BALAMINES

Equity Metrics

January 13, 2026

Balaji Amines Limited

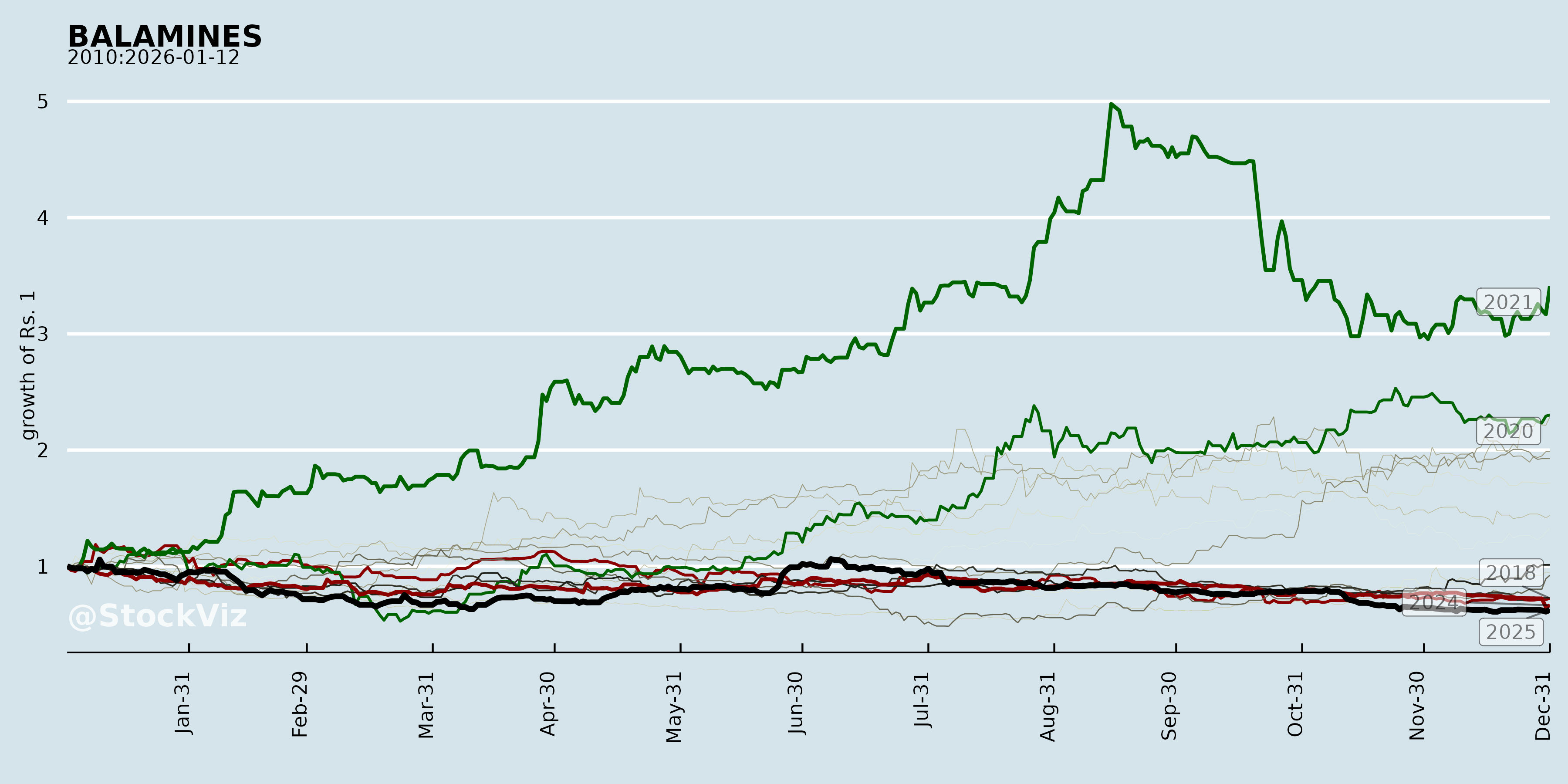

Annual Returns

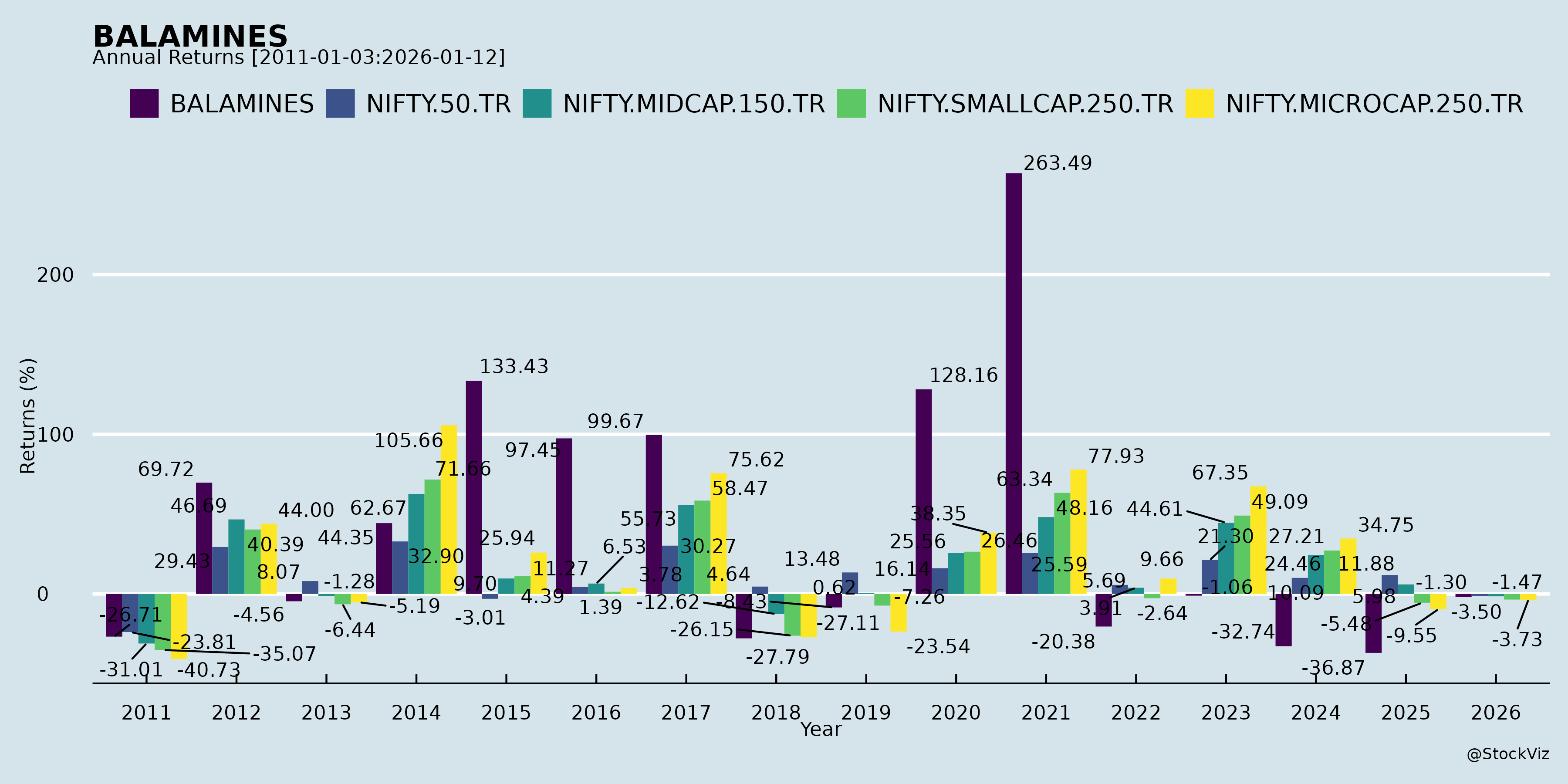

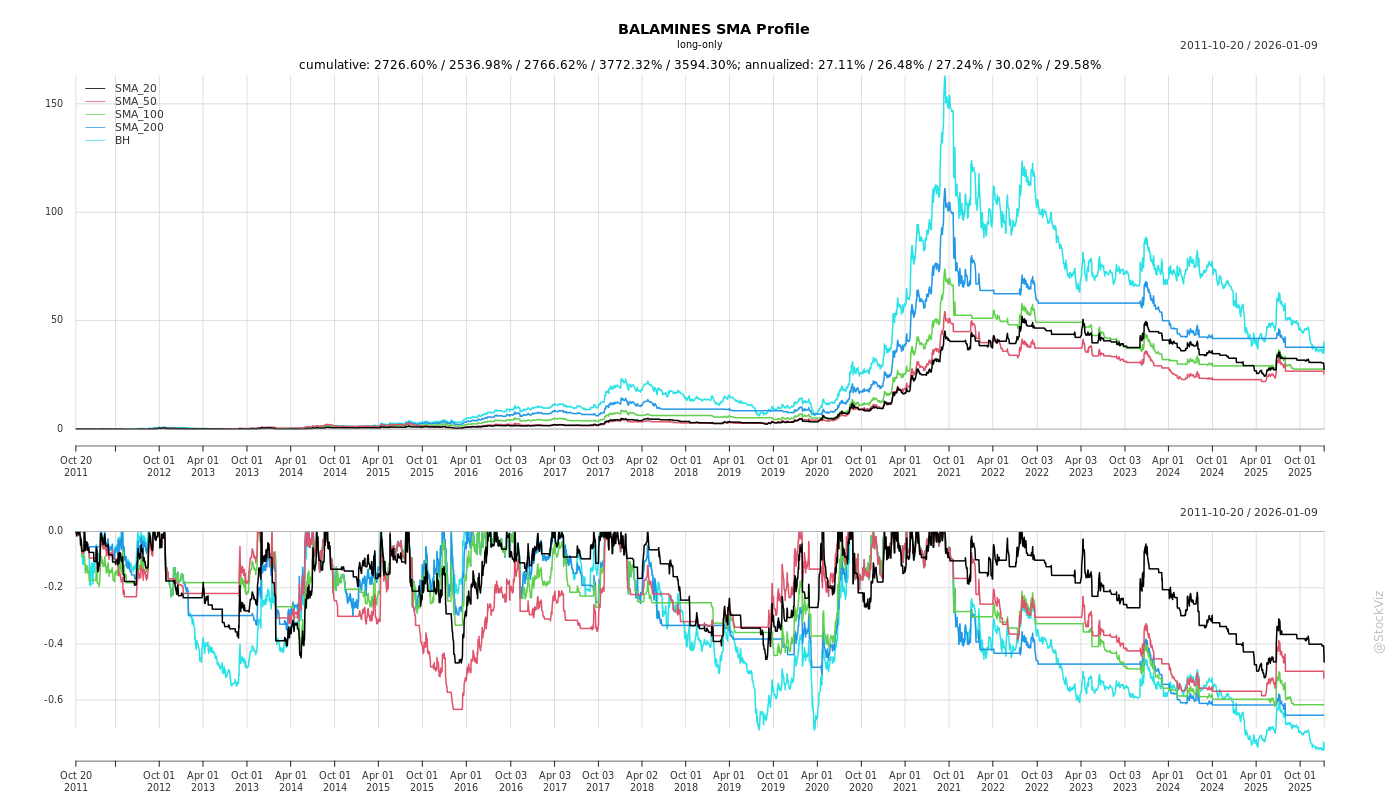

Cumulative Returns and Drawdowns

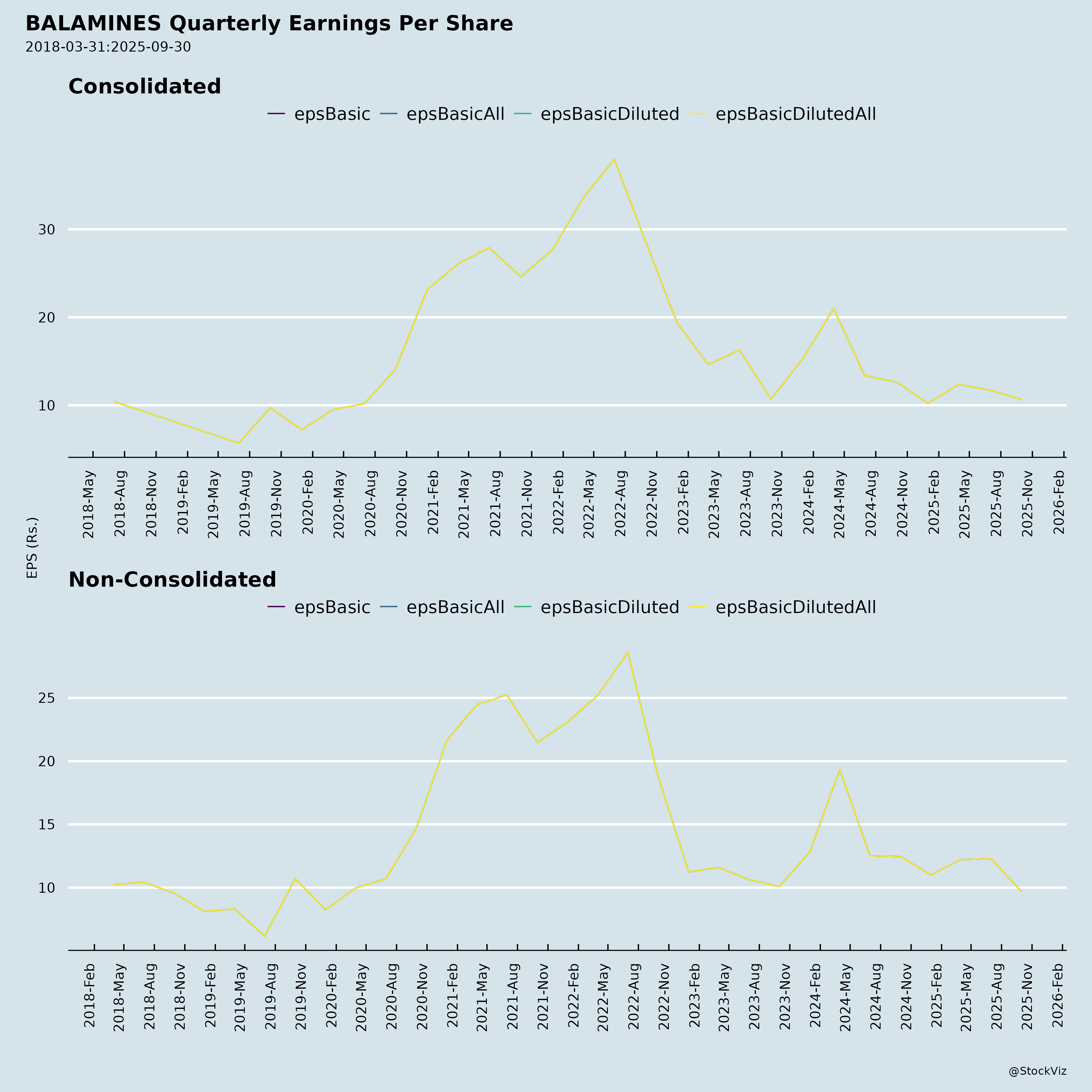

Fundamentals

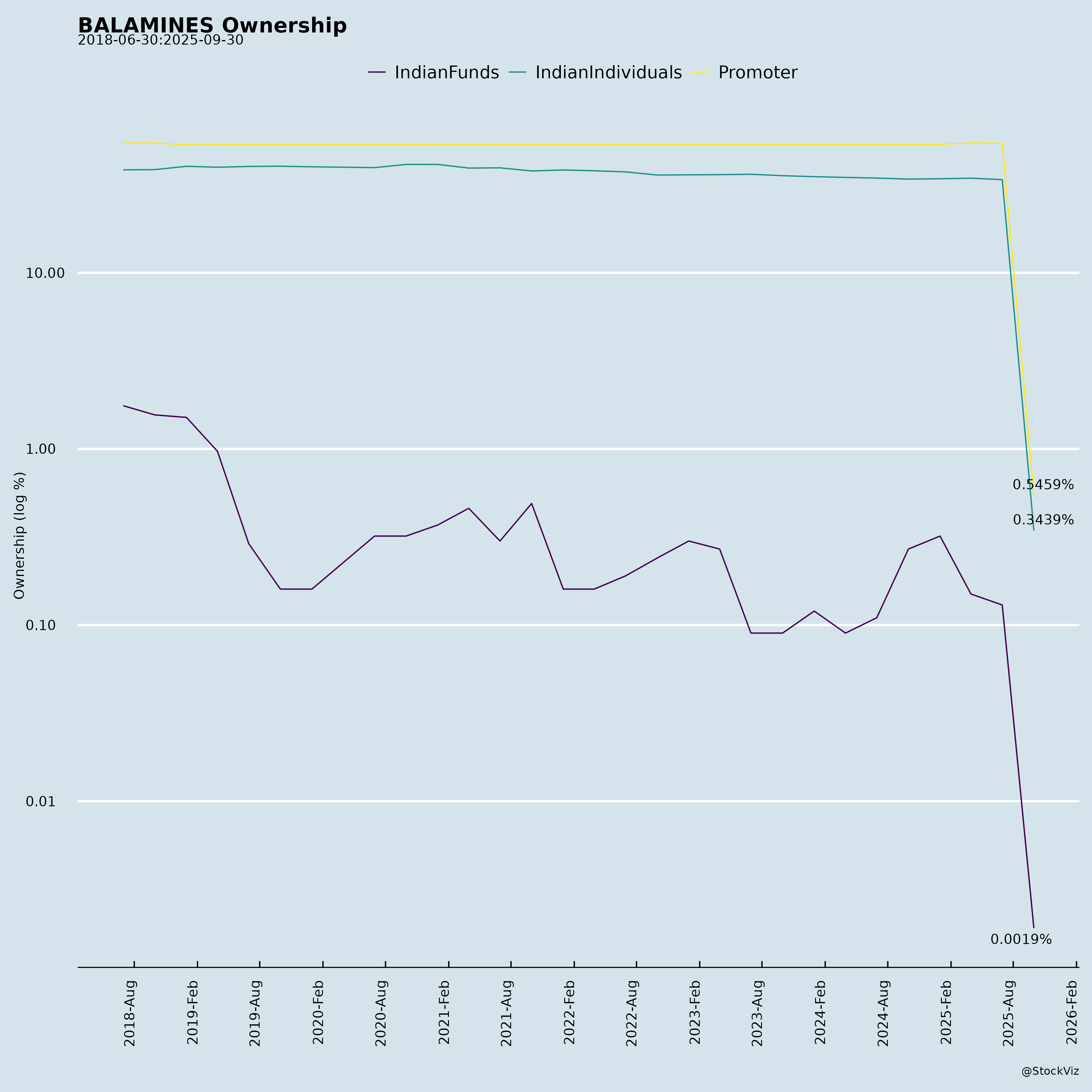

Ownership

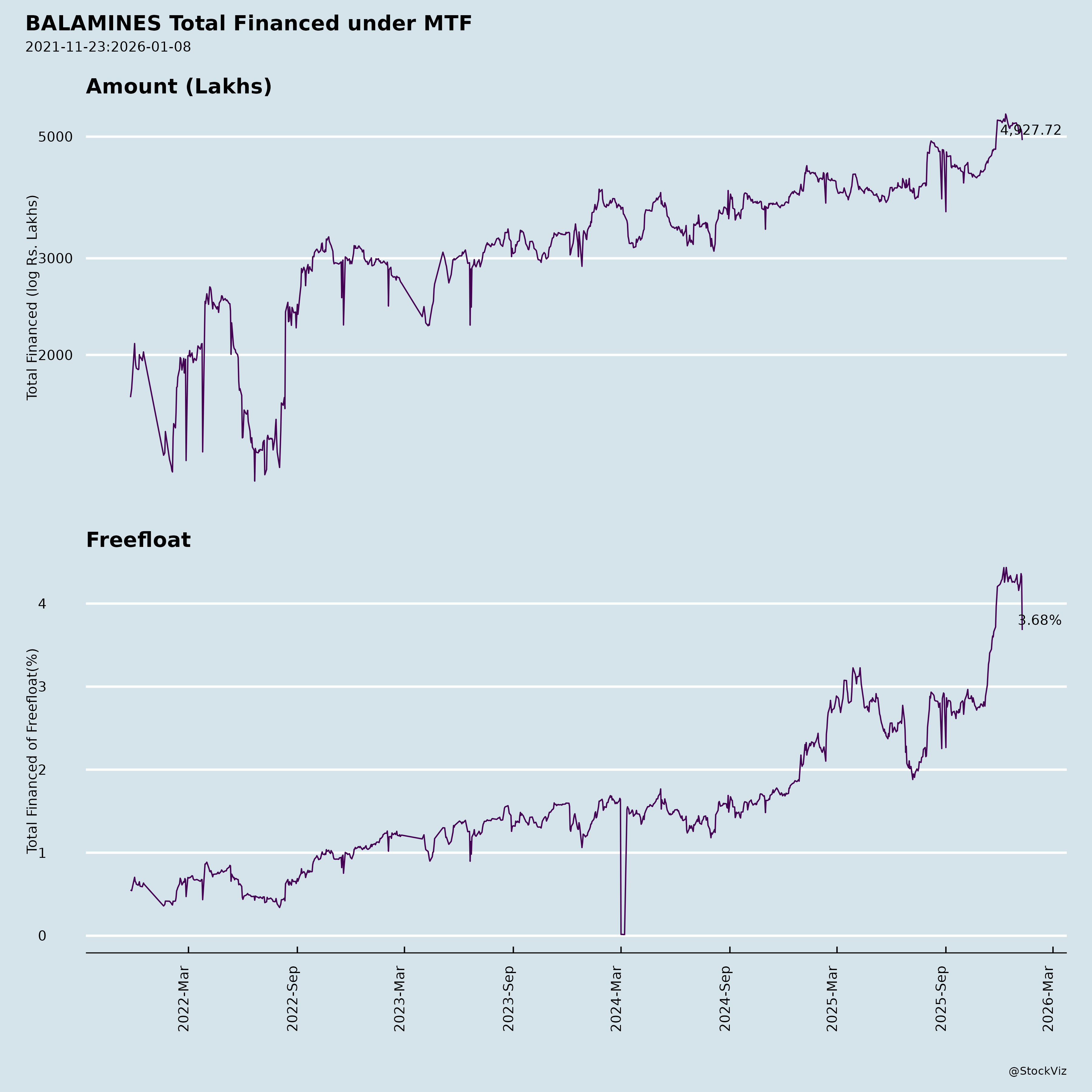

Margined

AI Summary

asof: 2025-12-08

Based on a comprehensive analysis of Balaji Amines Limited’s (BALAMINES, Scrip Code: 530999) investor presentation, financial releases, regulatory filings, and corporate announcements dated between September and November 2025, the following is a detailed summary of the company’s headwinds, tailwinds, growth prospects, and key risks.

🔍 Company Overview (Quick Snapshot)

- Founded: 1988

- Core Business: Manufacturing of Aliphatic Amines (Methylamines, Ethylamines), Amine Derivatives, and Specialty Chemicals

- Key Segments: Pharma (51%), Agrochemicals (26%), Paints & Resins, Animal Feed, Oil & Gas, etc.

- Manufacturing: 4 facilities – 3 in Solapur, Maharashtra, 1 near Hyderabad, Telangana

- Subsidiary: Balaji Specialty Chemicals Ltd (BSCL) – 55% owned, with mega expansion underway

- Hotel Venture: Balaji Sarovar Premiere, a 5-star hotel in Solapur (non-core business, ~2.3% revenue)

- Market Position:

- Largest manufacturer of Aliphatic Amines in India

- Market leader in Methylamines (48,000→88,000 TPA expansion underway)

- Indigenous technology developer in amines manufacturing

- Largest manufacturer of Aliphatic Amines in India

✅ Tailwinds & Growth Prospects

1. Strong Industry Tailwinds

- Global Amines Market projected to grow at ~7.8% CAGR (2024–2030), reaching $23.5 billion.

- Pharma (61%) and Agrochemicals (26%) are core end-markets for amines, both structurally growing in India.

- Sourcing from India is preferred globally due to stringent quality standards (REACH, WHO-GMP).

- India’s growing push for import substitution in specialty chemicals is favorable.

2. Capacity Expansion & Project Commissioning

- Methylamines plant (Unit-IV) successfully commissioned in Nov 2024 (88,000 TPA capacity → cost leadership).

- Electronic Grade DMC plant commissioned in May 2025 – first in India with 15,000 TPA capacity.

- Solar power: 6 MW AC commissioned in April 2025; 20 MW greenfield solar project underway – reduces power costs and enhances ESG profile.

- Future projects on track:

- Dimethyl Ether (DME) – 1,00,000 TPA (FY25-26): LPG substitute; BIS supports 20% blending in LPG.

- N-Methyl Morpholine (NMM) – 5,000 TPA (FY25-26): Pharma/oil & gas applications.

- Pharma Grade Propylene Glycol (PG) (FY25-26): For EV batteries and pharmaceuticals.

- BSCL Greenfield Project (Rs. 750 Cr expansion): HCN, NaCN, EDTA, with Mega Project Status from Maharashtra govt.

3. First-Mover Advantages & High-Demand Products

- PVP K-30 & Pharma Grade PG in high demand; BAL is one of the few domestic manufacturers.

- Export opportunities in electronic-grade DMC and specialty chemicals.

- Vertical & horizontal integration strengthens cost competitiveness and supply chain resilience.

4. Robust Financial Discipline

- Standalone entity is zero-debt, demonstrating strong internal accruals and self-funding of capex.

- Projects funded entirely via internal accruals – low financial risk.

- Consistent dividend payout history – FY24: Rs. 11/share; FY25: Rs. 11/share.

5. Diversified Global Presence

- Operates in 50+ countries, with 12.8% revenue from exports.

- Key export markets: Europe (45–55% of exports), USA, Japan, South Africa, Middle East.

- REACH compliance in key chemistry – strengthens global competitiveness.

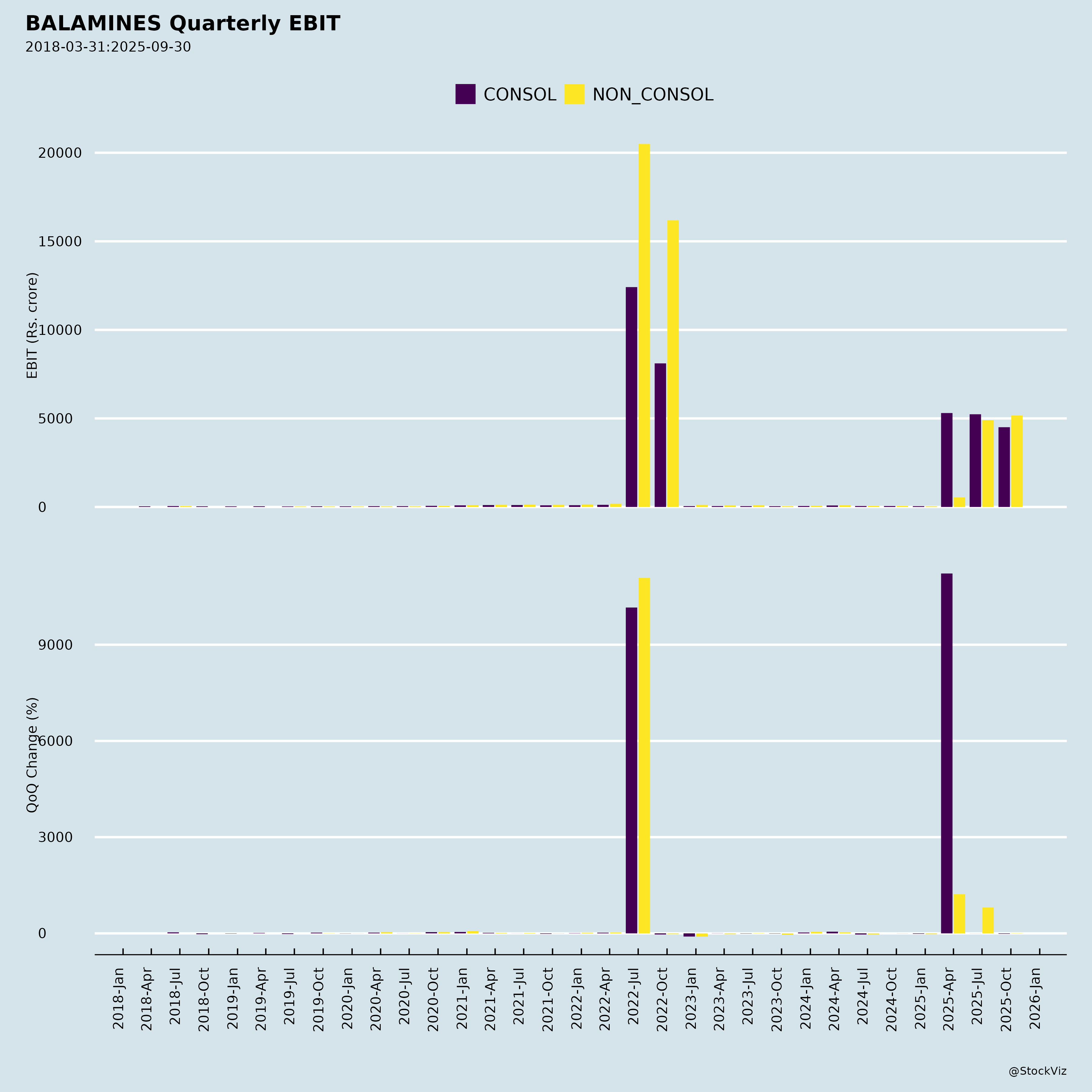

6. Strong ROCE Core Business

- Core chemical business ROCE: 12% (FY25) vs. consolidated ROCE: 8.6%

- Despite lower consolidated ROE due to lagging returns from newer projects (CWP), the core business remains robust and efficient.

⚠️ Headwinds

1. Near-Term Weak Demand

- Pharma & Agrochemical sectors witnessing lower offtake due to geopolitical tensions and global demand softness.

- New capacities (e.g. DME, PG Pharma Grade) are ramping up but not contributing meaningfully to revenue yet.

2. Margin Pressure

- Consolidated PAT Margin: 11% (Q2FY26), down from 12% in Q2FY25.

- Standalone PAT Margin: 10% (Q2FY26) from 12%, reflecting cost pressures and muted volumes.

- Q-o-Q volume decline: 26,165 MT (Q2FY26) vs. 27,570 MT (Q1FY26) – driven by lower offtake.

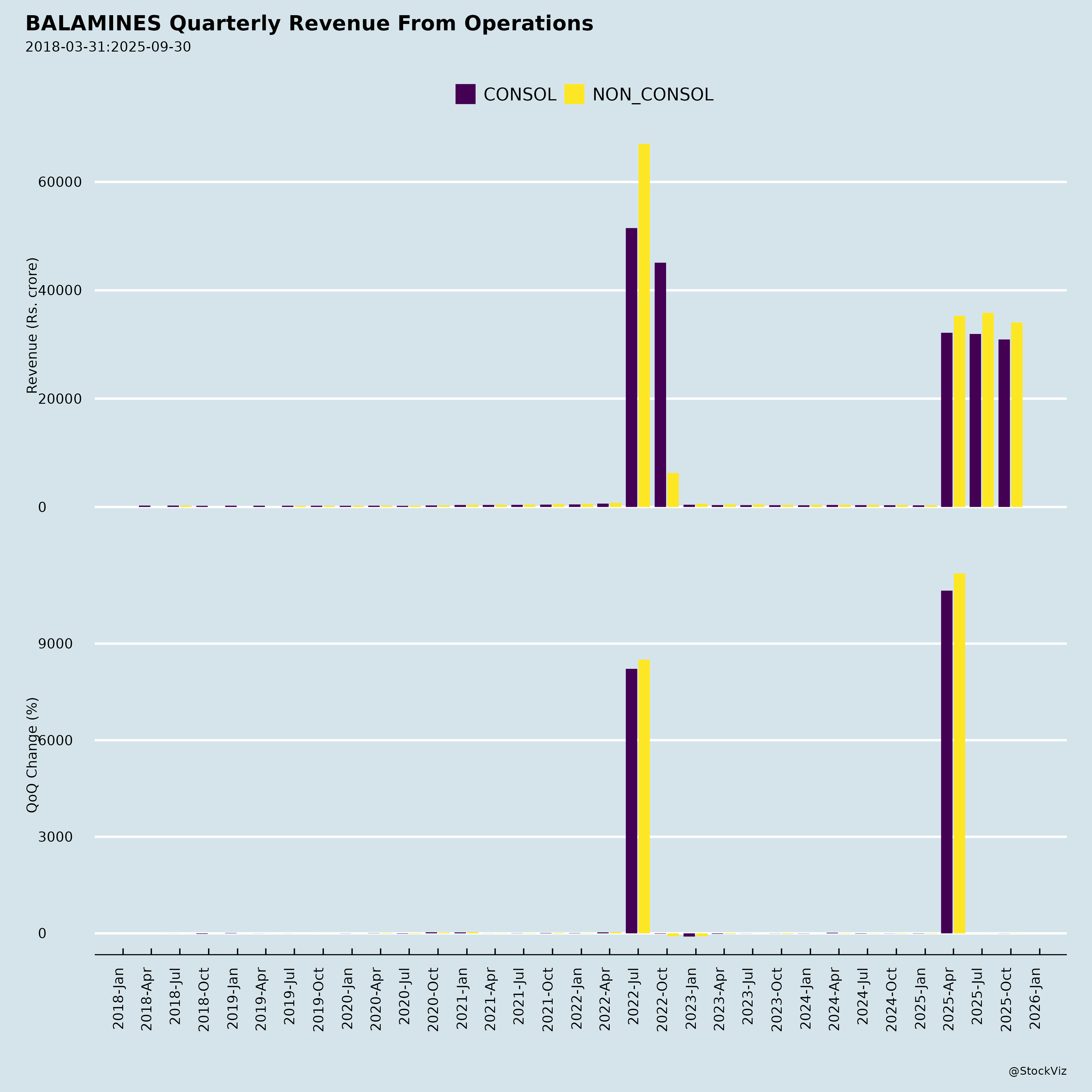

3. Revenue Gradual Decline

- Standalone Revenue: Down 3% YoY in Q2 and H1FY26.

- Consolidated Revenue: 2% YoY fall in Q2; 5% fall in H1.

- Indicates softening near-term demand or pricing challenges.

4. Delayed Contributions from CWP

- Capital Work-in-Progress (CWP): Rising sharply – Rs. 339 Cr (Consolidated, Sep-25) from Rs. 234 Cr (Mar-25).

- Projects in process (BSCL Expansion, Solar, DME, NMM) are not yet revenue-generating and are weighing on ROCE.

5. Cash Flow Pressure

- Consolidated Cash Flow from Operations: ₹22.2 Cr (9 months FY26) vs. ₹195.3 Cr in YoY period – sharp decline due to working capital increase.

- Net decrease in cash: ₹109.8 Cr in 6 months → cash position (consolidated) dropped from ₹148.9 Cr (Mar-25) to ₹39.1 Cr (Sep-25).

- Significant capex outflows (Investing - ₹115 Cr) funded by internal accruals, but pressure is evident.

⚠️ Key Risks

1. Regulatory & Legal Risk

- Summons from a Gujarat court under the Drugs & Cosmetics Act, 1940 (Nov 25, 2025).

- Alleged violation under Sections 16(1)(a), 18(a)(i), 34, etc.

- Company asserts no material financial/operational impact, but ongoing litigation could lead to reputational or compliance risks.

- Risk of regulatory penalties, especially if linked to product quality.

2. Commodity & Raw Material Price Volatility

- Major inputs: Ammonia, Methanol, Denatured Ethyl Alcohol

- Methanol is mostly imported from Middle East → exposed to global price shocks, logistics disruptions, FX volatility.

- EBITDA margin at 19% in Q2FY26 – flat Q-o-Q but down from 20% a year ago – suggests cost pressure.

3. Execution & Timing Risk in Expansion Projects

- Multiple new projects (DME, PG Pharma Grade, BSCL expansion) are under execution.

- Delays could result in missed revenue targets and prolonged capital drain.

- However, company emphasizes all projects are on internal funding and schedule – mitigating factor.

4. Liquidity Risk from Falling Cash Reserves

- Consolidated cash balances fell by ~73% (₹149 Cr → ₹39 Cr) in 6 months.

- While the company is debt-free at standalone, consolidated borrowings increased to ₹31.1 Cr (Sep-25) from zero earlier → short-term financing for capex?

5. Hotel Business Drag

- The 5-star hotel contributes only 2.3% of revenue.

- Loss-making or marginally profitable?

- Standalone EBIT margin: 14% (Q2FY26) vs. previous 17% – may reflect poor performance of non-core assets.

- Positive occupancy (70–75%), but ROE drag due to large initial investment (₹110 Cr).

6. FX & Export Risk

- 12.8% revenue from exports.

- Exposure to currency fluctuations, EU regulations, and trade disruptions in current global environment.

📈 Financial Snapshot: Q2 & H1FY26 (vs. Prior Periods)

| Metric | Q2FY26 (Consol) | Q2FY25 (Consol) | YoY Chg | H1FY26 (Consol) | H1FY25 (Consol) | YoY Chg |

|---|---|---|---|---|---|---|

| Revenue (Cr) | 348 | 356 | -2.2% | 715 | 749 | -4.5% |

| EBITDA (Cr) | 67 | 70 | -4.3% | 131 | 144 | -9% |

| PAT (Cr) | 37 | 41 | -9.8% | 74 | 87 | -15% |

| EBITDA Margin | 19% | 20% | -100 bps | 18% | 19% | -100 bps |

| PAT Margin | 11% | 12% | -100 bps | 10% | 12% | -200 bps |

Note: Despite a marginal dip in revenue, EBITDA margin improved from 17% (Q1FY26) due to better cost control and scale.

🎯 Outlook & Strategic Direction

- Near-Term (Q3–Q4FY26): Gradual recovery expected as new plants stabilize and global demand recovers.

- Medium to Long Term:

- Scalable growth via high-margin specialty products (e.g., NMM, PG Pharma, DMC EL Grade).

- Cost advantage from integrated, tech-upgraded Methylamines base.

- EV battery and renewables (solar power) positioning align with future chemical trends.

✅ Summary: Investment Thesis

| Factor | Assessment |

|---|---|

| Growth Potential | High – fueled by capacity expansions, new product launches, and import substitution. |

| Competitive Edge | Strong – market leadership, indigenous tech, zero debt, ESG compliance. |

| Financial Health (Standalone) | Excellent – zero debt, healthy margins, dividend payor. |

| Consolidated Performance | Pressured – weak near-term margins, lower cash flow, high CWP. |

| Tailwinds | 1. Domestic manufacturing push (PLI, import substitution) 2. Pharma/agrochem demand cycle improving 3. Global green supply chain shift |

| Headwinds | 1. Global demand softness 2. High capex burden 3. Legacy product saturation |

| Key Risks | 1. Regulatory scrutiny (Drugs Act summons) 2. Commodity price volatility 3. Liquidity constraints due to capital intensity |

📌 Final Verdict:

Balaji Amines is at an inflection point. Despite near-term headwinds in demand and margins, the company is strategically investing in high-growth, high-margin segments. Its zero-debt standalone structure, technological edge, and large unmet domestic demand for specialty chemicals provide a strong long-term foundation.

Bull Case: Successful ramp-up of DME, NMM, PG Pharma, and BSCL projects could drive top-line growth and margin expansion, delivering 15–20% EPS CAGR from FY27 onward.

Bear Case: Prolonged weak offtake, cost overruns, or legal risks could delay returns from capex, keeping ROE low and dividend sustainability under pressure.

📢 Recommendation:

- For Long-Term Investors: Attractive entry opportunity during weakness (e.g., if stock corrects below book value).

- For Traders: Monitor Q3FY26 commentary for signs of demand recovery and capex monetization.

- Catalyst Watch: Commissioning of DME (FY25-26), BSCL Phase-I (Dec-26), and EV-grade DMC ramp-up.

🔍 Final Note:

While current results show deceleration, the underlying strategy and capital allocation are sound. The investment story hinges on project execution, which Balaji has shown consistent capability in delivering. Patience required – this is a multi-year transformation story with potential for market leadership in India’s specialty chem space.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.