Media & Entertainment

Industry Metrics

January 13, 2026

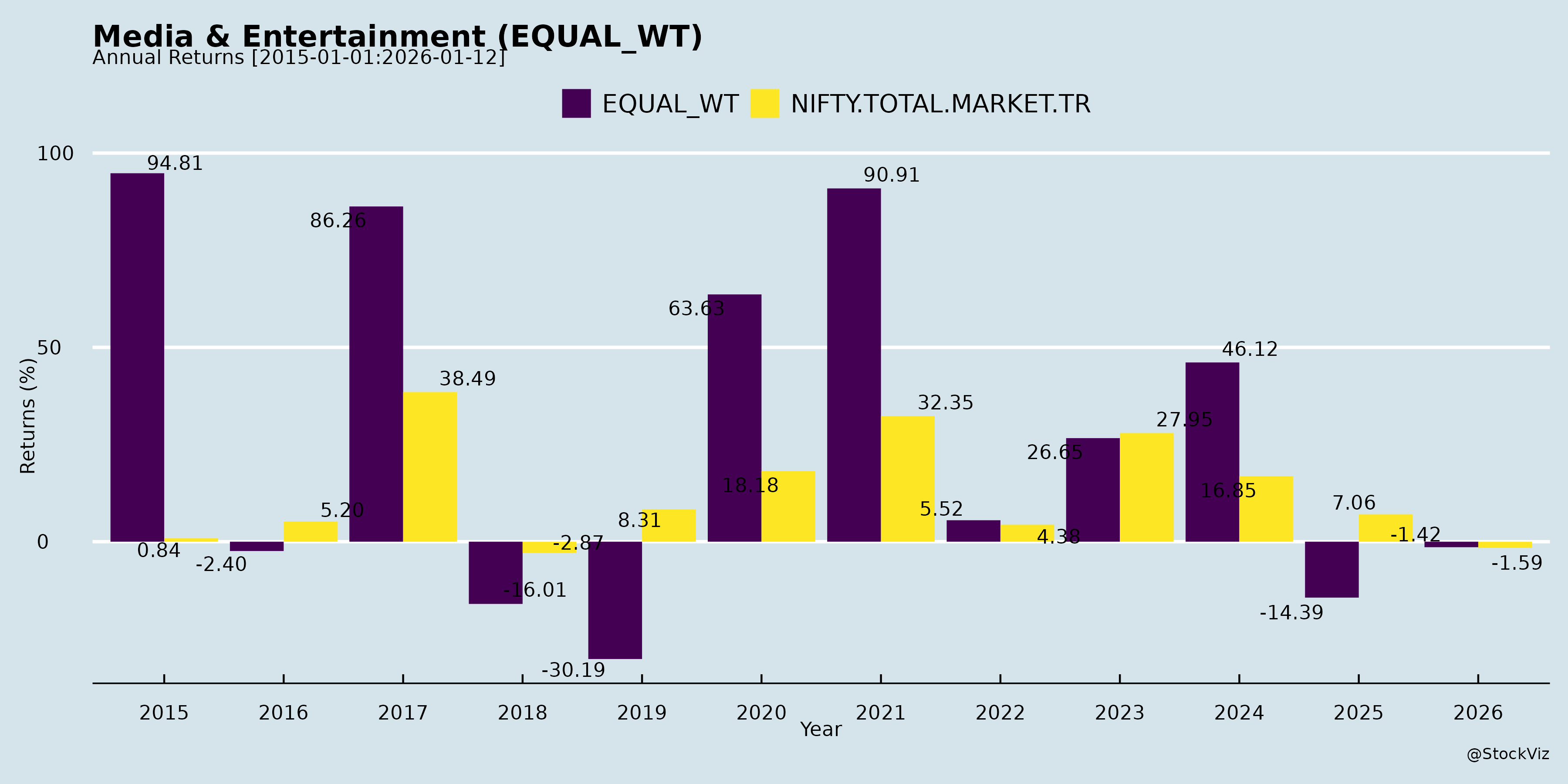

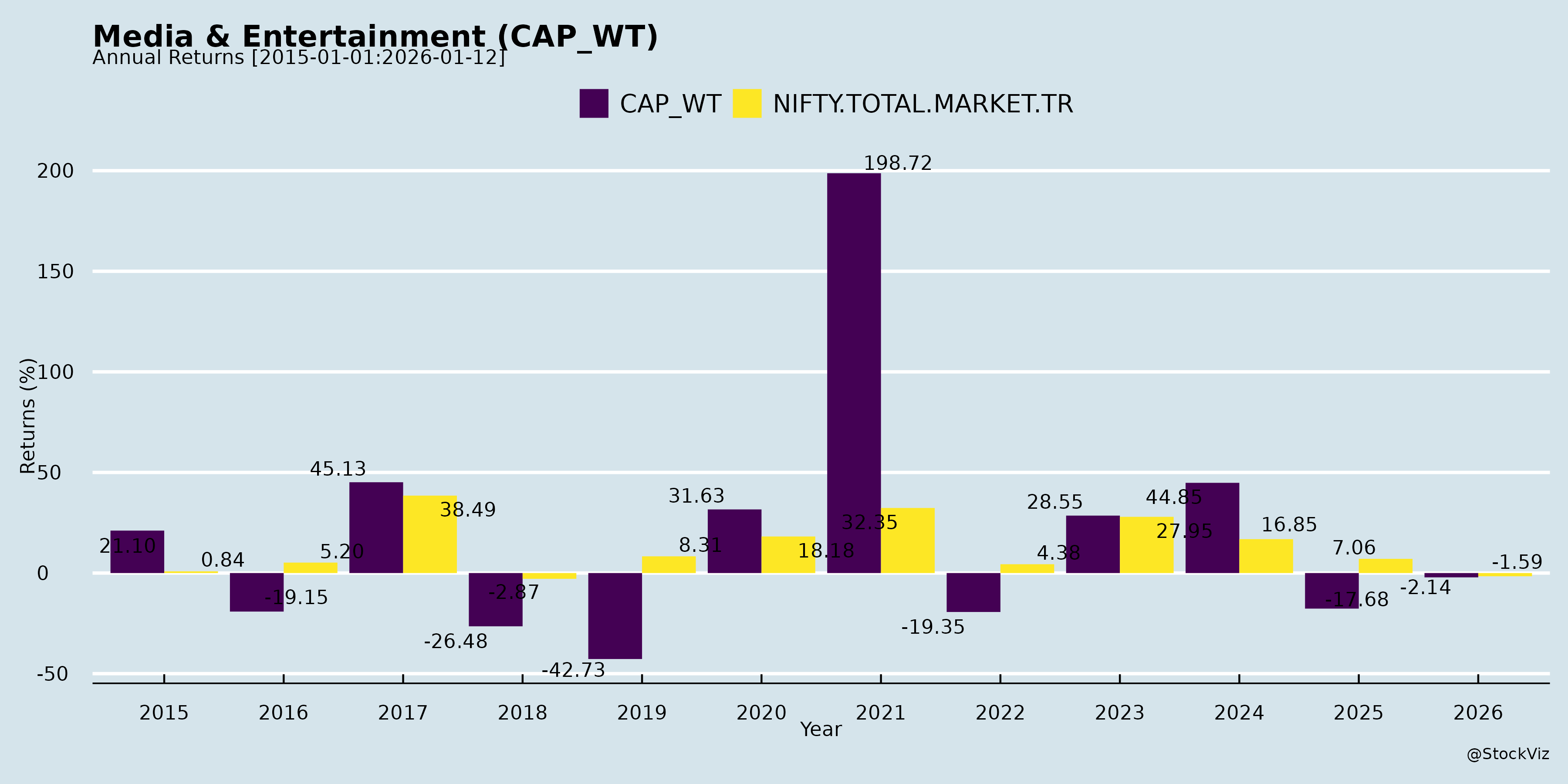

Annual Returns

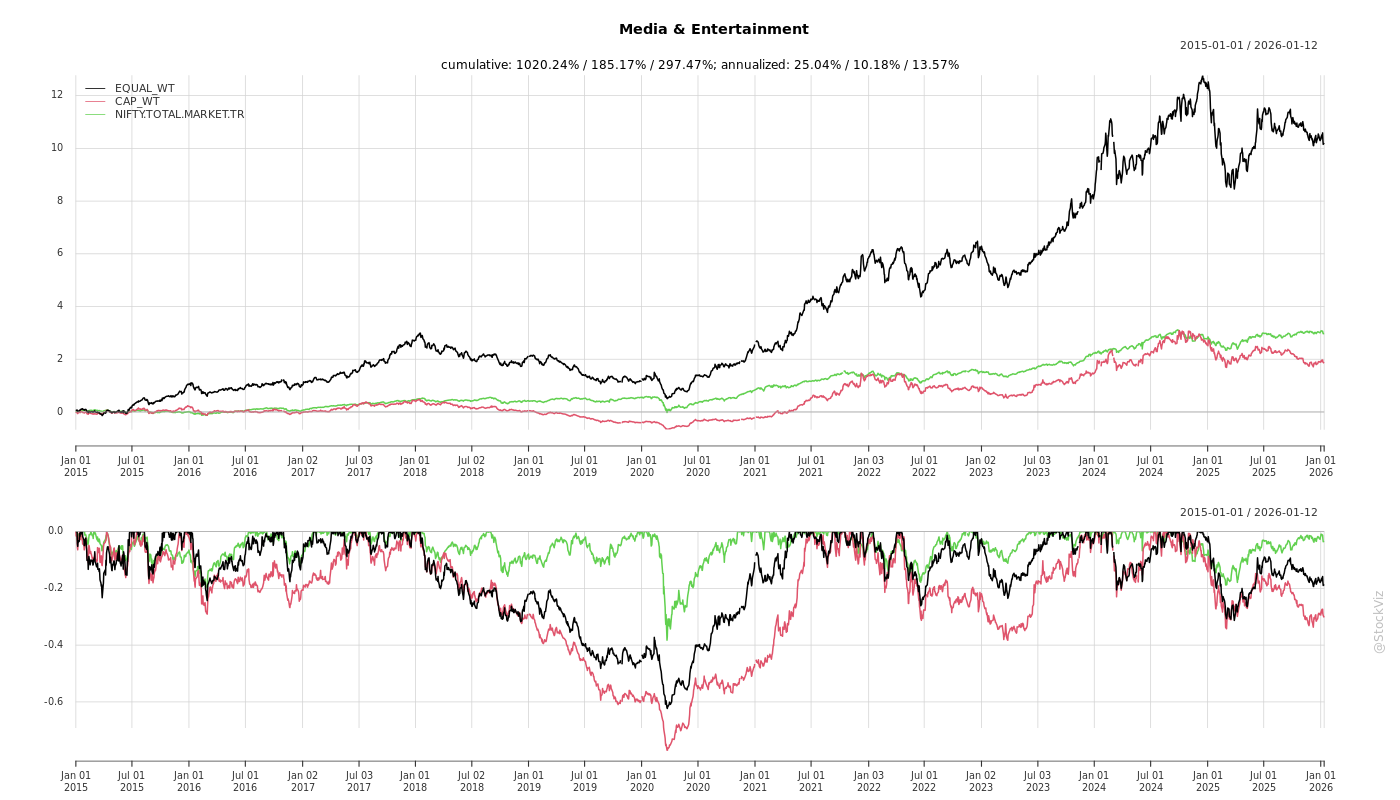

Cumulative Returns and Drawdowns

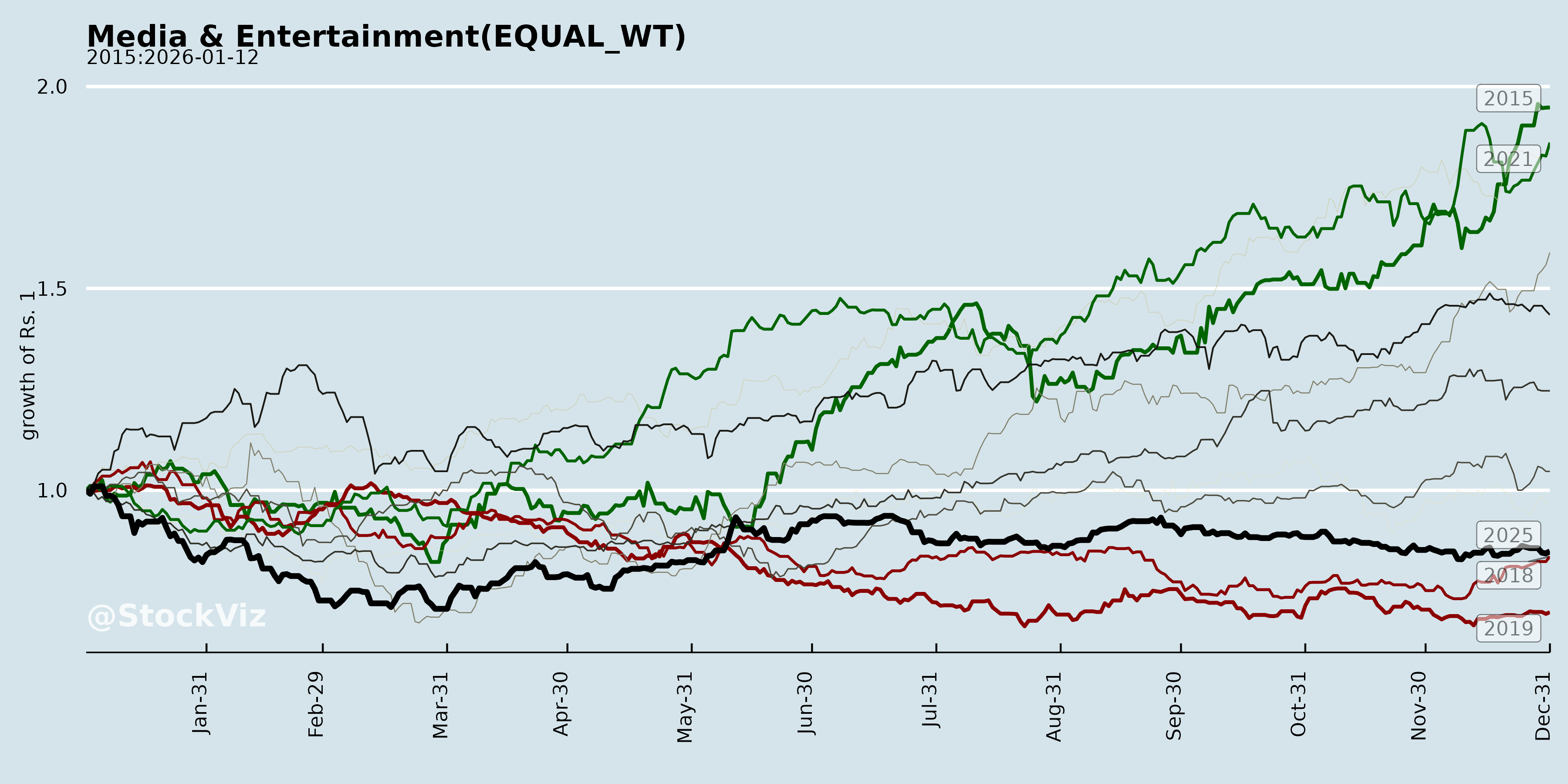

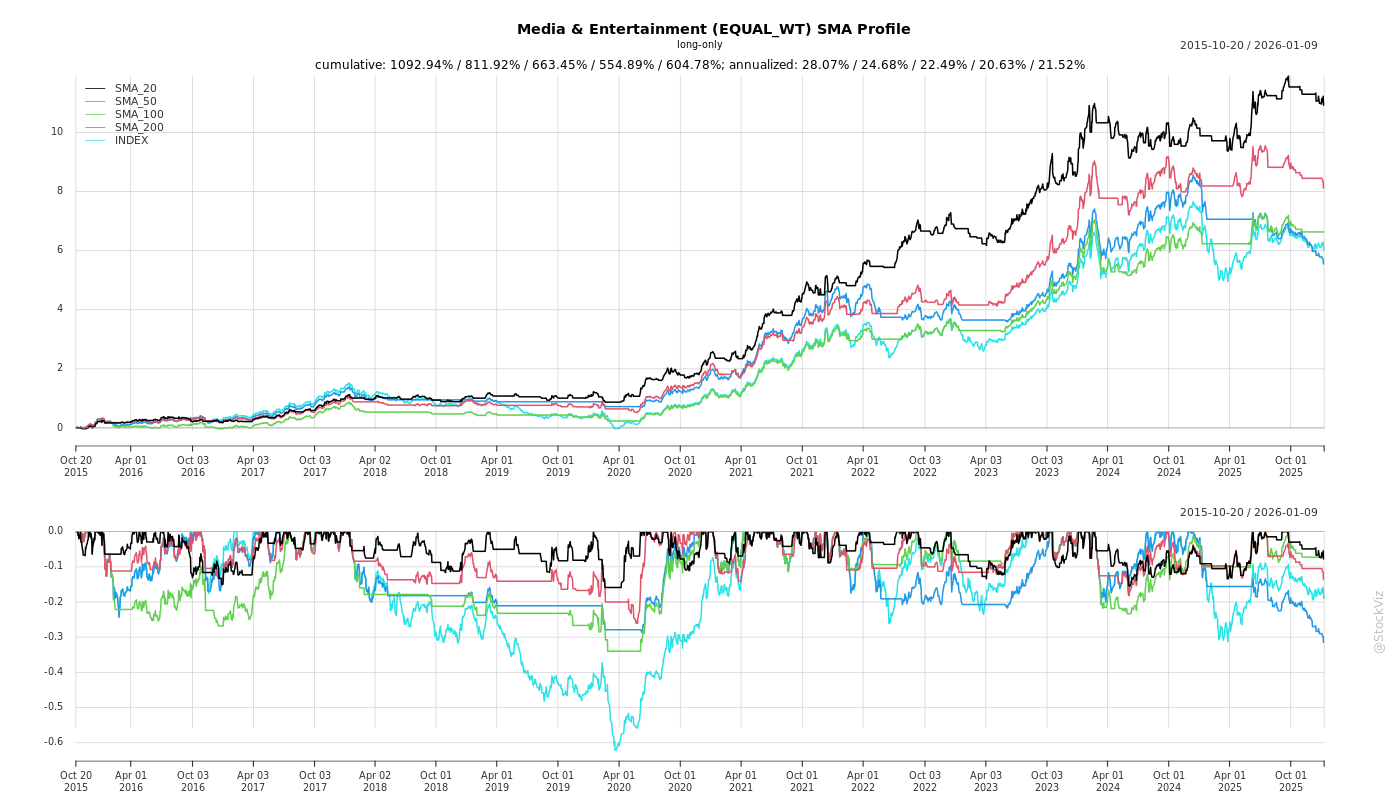

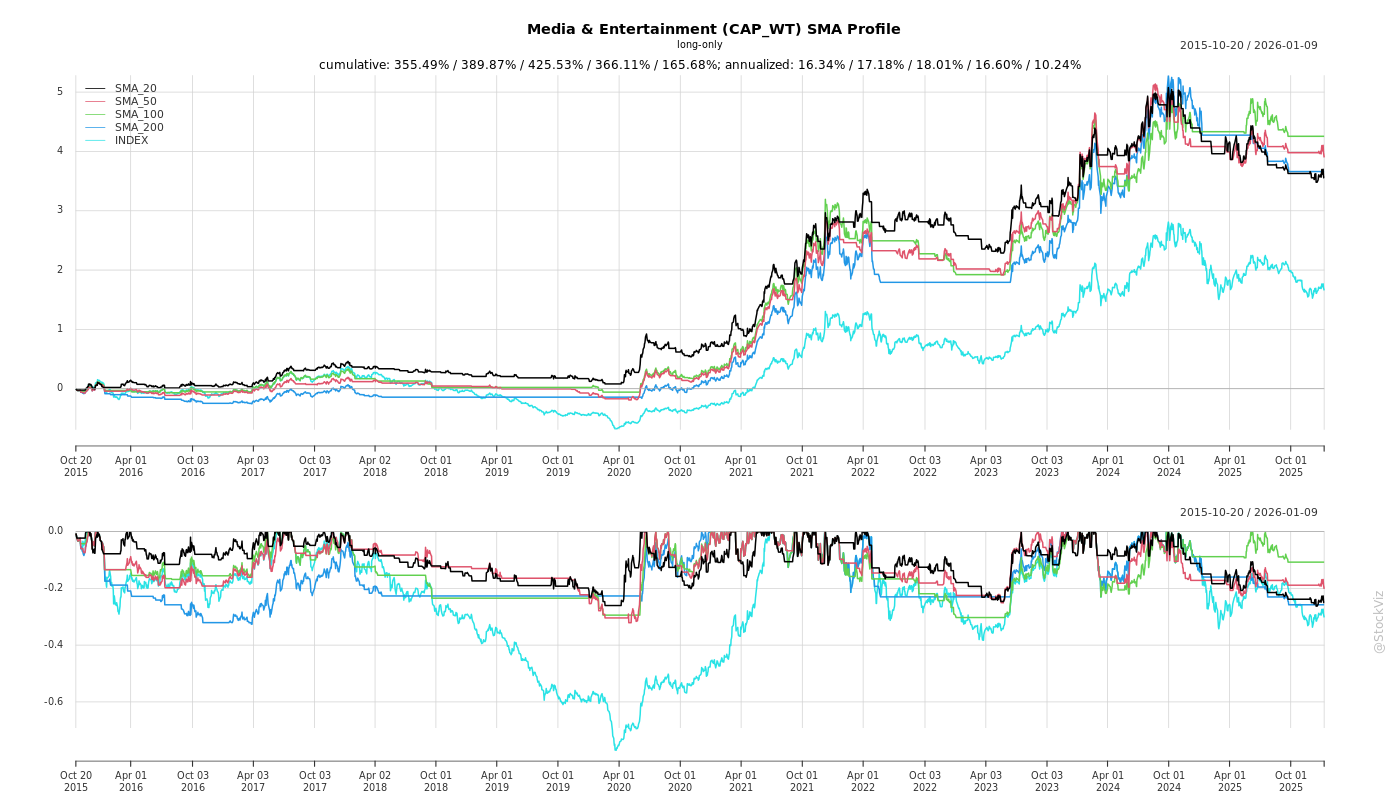

SMA Scenarios

Current Distance from SMA

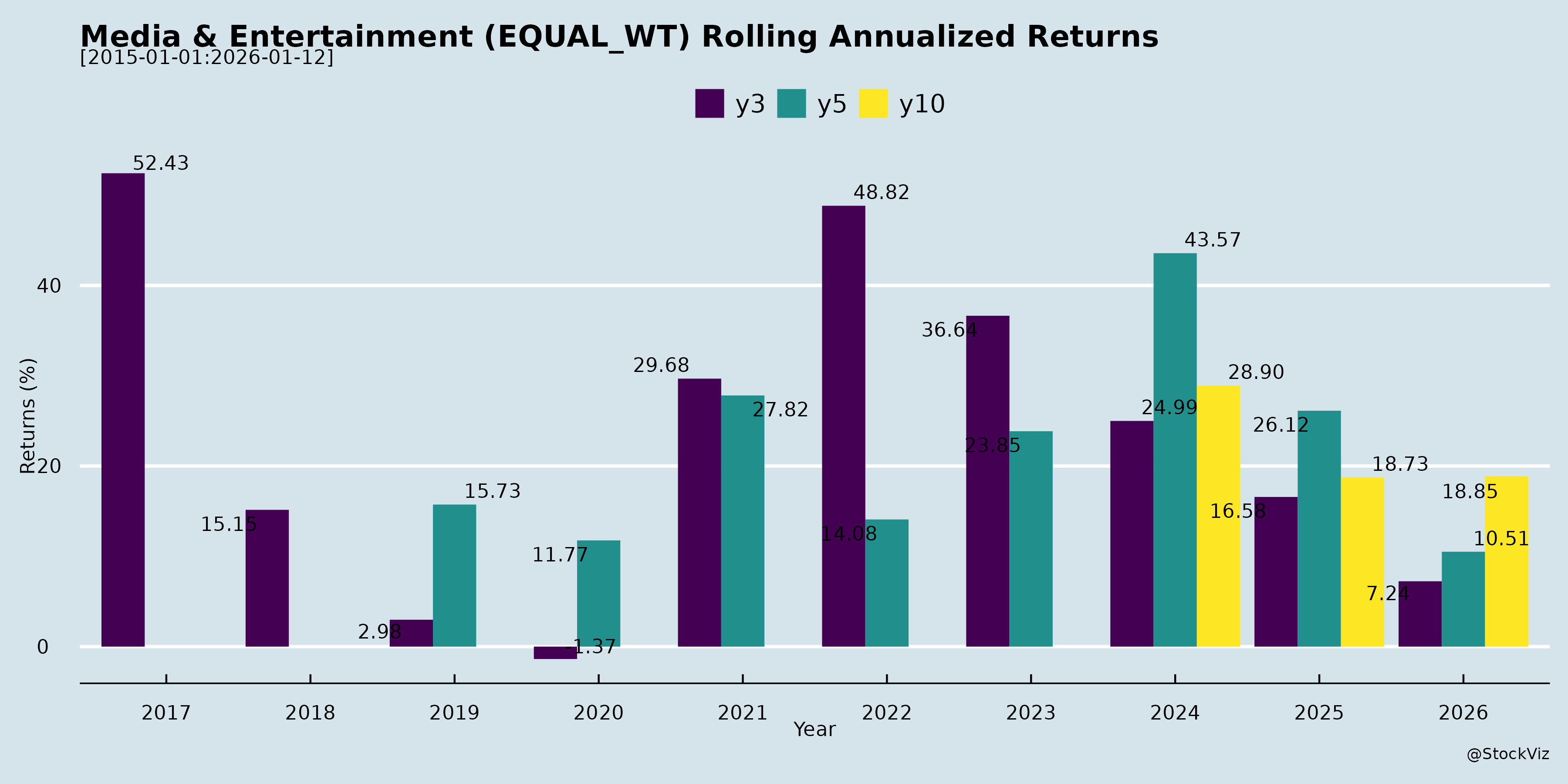

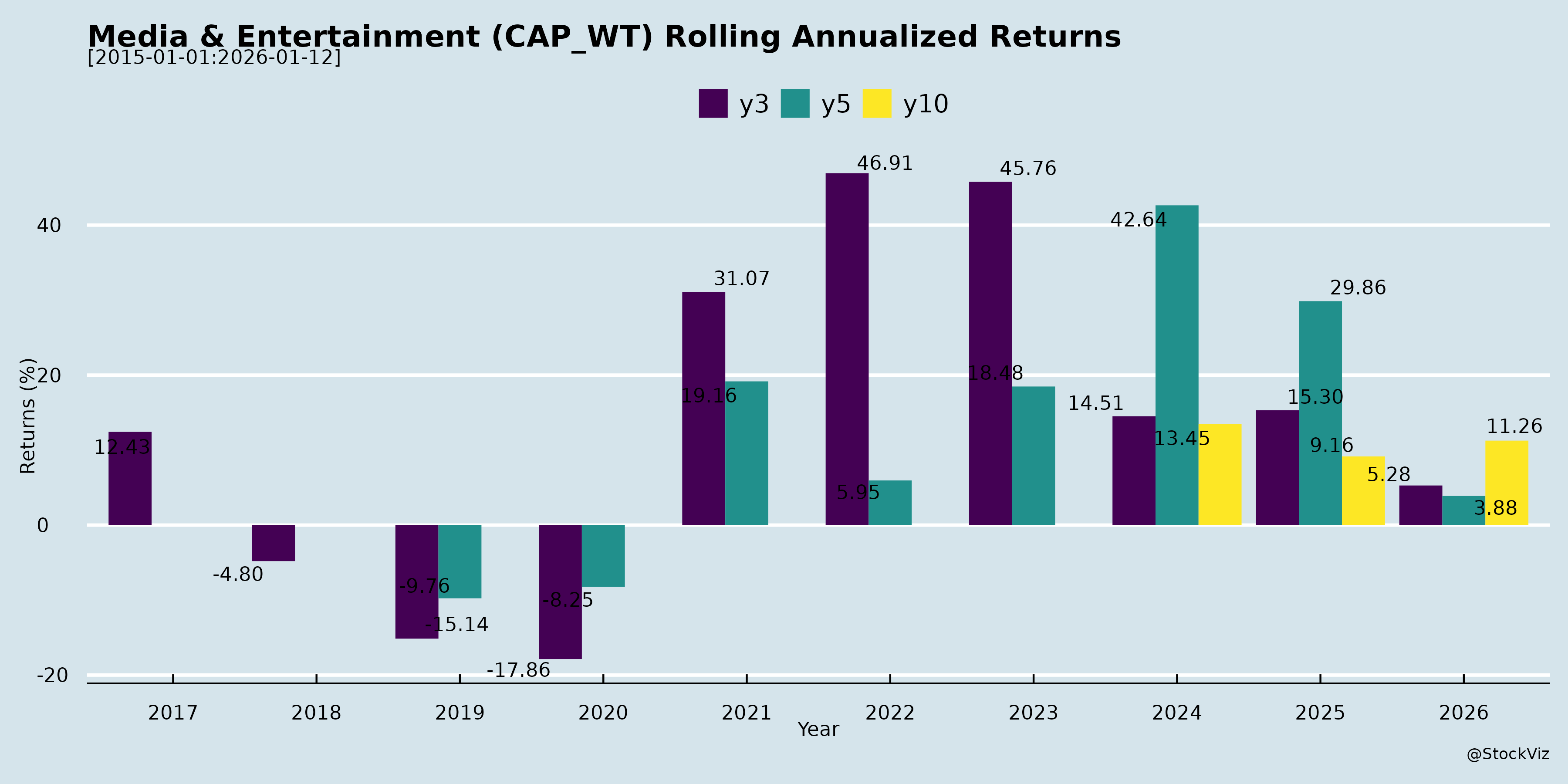

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Analysis of Indian Media & Entertainment (M&E) Sector (Based on Q2 FY26 Earnings Transcripts)

The provided documents cover key players in music (Saregama, Tips Music), TV/digital production (Balaji Telefilms), radio/digital audio (ENIL/Gaana, Music Broadcast/Radio City), and ancillary filings. They reflect a sector transitioning from traditional (radio/TV) to digital/live experiences, amid ad market softness but strong digital tailwinds. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring Near-Term Performance)

- Radio & Traditional Ad Slowdown: Muted advertiser sentiment due to GST anticipation, geopolitical uncertainty, and deferred campaigns (ENIL: radio ad volumes flat; Radio City: 74% utilization vs. 70% YoY, but rates at 75-80% pre-COVID levels). Sector-wide single-digit growth expected.

- TV Episodic Pressure: Mature shows ending (Balaji: 3 shows closed, e.g., Kumkum Bhagya at 3,192 episodes), broadcaster budgets cut (rates down to ₹24-25L/hour from ₹28-29L), leading to revenue dips (Balaji H1 revenue ₹121cr vs. ₹293cr YoY).

- Lumpy Video/Movie Revenues: Cyclical releases cause QoQ volatility (Saregama: Video degrowth 39% QoQ due to fewer releases; Balaji: Film segment 10% of Q2 revenue).

- Digital Platform Disruptions: Free tier dominance delays subscription shift (Saregama/ENIL: Platforms like Wynk closed; slow ARPU growth, India at global lows). High churn (Balaji: 65-70% on SVOD).

- Cost Pressures: Rising production/content costs (ENIL: Up with 101% events growth; Radio City: Rationalizing via 10-15% headcount cuts, asset-light model saving ₹6-7cr/qtr).

Tailwinds (Positive Structural Shifts)

- Digital Audio/Video Boom: Explosive growth in streaming (Saregama: YouTube CPMs/views up; ENIL Gaana: 149% YoY to ₹31.5cr, 33% of traditional biz). Short-form/micro-series demand (Saregama/Balaji: 1-3min episodes, 400mn+ views).

- Live Events & IP Surge: Post-COVID experiential demand (ENIL: Events/IP +101% to ₹34.5cr non-FCT; Saregama: Diljit tour, music festivals).

- Subscription Push: Platforms promoting paid tiers (Saregama: Spotify/JioSaavn promotions; ENIL: Industry shifting, competitors pricing down to ₹399; 50% revenue share to labels).

- Tech Enablers: Gen AI slashing video production costs/time (Saregama: 10-12 days to 2-3 days for old song videos; Balaji: AI content on apps).

- Diversification: Artist management (Saregama: 230+ artistes, 200mn+ followers), B2B licensing/order books (Balaji: ₹300cr digital), brand sponsorships (Saregama: Oppo/Unilever tie-ups).

Growth Prospects (Medium-Term Opportunities, FY26-FY27+)

- Music Licensing/Streaming: 19-23% YoY FY26 (Saregama), driven by regional/film albums (e.g., Love & War slip but Q3/Q4 pipeline strong). Long-term 23% CAGR; subscription hockey-stick upside (India penetration low).

- Digital/OTT: Hybrid SVOD/AVOD scaling (Balaji: 11mn subs, Kutingg app traction; ENIL Gaana: ARR ₹90-100cr, breakeven by Jun-Sep FY27). Micro-series, YouTube (Saregama: 1,500 releases, Gen Z focus).

- Movies & Live: Presales de-risking (Balaji: 85-90% recovery, 4 big releases FY27 incl. Akshay Kumar film); events CAGR 20%+ margins (ENIL).

- Overall Guidance: Saregama: 30% revenue CAGR ex-Carvaan FY24-27, 32-33% EBITDA; ENIL: Digital to 50% of biz; Radio City: Better profitability post-cost cuts.

- Sector-Wide: Digital ad 14-15% growth, live events tailwinds (3-5yr horizon), policy reforms (e.g., DAVP rate hikes +25%, digital radio).

| Segment | FY26 Growth Outlook | Key Drivers |

|---|---|---|

| Music/Digital Audio | 19-30% | Subscriptions, AI videos, artist mgmt. |

| Radio | Mid-single digit | Volume uptick, diversification (34% alternate rev at Radio City). |

| TV/Digital Video | Stable-Muted (rebuild phase) | OTT order books, micro-series. |

| Events/Live | 50-100%+ | Post-COVID demand. |

Key Risks

- Ad Cyclicality & Mix Shift: Heavy reliance on Tier-1/top clients (Radio City: Tier-2/3 yields lower); festive spillover impacts (Radio City: Single-month festivals hurt YoY).

- Content Slippages: Film/album delays (Saregama: Love & War to FY27) cause lumpy growth.

- Subscription Adoption Delay: Behavioral resistance (ENIL: Free-to-paid shift slow; <35 age ready but ARPUs low ₹10-99).

- Regulatory/Policy: Digital radio migration costs (Radio City/ENIL: ₹130cr/Mumbai unsustainable; TRAI consultations ongoing). Platform bans (Balaji ALTT).

- Competition & Margins: New entrants in events/digital (ENIL); mix shift to lower-margin non-radio (50:50 target pressures EBITDA).

- Execution: High churn/cost discipline (Gaana breakeven path); inventory surges (Balaji: ₹55cr QoQ).

Summary

The Indian M&E sector faces short-term headwinds from ad softness and TV/radio cyclicality (revenues down 20-60% YoY in parts), but robust tailwinds in digital/live (100%+ growth) signal a pivot to high-growth areas. Growth prospects are strong at 20-30% CAGR for leaders (music/digital-led), fueled by subscriptions/AI/events, with profitability improving via cost cuts (e.g., Radio City +₹6-7cr/qtr savings). Key risks center on execution delays and policy, but cash-rich balance sheets (₹137-362cr across cos) provide buffers. Overall, bullish medium-term (FY27+), with digital/subscriptions as key unlockers; evaluate on TTM/12M basis due to lumpiness. Sector poised for 15-25% structural growth as consumption rises (400mn+ internet users).

General

asof: 2025-12-03

Summary Analysis: Indian Media & Entertainment (M&E) Sector

Based on the provided regulatory filings from key listed M&E companies (e.g., Prime Focus, Saregama, Network18, Balaji Telefilms, ENIL, Shemaroo, Music Broadcast/Radio City, Radaan Mediaworks), the sector exhibits a mixed outlook. Capital raises and international expansions signal resilience, but persistent litigation, tax disputes, liquidity strains, and qualified audits highlight vulnerabilities. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring the Sector)

- Financial Distress and Liquidity Crunch: Radaan Mediaworks reports fully eroded net worth (₹-1,142 Cr consolidated), current liabilities exceeding assets, unpaid statutory dues (₹330 Cr), and a qualified audit opinion citing “material uncertainty” on going concern. Similar liquidity pressures implied in delayed projects (e.g., CWIP delays due to construction issues).

- Regulatory and Tax Scrutiny: Shemaroo faces GST show-cause notice (₹30.68 lakhs for FY22); ENIL updates ongoing Madras HC litigation with SIMCA (music royalties), with appeals reserved post-arguments—potentially escalating costs.

- Operational Disruptions: Network18’s cessation of ETPL as associate (voting rights assigned, economic interest retained) reflects structural shifts from regulatory approvals (CCI order). Post-COVID impacts persist (Radaan notes lingering effects).

- Audit Qualifications: Recurrent issues in Radaan (17th/12th/4th time for going concern, subsidiary investments, CWIP)—no impairment on subsidiary investments despite losses.

Tailwinds (Supportive Factors)

- Capital Infusion via Preferential Allotments/ESOPs: Prime Focus secures trading approval for 46.27 Cr shares (preferential basis), boosting liquidity. Balaji Telefilms allots 2.75L ESOP shares, signaling employee retention amid modest capital increase (₹23.94 Cr to ₹23.99 Cr).

- Talent and Governance Strengthening: Saregama appoints experienced CS (15+ yrs in finance/secretarial), updates KMP authorizations, enhancing compliance.

- Stable Financial Reporting: Music Broadcast publishes Q2/H1 FY26 results extracts (revenue ₹166 Cr H1, PAT ₹12 Cr); Railtel (tangential) shows strong growth (revenue ₹558 Cr FY25 half-year).

- No Major Net Worth Impact from Restructuring: Network18’s ETPL changes maintain fair-valued investments per AS.

Growth Prospects

- International Expansion: Saregama incorporates Dubai WOS (“Saregama Performing Arts and Music Festivals LLC”) for live events, content licensing, and artist collaborations in Middle East/Asia—tapping regional potential (initial capital AED 1M, media/entertainment industry).

- Digital/Content Revival: Radaan eyes digital segment revival in Singapore subsidiary; broader sector shift evident (Prime Focus preferential shares to promoters/non-promoters for potential VFX/digital growth).

- Revenue Stability: Steady teleserial/digital income (Radaan: ₹228 Cr FY25; Balaji ESOPs support talent for content production). Potential in live events/music post-regulatory nods.

- M&A/Open Offers: References to open offers (e.g., CMS Holdings) indicate consolidation opportunities.

Key Risks

| Risk Category | Details | Impact Level | Mitigation Noted |

|---|---|---|---|

| Liquidity/Going Concern | Negative working capital, unpaid dues (Radaan); high finance costs (₹243 Cr FY25). | High (qualified audits) | Management confidence in revival/obligations. |

| Litigation/Tax | SIMCA suit (ENIL), GST notice (Shemaroo ₹30L); statutory non-compliances. | Medium | Ongoing HC hearings; no material financial impact claimed. |

| Regulatory/Compliance | Lock-ins on preferential shares (Prime Focus: up to May 2027); CCI approvals (Network18). | Medium | Filings via NEAPS; approvals secured. |

| Operational | CWIP ageing (Radaan ₹1,920 Cr, cancellation planned); subsidiary underperformance. | High | Shareholder approvals for cancellations; revival plans. |

| Market/External | Music royalties, COVID legacy; foreign sub unaudited (Radaan Singapore). | Medium | Arm’s-length transactions; diversification (Dubai WOS). |

Overall Outlook: Moderately positive with tailwinds from capital access and global push (e.g., Saregama/Prime Focus), but headwinds dominate smaller players (Radaan). Growth hinges on digital/live events (projected via Dubai entity), but risks from liquidity/litigation could amplify in a high-interest environment. Sector resilience shown via disclosures/compliances, but monitor Q3 FY26 results for trends. Investors should prioritize companies with clean audits and international diversification.

Investor

asof: 2025-11-30

Analysis of Indian Media & Entertainment Sector

Based on the provided documents (primarily Q2 FY26 earnings transcripts from Saregama, Balaji Telefilms, ENIL (Mirchi/Gaana), Music Broadcast (Radio City), and ancillary filings from Tips Music, Shemaroo, and Network18), the Indian Media & Entertainment (M&E) sector exhibits a mixed outlook. The analysis draws from music, radio, TV/digital content, events, and OTT segments. Key insights are derived from management commentary on revenues, costs, market dynamics, and strategies.

Headwinds

- Advertising Slowdown in Traditional Media: Radio (FCT) and TV faced muted demand due to advertisers deferring spends amid GST anticipation and geopolitical uncertainty (ENIL: radio ad sales slowdown; Radio City: subdued Q2 volumes at 74% utilization, flat YoY growth; Balaji: TV yields down to ₹24-25L/hour episodic).

- Lumpy/Seasonal Revenues: Video/film segments volatile due to release slippages (Saregama: Video degrowth 39% YoY in Q2; Balaji: Mature TV shows ended, H1 revenue down 59% YoY).

- Free Streaming Dominance: Low subscription penetration/ARPU in India (Saregama/ENIL: Platforms like Spotify/JioSaavn pushing subs but free tier persists; high churn 65-70% on SVOD per Balaji).

- Platform Closures & Consolidation: Wynk closure impacted revenues (Saregama: full Airtel Wynk impact ends Q3); 3-4 large platforms shut in 18 months.

- Cost Pressures: Rising content acquisition (Saregama: ₹320-330Cr planned spend); TV broadcaster budget cuts (Balaji).

- Shift to Short-Form: Time spent on Instagram Reels/YouTube Shorts rising, but monetization lags (Saregama: Short-form revenue small, awaits ad revenue share).

Tailwinds

- Digital & Streaming Boom: Music/digital revenues surging (ENIL: Digital +149% YoY to ₹31.5Cr, 33% of traditional biz; Saregama: YouTube/CPMs stable, subscription push by platforms).

- Live Events & Experiential Growth: Post-COVID tailwinds (ENIL: Events/IP +101% YoY; Saregama: Diljit tour, music festival planned; Radio City: 34% alternate revenue).

- Gen AI Adoption: Cost/time savings for content (Saregama: AI videos for old songs in 2-3 days vs. 10-12; Balaji: AI in Kutingg shows).

- Diversification Success: Artist management (Saregama: 230+ artists, 200M+ followers); brand sponsorships (Saregama: Partnerships with Oppo, Unilever); hybrid OTT (Balaji: Kutingg/AstroVani apps).

- Subscription Momentum: Platforms promoting subs (ENIL/Saregama: Spotify price cuts to ₹399, Latin America success; India ARPU low but upside potential).

- Strong Balance Sheets: Cash reserves (ENIL: ₹345Cr; Radio City: ₹362Cr; Balaji: ₹137Cr) enabling investments.

Growth Prospects

- Music Licensing/Streaming: 19-23% CAGR mid-term (Saregama: FY26 guidance 19-20%; ENIL Gaana ARR ~₹90-100Cr, breakeven by Jun-Sep FY27).

- Digital/OTT: Hybrid SVOD/AVOD, micro-series, regional content (Balaji: ₹300Cr B2B order book; ENIL: Digital solutions EBITDA-accretive at 10-12%; Saregama: 1,500+ releases).

- Events & Non-FCT: 100%+ YoY growth trajectory (ENIL: ₹75Cr+ FY26 est.); Saregama targets 50:50 radio/non-radio mix.

- Movies/Video: De-risked via presales (Balaji: 85-90% cost recovery, 4 big releases FY27); Saregama: 30% consolidated revenue CAGR FY24-27 ex-Carvaan.

- Overall Guidance: EBITDA margins 32-33% (Saregama); radio single-digit growth (ENIL/Radio City); sector tailwinds from digital consumption (400M+ internet users).

- Radio Evolution: Digital radio (TRAI recos) for better reach/data (ENIL/Radio City); DAVP rate hikes (~25%) expected.

| Segment | Q2 FY26 Growth (YoY) | FY26/Future Outlook |

|---|---|---|

| Music/Digital | +12-149% | 19-30% CAGR |

| Events/Non-FCT | +42-101% | High double-digits |

| Radio FCT | Flat/Single-digit | Single-digit |

| TV/Video | -39-59% | Recovery via pipeline |

Key Risks

- Ad Market Volatility: Dependency on FMCG/auto (muted sentiment); geopolitical/GST delays (ENIL/Radio City).

- Subscription Adoption: Behavioral shift needed (low ARPU, high churn); free tier competition (Saregama/ENIL).

- Content Risks: Release slippages, 5-year payback breaches (Saregama); IP expiry (60-year copyright, but publishing rights extend).

- Regulatory/Tech: Digital radio migration costs (₹130Cr/Mumbai est., under discussion); MIB bans (Balaji ALTT).

- Competition/Fragmentation: New event entrants (ENIL); short-form platforms; talent acquisition wars.

- Execution: Breakeven timelines (Gaana/Pocket Aces); manpower rationalization impacts (Radio City: 10-15% headcount cut).

- Macro: Festive lumpiness (compressed this year); Tier 2/3 yield dilution.

Summary

The Indian M&E sector is in transformation mode, with digital/music/events as high-growth engines (20-100%+ YoY) offsetting traditional radio/TV headwinds (flat/declining ad spends, lumpiness). Tailwinds from Gen AI, subscriptions, and live events signal 20-30% medium-term revenue CAGR potential, driven by 400M+ digital users and diversification. However, ad slowdowns and free-tier dominance pose near-term risks, with profitability hinging on subscription ramps and cost discipline (e.g., ₹6-7Cr/Q savings at Radio City). Companies with strong cash (₹100-300Cr+), IP (Saregama catalogue), and hybrid models (ENIL/Balaji) are best positioned. Bull case: Subscription hockey-stick + events boom (EBITDA 30%+). Bear case: Prolonged ad weakness + delayed subs (margins <20%). Overall, cautiously optimistic for FY26 recovery via Q3/Q4 pipelines.

Meeting

asof: 2025-12-03

Indian Media & Entertainment Sector Analysis (Based on Q2/H1 FY26 Disclosures)

The provided documents cover unaudited Q2/H1 FY26 financial results (Sep 2025) and related disclosures from key listed players: Saregama, Tips Music, Prime Focus, ENIL (Radio), Shemaroo, Music Broadcast (Radio City), Balaji Telefilms, Network18, Cinevista, Next Mediaworks, Silly Monks, and Radaan. These represent diverse sub-sectors (music, radio, TV/film production, digital content). Overall, the sector shows resilience in music/digital amid traditional media headwinds, with revenue growth in profitable segments but persistent losses in radio/TV. Aggregate revenue trends positive (~10-20% YoY in music leaders), but EBITDA margins volatile (5-20%). Key insights below.

Headwinds (Challenges)

- High Content & Operational Costs: Royalty (e.g., Saregama: Rs. 3.4 Cr H1), production (ENIL: Rs. 8 Cr H1), and employee expenses dominate (20-30% of revenue). Leads to margin compression (e.g., Tips Music EBITDA ~75%, but radio cos <10%).

- Traditional Media Slump: Radio (ENIL, Music Broadcast) reports losses (ENIL: Rs. 9 Cr H1 PAT loss; Radio City: negative EBITDA). Ad revenue weak due to digital shift; PPL royalty disputes ongoing (ENIL, Radio City).

- Liquidity & Losses: Shemaroo (Rs. 95 Cr H1 loss), Radaan (Rs. 3 Cr loss), Cinevista persistent losses/negative net worth. Statutory dues unpaid (Radaan: Rs. 34 Cr); going concern emphasis (qualified audit opinions).

- Impairments & Provisions: ENIL (Rs. 35 Cr prior impairment), Shemaroo (GST disputes Rs. 70 Cr+), impacting balance sheets.

Tailwinds (Positive Drivers)

- Music & Digital Strength: Saregama (Rs. 44 Cr H1 revenue, Rs. 88 Cr PAT; Music 70% segment), Tips Music (Rs. 178 Cr H1 revenue, Rs. 99 Cr PAT). Growth in streaming (Spotify/YouTube), artist mgmt (+50% YoY), events.

- Content Diversification: Balaji Telefilms AGM approvals; Network18 acquisition (News18 Lokmat); Saregama-Pocket Aces digital push. Digital revenue rising (Saregama Video/Events up).

- Cash Generation & Dividends: Strong FCF in music (Saregama Rs. 26 Cr H1 OCF; Tips Rs. 46 Cr). Interim dividends: Saregama Rs. 4.5/sh, Tips Rs. 4/sh.

- Corporate Actions: ESOPs (Shemaroo 5.9L options), preferential issues (Silly Monks), acquisitions signal confidence.

Growth Prospects

- Digital/OTT Boom: Music streaming (Saregama Music Rs. 303 Cr H1, +3% YoY); short-form video (Pocket Aces); YouTube channels (Cinevista). Projected 15-20% sector CAGR to FY28 (FICCI-EY).

- Events & Artist Mgmt: Saregama Events Rs. 27 Cr Q2 (+ve shift); Tips ad/sales promotion up.

- M&A/Expansion: Network18 (Rs. 25 Cr JV buyout); Prime Focus (DNEG exit option); Silly Monks warrants issuance. International (ENIL Bahrain/US).

- IP Monetization: Back-catalogue (Saregama intangible assets Rs. 740 Cr); film/TV revival post-strikes.

Key Risks

| Risk Category | Details | Impacted Cos. | Mitigation |

|---|---|---|---|

| Regulatory/Legal | Royalty disputes (PPL: ENIL/Radio City); GST (Shemaroo Rs. 70 Cr); NCLT petitions (Music Broadcast). | Radio/TV (ENIL, Radio City, Shemaroo) | Appeals/Deposits; stays granted. |

| Liquidity/Going Concern | Negative net worth (Radaan, Shemaroo, Cinevista); high debt (Shemaroo Rs. 290 Cr). | Loss-makers (Shemaroo, Radaan) | Revival plans; asset sales (Radaan property unwind). |

| Impairment/Asset Quality | Untested sub investments (Radaan Rs. 9L); prior impairments (ENIL Rs. 35 Cr). | Holding cos (Radaan) | Digital revival (Singapore sub). |

| Competition/Shift | Digital disruption eroding radio/TV ads (ENIL revenue flat). | Traditional (ENIL, Balaji) | Diversification (Saregama Artist/Video). |

| Macro | Ad slowdown; content costs inflation. | All | Cost controls; streaming growth. |

Overall Outlook: Selective Optimism. Music/digital (Saregama/Tips: 20-30% growth) thriving; radio/TV need restructuring. Sector FY26 growth ~12-15% (music-led), but risks from legacy issues. Watch: Digital ad recovery, royalty resolutions. Recommendation: Favor music pure-plays; monitor radio deleveraging.

Press Release

asof: 2025-11-30

Indian Media & Entertainment Sector Analysis

Based on the provided documents from key players (Prime Focus, Saregama, Network18, TIPS Music, Balaji Telefilms, ENIL/Radio Mirchi & Gaana, and Music Broadcast/Radio City), here’s a synthesized analysis of the Indian Media & Entertainment (M&E) sector. These announcements reflect Q2/Q3 FY26 (H1 FY26) performance amid a transitional phase marked by digital acceleration and traditional media headwinds. The sector shows resilience through diversification, with aggregate revenue growth (e.g., 11-24% YoY across firms) despite ad softness.

Tailwinds (Positive Drivers)

- Digital Momentum & Platform Shift: Explosive growth in digital/audio streaming (ENIL: Digital = 52.5% of radio ads, up from 21%; Saregama: 400Mn followers; TIPS: 134Mn YT subs; Radio City: 53% digital YoY growth). Low subscription penetration in India (Saregama highlights untapped potential vs. global markets) fuels ARPU upside. YouTube dominance (Network18: 3x competitor views; Saregama/TIPS chartbusters).

- Content & IP Strength: Robust new releases (Saregama: 1,500+ tracks, major films; TIPS: 133 songs/Q2; Prime Focus: VFX/tech for global studios). Strong licensing (Saregama: OTT/brands/broadcast; Network18: Multi-platform leadership).

- Diversification Success: Non-ad revenues surging—live events (Saregama: Diljit tour; ENIL: Events growth), artiste mgmt. (Saregama: 230+ artists), fintech/influencers (Network18 Moneycontrol-HDFC tie-up, Creator18), apps (Balaji Astro Guide: 250K downloads in 24hrs).

- Operational Efficiency: Margin resilience (Saregama: 37% EBITDA; TIPS: 76% Op. EBITDA; ENIL: 19% ex-digital). Cost controls amid ad slowdown.

- Tech/AI Adoption: AI for content (Saregama: 70% cost savings), workflows (Prime Focus), personalization (Network18/News18).

Headwinds (Challenges)

- Ad Market Softness: Persistent weakness in traditional ads (Network18: 7% inventory decline; ENIL/Radio City: Radio ad pressure; industry-wide sentiment). Q1 election boost faded, leading to flat/YoY declines in some segments (Saregama Video: -70% YoY).

- High Content Costs: Rising investments (Saregama: ~₹10,000Mn in new content; amortization pressures). Film/video volatility (Saregama: Video revenue down).

- Traditional Media Pressure: TV/radio facing digital migration (News18: Soft TV news yields; radio market share stable at 19% but growth challenged).

- Macro Environment: Weak consumer demand, inflation impacting discretionary spends (implied in ad slowdowns).

Growth Prospects

- High Double-Digit Trajectory: Sector poised for 7-18% CAGR (Saregama: Music 14%, Live Events 18%, M&E overall 7% via digitization). Digital/subscriptions to drive (India: 4-5x growth potential in subs/ARPU per Saregama).

- Regional & Multi-Language Expansion: Leadership in Hindi/South (Saregama/TIPS regional hits; Network18 regional TV; News18 Lokmat acquisition).

- Monetization Levers: Ad-sharing from short-form (YouTube/Reels), premium subs (Moneycontrol Pro: 1Mn+ subs), live/experiential IP, global reach (Firstpost intl. push).

- Adjacent Plays: Astrology/fintech/apps (Balaji), VFX/tech services (Prime Focus), creator ecosystems. Projected M&E size: Music ₹32Bn (2024), Video ₹187Bn.

- H1FY26 Momentum: Avg. 10-15% revenue growth; EBITDA margins 30-70% signal scalability.

| Metric | H1FY26 Snapshot (Across Cos.) |

|---|---|

| Revenue Growth | 8-24% YoY (Digital-led) |

| EBITDA Growth | 7-28% YoY |

| Key Drivers | Digital (50%+ mix), Events, Licensing |

Key Risks

- Ad Cyclicality: Over-reliance on ads (60-70% revenue); prolonged slowdown could erode margins (e.g., Network18 EBITDA ~1.5%).

- Content Volatility: Hit-or-miss releases (Saregama Video down 70%); high capex (₹1-2K Cr) with recoupment delays.

- Competition: Global OTT giants (Netflix/Spotify), short-video platforms eroding traditional share.

- Regulatory/Execution: Phase-III radio auctions, content piracy, SEBI compliance (all filings under Reg 30). Digital policy shifts (e.g., data privacy).

- Macro/External: Economic slowdown, forex (intl. ops), inflation on costs. Exceptional items (Network18: ETPL fair-value gains) mask underlying losses.

- Tech/Platform Dependency: YT/Meta algo changes; low monetization from short-form.

Overall Outlook: Optimistic with Caution. Tailwinds from digital diversification outweigh headwinds, projecting 10-15% sector growth FY26+. Firms like Saregama/ENIL exemplify resilience (20%+ digital ramps). Risks mitigated by cash-rich BS (ENIL: ₹345Cr cash) and IP moats, but ad recovery key for sustained PAT expansion. Investors should monitor Q3 ad trends and digital ARPU.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.