Specialty Chemicals

Industry Metrics

January 13, 2026

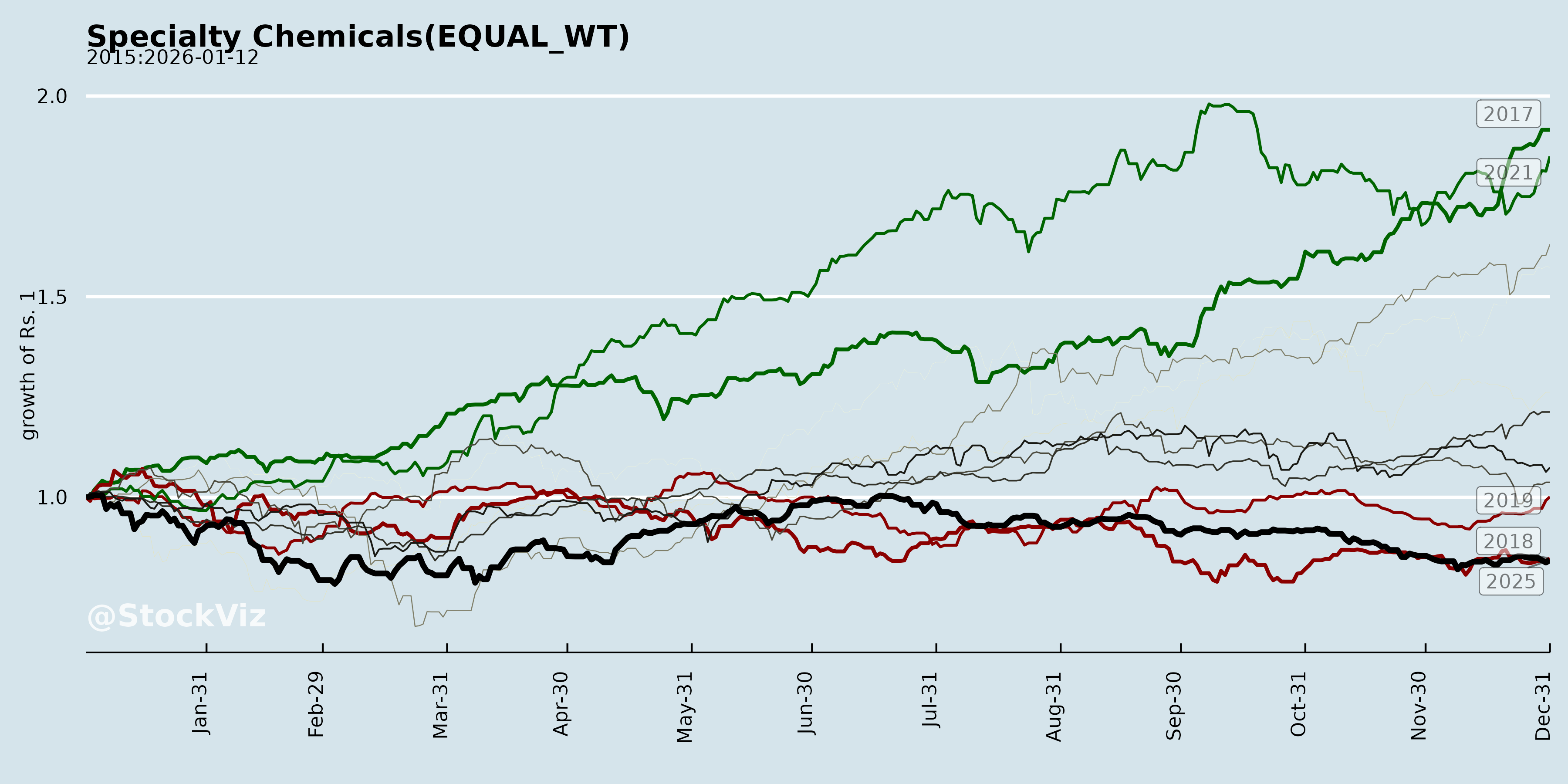

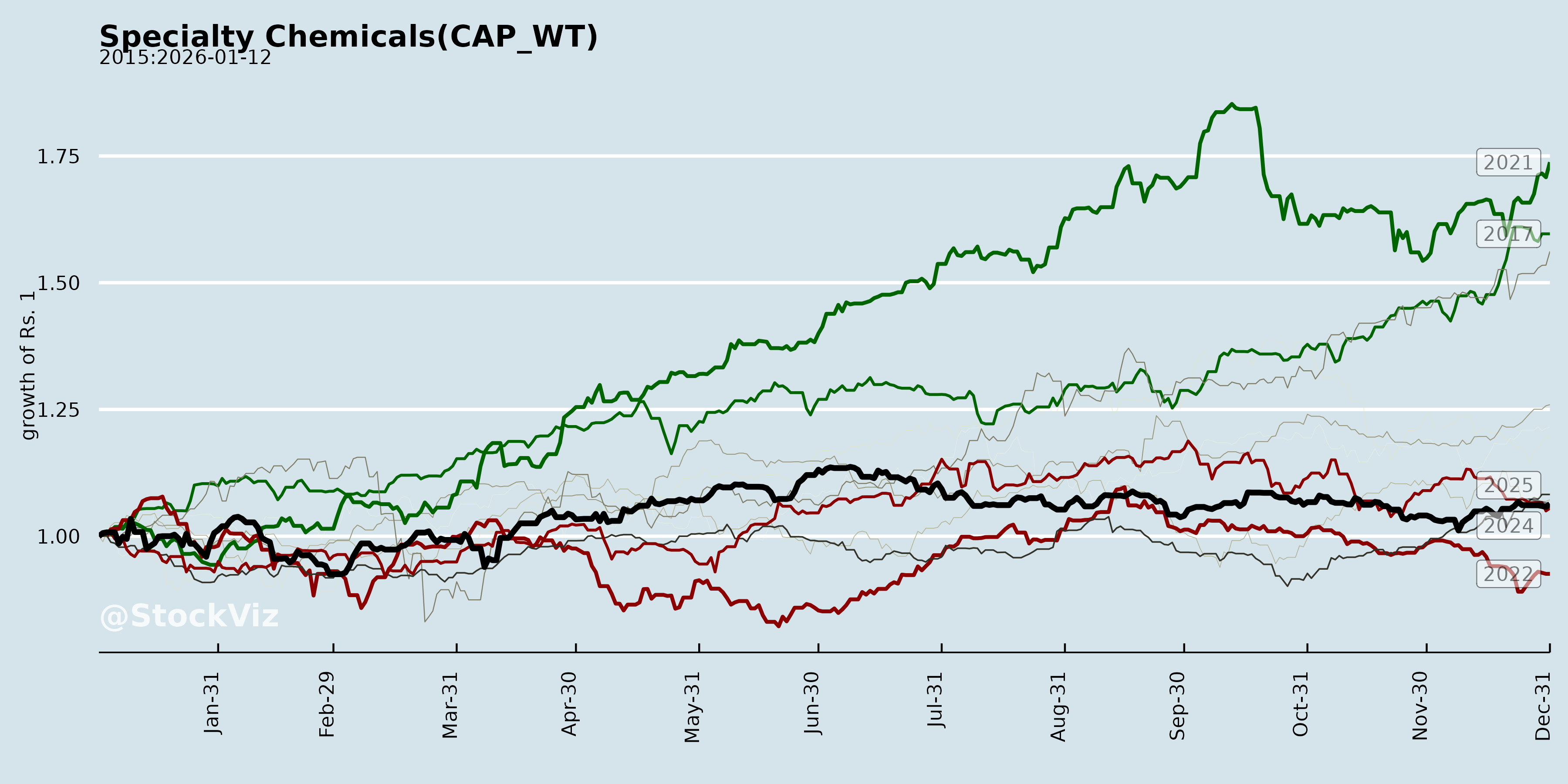

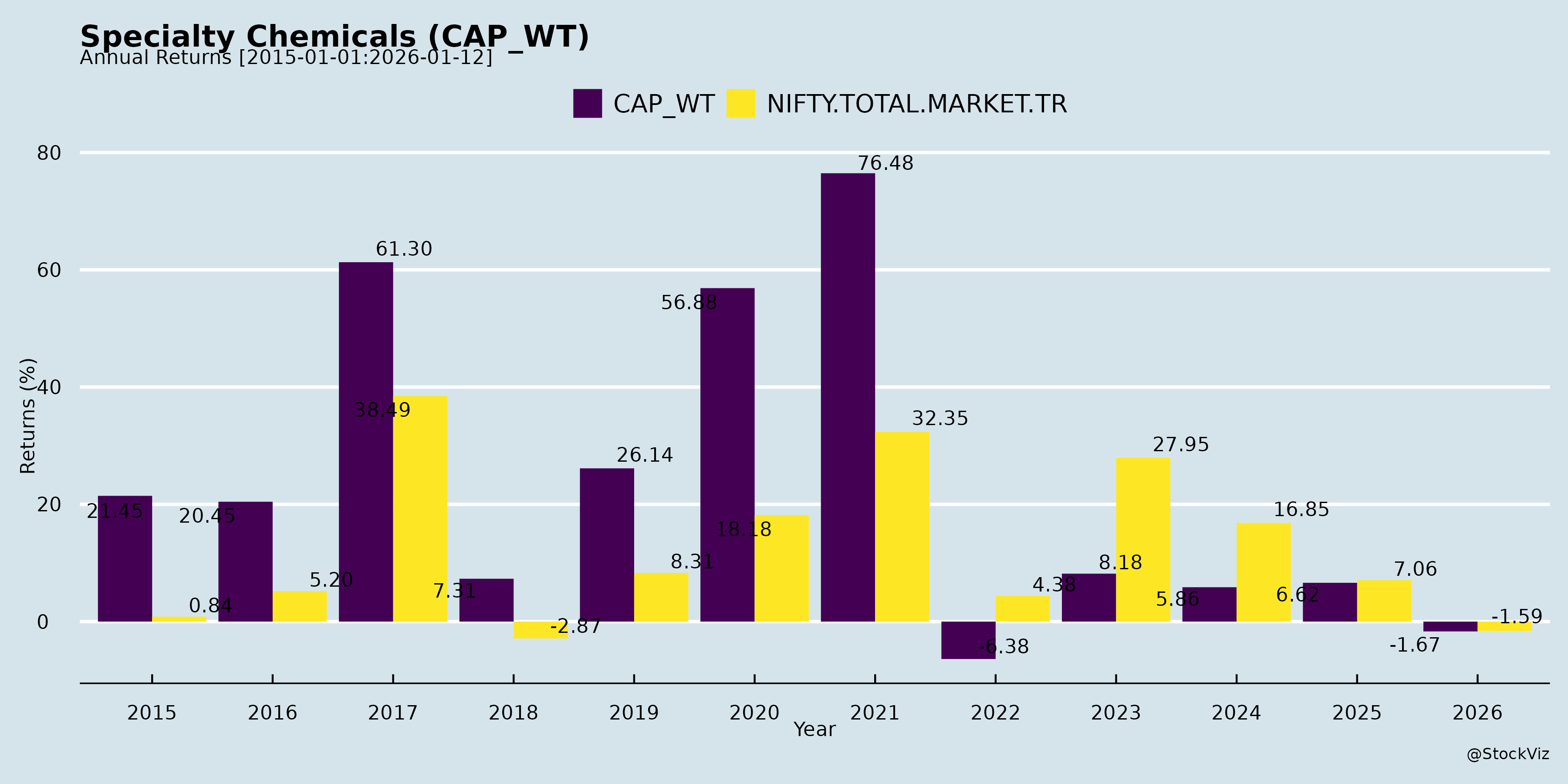

Annual Returns

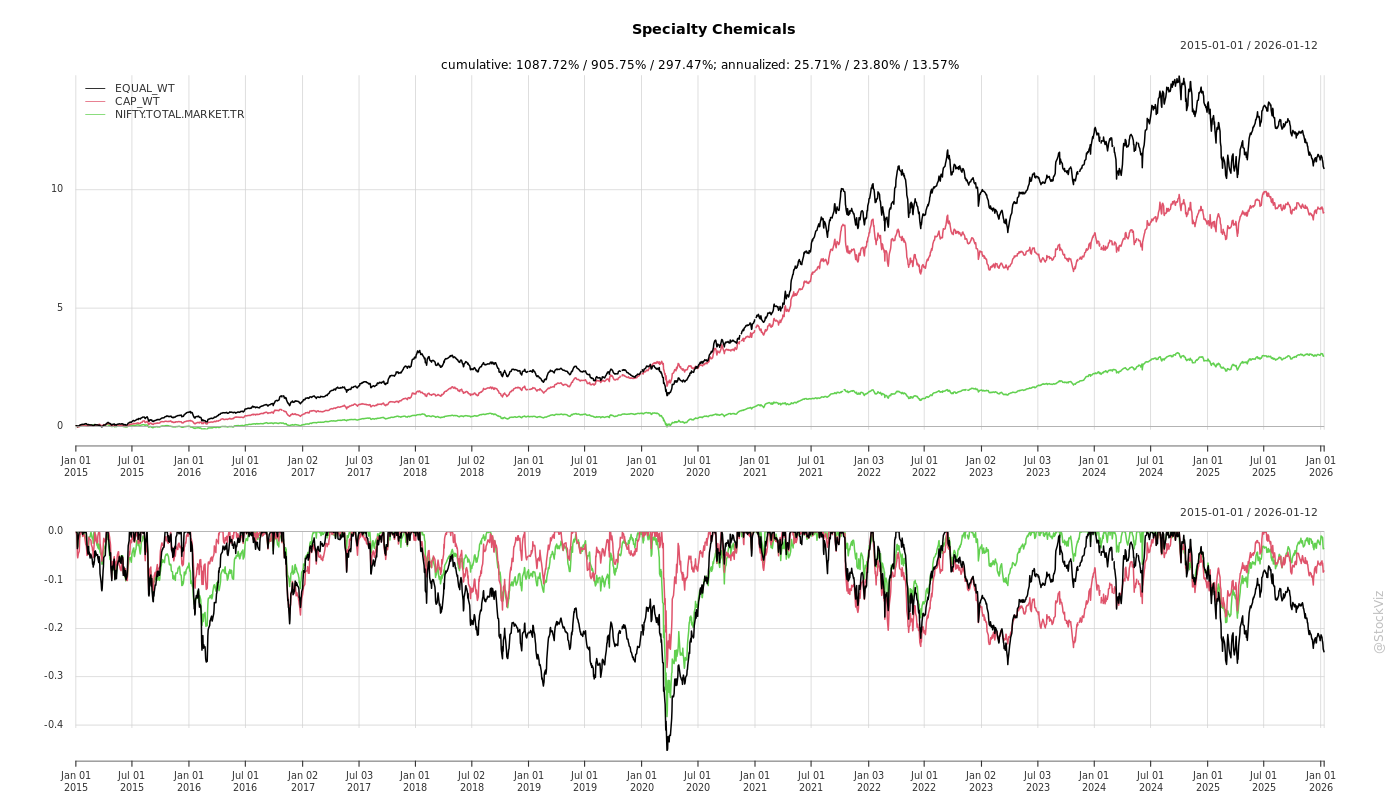

Cumulative Returns and Drawdowns

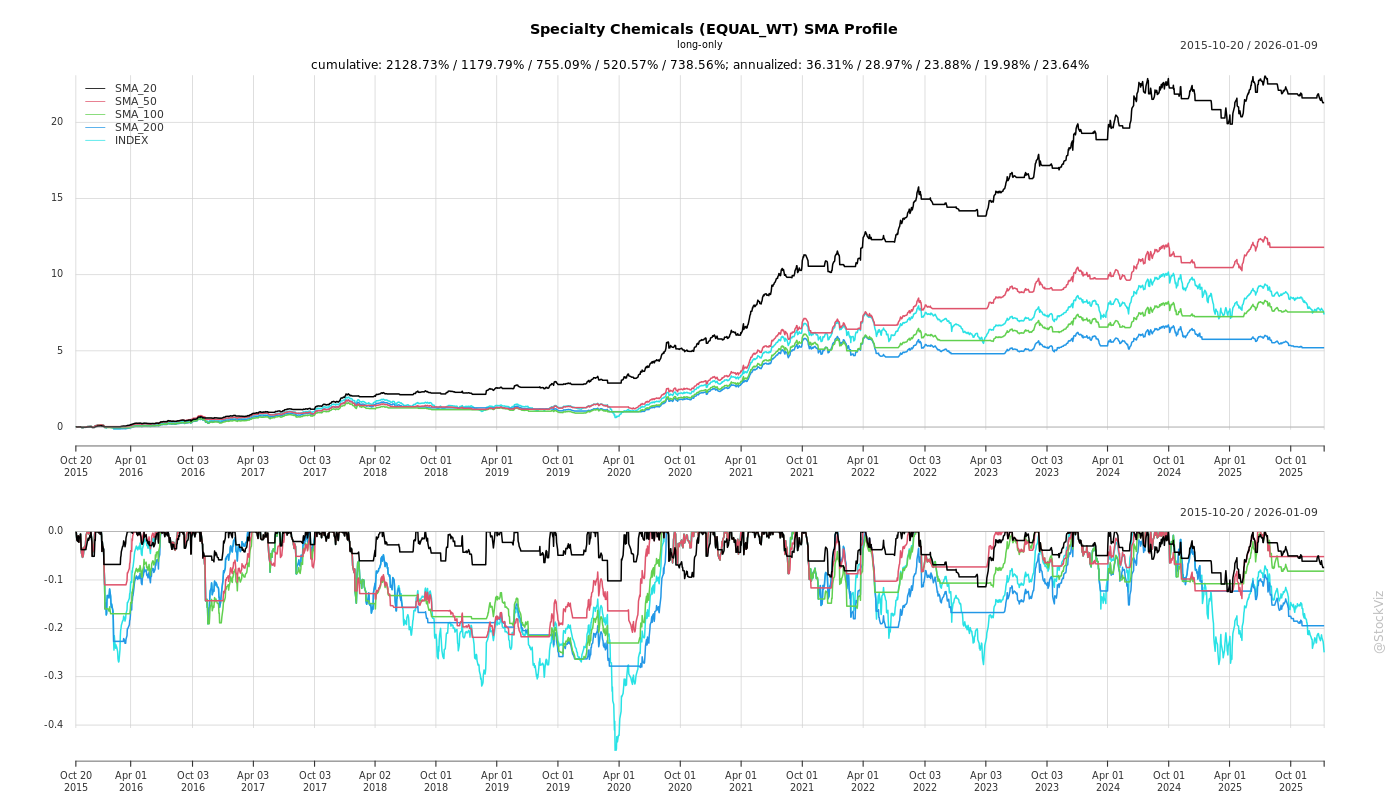

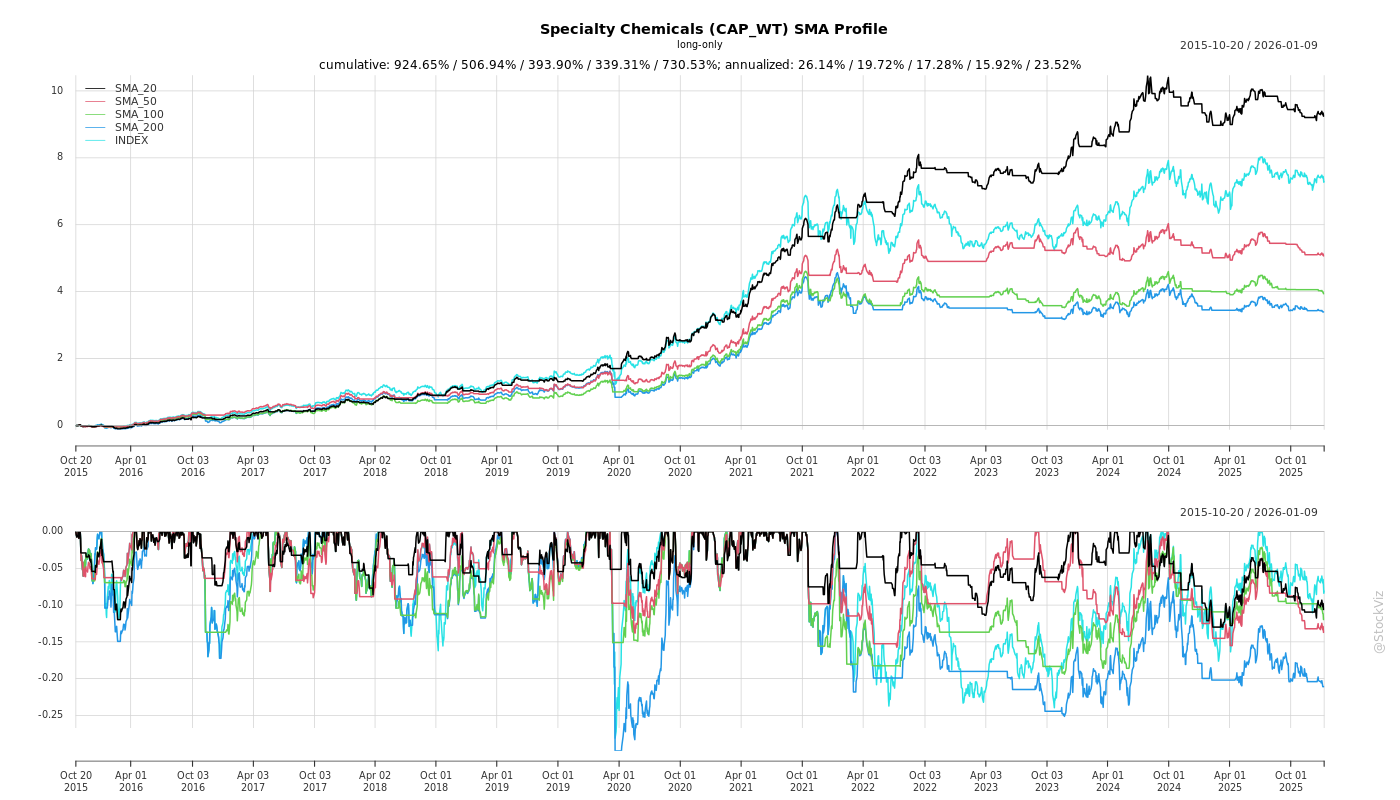

SMA Scenarios

Current Distance from SMA

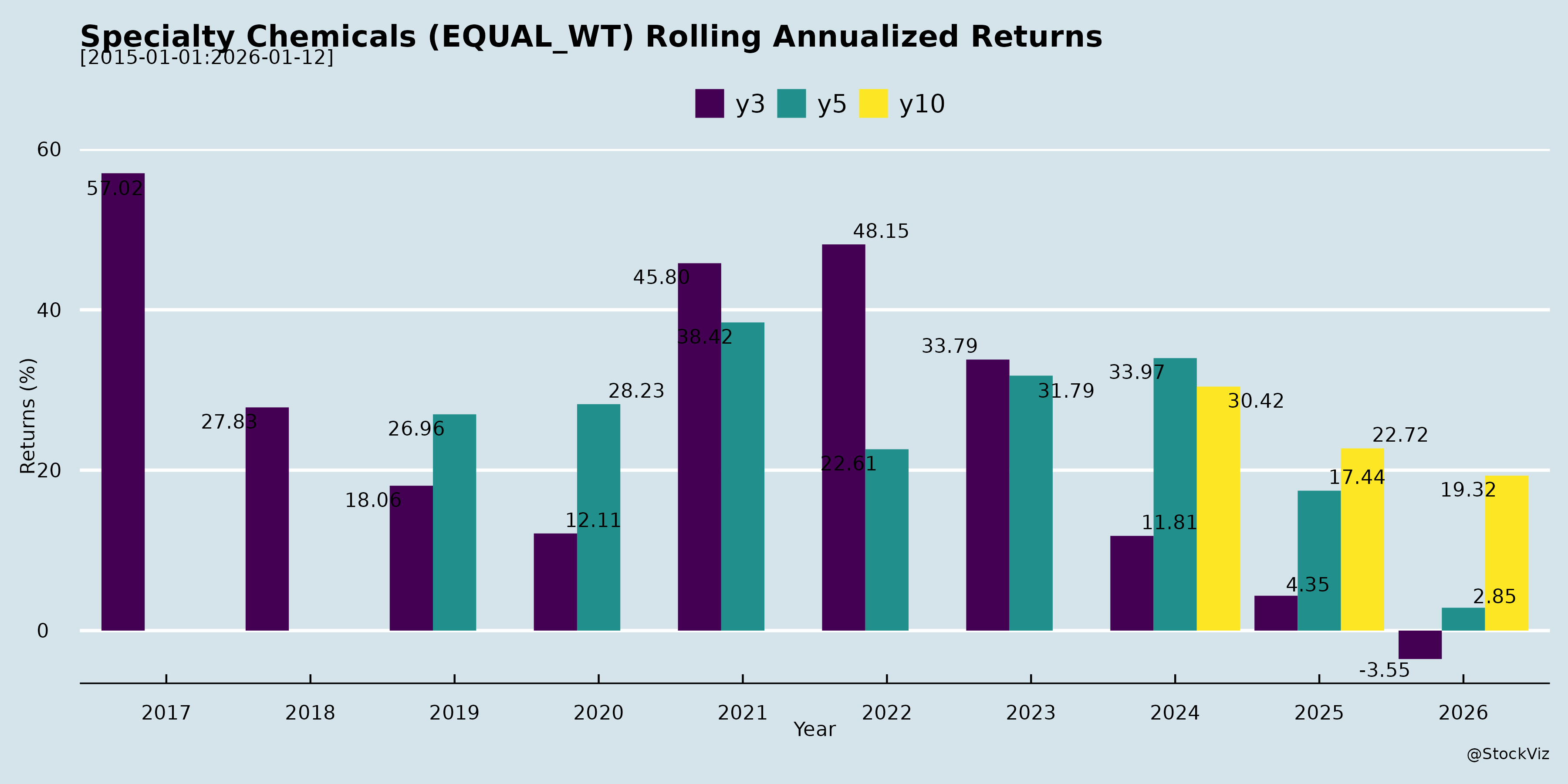

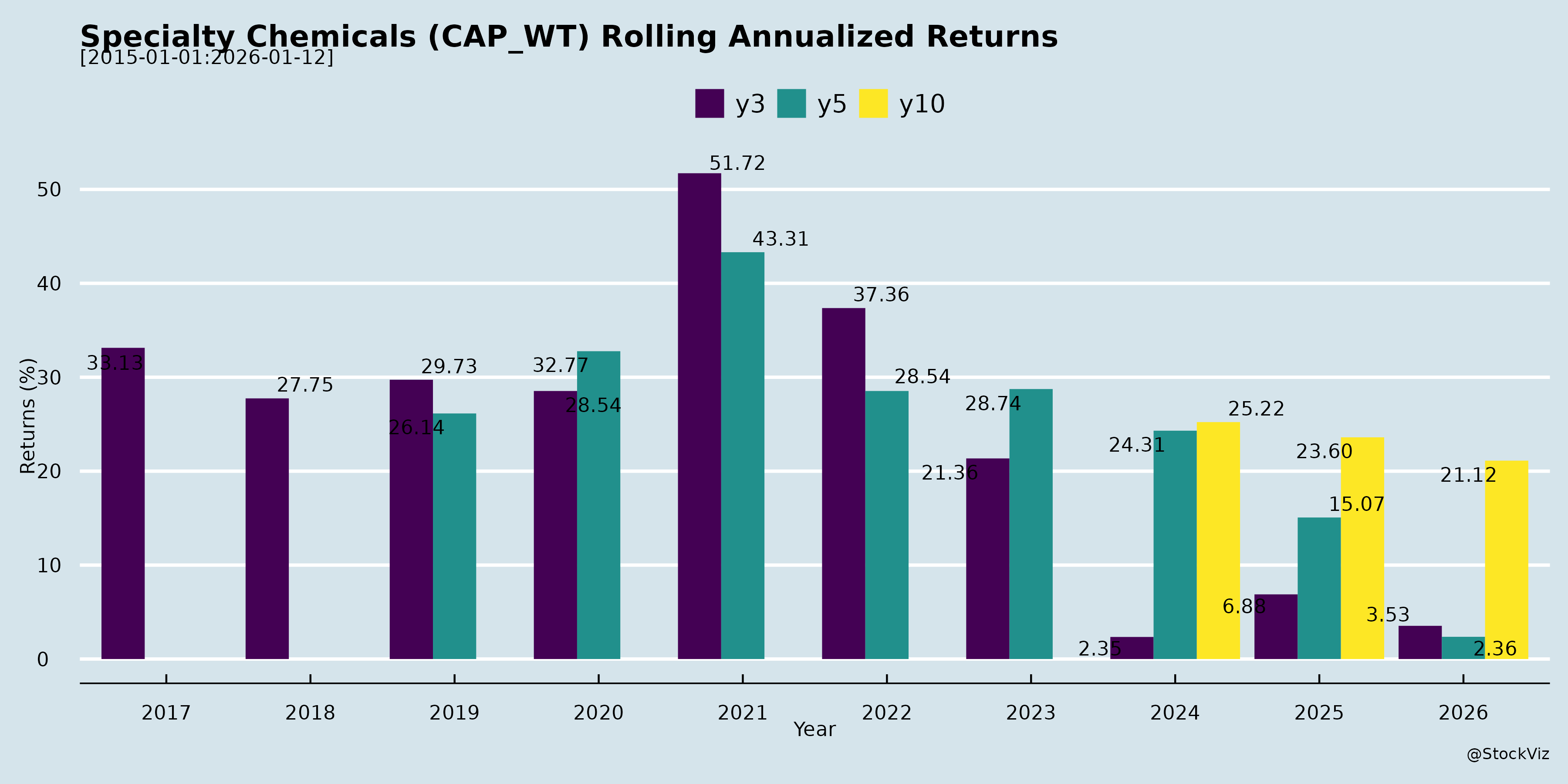

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Indian Specialty Chemicals Sector Analysis (Based on Q2/H1 FY26 Earnings & Announcements)

The provided documents from key players (e.g., Pidilite, SRF, Gujarat Fluorochemicals, Navin Fluorine, Deepak Nitrite, BASF India, Atul, Vinati Organics, Anupam Rasayan, Aarti Industries, Fine Organic, Privi Speciality Chemicals) highlight a sector showing resilient recovery amid cyclical challenges. Revenue growth is strong (20-50% YoY/H1), driven by volumes, but margins face pressure. Overall sentiment is cautiously optimistic, with focus on capacity ramps, diversification, and innovation. Below is a structured analysis.

Headwinds (Short-term Pressures)

- US Tariffs & Trade Barriers: Recurrent theme (Gujarat Fluorochemicals, Deepak Nitrite, Aarti Industries, Anupam Rasayan). Impacts 20-40% of exports; forces diversification (e.g., to Europe/Middle East/Africa). Temporary volume/margin erosion (5-15% hit); uncertainty delays decisions.

- Chinese Dumping/Overcapacity: Aggressive pricing in fluoropolymers, agro intermediates, MMA, antioxidants (SRF, Gujarat Fluorochemicals, Navin Fluorine, Deepak Nitrite, Aarti). Erodes realizations (e.g., 15-20% price drops); affects 30-50% of portfolios.

- Agrochem Cyclicality: Inventory destocking, weak commodity prices (soybean, cotton), erratic monsoons delay sprays (Deepak Nitrite, Navin Fluorine, BASF). 20-50% YoY revenue dips in agro-linked products.

- Working Capital Strain: High inventories (200-400 days) and receivables (100-250 days) due to destocking/delays (Anupam Rasayan, Deepak Nitrite). Debt/EBITDA peaks (1.5-2x); ROCE lags (8-14%).

- Raw Material Volatility: Propylene, naphtha swings; forex hedging costs (Aarti, Deepak Nitrite).

Tailwinds (Supportive Factors)

- Capacity Expansions/Debottlenecking: 20-50% hikes (ATBS in Vinati, MMA in Aarti/Deepak Nitrite, fluoropolymers in Gujarat/Navin). Ahead-of-schedule ramps boost volumes 15-30% (Privi, Fine Organic).

- Domestic Demand Resilience: Pharma (25-50% growth), polymers/EV materials, personal care/FMCG (Vinati, Privi, Navin Fluorine). Infrastructure/infra tailwinds (BASF).

- Anti-Dumping Duties: PTFE (Gujarat Fluorochemicals: 50-60% import displacement), R32 refrigerants.

- Backward Integration/Cost Optimization: Reduces RM costs 10-20%; renewable energy shifts (20-80% green power). State incentives (Rs.7-10 Cr/yr, Privi).

- Sustainability/ESG Edge: Platinum ratings, bio-based innovations (Privi, Gujarat); China+1 shift favors India.

Growth Prospects (Medium-Term Outlook: FY26-28)

- Revenue CAGR: 20-25% guided (Vinati, Privi: 5K Cr by FY28-29; Deepak Nitrite: 50%+ FY26). H1 FY26: 40-120% YoY across firms.

- Key Drivers: | Segment | Growth Levers | Potential | |———|—————|———–| | Agro Intermediates | Cycle recovery, new molecules (Deepak Nitrite, Navin Fluorine) | 20-40% FY26 | | Fluoro/Polymers | EV/battery (Gujarat: LiPF6; Navin: HFC) | 25-75% | | Pharma/CDMO | New launches, EU/US ramps (Anupam, Navin) | 50-100% | | Antioxidants/Specialties | Portfolio expansion (Vinati: 70% FY25) | 30-50% |

- Capex Digestion: Rs.1,000-1,500 Cr FY26 (Aarti, Deepak); ROCE to 15-20% by FY27.

- Exports: 55-80% mix; diversification mitigates tariffs. Global share gains (ATBS: 60-65%).

- Innovation: 7-10 new molecules/yr (Privi, Vinati); R&D spend Rs.50-55 Cr.

Key Risks

| Risk | Impact | Mitigation |

|---|---|---|

| Tariffs/Trade Wars | 10-20% export hit | Diversification (Europe/ME); 40-60% exempt products |

| Chinese Competition | Margin erosion (10-20%) | AD duties, backward integration, innovation |

| Agro Volatility | 20-50% revenue swings | Product diversification (pharma/polymers up 30%) |

| RM/Inventory | WC days 200-400; debt rise | De-stocking (50% reduction), green energy |

| Execution Delays | Capex digestion (ROCE <15%) | Phased ramps, MPP flexibility |

| Geopolitical/Monsoon | Demand softness | Multi-year order book (Rs.14K Cr, Anupam) |

Overall Summary

Bullish Recovery Phase: Sector delivered 40-120% H1 YoY growth via volumes (15-30%) despite headwinds. Tailwinds (expansions, domestic demand) outweigh headwinds (tariffs, China dumping). Prospects: 20-25% CAGR to FY28, led by pharma/polymers (50%+ growth); EBITDA margins 24-27%. Risks moderate with diversification. Preferred Picks: Leaders in fluoro/EV (Gujarat/Navin), antioxidants (Vinati), aroma (Privi). Sector ROCE to improve to 15-20% by FY27 as capex digests. Rating: Positive – Buy on dips for 3-5 yr horizon.

General

asof: 2025-11-29

Analysis of Indian Specialty Chemicals Sector

Based on the provided regulatory filings (SEBI Reg 30 disclosures, BRSR reports, and investment announcements from companies like Pidilite, SRF, Gujarat Fluorochemicals, Navin Fluorine, BASF India, Atul, Vinati Organics, Anupam Rasayan, Aarti Industries, Fine Organics, and Privi Speciality Chemicals), here’s a concise summary of the sector’s headwinds, tailwinds, growth prospects, and key risks. These documents highlight expansion activities, sustainability focus, and compliance efforts as of late 2025, reflecting a resilient but regulated sector amid global green transitions.

Tailwinds (Positive Drivers)

- Sustainability & ESG Momentum: Strong emphasis on net-zero (e.g., Anupam Rasayan’s Scope 1/2 net-zero by 2027, 42% Scope 2 reduction via solar/wind hybrids), zero-waste-to-landfill (87% diversion), and ZLD systems. ESG ratings (e.g., Navin Fluorine’s “Strong” score of 61) attract investors. Renewable investments (Aarti’s ₹16.7 Cr in wind-solar SPV; BASF’s 26% stake in Clean Max for 28,860 MWh hybrid power) align with India’s green policies.

- Capex Discipline via Subsidiaries: Investments in WoS (e.g., Pidilite’s ₹5.1 Cr for 20% in Printpanda home décor; Vinati’s ₹38.45 Cr rights issue; Fine Organics’ ₹65 Cr preference shares; SRF’s ₹30L equity) signal efficient scaling without diluting listed equity.

- Policy Support: Compliance with SEBI BRSR, PAT schemes, and EPR (e.g., Gujarat Fluoro’s zero re-lodgement requests) builds investor confidence; exports (Anupam: 37.86%) benefit from global demand.

Headwinds (Challenges)

- Regulatory & Compliance Burden: Frequent disclosures (e.g., monthly share re-lodgement, IEPF transfers by Atul) and delays (Privi’s scheme withdrawal due to exchange observations) indicate scrutiny. Environmental audits (Anupam: 205 internal/17 external) highlight ongoing costs for emissions (NOx/SOx/PM), water (5.17L KL withdrawal), and waste (30K MT generated).

- Cost Pressures: High energy intensity (Anupam: 1.3M GJ total), water stress mitigation, and training (100% workforce coverage) strain margins. Turnover rates (6-7%) and low female participation (5%) signal talent retention issues.

- Macro Slowdown: Adjacency bets (Pidilite in décor; SRF in real estate) imply core chemical demand softness, with subsidiaries yet to scale (e.g., Fine SEZ pre-ops).

Growth Prospects

- Capacity Expansion: ₹100+ Cr investments in chemical/adjacency units (e.g., Veeral Organics FY25 turnover ₹10.55 Cr; MagicDecor ₹6.29 Cr) position for 10-20%+ sector CAGR, driven by pharma/agrochem/pharma intermediates.

- Green Premium: Renewables (17.9 MW solar + 9.6 MW hybrid) and process efficiencies (e.g., hydrogenation reducing hazardous waste) enable premium pricing/export edge. Targets like 50% supplier sustainability (Anupam by 2030) strengthen supply chains.

- Diversification: Entry into renewables (Aarti/BASF), home décor (Pidilite), and biotech (Privi merger refile) taps adjacencies; B2B focus (Anupam serves MNCs) supports 15-20% revenue growth via custom synthesis.

Key Risks

| Risk Category | Details | Mitigation from Filings |

|---|---|---|

| Regulatory/Compliance | SEBI/NGT scrutiny (e.g., scheme withdrawals, EPR/plastic waste); non-compliance fines (Anupam: zero but monitored). | ISO certifications (9001/14001/45001), audits, vigil mechanisms. |

| Environmental/Operational | GHG (84K MtCO2e Scope 1), waste (3K MT landfilled), safety incidents (zero LTIFR but historical risks). | ZLD, 3R waste, HAZOP/HIRA; net-zero roadmap. |

| Financial | High capex (₹100+ Cr), RPTs (8-12% purchases), low MSME sourcing (1-2%). | Arms-length RPTs exempt; cash infusions maintain 100% WoS control. |

| Execution/Talent | Subsidiary delays, turnover (7%), low diversity (5% women). | Training (25+ hrs/employee), CSR (e.g., Anupam: 50K+ beneficiaries). |

| Market/Geopolitical | Input volatility, exports (38%); cyber/data risks (zero breaches). | Sustainable procurement (3%), GHS labeling. |

Overall Outlook: Bullish with cautious optimism. Tailwinds from green capex outweigh headwinds; growth via subsidiaries/renewables could drive 12-15% EBITDA CAGR. Risks are manageable via compliance focus, but execution in unproven adjacencies and regulatory delays warrant monitoring. Sector PE likely premiums on ESG adherence.

Data as of Nov 2025 filings; consolidated from standalone trends.

Investor

asof: 2025-12-02

Indian Specialty Chemicals Sector Analysis

The Indian specialty chemicals sector, as reflected in recent Q2/H1 FY26 earnings transcripts and announcements from key players (e.g., Pidilite, SRF, GFL, Navin Fluorine, Deepak Nitrite, BASF India, Atul, Vinati Organics, Anupam Rasayan, Aarti Industries, Fine Organic, Privi), demonstrates resilience amid challenges. The sector benefits from India’s position as the world’s largest net importer of chemicals (₹7.3 bn trade deficit in Chapter 29, FY25), domestic demand in high-growth areas (EV/batteries, pharma, polymers), and policy support. However, it faces external shocks like US tariffs and Chinese dumping. Below is a structured analysis based on the documents.

Headwinds (Key Challenges)

- US Tariffs and Trade Uncertainty: Recurrent theme across 70% of transcripts (GFL, Deepak Nitrite, Aarti Industries, Navin Fluorine). 10% tariffs on most Indian exports (exemptions for pharma/semiconductors limited). Led to 4-15% volume erosion in Q2 FY26 (e.g., GFL Fluoropolymers down 4% QoQ; Aarti Polymers impacted). Customer decisions delayed; re-exports from US add risks. Potential escalation post-July 2025.

- Chinese Dumping/Overcapacity: Aggressive pricing (e.g., GFL R125/Fluorochemicals; Deepak Nitrite sodium nitrite/DASDA; Aarti fluoro products). Erodes margins (Deepak AI segment at 4% EBIT); India imports heavily despite AD duties (e.g., PTFE benefiting GFL).

- Subdued Demand/Inventory Destocking: Agrochem weak (monsoons, crop losses; GFL/Deepak down 15-51% YoY in parts); dyes/pigments muted. H1 FY26 volumes flat/moderately up despite revenue growth.

- High Working Capital/Inventory Pressures: 120-400+ days (Deepak Nitrite 182 days; Anupam Rasayan 247 days). Delays ramp-up (e.g., Deepak EV materials).

- Raw Material Volatility/Costs: Ammonia, propylene, phosphoric acid pressures (Deepak Nitrite, GFL).

Tailwinds (Positive Drivers)

- Capacity Expansions/Debottlenecking: Aggressive investments (₹1,000-6,000 cr over 3-5 years; GFL EV ₹1,500 cr FY27; Deepak polycarbonate ₹9,000 cr; Navin Fluorine HFC ₹236 cr; Vinati ATBS ₹400 cr). Phase-1 completions ahead (Privi +6,000 TPA by Dec’25).

- Policy Support/AD Duties: PTFE AD (GFL 50-60% import capture); state incentives (Privi ₹9 cr H1; Fine Organic). China+1 shift favors India (BASF, Privi).

- Domestic Demand Surge: EV/batteries (GFL LiPF6 prices +70%; SRF); renewables/infra (Aarti); pharma/CDMO (Navin 98% YoY growth).

- Cost Optimization: EBITDA margins up 300-1,100 bps YoY (Navin 32.5%; Deepak 12%; Privi 26.8%). Renewables (BASF 80% green energy).

- Sustainability/ESG: Awards (Privi Platinum EcoVadis); bio-based innovations (Privi Biotech).

Growth Prospects

- High-Growth Segments: | Segment | Key Drivers | Prospects (CAGR to 2030) | |—|—|—| | EV/Batteries | LiPF6/LFP (GFL ₹17/kg; SRF); demand from data centers/AI/EV/BESS. | 20-50% (GFL FY28 scale-up). | | Fluorochemicals | R32/PTFE (GFL/Navin 20-25% growth); AD duties. | 25% (GFL FY26 guidance). | | Pharma/CDMO | APIs/intermediates (Navin 98% YoY; Deepak). | 20-40% (Navin H1 57%). | | Polymers/Performance | Engineering plastics (Deepak/Aarti Zone 4). | 10-20% (Aarti PEDA Q4 FY26). |

- Overall Sector: Production up 1.5% FY24 (India 6th globally); consumption 4th (₹175 bn). 20% CAGR targets (Vinati, Privi 5K revenue/1K EBITDA in 3-4 yrs; Anupam 50% FY26).

- Exports: 55-86% revenue; diversification to Europe/ME/Africa offsets US risks.

- Innovation: New molecules (GFL LFP CAM; Privi biotech; Vinati AO).

Key Risks

| Risk | Description | Mitigation |

|---|---|---|

| Tariff Escalation | US 10%+; China retaliation/dumping. | Diversification (Europe/ME); AD duties; stockpiling. |

| Demand Volatility | Agro/inventory destock; monsoons. | Portfolio diversification; domestic focus (infra/EV). |

| Capex Ramp/Digestion | ₹1,000-9,000 cr; delays (Deepak EV). | Phased execution; ROCE focus (Atul 15%). |

| WC/Debt Pressures | 120-400 days; net debt ₹730-1,020 cr. | Inventory liquidation; incentives (₹7-10 cr/yr). |

| RM/Geopolitics | Ammonia/propylene volatility; China supply. | Backward integration; renewables (80% green). |

| Competition | China overcapacity; new capacities. | IP/sustainability; R&D (Navin ₹55 cr FY25). |

Summary & Outlook

Bullish Long-Term: Sector poised for 15-20% CAGR (FY26-30) driven by EV/pharma/polymers (20-50% sub-segment growth), domestic infra (PLI/AD duties), and China+1. Companies target 20%+ revenue CAGR (e.g., Privi 2x in 3-4 yrs). EBITDA margins stabilizing at 25-30% via leverage/innovation.

Near-Term Cautious (FY26): US tariffs/dumping cap upside (10-20% volume risks); expect 20-50% revenue growth (Anupam/Vinati) but volatile margins (19-32%).

Overall Sentiment: Resilient (Q2 revenues up 21-149% QoQ); expansions to digest by FY27-28. Risks manageable via diversification/integration; monitor tariffs/CDMO ramp. Net Positive for integrated players with EV/pharma exposure.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.