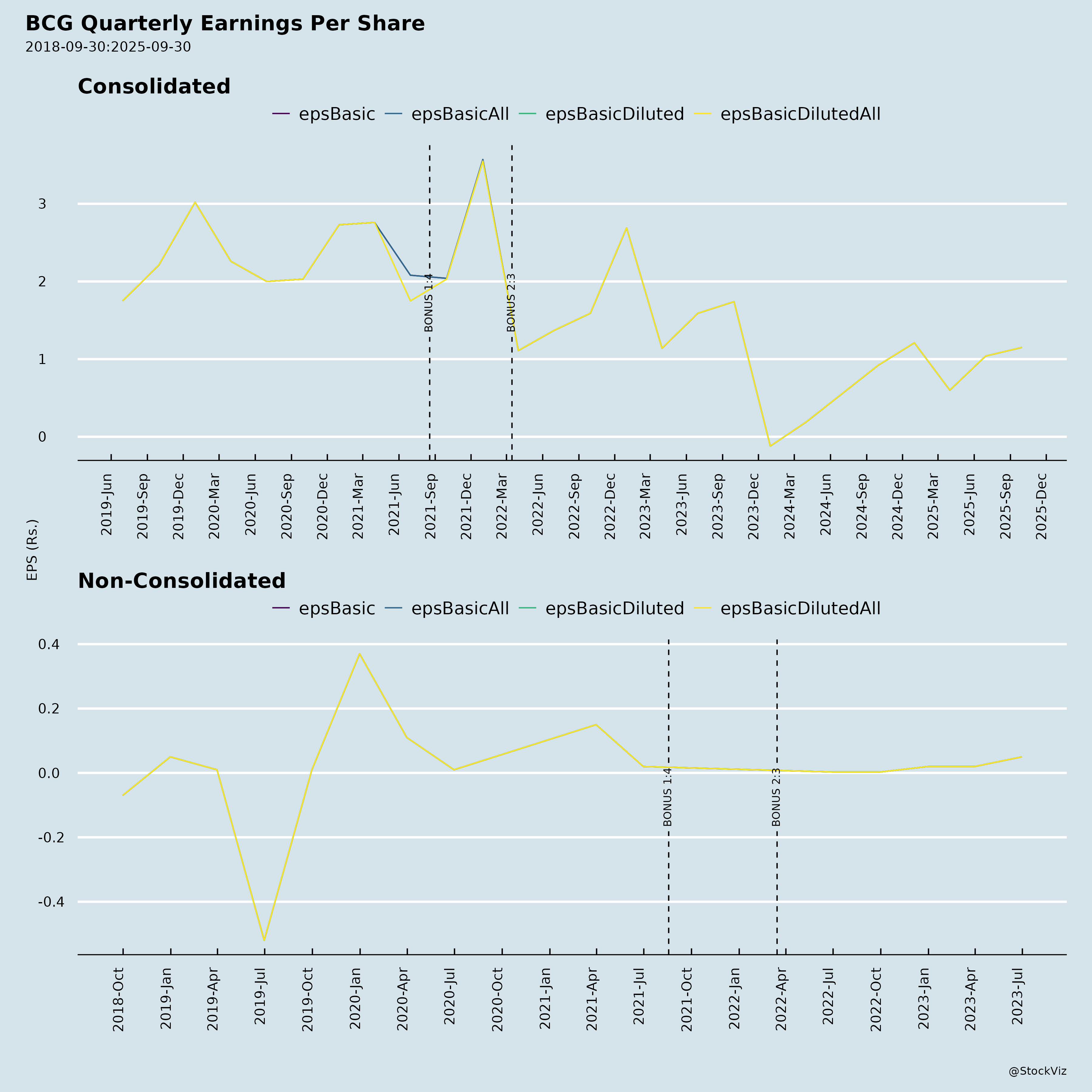

Fundamentals

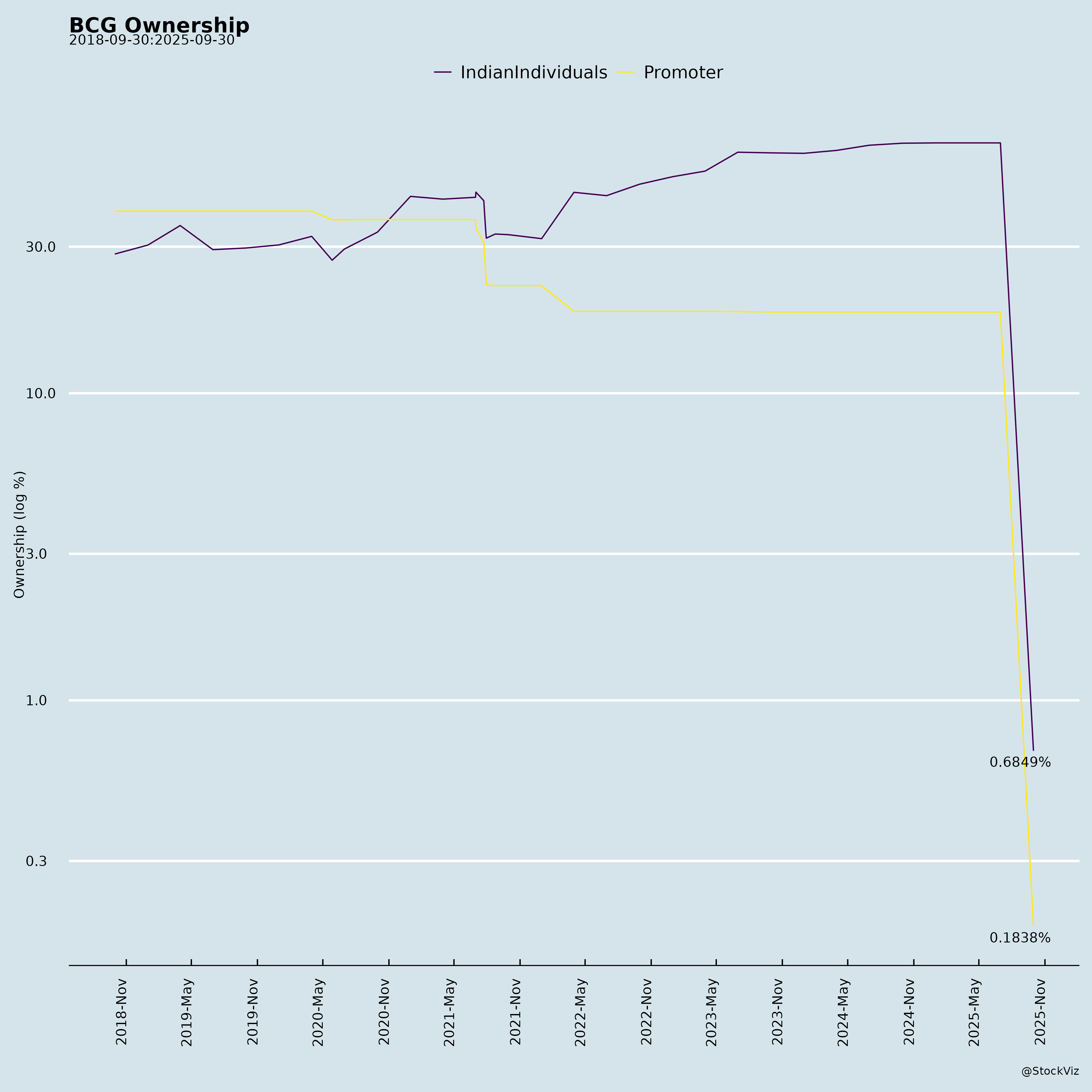

Ownership

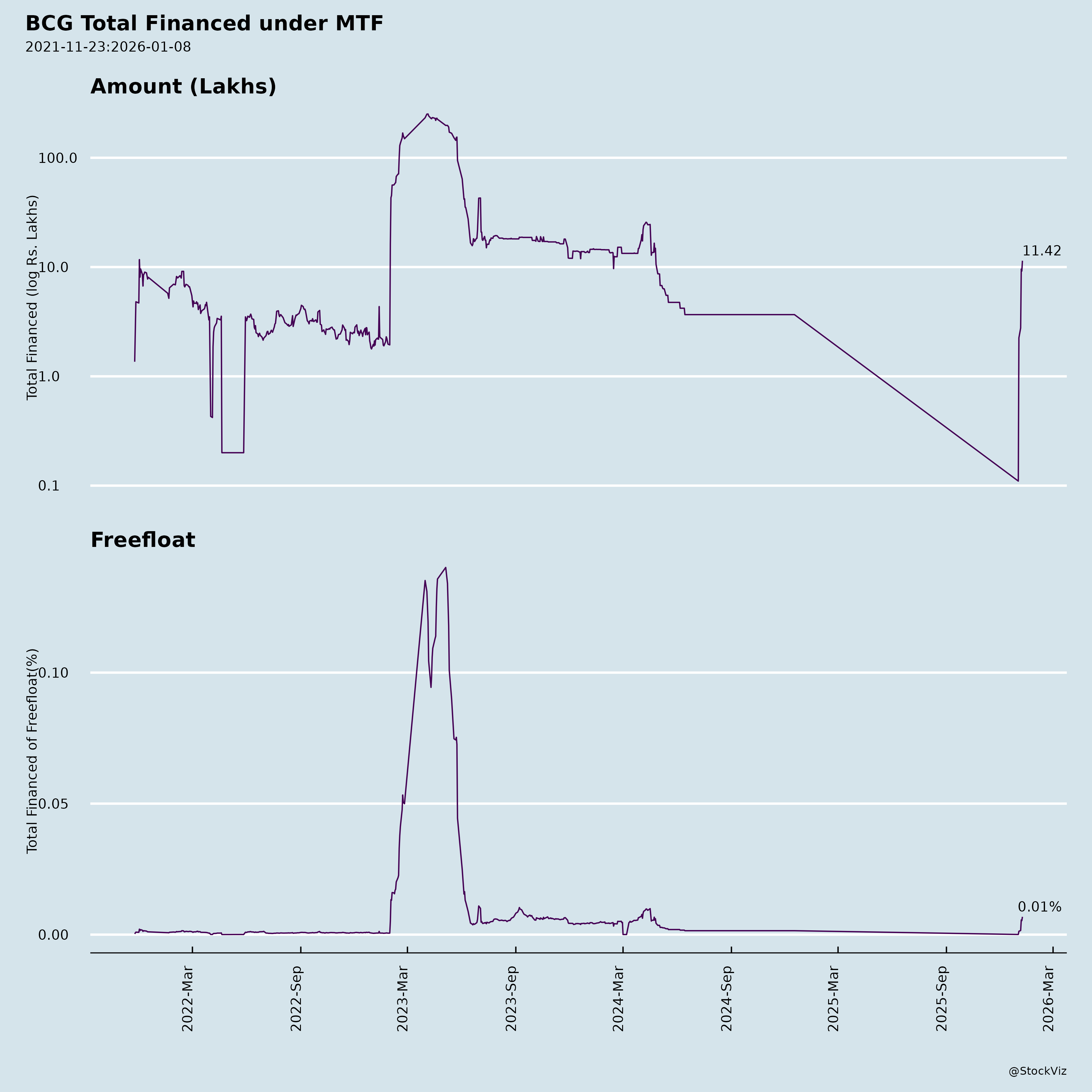

Margined

AI Summary

asof: 2025-11-27

Summary Analysis for Brightcom Group Limited (BCG)

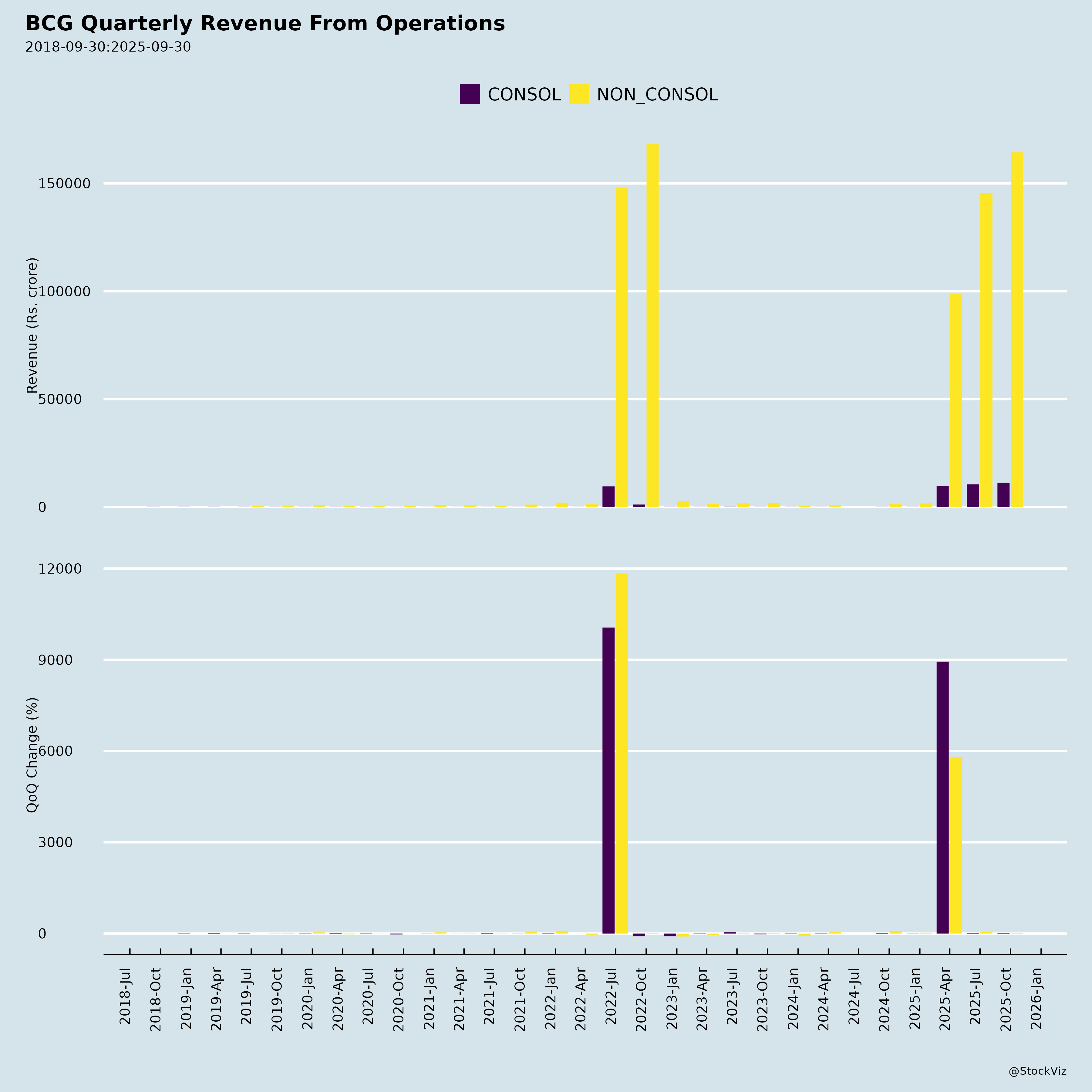

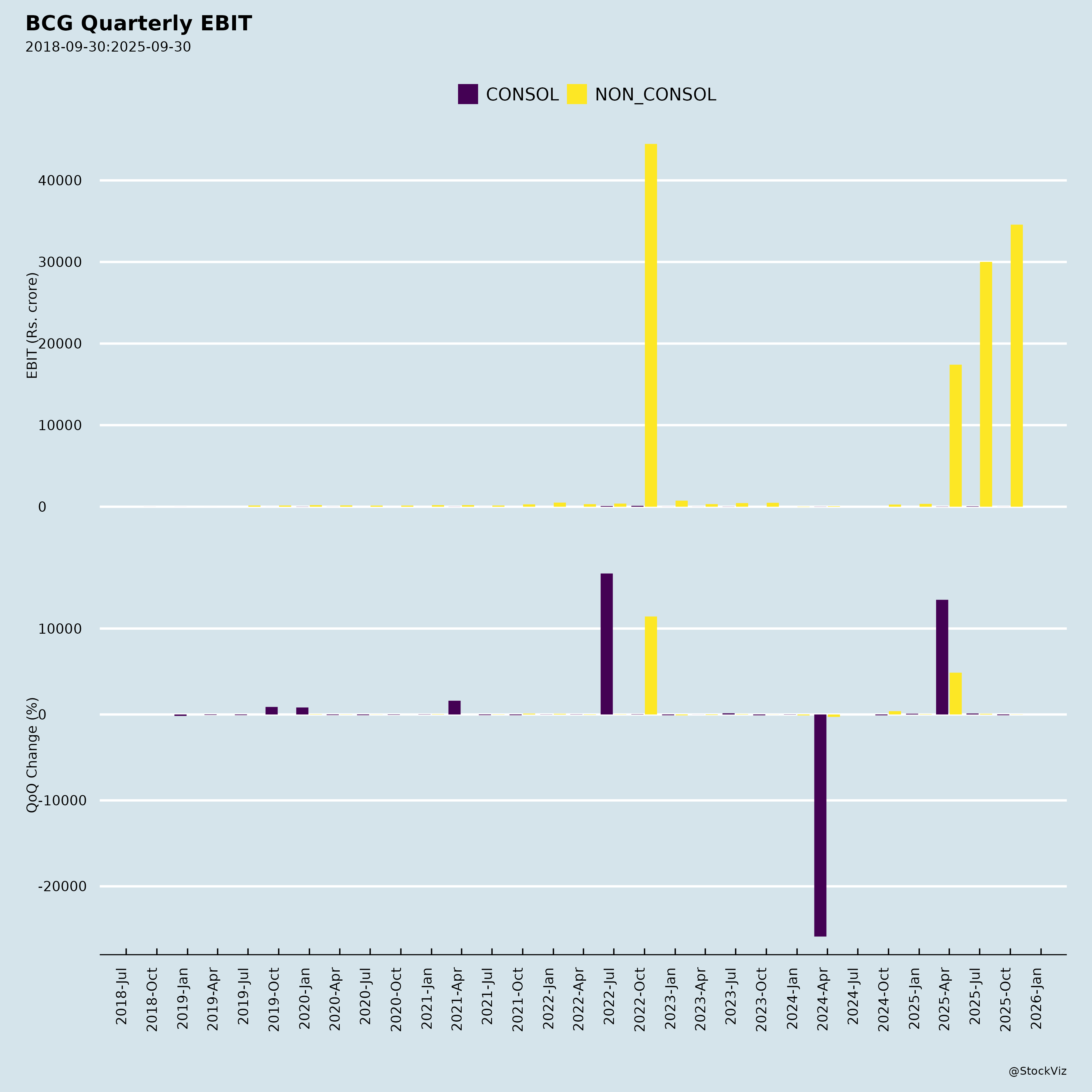

Brightcom Group (BSE: 532368, NSE: BCG) is a digital marketing and AdTech-focused company with international operations, expanding into defence tech. FY25 consolidated financials show revenue growth to ₹5,146 Cr (+10.4% YoY) driven by Digital Marketing (92% of revenue), but PAT growth slowed to ₹710 Cr (+3.4% YoY, EPS ₹3.52). Standalone results are modest (revenue ₹418 Cr). However, qualified audit opinions (continuing from prior years) due to SEBI-mandated peer reviews, unprovisioned impairments (~₹168 Cr in Vuchi Media + Ybrant sub), reliance on unaudited foreign subs/branch FS, and ongoing litigation cast significant doubt. High trade receivables (₹3,926 Cr consolidated) signal collection risks. Positive diversification via defence MoU and strong Seller Trust Index (STI) rankings provide tailwinds, but regulatory overhang dominates.

Tailwinds (Supportive Factors)

- AdTech Strength: Ranked #5-#58 in Pixalate STI across 19 countries (e.g., #5 Switzerland, #9 Germany), validating programmatic seller quality and global buyer trust.

- Revenue Momentum: Consolidated top-line +10.4% YoY; Digital Marketing segment robust at ₹4,733 Cr annual revenue.

- Diversification: New Defence division MoU with Project DYNAMO (US veteran-led NGO) for AI-driven disaster response/HADR systems. Aligns with India’s G20 DRR priorities; taps growing markets (APAC Incident Mgmt: $36.6B in 2025, 9.3% CAGR; Global: $177.7B+).

- Operational Scale: Large asset base (₹9,800 Cr consolidated), positive operating cash flow pre-tax (₹1,339 Cr), low debt (finance costs negligible).

- Governance Continuity: AGM scheduled (28 Dec 2025), auditor re-appointment ratified.

Headwinds (Challenges)

- Audit Qualifications: Qualified opinions on standalone/consolidated FY25 results (no adjusted figures; impacts unquantified). Key issues: Unconfirmed opening/closing balances pending SEBI peer review (FY15-22 FS); no impairment on negative-NBW sub (Ybrant); foreign branch/subsidiary FS relied upon without direct audit.

- Slow Profitability: PAT growth lags revenue (3.4% vs. 10.4%); high expenses (depreciation ₹307 Cr, employee ₹262 Cr).

- Liquidity Strain: Cash equivalents down to ₹1,153 Cr (-ve net change ₹55 Cr); massive receivables (40% of assets) vs. payables ₹359 Cr; negative standalone cash flow from ops.

- Segment Imbalance: Software Dev minimal (8% revenue); heavy Digital Marketing reliance exposes to ad market cyclicality.

- Macro/OpCo Dependence: 14 foreign subs contribute ~96% revenue/assets (not directly audited by Indian CA); forex translation gains/losses volatile.

Growth Prospects

- Core AdTech: Leverage STI rankings for more global programmatic deals; historical clients (Coke, Samsung) + acquisitions (10+ entities) support scale.

- Defence Pivot: MoU enables co-branded AI platforms for crisis coordination; targets govt/public-sector in HADR (strategic airlift, ISR). Potential for high-margin recurring revenue amid rising disasters/conflicts.

- Financial Trajectory: If receivables collected and impairments avoided, PAT could accelerate (segment profits ₹1,014 Cr pre-tax). Market expansion (US, Europe, APAC subs) + Intangibles/CWIP build-up (₹1,200 Cr+ invested) signals R&D for AI/autonomous systems.

- Medium-Term: FY26 growth hinged on SEBI resolution; defence could add 10-20% revenue if contracts materialize (global disaster mgmt to $244B by 2030).

Key Risks

| Risk Category | Details | Potential Impact |

|---|---|---|

| Regulatory/Litigation | SEBI interim/confirmatory orders (2023-24); ongoing SAT appeals (#474/2024) & Telangana HC writ (interim relief on penalty); peer review pending; Vuchi deal cancellation (₹169 Cr investment + 14M shares un-cancelled). Promoter holding uncertain. | Trading curbs, fines, restated FS, delisting risk. Highest threat. |

| Financial/Impairment | Unprovisioned losses (Ybrant negative NBW, Vuchi); high receivables (collection delays); peer review could restate priors. | 10-20% PAT hit; equity erosion (current ₹8,689 Cr). |

| Operational | Foreign reliance (USA branch/subs ~96% ops); unaudited subs FS; negative investing cash (₹379 Cr outflow on intangibles). | Revenue volatility, forex risk, control gaps. |

| Market/Liquidity | AdTech cyclicality; slow PAT growth; cash burn if receivables stall. | Liquidity crunch; EPS dilution if issues escalate. |

| Governance | Auditor qualifications continuing; SEBI non-compliance flags (e.g., sub FS dissemination). | Investor distrust, share price pressure. |

Overall Outlook: High Risk, Cautious Hold. Tailwinds from AdTech validation and defence entry offer 15-20% growth potential post-FY25, but SEBI overhang + audit qualifiers dominate (stock likely under suspension/trading halt based on context). Resolve litigations/peer review for upside; else, downside to impairments/delisting. Monitor AGM (Dec 2025) & HC/SAT updates. Not investment advice; DYOR.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.