IT Enabled Services

Industry Metrics

January 13, 2026

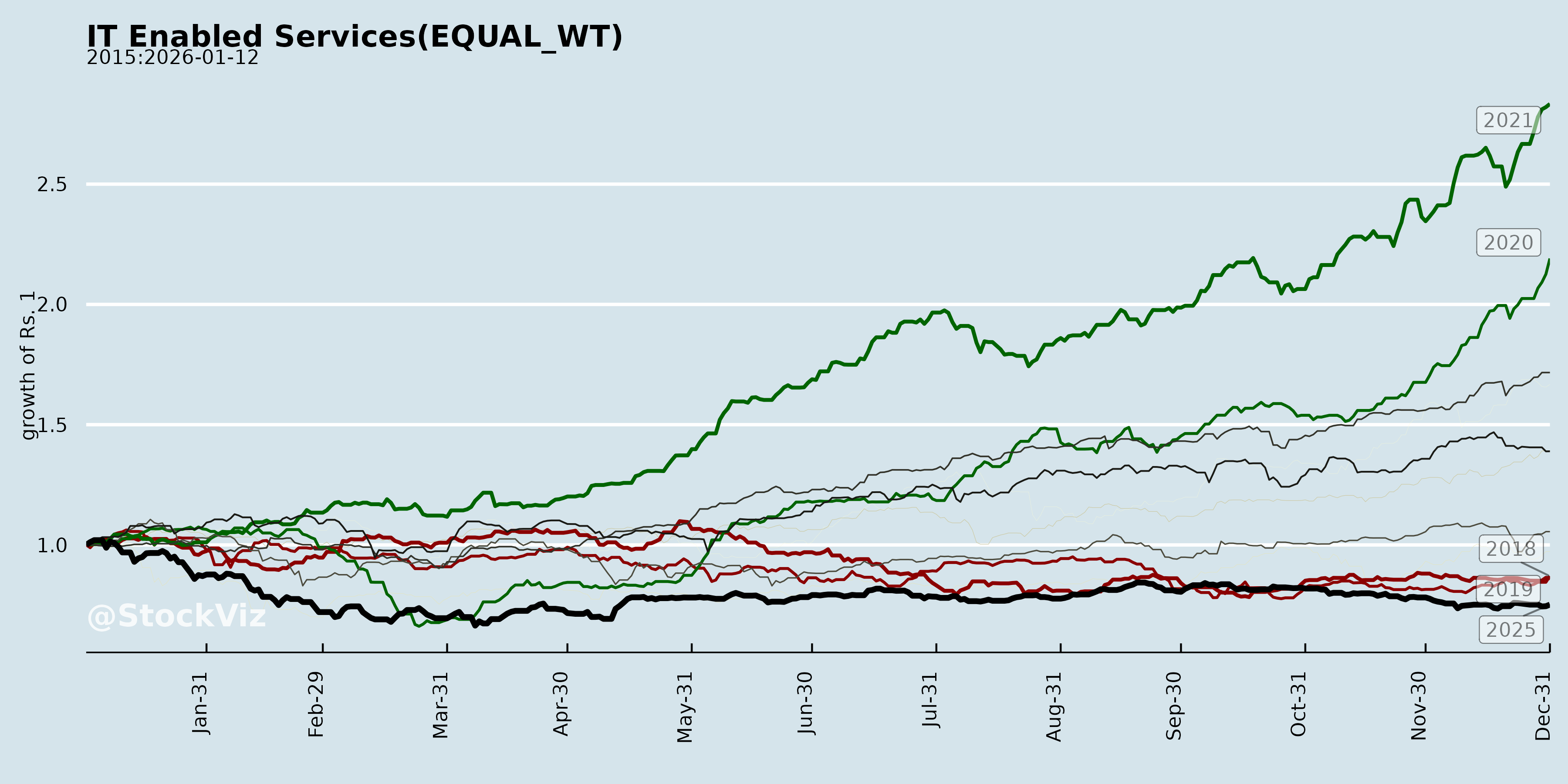

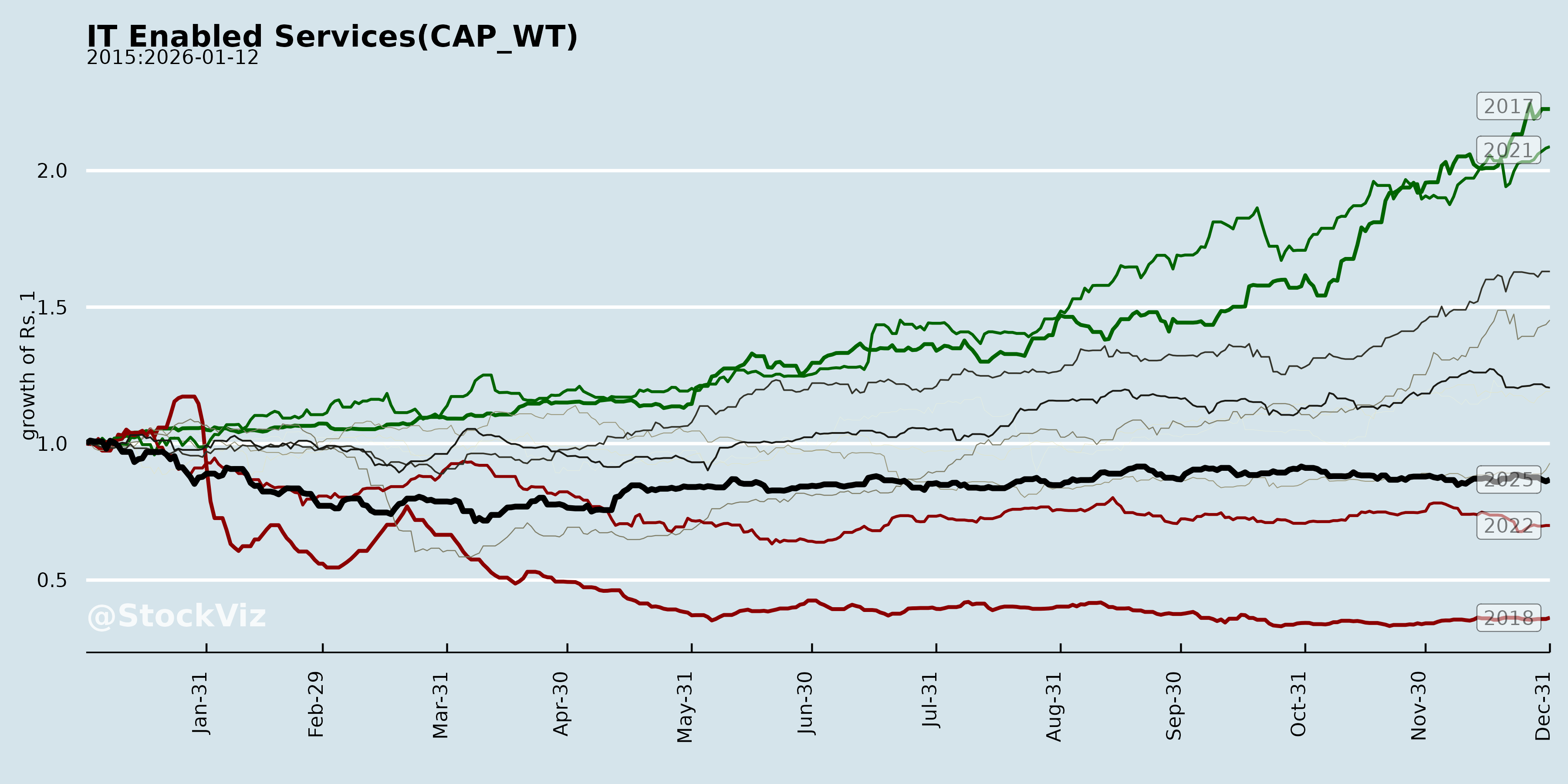

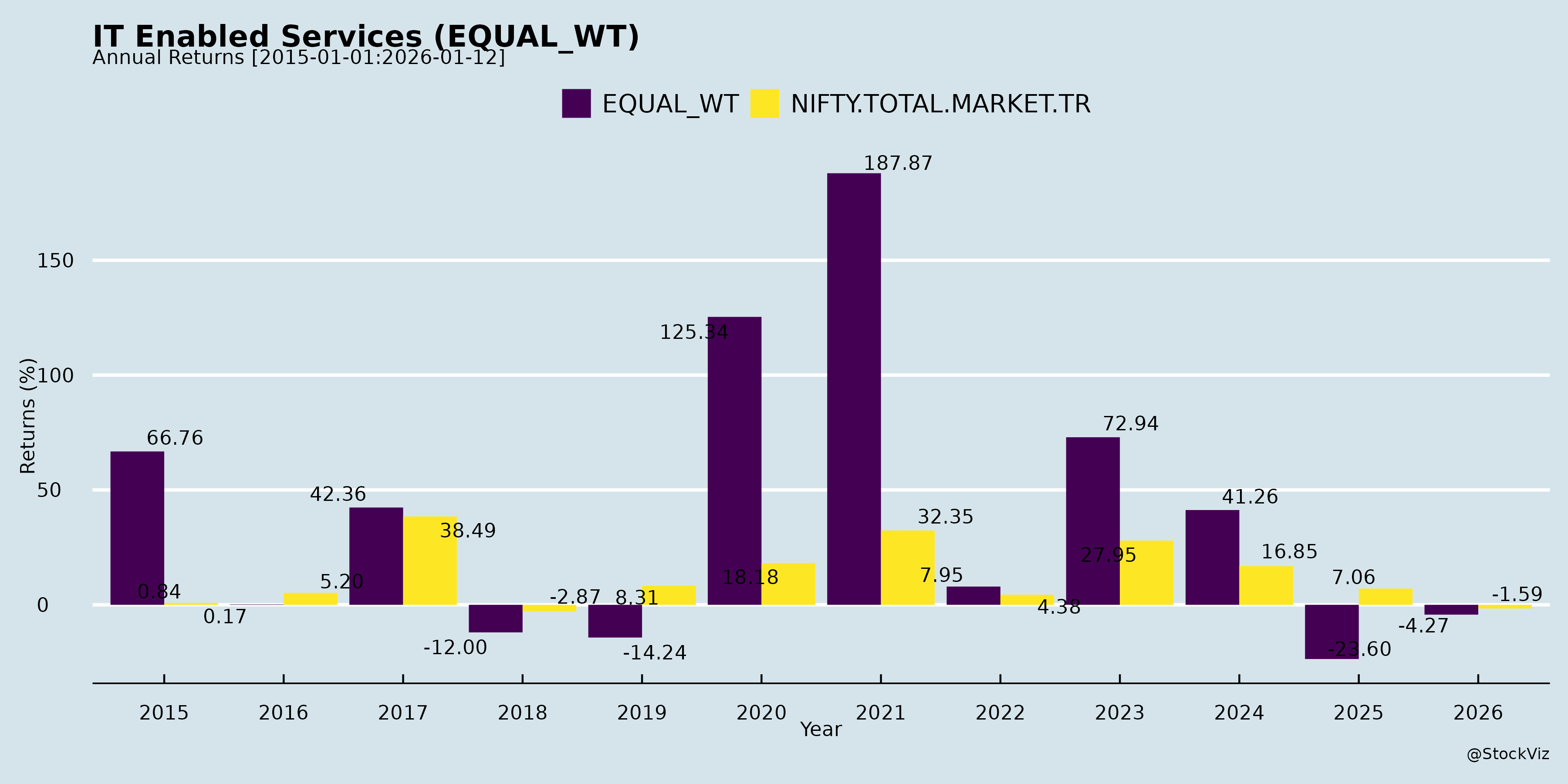

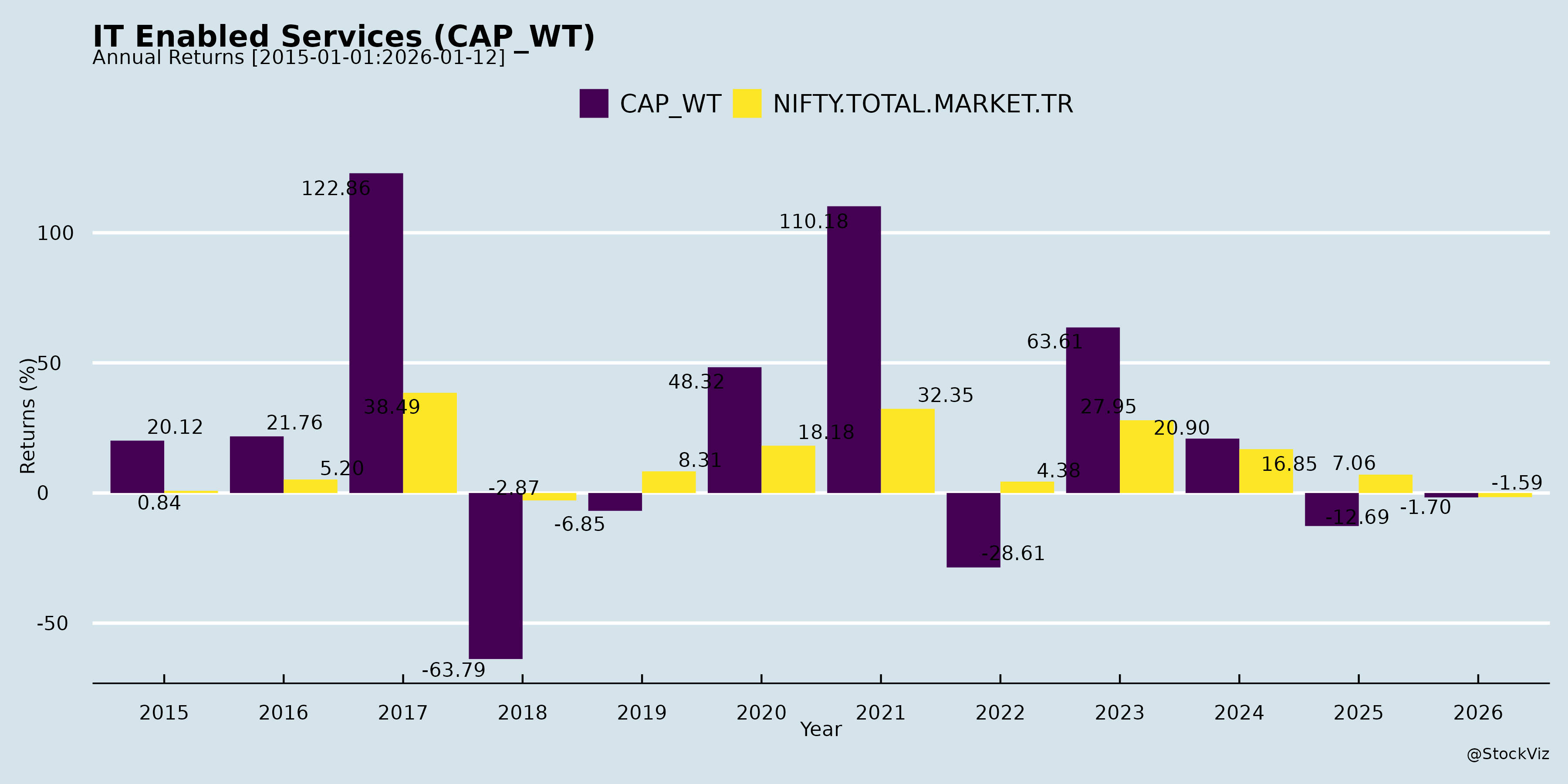

Annual Returns

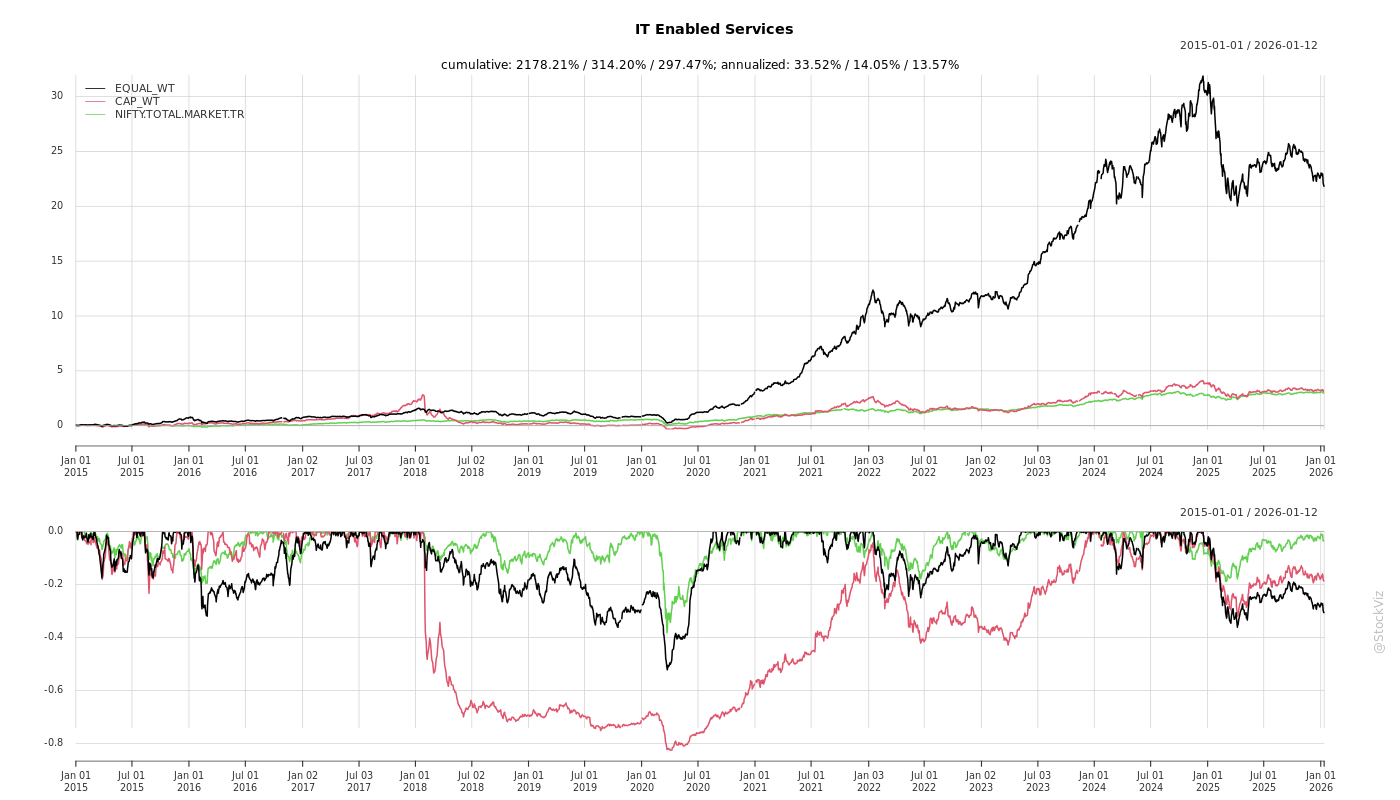

Cumulative Returns and Drawdowns

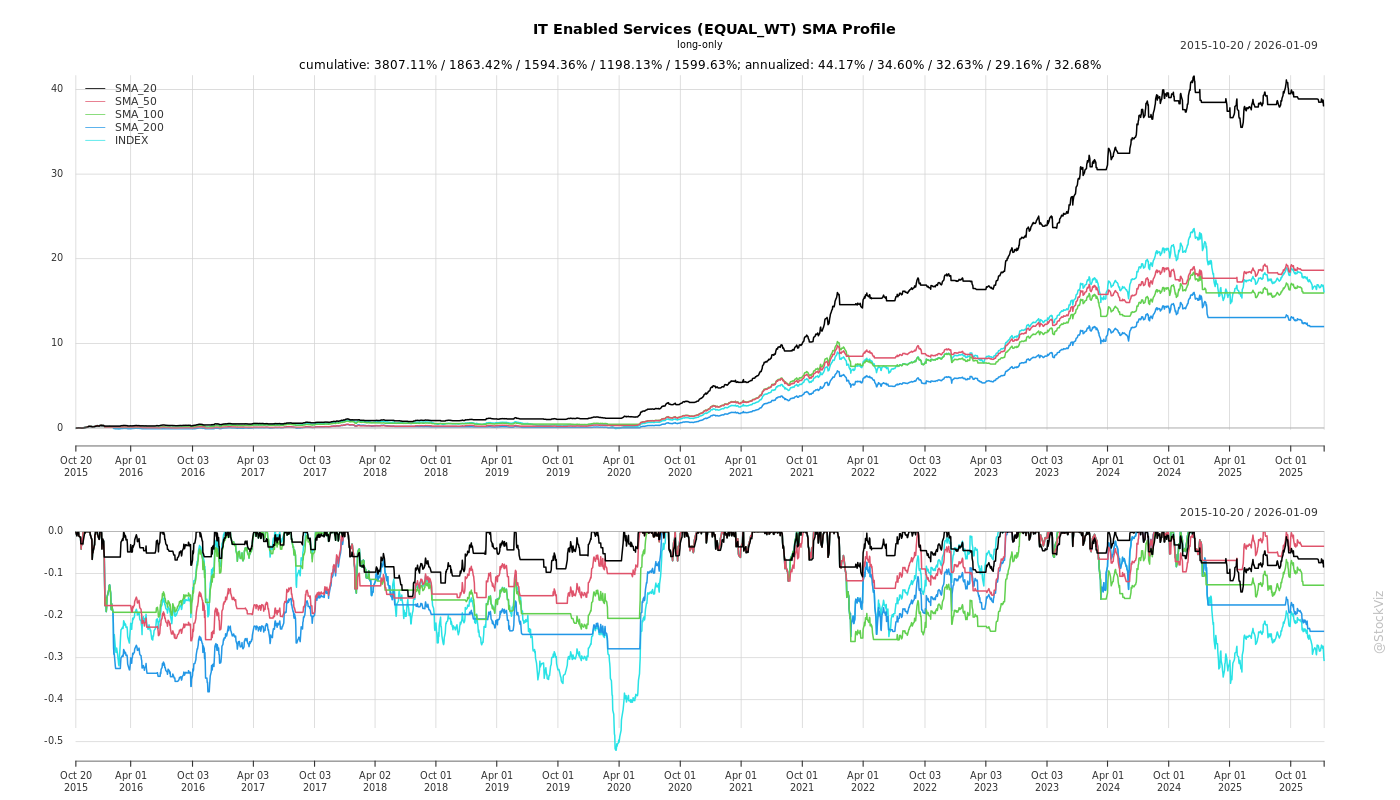

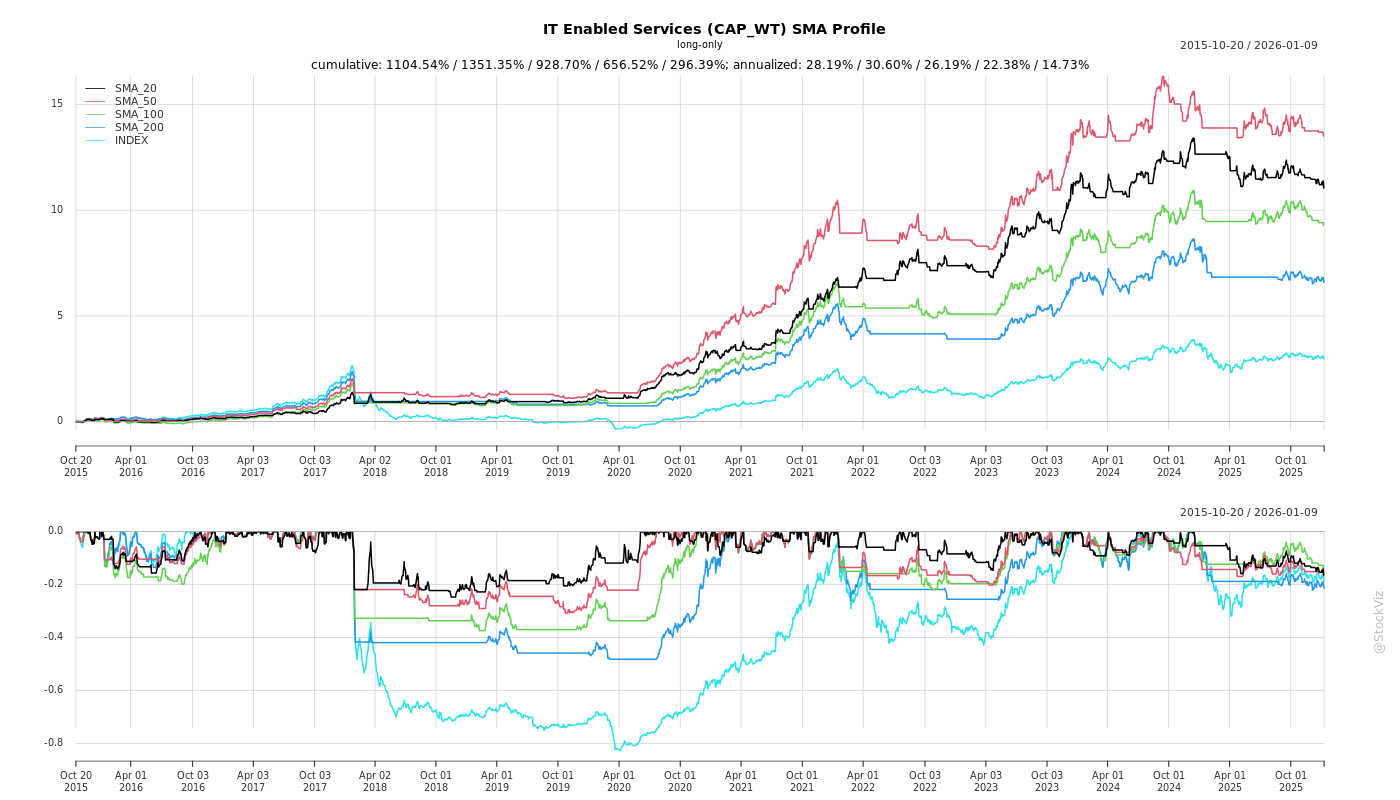

SMA Scenarios

Current Distance from SMA

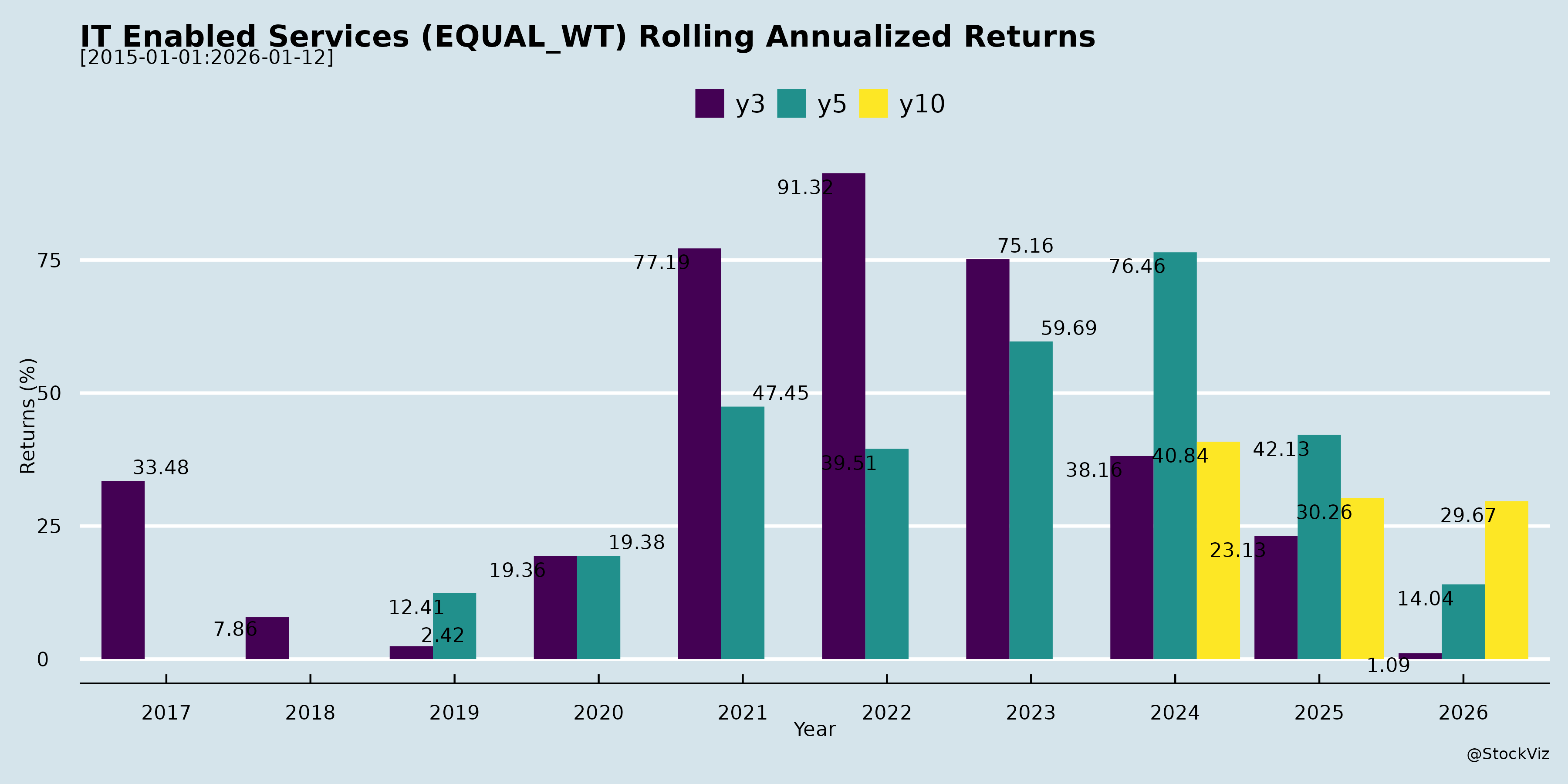

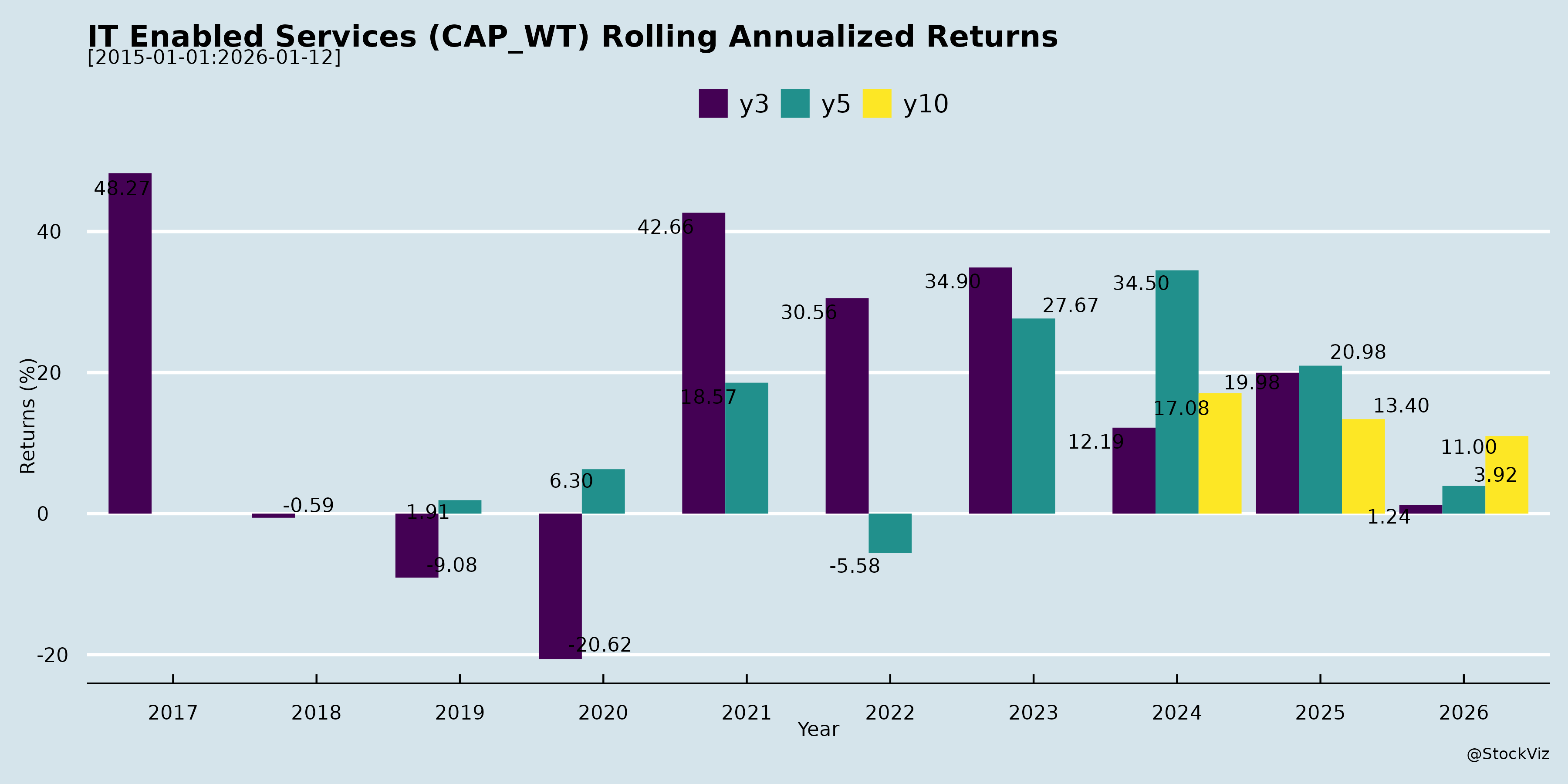

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Analysis of Indian IT Enabled Services (ITES) Sector

The provided documents primarily feature announcements and earnings transcripts from key Indian ITES/ER&D players (e.g., Tata Technologies, Cyient, Black Box, E2E Networks, LTTS, Sagility, etc.) for Q2/H1 FY26. These reflect a sector encompassing engineering R&D (ER&D), cloud/GPU infrastructure, digital transformation, AI/ML services, and niche IT solutions. The analysis distills headwinds (challenges), tailwinds (supports), growth prospects (opportunities), and key risks based on recurring themes like sequential growth recovery, AI demand, order books, and macro pressures.

Headwinds

- Macro and Geopolitical Uncertainty: Tariff announcements (US/EU), elections, and EV incentive run-offs delayed decisions in Q1/Q2 (Tata Tech, Cyient). JLR’s IT restoration post-cyber incident caused short-term disruptions (Tata Tech).

- Seasonal/Operational Softness: Q3 expected moderation due to holidays/festivals, furloughs in Europe, and salary hikes (Tata Tech, Cyient, Black Box). Wage increments for 88-90% of staff added margin pressure (Tata Tech, Cyient).

- YoY Growth Stagnation: Flat/declining YoY revenue in some (Cyient DET: -0.6% CC YoY; Tata Tech PAT down QoQ). DSO uptick to 109 days (Tata Tech).

- Customer-Specific Delays: Ramp-downs, protracted decisions, and project delays in education/strategic units (Tata Tech, Cyient). High attrition (15.1% TTM in Tata Tech).

- High Capex/Depreciation Burden: E2E Networks reported net loss (Rs. 13.5 Cr) due to GPU depreciation (Rs. 42-50 Cr run-rate); inventory buildup from partnerships (Black Box Wind River).

Tailwinds

- Sequential Momentum Recovery: Strong QoQ growth (Tata Tech: 6.4%; Black Box: 14%; E2E: 21%; Cyient DET: 0.5% CC). Order books expanded (Black Box: $555 Mn; Tata Tech large deals).

- Margin Resilience: Adjusted EBITDA up (Tata Tech: 16.4%; Cyient DET: 12.2% +16 bps; E2E: 41%; Black Box: 9%). Cost optimization and utilization improvements (Cyient, Tata Tech).

- Deal Wins & Partnerships: IndiaAI Mission orders (E2E: Rs. 265 Cr), ES-TEC acquisition (Tata Tech), Wind River (Black Box: Rs. 1,350 Cr potential), BMW JV scaling (Tata Tech). New logos in aerospace/defense (Cyient).

- AI/Cloud Demand Surge: GPU capacity ramp (E2E: 3,900+ GPUs, 2k-4k Blackwell planned), hyperscaler traction (Black Box), AI labs/partnerships (Tata Tech, Cyient).

- Cash Generation: Strong FCF (Cyient: 114-117%; Black Box on track), interim dividends (Cyient: Rs. 16 highest ever).

Growth Prospects

- H2 FY26 Acceleration: Stronger H2 vs. H1 guided (Tata Tech Q4 rebound; Cyient; Black Box: Rs. 6,700 Cr FY26). Organic mid-teens (Black Box, Tata Tech).

- AI/ML & Digital Infra Boom: GPU/cloud demand (E2E MRR Rs. 35-40 Cr by Mar’26; Black Box data centers/AI; Cyient AI CoE). Sovereign AI push via IndiaAI Mission.

- Vertical Tailwinds: Aerospace/industrial (14% USD growth Tata Tech/Cyient), automotive stabilization/EV (Tata Tech ES-TEC), semiconductors (Cyient carve-out: $100 Mn ASIC pipeline).

- Inorganic/Expansion: Acquisitions (Tata Tech ES-TEC, E2E Jarvis Labs; Black Box: $700-800 Mn target by FY29), global partnerships (Wind River, Synopsys).

- Long-Term Targets: $2 Bn revenue by FY29 (Black Box), double-digit FY27 growth (Tata Tech), EBIT-neutral semiconductors FY27 (Cyient), 15% EBIT Q4 FY27 (Cyient).

Key Risks

- Execution & Ramp Delays: IndiaAI orders pending go-live (E2E), JLR IT recovery (Tata Tech), large deal ramps (Cyient).

- Capex Intensity & Obsolescence: GPU heavy bets (E2E: Rs. 1,000 Cr+ potential; debt Rs. 450 Cr facility), tech cycles (7-8 yr life, but rapid AI evolution).

- Customer/Geopolitical Concentration: Anchor client reliance (Tata Tech JLR/BMW; Cyient key accounts), tariffs/supply chain risks.

- Margin Volatility: Wage hikes, restructuring (Cyient 200 bps hit), FX unrealized gains/losses impacting PAT.

- Competition & Funding: Hyperscalers (AWS/Azure), AMD/NVIDIA shifts, equity dilution/fundraise needs (E2E authorized capital hike).

- Regulatory/Export Controls: Potential US restrictions on Blackwell exports (E2E query); no UPSI shared in meets.

Summary

The Indian ITES/ER&D sector shows resilient sequential recovery amid macro headwinds, driven by AI/cloud tailwinds and strong order pipelines. Q2 FY26 highlights 6-21% QoQ growth and margin stability (9-41% EBITDA), with H2 optimism (mid-teens organic growth). AI/GPU infrastructure (E2E, Black Box) and ER&D verticals (aerospace/auto Tata Tech/Cyient) offer robust prospects, bolstered by govt. initiatives (IndiaAI) and partnerships. However, capex risks, execution delays, and geo-macro pressures loom large. Overall, positive outlook for FY27+ (double-digit growth, margin expansion to 15%+), but prudent capex and diversification are critical. Sector poised for 12-15% CAGR, led by AI/digital transformation.

Financial

asof: 2025-12-02

Analysis of Indian IT Enabled Services (ITES) Sector

Overview: The provided documents represent Q3/Nine Months FY25 (ended Dec 31, 2024) financial results from 12 listed Indian ITES/engineering/BPO/fintech players (e.g., LTTS, Cyient, Sagility, Datamatics, Cigniti, R Systems). The sector shows resilient mid-single digit YoY revenue growth (avg. 8-12% across sample), driven by digital engineering and cost optimization, but muted QoQ growth (flat to +3%) amid macro caution. EBITDA margins stable at 15-18%, with PAT growth ~10-15% YoY. Key themes: Segment reorg (e.g., LTTS: Mobility/Sustainability/Tech), acquisitions (e.g., Cyient Altek, Sagility BroadPath), forex volatility, and forex compliance delays.

Headwinds (Challenges)

- Macro/Discretionary Spending Slowdown: Flat QoQ revenue in LTTS (+3% Q3), Cyient (+3%), R Systems (+1%). US clients (70-80% exposure) cautious post-elections; e.g., Datamatics EBITDA margin dip to 17% from wage hikes.

- Forex & Compliance Issues: Black Box highlights FEMA delays (₹33Cr payables overdue); LTTS OCI forex losses (₹456Mn Q3). Rupee appreciation hurts USD revenues.

- Cost Pressures: Employee expenses 55-65% of revenue (e.g., Sagility 64%, Cigniti 61%); attrition/utilization volatility (Cigniti 83.9%, R Systems implied high).

- Margin Compression: Subcontracting up (Cigniti hired costs); exceptional items (Datamatics ₹32Cr acquisition costs).

Tailwinds (Positives)

- Margin Expansion: Adj. EBITDA up QoQ in Cigniti (+10%, 17.3%), LTTS stable ~20%; pricing leverage in renewals (R Systems 17% EBITDA).

- Inorganic Momentum: 6/12 cos pursued M&A (LTTS Intelliswift $110Mn, Cyient Altek $20Mn, Sagility BroadPath ₹502Cr); strengthens AI/engineering (e.g., Datamatics TNQ Tech).

- Forex Gains in Some: Cigniti ₹144Mn Q3 gain; Zaggle strong cash flows.

- Operational Efficiency: Utilization steady (83-85%); ESOP allotments signal talent retention.

Growth Prospects

- High Double-Digit Potential: YoY revenue +10-20% (Zaggle +63% 9M, Netweb +60%, Sagility +15%); order books strong (Cigniti $220Mn TCV).

- Vertical Tailwinds: Mobility/Sustainability/Tech up 10% YoY (LTTS ₹77Bn 9M rev); Healthcare/BFSI resilient (Inventurus +63%, Sagility BPO).

- AI/GenAI/Digital Wave: Hyperscalers/MedTech deals (LTTS Tech +12%); engineering services pivot (Cyient DET 75% rev).

- Geographic/Inorganic: US/EMEA 80-90% rev; UAE/Mexico subsys (R Systems, NPST) for diversification. FY26 guidance: 12-15% growth (implied from deal ramps).

| Company | 9M FY25 Rev Growth (YoY) | EBITDA Margin | Key Driver |

|---|---|---|---|

| LTTS | +8% | 17% | Segments reorg, acquisitions |

| Sagility | +15% | 13% | BPO healthcare ramp |

| Cigniti | +10% | 17% | Order intake $83Mn Q3 |

| Zaggle | +63% | 22% | Fintech scaling |

Key Risks

| Risk Category | Details | Impact (High/Med/Low) |

|---|---|---|

| Client Concentration | Top-5 clients 25-45% rev (Cigniti 32%, LTTS implied); US slowdown risk. | High |

| Execution/Talent | Attrition 12-14% (Cigniti); pyramid rebuilding (Datamatics). | High |

| Forex/Regulatory | FEMA delays (Black Box ₹55Cr); rupee vol (Cyient OCI ₹456Mn loss). | Med-High |

| Margin/Geopolitical | Wage inflation; US visa/election risks (80% US rev). | Med |

| M&A Integration | 5+ deals (Cyient/Sagility); goodwill impairment (LTTS ₹288Mn). | Med |

| Competition | Global captives/low-cost peers eroding pricing. | Med |

Overall Outlook: Moderate Growth (10-15% FY26E) amid US caution, buoyed by AI/deal wins. Tailwinds from engineering/digital > headwinds; focus on margins (target 18-20%). Risks tilted to execution/macro; diversify verticals/geo. Sector PE ~25x fwd; select buys on dips (e.g., LTTS/Cigniti).

General

asof: 2025-12-03

Analysis of Indian IT Enabled Services (ITES) Sector

The provided documents from listed IT/ITES companies (e.g., Inventurus, Tata Technologies, Netweb Technologies, Black Box, eMudhra, etc.) reflect a sector focused on digital transformation, cloud/AI infrastructure, healthcare tech, cybersecurity, and sustainability. Key insights are drawn from regulatory filings, investor presentations, ESG reports, and operational updates. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring the Sector)

- Regulatory and Tax Scrutiny: Increasing GST/ITC disputes (e.g., Tata Technologies faced INR 1.77 Cr demand + penalty for ITC rejection across FY19-23; company plans appeals but notes no material impact). This signals heightened compliance burdens and cash flow pressures.

- Revenue Volatility and Subdued Orders: Black Box reported 8-9% YoY revenue decline in 9M FY25 due to delayed decisions and exit from low-value “tail” customers, despite strong EBITDA margins (up 230 bps YoY).

- Operational Restructuring: Branch closures (e.g., Cyient’s Korea office) indicate cost optimization amid global slowdowns or geopolitical shifts.

- Talent and Margin Pressures: High attrition (e.g., eMudhra: 26-35% turnover; female higher at 35-49%) and rising costs in a competitive labor market.

Tailwinds (Supportive Factors)

- Government Initiatives: Strong policy support via ‘Make in India’, PLI scheme, and IndiaAI Mission (₹103,000 Mn outlay). Netweb benefits as a key OEM for AI GPUs/supercomputers, with 600+ HPC installs.

- Margin Expansion and Efficiency: Black Box achieved record Q3 PAT (INR 56 Cr, +37% YoY) via productivity gains; Netweb’s H1 FY26 Op EBITDA margin at 14.9%, ROCE 30.2%.

- ESG Momentum: Positive ratings/awards (Datamatics: Crisil ESG 57 ‘Adequate’; Zaggle: Top 10 DGEMS 2025; eMudhra BRSR compliance) enhance investor appeal amid global sustainability mandates.

- Diversified Clientele: Repeat revenue high (Netweb: 74.7%; Black Box: Top 10 clients >20-year tenure); marquee partners (NVIDIA, Intel for Netweb; hyperscalers for Black Box).

Growth Prospects

- AI/Cloud/HPC Boom: Explosive demand for on-prem AI infra (Netweb: 7000+ GPU installs, sovereign AI systems; Black Box: hyperscaler capex surge to $100Bn+). IndiaAI Mission and indigenous LLMs fuel this; Netweb eyes Europe/ME expansion.

- Digital Infrastructure: Black Box targets $2Bn revenue by FY29 (from $800Mn FY25), riding data center/AI capex (e.g., US hyperscaler orders INR 250 Cr); order book US$465 Mn.

- Sector Tailwinds: High-end computing (Netweb H1 revenue INR 6,049 Mn, +CAGR); healthcare platforms (Inventurus USD 10M investment); B2B focus (eMudhra 100% IT consultancy turnover).

- Exports and Verticals: Pan-India + 25+ countries (eMudhra); BFSI/healthcare/govt focus; FY26 guidance upbeat (Black Box: 9-9.2% EBITDA margins).

Key Risks

| Risk Category | Description | Mitigation (from Docs) |

|---|---|---|

| Regulatory/Tax | GST penalties, data privacy (e.g., cybersecurity risks in eMudhra/Black Box). | Appeals filed; robust POSH/ethics policies; WebTrust/CCA compliance. |

| Execution/Competition | Project delays, hyperscaler dependency (Black Box pipeline conversion). | Strong order books (Netweb ₹4,939 Mn); R&D (Netweb indigenous tech). |

| Geopolitical/Talent | Branch closures (Cyient); high attrition (eMudhra 34%). | Global footprint (35+ countries); 100% training coverage; meritocratic culture. |

| Cyber/Environmental | Data breaches/privacy (ITES core); Scope 1/2 emissions (eMudhra: 160 MT CO2e). | Cybersecurity frameworks; solar power (100 kW); ZLD mechanisms. |

| Financial | Debt (Black Box low leverage); forex volatility. | Positive cash flows (Black Box ROE/ROCE strong); diversified revenue (74% North America). |

Overall Summary: The Indian ITES sector shows resilience with AI/digital infra as core growth engines (tailwinds from govt policies, hyperscaler spends), offsetting headwinds like tax disputes and revenue softness. Prospects are strong (20-30% CAGR in AI/HPC subsets), but risks from regulation and execution persist. Companies like Netweb/Black Box exemplify optimism, targeting multi-fold revenue growth by FY29 amid ‘Make in India’ push. Sector poised for 15-20% growth if macro stabilizes.

Investor

asof: 2025-12-03

Analysis of Indian IT Enabled Services (ITeS) Sector

The provided documents primarily cover disclosures from Indian-listed IT/ER&D (Engineering Research & Design), cloud infrastructure, and digital services firms (e.g., Tata Technologies, Cyient, Black Box, E2E Networks, LTTS, Sagility, etc.). These reflect Q2/H1 FY26 performance (ending Sep 2025), earnings calls, investor meets, and strategic updates. The sector shows resilience amid macro challenges, with focus on AI/digital transformation, but faces execution hurdles. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Headwinds

- Macro/Geopolitical Uncertainty: Tariffs (US/EU), elections, EV incentive cuts, and supply chain disruptions slowed ramps/decision-making in Q1-Q2 (Tata Tech, Cyient). JLR’s IT restoration post-cyberattack caused Q3 moderation (Tata Tech).

- Seasonal/Customer-Specific Softness: Q3 expected weak due to holidays/festivals, wage hikes (8-10% hikes across firms), and program ramps-down (Cyient, Tata Tech). Automotive stabilization but flat YoY (Tata Tech).

- Margin Pressures: One-offs (cyber costs, restructuring ~200bps hit in Cyient), salary revisions, and investments in sales/R&D/AI offset gains. EBITDA margins stable (12-16%) but Q3 dip anticipated.

- High Attrition/DSO Stretch: Attrition up to 15% (Tata Tech); DSOs at 109 days (Tata Tech) due to payment delays.

- Capex Intensity: GPU/cloud infra heavy (E2E: high depreciation Rs.42cr/qtr); inventory buildup for partnerships (Black Box Wind River).

Tailwinds

- AI/Digital Demand Surge: Robust GPU/cloud uptake (E2E: IndiaAI orders Rs.265cr total; Black Box data centers/AI). Sovereign AI push (IndiaAI Mission) boosts domestic LLMs/infra.

- Order Book Momentum: Strong bookings ($1B FY26 target Black Box; Tata Tech/Cyient new logos/deals). Backlogs up (Black Box $555M).

- Vertical Recovery: Aerospace/industrial heavy machinery +14% (Tata Tech); networks/transport +3-4% QoQ (Cyient). Education/products rebound.

- Strategic Wins/Partnerships: Acquisitions (Tata Tech ES-TEC for VW access; E2E Jarvis Labs); alliances (Black Box Wind River ~Rs.1,350cr/5yrs; Cyient Global Foundries).

- Margin Discipline: Adj. EBITDA up (Tata Tech 16.4%; Cyient 12.2% +16bps; E2E 41%; Black Box 9% +60bps). Cost optimization yielding results.

Growth Prospects

- H2 FY26 Acceleration: Consensus for stronger H2 vs. H1 (Tata Tech Q4 sharp recovery; Cyient/DATAMATICS pipeline +10%; Black Box 12-15% QoQ).

- FY26/FY27 Targets: Organic mid-teens (15% Tata Tech/Black Box); $2B rev by FY29 (Black Box). Double-digit aspirations (Cyient DET).

- High-Growth Areas: AI GPUs (E2E: 2-4k Blackwell GPUs; global demand), data centers, SDV/ADAS (Tata Tech), semiconductors/DLM (Cyient), edge/cloud (Black Box).

- Domestic Boost: IndiaAI Mission, sovereign cloud (E2E MRR Rs.35-40cr by Mar’26); expanding Europe/US (LTTS/Tata Tech conferences).

- Long-Term: 15% EBIT target Q4 FY27 (Cyient); AI-led transformation, cross-selling, large deals.

Key Risks

| Risk Category | Details | Impacted Firms |

|---|---|---|

| Execution | Deal ramps/delays (IndiaAI go-live; JLR restoration); capacity utilization (E2E GPUs). | All (esp. Tata Tech, E2E) |

| Macro/External | Tariffs/geopolitics prolong slowdown; hyperscaler competition (AWS/Azure). | Tata Tech, Cyient |

| Financial | High capex/debt (E2E Rs.450cr facility; GPU obsolescence 6-8yr life); low tax normalization (Black Box 15-20%). | E2E, Black Box |

| Operational | Attrition (15%+), DSO stretch; integration risks (acquisitions). | Tata Tech, Cyient |

| Tech/Regulatory | GPU tech shifts (AMD/NVIDIA); US export curbs (Blackwell chips); sovereignty compliance. | E2E, Tata Tech |

Summary

The Indian ITeS/ER&D sector (FY26 Q2) exhibits cautious optimism: QoQ growth (6-21%) amid flat YoY, with AI/cloud tailwinds offsetting macro headwinds. H2 poised for 10-15% acceleration via orders/deals, but Q3 softness risks miss. Growth anchored in AI infra (GPUs, sovereign models), targeting mid-teens organic + inorganic. Risks center on execution/macro, but strong pipelines/order books (e.g., $1-2B targets) signal resilience. Sector EBITDA ~12-16%; monitor Q3 ramps for FY27 trajectory. Overall outlook: Positive for AI-focused players, with 10-15% CAGR feasible if macros stabilize.

Press Release

asof: 2025-12-03

Summary Analysis: Indian IT Enabled Services Sector (Based on Provided Press Releases)

The provided documents cover Q2/H1 FY26 financials and announcements from key players in Indian ITES (e.g., engineering R&D, digital transformation, healthcare tech, AI/cloud, fintech SaaS). Companies like LTTS, Tata Technologies, Affle, Sagility, Netweb, Black Box, eMudhra, Zaggle, Datamatics, etc., report robust growth amid AI/digital tailwinds, but highlight macro headwinds. Overall sector sentiment is positive with 15-40% YoY revenue growth, expanding margins, and strong pipelines.

Tailwinds

- AI/GenAI & Digital Innovation Boom: Pervasive theme (LTTS-NVIDIA digital twins for MedTech; Netweb AI systems +160% YoY H1 growth; E2E TIR AI/ML platform for M&E; Datamatics AI tax processing; Affle AI agents like Niko). Driving new deals, products (Zaggle GlobalPay), and partnerships (Tata Tech-Synopsys, Black Box-Wind River).

- Healthcare & Domain-Specific Demand: Sagility (25.2% YoY revenue, payer/provider growth); IKS Health (22% YoY revenue, new Coimbatore office for US healthcare).

- Order Backlogs & Client Wins: Black Box backlog ₹4,846 Cr (+7% QoQ); Tata Tech strategic OEM deals; Cyient-CNH autonomy expansion.

- Operational Efficiencies: Margin expansions (Datamatics EBITDA 18.1%; Affle 22.6%; eMudhra 24.8%; Zaggle 10.1%) via cost optimization, AI automation.

- Geographic/Policy Support: ‘Make in India’ (Netweb sovereign AI orders ₹21,840 Mn); expansions (IKS 1,000-seat facility); awards/recognition (Sagility Great Place to Work).

Headwinds

- Macroeconomic Pressures: Client profitability challenges (Sagility); short-term demand softness/tactical issues in Q3 (Tata Tech); global uncertainties impacting H1 run-rates (Black Box normalized tariffs post-Q1 delays).

- High Attrition: Tata Tech 15.1% LTM; Sagility 26.3% voluntary (up YoY).

- Client Concentration: Sagility top-3 clients 63.1% revenue; top-10 87.6%.

- Integration/Costs: eMudhra Cryptas acquisition losses (₹15.6 Mn); Zaggle higher sales/marketing & depreciation from R&D capex.

Growth Prospects

- High Double-Digit Revenue Trajectory: Broad-based (20-40% YoY: Zaggle 42%, Sagility 25%, Affle 19%, Datamatics 20%, Netweb 51% H1). H2 acceleration expected (Black Box; Tata Tech rebound in Q4).

- AI/ML as Core Engine: 25-160% segment growth; platforms like TIR for M&E/content; healthcare AI diagnostics (LTTS).

- Diversification & Expansion: New verticals (EV/autonomy: Tata Tech/Cyient; fintech cards: Zaggle); geographies (US/Europe/ME: eMudhra, IKS); workforce scaling (Sagility 44k employees +15% YoY).

- Guidance Upgrades: Zaggle to 40-45% FY26 revenue growth; healthy pipelines/order books signal sustained 15-25% sector growth.

- Sustainability/Policy Alignment: Battery passports (Tata Tech), sovereign cloud (Netweb/E2E), positioning for India as AI hub.

Key Risks

- Demand Volatility: Macro slowdowns, client spending cuts (Tata Tech Q3 caution; Sagility client profitability pressures).

- Execution/Dependency: Large strategic orders (Netweb ₹21,840 Mn by FY27); project delays (Black Box Q1); integrations (eMudhra).

- Talent & Costs: Elevated attrition; rising sales/marketing/R&D expenses (Zaggle).

- Concentration & Competition: Heavy reliance on top clients; intense rivalry in AI/IT services.

- External Factors: Currency fluctuations, regulatory changes (healthcare compliance), geopolitical/macro risks (forward-looking statements across docs).

- Profitability Dilution: ESOP costs (Zaggle), one-offs (exceptional items in Datamatics).

Overall Outlook: Strong tailwinds from AI/digital adoption outweigh headwinds, supporting 20%+ sector growth in FY26. Focus on AI-healthcare diversification and ‘Make in India’ enhances resilience, but monitor macro/client concentration risks.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.