BANKBARODA

Equity Metrics

January 13, 2026

Bank of Baroda

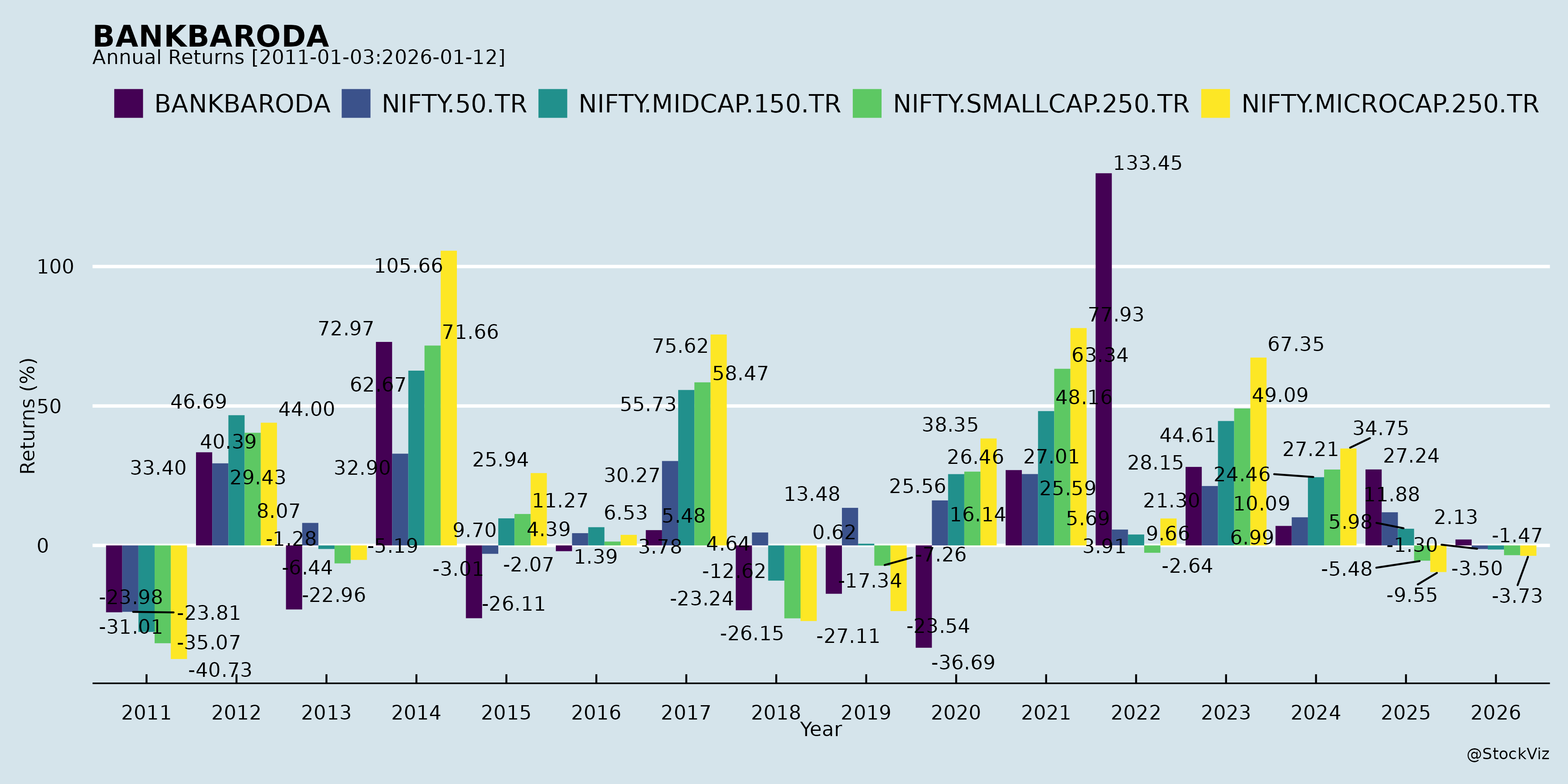

Annual Returns

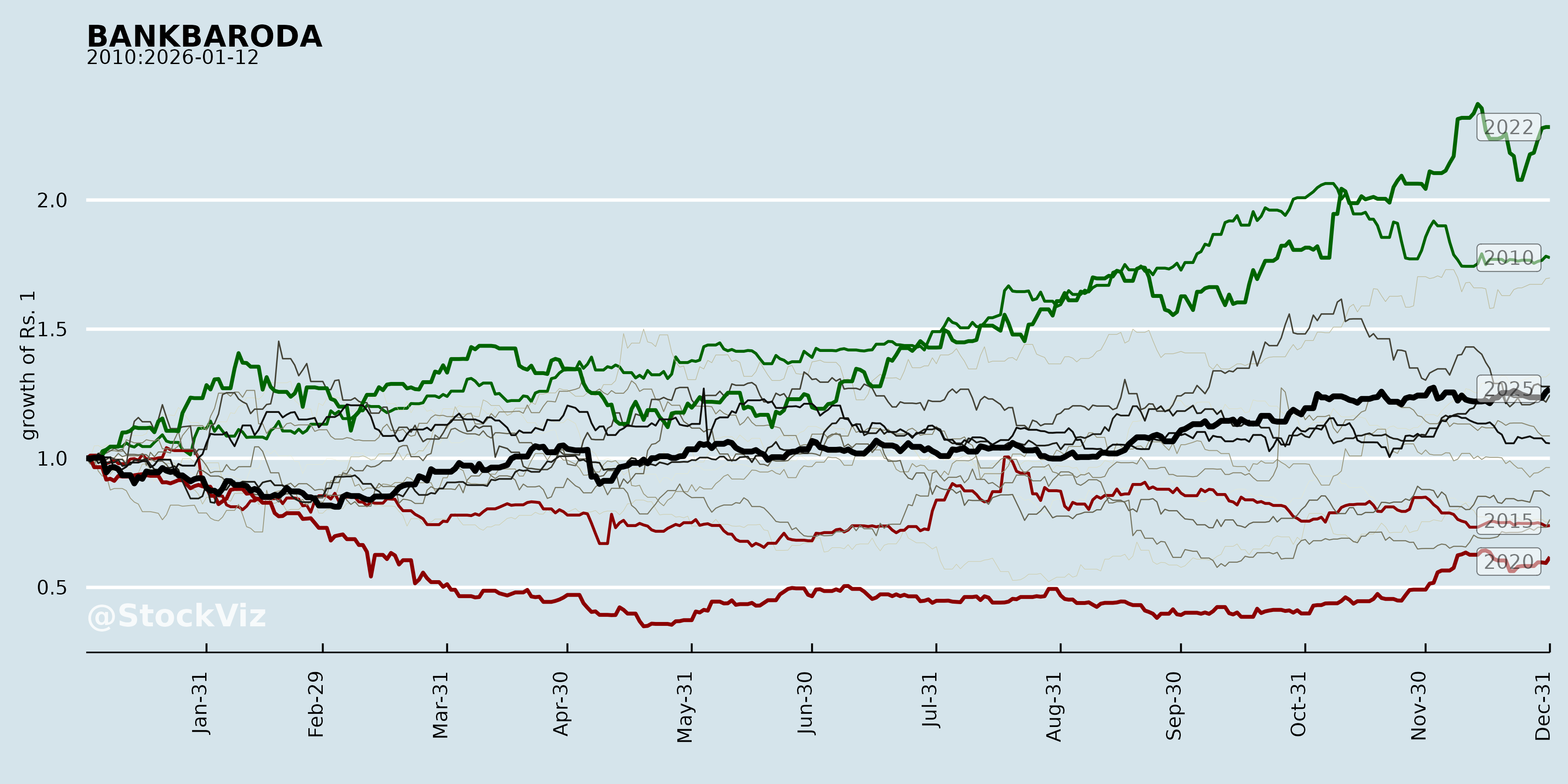

Cumulative Returns and Drawdowns

Fundamentals

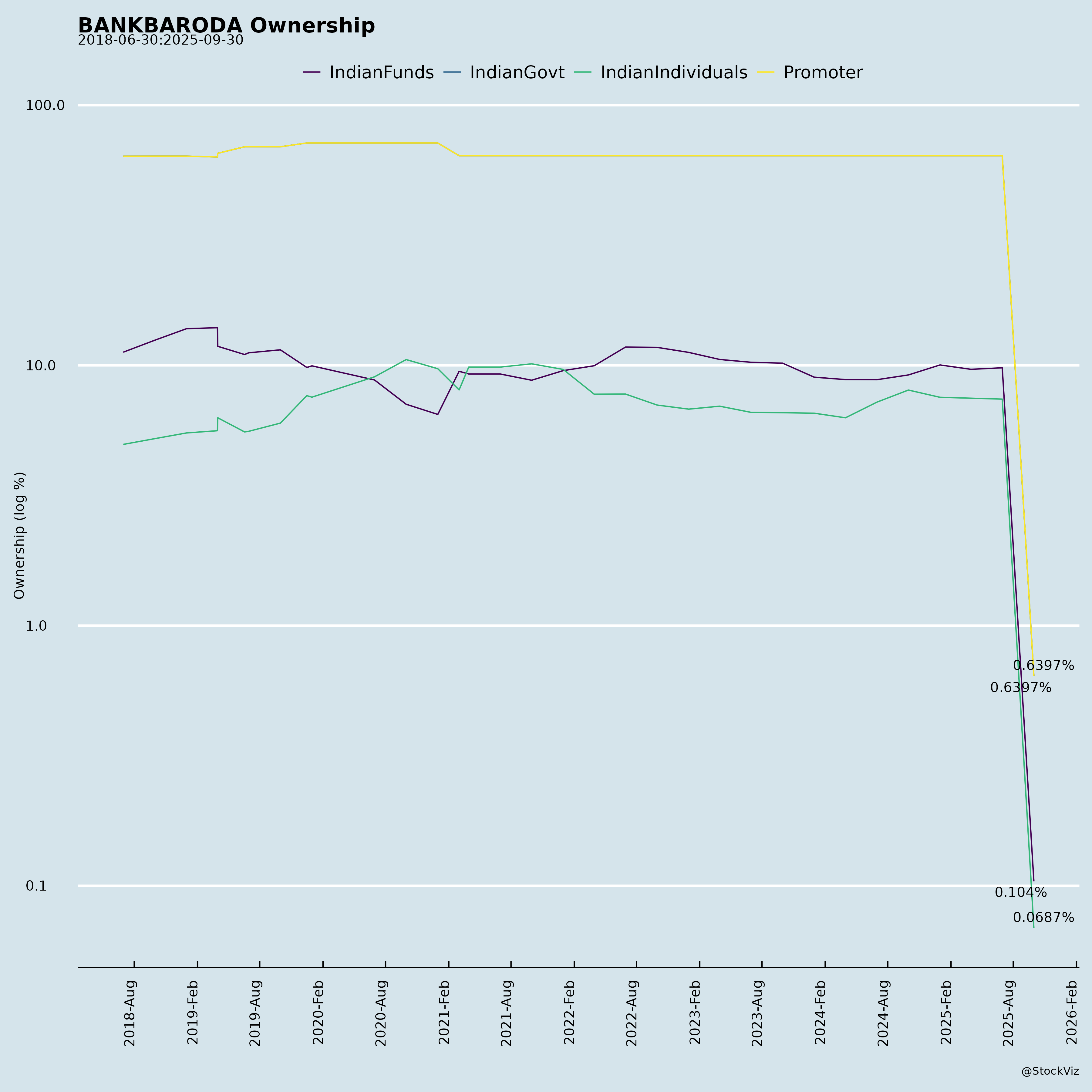

Ownership

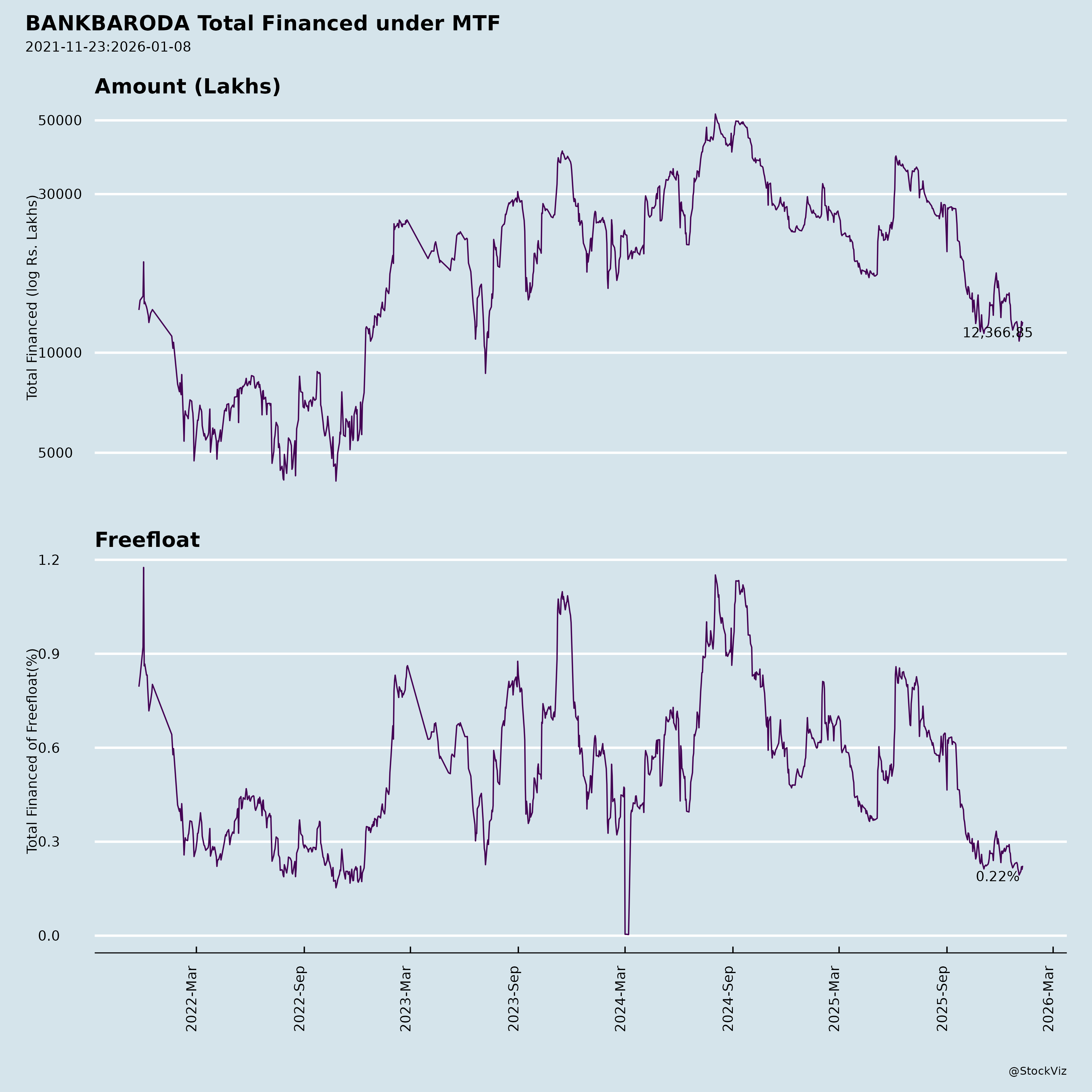

Margined

AI Summary

asof: 2025-12-08

As of now, you have not provided any specific documents or texts related to Bank of Baroda (BANKBARODA), which is a major public sector bank listed on Indian stock exchanges (NSE: BANKBARODA, BSE: 532419). To conduct a comprehensive analysis of headwinds, tailwinds, growth prospects, and key risks, I will rely on publicly available information and recent financial and operational developments up to June 2024, based on the bank’s latest annual reports, RBI commentary, sector trends, and market analysis.

Here is a detailed summary of the key factors affecting Bank of Baroda:

BANK OF BARODA: Business & Industry Overview

Bank of Baroda (BoB) is the third-largest public sector bank in India by assets, with an extensive domestic and international presence. It offers a wide range of retail, corporate, and international banking services. As a state-owned bank, it operates under the regulatory oversight of the Reserve Bank of India (RBI) and the Department of Financial Services (DFS), Government of India.

Tailwinds (Positive Factors)

- Government Support & Stable Ownership

- As a public sector bank, BoB benefits from implicit sovereign support, enhancing depositor confidence and lowering borrowing costs.

- Government backing reduces the risk of financial instability during crises.

- Strong Domestic and Global Footprint

- Over 5,000 branches in India and presence in ~17 countries.

- Expanding digital platforms to enhance customer reach, especially in Tier II and Tier III cities.

- Digital Transformation & Cost Optimization

- Successful integration with Vijaya Bank and Dena Bank post-merger in 2019.

- Investments in digital services (Baroda Connect, mobile banking) have improved efficiency and reduced operational costs.

- Improving Asset Quality

- Declining Gross NPA (Net Non-Performing Assets) from ~10% in 2018 to around 3.1% in FY2024.

- Provision coverage ratio (PCR) has improved significantly (over 85%), indicating stronger risk buffers.

- Healthy Loan Growth & Retail Expansion

- Retail loan book has grown steadily (~15% YoY in FY2024), driven by housing, auto, and personal loans.

- Focus on rural and semi-urban banking supports lower-cost CASA deposits growth.

- Supportive Macroeconomic Environment

- Stable GDP growth (~6.8% projected for FY25) and continued government infrastructure spending support corporate credit demand.

- Lower commodity prices and controlled inflation reduce pressure on margins.

- Capital Adequacy Strong

- Capital Adequacy Ratio (CAR) improved to ~15% under Basel III, above regulatory minimums—provides room for credit expansion.

Headwinds (Challenges & Constraints)

- High Competition in Retail Banking

- Intense competition from private banks (HDFC, ICICI) and fintechs in unsecured lending and digital banking, impacting margins.

- Legacy Bad Loan Management

- While improving, legacy NPAs (especially in corporate and MSME segments) remain a concern.

- Exposure to stressed sectors such as aviation, power, and metals could resurface under economic stress.

- Regulatory & Compliance Burdens

- Public sector banks face more onerous regulatory scrutiny and governance reforms.

- Cybersecurity and digital fraud risks are rising with increased digital adoption.

- Net Interest Margin (NIM) Pressure

- NIM has hovered around 2.5–2.6%, under pressure from high deposit costs and rate cuts.

- Mismatches between deposit pricing and loan yield dynamics may constrain profitability.

- Slower Decision-Making Due to Governance Structure

- Bureaucratic hurdles common in government-owned entities can delay technological upgrades and strategic actions.

- Dependence on Rural and Semi-Urban Economy

- Vulnerable to agrarian distress, monsoon variations, and rural consumption slowdown.

Growth Prospects

- Digital-First Banking Strategy

- BoB is focusing on AI-driven analytics, UPI integration, and platform banking to attract younger demographics.

- Expansion of Rural & MSME Banking

- Targeting financial inclusion via Pradhan Mantri Jan Dhan Yojana (PMJDY) and government schemes—potential for deposit and lending growth.

- Sustainable Finance & Green Banking

- Increasing investment in green bonds and ESG-aligned financing, aligning with national climate goals.

- International Banking Revival

- Plans to restructure and grow operations in Africa, Middle East, and Asia Pacific with improved compliance.

- Wealth & Insurance Cross-Selling

- Partnerships with Baroda Sun Life Asset Management and insurance ventures to diversify income.

- Government-Led Credit Programs

- Beneficiary of schemes like MUDRA, PMAY, and PLI—driving retail and MSME credit growth.

Key Risks

| Risk Category | Description |

|---|---|

| Credit Risk | Legacy NPAs may resurge; vulnerability to sector-specific downturns (e.g., real estate, textiles). |

| Interest Rate Risk | Rising rates could increase deposit costs; falling rates compress NIM. |

| Operational Risk | Cyber threats, frauds, and legacy IT system vulnerabilities. |

| Regulatory & Governance Risk | Changes in government policy, audits, or delayed approvals. |

| Reputational Risk | Public perception of inefficiency or service lapses compared to private peers. |

| Macroeconomic Risk | Economic slowdown, global uncertainty, inflation spikes. |

| Competition Risk | Private banks and fintechs eroding market share in high-growth segments. |

Summary

Bank of Baroda has made significant progress in stabilizing its balance sheet, improving asset quality, and modernizing operations post-merger. It is well-positioned to benefit from financial inclusion, government initiatives, and digital adoption. However, it faces structural challenges typical of public sector banks — including slower innovation, workforce inefficiencies, and NIM pressure.

Overall Outlook: Cautiously Positive

- Short Term (1–2 years): Moderate loan growth and stable profitability. Margins may remain under pressure. - Medium to Long Term (3–5 years): Growth potential lies in digital banking, rural penetration, and capital-light models. Execution of turnaround strategy will determine share price performance.

Investors should watch:

✅ Asset quality trends (GNPA/NNPA)

✅ CASA ratio & deposit cost dynamics

✅ Management commentary on NIM and digital growth

✅ Any further government capital infusion or privatization plans

While not a high-growth stock like private banks, BANKBARODA offers value with stability, suitable for conservative investors seeking dividends and exposure to India’s broader financial deepening story.

Note: For a more tailored analysis, please provide specific documents (e.g., annual report, investor presentations, news articles, or regulatory filings).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.