AXISBANK

Equity Metrics

January 13, 2026

Axis Bank Limited

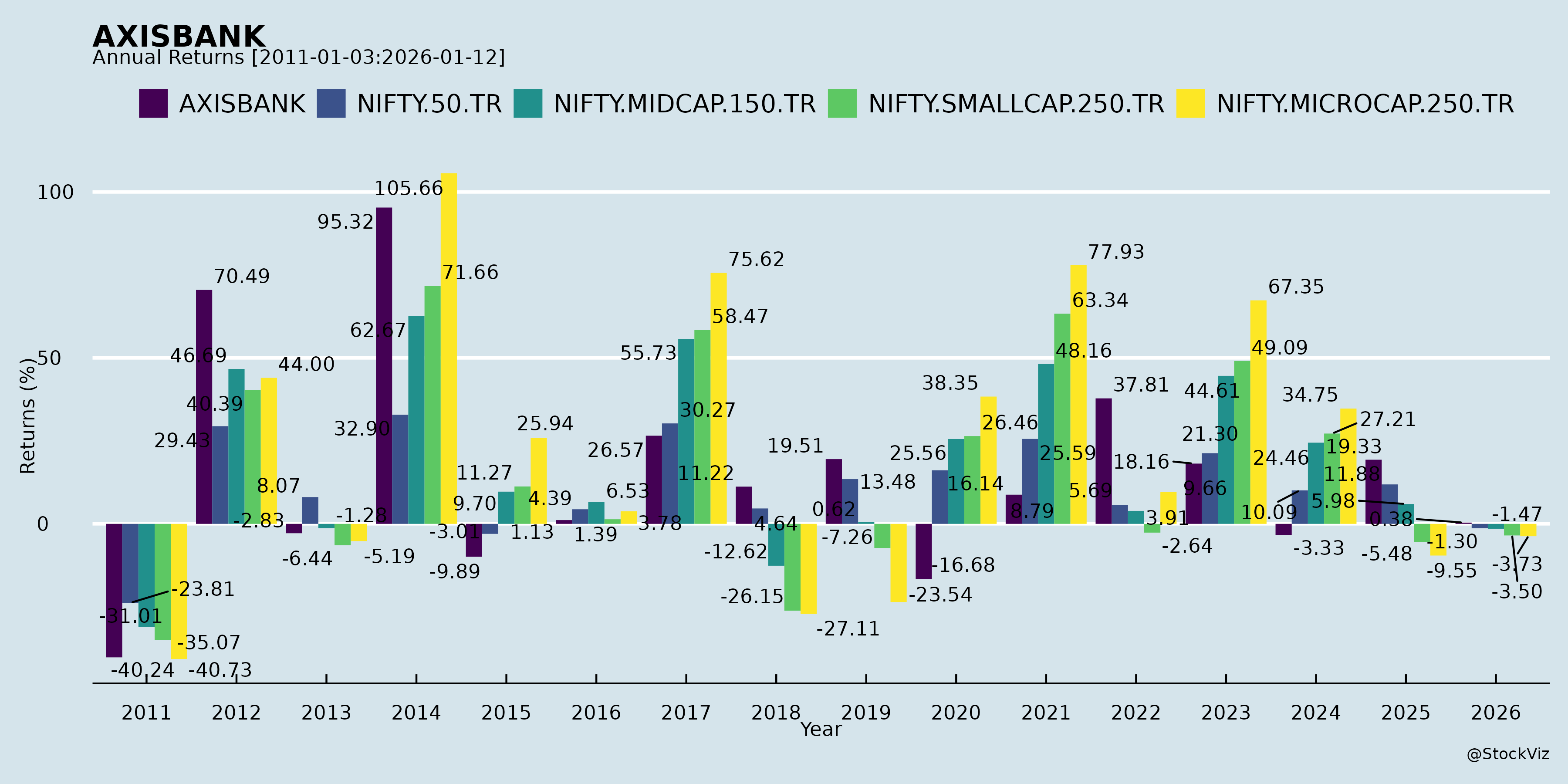

Annual Returns

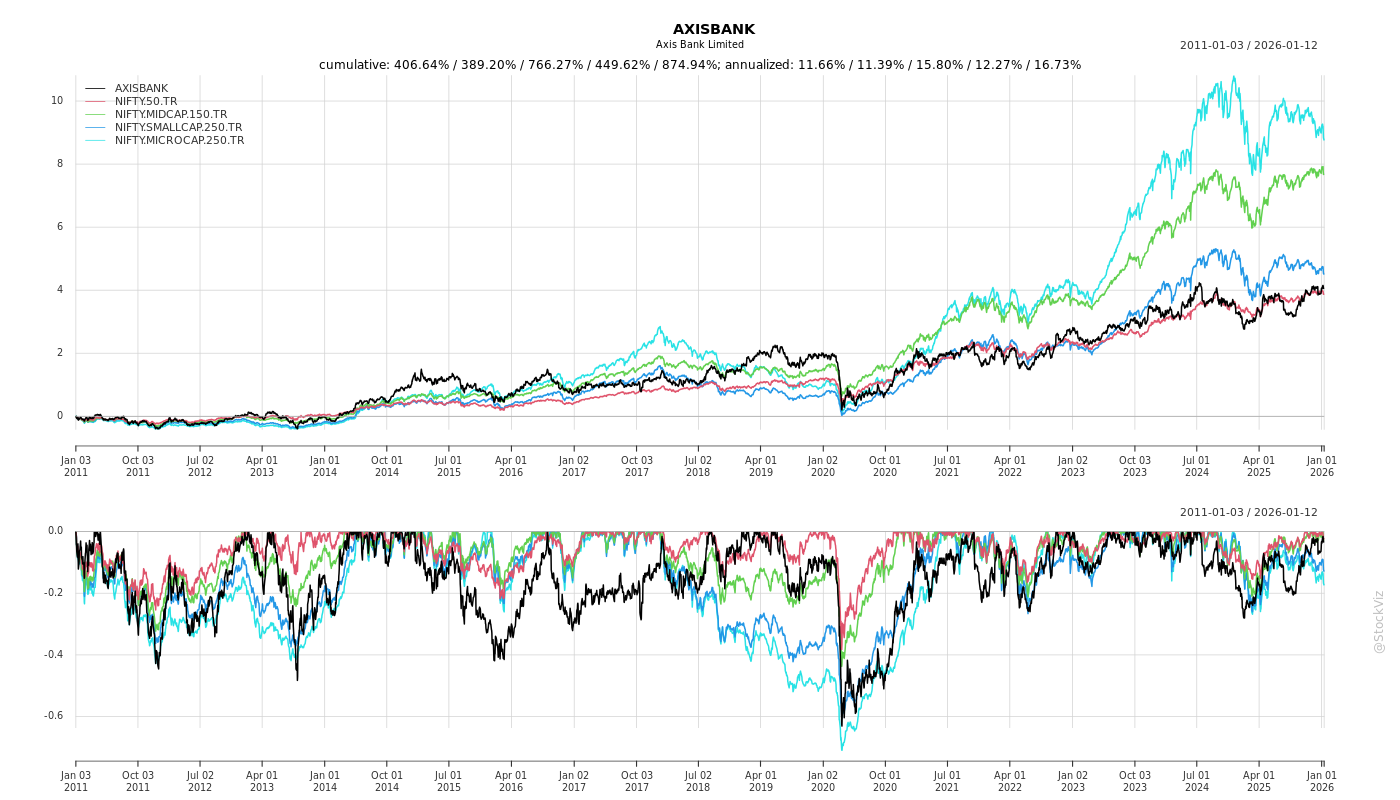

Cumulative Returns and Drawdowns

Fundamentals

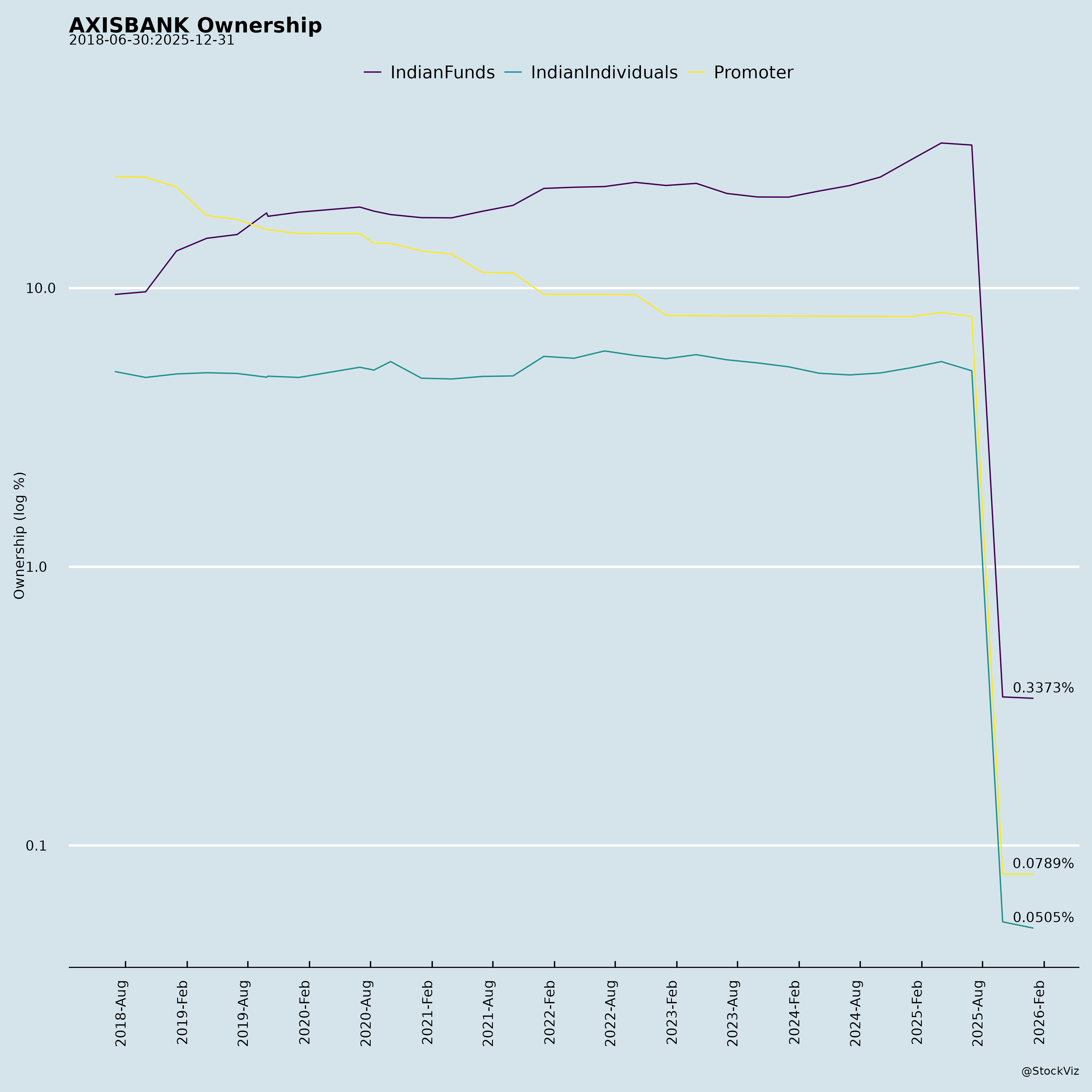

Ownership

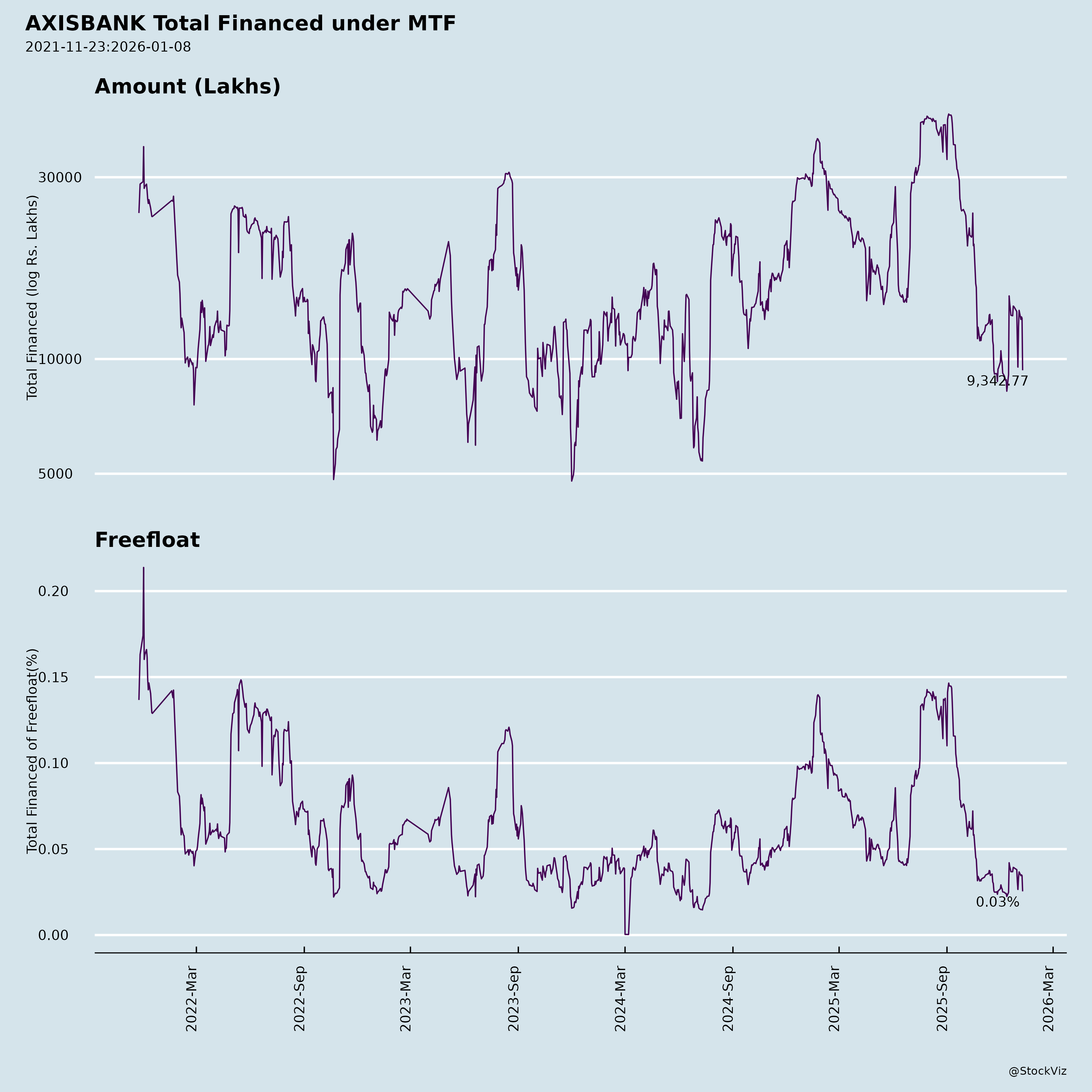

Margined

AI Summary

asof: 2025-11-27

Axis Bank (AXISBANK) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

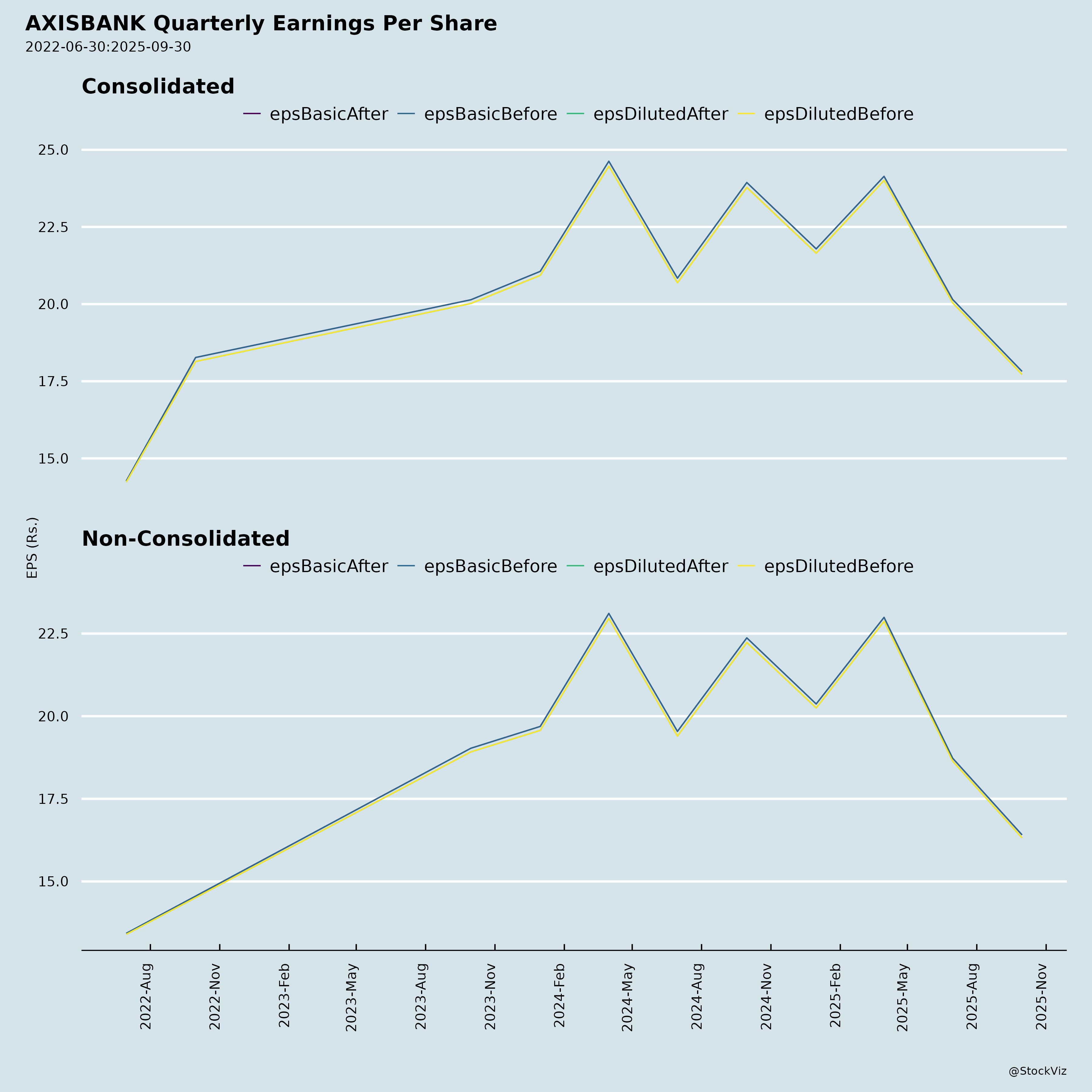

Summary Overview: Axis Bank reported steady Q2FY26 results with 11% YoY deposit growth and 12% advances growth, driven by granular segments (SBB+SME+MC at 24% of loans). However, net profit fell 26% YoY to ₹5,090 Cr due to higher provisions (₹3,547 Cr, up 61% YoY). Asset quality remained stable (GNPA 1.46%, NNPA 0.44%, PCR 70%), NIM at 3.73%, and CAR at 16.55%. Subsidiaries showed robust growth (e.g., Axis Finance PAT +18% YoY). The bank maintains digital/payments leadership (37% UPI share, 15Mn+ cards). Overall, tailwinds from granular focus and digital outweigh headwinds from provisions, positioning for 12-15% loan CAGR, but profitability recovery hinges on lower credit costs.

Tailwinds (Positive Drivers)

- Strong Liability Franchise: Deposits grew 11% YoY (MEB)/10% (QAB), gaining market share; CA +13% YoY, granular focus (SA +6%, TD +12%). CASA at 40% (MEB), cost of funds down 30 bps YoY.

- Granular Asset Growth: Advances +12% YoY; SBB +14%, SME +19%, MC +28%; Retail secured at 72%. Focus segments (SBB+SME+MC) now 24% of book (up 738 bps in 4 yrs).

- Fee & Non-Interest Income: Fees +10% YoY (₹6,037 Cr, 91% granular); Retail fees +10%. Transaction banking strong (11% YoY growth ex-FX/trade).

- Digital/Payments Leadership: 37% UPI payer share (lowest declines), 15Mn+ cards (14% share), top-rated app (4.7/4.8 rating, 15Mn MAU). 97% digital transactions.

- Capital & Liquidity: CET1 14.43% (+31 bps YoY), CAR 16.55%; Excess SLR ₹1.01L Cr, LCR 119%. Subsidiaries PAT +1% YoY (ROI 49%).

- NIM Stability: 3.73% (domestic 4.08%), aided by mix shift (Retail/SME up).

Headwinds (Challenges)

- Profitability Pressure: Net profit -26% YoY; Operating profit -3% YoY. Higher provisions (61% YoY rise) due to ₹1,231 Cr one-time crop loan provision (RBI advisory) and slippages.

- Credit Costs Elevated: Annualized net credit cost 0.73% (down 65 bps QoQ but up YoY); Gross slippages 2.11% annualized (down QoQ).

- Opex Growth: +5% YoY (statutory/tech costs up), Cost/Assets 2.38% (-14 bps YoY but pressured).

- Trading Income Volatility: -55% YoY (₹498 Cr).

Growth Prospects

- Granular Lending (High Conviction): SBB+SME+MC (₹2.66L Cr) to drive 20%+ CAGR; Retail (57% share) via secured products/digital (58% PL digital). Bharat Banking expansion (RuSu asset-led model).

- Liability & Fee Momentum: 13% 5-yr deposit CAGR > industry; Fees to grow via cards (1Mn+ adds), wealth (₹6.45L Cr AUM, Burgundy +16% YoY), transaction banking.

- Digital Monetization: UPI leadership, AA ecosystem, Neo for corporates/SMEs; Subsidiaries (Axis Finance Retail +24% YoY, AMC QAAUM +12%).

- Corporate Cycle: 20% YoY growth; High-rated book (90% A- & above), bond market (#1 arranger).

- Overall: 12-15% loan/deposit CAGR sustainable; ROE target 16-18% via NIM stability (3.7-3.8%), opex control, credit cost <0.8%.

Key Risks

- Asset Quality Deterioration: Retail slippages high (₹5,222 Cr); Technical impact masked metrics (adj. GNPA 1.29%). Crop loan provision write-back tied to recovery (by FY28).

- Provisioning/Regulatory: RBI scrutiny (crop loans, inspections); Higher standard provisions could recur.

- Macro/Competition: Rate cuts may compress NIM; Intense deposit competition; Slow capex cycle impacts corporates.

- Opex/Execution: Wage hikes, tech spends; Integration risks (LD2).

- Subsidiary/Concentration: 57% advances in Retail; Subsidiary reliance for fees/profit.

Investment View: Positive on structural shifts (granular/digital), but near-term profitability dip warrants caution. Stock likely range-bound until credit costs normalize (target FY26 ROA ~1.5%). Hold/Buy on dips for 12-15% EPS CAGR. (Based solely on provided docs; market prices as of Oct 2025 assumed stable.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.