BALAJITELE

Equity Metrics

January 13, 2026

Balaji Telefilms Limited

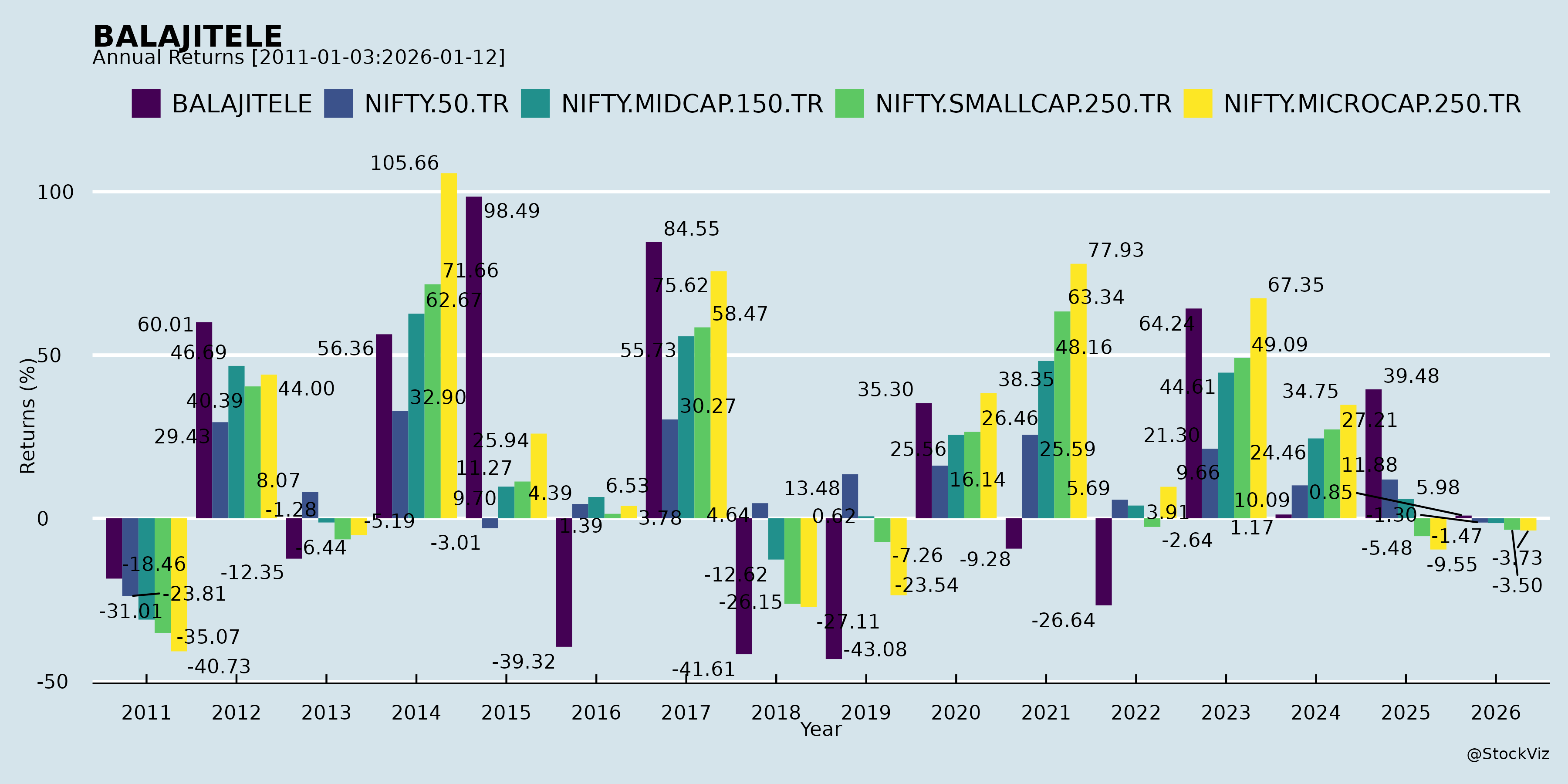

Annual Returns

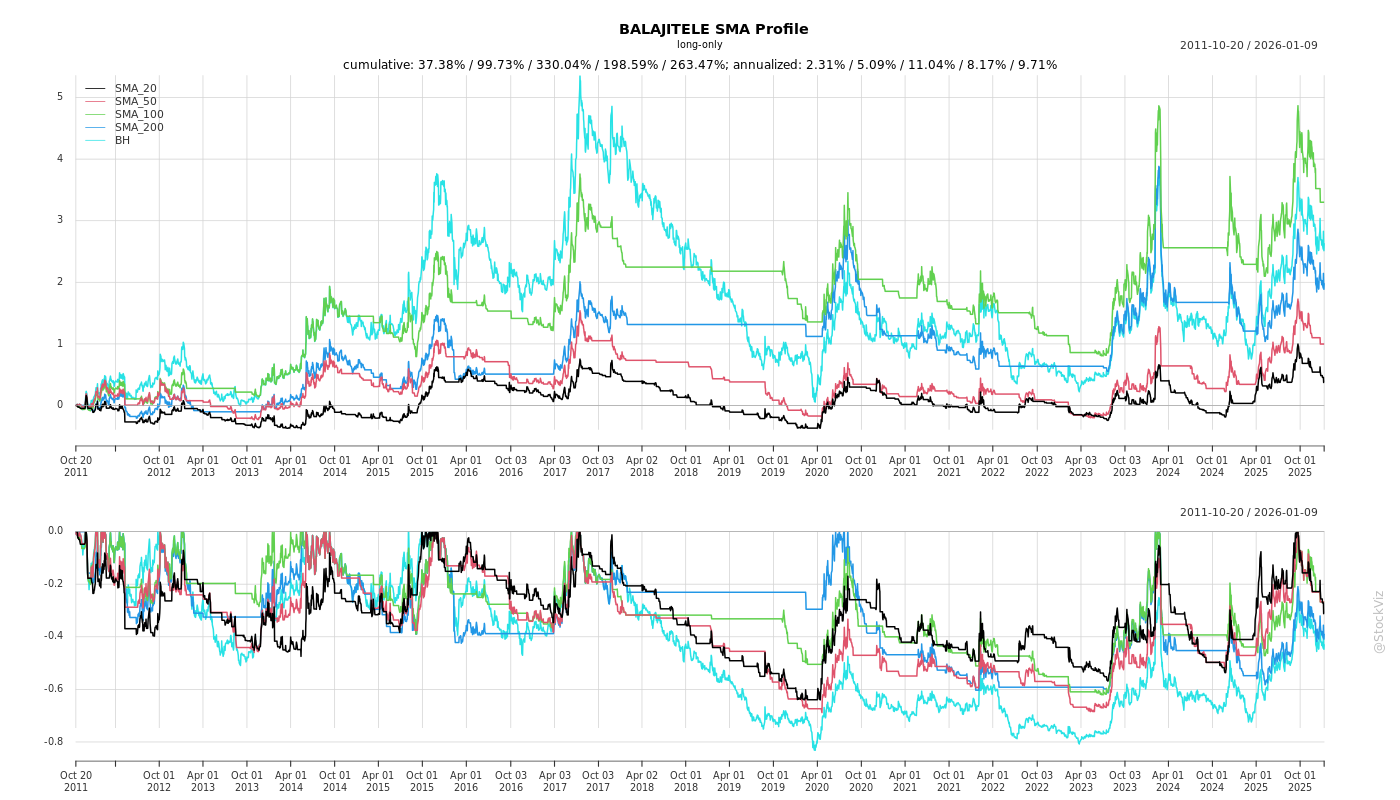

Cumulative Returns and Drawdowns

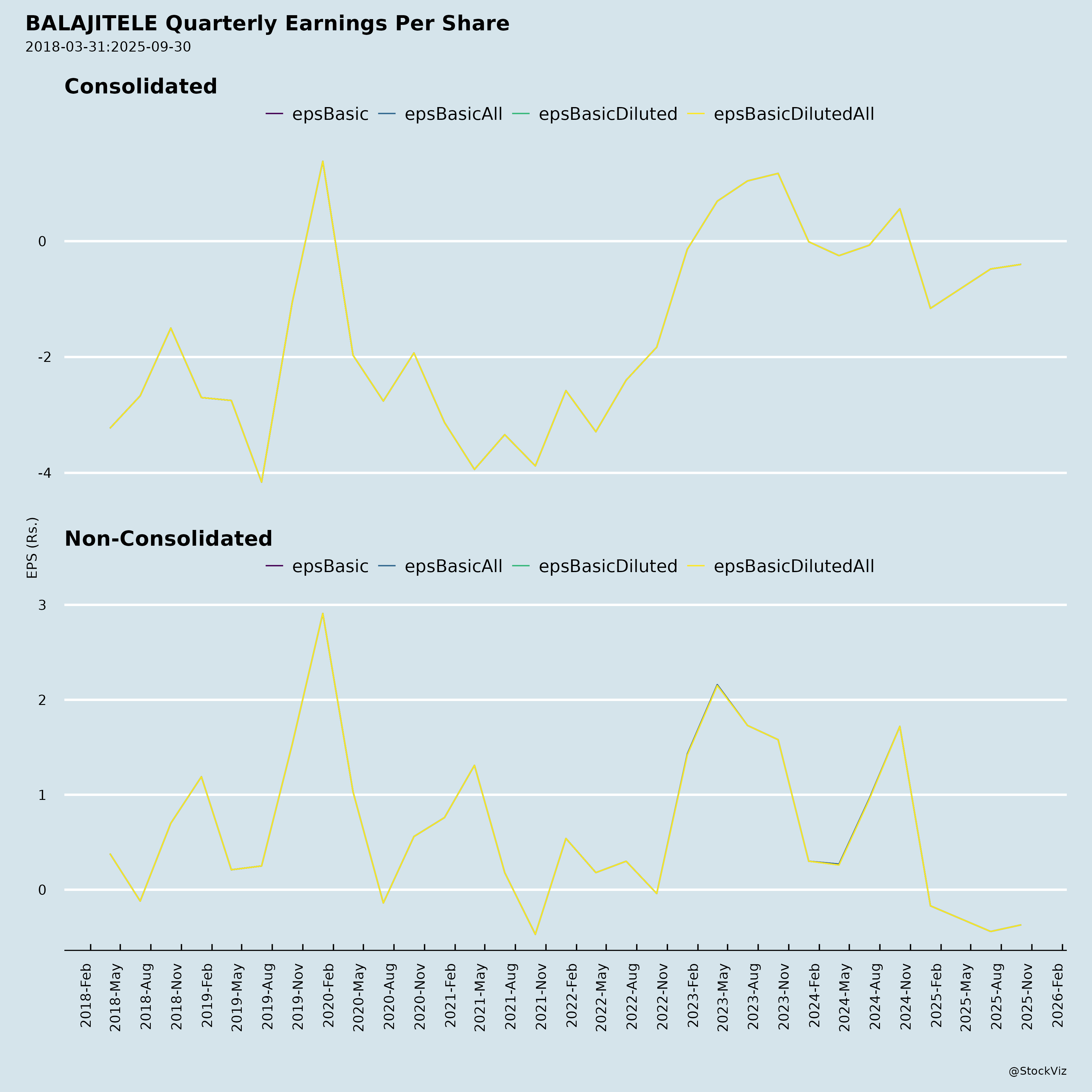

Fundamentals

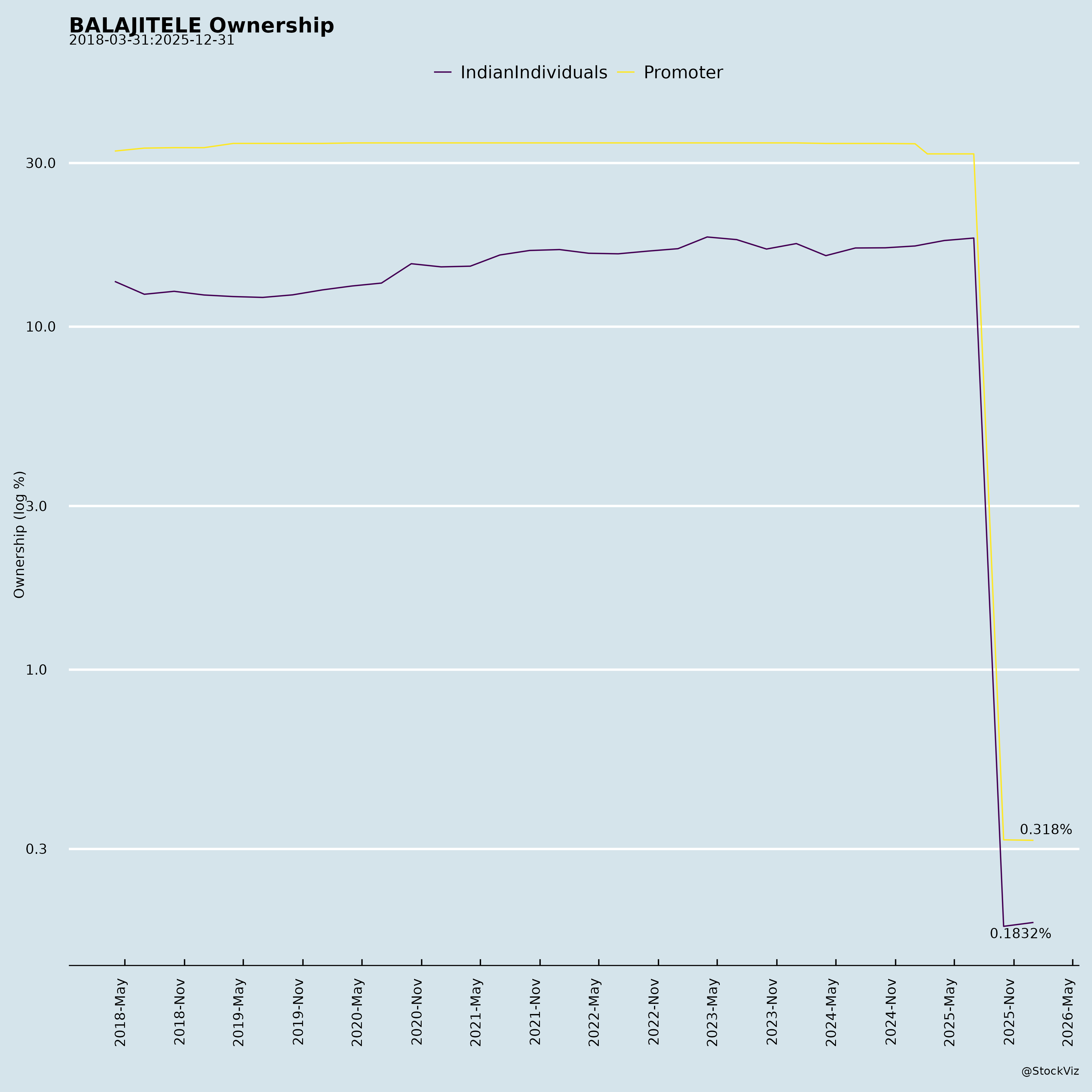

Ownership

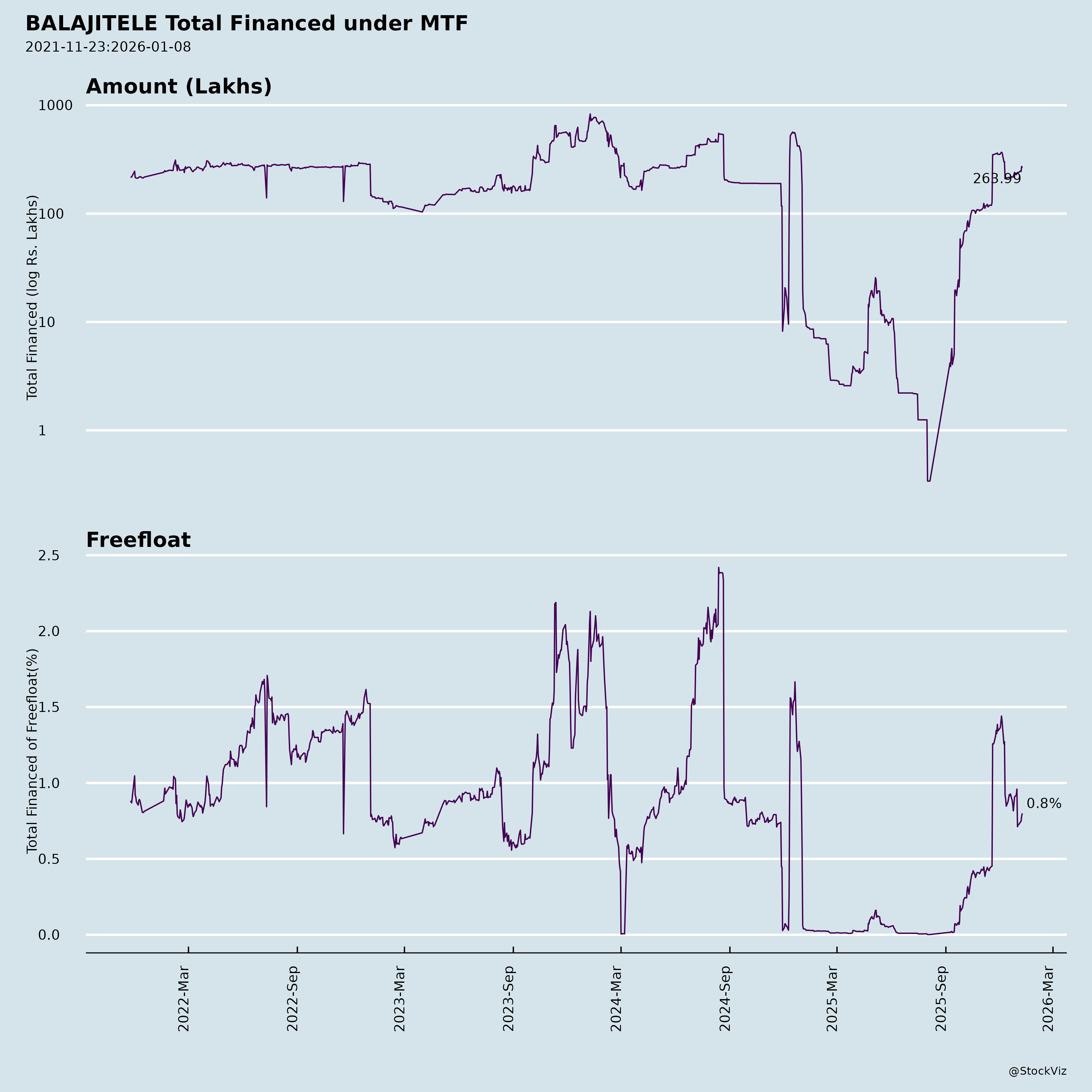

Margined

AI Summary

asof: 2025-11-27

Balaji Telefilms Ltd. (BALAJITELE) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

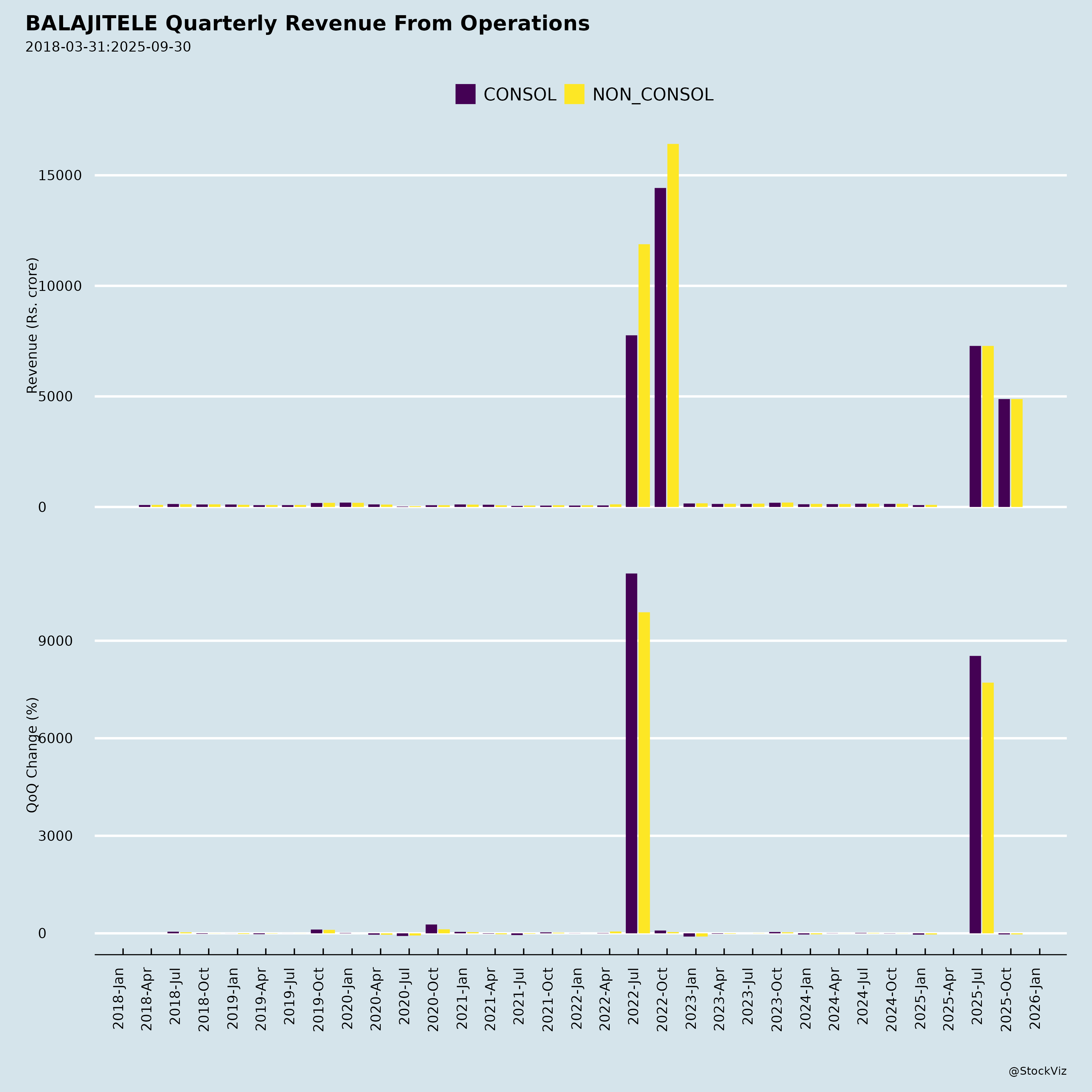

Balaji Telefilms Ltd., a veteran in Indian entertainment (TV, films, digital/OTT), reported weak H1 FY26 results (ended Sep 30, 2025) with revenue down ~59% YoY to ₹121 cr (standalone) amid TV show wind-downs and digital disruptions. However, a robust digital order book (₹300 cr), upcoming films, new app launches, and post-merger efficiencies provide a foundation for recovery. Cash reserves stand at ₹137 cr, supporting growth. Below is a structured summary based on Q2/H1 FY26 earnings transcript, financial results, AGM minutes, ESOP allotment, and press releases.

Headwinds (Challenges Impacting Near-Term Performance)

- TV Segment Weakness (Core Revenue Anchor, 68-77% of Q2/H1 Revenue): Mature shows ended (e.g., Parineeta: 1,216 eps; Kumkum Bhagya: 3,192 eps; Bade Achhe Lagte Hain: 70 eps), reducing programming hours (131 hrs in Q2). Broadcaster budget cuts led to lower yields (₹24-25L/hour vs prior ₹28-29L), with episodic revenue under pressure. Linear TV declining industry-wide.

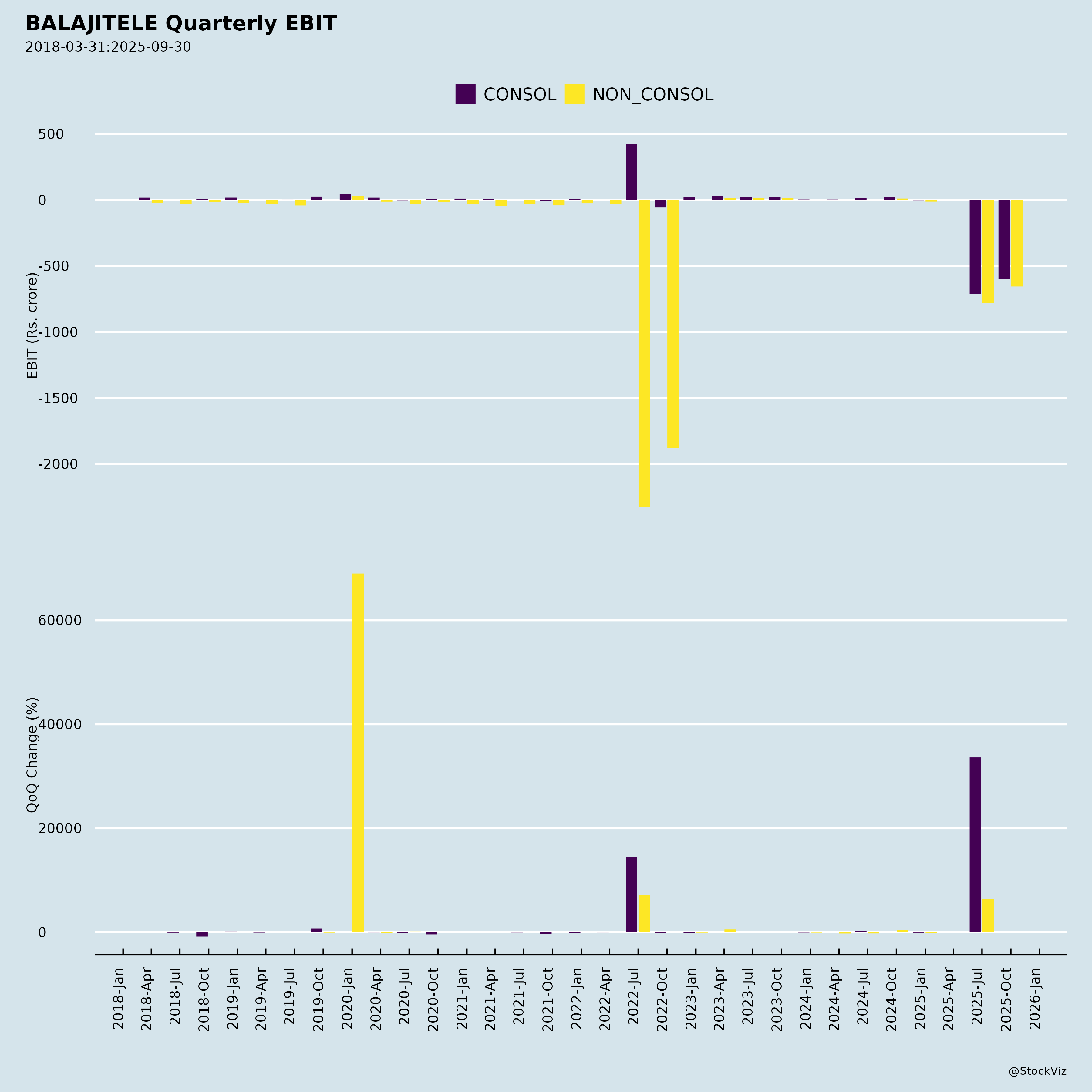

- Revenue & Profitability Dip: Q2 revenue ₹48.8 cr (-66% YoY); H1 loss after tax ₹10 cr (standalone)/₹10.9 cr (consolidated). Sequential EBITDA improved (from -₹8.8 cr in Q4 FY25 to -₹4.3 cr), but Q3/Q4 FY26 expected muted.

- Digital Disruptions: ALTT app banned by MIB (45-60 days offline), forcing relaunch as family-friendly Kutingg (Sep 2025). High churn (65-70%), low ARPU (90% on lowest plans), subscriber reset to near-zero.

- Inventory Build-Up: ₹55 cr added (H1), tied to films (Vrusshabha, Bhoot Bangla, Vvan) entering production—capital-intensive.

- Cyclical Business Nature: TV pipeline rebuild every 3-5 years; films/digital content success unpredictable.

Tailwinds (Positive Structural Supports)

- Post-Merger Efficiencies: ALT Digital and Marinating Films merged (effective Apr 1, 2024)—₹117 cr GST input credit, ₹100+ cr brought-forward losses (no tax for 4-5 yrs), shared resources, IP leverage.

- Strong Liquidity & Capital Raise: ₹137 cr cash; unutilized ₹131 cr raised (₹65 cr films, ₹33 cr music/digital/distribution). Funds low-capex digital (₹20-25 cr working capital).

- Digital B2B Momentum: ₹300 cr order book (Netflix ₹250 cr, Zee ₹42 cr, Amazon/Sony/Star). 93 shows on Kutingg (400M+ views), regional tie-ups (ETV, Aha), hybrid SVOD+AVOD scaling.

- Cost Optimization: AI for content creation (speed/cost savings, esp. digital); TV margins ~30% on variable costs.

- New Initiatives Traction: AstroVani/Balaji Astro Guide (Nov 2025)—250k+ downloads in 24 hrs, #1 iOS Lifestyle; Balaji Studio for emerging talent; Netflix collaboration.

Growth Prospects (Medium-Term Outlook: FY27 Onward)

- Movies as Key Driver (De-Risked Model): 85-90% cost recovery via presales/co-productions. Pipeline: Vrusshabha (Dec 2025, multi-language), Bhoot Bangla (Akshay Kumar, fully presold—pure profit), Vvan (Siddharth Malhotra). 4+ big-budget releases in FY27; expected to lead revenue/profitability (vs current 5-10% mix).

- Digital Expansion (27% H1 Mix, Scalable): B2B order book realization from FY27; Kutingg for mass/family audience (short-form, AI content, binge/episodic); Astro Guide as recurring revenue (₹5 cr FY27 top-line est., low-capex on existing infra). Long-term: Movies > Digital > TV (TV ~25% in 3 yrs).

- Balanced Portfolio Shift: TV stable (4 shows, prime-time slots); overall upside from FY27 Q1 (post first big film). Management targets consistent profitable growth via IP-led businesses.

- Guidance: FY26 muted (similar to H1); FY27 inflection with films/digital ramp-up. 11M active subs targeted; advertiser-funded scaling.

Key Risks (Potential Downside Catalysts)

| Risk Category | Description | Mitigation |

|---|---|---|

| Content/Box Office Failure | High dependence on hits (TV shows end cyclically; films unproven despite presales). | 85-90% presales; diverse pipeline (regional/multi-lang); AI efficiencies. |

| Regulatory/Platform Risks | MIB bans (ALTT precedent); OTT policy changes. | Relaunch as Kutingg (family-safe); B2B focus reduces direct exposure. |

| Competition & Market Shift | OTT giants (Netflix, etc.); linear TV decline to connected TV. | Partnerships (Netflix collab); hybrid model; niche apps (astrology). |

| Execution/Capital Intensity | Film inventory surge (₹188 cr current); capex overruns. | Cash buffer; de-risked presales; low digital capex. |

| Subscriber/Churn Dynamics | High churn (65-70%); low ARPU in India. | Content velocity (new drops); annual plans for globals; mass-market focus. |

| Macro/Economic | Ad spends, broadcaster cuts; GST rationalization impact. | Diversification (digital/movies); tax holidays. |

| Governance | Past board composition lapses (fixed May 2024). | Recent independent director additions; ESOP allotments (86k shares Nov 2025). |

Overall Summary: Balaji faces near-term headwinds from TV cyclicality and digital resets, leading to losses and muted FY26. Tailwinds from liquidity, order book, and efficiencies position it for FY27 recovery, driven by films (high-margin) and digital (scalable, e.g., Astro Guide’s viral launch). Growth prospects strong in evolving OTT/film landscape, but execution risks remain high in content biz. Investment Thesis: Value play for patient investors; monitor Dec 2025 Vrusshabha release and Q3 results for inflection. Target multiple expansion on profitability turnaround.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.